Awake-in-3D : Calculating the USD Value of 100T ZIM Bond in RZB Digital Gold-backed Tokens

Awake-in-3D

Calculating the USD Value of 100T ZIM Bond in RZB Digital Gold-backed Tokens

Once Zimbabwe’s currency is stabilized, will the RZB eventually open their Golden ZIM Token for exchange internationally?

More specifically, will all of us legal owners of 2008 AA Series ZIM Bonds be able to redeem our bonds 1-to-1 for Gold-backed ZIM digital tokens at its current (or future) value?

Doing the math (based on published Gold Token value data from the Reserve Bank of Zimbabwe May 12th, 2023):

A 100T ZIM bond will buy the equivalent of 991.375 billion milligrams of gold (purchased in ZIM digital gold tokens)

Awake-in-3D

Calculating the USD Value of 100T ZIM Bond in RZB Digital Gold-backed Tokens

Once Zimbabwe’s currency is stabilized, will the RZB eventually open their Golden ZIM Token for exchange internationally?

More specifically, will all of us legal owners of 2008 AA Series ZIM Bonds be able to redeem our bonds 1-to-1 for Gold-backed ZIM digital tokens at its current (or future) value?

Doing the math (based on published Gold Token value data from the Reserve Bank of Zimbabwe May 12th, 2023):

A 100T ZIM bond will buy the equivalent of 991.375 billion milligrams of gold (purchased in ZIM digital gold tokens)

Current valuation of gold set by RZB is equivalent to $0.0688 USD/mg (according to actual source data from Reserve Bank of Zimbabwe).

This means a 100T ZIM bond would be worth approximately $68 Billion (current) US Dollars in gold-backed digital ZIM token value (if redeemed 1-to-1).

Well ok then… When do we redeem?!!

Does Zimbabwe have access to that much gold (or equivalent gold certificates)?

Right now they don’t. Or do they?

@GCR_RealTimeNews

Many Blessings,

Ai3D

https://t.me/GCR_RealTimeNews/293GCR Real-Time News, [May 14, 2023 at 13:13]

Awake-in-3D: The results are in for the first week of sales for the Golden ZIM Digital Token

Awake-in-3D

The results are in for the first week of sales for the Golden ZIM Digital Token

HEY IRAQ!!!

Are you seeing this??

The Reserve Bank of Zimbabwe (RZB) sold nearly all of the 140kg of gold used to back the first-round auction of the ZIM digital token. A total of ZWD 139.6 million ($11.8 million USD) in the RZB Gold Token were sold last week.

Private Citizens were able to invest in the Digital Tokens for as little as $10 USD while businesses were held to a $5,000 USD minimum transaction amount.

Gold-backed digital tokens allow gold to be purchased in small fractional amounts and eventually making it usable for every-day purchases.

Awake-in-3D

The results are in for the first week of sales for the Golden ZIM Digital Token

HEY IRAQ!!!

Are you seeing this??

The Reserve Bank of Zimbabwe (RZB) sold nearly all of the 140kg of gold used to back the first-round auction of the ZIM digital token. A total of ZWD 139.6 million ($11.8 million USD) in the RZB Gold Token were sold last week.

Private Citizens were able to invest in the Digital Tokens for as little as $10 USD while businesses were held to a $5,000 USD minimum transaction amount.

Gold-backed digital tokens allow gold to be purchased in small fractional amounts and eventually making it usable for every-day purchases.

Why?

Because it’s very difficult to bring physical gold coin (currently values over $2,000 USD) to a grocery store and buy only $100 of goods.

Perhaps Zimbabwe is now showing the way for utilizing gold to stabilize hyper-inflationary local currencies against a predatory US Dollar in their local markets.

So far so good!

I expect individual US States (like Texas and others) to eventually offer gold-backed digital tokens as an alternative to the FED’s malevolent CBDC US Dollar tokens.

