Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Tony Robbins: 7 Tips for Building Financial Security in Tough Times

Tony Robbins: 7 Tips for Building Financial Security in Tough Times

Gabrielle Olya Wed, June 18, 2025 GOBankingRates

Money is an all-too-common source of worry and stress. We fear losing our jobs, stock market crashes or simply not being able to pay all of our bills next month. While we can’t control the greater economy or even our job security, there are steps we can take to protect our finances as much as possible and ride out any waves that come our way.

In a blog post, entrepreneur and author Tony Robbins outlined a few effective tips to build financial security, regardless of what’s happening in the wider economic environment. Here’s how to create financial certainty in an uncertain world.

Tony Robbins: 7 Tips for Building Financial Security in Tough Times

Gabrielle Olya Wed, June 18, 2025 GOBankingRates

Money is an all-too-common source of worry and stress. We fear losing our jobs, stock market crashes or simply not being able to pay all of our bills next month. While we can’t control the greater economy or even our job security, there are steps we can take to protect our finances as much as possible and ride out any waves that come our way.

In a blog post, entrepreneur and author Tony Robbins outlined a few effective tips to build financial security, regardless of what’s happening in the wider economic environment. Here’s how to create financial certainty in an uncertain world.

1. Focus on What You Can Control

Don’t let your financial fears get the best of you.

“When the world seems uncertain, most people freeze or panic,” Robbins wrote. “But the most successful people in history — those who built fortunes and legacies — did so by acting when others were paralyzed by fear. Remember, where focus goes, energy flows. If you focus on what you can control, you’ll find the power to act, even when the sky seems to be falling.”

Some things you can do to gain control are to build an emergency fund for short-term needs and to plan ahead for long-term goals through retirement savings accounts and life insurance.

2. Shift Your Mindset

Robbins says that if you want to “shift your results,” you first have to “shift your state.”

“Don’t let the news or social media dictate your emotions,” he wrote. “Take care of your body, move, breathe deeply, and prime your mind every morning for strength and gratitude. Certainty starts from within.”

3. Focus on the Facts

Paying attention to negative speculation can make you feel more fearful than is necessary.

“In times of uncertainty, rumors and negativity spread faster than the truth,” Robbins wrote. “Get the real facts about your finances, your job and your opportunities. Make a list of your assets, your skills and your connections. Knowledge is power, and clarity is the antidote to fear.”

4. Create a Budget

One of the best ways to gain control of your money and work toward financial freedom is to create a budget that includes room for saving, investing and paying down debt.

“Now is the time to get lean and strategic,” Robbins wrote. “Review your expenses and cut what isn’t serving you. But don’t just focus on scarcity — look for places to invest in your growth. The greatest fortunes are made in times of crisis, not comfort. Invest in your skills, your relationships and your health. These are assets that no market crash can take away.”

TO READ MORE: https://www.yahoo.com/finance/news/tony-robbins-7-tips-building-131606255.html

Weekend Coffee with MarkZ. 06/21/2025

Weekend Coffee with MarkZ. 06/21/2025

MarkZ Disclaimer: Please consider everything on this call as my opinion. Be sure to consult a professional for any financial decisions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

Weekend Coffee with MarkZ. 06/21/2025

MarkZ Disclaimer: Please consider everything on this call as my opinion. Be sure to consult a professional for any financial decisions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

THANK YOU ALL FOR JOINING. HAVE A BLESSED WEEKEND! SEE YOU ALL MONDAY MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

Fed Rate Cut? Bubba Calls it a ‘Horrific Mistake’ that will Bankrupt Main Street

Fed Rate Cut? Bubba Calls it a ‘Horrific Mistake’ that will Bankrupt Main Street

Daneila Cambone: 6-20-2025

Veteran trader Todd “Bubba” Horwitz, founder of BubbaTrading.com, is sounding the alarm about a significant downturn brewing in the stock market. In a recent interview with Daniela Cambone on ITM Trading, Horwitz minced no words, predicting that “the next lows will take out the previous lows in the NASDAQ, the S&P, and the Dow.”

Horwitz’s grim outlook isn’t based on gut feeling, but rather on troubling underlying market dynamics. His primary concern is the severe lack of participation in the current market rally.

Fed Rate Cut? Bubba Calls it a ‘Horrific Mistake’ that will Bankrupt Main Street

Daneila Cambone: 6-20-2025

Veteran trader Todd “Bubba” Horwitz, founder of BubbaTrading.com, is sounding the alarm about a significant downturn brewing in the stock market. In a recent interview with Daniela Cambone on ITM Trading, Horwitz minced no words, predicting that “the next lows will take out the previous lows in the NASDAQ, the S&P, and the Dow.”

Horwitz’s grim outlook isn’t based on gut feeling, but rather on troubling underlying market dynamics. His primary concern is the severe lack of participation in the current market rally.

“Only 4–5% of the people in the population are trading these markets right now,” he explains, highlighting an alarming disconnect between the market’s perceived strength and the actual investor base. This limited participation, coupled with significantly reduced trading volume – “Volume is at about 50% of normal” – paints a picture of a fragile and unsustainable market propped up by a select few.

Beyond the market’s internal weaknesses, Horwitz also voiced strong opinions on monetary policy, particularly the potential for a rate cut. He believes that lowering interest rates would be a “horrific mistake,” arguing that such manipulation disproportionately benefits banks and the wealthy, leaving the average American behind.

This statement underscores his belief that current economic policies are exacerbating wealth inequality and further distorting the market’s true value.

While pessimistic about the near-term prospects for equities, Horwitz remains firmly bullish on gold. He predicts that the precious metal will eventually reach $5,000 per ounce, a significant increase from current levels. However, he also anticipates a short-term pullback in gold prices before the anticipated long-term surge. This suggests that while he views gold as a safe haven in the long run, investors should be prepared for potential volatility in the near future.

Horwitz’s stark warnings and insightful analysis offer a critical perspective on the current market landscape. He urges investors to look beyond the headlines and examine the underlying data, which he believes points towards an imminent market correction.

Investors looking to understand Horwitz’s detailed analysis and reasoning are encouraged to watch the full video interview from ITM Trading for a comprehensive understanding of his market predictions and investment strategies.

Ultimately, Horwitz believes that understanding the current market vulnerabilities is crucial for navigating the potential challenges ahead.

“Tidbits From TNT” Saturday 6-21-2025

TNT:

Tishwash: The budget includes... next Saturday's parliament session.

