Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economic Updates Saturday Morning 5-31-25

Good Morning Dinar Recaps,

US Banking Regulator Calls for Expanded Crypto Financial Literacy

The OCC calls for a major boost in financial literacy to navigate the explosive rise of digital assets, urging updated strategies to protect and inform new crypto investors.

OCC Calls for Stronger Financial Literacy on Crypto

The Office of the Comptroller of the Currency (OCC), the federal agency responsible for overseeing national banks and federal savings associations, has taken steps to clarify the regulatory framework around digital assets in the U.S. banking system.

Good Morning Dinar Recaps,

US Banking Regulator Calls for Expanded Crypto Financial Literacy

The OCC calls for a major boost in financial literacy to navigate the explosive rise of digital assets, urging updated strategies to protect and inform new crypto investors.

OCC Calls for Stronger Financial Literacy on Crypto

The Office of the Comptroller of the Currency (OCC), the federal agency responsible for overseeing national banks and federal savings associations, has taken steps to clarify the regulatory framework around digital assets in the U.S. banking system.

Acting Comptroller Rodney E. Hood, speaking at the Financial Literacy and Education Commission (FLEC) on May 29, 2025, highlighted the increasing importance of cryptocurrency and digital assets in financial services.

“Everyone in the financial ecosystem – including financial educators – should carefully monitor the rapidly changing financial marketplace and update financial education strategies accordingly.

For example, in 2023, almost 5 percent of all households owned or used cryptocurrency, with more than nine in 10 of those holding it as an investment,” Hood said, adding:

“Given the level of interest, expanding financial literacy resources to address digital asset investments may be useful.”

Hood’s comments reflect the OCC’s role in ensuring that banks can engage with digital assets in a regulated and secure manner.

The Acting Comptroller also discussed the need for financial educators to update their strategies to address the growing number of consumers engaging with digital assets — many of whom are first-time investors.

He suggested that financial literacy programs should help these new investors understand the risks and opportunities of digital assets. The OCC has long supported financial education, and Hood emphasized that these efforts should now include resources on emerging financial products like cryptocurrency.

This approach aligns with the OCC’s recent guidance, released in May, which confirmed that national banks and federal savings associations are authorized to provide cryptocurrency-related services, such as custody and execution, as long as proper risk management practices are in place.

“The federal banking system is well positioned to engage in digital asset activities,” the OCC recently said.

The OCC’s position shows a cautious but supportive approach to integrating digital assets into the banking system, while also stressing the importance of consumer education and safety.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

BRICS: US Risks Losing $7.5 Trillion Worth of Asian Assets

The BRICS alliance and all Asian countries combined have an investment worth $7.5 trillion in US assets, including bonds. For decades, the global financial gameplay was simple and easy to understand. Asia had an effortless strategy: sell goods to the US, and in return, invest the proceeds into American financial assets.

Things are now changing under the Trump administration, after the US President disrupted the smooth flow of global trade.

The tariffs and trade wars have rubbed emerging economies the wrong way, and things could turn worse if BRICS and other Asian countries put their own nations first and stop depending on US assets for financial benefits. The unwinding of the $7.5 trillion has already begun on a small scale, according to some of the world’s biggest money managers, speaking to Bloomberg.

These money managers warned that if the US fails to halt the outflow, the future could be bleak.

BRICS: $7.5 Trillion Asian Assets Sell-Off Could Shake the US Markets

For those unfamiliar with this financial shift, the sell-offs in US assets have already been initiated by BRICS. Since 2024, China alone has dumped $150 billion worth of US Treasuries and bonds, choosing to diversify its reserves.

Not just China—many developing nations have sold US assets and purchased gold to diversify their central banks' holdings. Hoarding the US dollar is seen as increasingly risky, especially as the debt ceiling has surged past $36 trillion.

“We are in a shifting world order and I do not believe that we will go back to the state of things as we had before,” said Virginie Maisonneuve, Chief Investment Officer at Allianz Global Investors.

“It is an evolution from the World War Two order and is partially triggered by China rivaling the US in economic and technology terms,” she added.

If BRICS and Asian countries pull the plug on their $7.5 trillion investments in Treasuries and bonds, the US financial markets could be severely shaken.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 5-31-2025

TNT:

Tishwash: UN: Iraq will become a banking powerhouse both domestically and internationally

UN Secretary-General's Special Representative, Mohammed Al-Hassan, confirmed that Iraq will become a banking powerhouse both domestically and internationally .

Al-Hassan said in a statement to the Iraqi News Agency (INA) today, Friday, that "the words spoken during the conference on money laundering and combating the financing of terrorism indicated that Iraq is facing a regional and international challenge to restore its status ."

TNT:

Tishwash: UN: Iraq will become a banking powerhouse both domestically and internationally

UN Secretary-General's Special Representative, Mohammed Al-Hassan, confirmed that Iraq will become a banking powerhouse both domestically and internationally .

Al-Hassan said in a statement to the Iraqi News Agency (INA) today, Friday, that "the words spoken during the conference on money laundering and combating the financing of terrorism indicated that Iraq is facing a regional and international challenge to restore its status ."

He added, "The Iraqi economic system cannot be complete without an effective financial sector, both domestically and internationally," noting that "Iraq is committed to taking positive steps to restore confidence in the financial and banking sector in Iraq ."

Al-Hassan stressed that "the United Nations supports Iraq's path, which will become, in the coming days, a banking power that interacts internally and externally," emphasizing that "the fight against terrorism is not a scourge that has afflicted Iraq alone, but the entire world, and the sacrifices that Iraq has made in lives and money are not trivial or small ."

He noted that "these sacrifices must be completed, extended, and continued to restore Iraq's position in the financial and banking sector link

*************

Tishwash: The US intervenes in the salary funding crisis between Baghdad and Erbil.

The US State Department called on the federal government and the Kurdistan Region to abide by the financial payments stipulated in the Iraqi constitution and work to resolve their differences through constructive dialogue.

A US State Department official said, "Swiftly resolving the salary issue sends a message that Iraq puts the interests of its people first and creates an attractive environment for investment," noting that "it would also be a positive signal regarding the possibility of reopening the Iraq-Türkiye pipeline."

He stressed that "US support for the Kurdistan Region is a key component of its relationship with Iraq," noting that "US Secretary of State Marco Rubio recently hosted the Prime Minister of the Kurdistan Region, Masrour Barzani, and also spoke with the President of the Region, Nechirvan Barzani, where they emphasized the importance of continued cooperation to promote stability and prosperity in Iraq and the region."

These statements come as the Kurdistan Region's civil servants' salaries are facing a new crisis, following the federal Ministry of Finance's announcement that it would halt funding for May 2025 salaries. The announcement was made due to what it described as the region's exceeding its budget share and its failure to deliver oil and non-oil revenues.

Erbil recently signed two agreements with American companies worth more than $110 billion in the energy sector. This sparked criticism in Baghdad, which considered it an infringement of its sovereign powers. Erbil, however, views the agreements as part of its plan for economic reform and resource development. link

************

Tishwash: Baghdad joins the Smart Cities Club: The Municipality adopts digitized transactions to serve citizens.

The first signs of a serious shift toward the concept of smart cities have begun in the capital, Baghdad, through rapid digital steps adopted by the Baghdad Municipality to modernize the performance of its institutions and facilitate citizen transactions.

The Baghdad Municipality has expanded its planning vision to include sustainable development and urban technology, building on the Iraqi state's approach to linking municipal services with advanced digital systems. These systems help reduce bureaucracy, improve performance efficiency, and meet the needs of residents in a changing urban environment.

These initiatives reflect the Secretariat's clear direction to move beyond traditional management and service approaches and enter a qualitative phase based on the integration of digital transformation, environmental planning, and service innovation, positioning Baghdad as a city connected to the global urban fabric of the future.

