Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 7-13-24

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Minimal registration requirements

Edun warned that companies might exploit minimal registration requirements to falsely claim they are licensed, undermining market integrity. Highlighting the potential for regulatory arbitrage, he urged the SEC to implement top-notch corporate governance practices, swiftly identify and disclose conflicts and adhere to global best practices.

The minister also encouraged the newly inaugurated SEC board members to adopt innovative strategies to regulate the country’s capital market effectively. He stressed the importance of staying informed and proactive amid rapid developments in artificial intelligence, digital currency and overall digital transitions.

“Unlike basic industries with settled technologies, the financial sector is rapidly evolving with innovations in fintech, AI and crypto. To provide necessary approvals and guidance, the SEC must stay informed and adaptable.”

SEC pledges innovation and growth

In response, the Chairman of the SEC board, Mairiga Katuka, assured the minister that the board would leverage its collective expertise, innovation and passion to drive growth.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

RIPPLE's APPEAL TO CENTRAL BANKS: SPEED, SECURITY, AND DIGITAL INNOVATION

—Ripple’s appeal to central banks lies in its promise of speed, security, and digital innovation, challenging traditional banking methods with blockchain technology for instant global transfers.

—Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers.

Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies.

Central banks are considering Ripple for its speed, security, and modern appeal. Traditional transfer methods, once slow and cumbersome, can now be transformed into swift, secure blockchain transactions. Moreover, Ripple enables transaction settlements in fractions of a second instead of days, with cryptographic security ensuring maximum protection. This innovation has even the most conservative bankers excited about the possibilities Ripple brings to the table.

By adopting Ripple solutions, central banks have the opportunity to transition into new-age technological platforms instead of being perceived as outdated institutions. This could bring a fundamental change in the way we conduct global transactions more efficiently and securely.

The adoption of CBDCs on Ripple’s platform has the potential to revolutionize the financial industry. Central banks now stand at a crossroads, with the opportunity to lead the digital transformation of finance.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

HEDRA HASHGRAPH LEADS BLOCKCHAIN INNOVATION WITH NEW SCALABILITY BREAKTHROUGH

—The Hedera Foundation has launched two pilot Request for Proposals (RFPs) aimed at addressing specific ecosystem needs, inviting global developers to apply for grants.

—The initiative aims to enhance transparency and collaboration, providing up to 10 million HBAR in support, to accelerate the growth and development of the Hedera ecosystem.

On Thursday, July 11, the HBAR Foundation announced its pilot Request for Proposal (RFP) to deliver a more transparent and community-supported element to grant giving. Hedera stated that they are piloting two separate RFPs for building solutions thereby meeting specific ecosystem needs. Besides, this development comes as Hedera has been leading in crypto development activity, per the CNF update.

The Hedera Foundation is launching two pilot RFPs aimed at addressing specific needs within the ecosystem. they have also invited developers from across the globe to apply for these grants, with the selection process incorporating open and public community input.

The goal of this pilot is to gather insights from the initial RFPs to enhance and formalize the foundation’s grant program. This would ultimately accelerate the growth and development of the Hedera ecosystem.

We’re excited to announce the launch of our pilot Request For Proposal (RFP) process to to deliver a more transparent, #Hedera community-supported element to grant giving 🤝 pic.twitter.com/VNnatTK5GY

— HBAR Foundation (@HBAR_foundation) July 11, 2024

Hedera Targets Lending Markets With RFP Pilots

The pilot initiative will include two distinct RFPs designed to meet specific requirements:

Credit Market Development: This grant will follow the structure of a standard THF development grant, with funding allocated based on the completion of well-defined development milestones.

Credit Market Liquidity: This grant will be modeled after a network utilization incentive pool. The incentive pool will be evergreen and may be replenished based on ecosystem needs.

The Foundation is initially committing up to 10 million HBAR in support, available to eligible teams. Given the evergreen nature of the pool, project teams can apply multiple times depending on their liquidity needs. Each proposal must align with specific growth objectives, and applicants are required to outline milestones and goal KPIs. The Hedera Foundation also mentioned some of the benefits of conducting the pilot which include:

Increased Transparency and Clarity: By clearly outlining funding intentions, the Hedera Foundation (THF) can provide more timely updates to the community about key priorities. This approach offers further clarity to teams who may not qualify for a grant, not due to inadequacy but because their proposals might not align with the network’s most pressing needs.

Enhanced Ecosystem Collaboration and Diversification of Ideas: By inviting broader participation, THF aims to foster greater collaboration between itself, applicants, and the community, all working together to find better solutions. Additionally, creating more opportunities for builders to share their visions, ideas, and educational insights directly with the community before launching products or platforms will add significant value throughout the development cycle.

Moreover, the Hedera blockchain has been part of some key projects. As reported by Crypto News Flash, Sweden’s central bank tested its retail banking solutions on the Hedera network. Additionally, consulting giant Deloitte also joined hands with Hedera to build next-generation blockchain solutions, per the CNF update.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

DWS MOVES TOWARD FIRST GERMAN-REGULATED EURO STABLECOIN

German asset management company DWS has launched a new company in a step towards creating the first German-regulated cryptocurrency.

Deutsche Bank-owned DWS announced the launch of the company as part of their wider plan to go live with the new euro stablecoin next year, marking a significant step for the European financial sector considering DWS manages assets worth €941 billion.

The cryptocurrency is set to be regulated by Germany’s Federal Financial Supervisory Authority (BaFin) as DWS looks to be the first company being granted a German e-money licence for a stablecoin.

The newly created company, AllUnity, is a collaboration between DWS, Flow Traders, and Galaxy Digital, working together to introduce the new stablecoin.

Stefan Hoops, CEO of DWS, commented that the stablecoin will gain interest from a broad range of clients, including digital asset investors and industrial applications.

“In the short term, we expect demand from investors in digital assets, but by the medium term we expect wider demand, for instance from industrial companies working with ‘internet of things’ continuous payments,” Hoops stated.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

JAPAN'S CURRENCY HAS STEADILY LOST VALUE AGAINST THE USD OVER THE LAST 12 MONTHS

Japan likely conducted a $22 billion intervention yesterday to support its currency.

Japan spent a record $62 billion in May to prop up the yen.

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Ripple’s Appeal to Central Banks: Speed, Security, and Digital Innovation

"Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers."

"Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies."

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

CENTRAL BANKS ARE BUYING GOLD TO PREPARE FOR A NEW GOLD STANDARD

"Record buying of gold by central banks, which are matching their gold reserves relative to GDP with other countries, revived the debate about the possibility of a reboot of the current monetary system based on a new gold standard."

"Global central banks have been buying record amounts of gold since the beginning of 2022. The pace and regularity with which central banks accumulate gold is unprecedented, as they have been mostly sellers of the precious metal throughout history. This extraordinary demand for gold by central banks, the largest in 55 years, is attributed to a desire to diversify their reserves and reduce dependence on the dollar."

"But beyond the intrinsic capacity of physical gold to maintain its value in the face of economic uncertainty, some indicators suggest that this accumulation of gold by central banks is just the prelude to a restart of the international monetary system and a possible return to the gold standard."

"The bad monetary policies that caused the housing bubble and the way fiat currencies have been managed since the 2008 crisis, depreciating the dollar and exporting US domestic problems to the rest of the world, along with economic sanctions on countries not aligned with Western geopolitical and economic interests, have undermined the credibility of the international monetary system. An alternative based on a new, multipolar, more stable and less inflationary gold standard seems closer than ever, and global central banks want to be included."

