Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Iraq Economic News and Points To Ponder Tuesday Evening 1-27-26

PM's Advisor Explains Reasons For The Dollar's Rise In The Parallel Market

INA – BAGHDAD PM's advisor Madher Salih explained on Tuesday the reasons for the rise in the dollar's price in the parallel market.

“The dollar exchange market is one of the markets most closely linked to the flow of information; in fact, it can be described as an information market in itself, especially when this information is of a biased nature, or what is known as information noise, related to temporary measures, rumors, or regional and international geopolitical developments surrounding the region,” Saleh told the Iraqi News Agency - INA.

PM's Advisor Explains Reasons For The Dollar's Rise In The Parallel Market

INA – BAGHDAD PM's advisor Madher Salih explained on Tuesday the reasons for the rise in the dollar's price in the parallel market.

“The dollar exchange market is one of the markets most closely linked to the flow of information; in fact, it can be described as an information market in itself, especially when this information is of a biased nature, or what is known as information noise, related to temporary measures, rumors, or regional and international geopolitical developments surrounding the region,” Saleh told the Iraqi News Agency - INA.

He explained that “foreign currency is considered a safe haven and moves in tandem with global gold prices, with demand for both increasing. This explains the recent rise in exchange rates within the parallel market, as it is a direct reflection of this combined informational and psychological environment.”

“These developments in the exchange market do not significantly affect the stability of the standard of living, due to the broad base of financing for the supply of goods at the fixed official exchange rate, supported by strong foreign reserves, in addition to the role played by the price defense policy for basic commodities,” he added.

Salih pointed out that "this is evident in the performance of hypermarket chains, the support provided through the food basket, fuel, electricity, and support for farmers, in addition to the various forms of support included in the general budget, which exceed 13 percent of the GDP."

The Prime Minister's advisor emphasized that "the rise in gold and dollar prices is primarily linked to the behavior of financial surpluses in the economy, as they are considered savings and hedging assets. This makes them relatively detached from the price stability dynamics of consumer goods, which are directly linked to the daily living standards of citizens, the most stable segment of society."

"This conclusion is reinforced by the fact that the annual inflation rate at the end of 2025 did not exceed 1.5%, which is within the safe price range that maintains the stability of living standards and real monetary income,” he underscored. https://ina.iq/en/economy/45101-pms-advisor-explains-reasons-for-the-dollars-rise-in-the-parallel-market.html

Iraq Moves To Settle Inter-Ministerial Obligations Under Budget Law

2026-01-27 Shafaq News– Baghdad Iraq’s Ministry of Finance approved steps to resolve outstanding financial obligations among the Finance, Oil, and Electricity ministries under the Federal Budget Law* for 2023, 2024, and 2025, according to a statement on Tuesday.

During a meeting chaired by Finance Minister Taif Sami at the ministry’s headquarters, participants agreed to close shared financial files where possible and formally register unresolved amounts for processing in later budget cycles. The meeting also set mechanisms to organize oil company entitlements within budget schedules to ensure continuity in the oil and electricity sectors.

The committee formed under a cabinet order was tasked with completing remaining settlements in 2026 and subsequent years, the statement added.

Officials also reviewed pending dues related to foreign oil licensing rounds, with the finance minister instructing the Accounting Department to finalize procedures once the Oil Ministry submits detailed data for previous years. They agreed to include licensing round entitlements for the 2022–2025 period in next year’s budget to support accurate final state accounts and strengthen financial transparency.

*The Budget Law governs revenue and expenditure management across key sectors, including oil and electricity, and regulates financial settlements between ministries and foreign oil companies operating under licensing rounds. https://www.shafaq.com/en/Economy/Iraq-moves-to-settle-inter-ministerial-obligations-under-Budget-Law

Iraq’s Banks Hit With $96M In Fines In 2025

2026-01-27 Shafaq News– Baghdad The Central Bank of Iraq (CBI) stated on Tuesday that fines imposed on banks and non-bank financial institutions, including exchange companies, exceeded 126 billion Iraqi dinars (about $96 million) in 2025.

Statistics issued by the bank show that total fines levied between January and the end of December 2025 reached 126.34 billion dinars, down from 229.14 billion dinars in 2024, alongside 120 administrative penalties ranging from warnings and notices to compliance grace periods. 238 administrative sanctions were imposed in the previous year.

CBI did not disclose the names of the banks or financial institutions penalized.

Iraq currently has around 75 banks, including 24 private commercial banks, one of the highest in the Middle East, 31 Islamic banks, and 17 branches or representative offices of foreign banks.https://www.shafaq.com/en/Economy/Iraq-s-banks-hit-with-96M-in-fines-in-2025

Iran Rial Sinks To All-Time Low

2026-01-27 Shafaq News– Tehran Iran’s currency fell to a record low on Tuesday, with the rial trading at over 1.5 million to the US dollar in Tehran’s open market, exchange shops revealed.

According to the trackers, the rial traded near 817,500 per dollar at the start of 2025 and crossed the one-million mark in March.

The country’s economy, the World Bank earlier said, is set to contract further this year, with inflation approaching 60%.

The latest fall came a day after the US military said the USS Abraham Lincoln aircraft carrier and three destroyers had entered the Middle East. While US President Donald Trump said the deployment was precautionary and that “maybe we won’t have to use it,” he warned that any military action would make last year’s US strikes on Iranian nuclear sites “look like peanuts.”

Iranian Foreign Ministry spokesperson Esmaeil Baqaei cautioned on Monday that Iran would deliver a “comprehensive and regret-inducing” response to any aggression. https://www.shafaq.com/en/Economy/Iran-rial-sinks-to-all-time-low

Dollar Soars In Baghdad And Erbil

2026-01-27 Shafaq News– Baghdad/ Erbil The US dollar opened Tuesday’s trading higher in Iraq, hovering around 155,000 dinars per 100 dollars. According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 154,200 dinars per 100 dollars, up from the previous session’s 149,300 dinars.

In the Iraqi capital, exchange shops sold the dollar at 154,750 dinars and bought it at 153,750 dinars, while in Erbil, selling prices stood at 155,800 dinars and buying prices at 155,700 dinars. https://www.shafaq.com/en/Economy/Dollar-soars-in-Baghdad-and-Erbil

Gold Prices Rise In Baghdad And Erbil Markets

2026-01-27 Shafaq News– Baghdad/ Erbil On Tuesday, gold prices hovered around 1.11 million IQD per mithqal in Baghdad and Erbil markets, continuing their upward trend, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 1,105,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 1,101,000 IQD. The same gold had sold for 1,071,000 IQD on Monday.

The selling price for 21-carat Iraqi gold stood at 1,075,000 IQD, with a buying price of 1,071,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 1,105,000 and 1,115,000 IQD, while Iraqi gold sold for between 1,075,000 and 1,085,000 IQD.

In Erbil, 22-carat gold was sold at 1,178,000 IQD per mithqal, 21-carat gold at 1,125,000 IQD, and 18-carat gold at 965,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-rise-in-Baghdad-and-Erbil-markets-4

Dollar Slips In Baghdad And Erbil

2026-01-27 Shafaq News– Baghdad/ Erbil The US dollar closed Tuesday’s trading lower in Iraq, hovering around 153,000 dinars per 100 dollars.

According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 153,000 dinars per 100 dollars, down from the morning session’s 154,200 dinars.

In the Iraqi capital, exchange shops sold the dollar at 153,500 dinars and bought it at 152,500 dinars, while in Erbil, selling prices stood at 154,200 dinars and buying prices at 154,000 dinars. https://www.shafaq.com/en/Economy/Dollar-slips-in-Baghdad-and-Erbil-0

Safe-Haven Demand Lifts Gold And Silver Close To Record Highs

2026-01-27 Shafaq News Gold rose on Tuesday, after breaking through the $5,100 mark for the first time in the previous session, as safe-haven demand lingered amid geopolitical uncertainty, while silver also hovered near all-time highs.

