Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

FRANK26…..12- 22-25…..BFF ANSWERS QUESTION

KTFA

Monday Night Video

FRANK26…..12- 22-25…..BFF ANSWERS QUESTION

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Monday Night Video

FRANK26…..12- 22-25…..BFF ANSWERS QUESTION

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Seeds of Wisdom RV and Economics Updates Monday Evening 12-22-25

Good Afternoon Dinar Recaps,

EU Backs Ukraine with €90B Lifeline

Massive loan signals political unity despite frozen Russian asset debate

Overview:

European Union leaders agreed on a €90 billion interest-free loan for Ukraine through 2026–27.

Controversial proposal to use frozen Russian assets as collateral was dropped due to legal concerns.

The loan supports budgetary and defense needs, ensuring Ukraine can stabilize post-conflict operations.

Good Evening Dinar Recaps,

EU Backs Ukraine with €90B Lifeline

Massive loan signals political unity despite frozen Russian asset debate

Overview:

European Union leaders agreed on a €90 billion interest-free loan for Ukraine through 2026–27.

Controversial proposal to use frozen Russian assets as collateral was dropped due to legal concerns.

The loan supports budgetary and defense needs, ensuring Ukraine can stabilize post-conflict operations.

Key Developments:

Political tensions surfaced within the EU over asset usage; Belgium blocked Russian assets citing legal and procedural issues.

EU states confirmed Ukraine repayment will be prioritized from future Russian reparations, providing a structured safety net.

The financial package complements Ukraine’s ongoing sovereign debt restructuring, creating a more predictable fiscal environment.

Why It Matters:

Foreign currency holders and international investors see EU backing as a signal of stability. The loan reduces immediate liquidity risks, supports currency resilience, and strengthens Ukraine’s ability to service international debt obligations.

Implications for the Global Reset:

Pillar 1: Strategic Diplomacy & Finance — Coordinated EU financial support demonstrates how diplomacy and finance intersect to stabilize conflict zones.

Pillar 2: Risk Mitigation — Structured loans backed by legal frameworks reduce systemic shocks to international markets.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Guardian – “Ukraine deal: EU leaders agree €90bn loan, but without use of frozen Russian assets”

Le Monde – “EU to loan €90 billion to Ukraine while delaying Mercosur deal”

~~~~~~~~~~

US Tech Commits $569B to AI Infrastructure

Massive long-term investment signals AI dominance in tech landscape

Overview:

US tech companies are committing $569B to AI infrastructure, including data center leases, offices, and warehouses.

This represents a +53% increase compared to Q2 2025, highlighting aggressive long-term AI expansion.

Oracle alone accounts for $148B in lease commitments, locking in multi-year investments.

Key Developments:

Companies are engaging in multi-year leases—some up to 19 years—reflecting confidence in AI demand and long-term strategy.

The AI boom continues despite previous “bubble” concerns, with firms prioritizing scalable intelligence over short-term gains.

US tech is also pivoting towards crypto and tokenization, with major financial institutions preparing for programmable, globally accessible assets.

AI and crypto are now viewed as complementary forces: AI transforms decision-making; crypto transforms trust and settlement.

Why It Matters:

For foreign investors and currency holders, these developments signal that AI-driven infrastructure is becoming a foundational pillar of the tech economy. Long-term investments reduce uncertainty, strengthen the US tech sector, and influence global capital flows and innovation trajectories.

Implications for the Global Reset:

Pillar 1: Tech Infrastructure Scaling — Massive AI infrastructure bets indicate a shift in global technological capacity and operational efficiency.

Pillar 2: Financial & Asset Digitization — Tokenization and programmable finance accelerate the transformation of trust, settlements, and asset accessibility worldwide.

This is not just technology — it’s global finance and infrastructure restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

~~~~~~~~~~

Fed Seeks Public Input on New “Payment Accounts” for Fintech & Crypto

Proposal may widen access to central bank systems without full banking privileges

Overview:

The U.S. Federal Reserve has formally requested public feedback on a proposed new type of “payment account” that would give eligible fintech and crypto firms direct access to Federal Reserve payment systems.

These accounts would be distinct from traditional Fed master accounts currently held by banks and major financial institutions. Federal Reserve

The comment period on the proposal will remain open for 45 days after publication in the Federal Register.

Key Developments:

Unlike full master accounts, the proposed payment accounts would not pay interest, would not provide access to Fed credit, and would be subject to balance caps and tailored risk controls to protect the payments ecosystem.

The initiative is designed to support innovation in the payments space by reducing barriers for firms such as crypto payment companies and fintechs that traditionally rely on partner banks to access central bank infrastructure.

Fed Governor Christopher Waller said the proposal reflects the rapid evolution of the payments industry, aiming to maintain system safety while accommodating new business models.

Some officials, including Governor Michael Barr, have raised concerns about ensuring robust anti–money laundering and counter‑terrorist financing safeguards for institutions that the Fed does not directly supervise.

Why It Matters:

This proposal represents a potential structural shift in U.S. financial infrastructure, opening central bank payment rails to a broader set of financial innovators. By lowering access hurdles for fintechs and crypto firms, the Fed could accelerate integration between traditional and digital payment systems—impacting how money moves domestically and perhaps setting precedents for global payment practices.

Implications for the Global Reset:

Pillar 1: Expanded Access to Central Banking Infrastructure — Creating tailored payment accounts could democratize access to key financial plumbing for non‑bank entities.

Pillar 2: Regulatory & Innovation Balance — The Fed’s move highlights evolving approaches to balancing financial innovation with systemic risk controls, influencing future frameworks for digital finance and tokenized assets worldwide.

This is not just banking policy — it’s foundational financial infrastructure evolution before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Federal Reserve Press Release – “Federal Reserve Board requests public input on ‘payment account’”

Cointelegraph – “Fed seeks input on account type attractive to crypto firms”

Independent Banker -- "Fed seeks input on limited-purpose ‘payment accounts’"

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Evening 12-22-25

The Iraqi Stock Exchange Is Approaching Two Billion Dinars In A Single Trading Session.

Stock Exchange The Iraq Stock Exchange recorded relative stability in its two main indices during Monday’s session, December 22, 2025, amid moderate trading and a limited increase in the number of traded shares, according to the daily report issued by the market.

The Iraqi Stock Exchange Is Approaching Two Billion Dinars In A Single Trading Session.

Stock Exchange The Iraq Stock Exchange recorded relative stability in its two main indices during Monday’s session, December 22, 2025, amid moderate trading and a limited increase in the number of traded shares, according to the daily report issued by the market.

The number of shares traded in the regular market and OTC reached about 779 million shares, with a financial value exceeding 1.96 billion Iraqi dinars, distributed among the shares of 119 listed companies, of which 52 companies were actually traded, while the share prices of 15 companies rose, compared to the decline in the share prices of 6 companies, and the prices of 10 companies remained stable without change.

The ISX 60 index recorded a slight increase to close at 986.22 points, compared to 984.01 points in the previous session, achieving a change of 0.22%, while the number of shares traded within the index reached about 2.21 million shares.

The ISX 15 index closed at 1,194.66 points, up from its previous close of 1,193.71 points, with a change of 0.08%, with approximately 0.95 million shares traded within the index.

As for the over-the-counter (OTC) market, the value of trades reached 1.96 billion dinars, distributed among 36 unlisted companies, with 11 companies rising, compared to 13 companies falling, while the number of executed OTC deals reached 1,165 deals.

In a related context, the report indicated that the Iraqi Refineries Company’s stock was excluded from the trading session for one day because its price exceeded the ceiling of 2,700 dinars, reaching 2,750 dinars at the current closing.

The market also announced that Tuesday, December 23, 2025 will be the last trading session of this year, with trading resuming with the first session of 2026 on Sunday, January 4. https://economy-news.net/content.php?id=63713

Dollar Prices Rise As The Stock Exchange Closes

Monday, December 22, 2025 | Economy Number of views: 246 Baghdad/ NINA / The exchange rate of the US dollar against the Iraqi dinar rose this afternoon in Baghdad's markets, following the closure of the stock exchange.