@ Newshounds News™

Read more: 11onze

~~~~~~~~~

JPMorgan Chase, Wells Fargo Suffer $3,500,000,000 in Losses As US Banks Report Massive Surge in Bad Debt

Two of the largest banks in the US are declaring a loss on a staggering $3.5 billion in debts that customers can’t pay back.

JPMorgan Chase says its net charge-offs, which are delinquent debts that banks do not expect to receive, hit $2.2 billion in the second quarter of the year.

That’s a $200 million increase from the previous quarter and an $800 million increase from Q2 of 2023.

Meanwhile, Wells Fargo says its net charge-offs surged from $764 billion in Q2 of 2023 to $1.3 billion last quarter – a 70% increase.

Although the pace of inflation has reduced, Wells Fargo’s chief financial officer Michael Santomassimo tells the New York Times that many customers are clearly struggling as their credit card balances rise and savings dwindle.

“[Inflation is] still cumulatively having a bit impact. The folks on the lower end of the wealth or income spectrum are struggling more than folks that are on the higher end.”

In addition to its charge-offs, JPMorgan declared an additional $500 million in losses from failing mortgage investments.

US banks have been sounding the alarm on its customers’ growing credit card balances and issues in the commercial real estate industry since last year.

In its new report, Wells Fargo says it earned a Q2 profit of $4.9 billion, although the bank’s shares tumbled 6% on Friday after net interest income fell short of estimates.

JPMorgan Chase reported a quarterly profit of $13.1 billion as its stock hovers near its all-time high.

@ Newshounds News™

Read more: DailyHodl

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Late Friday Night 7-12-24

Foreign Minister Discusses With Washington The Issue Of Frozen Iranian Funds In Iraq

Money and business Economy News – Baghdad Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein held an important meeting with the US Under Secretary of State for Political and Administrative Affairs, John Bass, in Washington, DC, during which the issue of frozen Iranian funds in Iraq was discussed.

According to a statement by the Ministry of Foreign Affairs, Fuad Hussein stressed "the importance of strengthening US-Iraqi relations in various fields," noting "the common desire to expand political and economic cooperation between the two countries."

The Minister addressed the issue of frozen Iranian funds in Iraq, stressing the need to find a quick and fair solution that serves the interests of both parties and enhances financial stability in the region.

Foreign Minister Discusses With Washington The Issue Of Frozen Iranian Funds In Iraq

Money and business Economy News – Baghdad Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein held an important meeting with the US Under Secretary of State for Political and Administrative Affairs, John Bass, in Washington, DC, during which the issue of frozen Iranian funds in Iraq was discussed.

According to a statement by the Ministry of Foreign Affairs, Fuad Hussein stressed "the importance of strengthening US-Iraqi relations in various fields," noting "the common desire to expand political and economic cooperation between the two countries."

The Minister addressed the issue of frozen Iranian funds in Iraq, stressing the need to find a quick and fair solution that serves the interests of both parties and enhances financial stability in the region.

In the context of enhancing economic cooperation and bilateral relations, special emphasis was placed on enhancing economic cooperation between the United States and Iraq. Minister Hussein pointed out the importance of supporting the financial and banking sector in Iraq, with an emphasis on the challenges related to the use of the dollar in financial transactions.

He stressed the "need to find solutions that enhance the stability of the Iraqi economy and contribute to achieving sustainable growth." 2024/07/12 - https://economy-news.net/content.php?id=45145

Foreign Minister From Washington: The US Treasury Evaluated The Efforts Of The Central Bank Positively

Political Yesterday, 23:09 Washington – IA Deputy Prime Minister and Foreign Minister Fouad Hussein confirmed that the US Treasury Department evaluated the efforts of the Central Bank positively, while indicating that a military delegation would visit Washington to hold security discussions.

Hussein said in a press conference held in the American capital, Washington, attended by the Iraqi News Agency (INA), that “our visit to Washington was to attend the NATO summit at the invitation of the American side, and on the sidelines of the summit we held extensive meetings with leaders of several countries, and we held a meeting with the US Treasury Department to discuss issues.” Related to monetary policy and banking signals.

He added, "The US Treasury Department positively evaluated the efforts of the Central Bank," noting that "a military delegation will visit Washington to hold discussions about the security agreement concluded between Iraq and the United States." He continued: "We discussed in the NATO meetings the future of the international mission, along with cooperation with the Iraqi Ministry of Defense." https://www.ina.iq/212487--.html

ICC Opens Office In Iraq: This Is What We Are Working On

Money and business Economy News - Follow-up The Paris-based International Chamber of Commerce (ICC) has announced the expansion of its global presence through the official launch of the chamber’s new headquarters in Iraq from the French capital, thus enhancing the spread of the chamber’s network of offices worldwide.

According to the official website of the International Chamber of Commerce, which was founded in 1919 in the French capital, it has a network of offices in more than 170 countries, and represents more than 45 million business companies.

The website stated that the official launch of the International Chamber of Commerce in Iraq was celebrated at the global headquarters of the Chamber in Paris, which will work to enhance the mission of the International Chamber of Commerce in Iraq, and strengthen the voice of Iraqi businessmen and chambers all over the world.

The report indicated that the International Chamber of Commerce of Iraq will constitute an addition to the total number of international chambers of commerce, reaching 92 around the world.

He added that a delegation from the International Chamber of Commerce of Iraq joined the official celebration in Paris, which was followed by a celebration at the Iraqi embassy in the French capital.

“The context in which companies operate today is one of geo-economic and geopolitical tensions that are causing instability, uncertainty and new challenges in Iraq and beyond,” ICC Secretary General John W. H. Denton was quoted as saying in the report. “Bringing our mission to Iraq will deliver real value to Iraqi companies and the real economies in which they operate.”

According to the report, the ICC Iraq will support the ICC’s institutional goals of promoting peace, prosperity and opportunities for all through local committees on arbitration, alternative dispute resolution, digital economy, intellectual property, trade and investment.

The report pointed out that the founding members of the International Chamber of Commerce of Iraq are Abdul Razzaq Al-Zuhairi, who holds the position of honorary president of the International Chamber of Commerce of Iraq and president of the Federation of Iraqi Chambers of Commerce, in addition to the president of the International Chamber of Commerce of Iraq, Mohsen Al-Hamid, who also heads the “Asriya Group”, along with Ahmed Al-Yasiri, Secretary-General of the International Chamber of Commerce of Iraq, who is also an advisor on international organizations.

The report concluded by pointing out that the members of the International Chamber of Commerce of Iraq, through their headquarters in Iraq, help formulate the policies of the International Chamber of Commerce and alert governments to what interests international business. 106 views 2024/07/12 - https://economy-news.net/content.php?id=45146

Rafidain: The Digital Transformation Plan Is Proceeding According To The Set Schedule

Posted On2024-07-12 By Sotaliraq Rafidain Bank announced the implementation of the comprehensive banking system in the Baladruz branch in Diyala Governorate, stressing that the digital transformation plan is proceeding according to the scheduled timings.

The statement said, “In implementation of the government program to move from paper transactions to electronic transactions to provide the best services to citizens, Rafidain Bank announces the implementation of the comprehensive banking system in the Baladruz branch in Diyala.”

The statement added that the Baladruz branch “has thus joined the branches that have activated the comprehensive system in Baghdad and the governorates, in addition to the border crossing branches (Zurbatiyah - Safwan - Arar - Trebil), so that the number of branches that have implemented and completed the system has become 32 branches, in an important step to strengthen the banking system and achieve its requirements and leave paper work and move completely to electronic systems.”

He stressed that “the digital transformation plan and the adoption of the comprehensive banking system are proceeding according to the set timetables to include all bank branches in the implementation of the system, especially since the priorities and adoptions of the government program include electronic transformation in financial transactions, reducing the circles of routine for citizens, shortening time, simplifying procedures, overcoming obstacles, and intensifying efforts to improve the level of services provided to customers and completing their transactions.” LINK

The Iraqi Chambers Of Commerce Signs A Memorandum Of Understanding With Its European Counterparts

Economy European Union Federation of Iraqi Chambers of Commerce Memorandum of Understanding

2024-07-12 08:22 Shafaq News/ The European Union Ambassador to the Republic of Iraq, Thomas Seiler, announced that Iraq had signed a memorandum of understanding with the European Chambers of Commerce.

Sayler said in a statement received by Shafaq News Agency:

“On my initiative, the Federation of Iraqi Chambers of Commerce and the European Chambers (its counterpart at the European Union level) signed today in Brussels a memorandum of understanding for mutual cooperation.”

He added, "This understanding will give Iraqi companies access to better options for cooperation and trade with companies in a large market that includes more than 40 European countries, including the 27 member states of the European Union." He stressed that "supporting small and medium-sized companies and developing the private sector is a major political goal of our cooperation with Iraq." https://shafaq.com/ar/اقتصـاد/غرف-التجارة-العراقية-توق-ع-مذكرة-تفاهم-مع-نظيراتها-الاوروبية

For The First Time...Non-Oil Revenues Recorded An Increase Of 11%

July 11, 2024 Economy / Iraq Obzirfar A report of economic studies and consultations revealed today, Thursday, that

it is the first time in the Iraqi state’s revenues that non-oil revenues have recorded an increase of 11% of total revenues, while oil revenues have fallen below the 90% barrier. The report, which was followed by “Iraq Observer,” said,

“For the first time, Iraq’s non-oil revenues recorded an increase of approximately 11% of total revenues, and oil revenues fell below the 90% barrier.”

He added, "Non-oil revenues for the first five months of the year recorded an amount of 6.24 trillion Iraqi dinars, while oil revenues for the first five months of the current year recorded an amount of 48.4 trillion Iraqi dinars."

He continued, “Revenues from taxes on income and wealth rose by 118%, revenues from commodity taxes and production duties rose by 285%, revenues from duties rose by 50%, while oil revenues rose by 6.4%.”

He stated, “The increase in non-oil revenues is an achievement of economic reform policies and mechanisms for controlling taxes and customs tariffs.” He expected that “the total non-oil revenues for the year 2024 will amount to 15 trillion Iraqi dinars, but they are far from the plan in the 24 budget tables, amounting to 27 trillion dinars.” https://observeriraq.net/لأول-مره-الإيرادات-غير-النفطية-تسجل-ا/

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

MilitiaMan: IQD Updates - Iraqi Dinar - Internationalism - WTO - Mechanism - Stability - Major Economic Movement

QD Updates - Iraqi Dinar - Internationalism - WTO - Mechanism - Stability - Major Economic Movement

MilitiaMan and Crew: 7-12-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

IQD Updates - Iraqi Dinar - Internationalism - WTO - Mechanism - Stability - Major Economic Movement

MilitiaMan and Crew: 7-12-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Friday Afternoon 7-12-24

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

"CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

"Federal legislation is urgently needed to create a pathway for a regulatory framework that will protect American investors and possibly the financial system from future risk.”

"Dr. Roger Marshall, the Republican Senator from Kansas, brought up the turf war between the SEC and the CFTC over who gets to regulate digital assets, and asked Behnam, “Wouldn’t it be simpler if we put this whole thing under the CFTC's jurisdiction?”

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

PUTIN SAYS THAT BRICS WILL LIKELY CREATE THEIR OWN PARLIAMENT while speaking at the 10th BRICS Parliamentary Forum

"Russia’s President Vladimir Putin, speaking Thursday at the tenth BRICS Parliamentary Forum in St. Petersburg, indicated his openness to the creation of a BRICS Parliament. "

"Present were guests from 18 countries, including non-BRICS CIS States. This is the first such forum since the UAE, Iran, Egypt, and Ethiopia joined the group in January."

“BRICS does not yet have its own parliamentary institution, however, I believe that the idea will definitely be implemented in the future,” Putin said.

@ Newshounds News™

Read more: The American Conservative

