Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 12-20-25

Good Afternoon Dinar Recaps,

Global Trade Set to Break Records in 2025 as Flows Surge Past $35 Trillion

Goods and services expansion underscores resilience amid global restructuring

Good Afternoon Dinar Recaps,

Global Trade Set to Break Records in 2025 as Flows Surge Past $35 Trillion

Goods and services expansion underscores resilience amid global restructuring

Overview

Global trade in goods and services is on track to exceed $35 trillion in 2025, marking the highest level on record.

Trade flows are expected to rise by approximately $2.2 trillion, or 7%, compared with 2024, reflecting continued expansion through the second half of the year.

Services trade is growing faster than goods, highlighting structural shifts in global commerce.

Key Developments

Trade in goods is projected to contribute roughly $1.5 trillion to overall growth, supported by resilient supply chains and continued demand.

Services trade is expected to expand by about $750 billion, nearly 9%, reinforcing its rising importance in global trade flows.

UN Trade and Development (UNCTAD) forecasts continued growth into the fourth quarter of 2025, though at a slower pace.

Quarterly growth is expected to moderate to 0.5% for goods and 2% for services, signaling stabilization rather than contraction.

The sustained expansion reflects adaptive trade networks, even as geopolitical fragmentation and policy realignment persist.

Why It Matters

Record-breaking global trade levels suggest that despite geopolitical tensions, sanctions, and supply chain reconfiguration, the global economy continues to function through diversified trade corridors. This resilience supports economic activity but also masks underlying shifts in trade settlement, currency use, and regional alignment.

Why It Matters to Foreign Currency Holders

As trade volumes expand, currency demand increasingly follows trade settlement preferences rather than legacy reserve norms. Growth in services and diversified trade routes may accelerate the use of non-dollar currencies, increasing volatility and repricing risk for foreign currency holders tied to traditional trade settlement systems.

Implications for the Global Reset

Pillar: Trade System Resilience

Record trade volumes demonstrate that global commerce is adapting rather than collapsing, even as structures are redesigned.Pillar: Currency Realignment

Expanding trade flows create pressure for alternative settlement mechanisms and regional currency usage beyond the dollar-centric system.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Industrial Metals Rally on Tight Supply and Demand Dynamics

Copper near record highs underpins bullish industrial metals narrative

Overview

Copper prices are trading within striking distance of all-time highs amid renewed tight supply concerns and structural demand growth. Benchmark copper on the London Metal Exchange rose to about $11,837 per ton, approaching the record $11,952 level set recently.

Bullish outlook persists even as the U.S. dollar strengthens slightly, with week-to-date gains and continued year-to-date strength (up ~35% in 2025).

Key Developments

Analysts from Goldman Sachs highlighted unique supply constraints as a core driver of the rally and reiterated long-term structural demand, citing copper as a favored industrial metal.

Aluminium reached multi-year highs, supported by both energy transition and infrastructure demand, while other base metals including tin and lead saw upward pressure.

Nickel prices climbed modestly after Indonesia proposed output cuts, tightening markets for battery and alloy metals.

A stronger U.S. dollar capped further gains, highlighting currency dynamics in commodity pricing.

Why It Matters

Copper’s sustained rally signals deeper shifts in global industrial demand — particularly for electrification, renewable infrastructure, and data-center capacity — while constrained mine supply underscores structural inflexibility in raw materials that are critical to the energy transition.

Why It Matters to Foreign Currency Holders

Rising real asset prices like copper often reflect weakening confidence in fiat currencies, driving investors toward tangible commodities. For holders of foreign currencies, such strength can signal inflation hedging behavior and reallocation of capital into hard assets.

Implications for the Global Reset

Pillar: Transition-Asset Realignment

Surge in critical industrial metals reflects fundamental rebalancing towards energy transition priorities and infrastructure buildout.Pillar: Monetary Risk Hedging

Persistent metals strength amidst currency dynamics highlights deepening investor preference for real assets over sovereign debt.

This is not just markets — it’s structural demand shaping future global capital flows.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Copper nears record high as supply tightness back in focus