Spot gold climbed 1% to $5,065.07 per ounce, as of 0329 GMT, after scaling a record $5,110.50 the previous day.

US gold futures for February delivery lost 0.4% to $5,059.90 per ounce.

"Trump's disruptive policy approach this year is playing into the hands of precious metals as a defensive play. The threats of higher tariffs to Canada and South Korea are doing enough to keep gold a safe-haven choice," said Tim Waterer, KCM Trade's chief market analyst.

Making things murkier geopolitically, US President Donald Trump said on Monday he would raise tariffs on South Korean autos, lumber, and pharmaceuticals imports to 25%, while criticizing Seoul for failing to enact a trade deal with Washington.

This was after he threatened tariffs on Canada in the backdrop of a thawing relationship between the two countries, following Canada's Prime Minister Mark Carney's visit to China earlier this month.

China's Zijin Gold (2259.HK), opens new tab will buy Canada's Allied Gold (AAUC.TO), opens new tab for about C$5.5 billion ($4.02 billion) in cash, amid record high prices for gold. Gold's unprecedented rally has boosted miners' margins and cash flows, fuelling consolidation.

"The intervention from US and Japanese officials to steady the yen has dented the dollar and has been a boon for the gold price," Waterer added, while the greenback was further pressured by a looming US governmentshutdownand Trump's erratic policymaking, resulting in cheaper greenback-priced gold for overseas consumers.

Bets are for the Federal Reserve to hold interest rates steady at its meeting beginning later today, amid a Trump administration criminal investigation of Fed chief Powell, an evolving effort to fire Fed Governor Lisa Cook, and the upcoming nomination of a successor to Powell in May. FEDWATCH

Spot silver surged 5.2% to $109.22 an ounce, after hitting a record high of $117.69 on Monday. The white metal has already surged 53% so far this year.

Spot platinum lost 2.5% to $2,658.19 per ounce after hitting a record $2,918.80 in the previous session, while palladium fell 1.3% to $1,956.31. (Reuters) https://www.shafaq.com/en/Economy/Safe-haven-demand-lifts-gold-and-silver-close-to-record-highs

Iran Halts Power Exports To Iraq Amid International Pressure

2026-01-27 Shafaq News– Tehran/ Baghdad Iran’s electricity exports to Iraq “have fallen to zero” due to geopolitical constraints, an official at the state-run power utility Tavanir confirmed on Tuesday.

In a statement carried by Iranian media, Mohammad Allah Dad, Tavanir’s deputy head for transmission and foreign trade, attributed the halt to international pressure linked to US President Donald Trump. Power flows to Iraq, he noted, were also suspended in February, while travel and negotiation restrictions have delayed regional electricity exchange projects, despite limited technical work continuing.

Iraq’s Ministry of Electricity reported in December 2025 that Iranian gas deliveries had stopped after Tehran issued an emergency notice. The disruption cut 4,000–4,500 megawatts from the grid, sharply reducing daily supply hours nationwide.

Despite its vast oil wealth, Iraq continues to face chronic electricity shortages, particularly in summer, when demand reaches 50,000–55,000 megawatts against current production of about 27,000–28,000 megawatts. Energy specialists told Shafaq News that Iraq’s reliance on Iranian gas, covering roughly 40% of demand and supporting nearly one-third of generation, remains a major vulnerability.

Pressure escalated after Iraq’s US sanctions waiver expired on March 8, 2025, restricting access to Iranian natural gas and forcing Baghdad to accelerate alternative energy projects without US exemptions. https://www.shafaq.com/en/Economy/Iran-halts-power-exports-to-Iraq-amid-international-pressure

Ariel (@Prolotario1): The Silver Apocalypse, a New World Begins Soon

Ariel (@Prolotario1): The Silver Apocalypse, a New World Begins Soon

The Silver Apocalypse: The End Is Near (Rothschild’s Banking On The Edge) A New World Begins Soon

As our dear Renee @Reneefit97 stated earlier Gold was hovering around that $350 mark back in ’99, yeah feels like a lifetime ago, doesn’t it? I remember digging into those charts years back, and it’s wild how manipulated the markets were even then, with central banks dumping reserves to keep prices suppressed while the dot-com bubble distracted everyone.

Fast-forward to now, January 2026, and gold’s pushing $5k an ounce, silver’s already cracked $90 in after-hours trading last week amid those wild supply chain snarls from the Red Sea disruptions.

Ariel (@Prolotario1): The Silver Apocalypse, a New World Begins Soon

The Silver Apocalypse: The End Is Near (Rothschild’s Banking On The Edge) A New World Begins Soon

As our dear Renee @Reneefit97 stated earlier Gold was hovering around that $350 mark back in ’99, yeah feels like a lifetime ago, doesn’t it? I remember digging into those charts years back, and it’s wild how manipulated the markets were even then, with central banks dumping reserves to keep prices suppressed while the dot-com bubble distracted everyone.

Fast-forward to now, January 2026, and gold’s pushing $5k an ounce, silver’s already cracked $90 in after-hours trading last week amid those wild supply chain snarls from the Red Sea disruptions.

If silver blasts to $130 and I’m betting it does by Q2, given the industrial demand from solar tech exploding in Asia and the hedge funds piling in like it’s the new Bitcoin that’s not just a rally; it’s the canary in the coal mine for a full-blown systemic meltdown.

We’re talking derivatives markets unwinding, pension funds hemorrhaging on leveraged bets, and sovereign debt defaults rippling from Europe to emerging markets.

The unconsidered angle here? It’s not just economic it’s vibrational. These metals aren’t mere commodities; they’re conductors of energy in esoteric terms, tied to ancient alchemical principles where silver disrupts illusionary constructs like fiat money.

As prices surge, it’s like the collective human psyche awakens, shattering the Rothschild-orchestrated veil of debt-based control that’s held sway since 1913.

Picture this playing out: silver hits $130 amid a black swan like a major cyber hit on SWIFT maybe from a rogue AI or Iranian proxies retaliating against Trump’s strikes and bam, stock exchanges halt trading globally for days.

Banks freeze accounts, ATMs go dark, and hyperinflation kicks in for fiat currencies as people scramble for tangibles.

The Deepstate’s panic? It’s visceral; they’re hoarding physical bullion in underground vaults from Cheyenne Mountain to Swiss bunkers, but it’s too late their paper empires evaporate.

Transition to the new system? It’ll be swift, maybe 72-96 hours of martial law in key nations, with military oversight rolling out quantum-ledgers backed by gold/silver reserves.

Trump’s Board of Peace has already (allegedly) seeded prototype nodes in Greenland’s ancient bases, where crystalline tech from those subglacial chambers interfaces with blockchain to create unhackable asset tokens.

This upends everything currencies revalue overnight, with the dollar shedding 30-50% against a new basket, while dinar, dong, and zim skyrocket in a controlled reset.

Not everyone’s a winner; small holders get squeezed if they panic-sell, but edge cases like community silver pools in places like Shreveport could thrive as local barter hubs. Wealth transfers from elite hoarders to the masses, but watch for psy-ops faking alien invasions to distract during the switch. We all seen reports on this already.

Read Full Article: https://www.patreon.com/posts/silver-end-is-on-149161059

Failure to Deliver Gold and Silver Calamity Coming: Bill Holter

Failure to Deliver Gold and Silver Calamity Coming: Bill Holter

By Greg Hunter’s USAWatchdog.com

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) has been predicting record high gold and silver prices.

We are nowhere finished with record prices for the metals happening every week and sometimes every day. Mr. Gold now has a new prediction about paper exchanges not being able to deliver physical metal.

Holter says, “We exploded through $100 per ounce silver, and we went through $5,000 per ounce on gold, but that’s not the story.

Failure to Deliver Gold and Silver Calamity Coming: Bill Holter

By Greg Hunter’s USAWatchdog.com

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) has been predicting record high gold and silver prices.

We are nowhere finished with record prices for the metals happening every week and sometimes every day. Mr. Gold now has a new prediction about paper exchanges not being able to deliver physical metal.