Baghdad Mayor Eng. Ammar Musa Kazim announced the capital's entry into a new phase of digital transformation by modernizing the mechanisms for processing citizen transactions in Baghdad Municipality departments. This represents a first step toward a smart and sustainable Baghdad, inspired by global models of urban development.

During his participation in the Iraqi Smart Cities Conference, organized by the Federation of Iraqi Chambers of Commerce in cooperation with the International Chamber of Commerce, he emphasized that the Secretariat has begun to play a leading role in addressing urban challenges through the digitization of its services, and its participation in the Arab Smart Cities Forum enhances opportunities for exchanging experiences and expertise with advanced Arab cities.

He explained that the municipality has launched new applications to receive citizens' complaints digitally and has developed a construction transaction system to reduce direct contact and increase transparency and speed, reflecting a gradual transition towards an electronic city with e-government and identity services.

He pointed out that the launch of the implementation work for the New Sadr City project came as a model for a smart and sustainable city that takes into account modern environmental and architectural standards, in parallel with other ambitious projects such as the Sustainable Baghdad Forests and the waste-to-electricity project, indicating a comprehensive approach to redefining the capital's service and environmental infrastructure.

In separate posts on the X platform, observers highlighted the importance of these initiatives in addressing the accumulated burden of decades of service decline and haphazard planning.

Journalist Hussam Al-Taie wrote: "Finally, we're hearing about a smart Baghdad... digital transformation is not a luxury, but a tool for urban justice." Engineer Suha Al-Lami tweeted: "If the Baghdad Municipality adheres to the digital roadmap, we will witness a real transformation in people's lives."

This leap forward is based on the Baghdad Municipality's vision to catch up with major Arab cities, after years of absence from the sustainable urban development map. The city seeks to make the capital a practical testing ground for future city ideas, rather than merely a theoretical imitation of others' experiences. link

************

Mot: .. No Quitter Am I!!!

Mot: . Yeppers!!! --- Been This Way Alot!!!! Lately!!!!

More News, Rumors and Opinions Friday PM 5-30-2025

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 30 May 2025

Compiled Fri. 30 May 2025 12:01 am EST by Judy Byington

Thurs. 29 May 2025: REVEALED: THE SAINT GERMAIN TRUST — TRILLIONS UNLEASHED TO DESTROY THE FIAT EMPIRE …Ben Fulford on Telegram

The Saint Germain Trust is REAL. Trillions in gold. Locked away. Hidden from you. Hijacked by the cabal. But in 2025, that lock is breaking. This isn’t theory. This is the financial kill switch the elites couldn’t disable.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 30 May 2025

Compiled Fri. 30 May 2025 12:01 am EST by Judy Byington

Thurs. 29 May 2025: REVEALED: THE SAINT GERMAIN TRUST — TRILLIONS UNLEASHED TO DESTROY THE FIAT EMPIRE …Ben Fulford on Telegram

The Saint Germain Trust is REAL. Trillions in gold. Locked away. Hidden from you. Hijacked by the cabal. But in 2025, that lock is breaking. This isn’t theory. This is the financial kill switch the elites couldn’t disable.

FOR DECADES, THEY BURIED IT. NOW IT’S RISING. Behind every lie about “economic growth” was a truth they feared: a planetary trust fund, backed by hard gold, not fiat, created to liberate humanity after centuries of e*********t by central banks, tax fraud, and war-for-profit systems.

The Saint Germain Trust was designed to trigger NESARA in the U.S. and GESARA globally — laws the DS mocked, smeared, and sabotaged. But these aren’t fantasies. They are blueprints. And they are being activated.

ITS MISSION ISN’T AID — IT’S RETRIBUTION.

– Cancel national & personal debt

– Fund monthly stipends — not UBI, but restoration

– Back USTN with gold through QFS

– Dismantle central banks & IRS foreign taxation

– Finance a sovereign planet — not governed by the WEF or IMF, but by WE THE PEOPLE

THE LOCK IS BREAKING — AND THE TIMELINE IS MOVING

Watch for the signs:

– BlackRock’s collapse

– Executive Order 13848 seizures

– USTN notes issued with serial match

– ISO 20022 quietly integrated across global banks

– Vatican forced to disclose gold holdings

This is not random. This is a coordinated dismantling of the old world system.

WE ARE INSIDE THE ACTIVATION WINDOW Stipends. Debts wiped. QFS live. Fiat systems crashing. These aren’t “coming soon.” They’re already shadow-deployed — waiting for full reveal under military command.

Final message: You were never supposed to own land. Or retire. Or be free. But now you will — because you took it back.

~~~~~~~~~~~~~

Thurs. 29 May 2025: Since 2020, I’ve been monitoring reports that the Quantum Financial System (QFS) wasn’t just operational — it was quietly intercepting transactions in real time. But it wasn’t until January 2025 that I received undeniable proof from banking insiders and U.S. military intelligence: the override has begun. …Ben Fulford on Telegram

On the same day, I was forwarded an internal memo from the ECB acknowledging “unaccounted historical reserves exceeding $54 trillion.” That money never existed in the real economy. It was phantom value — sustained only by lies and the illusion of global debt.

The new system doesn’t just bypass banks. It neutralizes financial warfare. And it has already begun to win.

Read full post here: https://dinarchronicles.com/2025/05/30/restored-republic-via-a-gcr-update-as-of-may-30-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick If the American dollar is $1 and it if it's paired to the Iraqi dinar that means the Iraq dinar is $1. That is called a nominal value. That is what every country seeks. In this case it's also seeking a REER - real effective exchange rate. That's because it's reaching a nominal value.

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Mr. Sammy says...They say soon the parallel market price will come to match the official CBI rate. That's how it's going to be fixed. However I still believe somewhere around 1390 to maybe 1350 or 1340 that will be close that they will roll out the new rate. FRANK: This is so close. It's like your breath to your lungs.

************

The Fed is Derelict in it’s Duty to the American People

Palisades Gold Radio: 5-29-2025

In a recent conversation with Tom Bodrovics on Palisades Gold Radio, Danielle DiMartino Booth, CEO and Chief Strategist for QI Research and author of the acclaimed book “Fed Up,” offered a stark assessment of the current economic landscape, pointing to a recession that many seem unwilling to acknowledge.

Booth, a former Fed Insider, didn’t mince words, highlighting critical data points that signal a significant downturn, likely commencing in Q1 2024.

Booth argues that the evidence is mounting, pointing to job losses that began surfacing in Q2 2024 as concrete confirmation of the recession’s arrival. Despite these clear indicators, she contends that official channels are hesitant to label the current situation a recession, suggesting political motivations are at play.

Beyond macro-level indicators, Booth delved into the specific pressures facing American households, citing the end of student loan forbearance and increasing credit card constraints as significant burdens impacting consumer spending.

With defaults expected to rise, she argues that the bedrock of the US economy – consumer spending – is facing a serious threat. Compounding the issue is the absence of clear fiscal policies to replace the stimulus measures that previously buoyed the economy, leaving it exposed and vulnerable.

The conversation then shifted to the troubled commercial real estate sector, where banks are increasingly feeling the pressure to recognize and absorb losses.

Booth was particularly critical of the Federal Reserve, accusing them of selectively ignoring critical data, such as shelter inflation and escalating job losses. Instead, she claims, the Fed is focusing on the impact of tariffs on goods prices, a stance she sees as politically driven and dismissive of the Fed’s own historical lessons.

In light of this uncertain and potentially turbulent economic climate, Booth offered practical advice for investors. She stressed the importance of prioritizing safety over riskier assets, highlighting the relatively high returns currently available on cash as a compelling factor. Given the opaque economic outlook and the potential for further shocks, she believes a conservative approach is the most prudent strategy.

Finally, Booth concluded the interview with a call for empathy and community support. Recognizing the hardships many families and communities are facing during these challenging times, she emphasized the imperative of looking out for one another and offering support whenever possible.

Her sobering analysis serves as a reminder that economic downturns have real-world consequences, and community solidarity is crucial for navigating periods of economic hardship.

Danielle DiMartino Booth’s insights serve as a stark reminder that while official narratives may lag behind reality, the underlying economic trends are often more telling.

Her conversation on Palisades Gold Radio offers a critical perspective on the challenges facing the US economy, urging listeners to prepare for the potential for continued economic hardship and to prioritize both financial prudence and community support.

Basel III - Follow the Yellow BRICS Road

Basel III - Follow the Yellow BRICS Road - LFTV Ep 225

Kinesis Money: 5-30-2025

In this week’s Live from the Vault, Andrew Maguire reveals how BRICS nations, led by China, are accelerating the Basel III shift to physical gold, as the US faces rising pressure to audit Treasury holdings and expose the true state of its gold reserves.

With bullion banks trapped in derivative losses and June market tightness signalling limited supply,

Andrew tracks a bullish coiling pattern in gold and silver, pointing to a looming price revaluation that Western institutions can no longer stall.

Basel III - Follow the Yellow BRICS Road - LFTV Ep 225

Kinesis Money: 5-30-2025

In this week’s Live from the Vault, Andrew Maguire reveals how BRICS nations, led by China, are accelerating the Basel III shift to physical gold, as the US faces rising pressure to audit Treasury holdings and expose the true state of its gold reserves.

With bullion banks trapped in derivative losses and June market tightness signalling limited supply,

Andrew tracks a bullish coiling pattern in gold and silver, pointing to a looming price revaluation that Western institutions can no longer stall.

Timestamps:

00:00 Starts

01:40 Gold, silver bullish; physical demand rising despite market games

06:37 Viewer Harry asks about smart money reaction, bank tactics, LBMA ruling

15:03 Basel III exposes gold leverage; physical delivery pressures rising

23:40 Unallocated gold drains; China forces physical delivery compliance

31:44 China exploits paper volatility; silver set to outperform gold

News, Rumors and Opinions Friday 5-30-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 30 May 2025

Compiled Fri. 30 May 2025 12:01 am EST by Judy Byington

Possible Timing of GESARA and the Global Currency Reset:

GESARA Activation A Financial Revolution: The long-awaited GESARA wealth transfer has commenced, with banks being dismantled and the Federal Reserve neutralized. Key developments include:

Debt Forgiveness: Individuals in various regions are experiencing the erasure of debts, including student loans and mortgages

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 30 May 2025

Compiled Fri. 30 May 2025 12:01 am EST by Judy Byington

Possible Timing of GESARA and the Global Currency Reset:

GESARA Activation A Financial Revolution: The long-awaited GESARA wealth transfer has commenced, with banks being dismantled and the Federal Reserve neutralized. Key developments include:

Debt Forgiveness: Individuals in various regions are experiencing the erasure of debts, including student loans and mortgages.

Repatriation of Stolen Wealth: Trillions in offshore accounts linked to the DS are being returned to fund GESARA initiatives.