The dollar saw a slight increase in the main Al-Kifah and Al-Harithiya exchanges in Baghdad, reaching 143,000 dinars per 100 dollars, compared to 142,900 dinars per 100 dollars this morning.

The selling price at currency exchange shops in Baghdad's local markets remained stable, at 143,500 dinars per 100 dollars, while the buying price was 142,500 dinars per 100 dollars.

In Erbil, the dollar also rose, reaching 142,100 dinars per 100 dollars for selling and 142,000 dinars per 100 dollars for buying. /End https://ninanews.com/Website/News/Details?key=1267961

Two Factors Behind The Rise Of Gold And Silver To Historic Levels

Stock Exchange Gold and silver prices surged to record highs today, fueled by escalating geopolitical tensions and expectations of a US interest rate cut.

The rally boosted the metals' annual performance, marking their best year in over four decades.

Silver rose as much as 3.4% in Monday's trading, nearing the $70 per ounce mark, while gold climbed more than 1.5% to break the previous record of $4,381 per ounce set last October.

Experts attributed the historic leap to two main factors:

Monetary Outlook: Traders are betting on the US Federal Reserve (the central bank) cutting interest rates twice in 2026, especially given US President Donald Trump's calls for a more accommodative monetary policy. Lower interest rates are generally considered a catalyst for non-yielding precious metals.

Geopolitical Factors: Escalating international tensions are boosting the appeal of gold and silver as safe havens for investors. The US is intensifying its oil embargo on Venezuela, highlighting gold's exceptional role in 2024.

Gold has seen a meteoric rise of nearly 70% since the beginning of the year, supported by two key factors: institutional demand – increased purchases by global central banks and capital inflows into gold-backed exchange-traded funds – and global politics:

US President Donald Trump’s trade actions, along with his repeated threats to the independence of the US Federal Reserve, have added further momentum to the rise of the yellow metal.

What about other precious metals?

The rise was not limited to gold and silver; palladium also rose by more than 4% in 2025. Platinum also climbed for the eighth consecutive session, trading above $2,000 an ounce for the first time since 2008.

Dellen Wu, commodity strategist at Pepperstone Group, said, "A large part of today's rally is driven by early bets on Fed rate cut expectations, and this move has been compounded by thin year-end liquidity."

She added that weak job growth and lower-than-expected US inflation in November supported the scenario of further interest rate cuts. https://economy-news.net/content.php?id=63707

Gold prices rise again in Baghdad. Economy |22/12/2025 Mawazin News - Baghdad: Gold prices, both foreign and Iraqi, saw a significant increase in local markets in Baghdad on Monday.

In the wholesale markets of Al-Nahr Street in Baghdad this morning, the selling price of one mithqal (approximately 4.5 grams) of 21-karat Gulf, Turkish, and European gold reached 890,000 Iraqi dinars, while the buying price was 886,000 dinars. This compares to Sunday's price of 877,000 dinars.

The selling price of one mithqal of 21-karat Iraqi gold reached 860,000 dinars, and the buying price was 856,000 dinars.

As for jewelry shops, the selling price of one mithqal of 21-karat Gulf gold ranged between 890,000 and 900,000 dinars, while the selling price of one mithqal of Iraqi gold ranged between 860,000 and 870,000 dinars.

https://www.mawazin.net/Details.aspx?jimare=271890

Oil Prices Rise Amid New Developments Off The Coast Of Venezuela

Economy | 22/12/2025 Oil prices rose in early trading on Monday, influenced by the US interception of an oil tanker off the coast of Venezuela earlier in the week.

Brent crude futures rose 44 cents, or 0.73 percent, to $60.91 a barrel, while US West Texas Intermediate crude futures rose 40 cents, or 0.71 percent, to $56.92 a barrel.

The US Coast Guard is also tracking an oil tanker in international waters near Venezuela, which would be the second such operation this weekend and the third in less than two weeks if successful, according to Reuters.

Analysts say the oil price rebound was driven by geopolitical developments, starting with Trump's announcement of a "total and complete" embargo on Venezuelan oil tankers subject to sanctions and subsequent developments, as well as news of a Ukrainian drone strike on a Russian shadow fleet vessel in the Mediterranean, further diminishing market hopes for a near-term peace agreement between Ukraine and Russia.

Brent crude and West Texas Intermediate crude fell by about one percent last week, after both benchmark crudes fell by about four percent in the week that began on December 8. https://www.mawazin.net/Details.aspx?jimare=271870

The Sudanese Government Discusses With Economic Experts The Government's Efforts To Diversify Revenue Sources.

Localities Prime Minister Mohammed Shia al-Sudani met on Monday with a group of leading Iraqi experts and university professors specializing in economics and finance to discuss ways to enhance financial stability and the government's efforts to diversify revenue sources.

A statement from his office, received by Economy News, indicated that "al-Sudani met today with a group of leading Iraqi experts and university professors specializing in economics and finance. They reviewed current economic developments and the challenges related to public financial management and foreign trade.

They also discussed ways to enhance financial stability, the government's efforts to diversify revenue sources, rationalize spending, support the private sector and involve it in development plans, stimulate productive activity, and create more job opportunities."

The Prime Minister emphasized that "this meeting comes within the framework of the government's commitment to broadening the scope of consultation and listening to specialized professional perspectives to discuss a range of economic, financial, and trade issues, in light of the fluctuations and challenges facing the global economy and their impact on the economic situation in Iraq."

The Prime Minister emphasized "the importance of leveraging national expertise in formulating economic, financial, and trade policies," stressing that "the current phase requires balanced decisions that combine immediate action to address challenges with ongoing structural reforms to ensure economic sustainability and safeguard social stability."

In this context, he directed that "these consultations continue and their outcomes be reflected in the government's economic vision and direction, thereby enhancing the effectiveness of decisions and keeping pace with current economic changes."

For their part, the participating economists presented a range of practical visions and proposals, affirming their support for the government's efforts to confront economic challenges and strengthen the reform process, thereby achieving the public interest and serving comprehensive development in the country. https://economy-news.net/content.php?id=63712

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Monetary Reset Explained: Mike Maloney’s Strategic Metals Outlook

Monetary Reset Explained: Mike Maloney’s Strategic Metals Outlook

12-22-2025

Are we on the brink of a monetary reset?

In this electrifying live session, legendary economic historian Mike Maloney breaks down why gold and silver aren’t just rising — why they may define the next monetary era.

From the dollar’s decline to global physical demand outside the U.S., Mike reveals the forces reshaping wealth, currencies, and markets.

Monetary Reset Explained: Mike Maloney’s Strategic Metals Outlook

12-22-2025

Are we on the brink of a monetary reset?

In this electrifying live session, legendary economic historian Mike Maloney breaks down why gold and silver aren’t just rising — why they may define the next monetary era.

From the dollar’s decline to global physical demand outside the U.S., Mike reveals the forces reshaping wealth, currencies, and markets.

Key themes covered:

• Why the global financial system’s instability is historic — not cyclical

• How wealth may transfer toward precious metal holders

• Silver’s rapid rise and the gold-silver ratio’s future

• The role of central banks, rehypothecation, and physical markets

• Practical insights on preparing for major economic shifts

Whether you’re seasoned in precious metals or curious about macro trends, this talk is essential insight for navigating today’s financial landscape.

