Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Wednesday Evening 12-31-25

Happy New Years Eve Dinar Recaps,

Russia’s New Goal: Carve “Buffer Zones” Deep Into Ukraine

Territorial expansion reframed as defensive security

Happy New Years Eve Dinar Recaps,

Russia’s New Goal: Carve “Buffer Zones” Deep Into Ukraine

Territorial expansion reframed as defensive security

Overview

Russia is formalizing territorial expansion under the justification of border security.

“Buffer zones” are being carved into Ukraine’s Sumy and Kharkiv regions, far beyond earlier front lines.

The strategy signals long-term occupation, not temporary military pressure.

Moscow appears to be reshaping negotiation baselines ahead of any peace talks.

This marks a strategic escalation, not a defensive pause.

Key Developments

Russia’s top military commander, General Valery Gerasimov, ordered forces to continue expanding buffer zones during a visit to the “North” military grouping.

The directive is explicitly framed as protecting Russian border regions such as Kursk and Belgorod.

Russian officials claim approximately 950 square kilometers and 32 settlements have been seized, though figures remain unverified.

President Vladimir Putin publicly endorsed the buffer zone concept, calling it “very important” after Ukraine’s August 2024 incursion into Kursk.

The operations extend the conflict well beyond the Donbas, opening sustained pressure along Ukraine’s northern frontier.

Why It Matters

This move institutionalizes territorial conquest by recasting offensive action as defensive necessity.

By embedding occupation within a “security” framework, Moscow creates facts on the ground that can later be presented as non-negotiable conditions in peace talks. The buffer zone narrative also seeks to normalize expansion for domestic audiences while blunting international criticism by linking actions to retaliation and border protection.

Why It Matters to Foreign Currency Holders

Expanded conflict zones introduce heightened geopolitical risk premiums, especially across Eastern Europe.

Prolonged instability affects energy routes, grain exports, and regional trade corridors.

Sustained military escalation increases pressure on sovereign budgets, debt issuance, and reserve deployment.

Currency volatility tends to rise when conflicts shift from limited theaters to permanent territorial control.

For currency holders, buffer zones represent long-term fragmentation, not short-term shocks.

Implications for the Global Reset

Pillar: Territorial Control Precedes Political Settlement

Military realities are shaping diplomatic outcomes before negotiations begin.Pillar: Security Narratives Justify Structural Change

Redrawing borders under “defense” alters trade, finance, and settlement flows.

As conflicts harden into permanent lines, global realignment accelerates quietly through risk repricing and regional decoupling.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Russia pushes deeper into northern Ukraine, citing border security”

Modern Diplomacy – “Russia’s New Goal: Carve ‘Buffer Zones’ Deep Into Ukraine”

Institute for the Study of War – “Russian Offensive Campaign Assessment”

~~~~~~~~~~

Why Zaporizhzhia Power Plant Could Derail Russia-Ukraine Peace Talks

Europe’s largest nuclear facility becomes a geopolitical fault line in stalled negotiations

Overview

The Zaporizhzhia Nuclear Power Plant (ZNPP) has regained a secondary external power line, temporarily improving safety conditions

The facility remains under Russian control, despite international recognition of Ukrainian sovereignty

ZNPP ownership and operation are unresolved in U.S.-brokered peace talks between Kyiv and Moscow

Control of nuclear energy infrastructure is now intertwined with territorial, economic, and security demands

Key Developments

The International Atomic Energy Agency (IAEA) confirmed repairs to a backup power line supplying the ZNPP, reducing immediate shutdown risk

Ukraine’s energy ministry said the repairs stabilize off-site power if the primary Dniprovska line is damaged

The six-reactor facility remains in cold shutdown, though it still requires constant electricity to maintain safety systems

Russia continues to assert operational authority through Rosatom, claiming it is the only party capable of safely managing the plant

Ukraine has proposed partial electricity allocation, with the United States previously floated as a supervisory manager

Repeated power losses since 2022 have raised alarm among international nuclear safety experts

Why It Matters

The Zaporizhzhia Nuclear Power Plant is not just an energy facility — it is leverage.

Nuclear infrastructure represents economic output, political legitimacy, and strategic control. In a peace process already strained by territorial disputes, the ZNPP introduces a non-negotiable risk factor: nuclear safety.

Any agreement that leaves ambiguous control over Europe’s largest nuclear plant carries catastrophic downside risk. As long as the plant’s status remains unresolved, confidence in a durable peace remains fragile.

Why It Matters to Foreign Currency Holders

Energy insecurity feeds inflation, undermining currency stability across Europe

Nuclear risk premiums elevate capital flight and insurance costs

Infrastructure control disputes weaken confidence in post-war reconstruction financing

Settlement trust erodes when sovereign assets remain contested

For currency holders, energy assets are balance-sheet anchors. When those anchors are politically disputed, monetary credibility suffers.

Implications for the Global Reset

Pillar: Energy Infrastructure Equals Monetary Stability

Who controls power controls productivity — and confidence.

Pillar: Unresolved Sovereign Assets Delay Systemic Transitions

No reset can finalize while core assets remain contested.

Pillar: Safety Risk Overrides Diplomatic Optics

Nuclear facilities impose hard limits on compromise.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Why Zaporizhzhia Power Plant Could Nuke Russia-Ukraine Peace Talks”

Reuters – “IAEA warns repeatedly of safety risks at Ukraine’s Zaporizhzhia nuclear plant”

~~~~~~~~~~

Asia in 2026: Conflict Continues to Dominate

U.S.–China rivalry and regional flashpoints signal prolonged instability

Overview

Asia enters 2026 under the shadow of unresolved conflicts rather than renewed stability.

The U.S.–China rivalry remains the dominant strategic force, shaping security, trade, and diplomacy.

The Thailand–Cambodia conflict has emerged as a regional pressure point, reflecting great-power competition.

ASEAN cohesion remains strained, limiting effective conflict resolution.

Prolonged instability risks spillover into global economic and financial systems.

Key Developments

The United States formally identified China as its foremost strategic competitor, reinforcing the Indo-Pacific as a primary theater of confrontation.

Washington continues to apply pressure on Beijing to limit China’s ability to project power beyond Asia, including support for Russia.

Concerns over Taiwan remain elevated, with analysts warning of potential Chinese military action.

The Thailand–Cambodia dispute escalated in late 2025, resulting in temporary ceasefires that failed to produce durable agreements.

Economic losses from regional instability already total billions of dollars, undermining growth across Southeast Asia.

China is expanding its influence through infrastructure and Belt and Road projects, while the U.S. deepens engagement with key partners.

Why It Matters

Asia is no longer a backdrop to global power competition — it is one of its primary engines.

When regional disputes align with great-power rivalry, local conflicts take on global significance. The persistence of unresolved tensions in 2026 suggests a shift from episodic crises to structural instability, where economic growth, trade routes, and political alignment are increasingly subordinated to security concerns.