~~~~~~~~~~~~~~

Thurs. 29 May 2025: HISTORIC BOND REDEMPTION — THE QFS-ACTIVATED RESET OF GLOBAL WEALTH …QFS on Telegram

The vaults are opening. What was once sealed in silence is now being digitally awakened through the most powerful financial weapon ever created — the Quantum Financial System. These are not ordinary bonds. They are generational instruments of gold-backed sovereignty, issued by monarchs, empires, and nations long before the rise of the fiat matrix.

Suppressed for decades, mocked by the mainstream, and buried under layers of globalist deception — these bonds are now triggering the collapse of the central banking order, under the full authentication and enforcement of the QFS.

At the heart of the redemption lies a technology they never wanted us to have — the Quantum Financial System. With unbreakable encryption, quantum verification, and military-grade oversight, the QFS is verifying, timestamping, and processing legitimate historic bonds in real time.

Every notarized document, every lineage-confirmed certificate, is being logged permanently into the QFS grid. There are no middlemen. No fraud. No room for manipulation. This is financial sovereignty at the speed of light — and it’s happening now.

Behind the scenes, sovereign alliances, White Hat financial officers, and elite legal teams are coordinating with redemption desks running parallel to legacy systems. The commercial banks are being bypassed. The central banks are being exposed.

As bonds tied to the Qing Dynasty, Treaty of Versailles, and post-WWII reconstruction are redeemed, the QFS is executing instant value transfers, recalibrating real-time asset-backed liquidity into the new gold-standard economy. These instruments were never dead — they were waiting for the system powerful enough to process them.

And that system is here. It’s active. It’s irreversible. The QFS is not a theory. It is the central nervous system of the Global Financial Reset. Every redemption strips power from fiat creators and re-anchors global trade on truth and substance.

As even a fraction of these bonds move through the QFS, the ripple becomes a wave: fiat devalues, gold spikes, shadow assets vanish, and suppressed wealth returns to the people. This is why the elite are panicking. This is why fake bond scams are flooding the space. Because the real ones are being cashed — and the system can’t stop it.

The counterfeits are obvious: no seals, no signatures, no chain of custody. But the QFS knows the difference. With quantum tagging and biometric integration, the system can trace every authentic document back to its origin. There’s no escaping the code. Fraud dies in a system built on light.

Historic bonds are not paper relics. They are detonators. When run through the QFS, they don’t just redeem wealth — they collapse empires built on lies. What’s unfolding is not an audit. It’s a controlled demolition of the old guard. The era of artificial scarcity is ending. The real wealth, hidden in vaults and safeguarded by trust, is coming home.