Reuters/Commodity price data wrap – Copper prices rise as tight supply is in focus

~~~~~~~~~~

Fed Withdraws Crypto Banking Ban, Opening Door for Digital Asset Innovation

Regulatory shift empowers state-chartered banks to engage with digital asset services

Overview

The U.S. Federal Reserve Board has officially withdrawn its 2023 policy statement that restricted state-chartered banks from engaging in certain cryptocurrency and innovative banking activities. The action marks a significant pivot toward enabling responsible financial innovation.

The withdrawn guidance had effectively limited state member banks, including uninsured banks, by tying them to the same narrow activity set as national banks.

The new policy framework creates a pathway for both insured and uninsured state-supervised banks to pursue novel activities — including digital asset services — so long as they satisfy supervisory and risk-management standards.

Key Developments

The 2023 policy statement — rescinded in December 2025 — had been viewed as a de facto barrier to crypto-related services by state-chartered banks, including payments, stablecoin support, and brokerage functions.

Under the new framework, state member banks may seek approval to offer innovative activities not previously permissible, provided they meet safety and soundness requirements.

Uninsured state banks particularly benefit, as the previous regime limited their access to Federal Reserve membership and payment infrastructure.

The Board’s shift reflects an evolved understanding of financial technologies and a desire to balance innovation with systemic stability.

Industry leaders have framed the move as a major regulatory pivot that could expand institutional participation in digital assets through the regulated banking system.

Why It Matters

This withdrawal of restrictive guidance signals a meaningful shift in the U.S. central bank’s approach to digital finance. By carving out an explicit route for state-chartered banks to engage in digital asset activities, the Fed is potentially integrating blockchain-based services more directly into the regulated financial system — a move that could reshape market structure and institutional participation in crypto-related markets.

Why It Matters to Foreign Currency Holders

The integration of digital asset capabilities into mainstream banking has implications for currency holders globally. As traditional financial institutions begin to support crypto and tokenized services under regulated frameworks, demand patterns for alternative settlement mechanisms, cross-border payments, and digital liquidity pools may evolve, pressuring established currency systems and reserve assets.

Implications for the Global Reset

Pillar: Regulatory Integration of Digital Finance

Enabling banks to engage in digital asset services under supervision bridges the divide between traditional finance and emerging technologies.Pillar: Financial System Evolution

The policy shift accelerates the normalization of digital asset markets within regulated banking systems, potentially influencing global capital flows and monetary treatment of crypto-based instruments.

This is not just policy — it’s the structural integration of digital finance into the global banking architecture.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

EV Metals Complex Under Strain as Battery Materials Lose Charge

Oversupply and tech shifts reshape metals trade and supply chains

Overview

Battery metals like lithium, nickel and cobalt are facing a third consecutive difficult year despite strong EV adoption, as oversupply and shifting battery chemistries weigh on prices and demand.

EV sales rose ~21% year-over-year, yet not all metals are benefiting equally due to evolving battery technology preferences.

Key Developments

Chinese companies advancing LFP and sodium-ion battery tech are displacing traditional nickel-cobalt chemistries, reducing demand pressures for those metals.

Nickel and cobalt markets are oversupplied, with elevated LME warehouse stocks and lagging demand growth compared to early-cycle forecasts.

Lithium remains dominant but is facing emerging competition from new chemistries, challenging traditional demand assumptions.

Copper and aluminum stand out as enduring winners, vital for wiring, infrastructure and vehicle construction even as battery mix shifts.

Why It Matters

The disconnect between EV sales momentum and lagging battery-metal pricing highlights how technological shifts and supply imbalances are redefining commodity demand patterns, with implications for producers, national export strategies and capital allocation.

Why It Matters to Foreign Currency Holders

Oversupplied metal markets amid evolving demand can temper inflationary pressures on input costs while signaling deeper structural shifts in trade flows for critical minerals — influencing currency valuations in commodity-dependent economies.

Implications for the Global Reset

Pillar: Strategic Resource Realignment

Technology-driven demand patterns force a rethinking of mineral investment and supply chain strategies globally.Pillar: Trade Flow Reconfiguration

Oversupply in traditional battery metals may redirect flows toward alternative critical commodities and produce new geopolitical dependencies.

This is not just technology — it’s a new blueprint for industrial commodities in a post-transition economy.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – EV revolution rolls on but battery metals lose their charge

Reuters – Commodities Market Headlines: battery metals under pressure

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Afternoon 12-20-25

The Dollar Is Rising Again And Putting Pressure On The Dinar In Local Markets.

Economy | 20/12/2025 Mawazin News - Baghdad: Local markets in Baghdad witnessed a rise in the exchange rate of the US dollar against the Iraqi dinar. The selling price reached 143,500 dinars per 100 dollars, while the buying price was 142,500 dinars per 100 dollars. Traders are cautiously monitoring market activity and the fluctuating exchange rates.

The Dollar Is Rising Again And Putting Pressure On The Dinar In Local Markets.

Economy | 20/12/2025 Mawazin News - Baghdad: Local markets in Baghdad witnessed a rise in the exchange rate of the US dollar against the Iraqi dinar. The selling price reached 143,500 dinars per 100 dollars, while the buying price was 142,500 dinars per 100 dollars. Traders are cautiously monitoring market activity and the fluctuating exchange rates. https://www.mawazin.net/Details.aspx?jimare=271801

Government Advisor: Iraq's Debt Does Not Pose A Burden On Financial Stability

Economy | 20/12/2025 Mawazin News - Baghdad: The Prime Minister's Financial Advisor, Mazhar Muhammad Salih, confirmed that

Iraq's external debt is 4%, which is within safe limits. He also indicated that both internal and external debt are within internationally accepted safe limits.

Salih stated, "Iraq's external public debt constitutes only about 4% of its GDP, a very low percentage compared to internationally recognized safe limits, which allow external debt to reach up to 60% of GDP." He added, "This means that Iraq is outside the circle of external debt overburden, which is clearly reflected in its stable credit rating at level B over the past years and up to the present."

He continued, "As for domestic public debt, the accumulated amount during the current government's term does not exceed 34 trillion dinars, a figure significantly lower than the hypothetical ceilings anticipated in the three-year budget."

He added, "The financial planning for that budget assumed annual borrowing levels nearly double what was actually achieved over the three years, meaning that the ratio of actual domestic debt to the planned amount did not exceed 15% during the implementation period of the three-year budget, as stipulated by Law No. (13) of 2023."

He pointed out that "the 2026 budget planning takes into account that the outstanding debt balance, particularly the inherited domestic debt accumulated over more than a decade, along with the remaining external debt, collectively constitutes only 31% of the total annual GDP. This percentage also falls within the globally safe range for financial stability and does not represent a structural burden on public finances."

He added, "The 2026 budget's reliance on a hypothetical borrowing ceiling is not a cause for concern; rather, it falls within the framework of sound risk management, particularly regarding the risks of global oil market volatility and its potential impact on planned revenue levels."

He pointed out that "this approach is reinforced by adopting a high level of fiscal discipline, the foundations of which are being laid in the draft federal budget law for next year, through controlling expenditures, enhancing non-oil revenues, and implementing high-level financial governance, while taking into account external shocks, especially those related to energy markets." https://www.mawazin.net/Details.aspx?jimare=271809

Warning Against Using It To Address The Financial Deficit... Economic Observatory: Iraq's Gold Reserves At Their Highest Levels

Saturday, December 20, 2025, 10:28 AM | Economy Number of views: 220 Baghdad ( NINA ) – An economic observatory announced on Saturday that Iraq's gold reserves have reached a record high of approximately $23.064 billion, while simultaneously warning against using or disposing of them to address the country's financial deficit.

The observatory stated in a report that "Iraq purchased approximately 8.2 tons of gold during 2025, bringing the total reserve to 170.9 tons." The report further explained that "this increase was distributed as follows: one ton in March, 1.6 tons in June, 3.1 tons in July, and 2.5 tons in August."

The report indicated that "the total reserve of 170.9 tons is currently equivalent to $23.064 billion, the highest level of gold reserves in Iraq's history."

The observatory attributed "this significant increase to the rise in global gold prices, and not to the volume of purchases made during 2025," explaining that "recent purchases represent approximately 6.4% of the total reserves since the beginning of this year."

The observatory warned against "any manipulation or misuse of gold reserves to cover financial deficits, whether through selling a portion of them or investing them in high-risk ventures," emphasizing that "gold is a sovereign asset dedicated to supporting financial stability, not to generating immediate revenue." https://ninanews.com/Website/News/Details?key=1267601

Iraq And Jordan Are Developing A Roadmap For Economic Cooperation And Integration.

December 20, 2025 Amman – Rand Al-Hashemi Baghdad – Qusay Munther Iraq and Jordan agreed to launch a roadmap for economic cooperation and integration between the two countries, which includes opening new investment opportunities and developing trade relations, within the framework of pushing joint development to broader horizons.

Meanwhile, an independent economic observatory warned of the danger of manipulating gold reserves to cover the budget deficit, stressing that such a step could threaten the stability of public finances and weaken confidence in the local economy.

A statement received by Al-Zaman yesterday said that, “Following up on the initiative launched after the meeting between Prince Hassan bin Talal and both the Iraqi Ambassador to the Hashemite Kingdom of Jordan, Omar Al-Barzanji, and the Iraqi Commercial Attaché, Mustafa Thamer Al-Alam, the second meeting of the Iraqi-Jordanian Economic Cooperation and Integration Forum was held, with the participation of a select group of senior business leaders and representatives of the private sector from both countries.”

The statement added that, “This meeting comes within the framework of following up on the directions agreed upon during that meeting, and the resulting formation of a joint working group concerned with exploring mechanisms to enhance economic cooperation, studying opportunities for integration between Iraq and Jordan, and developing projects of common priority.”

It continued, “The participants discussed setting general strategic guidelines for the forum’s work, and defining the executive frameworks for the next phase, including supporting mutual investment, activating the joint industrial zone, and strengthening cooperation in the productive and service sectors. The outcomes of the first meeting were also reviewed, and follow-up mechanisms were updated.”

The statement concluded by saying that, “The forum concluded its meeting by affirming the continuation of holding periodic sessions, expanding participation, and working to develop a practical plan that opens new horizons for cooperation.” (Economic partnership between the two countries).

For his part, Barzanji affirmed that (the forum represents a practical step towards consolidating the economic partnership between the two countries), noting that (all outputs and recommendations will be presented to Prince Talal for final approval and implementation, in a way that supports the path of bilateral economic integration).

On the other hand, an observatory calling itself Eco Iraq warned of the dangers of tampering with Iraq's gold reserves, valued at approximately $23.64 billion, to address the country's financial deficit. The observatory stated in a report yesterday that Iraq purchased approximately 8.2 tons of gold this year, raising its total reserves to 170.9 tons. It noted that this increase was distributed as follows: one ton in March, 1.6 tons in June, 3.1 tons in July, and 2.5 tons in August.

The observatory explained that Iraq's total reserves of 170.9 tons are currently equivalent to $23.064 billion, the highest level ever recorded for gold reserves. It attributed the significant increase in the reserve's value to the rise in global gold prices, not to the volume of purchases made in recent months, which constituted 64 percent of the total reserves since the beginning of the year.

The observatory warned against any manipulation of the gold reserves to cover deficits, whether by selling a portion of them or subjecting them to high-risk investments, emphasizing that gold is a sovereign asset allocated for financial stability, not for generating immediate revenue. In a related development, an economic expert identified key pillars for strengthening the Iraqi economy.Salah Nouri stated yesterday that “economic strength lies in local production that competes with imported goods, especially agricultural and livestock production,” emphasizing that “Iraq is historically an agricultural country and the elements of agricultural production can be provided, provided the water problem is solved at present.”

Nouri explained that “the second pillar depends on strengthening industrial production through public-private partnership contracts, as well as encouraging small and medium enterprises by supporting them with soft loans while ensuring monitoring and regulation of these projects,” stressing “the importance of accelerating the completion of the electricity infrastructure and utilizing the natural gas associated with oil extraction,” calling for “reconsidering the size of the operational budget and streamlining spending, especially unjustified privileges in light of the financial crisis.”

He added that “the success of these pillars, in addition to the International Development Road project, depends on combating corruption in contracting and implementation processes.” LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Jon Dowling: Economy in 2026, Global Reset Prediction, Gold Revaluation with Micah Haince, Dec. 2025

Jon Dowling: Economy in 2026, Global Reset Prediction, Gold Revaluation with Micah Haince, Dec. 2025

12-20-2025

As we navigate the complexities of the global economy, investors are increasingly turning to precious metals as a safe-haven asset.

In a recent podcast episode, Micah Haince, a senior sales associate at Noble Gold Investments, shared his expert perspective on the current and future state of the precious metals market, particularly gold and silver.

Jon Dowling: Economy in 2026, Global Reset Prediction, Gold Revaluation with Micah Haince, Dec. 2025

12-20-2025

As we navigate the complexities of the global economy, investors are increasingly turning to precious metals as a safe-haven asset.

In a recent podcast episode, Micah Haince, a senior sales associate at Noble Gold Investments, shared his expert perspective on the current and future state of the precious metals market, particularly gold and silver.

With nearly a decade of experience in precious metals investing, Micah provided valuable insights into the key drivers behind the recent price surges, the undervaluation of precious metals in American portfolios, and the impending economic shifts that could shape the market heading into 2026.

According to Micah, a “perfect storm” is brewing in the precious metals market, driven by a combination of technical and fundamental factors.

One of the primary drivers is the supply deficit in the market, which is expected to continue as industrial demand for silver and other precious metals remains strong. Additionally, geopolitical movements, such as the rise of the BRICS nations and their gold-backed alternative financial system, are likely to further fuel the demand for precious metals.

The BRICS nations, comprising Brazil, Russia, India, China, and South Africa, have been working towards creating a new financial order that is less dependent on the US dollar.

As this movement gains momentum, it is likely to erode confidence in the US dollar and drive investors towards alternative stores of value, such as gold and silver.

The conversation with Micah also touched on the possibility of a return to a gold standard in the mid-to-late 2020s. While this may seem like a radical idea, it is not entirely implausible.

With the US dollar facing increasing pressure from global economic shifts, a gold-backed financial system could provide a much-needed anchor for the global economy.

Micah speculated that a Trump Administration could potentially lead to significant changes in the Federal Reserve leadership and the merging of the Fed and Treasury. While this is still speculative, it highlights the potential for significant shifts in the global economic landscape.

Despite the potential risks and uncertainties, Micah remains optimistic about the future of precious metals. He forecasts that gold could potentially reach $10,000 per ounce by 2030, driven by fundamental scarcity and a shift in global currency confidence. Silver, in particular, is expected to surge to $300 per ounce or more, driven by its industrial demand and limited supply.

Micah stressed the importance of proactive investment in physical precious metals as a hedge against currency devaluation, stock market crashes, and economic instability. With the global economy facing increasing uncertainty, investors would do well to consider diversifying their portfolios with precious metals.

In conclusion, the insights shared by Micah Haince provide a compelling case for the importance of precious metals in a diversified investment portfolio. As the global economy continues to evolve, it is likely that gold and silver will play an increasingly important role as safe-haven assets.

Investors would do well to take a proactive approach to investing in physical precious metals, and Noble Gold’s holiday promotion provides a timely opportunity to do so.

For further insights and information, be sure to watch the full video from Jon Dowling. With expert analysis and commentary, this video provides a valuable resource for investors looking to navigate the complexities of the precious metals market.

News, Rumors and Opinions Saturday 12-20-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 20 Dec. 2025

Compiled Sat. 20 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: The long-awaited Global Currency Revaluation (RV) has (allegedly) entered its final launch phase, with the Quantum Financial System (QFS) now (allegedly) fully operational across 209 nations, facilitating gold-backed digital currencies and the greatest wealth transfer in history.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 20 Dec. 2025

Compiled Sat. 20 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: The long-awaited Global Currency Revaluation (RV) has (allegedly) entered its final launch phase, with the Quantum Financial System (QFS) now (allegedly) fully operational across 209 nations, facilitating gold-backed digital currencies and the greatest wealth transfer in history.

High-level sources report that Tier 4B (Us, the Internet Group who hold foreign currency to exchange and Zim Bonds to redeem) notifications and payouts could commence as early as this weekend, ushering in unprecedented abundance under NESARA/GESARA protocols.

Debt forgiveness is (allegedly) actively processing, erasing mortgages, credit cards, and personal loans for millions, as the fiat system collapses in favor of sovereign prosperity.

Pray for the swift rollout, that all may experience this blessing soon.

As the QFS secures trillions in repatriated funds, humanitarian projects will (allegedly) receive immediate liquidity, enabling the rebuilding of communities and the healing of our planet.

This wealth transfer marks the end of financial experiment, returning power to the people through asset-backed sovereignty.