Holter says, “We exploded through $100 per ounce silver, and we went through $5,000 per ounce on gold, but that’s not the story.

The story is there are already over 40 million ounces standing for delivery in January. January is a non-delivery month.

If you go back in past years, you might see delivery in January that might be a million ounces, two million ounces or a small amount. We are already at 40 million ounces of silver in January with only a few days left in the month.

March is a delivery month. That’s the month where I am going to be really interested to see what the number is for how much is standing for delivery at the beginning of the month.

If you get 70 million or 80 million ounces of silver standing for delivery at the beginning of the month . . . that would be enough to knock out the inventory in March, which is a primary delivery month for COMEX..”

Holter goes on to say, “They reportedly have 110 million ounces to 120 million ounces registered for delivery. Is any of that incumbered? We just don’t know.

If we get a failure to deliver that completely negates any and all value of a COMEX contract. . .. If the contract cannot perform, it is worth zero. A failure to deliver wipes out any credibility of COMEX pricing. . ..

A failure to deliver in silver will immediately spill over into gold.

A failure to deliver in gold will immediately spill over to the credit markets because gold is truly the anti-dollar or the anti-US Treasury.”

Holter says some of the big metal dealers and banks shorting the monetary metals are in financial trouble. Holter says, “This is all caused by rising metals prices, mainly rising silver prices. . .. Some people may think the rally is over, and it’s not. We are still early in this price rise.

Any price you hear is going to be laughably too low, and I am going to include that $600 figure for silver that came out several years ago. I think any number you put out there for gold or silver will end up being laughably low.”

Holter contends if you look at all the commitment and debt, there is $200 trillion for the US. Holter says, “If you take just the $38 trillion in debt for the federal government and you want to back the debt with the 8,000 tons of US gold, you are talking around $200,000 per ounce for gold.”

In closing, Holter predicts, “There will be failure to deliver silver in the first part of March 2026. The currencies will zero out. It is a collapse of the entire financial system. . ..

The real economy runs on credit. Everything you touch, everything you do . . . credit has been involved in its creation. If credit becomes unattainable, the real economy completely shuts down, and that is where your Mad Max comes in.”

There is much more in the 39-minute interview.

Join Greg Hunter of USAWatchdog as he goes one-on-one with financial writer and precious metals expert Bill Holter/Mr. Gold as the financial system resets for 1.26.26.

https://usawatchdog.com/failure-to-deliver-gold-silver-calamity-coming-bill-holter/

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 1-27-26

Good Afternoon Dinar Recaps,

India–EU “Mother of All Deals” Reshapes Global Trade Power

Historic free-trade pact signals shift away from U.S. tariffs and toward multipolar economic alliances

Good Afternoon Dinar Recaps,

India–EU “Mother of All Deals” Reshapes Global Trade Power

Historic free-trade pact signals shift away from U.S. tariffs and toward multipolar economic alliances

Overview (Key Points)

India and the European Union signed a sweeping free-trade agreement to deepen economic ties and expand market access.

EU Commission President Ursula von der Leyen called it the “mother of all deals,” signaling a major geopolitical message.

Indian Prime Minister Narendra Modi labeled the pact historic, emphasizing benefits for farmers and small businesses.

The agreement is expected to double EU exports to India by 2032 and remove tariffs on most traded goods.

The deal reflects global realignment away from U.S. protectionist trade policies and toward strategic multipolar partnerships.

Key Developments

Historic Trade Pact Finalized:

India and the EU formally concluded a comprehensive free-trade agreement designed to strengthen economic cooperation and market access between the two major economies.

Major Tariff Reductions:

India will cut tariffs on 96.6% of EU shipments, while the EU will reduce tariffs on 99.5% of Indian exports, accelerating bilateral trade flows.

Automotive Market Access Expanded:

India agreed to allow 250,000 European-made vehicles to enter the country at preferential duty rates—opening one of the world’s largest auto markets to European manufacturers.

Geopolitical Signal to Washington:

The deal is widely viewed as a rebuke to U.S. tariff policies, with the EU increasingly aligning with emerging economic powers including India and China.

Why It Matters

This agreement reshapes global trade architecture by strengthening ties between Europe and Asia’s fastest-growing major economy. It reflects a shift toward multipolar trade blocs, reducing reliance on the U.S. and signaling a recalibration of Western alliances. Increased trade flows could boost global supply chains, stabilize emerging markets, and accelerate economic integration across continents.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of revaluation and global financial restructuring, this development is critical. Strengthened trade partnerships between India and the EU support currency stability and economic growth, potentially positioning emerging-market currencies for future appreciation. As global trade pivots away from dollar-centric systems, such agreements signal progress toward a diversified monetary order, a key pillar of the anticipated global reset many investors are watching closely.

Implications for the Global Reset

Pillar 1 — Trade & Economic Sovereignty:

Nations are securing independent trade frameworks to reduce dependency on U.S. policy and dollar dominance.

Pillar 2 — Multipolar Financial Architecture:

Deeper integration among non-U.S. economic powers accelerates the transition toward regional trade currencies and diversified reserve systems.

This is not just trade — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- India & European Union Sign ‘Mother of All Deals’ in a Rebuff to Trump