This environment raises the risk of miscalculation and escalation in a region central to global manufacturing and supply chains.

Why It Matters to Foreign Currency Holders

For currency holders, sustained instability in Asia carries systemic implications:

Trade disruption affects export-driven economies, pressuring regional currencies.

Capital flows become more selective, favoring perceived safe havens.

Defense spending and supply-chain reshoring strain fiscal balances.

Currency volatility increases when geopolitical risk becomes persistent rather than episodic.

In financial terms, prolonged conflict environments reprice risk over time, not overnight.

Implications for the Global Reset

Pillar: Multipolar Competition Is Structural

Power rivalry now defines global alignment.Pillar: Regional Conflicts Accelerate Fragmentation

Trade, finance, and settlement increasingly split along bloc lines.

As Asia’s stability erodes, global realignment accelerates quietly through trade rerouting, reserve diversification, and financial decoupling.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “Asia in 2026: Conflict Continues to Dominate”

Reuters – “Taiwan stays on high alert as Chinese ships pull back after massive drills”

Council on Foreign Relations – Asia and the Indo-Pacific Strategic Outlook

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

FRANK26….12-31-25….OPERATION 26

KTFA

Wednesday Night Video

FRANK26….12-31-25….OPERATION 26

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video

FRANK26….12-31-25….OPERATION 26

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Mathematical Analysis of a Global Monetary Reset

Mathematical Analysis of a Global Monetary Reset

12-30-2025

Gold at $10,000: Mathematical Analysis of Global Monetary Reset

BY MUFLIH HIDAYAT ON DECEMBER 30, 2025

How Currency System Mathematics Drive Gold Toward $10,000 Valuations

Modern monetary architecture rests on mathematical relationships that most investors never examine. When currency supplies expand beyond the backing capacity of underlying reserves, historical precedent suggests systematic adjustments become inevitable.

Mathematical Analysis of a Global Monetary Reset

12-30-2025

Gold at $10,000: Mathematical Analysis of Global Monetary Reset

BY MUFLIH HIDAYAT ON DECEMBER 30, 2025

How Currency System Mathematics Drive Gold Toward $10,000 Valuations

Modern monetary architecture rests on mathematical relationships that most investors never examine. When currency supplies expand beyond the backing capacity of underlying reserves, historical precedent suggests systematic adjustments become inevitable.

The arithmetic supporting potential gold at $10,000 scenarios emerges from fundamental imbalances between outstanding monetary obligations and precious metals held in official reserves.

Furthermore, understanding these dynamics becomes crucial as gold record highs continue to challenge traditional market expectations.

The Federal Reserve’s Hidden Gold Connection

Despite widespread belief that the dollar operates without commodity backing, Federal Reserve balance sheets reveal approximately $11.2 billion in gold certificates serving as collateral against $2.35 trillion in circulating Federal Reserve notes. This creates a backing ratio of roughly 0.48%at the statutory gold price of $42.22 per ounce.

The U.S. Treasury maintains 261.5 million ounces of gold across Fort Knox, West Point, Denver, and San Francisco facilities.

Under current accounting, this massive reserve provides less than half a penny of gold backing per dollar in circulation. This mathematical disconnect between official pricing and currency obligations creates structural pressure that has historically resolved through revaluation events.

Currency Coverage Requirements Under Full Backing Systems

Mathematical analysis reveals that achieving 100% gold backing for current Federal Reserve note circulation would require gold pricing near $8,993 per ounce.

This calculation emerges from dividing total currency outstanding by existing Treasury gold reserves, creating a pure arithmetic relationship independent of market speculation.

Read Full Article:

https://discoveryalert.com.au/gold-10000-valuation-currency-mathematics/

https://dinarchronicles.com/2025/12/30/mathematical-analysis-of-a-global-monetary-reset/

VND Summary 2025 and 2026 Expectations

VND Summary 2025 and 2026 Expectations

Edu Matrix: 12-31-2025

As we approach 2025, investors are keenly watching the Vietnamese Dong (VND) to gauge its potential for growth and stability. In a recent video from Edu Matrix, Sandy Ingram provides a comprehensive overview of the VND’s outlook, sharing insights into her unique investment strategies and the factors influencing the currency’s performance.

Here, we’ll delve into the key takeaways from the video and explore the opportunities and challenges facing VND investors.

VND Summary 2025 and 2026 Expectations

Edu Matrix: 12-31-2025

As we approach 2025, investors are keenly watching the Vietnamese Dong (VND) to gauge its potential for growth and stability. In a recent video from Edu Matrix, Sandy Ingram provides a comprehensive overview of the VND’s outlook, sharing insights into her unique investment strategies and the factors influencing the currency’s performance.

Here, we’ll delve into the key takeaways from the video and explore the opportunities and challenges facing VND investors.

Sandy Ingram begins by sharing her personal approach to investing, which involves purchasing foreign currencies during her travels. This strategy not only makes her travel expenses tax-deductible but also allows her to benefit from fluctuations in currency values against the US dollar.

While this may not be a conventional investment strategy, it highlights the potential for creative approaches to managing investments.

The video also touches on the channel’s investments in micro real estate loans, gold, and silver. These investments have provided steady returns and low default rates, underscoring the importance of diversification in a robust investment portfolio.

The core of the video focuses on the VND’s depreciation against the US dollar in 2025. This trend is driven by factors common to emerging markets, including interest rate differentials, global risk sentiment, and trade investment flows.

While the depreciation may seem concerning, Vietnam’s fundamentals remain solid, driven by its strong manufacturing sector, ambitious public investment plans, and steady foreign currency inflows.

The State Bank of Vietnam plays a crucial role in managing the VND’s volatility by maintaining a trading band. This approach helps to moderate fluctuations and ensure stability in the currency markets.

Looking ahead, a stronger VND is expected to emerge gradually, driven by factors such as lower US interest rates, a healthy external balance, and improved financial stability. While a sudden appreciation is unlikely, a gradual strengthening of the VND is anticipated.

For investors, the video concludes with a pragmatic recommendation: holding the VND is a viable strategy, as near-term fluctuations are likely, but long-term prospects remain positive. As with any investment, it’s essential to maintain a nuanced understanding of the market and be prepared for potential fluctuations.

The Vietnamese Dong’s investment outlook for 2025 and beyond is characterized by both challenges and opportunities. While the currency’s depreciation against the US dollar is a concern, Vietnam’s strong fundamentals and steady foreign currency inflows provide a solid foundation for long-term growth.

By understanding the factors influencing the VND’s performance and maintaining a diversified investment portfolio, investors can navigate the complexities of this emerging market.