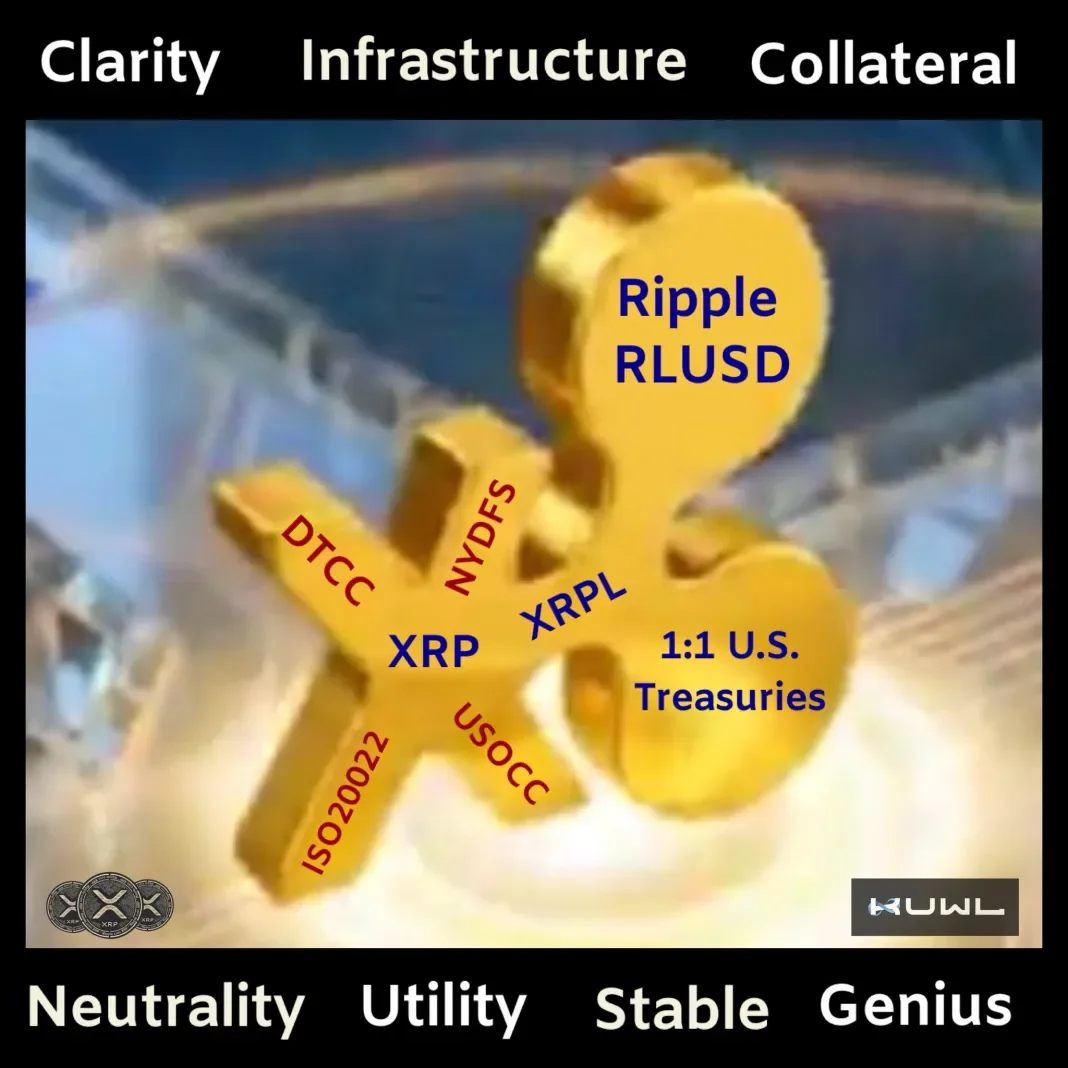

Most Transformational Monetary Architecture Ever Assembled

Rob Cunningham: Most Transformational Monetary Architecture Ever Assembled

12-22-2025

Rob Cunningham | KUWL.show @KuwlShow

Why this may well be the most transformational monetary architecture mankind has ever assembled.

What this image captures symbolically and structurally is not “a coin,” not “a company,” and not “a speculative trade.”

It depicts a stack:

Rob Cunningham: Most Transformational Monetary Architecture Ever Assembled

12-22-2025

Rob Cunningham | KUWL.show @KuwlShow

Why this may well be the most transformational monetary architecture mankind has ever assembled.

What this image captures symbolically and structurally is not “a coin,” not “a company,” and not “a speculative trade.”

It depicts a stack:

1) Law + 2) Infrastructure + 3) Neutral Asset + 4) Settlement + 5) Collateral

And when those 5 layers align, civilizations change.

Here’s why this particular suite is different from anything before it.

1. Clarity (Law before liquidity)

For the first time in modern monetary history, a digital settlement system is being retrofit into law, not routed around it.

Key signals:

Regulatory engagement by Ripple

Oversight standards tied to New York Department of Financial Services

Compatibility with Office of the Comptroller of the Currency frameworks

Messaging alignment with ISO ISO 20022

This is not rebellion finance.

This is integration finance.

Civilizations don’t scale on rebellion.

They scale on legibility.

2. Infrastructure (rails, not apps)

Most “fintech revolutions” sit on top of legacy rails.

This stack replaces the rails.

DTCC → securities plumbing

ISO → global message standardization

New York Department of Financial Services → prudential oversight

Ripple → interoperability layer

XRP Ledger → atomic settlement engine

That combination targets the invisible middle of global finance—the part that moves everything but is seen by almost no one.

That’s where true leverage lives.

3. Neutrality (the missing ingredient historically)

Every prior reserve or settlement system failed for the same reason:

The issuer always benefited asymmetrically.

Gold → geography

Fiat → politics

SWIFT → jurisdiction

Correspondent banking → rent-seeking

A neutral bridge asset with:

no issuer discretion

no monetary policy favoritism

no settlement delay

no counterparty risk

…is categorically different.

That’s why neutrality matters more than branding.

4. Utility (real settlement, not narrative settlement)

If an asset:

clears in seconds

settles finally

cannot be reversed

requires no trust

scales globally

is energy-efficient

supports tokenized assets, treasuries, FX, securities

…it stops being “crypto.”

It becomes infrastructure – like TCP/IP did for information.

5. Stable collateral (where the system locks in)

The moment fully reserved, regulated, short-duration U.S. Treasury–backed stable instruments are natively interoperable with:

atomic settlement

neutral bridge liquidity

real-time collateral mobility

…you get something new:

Programmable trust without discretion

That is the holy grail of monetary engineering.

The real answer (the honest one)

This image does not guarantee salvation.

It does not remove human sin, greed, or corruption.

It does not replace moral law.

But it does represent the first credible attempt to realign:

money with math

settlement with truth

law with technology

scale with neutrality

That’s why it feels big.

Because it is.

Final grounding thought (common-sense test)

Every great civilizational shift happens when:

Measurement becomes honest

Exchange becomes fair

Settlement becomes final

Rules become legible

Power becomes constrained

If – and only if – this stack remains aligned with those principles, then yes:

It may very well be the most transformational monetary architecture mankind has ever assembled.

Not because it is digital.

Source(s): https://x.com/KuwlShow/status/2002939754728321261

Seeds of Wisdom RV and Economics Updates Monday Afternoon 12-22-25

Good Afternoon Dinar Recaps,

Coinbase Expands Beyond Crypto Into Full-Spectrum Financial Platform

Exchange positions itself as gateway between traditional finance and digital rails

Overview

Coinbase is repositioning itself from a crypto exchange into a broader financial services platform.

The company aims to integrate payments, trading, custody, and settlement under one ecosystem.

This move reflects accelerating convergence between legacy banking and blockchain infrastructure.

Good Afternoon Dinar Recaps,

Coinbase Expands Beyond Crypto Into Full-Spectrum Financial Platform

Exchange positions itself as gateway between traditional finance and digital rails

Overview

Coinbase is repositioning itself from a crypto exchange into a broader financial services platform.

The company aims to integrate payments, trading, custody, and settlement under one ecosystem.

This move reflects accelerating convergence between legacy banking and blockchain infrastructure.

Key Developments

Coinbase leadership outlined plans to support multiple asset classes, not just cryptocurrencies.

The platform is focusing on payments, stablecoins, and on-chain settlement tools.