@GCR_RealTimeNews

https://t.me/GCR_RealTimeNews/292GCR Real-Time News, [May 14, 2023 at 12:29]

Many Blessings,

Ai3D

Awake in 3D " California Defaults On $18.6 Billion In Debt, Saddling Employers With The Expense"

Awake in 3D: May 7th, 2023

There are US States that will lead us to a GCR the good way (see Texas gold-backed currency article ), and there are States that will lead us to a GCR the hard way - like the State of California.

California Defaults On $18.6 Billion In Debt, Saddling Employers With The Expense

The more CA lawmakers push their gross financial negligence (sheer fiscal stupidity) on businesses and taxpayers, the more business closings there are, leading to collapsing tax revenues.

This, in turn, increases unemployment, raises the everyday costs of everything, and pushes further stress onto banks (loan defaults), and the State Government’s daily expenses (unemployment insurance, healthcare and general welfare like food assistance).

Awake in 3D: May 7th, 2023

There are US States that will lead us to a GCR the good way (see Texas gold-backed currency article ), and there are States that will lead us to a GCR the hard way - like the State of California.

California Defaults On $18.6 Billion In Debt, Saddling Employers With The Expense

The more CA lawmakers push their gross financial negligence (sheer fiscal stupidity) on businesses and taxpayers, the more business closings there are, leading to collapsing tax revenues.

This, in turn, increases unemployment, raises the everyday costs of everything, and pushes further stress onto banks (loan defaults), and the State Government’s daily expenses (unemployment insurance, healthcare and general welfare like food assistance).

All of this then spreads in a financial contagion to other states, and eventually onto the US Federal Government.

This than increases inflation and a worsening national recession, which feeds into an increasing likelihood of total financial collapse.

Wash, rinse, repeat. A Financial collapse vortex.

Then a GCR.

@GCR_RealTimeNews

https://t.me/GCR_RealTimeNews/289GCR Real-Time News, [May 7, 2023 at 19:07]

————————————-

https://www.zerohedge.com/political/california-defaults-186-billion-debt-saddling-employers-expense

Many Blessings,

Ai3D

Awake-In-3D "Texas Committee Passes Bill To Create 100% Reserve Gold and Silver Backed Transactional Currencies

Awake in 3D

Texas Committee Passes Bill To Create 100% Reserve Gold And Silver-Backed Transactional Currencies

As I reported earlier last week at GCR Real-Time News, individual states in the USA have a constitutional right to recognize gold/silver as legal tender.

Over 30 states are currently proposing and passing legislation along this path.

Why?

Because under the US Constitution, states are bound to only recognize and use gold and silver as legal tender. Which means, they can technically reject the current “Federal” US Dollar as it is a fiat currency, not backed by gold or silver since 1971.

Awake in 3D

Texas Committee Passes Bill To Create 100% Reserve Gold And Silver-Backed Transactional Currencies

As I reported earlier last week at GCR Real-Time News, individual states in the USA have a constitutional right to recognize gold/silver as legal tender.

Over 30 states are currently proposing and passing legislation along this path.

Why?

Because under the US Constitution, states are bound to only recognize and use gold and silver as legal tender. Which means, they can technically reject the current “Federal” US Dollar as it is a fiat currency, not backed by gold or silver since 1971.

With the growing possibility of the Federal, US Treasury introducing a fiat CBDC (Central Bank Digital Currency) which can enable unprecedented tracking and control over US citizens, a growing number of states are preparing to reject such Federal control and limitations of freedom.

Texas continues to lead the way with their latest legislation.

Details on latest Texas HB4903 State Legislation:

“On May 2, a Texas House committee passed a bill to create 100% reserve gold and silver-backed transactional currencies.”

“The comptroller would also be required to create a mechanism to use 100% backed gold and silver digital currencies in everyday transactions.”

“The creation of state-issued gold-backed and silver-backed digital currencies would create currency competition with Federal Reserve notes and undermine the Fed’s monopoly on money. It would also provide a sound money-backed competitor if the Federal Reserve implements a central bank digital currency.”