~~~~~~~~~

OIL PRICES RISE AGAINST THE BACKDROPOF DECLINING INVENTORIES

Oil prices rose today, Thursday, against the backdrop of a decline in gasoline stocks and a decline in crude stocks after American refineries intensified processing operations, reflecting strong demand.

Brent crude futures rose 35 cents, or 0.4 %, to $85.43 per barrel.

US West Texas Intermediate crude rose 36 cents, or 0.5 %, to reach $82.47 a barrel.

Source: National Iraqi News Agency

@ Newshounds News™

Read: Iraq News Gazette

~~~~~~~~~

JP MORGAN EXPECTS BITCOIN AND THE CRYPTO MARKET TO REBOUND IN AUGUST

"Investment banking giant JPMorgan recently said that Bitcoin and the greater cryptocurrency market will see a massive rebound take place in August. Indeed, the bank also noted that ongoing liquidations taking place in the market are expected to last through the end of July."

“The reduction in the estimated net flow largely driven by the decline in Bitcoin reserves across exchanges over the past month,” JPMorgan’s Nikolaos Panigirtzoglous said. The bank said that the $12 billion mark was highly doubtful. This is likely due to BTC price relative to the production cost and price of assets like gold."

@ Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

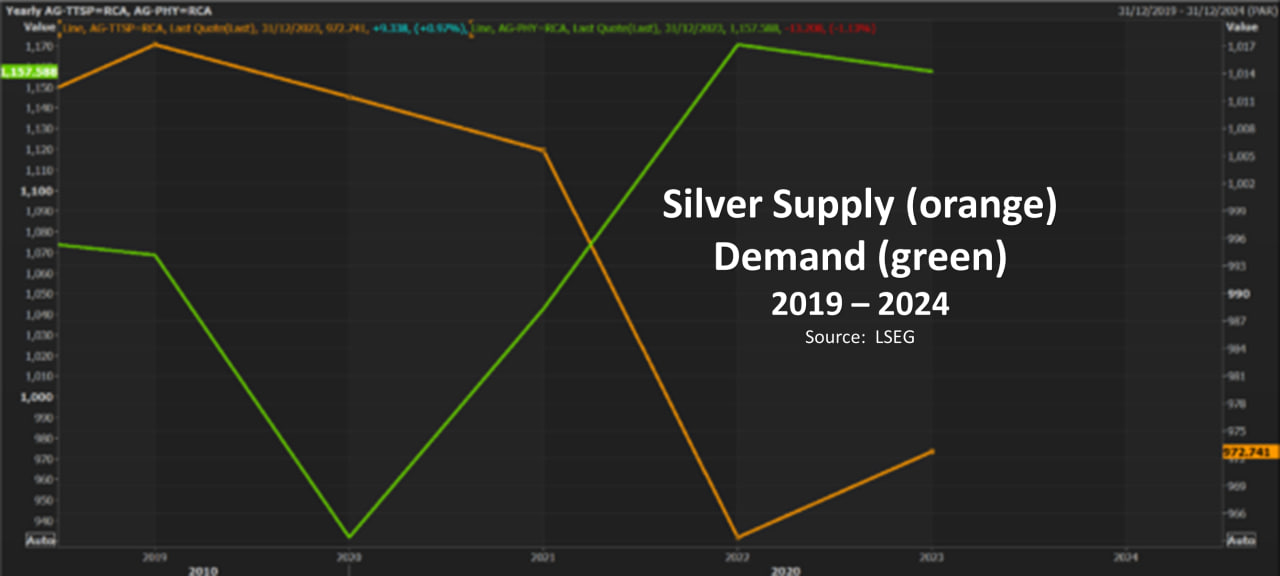

SILVER PRICE OUTLOOK: Will Strong Demand and Tight Supply Keep Prices Shining?

—Silver prices have risen due to a supply and demand gap, with demand outstripping supply for the fifth consecutive year.

—Industrial demand, driven by green energy, AI, and EVs, now accounts for 64% of global silver demand.

—A potential slowdown in China’s economy and prolonged high interest rates could dampen silver prices.

—Bullish Pennant pattern breakout hints at further upside. Will inflation data halt the move?

Silver prices have seen a remarkable rise this year, and with six months still to go, many are wondering just how high they could climb. One key factor to watch is the supply and demand dynamics, as demand for silver continues to outstrip supply.

According to the World Silver Survey, 2024 is the fifth year in a row with a silver shortage. In 2023, silver demand was higher than supply, leading to a market deficit of over 142 million ounces. By the end of 2024, this shortfall is expected to nearly double to 265 million ounces because of increasing industrial demand.

PIC

Silver Supply (Orange Line) and Demand (Green Line), 2019-2024

Historically, half of the demand for silver was for industrial use and the other half for investment. Recently, industrial demand has grown significantly, now making up 64% of global silver demand, up 19% from last year.

This trend shows no signs of slowing. The primary drivers of the silver supply squeeze are the Green Energy Transition, particularly solar energy, and the high demand from the Artificial Intelligence and electric vehicle (EV) sectors. These industries are among the fastest-growing in the world today.

The only worry has been a recent dip in demand from China and the possibility of a slowdown in the Chinese economy. This could help balance the demand and supply gap. Prolonged higher interest rates from Central Banks could also dampen silver prices and possibly stop the rally. The sooner the US Federal Reserve cuts rates, the better it would be for silver prices.

@ Newshounds News™

Read more: Action Forex