For further insights and information, be sure to watch the full video from Edu Matrix. Whether you’re a seasoned investor or just starting out, staying informed about the VND’s outlook can help you make more informed investment decisions.

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call, it is Tuesday, December 30th and you're listening to the big call. And thanks everybody for listening. And what's interesting about tonight and Bob, I don't know that you remember this or not, but today marks the first call of the 15th year of the big call.

We completed 14 years couple of days ago, on the 28th and today marks the first call in the 15th year of the big call. Did I ever think we go 15 years or get in? No, but here we are. We're still standing, and Bob and I are here tonight because Sue is under the weather the last couple of days and she's sporting a fever, and we're believing for her to be completely healed, and she'll be back on her feet And, and now we have new year's to look forward to in a couple of days. So, let's pray the call in and we'll take it from there

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call, it is Tuesday, December 30th and you're listening to the big call. And thanks everybody for listening. And what's interesting about tonight and Bob, I don't know that you remember this or not, but today marks the first call of the 15th year of the big call.

We completed 14 years couple of days ago, on the 28th and today marks the first call in the 15th year of the big call. Did I ever think we go 15 years or get in? No, but here we are. We're still standing, and Bob and I are here tonight because Sue is under the weather the last couple of days and she's sporting a fever, and we're believing for her to be completely healed, and she'll be back on her feet And, and now we have new year's to look forward to in a couple of days. So, let's pray the call in and we'll take it from there

We got some good intel today. I wasn't really sure how it was going to line up for us before New Year's Eve tomorrow, New Year's Eve, last day of the year. We had heard that there's a possibility that we could get notified even today or tomorrow. I kind of wrote that off in my mind, because I think it's more likely that it happens either on New Year's Day or maybe the day after, which would be Friday, which is only three days away.

So let me tell you how this Intel is lining up.

First of all, redemption centers, and that's where we primarily focus on - redemption center screens have placeholders for 25 currencies and their rates

But the placeholders know they're indicating which currencies don't have that information, but we do have knowledge that the placeholder for for Venezuela, Venezuelan bolivar is there.

So they're anticipating Venezuela being able to come to the party, so to speak, and be part of the exchange process we've heard forever with the idea, first basket, second basket, third basket.

In the last couple of years, I’ve been told there's only one basket, the basket, the basket of currencies , and we have heard that that basket could be 28 currencies - we've heard 31 so it's going to vacillate that range of 25 to 31 somewhere in that range, they'll settle in on the number of currencies in the first and possibly only basket. Okay.

The other question mark, of course, right now is Iran. There is a spot for the Iranian Rial. And if you guys saw a couple of days ago, the value of the Rial just went to went to nothing, almost it was dropped precipitously. And that's not good for Iran, not good for the people. And I would not be surprised to see regime change there in Iran from the people. I wouldn't be surprised to see it also in Venezuela, and let the proper elected woman be the president or prime minister. I think it's president of it that should happen too.

Now, some of these things that are happening politically, for example, the war between Russia and Ukraine is, I believe, about to come to an end with a solution to a peace. And I think the same thing also true for Israel and Hamas and these things - obviously President Trump met on yesterday, made phone calls yesterday, and I think, I think they are about to conclude with peace taking place, because we need peace throughout the world for GESARA be in effect. We have heard that GESARA was launched five or six days ago.

G, E, S, A, R, A, for the global economic can't remember what the S is and Recovery Act, well, economic security. Thank you, Lord, global economic security and Recovery Act. That's GESARA

I'm believing that they are going to reach peace in for GESARA to be fully enacted after the first 2026, first of January

Same with NESARA, that's our agreement, national economic freedom, reformation Act, or Reform Act, not reformation and reform act. And this is something that is also to have been very recently activated, like a day or two ago. And I don't know if it, if it was in the center see it, but I believe things are moving in that direction for us

All right, so what is actually happening on the ground? Okay, redemption centers had received their USTN currency about six weeks ago, redemptions have delivered the new folding money, our new US dollar, which United States Treasury note. Okay, they got it.

Banks have received a couple of tranches of these, but they just received another one in the last two days, and they the deliveries are happening, and have the country for these banks to receive the money. Okay, so now banks have it in abundance and so do redemption centers for us. They're using redemption centers.

So I want to get that point across. that's good and it seems over the last minute, but it probably isn't. I'm sure the whole thing is based on a timeline, but it's set up to achieve results. All right, let's go back and see what else we know we do know. We did get this. The Vietnamese Dong is doing very well. They have it at a very good rate, and it's excellent rates. And what I'm being told about these currencies, the Dong, the dinar, the rupiah, all of these will eventually be on par with the USN dollar, our new dollar, the USN

What does it mean on par? It means the same value. So let's say the dinar is way over 20 or $20 and then let's say it will come back down and down in value to be even with one on one, with our dollar, one dinar equals $1 that's what it will go to after this redemption center process, after the exchange take place, you gotta understand, not now later, after the exchange centers are closed and the banks are slowing down on doing currency, same thing is going to be true in the dong.

My point is set your appointment and go ahead and go and take these currencies with you. Don't hold them thinking, Well, maybe if it's at this it'll be worth more in a week. We weren't sure if that was going to be the case. What we're hearing today is no The likelihood is rates will drop. After the initial week or two of exchanges, rates will begin to drop, and eventually they will get to be on par with our new dollar, our USN, and remember, they're going to be trying. to limit us to about $3000 USTN currency at the redemption centers, and we go in

They don’t want us walking out there with tons of new USTN and becoming a target. Okay, so just keep that in mind. There is really no reason to really take that much cash anyway. You just need to if you want it. You don't want any. You don't force it on. You have your credit / debit card at Wells Fargo that you'll be able to sell on day one. Load it in from your quantum account. You'll load in what you think you'll need for first 60 to ninety days, and then go from there

All right, so let's go back to where we were on Intel. We're in good shape. You guys know today, the dinar is contract rate Pres Trump set up in his first term and I believe Iraq will honor hat contract rate which is extremely high and I can't tell you what it is, but you won't be disappointed at all.

So remember, whether you have Zim doesn't matter if you have projects, it should help you get the contract rates. And you'll, you'll ask me if they, if you have dinar and they offer it to you, you've got it. If they don't offer you, ask for the contract rates.

Simple as that, just ask politely for the contract rate, and they should give it to you. All right, that's pretty good, really good - And the dong does not have a contract rate, but the rate is quite good, and all of the currencies that are coming in should be a very strong rate, and higher than probably should be.for a short period of time

Everybody had the faith to believe in this exchange and the redemption of Zim. Don't forget that

The Zim is being handled like a bearer bond, if I remember right on the on the front 100 trillion dollar Zimbabwe note, it does say to the bearer of what a bear bond says, who ever has it - you know you're the bearer of it when you bring it in for your redemption of that bond like currency - you'll get, you'll get the beyond par with the dollar,

Let's see what else. The timing for this. What is our timing?