Member of Parliament Mohammed Al-Ziyadi confirmed that "the House of Representatives will begin its sessions on Saturday, as part of the final legislative term, after the legislative recess was canceled." He noted that the parliament's agenda includes a number of important laws that are a priority for the next phase.

Al-Ziyadi said on Thursday, in a statement seen by Al-Masry, that "the Iraqi parliament will resume its sessions starting next Saturday, after a decision was issued to cancel the legislative recess."

TNT:

Tishwash: The budget includes... next Saturday's parliament session.

Member of Parliament Mohammed Al-Ziyadi confirmed that "the House of Representatives will begin its sessions on Saturday, as part of the final legislative term, after the legislative recess was canceled." He noted that the parliament's agenda includes a number of important laws that are a priority for the next phase.

Al-Ziyadi said on Thursday, in a statement seen by Al-Masry, that "the Iraqi parliament will resume its sessions starting next Saturday, after a decision was issued to cancel the legislative recess."

He added, "Among the most prominent laws that will be discussed and approved during this session are the law restructuring the Popular Mobilization Forces, amending the Industrial Investment Law, and the Education Law, in addition to voting on the 2025 budget schedules." link

************

Tishwash: The Central Bank of Iraq Organizes a Workshop on National and Sector Assessment Procedures

The Central Bank of Iraq's Erbil Branch organized a training workshop on "National and Sector Assessment Procedures," attended by the Director General of the Erbil Branch, in cooperation with the Center for Banking Studies and the Compliance Supervisor's Office at the Central Bank of Iraq.

The workshop was attended by a group of private banks, non-banking financial institutions, and electronic payment companies operating in the region.

The workshop also addressed Anti-Money Laundering and Terrorist Financing Law No. (39) of 2015 and the Financial Action Task Force (FATF) recommendations, as well as the national assessment of money laundering and terrorist financing risks based on international standards.

The workshop focused on practical applications and operational risk assessment, and presented real-life case studies that contributed to enriching the discussion and developing the participants' analytical skills.

The lecturers emphasized the importance of private banks, non-banking financial institutions, and electronic payment companies adhering to updated compliance policies and effective cooperation between relevant units to ensure a cohesive banking environment that keeps pace with international standards and embodies the Central Bank of Iraq's vision in this regard.

This workshop comes as part of the vision of the Center for Banking Studies at the Central Bank of Iraq and the Office of the Compliance Controller of the Central Bank to prepare a qualified banking generation capable of meeting modern regulatory challenges and instilling a culture of compliance as the cornerstone of sound banking governance.

Central Bank of Iraq

Media Office

June 18, 2025 link

************

Tishwash: Early Warning"... Closing the US Embassy in Baghdad Will Be Followed by an Unprecedented Event

Member of the Parliamentary Security and Defense Committee, Mohammed Al-Shammari, warned on Friday of the "danger" of closing the US embassy in Baghdad, considering it an "early warning" of an unprecedented security event that Iraq and the region may witness.

Al-Shammari told Shafaq News Agency, "The closure of the US embassy is a dangerous sign and a warning that the United States and Israel may carry out a dangerous act that requires the evacuation of the embassy staff." He stressed that "these indicators require political and security preparation within Iraq."

He added, "The Parliamentary Security and Defense Committee is a regulatory and legislative body, and it is its duty to investigate the mechanisms behind Iraq's weak defense, which is largely due to the lack of financial sovereignty."

He explained that "Iraq does not possess full sovereign power, because oil revenues go to the US Federal Reserve, which controls the transfer of funds to Baghdad." He noted that "if Iraq concludes any arms contract with a country that Washington does not approve of, the US Federal Reserve will refrain from making the transfer."

Al-Shammari pointed out that "if the money were in Iraq's hands, its armaments, salaries, and retirement would be national," adding that "sovereignty is not just air and land sovereignty, but begins with financial sovereignty."

Regarding the departure of US forces, Al-Shammari confirmed the existence of a binding agreement stipulating their complete withdrawal from the country by 2026, noting that "the withdrawal will be in accordance with a timetable agreed upon by both parties."

Earlier on Friday, the US Embassy in Iraq issued a statement to Shafaq News Agency, stating that "there has been no change to the operational status of the Embassy in Baghdad and the Consulate General in Erbil."

She added, "The United States is firmly committed to advancing its policy priorities in Iraq, strengthening its sovereignty, and engaging with Iraqi leaders and the Iraqi people."

Last week, the US Embassy in Baghdad issued a security alert warning American citizens of the increased possibility of violence or attacks against its interests in Iraq .

In a statement seen by Shafaq News Agency, the embassy called on all American citizens in Iraq to avoid places frequented by foreigners, in addition to avoiding large gatherings and crowds .

The embassy affirmed that it will continue to closely monitor the security situation and provide necessary updates as they become available. The US State Department maintains its travel warning for Iraq at Level 4 (No Travel ).

Last Sunday, Kata'ib Hezbollah in Iraq threatened to target US interests and bases across the region if Washington intervenes militarily in the ongoing war between Iran and Israel. The group also sent a message to the Iraqi government and the Coordination Framework. link

****************

Mot: Like Father Like Son

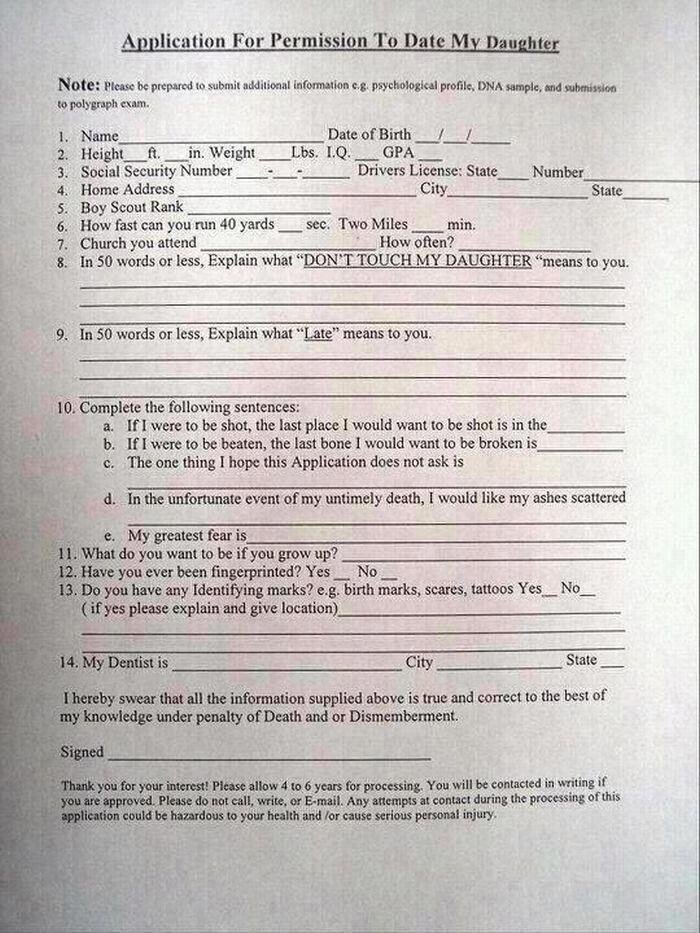

Mot . Here Ya Go -- When Ya Has a Daughter!!!