Source: GCR Real-Time News

https://t.me/GCR_RealTimeNews/288GCR Real-Time News, [May 7, 2023 at 16:01]

Many Blessings,

Ai3D

Awake-in-3D "What Really Happened With First Republic Bank" 5-1-2023

Awake-in-3D

What Really Happened with First Republic Bank

Big Banksters of the world rejoice…

- The FDIC (funded by everyone’s bank deposits nationwide) took over FRB this past weekend and conducted an auction with Big Banks to find a buyer.

- JPMorgan stepped in and offered to buy First Republic, but only if the US Government guaranteed to backstop any losses.

Awake-in-3D

What Really Happened with First Republic Bank

Big Banksters of the world rejoice…

- The FDIC (funded by everyone’s bank deposits nationwide) took over FRB this past weekend and conducted an auction with Big Banks to find a buyer.

- JPMorgan stepped in and offered to buy First Republic, but only if the US Government guaranteed to backstop any losses.

- The FDIC agreed.

- JPM bought FRB, getting all the “healthy” assets and deposits for pennies on the dollar and the FDIC (meaning everyone with bank deposits nationwide) kept the toxic assets.

- The toxic assets consist of “interest-only” mortgages held by ultra-wealthy homeowners.

- The FDIC will likely bail out the wealthy homeowners leaving all of us to foot the bill.

You can’t make this stuff up! What a wonderful financial system we have…

If JPM-Chase wanted to buy First Republic in early February this year, they would’ve had to pay over $140 per share. They likely paid less than $5.00 per share today, without any of FRB’s toxic assets - thanks to the FDIC.

Jamie Diamond (JPM CEO) is laughing all the way to his bank.

I wonder which bank is next?

Source: @GCR_RealTimeNews

Many Blessings,

Ai3D

Awake-In-3D: Can individual States initiate a GCR and Gold-back the US Dollar at the State level? Yes!

Awake in 3D:

Forget America’s Federal-issued Fiat currency - can individual States initiate a GCR and Gold-back the US Dollar at the State level? Yes!

We always hear that the USA is holding up Our GCR, yet individual States are moving forward with gold and silver legislation.

Can they do this?

The United States Constitution’s Framers (in 1787) were mindful of the hardships brought by continentals, the fiat paper money issued by the Continental Congress to finance the Revolution.

Awake in 3D:

Forget America’s Federal-issued Fiat currency - can individual States initiate a GCR and Gold-back the US Dollar at the State level? Yes!

We always hear that the USA is holding up Our GCR, yet individual States are moving forward with gold and silver legislation.

Can they do this?

The United States Constitution’s Framers (in 1787) were mindful of the hardships brought by continentals, the fiat paper money issued by the Continental Congress to finance the Revolution.

Notable Founders — including Thomas Jefferson, George Washington, James Madison, and Thomas Paine — warned about the ravages of issuing unbacked currency.

That’s why the Constitutional Convention overwhelmingly embraced gold and silver.

Washington wrote that paper money was “wicked.”

Madison called it “unjust” and “unconstitutional.”

Jefferson wrote that “its [paper money’s] abuses also are inevitable and, by breaking up the measure of value, makes a lottery of all private property.”

Following the example envisioned by the Founding Fathers and described in Article I, Section 10 of the United States Constitution, states should reaffirm gold and silver as a tender in payment of debts.

Article I, Section 10 of the United States Constitution:

“No State shall … coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts …”

That’s why sound money activists are launching exciting initiatives at the state level to challenge the monetary monopoly of the Fed. From Alabama to Wyoming, states across the U.S. continue to pass legislation to eliminate taxes on gold and silver, establish in-state depositories, protect state taxpayer funds with sound money, and more.

For USA residents - To research where your state is in all of this, click the link below.

Source: @GCR_RealTimeNews

————————————-

https://www.soundmoneydefense.org/sound-money-index

Many Blessings,

Ai3D

Awake in 3D "GCR Sign???" 4-26-2023

Awake-in-3D: GCR Sign???

Yuan overtakes dollar to become most-used currency in China's cross-border transactions

Is this meaningful in Our GCR landscape? No. Not really. But I’m sure this article will make its way around GCR Land saying the opposite.