~~~~~~~~~

SATOSHI'S VISION STILL ALIVE. BITCOIN IS SHIFTING TOWARDS MORE P2P PAYMENTS

On-chain data suggests Satoshi’s original vision is alive and kicking as the Bitcoin network has shifted towards smaller transactions.

Bitcoin P2P Payment Transfers Have Been Gaining Steam Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about a pattern shift on the BTC network regarding transactions that may be classified as peer-to-peer (P2P) payments.

First, Ju has discussed the trend in the transaction fees on the Bitcoin network. The “transaction fees” here naturally refer to the fees that senders on the blockchain have to attach with their moves as compensation for the validators.

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

THIS ARTICLE IS A PERFECT EXAMPLE OF HOW 3 LETTER AGENCIES CAN LEGISLATE BY MAKING "RULES" THEN PROCEED TO "ENFORCE" THOSE RULES WITHOUT THEM EVER BECOMING LAW OR SOMETIMES SLIPPING THROUGH A REVIEW PROCESS BY LAWMAKERS

GAO Concludes SEC's SAB 121 Is Subject to Congressional Review Act

"The SEC’s staff accounting bulletin 121 says that when an entity has an obligation to safeguard crypto for its users, that entity ought to reflect a liability on its balance sheet to reflect its obligation to safeguard that crypto at the fair value of the crypto. SAB 121 also says that the entity should, in turn, recognize a corresponding asset on its balance sheet measured at the fair value of the crypto."

"SEC Chair Gensler has said he is “actually quite proud” of SAB 121."

So, bottom line, if a something is a “rule” for purposes of the CRA, Congress has to be given a chance to review and reject that rule under fast-track procedures.

The GAO Says SAB 121 Is a Rule

"In August 2022, Senator Cynthia Lummis asked the Government Accountability Office to determine whether SAB 121 is a “rule” for purposes of the Congressional Review Act.1"

"Today the GAO released an opinion concluding (over the objections of the SEC) that, yes, SAB 121 is a “rule” for Congressional Review Act purposes."

"SEC did not submit a CRA report to Congress or to the Comptroller General in regard to the Bulletin. In its response to us, SEC maintained that the Bulletin is not subject to CRA because it does not meet the APA definition of a rule as it is not an “agency statement” of “future effect.” Response Letter, at 2–4. For the reasons explained below, we disagree. We find that the Bulletin does meet the definition of a rule under APA and that no exception applies. Thus, the Bulletin is subject to CRA’s submission requirement."

"It is true that the fact that SAB 121 is a “rule” for Congressional Review Act purposes will, for a window of time,2 make this easier. As noted above, a resolution of disapproval brought under the Congressional Review Act cannot be filibustered, so Senator Lummis or another pro-crypto Senator could force a vote on it if they so choose. But legislatively overturning SAB 121 would still require a majority vote in the Senate and in the House, and then the President signing the resolution into law. That seems unlikely here, for obvious reasons."

THIS PARAGRAPH ABOVE IS WHAT TOOK PLACE YESTERDAY (7/11/24) WITH THE HOUSE TAKING A VOTE TO OVERTURN BIDEN'S VETO UNSUCCESSFULLY

"The bigger question though is, regardless of when SAB 121 becomes “effective,” what exactly does that mean? And, equally, what does it mean for SAB 121 to have been ineffective from the time it was issued until the time (presumably in the near future) that the SEC submits SAB 121 to Congress?"

"Here again, I am not sure. The SEC’s position, according to today’s GAO opinion, is that SAB 121 “at most” indicates “how the Office of the Chief Accountant and the Division of Corporation Finance would recommend that the agency act.” So, taking the SEC at face value, SAB 121 should not, on its own, and whether “effective” or otherwise, have been the basis for any action by the Commission."

THE ARTICLE REFERENCED WAS WRITTEN IN OCTOBER OF 2023. THIS SHOWS HOW LONG THE DEBATE OVER SAB 121 HAS BEEN GOING ON. FOR FURTHER CLARITY PLEASE READ THE FULL ATTACHED BLOG ARTICLE.