Iraq Economic News and Points To Ponder Saturday Morning 6-21-25

Low Inflation Or Early Warning? The Reality Of The Iraqi Economy According To Inflation Data.

Economy 2025-06-20 | 04:03 656 views Alsumaria NewsThe Iraqi Statistical Authority announced that the monthly inflation rate in the country declined by 0.3% during the month of April, while the annual general inflation rate recorded 1.6%, and core inflation 0.6%.

However, it is noteworthy that food prices continued to rise annually by 3.2%, despite the decline in the prices of bread, meat, and fish. This is due to sharp jumps in the prices of fruits and vegetables, which rose by 13.7% and 8.4%, respectively, according to the economic expert.Manar Al-Abidi.

Low Inflation Or Early Warning? The Reality Of The Iraqi Economy According To Inflation Data.

Economy 2025-06-20 | 04:03 656 views Alsumaria NewsThe Iraqi Statistical Authority announced that the monthly inflation rate in the country declined by 0.3% during the month of April, while the annual general inflation rate recorded 1.6%, and core inflation 0.6%.

However, it is noteworthy that food prices continued to rise annually by 3.2%, despite the decline in the prices of bread, meat, and fish. This is due to sharp jumps in the prices of fruits and vegetables, which rose by 13.7% and 8.4%, respectively, according to the economic expert.Manar Al-Abidi.

He saysAl-ObaidiIn a blog post, it was noted that tobacco prices declined by a significant 26%, while clothing and footwear prices saw a slight annual increase of 2%. Household appliances recorded a 1% decline, while furniture and office equipment prices rose by 0.5%.

In terms of geographical distribution, the annual inflation rates by region were as follows:

Kurdistan: 1.1%

Central Governorates: 1.4%

Southern Governorates: 3.1%

It shows that the decline in prices, despite its positive impact on the citizen, especially in sectors such as electrical appliances and furniture, mayReflectsA market recession is a result of weak consumer confidence, limited liquidity, and declining financing for the private sector, particularly given the weak insurance services provided by financial institutions.

Although lower inflation may appear to be a positive indicator, it may also be a bellwether.warningA recession threatens to reduce private sector job opportunities and weaken the competitiveness of local products due to rising costs.

This could lead to further pressure on the public sector, given the high unemployment rates, according to Al-Obaidi, who stresses that close monitoring of economic indicators is required, and serious steps are taken to stimulate economic activity and support the private sector, to prevent signs of recession from turning into a broader crisis affecting the entire Iraqi economy. LINK

The First Meeting Of The Special Committee For Establishing The Iraqi Media City

Posted on2025-06-20 by sotaliraq June 20, 2025: The Special Committee for the Establishment of the Iraq Media City held its first meeting, chaired by the Deputy Minister of Culture, Tourism and Antiquities, Fadel Al-Badrani. A statement from the Baghdad Governorate stated that the Technical Deputy Governor of Baghdad, Mr. Hani Al-Rubaie, participated in the first meeting of the committee in charge of establishing the Iraq Media City, which was held under the chairmanship of Dr. Fadel Al-Badrani, Undersecretary of the Ministry of Culture and Information.

He explained that the meeting was attended by a number of prominent media and artistic figures, including: Mohammed Al-Rubaie, Director General of the Directorate of Relations and Media in the Baghdad Municipality; Jabbar Judy, Director General of the Cinema and Theater House; Alaa Majeed, Director General of the Department of Musical Arts; Ali Sabah, representative of the Iraqi Media Network; Jabbar Trad, representative of the Iraqi Journalists Syndicate; and Mazen Mohammed, representative of the Iraqi Artists Syndicate.

He added that this meeting comes within the framework of efforts aimed at establishing an integrated media city, aiming to support and develop the media and arts sector in Iraq, and providing an incubator environment for media and artistic creativity, which contributes to the advancement of the Iraqi cultural reality. LINK

Iraqi Oil Prices Rise In Global Markets

Friday, June 20, 2025 12:15 | Economic Number of reads: 210 Baghdad / NINA / Iraqi oil prices rose on Friday during daily trading in the global market.

According to data, Basra Medium crude recorded $75.78 per barrel, while heavy crude recorded $72.83 per barrel, with a change rate of 1.11% for both.

The data also showed global oil prices, with British Brent crude recording $77.27, while US West Texas Intermediate crude recorded $75.67 per barrel, with a change rate of -1.58% and +0.56%, respectively. /End https://ninanews.com/Website/News/Details?key=1235421

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 6-21-25

Good Morning Dinar Recaps,

Ripple Unveils Urgent 4-Point Plan to Ignite UK Crypto Revolution

Ripple has issued a powerful call to action aimed at positioning the United Kingdom as a global leader in crypto innovation, unveiling a four-point regulatory strategy designed to unlock investment, expand financial access, and accelerate blockchain-driven modernization.

Good Morning Dinar Recaps,

Ripple Unveils Urgent 4-Point Plan to Ignite UK Crypto Revolution

Ripple has issued a powerful call to action aimed at positioning the United Kingdom as a global leader in crypto innovation, unveiling a four-point regulatory strategy designed to unlock investment, expand financial access, and accelerate blockchain-driven modernization.

New Recommendations Set Stage for UK’s Explosive Crypto Power Shift

On June 18, Ripple convened key stakeholders at the London Policy Summit, co-hosted with the UK Centre for Blockchain Technology and Innovate Finance, to assess the UK’s fast-evolving digital asset policy landscape.

The summit spotlighted recent UK government initiatives, including:

Chancellor Rachel Reeves’ April address supporting digital finance.

HM Treasury’s draft legislation on crypto-assets.

FCA consultations covering stablecoins, custody rules, and prudential oversight.

Launch of the Digital Securities Sandbox and pilot for a digital UK government bond (DIGIT).

Ripple used the summit to deliver a sharp message: Now is the time to act—boldly and fast.