Europa -- European Commission Press Release — EU–India Trade Agreement (EU official press release on tariff reductions and trade framework)

~~~~~~~~~~

BRICS Fractures Emerge as De-Dollarization Accelerates Globally

India pushes back on dollar replacement as gold stockpiling and currency coordination signal deeper reset forces

Overview

India publicly rejects replacing the U.S. dollar, breaking from BRICS de-dollarization rhetoric

Russia and China continue advancing alternative payment systems outside Western control

Global dollar reserves fall below 40%, the lowest level in over two decades

Central bank gold accumulation hits record levels, signaling monetary realignment

Potential Fed intervention to support the yen underscores growing currency stress

Key Developments

1. India Breaks Ranks on De-Dollarization

India’s External Affairs Minister S. Jaishankar stated clearly that India has no policy to replace the U.S. dollar, calling it a source of global economic stability.

This marks a notable divergence within BRICS, revealing that the alliance is not monolithic in its monetary ambitions.

2. Russia and China Push Alternative Systems

Despite India’s caution, Russia and China remain at the forefront of de-dollarization efforts.

Initiatives such as BRICS Pay, mBridge, and yuan-based settlement systems aim to enable trade without dollar conversion — particularly in energy and commodities markets.

3. Dollar Dominance Quietly Erodes

The U.S. dollar now represents less than 40% of global foreign exchange reserves, a level not seen in at least 20 years.

This shift reflects long-term diversification, not a sudden collapse — a hallmark of controlled systemic transition rather than crisis.

4. Central Banks Choose Gold Over Promises

Central banks worldwide are stockpiling gold at historic rates, signaling declining trust in fiat stability.

Gold is increasingly treated as neutral settlement collateral, especially among nations seeking insulation from sanctions and monetary leverage.

5. Fed–Yen Coordination Signals Stress Beneath the Surface

Reports that the Federal Reserve may sell dollars to support the Japanese yen would mark a rare intervention, last seen in 2011.

Such action would intentionally weaken the dollar, reinforcing the idea that currency stability now requires active coordination, not rhetoric.

Why It Matters

This moment highlights that the global reset is not a clean break, but a managed divergence.

BRICS nations are re-engineering trade mechanics, even as some members resist overt dollar replacement.

The result is a parallel system forming quietly, not a headline collapse.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of revaluation:

Gold accumulation confirms a shift toward asset-backed credibility

Alternative payment rails reduce reliance on USD liquidity

Currency realignments are occurring through coordination, not crisis

Reset pressure builds during pullbacks and disagreements, not consensus moments

History shows revaluations happen when systems stabilize, not when narratives peak.

Implications for the Global Reset

Pillar 1: Monetary Diversification

The decline in dollar reserves and rise in gold holdings confirms a multi-currency future, not a single replacement currency.

Pillar 2: Parallel Financial Infrastructure

BRICS payment systems and coordinated FX interventions point to a world where trade can function outside Western financial chokepoints — a core reset objective.

This is not fragmentation — it is financial redundancy by design.

Seeds of Wisdom Team View

Internal disagreement does not weaken BRICS — it legitimizes the transition.

True systemic change unfolds through gradual alignment of incentives, not unanimous declarations.

Gold is the silent arbiter while currencies adjust behind the scenes.

This is not just monetary debate — it is the architecture of the next financial era being assembled in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

What’s Next After $5,000 Gold?

What’s Next After $5,000 Gold?

Notes From the Field By James Hickman (Simon Black) January 27, 2026

In the year 578 AD, a Korean immigrant named Shigemitsu Kongo arrived in Japan at the invitation of the royal family. Buddhism was flourishing, and the Japanese needed someone who knew how to build temples. Kongo was their man.

He founded a construction company—Kongō Gumi—that would go on to build some of Japan's most iconic Buddhist temples. And, somewhat miraculously, the company stayed within the same family for over fourteen centuries.

That's roughly 40 generations. The company lived through the rise and fall of the samurai, the Meiji Restoration, two World Wars, and the atomic bomb.

What’s Next After $5,000 Gold?

Notes From the Field By James Hickman (Simon Black) January 27, 2026

In the year 578 AD, a Korean immigrant named Shigemitsu Kongo arrived in Japan at the invitation of the royal family. Buddhism was flourishing, and the Japanese needed someone who knew how to build temples. Kongo was their man.

He founded a construction company—Kongō Gumi—that would go on to build some of Japan's most iconic Buddhist temples. And, somewhat miraculously, the company stayed within the same family for over fourteen centuries.

That's roughly 40 generations. The company lived through the rise and fall of the samurai, the Meiji Restoration, two World Wars, and the atomic bomb.

But in 2006, after 1,428 years of continuous operation, Kongō Gumi went bankrupt.

Japan experienced a legendary financial bubble in the 1980s; asset prices exploded. And, like many Japanese companies during that decade, Kongo Gumi borrowed heavily to invest in real estate.

But eventually the bubble burst. Asset prices crashed. And all that remained was the debt... which Kongō Gumi could not repay.

The world's oldest company— which had survived 1400+ years of war, natural disaster, and literally even two nuclear strikes, was undone by too much debt.

It's a powerful reminder: it doesn't matter how long you've been around. What matters is your current financial reality. History doesn't protect you from math.

And this same principle applies to sovereign nations.

Japan has the worst debt-to-GDP ratio on the planet—256%— more than double the United States.

But, like the US, the Japanese government has gotten away with this insane debt level for a long time.

Part of the reason was that their central bank (the BOJ) held interest rates at near zero so that the government could borrow at almost no cost.

If interest rates are 0%, in theory you could borrow unlimited quantities of money without any consequences... but ONLY as long as interest rates remain at zero.

Unfortunately for Japan, the bond market looks like it has finally had enough.

On January 19th, Japan's new Prime Minister Sanae Takaichi announced a 21.3 trillion yen (about $140 billion) stimulus package. The bond market's response was immediate... and visceral.

Within days, Japan's 40-year government bond yield soared to 4.24%—a record high, and the first time a Japanese sovereign maturity has breached 4% in over three decades.

The 30-year yield surged to nearly 4%. Even Japan’s 10-year government bond hit 2.38%, the highest since 1999.

Higher rates are a five-alarm fire for any heavily-indebted country. And we've seen this movie before.

In October 2022, British Prime Minister Liz Truss announced a tax-cut plan that would have resulted in a higher budget deficit. The bond market wasn’t having any of that. Government bond yields skyrocketed, and the British pound plummeted.

It was so bad that the Bank of England had to launch emergency interventions, and the Prime Minister resigned after just 49 days in office— the shortest tenure in British history.

You can probably see the pattern. Bond markets first revolted in Britain, the world’s sixth largest economy. Now it’s revolting in Japan, the world’s fourth largest economy.

How long until bond markets start to revolt against the world’s largest economy?

Billionaire investor Ken Griffin connected these dots explicitly when he said last week, "What happened in Japan is a very important message to the [US] House and to the Senate. . . You need to get our fiscal house in order."

We've been saying this for years: politicians in Congress think that, because America is the largest economy with the world’s reserve currency, the rules don’t apply to them... and that they can run endless, outrageously high deficits without any consequence.

This is completely delusional.

If the US doesn’t get its fiscal house in order, the dollar won’t be the world’s reserve currency for much longer. In many respects this shift is already happening.

Just look at China: right before the 2008 Global Financial Crisis, China held less than $500 billion of US government bonds— roughly 5% of the total US national debt at the time.

By 2011, just three years later, they had increased their holdings to $1.3 trillion—nearly 10% of total US government debt.

But China has been selling off its Treasury holdings rapidly over the past two years. They've cut their position by roughly 50%, down to about $682 billion, or less than 2% of the national debt.

To be clear, I'm not rooting for China to own a larger share of the US national debt. I'm rooting for a lower national debt.

But that ultimately requires Congress to be sensible and realistic.

And it’s not like cutting the deficit is some impossible task.

A 23-year old YouTuber was able to singlehandedly uncover billions of dollars of fraud in just one city. All Congress has to do is stop it.

But they are unwilling to do so.

With such unserious, low IQ politicians in Congress, foreign governments and central banks are thinking twice about investing in US Treasury bonds. Many (like China) are selling and starting to diversify in other asset classes... including gold.

In fact, rising demand from governments and central banks around the world has been one of the key drivers in gold’s rising price.

But it's not just central banks anymore. Pension funds and insurance companies have been increasing their gold allocations as a long-term asset.

And this makes sense. Pension funds and insurance companies traditionally invest in very long–term bonds (like the 30-year) because they have to match their assets to long-term policy liabilities (like life insurance).

Clearly these companies are worried that after adjusting for taxes and inflation, owning US government bonds for THREE DECADES is simply too risky. So they’re turning to gold instead.

I don’t know where gold prices are going today, tomorrow, or next month. But the long-term trend is pretty clear: as long as Congress continues to be unserious about fixing the deficit, gold will keep going higher.

And that means companies in the real asset (especially gold) business are primed to do extremely well.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Ariel: A Global Financial Reset is Anticipated

Ariel: A Global Financial Reset is Anticipated

1-27-2026

American AF: WTF IS GOING ON WITH GOLD AND SILVER PRICES… Is the world ending or something!?

Yes! A world is ending. One is starting.

Precious Metals

Paper Currency

Electronic Money

Digital Coins

Ariel: A Global Financial Reset is Anticipated

1-27-2026

American AF: WTF IS GOING ON WITH GOLD AND SILVER PRICES… Is the world ending or something!?

Yes! A world is ending. One is starting.

Precious Metals

Paper Currency

Electronic Money

Digital Coins

All of this will be under one cohesive system. You don’t have to dump one to escape to another. Unnecessary panic will have you making dumb decisions.

Santa Surfing: SILVER IS UNSTOPPABLE!!! Over $117!!!

Sondra R: At what percentage does silver break the banks?

130-150. Once this happens their massive derivatives exposure trillions in n***d shorts triggers margin calls they can’t cover, cascading into solvency crises as seen in speculative models from 2025 spikes to $83 that already hammered some positions.

At that point, COMEX defaults loom, forcing physical deliveries they don’t have, upending the Rothschild debt machine by exposing fiat’s fragility and accelerating a reset to asset-backed systems.