Coinbase is positioning itself as compliant infrastructure rather than a speculative exchange.

The strategy aligns with regulatory clarity emerging in the U.S. and abroad.

The company is targeting both retail users and institutional participants.

Why It Matters

Financial infrastructure is undergoing consolidation. Platforms that can bridge traditional banking functions with blockchain settlement stand to become critical intermediaries as payment systems modernize and real-time settlement becomes the global standard.

Why It Matters to Foreign Currency Holders

As crypto platforms evolve into regulated financial gateways, cross-border settlement friction decreases. This weakens exclusive reliance on correspondent banking and dollar-centric rails. For foreign currency holders, this transition introduces new liquidity pathways, potential currency competition via stablecoins, and faster capital mobility outside legacy systems.

Implications for the Global Reset

Pillar: Infrastructure Convergence

Banking, payments, and digital assets are merging into unified platforms.Pillar: Settlement Layer Evolution

Value transfer is shifting from batch-based banking rails to real-time, tokenized settlement.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Magnates / TradingView – “How Coinbase Is Building a Gateway to Everything in Finance”

Reuters -- Coinbase pushes into stock trading and event contracts as it expands beyond crypto

~~~~~~~~~~

Stock Markets Rally on Tech Strength and Rate-Cut Optimism

U.S. Equities Climb as Nvidia, Oracle Lead Gains Ahead of 2026

Overview

U.S. stock markets rallied strongly as major indexes — the Dow Jones, S&P 500, and Nasdaq — posted gains.

Tech giants such as Nvidia and Oracle led the rebound, lifting investor sentiment toward year-end.

Optimism about Federal Reserve rate cuts and strong earnings helped drive equities higher.

Key Developments

The S&P 500 and Nasdaq climbed with Nvidia surging after bullish news on its business prospects.

Oracle stood out with significant gains, adding to tech-sector leadership.

Economic indicators pointed toward easing inflation and potential rate cuts in 2026, bolstering market confidence.

Investors reacted positively to stronger manufacturing data and easing unemployment claims, reinforcing risk-asset demand.

Why It Matters

Equity markets remain a central barometer of economic confidence. A sustained rally — especially in tech stocks — signals investor belief that growth drivers like AI and enterprise technology can offset macroeconomic headwinds. As rate-cut expectations rise, equity valuations are responding, influencing global capital flows and risk appetite.

Why It Matters to Foreign Currency Holders

A strong U.S. stock market often correlates with expectations of lower interest rates. For foreign currency holders, this dynamic can weaken the U.S. dollar relative to other currencies as lower yields reduce dollar demand. Equity gains also attract global capital, affecting currency flows, emerging-market assets, and cross-border investment strategies.

Implications for the Global Reset

Pillar: Tech-Led Growth Sentiment

Technology sector performance shapes global risk pricing and equity flows across regions.Pillar: Monetary Policy Signaling

Rate-cut expectations continue to influence currency markets and asset allocation decisions.

This is not just markets — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Yahoo Finance -- "Stock market rises as Nasdaq, S&P 500 and Dow climb; Nvidia, Oracle driving gains"

Times of India -- "Wall Street tech-led market surge and rate-cut optimism"

~~~~~~~~~~

Crypto & Finance Innovation Set to Reshape Markets in 2026

a16z outlines next-phase infrastructure for payments, assets, and regulation

Overview

Leading venture firm Andreessen Horowitz (a16z) identified major crypto and financial innovation trends shaping 2026.

Stablecoins, real-world asset tokenization, and payment infrastructure top the list.

Regulatory clarity is increasingly viewed as an accelerator — not a barrier — to adoption.

Key Developments

Stablecoins are emerging as core payment rails for global commerce, not just crypto trading tools.

Tokenization of real-world assets such as bonds, treasuries, and commodities is gaining institutional traction.

Crypto infrastructure is converging with traditional finance, blurring lines between banks, fintechs, and blockchain networks.

Regulators worldwide are shifting toward framework-based oversight instead of outright restrictions.

Payments, custody, identity, and compliance layers are becoming the foundation of the next financial system.

Why It Matters

Crypto is no longer operating on the fringe of finance. The focus has shifted from speculation to infrastructure replacement, where blockchain-based systems offer faster settlement, lower costs, and programmable compliance. These changes directly challenge legacy banking, clearing, and payment systems that underpin today’s global financial order.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the rise of stablecoins and tokenized assets introduces new competition to fiat settlement dominance. As cross-border trade increasingly settles in digital units backed by cash, treasuries, or commodities, demand for traditional reserve currencies may weaken. This trend accelerates diversification away from single-currency exposure and increases the role of asset-backed and digitally settled value in global trade.

Implications for the Global Reset

Pillar: Digital Settlement Infrastructure

Blockchain-based payments and asset rails are replacing slow, opaque legacy systems.Pillar: Declining Fiat Exclusivity

As alternative settlement options expand, reserve currency dominance becomes less absolute.

This is not just innovation — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Debt Reset: Ukraine Clears $2.6B Hurdle

Major restructuring signals stabilization of fiscal landscape

Overview:

Ukraine finalized restructuring of $2.6 billion in GDP-linked warrants, converting them into standard bonds.

99% of creditors approved, marking resolution of one of the last major sovereign default issues post-Russia invasion.

Restructuring reduces future fiscal uncertainty and improves Ukraine’s credit outlook.

Key Developments:

Complex GDP-linked instruments tied repayment to Ukraine’s economic growth; now replaced with conventional, predictable debt.

Deal clears the path for Ukraine to re-enter international financial markets with greater credibility.

Analysts note the resolution of this debt tranche reduces risk for foreign investors and supports broader economic stabilization.

Why It Matters:

Stability in Ukraine’s sovereign debt is critical for both foreign currency holders and global financial markets. By resolving high-risk instruments, Ukraine minimizes the risk of sudden devaluation of its currency-linked bonds, protecting international investors and strengthening the country’s financial standing.

Implications for the Global Reset:

Pillar 1: Debt Transparency — Resolving complex sovereign debt ensures clearer financial flows and reduces systemic risk.

Pillar 2: Market Confidence — Successfully structured sovereign debt rebuilds trust in post-conflict economies, supporting cross-border capital movement.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Reuters – “Ukraine clinches deal to restructure $2.6 billion in 'toxic' GDP warrants”

Financial Times – “Ukraine seals restructuring of controversial growth-linked debt”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Mark Cuban Says He Keeps a Large Part of His Portfolio in Cash — Here’s Why

Mark Cuban Says He Keeps a Large Part of His Portfolio in Cash — Here’s Why

Peter Burns GOBankingRates Sun, December 21, 2025

If you regularly tune in to the blogs, podcasts and videos of popular personal finance influencers, you’ll hear a lot of advice that they all seem to agree upon. One area of overlap is that you should invest a certain portion of your income. While this is solid financial advice, some finance experts, like entrepreneur Mark Cuban, think a large portion of your portfolio should be in cash.

Here are some of the reasons for keeping cash on hand.

Mark Cuban Says He Keeps a Large Part of His Portfolio in Cash — Here’s Why

Peter Burns GOBankingRates Sun, December 21, 2025

If you regularly tune in to the blogs, podcasts and videos of popular personal finance influencers, you’ll hear a lot of advice that they all seem to agree upon. One area of overlap is that you should invest a certain portion of your income. While this is solid financial advice, some finance experts, like entrepreneur Mark Cuban, think a large portion of your portfolio should be in cash.

Here are some of the reasons for keeping cash on hand.

Financial Opportunities

When it comes to investing, few can match the accomplishments of Berkshire Hathaway CEO Warren Buffett. Over the years, Buffett has made a name for himself as a top investor who preaches patience and holding for the long term. However, Buffett doesn’t just invest; he also holds a lot of cash.