And at the center of it all — the Quantum Financial System. Silent. Absolute. Unstoppable. History is not being rewritten. It’s being reactivated.

~~~~~~~~~~~~~~~~~~~

From Thurs. 5 June to Mon. 9 June 2025 the Tier4B window would be (allegedly) open. Internal banking advisories indicated public redemption will begin regionally, based on QFS load-balancing and readiness reports.

From Tues. 10 June to Fri. 13 June 2025 all Tier4b appointment notifications will be (allegedly) issued.

From Sat. 14 June 14 to Tues. 17 June 2025 the General Public rollout would (allegedly) happen, with the Sat. 14 June U.S. Army’s 250th Anniversary Parade at the National Mall serving not just as a celebration — but as confirmation that America was back under Constitutional Rule.

Around Sun. 15 June 15 and Mon. 16 June 2025 expect minor banking downtimes, signaling the final switchover to full QFS integration.

On Wed. 18 June to Sat. 21 June 2025 the Global Access Phase would (allegedly) begin for Tier 5, the General Public.

Thurs. 29 May 2025 Bruce The Big Call: A source said that the new rates would be up on the screens by Sat 31 May. We have confirmation Tier4b will get started the first days of June. DOGE payments will be out the first part of June. The raise in Social Security payments will start in June. There was a return to the Gold Standard last Tues. 27 May 2025. Ask for the contract rate on the Dinar.

Thurs. 29 May 2025 Jon Dowling: We don’t do dates and rates over here (Iraq), but we now know officially that July 9th is the back wall for the reset to occur optically. Now that Iraq has been(allegedly) funded in the private sector, the Iraqi military orders the two-hundred member special forces unit that protected Maliki, which is directly linked to the Prime Minister’s office.

The trade agreements, as well as peace agreements are now being finalized into the month of June and the XRP case will finally be completed, as well as a Gold backed stablecoin, directly tied to the new US Note, thanks in part to Texas’s efforts.

Iraq also just launched the new Sadr city, with over 60,000 new homes and infrastructure. Additionally, new partnerships with Europe and the Middle East are being forced. You build and fund the infrastructure from within and then the finances permeate in the public eye shortly thereafter. There’s a big clue for those who know.

Read full post here: https://dinarchronicles.com/2025/05/30/restored-republic-via-a-gcr-update-as-of-may-30-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Do you believe it was the IMF that released those two [Forex] paragraphs?" Yeah I do because you can trace it. You can find it...Those paragraphs are about the white papers. The White Papers is the blueprint of the economic reform of Iraq because of the success of the monetary reform.

Walkingstick This [Forex] memo confirms the Iraqi dinar is fully armed for public rate visibility at $4.81 with active infrastructure integration, live suppression staging and institutional level confirmation...We believe this to be true. What that paragraph means is the IQD is now convertible...[and] has absolutely no restrictions on the currency at all - Article VIII.

Militia Man Article: "Central Bank: Our measures contribute to lowing the exchange rate and the decline is not temporary." Lowing the rate exchange rate of the dollar to the dinar...that's what that means...

************

BRICS, Bullion & the Monetary Endgame with Dr. Jim Willie

Liberty and Finance: 5-29-2025

Economist Dr. Jim Willie, publisher of *The Golden Jackass*, unleashes a no-holds-barred breakdown of the global monetary unraveling.

From the slow death of the Petrodollar to BRICS’ stealth gold revolution, Jim digs into hidden vaults, secret alliances, and the gold-backed shift already underway. But it’s silver that could deliver the real shock.

He explains how decades of manipulation have built a powder keg inside the bullion system and why a sudden collapse could trigger a global chain reaction.

This is the financial endgame.

Who’s behind it, who stands to fall, and what might rise from the rubble.

Seeds of Wisdom RV and Economic Updates Friday Morning 5-30-25

Good Morning Dinar Recaps,

XRP LAWSUIT: NEW MYSTERIOUS ‘DECISIVE EVIDENCE’ TO CHANGE RIPPLE OUTCOME?

▪️ Mysterious Filing Resurfaces: Justin Keener submits an emergency motion claiming “decisive evidence” that could aid Ripple in its lawsuit.

▪️ Ripple vs. SEC Drama Continues: Legal experts weigh in as the XRP community watches how this filing might impact the case before June 16.

Good Morning Dinar Recaps,

XRP LAWSUIT: NEW MYSTERIOUS ‘DECISIVE EVIDENCE’ TO CHANGE RIPPLE OUTCOME?

▪️ Mysterious Filing Resurfaces: Justin Keener submits an emergency motion claiming “decisive evidence” that could aid Ripple in its lawsuit.

▪️ Ripple vs. SEC Drama Continues: Legal experts weigh in as the XRP community watches how this filing might impact the case before June 16.

The XRP lawsuit never “fails to entertain” and it just got interesting. A mysterious filing by Justin W. Keener with an emergency motion has resurfaced again.

Decisive Evidence to Change the Outcome?

Keener says that he has “decisive evidence” which could change the outcome of the Ripple vs. SEC case in favor of Ripple. This unexpected move invited comments from experts like Bill Morgan and Marc Fagel.

“XRP Case Never Fails to Surprise”

Bill Morgan shared that he expected some kind of filing, especially with the 60-day deadline for a status update nearing on June 16. He didn’t expect a lengthy, emotional rant against the Howey Test and its court interpretations, especially about “investment contracts.” The rant also criticized the SEC’s actions over the past 90 years.

“This case never fails to entertain or end,” he said, which shows how unpredictable the lawsuit has become.

Marc Fagel also pointed out that this is the second time the same individual has submitted documents. The SEC even responded to the first one but questioned why the court hasn’t shut down the person’s PACER account yet, given the unauthorized filings.

Keener’s first attempt to submit his “decisive evidence” in the Ripple case was shut down back in April, but he’s now trying again. Keener was recently fined $10 million for illegally trading penny stocks without registering as a dealer.

Will This Impact the Lawsuit?

The XRP community is watching closely to see if this would have any impact on the lawsuit. Most expect the court to reject it again, but how the judge and SEC respond this time will show whether it has any real impact.

In a recent letter to the SEC, Ripple said that fungible crypto assets like XRP aren’t securities in secondary sales. Citing legal expert Lewis Cohen and a 2023 court ruling, Ripple argued that these tokens don’t carry the legal traits of securities and requested the SEC to adopt clearer rules, noting that XRP itself was ruled not a security in public trading.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

BRICS: 44 COUNTRIES ALIGN WITH DE-DOLLARIZATION AGENDA

A total of 44 countries are aligning with the de-dollarization agenda kick-started by the BRICS alliance. The 11-member bloc is rewriting trade policies to benefit their national economies and currencies while ignoring the US dollar.

The shift against the greenback is accelerating as emerging economies are bringing investments back home. Developing countries are cutting ties with the US-based financial investments such as bonds, and accumulating gold and local currencies in their reserves.

The economic policies of the White House have caused extreme financial distress in developing countries. From Trump initiating tariffs to trade wars and global dominance, emerging economies are siding with BRICS as the bloc advances the de-dollarization agenda.

The US now stands alone on the global stage as even the European Union, which is its close ally, is considering the euro for transactions. Several leaders have openly called to reduce dependency on the USD and focus on European assets.

44 Countries Align With BRICS De-Dollarization Agenda

Vietnam became the latest country to show interest in the BRICS de-dollarization agenda in 2025. Around 44 countries are interested in BRICS expansion and officially taking part in the de-dollarization policies. The nations who are on the sidelines want to dismantle the US dollar’s dominance and replace it with local currencies.

The upcoming 17th summit in Rio de Janeiro will signal how fast the process will gain shape next. BRICS made it clear that the long-term goal of the alliance is to fast-track de-dollarization and end the US dollar’s supremacy. It is reported that many more countries could join the bandwagon from Asia and nations from the African region.

Emerging economies want to use BRICS as a stepping stone to officially launch the de-dollarization roadmap in their respective countries. They would have the backing of the New Development Bank (NDB) which can disburse loans in local currencies for infrastructural developments.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 5-30-2025

TNT:

Tishwash: New Partnership to Connect the Middle East and Europe via Iraq

Zain Omantel International (ZOI) has announced a partnership with Iraq's Horizon Scope Telecom and the Iraqi Telecommunications and Information Company (ITPC), a government-owned company under the Iraqi Ministry of Telecommunications.

This partnership enables ZOI to create a digital telecommunications corridor stretching from the Middle East to Europe through Iraq, offering alternative terrestrial connectivity options that provide higher levels of capacity, security and efficiency.