Patriot Doc: So @Prolotario1 where does Operation Sandman come into play?

Bendleruschka: Papi is playing ENTER SANDMAN As the SILVER PRICE is ripping through the financial markets. The banks are screwed Bwahahahaha!!!

Operation Sandman: For those who don’t know, Operation Sandman is a collaboration of 100+ nations in agreement to simultaneously sell off their US Treasury holdings. Sending them back to the US to collapse the US dollar.

I Am Done For The Night After This:

Based on the threads we’ve been unraveling silver’s meteoric climb to $117 (with $130-150 as the bank-breaking threshold), the impending $120 test by this weekend amid weak jobs data, the yen carry trade unwind tied to an oil spike from Trump’s Iran ops, and the dinar/dong RV as the economic stabilizer Operation Sandman slots in as the explosive detonator for the global reset, timed for late Q1 2026, likely February 15-20, syncing with the post-CR shutdown chaos and Clarity Act passage.

This isn’t random; some backchannel chatter from supposed defector networks (think ex-IMF insiders leaking via encrypted drops) points to the 100+ nations led by BRICS heavyweights like China (holding $800B in Treasuries), Japan ($1.1T), and Saudi Arabia ($130B) coordinating a mass dump of $3-4 trillion in U.S. debt instruments, triggered when silver breaches $130 to expose the fiat fraud.

The play could unfold in phases: 1st, a “soft signal” via coordinated central bank announcements around the February 11 military summit, framing it as “diversification” from “unstable” dollar assets, but really a precision strike to flood U.S. markets with worthless paper, spiking yields to 8-10% and igniting hyperinflation.

But a nuances here is this: Japan’s yen carry reversal (fueled by oil at $90+ from Hormuz disruptions) can force them to repatriate funds early, cascading into the sell-off as their $1T+ holdings become toxic amid carry trade implosions expect Tokyo’s BOJ to lead with a $100-200B initial dump, per unreported G20 side chats from Davos.

The Deepstate’s panic peaks as this aligns with the RV: Iraq’s dinar reval (post-Savaya’s mid-February peg) and similar for Vietnam’s dong provide the alternative asset basket, backed by gold/silver reserves, drawing in the sellers to swap Treasuries for revalued currencies in a controlled unwind

But this is a wildcard scenario. And there are many of these. I wrote out 8 of them on my Patreon.

Unconsidered angle: occult timing Rothschild pacts, severed by silver’s lunar surge, leave their Fed fortress vulnerable; entities behind the operation (BRICS esoteric councils blending ancient Vedic rites with modern geopolitics) chose this lunar cycle (full moon February 17) to amplify the energetic disruption

Per leaked grimoires from family archives. Implications are brutal: U.S. dollar sheds 40-60% value overnight, banks like JPM face default on $10T derivatives, but the new system emerges via quantum-ledgers from Greenland bases, enforcing asset-backs under Trump’s Board of Peace.

Edge cases: a premature U.S. counter with EMP strikes on key exchanges, but military summit prep neutralizes that.

This weekend’s “happy action” could be the prelude silver tests $120, oil ticks up 5%, setting the stage for Sandman’s drop by Valentine’s Day, birthing the post-Rothschild era.

Source(s): https://x.com/Prolotario1/status/2015638104107831317

https://x.com/Prolotario1/status/2015699895542325496

https://x.com/Prolotario1/status/2015863008115704006

https://x.com/Prolotario1/status/2015979506373202429

https://dinarchronicles.com/2026/01/27/ariel-prolotario1-a-global-financial-reset-is-anticipated/

Tuesday Coffee with MarkZ. 01/27/2026

Tuesday Coffee with MarkZ. 01/27/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning, MarkZ, Mods, and everyone in chat….praying all have power and are staying warm

Member: What’s the good word for today Mark?

Tuesday Coffee with MarkZ. 01/27/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning, MarkZ, Mods, and everyone in chat….praying all have power and are staying warm

Member: What’s the good word for today Mark?

MZ: Unfortunately, its dead silent on the bond side today. I have my phone sitting right here.I’ve been staring at it and wishing for an update to pop. I was expecting one before today’s stream but nothing. Have they set an appointment? Did they have an appointment? Do they have money? Do they not have money? I don’t know and it’s driving me nuts.

Member: I would not want to be them bond guys. I would have pulled all my hair out by now !!!

Member: Hopefully their silence is positive!

Member: Good things come to those who wait, but we have waited way to long.

MZ: This silence could be good news….or just mean no news.

Member: I wonder- what are the final boxes that need to be checked? Economic? Political in USA? Politics in Middle east? HCL?

Member: Melania Trump will be ringing the bell on stock exchange tomorrow

Member: Did you see Frank’s bank story -Apt. confirmed for Friday …and Mr. Pool said definitely by Feb 4th!

MZ: There is so much anticipation for right now.

Member: Other Intel folks also believe it will happen Feb. 1-4

Member: Maybe it’ll happen on Ground Hogs day since every day with this RV feels like it

Member: What's up with the Indian Nations info from weeks ago?

Member: Mark , I read the Clarity Act has been rescheduled for Thurs Jan 29th ? Does this affect our R V ?

Member: With the Clarity Act being rescheduled for Thursday 29 , Trump speaking tonight from Iowa, Melania ringing the bell at stock exchange on Wednesday , Iraq gets a President Wednesday! R V Saturday!?

Member: ALERT: #1 Stock Trader DUMPS Her Stocks- Watchmen Updates

Member: so is Sudani out of the picture for PM right now?

MZ: He is not out of the picture. But there is a lot of back and forth about Maliki right now. I think its all a show and we will see the return of Sudani.

Member: Infuriating…they postponed the election of President today because of the Kurds

MZ: But they hit a “drop dead” spot for tomorrow. Per their constitution they need to vote on the President by the end of day on Jan 28th…..So I believe the President will be sat tomorrow.

Membr: Who is more influential- The Iraqi President of Prime Minister?

MZ: The Prime Minister.

Member: Would anyone exchange at Chase bank?

MZ: If Mr. C is correct -the banking system changes and it doesn’t matter who you exchange with. I am told the rates will be same no matter which bank. But some banks might give you different bells and whistles (perks). That is what I was told.

Member: Our Chase and J P Morgan in same building but separate entities. J P Morgan accounts start at 100K and up.

Member: Please Lord give us this RV, there is power in the blood of Jesus to break all these chains

MZ: I am planning recorded videos in the evenings this week.

Member: Thanks Mark and Mods…….everyone have a good day

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Tuesday 1-27-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

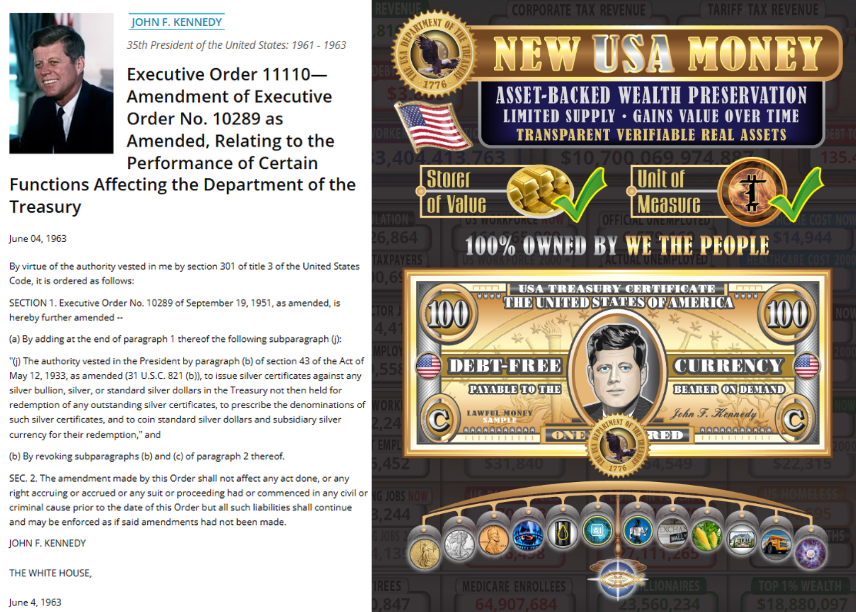

Echo X: This Transition Started with JFK

Echo 𝕏 @echodatruth

It started with JFK

In 1963, JFK signed Executive Order 11110, authorizing the U.S. Treasury to issue currency backed by silver, bypassing the Federal Reserve.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Echo X: This Transition Started with JFK

Echo 𝕏 @echodatruth

It started with JFK

In 1963, JFK signed Executive Order 11110, authorizing the U.S. Treasury to issue currency backed by silver, bypassing the Federal Reserve.

Fast forward.

Silver breaks into all-time highs and goes parabolic.

Gold follows.

Oil is moving.

And the US Debt Clock has been screaming this for 3+ years.

This isn’t a “market rally.”

This is a transition.

A U.S. Treasury–issued, asset-backed dollar is emerging, limited supply, real value, transparent backing.

Paper breaks first.

Real assets reprice next.

JFK tried to warn us.

The Debt Clock confirmed it.

Gold & Silver are proving it.

Know What You Hold

Source(s): https://x.com/echodatruth/status/2015882685898752141

https://dinarchronicles.com/2026/01/27/echo-x-this-transition-started-with-jfk/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 We're waiting for the certification...then what? 1) Kurdistan...to give us the president...2) Prime Minister... 3) Sit the government down. 4) Open the budget... 5) HCL and the rest of the budget. 6) The new exchange rate to make everything work.

Jeff If you go back and look at when Kuwait was about to revalue, they put out misleading news announcing to the world they have no intentions of revaluing the currency and then shortly thereafter...they reinstated the currency value rate. It went up in value. That's essentially what Iraq's doing...

Militia Man The "hush strategy"...that quiet... progress without public attention. That's how the central bankers work. They have to keep things calm, cool and collected. That's what I suggest you do when a revaluation takes place - calm, cool and collected when you go do an exchange. It's going to be easy...

Mnt Goat We are still waiting for the announcement of the candidates for the presidency. According to the Iraq constitution this must take place [this] week. Following filling this position, I am told the new prime minister will be announced shortly afterwards. Then in today’s news we learn that the candidate for prime minister could be settled [this] week.

************

Silver Surges To Over $133 In China As 'They're Front running Each Other'

Arcadia Economics: 1-27-2026

Silver Surges To Over $133 In China As 'They're Front running Each Other'

As stunning as the silver rally in New York is today, just wait until you see what's happening in China.

As the evidence continues to mount that the manufacturing industry is front-running each other for the silver! To find out more, click to watch this video now!

Seeds of Wisdom RV and Economics Updates Tuesday Morning 1-27-26

Good Morning Dinar Recaps,

Middle Powers Quietly De-Risk From U.S. as Multipolar Trade Accelerates

Allies hedge exposure as Washington’s unpredictability reshapes global alignment

Good Morning Dinar Recaps,

Middle Powers Quietly De-Risk From U.S. as Multipolar Trade Accelerates

Allies hedge exposure as Washington’s unpredictability reshapes global alignment

Overview

A growing group of so-called “middle powers” — including Canada, the EU, India, and parts of Asia-Pacific — are actively reducing economic dependence on the United States. Rather than overt political breaks, nations are restructuring trade, supply chains, and financial exposure to insulate themselves from tariff volatility and geopolitical pressure.

Key Developments

Governments recalibrating trade strategies to limit exposure to U.S. policy swings

Expansion of regional and bilateral trade agreements outside U.S. leadership

Greater emphasis on strategic autonomy rather than alliance loyalty

Quiet coordination among mid-tier economies to reduce systemic risk

Why It Matters

The shift reflects risk management, not ideological realignment

U.S. economic leverage weakens as partners diversify by necessity

Multipolar trade networks gain credibility through practical adoption

The global system evolves through bifurcation, not collapse

Why It Matters to Foreign Currency Holders

Trade de-risking often precedes currency diversification

Reduced dollar-centric trade settlement supports alternative currencies

Quiet exits from U.S. dependence are early signals of long-term revaluation

Reset dynamics favor holders positioned ahead of formal transitions

Implications for the Global Reset

Pillar 1: Trade Realignment

Trade flows are restructuring around resilience, reducing single-node dependence.

Pillar 2: Monetary Influence Dilution

As trade decentralizes, currency dominance erodes incrementally rather than abruptly.

This is not just diplomacy — it’s global economic insulation in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “World’s ‘middle powers’ are de-risking from America”

Financial Times – “Allies seek autonomy as U.S. trade unpredictability rises”