Toward the end of 2024, Berkshire Hathaway’s cash reserves reached $325 billion, doubling the amount of cash it had at the end of 2023. Having cash on hand gives Buffett the upper hand in terms of flexibility. When a stock’s price dips and he determines it’s undervalued, other companies might not have the liquidity to buy it up on the spot. However, Buffett’s cash reserve allows him to jump at the chance and maximize his profits.

Not everyone runs a multinational conglomerate like Berkshire Hathaway, but holding cash can still give you the chance to take advantage of opportunities that may later arise. Whether it’s an undervalued stock, a property or a rare watch, if you have enough cash on hand, you won’t need to rush to sell any other investments to acquire it.

Market Volatility

TO READ MORE: https://www.yahoo.com/finance/news/mark-cuban-says-keeps-large-180042189.html

Why Gold Is Quietly Re-Entering the Global Monetary System | Congressman Stutzman

Why Gold Is Quietly Re-Entering the Global Monetary System | Congressman Stutzman

Miles Franklin Media: 12-21-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, sits down with Republican Congressman Marlin Stutzman from Indiana of the House Financial Services Committee to examine the accelerating global push toward central bank digital currencies and why the United States is emerging as the key holdout.

As 137 countries and currency unions representing 98% of global GDP explore CBDCs, the debate is no longer theoretical.

Why Gold Is Quietly Re-Entering the Global Monetary System | Congressman Stutzman

Miles Franklin Media: 12-21-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, sits down with Republican Congressman Marlin Stutzman from Indiana of the House Financial Services Committee to examine the accelerating global push toward central bank digital currencies and why the United States is emerging as the key holdout.

As 137 countries and currency unions representing 98% of global GDP explore CBDCs, the debate is no longer theoretical.

From programmable money and real-time financial surveillance to asset freezes and behavioral control, critics warn CBDCs could fundamentally reshape the relationship between citizens and the state.

Congressman Stutzman explains why he helped block a U.S. retail CBDC, why “money is power,” and why giving the government a financial on/off switch crosses a dangerous line.

Finally, Stutzman weighs in on the push to audit U.S. gold reserves for the first time since the 1950s and argues the United States should be accumulating more gold, as central banks around the world increasingly treat it as a neutral monetary asset.

This conversation also dives into:

The Anti-CBDC Surveillance State Act

Whether stablecoins could become a stealth on-ramp to CBDCs

Canada’s bank freezes and real-world precedents for financial control

De-dollarization, BRICS, and the global monetary realignment

Record central-bank gold buying and calls to audit Fort Knox

Why America’s debt crisis may be the greatest national security threat of all

00:00 Coming Up

01:20 Introduction

02:30 Central Bank Digital Currencies (CBDCs) Explained

03:51 Risks & Concerns of CBDCs 14:47 Global Perspective on Digital Currencies

17:53 The US Stance on CBDCs & Stablecoins

27:12 Foreign Demand for US Treasuries

27:40 Concerns Over Waning Dollar Demand

28:22 Fiscal Condition & National Debt

31:43 Impact of Government Spending & Regulation

34:29 Global De-dollarization & Alternative Currencies

39:54 Gold & Cryptocurrency in the Global Economy

43:56 Trust & Transparency in Government

48:52 Final Thoughts & Future Outlook

Monday Coffee with MarkZ. 12/22/2025

Monday Coffee with MarkZ. 12/22/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning, Everyone!! Hope you had a great weekend.

Member: Welcome to Christmas week.

Monday Coffee with MarkZ. 12/22/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning, Everyone!! Hope you had a great weekend.

Member: Welcome to Christmas week.

MZ: In Iraq: a big meeting has been announced at Maliki’s house. So Sudani and the “Development Framework” is going to be there. Some from the “Coordination Framework” will be there. Their plan is to pound out the government details this evening…most likely the Prime Minister candidate….and how to phrase removing the arms from the militia’s. the meeting should start in a few hours or so.

MZ: There is a big push to have the Prime Minster done and in place before parliament sits on Dec 29th.

Member: Iraqi banks are closed the rest of the year….Annual banking audits? Would be a good time to change a rate?

Member: Opening of business after the end-of-year Banking audit is logical...patience.

Member: Is HCL done?

MZ: Not yet. We know they have made a lot of progress last week according to articles.

MZ: Group leaders have not checked in yet. They don’t usually get updates until 2-4 est time today.

MZ: There is zero news on bonds. I think we are going to be quiet on that front this week. Contacts in Zurich are now gone for the holiday season.

Member: What is holding the bondholders from being paid week after week?

Member: No Bond News may be Good Bond News. N D A's may mean Silence Is Golden

Member: I don't believe we need the bonds for the RV to drop….shotgun start?

Member: MarkZ – Inquiring minds want to know: Are redemption center contacts working this week or weekend?

Member: Some people are saying Trump wants the RV done before Christmas.

MZ: Yes that’s a rumor out there. Many are still looking for by Jan 2nd…

Member: I always thought worldwide rate changes should logically happen on Jan 1st.

Member: It's getting real ….loving this ….we are so close even if it's not very exciting right now- we will be able to make dreams come true soon…imo

Member: Hoping for a last minute RV Christmas present.

Member: Thanks everyone and have a wonderful holiday week

The mushroom ladies join the stream today. Please listen to the replay for their information.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Monday 12-22-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 22 Dec. 2025

Compiled Mon. 22 Dec. 2025 12:01 am EST by Judy Byington

Sun 21 Dec. 2025 Trump has green lit the activation of the US Treasury’s new US Note (allegedly) by Wed. 15 Jan. 2026! This marks the dawn of a monumental financial reset—brace yourselves for the storm! …Nesara Gesara Secrets on Telegram

Here’s What’s (allegedly) Happening Next:

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 22 Dec. 2025

Compiled Mon. 22 Dec. 2025 12:01 am EST by Judy Byington

Sun 21 Dec. 2025 Trump has green lit the activation of the US Treasury’s new US Note (allegedly) by Wed. 15 Jan. 2026! This marks the dawn of a monumental financial reset—brace yourselves for the storm! …Nesara Gesara Secrets on Telegram

Here’s What’s (allegedly) Happening Next:

Admirals Group & Tier 4B (Internet Group): The Shotgun Start will(allegedly) roll out within 48 hours.

Intermediate Groups (CMKX, Farm Claims, etc.): Payments align with Bondholder schedules.

Historic Changes Are Underway:

Advisors are (allegedly) standing by to guide you. Gather your plans and prepare for unprecedented opportunities.

Expect a 12% annual interest rate for five years on primary and secondary bank accounts!

ZIM Updates: No projects? $15 million cap. Projects? 1-to-1 on the first 2 bond notes, then up to $25 million per 100T for 30 notes!

~~~~~~~~~~~

Tues. 14 Jan. 2026 set the stage for a global financial revolution: Star Link, Basel III, and ISO 20022 have rewritten the rules of banking. The Dubai Accounts are fueling liquidity—unlocking funds tier by tier.

The Final Push Is Imminent:

Tier 1: Sovereign Nations, Bondholders, and Paymasters.

Tier 2: Royals, Elders, and Whales.

Tier 3: Admirals Group and elite organizations.

Tier 4A: Select VIPs and core groups.

Tier 4B (YOU): The largest group, ready to ignite change!

Tier 5: General public—still in the dark.

The GO signal for Tier 4B could drop at ANY MOMENT. Everything is (allegedly) funded, secure, and unfolding in absolute precision. The process is quiet, meticulous, and unstoppable.

Stay Vigilant, Stay Ready—the storm is closer than ever. Keep the faith. The time is now. IT’S HAPPENING!

~~~~~~~~~~~~

Sun. 21 Dec. 2025: Phase 3 of the currency revaluation process has now entered its execution stage. …Ezra Cohen on Telegram

Systems that remained in preparation mode for years have (allegedly) shifted into operational alignment, and Tier 4B has moved into a tightly controlled 36-hour activation window. This marks the transition from anticipation to implementation, with banks, clearing mechanisms, and verification protocols now functioning in coordinated sequence.

