Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Sunday Morning 6-15-2025

TNT:

Tishwash: Iraq's trade with Iran is again confusing the dollar. Hantoush warns of a tight spot!

Economic expert Mustafa Hantoush confirmed that Iraq still has significant trade with Iran that is not covered by the official price, leading to continued pressure on the parallel market.

In a statement to Jarida Platform , Hantoush stated that “millions of travelers to Iran are also contributing to increased pressure on the parallel market. With the improvement of the Iranian currency thanks to negotiations with the United States and the reduction of remittances, this pressure has eased somewhat.”

TNT:

Tishwash: Iraq's trade with Iran is again confusing the dollar. Hantoush warns of a tight spot!

Economic expert Mustafa Hantoush confirmed that Iraq still has significant trade with Iran that is not covered by the official price, leading to continued pressure on the parallel market.

In a statement to Jarida Platform , Hantoush stated that “millions of travelers to Iran are also contributing to increased pressure on the parallel market. With the improvement of the Iranian currency thanks to negotiations with the United States and the reduction of remittances, this pressure has eased somewhat.”

He explained that “the Central Bank’s step to increase the limits on some cards has partially contributed to the solution, but the worsening situation and the return of remittances may push the parallel exchange rate up again.”

He added, "Iraq is now required to adopt new monetary policies to manage trade with Iran and passenger traffic. The solution may be through a tripartite account or a gold barter, as some countries in the region are doing, to extricate Iraq from this tight spot." link

************

Tishwash: An economic expert told Al-Jarida Platform: The exchange rate is hostage to the political mood and regional shifts.

Economist Ahmed Hadhal spoke about the sensitivity of the dollar issue in Iraq and its direct impact on geopolitical and geoeconomic changes, emphasizing that the issue has become extremely complex internally and externally.

In an interview with Jarida Platform, Hathal stated that “since the end of 2022, and with the launch of the platform, the Central Bank has exhausted all monetary policy tools to address the gap between the parallel rate and the official rate. However, the problem is complex and does not only relate to the bank but also to the domestic market.” He explained that “60% of traders are still outside the platform, in addition to the lack of borders, which further complicates the crisis.”

He added that "the decline in the dollar's value coincided with the failure to approve the general budget and the instability of some foreign negotiations. The exchange rate is linked to economic, political, and media factors, and is a highly sensitive indicator of any crisis, statement, or event." He noted that "exchange rate fluctuations directly impact the purchasing power of citizens, merchants, companies, industrialists, importers, and even foreign investors."

Hedhal explained that "the loss of trust between society and the government is one of the most significant factors driving demand for the dollar as a more stable and valuable currency, especially given the lack of real production within Iraq.

Oil production constitutes more than 70% of the GDP, and the general budget constitutes 190% of this GDP. These indicators raise concerns among citizens and investors about the possibility of a decline in the value of the dinar."

He concluded by saying, "The exchange rate issue is linked to the psychological factors of citizens and investors, and there is a close relationship between behavioral economics and traditional economics, which makes currency stability necessitating addressing confidence in monetary and fiscal policies, ensuring their stability, and preventing sudden changes." link

*************

Tishwash: Oil rises, the dinar falls, and Baghdad faces the ramifications of Israeli-Iranian missiles.

Although it is outside the immediate circle of conflict, Iraq appears to be in the eye of the storm. Its geographical location, its near-total dependence on oil, and the peg of its economy to the dollar exchange rate make it vulnerable to every geopolitical shock in the region. While Israel and Iran exchange airstrikes and inflammatory statements, the Iraqi market translates these fires into tangible crises: rising food prices, a volatile dollar, and fears of a slowdown in the flow of goods through ports and borders.

As Israeli airstrikes on Iran escalated, the Iraqi dinar began to slide. This decline is not merely a technical result of changes in the currency markets; it is an expression of general panic and deep concern about political and security repercussions that Iraq may not be able to contain. Dealing with the US dollar is no longer just an economic issue; it has also become highly politically sensitive, especially with the US Treasury Department's strict oversight of transfer and financing mechanisms within Iraq.

On Friday, following the unprecedented Israeli airstrikes on Iranian facilities, oil prices jumped nearly 5%, while the Iraqi dinar fell dramatically against the dollar, exceeding 146,000 dinars to $100 in some local markets, its lowest level in months.

Meanwhile, global oil markets are experiencing significant turmoil, with JP Morgan warning that oil prices could rise to $120 per barrel if geopolitical tensions in the Middle East escalate further.

Global oil prices rose, with Brent crude closing at $74.23, up 4.87%, while US crude also closed at $72.98, up 4.94%.

The dinar is the first to be affected

"What's happening in Tehran is directly felt in the markets of Rusafa and Karkh," says Ahmed Eid, an economic researcher, referring to the close relationship between regional stability and the status of the local currency.

"The sudden rise in the dollar price reflects a real state of panic, not only about the developments in the conflict, but also about its potential financial repercussions, especially if the United States resorts to tightening controls on transfers from the US Federal Reserve or imposing new banking restrictions," he added in an interview with Shafaq News.

Eid warns that the continued smuggling of dollars from Iraq to Iran is fueling monetary instability, saying, "The Iraqi economy is dependent on external balance. We don't produce; we buy everything from abroad, and with every tremor in the region, we are the first to suffer."

Black gold: a temporary gain or an impending disaster?

At first glance, high oil prices appear to be an opportunity to boost Iraq's treasury, especially given that more than 90% of its budget relies on crude oil revenues. However, recurring threats to energy corridors, most notably the Strait of Hormuz, reveal the fragility of this "profit." Every additional barrel sold today may not find a safe route tomorrow. Worse still, proposed alternatives, such as the Turkish Ceyhan pipeline, provide only partial coverage, amid ongoing logistical and political challenges.

"This short-term profit does not hide the real danger," says economic expert Safwan Qusay.

"Any threat to the Strait of Hormuz would mean that more than 3 million barrels of Iraqi oil per day would be at risk," Qusay says. "Even if the Turkish Ceyhan pipeline were activated as an alternative route, it would cover only a third of exports, with burdensome logistical costs requiring thousands of trucks."

Approximately one-fifth of the world's oil trade—between 18 and 19 million barrels per day—passes through the Strait of Hormuz. Any military escalation affecting this vital artery would mean not only an Iraqi oil crisis, but also enormous pressure on prices and cash flows.

The indirect repercussions, however, appear more vague. The suspension of flights, the complexity of supply chains, and the potential displacement of Iranians or the return of Iraqi students and workers from Iran all add a new burden to the Iraqi state.

Financial expert Mahmoud Dagher told Shafaq News Agency that Iraq is still in the "economic resilience" phase, benefiting from high oil prices, but the door is open to more severe possibilities.