Ripple’s 4-Point Plan for UK Crypto Leadership

In a whitepaper released after the summit, Ripple laid out four key regulatory priorities critical to the UK’s ascent in the digital economy:

1. Accelerate Regulatory Framework Finalization

“The government and regulators must act at pace to develop a crypto-asset regulatory framework that drives investment and growth.”

Ripple emphasized that early movers in crypto regulation will reap long-term rewards in global competitiveness and capital inflows.

2. Ensure Global Standards Alignment

Ripple urged the UK to harmonize its rules with international frameworks, helping firms avoid conflicting obligations and maintain global interoperability.

3. Advance Stablecoin Regulation

Ripple pushed for the swift regulation of stablecoins, including legal pathways to allow overseas-issued stablecoins to circulate in the UK without local issuance requirements—a move that would increase liquidity and stimulate market innovation.

4. Remove Legal, Regulatory, and Tax Barriers

To solidify leadership in tokenization, Ripple proposed an integrated approach to overcome legacy barriers that hinder the tokenization of traditional assets like bonds and equities.

“The opportunity for the UK is huge. If the regulatory framework is designed correctly, it can facilitate innovation, enhance financial inclusion, and solidify the UK’s position as a competitive global financial centre.”

— Ripple

A Strategic Moment for UK Finance

Ripple underscored the transformative role of blockchain in modernizing payments, increasing transparency, and broadening access to financial services. With over 90% of major financial institutions engaged in crypto by 2024, the stakes for leadership are rising fast.

Summit participants echoed a growing consensus:

Rapid regulatory clarity is no longer optional—it’s essential to unlocking crypto’s full potential and ensuring the UK remains at the forefront of global finance.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

South Korea’s Central Bank Open to Stablecoin Amid Cautious Forex Outlook

South Korea may soon join the growing list of nations backing fiat-pegged stablecoins. The Governor of the Bank of Korea signaled openness to the issuance of a won-based stablecoin, though he voiced concerns over its foreign exchange impact, particularly in relation to dollar-backed tokens.

Cautious Approval from the Central Bank

At a press conference covered by Reuters, Bank of Korea Governor Rhee Chang-yong stated that while he does not oppose the creation of a won-pegged stablecoin, there are critical risks tied to its adoption:

“Issuing won-based stablecoin could make it easier to exchange them with dollar stablecoin rather than working to reduce use of dollar stablecoin.”

Rhee warned this could inadvertently increase demand for dollar stablecoins and complicate forex management, undermining efforts to strengthen South Korea’s own currency reserves and monetary autonomy.

Shrinking Forex Reserves Add Pressure

The concern comes amid declining national reserves.

At the end of December 2024, South Korea held $415.6 billion in forex reserves.

By May 2025, that figure dropped to $404.6 billion—a $11 billion decrease in just six months.

This underscores the urgency in crafting a stablecoin policy that enhances domestic financial resilience without unintentionally driving capital back into U.S.-dollar-based instruments.

Democratic Party Pushes Pro-Stablecoin Legislation

Newly elected President Lee Jae-myung is advancing crypto reform as part of his campaign promises. On June 10, his Democratic Party introduced the Digital Asset Basic Act, a legislative proposal that would:

Allow companies with at least $368,000 in equity capital to issue stablecoins.

Require issuers to maintain sufficient reserves for redemptions.

Mandate approval from the Financial Services Commission (FSC) prior to issuance.

This move aims to foster innovation, reduce U.S. dollar reliance, and offer a regulatory pathway for local stablecoin ecosystems to thrive.

Regulators Scrutinize Exchanges and Fees

South Korea’s FSC is currently probing local exchanges over the transaction fees they charge, aligning with President Lee’s pledge to lower trading costs for retail investors, especially younger users.

The regulatory scrutiny marks a shift toward a more competitive and transparent crypto exchange landscape, which could boost local investor confidence.

The Global Stablecoin Landscape Is Evolving

While U.S. dollar-backed stablecoins still dominate, with Tether (USDT) and Circle’s USDC leading at $156 billion and $61 billion respectively, non-USD options are starting to gain traction.

Circle’s euro-pegged EURC saw a 156% market cap increase since the start of 2025, now totaling $203 million. Momentum grew further after U.S. lawmakers backed the GENIUS Act, a key stablecoin regulatory bill, sending Circle’s stock sharply higher.

South Korea Eyes Its Own Path

As global stablecoin competition intensifies, South Korea’s measured but open stance on a won-based stablecoin could position the nation as a regional leader in digital finance, provided it carefully balances innovation with macroeconomic stability.

The next steps will likely involve regulatory fine-tuning, market feedback, and possible pilot programs to test the feasibility of stablecoin circulation under central bank oversight.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Crypto ETF Approval Odds Surge to “90% or Higher,” Say Bloomberg Analysts

The approval of a broad array of U.S. crypto exchange-traded funds (ETFs) is now considered “almost certain,” according to top Bloomberg analysts. In a major shift in regulatory tone, the Securities and Exchange Commission (SEC) appears increasingly willing to approve spot ETFs for altcoins like XRP, Solana, Dogecoin, and Cardano, signaling expanding institutional access to digital assets.

Bloomberg: ETF Approval Odds at 90% or Higher

Analysts James Seyffart and Eric Balchunas raised their estimated approval odds to “90% or higher” on Friday, citing “very positive” engagement from the SEC in recent weeks.

“The tone and feedback from the SEC has shifted meaningfully,”

Seyffart said in a post on social media, emphasizing that this new posture marks a clear pro-crypto pivot at the regulatory agency.

One key reason for the rising optimism: The SEC appears to categorize many major cryptocurrencies — including XRP, Solana (SOL), Litecoin (LTC), Dogecoin (DOGE), and Cardano (ADA) — as commodities, not securities. This classification would place them largely outside of the SEC’s strictest enforcement scope, removing one of the biggest regulatory roadblocks.

Timeline Unclear, But Momentum Is Building

While approvals now seem likely, Seyffart cautioned that actual product launches may still take several months, potentially extending past October. The agency must still finalize reviews and respond to public comments on a number of ETF proposals — including XRP and SOL ETF filings by Franklin Templeton.

Bitcoin ETF Success Fuels Altcoin Hopes

The surge in altcoin ETF interest follows the historic success of spot Bitcoin ETFs, which have shattered records. BlackRock’s iShares Bitcoin Trust (IBIT) recently surpassed $70 billion in assets after just 341 days — making it the most successful ETF launch in U.S. history.