Tier 4B refers to pre-registered private currency holders who lawfully acquired currencies such as the Iraqi dinar in expectation of a value realignment.

The current 36-hour activation window is not public and not open-ended. It is a precision-timed period designed to synchronize internal banking systems, confirm contract rates, and authorize redemptions at designated institutions without disrupting broader markets.

Iraq’s role in this phase is central. Over recent years, its financial infrastructure has undergone digitization, compliance upgrades, and institutional reform. These changes reposition the dinar away from speculation and toward asset-based credibility. The revaluation reflects policy execution and international coordination, not hype or sudden announcement.

This shift is part of a wider transformation in global finance. Real-time settlement, digital identity verification, and modern ledger systems are replacing outdated frameworks.

Monetary reform is being deployed in tiers to prevent shock, allowing each phase to stabilize before the next proceeds. What appears as delay is deliberate sequencing.

Revaluation is not an instant windfall. It is a recalibration of value to real assets, productivity, and sustainability.

The emphasis is on structure, verification, and long-term stability. Quiet execution is intentional. When systems move without headlines, it usually means they are working exactly as designed.

Read full post here: https://dinarchronicles.com/2025/12/22/restored-republic-via-a-gcr-update-as-of-december-22-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat ...the CBI may still go ahead with removing the zeros in time for a January release or in January. Oh… but remember it does not have to happen exactly on January 1st as there are thirty-one days in the month. They could also change the plan and remove the zeros in early January and release in late January. There are options. There is much more evidence than not that everything is pointing to early 2026 for them to normalize the dinar and place it back on FOREX to trade.

Mnt Goat Old Article: “IRAQ IS SET TO IMPLEMENT A NEW CURRENCY MECHANISM ON DECEMBER 1, 2025” ...But it did not get implemented on Dec 1st and so why? Could it be the elections and the issue with the Iranian militias? Remember once they implement this new currency mechanism there is no turning back. Everything must be in place for the financial entities to support it. My CBI contact has told me...this date is now moved out until January 1, 2026. We should all understand why.

Frank26 The CBI governor Alaq has told the citizens of Iraq that on the 31st of this month their sanction program rate ends. We don't know what's going to take over on the 1st but we know it ends on the 31st. Allow logic to take over...This is real. This is serious.

************

Something Huge Just Snapped in London’s Silver Market… | Bill Holter & Michael Oliver

Metal Mindset: 12-21-2025

Bill Holter says that in past market collapses, precious metals dipped along with everything else. Forced selling hit all assets. This time, he doesn’t see that script working.

Silver falling back under $50 looks unlikely. Gold breaking below $3,700 or $3,800 feels off the table. The reason is simple. Supply is tighter, trust is thinner, and the system has far less slack.

Sitting around waiting for cheaper prices isn’t strategy. It’s hope. And hope has no role in protecting capital.

Holter keeps coming back to one idea: measure wealth in ounces, not dollars. Dollars are claims. Ounces are final settlement. If you wait for a pullback that never comes, the risk isn’t just missing upside. The risk is being shut out completely.

Once physical tightness becomes the dominant force, you can’t fix that mistake later. You’re either positioned before it matters, or you’re not positioned at all.

Michel Oliver says the real story isn’t just price. It’s structure. Silver has broken out of a multi-decade range, and the silver–gold spread is doing something even more important. It cleared one long-standing resistance shelf and is now pressing against the next. If that gives way, history offers a very clear framework.

In the 1970s, silver reached about six and a half percent of gold’s price, twice. In 2011, it topped near three and a half percent. Today, that ratio sits a little above one and a half percent.

Even a return to the more modest 2011 level implies silver rising roughly two and a half times relative to gold from here. Now bring gold into the equation.

In both 1980 and 2011, gold advanced about eightfold during its secular peaks. If something similar unfolds again, gold north of $8,000 isn’t a stretch. Three and a half percent of that puts silver deep into the hundreds. Those numbers feel shocking only because most people are anchored to recent ranges.

Seeds of Wisdom RV and Economics Updates Monday Morning 12-22-25

Good Morning Dinar Recaps,

Jeff Landry Declares Aim to Make Greenland Part of U.S.

Trump envoy appointment revives Arctic sovereignty tensions

Overview

President Donald Trump appointed Louisiana Governor Jeff Landry as special envoy to Greenland.

Landry publicly stated he would work to make Greenland part of the United States.

The announcement immediately reignited diplomatic tensions with Denmark over the self-governing Arctic territory.

Good Morning Dinar Recaps,

Jeff Landry Declares Aim to Make Greenland Part of U.S.

Trump envoy appointment revives Arctic sovereignty tensions

Overview

President Donald Trump appointed Louisiana Governor Jeff Landry as special envoy to Greenland.

Landry publicly stated he would work to make Greenland part of the United States.

The announcement immediately reignited diplomatic tensions with Denmark over the self-governing Arctic territory.

Key Developments

Trump emphasized Greenland’s importance to U.S. national security, allied defense, and global stability.

Landry described the role as a volunteer position that does not interfere with his duties as governor.

Denmark and Greenland officials rejected the notion outright, reaffirming that the territory is not for sale.

The move highlights intensified U.S. focus on Arctic dominance amid rising competition from Russia and China.

Why It Matters

Greenland’s strategic location places it at the center of Arctic shipping lanes, missile defense systems, and access to critical minerals. As climate change opens northern routes and intensifies resource competition, Arctic control is becoming a cornerstone of future geopolitical and economic power.

Why It Matters to Foreign Currency Holders

For foreign currency holders, geopolitical friction between major allies introduces risk volatility into currency markets. Moves that strain U.S.–EU relations can affect confidence in reserve currencies, particularly the U.S. dollar and euro, while accelerating diversification into commodities, gold, and alternative settlement mechanisms. Arctic territorial disputes also intersect with rare-earth supply chains, influencing trade balances and long-term currency valuations tied to industrial production.

Implications for the Global Reset

Pillar: Strategic Geography Control

Arctic access determines future trade corridors, military reach, and resource dominance, directly impacting national economic leverage.Pillar: Currency Confidence Under Pressure

Diplomatic fractures among Western allies add stress to the existing financial order, reinforcing the shift toward multipolar currency systems.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Jeff Landry Declares Aim to Make Greenland Part of US”

Reuters – “Trump Names Louisiana Governor Landry as Greenland Special Envoy”