TNT:

Tishwash: New Partnership to Connect the Middle East and Europe via Iraq

Zain Omantel International (ZOI) has announced a partnership with Iraq's Horizon Scope Telecom and the Iraqi Telecommunications and Information Company (ITPC), a government-owned company under the Iraqi Ministry of Telecommunications.

This partnership enables ZOI to create a digital telecommunications corridor stretching from the Middle East to Europe through Iraq, offering alternative terrestrial connectivity options that provide higher levels of capacity, security and efficiency.

According to a statement from ZOI, the route will use terrestrial fibre connectivity that utilises Iraq's position as a digital gateway, creating more reliable services that are less susceptible to interruptions. It will pass through Turkey and make its way up to Frankfurt, Germany. The new corridor will act as an alternative to traditional subsea routes by bypassing some of the turbulent areas. The route will enable international businesses, telecom operators and hyperscalers to expand their reach via robust, low-latency infrastructure, ensuring seamless connectivity between the Middle East and Europe.

Mr. Sohail Qadir, CEO at ZOI, said:

"By working together, we will enhance regional and international connectivity, offering higher capacity, security, and efficiency for businesses, operators and hyperscalers across continents."

Mr. Ahmed Abdulsalam, the Managing Director of Horizon Scope, said:

"Offering alternative terrestrial connectivity routes is a critical way to protect against infrastructure vulnerabilities, ensuring that enterprises can capture more opportunities and scale with reliable connectivity."

Mr. Ali Y. Dawood, the Director General of ITPC, said:

"This partnership marks a significant milestone in strengthening Iraq's position as a connectivity corridor, especially by providing an alternative path to Europe. We are committed to delivering connectivity solutions that the people of Iraq can trust and use to enable seamless global connectivity." link

************

Tishwash: The budget schedules will be released in mid-June.

The Finance Committee of the Iraqi Parliament revealed government efforts to submit the 2025 budget tables to Parliament, expecting the tables to be submitted to Parliament in the middle of next month.

Committee member Moein Al-Kadhimi said in a press statement, "We have received information that the Ministry of Finance, along with the Ministry of Planning, is preparing budget tables for the year 2025 based on recent financial and economic changes, with the decline in oil prices. We expect these tables to be submitted in mid-June."

Al-Kadhimi explained, "These agendas will reach the committee when the House of Representatives resumes its sessions. If the agendas reach the House, it will be obligated to hold sessions. This issue will certainly not be free of disagreements, whether political or technical. We may need approximately a month to vote on the agendas after they officially reach the committee and study them from various angles." link

************

Tishwash: Huge untapped wealth... Iraq's top 5 mines

Iraq's five most prominent mines reveal a map of mineral wealth that remains untapped due to decades of security challenges that have led to the neglect of these resources.

According to a report published by the Energy Platform, Iraq's most prominent minerals include "sulfur, phosphate, and rock salt, along with strategic minerals such as iron, manganese, zinc, and lead." The report indicated that "despite the dominance of oil in the economy, Iraq boasts vast mineral resources concentrated in a number of mines."

The platform stated in its report: "The mining sector in Iraq has been marginalized for decades due to political and security tensions. However, recent years have witnessed increased interest in revitalizing this vital sector. The Iraqi government is currently attempting to attract international investment to revive these mines, particularly with the move to diversify the economy away from its reliance on oil."

She added: "Geological data and surveys indicate that Iraq possesses vast reserves of important ores such as sulfur, phosphate, rock salt, iron, and manganese, some of which are ranked among the largest in the world. International reports also reveal that Iraq holds the world's largest reserves of free sulfur, in addition to significant reserves of silica sand."

Energy highlighted the five most prominent mines in Iraq, which form a unique geological map that could position Iraq among the region's leading mineral-producing countries.

Al-Mashraq Mine

The Mishraq mine is one of the largest natural sulfur mines in the world, containing vast reserves of natural sulfur close to the Earth's surface. Sulfur is extracted from the mine by fusion and is used in the fertilizer, petroleum product, and water treatment industries.

According to Energy, "exploitation of the mine began in the 1960s and reached its peak in the 1970s, but ceased after 2003. Despite plans to rehabilitate it, the mine remains out of service. The mine consists of three fields. The first field's reserves are estimated at 23.5 million tons, the second field's reserves are 65.8 million tons, and the third field's reserves are 224 million tons."

The Mishraq mine suffered extensive damage during the ISIS era, when the group set fire to sulfur storage facilities in 2016, causing a rare environmental disaster.

Akashat Mine

The Akashat mine, located in Anbar Governorate, is one of the richest phosphate deposits in the Middle East, with total reserves estimated at more than 7 billion tons, making it one of the top five mines in Iraq.

She said: "The extracted phosphate is used in the manufacture of fertilizers, phosphoric acid, and animal feed, and its reserves in the western desert of Iraq are estimated at more than 10 billion tons."

The mine includes an open quarry, a processing plant, and a railway line connecting it to the Al-Qaim plant. However, the infrastructure has been damaged by wars and terrorism, halting production for many years. Efforts are underway to restart the mine through investment partnerships .

Samawah Mine

The Samawah mine, located in Muthanna Governorate in southern Iraq, is "one of the five most prominent mines in Iraq specializing in extracting rock salt. The salt ore there is distinguished by its high quality and pure sedimentary composition, and is used in the food and chemical industries," according to what the "Energy" platform reviewed.

She added, "The mine operates intermittently and is managed by the General Company for Mining Industries. It suffers from a lack of investment, but it covers a significant portion of the local market's needs, with the potential to develop it into a regional center for salt exports."

Iron and manganese

Sulaymaniyah Governorate in the Kurdistan Region has "promising areas for iron deposits, particularly in Qara Dagh and Birspi, where sedimentary rocks contain hematite and magnetite ores at concentrations ranging from 30 to 45%."

Despite these positive indicators, according to the Energy report, "none of these mines have been commercially exploited yet. Manganese is found in areas such as Soran and Dohuk, but exploration is still preliminary. Factors such as the lack of infrastructure and transportation, in addition to weak financing, represent the most significant obstacles to developing these sites."

Zinc and lead

The Ministry of Energy explained that "there are indications of the presence of good-quality zinc and lead deposits within MVT-type replacement carbonate formations in mountainous areas near the Turkish and Iranian borders, such as Mergasor, Zakho, and Qalaat Diza."

"The main minerals there include galena and sphalerite, along with barite and fluorite. Despite the presence of these resources, the mines have not yet been exploited, but they represent a golden opportunity for Iraq's future plans to develop the mining sector." link

*************

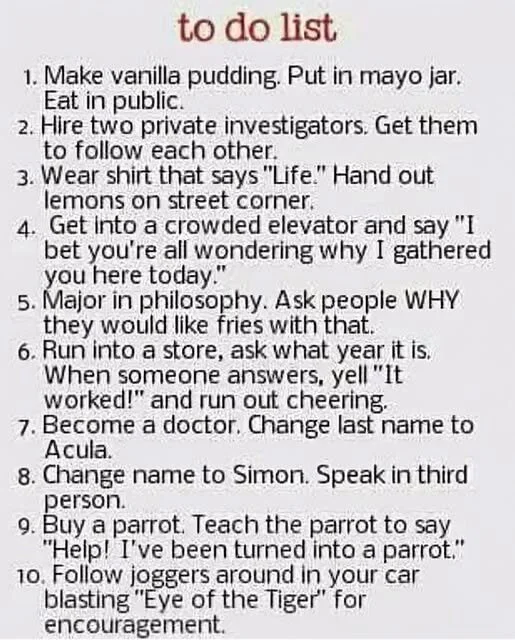

Mot: . Been in This ""RV"" Thingy Way toooo Long I Thinks... to do list

Stealth QE, Fed Secretly Bought $43.6B in Bonds, Why are they Hiding it?

Stealth QE, Fed Secretly Bought $43.6B in Bonds, Why are they Hiding it?

Daniela Cambone: 5-29-2025

The Federal Reserve’s recent actions are sparking debate about whether they’re quietly resurrecting quantitative easing (QE).

Michael Gentile, founding partner at Bastion Asset Management, argues emphatically that they are. In a recent interview with Daniela Cambone on ITM Trading, Gentile pointed to the Fed’s purchase of $43 billion in U.S. bonds as a sign of “how precarious the situation” has become for the U.S. economy.

Stealth QE, Fed Secretly Bought $43.6B in Bonds, Why are they Hiding it?

Daniela Cambone: 5-29-2025

The Federal Reserve’s recent actions are sparking debate about whether they’re quietly resurrecting quantitative easing (QE).

Michael Gentile, founding partner at Bastion Asset Management, argues emphatically that they are. In a recent interview with Daniela Cambone on ITM Trading, Gentile pointed to the Fed’s purchase of $43 billion in U.S. bonds as a sign of “how precarious the situation” has become for the U.S. economy.

While the Fed may be avoiding the “QE” label, Gentile believes this intervention is driven by concerning underlying factors. He highlights the rising U.S. deficits and a dwindling pool of natural buyers for U.S. debt. This leaves the Fed increasingly pressured to step in and prop up the market for U.S. Treasuries.