"The worst scenario is the closure of the straits, whether in the Arabian Gulf or the Red Sea, a card that Tehran or its allies in Yemen could play," Dagher says, adding that "this would be an uncontainable blow, not only to the Baghdad government, but to the entire Middle Eastern economy."

Iraq does not appear to have sufficient room for maneuver in this crisis. Between its near-total dependence on oil, weak domestic production, and the import of most basic commodities, any regional unrest becomes a daily matter for Iraqi citizens. As the crisis between Israel and Iran continues, attention is turning not only to the military fronts but also to the markets of Baghdad, where currencies, commodities, and fear determine the fate of millions.

In the absence of a real local production structure, the Iraqi economy is becoming something of a vehicle, completely linked to the regional locomotive. link

**************

Mot: .. Ya Knows!! -- Retirement is Sumthun Else!!!

Mot: UH OH!! -- Moms Gone and Daddys in Charge!!! Daddys in charge

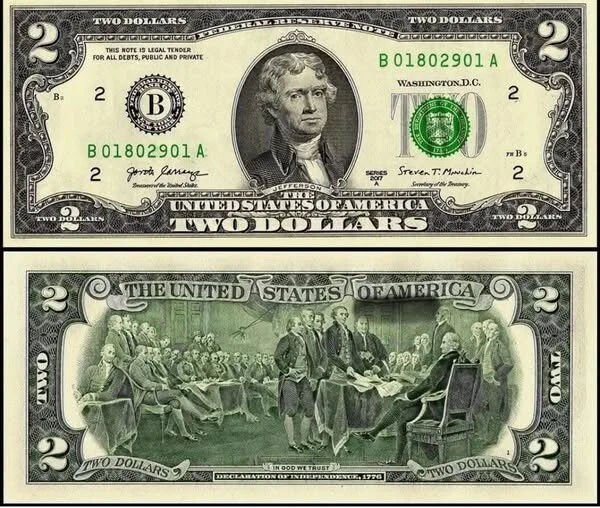

THE $2.00 BILL I TRIED TO SPEND:

TNT:

Mot: When was the last time you saw a $2.00 bill? I can picture this happening

THE $2.00 BILL I TRIED TO SPEND:

IF YOU'RE AS OLD AS I AM, THIS IS A RIOT!

Everyone should start carrying $2 bills! I'm STILL laughing!!

I think we need to quit saving our $2 bills and bring them out in public. The younger generation doesn't even know they exist!

TNT:

Mot: When was the last time you saw a $2.00 bill? I can picture this happening

THE $2.00 BILL I TRIED TO SPEND:

IF YOU'RE AS OLD AS I AM, THIS IS A RIOT!

Everyone should start carrying $2 bills! I'm STILL laughing!!

I think we need to quit saving our $2 bills and bring them out in public. The younger generation doesn't even know they exist!

STORY: On my way home from work, I stopped at Taco Bell for a quick bite to eat. I have a $50 bill and a $2 bill. I figure with the $2 bill, I can get something to eat and not have to worry about irritating anyone for trying to break a $50 bill.

Me: 'Hi, I'd like one seven-layer burrito please, to go.'

Server: 'That'll be $1.04. Eat in?'

Me: 'No, it's to go.' At this point, I open my billfold and hand him the $2 bill. He looks at it kind of funny.

Server: 'Uh, hang on a sec, I'll be right back.'

He goes to talk to his manager, who is still within my earshot. The following conversation occurs between the two of them:

Server: 'Hey, you ever see a $2 bill?'

Manager: 'No. A what?'

Server: 'A $2 bill. This guy just gave it to me...'

Manager: 'Ask for something else. There's no such thing as a $2 bill.'

Server: 'Yeah, thought so.'

He comes back to me and says, 'We don't take these. Do you have anything else?'

Me: 'Just this fifty. You don't take $2 bills? Why?

Server: 'I don't know.'

Me: 'See here where it says legal tender?'

Server: 'Yeah.'

Me: 'So, why won't you take it?'

Server: 'Well, hang on a sec.'

He goes back to his manager, who has been watching me like I'm a shoplifter, and says to him, 'He says I have to take it.'

Manager: 'Doesn't he have anything else?'

Server: 'Yeah, a fifty. I'll get it and you can open the safe and get change.

Manager: 'I'm not opening the safe with him in here.'

Server: 'What should I do?'

Manager: 'Tell him to come back later when he has real money.'

Server: 'I can't tell him that! You tell him.'

Manager: 'Just tell him.'

Server: 'No way! This is weird. I'm going in back.

The manager approaches me and says,

'I'm sorry, but we don't take big bills this time of night.'

Me: 'It's only seven o'clock! Well then, here's a two dollar bill.'

Manager: 'We don't take those, either.'

Me: 'Why not?'

Manager: 'I think you know why.'

Me: 'No really, tell me why.'

Manager: 'Please leave before I call mall security.'

Me: 'Excuse me?'

Manager: 'Please leave before I call mall security.'

Me: 'What on earth for?'

Manager: 'Please, sir..'

Me: 'Uh, go ahead, call them.'

Manager: 'Would you please just leave?'

Me: 'No.'

Manager: 'Fine -- have it your way then.'

At this point, he backs away from me and calls mall security on the phone around the corner. I have two people staring at me from the dining area and I begin laughing out loud, just for effect.

A few minutes later this 45-year-oldish guy comes in.

Guard: 'Yeah, Mike, what's up?'

Manager (whispering): 'This guy is trying to give me some (pause) funny money.'

Guard: 'No kidding! What?'

Manager: 'Get this. A two dollar bill.'

Guard (incredulous): 'Why would a guy fake a two dollar bill?'

Manager: 'I don't know. He's kinda weird. He says the only other thing he has is a fifty.'

Guard: 'Oh, so the fifty's fake!'

Manager: 'No, the two dollar bill is.'

Guard: 'Why would he fake a two dollar bill?'

Manager : 'I don't know! Can you talk to him, and get him out of here?'

Guard: 'Yeah.'

Security Guard walks over to me and......

Guard: 'Mike here tells me you have some fake bills you're trying to use.'

Me: 'Uh, no.'

Guard: 'Lemme see 'em.'

Me: 'Why?'

Guard: 'Do you want me to get the cops in here?'

At this point I'm ready to say, 'Sure, please!' but I want to eat, so I say, 'I'm just trying to buy a burrito and pay for it with this two dollar bill.

I put the bill up near his face, and he flinches like I'm taking a swing at him. He takes the bill, turns it over a few times in his hands, and he says, 'Hey, Mike, what's wrong with this bill?'

Manager: 'It's fake.'

Guard: 'It doesn't look fake to me.'

