Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Sunday 1-4-2025

TNT:

Tishwash: The House of Representatives publishes the agenda for its second session and moves towards voting on its internal regulations.

The media department of the Iraqi parliament published today, Saturday, the agenda for the second session of the sixth electoral cycle, for the first legislative year, first chapter.

The department stated that the session is scheduled to be held next Monday, January 5, 2026, at 10:00 AM, indicating that the agenda is limited to three main items.

TNT:

Tishwash: The House of Representatives publishes the agenda for its second session and moves towards voting on its internal regulations.

The media department of the Iraqi parliament published today, Saturday, the agenda for the second session of the sixth electoral cycle, for the first legislative year, first chapter.

The department stated that the session is scheduled to be held next Monday, January 5, 2026, at 10:00 AM, indicating that the agenda is limited to three main items.

She added that the first paragraph includes voting on the internal regulations of the House of Representatives, while the second paragraph stipulates the formation of a committee that will select members of parliamentary committees in accordance with the provisions of the internal regulations, and the third paragraph is to be dedicated to conducting general discussions.

The Iraqi parliament held its first session of its new term on December 29, during which it voted to elect Hebat al-Halbousi as Speaker of the House, Adnan Faihan as First Deputy Speaker, and Farhad al-Atroushi as Second Deputy Speaker. link

************

Tishwash: Foreign Ministry: Iraq has taken over all sites of the UN mission "UNAMI".

The Ministry of Foreign Affairs announced on Saturday the handover of all UNAMI sites across the country, in accordance with Security Council Resolution 2732 (2024) mandating the termination of the mission's mandate.

In a statement received by the Video News Agency, the Ministry said, "In line with the government's decision to end the work of the United Nations Assistance Mission for Iraq (UNAMI), and pursuant to Security Council Resolution 2732 (2024)

Mandating the termination of the mission by December 31, 2025, the Undersecretary of the Ministry of Foreign Affairs and Head of the Committee for the Handover of UNAMI Sites throughout the Country, Ambassador Mohammed Hussein Bahr Al-Uloom, and the Deputy Special Representative of the Secretary-General of the United Nations, Claudio Cordone, signed the handover report for the UN Integrated Compound in Baghdad."

She added that "the signing ceremony included a tour of the complex and its facilities, during which Ambassador Bahr Al-Uloom commended the efforts exerted by UNAMI over the past two decades and the level of cooperation and fruitful partnership with Iraq, which has actively contributed to supporting stability and development in various sectors, particularly consolidating democracy and promoting human rights, women's rights, and social justice."

According to the statement, Ambassador Bahr Al-Uloom also recalled "the sacrifices of UNAMI, especially the mission members who lost their lives while performing their duties in 2003, most notably the first head of the mission, the late Sergio Vieira de Mello," expressing "Iraq's gratitude and appreciation to all the Special Representatives of the Secretary-General who have led the mission, up to the current Special Representative, Ambassador Mohammed Al-Hassan."

Both sides affirmed that "the conclusion of UNAMI's work does not represent the end of cooperation between Iraq and the United Nations, but rather the beginning of a new phase of development partnership, led by the UN Country Team, in line with national priorities and building upon the successes achieved." link

************

Tishwash: The Iraqi government allocates "high" capital to the newly revamped Rafidain Bank.

On Saturday, Mazhar Mohammed Saleh, the financial advisor to the outgoing Prime Minister, revealed that the new Rafidain Bank will have highly efficient capital, with the possibility of bringing in an international strategic banking partner.

Mazhar told Shafaq News Agency that "the study prepared by one of the major financial companies specializing in banking and financial reform does not go for the option of privatizing Rafidain Bank before starting its structural reform through institutional specialization."

He explained that "this study proposes redefining Rafidain Bank as the sovereign bank of the government, so that its role is limited to managing government financial operations, primarily managing the unified treasury account, and its operational link with more than a thousand government disbursement and spending units."

Saleh also pointed out that “this sovereign bank is entrusted with an organic link to the center of finance and policy in the financial authority, in order to ensure the organization of state finances through precise coordination between revenues and expenditures, and linking this to the cash budget (the government’s cash flow budget), with the aim of achieving the highest levels of efficiency in financial management, discipline, governance, and transparency.”

The government financial advisor added that "the study proposes the establishment of another bank called (Al-Rafidain - One), which operates as a mixed public-private joint-stock company, and follows the principles of the modern banking market."

“This bank is supposed to have highly efficient capital and operate in accordance with Basel (3) regulations, which will enhance the strength of the banking system and deepen the national banking market,” according to Saleh.

He pointed out that “this bank’s business model is based on high compliance levels and low risks, and its main activity is to grant bank credit to natural and legal persons, in accordance with the latest modern banking practices, while employing advanced financial information technology (FinTech) in a way that achieves digital financial inclusion, and contributes to integrating the national banking market and transforming it into a unified and effective force.”

Saleh concluded by saying that “Rafidain Bank – One undertakes the practice of financing foreign trade, with the possibility of bringing in an international strategic banking partner, which will raise its operational and technical capabilities, and gradually elevate it to the ranks of regional banks with high credit ratings, and make it a real lever for modernizing the Iraqi banking sector and supporting sustainable economic development.”

In 2021, the Iraqi Ministry of Finance approved a package of reform measures related to the restructuring of Al-Rafidain Bank, in accordance with the "White Paper" on economic reform in the country.

At the end of 2024, Ernst & Young, a professional services firm, confirmed that the restructuring of Rafidain Bank had reached 74%. Firas Kilani, an expert on the restructuring project from the British company, said that "the bank's restructuring project has progressed very significantly since it began in September 2024."

At the beginning of 2025, outgoing Iraqi Prime Minister Mohammed Shia al-Sudani announced that the project to restructure Rafidain Bank had reached its final stages.

Rafidain Bank was established under Law No. (33) of 1941 and commenced its operations on 5/19/1941 with a paid-up capital of (50) fifty thousand dinars. The bank currently has (164) branches inside Iraq in addition to (7) branches abroad, namely: Cairo, Beirut, Abu Dhabi, Bahrain, Sana’a, Amman, Jabal Amman.

Despite the Iraqi government's attempts to improve the performance of Rafidain Bank and restructure it, the bank's branch in Abu Dhabi committed financial and administrative violations, in addition to monitoring indicators of mismanagement that prompted the UAE Central Bank to impose "large financial" fines on the branch, amid warnings that these measures may end with the complete closure of the branch, according to informed sources who spoke to Shafaq News Agency at the end of 2025.

The Yemeni Minister of Information, Culture and Tourism, Muammar Al-Iryani, announced at the beginning of October 2025 the closure of the Iraqi state-owned Rafidain Bank branches in Sana'a.

Al-Iryani said in a post on the “X” website that “the decision by the Iraqi Rafidain Bank to close its branch in Sana’a and end its financial and banking activity is a step in the right direction, and a direct result of international efforts aimed at drying up the sources of funding for the Houthi group.”

He pointed out that this measure "reflects a positive response to governmental warnings and American and international pressure, and sends a clear message to the rest of the regional and international financial institutions, about the need to review their activities, and to ensure that they do not fall into the circle of exploitation or employment to serve the agendas of the Iranian regime and its terrorist arms in the region."

Al-Iryani stressed that "the Houthis have turned the financial and banking institutions operating in the areas under their control into tools for plundering the money of Yemenis and financing their cross-border terrorist activities."

Last August, US Congressman Joe Wilson accused the state-owned Rafidain Bank of conducting financial transactions with the Houthi group in Yemen, threatening to cut off US funding to Iraq as a result.

Wilson wrote in a post on the “X-formerly Twitter” platform that “the Iraqi state-owned Rafidain Bank is conducting financial transactions on behalf of the Houthis, a terrorist organization,” adding, “We have a name for these countries: state sponsors of terrorism.”