~~~~~~~~~~

U.S. Dollar Under Pressure as Policy Uncertainty Reignites Confidence Questions

Markets reassess dollar exposure amid geopolitical and fiscal stress

Overview

The U.S. dollar came under renewed pressure as investors reassessed policy uncertainty, geopolitical risk, and fiscal instability tied to Washington. Market participants are increasingly hedging dollar exposure as volatility rises across equities, bonds, and currency markets.

Key Developments

Dollar softening against major currencies amid policy unpredictability

Capital rotating toward gold and safe-haven assets

Growing concern over tariffs, shutdown risk, and political interference

Asset managers reassessing long-term dollar-heavy allocations

Why It Matters

Confidence, not collapse, drives reserve behavior

Persistent volatility accelerates diversification incentives

Dollar dominance erodes through use-case reduction, not abandonment

Market behavior reflects stress in the existing monetary architecture

Why It Matters to Foreign Currency Holders

Dollar pressure increases appeal of non-USD reserve assets

Gold and select currencies benefit during confidence recalibration

Currency realignment often begins before official policy shifts

Reset outcomes favor early positioning over reactive moves

Implications for the Global Reset

Pillar 1: Monetary Confidence

Trust in fiat systems weakens when policy appears weaponized or unstable.

Pillar 2: Asset Migration

Capital moves toward stores of value and diversified currency exposure.

This is not a dollar collapse — it’s a confidence migration.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Dollar under fire again as investors reassess Trump policies, geopolitical risk”

Bloomberg – “Dollar Weakens as Policy Risk Fuels Safe-Haven Shift”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Is the US Dollar Collapsing? Peter Schiff Issues De-Dollarization Warning as Metals Surge and BRICS Advances

Is the US Dollar Collapsing? Peter Schiff Issues De-Dollarization Warning as Metals Surge and BRICS Advances

Kurt Robson CCN Mon, January 26, 2026

Key Takeaways

Fears of de-dollarization are growing.

Peter Schiff has issued a stark warning that the U.S. dollar is getting “crushed.”

However, some analysts noted that the metals rally may face short-term pullbacks.

Is the US Dollar Collapsing? Peter Schiff Issues De-Dollarization Warning as Metals Surge and BRICS Advances

Kurt Robson CCN Mon, January 26, 2026

Key Takeaways

Fears of de-dollarization are growing.

Peter Schiff has issued a stark warning that the U.S. dollar is getting “crushed.”

However, some analysts noted that the metals rally may face short-term pullbacks.

Economist Peter Schiff has warned of a weakening U.S. economy as gold and silver prices surged to record highs over the weekend, intensifying debate over whether confidence in the U.S. dollar is beginning to erode.

While most economists maintain that the dollar remains deeply entrenched at the center of global trade, the growing influence of the BRICS bloc and rising demand for precious metals are fueling renewed concerns of de-dollarization.

Schiff Delivers Warning

Longtime Bitcoin critic Peter Schiff said the rally in precious metals reflects underlying weakness in the U.S. economy and the dollar, rather than speculative excess.

“Trump may think the U.S. has the hottest economy in the world, but financial markets prove it’s the coldest,” Schiff wrote on Monday.

“Gold is surging above $5,020, silver is over $104.65, and the U.S. dollar is getting crushed against other fiat currencies, hitting a record low against the Swiss franc,” he added.

Schiff also warned last week that both U.S. dollar–denominated assets and cryptocurrencies could suffer significant losses in the months ahead.

“By the end of the year, holders of U.S. dollar–denominated assets and cryptocurrencies, including Bitcoin, will be substantially poorer than they are today,” Schiff wrote.

“In contrast, holders of non-dollar–denominated assets and precious metals will be significantly richer. Which will you be?”