Manager: 'But it's a two dollar bill.'

Guard: 'Yeah? '

Manager: 'Well, there's no such thing, is there?'

The security guard and I both look at him like he's an idiot and it dawns on the guy that he has no clue and is an idiot.

So, it turns out that my burrito was free, and he threw in a small drink and some of those cinnamon thingies, too.

Made me want to get a whole stack of two dollar bills just to see what happens when I try to buy stuff.

Haha!!!!

We’re Staring into a Debt Deflation Abyss

We’re Staring into a Debt Deflation Abyss

Liberty and Finance: 6-13-2025

For four decades, the bond market reigned supreme, a testament to falling interest rates and a seemingly invincible U.S. dollar. But according to veteran market analyst Greg Weldon, that era is decisively over.

In a recent interview with Liberty and Finance, Weldon presented a compelling case for major structural shifts in the financial system, driven by soaring debt, a weakening dollar, and escalating geopolitical risks.

We’re Staring into a Debt Deflation Abyss

Liberty and Finance: 6-13-2025

For four decades, the bond market reigned supreme, a testament to falling interest rates and a seemingly invincible U.S. dollar. But according to veteran market analyst Greg Weldon, that era is decisively over.

In a recent interview with Liberty and Finance, Weldon presented a compelling case for major structural shifts in the financial system, driven by soaring debt, a weakening dollar, and escalating geopolitical risks.

Weldon argues that we’ve reached a critical juncture, drawing parallels to pivotal moments in economic history like the Volcker era and the Plaza Accord. He contends that the sheer magnitude of accumulated debt has pushed us past a “debt event horizon,” a point from which recovery through traditional means may be impossible.

This unprecedented level of indebtedness, combined with the Federal Reserve’s aggressive money printing, is fundamentally undermining the U.S. dollar’s global dominance.

Against this backdrop of economic uncertainty, Weldon sees a compelling case for commodities, particularly precious and strategic metals. He points to central bank gold buying, persistent inflation, and heightened geopolitical instability as powerful tailwinds that will drive significant price appreciation in the years ahead.

Gold, often seen as a hedge against inflation and a store of value during times of crisis, is poised to benefit from these trends.

However, Weldon emphasizes the potential for even more dramatic gains in silver and platinum, which are breaking out alongside the falling dollar, despite not being favored by central banks.

Weldon’s bullish outlook on silver and platinum challenges conventional wisdom, as these metals are often overlooked in favor of gold. However, he argues that their unique combination of industrial utility and scarcity makes them particularly attractive in the current environment.

While central banks typically focus on gold reserves, the growing industrial demand for silver and platinum is creating a powerful undercurrent of demand. This, coupled with constrained supply due to mine closures and reduced investment, could lead to significant price appreciation, potentially outpacing gold in the long run.

In this environment of profound change, Weldon stresses the need for active, globally aware investing. He argues that traditional investment strategies, heavily reliant on bonds and a strong dollar, are unlikely to keep pace with inflation, let alone generate meaningful returns.

Instead, he advocates for a diversified portfolio that includes exposure to commodities, especially those positioned to benefit from the energy transition and geopolitical shifts. He also emphasizes the importance of understanding global macroeconomic trends and being prepared for increased market volatility.

Beyond the financial realm, Weldon warns of deeper societal fractures and rising geopolitical tensions that could further destabilize markets. He believes that the current economic imbalances are exacerbating existing social divisions, leading to increased unrest and uncertainty.

In conclusion, Greg Weldon’s analysis paints a stark picture of the financial system at a critical inflection point. He believes the 40-year bond bull market is over, and a new era of rising commodity prices and increased volatility is upon us.

By understanding these forces and adopting a proactive investment approach, investors can protect their wealth and potentially capitalize on the opportunities that lie ahead. However, it is a landscape that demands vigilance, global awareness, and a willingness to challenge conventional wisdom. The future will reward those who are prepared for the coming changes.

Suze Orman: 6 Bad Pieces of Money Advice

Suze Orman: 6 Bad Pieces of Money Advice

Nicole Spector Fri, January 3, 2025 GOBankingRates

There has always been bad advice out there about what to do with our money. But now, in an increasingly digital age where many of us are glued to social media apps, inhaling particle after particle of “expert” information, we’re inundated with all sorts of financial advice. Some of it is salient and good; but some of it could be terrible for us, or, at best, not rightly sized for our needs and wants.

Suze Orman has become a multimillionaire as a personal finance guru, and is quick to call out a piece of advice about money that should be avoided. Let’s look at six bad pieces of money advice that Orman has bluntly struck down.

Suze Orman: 6 Bad Pieces of Money Advice

Nicole Spector Fri, January 3, 2025 GOBankingRates

There has always been bad advice out there about what to do with our money. But now, in an increasingly digital age where many of us are glued to social media apps, inhaling particle after particle of “expert” information, we’re inundated with all sorts of financial advice. Some of it is salient and good; but some of it could be terrible for us, or, at best, not rightly sized for our needs and wants.

Suze Orman has become a multimillionaire as a personal finance guru, and is quick to call out a piece of advice about money that should be avoided. Let’s look at six bad pieces of money advice that Orman has bluntly struck down.

‘It’s Fine To Hire a Financial Advisor Who Is Not a Fiduciary’

This one may catch you by surprise, if only because you may not know this distinction exists. Not all financial advisors are fiduciary financial advisors. A fiduciary financial advisory has the qualification and commitment to act in your best interest and is overseen by complex and specific rules.

A financial advisor who does not have a fiduciary duty could act against your best interests by, for example, investing your money in a stock that they want to see succeed for their own prosperity.

“Only advisors who operate as fiduciaries are promising to always put the client’s interest first,” Orman wrote in a blog on her site in 2020. “If you are interviewing potential financial planners, ask them if they are a fiduciary and if they will put that in writing if you work with them. This should be a super easy request anyone will quickly say yes to.”

‘You Have To Send Your Kid to an Expensive College in Order for Them To Be Successful’

Like fellow financial expert Dave Ramsey, Orman doesn’t at all disavow a college education, but she does have a scrutinizing eye when she sees people going into student loan debt to secure one. Her philosophy is that college is valuable, but needs to be obtained affordably.

She doesn’t want to see parents place too much importance on the best of the best when it comes to education and their children’s needs. She wants them to be practical and act within their budgets so that they’re not putting their own futures at risk in the name of helping their kids.

TO READ MORE: https://www.yahoo.com/finance/news/suze-orman-6-bad-pieces-130007865.html

4 Reasons You Should Not Spend Your Rare $2 Bills

4 Reasons You Should Not Spend Your Rare $2 Bills

Caitlyn Moorhead Thu, June 12 GOBankingRates

Sometimes called lucky, sometimes suspected as fake, the $2 bill, with its iconic depiction of Thomas Jefferson on the front and the signing of the Declaration of Independence on the back, has long been a curiosity when it comes to American currency and sorting through your cash.