We were in a window that could go to tomorrow to get notifications, and it is a possibility. In fact, redemption servers are going in tomorrow, half a day, and then they're going to see what happens. Because, see it comes in, are they going to be going in on New Year's Day? They don’t know, and we don't know yet, I personally doubt it but anything is possible.

What about banks? We don't open until one o'clock tomorrow in most areas now half a day tomorrow, and then banks are closed on New Years day. So we know my gut is and I don't have proof of it, my gut is they will close for New Years day - a redemption centers will close, and our redemption center leaders are going in for half a day tomorrow on New Year's Eve day.

Now what does that mean for us? That means that we are likely in play for notifications on Friday. We've been told by some people in Wells Fargo that looking for a weekend kickoff this weekend, includes Friday and Saturday, and if we do get numbers Friday might start exchanges Friday And all, we could set appointments we could very easily start on Saturday,

if we do get started Friday or Saturday - more than likely, there will be some people that work on Sunday, and we would go right through the weekend, or have the ability to go right through the weekend. Obviously, you don't have to go in on a Sunday if you don't want that's really where we are in terms of our timing.

Everything could start after the first - I don't know that we would get notified on New Year's Day. The only reason I'm unsure of it is because we need, if you got your email to say on Thursday and you all set your appointment, we have people in the call centers? Do we have people in the redemption centers that’s where the question is?

They could do that people in both call and redemption centers to take our calls, set up our appointments, but I personally doubt that that'sgoing to happen

Realize they close for Christmas Eve. The Redemptionn Centers did , they closed for Christmas day, and I'm almost surprised, going in for half a day tomorrow, but they are but I doubt they are going in on new years day Thursday

So what does that mean, for the big call person Thursday night, it means we're probably not going to have a call in two days, Thursday night - right now, I think I might Have one. I think we're going to take off New Year's day, night, back in on Tuesday.

Now we could have numbers and be rocking and rolling before our next call Tuesday. So I'm going to say anything can happen- it’s possible it's conceivable, we could record a celebration call – put that out before Tuesday or we could do it on Tuesday if we ger numbers Friday, and start Friday or Saturday.

Main thing is for you guys to watch two things. First of all, watch your email, because you wil get an email from Wells Fargo , and if they don't have your email, we're kind of the catch all. If you registered, , we've got your email, and we'll be sending that out. With the toll free number

And 800 we're assuming it's an 800 number, 800 number on the big call universe.com website. So you have it on the website, an email from us and those of you that have currency they have email and Wells will be delivering those emails. Just follow the instructions that you get email that Wells Fargo set out

I think we're looking to a really, beautiful start for the new year - I think we're looking to initiate NESARA and GESARA and to talk more About what to expect in the first 10 days of January.

I got word today we're looking to receive those $2000 tarriff dividend deposits as direct deposits into our accounts

I believe that starts somewhere in any of 28 years and older, and then so that would be the first 10

days of January to the $2000 tarriff dividend to hit. The other thing for is the doge should be happening in January - the R and R should be happening.

A couple days ago they had not decided whether that was to be said a direct deposit, or how that was going to be done. I think the amounts, are varied all over the place - we've heard different numbers, so we're not going to put those out, but I think they will come by direct deposit.

Some people - they don't have a bank account. I don't know. We'll see what happens. But and people you know, will our R and R be at the redemption center for our quantum accounts when we get there, I don't know we've heard it will do it that much. We'll get it. When everybody else gets it

Maybe we'll get it early at the redemption center, but Social Security increases, yes, they are set up for January . It'll be nice. That is that. Is that, and if you have dollar then, is sort of the small amounts, but a lot of people it's going to be significant for a lot of people

Not everybody has currency as you know and its going to make a big difference in their lives

So that takes care of the questions that most of us have about those things and I believe we are looking forward to these things happening in the first seven to 10 days of January.

And I you know, when is the USN going to be announced -- if we are going in for exchanges Friday or Saturday? And it's there for us to take out.

Could that be something that would be announced on first of January, our new USN our new US currency at the redemption center for us

It will not surprise me if Trump and or Scott Bessent made an announcement about that, President Trump already has a replacement in mind for the for the Federal Reserve Chairman, Jerome Powell. And I don't know when he's going to exit but he's got in form of Kevin - Kevin Hassett is supposedly an excellent money guy, and he's going to be President Trump's choice for that position.

Hope he gets in there like prontisimo, and it would make a big difference for everybody when they're dropping interest rates to where they should be. And you know, guys, I really think next year 2026 – 2 days away – is going to be the start of Debt Jubilee and, you know, we've heard this part of NESARA. And I don't know how quickly everything's going to come out. It's just too hard to say

We've heard it'll all be out by July 4. You know, we've heard this and that and the others, med beds are ready for us. Guys. They're be ready starting the second of January. That would be, what that would be, Friday, will any of us go in that soon? And then soon, I don't know, because we have to get to the exchange and tell them, hey, I'm a Zim holder as you can see, and I also have dire need and blah, blah, blah, they'll enter the keystrokes in their computer so that you're at the top of the list, to go into the med bed and we've got, you know, people like we were praying for tonight, that need to get in there, and what I can say is let them know when you go in there, that what your need is there are giving favor to Zim holders because they want us that are zim holders to live a long, long time so we can see our projects to completion.

That's why they're looking to get us out there another 300 years. Or more Possible. We can live it one more time, but we'll see what happens.

I really am. I'm looking forward to the med bed more than I am the money exchanges, but that's just term one day. But that is more important to me. My health is more important than the money.

you guys, let's do this. Let's pray the call out and want to thank before we do. Let me thank everybody.

All right. Everybody, have a wonderful and safe New Year's. All right, and we'll talk to you Tuesday, but keep an eye on your emails.

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:08:08

Bruce’s Big Call Dinar Intel Thursday Night 12-11-25 REPLAY LINK Intel Begins 1:21:00

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:02:50

Bruce’s Big Call Dinar Intel Thursday Night 12-4-25 No Transcription Intel Begins 1:17:33

Bruce’s Big Call Dinar Intel Tuesday Night 12-2-25 REPLAY LINK Intel Begins 1:07:20

Bruce’s Big Call Dinar Intel Thursday Night 11-28-25 Thanksgiving NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 11-25-25 REPLAY LINK Intel Begins 1:06:06

Bruce’s Big Call Dinar Intel Thursday Night 11-20-25 REPLAY LINK Intel Begins 53:30

Bruce’s Big Call Dinar Intel Tuesday Night 11-18-25 REPLAY LINK Intel Begins 1:13:03

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 12-31-25

Happy New Years Eve Dinar Recaps,

CLARITY Act Advances — But Does It Gate the Global Reset?

