Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Thursday Morning 12-25-25

Merry Christmas Dinar Recaps,

Stock Markets Rally to Record Highs Amid Holiday Season Optimism

Major indexes hit new peaks, gold and safe assets surge on geopolitical risk

Merry Christmas Dinar Recaps,

Stock Markets Rally to Record Highs Amid Holiday Season Optimism

Major indexes hit new peaks, gold and safe assets surge on geopolitical risk

Overview:

U.S. stock markets reached record highs on Christmas Eve 2025 as major indexes climbed on optimism around potential economic growth and easing interest rate expectations.

The S&P 500, Dow Jones, and Nasdaq all posted gains, fueled by robust AI sector performance and stronger-than-expected economic indicators.

Precious metals such as gold, silver, and platinum hit record prices as investors sought protection amid lingering geopolitical tensions.

The rally unfolded during a typically low-volume holiday period, with markets responding to data showing resilient corporate performance and prospects for looser monetary policy in 2026.

Key Developments:

AI-related technology stocks led gains, reflecting continued investor confidence in long-term growth potential.

Energy and materials sectors saw mixed reactions, with gold and platinum hitting all-time highs in safe-haven flows.

Positive economic data, including declining jobless claims and solid GDP growth, provided broader market support.

Market anticipation of a dovish Federal Reserve in 2026 contributed to asset price increases across equities and commodities.

Why It Matters:

Record market highs alongside soaring precious metal prices signal a complex macro landscape: risk assets are priced for growth, yet safe havens are being bid on uncertainty. This duality reflects a financial system at a crossroads, where traditional indicators of confidence coexist with caution around geopolitical and economic headwinds.

Why It Matters to Foreign Currency Holders:

For holders of foreign currency and global assets, this environment has direct implications for capital allocation, foreign exchange stability, and reserve strategies. Strong equity performance often supports demand for risk-linked currencies, while rising gold prices and safe-haven flows can weaken confidence in fiat money and bolster diversification into alternative stores of value. Exchange rates, cross-border capital flows, and currency hedging costs may shift significantly as investors balance growth expectations with risk protection.

Implications for the Global Reset:

Pillar 1: Asset Repricing & Safe Havens — Equities and precious metals simultaneously reaching new highs point to evolving risk and reserve valuation dynamics.

Pillar 2: Monetary Policy Signals — Anticipated shifts in central bank policy continue to shape cross-border capital flows and currency demand.

This is not just a holiday market anomaly — it’s a signal of how capital and confidence are being recalibrated across the global financial system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Guardian – “S&P 500 and Dow hit record highs as Santa rally reaches Wall Street”

Reuters – “S&P 500, Dow hit all-time closing highs; gold, silver touch records”

~~~~~~~~~~

Megaprojects Accelerate Worldwide as 2026 Build Cycle Expands

Trillions in infrastructure signal long-term economic and financial realignment

Overview:

Governments across multiple regions are advancing mega-scale infrastructure projects slated for major construction phases through 2026.

Projects span transportation, logistics, industrial hubs, and futuristic cities, reshaping regional economies.

Combined investment runs into the trillions of dollars, reflecting strategic economic planning rather than short-term stimulus.

Key Developments:

Saudi Arabia’s NEOM continues development as a cornerstone of Vision 2030, including The Line, Oxagon port, and coastal economic zones, with projected costs approaching historic levels.

California’s High-Speed Rail project has active construction underway across the Central Valley, supported by long-term state funding commitments despite cost escalations.

King Abdullah Economic City (KAEC) expands industrial, logistics, and special economic zones along the Red Sea, strengthening Saudi Arabia’s trade infrastructure.

The U.K.’s Lower Thames Crossing prepares for construction in 2026, creating the country’s largest road tunnel to ease congestion and enhance freight movement.

These projects emphasize connectivity, industrial capacity, and regional resilience rather than purely residential development.

Why It Matters:

Large-scale infrastructure programs signal confidence in long-term economic growth and reflect strategic positioning in trade, logistics, and industrial competitiveness. Unlike short-term fiscal measures, megaprojects anchor decades of economic activity and reshape global supply chains.

Why It Matters to Foreign Currency Holders:

Megaproject investment influences capital flows, debt issuance, and currency demand. Countries funding large infrastructure builds often attract foreign investment, strengthen trade settlement volumes, and increase demand for local currencies in construction, energy, and materials markets. These dynamics can support currency stability while also increasing sovereign debt exposure tied to long-duration assets.

Implications for the Global Reset:

Pillar 1: Infrastructure-Backed Value Creation — Physical assets increasingly underpin economic credibility and long-term currency strength.

Pillar 2: Trade & Logistics Realignment — Ports, rail, and industrial hubs redefine global trade routes and settlement flows.

This is not just construction — it’s the physical foundation of the next global economic cycle.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Newsweek – “Megaprojects Under Construction Around World in 2026”

BBC News – “Lower Thames Crossing: UK’s biggest road tunnel project explained”

~~~~~~~~~~

China Accuses U.S. of Interfering in China–India Relations

Beijing rejects Pentagon claims amid shifting Indo-Pacific alignments

Overview:

China formally accused the United States of misrepresenting its defense policy to interfere in improving relations between China and India.

The response followed a Pentagon report suggesting Beijing may be easing border tensions with India to limit closer U.S.–India ties.

China emphasized that its border issues with India are strictly bilateral and opposed third-party involvement.

Key Developments:

Chinese Foreign Ministry spokesperson Lin Jian stated China views relations with India from a long-term strategic perspective.

Beijing rejected U.S. assessments that it is seeking to exploit reduced Himalayan border tensions for geopolitical leverage.

The Pentagon report reflects growing U.S. concern over China’s expanding influence in South Asia and the Indo-Pacific.

China and India have engaged in diplomatic and military talks aimed at de-escalating years of standoffs along their disputed border.

The U.S. continues to deepen its strategic and defense partnership with India as part of broader Indo-Pacific positioning.

Why It Matters:

The exchange highlights intensifying great-power competition in Asia, where diplomatic narratives increasingly shape security alliances. Any sustained thaw in China-India relations could recalibrate regional power dynamics and influence U.S. strategy across the Indo-Pacific.

Why It Matters to Foreign Currency Holders:

Shifts in China-India-U.S. relations directly affect regional currency stability, trade settlement expectations, and capital flows. Reduced border tensions may support regional trade and currency resilience, while heightened U.S.–China rivalry can drive volatility, safe-haven demand, and diversification away from geopolitically exposed assets.

Implications for the Global Reset:

Pillar 1: Multipolar Diplomacy — Bilateral engagement outside Western mediation signals a move toward regional self-balancing.

Pillar 2: Strategic Realignment — Currency, trade, and investment strategies increasingly reflect geopolitical alliances rather than pure economic fundamentals.

This is not just diplomacy — it’s the geopolitical realignment shaping future trade, currency flows, and global financial architecture.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Modern Diplomacy – “China Rebukes U.S. Claim It Seeks to Curb Closer India-Washington Ties”

Reuters – “China says U.S. misrepresents its defence policy to interfere in China-India ties”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything. Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Sorry, Winning Powerball’s $1.7 Billion Jackpot Won’t Make You A Billionaire

Sorry, Winning Powerball’s $1.7 Billion Jackpot Won’t Make You A Billionaire. Here’s why you might end up with $136.6 million instead.