The $2 bill has been in circulation, in various designs, since 1862, and while it is rarer than other dollars in your pocket, you can spend it like any other bill. Despite the novelty of it, you may or may not want to keep some of them in your stash as some are quite collectible and valuable.

4 Reasons You Should Not Spend Your Rare $2 Bills

Caitlyn Moorhead Thu, June 12 GOBankingRates

Sometimes called lucky, sometimes suspected as fake, the $2 bill, with its iconic depiction of Thomas Jefferson on the front and the signing of the Declaration of Independence on the back, has long been a curiosity when it comes to American currency and sorting through your cash.

The $2 bill has been in circulation, in various designs, since 1862, and while it is rarer than other dollars in your pocket, you can spend it like any other bill. Despite the novelty of it, you may or may not want to keep some of them in your stash as some are quite collectible and valuable.

Here are four reasons why you shouldn’t spend your $2 bills.

Collectors Could Pay You Much More Than $2

While most $2 bills are worth their face value, of well, $2, certain older bills or bills with unique serial numbers might fetch a premium among collectors. Here are some rare bills that could fetch you a lot of paper:

1862 and 1869 legal tender notes: These are the earliest $2 bills and feature a portrait of Alexander Hamilton (which was later replaced by Jefferson)

1890 $2 Treasury Note: An 1890 $2 Treasury Note featuring General James McPherson can be worth thousands so double check you’re not using it to tip your delivery driver, unless you were hoping to be very generous.

1928 red seal notes: The 1928 $2 bill was the first to feature Thomas Jefferson’s home, Monticello, displayed with a red seal rather than a green one.

1976 bicentennial $2 bills: This $2 bill was released to celebrate the U.S. bicentennial, and while most of them are only worth face value, some with special serial numbers, misprints, stamps or star notes can be worth hundreds of dollars.

Sometimes It Makes Sense To Be Sentimental

Many people have received $2 bills as gifts, keepsakes, tips or tokens of good luck. If your bill has sentimental value, you might be more inclined to keep it for its personal significance rather than its monetary worth.

Good luck can be hard to come by in this economy, so though handing over a $2 bill often leads to stories, questions and sometimes even debates about its legitimacy as currency, it may be worth keeping in your pocket next to your rabbit foot if you don’t need to spend it.

It Wouldn’t Make an Economic Impact

TO READ MORE: https://www.yahoo.com/lifestyle/articles/4-reasons-not-spend-rare-200108291.html

'The End of Fiat Is Now' - Why Bitcoin and Gold Are the Future | Ricardo Salinas

'The End of Fiat Is Now' - Why Bitcoin and Gold Are the Future | Ricardo Salinas

Kitco News: 6-14-2025

Billionaire Ricardo Salinas says fiat money is collapsing and Bitcoin is the only path to monetary freedom.

In this exclusive Kitco News interview, Salinas explains why central banks are running a global Ponzi scheme, how CBDCs will institutionalize financial surveillance, and why the peso is already in trouble under Mexico’s new leadership.

He also breaks down gold’s strategic role, mining risks in Mexico, and why he’s preparing for what he calls “the fiat endgame.”

'The End of Fiat Is Now' - Why Bitcoin and Gold Are the Future | Ricardo Salinas

Kitco News: 6-14-2025

Billionaire Ricardo Salinas says fiat money is collapsing and Bitcoin is the only path to monetary freedom.

In this exclusive Kitco News interview, Salinas explains why central banks are running a global Ponzi scheme, how CBDCs will institutionalize financial surveillance, and why the peso is already in trouble under Mexico’s new leadership.

He also breaks down gold’s strategic role, mining risks in Mexico, and why he’s preparing for what he calls “the fiat endgame.”

Salinas, chairman of Grupo Salinas and founder of Banco Azteca, is one of Latin America’s largest private Bitcoin holders. He shares his personal experience with hyperinflation, how it shaped his investment philosophy, and why he believes we’re entering a new monetary era where Bitcoin, gold, and miners will replace trust in governments and paper money.

Key topics:

– Why Salinas calls fiat “a lie” and Bitcoin “monetary truth”

– CBDCs, surveillance, and the end of financial privacy

– Mexico’s peso risk and political instability

– Gold vs Bitcoin: why he holds both

– Are miners undervalued in this monetary reset?

– Capital controls, confiscation risk, and hard asset strategy

– How to build generational wealth through Bitcoin and gold

– Insights from Salinas’ new book The Bitcoin Enlightenment

00:00 Introduction

01:19 Ricardo Salinas

02:01 Fiat Currency Critique and Bitcoin Advocacy

03:49 Global Liquidity and Bitcoin's Behavior

06:20 Government Control and Bitcoin's Future

12:41 Central Bank Digital Currencies (CBDCs)

15:35 Bitcoin as a Global Monetary Base

18:04 Bitcoin and the Banking System

19:33 Latin America's Role in Bitcoin Adoption

20:16 Bitcoin vs. Gold: A Comparative Analysis

21:31 Challenges in the Mexican Mining Sector

23:46 Investment Strategies: Bitcoin, Gold, and Miners

27:34 Tokenization and the Future of Gold

29:07 The Core Message of Bitcoin: Freedom

31:47 Preparing the Next Generation for a Broken Financial System

33:36 Final Thoughts

News, Rumors and Opinions Saturday 6-14-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 14 June 2025

Compiled Sat. 14 June 2025 12:01 am EST by Judy Byington

Fri. 13 June 2025 EBS Alert Imminent …JFK Awakening Q17 on Telegram

Expect official statements from financial authorities confirming the reset, possibly unveiling new currency rates or debt-cancellation policies. Be ready: when the signal goes out, millions will see proof of the new system.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 14 June 2025

Compiled Sat. 14 June 2025 12:01 am EST by Judy Byington

Fri. 13 June 2025 EBS Alert Imminent …JFK Awakening Q17 on Telegram

Expect official statements from financial authorities confirming the reset, possibly unveiling new currency rates or debt-cancellation policies. Be ready: when the signal goes out, millions will see proof of the new system.

Authority Statements: Central bank governors and financial ministers are on standby to speak publicly. Briefings will emphasize transparency, sovereignty, and the end of financial tyranny.

System Status: Technical monitoring dashboards are green across the board. I’ve confirmed that core QFS servers are handling simulated transaction loads flawlessly with no errors.

Market Readiness: Even traditional financial markets are adjusting: stock exchanges and currency platforms are poised to switch to the new asset-backed basis. New exchange rates may be published within hours.