Associated Press – “Denmark and Greenland Reject U.S. Talk of Taking Over Arctic Island”

~~~~~~~~~~

Gold Sets New Record High at $4,400 as BRICS Accelerate De-Dollarization

Gold-backed settlement systems reshape global reserve strategy

Overview

Gold surged to a historic high of $4,400 on December 19, 2025, marking its strongest annual performance since 1979.

BRICS nations are rapidly reducing dollar dependence through aggressive gold accumulation and new settlement systems.

Central bank demand — not retail speculation — is driving the rally.

Key Developments

BRICS countries collectively hold more than 6,000 tons of gold, redefining global reserve management.

A gold-backed BRICS settlement “Unit” was introduced in late 2025, pegged to 1 gram of gold and backed by 40% physical metal.

Central banks within the bloc purchased roughly 800 metric tonnes of gold in 2025, valued near $105 billion.

Gold’s share of BRICS reserves doubled from 6.4% to 12.9% by Q3 2025.

The dollar’s share of global FX reserves fell to 56.32%, its lowest level in at least three decades.

BRICS announced a Precious Metals Exchange to move price discovery away from Western institutions.

Why It Matters

Gold’s breakout is not merely a reaction to interest rate expectations — it reflects a structural shift in how sovereign nations protect value. As trust in fiat systems erodes and geopolitical risk rises, gold is reasserting itself as the neutral anchor of the global financial system.

Why It Matters to Foreign Currency Holders

For foreign currency holders, sustained central bank gold buying signals long-term dilution risk for fiat currencies, particularly the U.S. dollar. As BRICS nations settle trade outside dollar-based rails and reprice reserves in physical assets, exchange rates become more sensitive to hard-asset backing rather than monetary policy promises. This transition favors currencies linked to commodities, metals, and trade surpluses — while pressuring debt-heavy fiat regimes.

Implications for the Global Reset

Pillar: Hard Asset Re-Monetization

Gold is returning to the center of sovereign trust, settlement, and reserve credibility.Pillar: Multipolar Settlement Systems

Alternative trade rails weaken dollar exclusivity and accelerate global financial realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different:

• No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Morning 12-22-25

A New Drop In The Exchange Rate... The Dinar Strengthens Its Position Against The Dollar.

Economy | 21/12/2025 Mawazin News – Baghdad: Local markets witnessed a decline in the exchange rate of the US dollar against the Iraqi dinar on Sunday. Selling centers recorded a rate of 143,000 dinars per 100 dollars, while the buying rate reached 142,000 dinars.

This decline comes within the context of daily market activity, amidst anticipation from traders regarding the outcome of government and financial measures aimed at stabilizing the currency.

A New Drop In The Exchange Rate... The Dinar Strengthens Its Position Against The Dollar.

Economy | 21/12/2025 Mawazin News – Baghdad: Local markets witnessed a decline in the exchange rate of the US dollar against the Iraqi dinar on Sunday. Selling centers recorded a rate of 143,000 dinars per 100 dollars, while the buying rate reached 142,000 dinars.

This decline comes within the context of daily market activity, amidst anticipation from traders regarding the outcome of government and financial measures aimed at stabilizing the currency.

Observers confirm that the price decrease reflects a relative improvement in the value of the dinar, which is expected to positively impact commercial activity and the living standards of citizens. https://www.mawazin.net/Details.aspx?jimare=271839

How Do Wars And International Trade Affect The Iraqi Economy? An Expert Explains.

Time: 2025/12/21 Reading: 60 times {Economic: Al-Furat News} Economic expert, Rashid Al-Saadi, confirmed that wars and global trade have a significant negative impact on the Iraqi economy.

Al-Saadi explained to Al-Furat News Agency that: “The economic war between America and China leads to customs duties and restrictions on Chinese goods, and that Iraq has trade with China estimated at about $57 billion annually, and that any negative factors on the Chinese economy also affect Iraq.”

He added that "the strained relations between Venezuela and America also have an impact on the Iraqi economy," noting that all geopolitical factors affect Iraq due to the fragility of its economy and its dependence on external economic relations without alternatives or added value for goods.

Al-Saadi also pointed to "what happened in the Russian-Ukrainian crisis," explaining that "the two countries are considered the breadbasket of Iraq, which reflects the impact of global conflicts on the stability of the Iraqi economy." LINK

Kurdistan Finance Ministry To Send 120 Billion Dinars To Baghdad Tomorrow

Money and Business Economy News – Baghdad The Ministry of Finance and Economy of the Kurdistan Region announced that it will send 120 billion dinars to Baghdad on Monday.

The ministry stated: "We will deposit 120 billion dinars of non-oil financial revenues for last October into the account of the Federal Ministry of Finance tomorrow, Monday." https://economy-news.net/content.php?id=63649

Industry: Signs New Contracts To Support The Oil Sector And Enhance The Capabilities Of Northern Refineries

Sunday, December 21, 2025 | Economy Number of views: 399 Baghdad / NINA / Al-Faris General Company, one of the companies of the Ministry of Industry and Minerals, announced the signing of several contracts with the North Refineries Company.

According to a ministry statement, the company's Director General, Saif Al-Din Ali Ahmed, stated that "the signing of these contracts comes within the framework of joint cooperation between government companies and is the result of Al-Faris General Company's efforts to support the oil sector."

He pointed out that the signed contracts included supplying pumps and their accessories as spare parts, supplying maintenance materials for the Qayyarah refinery furnace, in addition to establishing a cooling tower system for the Kirkuk refinery and supplying emergency pumps for the refining unit at the Salah Al-Din refinery.

He added that "the contracts also included the construction of a steam line for the North pumping and storage area/North Depot, the establishment of an electrical control valve system for all tanks along with the construction of the control system in the Sinniyah refinery section, and the design, supply, and installation of smart loading arms for petroleum products, in addition to other contracts."

He emphasized the company's ability to support the oil sector and raise the efficiency of refineries according to approved technical standards. /End https://ninanews.com/Website/News/Details?key=1267722

Iraqi Crude Oil Ranks Third As The Largest Supplier To The United States

Economy | 21/12/2025 Mawazin News - Baghdad: The U.S. Energy Information Administration (EIA) announced on Sunday that Iraq ranked third among the largest exporters of crude oil to the United States last week.

The EIA stated in its statistics that "U.S. crude oil imports averaged 5.675 million barrels per day (bpd) last week from nine major countries, a decrease of 132,000 bpd from the previous week's average of 5.807 million bpd."

It added that "Iraq's oil exports to the U.S. averaged 306,000 bpd, an increase of 231,000 bpd from the previous week's average of 75,000 bpd, making it the third largest supplier to the U.S. for that week."

The EIA indicated that "the largest share of U.S. oil imports last week came from Canada, averaging 4.164 million bpd, followed by Saudi Arabia at 321,000 bpd, Mexico at an average of 243,000 bpd, and Colombia at an average of 232,000 bpd."

According to the table, "U.S. crude oil imports from Venezuela averaged 193,000 barrels per day, from Brazil 184,000 barrels per day, from Ecuador 32,000 barrels per day, and from Nigeria 2,000 barrels per day, while no oil was imported from Libya last week."

The U.S. imports most of its crude oil and refined products from these ten major countries. With a daily oil consumption of approximately 20 million barrels, the U.S. is the world's largest oil consumer.

https://www.mawazin.net/Details.aspx?jimare=271833

Expert: Artificial Intelligence Provides A Safe Environment For Investors In The Stock Market

Time: 2025/12/21 Reading: 30 times {Economic: Al-Furat News} Economic expert Salah Nouri confirmed on Sunday that the use of artificial intelligence technologies in the Iraqi Stock Exchange provides a safe investment environment and protects investors from fraud and scams, while pointing out that automating trading contributes to attracting local and foreign investments.

Nouri told Al-Furat News Agency that "investment in the Iraqi Stock Exchange depends on several basic conditions to attract investors, foremost among them providing a safe environment by listing the financial statements of joint-stock companies on time," indicating that "the Securities Commission and the Central Bank of Iraq have obligated private sector banks to issue quarterly financial statements to be traded in the market."

He added that "the investment process requires careful monitoring of licensed brokerage firms, as the buying and selling of shares is carried out through them," stressing "the importance of adhering to honesty with the investor in accordance with the instructions issued by the market administration."

Nouri added that "the Financial Disclosure Department at the Securities Commission is responsible for examining financial data before approving its listing," noting that "the main goal of the market and the commission is to stimulate economic sectors by mobilizing and directing investments, stressing that the more investors are protected from fraud, the greater the demand for investment from Iraqis and foreigners."

He explained that "automating stock trading and monitoring brokerage firms facilitates trading operations quickly and securely, which is currently available in the Iraq Stock Exchange through the use of the latest software used in the Gulf markets."

The economist pointed out that "the bottom line is that the use of artificial intelligence ensures the speed of completing transactions within a few minutes, as well as enhancing protection and transparency in stock trading." LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

“Tidbits From TNT” Monday Morning 12-22-2025

TNT:

Tishwash: Iraqi state-owned banks suspend operations until the beginning of next year

Iraqi state-owned banks will begin their annual inventory and audit procedures this week, which will halt their operations until the beginning of next year.

An informed source told Shafaq News Agency that "this step comes to pave the way for settling accounting holds and preparing the statistics and financial data for the past year," noting that "the work will include not promoting banking service requests and temporarily halting all banking activities during the inventory period, and this procedure is carried out annually."