Charles Passy MarketWatch Tue, December 23, 2025

You just won the big $1.7 billion Powerball jackpot and you’re feeling like, well, a billion bucks.

But let’s get real for a moment: You’re almost certainly not a billionaire.

There’s no doubt that someone who wins a lottery jackpot will walk away a rich person. And Wednesday’s Powerball prize — the drawing is set for 10:59 p.m. Eastern time — is the fourth largest in the game’s history. But even when a jackpot heads into billion-dollar territory, the winner isn’t likely to see that kind of money. When all is said and done, they may be fortunate enough to call themselves a centimillionaire — someone with a net worth of $100 million or more

Sorry, Winning Powerball’s $1.7 Billion Jackpot Won’t Make You A Billionaire. Here’s why you might end up with $136.6 million instead.

Charles Passy MarketWatch Tue, December 23, 2025

You just won the big $1.7 billion Powerball jackpot and you’re feeling like, well, a billion bucks.

But let’s get real for a moment: You’re almost certainly not a billionaire.

There’s no doubt that someone who wins a lottery jackpot will walk away a rich person. And Wednesday’s Powerball prize — the drawing is set for 10:59 p.m. Eastern time — is the fourth largest in the game’s history. But even when a jackpot heads into billion-dollar territory, the winner isn’t likely to see that kind of money. When all is said and done, they may be fortunate enough to call themselves a centimillionaire — someone with a net worth of $100 million or more.

We did some research and crunched some numbers to come up with the following scenario, showing how a $1.7 billion jackpot can turn into an actual prize of $136.6 million — again, nothing to sneeze at, but not quite enough to put you in Elon Musk territory (net worth: $748 billion). Or even Jerry Seinfeld territory (net worth: $1.1 billion).

Here’s how it all breaks down.

You may have to split the prize

It’s great if you can keep that jackpot all to yourself, but that doesn’t always happen. In fact, in the 50 largest lottery jackpots claimed to date, the prize has been split by two or more winners 10 times, and in some cases by as many as three. Let’s assume a worst-case scenario here, and you get only a third of that jackpot.

Your share of the $1.7 billion prize is $566,666,667.

You take the lump sum

The big advertised jackpot number reflects the amount you’d receive if you opted to annuitize your prize over 29 years (30 payments in all). But the vast majority of jackpot winners go for the lump-sum payout, according to reports.

And at least some financial advisers say there’s good logic behind doing that, because it leaves you in control of how to invest (and presumably grow) the money. Still, taking the lump sum cuts the total by more than 50%, according to what Powerball shares. The current lump sum if only one winner claims the $1.7 billion jackpot is $781.3 million. If there are three winners, that would have to be split three ways.

Your prize is now $260,433,333.

You have to pay Uncle Sam

You didn’t think the taxman would forget to come for a share of your winnings, did you? With a big lottery prize, you’ll now be in the highest federal tax bracket, which means a 37% hit. (You can do the math yourself, but trust us: You’ll be among the top earners.)

Your prize is now $164,073,000.

Your state and city can come calling, too

Most states — and some municipalities — levy their own income taxes. So that’s another chunk to calculate based on that $260,433,333 figure. The rates vary considerably, but let’s say you live in a place with a high income-tax rate, especially for wealthy individuals. For example, New York state’s top tax rate is 10.9% (New York City residents pay an additional income tax) and New Jersey’s is 10.75%, according to the Tax Foundation website. For the sake of simplicity, we’ll consider what a 10% state income-tax hit might do to your winnings.

You need to bring in professionals to sort everything out

If you talk to folks who work with high-net-worth individuals, they’ll all tell you pretty much the same thing: It costs money to be a rich person, because you need to sort through a minefield of legal and tax-related matters.

TO READ MORE: https://finance.yahoo.com/news/sorry-winning-powerball-1-6-221200157.html

FRANK26….12-24-25……MERRY CHRISTMAS

KTFA

Wednesday Night Video

FRANK26….12-24-25……MERRY CHRISTMAS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video

FRANK26….12-24-25……MERRY CHRISTMAS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

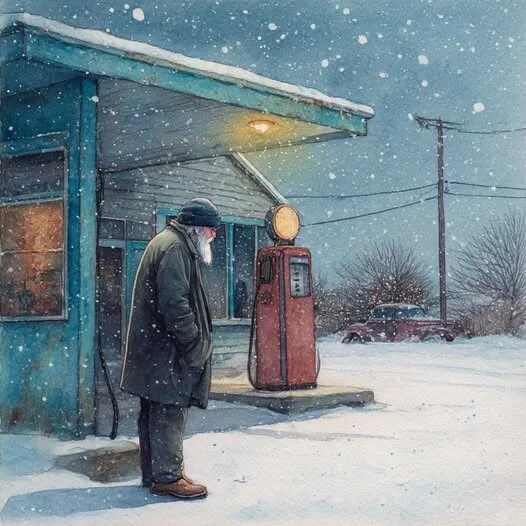

The old man sat in his gas station on a cold Christmas Eve

TNT:

Tishwash: The old man sat in his gas station on a cold Christmas Eve

A beautiful read during this magical season

The old man sat in his gas station on a cold Christmas Eve. He hadn't been anywhere in years since his wife had passed away. It was just another day to him. He didn't hate Christmas, just couldn't find a reason to celebrate.

He was sitting there looking at the snow that had been falling for the last hour and wondering what it was all about when the door opened and a homeless man stepped through.

TNT:

Tishwash: The old man sat in his gas station on a cold Christmas Eve

A beautiful read during this magical season

The old man sat in his gas station on a cold Christmas Eve. He hadn't been anywhere in years since his wife had passed away. It was just another day to him. He didn't hate Christmas, just couldn't find a reason to celebrate.

He was sitting there looking at the snow that had been falling for the last hour and wondering what it was all about when the door opened and a homeless man stepped through.

Instead of throwing the man out, Old George as he was known by his customers, told the man to come and sit by the heater and warm up. "Thank you, but I don't mean to intrude," said the stranger. "I see you're busy, I'll just go." "Not without something hot in your belly." George said.

He turned and opened a wide mouth Thermos and handed it to the stranger. "It ain't much, but it's hot and tasty. Stew ... Made it myself. When you're done, there's coffee and it's fresh."

Just at that moment he heard the "ding" of the driveway bell. "Excuse me, be right back," George said. There in the driveway was an old '73 Chevy. Steam was rolling out of the front. The driver was panicked. "Mister can you help me!" said the driver, with a deep Spanish accent. "My wife is with child and my car is broken." George opened the hood. It was bad. The block looked cracked from the cold, the car was dead. "You ain't going in this thing," George said as he turned away.

"But Mister, please help ..." The door of the office closed behind George as he went inside. He went to the office wall and got the keys to his old truck, and went back outside. He walked around the building, opened the garage, started the truck and drove it around to where the couple was waiting. "Here, take my truck," he said. "She ain't the best thing you ever looked at, but she runs real good."