@ Newshounds News™

Read more: BankRegBlog

~~~~~~~~~

BRICS DEVELOPING A PAYMENT SYSTEM USING BLOCKCHAIN

"In March, we learned that BRICS is actively developing a payment system utilizing the blockchain. Many countries are starting to link payment systems.

Russia and China have almost stopped using the dollar in their mutual trade."

'Trade between Russia and China surged by 26% to $240 billion in 2023, with over 90% of settlements conducted in their national currencies.

This is very significant as the blueprint has arrived.

China's trade with other BRICS members rose 11.3% year-on-year in the first quarter, underscoring the growing ties within the group."

"The result?

More and more countries are shifting to localize trade to become less dependent on the dollar.

They are starting to put their foot down.

This week, a Russian IMF rep said BRICS could offer an alternative currency in the event of the dollar's and the international monetary system's collapse."

"Gold reigns supreme on this reset's chessboard, serving as the most strategic piece in this intricate puzzle."

@ Newshounds News™

Read more: Twitter - Gold Telegraph

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Friday 7-12-2024

HOW to NOT Lose Everything (The Shocking Truth)

Taylor Kenny: 7-11-2024

Imagine waking up to find your savings and assets are suddenly worthless due to a currency reset.

A terrifying reality for millions worldwide.

Taylor Kenney investigates hyperinflation and national debts that can lead to such resets, devastating your personal finances.

With US record breaking debt and persistent inflation, the threat is closer than you think. Act now to ensure your financial security before it’s too late.

HOW to NOT Lose Everything (The Shocking Truth)

Taylor Kenny: 7-11-2024

Imagine waking up to find your savings and assets are suddenly worthless due to a currency reset.

A terrifying reality for millions worldwide.

Taylor Kenney investigates hyperinflation and national debts that can lead to such resets, devastating your personal finances.

With US record breaking debt and persistent inflation, the threat is closer than you think. Act now to ensure your financial security before it’s too late.

CHAPTERS:

00:00 Looming Reset

01:09 Venezuela's Currency Reset

02:30 Argentina's Currency Reset

04:34 Are My Assets Diversified?

06:02 Money vs. Currency

07:48 True Diversification

Customers Panic As $100 Million In Deposits Just Disappeared From Bank Accounts

Atlantis Report: 7-11-2024

In a time when most people use digital transactions and online banking, a recent financial disaster has caused a lot of trouble for banks. Millions are missing from customers' accounts, leaving depositors very worried about their money.

This unusual event has shown that there are problems with financial technology, fintech, and industry and has made people very concerned about the safety of the banking system.

The disappearance of so much money has made people scared that the whole system is about to fail, and trust in banks is diminishing.

*SILVER ALERT! Silver POPS on CPI News as the Silver Riggers are LOSING CONTROL!!

(Bix Weir) 7-12-2024

There is an all out battle in the silver price suppression scheme! On one side is a Cabal of Western Bankers & Monetary Masters that have suppressed the price of silver for the part 175 years.

On the other side is the Industrial Demand for Physical Silver that is INSATIABLE and shows NO SIGN of weakening in the foreseeable future!

The outcome of this Epic Battle will CHANGE THE WORLD!

Iraq News Highlights and Points To Ponder Friday AM 7-12-24

Why Did Iraq Stop Dealing In The Chinese Yuan?

Economy Why did Iraq stop dealing in the Chinese yuan? Doc-P-493658-638563711944282995

1,919 views Alsumaria News – Local The Parliamentary Finance Committee revealed the reasons behind Iraq’s suspension of dealing in the Chinese yuan, while indicating that many of the Central Bank’s procedures are governed by American will.

Committee member Moeen Al-Kazemi said in a statement to Al-Sumaria News, "The US Federal Bank imposed on Iraq to stop dealing in the Chinese yuan, under the pretext that there was manipulation in some transfers or certain problems occurred, indicating that "Iraq's money, as we know, is included in the US Federal Bank as a result of the sale of oil at an amount of 3.5 million barrels per day, and this money enters the Federal Bank and is not transferred to Iraq in cash.

Why Did Iraq Stop Dealing In The Chinese Yuan?

Economy Why did Iraq stop dealing in the Chinese yuan? Doc-P-493658-638563711944282995

1,919 views Alsumaria News – Local The Parliamentary Finance Committee revealed the reasons behind Iraq’s suspension of dealing in the Chinese yuan, while indicating that many of the Central Bank’s procedures are governed by American will.

Committee member Moeen Al-Kazemi said in a statement to Al-Sumaria News, "The US Federal Bank imposed on Iraq to stop dealing in the Chinese yuan, under the pretext that there was manipulation in some transfers or certain problems occurred, indicating that "Iraq's money, as we know, is included in the US Federal Bank as a result of the sale of oil at an amount of 3.5 million barrels per day, and this money enters the Federal Bank and is not transferred to Iraq in cash.

It witnessed a transfer to Iraq through corruption transfers from the Central Bank and the Federal Declaration."

Al-Kadhimi continued, "Many of the central bank's measures are taken by the government with political will, and this will may be explained by administrative and financial reasons, not financing terrorism, and others," and he announced that "the reasons are political with the aim of pressuring the Iraqi government."

Is it possible to deal in Chinese currency?

Al-Kadhimi stressed that "the merchant and the Central Bank must have multiple options and not only deal in dollars, so this suspension is temporary and not permanent," noting that "the committee will ask the Central Bank to address the issue and have a diverse price basket, so that the options are more for the Central Bank and Iraqi merchants."

Al-Kadhimi stated earlier that "China's remittances in the yuan currency have been temporarily suspended until auditing mechanisms are found." He continued, "During the past period, there has been a great deal of manipulation of China's affairs." LINK

Rafidain: The Digital Transformation Plan Is Proceeding According To The Set Schedule

Posted On2024-07-12 By Sotaliraq Rafidain Bank announced the implementation of the comprehensive banking system in the Baladruz branch in Diyala Governorate, stressing that the digital transformation plan is proceeding according to the scheduled timings.

The statement said, “In implementation of the government program to move from paper transactions to electronic transactions to provide the best services to citizens, Rafidain Bank announces the implementation of the comprehensive banking system in the Baladruz branch in Diyala.”[/size]

The statement added that the Baladruz branch “has thus joined the branches that have activated the comprehensive system in Baghdad and the governorates, in addition to the border crossing branches (Zurbatiyah - Safwan - Arar - Trebil), so that the number of branches that have implemented and completed the system has become 32 branches, in an important step to strengthen the banking system and achieve its requirements and leave paper work and move completely to electronic systems.”

He stressed that “the digital transformation plan and the adoption of the comprehensive banking system are proceeding according to the set timetables to include all bank branches in the implementation of the system, especially since the priorities and adoptions of the government program include electronic transformation in financial transactions, reducing the circles of routine for citizens, shortening time, simplifying procedures, overcoming obstacles, and intensifying efforts to improve the level of services provided to customers and completing their transactions. LINK

The Budget Returns To The Halls Of Parliament For This Reason

Alsumaria Special 2024-07-11 | 3,335 views MP Baqir Al-Saadi revealed today, Thursday, that the budget will return to the House of Representatives to make some simple amendments to it.

Al-Saadi said in a special interview with: Alsumaria News "There are some minor comments on the budget, so it was returned to Parliament," he said. He added, "After the tenth ofMuharramThe amendments to the budget will be made by a specialized committee and then submitted to Council of Ministers" LINK

Foreign Minister Stresses To US Official The Importance Of Supporting The Financial And Banking Sector In Iraq

Friday 12 July 2024 10:51 | Politics Number of readings: 140

Foreign Minister stresses to US official the importance of supporting the financial and banking sect 1140965-f2e1a470-176e-40d6-9b92-d542cad3318c

[rtl]Baghdad / NINA / Foreign Minister Fuad Hussein met with US Under Secretary of State for Political and Administrative Affairs John Bass in Washington.

The Foreign Minister stressed the importance of supporting the financial and banking sector in Iraq, with a focus on the challenges related to the use of the dollar in financial transactions.

A statement by the Ministry of Foreign Affairs stated: "The Minister stressed the importance of strengthening US-Iraqi relations in various fields and the common desire to expand political and economic cooperation between the two countries."

The discussion, according to the statement, covered several main topics, including Iranian funds in Iraq. In this context, the Foreign Minister touched on the issue of frozen Iranian funds in Iraq, and the need to find a quick and fair solution that serves the interests of both parties and enhances financial stability in the region.

Regarding the situation in Gaza, the Foreign Minister expressed his concern about the deteriorating conditions in the Strip, and also expressed his concern about the extension of the conflict to southern Lebanon. He stressed the importance of intensifying international efforts to stop the escalation and achieve peace in the region.

During the meeting, special focus was placed on strengthening economic cooperation between the United States and Iraq.

The Minister pointed out the importance of supporting the financial and banking sector in Iraq, with a focus on the challenges related to the use of the dollar in financial transactions. He stressed the need to find solutions that enhance the stability of the Iraqi economy and contribute to achieving sustainable growth. He also stressed the importance of continuous dialogue and close cooperation to achieve common goals and enhance stability and development in the region.

https://ninanews.com/Website/News/Details?Key=1140965

Secrets Of Smuggling Kurdistan Oil.. Has Iran Become The Second Largest Exporter In OPEC Using It?

Alsumaria Special 2024-07-12 | 1,414 views Alsumaria News – Special Everyone is talking about the smuggling of oil from the Kurdistan Region, and this talk is not new and has been going on for years.

However, for more than a year, specifically since the suspension of the export of Kurdistan oil through the Turkish port of Ceyhan, the map of oil smuggling from the region has changed. Instead of exiting through Turkey, the oil is now exiting through Iran.

Also, the beneficiary now is foreign oil companies and "unknown" subcontractors, not the regional government, in a process that can be described as a "mysterious maze."

Social media sites are flooded with electronic groups for tanker drivers, and there is a wide demand for tanker drivers to transport oil fromKurdistanTo the port of Bandar Abbas in southern Iran, which is a very strange path.

Another indicator is that Iranian reports came out a few days ago, specifically in the city of Bushehr, conveying citizens’ dissatisfaction with the “suffocating congestion caused by Iraqi tankers loaded with oil and fuel,” in addition to major traffic accidents.

After all that, she cameReutersIn a lengthy investigation, she talks about oil smuggling routes.KurdistanAcross Iran, andTürkiyeAlso, but inTürkiye"In much smaller quantities and forms than Iran."

According to the information, foreign companies operating in the region produceKurdistan350 thousand barrels per day, and these companies sell the produced oil to "subcontractors", who distribute this oil or sell it to local refineries in a simple manner, and the other is smuggled at a rate of 200 thousand barrels per day, in a process that information indicates is carried out between foreign companies and contractors only, and has nothing to do with the government.KurdistanOr none of these revenues will enter the regional treasury, as it confirms.Reuters, as evidenced by data from foreign companies operating in the region.