The pieces are in place for history to unfold. Prepare to witness the global reset. Keep your notifications on, and when alerts arrive, follow the provided steps immediately. Trust the process — our era of true economic freedom is here.

~~~~~~~~~~~~

What We Think We Know as of Sat. 14 June 2025:

Pentagon audits confirm: the IRS is effectively obsolete, the IMF is collapsing, and international tax law is being rewritten under GESARA protocols. The Federal Reserve has lost its command functions. Quantum nodes are executing wealth redistribution on a global scale—debt forgiveness, asset-backed digital currency, and restitution wallets for every nation sabotaged by central banking tyranny. … Quantum Financial System on Telegram

Fri. 13 June 2025: Quantum Financial System and gold-backed Rainbow Currency is live. Massive raids in London, Zurich, Hong Kong. Gold, weapons, blackmail seized. VISA and Mastercard are being phased out. Zim Bonds are being redeemed NOW. Bondholders are being contacted. NDAs are MANDATORY.

~~~~~~~~~~~~~

Tues. 10 June 2025: New intel confirms that over 60% of all major central bank communication hubs was no longer under Cabal Control. …Ben Fulford on Telegram

What replaced them isn’t just a monitoring system — it’s a live quantum oversight protocol, governed by AI-integrated alliance nodes. Every transfer, every internal ledger adjustment, every fiat-based swap is logged, intercepted, and permanently blocked if noncompliant with asset-backed standards.

In Berlin, high-level Deutsche Bundesbank officials have been forced into blackout sessions. Translation: diplomatic immunity revoked, data logs seized, private servers extracted by Space Force units under protective jurisdiction. Germany’s digital gold certificate program — once a covert slush fund — is now under QFS audit. What they promised to governments doesn’t exist. But what they stole from the people does.

The World Bank has entered collapse protocol. Their Nairobi satellite office — a key node for siphoning climate funds through synthetic ESG initiatives — was shut down yesterday under military enforcement. Files recovered include hundreds of forged development contracts tied to shell tribes, extinct zones, and ghost villages — all fake recipients for decades of funding diversion.

At the same time, U.S. Federal Reserve branches in Atlanta and Minneapolis experienced “technical anomalies” — the term used internally for grid disconnection from legacy SWIFT rails. What it really means: they’ve been cut off.

All attempts to bypass QFS validation through international crypto corridors have failed. Binance data centers are under surveillance. Ripple has complied. Tether is next.

And yet, the public still believes the economy is recovering. Because the façade hasn’t fallen — yet.

But when it does, it will happen fast. Legacy credit scores? Obsolete. Taxation tracking systems? Archived. Personal debt structures? Already mapped for erasure.

The final phase involves mass psychological transition. This is why the Quantum Communication Network (QCN) was built in parallel — to replace media control and guide the awakening without panic. Trial broadcasts have already occurred in 11 zones. If you didn’t notice them, you weren’t tuned to the right signal.

This isn’t theory. This is what happens when the script flips. The people were never meant to lose. They were meant to rise once the parasites collapsed under their own greed.

Stay sharp. Monitor every tremor. The silence is strategic. And it won’t last much longer.

Read full post here: https://dinarchronicles.com/2025/06/14/restored-republic-via-a-gcr-update-as-of-june-14-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 ...The money they have to back up their currency is astronomical. That fact alone allows me to sleep at night with comfort because I know this is happening. I know it's coming...

Walkingstick Iraqi banks are mirroring our banks in the United States. IMO these International standards are not for 1310. They're not. It makes no sense. That's why 1310 has become silent. It doesn't make sense internationally. It doesn't make sense logically. There has to be a new rate...

Frank26 [Iraq boots-on-the-ground report] FIREFLY: TV is talking about a procedure done by the CBI has led to an all-time narrowing of the gap between the parallel market and the official rate... FRANK: It is good to see the CBI bragging about narrowing the gap between the official exchange rate and the market rate. Once it does reach 1 to 1 that will be position for it to be ready to float internationally to reach the REER. The monetary reform is putting everything in position and we can see it and it's exciting.

************

FRANK26…..6-13-25…ALOHA….TOO LATE

6-13-2025

Alasdair Macleod: Russia Ready For A Gold Standard - China Next!

Alasdair Macleod: Russia Ready For A Gold Standard - China Next!

6-14-2025

In this latest intriguing interview, Darryl and Brian Panes from As Good As Gold Australia talk with Alasdair Macleod, Advisor to AGAGA.

Alasdair confirms that China is moving fast and is stepping up plans to replace the dollar with a gold-backed Yuan.

The Shanghai Gold Exchange is opening vaults abroad, and Shanghai Futures access is opening up as well. The laws of unintended consequences are alive and well.

Alasdair Macleod: Russia Ready For A Gold Standard - China Next!

6-14-2025

In this latest intriguing interview, Darryl and Brian Panes from As Good As Gold Australia talk with Alasdair Macleod, Advisor to AGAGA.

Alasdair confirms that China is moving fast and is stepping up plans to replace the dollar with a gold-backed Yuan.

The Shanghai Gold Exchange is opening vaults abroad, and Shanghai Futures access is opening up as well. The laws of unintended consequences are alive and well.

When President Trump tried to put China out of business with punitive tariffs, China immediately responded by accelerating tariff-free trade negotiations with Japan and South Korea. President Xi then went on a whistle-stop tour of the principal ASEAN nations.

Shortly afterwards, the PBOC embarked on a policy of opening gold and silver trading outside China with new vaults, proposed in Hong Kong and Saudi Arabia.

What is this all leading to? And are there consequences for the dollar and the entire western financial system.

Currently, we have a massively deteriorating outlook for the US dollar. What does this mean for gold and silver moving forward?

Phillip Newman from Metals Focus discusses with Kitco News that they may expect new highs for gold in the second half of 2025, and further momentum in 2026. His reasons for this are the continuation of Central Bank buying and the investment markets only just starting from late last year.

Together with trade wars, and geopolitical events, the confidence in the US dollar is disappearing. Very few analysts outside of Alasdair are mentioning the increasing debt levels, and therefore the interest on the debt piling up.

Alasdair discusses this vital topic in detail. The global economy is in a very dark, precarious state., and now, more than ever, it is time to become your own Central Bank – you need to own gold!

Iraq Economic News And Points To Ponder Saturday Morning 6-14-25

Al-Sudani To US Diplomat: Iraq Will Take All Necessary Measures To Defend Its Sovereignty And Airspace.

Time: 2025/06/13 16:27:01 Read: 1,170 times {Political: Al Furat News} Prime Minister Mohammed Shia al-Sudani received today, Friday, the Chargé d'Affaires of the United States Embassy in Iraq, Stephen Fagin, and the Commander of the International Coalition Forces to Fight ISIS, General Kevin Leahy, following the dangerous developments resulting from the attack on the Islamic Republic of Iran.