George helped put the woman in the truck and watched as it sped off into the night. He turned and walked back inside the office. "Glad I gave 'em the truck, their tires were shot too. That 'ol truck has brand new ." George thought he was talking to the stranger, but the man had gone. The Thermos was on the desk, empty, with a used coffee cup beside it. "Well, at least he got something in his belly," George thought.

George went back outside to see if the old Chevy would start. It cranked slowly, but it started. He pulled it into the garage where the truck had been. He thought he would tinker with it for something to do. Christmas Eve meant no customers. He discovered the block hadn't cracked, it was just the bottom hose on the radiator. "Well, shoot, I can fix this," he said to himself. So he put a new one on.

"Those tires ain't gonna get 'em through the winter either." He took the snow treads off of his wife's old Lincoln. They were like new and he wasn't going to drive the car anyway.

As he was working, he heard shots being fired. He ran outside and beside a police car an officer lay on the cold ground. Bleeding from the left shoulder, the officer moaned, "Please help me."

George helped the officer inside as he remembered the training he had received in the Army as a medic. He knew the wound needed attention. "Pressure to stop the bleeding," he thought. The uniform company had been there that morning and had left clean shop towels. He used those and duct tape to bind the wound. "Hey, they say duct tape can fix anythin'," he said, trying to make the policeman feel at ease.

"Something for pain," George thought. All he had was the pills he used for his back. "These ought to work." He put some water in a cup and gave the policeman the pills. "You hang in there, I'm going to get you an ambulance."

The phone was dead. "Maybe I can get one of your buddies on that there talk box out in your car." He went out only to find that a bullet had gone into the dashboard destroying the two way radio.

He went back in to find the policeman sitting up. "Thanks," said the officer. "You could have left me there. The guy that shot me is still in the area."

George sat down beside him, "I would never leave an injured man in the Army and I ain't gonna leave you." George pulled back the bandage to check for bleeding. "Looks worse than what it is. Bullet passed right through 'ya. Good thing it missed the important stuff though. I think with time you’re gonna be right as rain."

George got up and poured a cup of coffee. "How do you take it?" he asked. "None for me," said the officer. "Oh, yer gonna drink this. Best in the city. Too bad I ain't got no donuts." The officer laughed and winced at the same time.

The front door of the office flew open. In burst a young man with a gun. "Give me all your cash! Do it now!" the young man yelled. His hand was shaking and George could tell that he had never done anything like this before.

"That's the guy that shot me!" exclaimed the officer.

"Son, why are you doing this?" asked George, "You need to put the cannon away. Somebody else might get hurt."

The young man was confused. "Shut up old man, or I'll shoot you, too. Now give me the cash!"

The cop was reaching for his gun. "Put that thing away," George said to the cop, "we got one too many in here now."

He turned his attention to the young man. "Son, it's Christmas Eve. If you need money, well then, here. It ain't much but it's all I got. Now put that pea shooter away."

George pulled $150 out of his pocket and handed it to the young man, reaching for the barrel of the gun at the same time. The young man released his grip on the gun, fell to his knees and began to cry. "I'm not very good at this am I? All I wanted was to buy something for my wife and son," he went on. "I've lost my job, my rent is due, my car got repossessed last week."

George handed the gun to the cop. "Son, we all get in a bit of squeeze now and then. The road gets hard sometimes, but we make it through the best we can."

He got the young man to his feet, and sat him down on a chair across from the cop. "Sometimes we do stupid things." George handed the young man a cup of coffee. "Bein' stupid is one of the things that makes us human. Comin' in here with a gun ain't the answer. Now sit there and get warm and we'll sort this thing out."

The young man had stopped crying. He looked over to the cop. "Sorry I shot you. It just went off. I'm sorry officer." "Shut up and drink your coffee " the cop said. George could hear the sounds of sirens outside. A police car and an ambulance skidded to a halt. Two cops came through the door, guns drawn. "Chuck! You ok?" one of the cops asked the wounded officer.

"Not bad for a guy who took a bullet. How did you find me?"

"GPS locator in the car. Best thing since sliced bread. Who did this?" the other cop asked as he approached the young man.

Chuck answered him, "I don't know. The guy ran off into the dark. Just dropped his gun and ran."

George and the young man both looked puzzled at each other.

"That guy work here?" the wounded cop continued. "Yep," George said, "just hired him this morning. Boy lost his job."

The paramedics came in and loaded Chuck onto the stretcher. The young man leaned over the wounded cop and whispered, "Why?"

Chuck just said, "Merry Christmas boy ... and you too, George, and thanks for everything."

"Well, looks like you got one doozy of a break there. That ought to solve some of your problems."

George went into the back room and came out with a box. He pulled out a ring box. "Here you go, something for the little woman. I don't think Martha would mind. She said it would come in handy some day."

The young man looked inside to see the biggest diamond ring he ever saw. "I can't take this," said the young man. "It means something to you."

"And now it means something to you," replied George. "I got my memories. That's all I need."

George reached into the box again. An airplane, a car and a truck appeared next. They were toys that the oil company had left for him to sell.

Here's something for that little man of yours."

The young man began to cry again as he handed back the $150 that the old man had handed him earlier.

"And what are you supposed to buy Christmas dinner with? You keep that too," George said. "Now git home to your family."

The young man turned with tears streaming down his face. "I'll be here in the morning for work, if that job offer is still good."

"Nope. I'm closed Christmas day," George said. "See ya the day after."

George turned around to find that the stranger had returned. "Where'd you come from? I thought you left?"

"I have been here. I have always been here," said the stranger. "You say you don't celebrate Christmas. Why?"

"Well, after my wife passed away, I just couldn't see what all the bother was. Puttin' up a tree and all seemed a waste of a good pine tree. Bakin' cookies like I used to with Martha just wasn't the same by myself and besides I was gettin' a little chubby."

The stranger put his hand on George's shoulder. "But you do celebrate the holiday, George. You gave me food and drink and warmed me when I was cold and hungry. The woman with child will bear a son and he will become a great doctor.

The policeman you helped will go on to save 19 people from being killed by terrorists. The young man who tried to rob you will make you a rich man and not take any for himself. "That is the spirit of the season and you keep it as good as any man."

George was taken aback by all this stranger had said. "And how do you know all this?" asked the old man.

"Trust me, George. I have the inside track on this sort of thing. And when your days are done you will be with Martha again."

The stranger moved toward the door. "If you will excuse me, George, I have to go now. I have to go home where there is a big celebration planned."

George watched as the old leather jacket and the torn pants that the stranger was wearing turned into a white robe. A golden light began to fill the room.

"You see, George ... it's My birthday. Merry Christmas."

George fell to his knees and replied, "Happy Birthday, Lord Jesus"

Merry Christmas!!

MERRY CHRISTMAS AND GOD BLESS

One of the most famous Christmas scenes in movie history was filmed in secret

TNT:

Mot: One of the most famous Christmas scenes in movie history was filmed in secret

One of the most famous Christmas scenes in movie history was filmed in secret, right in front of thousands of New Yorkers who didn’t know what was going on.

When you watch Miracle on 34th Street, you’re not looking at a Hollywood set or paid extras. You’re seeing a real moment from 1946, captured as it happened.