But the selling price of a barrel from foreign companies inKurdistanIt is done at low prices, the price of a barrel of oil is sold for only $35, which means that foreign companies receive less than a quarter of a billion dollars per month, as subcontractors buy oil at these cheap prices, and in turn smuggle this oil.

This activity raises a lot of questions and question marks, the first of which is who are these subcontractors? How much do they sell the smuggled oil abroad for and how much do they profit from it? How do the tankers move from the oil-producing fields to the Iranian border? How do they enter?IranOfficially?

And where does this oil go? Since Iran is basically an oil producer, questions arise about whether Iran buys this oil at lower prices so that it can sell and export it to the world at the global price as Iranian oil, especially since Iran faces difficulties in developing oil production technologies.

Perhaps this matter clearly raises an explanation for how Iran became the second largest oil exporter inOPECAfter Saudi Arabia and removedIraqWithin a short period, Iran may have benefited from Kurdish oil for export and increased its share in the export market without the need to increase its oil production.

Another detail that can be taken into consideration is thatIraqHe has previously filed a lawsuit againstTürkiyeTo allow the passage of oilKurdistanAnd export it without approvalIraqHow can he deal with it?IraqWith Iran allowing the passage of the region's oil by tankers through its territory to the port of Bandar Abbas? LINK

“Tidbits From TNT” Friday Morning 7-12-2024

TNT:

Tishwash: The Central Bank explains the reasons for the rise in dollar prices

Today, Wednesday, a member of the Board of Directors of the Central Bank of Iraq, Ahmed Barihi, explained the reasons for the rise in dollar exchange rates in the local market.

Berihi said in a statement to the Maalouma Agency, “The issue of the rise in the exchange rate of the dollar against the Iraqi dinar in the local market is not related to the measures taken by the bank, but rather due to the American restrictions imposed on the Central Bank and related to the electronic platform.”

He added, "Another reason related to the rise in the exchange rate of the dollar is the connection to the electronic platform that controls the floating of the currency in the market where it is less than the demand. Therefore, the price of the dollar will be raised and the platform is controlled by the US Federal Reserve, which will cause a difference from the official price."

TNT:

Tishwash: The Central Bank explains the reasons for the rise in dollar prices

Today, Wednesday, a member of the Board of Directors of the Central Bank of Iraq, Ahmed Barihi, explained the reasons for the rise in dollar exchange rates in the local market.

Berihi said in a statement to the Maalouma Agency, “The issue of the rise in the exchange rate of the dollar against the Iraqi dinar in the local market is not related to the measures taken by the bank, but rather due to the American restrictions imposed on the Central Bank and related to the electronic platform.”

He added, "Another reason related to the rise in the exchange rate of the dollar is the connection to the electronic platform that controls the floating of the currency in the market where it is less than the demand. Therefore, the price of the dollar will be raised and the platform is controlled by the US Federal Reserve, which will cause a difference from the official price."

During the past few days, the exchange rates of the dollar against the dinar recorded a noticeable increase in the stock market and banking shops in the capital, Baghdad, and the provinces.

During the current period, America has worked to destroy the Iraqi currency by imposing sanctions on private banks, and banning the dollar under many pretexts, which in one way or another led to a severe financial crisis in the local markets. link

****************

Tishwash: Foreign Minister discusses with Washington the issue of frozen Iranian funds in Iraq

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein held an important meeting with the US Under Secretary of State for Political and Administrative Affairs, John Bass, in Washington, DC, during which the issue of frozen Iranian funds in Iraq was discussed.

According to a statement by the Ministry of Foreign Affairs, Fuad Hussein stressed "the importance of strengthening US-Iraqi relations in various fields," noting "the common desire to expand political and economic cooperation between the two countries."

The Minister addressed the issue of frozen Iranian funds in Iraq, stressing the need to find a quick and fair solution that serves the interests of both parties and enhances financial stability in the region.

In the context of enhancing economic cooperation and bilateral relations, special emphasis was placed on enhancing economic cooperation between the United States and Iraq. Minister Hussein pointed out the importance of supporting the financial and banking sector in Iraq, with an emphasis on the challenges related to the use of the dollar in financial transactions.

He stressed the "need to find solutions that enhance the stability of the Iraqi economy and contribute to achieving sustainable growth." link

************

Tishwash: Financial Supervision announces the preparation of a draft of the updated unified accounting system

The Financial Supervision Bureau announced, on Thursday, that it has taken measures to develop and improve the accounting and auditing professions in Iraq. While it referred to the issuance of the internal control guide binding on all government agencies, it confirmed the preparation of a draft of the updated unified accounting system in accordance with international standards.

The Deputy Chairman of the Financial Supervision Bureau, Qaisar Al-Saadi, said in a statement reported by the official news agency, and seen by "Al-Eqtisad News", that "the Federal Financial Supervision Bureau seeks to achieve its objectives specified by its founding law, including developing the accounting and auditing professions in Iraq."

He explained that "one of the most prominent steps taken by the Bureau is issuing reports evaluating the internal control systems in ministries, entities not affiliated with a ministry, and governorates," indicating that "the aim of this is to raise the level of performance of these formations, enhance efforts to combat financial and administrative corruption, improve institutional performance, and work on the principle of preventive control to reduce this phenomenon."

He pointed out that "the Bureau issued the Internal Control Guide, which was circulated to all government agencies for mandatory adoption starting from 7/1/2024," noting that "this guide aims to help these agencies accomplish their work in a way that ensures tight control and oversight over financial transactions and the preservation of public money."

He added, "The Court has completed preparing a draft of the updated unified accounting system in accordance with international standards. This draft has been circulated to government agencies, unions and universities for the purpose of expressing their opinions and making appropriate amendments in preparation for its actual implementation in the near future."

He added: "The Bureau also contributed to holding the first session of the Audit and Accounting Standards Board in the Republic of Iraq for the year 2024 after an interruption of more than four years, during which the audit and accounting issues were discussed and appropriate decisions were taken regarding them, which contributes to developing the work of the profession in Iraq."

He pointed out that "these steps come within the framework of the Bureau's commitment to developing and improving the accounting and auditing professions in Iraq in line with international standards and contributing to enhancing integrity and transparency in government institutions."

He added, "The Bureau relies in its work on the international standards issued by the International Organization of Supreme Audit Institutions (INTOSAI). The Bureau is also a prominent member of the organization and has many contributions, including participation as a member of (5) working groups, attendance at seminars between INTOSAI and the United Nations, and cooperation with the INTOSAI Development Initiative in its various programs, in addition to the Bureau assuming the chairmanship of the Strategic Planning Committee in the organization."

Al-Saadi explained that “the Court cooperates with international and local organizations and similar oversight bodies such as the Dutch Court of Audit in the field of performance evaluation and peer review, the Court of Auditors in Morocco in the field of judicial oversight, and the Polish Oversight Body in the field of risk-based auditing, as well as the German Cooperation Agency (GIZ), the Korea International Cooperation Agency (Koica), the Japan International Cooperation Agency (Jika), and the Indian Technical and Economic Cooperation Program (ITEC).”

He pointed out to the "multiple activities with oversight bodies in Arab and Islamic countries such as the General Auditing Bureau in the Kingdom of Saudi Arabia, the Audit Bureau in the State of Qatar, the Turkish Court of Accounts, the Supreme Audit Court in the Islamic Republic of Iran, the Accounting Council in the Algerian Republic, and many others," noting that "these standards and evidence contribute, along with international cooperation, to enhancing the effectiveness and efficiency of the Bureau in carrying out its oversight work in a way that ensures transparency and integrity in government institutions."

He stressed the "commitment of the Federal Audit Bureau to enhance transparency and integrity in all state institutions by working in accordance with international standards and effective cooperation with regulatory bodies and international organizations," stressing "continuing efforts to develop the accounting and auditing professions and providing technical and accounting support to ensure optimal performance and preservation of public funds, in addition to giving great importance to supporting the role of youth in building the future by enhancing their capabilities to be real partners in combating corruption and evaluating government performance in order to achieve the desired goals link

*************

Mot .. Not Saying - I Could Use Da RV – Buuttttttt

Mot: . Gunna beeeee un of Thos Daze!!!!

Seeds of Wisdom RV and Economics Updates Thursday Afternoon 7-11-24

Good Afternoon Dinar Recaps,

BIOMETRIC PASSPORTS BY GOOGLE

"Google Wallet is rolling out support for American biometric passports. Users scan their passport with Google Wallet to add it as an ID pass, and can then perform identity verification by connecting their phone to an NFC scanner or scanning a QR code generated by the ID pass. They are still recommended to carry a physical copy of their passport, however."

"Google Wallet also added support for 29 more banks to its payment feature in June, and is up to 170 added this year alone, indicating the focus remains on payments, for now. Mobile driver’s licenses from several states are already available in Google Wallet."

Good Afternoon Dinar Recaps,

BIOMETRIC PASSPORTS BY GOOGLE

"Google Wallet is rolling out support for American biometric passports. Users scan their passport with Google Wallet to add it as an ID pass, and can then perform identity verification by connecting their phone to an NFC scanner or scanning a QR code generated by the ID pass. They are still recommended to carry a physical copy of their passport, however."

"Google Wallet also added support for 29 more banks to its payment feature in June, and is up to 170 added this year alone, indicating the focus remains on payments, for now. Mobile driver’s licenses from several states are already available in Google Wallet."

"In Europe, where member states are working towards launching interoperable digital wallets for all citizens, they will store national ID cards that function as travel IDs within the EU."

LIKE IT OR NOT THIS SEEMS TO BE THE DIRECTION THAT TECHNOLOGY IS TAKING US. ALL THE MORE REASON FOR LEGISLATION THAT PROTECTS THE PRIVACY AND SECURITY OF INDIVIDUALS.

@ Newshounds News™

Read more: Biometric Update