“There’s an arms race to replicate the Bitcoin ETF’s success,”

said Balchunas, pointing to strong demand for crypto exposure among institutional and retail investors alike.

However, not all crypto ETFs have performed equally. Ether ETFs, launched in July, have seen mixed reception, with Glassnode reporting in May that average ETH ETF investors were still “substantially underwater.”

Altcoins Rising, But Bitcoin Remains Dominant

While interest in altcoin ETFs is surging, analysts don’t expect any product to eclipse Bitcoin’s dominance in the near term. Still, the entry of top-tier asset managers like Franklin Templeton and the SEC’s willingness to open comment periods marks a turning point in mainstream crypto adoption.

With market watchers tracking every signal from Washington, these ETF developments could define the next chapter of crypto-finance integration in the United States.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan & Crew: The IQD Update-Reality of the Federal Court-A Red Line-Salaries-Budget Tables for 2025

MilitiaMan & Crew: The IQD Update-Reality of the Federal Court-A Red Line-Salaries-Budget Tables for 2025

6-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew: The IQD Update-Reality of the Federal Court-A Red Line-Salaries-Budget Tables for 2025

6-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

90% Market Crash Coming - What to Do Before & After It Hits

Harry Dent: 90% Market Crash Coming - What to Do Before & After It Hits

Wealthion: 6-18-2025

Economist and author Harry Dent delivers his most urgent warning yet: the U.S. economy is heading into the biggest crash in modern history, and the fallout will be far worse than 2008.

In this explosive interview with Maggie Lake, Dent explains why the bubble is already bursting, how stocks could fall up to 90%, and why real estate is ground zero for the coming collapse. In this hard-hitting interview:

Why $27 trillion in stimulus distorted the economy

How zombie companies and malinvestment are dragging us down

Harry Dent: 90% Market Crash Coming - What to Do Before & After It Hits

Wealthion: 6-18-2025

Economist and author Harry Dent delivers his most urgent warning yet: the U.S. economy is heading into the biggest crash in modern history, and the fallout will be far worse than 2008.

In this explosive interview with Maggie Lake, Dent explains why the bubble is already bursting, how stocks could fall up to 90%, and why real estate is ground zero for the coming collapse. In this hard-hitting interview:

Why $27 trillion in stimulus distorted the economy

How zombie companies and malinvestment are dragging us down

What the Fed and Politicians still don’t understand about recessions

Why Millennials will be the biggest winners of the crash

The only true safe haven (hint: it’s not gold or Bitcoin)

And when Dent believes the crash will begin, and end

Chapters:

1:00 - Harry Dent’s Bold Prediction: The Greatest Crash in History

6:44 - The Walking Dead Economy: Malinvestment & Zombie Companies

10:09 - Has the Fed Already Lost Control?

13:32 - What Will Finally Trigger the Collapse?

17:07 - Real Estate Is Ground Zero for the Coming Crash

20:13 - How to Survive the Crash: Dent’s Safe Haven Picks

25:21 - Is Bitcoin the Big Winner After the Dust Settles?

27:48 - Are We Heading Into a 1930s-Style Depression?

30:22 - Will the Government Make It Even Worse?

32:29 - Is the U.S. Still the Safe Haven Everyone Thinks?

35:34 - AI vs Demographics: What Really Drives the Next Boom?

39:19 - Timing the Collapse: Dent’s 2025-28 Roadmap

This is How Fiat Currencies End and What will Replace it

This is How Fiat Currencies End and What will Replace it

VRIC Media: 6-19-2025

The global economic landscape feels increasingly precarious, riddled with uncertainty and simmering anxieties. In a recent interview with VRIC Media, Jay Martin sat down with market expert Matthew Piepenburg to dissect the forces driving this instability, offering insights into potential strategies for navigating the turbulence.

Their conversation paints a compelling picture of a world grappling with unprecedented debt, rising inflation, eroding trust, and shifting geopolitical alliances.

This is How Fiat Currencies End and What will Replace it

VRIC Media: 6-19-2025

The global economic landscape feels increasingly precarious, riddled with uncertainty and simmering anxieties. In a recent interview with VRIC Media, Jay Martin sat down with market expert Matthew Piepenburg to dissect the forces driving this instability, offering insights into potential strategies for navigating the turbulence.

Their conversation paints a compelling picture of a world grappling with unprecedented debt, rising inflation, eroding trust, and shifting geopolitical alliances.

One of the central themes explored was the crippling effect of global debt. Piepenburg argues that runaway debt fuels populist movements, as citizens become increasingly disillusioned with governments seemingly unable to manage finances effectively.

This economic stress, in turn, breeds civil unrest, as individuals grapple with rising costs and a perceived lack of opportunities. The interview raises a crucial question: Can the world still choose cooperation over conflict in the face of such widespread economic pressure?

Martin and Piepenburg delve into the idea that perhaps the system itself is fundamentally flawed. Was there ever real hope for reform, or are we simply witnessing the inevitable consequences of decades of unsustainable practices? This critical examination leads to a discussion on the players best positioned to navigate this complex environment.

The interview highlights China’s strategic approach to global power. By playing the long game, focusing on economic development and infrastructure investment, China has positioned itself as a significant player on the world stage.

This rise prompts the question: Can the West still lead through alliances? Can existing partnerships, like the one with Saudi Arabia, provide crucial resources, such as rare earth minerals, to bolster Western economies? The potential for rebuilding U.S. industry from scratch is also considered, questioning whether such a feat is feasible in the current globalized context.

Amidst this backdrop of economic and geopolitical uncertainty, the conversation turns to the quiet but significant accumulation of gold by central banks. Piepenburg suggests this stockpiling is not accidental. In a world where faith in fiat currencies is dwindling, and inflation continues to erode purchasing power, gold represents a tangible and historically reliable store of value.

Ultimately, the interview focuses on practical advice for investors navigating this uncertain world. Piepenburg emphasizes the importance of understanding risk, recognizing the power of currency fluctuations, and appreciating the evolving nature of sovereignty. He suggests that diversification and hedging strategies, including exploring alternative assets like gold, are crucial for protecting wealth in an era of unprecedented economic volatility.

The discussion between Jay Martin and Matthew Piepenburg provides a sobering yet insightful analysis of the current global landscape. It highlights the interconnectedness of debt, geopolitics, and individual financial well-being. By understanding the forces at play, and considering strategies for hedging against uncertainty, investors can better prepare for the challenges and opportunities that lie ahead.

For a more in-depth understanding of these critical issues, be sure to watch the full video interview from VRIC Media.