Director George Seaton decided not to use a studio and instead put his cast in the real Macy’s Thanksgiving Day Parade.

TNT:

Mot: One of the most famous Christmas scenes in movie history was filmed in secret

One of the most famous Christmas scenes in movie history was filmed in secret, right in front of thousands of New Yorkers who didn’t know what was going on.

When you watch Miracle on 34th Street, you’re not looking at a Hollywood set or paid extras. You’re seeing a real moment from 1946, captured as it happened.

Director George Seaton decided not to use a studio and instead put his cast in the real Macy’s Thanksgiving Day Parade.

Since the parade was live and couldn’t be stopped or done again, the crew had to work very carefully.

To avoid drawing attention, cameras were tucked away in apartment windows and small nooks along the street.

Edmund Gwenn didn’t just play Santa for the movie; he actually served as the official Santa for the real 1946 parade.

He rode the final float and even climbed the ladder to the Macy’s marquee at the end, all while thousands of cheering spectators had no clue he was an actor filming a movie.

The crew used nine cameras simultaneously to ensure they caught every moment. It was so cold that November morning that the cameras actually froze, forcing the crew to use heating blankets to keep them running.

The looks of amazement on the children’s faces in the film are real because they truly thought they were witnessing Santa Claus’s arrival in New York. Even 8-year-old Natalie Wood, who played Susan, admitted years later that she believed Gwenn was the real deal during filming because she never saw him without his beard.

This mix of real life and storytelling turned the film into a lasting snapshot of the true joy of a New York City Christmas after the war.

Gwenn’s belief wasn’t just a charming sentiment for the cameras; it was rooted in a production that blurred the lines between fiction and reality.

"Now I know there's a Santa Claus." The "miracle" followed Edmund Gwenn all the way to the Academy Awards. When he stepped onto the stage to accept his Best Supporting Actor Oscar, he stayed true to the spirit of the film. He famously told the audience:

"Now I know there's a Santa Claus."

Merry Christmas ALL, from Rodney!!

Warm holiday greetings friends!

It’s that time of year again, time for some more a cappella Christmas cheer!

I'm so honored to be able to spread Christmas love via music with my friends!

If you’ve already received this gift through social media or other means I apologize. Just trying to be sure no one gets left out! Please share and share again with other music lovers!

Here's the youtube link for this year’s present.

Warm holiday greetings friends!

It’s that time of year again, time for some more a cappella Christmas cheer!

I'm so honored to be able to spread Christmas love via music with my friends!

If you’ve already received this gift through social media or other means I apologize. Just trying to be sure no one gets left out! Please share and share again with other music lovers!

Here's the youtube link for this year’s present.

https://youtu.be/2zVwHyp8i58

Or you can click here and listen to Christmas arrangements from the past.

They are all here on my youtube channel. Feel free to subscribe or just drop by for a listen.

https://www.youtube.com/@musicology47/playlists

Enjoy and have a very Merry Christmas!!

God Bless!

~Rod

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the call tonight - It is Tuesday, December 23rd and you're listening to the big call. Thanks everybody for joining us again. We're looking forward to tonight's call, and we're welcoming you back since last Thursday, five days later, here we are ready for another call, and we just are so blessed and thankful at this time of year

So let's, let's get into the Intel, and let's see what we have for you tonight. We were in a window that just expired at 9pm Eastern. It started at 6am in the morning Sunday, last Sunday and today is Tuesday night, it was to go until 9pm tonight. This was a window of opportunity, according to one of our redemption center leaders that said the email that he got from Treasury, and then treasury to Wells Fargo, and Wells Fargo to him, and all the redemption center leaders were putting this window of opportunity in play.

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the call tonight - It is Tuesday, December 23rd and you're listening to the big call. Thanks everybody for joining us again. We're looking forward to tonight's call, and we're welcoming you back since last Thursday, five days later, here we are ready for another call, and we just are so blessed and thankful at this time of year

So let's, let's get into the Intel, and let's see what we have for you tonight. We were in a window that just expired at 9pm Eastern. It started at 6am in the morning Sunday, last Sunday and today is Tuesday night, it was to go until 9pm tonight. This was a window of opportunity, according to one of our redemption center leaders that said the email that he got from Treasury, and then treasury to Wells Fargo, and Wells Fargo to him, and all the redemption center leaders were putting this window of opportunity in play.

That window closed at 9pm tonight, staring of the call, and that wasn't connected to it. That wasn't the reason it just happened to close at 9pm but the good news is a new window opened up at 9pm tonight, the start of the big call that goes until January. 3rd

Boy, Bruce, that's a long window. What? What are you saying? Are you saying we're not going till January? No, because we can go anytime within that window from tonight to January 3, anytime within but here's the reason for the push.

This made a little bit of sense to me when I heard this today

There are still 17 countries that are not yet asset backed with a currency. 17 countries have from now until Saturday, four days from now until Saturday asset backed, or they'll be on the outside looking in, out of the loop.

So they have four days to get their act together and get their currencies asset backed. Because guess what? Look what they lose if they're not asset backed. Number one, they cannot get on the quantum financial system.

Number two, they're out of the loop on GESARA and the benefits that go to all of these countries around the world.

So they better get their act together and get their currencies asset backed pronto, because Saturday is four days away. And you know, guys, I can't tell you they it's not like they didn't know this was happening. It's not like they didn't know this was coming.

So what are they doing? You know, sitting on their hands. I mean, really, this is just nuts. And, you know, we put it pushed us to a new window. Otherwise, we had our numbers by tonight and we'd be off to the races, but right now, we have a window from tonight to January 3, and the good news is that we did get information today, this afternoon, later that said that redemption centers and banks will have brand new rates on their screens, locked in, locked In by Friday evening.

Now the evening starts at 6pm - so by Friday at 6pm or Friday evening, redemption centers and banks will have good live, solid rates on their screens Friday evening and the same individual thought based on that information that he received today, this is a leader of a redemption Center. He said it could be a weekend start, which is probably a Saturday, but it could be a Saturday or Sunday start, so we'll see.

The window goes to January 3 is when we're supposed to go anytime within. But I'm encouraged that, yeah, it's encouraging to me that those rates will be solidified at 6pm that's called Friday evening, three days away. Today's Tuesday, Wednesday, Thursday, right? Wednesday, Thursday, Friday. Three days from now, those rates will be solid. Now, the other thing we learned about rates was on the Forex.

Remember, we're kind of halfway interested in whether all the currencies made their way to the Forex? Well they did Sunday evening, because that's when the Forex opens back up. This is 5pm eastern - and that is when they showed up, and we found out that that was the case on Monday morning.

Yesterday morning, we had three verifications of that that the Forex lit up, and we received information that over that weekend, starting Sunday, probably that Iraq did have a new international rate. We did.

We haven't received the confirmation of what it is. And be honest with you guys, it really doesn't matter to me, but it is.

It does not affect our previously contracted contract rate by President Trump in his first term, that contract rate is still valid for us that he did in his first term. And it is absolutely stellar.

It is excellent. I mean, it's almost unbelievable. I wouldn't believe it, but I know that President Trump worked it out and made it work. And it's going to be if you add dinar and they don't offer you the contract rate at only the redemption centers, be sure to ask for it, and they should give it to you, even if you have zim Bruce, even if you have it done, yeah, even if you have them.