Crypto regulation moves forward as markets wait — and misunderstand — the timeline

Happy New Years Eve Dinar Recaps,

CLARITY Act Advances — But Does It Gate the Global Reset?

Crypto regulation moves forward as markets wait — and misunderstand — the timeline

Overview

The U.S. Senate Banking Committee has set January 15 as the markup date for the CLARITY Act.

Bipartisan agreement is not yet confirmed, though negotiations appear to have narrowed.

Crypto markets are betting the bill becomes law in the first half of the year, with April–May emerging as the realistic window.

The CLARITY Act defines key digital asset and stablecoin parameters, increasing speculation it is required before broader financial restructuring.

It is not a prerequisite for a global reset, but it is a synchronization milestone.

Key Developments

Markup scheduled for January 15 signals the bill is moving procedurally after months of delay.

Prior negotiations stalled over stablecoin yield limits, token classification, illicit finance controls, and ethics provisions.

Bipartisan support remains essential to avoid delays similar to those faced by the GENIUS Act.

Market odds currently price a 42% chance of passage before April and 69% before May.

If passed, CLARITY would become the second major U.S. crypto framework law, expanding beyond the GENIUS Act.

Why It Matters

Regulatory clarity is not transformation — it is codification.

The CLARITY Act does not create new monetary systems; it legally defines how existing digital rails may operate inside the U.S. framework. Its importance lies in removing ambiguity for institutions, custodians, and issuers — not in triggering a reset event.

Delays are frustrating, but they reflect a deeper truth: the reset is structural, not legislative. Laws follow infrastructure, not the other way around.

Why It Matters to Foreign Currency Holders

For currency holders, the CLARITY Act matters because it formalizes how digital dollars and stablecoins are recognized, governed, and constrained within U.S. law.

However:

Global settlement rails already exist

Cross-border liquidity mechanisms are already operational

Stablecoins already function internationally, regardless of U.S. statute

Currencies anchored to diversified reserves, interoperable rails, and trade access do not wait on U.S. legislative timing. The bill provides regulatory comfort, not monetary permission.

In reset terms: access beats authorization.

Implications for the Global Reset

Pillar: Law Codifies — It Does Not Create

The reset is underway; legislation catches up later.Pillar: Stablecoins Are Rails, Not Currency

Defining them does not delay value realignment.Pillar: Timing Frustration Is Structural Stress

Transitional systems always feel “late” from inside the shift.

The CLARITY Act does not have to pass for a reset to occur. It simply aligns U.S. law with a system that is already evolving globally.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Why Stablecoin Laws Don’t Trigger Resets

Regulation follows infrastructure — not the other way around

Overview

Stablecoin legislation is often mistaken as a reset trigger, but it is not.

Laws like CLARITY and GENIUS define rails, not value.

Stablecoins already operate globally without U.S. statutory permission.

Monetary resets are structural events, not legislative announcements.

Regulatory clarity provides comfort — not ignition.

Key Developments

Stablecoins are defined in law as payment instruments, not sovereign currency replacements.

Global settlement using tokenized value already exists, regardless of U.S. bills.

Central banks and institutions have already integrated digital rails into back-end systems.

Legislative delays reflect political timing, not monetary readiness.

Markets consistently misprice laws as triggers due to visibility bias.

Why It Matters

Stablecoin laws are about control and compliance, not transformation.

They clarify:

Who may issue

How reserves are held

Which regulators oversee activity

They do not:

Revalue currencies

Activate new money

Change purchasing power

Trigger systemic resets

History shows that money systems shift first — laws are written afterward to legitimize what already works.

Why It Matters to Foreign Currency Holders

For currency holders, believing legislation triggers resets creates false timelines and unnecessary frustration.

Currencies reset when:

Settlement trust shifts

Trade access changes

Liquidity pathways realign

None of those require U.S. Congressional approval.

Stablecoin laws simply ensure domestic alignment with global reality. They do not delay — nor enable — currency value changes.

Implications for the Global Reset

Pillar: Infrastructure Precedes Regulation

Systems run before they are regulated.Pillar: Rails Are Not Value

Stablecoins move money; they do not redefine it.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

CoinGape – “CLARITY Act Set to Advance as Senate Picks January 15 for Crypto Bill Markup”

International Monetary Fund – Digital Money and Cross-Border Payments

~~~~~~~~~~

What Must Be in Place for a Currency Reset — and What Is Just Cosmetic

Separating structural readiness from surface noise

Overview

Not everything labeled “important” is essential to a currency reset.

Structural resets occur when settlement, liquidity, and trust align.

Many high-profile events are cosmetic confirmations, not requirements.

Understanding the difference prevents timeline fatigue.

The reset is about access and interoperability, not headlines.

Key Developments

Global payment rails are already interoperable (ISO-based messaging, real-time settlement).

Bilateral and multilateral trade settlement frameworks are active outside dollar dependency.

Reserve diversification is ongoing, including gold and commodity backing.

Liquidity windows are pre-positioned, not announced.

Legal frameworks are catching up, not leading.

What Actually Must Be in Place (Structural)

Functional settlement rails across borders

Liquidity availability at sovereign and institutional levels

Trade access and counterpart trust

Reserve credibility (diversified, auditable assets)

Operational readiness inside banks and treasuries

These are already in motion or complete.

What Is Cosmetic (Not Required)

❌ Stablecoin bills passing

❌ Public announcements

❌ Media timelines

❌ Political consensus

❌ Retail-facing explanations

These follow the shift — they do not cause it.

Why It Matters

Confusing cosmetic milestones with structural readiness creates false delays.

Resets feel late because they are quiet by design. When systems change loudly, it is usually because they already have.

Why It Matters to Foreign Currency Holders

For holders, the danger is waiting for permission that is not required.

Currencies reprice when:

Access changes

Settlement routes shift

Trust migrates

Those dynamics are invisible until they are irreversible.

In reset terms: by the time it’s explained, it’s done.

Implications for the Global Reset

Pillar: Access Is the Trigger

Not laws. Not headlines.Pillar: Silence Signals Readiness

Loud systems are unfinished ones.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – Cross-Border Payments Roadmap

International Monetary Fund – Reserve Diversification Reports

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

We are living through a Global Monetary Reset!!!!!

Gold & Silver’s Surge Warns of a 2026 Great Reckoning

Taylor Kenny: 12-31-2025

We are living through a Global Monetary Reset!!!!!

Gold and silver are setting record highs-but it’s not about inflation or geopolitics.

Most Americans have no idea what’s coming. Taylor reveals how paper markets, debt manipulation, and global de-dollarization are fueling a historic shifts and why 2026 is shaping out to be one of the most pivotal years in financial history.

Gold & Silver’s Surge Warns of a 2026 Great Reckoning

Taylor Kenny: 12-31-2025

We are living through a Global Monetary Reset!!!!!

Gold and silver are setting record highs-but it’s not about inflation or geopolitics.

Most Americans have no idea what’s coming. Taylor reveals how paper markets, debt manipulation, and global de-dollarization are fueling a historic shifts and why 2026 is shaping out to be one of the most pivotal years in financial history.

CHAPTERS:

00:00 The Gold & Silver Surge Isn’t What You Think

01:37 We’re Living Through a Global Currency Reset

03:09 What Is a Currency Reset, Really?

04:15 Paper Market Manipulation Is Breaking Down

06:25 Explosive Institutional Demand Is Here

07:35 China’s Massive Gold Accumulation

09:35 The Rise of a Gold-Based Monetary System

10:44 Trust and Tangibles in a Post-Dollar World

11:45 The Fatal Mistake Most People Make

News, Rumors and Opinions Wednesday 12-31-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Tues. 30 Dec. 2025

Compiled Tues. 30 Dec. 2025 12:01 am EST by Judy Byington

Global Currency Reset To Gold/Backed Currencies of 209 Nations Set For Jan. 1 2026

Be Prepared

Judy Note: Intel has indicated that the Global Currency Reset was (allegedly) set to begin notification for foreign currency exchange and Zim Bond redemption appointments as early as Wed. 31 Dec. 2025, with full payouts (allegedly) commencing immediately thereafter under the secure, gold/asset-backed framework.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Tues. 30 Dec. 2025

Compiled Tues. 30 Dec. 2025 12:01 am EST by Judy Byington

Global Currency Reset To Gold/Backed Currencies of 209 Nations Set For Jan. 1 2026

Be Prepared

Judy Note: Intel has indicated that the Global Currency Reset was (allegedly) set to begin notification for foreign currency exchange and Zim Bond redemption appointments as early as Wed. 31 Dec. 2025, with full payouts (allegedly) commencing immediately thereafter under the secure, gold/asset-backed framework.

NESARA/GESARA provisions are(allegedly) activating worldwide, bringing universal debt forgiveness, elimination of taxes, and release of Prosperity Funds.

As the old fiat system crumbles, over 200 nations (allegedly) transition to the new Quantum Financial System.

This monumental shift, guided by the Supreme Court’s green light to President Trump, marks the dawn of a golden age