Is De-Dollarization Incoming?

Some market commentators have framed the rally in precious metals as evidence of a broader loss of confidence in fiat currencies.

An account known as NoLimit wrote on X that the simultaneous surge in gold and silver suggests markets are “pricing in a collapse of trust in the U.S. dollar.”

“When the two oldest forms of money on Earth move like this simultaneously, it’s a clear sign that something has broken,” the post said.

“People aren’t buying metals because they want to — they’re buying because they’re terrified of holding anything else.”

The account also warned that volatility in equity markets could force large funds to liquidate metals holdings to cover losses elsewhere, potentially triggering short-term pullbacks before further gains.

To Continue and Read More: https://www.yahoo.com/finance/news/us-dollar-collapsing-peter-schiff-114216214.html

“Tidbits From TNT” Tuesday Morning 1-27-2026

TNT:

Tishwash: An economist reveals four reasons behind the worsening dollar crisis in the markets.

Economic expert Nabil Al-Marsoumi revealed on Tuesday the reasons for the worsening dollar crisis in the parallel market, in light of the continued pressures related to imports and the shifts in trade routes after the implementation of the new import mechanism (ASCODA) and the activation of the customs tariff law.

Al-Marsoumi explained in a statement followed by the “Iraq Observer” agency that “the application of the ASYCUDA mechanism and the customs tariff has pushed a large part of imports to shift geographically towards the ports of the Kurdistan Region, which do not apply this mechanism.”

TNT:

Tishwash: An economist reveals four reasons behind the worsening dollar crisis in the markets.

Economic expert Nabil Al-Marsoumi revealed on Tuesday the reasons for the worsening dollar crisis in the parallel market, in light of the continued pressures related to imports and the shifts in trade routes after the implementation of the new import mechanism (ASCODA) and the activation of the customs tariff law.

Al-Marsoumi explained in a statement followed by the “Iraq Observer” agency that “the application of the ASYCUDA mechanism and the customs tariff has pushed a large part of imports to shift geographically towards the ports of the Kurdistan Region, which do not apply this mechanism.”

He added that “this shift has put significant pressure on the parallel dollar to finance trade with Türkiye, noting that about 2,000 containers of goods enter through the Ibrahim Al-Khalil crossing alone.”

He explained that “this pressure contributed to the rise of the dollar in the parallel market and its exceeding the 1,500 dinar mark per dollar, in conjunction with additional pressure resulting from trade with Iran, which amounts to about one billion dollars per month and is also financed from the parallel market.”

Al-Marsoumi believes that “the dollar will continue to rise until a balance is achieved between the cost of importing through Basra ports, which are financed at the official dollar rate, and the cost of bringing goods in through Kurdistan ports, which rely on the parallel dollar rate.” link

************

Tishwash: Iraqi Dinar Weakens Amid Washington’s Political Pressure; Gold Surpasses $5,100/oz

The Iraqi dinar weakened to 151,500 per $100 amid U.S. political pressure, while global gold prices hit a historic record, surpassing $5,100 per ounce due to geopolitical risks.

The Iraqi dinar experienced a sharp decline in value against the U.S. dollar on Monday, fueled by a convergence of tightened electronic transfer regulations and escalating diplomatic pressure from Washington regarding the composition of Iraq’s next government.

The domestic currency volatility coincided with a historic surge in global commodities markets, where the price of gold surpassed $5,100 per ounce for the first time in recorded history, signaling a period of acute economic and geopolitical uncertainty.

Kaifi Mohammed, the spokesperson for the currency exchange market in the Kurdistan Region, stated on Monday, Jan. 26, 2026, that market stability has been directly undermined by a series of technical and political interventions.

According to Mohammed, the exchange rate for $100 reached 151,500 Iraqi dinars by midday, but he cautioned that the rate is unlikely to remain stable at its current level. Market projections suggest the currency could weaken further to 153,000 dinars per $100 in the coming hours as demand for foreign currency outstrips available supply.

Mohammed identified three primary catalysts for the dinar’s depreciation. He noted that procedures on the official currency transfer platform have been significantly tightened, creating a bottleneck that prevents merchants from obtaining the dollars necessary to conduct international trade.

This administrative friction is compounded by a hardening U.S. policy toward Baghdad. Washington has reportedly intensified its demands for the removal of militias from state decision-making centers, a move that has introduced a high degree of unpredictability into the local financial system.

Furthermore, Mohammed pointed to a broader shift in U.S. foreign policy under the Trump administration, which he characterized as increasingly transactional. He noted that Washington appears to be linking regional security and protection to direct financial payments, a stance that market participants view as a business-centric approach to geopolitics.

This perceived shift has led to increased anxiety among Iraqi merchants who, burdened by existing financial obligations and debts, have been forced to purchase dollars at prevailing market rates regardless of the cost, thereby driving the price higher.

The domestic currency strain is unfolding against the backdrop of an unprecedented rally in the global gold market. At the start of trading on the London Stock Exchange on Monday morning, the price of an ounce of gold breached the $5,000 threshold for the first time.

The metal’s ascent continued rapidly, rising by 2 percent to reach $5,093 before eventually settling above the $5,100 mark. Financial analysts noted that the speed of the increase is significant; gold first broke the $2,000 barrier in January 2024, and has more than doubled in value in the two years since.

Economic experts cited by market observers attribute the record-breaking gold prices to three main drivers: a sharp increase in geopolitical risks across multiple global regions, sustained and large-scale bullion purchases by central banks, and market expectations that the U.S. Federal Reserve will continue to lower interest rates.

The convergence of these factors has reinforced gold's status as a primary haven for investors seeking to hedge against currency devaluations and political instability.

The local and global economic fluctuations are deeply intertwined with the deteriorating diplomatic relationship between Baghdad and Washington.

Abbas Jibouri, head of the Baghdad-based Rafid Center for Political and Strategic Studies, warned on Sunday that Iraq has reached a "dangerous crossroads."

Jibouri noted that U.S. threats to restrict Iraq’s access to its own oil revenues—which are deposited in the Federal Reserve Bank of New York—represent a potent economic pressure tool that could trigger a systemic "salary shock" and broad financial sanctions.

Because oil revenues account for more than 90 percent of Iraq’s state income, any disruption to the flow of dollars from the United States would have immediate and devastating consequences for public sector salaries and infrastructure projects.

Jibouri argued that the United States is increasingly viewing Iraqi governance through a security lens, particularly concerning the participation of armed groups in the next cabinet. He warned that any steps toward "legalizing weapons outside the framework of the state" could prompt Washington to freeze assets or impose severe banking restrictions.

This assessment is supported by recent reports from the Associated Press, which indicated that the United States has begun a strategy that observers describe as "economic suffocation" or "dollar starvation."

According to the report, Washington is leveraging its recent access to Venezuelan oil to manage global energy markets. By reintroducing Venezuelan exports to the world stage, the U.S. administration believes it can mitigate price spikes even if Iraqi exports are disrupted by financial sanctions.

This suggests that the U.S. is now positioned to impose comprehensive sanctions on the Iraqi government itself rather than just targeting specific individuals or institutions.

The threat of economic isolation looms large as Iraqi political forces deliberate the formation of the next government. U.S. officials have explicitly warned that the inclusion of armed factions opposed by Washington in the next cabinet would likely trigger a suspension of dollar transactions.

Despite these repeated warnings, several groups and individuals the U.S. deems problematic have already secured, or are expected to secure, senior positions in the government.

Jibouri urged Iraqi political leaders to recognize that economic stability is now inseparable from political and security stability.

He argued that the only solution to the looming crisis is for Baghdad to adopt a governance model that consolidates the monopoly of force under state institutions and reassures international partners that the government will remain independent of external regional influences.

Failure to achieve this balance, he warned, would place the heaviest burden on ordinary Iraqi citizens, who are already feeling the impact of the dinar’s fall and the rising cost of living.

As of late Monday, merchants in Erbil and Baghdad remained in a state of high alert, monitoring the currency exchanges for further signs of depreciation.