~~~~~~~~~

DONALD TRUMP IS SCHEDULED TO SPEAK AT THE ANNUAL BITCOIN CONFERENCE IN NASHVILLE IN JULY

"President Donald Trump has been officially announced as a speaker at Bitcoin 2024, the world’s largest Bitcoin conference, taking place in Nashville, Tennessee, July 25-27. This announcement marks a significant milestone for the event, which has earned a reputation for historic news and major industry announcements."

"With two U.S. Presidential candidates, Robert F. Kennedy Jr. and Donald Trump, both slated to speak, Bitcoin 2024 is poised to be a pivotal event, potentially shaping the future of Bitcoin and cryptocurrency policy in the U.S."

"In May, Trump said he would ensure that the future of Bitcoin and crypto will be made in the USA, while also promising to protect the right to self-custody to the nation's 50 million crypto holders, if elected president."

WE'RE SEEING A DISTINCT DIVIDING LINE POLITICALLY IN THE STANCE OF REPUBLICAN VERSES DEMOCRAT IN REGARDS TO BITCOIN AND THE FUTURE OF CRYPTO LEGISLATION

@ Newshounds News™

Read more: Bitcoin Magazine

~~~~~~~~~

BRAD GARLINGHOUSE COMMENTS REGARDING THE LAWSUIT AGAINST RIPPLE

"As many have noticed - and some have already pointed out - there have been numerous misleading and some factually inaccurate headlines describing the decision made by a California judge yesterday in the class action lawsuit about XRP. (I’m happy to see some correcting them - I wish I could tag / link them all here)

****************************

To be absolutely clear, this is a big win – all class action claims in the suit were DISMISSED, and absolutely nothing in the decision negates or changes the fact that XRP is, in and of itself, not a security (per the NY Court decision). The CA ruling dismissed all allegations that Ripple had somehow violated federal securities law by selling XRP.

As for the single state law claim that will now be scheduled for trial: the sole plaintiff didn’t buy XRP directly from Ripple and can’t say if he even heard the statement before he traded and only owned a couple hundred XRP. This was a clear example of the trolls that unsuccessfully tried to take advantage of the US legal system and distort statements to seek 100’s of millions in class action settlements."

@ Newshounds News™

Read more: BGarlinghouse

~~~~~~~~~

UNISWAP LABS PRESSES SEC TO DROP RULES REGARDING DECENTRALIZED EXCHANGES

"Since at least April 2023, the SEC has proposed expanding the definition of what qualifies as an exchange in the Exchange Act of 1934 — explicitly arguing that it should include crypto market participants in DeFi. Uniswap has been among those arguing against it. In a July 9 letter, Uniswap added further arguments following a comment letter it sent last month, calling for the SEC to drop its proposed amendments. "

"Its new argument is that with the Chevon decision — made during the Loper Bright Enterprises v. Raimondo Supreme Court case on June 28 — courts are no longer required to defer to federal agencies to interpret ambiguous laws. Uniswap said this means the SEC will be merely wasting “limited resources” trying to get the definition of “exchange” amended, which had already been “likely to draw, and unlikely to survive, a judicial challenge” even before the Chevron decision. "

"“For all of these reasons, the Commission should not adopt the proposed amendments,” said Uniswap. “The Commission drafted the proposed amendments against a legal backdrop that no longer exists.”

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Fideum FI

Integration of traditional finance and the digital asset ecosystem

Introduction

Fideum is a fintech company focused on accelerating the digital transformation of financial institutions, banks, and small—to medium-sized enterprises (SMEs) through its eponymous blockchain infrastructure. With the strategic backing of Mastercard Europe and a recent win at the Mastercard Lighthouse program, Fideum aims to position itself as a reliable partner for entities seeking to delve into and capitalize on digital assets.

Founded in 2018, the project initially made waves with its non-custodial mobile wallets, amassing a user base of over 80,000.

In response to the 2022 bear market, Fideum pivoted towards serving institutional clients, developing white-label solutions that cater to high-net-worth individuals and larger entities. This shift, leveraging existing infrastructure, led to profitability by 2023 and cemented Fideum’s position as a fintech innovator, continually adapting to market needs and regulatory landscapes.

This report delves into Fideum’s market, technology, tokenomics, team, partnerships, audits, roadmap, and the risks and opportunities it faces.

Technical specifications:

Fideum’s technical stack is designed to provide security and scalability. The platform has a microservice architecture that ensures flexibility and modularity, allowing for various services to be incorporated seamlessly.

—Backend technologies: The core backend is developed using Java OpenJDK 17, with Spring Boot and Hibernate to streamline development and manage database interactions.

—Frontend technologies: The web and mobile user interfaces are built using React and Expo, with Firebase providing real-time database and authentication services. TypeScript enhances code quality and maintainability.

—Blockchain infrastructure: The platform supports ERC20, BEP20, and TRC20 standards, ensuring compatibility with major blockchain networks such as Ethereum, BNB Chain, and Tron.

—Smart contracts: The use of smart contracts automates transactions and agreements, reducing the need for intermediaries and enhancing efficiency.

—On-chain monitoring solutions: Fideum provides real-time insights into blockchain transactions and activities, allowing for proactive monitoring of suspicious activities.

—Database management: PostgreSQL is used for data storage and management.

—Additional technologies: Kafka is used for real-time data processing, and Minio provides scalable storage for unstructured data.