Because some people like I talked about many years ago, are going to use some of the currencies like Dong and dinar, rupia, Afghani, for their so called own purposes, and use their Zim for the International and other humanitarian projects, right? So that's still the good concept, but really, you know, all the money is God's, and you guys are stewards of it.

We're all going to be good stewards of it, and we'll do what needs to be done to level the playing field and uplift humanity globally, not just here, yeah, we're going to start with the US, yeah, like would be, but we're also going to help other countries and islands and stuff you know, that have Been whacked by hurricane Helene and hurricane Melissa.

Okay, so we haven't forgotten about you. -- Those other countries we talked about working with Haiti if they'll let us and if they don't red tape us to death, Haiti, Dominican Republic, the Bahamas and and others like Jamaica, remember, just got whacked by Melissa and a force five hurricane. They need a lot. They need homes. They probably need schools, businesses. And I think we could do some things, some major things in Jamaica, I really think we can't now. They're resilient people, but they need help, and that’s one we will help internationally.

Let's see what else.

The other thing is, other rates. Okay, let's talk a little bit about what's going on in Venezuela? Venezuela, use to be like a terrific economic power, beautiful country. I have friends from Venezuela in college, two guys in karate with me, and good guys, you know?

Yeah, really, all right, so with that latest regime, I hope he's on his way out, and I believe he is but the real, legally elected woman, which is wonderful, and I'm not sure guys, so they haven't read the name, but I think it's, I don't know if I'm wrong, I'm wrong, but she is the new duly elected president of Venezuela, and I would love to see that come to freedom and get Venezuela all buttoned up, and you know all about the drug trafficking, and I know more than I can share on the story and about what they were carrying and I’m going to say who they were carrying -, and all that stuff needs to come to an end.

All that stuff needs to come to an end. So there's a lot of going on. There's a lot of cleanup. There's a lot still clean up here in the country, in the US. It looks like things are moving well

Now, I’m going to make one comment about the med beds, number one. They are out and have been out for a couple of years at least

We've got about 50,000 med bed centers, only 6000 plus med bed centers, 23,500 hospitals, that's right, that have two to four med beds in each hospital, half of them have two med beds. The other half have four med beds.

Those hospitals, plus the other independent, let's call them med bed centers. Total pretty close to 50,000 in the US, not as many, of course, in Canada, as many in Mexico, and internationally, I could do it around the club. We don't have that Intel, but we do have it for the US, and we know they're being military, and they're being used for children that have been trafficked, that they rescued out of the tunnels in different places.

They are using them on those and especially on regeneration of legs and arms, hands, face, all of this stuff where we're of seven different accounts. This that we, our team, has witnessed – IN PERSON - meaning, seeing it happen, watching the healing take place.

In a Period of time, the time is amazingly fast, so I'm looking forward that myself, and I know a lot of you as well, and the date that those med beds will be available for zim holders with dire need begins, January 2.

January 2. Now the so called public is supposed to start in mid could be pushed. The only thing is, we have to start exchanges and then go when you're in the regime, actually let them see what your dire need is they can see it visually, if not you talk, and then they will enter a few keystrokes in your computer, and you'll be able to set appointment, or they'll contact you for your appointment for the bed. Beds, that's mini med bed. That's all that is. But I want to go. That's the timing prayer. When they're going to be here. We already know they're there, and we already know we're going to start using them Okay, obviously, it's based on the new window - which we're in now that I look about between now and January 3rd for our notifications exchanges.

All right, let's see if there's anything relevant other than Merry Christmas.

I will be doing call Christmas night, nine o'clock Eastern, same time, same station. We'll be there. Probably be about6 an hour calll. We're not gonna go long call, it, we're going to do role play on setting appointments at the calls centers – it’s going to be fun. And you'll probably hear Sue laughing because whe she has fun – she tends to do that . It was a very beautiful laugh.

Now, is there anything else that we need to know that the only thing about is this? Okay? Some of you have this way than Bolivar, B, O, L, I, V, A, R, Bolivar is one of the best currencies for the return on it. It's not as strong as the doom, but it's good because the denominations are high, and I know what the rate is predicted to be. It's not on the screens right now, but I know what it was on the screen, so I know it's projected.

So and get that, get their situation, salt bar will come back up on the screen and be worth what it should at the time of the redemption so redemption centers are moving personnel. They're moving into position, struggle locations. And we're ready. We've been ready. I know I've been ready, but window, because 17 countries, and you know who you are. I can confuse you over and get set back by Saturday, or there's under the outside the money rest on brag. Outside the building. So you don't want to be crying, you better get your stuff together.

Okay, and get your currency assets you're Iraq was partying Sunday and yesterday because of the debate, and so that's cool. That's really good. And partying Christmas night here on the bill.

I'm disappointed that we can get before New Year's How about that? That would be great. Let's get it after Christmas.

January 3 happened, but let's get it. Let's get it now, as soon as we right now, I want everybody just to enjoy the holiday when you're traveling California under all the rain and so I mean, it's going to be a lot, and you can watch out for slides, landslides.

It's starting tonight.

The fronts are coming, and they'll speak out, out there in LA candy, San Diego, every place Be careful. And get ready. All right, let's pray the call out. Have a wonderful Christine tomorrow, and we're great. And I will see you Christmas. And I can't even say that bless you all, and God bless.

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:08:08

Bruce’s Big Call Dinar Intel Thursday Night 12-11-25 REPLAY LINK Intel Begins 1:21:00

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:02:50

Bruce’s Big Call Dinar Intel Thursday Night 12-4-25 No Transcription Intel Begins 1:17:33

Bruce’s Big Call Dinar Intel Tuesday Night 12-2-25 REPLAY LINK Intel Begins 1:07:20

Bruce’s Big Call Dinar Intel Thursday Night 11-28-25 Thanksgiving NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 11-25-25 REPLAY LINK Intel Begins 1:06:06

Bruce’s Big Call Dinar Intel Thursday Night 11-20-25 REPLAY LINK Intel Begins 53:30

Bruce’s Big Call Dinar Intel Tuesday Night 11-18-25 REPLAY LINK Intel Begins 1:13:03

Bruce’s Big Call Dinar Intel Thursday Night 11-13-25 REPLAY LINK Intel Begins 1:10:20

Bruce’s Big Call Dinar Intel Tuesday Night 11-11-25 REPLAY LINK Intel Begins 1:24:24

The End of the Fiat Experiment – Bill Holter

The End of the Fiat Experiment – Bill Holter

By Greg Hunter’s USAWatchdog.com

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) has been sounding the alarm of the profound risk in the financial system.

At the beginning of December, Mr. Gold warned about the record setting silver prices and said, “It’s pretty clear and pretty obvious that something behind the scenes is breaking.” What is “breaking” is the extremely leveraged futures markets with not enough physical silver to deliver.

The End of the Fiat Experiment – Bill Holter

By Greg Hunter’s USAWatchdog.com

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) has been sounding the alarm of the profound risk in the financial system.

At the beginning of December, Mr. Gold warned about the record setting silver prices and said, “It’s pretty clear and pretty obvious that something behind the scenes is breaking.” What is “breaking” is the extremely leveraged futures markets with not enough physical silver to deliver.

Fast forward to the end of the month, and new record highs in gold and silver are happening every day.

Mr. Gold says, “They are gobbling up all the supply available because they understand this is the end of the fiat currency experiment that started August 15 of 1971.

Fiats are collapsing.

This is the Hunt brothers on steroids because you have the entire world buying physical. The Hunt brothers got into trouble because they were buying paper contracts, and COMEX changed the rules. COMEX can change any rules they want . . . it won’t matter because the rest of the world is buying cash and carry . . . they will not accept paper contracts. They want real physical metal.”

Here is where it gets both interesting and dangerous.

What happens if the short sellers cannot deliver the silver promised? Mr. Gold says, “People say if they can’t deliver, and I am going to tell you at some point they will not be able to deliver, when that moment happens, it’s game over for the entire financial system.

Silver, and I believe it will be silver that fails to deliver, silver is the blasting cap to the gold nuclear bomb. When silver fails to deliver, then immediately there will be a pile into COMEX gold, and they will not be able to deliver the gold.

Once that happens, you have failures of contracts that are proven fraudulent. They are zeroed out and cannot perform. Then it spreads to cattle, pork bellies, grains and you name it.

This is not to mention the financials of stocks and bonds. Once you prove fraud in silver, that’s going to spread to all the derivatives, and we will have a derivative meltdown. . .. The world wants gold and silver because those are the only two monies that cannot default.”

What you are seeing in the gold and silver markets now is far from a top. This is just getting started.

Mr. Gold says, “These contracts are a zero-sum game. There is a winner and a loser. If the loser loses so big that they go belly up, then the winner becomes a loser because they can’t get paid.

That is the problem. . .. When this actually hits and there is a failure to deliver, gold and silver will be wiped off the shelves, and there will be none to be bought. . .. This will be a run for safety, and fear is the greatest emotion there is.

Fear is a far greater emotion than greed. . .. This is going to turn into a reverse bank run into gold and into silver because they cannot default in a world that is defaulting. . .. What you are witnessing is the end of trust.

When you have the end of trust, the confidence breaks and credit is forthcoming only when there is trust. Once confidence breaks, the credit markets will begin to seize up. . .. When credit stops, it’s game over. You will see markets, institutions and stores shutter.”

Holter says you should be able to be self-sufficient for a while when the system shuts down. Storing up food and water is a good place to start.

In closing, Holter says, “This is the finale of the great financial reset. Make no mistake, what you are watching is the world resetting before your very eyes.”

There is much more in the 43-minute interview.

Join Greg Hunter of USAWatchdog as he goes One-on-One with financial writer and precious metals expert Bill Holter/Mr. Gold as the financial system begins its reset for 12.23.25.

https://usawatchdog.com/the-end-of-the-fiat-experiment-bill-holter/

Wednesday Coffee with MarkZ,. 12/24/2025

Wednesday Coffee with MarkZ,. 12/24/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning everybody…Merry Christmas Eve!

Member: what are you hearing on the RV today Mark?

Wednesday Coffee with MarkZ,. 12/24/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good morning everybody…Merry Christmas Eve!

Member: what are you hearing on the RV today Mark?

MZ: Lots of rumors….but waiting on something solid. I avoid saying the ones that have to much hopium until I can vet them.

Member: Bruce says we will see it by the 3rd?

MZ: The majority of my Iraqi contacts and group leaders believe the same. The bond folks also agree with him…by and large.

Member: Jan 3rd is next week guys, light is getting brighter for this thing to happen.

MZ: The bond side is still very hopeful for this week. This is coming out of my Asian contacts.the European contacts are gone for the holidays. A couple contacts commented they would be returning before Jan 1st. This is very unusual.

Member: Will you still get group updates this week even though its Christmas?

MZ: Yes I still expect updates. But they may start peculating slowly. I do not expect any tomorrow or the 26th…..but hopefully we start getting updates on the 27th.

Member: Hey Mark, I said last August that my Reno bond contact did not expect anything until early 2026

MZ: Well we are almost there.

Member: IYO Mark are we waiting on new parliament to get set and settle HCL with a new rate?

MZ: “ The House of Representatives concludes its preparations to hold its first session next Monday” Hmmmmm They hope to seat the Prime Minister and Speaker of the house that day. So good progress in Iraq.

MZ: “Iraq starts exporting gas after achieving self sufficiency” this is almost 3 years ahead of schedule.

MZ: “Iran’s currency continues to fall amid worsening economic crisis in the country” $8 or $9 bucks will buy you about a million Toman right now. Iran is on the cusp of a collapse.

Member: Shanghai exchange closed at 77.80 silver last night folks

Member: I remember we used to talk about silver hitting $50 now we are talking about $70 wow, look how far we have come

MZ: I thought this one was interesting. “Why does everyone flee to gold in every economic crisis?” they are talking about how everyone is running to gold and silver right now. The dollar is only backed by the US military. They are saying the only real value is in metals. This article goes into when Nixon took us off of the Gold Standard. The whole world has finally figured out that the paper money is really not worth much unless backed by an asset.

MZ: It is time for a reset.

Member: Is Venezuela going to be in the first basket?

MZ: I do not believe it is.

Member: Darn it…..We have a lot of bolivar.

Member: Just hold onto it. It still may revalue soon after

Member: I have read that Japan’s $$$ woes will cause the fiat system to collapse.

Member: From all the economists…..its going to be soon.

Member: Merry Christmas Everyone! Jesus is the reason, we celebrate him!

Member: All I want for Christmas is to RV ... ho ho ho Merry Christmas to all ...May all your prayers and wishes be fulfilled!!!

Lewis Herms joins the stream today. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! NO NIGHTLY PODCASTS THIS WEEK ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Wednesday 12-24-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 23 Dec. 2025

Compiled Wed. 24 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: I’m going to take a break and celebrate the holidays with my family, so this will be my last update until after the holidays, or perhaps even further. We’ll wait and see what is needed in terms of broadcasting the Truth.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 23 Dec. 2025

Compiled Wed. 24 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: I’m going to take a break and celebrate the holidays with my family, so this will be my last update until after the holidays, or perhaps even further. We’ll wait and see what is needed in terms of broadcasting the Truth.

One of the reasons I made this decision was that little news about the RV, EBS and Ten Days of Darkness was being let out. It needs to be a surprise for a lot of reasons. Although, we do know that the World will be (allegedly) changing over to the new financial system on Thurs. 1 Jan. 2026.

With the Global Currency Reset in place across the World, plus the Restored Republic announced, there would likely no longer be a need for my services as is. After all, for the past twelve years my daily update was known as “Restored Republic via a Global Currency Reset.”

Now I can say: “Mission Accomplished!”

On other matters, the Global Currency Reset has (allegedly) fully activated within the Quantum Financial System (QFS), with gold-backed currencies (allegedly) live and the greatest wealth transfer in history commencing imminently.

Trillions reclaimed from Cabal control flow to the people, with notifications, exchanges, and payouts ready to begin as redemption centers (allegedly) prepare for appointments. This divine redistribution ends engineered scarcity, restoring prosperity as promised in the scriptures.