What most likely won’t see mentioned on internet clickbait is the following, final paragraph of the article - which puts things into factual context.

“Data from SWIFT showed that the yuan's share of global currency transactions for trade finance rose to 4.5% in March, while the dollar accounted for 83.71%.”

Awake-in-3D: GCR Sign???

Yuan overtakes dollar to become most-used currency in China's cross-border transactions

Is this meaningful in Our GCR landscape? No. Not really. But I’m sure this article will make its way around GCR Land saying the opposite.

What most likely won’t see mentioned on internet clickbait is the following, final paragraph of the article - which puts things into factual context.

“Data from SWIFT showed that the yuan's share of global currency transactions for trade finance rose to 4.5% in March, while the dollar accounted for 83.71%.”

While this is good news for China in their efforts to increase the Yuan’s use in cross-border trade, it’s of little significance to sparking a Global Monetary Reset.

I can explain…

The US Dollar supports a very deep capital market globally. No other currencies come close, and deep Capital is what fuels efficient global trade and economic development.

The USD remains the undisputed king of global commerce. Even if most countries dramatically reduce their holdings of USD reserves, 84% of global transactions are in USDs. This is the only thing that matters.

Even if China and Saudi Arabia begin transacting all oil sales in Yuan (instead of USD), Saudi Arabia cannot effectively utilize/spend all those billions of Yuan in the global market. That’s a serious problem!

Another fact we must all remember is that the Chinese Yuan is actually pegged to the US Dollar.

No significant global trading nations are going to stockpile and use Yuan that is dependent on the USD for its exchange rate value. They’re going to stick with dollars, which are liquid and readily convertible into every currency and accepted by every cross-border payment settlement exchange on the planet.

Can China end its USD peg?

Sure. But China maintains their peg so that the Yuan is remains less valuable than the dollar. This ensures that all things manufactured and exported from China have very low prices compared to other countries exports. And the USA is China’s largest export customer.

China is not going to end its USD currency peg anytime soon.

The only realistic way for the Yuan to meaningfully challenge the Dollar, and increase its attractiveness in global Capital Markets is for the Yuan to become readily convertible for use everywhere on earth.

How does China do that? They back the Yuan with gold and make the Yuan directly exchangeable for a fixed amount of the yellow metal.

And this is what I believe the BRICS endgame will be - creating a new, asset-backed currency to challenge the USD’s global convertibility for international trade.