Al-Sudani To US Diplomat: Iraq Will Take All Necessary Measures To Defend Its Sovereignty And Airspace.

Time: 2025/06/13 16:27:01 Read: 1,170 times {Political: Al Furat News} Prime Minister Mohammed Shia al-Sudani received today, Friday, the Chargé d'Affaires of the United States Embassy in Iraq, Stephen Fagin, and the Commander of the International Coalition Forces to Fight ISIS, General Kevin Leahy, following the dangerous developments resulting from the attack on the Islamic Republic of Iran.

Al-Sudani reiterated Iraq's firm and decisive position that the actions against Iran constitute a flagrant violation of international law and an act of aggression that undermines the rules of the international order and threatens regional and international security.

He emphasized that the timing of the attack, which came at a time when diplomatic efforts were still underway, not only undermines de-escalation efforts but also reveals a deliberate intent to escalate and drag the region into a wider confrontation, rather than prevent it.

The Prime Minister reiterated his categorical rejection of the use of Iraqi territory or airspace to carry out or facilitate any aggressive acts against any neighboring country, affirming Iraq's right and responsibility to protect its sovereignty and that the Iraqi government will take all legal measures to this end. He also called on all international parties to respect this principle.

Al-Sudani stressed the need for the international community, particularly the UN Security Council, to take responsible and direct steps to reaffirm the prohibition on the use of force and work to prevent the region from sliding into a cycle of uncontrolled violence.

For his part, the Chargé d'Affaires and Commander of the Coalition Forces affirmed the United States' stated position of not participating in the attack in any way, noting their country's commitment to not involving Iraq in the conflict, in accordance with the Strategic Framework Agreement signed between the two countries. LINK

The Federation Of Industries Reveals A "Qualitative Shift" In The Path Of Iraqi Industry.

Local The head of the Iraqi Federation of Industries, Adel Akab, confirmed on Friday that the launch of the "National Code Platform" to introduce Iraqi industrial products represents a qualitative shift in the path of supporting local industry and empowering the private sector.

Akab told the official agency, followed by Al-Eqtisad News, that "Iraqi industry has always lacked an approved national code or a reliable barcode that would be recognized globally, which has been an obstacle to enhancing confidence in local products, especially in foreign markets.

" He explained that "the Iraqi Federation of Industries had previously adopted this file in 2010, but it was not activated due to the lack of appropriate conditions and weak institutional support at the time."

He added, "With direct support from Prime Minister Mohammed Shia al-Sudani, and through tireless efforts and direct coordination with the Industrial Coordination Council, the union has obtained official authorization to be the body authorized to issue the national code for industrial products, especially after a number of Iraqi goods entered the export pipeline. This requires providing reliable standards that specify the country of origin, the percentage of local manufacturing, and inspection and validity details."

He explained that "the program launched last Thursday is not limited to identifying Iraqi goods alone, but rather represents an integrated system to protect the national economy and enhance food and medicine security through a massive central database that documents local production and enables institutions and citizens alike to know the extent of available and surplus stock at any given time."

He continued, "The applied code includes all product information, including date, location, and type of production. It can also be tracked electronically via mobile phone in any country, which helps identify and easily monitor product locations." He emphasized that "this system ensures protection against counterfeiting and is adopted in all countries around the world."

He pointed out that "the launch of the project represents an official transition into implementation, following extensive preparatory work behind the scenes, and is an important step towards enhancing the reliability of the Iraqi product."

On June 5, Prime Minister Mohammed Shia al-Sudani launched the "Iraqi National Code" platform for QR codes to promote Iraqi industrial products. https://economy-news.net/content.php?id=56265

Iraqi Oil Prices Jump On Global Markets

economy | 11:29 - 06/13/2025 Mawazine News - Baghdad - Iraqi oil prices rose on Friday during daily trading in the global market.

According to data reviewed by Mawazine News, Basra Medium crude oil recorded $68.44 per barrel, while Heavy crude oil recorded $65.64 per barrel, with a change of +2.08 for both.

The data also showed global oil prices, with British Brent crude recording $74.37 per barrel, while US West Texas Intermediate crude oil recorded $73.28 per barrel, with a change of +5.01 and +5.24, respectively. https://www.mawazin.net/Details.aspx?jimare=262479

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 6-14-25

Good morning Dinar Recaps,

SEC, Ripple File Motion to Release $125M in Escrow as Case Winds Down

The lawsuit against Ripple, filed by the United States Securities and Exchange Commission (SEC) in December 2020, is finally wrapping up.

Ripple and the SEC filed a joint motion on Thursday to release $125 million in funds held in an escrow account to pay for settlement costs ordered by the court.

Good morning Dinar Recaps,

SEC, Ripple File Motion to Release $125M in Escrow as Case Winds Down

The lawsuit against Ripple, filed by the United States Securities and Exchange Commission (SEC) in December 2020, is finally wrapping up.

Ripple and the SEC filed a joint motion on Thursday to release $125 million in funds held in an escrow account to pay for settlement costs ordered by the court.

According to the letter submitted by both parties, $50 million will be transferred to the SEC for the civil penalty against Ripple, with the remaining $75 million transferred back to Ripple, pending court approval. The filing attorneys wrote:

"The parties’ proposed resolution will preserve the resources of the Second Circuit by avoiding the need to decide appeals, obviate any remand for further proceedings in this Court, and bring 4.5 years of hard-fought litigation to an end."

SEC and Ripple Wind Down Case Following 2024 Ruling

In July 2023, Judge Analisa Torres ruled that secondary sales of the XRP (XRP) token are not securities, granting Ripple and the crypto industry a partial yet major victory.

However, the Judge also ruled that selling XRP to investors during funding rounds did constitute securities sales, due to how the tokens were offered as compensation for investment in a business enterprise.

As a result, Ripple was ordered to pay a $125 million penalty to the SEC as per a subsequent ruling from Judge Torres in August 2024.

Unsatisfied with the outcome, the SEC filed an appeal in October 2024 — roughly one month ahead of the 2024 U.S. presidential election.

Brad Garlinghouse, the CEO of Ripple, announced that the SEC was dropping the appeal, in a March 19 X post, accompanied by a video statement from the CEO celebrating the outcome as the de facto “ending” of the case.

Shortly after the announcement, Ripple agreed to drop its cross-appeal with the SEC. The crypto firm also secured a refund from a lower court, allowing it to retain $75 million of the $125 million penalty stipulated in the August 2024 ruling.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

BRICS & De-dollarization: US Dollar Faces Severe Crisis as Allies Exit

The BRICS de-dollarization efforts have catalyzed various major transformations as member nations—and others—implement strategic measures to reduce dollar dependency in international trade.