NESARA/GESARA implementations bring complete debt forgiveness—erasing mortgages, loans, credit cards—while (allegedly) dissolving the old central banking system.

A new fair tax structure (allegedly) emerges, with restitution funds and abundance packages ushering in an era where homes, vehicles, and essentials are affordable for all under God’s bountiful grace.

Prepare your homes with supplies, remain calm in faith, and trust that victory over the Cabal is assured through heavenly justice.

~~~~~~~~~~~~

Tues. 23 Dec. 2025 The Big Call, Bruce:

A new window opened up: Tier4b can now go anytime from Tues. night 23 Dec. to Sun. 4 Jan. 2026

It did not go because there are 17 countries that were not yet asset-backed. They have until Sat. 27 Dec. 2025 to get asset-backed, or they cannot be part of the Global Financial System, nor be part of GESARA wealth distribution.

Redemption Centers and banks will have the new rates locked in on their screens by Fri. evening 26 Dec. 2025. That would make it a weekend start around Sat. 27 Dec. 2025.

At 5 pm EST Sun. 21 Dec. the Forex had the new rates on their back screens.

Read full post here: https://dinarchronicles.com/2025/12/24/restored-republic-via-a-gcr-update-as-of-december-24-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man I can't hammer it home enough. What we've been waiting for is actually taking place in a quiet mode. They've been doing systemic steps all the way along the way. They've been telling us in their own way, not in a way we want to hear, date and rate...

Jeff Article: "Iraq Central Bank Reduces Supply of Dinars" They're reducing the money supply to help them or position them to revalue the currency...Very critical step towards revaluing the currency.

Frank26 [Iraq boots-on-the-ground report] OMAR: The new currency mechanism was to roll out on December 1st and it didn't, all because the issue with the imports at the border still wasn't fixed with the ASYCUDA system. They asked for an extension and they got the extension to the end of December. IMPO we will see a rate along with import system fixed, expiring of 1310 all at the end of December. FRANK: The ASYCUDA is also looking for a new exchange rate in order for everything that it is doing, saying and implementing in order for it to work...The 29th to the 31st will determine what happens on the 1st of January.

************

Trump’s Economic System Is Picking Up Speed, Trump Explains The Economic Path Forward

X22 Report: 12-24-2025

The world is moving away from wind and solar, coal demand is up, China was never going along with the green new scam.

Trump is moving carefully through the [CB] minefield economy. Gold is on the move.

Trump is moving the country out of the old system.

Seeds of Wisdom RV and Economics Updates Wednesday Morning 12-24-25

Good Morning Dinar Recaps,

US Economy Surges at Fastest Pace in Two Years — Growth Beats Forecasts

Unexpected strength reshapes global economic expectations

Overview:

The U.S. economy grew at an annualized 4.3% rate in the third quarter of 2025, marking the fastest expansion in two years.

Growth was driven by strong consumer spending, robust exports, and increased government investment, exceeding economist forecasts.

Inflation remains slightly above target, complicating central bank policy decisions as labor market momentum weakens.

Good Morning Dinar Recaps,

US Economy Surges at Fastest Pace in Two Years — Growth Beats Forecasts

Unexpected strength reshapes global economic expectations

Overview:

The U.S. economy grew at an annualized 4.3% rate in the third quarter of 2025, marking the fastest expansion in two years.

Growth was driven by strong consumer spending, robust exports, and increased government investment, exceeding economist forecasts.

Inflation remains slightly above target, complicating central bank policy decisions as labor market momentum weakens.

Key Developments:

Consumer expenditure contributed a significant portion of the expansion, signaling enduring domestic demand.

Export growth and government outlays helped offset slower private investment.

Despite rapid GDP growth, consumer confidence hit a multi-year low, highlighting uneven sentiment across economic sectors.

Core inflation pressures persist, influencing expectations around future interest rate moves.

The slowdown in the labor market and government shutdown risks may temper growth in the quarter ahead. The Times

Why It Matters:

Stronger-than-expected U.S. growth influences global capital flows, currency markets, and risk pricing. As the world’s largest economy outperforms forecasts, investors recalibrate portfolios, interest rate expectations shift, and reserve managers reassess holdings tied to dollar-linked assets and global liquidity conditions.

Why It Matters to Foreign Currency Holders:

For foreign currency holders, a resilient U.S. economy can reinforce demand for the dollar, strengthening its role as a reserve and settlement currency relative to others. However, persistent inflation above targets and labor market softness complicate monetary policy projections, potentially driving volatility in FX markets. Strong U.S. output also attracts capital flows, which can tighten external financing conditions for emerging market currencies and reshape reserve diversification strategies.

Implications for the Global Reset:

Pillar 1: Dollar Strength & Reserve Demand — U.S. economic outperformance supports the dollar’s centrality, affecting FX allocation decisions.

Pillar 2: Monetary Policy Divergence — Decisive growth with inflation risks may accelerate divergent policy paths, impacting global borrowing costs and capital flows.

This is not just GDP data — it’s a key input into how currency, capital, and confidence are recalibrated across the global financial system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Times – “US economy expands at the fastest rate in two years”

The Guardian – “US economic growth surges to fastest rate in two years”

~~~~~~~~~~

Zelensky Signals Major Concession as Ukraine War Talks Advance

Territorial flexibility hints at potential breakthrough after years of stalemate

Overview:

Ukrainian President Volodymyr Zelensky indicated willingness to withdraw troops from parts of eastern Donetsk under proposed peace terms.

Options under discussion include demilitarized zones, potential free economic areas, or a freeze along current territorial lines.

The move marks one of the most significant shifts in Kyiv’s negotiating posture since the war began.

Key Developments:

Zelensky confirmed Ukraine is considering a demilitarized buffer zone monitored by international forces.

A proposal for free economic zones in contested regions aims to break the deadlock over sovereignty disputes.

Kyiv may submit any territorial agreement to a national referendum, underscoring domestic political sensitivity.

Negotiations include unresolved issues such as military size limits and control of the Zaporizhzhia Nuclear Power Plant.

U.S.-backed talks intensified following renewed diplomatic engagement under President Trump’s second term.

Why It Matters:

Territorial disputes have been the primary obstacle preventing a negotiated end to Europe’s largest land war in decades. Zelensky’s willingness to explore compromise suggests momentum toward a ceasefire framework, even as constitutional, security, and sovereignty hurdles remain unresolved.

Why It Matters to Foreign Currency Holders:

Any credible move toward peace reduces regional currency volatility, stabilizes Eastern European financial markets, and lowers geopolitical risk premiums embedded in foreign exchange pricing. A reduction in war-related uncertainty could strengthen regional currencies, impact capital flows, and influence reserve positioning tied to European and dollar-based assets.

Implications for the Global Reset:

Pillar 1: Conflict-to-Capital Transition — De-escalation opens pathways for reconstruction finance, debt restructuring, and renewed trade corridors.

Pillar 2: Geopolitical Risk Repricing — Markets recalibrate currency, bond, and commodity risk once prolonged conflict enters a resolution phase.