Source: @GCR_RealTimeNews

————————————-

Many Blessings,

Ai3D

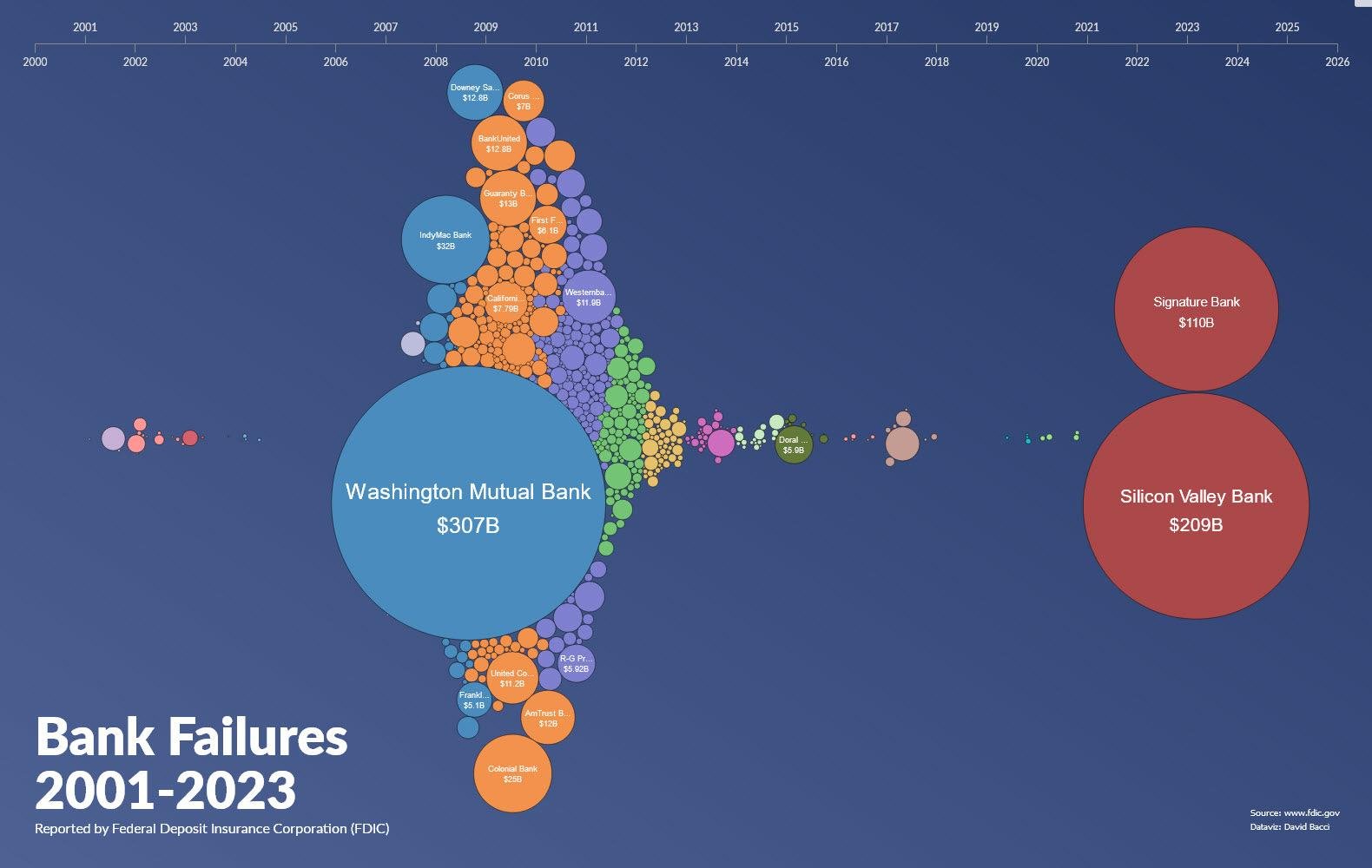

Awake in 3D: Visualizing Bank Failures from 2000 to Today

Awake in 3D:

Visualizing USA Bank Failures from 2000 to Today

Taken from FDIC data, this is an impressive graphical representation of bank failures by number of banks and their asset size.

The number of circles are the number of failed banks. The relative size of each circle represents the bank’s dollar assets (the bigger the circle, the bigger the bank).

Clearly, many banks failed as a result of the 2008-2012 Great Financial Crisis. Yet, most were relative small banks.

Looking at today, banks failures so far this year are few but much larger in dollar assets held.

Awake in 3D:

Visualizing USA Bank Failures from 2000 to Today

Taken from FDIC data, this is an impressive graphical representation of bank failures by number of banks and their asset size.

The number of circles are the number of failed banks. The relative size of each circle represents the bank’s dollar assets (the bigger the circle, the bigger the bank).

Clearly, many banks failed as a result of the 2008-2012 Great Financial Crisis. Yet, most were relative small banks.

Looking at today, banks failures so far this year are few but much larger in dollar assets held.

The bailouts this time around will be massive, and cause more persistent inflation. Which will cause the FED to raise interest rates. Which is what’s causing today’s bank failures to begin with.

Will First Republic be the next big circle? What a mess.

It’s such a wonderful Fiat Currency Debt System we have… the time for an alternative GCR grows ever nearer.

Source: @GCR_RealTimeNews

Many Blessings,

Ai3D

Awake-In-3D "The Truth About Zimbabwe's Plans to Launch a Gold Backed CBDC

Awake-in-3D

The Truth About Zimbabwe’s Plans to Launch a Gold-backed CBDC

This chart says it all. It’s not a list any country wants to be on.

While it’s a step in the right direction to possibly stem another Zimbabwe hyperinflation event, unfortunately, it’s not a definitive RV/GCR signpost.