Bruce’s Big Call Dinar Intel Thursday Night 6-19-25

Bruce’s Big Call Dinar Intel Thursday Night 6-19-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody to the big call tonight. It's Thursday, June 19th otherwise known as Juneteenth, and thanks everybody for tuning tonight. We've got a really good call, I think for you tonight, I know I'm excited about what I have and what Sue has, and I know I'll be excited about what Bob has to share tonight. I really enjoyed Tuesday night's call. I thought it was really good, very fun, very enlightening all the way around. Let's do this. Let's pray the call in,

All right, let's see where we stand now from our intel point of view. Let's talk, first of all about the USN and ust our new currency, our new USTN, United States Treasury note. Notice, there's no Federal Reserve in that. The Fed is out of the way, fortunately and the USN is just the short designation of it that is used on the bank screens to designate the currency and the value so USN, USTN, I consider it as physical money, physical notes that we're going to be keeping in a wallet or money clip with your purse.

Bruce’s Big Call Dinar Intel Thursday Night 6-19-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody to the big call tonight. It's Thursday, June 19th otherwise known as Juneteenth, and thanks everybody for tuning tonight. We've got a really good call, I think for you tonight, I know I'm excited about what I have and what Sue has, and I know I'll be excited about what Bob has to share tonight. I really enjoyed Tuesday night's call. I thought it was really good, very fun, very enlightening all the way around. Let's do this. Let's pray the call in,

All right, let's see where we stand now from our intel point of view. Let's talk, first of all about the USN and ust our new currency, our new USTN, United States Treasury note. Notice, there's no Federal Reserve in that. The Fed is out of the way, fortunately and the USN is just the short designation of it that is used on the bank screens to designate the currency and the value so USN, USTN, I consider it as physical money, physical notes that we're going to be keeping in a wallet or money clip with your purse.

Okay, that's what those are. And they say United States Treasury note on them - and those have been printed for over 2 years, at least. Maybe two and a half by now, and they're in the banks and the redemption centers for us in the redemption center, shrink wrapped, probably in amounts of 1000 I don't know if they've got 2500 or 5000 in a separate, you know, shrink wrap, or if they're all just 1000 shrink wraps, and you just get two, three or four or five of those, you know, in the redemption center, and that'll come off of your balance.

It's not free. You get it out of your exchange balance. All right, so what about that? Yesterday, Wednesday - we had confirmation of what we had received early morning, early and what came in was a thing that came in an email from one of our sources that said that we would have that they were they had passed the genius act like G, E, N, I, U, S, the genius Act was about there were two ways I looked at this.

The information that we got from a source said that this act would create the ability to have a new currency, a new money that was asset backed by gold and silver, and that this would be thing that was voted on and actually passed in the Senate yesterday. Then we go from there as a bill, the genius act as a bill would go to house - that piece backwards, usually the house and then the Senate first, and then the house for final approval, and then it would become law.

What's interesting about is this time in all of these years that we've had any reference to a new currency for us, and it actually gave credit back to President John F Kennedy, because before he was assassinated guess what, he was trying to put us back on the gold standard. May not use gold standard as a term to describe this new money for us, but it is backed by assets, some of which are gold and silver.

You might add palladium, you might add platinum, you could add oil, you could add natural gas. There are several asset classes that can be used to back the value of a country's currency.

This was passed, and I had confirmation on this information that I received in the morning, I had confirmation in the afternoon on Newsmax. The difference was that Newsmax did not focus on gold or silver assets backing the currency. It focused on XRP, the crypto coin backing our currency.

And we know that XRP as a crypto currency, a crypto coin, is backing the digital value of our USN, digitally. So there is a combination of gold backed crypto coins, and I think XRP is just one of them. I know bitcoin is another one. Ethereum is another one, and there are two others, and they're all probably be used in combination as a backing for our USN currency and USTN money, let's just call it that way, money that the actual foldable paper class, money that we carry.

All right. So that was a big move. Now we also heard that that would be accomplished, and I look forward to this making its way all the way to I don't know that the house is going to vote on it quite yet. They may tweak it. You know how they are. They can't just pass something like it is. They've got to try to add something to it, or take something away from it, or modify it somehow, or whatever it is it's in the hand of the house representatives to do something with it and pass it on through

All right. Now that kind of talks about our money. Let me see what else we want to talk about. Let's talk about, Okay, here's another situation. Sort of related to it - We know of a few people that were in the process of buying gold in a big way, large amounts.

And they're working through a couple of our pay masters that we know, and it ends up that they made a decision to switch their buy, which was a half a billion dollars from gold to silver. And this was transacted at Wells Fargo in Miami, and it was said, make sure you have all your work in by 6pm Friday.

That's make sure it's all in. Well, they got it, but they were told to him, because their confirmation of the buy was to take place at 6:30pm tomorrow evening. And so that's what's happening, that's just a separate story, but something that's related to and I think the timing is interesting.

Why by 6pm tomorrow, I've heard from one of our sources that something might might happen for us after 6pm tomorrow, and then we heard from another source from Iraq that we would be looking for a surprise from this individual Saturday morning at nine Eastern.

So it's pointing toward a Friday night into Saturday something. Now, I think that's something should point to us in the notification of our emails for the toll free numbers 800 number that we will call set up for appointments right now is pointing to a Friday, excuse me, Saturday, Sunday notification period that actually could extend into Monday. ‘

So I'm thinking Saturday, Sunday or Monday of this coming weekend, and then Monday we should be receiving our emails with the 800 number on it. As soon as we get the 800 and verify, we will put it on and we'll also send out a green email to everybody who has sent in their email address and registered it on big call universe.com now that's pointing toward Saturday, Sunday or Monday.

And exchanges, I've been told should be very early this week. I don't know if that means Sunday or Monday. I think both days are even possible. Even Sunday is possible. So we'll see what that looks like. It might be.

We don't do anything until Monday and Tuesday, but I do feel good about the fact that they're talking about this going over the weekend. Rates have not been on redemption center screens. Let's see through yesterday, I don’t know if they are back up yet - my belief is that we'll get all new rates then on Sunday evening, after the Forex reopens, and they may come up beforehand.

They might come up on the bank screens and redemption center screens before the Forex opens at 5pm Sunday. So we have to keep an eye out for that. As you guys know, I always get some information late you know, either Thursday or Friday or Saturday, giving some new opportunity to see where we actually are.