This is not just diplomacy — it’s geopolitical risk being repriced across the global financial system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Newsweek – “Zelensky Makes Major Concession to End Ukraine War”

Associated Press – “Zelensky floats demilitarized zones, economic areas in Ukraine peace talks”

~~~~~~~~~~

Pentagon Warns China’s Military Rise Leaves U.S. Homeland Vulnerable

Defense report reframes global security and financial risk calculus

Overview:

The U.S. Defense Department released a new assessment warning that China’s expanding military power increasingly threatens U.S. homeland security.

China has nearly tripled its nuclear arsenal since 2020 and is rapidly modernizing conventional forces.

The Pentagon identifies China as the United States’ primary long-term “pacing challenge.”

Key Developments:

China is leveraging its manufacturing scale to outproduce the U.S. in warships, missiles, and advanced weapons systems.

The report highlights progress toward China’s stated goal of being capable of taking Taiwan by force by 2027.

Cyber risks remain elevated following revelations that state-sponsored Chinese hackers penetrated U.S. critical infrastructure systems, including energy and communications.

Beijing is consolidating military control around the first island chain, strengthening its regional dominance while developing long-range strike capabilities exceeding 2,300 miles.

Despite the warnings, U.S.-China military communications have improved under renewed diplomatic engagement.

Why It Matters:

This assessment underscores a fundamental shift in global power dynamics. China’s accelerating military capabilities elevate geopolitical risk across the Indo-Pacific, forcing the U.S. and its allies to reassess defense posture, alliance structures, and deterrence strategies in an increasingly multipolar world.

Why It Matters to Foreign Currency Holders:

Rising U.S.–China tensions directly influence currency stability, capital flows, and reserve management. Heightened military risk premiums can strengthen safe-haven demand for gold and select currencies while increasing volatility in Asian and emerging-market FX. Any escalation around Taiwan would also disrupt semiconductor supply chains, impacting trade balances and currency valuations worldwide.

Implications for the Global Reset:

Pillar 1: Security-Driven Capital Flows — Military risk increasingly dictates investment allocation, reserve diversification, and asset hedging.

Pillar 2: Multipolar Power Realignment — Strategic competition accelerates fragmentation of financial, technological, and defense systems into competing blocs.

This is not just a defense warning — it’s a recalibration of global risk across finance, currency, and power structures.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

~~~~~~~~~~

How Much Gold Did BRICS Buy in 2025? Total Reserves Revealed

Record accumulation signals accelerating shift in global reserve strategy

Overview:

BRICS nations purchased approximately 663 metric tonnes of gold in the first nine months of 2025, valued near $91 billion.

Combined BRICS gold reserves now total 6,026 tonnes, reflecting sustained accumulation despite record prices.

The buying surge aligns with de-dollarization efforts and the launch of a gold-linked BRICS settlement unit.

Key Developments:

Central bank gold purchases rose 41% year-over-year in Q2 2025, reaching 166 tonnes in a single quarter.

Russia now holds roughly 2,336 tonnes, China 2,298 tonnes, and India 880 tonnes in official reserves.

Brazil resumed gold purchases for the first time since 2021, lifting reserves from 129.7 to 145.1 tonnes.

BRICS introduced a gold-backed settlement unit in November 2025, pegged partially to gold and partially to member currencies to facilitate cross-border trade.

Why It Matters:

Gold is no longer functioning solely as a passive reserve asset. For BRICS nations, it is becoming an active monetary anchor, reinforcing trade settlement credibility, insulating reserves from sanctions risk, and reducing exposure to dollar-centric financial systems.

Why It Matters to Foreign Currency Holders:

Foreign currency holders should note that sustained BRICS gold accumulation alters global reserve composition and currency demand dynamics. As gold’s share of reserves rises and the dollar’s share declines, currency valuations tied heavily to dollar liquidity may face increased volatility. Gold-anchored settlement mechanisms can also reduce reliance on FX conversions, reshaping demand for reserve currencies over time.

Implications for the Global Reset:

Pillar 1: Reserve Realignment — Central banks are shifting from dollar-heavy reserves toward hard assets to preserve sovereignty and stability.

Pillar 2: Trade Settlement Transformation — Gold-linked instruments signal movement away from fiat-only settlement toward asset-backed frameworks.

This is not just gold accumulation — it’s monetary system restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Watcher.Guru – “How Much Gold Did BRICS Buy in 2025? Total Reserves Revealed”

World Gold Council – “Central Bank Gold Reserves and Net Purchases”

…………………………………………………………………………………………………………………….

About Seeds of Wisdom

A Message to Our Currency Holders

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different:

• No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents.

Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Financial Experts Warn Future Winner Of The $1.7 Billion Powerball

Financial Experts Warn Future Winner Of The $1.7 Billion Powerball: Don’t Make These Common Money Mistakes

Ashley Lutz Fortune Updated Tue, December 23, 2025

Powerball’s $1.7 billion jackpot may create a new ultrarich winner, but financial planners say what happens after the drawing can matter more than the winning numbers. They describe a consistent set of mistakes that can quietly turn a once‑in‑a‑lifetime windfall into a long, public mess.

Financial Experts Warn Future Winner Of The $1.7 Billion Powerball: Don’t Make These Common Money Mistakes

Ashley Lutz Fortune Updated Tue, December 23, 2025

Powerball’s $1.7 billion jackpot may create a new ultrarich winner, but financial planners say what happens after the drawing can matter more than the winning numbers. They describe a consistent set of mistakes that can quietly turn a once‑in‑a‑lifetime windfall into a long, public mess.

Rushing big decisions

Many experts warn that acting too quickly—quitting a job, claiming the prize immediately, or committing to big purchases—is one of the most damaging errors. Articles in outlets including CNBC, NerdWallet, and USA Today emphasize slowing down, taking time to process the shock, and making no irreversible decisions until a plan is in place.

A related misstep is choosing between the lump sum and annuity on instinct instead of analysis, even though that decision locks in tax timing, investment options, and how long the money is likely to last. Financial writers note that many winners default to the lump sum without modeling scenarios with professionals and understanding that, after taxes, the headline $1.7 billion quickly shrinks.

Going public and losing privacy

Coverage in CNBC highlights that bragging about your win on social media or talking openly about it can invite lawsuits, scams, and constant money requests. Advisors repeatedly stress “keep it quiet” and, where allowed, explore ways to claim through a trust or remain anonymous to avoid becoming a target.

Experts also point out that winners often underestimate the emotional toll of overnight fame, which can strain marriages, friendships, and even personal safety if boundaries are not set early.

Skipping a professional team

A recurring theme across NerdWallet, Business Insider, and other outlets is that trying to DIY a nine‑ or 10‑figure fortune is a costly mistake. Financial planners urge winners to assemble a small, vetted team—typically an attorney, a tax professional, and a fiduciary advisor with experience in sudden wealth—before claiming the prize.

TO READ MORE: https://www.yahoo.com/finance/news/financial-experts-warn-future-winner-175214867.html

MilitiaMan and Crew: IQD News Update-Quiet Revolution-Guardian of Integration

MilitiaMan and Crew: IQD News Update-Quiet Revolution-Guardian of Integration

12-23-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Quiet Revolution-Guardian of Integration

12-23-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..