And, it’s certainly not GESARA.

It’s local, not global. There’s no bearing on ZIM bonds, it’s only about saving their current Zimbabwe Dollar in the local economy.

When Zimbabwe joins BRICS+ we will see the marker of redeeming 2008 ZIM bonds.

Awake-in-3D

The Truth About Zimbabwe’s Plans to Launch a Gold-backed CBDC

This chart says it all. It’s not a list any country wants to be on.

While it’s a step in the right direction to possibly stem another Zimbabwe hyperinflation event, unfortunately, it’s not a definitive RV/GCR signpost.

And, it’s certainly not GESARA.

It’s local, not global. There’s no bearing on ZIM bonds, it’s only about saving their current Zimbabwe Dollar in the local economy.

When Zimbabwe joins BRICS+ we will see the marker of redeeming 2008 ZIM bonds.

It’s a step in the right direction. Yet it has little significance to any 2008 ZIM Bond holdings.

This is a local plan by the RBZ to stop its population from continuously converting their ZIM dollars into USDs and Euros (the same issue is ongoing in Iraq).

The reason people convert to USDs is because the local currency is very unstable (consistently loosing value to USDs and Euros). By Zimbabwe anchoring some of their currency to gold, they hope to reduce ZIM dollar instability and encourage more citizens to hold and spend ZIM dollars instead of other foreign currencies.

The question to be answered is how much gold will the RBZ use to back their currency and at what Gold:ZIM exchange rate. It’s also worth noting that this new plan is actually a gold-backed CBDC.

The bottom line is that we cannot exchange our ZIM “bonds” for the current ZIM gold-backed dollar “currency”. We need a GCR “Event” for that.

@GCR_RealTimeNews : GCR Real-Time News

Many Blessings,

Ai3D

Awake-In-3D: Stiff Drink Time! FDIC Discussses if "The Public" Should Be Informed About Bank Bailins

Awake-in-3D

Stiff Drink Time! FDIC Discusses if “The Public” Should be Informed About Bank Bail-ins

You may need to watch this clip several times.

Apparently, this is a recent, official FDIC senior management meeting where they discuss whether or not to inform the USA public about the risk of their bank deposits being bailed-in (frozen to protect the banks from insolvency).

I’ve tried to verify this video’s authenticity, but I couldn’t find evidence that it’s NOT authentic.

IF it is real, it’s very disturbing. Especially when they chuckle about the public having more confidence in the banking system than they do.

Awake-in-3D

Stiff Drink Time! FDIC Discusses if “The Public” Should be Informed About Bank Bail-ins

You may need to watch this clip several times.

Apparently, this is a recent, official FDIC senior management meeting where they discuss whether or not to inform the USA public about the risk of their bank deposits being bailed-in (frozen to protect the banks from insolvency).

I’ve tried to verify this video’s authenticity, but I couldn’t find evidence that it’s NOT authentic.

IF it is real, it’s very disturbing. Especially when they chuckle about the public having more confidence in the banking system than they do.

It’s also unsettling that they determine that “institutional and professional depositors” can understand the risks (because they can afford high-paid advisors), but the public should be kept in the dark.

They all know a financial crash is coming. Unnerving times indeed.

@GCR_RealTimeNews

————————————

Many Blessings,

Ai3

Awake-In-3D "GCR Infrasturcture? IMF & DCMA Announces Global Foreign Exchange Digital Currency

Awake-In-3D

RV/GCR infrastructure? IMF & DCMA Announces Global Foreign Exchange Digital Currency

When I first became involved in the RV/GCR 12 years ago, it was frequently stated that our RV currency exchange and bond redemption proceeds would be:

non-fiat, asset-backed money

managed by an intelligent computing network

traceable transactions to prevent criminal usage of RV funds

connected to all countries and currencies worldwide to create fair and equal economic prosperity

Back then there were no blockchains, digital tokens nor Ai technologies capable of such a GCR scenario. I thought it was unrealistic and impossible at the time.