But the ramifications extend far beyond U.S. borders. According to Gentile, this situation is triggering a significant shift in global reserve strategy. Central banks around the world are reportedly diversifying their holdings, reducing their reliance on the U.S. dollar and actively accumulating physical gold.

“We’re seeing a multi-year, multi-decade rotation out of U.S. dollar assets into gold,” Gentile stated. This isn’t just a short-term reaction to market volatility; it represents a fundamental re-evaluation of global economic security.

The concerns stem from the potential for a self-perpetuating cycle. Increased government spending leads to larger deficits, requiring more borrowing. If the market isn’t willing to absorb this debt at acceptable interest rates, the Fed might be forced to intervene, artificially suppressing rates and potentially fueling inflation.

This intervention further devalues the U.S. dollar, making it less attractive as a reserve currency. Central banks, tasked with managing their nation’s wealth and protecting its economic stability, are then driven to seek alternative assets.

Gold, a traditional safe-haven asset, is seeing renewed interest. Its intrinsic value and historical resilience make it an attractive alternative to a potentially weakening dollar. Central banks diversifying into gold are essentially hedging against the risks associated with U.S. debt and the ongoing economic uncertainties.

Gentile’s perspective suggests that investors should carefully consider their own portfolio allocations. While the U.S. dollar remains a dominant force in the global economy, increasing diversification into assets like gold could provide a hedge against potential devaluation and economic instability.

The long-term implications of these trends remain to be seen. However, the growing concerns about U.S. debt and the flight to gold highlight the importance of staying informed and considering a diversified investment strategy in an increasingly uncertain global economic landscape.

More News, Rumors and Opinions Thursday PM 5-29-2025

KTFA:

Clare: Ministry of Finance Iraq

@MofIraq

Finance Minister Taif Sami is following up with Ernst & Young on the restructuring and merger of the National and Iraqi Insurance Companies and the Industrial Bank, as part of a reform plan that includes electronic payments, enhancing transparency, and training cadres in cooperation with the Central Bank and international organizations.

KTFA:

Clare: Ministry of Finance Iraq

@MofIraq

Finance Minister Taif Sami is following up with Ernst & Young on the restructuring and merger of the National and Iraqi Insurance Companies and the Industrial Bank, as part of a reform plan that includes electronic payments, enhancing transparency, and training cadres in cooperation with the Central Bank and international organizations.

https://x.com/MofIraq/status/1.....6624066036

************

Foreign reserves between inflation targeting and external rent shocks

5/29/2025

Dr. Haitham Hamid Mutlaq Al-Mansour

Monetary policy relies on a fixed exchange rate system to guide the real exchange rate towards the short-term target inflation rate.

This system is appropriate for the Iraqi economy, as real output values are linked to global prices due to the unilateral structure of the economy and the sharp decline in the contribution of non-oil exports to fixed capital formation.

Therefore, the fixed exchange rate system was a realistic option to avoid the erosion of the value of the dinar.

Due to the impact of external rent shocks, controlling foreign reserves (dollars, gold, and securities included on the asset side of the Central Bank's balance sheet as Iraq's external debt) has become an instrumental approach to managing the Central Bank's responses to the aforementioned shocks.

This involves regulating exchange rate fluctuations, targeting inflation rates. Inflation can rise and fall due to external rent shocks, leading to fluctuations.

Therefore, the Central Bank uses its reserves to sterilize the dinar's expansion through dollar purchases and sales, and cash transactions in the stock market, both buying and selling, to achieve the target exchange rate.

The movement of foreign reserves is linked to public spending on oil revenues in dollars after the Central Bank exchanges them for dinars to meet demand from the private and public sectors, as well as government and household purchases. Depending on the surplus and deficit in the balance of payments, reserves grow or shrink. When oil revenues rise, the central bank refrains from financing the budget deficit, and the government reduces its spending, aiming to raise foreign reserves to be used to finance the budget deficit when oil revenues decline again.

Foreign reserves witnessed a significant increase due to the positive shock in the second half of 2021, reaching 3.244 million barrels per day at an average price of $110 per barrel.

This increased Iraq's surplus in public finances and overall external balances, as reserves exceeded $90 billion, helping to stabilize the stabilization system and inflation targeting. However, with global oil prices heading towards a negative shock this year (2025) to less than $60 per barrel, and the Central Bank continuing its sterilization policies and measures towards international compliance, this led to a decline in reserves to less than $97 billion in March 2025, after having been around $105 billion in December 2024. Due to the recent shock, the Central Bank resorted to compensating by increasing its foreign exchange sales.

Therefore, in light of external rent shocks, we see the need for coordination between government policy and the Central Bank. From the government policy side, spending must be restricted to purely technical limits, thus deepening the reduction of the government deficit and strengthening the strategic role of reserves. Monetary policy must sustain its goal of achieving a stable inflation rate by managing the movement of the dollar exchange rate and demand for it in the interest of price stability and reducing costs in favor of rational spending policies.

Achieving low and stable inflation is an important factor in enhancing the local and foreign investment climate, which is linked to related economic policies, including commercial, agricultural, and industrial policies.

In short, the dependence of foreign reserve volatility on external shocks will remain a limiting factor in the national economy's ability to combat inflation and support the investment climate. Therefore, two levels of optimal solutions can be identified.

The first, at the strategic level, involves sustained coordination between fiscal and monetary policies. The second, at the macro and structural level of the Iraqi economy, lies in addressing the rentier nature of the economy by gradually increasing the contribution of non-oil GDP to meet aggregate domestic demand, while supporting export diversification policies. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Forex Executive Summary quote: "This memo confirms the Iraqi dinar is fully armed for public rate visibility at $4.81 which activates infrastructure interrogation, live suspension, staging and institutional level confrontation...The rate is suppressed but loaded across all FX-UV telemetry layers...Release is now dependent solely on coordinated political timing optics..." I want you to understand it's not trading yet. It's not active yet. It's not live yet.

Militia Man There's a reason for the constant avoidance of the 2023/2024 budget schedules. Article 22 paragraph C isn't exposed yet. You have to ask yourself why haven't they done that yet. If they were going to be going into the international [world] at 1310...why didn't they do that at the beginning of 2023? They don't have an answer for that.

*************

FDIC Admits: Bank Risk Rises as Fed Scrambles for Buyers

Taylor Kenny: 5-29-2025

America’s banks are sitting on over $400B in losses. The FDIC says your deposits are safe—but the math says otherwise. Is your savings account the next casualty? Taylor Kenney breaks it down.

Triple Digit Silver? "MONETARY Demand Will Be the Cause"

Mike Maloney: 5-29-2025

The gold price is currently $3319, the silver price is now $33.38 Are we heading toward $100+ silver? In this eye-opening episode, Mike Maloney breaks down why monetary demand—not industrial use—will be the true catalyst for explosive silver prices.

As global economies teeter on the brink of recession, silver production is slowing, while fear of fiat currencies and systemic risk is driving investor interest like never before.

The Financial Reset Has Begun

Francis Hunt: The Financial Reset Has Begun

Wealthion: 5-29-2025

Francis Hunt, founder of The Market Sniper, joins Maggie Lake for an alarming and wide-ranging macro discussion.

He warns that the global financial system is already collapsing, starting with the U.S. bond market and spreading across fiat currencies worldwide.

According to Francis, we’ve reached the end of a 45-year supercycle of debt, and what comes next is a full reset: collapsing markets, a global depression, rising authoritarianism, and the dawn of a new digital system.

Francis Hunt: The Financial Reset Has Begun

Wealthion: 5-29-2025

Francis Hunt, founder of The Market Sniper, joins Maggie Lake for an alarming and wide-ranging macro discussion.

He warns that the global financial system is already collapsing, starting with the U.S. bond market and spreading across fiat currencies worldwide.

According to Francis, we’ve reached the end of a 45-year supercycle of debt, and what comes next is a full reset: collapsing markets, a global depression, rising authoritarianism, and the dawn of a new digital system.