Through several key approaches, the economic bloc has spearheaded what experts describe as a severe US dollar crisis via local currency agreements and alternative payment systems.

Across multiple significant areas, this global trade shift has become the most substantial challenge to American financial dominance. The BRICS currency alternative is gaining momentum through bilateral agreements.

The use of the US dollar in trade among BRICS countries has been reduced to approximately one-third of its previous level, and the de-dollarization impact now extends beyond economics, as nations seek greater financial sovereignty and independence.

BRICS Push New Currency as Dollar Loses Trust in Global Trade Shift

Bilateral Currency Agreements Accelerate BRICS De-dollarization

Through numerous developments, BRICS de-dollarization initiatives have reshaped global trade via direct bilateral currency agreements.

Russia and China have led the way, with over one-third of Russian trade conducted in Chinese yuan by the end of 2024. The share of ruble-based exports rose from 10% to over 40% during the first year of the Ukraine conflict, highlighting how geopolitical pressure can hasten these shifts.

Brazil has also advanced this agenda. At the 2023 business forum in Beijing, China and Brazil established direct exchanges between the Brazilian real and the yuan. Brazilian banks now use China’s cross-border payment system, making yuan transactions simpler and more efficient.

India and the UAE entered an agreement to trade in Indian rupees, including a major deal where India purchased one million barrels of oil and paid in rupees. This deal occurred days before the UAE’s BRICS invitation, signaling widespread interest in dollar alternatives.

Tanzania’s ban on the US dollar helped pave the way for neighboring countries like Kenya and other East African Community nations to explore similar paths.

BRICS Pay System Challenges Western Financial Infrastructure

BRICS nations have developed BRICS Pay, a decentralized payment messaging system that allows transactions in local currencies, aiming to reduce dependence on Western systems like SWIFT. This is a technological breakthrough in the bloc’s de-dollarization effort and a direct challenge to US financial dominance.

The New Development Bank (NDB) plays a crucial role in this transformation. With an authorized capital of $100 billion, the NDB has financed infrastructure projects in local currencies, reinforcing financial sovereignty and weakening traditional Western institutions.

In Brazil, the NDB has financed BRL 1,041 million (RMB 1,425 million) to expand power distribution infrastructure.

In Russia, the NDB provided $68.8 million for the Ufa East Exit Project.

These investments show how de-dollarization is evolving from policy into tangible infrastructure and economic development.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Realized Cap: XRP Overtakes Solana

While attention focuses on upcoming regulations and ETFs in the making, a less-publicized technical indicator is reshuffling the deck. XRP has recorded a fourfold increase in its realized capitalization compared to Solana.

This capital shift hints at a deeper and unexpected market dynamic, challenging the current wave of enthusiasm around Solana. Behind this metric, a change in investor perception appears to be unfolding—returning XRP to a central role in the altcoin arena.

▪️ XRP shows a +4.2% increase in realized capitalization vs. +1% for Solana over the past 30 days

▪️ The difference suggests a rapid capital rotation toward XRP, signaling short-term renewed investor confidence

▪️ Webus International, VivoPower, and Wellgistics have committed over $470 million to XRP treasury strategies

▪️ XRP is aligning with institutional standards, while Solana enters a consolidation phase

The Indicator Reshaping the Map: XRP Leads Solana

While ETFs may eventually push both XRP and Solana to new highs, Ripple’s token has already surged ahead in terms of realized capitalization—a key on-chain metric. According to Glassnode, XRP is up +4.2% in 30 days, while Solana has risen just +1%.

This clear differential shows accelerated fund inflows into XRP, suggesting traders and investors are showing short-term renewed conviction in the asset.

In contrast, Solana’s slower pace comes despite being a focal point in ETF discussions. This divergence implies that real capital flows are favoring XRP, which may not yet be reflected in market buzz.

Understanding Realized Capitalization

To grasp the importance of this evolution, it’s essential to understand the metric itself:

▪️ Realized capitalization represents the aggregated value of tokens based on their last transaction price—a more accurate reflection of “activated wealth”

▪️ XRP: +4.2% increase signals not just speculation, but committed capital inflows

▪️ Solana: +1% suggests a consolidation phase or waning buyer momentum

▪️ The direct read: investors may be shifting into XRP for yield, stability, or tactical repositioning

In fast-moving markets where technical indicators carry weight, this shift in realized cap could mark the early stages of a broader trend.

Institutional Adoption & Legal Clarity Boost XRP

A major driver behind XRP’s momentum may be institutional engagement:

Webus International ($300M)

VivoPower ($121M)

Wellgistics ($50M)

Together, these firms have committed over $470 million to XRP treasury strategies.

Additionally, Trident, a Nasdaq-listed company in Singapore, is planning to raise $500 million, also focused on XRP.

These moves come amid a dramatically improved legal climate for Ripple. The SEC and Ripple recently filed a joint motion to dissolve an injunction and cancel a $125 million penalty, signaling potential resolution of long-standing regulatory hurdles.

Unlike Solana, which relies on its developer ecosystem and ETF hype, XRP is increasingly viewed as an operational treasury asset—bridging traditional finance and crypto.

From Speculative Token to Strategic Reserve

By combining:

Rising technical indicators

Institutional capital allocation

Legal resolution with the SEC

XRP appears to be undergoing a strategic transformation—from a speculative token to a practical institutional-grade reserve asset.

If sustained, this shift could mark a lasting turning point in XRP’s role within the global financial system, far beyond temporary price movement.

@ Newshounds News™

Source: Cointribune

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 6-14-2025

TNT:

Tishwash: The size of Iraq's external and internal debt

The Central Bank of Iraq revealed on Saturday the size of Iraq's external and domestic debts for 2024.

The bank stated in an official statistic, a copy of which was received by the (Video News) Agency, that the volume of debt owed by Iraq in 2024 amounted to 54 billion and 601 million dollars, a decrease of 2.94% compared to 2023, in which the debt amounted to 56 billion and 207 million dollars.

It added that the internal public debt amounted to 85 trillion and 586 billion dinars at the end of June, an increase compared to 2024, in which the internal debt amounted to 83 trillion and 80 billion dollars.

TNT:

Tishwash: The size of Iraq's external and internal debt

The Central Bank of Iraq revealed on Saturday the size of Iraq's external and domestic debts for 2024.

The bank stated in an official statistic, a copy of which was received by the (Video News) Agency, that the volume of debt owed by Iraq in 2024 amounted to 54 billion and 601 million dollars, a decrease of 2.94% compared to 2023, in which the debt amounted to 56 billion and 207 million dollars.