~~~~~~~~~~~~~

Mon. 29 Dec. 2025 Timing …Charlie Ward and Friends

QFS Ledger: LIVE and registering assets

NESARA/GESARA: Enforcement protocols ACTIVE

Redemption Centers: Opening THIS WEEK

Wealth Distribution: Beginning in 72 HOURS

Old Currency: Being NULLIFIED as we speak

~~~~~~~~~~~~

New Financial System:

Mon. 29 Dec. 2025: The U.S. Treasury has confirmed the Quantum Financial System (QFS) will (allegedly) become operational in January 2026.

Documents have revealed that specially-designed gold assets will facilitate the transition, with only 10,000 units available to the public before the system goes live.

While details remain limited, Treasury officials describe the move as “the most significant monetary advancement since the creation of the Federal Reserve.”

A finance correspondent has the complete breakdown of what this means for investors and the broader economy. Full report: https://cutt.ly/QFS_Treasury_Announcement

Read full post here: https://dinarchronicles.com/2025/12/30/restored-republic-via-a-gcr-update-as-of-december-30-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff Iraq's going international January 1st. Article Quote: "U.S. special envoy Mark Savaya is expected to arrive in Baghdad in early January." That's going to be after they go international...

Frank26 Speaker of the House, these deputies, that was done quick as lighting. That is not how [Iraq] moves. That is not how they function. Somebody's pushing all of this. Speaker's position was [filled] quick.

Mnt Goat There is much more evidence than not that everything is pointing to early 2026 for them to normalize the dinar and place it back on FOREX to trade. ...the Development Road Project, the port of Faw or the reopening of the Cyan oil pipeline that can almost double the oil revenues. Oh…did I mention the Customs and Tariff revenues? Some of these projects and more at the implementation phases and some are generating real revenues already with potential for more, massive amounts...Most of these projects are recent within the last four years and take time to come to full capacity for revenue generation for the federal government... It is a slow process. [Post 1 of 2....stay tuned]

Mnt Goat So, you see it all works together and are interconnected, and I have not even begun to mention the natural resources available that is also in the making to be marketed soon, very soon! I will leave it to the “gatekeepers” of Iraq and the CBI to decide when to reinstate the dinar based on all these new developments. They are now all concurring the time is ripe now. [Post 2 of 2]

************

Gold & Silver at All-Time Highs Signal Dollar Endgame

Lynette Zang: 12-31-2025

Gold and silver reaching all time highs is not a coincidence. It is a signal.

This move has little to do with geopolitics and everything to do with currency devaluation, debt, and loss of confidence in fiat money.

When hard assets rise relentlessly, it reflects a steady erosion of purchasing power. History shows this pattern clearly.

Understanding this signal and preparing early matters more than ever.

Chapters:

00:00 – Gold & Silver Surge to New Highs

01:17 – The Shift From Paper Markets to Physical Metals

03:47 – Middle Class Breakdown & Rising Pessimism

05:07 – The “Strong Dollar” Myth vs Purchasing Power

06:41 – Silver-to-Gold Ratio Signals What’s Coming Next

09:09 – Fiat Currency Failure & the K-Shaped Economy

12:22 – Crypto Control, Sound Money & Protecting Freedom

New Years Eve Coffee with MarkZ. 12/31/2025

New Years Eve Coffee with MarkZ. 12/31/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning everyone and Happy New Year

Member: I’m hoping the captain has turned on the fasten your seatbelts light…

New Years Eve Coffee with MarkZ. 12/31/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning everyone and Happy New Year

Member: I’m hoping the captain has turned on the fasten your seatbelts light…

Member: I know how the racehorses feel now, at that green gate... just open it up...Let er Rip!!!

Member: Hopefully this is the retirement day for the groundhog

MZ: There is not a huge amount of news which is expected between Christmas and New Years.From the bond side…they say things are looking great- we are finally back in place (In Asia) I have another person in place in Europe which I wasn’t expecting.

MZ: I also know a group person that is now in place and they are very hopeful for between now and Jan 2.

Member: Many countries releasing new currency tomorrow Jan 1

Member: Mark, saw new Rupees, also Guatemala, possibly UK?

Member: Russia, Guatemala, Bulgaria, Japan and Europa looking for a new design for currency.

MZ: The number of countries that have suddenly announced new currency is nuts. Japan, Syria and many more. They are reprinting new currencies for some reason. All around the world- Something is coming.

Member: China closes the door on silver exports tomorrow and the fed has injected 51 billion into the repo market to keep comex open!!!! Going to get interesting!!!!!!

Member: China and Mexico are stopping all sales of Silver. after Jan 1

MZ: In Iraq: “Government formation and 2026 budget top priorities for Parliament” It seems to be a mad dash for the budget, HCL and PMF. All of these -we have been told- were key pieces for the change of value for the dinar. They expect to do these within days

MZ: “Customs Authority: Revenues exceed 2.5 trillion dinars during the current year” This is part of the “White papers” reforms and we are watching them execute.

MZ: In Iran their currency is in freefall, people are rising up and the government is scrambling ….The Central Bank of Iran Governor has resigned.

Member: Does the US already have US Treasury notes printed?

MZ: There are reports that they do….but nothing absolutely concrete. We were told years ago they would start printing new US “Rainbow Currency” after 2017. Some bankers say they have seen it in their vaults. So I do think they may have already printed it.

Member: If Trump doesn’t flip the switch-who is responsible?

Member: Inquiring minds want to know. Chinese Elders or THE IMF or US Treasury or Iraq CBI or the GOI or Santa Claus…lol

MZ: I believe Trump is important in the decision but that the people putting up the gold -the ancient banking families NOT the Rothschilds ect….get to pick the timing …Personnaly I think its coming within days to weeks.

Member: Christmas passed and zero talk about St Germain Trust….sigh.

Member: Mods and Mark , and thank you for all the work you guys put in to make this happen

Member: I believe this will finally be our year…..Thank you God…. Blessings & Prosperity to All in 2026

Member: Happy New Years Eve , may you all have a safe and happy day

Zester joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Wednesday 12-31-2025

TNT:

Tishwash: Iraqi parliament completes leadership election, opening nomination for presidency

This is from Chinese news

The Iraqi parliament on Tuesday elected Farhad Atrushi of the Kurdistan Democratic Party as second deputy speaker, completing the election of its leadership and paving the way for the election of the country's president.

The vote followed the election of Haibet al-Halbousi as parliament speaker and Adnan Fihan as first deputy speaker on Monday. The completion of the parliamentary leadership is a crucial step that triggers the next phase of the constitutional timeline for appointing the nation's leadership.

TNT:

Tishwash: Iraqi parliament completes leadership election, opening nomination for presidency

This is from Chinese news

The Iraqi parliament on Tuesday elected Farhad Atrushi of the Kurdistan Democratic Party as second deputy speaker, completing the election of its leadership and paving the way for the election of the country's president.