But I think what you guys are interested in and what it might be that we don't know what it's going to be Saturday morning, but we know that the dinar has been put out in Iraq at a rate, and it's gone up about $1 it's coming up again about $1 it may interact. I'm talking in country, not our race, what it looks maybe it's a further revaluation of Iraq Dinar and for the first time, everybody globally will actually see it. Because even though we’ve sai its international – this and that -- if out I'm not so sure. I think they’ve kept it from us -

Now, some of our bank screens have had it. Our redemption screens have had it. But you know, not everybody has access to that - we're fortunate enough to be able to get access to that occasionally. And we know what it is, we know it's reading.

This is where we are looking for the proof of the pudding when it comes out to rates, we know that the Okay, let's get into this for a minute. What about Iran”? Iran’s currency came off the screens either Monday or Tuesday. I believe it was Monday It came off. It was on the redemption center screen. I know roughly what it was worth, but they've taken it off, at least temporarily.

Doesn't mean it won't go back up, come back on, okay. But what's happening with Iran? As you guys know there's been back and forth between Israel and Iran. And Israel started this last wave as a preemptive way to try to reduce the possibility of Iran having a nuclear weapon and to weaponize missiles and bombs with a nuclear warhead, and we've heard this for 15 or 20 years, but they're close to getting a nuclear weapon.

They're close, they're weak, they're months away, they're weeks away. We heard they were days away. I'm not so sure they're that close different opinions from different fucking heads and different experts that really do know going on, but I can tell you this, President Trump said that he would wait until last minute to make a decision about using b2 bombers and a bunker busting bomb, you take more than one

Now i This is my opinion. Now, I think he's very patient, and has said that it might take him up to two weeks to make a decision about that – he wants to wait for every available bit of information to come in, he said because things change, and they do change. and then he can make a more informed decision on whether to go or not to go. There's all kinds of opinions out there on to do it or not to do why I believe President Trump wants to prevent war. Not engage in it

I believe he is more in favor of Iran and the Ayatollah Khomeini to give it up and stepped down and basically changed the form of government they have

We are not in the business but I do know this much they did exactly work for- they decided to put something together, to go over a possible peace plan or a surrender of some description. They did put that together. And yesterday, he was going to fly from Iran to Qatar. And that was changed, and then instead, they were routed to for peace talks.

Now there's a delegation from Iran, there's a delegation from a lot of people in to go over this and talk about this, Russia and China, too. I believe so. The point is, I believe that Khomeini will make a decision, hopefully to make a regime change or same face somehow and accept some version, retooled version of a peace plan that would allow a new form government, which we're talking republic of Iran, similar to Republic of Iraq, their next door neighbor, to Come in and have a new form of government with a parliament like Iraq which has s president and or prime minister like Iraq has, I believe we're looking at something and I'm looking forward to that for Iran.

You know, the Iranian people are fine people, it's the caliphate, it's the extremism that is dangerous, and nobody in the Middle East wants them in either. Nobody wants Iran, as they currently are, to exist. They're all in favor of a regime change. It's not just us and it's not just Israel.

So the reason I'm bringing this up is –I believe we could have a decision Ayatollah Khomeini quick, possibly even tomorrow. So let's see what that turns into.

You know, we're very patient. We've been too patient in some ways, but I know President Trump does not want us to be at war, and he's going to do everything he can to make a deal, because he's make a deal to transition Iran – and do you know what he said yesterday. Sometimes President Trump said, make money, not war.

Remember in the 60s, we said, Make love, not war, to take off on that make money, not war. He's showing Iran their potential and what they could do, you know, and giving them financial opportunity and trade and everything that they that they would want in that new world. So let's for that belief, to see that future, because, God willing, the direction we're going in now, how does that affect us? If we see

May, let's say, Tomorrow, by tomorrow, sometime I think it allows everything to go forward under the current timeline. I know that is what President Trump wants -- He wants us to roll out NESARA between, let's call it now and July 4 in its entirety, the new currency the USA, the RNR, will have that at the redemption center.’

DOGE payments are coming out. Increase in Social may or may not happen this month. I know it's already happened for somebody made out on Monday, and it was a nice, huge. That was on a Monday, not on Wednesday yesterday. So I don't know. It's just one of those anomalies. So I want to, I don't know, maybe we will get that increase this month.

You know, what's today? The 19th, 11 or 12 days to go in the month, yeah, so we'll see what happens on that. But I know President Trump wants this well underway before the Fourth of July. I think we're going to get some announcements on the 4th that will be part of the NESARA --

So we'll see what happens. I Don't want to say or get not all, but I know we need to move on this thing with Iran, toward peace, toward the elimination of their nuclear capability. That ain’t gonna Happen under President Trump? No nuclear weapon.

All right, so that's everything I wanted to bring in terms of Intel,

So looking forward to it, guys, really thank you for listening. All right, I know I'm going on and on. Let's go ahead and pray the call out

Have a great weekend. Let's see what happens. I'm expecting some good things, starting probably Saturday, maybe Sunday. We'll see how it goes. Okay, keep an eye on your emails and get in touch with Sue. Okay, thanks so much. God bless you guys. Tonight,

Bruce’s Big Call Dinar Intel Thursday Night 6-19-25 REPLAY LINK Intel begins 1:03:03

Bruce’s Big Call Dinar Intel Tuesday Night 6-17-25 REPLAY LINK Intel Begins 1:12:40

Bruce’s Big Call Dinar Intel Thursday Night 6-12-25 REPLAY LINK Intel begins 1:12:12

Bruce’s Big Call Dinar Intel Tuesday Night 6-10-25 REPLAY LINK Intel Begins 1:17:07

Bruce’s Big Call Dinar Intel Thursday Night 6-5-25 REPLAY LINK Intel begins 1:03:53

Bruce’s Big Call Dinar Intel Tuesday Night 6-3-25 REPLAY LINK Intel Begins 1:06:00

Bruce’s Big Call Dinar Intel Thursday Night 5-29-25 REPLAY LINK Intel begins 1:29:00

Bruce’s Big Call Dinar Intel Tuesday Night 5-27-25 REPLAY LINK Intel Begins 1:15:15

Bruce’s Big Call Dinar Intel Thursday Night 5-22-25 REPLAY LINK Intel begins 1:18:40

Bruce’s Big Call Dinar Intel Tuesday Night 5-20-25 REPLAY LINK Intel Begins 1:11:00

Seeds of Wisdom RV and Economic Updates Friday Afternoon 6-20-25

Good Morning Dinar Recaps,

BRICS vs NATO: Who Holds More Power in 2025—Military, Economic, and Strategic Influence Compared

The BRICS vs NATO rivalry has become the defining geopolitical fault line of 2025. While NATO leads in global military coordination, BRICS commands accelerating economic momentum and demographic dominance—reshaping the global power structure into an increasingly multipolar world.