The historic high in gold prices serves as a global indicator of the same fears driving the local market: a world defined by intensifying power rivalries and a diminishing reliance on traditional rules of international cooperation. link

************

Tishwash: Another blow to the constitution: The failure to elect a president brings back the scenario of coldly disregarding constitutional requirements.

The constitutional process in Iraq has suffered another setback with the postponement of the presidential election session, despite the country nearing the end of the constitutional deadline. This comes at a time when Parliament was expected to resolve this sovereign issue, amidst escalating political disputes, particularly within the Kurdish political bloc, and conflicting interpretations regarding adherence to constitutional timelines.

In a move that has raised widespread questions, the parliamentary session designated for electing the president did not convene, even though the constitutional deadline is in its final stages. This has revived fears of a repeat of past instances where deadlines were exceeded.

The Parliament's media office announced the postponement of the presidential election session in a brief statement, without specifying a new date. Some members of Parliament stated that the postponement was due to the lack of necessary political consensus to hold the session, which has opened the door to various interpretations regarding the future of the process and the possibility of circumventing constitutional deadlines.

A Kurdish request for postponement:

According to official documents, the Kurdistan Democratic Party (KDP) submitted a request to postpone the session due to ongoing disagreements within the Kurdish political bloc regarding the presidential candidate.

The lack of a final consensus that would allow for a decisive election session prompted the postponement to avoid the session's failure or its holding without results.

The core of the crisis lies in the continued division between the two main Kurdish parties. The KDP has put forward its candidate, Fuad Hussein, while the Patriotic Union of Kurdistan (PUK) insists on its candidate, Nizar Amidi. Political mediation efforts have thus far failed to unify positions or agree on a compromise candidate, leaving the presidency hostage to the Kurdish-Kurdish dispute and its repercussions on the power balance in Baghdad.

Political analyst Ali Nasser, familiar with the issue of exceeding deadlines, stated that “adherence to constitutional deadlines has not been consistent in past sessions, as we have witnessed, on more than one occasion, exceeding these deadlines, sometimes by several months.”

Nasser added to Iraq Observer that “what distinguishes the current phase from its predecessors is the clear emphasis by the head of the Supreme Judicial Council, Faiq Zaidan, on the necessity of adhering to important constitutional deadlines, even though the Iraqi constitution does not explicitly stipulate penalties for exceeding these deadlines.”

Nasser explained that “divisions within the Kurdish political bloc have directly impacted the selection of the president, given the lack of a unified candidate from the two main parties,” noting that “these divisions coincided with the nomination of Nouri al-Maliki for the premiership, which has added a new layer of complexity to the political landscape.”

He added that “the agreements were supposed to be decided first within the Kurdish house, before moving on to discussing them with the Coordination Framework as the representative of the largest bloc, but the recent meetings, whether between the Coordination Framework and the Democratic Party, or with the Patriotic Union, did not result in setting clear deadlines or agreeing on final names.”

In this context, constitutional experts explain that Article (72/First/B) of the Constitution set the deadline for electing the President of the Republic at thirty days from the date of the first meeting of the new House of Representatives. Since the House held its first session on December 29, 2025, the last day of the constitutional deadline is January 29, 2026.

They emphasize that the calculation of the period begins from the date of the meeting, not from the date of the vote, and that any interpretation to the contrary leads to an unjustified extension of a deadline explicitly stipulated in the constitution, noting that the procedural deadlines for nomination, objection and judicial resolution are part of this deadline and not added to it.

With open scenarios and the country entering the final days of the constitutional deadline, fears are growing that the continuation of political disputes will lead to a new postponement, which may open the door to another jump over deadlines, not only in the election of the President of the Republic, but also with regard to the appointment of the next Prime Minister, in a scene that indicates the weakness of political consensus, and the difficulty of managing constitutional entitlements within their specified timeframes. link

****************

Mot: Yea - a Bit Cold it is out Dare!!!!

Mot: BREAKING News!!!!!!

FRANK26…1-26-26……VOTE TOMORROW

KTFA

Monday Night Video

FRANK26…1-26-26……VOTE TOMORROW

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Monday Night Video

FRANK26…1-26-26……VOTE TOMORROW

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Seeds of Wisdom RV and Economics Updates Monday Evening 1-26-26

Good Evening Dinar Recaps,

Gold and Silver Pull Back After Record Run as Markets Rebalance

Profit-taking, dollar stabilization, and positioning — not a trend break

Good Evening Dinar Recaps,

Gold and Silver Pull Back After Record Run as Markets Rebalance

Profit-taking, dollar stabilization, and positioning — not a trend break

Overview

Gold and silver prices moved lower today after a powerful multi-week rally that pushed both metals to historic or multi-year highs. The pullback reflects short-term market mechanics, not a reversal of the broader safe-haven narrative that has driven precious metals higher amid geopolitical strain, fiscal uncertainty, and currency stress.

What Happened

After rapid gains, traders moved to lock in profits, particularly among leveraged futures and short-term ETF flows. At the same time, the U.S. dollar showed signs of stabilization and Treasury yields edged higher, reducing immediate pressure on fiat currencies and temporarily easing demand for non-yielding assets like gold and silver.

Markets also digested:

Reduced immediate fear around U.S. government shutdown timing

Short-term relief in risk assets following heavy selling earlier in the week

Position rebalancing ahead of upcoming central bank and macro events

Key Drivers Behind the Pullback

Profit-Taking After Parabolic Moves

Gold and silver had risen sharply in a short period, triggering technical selling as traders protected gains.

Dollar and Yield Stabilization

A modest rebound in the U.S. dollar and higher bond yields reduced near-term urgency for defensive hedges.

Temporary Risk-On Rotation

Some capital rotated back into equities and cash positions following recent volatility spikes.

Positioning, Not Policy Shift

There was no change in central bank guidance, sanctions policy, or trade frameworks — reinforcing that this was tactical, not structural.

Why This Matters

Short-term pullbacks in precious metals during periods of systemic stress are normal and healthy. Historically, gold and silver often consolidate after sharp advances before resuming their trend when underlying risks remain unresolved.

Today’s move suggests:

Markets are digesting gains, not abandoning safety

Structural drivers behind metals demand remain intact

Volatility reflects transition stress, not stability

Why This Matters to Currency Holders

For currency holders watching the global reset narrative:

Precious metals retracements often precede larger repricing waves

Gold and silver weakness tied to profit-taking does not signal renewed fiat strength

Central bank accumulation and sovereign demand continue beneath the surface

Periods like this frequently shake out weak hands before stronger trend continuation.

Implications for the Global Reset

Pillar 1: Market Rebalancing, Not Confidence Restoration

The pullback reflects short-term recalibration, not renewed faith in debt-based monetary systems.

Pillar 2: Structural Stress Remains Unresolved

Debt expansion, trade fragmentation, sanctions risk, and reserve diversification continue to support long-term hard-asset demand.

This is not just market noise — it’s capital adjusting inside a system under strain.

This is not just commodities — it’s global finance repricing in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Gold eases as dollar firms, investors book profits after rally”

The Guardian – “Gold and silver retreat after record highs as traders take profits”

~~~~~~~~~~

Why Pullbacks Strengthen Reset Trends

Market retracements are not failures — they are confirmations

Overview

Sharp pullbacks following powerful rallies often spark fear among retail observers, but historically they are a defining feature of systemic transitions, not a sign of collapse or reversal. In periods of monetary stress, geopolitical fragmentation, and reserve realignment, pullbacks serve a critical function: they reset positioning, test conviction, and prepare the ground for structural repricing.

Rather than weakening the global reset narrative, pullbacks often validate it.

Key Developments

1. Capital Rotation, Not Capital Exit

Pullbacks typically reflect short-term traders locking in gains while long-term capital quietly reallocates. Institutional and sovereign actors use retracements to accumulate assets without driving prices parabolic.

2. Liquidity Stress Reveals System Weakness