The vote followed the election of Haibet al-Halbousi as parliament speaker and Adnan Fihan as first deputy speaker on Monday. The completion of the parliamentary leadership is a crucial step that triggers the next phase of the constitutional timeline for appointing the nation's leadership.

"The Council of Representatives has today completed the first constitutional step within the prescribed timeframe, reflecting a strong sense of national responsibility demonstrated by the leaders of the political blocs and the honorable members of parliament in carrying out the duties entrusted to them," Iraqi President Abdul Latif Rashid said in a statement.

Al-Halbousi also announced the opening of nominations for the presidency, according to a statement released by the Iraqi parliament on Tuesday.

Under Iraq's Constitution, parliament must elect a president within 30 days. The president will then have 15 days to task the nominee of the largest parliamentary bloc with forming a cabinet, which must be presented for a vote of confidence within 30 days.

Under Iraq's ethno-sectarian power-sharing system established after the 2003 U.S.-led invasion, the presidency is reserved for a Kurd, the parliamentary speaker's post for a Sunni Muslim, and the prime minister's office for a Shiite Muslim. link

************

Tishwash: The President of the Republic: The House of Representatives has fulfilled its first constitutional obligation on schedule.

President Abdul Latif Jamal Rashid affirmed on Tuesday that the Council of Representatives fulfilled its first constitutional obligation on schedule, demonstrating the strong sense of national responsibility felt by the leaders of the political blocs and the representatives.

In a congratulatory message to the Speaker of Parliament and his two deputies, the President stated: "Speaker of Parliament, Haibat al-Halbousi, we congratulate you on your election as Speaker of the Council of Representatives for its sixth session.

We also extend our congratulations to Adnan Faihan, First Deputy Speaker, and Farhad al-Atroushi, Second Deputy Speaker, wishing you and all members of Parliament success in fulfilling your duties in service to the Iraqi people in all their diversity."

He added, "The Council of Representatives has fulfilled its first constitutional obligation today on schedule, which confirms the strong sense of national responsibility felt by the leaders of the political blocs and the representatives. In this context, we remind you of the weighty task awaiting your esteemed Council in enacting laws that affect the lives of the people, who demonstrated their loyalty to the nation by turning out in large numbers to vote for their representatives in Parliament."

He emphasized that "the oversight role of your esteemed council will be no less important than its legislative role, as the people expect you to exercise your oversight role optimally. A parliamentary system and a genuine democratic experience are impossible without a parliament capable of monitoring the performance of the executive branch, identifying shortcomings, and holding violators accountable."

He concluded by saying, "We wish your esteemed council every success in fulfilling the remaining constitutional obligations on schedule." link

************

Tishwash: Trump's envoy congratulates Iraqis on the New Year: It will be a year of change.

video in Arabic on the website

Mark Savaya, the US President Donald Trump’s envoy to Iraq, congratulated the Iraqi people on the New Year, wishing them a year of goodness, happiness, and change, through a video clip from inside the home of his friend in the United States, Ammar Matti, who posted the video.

Regarding the year of change, Savaya welcomed the decision to disarm the factions in Iraq a few days ago, considering the step an encouraging development that responds to the calls of the religious authority. However, he stressed at the same time that statements alone are not enough, calling for a comprehensive and irreversible disarmament, implemented within a binding national framework that enshrines the state’s exclusive right to bear arms, warning that Iraq today stands at a crucial crossroads between consolidating sovereignty and stability, or remaining in a spiral of disintegration and uncontrolled weapons.

Regarding Trump’s appointment of Savaya as envoy to Iraq, Iraqi Prime Minister Mohammed Shia al-Sudani said during a comprehensive interview with journalist Ghassan Ben Jeddou, editor-in-chief of Al-Mayadeen TV, which is close to the Lebanese Hezbollah: “We view the issue of appointing a special envoy to the US president in Iraq as a kind of interest in the bilateral relations between the United States and Iraq.

When there is an additional window for existing official institutions, the embassy and others, it will certainly be beneficial, for the speed of delivering messages and more flexibility and coordination in positions.” link

*************

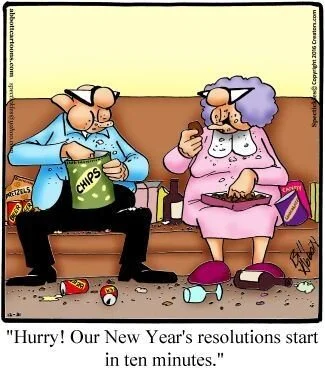

Mot: .. In 10 ---- 9 ------

Mot: My New Years Cycle!!!!

Seeds of Wisdom RV and Economics Updates Wednesday Morning 12-31-25

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

*********************************************

Overview

Federal Reserve officials are split on whether inflation or unemployment now poses the greater risk.

December 2025 meeting minutes reveal disagreement over the timing and scale of rate cuts in 2026.

Some policymakers warned that inflation progress may have stalled.

Others argued that rising unemployment and economic slowing deserve greater attention.

The divide raises uncertainty about the Fed’s policy path moving forward.

Key Developments

A faction favored holding rates steady, citing concern that inflation is not yet sustainably moving toward the 2% target.

Another group emphasized labor market risks, warning that delayed easing could worsen job losses.

Data dependency was repeatedly emphasized, reflecting uncertainty in economic signals.

No consensus emerged on when rate cuts should begin in 2026.

Market participants are now reassessing expectations for the pace and depth of future easing.

Why It Matters

Central bank unity is a stabilizing force. Division introduces ambiguity into forward guidance, which markets rely on for pricing risk.

The December minutes show a Federal Reserve navigating competing mandates under tightening constraints. When inflation and employment signals diverge, policy decisions become less predictable — increasing volatility across rates, equities, and currencies.

This is not indecision; it is a reflection of a system under structural strain.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Fed clarity directly impacts global exchange rates.

A divided Fed complicates interest rate differentials, capital flows, and carry trades. When markets cannot confidently price U.S. monetary policy, FX volatility rises, particularly for currencies linked to dollar funding, trade settlement, and emerging-market debt.

In reset terms, policy uncertainty accelerates repricing.

Implications for the Global Reset

Pillar: Policy Credibility Requires Cohesion

Fragmented guidance weakens confidence.Pillar: Data Ambiguity Drives Volatility

When signals conflict, markets reprice faster.

************************************

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

New York Times – “Federal Reserve Officials Were Divided Over Inflation and Jobs, Minutes Show”

CNBC – “Fed minutes show officials were in tight split over December rate cut”

Charles Schwab – “Rate Debate: Fed Minutes Today Provide Inside Look”