Awake-In-3D

RV/GCR infrastructure? IMF & DCMA Announces Global Foreign Exchange Digital Currency

When I first became involved in the RV/GCR 12 years ago, it was frequently stated that our RV currency exchange and bond redemption proceeds would be:

non-fiat, asset-backed money

managed by an intelligent computing network

traceable transactions to prevent criminal usage of RV funds

connected to all countries and currencies worldwide to create fair and equal economic prosperity

Back then there were no blockchains, digital tokens nor Ai technologies capable of such a GCR scenario. I thought it was unrealistic and impossible at the time.

I concluded that such a GCR reality would have to have a centralized monetary unit, backed by gold/other assets, and managed by existing infrastructure such as the IMF or BIS.

Wait! But aren’t those organizations run by Bad Guys?

I was then informed (consistently) that there were many White Hats in place globally and positioned across the financial system at the IMF, BIS, Central Banks and national Treasury departments worldwide. Additionally, these Good Guys were actively building the system and preparing for an Event that would bring the RV/GCR into reality.

Of course, who knew it would take all this time to come into view? And what is the “Event” that would make it a reality?

I came to discover that the Event must be the logical conclusion of the current, global fiat currency experiment. After all, every fiat currency tried by any country over the past 2,000 years has failed and caused the eventual collapse of all great Civilizations or Empires that adopted a fiat currency.

However, never before has the entire planet adopted a concurrent fiat currency system like we have today.

Most don’t realize the fact that after WW2 (in 1944 Bretton Woods Agreement), the world officially recognized the US Dollar as the first Global Reserve Currency, and since the USD was gold-backed, every country that pegged their currency to the USD was also gold-backed. When the USA ended the Gold Standard in 1971 and became a 100% fiat currency, every other national currency became Fiat as well.

It’s also worth noting that the IMF was first created by the 1944 Bretton Woods Agreement.

Fast forward to today…

At the recent International Monetary Fund (IMF) Spring Meeting, a new “Universal Monetary Unit” named UniCoin was introduced by the Digital Currency Monetary Authority (DCMA).

Based on the information released, this new UniCoin has all of the RV Exchange features described above.

If there truly are secretive White Hats at the IMF and embedded throughout the Global Financial System, I cannot help but wonder if this is Universal Monetary Unit just announced is the Trojan Horse disguised as the coming, asset-backed (by Historical Royal/Elder Gold Certificates) Base Currency Unit by which all global currencies will be Reset, Revalued and rationed equally according to a country’s Economic Output (GDP) and Natural Resources relative to the new Universal Monetary Unit.

This system could easily RV currencies and bonds from Iraq, Vietnam, Zimbabwe, etc. to high values relative to an equalized USD and Euro (for example).

While I certainly recognize that such a system could also be used malevolently by the Bad Guys, I cannot see any other mechanism that could realize our RV/GCR out there. I certainly don’t subscribe to ET “Savior” intervention scenarios, nor a USA military-backed coup to force a NESAR/GESARA scenario.

If one considers the above with an open and unbiased approach, a devastating collapse of the current Fiat Debt System would bring about an unprecedented awakening and global Consciousness Shift. No one would want to keep the same leaders in charge who brought down the entire system on their watch.

At this point, it’s time for the White Hats to unveil Our GCR.

I don’t personally subscribe to an “all things financial and political are inherently evil” world view.

Blockchains, Digital Currencies, and Financial System infrastructures are merely Tools. It’s those who wield those tools that determine whether they’re utilized for good or evil.

Sure there are Bad Guys in positions of power and control. Yet there are certainly many Good Guys as well. One things for sure, the Current Debt System is imploding and will collapse in on itself. Every experienced, financial monetary system professional knows this. The BRICS nations also certainly know this.

What will eventually replace the old system upon its deathbed is not predictable. One just has to look around the world and observe the constant reports about gold as “real money” and new asset-backed currency plans in the works to ascertain what’s coming.

Good Guys or Bad Guys notwithstanding, it will come down to what “We the People” allow to replace the old financial system.

Source: @GCR_RealTimeNews

Many Blessings,

Ai3D