It added that the internal public debt amounted to 85 trillion and 586 billion dinars at the end of June, an increase compared to 2024, in which the internal debt amounted to 83 trillion and 80 billion dollars. link

************

Tishwash: International coalition air defenses shoot down a drone near Ain al-Asad base.

A security source reported that a drone was shot down near Ain al-Asad Air Base in Anbar.

The source said, "The defenses of the international coalition forces shot down a drone near Ain al-Asad Air Base."

He added, "The aircraft is unknown and will be identified through forensic examination." link

************

Tishwash: The Iraq Investment Forum has been postponed until further notice.

The Iraqi Economic Council announced, on Friday, the postponement of the Iraq Investment Forum, which was scheduled to be held on June 14 and 15, until further notice.

The council said in a statement received by the Iraqi News Agency (INA), that "the final preparations for holding the forum have been fully completed, and official invitations have been sent to guests from more than 35 Arab and foreign countries."

The statement added that "the postponement decision came as a result of the repercussions and unstable conditions in the region, which directly affect Iraq and neighboring countries, and led to the closure of airspace and airports in a number of countries, including Iraq."

It indicated that "the Supreme Organizing Committee has decided to postpone the forum until further notice to be determined later." link

************

Tishwash: Al-Sudani to the US Chargé d'Affaires: We will take all necessary measures after the use of Iraqi airspace to bomb Iran.

Prime Minister Mohammed Shia al-Sudani reiterated his rejection of the use of Iraqi territory or airspace to carry out aggressive acts against any neighboring country, while affirming the country's right to take legal action in this regard.

The Prime Minister's Office said in a press statement that "al-Sudani received the Chargé d'Affaires of the United States Embassy in Iraq, Stephen Fagin, and the Commander of the International Coalition to Defeat ISIS, General Kevin Leahy, following the dangerous developments resulting from the attack on the Islamic Republic of Iran."

According to the statement, al-Sudani pointed out "Iraq's firm and decisive position that what happened against Iran represents a flagrant violation of international law and an aggressive act that undermines the rules of the international system and threatens regional and international security," stressing that "the timing of the attack, which came at a time when diplomatic efforts are still underway, not only weakens de-escalation efforts, but also reveals a deliberate intention to escalate and drag the region into a wider confrontation rather than prevent it."

He reiterated Iraq's absolute rejection of the use of Iraqi territory or airspace to carry out or facilitate any aggressive acts against any neighboring country, and emphasized Iraq's right and responsibility to protect its sovereignty, stressing that the Iraqi government will take all legal measures to this end, while calling on all international parties to respect this principle.

Al-Sudani also stressed "the need for the international community, especially the United Nations Security Council, to take responsible and direct steps to reaffirm the prohibition on the use of force and work to prevent the region from sliding into a cycle of uncontrolled violence."

For his part, the Chargé d'Affaires and Commander of the Coalition Forces affirmed the United States' declared position of not participating in the attack in any way, indicating their country's keenness to prevent Iraq from being drawn into the conflict in accordance with the Strategic Framework Agreement signed between the two countries. link

****************

Mot: Camping is Fun - They Said!!!

Mot: Its Getting - out of hand it is!!!

Ariel : The Three Things to End it all

Ariel : The Three Things to End it all

June 13, 2025

Coming In Hot

The Three Things To End All:

The Stablecoin Bill

The GENIUS Act

SEC/Ripple Case

Ariel : The Three Things to End it all

June 13, 2025

Coming In Hot

The Three Things To End All:

The Stablecoin Bill

The GENIUS Act

SEC/Ripple Case

We are on the cusp of events taking a definitive turning point in American history that will be talked about for eons to come.

Are you ready?

Watcher.guru: JUST IN: President Trump says he's working to create "clear and simple market framework" that will allow America to Dominate Bitcoin and crypto.

https://twitter.com/i/status/1933173921198547441

Francis Hadlocon @fns_francis

The Stablecoin Bill sets the rails.

The GENIUS Act unlocks asset-backed flows.

The SEC/Ripple case clears the gatekeepers.

Together, they don’t just regulate.

They replace; fiat scaffolding gives way to programmable, ledger-native liquidity.

Trump’s “clear and simple market framework” isn’t a tech policy. It’s an open signal: the U.S. won’t lead crypto through innovation; it will dominate by legal embedding.

This is how resets happen:

– Institutions pre-position quietly

– Legislation locks timing

– Public “clarity” arrives only after infrastructure is live

America won’t adopt the new system.

It will announce it’s been running it all along.

Source(s): https://x.com/Prolotario1/status/1933175878046843308

https://dinarchronicles.com/2025/06/13/ariel-prolotario1-the-three-things-to-end-it-all/

Monetary Reset and Debt Jubilee?????

This Ends in Chaos: Bloodshed and Revolution in Coming Debt Collapse

Daniela Cambone: 6-13-2025

“I don’t see how we make it to the end of Trump’s four-year term without some sort of very extreme debt event,” warns Tom Bilyeu, CEO of Impact Theory.

In his conversation with Daniela Cambone, Bilyeu argues that U.S. government, corporate, and individual debt levels are unsustainable. To maintain social and economic stability, he believes the country will be forced to print massive amounts of money—eroding the dollar’s value and widening the wealth gap.

This Ends in Chaos: Bloodshed and Revolution in Coming Debt Collapse

Daniela Cambone: 6-13-2025

“I don’t see how we make it to the end of Trump’s four-year term without some sort of very extreme debt event,” warns Tom Bilyeu, CEO of Impact Theory.

In his conversation with Daniela Cambone, Bilyeu argues that U.S. government, corporate, and individual debt levels are unsustainable. To maintain social and economic stability, he believes the country will be forced to print massive amounts of money—eroding the dollar’s value and widening the wealth gap.

“We’re gonna print, print, print to calm people down because nobody has the discipline to say, ‘Yeah, it’s gonna suck, but it’s gonna suck a lot less than the implosion of the entire economy.’”

Bilyeu also addresses the growing discussion around a “monetary reset,” which he interprets as a debt jubilee—a dramatic cancellation of debts that has historically triggered unrest.

“Take your revolutionary pick… whether you like your chaos in the French style or the American Revolution—those are never subtle.”

Chapters:

00:00 The precarious state of U.S. debt

03:43 Basic steps for protecting your finances

07:00 Why can’t the Fed fix this?

10:00 Consumer debt hits alarming levels

11:43 How close are we to a breaking point?

12:46 Trump’s vision for America and its consequences

15:43 The case for a monetary reset

17:00 Could a gold-backed system return?

18:55 Economic unrest on the streets of L.A.

20:43 A potential awakening moment for the nation

23:26 Tom’s view on the physics of money

26:27 Tom’s advice to everyday Americans