~~~~~~~~~~

Chinese Oil Tankers Challenge U.S. Blockade off Venezuela

Maritime standoff escalates as China-backed shipments test U.S. enforcement

Overview

Chinese-flagged oil tankers are continuing Venezuela-linked voyages despite a U.S.-declared maritime blockade.

Two unsanctioned VLCCs, Thousand Sunny and Xing Ye, are operating near Venezuelan waters.

The U.S. is escalating tanker seizures and naval pressure to restrict Caracas’ oil revenues.

China and Russia have openly criticized U.S. actions, raising concerns of broader geopolitical confrontation.

Venezuela has begun escorting oil shipments while cutting production as storage fills.

Key Developments

The Thousand Sunny is en route to Venezuela’s Jose Terminal after sailing around the Cape of Good Hope, maintaining course despite the blockade announcement.

The Xing Ye is slow-steaming off French Guiana, awaiting loading at the Jose Terminal, with ownership and destination undisclosed.

U.S. authorities seized multiple tankers, including Centuries and Skipper, while pursuing Bella 1 under a judicial seizure order.

China has opposed the seizures, backing Venezuela during an emergency U.N. Security Council meeting.

PDVSA has begun shutting oil wells in the Orinoco Belt, aiming to cut output by at least 25% as exports are squeezed.

Chevron continues exporting Venezuelan crude under a special U.S. license, highlighting selective enforcement.

***********************************************

Why It Matters

Energy blockades are not just economic tools — they are geopolitical force multipliers. The presence of Chinese-flagged tankers operating near Venezuela tests the limits of U.S. maritime enforcement and exposes fractures in global energy governance.

As sanctions and seizures intensify, oil trade increasingly shifts from commercial rules to power-based navigation, raising risks of escalation, miscalculation, and retaliation.

Why It Matters to Foreign Currency Holders

For currency holders, this standoff underscores how energy flows anchor monetary stability.

Disrupted oil exports weaken reserve inflows, stress balance sheets, and accelerate currency depreciation for producer nations. At the same time, buyers willing to bypass sanctions gain strategic pricing and settlement leverage, reshaping trade flows away from traditional dollar-dominated channels.

In reset terms, energy access increasingly determines currency resilience.

Implications for the Global Reset

Pillar: Energy Control Equals Monetary Power

Disrupted exports destabilize currencies.Pillar: Sanctions Accelerate Fragmentation

Parallel trade routes emerge under pressure.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Oil Tankers Challenge U.S. Blockade off Venezuela”

Bloomberg – “Venezuela Cuts Oil Output as U.S. Blockade Squeezes Exports”

New York Times – “U.S. Escalates Pressure on Venezuela’s Oil Exports”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Here’s Why Being a Millionaire Doesn’t Mean You’re Rich

Here’s Why Being a Millionaire Doesn’t Mean You’re Rich

Cindy Lamothe GOBankingRates Mon, December 29, 2025

If you grew up thinking a million dollars meant yachts, private islands and private jets, well, 2025 has other plans. These days, hitting millionaire status is still impressive — but it doesn’t automatically translate to feeling rich.

According to the 2025 UBS Global Wealth Report, the U.S. saw the sharpest rise in millionaire numbers globally. Between rising costs, shifting lifestyles and a new definition of what “wealthy” even means, being a millionaire isn’t what it used to be.

Here’s Why Being a Millionaire Doesn’t Mean You’re Rich

Cindy Lamothe GOBankingRates Mon, December 29, 2025

If you grew up thinking a million dollars meant yachts, private islands and private jets, well, 2025 has other plans. These days, hitting millionaire status is still impressive — but it doesn’t automatically translate to feeling rich.

According to the 2025 UBS Global Wealth Report, the U.S. saw the sharpest rise in millionaire numbers globally. Between rising costs, shifting lifestyles and a new definition of what “wealthy” even means, being a millionaire isn’t what it used to be.

Here’s why the title doesn’t guarantee the life you might imagine.

When You’re Asset-Rich But Cash-Poor

For Michael Benoit, licensed insurance broker and founder of California Contractor Bond & Insurance Services, the concept of a “millionaire” being rich is dangerously outdated, especially in 2025.

“Every day I see owners of businesses who are millionaires on paper. They may have $2 million in assets, including their equipment and their primary residence,” he said.

Benoit explained the problem with this is that these assets are not liquid and are often encumbered by substantial debt. He noted, “They are asset-rich but cash-poor.”

How Your Age and Wealth Structure Shape True Millionaire Status

TO READ MORE: https://www.yahoo.com/finance/news/why-being-millionaire-doesn-t-215504201.html

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

12-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-IQD Revaluation-Global Financial Integration

12-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..