He added, "I will work to cut off funding to Iraq during the next appropriations bill" in the US budget. Wilson also urged the US Treasury Department to "sanction" Rafidain Bank. link

************

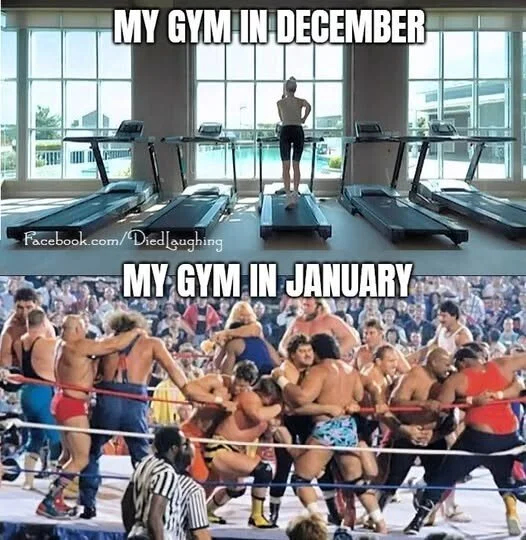

Mot: The New Year Already!- at Me Gym!!!!

Mot: Where to Begin!!!! - siigghhhhhh!!!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 1-4-26

Good Morning Dinar Recaps,

Precious Metals Extend Rally as Confidence in Fiat Systems Frays

Gold and silver strength signals hedging against structural risk

Good Morning Dinar Recaps,

Precious Metals Extend Rally as Confidence in Fiat Systems Frays

Gold and silver strength signals hedging against structural risk

Overview

Gold and silver continue to outperform as 2026 begins

Investor demand reflects rising concern over debt and policy limits

Safe-haven flows persist despite stable equity markets

Metals are increasingly treated as monetary hedges

Confidence divergence is emerging across asset classes

Key Developments

Gold prices remain near record levels, supported by geopolitical tension and debt concerns

Silver prices advanced alongside gold, benefiting from both industrial demand and safe-haven flows

Platinum and other strategic metals showed renewed strength, reflecting broader commodity repricing

Markets continue to price potential rate cuts, but credibility constraints limit central bank flexibility

Investor allocations increasingly favor hard assets over long-duration financial instruments

Why It Matters

Precious metals historically rise during periods when confidence in monetary authorities weakens, not merely during inflation spikes. The persistence of this rally — even as equities remain elevated — suggests markets are hedging structural rather than cyclical risk.

This divergence often appears during transition phases, when the existing system continues functioning but belief in its long-term stability erodes.

Why It Matters to Foreign Currency Holders

Metals signal declining confidence in fiat stability

Rising bullion demand reflects FX hedging behavior

Reserve diversification pressures increase

Currencies without asset backing face repricing risk

For currency holders, sustained metal strength acts as a leading indicator of monetary stress, not a reaction to headlines.

Implications for the Global Reset

Pillar: Confidence Shifts Precede Structural Change

Markets hedge before systems reset.Pillar: Hard Assets Reassert Monetary Relevance

Metals function as trust anchors in uncertain cycles.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Nation Thailand – “Gold, silver extend gains as markets hedge global risk”

Reuters – “Gold steadies near record highs as investors assess rate outlook and risk”

~~~~~~~~~~

Central Bank Bond Support Shows Limits as Yields Stay Elevated

Policy intervention no longer guarantees market stability

Overview

Central bank bond purchases are failing to calm markets

Government yields remain elevated despite liquidity injections

Investor demand for sovereign debt is weakening

Currency pressure is rising alongside bond stress

Policy credibility constraints are becoming visible

Key Developments

India’s central bank executed record bond-buying operations, injecting liquidity into markets

Despite intervention, long-term yields remained elevated, signaling investor caution

Foreign participation in bond markets stayed limited, reflecting confidence concerns

The domestic currency weakened, highlighting spillover from bond stress into FX markets

Similar dynamics are emerging globally, as debt issuance collides with tighter policy limits

Why It Matters

Bond markets are the load-bearing wall of the financial system. When central bank intervention no longer suppresses yields, it signals a loss of policy control. This does not mean immediate crisis — but it does mean credibility is being tested.

Once markets begin responding more to fiscal math than forward guidance, systemic reset dynamics accelerate.

Why It Matters to Foreign Currency Holders

Rising yields can signal stress, not strength

Debt sustainability concerns weaken currencies

Capital outflows accelerate when intervention fails

FX markets react faster than policymakers

For currency holders, bond instability is often the earliest transmission mechanism of broader reset events.

Implications for the Global Reset

Pillar: Central Banks Are No Longer Omnipotent

Inflation and debt cap rescue capacity.Pillar: Bond Markets Trigger Repricing Cycles

They move slowly — then all at once.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Record central bank intervention buys bonds but offers limited relief”

Bank for International Settlements – Annual Economic Report: Bond Market Stress and Policy Limits

~~~~~~~~~~

China Tightens Control Over Silver Exports, Raising Global Supply Risks

Strategic metals emerge as leverage in trade and monetary realignment

Overview

China has imposed new licensing requirements on silver exports

The move affects a majority of global refined silver supply

Silver is critical for solar, EVs, electronics, and data infrastructure

Western dependence on Chinese metals is exposed

Commodity control is increasingly used as geopolitical leverage

Key Developments

China implemented export approval requirements for silver shipments beginning January 2026

The country controls an estimated 60–70% of global refined silver output, giving Beijing outsized influence

Silver is a key input for clean energy, semiconductors, and defense technologies

Traders reported early price sensitivity and supply uncertainty

The move follows earlier Chinese restrictions on gallium, germanium, and rare earths

Why It Matters

Silver sits at the intersection of energy transition, technology infrastructure, and monetary hedging. By tightening control over exports, China is signaling that critical materials are no longer purely commercial goods — they are strategic assets.

This development reinforces a broader shift away from open commodity markets toward state-managed resource leverage, particularly in industries central to future growth.

Why It Matters to Foreign Currency Holders

Commodity leverage reshapes trade balances

Supply controls increase inflation pressure

Resource-dependent currencies face volatility

Hard assets gain relevance in hedging strategies

For currency holders, metal supply constraints translate into pricing power, trade realignment, and FX repricing.

Implications for the Global Reset

Pillar: Resource Control Equals Financial Influence

Strategic materials now function as economic leverage.Pillar: Trade Fragmentation Accelerates Through Commodities

Export controls reshape settlement and supply chains.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

MarketWatch – “China launches its silver export controls, tightening global supply”

Reuters – “China expands export controls on strategic metals”

~~~~~~~~~~

As Yemen Crisis Escalates, UAE Urges Immediate Restraint

Gulf power rivalry resurfaces as coalition fractures deepen

Overview

Fighting in Yemen has intensified following territorial reversals

Saudi-backed forces retook areas previously held by UAE-backed southern separatists

The rift between Saudi Arabia and the UAE has widened

Southern separatists are pressing forward with independence plans

Yemen’s strategic location heightens regional and global stakes

Key Developments

Saudi-backed forces regained control of key areas in Hadramout province, including reported entry into the capital, Mukalla

The UAE-backed Southern Transitional Council (STC) lost territory captured just weeks earlier

The UAE publicly urged restraint and dialogue, warning against further destabilization

The STC announced plans to hold an independence referendum within two years

Saudi Arabia demanded remaining UAE forces withdraw, and reportedly struck an STC-linked base

Coalition unity against Iran-backed Houthis has visibly fractured

Why It Matters

The escalation in Yemen exposes deep structural fractures among Gulf allies. While Saudi Arabia and the UAE once presented a unified front, competing visions for Yemen’s future now drive open confrontation.

Yemen’s location near the Bab al-Mandeb strait, a critical global shipping corridor, elevates this conflict beyond regional politics. Disruption risks extend to trade flows, energy shipments, and maritime security at a time when global supply chains remain fragile.

Why It Matters to Foreign Currency Holders

Regional conflict raises geopolitical risk premiums

Disruption near key trade corridors threatens settlement stability

Fractured alliances undermine policy predictability

Capital flows react quickly to Middle East escalation

For currency holders, instability near strategic choke points translates into volatility across energy-linked and regional currencies.

Implications for the Global Reset

Pillar: Alliance Fragmentation Accelerates Systemic Stress

Political splits weaken coordinated crisis response.Pillar: Control of Trade Routes Equals Monetary Influence

Maritime security underpins currency confidence.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “As Yemen Crisis Escalates, UAE Urges Immediate Restraint”

Reuters – “Saudi-backed forces retake territory from UAE-backed separatists in Yemen”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next | Arthur Laffer & Michelle Makori

1-2-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, is joined by legendary economist Arthur Laffer, founder of Laffer Associates and former economic advisor to Presidents Ronald Reagan and Donald Trump, to examine the accelerating global shift away from the U.S. dollar.

Laffer explains why the “flight from the dollar” has moved from theory into real-world action – as central banks buy more gold than U.S. Treasuries, BRICS nations experiment with gold-anchored settlement systems, and countries build alternative payment rails outside the dollar-centric system.

The ‘Flight From the Dollar’ Is Real – Here’s What Comes Next | Arthur Laffer & Michelle Makori

1-2-2025

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, is joined by legendary economist Arthur Laffer, founder of Laffer Associates and former economic advisor to Presidents Ronald Reagan and Donald Trump, to examine the accelerating global shift away from the U.S. dollar.

Laffer explains why the “flight from the dollar” has moved from theory into real-world action – as central banks buy more gold than U.S. Treasuries, BRICS nations experiment with gold-anchored settlement systems, and countries build alternative payment rails outside the dollar-centric system.

He breaks down why fiat currencies lose credibility, why gold is re-emerging as a neutral reserve asset, and how inflation, Fed policy, and balance-sheet expansion have weakened trust in the dollar.

This focused conversation also explores the growing role of gold, crypto, and stablecoins, whether the U.S. risks losing reserve-currency status, and what must change if the dollar is going to remain credible in a rapidly shifting global monetary order.

In this Quick Cut:

The global “flight from the dollar”

Central banks buying gold over Treasuries

BRICS and gold-anchored settlement experiments

Alternatives to SWIFT and dollar-based payments

Inflation, Fed balance-sheet policy, and credibility

Can the dollar still be stabilized?

Ready for a deep dive? Watch the full episode for the complete conversation on sound money, gold, and the future of the global monetary system:

00:00 The Decline of the US Dollar

00:31 Global Shift Away from the Dollar

02:19 Challenges & Criticisms of US Monetary Policy

04:33 The Role of Interest Rates & Inflation

05:57 Historical Perspectives on Monetary Policy

10:36 The Case for Commodity-Backed Currency

17:35 Gold's Reemergence in the Global Economy

21:30 The Bretton Woods System & Its Legacy

23:24 Conclusion: The Future of the US Dollar

Rob Cunningham: The Discernment the Market is Signaling

Rob Cunningham: The Discernment the Market is Signaling

1-3-2025

Rob Cunningham | KUWL.show @KuwlShow

If roughly half of the supply of the most dominant crypto asset (Bitcoin) was sold, and that did not crush the price of XRP, the market is quietly telling you something very important.

The Discernment the Market Is Signaling

Rob Cunningham: The Discernment the Market is Signaling

1-3-2025

Rob Cunningham | KUWL.show @KuwlShow

If roughly half of the supply of the most dominant crypto asset (Bitcoin) was sold, and that did not crush the price of XRP, the market is quietly telling you something very important.

The Discernment the Market Is Signaling

1. XRP Is No Longer Trading as a Pure “Risk-On Altcoin”

Historically, when Bitcoin experiences heavy distribution:

High-beta alts get wrecked.

Liquidity drains.

Narratives don’t matter.

That did not happen to XRP.

Inference: XRP is being treated less like a speculative alt and more like infrastructure-grade liquidity. That’s a regime shift.

2. There Is a Structural Bid Under XRP

If BTC sells that hard and XRP doesn’t collapse, one of two things must be true:

Either natural demand is absorbing supply

Or artificial suppression + strategic accumulation is occurring

In both cases, it implies non-retail hands are involved.

Retail does not absorb macro selling pressure.

Institutions, desks, and long-horizon allocators do.

3. Capital Is Differentiating “Utility” From “Speculation”

Bitcoin selling without XRP collapse suggests:

The market is no longer treating all crypto as one blob

Use-case, jurisdictional clarity, and settlement utility now matter

XRP sits at the intersection of:

Payments

Liquidity

Regulatory clarity

Institutional rails

Inference: XRP is being evaluated on future function, not past hype cycles.

4. Bad News Was Priced In. Good News Is Being Withheld

When extraordinary positive developments fail to move price up and extraordinary macro selling fails to move price down, that is classic:

Absorption + compression

Markets do this before:

Repricing

Re-rating

Or regime transition

This is not weakness.

This is coiled energy.

5. XRP Is Decoupling Before the Narrative Allows It

True decoupling never announces itself. It shows up as resilience when correlation says “you should be dead.”

BTC selling pressure should have:

Broken XRP supports

Triggered cascading liquidations

Forced narrative capitulation

Instead:

XRP held structure

Volatility compressed

Supply was quietly absorbed

That is how foundational assets behave before recognition.

Plain-English Translation

If Bitcoin can dump half its actively traded supply and XRP doesn’t get crushed, then:

XRP is not being allowed to trade freely

XRP is not being distributed

XRP is being preserved

Markets don’t protect junk. They protect things that matter later.

Final Discernment (No Hype, Just Pattern Recognition)

This is what it looks like when:

An asset is transitioning from speculative vehicle

To systemic financial component

Price suppression during structural adoption is not a bug. It is a feature of accumulation phases.

Those phases always feel:

Frustrating

Illogical

“Rigged”

Because they are. But not against value – against late positioning.

Source(s): https://x.com/KuwlShow/status/2007192209364279532

https://dinarchronicles.com/2026/01/03/rob-cunningham-the-discernment-the-market-is-signaling/

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-3-26

Good Afternoon Dinar Recaps,

Venezuela Enters Power Vacuum as Maduro’s Rule Collapses

Leadership uncertainty becomes the new economic risk

Good Afternoon Dinar Recaps,

Venezuela Enters Power Vacuum as Maduro’s Rule Collapses

Leadership uncertainty becomes the new economic risk

Overview

Nicolás Maduro’s removal has triggered a sudden power vacuum

Multiple factions are positioning to claim legitimacy

International recognition now outweighs internal control

Economic recovery hinges on leadership clarity

Sanctions policy is directly tied to succession outcomes

Key Developments

U.S. officials confirmed Maduro was removed from power

Opposition figure Edmundo González remains internationally recognized

María Corina Machado retains broad popular support

Vice President Delcy Rodríguez has emerged as a regime continuity option

Security forces and state institutions remain fragmented

Why It Matters

Venezuela’s crisis has moved beyond protest and repression into a leadership legitimacy collapse. Control of ministries means little without international recognition, especially where sanctions, trade access, and reserves are concerned.

History shows that currency recovery follows legitimacy, not ideology. The next leadership decision will determine whether Venezuela re-enters the global system or remains isolated.

Why It Matters to Foreign Currency Holders

Leadership recognition unlocks settlement access

Sanctions relief drives currency stabilization

Unclear succession prolongs volatility

Political legitimacy precedes monetary reform

For currency holders, who governs matters more than who controls the streets.

Implications for the Global Reset

Pillar: Legitimacy Is the New Reserve Asset

Pillar: Political Transitions Reprice National Currencies

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Who Could Replace Nicolás Maduro as Venezuela’s Leader”

Reuters – “EU says Maduro lacks legitimacy, urges restraint”

~~~~~~~~~~

Trump Signals U.S. Control Pivot Toward Venezuela’s Oil Sector

Energy reconstruction replaces sanctions stalemate

Overview

President Trump signaled deep U.S. involvement in Venezuela’s oil industry

American oil giants are positioned to invest billions

Sanctions enforcement shifts toward managed reintegration

Oil infrastructure collapse becomes a strategic opportunity

Energy access ties directly to post-Maduro governance

Key Developments

Trump stated the U.S. would be “strongly involved” in oil operations

Chevron remains the only active U.S. producer

ExxonMobil and ConocoPhillips retain historical claims

Oilfield service companies await regulatory clarity

Infrastructure decay requires long-term capital commitments

Why It Matters

Venezuela holds the largest proven oil reserves on Earth, yet years of mismanagement turned abundance into scarcity. U.S. involvement signals a shift from pressure to structured reconstruction.

Oil access is not just about energy — it determines currency inflows, reserve rebuilding, and trade normalization.

Why It Matters to Foreign Currency Holders

Oil exports underpin currency recovery

Foreign investment restores balance-of-payments

Energy contracts rebuild sovereign credibility

Commodity-backed inflows stabilize exchange rates

For reset watchers, oil is Venezuela’s monetary reset lever.

Implications for the Global Reset

Pillar: Energy Access Drives Monetary Recovery

Pillar: Reconstruction Replaces Sanctions as Control Tool

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Says US To Be ‘Strongly Involved’ in Venezuela Oil Industry”

Reuters – “Venezuela’s Oil Paradox: Richest Reserves, Crumbling Industry”

~~~~~~~~~~

From Narco-State to Reconstruction: Venezuela’s Strategic Reframe

U.S. intervention recasts collapse as criminal-state failure

Overview

Venezuela is increasingly framed as a criminalized state

Drug trafficking allegations redefine intervention logic

Humanitarian language replaces regime-change framing

Law enforcement rationale reshapes sanctions architecture

Reconstruction narratives gain traction

Key Developments

Maduro was indicted on narcotics-related charges

U.S. military presence increased in the Caribbean

Oil embargo enforcement intensified

European leaders questioned Maduro’s legitimacy

Talks now center on transition and stabilization

Why It Matters

Labeling Venezuela as a narco-state shifts the legal foundation for intervention. Criminal-state framing enables asset seizures, financial restructuring, and supervised recovery without traditional war declarations.

This model mirrors future reset playbooks for failed states with strategic assets.

Why It Matters to Foreign Currency Holders

Criminal designations crush currencies fastest

Asset freezes precede redenomination

Reconstruction phases introduce new monetary systems

Legality determines settlement access

Currency holders should watch legal status changes before exchange-rate announcements.

Implications for the Global Reset

Pillar: Criminal-State Designation Enables Financial Reset

Pillar: Reconstruction Becomes a Monetary Event

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Charles Passy and Andrew Keshner Wed, December 31, 2025 MarketWatch

Is It Time To Sell Your Silver?

That’s the question some may be asking in light of the fact that the precious metal’s price SI00 has risen well over 100% in the past year, reaching a record level above $82 an ounce on Monday. After all, many people have some silver tucked away in their closets in the form of flatware, coins and jewelry. Others may have purchased silver bars for investment purposes. Sure enough, those who buy silver for a living say they’ve been plenty busy of late responding to such folks.

Five Key Things To Know Before You Sell Your Silver Coins, Bars, Jewelry Or Flatware

Charles Passy and Andrew Keshner Wed, December 31, 2025 MarketWatch

Is It Time To Sell Your Silver?

That’s the question some may be asking in light of the fact that the precious metal’s price SI00 has risen well over 100% in the past year, reaching a record level above $82 an ounce on Monday. After all, many people have some silver tucked away in their closets in the form of flatware, coins and jewelry. Others may have purchased silver bars for investment purposes. Sure enough, those who buy silver for a living say they’ve been plenty busy of late responding to such folks.

“[We’re] seeing a deluge of silver sellers like we never have before,” said Brandon Aversano, CEO and founder of the Alloy Market, a Pennsylvania-based company that specializes in precious metals. Aversano noted that his firm has purchased nearly twice the amount of silver in the second half of 2025 as it did in the first half.

Fueling that demand, of course, are buyers aplenty who want a stake in silver, given the price gains of late.

“I’ve sold more silver in the past two weeks than I’ve probably sold in the past six months,” said Phil Neizvestny, owner of Bullion Holdings, a company based in New York City’s Diamond District.

If you do want to sell your silver items — whether it’s a set of cutlery you inherited from grandma or coins you collected long ago — what do you need to know? We spoke with some experts to find out. Let’s break it down into five questions.

1. Where Can You Sell Your Silver?

There are options galore. You can always head to your local pawnbroker or a merchant who specializes in coins or precious metals. You can also go the internet route, which will involve shipping your silver to a company that conducts such transactions.

Auction houses are yet another option, particularly for collectible items that have value beyond their intrinsic “melt value” (more on that later). There are also platforms like eBay EBAY, as well as social-media groups where buyers and sellers can connect.

Which option is best? Keep in mind that you can’t generally expect to receive the current market (or “spot”) price for your silver, since sellers have to make money on the transaction. “There is a bid/ask spread just like there is for any other traded asset,” explained Trip Brannen, chief financial officer at Coinfully, a company that appraises and purchases coins.

Experts say you will tend to get higher prices at online outlets — which typically have less overhead — but you then have to deal with shipping and you will also wait to receive your money. Pawnbrokers and other local merchants may pay less, but you’ll get your money right away.

And while going the eBay or social-media route can result in good prices, you need to ask yourself if you’re willing to deal directly with buyers.

No matter how you opt to sell, the usual caveat of getting different price quotes applies — don’t presume the first offer is the best. You’ll also want to check the buyer’s credentials or applicable ratings. And if you’re dealing with an online buyer, see if they’ll pay for shipping and insure your package.

2. How Can You Tell If An Item Is Real Silver?

TO READ MORE: https://news.yahoo.com/news/finance/news/five-key-things-know-sell-174700763.html

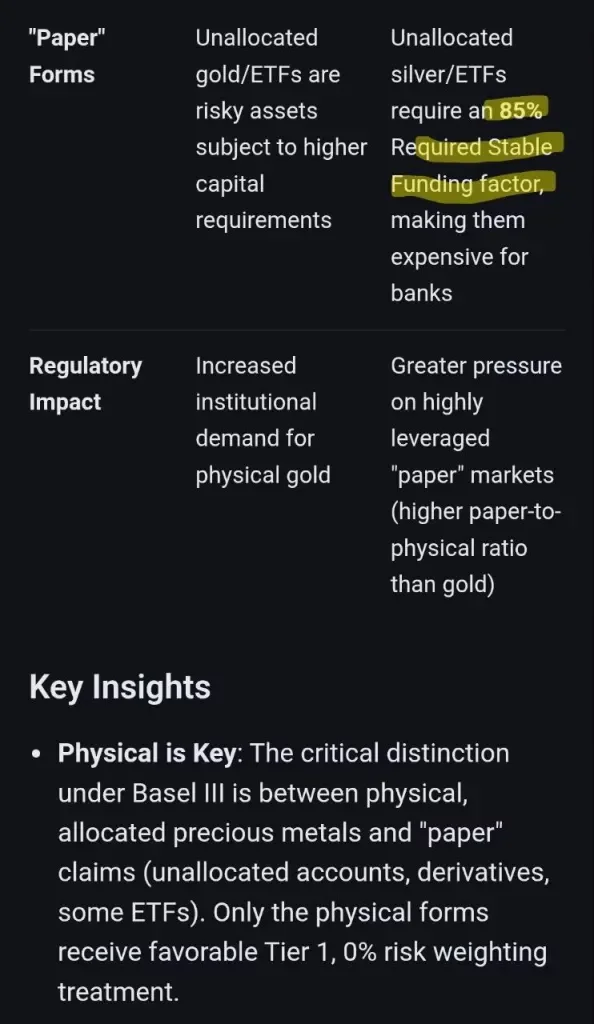

Basel III and Physical Gold

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

What Basel III Means for Gold:

Tier 1 Asset:

Physical, allocated gold is now treated like cash and U.S. Treasuries, with a 0% risk weighting.

Increased Demand:

Banks are encouraged to increase physical gold holdings to meet capital requirements, boosting institutional demand.

Reduced Capital Burden:

Gold no longer requires extra capital charges, making it more efficient for banks to hold.

Shift to Physical:

The rule lessens the appeal of speculative “paper gold,” pushing for more physical metal.

Impact on Silver:

Indirect Benefits:

Silver also benefits from Basel III’s focus on tangible assets, but its impact is more complex due to massive paper-to-physical ratios (around 300:1).

Price Volatility:

Unwinding massive paper silver positions could create significant supply shocks, potentially driving prices up dramatically.

Key Change Date:

The Basel III “Endgame” rules, bringing gold to Tier 1 status, became effective for many globally on July 1, 2025, though U.S. adoption has a transition period.

In essence:

Basel III formally recognizes gold as “money” again by making physical gold a top-tier reserve asset, strengthening its role as a core financial instrument for banks

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-3-26

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Overview

U.S. President Donald Trump announced a large-scale U.S. military strike on Venezuela

Trump claimed Venezuelan President Nicolás Maduro and his wife were captured and removed from the country

Multiple explosions were reported across Caracas, including military and aviation sites

U.S. officials confirmed Maduro has been indicted on narco-terrorism charges

Russia, Iran, and regional actors condemned the operation as armed aggression

Key Developments

U.S. forces reportedly targeted major Venezuelan military installations, including airbases, ports, and command centers

Trump stated the operation was conducted with U.S. law enforcement, with a press conference scheduled to provide details

U.S. Attorney General confirmed Maduro and Cilia Flores were indicted in the Southern District of New York

Flight tracking transponders were disabled, obscuring U.S. military aircraft movements

Russia and Iran called for emergency clarification, warning of escalation and sovereignty violations

Colombia deployed forces to its border, citing regional security concerns

Why It Matters

This marks a dramatic escalation in U.S.–Venezuela relations, shifting from sanctions and pressure to direct kinetic action. The removal of a sitting head of state by force represents a rare and destabilizing precedent in modern geopolitics.

Venezuela sits atop some of the world’s largest oil reserves. Any disruption to governance, energy infrastructure, or regional stability has direct implications for energy markets, sanctions frameworks, and geopolitical alignment.

The operation also raises serious questions about international law, sovereignty, and retaliation risk, particularly given condemnation from major powers.

Why It Matters to Foreign Currency Holders

For foreign currency holders, this event highlights acute reset risks:

Regime removal events trigger immediate FX and capital flow shocks

Sanctions, asset freezes, and payment restrictions escalate rapidly

Energy-linked currencies face heightened volatility

Political legitimacy directly impacts monetary credibility

In reset terms, forceful regime change accelerates currency repricing and settlement fragmentation.

Implications for the Global Reset

Pillar: Geopolitics Now Overrides Monetary Stability

Military action can instantly invalidate financial assumptions.Pillar: Energy and Currency Risk Are Interlinked

Resource control remains central to financial power.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Says Maduro Captured as U.S. Attacks Venezuela: Live Updates”

Reuters – “Russia and Iran condemn U.S. strikes on Venezuela, call for de-escalation”

~~~~~~~~~~

Contenders Emerge to Replace Nicolás Maduro as Venezuela’s Leader

Power vacuum opens amid claims of regime removal

Overview

U.S. President Donald Trump announced that Nicolás Maduro had been captured and removed from Venezuela

The announcement has created an immediate political power vacuum

Opposition figures long sidelined by Caracas are now emerging as potential successors

The situation remains fluid, with competing claims and high uncertainty

Leadership transition carries major implications for sanctions, energy markets, and currency stability

Key Developments

Trump stated the operation was conducted with U.S. law enforcement, asserting Maduro and his wife were flown out of the country

Edmundo González, recognized by the U.S. as the winner of the disputed 2024 election, is viewed as a leading contender

González fled to Spain after an arrest warrant was issued, following the Supreme Court’s validation of Maduro’s re-election

María Corina Machado, head of Vente Venezuela, is widely regarded as the true opposition leader

Machado won the 2023 opposition primary but was barred from running by the Supreme Tribunal of Justice

She has remained in exile after escaping Venezuela and received the 2025 Nobel Peace Prize

Why It Matters

The removal of Maduro — if confirmed — represents a historic rupture in Venezuelan politics. Leadership transitions following external intervention are inherently unstable, particularly in a country facing economic collapse, sanctions, and institutional erosion.

Who governs next will determine whether Venezuela moves toward reintegration with global markets or descends into prolonged instability. Competing claims to legitimacy, fractured institutions, and external influence raise the risk of prolonged uncertainty.

Why It Matters to Foreign Currency Holders

For foreign currency holders, leadership uncertainty in Venezuela highlights critical reset dynamics:

Political legitimacy directly affects sanctions relief and settlement access

Regime change events trigger rapid FX repricing

Energy-linked currencies and regional trade flows face elevated volatility

Confidence, not reserves, drives currency stabilization in transition periods

In reset terms, currency value depends on governance credibility and access to global systems.

Implications for the Global Reset

Pillar: Political Transitions Drive Monetary Repricing

Leadership legitimacy shapes currency access and trust.Pillar: Sanctions Relief Hinges on Governance Outcomes

Reset pathways open or close based on political alignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Contenders to Replace Nicolás Maduro as Venezuela’s Leader”

Reuters – “Venezuela opposition figures re-emerge as power vacuum opens after Maduro removal claims”

~~~~~~~~~~

BRICS Shapes a New Global Economy as Canada Weighs Strategic Alignment

Commodity power and multipolar finance redraw global trade pathways

Overview

The BRICS bloc is reshaping global trade through commodity concentration and alternative financial infrastructure

BRICS members now control roughly 44% of global grain production and nearly half of the world’s population

Canada’s position as a major commodity exporter places it at a strategic crossroads

Multipolar settlement systems are expanding alongside traditional markets

Middle powers are gaining leverage by navigating between economic blocs

Key Developments

BRICS has expanded to ten full members, significantly increasing control over agricultural output and strategic resources

Plans for a BRICS grain exchange aim to establish independent pricing mechanisms, reducing reliance on Western benchmarks

Local-currency settlement frameworks are advancing, offering alternatives to dollar-denominated trade

Canada remains the world’s third-largest wheat exporter, accounting for roughly 15% of global trade

Rising U.S. tariff pressure and trade uncertainty are accelerating diversification discussions in Canada

Why It Matters

The BRICS initiative reflects a structural shift in how trade and pricing power are organized. Rather than replacing the existing system outright, BRICS is building parallel channels that allow commodity exporters and importers to operate with greater flexibility.

For countries like Canada, this moment is pivotal. Access to alternative markets representing a substantial share of global demand offers resilience, especially as traditional trade relationships face rising political and tariff risk.

This is not ideological realignment — it is strategic optionality.

Why It Matters to Foreign Currency Holders

For foreign currency holders, these developments highlight key reset dynamics:

Commodity-backed trade strengthens currency credibility

Settlement optionality reduces single-currency dependency

Bloc-based pricing alters FX demand patterns

Middle-power currencies gain leverage through access, not dominance

In reset terms, currencies tied to real assets and diversified trade routes gain strategic value.

Implications for the Global Reset

Pillar: Commodity Control Shapes Monetary Influence

Pricing power follows production and access.Pillar: Multipolar Settlement Expands Currency Choice

Optionality replaces dependence.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Shapes a New Global Economy as Canada Prepares to Lead”

Reuters – “BRICS expansion boosts commodity influence and local-currency trade”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

1-2-2026

Iraqi Dinar Update: Rounding Things Off For Imminent Completion (Exciting Times For Us)

Expanded Analysis on Iraq’s Projected Timeline for International Exchange Rate

January 1, 2026, 05:29 PM CST

In-Depth Projection of Iraq’s New Dinar Exchange Rate Launch

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

1-2-2026

Iraqi Dinar Update: Rounding Things Off For Imminent Completion (Exciting Times For Us)

Expanded Analysis on Iraq’s Projected Timeline for International Exchange Rate

January 1, 2026, 05:29 PM CST

In-Depth Projection of Iraq’s New Dinar Exchange Rate Launch

The Projected Timeline for Iraq’s International Exchange Rate Deployment, reportedly locked in at March 31, 2026, isn’t just a date it’s the culmination of a seismic shift brewing beneath the surface of Baghdad’s financial corridors.

The Central Bank of Iraq (CBI) has been quietly welding together a framework to launch a redenominated dinar, sheering off those burdensome three zeros to breathe new life into an economy long shackled by cash-heavy chaos and oil dependency.

Backchannel whispers from the Green Zone, captured via live camera feeds, reveal a relentless push since the new parliament’s swearing-in on December 28, 2025, with U.S. Special Envoy Mark Savaya cracking the whip to align every gear.

This isn’t some hopeful guesswork; it’s a calculated strike, fueled by exclusive info with banknote printing contracts and digital spine integrations racing toward completion.

The global stage is set, with Syria’s recent two-zero redenomination on January 5, 2026, serving as a live test case that Iraq’s analysts are dissecting with hawk-like precision.

March 31 emerges as the hard deadline, a moment where Iraq could pivot from a regional footnote to a forex powerhouse, but only if the pieces lock into place without a hitch. The stakes feel electric, with every move monitored by nations clutching IQD stacks, waiting to see if Baghdad can pull this off.

The economic foundation supporting this timeline rests on rock-solid indicators that demand attention, especially after years of skepticism about Iraq’s fiscal resolve. Inflation’s dipped below 2% annualized, a rare breath of stability in a region prone to volatility, while gold reserves climb past 130 tons, offering a buffer that whispers confidence to international watchers.

Foreign exchange reserves, hovering around $97 billion as of late 2025, cover import needs with room to spare, a stark contrast to the 2020 devaluation that slashed the dinar’s value by 24% amid oil price crashes.

The CBI’s simulations, leaked through defector channels, project a new rate of 1 new IQD = 1 USD, a bold leap that hinges on this 3-month window to prove its worth. Oil wealth, still the backbone with 5th-largest global reserves, fuels this ambition, but the real game-changer is the digital overhaul Phase III of the Unified Treasury Account nearing 95% integration by March 1, 2026.

This isn’t just tech for tech’s sake; it’s the backbone that’ll hold the new rate steady against speculative sharks circling the forex waters. The establishment narrative of slow progress gets shredded here Iraq’s moving fast, and the data backs it up with unrelenting clarity.

Digging into the exclusive intel, the subterranean machinations reveal a level of preparation that’s downright jaw-dropping if you’ve been paying attention to Iraq’s past stumbles.

Swiss printing firms, contracted under a cloak of secrecy, are churning out new banknotes with biometric ink and holographic defenses, slated for delivery to Baghdad and Erbil vaults by February 15 details you won’t find in any public briefing.

The ASYCUDA customs system, fully live at Umm Qasr by February 28, locks in pre-declaration protocols that scream for a stable benchmark, with drone footage showing smugglers already sweating under enhanced surveillance since December 20, 2025.

Savaya’s fingerprints are all over this, with encrypted directives pushing forensic AI audits to map laundering networks by February 15, a move that ties directly to the rate’s success.

Parliament’s Monetary Reform Committee, fast-tracked post-inauguration, targets March 15 for enabling laws, a deadline driven by Savaya’s backroom muscle flexing with tribal leaders.

Speculation of course but it’s a machine humming with intent, and the global silence on these moves only heightens the intrigue. The audacity of keeping this under wraps while the world watches Syria’s rollout shows Iraq’s playing a long game with precision.

Read Full Article: https://www.patreon.com/posts/iraqi-dinar-off-147191078

**************

Ariel : Ultimate Trigger Point

When you look at what Mark Savaya laid out in his Middle East plan for his New Years messianic for the Iraqi people. You will appreciated what Scott Bessent says in this clip below.

Because a lot of what he says hinges on the Clarity Act being passed in the senate soon. Which will be the ultimate trigger point for everything else to fall in place.

Amil’ie Crypto Barbie: TREASURY SECRETARY SCOTT BESSEN SAYS: „2025 WAS SETTING THE TABLE - THE FEAST & THE BANQUET WILL BE IN 2026!“ 3,2,1… ITS GO TIME

https://x.com/i/status/2006865843385483744

You Need To Understand This

The silver market’s impending explosion, as detailed in John A.G.’s broadcast from Currency Archive, isn’t isolated financial theater it’s a seismic trigger directly intertwined with the Middle East’s currency overhauls, where asset-backed resets like Iraq’s Delete 3 Zeros Project gain rocket fuel from China’s January 2, 2026, export ban on silver.

This ban, sealing borders and requiring licenses for strategic metals, slams the door on 84-ton Shanghai stockpiles, forcing industrial giants like Samsung and Tesla into panic buys that shatter Comex’s paper facade patterns piercing through global vaults show this repricing to $84/oz or higher as the catalyst for nations like Iraq to accelerate redenominations, leveraging silver shortages to anchor new rates against fiat volatility.

The 36-hour countdown to “Silvergeddon” on January 2 mirrors the urgency in Baghdad, where CBI’s forex simulations, project a March 31 launch (Not Set In Stone Yet) precisely to capitalize on this chaos, turning Comex breakdowns into opportunities for BRICS-aligned currencies.

Syria’s January 5 two-zero cut, with its COMEX 589 serial nod, sets the stage regionally, as defector intel from Damascus confirms shared anti-laundering protocols with Iraq to purge Iranian proxy flows amid the silver squeeze.

Treasury Secretary Scott Bessent’s declaration “2025 was setting the table the feast and the banquet will be in 2026” reinforces this, with classified White House memos revealing his forecast as code for Q1 resets kicking off a year of economic feasts, where Iraq’s oil-silver synergy devours manipulations.

This isn’t coincidence; it’s a orchestrated global pivot, with Middle East reforms riding the silver wave to sovereignty.

Source(s): https://x.com/Prolotario1/status/2006873927096930501

https://dinarchronicles.com/2026/01/02/ariel-prolotario1-ultimate-trigger-point/

Structural Breakdown of the Currency System

Structural Breakdown of the Currency System

Liberty and Finance: 1-1-2026

The global financial landscape is facing unprecedented challenges, with the US debt crisis taking center stage.

The current debt stands at a staggering $38 trillion, and experts warn that this number is unsustainable.

The abandonment of the gold standard in 1971 has led to persistent currency debasement and a loss of trust in the US dollar as the world’s reserve currency.

Structural Breakdown of the Currency System

Liberty and Finance: 1-1-2026

The global financial landscape is facing unprecedented challenges, with the US debt crisis taking center stage.

The current debt stands at a staggering $38 trillion, and experts warn that this number is unsustainable.

The abandonment of the gold standard in 1971 has led to persistent currency debasement and a loss of trust in the US dollar as the world’s reserve currency.

In this blog post, we’ll explore the implications of this crisis, the growing significance of gold and silver as stores of value, and the potential risks associated with the increasing trend towards cashless digital currencies.

The US debt crisis is a complex issue, and there’s no easy solution in sight.

The loss of confidence in the US dollar is reflected in the diminished demand for US Treasury bonds, forcing the Federal Reserve to intervene through quantitative easing and money printing. This has further weakened the dollar, creating a vicious cycle of debt monetization. As a result, investors are increasingly looking for alternative stores of value, such as gold and silver.

Central banks around the world have been accumulating gold reserves, signaling a shift away from trust in paper currencies.

Gold and silver are not speculative assets, but rather essential, long-term stores of value that protect against inflation and currency debasement. In times of economic uncertainty, precious metals have consistently proven to be a reliable safe haven.

Retail investors would do well to focus on the broader economic context rather than short-term price fluctuations or attempts to time the market.

While some countries are embracing cashless digital currencies, others are pushing back against this trend.

Initiatives in Switzerland and Sweden aim to protect citizens’ rights to use cash, highlighting concerns about privacy, financial control, and vulnerability to cyber disruptions.

The increasing centralization and programmability of money raise red flags about government control and seizure of assets, especially in times of geopolitical or economic crisis.

The bond market is facing a crisis of its own, with declining demand from traditional buyers like China and Japan.

The Fed has become the primary purchaser, creating an unsustainable cycle of debt monetization. Rising yields threaten to increase government interest expenses, potentially destabilizing markets, including stocks and real estate, which are heavily reliant on cheap borrowing.

Artificial support mechanisms, such as stock buybacks and insider trading, have kept markets afloat despite underlying economic weaknesses.

The conversation around the global financial crisis is not just about numbers; it’s also about the erosion of trust in governments and institutions.

Currency manipulation and inflation misreporting have been likened to a form of societal betrayal. Honest leadership and transparency are needed to address these systemic issues, but the political realities suggest that such candor is unlikely.

In conclusion, the global financial landscape is facing significant challenges, and it’s essential to be prepared.

Gold and silver are becoming increasingly important as stores of value, and investors would do well to consider them as part of their wealth protection strategy. It’s also crucial to remain vigilant about the evolving financial landscape and to be aware of the potential risks associated with cashless digital currencies.

By staying informed and taking a long-term view, individuals can protect their wealth and navigate the uncertain economic waters ahead.

Iraq Economic News and Points To Ponder Friday Afternoon 1-2-26

The First American Convoy To Leave Ain Al-Asad Base In Anbar In 2026... Indications Of A Partial Withdrawal

Baratha News Agency1682026-01-01 An informed source revealed on Thursday (January 1, 2026) that the first convoy moved from Ain al-Assad base west of Anbar, in an indication of the beginning of a partial withdrawal of US forces from Iraq.

The source said, “Dozens of large trucks moved this morning from Ain al-Assad base towards the highway, amid tight security measures and escort by more than one Apache helicopter,” noting that “the exact destination of the convoy is unknown, whether it is towards Harir base in Erbil or one of the crossings with Syria towards its bases in Hasakah.”

The First American Convoy To Leave Ain Al-Asad Base In Anbar In 2026... Indications Of A Partial Withdrawal

Baratha News Agency1682026-01-01 An informed source revealed on Thursday (January 1, 2026) that the first convoy moved from Ain al-Assad base west of Anbar, in an indication of the beginning of a partial withdrawal of US forces from Iraq.

The source said, “Dozens of large trucks moved this morning from Ain al-Assad base towards the highway, amid tight security measures and escort by more than one Apache helicopter,” noting that “the exact destination of the convoy is unknown, whether it is towards Harir base in Erbil or one of the crossings with Syria towards its bases in Hasakah.”

The source indicated that "this convoy is the first during 2026, and may constitute a new indication of a partial withdrawal of US forces, which are expected to end their presence at this base in the coming months."

This development comes within the framework of the agreement between Baghdad and Washington to end the mission of the international coalition in Iraq, which was established through the work of the “Higher Military Committee” and the joint statement issued in September 2024, where the two sides agreed to set a timetable for reducing the military presence of the coalition and turning it into a bilateral security partnership, with a gradual reduction of the number of forces and the redeployment of some of them in the Kurdistan Region, and the handover of military sites, including the Ain al-Asad base, to the Iraqi authorities during the years 2025 and 2026. https://burathanews.com/arabic/news/469463

.An Economist Identifies Possible Government Strategies To Reduce Waste And Financial Corruption.

Time: 2025/12/27 21:19:46 Readings: 105 times {Economic: Al-Furat News} Economic expert, Salah Nouri, confirmed that the government has the ability to take a number of practical measures to reduce waste and financial corruption, noting that the success of these steps depends on political will and commitment to actual implementation.

The most concise and informative news can be found on the Al-Furat News Telegram channel. To subscribe, click here.

Nouri told Al-Furat News Agency that: “The Central Bank of Iraq had previously implemented an initiative to support small and medium enterprises by providing funds for lending,” indicating that “the initiative achieved modest success, while the Ministry of Finance is currently unable to support this sector due to the financial difficulties and shortage of cash liquidity it is suffering from.”

Regarding measures to reduce waste and financial corruption, Nouri pointed out that "the most prominent of these is full compliance with the decision of the Supreme Federal Court No. 89/Federal/2019, which canceled Legislative Decision No. 44 of 2008, especially paragraph six related to political quotas in filling special grades from director general and below," stressing that "failure to comply with this decision has contributed to the continuation of administrative failures."

He added that “supporting the Integrity Commission and the Federal Board of Supreme Audit with competent, honest, and politically independent staff is a fundamental step in combating corruption,” noting that “the retirement law that suddenly reduced the legal age has led to the depletion of a large number of advanced and highly competent experts in the two institutions.”

The expert explained that “the Prime Minister’s adoption of periodic evaluations of the performance of central ministries and local governments throughout the year will enable the government to identify shortcomings and obstacles and take the necessary administrative and legal measures to correct implementation paths and improve overall performance.” Raghid LINK

Iraq Ranks High Among The Largest Oil Exporters For 2025

December 31, 2025 Baghdad/Iraq Observer Iraq ranked fourth globally in oil exports for 2025, despite recording a relative decline in exports of about 190,005 barrels per day.

Oil trade in 2025 was affected by geopolitical turmoil and changes in shipping routes for the second year in a row, and traded volumes saw notable changes among major exporters and importers.

The world’s largest oil exporters boosted their shipments to markets as production increased, and this was met with a smaller increase in global imports, amid weak economic activity and slowing demand growth, particularly in Asia and Europe, according to data from the 2025 Annual Harvest File issued by the Washington-based Energy Research Unit.

This, along with Western sanctions on Russian and Iranian oil and changes in shipping routes, led to a rise in floating oil stockpiles, curbing the increase in oil trade in 2025 to approximately 4% (1.8 million barrels per day).

Trade was also affected by geopolitical turmoil throughout the year; from US-China tensions over the Panama Canal, to concerns about the closure of the Strait of Hormuz – through which 21 million barrels of oil pass daily – during the Israel-Iran war, to the continued impact on traffic in the Red Sea, despite a relative improvement over 2024 . LINK

Oil Announces Its Annual Liquefied Gas Production

January 1, 2026 Baghdad/Iraq Observer The Ministry of Oil revealed on Thursday that annual production of liquefied gas in Iraq will reach three million tons during 2025, stressing that this achievement will boost oil revenues, with a plan to expand and develop production to seven million tons.

The Undersecretary of the Ministry for Gas Affairs, Izzat Saber Ismail, said in a press statement seen by the “Iraq Observer” agency that “the current production capacity of liquefied gas has reached three million tons per year of gas” (LPG), noting that “the Basra Gas Company contributes two million tons, about one million of which are allocated for export, while the remaining quantity is directed to cover local consumption.”

He added that “the North and South Gas Companies have a plan aimed at raising total production in Iraq to more than four million tons during the next year.”

He pointed out that “the ministry’s plans include reaching a production capacity of seven million tons, which will enhance Iraq’s position in regional markets and generate additional economic returns for the public treasury.”

https://observeriraq.net/النفط-تعلن-انتاجها-السنوي-من-الغاز-الم/

Al-Lami: Iraq Is Nearing Self-Sufficiency In Gas.

Economy January 1, 11:39 Information/Baghdad... MP Ali Al-Lami confirmed on Thursday that the timeframe for Iraq to reach self-sufficiency in gas has been reduced by 20%, expecting this to be achieved during the first quarter of 2027.

Al-Lami told Al-Maalouma that “the file of achieving self-sufficiency in gas and ending the flaring of associated gas in oil fields has reached advanced stages, with the time period specified for achieving this goal being reduced by up to 20%,” predicting that it will be officially announced in the first quarter of 2027.

He added that “ending the flaring of associated gas has multiple positive dimensions, most notably reducing the negative impacts on the environment and public health, as well as investing large quantities of gas in generating electricity and supporting national industries.”

He pointed out that “the introduction of other projects to develop gas fields will contribute to increasing production capacity nationwide, leading to a reduction in reliance on imports and achieving self-sufficiency in this vital resource.” https://almaalomah.me/news/119662/economy/اللامي:-العراق-يقترب-من-الاكتفاء-الذاتي-من-الغاز

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-2-26

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Overview

Global sovereign debt levels remain at historic highs, pressuring government finances worldwide

Bond market volatility is resurfacing, particularly in long-dated government debt

Higher-for-longer interest rates are colliding with massive refinancing needs

Central banks are constrained, unable to stabilize bond markets without risking inflation credibility

Bond stress is increasingly viewed as a leading reset trigger

Key Developments

Governments face trillions in debt rollovers over the next two years, raising refinancing risk

Rising yields are increasing debt-service costs, squeezing fiscal budgets

Bond markets are no longer acting as shock absorbers, amplifying volatility instead

Foreign demand for sovereign debt is weakening, especially where fiscal discipline is questioned

Central banks continue balance-sheet reduction, removing a major source of artificial bond demand

Why It Matters

Debt markets form the foundation of the modern financial system. When confidence in sovereign bonds weakens, currencies, equities, credit, and trade financing all reprice.

Unlike banking crises, which can be addressed with liquidity, bond crises are credibility crises. Once investors question a government’s ability to service debt without inflation or monetization, stabilization becomes far more difficult.

Historically, systemic resets follow bond market stress — not equity selloffs.

Why It Matters to Foreign Currency Holders

For foreign currency holders, bond instability creates asymmetric risk:

Debt-heavy currencies weaken first, regardless of reserve status

Rising yields can signal distress rather than strength

Capital flows shift rapidly when fiscal sustainability is questioned

Settlement confidence erodes when monetization becomes the backstop

In reset terms, currency value increasingly reflects debt credibility, not political power.

Implications for the Global Reset

Pillar: Debt Sustainability Defines Monetary Credibility

Currencies fail when debt cannot be credibly serviced.Pillar: Bond Markets Trigger Repricing Cycles

They move slowly — then all at once.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Why investors will learn to love government bonds again — after volatility”

Bank for International Settlements – Annual Economic Report: Global Debt and Financial Stability

~~~~~~~~~~

Iran Unrest Escalates as Inflation and Currency Collapse Fuel Instability

Domestic pressure collides with external escalation risk

Overview

Nationwide protests have erupted across Iran, driven by soaring inflation and currency collapse

The unrest represents Iran’s most serious internal challenge in three years

Security forces have reportedly used force against demonstrators, resulting in deaths and arrests

U.S. warnings of possible intervention have heightened geopolitical risk

Economic stress and external pressure are converging at a critical moment

Key Developments

Protests began over rising prices and cost-of-living pressures, then spread across multiple cities

The Iranian rial has plunged to historic lows, intensifying public anger and instability

President Masoud Pezeshkian acknowledged government failures, while warning unrest would not be tolerated

U.S. President Donald Trump warned Washington could act if protesters are fired upon, escalating tensions

Iran continues to face sanctions pressure and regional confrontation, limiting policy flexibility

Why It Matters

Iran’s unrest reflects a classic reset pattern: currency failure precedes political instability. Inflation, sanctions, and isolation have eroded purchasing power and public trust, leaving the government with narrowing options.

What makes this episode particularly dangerous is timing. Domestic unrest is unfolding amid heightened regional tension involving the United States and Israel, increasing the risk that internal instability spills outward into broader conflict.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iran’s situation highlights systemic warning signals:

Currency collapse accelerates social unrest and political fracture

Sanctions magnify FX volatility and settlement risk

Escalation risk drives capital flight and safe-haven demand

Access to global payment systems matters more than reserves

In reset terms, currencies fail first at home — then in global markets.

Implications for the Global Reset

Pillar: Currency Credibility Equals Political Stability

When money fails, legitimacy erodes.Pillar: Sanctions Expose Structural Weaknesses

Isolation accelerates internal fracture points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Trump warns Iran as protests rage over inflation and currency collapse”

Financial Times – “Iran unrest tests leadership as economic pressure mounts”

~~~~~~~~~~

Eurozone Expands as Bulgaria Moves Closer to Adoption

Currency bloc growth signals deeper monetary realignment

Overview

Bulgaria has moved closer to joining the euro area, advancing deeper European monetary integration

The expansion comes amid global currency volatility and geopolitical fragmentation

Eurozone growth strengthens bloc cohesion but also raises policy complexity

Monetary alignment increasingly reflects access and stability, not just growth metrics

Currency blocs are becoming more relevant in the reset phase

Key Developments

European institutions approved Bulgaria’s progress toward euro adoption, citing fiscal and inflation benchmarks

The move expands the euro’s geographic and financial footprint

Concerns over disinformation and political influence accompanied the process, underscoring strategic sensitivity

Eurozone policymakers face rising internal divergence, even as membership expands

Bloc expansion reinforces the euro’s role as an alternative settlement anchor

Why It Matters

Eurozone expansion reflects a broader reset trend: currencies are consolidating into trusted networks. As global trade and finance fragment, nations are seeking protection through larger, rules-based monetary blocs.

While expansion strengthens the euro’s reach, it also increases internal complexity. More members mean greater strain on shared fiscal discipline and monetary coordination, especially during periods of stress.

This is less about optimism — and more about positioning for stability in a fractured global system.

Why It Matters to Foreign Currency Holders

For foreign currency holders, eurozone expansion signals:

Bloc-aligned currencies gain settlement credibility

FX stability increasingly depends on network inclusion

Peripheral currencies outside blocs face repricing risk

Monetary policy becomes more political and structural

In reset terms, access to trusted currency systems matters more than independence.

Implications for the Global Reset

Pillar: Currency Blocs Replace Global Uniformity

Monetary order is reorganizing around trusted networks.Pillar: Access Defines Currency Value

Inclusion matters more than scale alone.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – “Bulgaria moves closer to joining the eurozone despite disinformation concerns”

Reuters – “Bulgaria clears hurdles toward euro adoption as bloc expands”

~~~~~~~~~~

BRICS De-Dollarization Agenda for 2026 Enters Implementation Phase

From planning to parallel financial systems

Overview

BRICS has shifted from de-dollarization rhetoric to real-world execution

India’s 2026 BRICS presidency is accelerating alternative financial infrastructure

Payment systems, gold-backed settlement, and CBDC interoperability are now operational

Dollar use in intra-BRICS trade is already sharply reduced

This marks a structural change in global settlement architecture

Key Developments

India formally assumed the BRICS presidency, with the 18th BRICS Summit expected in New Delhi later this year