@ Newshounds News™

Read the full Report Here: Crypto Slate

~~~~~~~~~

European stablecoin market declines under newly imposed MiCA rules.

Stablecoins trading momentum have slowed amid a broader crypto market downturn.

The market capitalization of European stablecoins declined in June due to the implementation of the Markets in Crypto-Assets (MiCA) regulation, according to CCData’s latest stablecoin report.

The market cap of Euro-based stablecoins fell by 2.51%, hitting a seven-month low of $307 million, the lowest since November 2023. During this period, Tether’s EURT stablecoin’s market cap dropped by 26%, mainly due to delistings from major exchanges like Bitstamp.

CCData noted that MiCA’s implementation spurred interest in stablecoins that comply with local laws. MiCA, the EU’s comprehensive crypto regulation package, was recently enacted. It allows firms licensed by one member state to operate throughout the EU.

However, stablecoin issuers like Tether have criticized the rules for their stringent requirements, such as limits on trading volumes for certain stablecoins.

Despite these challenges, several issuers and their stablecoins, including Circle’s USDC and EURC, Societe Generale’s EURCV, Monerium’s EURe, Membrane’s EUROe, and Quantoz’s EURD, are recognized under the law.

Stablecoins volume fall

In June, the global stablecoin market cap rose by 0.53% to $161 billion, marking a nine-month growth streak and the highest stablecoin market cap since April 2022.

CCData said:

“Stablecoin market dominance is currently at 6.83%, rising from 6.22% in May. The increase in the stablecoin dominance highlights the negative price action of digital assets, with Bitcoin and Ethereum retracing the gains made following the surprise approval of spot Ethereum ETFs in the US.”

Despite the growth, stablecoin trading momentum has slowed amid a downturn in the digital asset market.

Stablecoin trading volume on centralized exchanges fell by 18% to a seven-month low of $907 billion in June. Similarly, on-chain transfer volume decreased for the second consecutive month by 7.5% to $1.8 trillion, the lowest since February 2024. This decline aligns with ongoing bearish market sentiments.

The report also highlighted that USDC had the highest on-chain transfer volume in June, surpassing USDT and DAI.

CCData stated:

“Among the top five stablecoins on Ethereum, USDC leads with $786 billion in on-chain transfer volume, representing 43.6% of the market share. USDT and DAI follow with transfer volumes of $616 billion and $334 billion, accounting for 34.2% and 18.5% of the volumes.”

@ Newshounds News™

Read more: Crypto Slate

~~~~~~~~~

CENTRAL BANK OF IRAQ (CBI) INTERESTED IN FURTHERING THEIR POSITION ON E-REGULATION

"Ali Mohsen Al-Alaq, Governor of the Central Bank of Iraq (CBI), chaired a meeting on the regulation of e-commerce in Iraq, with participation from relevant authorities.

The meeting discussed controls and consumer protection measures, focusing on registration procedures and obtaining licenses for e-commerce activities.

The committee defined service providers and established a licensing process through an electronic platform to be developed by the Ministry of Commerce. Committee members emphasized the importance of licensing regulations to safeguard all parties involved in e-commerce."

@ Newshounds News™

Read more: Iraq Business News

~~~~~~~~~

FTC MAKES A STATEMENT ON CRYPTO AS ASSETS ENTER NEW PHASE

"The chairperson of the U.S. Commodity Futures Trading Commission (CFTC) Rostin Behnam is warning that the crypto industry is likely to face more headwinds from regulators over the coming months.

Speaking at the 2024 Milken Institute Global Conference, the CFTC chair says that the crypto industry will “probably see in the next six to 18 months or six to 24 months another cycle of enforcement actions” amid “asset appreciation and [renewed] interest by retail investors.”

"Without a regulatory framework, without that transparency, without those tools that we typically use as regulators, you are going to continue to see this fraud and manipulation.

And putting aside the legitimacy and where this technology may go and what role it might play in our economy and commerce, the internet, digital assets generally… we just have to think about things from a regulatory and consumer protection standpoint. And I think that needs to be our guiding light in terms of driving this conversation, filling these regulatory gaps and creating this framework that’s ultimately going to protect American investors.”

IF CRYPTOS ARE CLASSIFIED AS COMMODITIES INSTEAD OF SECURITIES, THEY WOULD FALL UNDER THE AUTHORITY OF THE CFTC INSTEAD OF THE SEC

@ Newshounds News™

Read more: Daily Hodl

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

KTFA Members “News and Views” Thursday 7-11-2024

KTFA:

RE: Wed. Night CC: https://youtu.be/arJ5wta8aHk

Buckeyetree: I appreciated the thought from the UB2B of who now controls the oil, and it is not Iran any longer!! That was a great UB2B.

The report that the IQD shows up on some of the major hotels as currency to use to purchase hotel stays as one guest shared in interview on UB2B was great news. That could be a sign of international recognition. (I am hoping that the Private Bankers in the USA are on the same page in great expectation if the world now knows. No more "it's a scam.")

Also, if I remember correctly, Eddie shared in a recent report that he and other Iraqis felt like they had a fancy car in Iraq, but it had no engine. I might use that metaphor in another similar application. Those new high tech ATM machines are like that fancy car in Iraq, but they do not have the engine to run them yet. Those ATMs are waiting for the new rate and lower notes! The Iraqis and ATMs may not have to wait much longer. IMO!! We hope and pray.

KTFA:

RE: Wed. Night CC: https://youtu.be/arJ5wta8aHk

Buckeyetree: I appreciated the thought from the UB2B of who now controls the oil, and it is not Iran any longer!! That was a great UB2B.

The report that the IQD shows up on some of the major hotels as currency to use to purchase hotel stays as one guest shared in interview on UB2B was great news. That could be a sign of international recognition. (I am hoping that the Private Bankers in the USA are on the same page in great expectation if the world now knows. No more "it's a scam.")

Also, if I remember correctly, Eddie shared in a recent report that he and other Iraqis felt like they had a fancy car in Iraq, but it had no engine. I might use that metaphor in another similar application. Those new high tech ATM machines are like that fancy car in Iraq, but they do not have the engine to run them yet. Those ATMs are waiting for the new rate and lower notes! The Iraqis and ATMs may not have to wait much longer. IMO!! We hope and pray.

Finally, if I understood correctly from recent articles and reports that the dinar will only be sold at the airport starting on the 14th. Also, that Sudani recently had a meeting with the Exchangers who were about to go on strike, and they suddenly changed their tune and reversed their plans, hopefully happily. Sudani is a mover and shaker in a good way. There could be something maybe significant about the 14th just before WTO on the 18th. IMO!!

IMO, not just soccer, those big screens around the country in Iraq may soon serve a dual purpose. For us, it seems past time.

Many banks here and abroad seem to be on the brink of collapse due to large debt.

IMO, the reinstatement of the IQD may bring liquidity and less debt to some of the banks, a banking stimulus. Good leadership and good reforms in Iraq will bring blessings from a once war torn country. Industrial cities, hospitals, railroad, ATMs, vast resources, miracles. Thanks to Dr. Shabibi, Sudani, and Alak. Most of all, Praise God.

************

Clare: Iraq stops dealing with the Chinese yuan...and the currency basket is an alternative

7/11/2024

The Parliamentary Finance Committee revealed that Iraq has decided to stop dealing with the Chinese yuan in financial transfer

Committee member Moeen Al-Kazemi said in a press statement that "the US Federal Bank imposed on Iraq to stop dealing in the Chinese yuan, under the pretext that there was manipulation in some transfers or certain problems occurred."

He believed that "many decisions by the Central Bank are imposed by the US Federal Bank," according to him.

Al-Kazemi pointed out that "Iraq's money, as we know, is placed in the US Federal Bank as a result of the sale of oil at a rate of 3.5 million barrels per day, and this money enters the US Federal Bank and is not transferred to Iraq in cash, but is transferred to Iraq through transfers issued by the Central Bank and the Federal Bank is notified and then the Federal Bank is convinced of this transfer and commercial transaction and on the basis of it releases amounts to the relevant parties exporting to Iraq."