Good Afternoon Dinar Recaps,

BRICS vs NATO: Who Holds More Power in 2025—Military, Economic, and Strategic Influence Compared

The BRICS vs NATO rivalry has become the defining geopolitical fault line of 2025. While NATO leads in global military coordination, BRICS commands accelerating economic momentum and demographic dominance—reshaping the global power structure into an increasingly multipolar world.

Military Power: NATO Dominates in Coordination and Budget, BRICS in Nuclear Arsenal

Defense Spending and Strategic Alignment

NATO commands unmatched military spending, led by the U.S., which contributed $877 billion to NATO’s total $1.3 trillion defense budget in 2024—over half of global military expenditures.

By contrast, BRICS nations collectively spent around $350 billion, with China contributing $225 billion and India significantly investing in regional and technological defense initiatives.

However, BRICS lacks unified military coordination, unlike NATO's Article 5 collective defense framework, which tightly integrates its 32 member states under a single strategic command.

Nuclear Capabilities

NATO maintains around 5,500 nuclear warheads, but BRICS—largely due to Russia—surpasses that with 6,360 warheads. While NATO leads in advanced military infrastructure, BRICS holds a quantitative edge in nuclear firepower, underscoring a more fragmented yet potent deterrence force.

Economic Power: BRICS Surpasses NATO in GDP and Trade Growth

GDP and Growth Trajectory

BRICS has surged ahead with a combined GDP of over $60 trillion in 2024, outpacing NATO’s $40 trillion. China ($18 trillion) and newcomers like Saudi Arabia and the UAE have significantly boosted the bloc’s global economic weight.

Growth rates underscore this shift:

BRICS: 4%+ annual GDP growth

NATO: 1–2.5% growth

Trade and Currency De-Dollarization

BRICS now accounts for 25% of global exports, driven by rising intra-bloc trade and new trade initiatives using local currencies—notably the Chinese Yuan and Indian Rupee—which challenge the US dollar’s global dominance.

Population and Global Influence: BRICS Leverages Demographics, NATO Holds Institutional Power

Demographics

BRICS nations represent 3.5 billion people, nearly 45% of the world’s population, compared to NATO’s 950 million. This massive demographic advantage drives consumer markets and economic scale, especially through India’s growing population and urbanization.

Institutional Control vs. Multipolar Reforms

NATO members retain disproportionate sway over global institutions such as:

UN Security Council (permanent seats)

IMF (voting power)

World Bank (leadership roles)

However, BRICS is building alternative institutions like the New Development Bank (NDB) to challenge Western-led governance and promote multipolar frameworks, particularly in the Global South.

Future Trajectory: Two Pillars of Global Power

The NATO vs BRICS rivalry highlights two divergent yet increasingly complementary power centers:

NATO continues to lead in military strength, technology, and alliance integration, shaping global security architecture.

BRICS, propelled by economic momentum, population size, and alternative financial systems, is redefining global economic leadership.

Both blocs now represent dual axes of power—military and economic—that are not merely competitive, but also structurally embedded in the emerging multipolar order.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Financial Thoughts From Ariel and 589bull Friday 6-20-2025

Ariel : What are we Looking for at this Point?

What are we looking for at this point?

Well as one of my followers Richie Rich put it.

Basel III (End Game) – July 1

Trump’s Tariffs End – July 9th

ISO20022 – July 14th

Fedwire – July 14th

Ariel : What are we Looking for at this Point?

What are we looking for at this point?

Well as one of my followers Richie Rich put it.

Basel III (End Game) – July 1

Trump’s Tariffs End – July 9th

ISO20022 – July 14th

Fedwire – July 14th

Genius Act – July (Senate)

Clarity Act – July (House)

IRAQ WTO 4th meeting – July

RIPPLE/SEC Ends – July

Peace in the middle-east – July

US Dollar tanks / Currencies Rise

Now you know what to keep your eyes on.

Source(s): https://x.com/Prolotario1/status/1935834752910569719

https://dinarchronicles.com/2025/06/19/ariel-prolotario1-what-are-we-looking-for-at-this-point/

************

Fed Announces ISO 20022 Migration

589bull: 6-20-2025

The Fed just announced their ISO 20022 migration is locked in for July 14. That’s the backend switch for the new global financial system.

Petrodollar out. Tokenized value in. And it’s all going live in the middle of global chaos.

Welcome to the flip

Federal Reserve Financial Services: The Fedwire Funds Service migration is coming soon. Use these resources to help make sure your financial institution is ready: https://bit.ly/3Rr5vrw #banking #payments #FederalReserve

DarKapital: Basel III kicks in July 1st Bull. You would think they want this done before

July 1st is the kickoff giving banks a three year phase in period to meet capital and reporting requirements by July 1st 2028.

Source(s): https://x.com/589bull10000/status/1935825962014589232

https://dinarchronicles.com/2025/06/19/589bull-fed-announces-iso-20022-migration/

Jon Dowling & Mark Z Discuss The RV & The Great Wealth Transfer June 2025

Jon Dowling & Mark Z Discuss The RV & The Great Wealth Transfer June 2025

6-20-2025

Snippets From MarkZ and Jon Dowling : I have one complaint we have not crossed the finish line yet… other than that things are good…. but I think we can agree ….I think we're hours or days away the way things are coming together .

"Look you know somewhere between now and July 4th 2026 we're going to we're going to gold back treasuries bare minimum a 50-year gold back treasury."

Then you see the stable coin bill that was just introduced, and the genius bill.

Jon Dowling & Mark Z Discuss The RV & The Great Wealth Transfer June 2025

6-20-2025

Snippets From MarkZ and Jon Dowling : I have one complaint we have not crossed the finish line yet… other than that things are good…. but I think we can agree ….I think we're hours or days away the way things are coming together .

"Look you know somewhere between now and July 4th 2026 we're going to we're going to gold back treasuries bare minimum a 50-year gold back treasury."

Then you see the stable coin bill that was just introduced, and the genius bill.

The Fed's been buying all of our treasuries from US we're buying the debt so it's uh like they write the IOU then they buy the IU so….. I mean they're creating money out of nothing you look at what he's put together…..

You look at Judy Shelton’s comments i mean she's a slam dunk the question is is whether or not she's running Treasury or Fed or both under one roof… I think she's running it under the Treasury and baking the Fed because that was done in 2020 during covid

We don't do dates and rates but I would say right now- I think we're a lot closer than people think we are

We are both nervous and excited waiting for the last shoe to fall