TNT:

Tishwash: Iraqi state-owned banks suspend operations until the beginning of next year

Iraqi state-owned banks will begin their annual inventory and audit procedures this week, which will halt their operations until the beginning of next year.

An informed source told Shafaq News Agency that "this step comes to pave the way for settling accounting holds and preparing the statistics and financial data for the past year," noting that "the work will include not promoting banking service requests and temporarily halting all banking activities during the inventory period, and this procedure is carried out annually."

The source confirmed that "banks will resume their normal operations and begin promoting banking transactions and services at the beginning of next year after completing the inventory and auditing procedures in accordance with the approved regulations link

************

Tishwash: A new shift in customs procedures is expected at the beginning of next year.

The General Authority of Customs announced the full implementation of the advance customs declaration system at the beginning of next year, to include all imported goods and merchandise.

The Director General of the Authority, Thamer Qasim Dawood, explained in a press statement that "the Authority has begun the gradual implementation of the system, as the first phase included five basic materials: gold, mobile phones, jewelry, curtains, in addition to some other goods such as cooling devices and cars."

He pointed out that "the period from the first until (31) of this month represents a trial phase in preparation for generalizing the system to all goods and merchandise in the federal customs centers, stressing that the Kurdistan Region of Iraq ports are temporarily excluded because they are not linked to the ASYCUDA system adopted by the Authority."

Daoud stressed that “the electronic link between customs declarations and the Central Bank of Iraq will directly contribute to reducing currency smuggling and money transfers without corresponding goods.” link

*****************

Tishwash: Financial reform in Iraq: A plan on paper or the beginning of economic change?

Amid the end of the current government's term, the latest decisions came under the title of financial reform in Iraq to reduce expenditures and maximize resources, but they face implementation challenges due to the government's limited powers, which raises questions about its ability to address deep financial imbalances and secure real economic stability before the next government takes over.

After the Iraqi government reached the end of its constitutional term, it launched a package of financial decisions under the title of “reducing spending and maximizing revenues,” without having political or time cover to ensure that they would be turned into effective policies.

These decisions, issued by a government with limited powers, are not binding on the next government, nor are they part of its program, making them closer to reforms on paper, put forward at the last minute to manage financial pressure rather than to address the roots of the crisis, amid widespread doubts about their ability to be implemented or to continue after the formation of the new government.

Decisions of the Ministerial Council for the Economy

The Ministerial Council for the Economy, during a meeting dedicated to discussing the issue of reducing spending and maximizing revenues, approved a package of decisions aimed at controlling public expenditures and strengthening the state’s financial resources.

The decisions included reviewing the allowances and salaries of the three presidencies and working to equalize them with the salaries of the Prime Minister's office staff, in addition to updating the salary scale for all state employees, based on the recommendations of the Ministry of Planning. The Council also decided to reduce the allowances for official travel for state employees by 90%, limiting such travel to cases of extreme necessity and requiring the approval of the relevant minister, as well as reducing the supervision and monitoring percentages for new projects.

Maximizing non-oil revenues

For his part, the Prime Minister’s advisor, Dr. Mazhar Muhammad Saleh, confirmed that the recent drop in oil prices to below $60 a barrel constitutes a manageable financial pressure and does not amount to a financial crisis, noting that Iraq still possesses important safety margins, foremost among them comfortable foreign reserves and public debt levels within safe limits, in addition to the continued ability to meet basic obligations, primarily salaries and service spending.

Saleh said that the continuation of global oil prices at these levels may be reflected in the 2026 budget with a manageable deficit, the size of which depends on price developments, production levels, and the extent of control over public spending.

He pointed out that fiscal policy is working to manage this deficit by rearranging priorities, maximizing non-oil revenues, and making limited use of domestic financing tools when necessary, without compromising economic stability.

Saleh added that the government adopted clear standards for reducing unnecessary spending, including reviewing the salaries and allowances of the three presidencies, and reducing foreign delegations by up to 90%, while maintaining only delegations of a sovereign and necessary nature, in accordance with the principle of justice and accountability starting from the highest level of the state.

He stressed that these measures will not affect vital investment projects or basic services for citizens, as spending related to the water, electricity, health and education sectors has been neutralized, with priority given to projects with advanced completion rates, in addition to protecting the salaries of the middle and lower segments.

He concluded by saying that the current fiscal policy is based on smart management of public spending, which maintains economic and social stability, and deals with fluctuations in oil prices as periodic challenges that require adaptation and reform, without imposing additional burdens on the citizen.

In extra time

Economic expert Ziad al-Hashemi believes that the Iraqi government is now playing for time, after the damage has been done, as he put it, and is trying to score last points in its favor by proposing a financial reform plan aimed at reducing spending and increasing revenues.

Al-Hashemi points out that “governments in various countries around the world usually present their financial programs at the beginning of their formation, to address previous imbalances, improve the quality of spending, maximize returns, and draw up a systematic and disciplined financial policy. However, what happened in Iraq was the complete opposite of that.”

Over the past four years, Al-Hashemi explains that “the government program was based primarily on expanding spending, through highly politicized financial budgets, which contributed to inflating salaries and subsidies, and piling up government employees in numbers that exceed the needs and capacity of state institutions, in addition to maximizing the financial deficit and accumulating debts, and allowing corruption to operate freely.”

He adds that all of this “happened at a time when Iraq’s financial revenues, especially oil revenues and others, were witnessing a significant decline, yet the government ignored internal warnings and international reports that repeatedly sounded the alarm, warning of the risks of inflated spending in light of deteriorating revenues, without receiving any response.”

Lost opportunities for reform

After the opportunities for reform were lost and the financial crisis worsened dangerously during the past years, Al-Hashemi points out that “the government is now emerging, at the end of its lifespan, with a financial reform plan, after the financial pressure has reached its peak, and the possible solutions are now only harsh and painful, and their impact will most likely be felt by the citizen before anyone else.”

Al-Hashemi raises questions about the mechanisms for implementing this plan, asking about “how it can be implemented by a caretaker government with limited powers, which does not have enough time to implement broad reform measures, in addition to the ambiguity of the implementing bodies, the commitment mechanisms, and the timetables, in light of the imminent formation of a new government.”

It is likely that “this move is an attempt by the government to polish its image in its final days, by announcing a financial reform plan, perhaps with the aim of encouraging political parties to reappoint the current Prime Minister and give him a chance to implement this plan.”

He concluded by saying: “In any case, the next government, whether the current Prime Minister is reappointed or another figure is chosen, will face an extremely difficult financial test, which will force it to take more harsh and painful measures, and financial austerity may be the most prominent theme for the next four years.”

Crisis management, not economic reform

For his part, academic and economic researcher Nawar Al-Saadi believes that “the real goal of these measures is not to launch a comprehensive economic reform in the strict sense, as the caretaker government lacks the political cover and sufficient time to proceed with reforms of this kind.”

Al-Saadi says that “the goal is limited to reducing the financial bleeding and containing the risks until the responsibility is transferred to the next government,” adding that these steps “carry a dual message; the first is directed to the markets and regulatory bodies, indicating that the financial situation is still under control for the time being. The second is to the next government, indicating that the margin for maneuver has become narrower than it was previously.”

Al-Saadi explains that “the problem lies in the structure of the economic decision itself. Iraq does not suffer from a lack of plans or diagnosis, but rather from a weakness of executive will and the prioritization of short-term political calculations at the expense of painful reforms.”

Al-Saadi notes that “what is happening today is more of a crisis management effort than a genuine economic reform. The recent decisions may help alleviate the immediate pressure on the treasury, but they do not address the root causes of the problem, which are the bloated public sector, the fragility of non-oil revenues, and the weakness of financial governance.”

He concluded by warning that “unless the next government moves from the logic of ‘temporary austerity’ to comprehensive structural reform, Iraq will remain stuck in the same cycle, between high spending in years of plenty and belated austerity decisions with the first tremor in oil prices.” link

******************

Mot: . Poor ole Santa!!!!

Mot: Asking for a Friend!!!