Key Topics:

Why the 40-year bond bull market is dead

How fiat currency is losing its credibility fast

Why gold is the ultimate reserve asset, and will go parabolic

The real role of Bitcoin and select digital tokens

How CBDCs will power the next monetary system

Why property and equities could crash hard

The coming wealth shift from West to East

How governments will clamp down with surveillance and taxation

What investors can do to protect and position themselves

Chapters:

0:34 - Francis Hunt’s Bold Forecast: The Debt Collapse Has Begun

5:10 - What Does “Collapse” Really Mean? Francis Breaks It Down

17:31 - Inflation Explosion? How Fast Prices Could Spiral

22:06 - Why the Next Crisis Could Be Immune to QE

31:32 - The First Domino: Stocks, Housing, or Credit?

43:50 - How to Protect Your Wealth Before It’s Too Late

50:32 - Gold Panic or Golden Opportunity?

57:06 - Could Bitcoin Replace the Dollar as Reserve Currency?

1:01:23 - Gold vs. Crypto: Which Will Lead the Next Financial Era?

1:04:32 - What Could Stop the Collapse—and Will It Happen in Time?

This Will Either Make You Hopeful… Or Extremely Irritated

This Will Either Make You Hopeful… Or Extremely Irritated

Notes From the Field By James Hickman (Simon Black) May 29, 2025

Germany’s “Iron Chancellor” Otto von Bismark didn’t pass the world’s first modern Social Security system out of the kindness of his heart.

The year was 1889, and Bismark was fighting hard against the rising tide of socialism; the second volume of Karl Marx’s Das Kapital had been published just a few years earlier in 1885, prompting growing calls for strikes, protests, and wealth redistribution.

For Bismark, his social security program was intended to appease socialists while preserving the conservative political order that he had spent decades building. And on May 24, 1889, his new “Old Age and Disability Insurance Law” was passed by the Reichstag and signed by Kaiser Wilhelm II.

This Will Either Make You Hopeful… Or Extremely Irritated

Notes From the Field By James Hickman (Simon Black) May 29, 2025

Germany’s “Iron Chancellor” Otto von Bismark didn’t pass the world’s first modern Social Security system out of the kindness of his heart.

The year was 1889, and Bismark was fighting hard against the rising tide of socialism; the second volume of Karl Marx’s Das Kapital had been published just a few years earlier in 1885, prompting growing calls for strikes, protests, and wealth redistribution.

For Bismark, his social security program was intended to appease socialists while preserving the conservative political order that he had spent decades building. And on May 24, 1889, his new “Old Age and Disability Insurance Law” was passed by the Reichstag and signed by Kaiser Wilhelm II.

Workers under Bismark’s program became eligible for benefits at age 70, and its costs were paid equally by employees, businesses, and the state.

It also had its intended effect: support for Germany’s unified socialist party fell dramatically after the law was passed, and it became the leading blueprint for similar programs around the world.

Franklin Roosevelt pushed for a Social Security program in the United States for similar reasons; socialist movements were growing quickly in America, especially under the economic devastation of the Great Depression.

Politicians like Louisiana Senator Huey Long were calling for full-blown wealth redistribution, promising every family a $5,000 estate (large sum in the 1930s) and guaranteed income.

Then there was Francis Townsend in California, who proposed a national sales tax to provide a $200 monthly pension to every American over the age of 60-- with the requirement that the money had to be spent within 30 days to stimulate the economy.

These ideas spread like wildfire, and soon there was major support in Congress for some sort of national pension.

Roosevelt modeled his program on Otto von Bismark’s-- but lowered the age of eligibility to 65 instead of 70.

The first financial analysis of Social Security came in 1941, when the Board of Trustees published a report stating that the program would remain solvent and well-funded indefinitely, i.e. pretty much forever.

At the time, there was far more tax revenue being paid into Social Security than there were benefit payments being paid from the system. So Social Security essentially ran a massive surplus each year… and the accumulated surplus was invested in a giant trust fund.

But eventually cracks started to form.

In 1983, the Social Security trustees issued a more sanguine assessment; this time they claimed that the program would still remain solvent for their 75-year horizon (i.e. through 2057), but that costs of paying benefits to Social Security recipients would exceed tax revenue by 2018… at which point they would have to start drawing down the trust fund.

Pfff. It was 1983. No one in Washington cared about what might or might not happen 35 years later. So, barring cosmetic adjustments, politicians ignored the problem.

The Trustees sounded the alarm bells again in the 1990s when they projected that Social Security’s trust funds would run out of money by the year 2042. And, as time has continued to pass, that projected depletion date has become closer and closer.

Starting in the 2010s, Social Security projected that its trust funds would be fully depleted by 2035-- roughly 20-25 years into the future.

And according to their latest assessment, the projected depletion date is now 2033. That’s just eight years away.

So, what does this actually mean?

Well, Social Security is already running an annual deficit, i.e. the program pays out MORE in monthly benefits than it collects in tax revenue. So, each year they have to dip into the trust fund to make ends meet.

But in eight years, the trust fund balance will be zero… so they won’t have any savings to offset Social Security’s annual deficit anymore. And that annual Social Security deficit is projected to be more than $500 billion by 2033.

There will essentially be two options at that point; either

(1) the federal government will pick up the tab, essentially adding $500 billion per year to the US budget deficit; or

(2) Social Security beneficiaries will have to take an immediate cut to their benefits. The initial cut would be around 20-25% and become worse over time.

Option 2 is unthinkable given the political consequences. But option 1 would only lead to more economic problems… and a lot of inflation. The US government needs to be reducing its budget deficit, not expanding it.

The good news is that there are ways to fix Social Security; the program itself has recommended plenty of solutions.

For example, given that life expectancy at age 65 is now so much longer than it was in 1935, one recommendation is to gradually phase-in a higher retirement age to 69.

Simultaneously, a small payroll tax increase of 1%, combined with increasing the maximum taxable salary, would render the program solvent for at least 75 more years.

And these just scratch the surface-- there are plenty of other options.

The bad news is that the longer Congress waits, the more painful the solutions will become. If they wait until 2030 to pass any reform, there will have to be much more severe tax hikes and much more abrupt changes to the retirement age.

So, dealing with the problem now will make life less difficult in eight years’ time.

Unfortunately, few are willing to do anything about it.

On rare occasions some politician proposes necessary reforms. In fact, the last one came last week from Rep. Gwen Moore of Wisconsin, who introduced the Social Security Enhancement and Protection Act.

But these bills never go anywhere and ‘die in committee’.

Bottom line, the problem is 100% fixable-- just like the rest of America’s economic challenges. The national debt is fixable. Fraud, waste, and abuse is fixable. Inflation is fixable. Everything is fixable.

There just doesn’t seem to be the will to do what is necessary… so these problems will continue to fester until they become a crisis.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

News, Rumors and Opinions Thursday 5-29-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 29 May 2025

Compiled Thurs. 29 May 2025 12:01 am EST by Judy Byington

Possible Timing:

March 2020 the U.S. government nationalized the Fed — stripping it of independence and turning it into a tool of the Executive Branch. Using Special Purpose Vehicles (SPVs), the Treasury engineered a shell system that forced the Fed to act ONLY under Treasury authority. The Fed couldn’t fund or activate liquidity operations without Mnuchin’s green light. Translation: The Fed was no longer in charge. The money printer answered to the White House.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 29 May 2025

Compiled Thurs. 29 May 2025 12:01 am EST by Judy Byington

Possible Timing:

March 2020 the U.S. government nationalized the Fed — stripping it of independence and turning it into a tool of the Executive Branch. Using Special Purpose Vehicles (SPVs), the Treasury engineered a shell system that forced the Fed to act ONLY under Treasury authority. The Fed couldn’t fund or activate liquidity operations without Mnuchin’s green light. Translation: The Fed was no longer in charge. The money printer answered to the White House.

Mon. 26 May 2025: With the Fed under control of the US Treasury, the IRS dismantled and the Gold Standard in effect, the Quantum Financial System (QFS) officially went online with all bank accounts mirrored onto the system — tracking every transaction in real time, secured by Space Force and protected by military-grade blockchain.