~~~~~~~~~~~~~~

Global Currency Reset:

Thurs. 18 Dec. 2025 The Big Call Bruce:

President Trump(allegedly) wants the RV exchanges started by Christmas.

A contact with HSBC Bank in Canada, the lead bank for the RV around the World, said that the Admirals Group in Tier 4A would(allegedly) have money in their accounts by this Fri. or Sat. 19, 20 Dec.

Another source said Tier4b would (allegedly) receive notifications Mon., Tues. with appointments for Zim Holders starting Fri. 26 Dec. and be finished with exchanges by Mon. 29 Dec. 2025.

That same source said Tier 4b (us, the Internet Group) would(allegedly) be notified to set our appointments to exchange early next week, on Mon. or Tues. 22, 23 of Dec. 2025.

That source said Redemption of Zim would(allegedly) start the day after Christmas, or on Fri. 26 Dec. 2025.

He also said that other Tier4b exchanges have to (allegedly) start before Mon. 29 Dec. 2025.

Another reliable source said that Tier4b would be(allegedly) notified prior to Christmas, or very early this coming week, Mon. or Tues 22, 23 of Dec. 2025 and then begin exchanges after Christmas.

That second source also said that they anticipated EBS announcements to start over this coming weekend and if they did, Tier4b would be notified to set appointments Mon. or Tues. 22, 23 of Dec. 2025.

Read full post here: https://dinarchronicles.com/2025/12/20/restored-republic-via-a-gcr-update-as-of-december-20-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] OMAR: The UN has clearly shown the domestic Iraq ends in 2025 and the international Iraq starts in 2026 with banking reforms. FRANK: Well, tell me UN, how did you convince the international world to accept 1310 as the rate?

Militia Man The bottom line is they're going to show you how they're going to do it on their time. We don't know exactly when that's going to happen...One thing for sure, all of Iraq's banks will need to be compliant 100%...

Jeff The Central Bank of Iraq is autonomous. That means they can change the rate separately from the government of Iraq whenever they want to. They don't need anything from the government to change the rate other than maybe like a mutual agreement ...They don't even need the government to be done and completed. They could do it while we're in the middle of this election period...because the CBI is completely autonomous.

************

Will Silver Hit $75/oz Soon? How About $100/oz? | Andy Schectman

12=19=2-25

The silver breakout continues, with the futures price now above $66/oz.

Can it hit $75/oz soon?

How about $100/oz?

Precious metals Andy Schectman will share his latest outlook on silver and what's going on with precious metals demand & supply. He'll also take live audience Q&A.

Seeds of Wisdom RV and Economics Updates Saturday Morning 12-20-25

Good Morning Dinar Recaps,

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Good Morning Dinar Recaps,

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different:

• No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

ECB Affirms Banks Will Be Central in Distributing Digital Euro

Policy makers aim to preserve banking intermediation and financial stability as digital currency design advances

Overview

European Central Bank officials reaffirmed that banks and payment intermediaries will distribute the digital euro, maintaining their key role in the financial system and credit intermediation.

The digital euro is being designed to avoid bank disintermediation, with holding limits, non-remuneration, and links to commercial accounts.

The ECB is progressing toward potential issuance, with regulatory approval and pilot phases targeted in the coming years.

Key Developments

ECB executives restated that banks will distribute the digital euro and manage customer interfaces, integrating digital euro wallets into existing banking services.

Safeguards to preserve credit intermediation include non-interest design, holding limits, and linked commercial accounts, preventing destabilising deposit outflows.

Technical design measures aim to ensure banks retain revenue from transactions and benefit from digital euro adoption through fee savings and compensated services.

The ECB continues public outreach and legislative engagement, while broader EU institutions work on legal frameworks and functionality (e.g., online/offline use).

Blockchain/DLT settlement preparations and cross-border ambitions are advancing, potentially reinforcing banks’ roles within a robust payments ecosystem.

Why It Matters

This emphasis by the ECB reflects policymakers’ desire to modernise the euro area’s payment systems without undermining traditional banking functions. By anchoring digital euro distribution through banks, the ECB aims to uphold the transmission of monetary policy, deposit-credit intermediation, and financial stability even as central bank money goes digital.

Why It Matters to Foreign Currency Holders

The design choices for the digital euro — including banks as distribution partners — will influence how digital currencies compete with cash, commercial deposits, and emerging stablecoins globally. A digital euro that preserves bank roles may stabilize demand for euro-area financial assets, support banking credit flows, and shape foreign portfolio allocations toward euro-denominated instruments.

Implications for the Global Reset

Pillar: Public-Private Financial Integration

Embedding a digital euro within the existing banking network bridges central bank money with private financial intermediation, supporting continuity in credit markets.Pillar: Monetary Stability & Sovereignty

A European CBDC designed to complement banks strengthens the euro area’s monetary order while mitigating fragmentation and foreign payment dependencies.

This is not just finance — it’s how digital money will integrate with the global banking system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

ECB – The digital euro: maintaining the autonomy of the monetary system

Reuters – EU Council backs digital euro with both online and offline functionality

~~~~~~~~~~

Russia and China Expand Joint Bomber Patrols as Strategic Pressure Builds

Evolving military cooperation signals deeper alignment against U.S.-led security architecture

Overview

Russia and China have steadily expanded joint bomber patrols since 2019, including aircraft capable of carrying nuclear weapons.

Patrols have moved beyond East Asia, extending into the Pacific and near Alaska, signaling a broader strategic reach.

The cooperation reflects a deepening “partnership without limits”, aimed at counterbalancing U.S. and allied military influence.

Key Developments

The 10th joint air patrol was conducted on December 9 near Japan, under an annual military cooperation plan between Moscow and Beijing.

Russian Tu-95MS bombers (nuclear-capable) and Chinese H-6K bombers participated, operating within Japan’s and South Korea’s air defense identification zones but outside sovereign airspace.

Patrol routes have expanded over time, moving from the Sea of Japan into the Philippine Sea, the Chukchi Sea, and the Bering Sea near Alaska.

Patrol frequency increased starting in 2022, with Russia and China conducting two joint missions per year for the first time.

Reciprocal landings at each other’s airfields in 2022 marked a milestone in operational trust and coordination.

The 2024 patrol near Alaska prompted interceptions by U.S. and Canadian fighter jets, underscoring heightened geopolitical sensitivity.

Why It Matters

These patrols reinforce a visible shift toward multipolar security dynamics as Russia and China coordinate military signaling beyond their immediate regions. Even if largely symbolic, the operations challenge U.S. strategic dominance in the Pacific and normalize joint power projection outside traditional theaters.

Why It Matters to Foreign Currency Holders

Escalating military coordination between major nuclear powers increases geopolitical risk premiums across global markets. Heightened security tensions often accelerate capital movement toward neutral reserves, commodities, and alternative settlement systems—placing added pressure on fiat currencies exposed to geopolitical instability.

Implications for the Global Reset

Pillar: Security Realignment

Coordinated military presence weakens unilateral enforcement power and supports a multipolar balance of deterrence.Pillar: Financial Risk Repricing

Rising geopolitical friction increases volatility, reinforcing the shift toward hard assets and non-dollar trade mechanisms.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

BRICS Ditches Dollar for Gold as Bloc Tightens Control Over Global Supply

Gold accumulation accelerates as de-dollarization reshapes monetary power

Overview

BRICS nations now control roughly 50% of global gold production through combined output from member and aligned countries.

Russia and China lead a multi-year gold accumulation drive, systematically reducing exposure to U.S. dollar assets.

Central banks purchased over 1,000 tons of gold annually from 2022–2024, marking the longest sustained buying streak in modern history.

Key Developments

BRICS and aligned producers—including China, Russia, Brazil, South Africa, Kazakhstan, Iran, and Uzbekistan—now dominate global gold supply, shifting pricing influence away from Western markets.

Collective BRICS gold reserves exceed 6,000 tons, with Russia holding approximately 2,336 tons, China 2,298 tons, and India 880 tons.

Brazil resumed gold buying in September 2025, adding 16 metric tons—its first purchase since 2021—raising reserves to 145.1 tons.

A BRICS gold-backed settlement instrument (“Unit”) has entered pilot phase, combining 40% physical gold and 60% member currencies, with each unit pegged to one gram of gold.

Russia and China now settle nearly all bilateral trade in local currencies, accelerating de-dollarization across Eurasian trade networks.

BRICS is developing a separate gold pricing benchmark, challenging dollar-based price discovery in global precious metals markets.

Why It Matters

This shift signals a structural reordering of global finance as monetary trust moves from fiat systems toward tangible reserves. By anchoring trade and reserves to gold, BRICS nations are insulating themselves from sanctions risk, dollar volatility, and Western financial leverage—undermining long-standing pillars of U.S.-led monetary dominance.

Why It Matters to Foreign Currency Holders

Foreign currency holders face rising exposure as reserve systems evolve away from dollar dependency. As gold-backed settlement mechanisms expand, currencies lacking hard-asset backing may experience declining demand, reduced liquidity, and long-term valuation pressure—particularly during future financial stress events.

Implications for the Global Reset

Pillar: Monetary Realignment

Gold accumulation and gold-linked settlement tools mark a transition away from fiat trust toward asset-backed credibility.Pillar: Financial Sovereignty

Independent pricing systems and local-currency trade weaken dollar enforcement mechanisms and reshape global capital flows.This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “BRICS Ditches Dollar for Gold, Bloc Now Controls 50% of Global Supply”

World Gold Council – “Central Bank Gold Reserves and Purchasing Trends”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Morning 12-20-25

Government Advisor: Iraq's Foreign Policy Is Moving Towards Adopting "Productive Diplomacy" To Achieve Development.

Time: 19/12/2025 Reading: 15 times {Economic: Al-Furat News} The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed on Friday that Iraq’s foreign policy is generally moving towards adopting what is known as “productive diplomacy,” noting that it represents a comprehensive approach to transforming diplomatic presence into an economic and developmental lever.

Government Advisor: Iraq's Foreign Policy Is Moving Towards Adopting "Productive Diplomacy" To Achieve Development.

Time: 19/12/2025 Reading: 15 times {Economic: Al-Furat News} The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed on Friday that Iraq’s foreign policy is generally moving towards adopting what is known as “productive diplomacy,” noting that it represents a comprehensive approach to transforming diplomatic presence into an economic and developmental lever.

******************************

Saleh told Al-Furat News Agency that "the international economic path occupies a prominent position among the priorities of this approach, as it is the most sustainable approach to building balanced partnerships, maximizing mutual benefits, and protecting the national economy against external shocks."

He added that “this diplomacy is based on making the economy a structural axis in shaping foreign relations, by expanding the base of common interests with regional and international countries, and linking political cooperation to clear agendas in the areas of trade, investment, energy, transport, logistical integration, and the digital economy,” explaining that “foreign policy is thus transformed from managing traditional relations to managing complex economic interests that serve the goals of growth and economic diversification.”

Saleh added that “productive diplomacy aims to diversify foreign partnerships and not be beholden to a single path or specific axis, which allows Iraq to benefit from its strategic geographical location, natural resources and human capabilities in building a flexible network of economic relations,” noting that “this constitutes an important element in supporting economic stability and reducing dependence on a single source of income, especially in light of the fluctuations in global energy markets.”

He explained that “economic diplomacy becomes, in this context, the practical pillar of this approach, as it is entrusted with attracting quality investments, transferring technology, expanding opportunities for access to foreign markets, as well as supporting major strategic projects and enhancing Iraq’s presence in regional and international value chains,” stressing that it “contributes to creating an advanced negotiating environment that enhances Iraq’s position as a reliable partner, not just as a consumer market.”

Saleh concluded by noting that “productive diplomacy is not a tactical or circumstantial option, but rather represents a strategic shift in the philosophy of Iraqi foreign policy, aimed at aligning political considerations with economic requirements, and linking national security with economic security, in a way that achieves Iraq’s higher interests and enhances its ability to integrate positively into the global economic system.” LINK

An Economic Expert Identifies 5 Pillars For Strengthening Iraq's Economic Power.

Time: 2025/12/19 Reading: 0 times {Economic: Al-Furat News} On Friday, economist Salah Nouri identified five key pillars for strengthening Iraq's economic power, stressing that the success of economic programs and the path to international development is linked to combating corruption in contracts and implementation.

Nouri told Al-Furat News Agency that "economic strength lies in local production that competes with imported goods, especially agricultural and animal production," noting that "the Iraqi environment is historically an agricultural country and the elements of agricultural production can be provided, provided that the water problem is solved at the present time."

*****************************************

He added that "the second pillar depends on enhancing industrial production through public-private partnership contracts, as well as encouraging small and medium enterprises by supporting them with soft loans while ensuring the monitoring and regulation of these projects."

Nouri stressed "the importance of accelerating the completion of the electrical power infrastructure and utilizing the natural gas associated with oil extraction," while also calling for "reconsidering the size of the operational budget and streamlining spending, especially unjustified privileges in light of the financial crisis."

The economist stressed that "the success of these programs, in addition to the International Development Road project, depends primarily on combating corruption in contracting and implementation processes." LINK

Al-Hakim From Najaf: We Are Facing An Important Opportunity To Affirm That Iraq Is Capable Of Building A Strong State, Not A State Of Internal Conflicts, External Dependence, Chaos, Or Power-Sharing And Spoils

Friday, December 19, 2025 | Politics Number of views: 158 Najaf/ NINA / Ammar al-Hakim, head of the National Wisdom Movement, stated that we are facing a significant opportunity to affirm that Iraq is capable of building a strong and dignified nation, not one plagued by internal conflicts, foreign dependency, chaos, or sectarian quotas and spoils.

He added, during a speech on Iraqi Martyrs' Day at the shrine of the Martyr of the Sanctuary, Muhammad Baqir al-Hakim, in Najaf,

"We are facing a significant opportunity to affirm to ourselves and the world that Iraq is capable of building a strong, just, and powerful nation, a nation that serves its people, not one plagued by internal conflicts, foreign dependency, chaos, or sectarian quotas and spoils.

" He further explained, "We may differ on politics... and this is natural. We may differ on programs, and this is healthy. However, we must not disagree on Iraq itself, nor should we allow the bait of discord to ensnare our youth, nor allow the rhetoric of betrayal to divide our hearts, nor allow petty squabbles to dissipate the energy of society."

He stressed the necessity of the state having a monopoly on the use of force, in accordance with the constitution and the directives of the highest religious authority, so that the law is above all, a law that must be implemented by the will of the Iraqi people and their national political forces, not by external dictates.

He continued, "We will not accept weapons outside the authority of the state, nor will we accept the use of this issue as a tool to pressure us and our brothers."

Al-Hakim called for expediting the formation of the government, respecting constitutional deadlines, and selecting an effective, balanced, and aware cabinet capable of addressing the challenges of this stage. /End.

https://ninanews.com/Website/News/Details?key=1267519

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

“Tidbits From TNT” Saturday Morning 12-20-2025

TNT:

Tishwash: we already know this I'm not sure why they are telling us again but they are

An Iraqi bank switches to the global standard "SWIFT MX"

The National Bank of Iraq announced that it has successfully completed the transition to the new global standard " SWIFT MX " for financial messages, in a step that constituted a significant milestone in the bank's technological infrastructure modernization and enhanced readiness for digital transformation.

The bank said in a statement, “The implementation of this transformation comes as part of the bank’s transition from the old MT standard to the MX ISO 20022 model , which is the most advanced, structured and data-rich framework in the global financial messaging sector.

TNT:

Tishwash: we already know this I'm not sure why they are telling us again but they are

An Iraqi bank switches to the global standard "SWIFT MX"

The National Bank of Iraq announced that it has successfully completed the transition to the new global standard " SWIFT MX " for financial messages, in a step that constituted a significant milestone in the bank's technological infrastructure modernization and enhanced readiness for digital transformation.

The bank said in a statement, “The implementation of this transformation comes as part of the bank’s transition from the old MT standard to the MX ISO 20022 model , which is the most advanced, structured and data-rich framework in the global financial messaging sector.

The transformation process was carried out across all operational channels with high efficiency and minimal downtime, reflecting the bank’s strong technical readiness, accurate planning, and commitment to providing its services without any significant interruption.”

He pointed out that "this transformation is an advanced step within the strategic roadmap of the National Bank of Iraq to modernize its systems, enhance its compatibility with global best practices, and provide an advanced digital banking experience for its individual and corporate clients."

For his part, the bank’s Chief Operating Officer and Deputy CEO, Aqeel Ezzedine, explained that “the smooth transition to the MX standard came as a result of a robust system of governance, teamwork and careful planning, and represents an important step in modernizing the payments infrastructure and enhancing the reliability and security of banking operations.”

Hani Khalil, head of the bank's transformation department, said that "achieving this transformation embodies the bank's commitment to keeping pace with the latest international standards in payment systems, and building a more transparent, integrated and high-quality financial data structure, which enhances the customer experience and strengthens the bank's position within the regional financial system."

The MX standard enables a more accurate and richer exchange of information in financial messages, with substantial improvements in transaction tracking and identification of parties, supporting global trends towards greater efficiency and transparency in payments. link

************

Tishwash: The torn currency: between the failure of paper circulation and the delay of digital transformation

The torn currency reveals a deeper flaw than the tearing of the paper, as it shows a cash management crisis, a delay in automation, and a weakness in replacement mechanisms, which makes the citizen the weakest link between banks that refuse, a market that punishes, and digital solutions that are not yet complete.

“No one will take it from me,” Zainab al-Khafaji, a government employee, whispered to herself, her voice thick with despair, as she strolled through the shops of Baghdad’s upscale Mansour district.

Pic torn up dinar

She clutched a five-thousand-dinar note that looked as if it had been through a war; it was tattered, its edges torn, and held together with a makeshift piece of tape.

Zainab says bitterly, “I don’t know who gave it to me while I was shopping in the crowded market, and when I tried to buy with it again, everyone refused it. Legally it is a national currency, but in the market’s view it is just a damaged piece of paper.”

Crisis of confidence in "small groups"

Zainab’s story is not an isolated case, but rather a reflection of the daily suffering experienced by millions of Iraqis, as worn-out paper currency, especially the small denominations (250, 500, 1000, 5000 dinars), has become a financial and psychological burden.

While worn-out currency is easy to trade in the Kurdistan Region or neighboring countries, citizens in central and southern Iraq face a popular and commercial “veto” on these papers.

Paper currency is subject to rapid deterioration, especially the smaller denominations, due to its frequent circulation and use by children in direct transactions between different shops and markets.

This is compounded by the lack of education from the Central Bank regarding the replacement of damaged currency at the bank, which has created an opening for unscrupulous individuals to take a percentage of the money in exchange for replacing damaged currency with new currency, sometimes reaching 50% of its value.

Black market for replacing damaged parts... commissions reaching 50%

This social “unacceptability” of the official currency opened the door for the emergence of a class of “weak-willed” people who exploited people’s needs and administrative complexities.

Due to poor education about central bank procedures, an illegal trade has emerged to exchange damaged currency for exorbitant commissions, sometimes reaching half the value of the amount.

Ali Al-Bahadli, a market owner, says: “Sometimes I have to leave my young son to manage the shop, and some people take advantage of his innocence and pass him quantities of small damaged denominations. At the end of the day, I find myself facing a financial loss for which I am not responsible. The only way out is for someone to come by from time to time and collect this (cash debris) in exchange for deducting a large percentage of its value, sometimes reaching 50%, so that he can later exchange it through his own means at the banks.”

As for Sobhi Hussein, a bus driver, he confirms that the banks themselves are contributing to the worsening of the crisis: “I have accumulated large amounts of 500 and 1000 denominations that are written on or torn. When I tried to deposit or exchange them in the banks, they were rejected outright, which forced me to sell them to exchange offices for a much lower value.”

Economic vision: The solution lies in "automation" and plastic currencies

Economic expert Dr. Hussein Al-Khaqani believes the crisis begins in the banks and ends in the streets. He says, “The central bank is the sole authority for issuing currency, but the refusal of some banks to accept damaged banknotes from merchants generates a defensive reaction from the public, causing them to stop using the currency for fear of losing its value.”

Al-Khaqani proposes a radical solution, which is to impose the use of electronic cards (Visa & MasterCard) on shops and gas stations, stressing that “the real application of automating transactions will reduce the amount of cash circulating manually, and protect the citizen from financial losses in small units.”

Other experts believe that solving this problem does not require additional resources, but rather a clear decision, strict implementation, and genuine coordination between the central bank, banks, and markets.

According to international reports, 15% of the money in circulation globally up to 2024 was printed using polymer material, which clearly contributed to reducing the percentage of torn money in the world.

Central Bank Guide: When to Accept Currency and When to Confiscate It?

Despite the public controversy, the Central Bank of Iraq has clear instructions aimed at protecting the value of the currency, which are as follows:

If the banknote is worn out or damaged even though it is not torn and no parts of it are missing, or if the banknote is made up of two parts (different numbers) and its area is close to the area of the original banknote and it is attached with adhesive tape, or if the banknote is attached with one or more transparent adhesive tapes along its length or width, or if the banknote has a cut in more than one corner.

Or if the banknote is defective in printing (in terms of design, size, color, or other security features that a genuine banknote has), or contains stamps or writings that do not affect its external appearance, or if the banknote has lost less than 50% of its area.

However, the Central Bank confirmed the confiscation of damaged banknotes that are not fit for circulation if changes have been made to the external appearance of the banknote as a result of writing, drawing, printing, stamps, or if it contains an adhesive substance, or if the banknote has lost 50% or more of its area, or if it is made up of two parts on one side.

If there is evidence that convinces the central bank that the missing parts of the papers have been completely destroyed, they will be partially or fully compensated. link

***************

Tishwash: At Christmas Party, Trump Publicly Acknowledges U.S. Envoy to Iraq

Trump praised U.S. Envoy to Iraq Mark Savaya at a White House Christmas event, as the U.S. President praised sweeping first-year achievements.

A brief but pointed acknowledgment by U.S. President Donald Trump of America’s envoy to Iraq, Mark Savaya, during the White House’s 2025 Christmas party has drawn attention in diplomatic and political circles, symbolizing both personal rapport and the broader confidence projected by the administration as it declares sweeping domestic and international achievements.

In a post on X dated Dec. 19, 2025, Savaya publicly thanked President Trump for recognizing him during the White House Christmas gathering, writing: “President Trump, thank you for your kind acknowledgment at the 2025 White House Christmas party. You are truly the greatest president this country has ever had. Merry Christmas and may God bless you and the United States of America.”

The post was accompanied by a video capturing the moment in which President Trump acknowledged Savaya among a select group of invited guests, offering praise in front of the assembled audience.

The exchange occurred during what President Trump described as a particularly exclusive and tightly attended event.

Addressing the crowd, the president reflected on the significance of the gathering, noting that the Christmas party was “the toughest invitation,” emphasizing that attendance was limited and that those present held “special significance.”

Within that context, Trump called out Savaya by name, remarking, “Mark Savaya. Hey Mark! You’re looking good,” before continuing to recognize others in attendance and expressing pride in those gathered.

The moment, though brief, was emblematic of the administration’s broader messaging during the holiday season—an effort to project unity, loyalty, and confidence as the White House closed out its first year in office.

Savaya’s public response, effusive in its praise of the president, underscored the personal dimension of that acknowledgment and highlighted the envoy’s visibility within the administration at a time of heightened focus on U.S. foreign policy in the Middle East.

Mark Savaya @Mark_Savaya

President Trump, thank you for your kind acknowledgment at the 2025 White House Christmas party. You are truly the greatest president this country has ever had. Merry Christmas and may God bless you and the United States of America. link

************

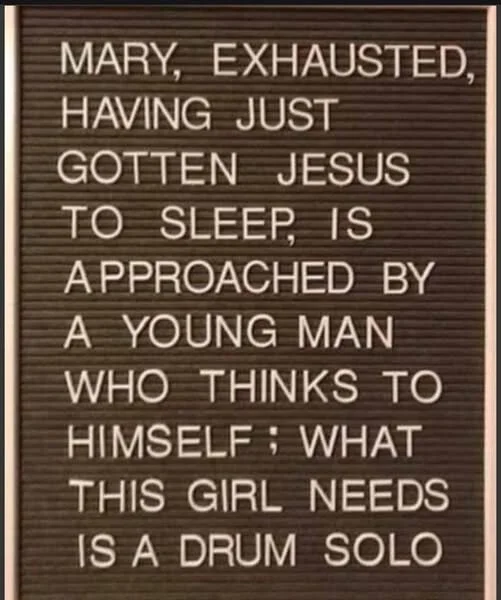

Mot: To Save YOU Time!!!

Mot: Just as Mary is exhausted ~~~~

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight it is Thursday, December 18th and you're listening to the big call. Tonight Bob will be joining us around 930 Eastern tonight, and he had a special event in the Tampa area. And so in the meantime, let's just welcome everybody to the call. Thanks for tuning in, wherever you are, Sue, and I will take this until Bob gets here about 930 so you're at the right place at the right time, and we're happy about that.

All right. So thank you, Bob again. I'm so glad you made it to the event and then made it out to the call. Let's get into some intel. Let's see where we stand. President Trump had a speech last night at nine o'clock that was 18 minutes long, and it was a review. It was a year of reviewing accomplishments that the President his Cabinet had made over the last 10 months, and he talked in terms of some future things. There were two things that were new that I didn't know about until I heard them, One was it looked like it was going to be like a warrior dividend, or a warrior bonus, something to that effect.

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight it is Thursday, December 18th and you're listening to the big call. Tonight Bob will be joining us around 930 Eastern tonight, and he had a special event in the Tampa area. And so in the meantime, let's just welcome everybody to the call. Thanks for tuning in, wherever you are, Sue, and I will take this until Bob gets here about 930 so you're at the right place at the right time, and we're happy about that.

All right. So thank you, Bob again. I'm so glad you made it to the event and then made it out to the call. Let's get into some intel. Let's see where we stand. President Trump had a speech last night at nine o'clock that was 18 minutes long, and it was a review. It was a year of reviewing accomplishments that the President his Cabinet had made over the last 10 months, and he talked in terms of some future things. There were two things that were new that I didn't know about until I heard them, One was it looked like it was going to be like a warrior dividend, or a warrior bonus, something to that effect.

And it was 1.45 million military all of our military people, men and women, would be receiving, and this was supposed to be by Christmas, they would be receiving a check, which could be a direct deposit. In some cases, I don't know that. It seems like it would be, but some people, I think in the military, are still receiving checks, and the value was to be $1,776

1776 a very important year for us. And you know, later next year, in July, we'll be celebrating our 250th year anniversary with 1776 and so that means that's meaningful. That's one new thing that is going out. The military is going to be very thankful, I'm sure, for that Christmas gift. And the other thing that was new was, let me think that was for a second.

The other thing that was new was a new website that President Trump has had made, which is about prescription drugs and maybe health things, and it's going to be called, or it is already called, Trump rx.gov, G, O, V, Trump, rx.gov and I don't know there's anything on it yet, but there will be, and I'm sure he's working things out to make it very important, informative, and possibly a way for us to save money for anybody that needs any prescription medications. All right, so those two were new.

He did not mention, obviously, he didn't mention the RV. He didn't mention DOGE. He didn't mention a lot of things. Didn't, you know, he did talk about a lower interest. Of course, those are going to come when we can get Jerome Powell to resign, hopefully early, and he has a new person in mind already. I know, as I was told, his name, that will be taking over that position as chairman of the Fed.

And then I think we have heard that not only will interest rates be lower, but it will be more affordable for first time home buyers. A lot of the first time home buyers are 40 to 42 years old on average before they can buy home

Now, in my era, when I came up, you would be in your 20s, 25 / 28 whatever, buy your first home. And so this is going to be helpful for a lot of people. Now, mortgage rates will be far lower. I've heard very low interest rates for mortgages. So we'll see how this thing home goes. I don't anticipate ever borrowing money ever after we get the RV and the blessing,

okay. I mean, really, it's going to be paying cash for things that we used to have to borrow money for not going to be rest. We're not going to need that.

So what else? Okay? I have heard a few things about our timing.

Now I told you guys Tuesday that I believe it's President Trump's plan to get this done for us before Christmas. Well, I got clarification on that for two very different sources that are both very high up.

Okay, and so I'm going to give you both opinions.

One opinion came as a result of the contact with HSBC in Canada. HSBC is the lead bank in Canada and basically around the world for this RV, our league in the United States here is Wells Fargo.

This came from HSBC.

HSBC is saying that we would be …. all right. Here's what they said. Let's go to the added groups. Now, we always refer to that as tier 4A and us in the Internet Group as tier 4B Okay, using those designations, even though Wells Fargo considers us all as part of tier 4.

That's fine, except we have heard that tier 4A or the admirals groups, would be paid tomorrow and Saturday. That's Friday and Saturday of this week. Now they didn't say when they have access to those funds in their accounts?

That's another question, but they're supposed to at least have the funds put into their accounts tomorrow and Saturday.

Okay, what about us? We're hearing from this course that we would receive notifications very early next week, Monday and Tuesday, this coming week, Monday and Tuesday, but we would have the exchanges and redemption of ZIM at the redemption centers, starting the day after Christmas, which is the 26th

We also heard that this has to be complete for us, and I mean that we have to be started with exchanges before the 29th of December. Before the 29th equals 26 27th and 28th days, those are the three days after Christmas, before the 29th so I think we can set our watch based on that. That's what we should be looking for.

Now, the other source was very similar, and this is how it was said.

The other source said we would be notified prior to Christmas on very early this coming week, which would be Monday, Tuesday, because remember, Christmas Eve is Wednesday, Christmas day is Thursday. One week from today, will you be notified Monday or Tuesday, and then begin exchanges after Christmas?

So what's the difference in these? The second one said that they anticipate the announcements that Emergency Broadcast System announcements start over this coming weekend, if they started over this weekend, it would be notified for Monday or Tuesday

Ok are you with me, so that's two ways to look at it, but the last way said we need to see the EVS announcement, which includes some information, military tribunals , a few things that a lot of people out there are going to be totally in shock about you and I know a lot of stuff that’s been going – we know are not a shock to us – we know about it. Know about it already.

However, what's interesting is CNN has had a change in some ownership, and it's actually coming to the bar a little bit.

My understanding is that CNN, of all networks, may be a primary network use for EBS to be transmitted. I'm also, I also said 24 hours of programming, whatever.

No, we're looking for six hours a day of programming how many networks, conversations it'll be on? Several be pretty boggling Information coming out.

Anyway, this is gonna go for like six hours a day, and it starts on the weekend, Saturday, Sunday. I don’t know how long it's going to go? How many days it's going to go,

By the way, while I’m talking about days -- You've all heard theory of 10 days of darkness and all of that. It's nonsense - except the concept of people are being arrested, still going hot and heavy on arrest in certain areas of the country - certain cities, certain times seem to be like a rolling blackout, because some of those areas will lose internet service, phone service - possibly even lose electricity,

I’m thinking more it's gonna be more phone and internet, and it's just so that the deep state cannot communicate what's going on between them. That's the dark that we're talking about, it's not for us. President Trump would never put us in darkness, not going But it may occur in some of the areas of the country - to happen sometimes, so that they pick up the bad guys. All right.

Both of these scenarios are good -Oh, the first one is really good, because we get notified before Christmas, so it’s almost like getting that gift, on Christmas Eve – and opening your on Christmas Day families that did that, we have the information that comes in that email And we call seven that's we're halfway home.

Second half is getting into the redemption center at our appointed time, not early, not really, and then getting your exchanges. Not more than ten minutes early getting your exchanges and getting your Zim redeemed and boom you come out of the redemption center

I'm trying anything that you guys need to know.

Really think we're at the point where we've got information that's lining up – let’s watch for EBS over the weekend. Watch for it - I don't expect to get anything before, but I am looking forward to getting notified Monday or Tuesday of next week, especially if we do get notified, set our appointments for the 26 / 27 / 28 let's go ahead and realize that that is going to be a wonderful, wonderful Christmas gift from God, this blessing.

Now, what about Tuesday? Yes, we're planning to have a call Tuesday. It could be a celebration call, if we have the numbers right, you guys have emails either Monday, Tuesday from Wells Fargo have the 800 number in it. If that is the case, Tuesday, we'll have a celebration call

What about Thursday? Christmas Day?

Could we have more information then that we don't have even next Tuesday. Maybe, maybe not – maybe we've got the 800 numbers and we're good to go and we have, everything we've looked for. Okay, that's a possibility.

However Thursday night Sue and I are available to do a call Christmas night.

Now, I would say it this way. We'll do it if we don't have 800 by then, or if we haven't had the celebration call on the Tuesday, , and we have more information, and we feel there's a need to do a call. We will do the call Thursday night, Christmas night.

So if you don't have plans for Christmas night, you've got Christmas done in the morning, you've had your Christmas dinner that afternoon, and you're looking around for movies or whatever to watch on Christmas, consider the big call may be on Same time, same station, nine o'clock Eastern. You know the drill. You know the number now that would occur if we don't have numbers before Christmas.

If you think we will, we should, and maybe we'll discuss some of the stuff. We'll just see if we have it or not, but Sue and I are prepared to do it, to do the call, and just be the soon brew show on Christmas night.

That's what I wanted to say for everybody. And I really appreciate Bob making it to the big call night and doing a segment very beautifully. I love the testimonials. I love what Sue brought to us tonight, everything from the teaching to her segments, let's go ahead and thank everybody to for doing that again tonight. Excellent information. Excited.

So thanks everybody again. Let's go ahead and pray the call out, and then we'll turn off the recording. Well good night everybody, and we will talk to you, on Tuesday, and let's see what happens over the weekend with the EBS, pay attention to that. Okay. God bless you all. Good night.

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:08:08

Bruce’s Big Call Dinar Intel Thursday Night 12-11-25 REPLAY LINK Intel Begins 1:21:00

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:02:50

Bruce’s Big Call Dinar Intel Thursday Night 12-4-25 No Transcription Intel Begins 1:17:33

Bruce’s Big Call Dinar Intel Tuesday Night 12-2-25 REPLAY LINK Intel Begins 1:07:20

Bruce’s Big Call Dinar Intel Thursday Night 11-28-25 Thanksgiving NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 11-25-25 REPLAY LINK Intel Begins 1:06:06

Bruce’s Big Call Dinar Intel Thursday Night 11-20-25 REPLAY LINK Intel Begins 53:30

Bruce’s Big Call Dinar Intel Tuesday Night 11-18-25 REPLAY LINK Intel Begins 1:13:03

Bruce’s Big Call Dinar Intel Thursday Night 11-13-25 REPLAY LINK Intel Begins 1:10:20

Bruce’s Big Call Dinar Intel Tuesday Night 11-11-25 REPLAY LINK Intel Begins 1:24:24

Bruce’s Big Call Dinar Intel Thursday Night 11-6-25 REPLAY LINK Intel Begins 38:38

Bruce’s Big Call Dinar Intel Tuesday Night 11-4-25 REPLAY LINK Intel Begins 45:35

Bruce’s Big Call Dinar Intel Thursday Night 10-30-25 REPLAY LINK Intel Begins 1:01:31

Stephanie Starr: They Said it out Loud

Stephanie Starr: They Said it out Loud

12-19-2025

Channel 8 English: “With falling oil prices and forecasts such as JPMorgan’s outlook on future oil markets, the next government may find no financial exit except changing the exchange rate in order to pay salaries, wages, and operating expenses,” Iraqi economist Abdulrahman al-Mashhadani emphasized.

Stephanie Starr: They Said it out Loud

12-19-2025

Channel 8 English: “With falling oil prices and forecasts such as JPMorgan’s outlook on future oil markets, the next government may find no financial exit except changing the exchange rate in order to pay salaries, wages, and operating expenses,” Iraqi economist Abdulrahman al-Mashhadani emphasized.

THEY SAID IT OUT LOUD.

“With falling oil prices… the next government may have **no financial exit except changing the official exchange rate.” — Iraqi economist on Channel 8.

Read that again.

Not borrowing.

Not printing.

Not devaluing.

CHANGING the rate.

Meanwhile:

Banking reforms underway

Tax systems being rebuilt

Spending reviewed

Sovereignty restored

War-era laws repealed

This is what pressure before a pivot looks like.

This is how governments prepare the public before big monetary moves.

When the problem is dinars…and the solution is the rate…

We are closer than most people think.

Source(s): https://x.com/StephanieStarrC/status/2001690353712402545

https://dinarchronicles.com/2025/12/19/stephanie-starr-they-said-it-out-loud/

FRANK26….12-19-25……QUESTIONS TO ECONOMIST

KTFA

Friday Night Video

FRANK26….12-19-25……QUESTIONS TO ECONOMIST

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26….12-19-25……QUESTIONS TO ECONOMIST

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-19-25

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-19-25

Good Afternoon Dinar Recaps,

Market Turmoil and Liquidity Signals: Global Stocks & Bonds Shift

Equities fluctuate as inflation cools, bond markets steady, and investor caution rises

Seeds of Wisdom RV and Economics Updates Friday Afternoon 12-19-25

Good Afternoon Dinar Recaps,

Market Turmoil and Liquidity Signals: Global Stocks & Bonds Shift

Equities fluctuate as inflation cools, bond markets steady, and investor caution rises

Overview

• Major U.S. equity mixed performance despite easing inflation

Inflation data showed slower price gains, lifting stocks though tech weakness persists.

• Continued volatility in major indexes

Indexes had consecutive losses amid renewed tech pressure and soft labor data.

• Fed liquidity measures calm year-end funding stress

U.S. Treasury bill purchases aim to reduce repo market strain into year-end.

• EU joint debt issuance welcomed by markets

Investors viewed €90B shared Ukrainian loan positively for fiscal unity.

Key Developments

Stocks show internal divergence

U.S. markets saw gains on one day while global indices oscillated, reflecting lingering AI bubble concerns and anticipation of future rate moves.

Bond markets show resilience

Yield trends stabilized as investors digest Fed liquidity support, though long-end yields remain sensitive to inflation and growth data.

EU joint borrowing signals fiscal evolution

EU’s decision to issue joint debt for Ukraine reinforces investor confidence in euro-area policy unity—even as debt supply grows.

Sentiment cautious on banks and sectors

Contrarian signals from fund managers indicate overly bullish positioning may be topping, suggesting risk management ahead.

Why It Matters