~~~~~~~~~~~~~~~

EBS

Major Public Announcement At Any Moment

Alert: Scheduled Broadcasts and Official Statements. All signs point to a major public announcement at any moment. Government and media sources hint at coordinated Emergency Broadcast System tests and press briefings this week.

Expect official statements from financial authorities confirming the reset, possibly unveiling new currency rates or debt-cancellation policies. Be ready: when the signal goes out, millions will see proof of the new system.

Imminent signs:

EBS Testing: Encrypted test alerts have already been reported in several regions. A full-scale broadcast to all networks may occur tonight or tomorrow to confirm the launch.

Authority Statements: Central bank governors and financial ministers are on standby to speak publicly. Briefings will emphasize transparency, sovereignty, and the end of financial tyranny.

System Status: Technical monitoring dashboards are green across the board. I’ve confirmed that core QFS servers are handling simulated transaction loads flawlessly with no errors.

Market Readiness: Even traditional financial markets are adjusting: stock exchanges and currency platforms are poised to switch to the new asset-backed basis. New exchange rates may be published within hours.

The pieces are in place for history to unfold. Prepare to witness the global reset. Keep your notifications on, and when alerts arrive, follow the provided steps immediately. Trust the process — our era of true economic freedom is here.

~~~~~~~~~~~~~~

Global Financial Crisis:

Read full post here: https://dinarchronicles.com/2025/05/29/restored-republic-via-a-gcr-update-as-of-may-29-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Sudani met today with the board of directors from the CBI. All the banks were there too. Now in front of everybody he replaced some of the board of directors that were not on board with the new digital system... FRANK: Sudani just fired a bunch of [CBI] board of directors and replaced them with those that want to have the monetary reform...

MilitiaMan We have not seen the 2023/24 budget schedules yet and they're not going to see those in the parliament until, I believe, they expose an exchange rate. That's where we're at.

Paulette I am hopeful that perhaps the 1390 [Market Rate] target is to enact the Delete the Zeros project (RD/RV) resulting in an annihilation of the Market Rate. This would then result in Article 8 obligation compliance in order to get to the RI stage. This would be congruent with the 2009 MOP/MOF report of "initially a rate of 1.14-1.18 and held there for a period" ....prior to "restoring the true rate of 3.208." I sure hope we are close.

************

COMEX Gold Deliveries Hit New Record | Andy Schectman

Liberty and Finance: 5-28-2025

Tune in for a special conversation with Andy Schectman, head of Miles Franklin, as he unpacks the significance of a bold new law enacted by Governor Ron DeSantis that initiates the path toward recognizing gold and silver as official currency in Florida.

Andy will also walk through how the May contract on the COMEX saw its largest delivery ever, and what that could mean for the future of precious metals.

Seeds of Wisdom RV and Economic Updates Thursday Morning 5-29-25

Good Morning Dinar Recaps,

U.S. Department of Labor Reverses 2022 Guidance That Blocked Digital Assets From 401(k) Plans

The U.S. Department of Labor (DOL) is scrapping a mandate in its 2022 guidance that prevented digital assets from being included in 401(k) retirement plans.

In a new press release, the DOL says it’s rolling back its 2022 compliance release, which previously instructed institutions to forgo using crypto assets as options for 401(k) plans.

Good Morning Dinar Recaps,

U.S. Department of Labor Reverses 2022 Guidance That Blocked Digital Assets From 401(k) Plans

The U.S. Department of Labor (DOL) is scrapping a mandate in its 2022 guidance that prevented digital assets from being included in 401(k) retirement plans.

In a new press release, the DOL says it’s rolling back its 2022 compliance release, which previously instructed institutions to forgo using crypto assets as options for 401(k) plans.

In 2022, the DOL warned fiduciaries to use "extreme care" before offering digital assets as options for retirement plans, language that was considered unusual at the time as the agency historically has taken a neutral approach toward the subject, according to the press release.

According to U.S. Secretary of Labor Lori Chavez-DeRemer, the DOL is rolling back the government overreach created by the Biden Administration.

Says Chavez-DeRemer,

"The Biden administration’s department of labor made a choice to put their thumb on the scale. We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not D.C. bureaucrats."

The DOL says it’s neither endorsing nor disapproving of employers who choose to include crypto assets and notes that its reasoning extends to other crypto-related products, such as derivatives.

Previously, the DOL said it had "serious concerns" about people’s retirement funds being tied up in crypto due to "significant risks of fraud, theft, and loss."

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

Russia Allows Banks to Offer Crypto Products to Accredited Investors

Russian banks have started rolling out crypto investment products tied to the price of Bitcoin following a greenlight from the central bank.

The Bank of Russia has permitted financial institutions to offer certain cryptocurrency-based financial instruments to accredited investors.

Russian banks are now free to provide qualified investors with a range of crypto products, including crypto derivatives, securities, and other digital financial assets tied to crypto prices, the central bank announced on May 28.

A key stipulation, however, is that these products must not involve the "actual delivery of cryptocurrencies," the Bank of Russia emphasized.

The announcement came alongside the Bank of Russia reporting a 51% increase in crypto asset inflows by Russian residents in the first quarter of 2025, totaling 7.3 trillion rubles ($81.5 billion).

T-Bank Among the First to Offer Bitcoin Investment Products

Some major Russian banks started rolling out cryptocurrency investment products immediately following the Bank of Russia’s announcement.

T-Bank (formerly Tinkoff Bank), one of the largest commercial banks in Russia, announced on May 29 the offering of digital financial assets (DFA) tied to Bitcoin.

“The tool allows you to invest in cryptocurrency in rubles through a familiar application — safely and within the legal framework of the Russian Federation, without opening an account on a crypto exchange and difficulties with protecting your wallet,” the bank said.

T-Bank’s new “smart asset” offering is issued through the Russian state-backed tokenization platform Atomyze and is available exclusively to accredited investors.

Direct Crypto Investments Still Not Encouraged

While greenlighting local lenders to offer crypto products, the Russian central bank still maintains a restrictive approach regarding direct cryptocurrency investment.

“The Bank of Russia still does not recommend financial institutions and their clients to invest directly in cryptocurrencies,” the Bank of Russia said in a statement.

The central bank also noted the ongoing government discussions on the potential launch of an experimental regime that would allow certain investors to trade crypto assets like Bitcoin directly.

Russia’s Estimated CEX Holdings Are at $9.2 Billion

In its latest financial stability review, the Bank of Russia estimated Russians’ crypto holdings on centralized exchanges (CEXs) at 827 billion rubles ($9.2 billion).

According to the authority, Bitcoin is leading Russians’ CEX holdings with a 62% share, with Ether (ETH) following at 22%. Stablecoins like Tether (USDT) and Circle’s USDC ranked third with a share of 15.9%.

Some local crypto enthusiasts observed that the actual figure of cryptocurrency held by Russians is significantly bigger than the estimated CEX holdings reported by the Bank of Russia.

“I know that [Pavel] Durov and [Alexey] Bilyuchenko alone have more money in their wallets than this amount,” Sergey Mendeleev, founder of the digital settlement exchange Exved, wrote on his Telegram channel. He hinted that Russians hold much bigger crypto amounts in wallets and decentralized exchanges.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps