Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 7-14-24

Good Afternoon Dinar Recaps,

ARE THE LARGEST BANKS IN THE WORLD STARTING TO INVEST IN CRYPTO?

“The largest investment banks in the world are rolling out crypto services and investing in crypto companies. JP Morgan. BNY Mellon. Goldman Sachs. They all foresee global adoption in the IMMEDIATE FUTURE From consumers to financial institutions the world is getting ready to use crypto as money."

@ Newshounds News™

Good Afternoon Dinar Recaps,

ARE THE LARGEST BANKS IN THE WORLD STARTING TO INVEST IN CRYPTO?

"The largest investment banks in the world are rolling out crypto services and investing in crypto companies.

JP Morgan. BNY Mellon. Goldman Sachs. They all foresee global adoption in the IMMEDIATE FUTURE

From consumers to financial institutions the world is getting ready to use crypto as money."

@ Newshounds News™

Source: Twitter

~~~~~~~~

XRP Climbs 10% In Bullish Trade

XRP was trading at $0.4968 by 00:26 (04:26 GMT) on the Investing.com Index on Saturday, up 10.07% on the day. It was the largest one-day percentage gain since March 11.

The move upwards pushed XRP's market cap up to $27.5901B, or 1.29% of the total cryptocurrency market cap. At its highest, XRP's market cap was $83.4407B.

XRP had traded in a range of $0.4738 to $0.4968 in the previous twenty-four hours.

Over the past seven days, XRP has seen a rise in value, as it gained 15.53%. The volume of XRP traded in the twenty-four hours to time of writing was $1.7086B or 3.08% of the total volume of all cryptocurrencies. It has traded in a range of $0.4036 to $0.4968 in the past 7 days.

At its current price, XRP is still down 84.90% from its all-time high of $3.29 set on January 4, 2018.

@ Newshounds News™

Read more: Investing

~~~~~~~~~

Ripple Finds a Spot in a Very Prestigious List: Details

“The digital asset space was buoyed in 2024 by strong price movements in cryptocurrencies,” CNBC and Statista noted.

Ripple was named one of the top 250 fintech companies for 2024 in the “digital assets” category by CNBC and Statista.

The company has received multiple awards, including the PAY360 Award and recognition as a top workplace by Fortune Magazine.

Ripple’s Latest Recognition

The American business news channel – CNBC – and the global industry statistics database – Statista – conducted a mutual study to find out the top 250 fintech companies for 2024. One of the awarded firms in the “digital assets” section is Ripple. It is one of the three entities placed on that list last year, with Coinbase and OpenSea being the others.

CNBC and Statista explained that the “digital assets” category comprises firms that make it “easier to access and use” cryptocurrencies and blockchain-based applications. They also noted the industry’s success in 2024, reminding that Bitcoin (BTC) hit an all-time high price of over $70,000 in March.

The entities revealed that 116 of the top 250 fintech companies are located in the United States (including Ripple, which is headquartered in San Francisco). The United Kingdom follows next with 30 firms, while India is home to 11 entities on the list.

The Previous Awards

This is not the first time Ripple has found a place in such a category. In October last year, it won the payment prize in the UK – the PAY360 Awards. The company topped the ranking for being the leader in digital currencies/assets in financial services.

One of the people acknowledging the achievement was Sendi Young – Managing Director of Ripple’s European operations. “Such an honour to win in this UK’s most prestigious payments awards,” she said at the time.

Prior to that, Fortune Magazine placed Ripple in the 13th position (out of 50) as “the best workplace in technology” for 2023. According to the business magazine, 94% of the firm’s employees consider it “a great place to work.” 98% of the staff said they were warmly welcomed upon starting their journey at the company, while 96% were supportive of the management team.

Last but not least, People Magazine included Ripple in its list of “top 100 companies who care for employees and society.” Other well-known corporations that were part of that club were American Express, NVIDIA, Deloitte, MasterCard, and more.

@ Newshounds News™

Read more: Crypto Potato

~~~~~~~~~

Five Major Reversal Indicators for Crypto Market in July: Goldman Sachs, ETH ETF S-1 filings and More

U.Today - The crypto market is gearing up for a potential turnaround in July, which will be fueled by several crucial factors. Here are five major indicators to watch:

Federal Reserve's potential rate cuts

The Federal Reserve may cut interest rates as early as September, according to recent rumors, and again in December. The markets will gain liquidity from these cuts, according to analysts, and cryptocurrencies might benefit from another positive CPI print.

Progress on Ethereum ETF S-1 filings

The Ethereum ETF issuers received their S-1 forms back from the SEC recently, with a request for small changes. Before being approved, these issuers must respond to the criticisms and resubmit, passing at least one more review round. It is a result of drawing in more institutional investors.

CFTC chair's stance on crypto regulation

According to recent comments made by the CFTC chair, between 70% and 80% of cryptocurrencies are not securities, underscoring the necessity for the CFTC to regulate these assets in accordance with the Commodities Exchange Act. This position may end the protracted discussion about whether cryptocurrencies are better classified as commodities or securities, providing much-needed regulatory clarity and enhancing investor confidence.

Goldman Sachs' tokenization projects

By the end of the year, Goldman Sachs wants to introduce three tokenization initiatives, with an emphasis on U. S. as well as European markets. These initiatives, which are led by tokenization and cryptocurrency enthusiast Mathew McDermott, have the potential to attract major institutional interest and investment into the crypto business.

JPMorgan's optimistic Bitcoin outlook

In a report released today, JPMorgan forecasts a bullish bounce for Bitcoin in August. In spite of recent market downturns, the bank is still bullish about Bitcoin's prospects. The analysis emphasizes that less downward pressure is anticipated as the recent wave of cryptocurrency liquidations fades. To better reflect the current state of the market, JPMorgan has also lowered its estimate of the year-to-date crypto net flow from $12 billion to $8 billion.

@ Newshounds News™

Read more: Investing

~~~~~~~~~

Gold Prices Forecast: Bullish Momentum Builds on Rate Cut Expectations

Key Points:

—Gold surges above $2,400 as Fed rate cut expectations soar. Inflation data fuels rally, with markets now pricing 96% chance of September cut.

—Fed officials turn dovish, boosting gold's appeal. Daly and Goolsbee signal potential rate cuts as disinflation trend resumes. Third weekly gain for gold.

—Global uncertainties support gold's safe-haven status. Central banks continue buying spree. Traders eye potential new record highs amid dovish sentiment.

@ Newshounds News™

Read more: FX Empire

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Sunday Afternoon 7-14-2024

KTFA:

Clare: A new economic crisis is on the horizon.. The war between the US dollar and the Chinese yuan in the Iraqi market

7/14/2024

In an "unsuccessful" move, as described by economic experts, the Central Bank of Iraq has stopped dealing in the Chinese yuan after the US Federal Reserve accused Iraq of "inflating remittances.

" While economic experts warned of the effects of this decision on the local market and its causing an increase in the exchange rate of the US dollar and an increase in inflation rates, which has negative repercussions on the economic situation of the Iraqi family, they presented 3 solutions to the Central Bank of Iraq to continue the flow of remittances to China.

KTFA:

Clare: A new economic crisis is on the horizon.. The war between the US dollar and the Chinese yuan in the Iraqi market

7/14/2024

In an "unsuccessful" move, as described by economic experts, the Central Bank of Iraq has stopped dealing in the Chinese yuan after the US Federal Reserve accused Iraq of "inflating remittances.

" While economic experts warned of the effects of this decision on the local market and its causing an increase in the exchange rate of the US dollar and an increase in inflation rates, which has negative repercussions on the economic situation of the Iraqi family, they presented 3 solutions to the Central Bank of Iraq to continue the flow of remittances to China.

In the latest Iraqi government move to stop dealing in the Chinese yuan, informed sources revealed to Shafaq News Agency, yesterday, Saturday, that the Governor of the Central Bank of Iraq, Ali Al-Alaq, is making an unannounced visit to the United States of America to discuss with officials in Washington the decision of the US Federal Reserve to stop Baghdad from dealing in the Chinese yuan.

The visit of the Governor of the Central Bank of Iraq, Ali Al-Alaq, to Washington coincides with a significant jump in the exchange rate of the dollar against the dinar, and more than two months after the visit of Prime Minister Mohammed Shia Al-Sudani to the United States.

"unsuccessful move"

Commenting on this decision, economic expert, Diaa Al-Mohsen, said, “The suspension of dealing in the Chinese yuan by the Central Bank of Iraq is an unfortunate step if we take into consideration that trade dealings with China exceed 65 billion dollars.”

Al-Mohsen added to Shafaq News Agency, "This decision will have a negative impact on the local market, and the demand for the dollar will increase, which means an increase in the exchange rate of the US dollar in the local market, which will increase inflation rates, which will have negative effects on the economic situation of the Iraqi family."

The economist points out that "the suspension of dealing in the Chinese yuan by the Central Bank of Iraq is a matter that has negative effects on economic organizations in the world, and may lead to the severing of their trade and economic relations with Iraq, due to the confusion of the policies of the Central Bank of Iraq that are not stable for a long period."

It is noteworthy that Iraq has strengthened its assets denominated in yuan through the Development Bank of Singapore to finance Iraqi trade and imports with China by about $12 billion annually.

Iraq has also moved to boost its assets in UAE dirhams and negotiated an increase in its euro-denominated assets to finance trade with the European Union, and Iraq has begun opening bank accounts in Indian rupees for a number of Iraqi banks.

"More political than economic"

For his part, the economic researcher, Ahmed Eid, believes that “the decision to stop dealing in the Chinese yuan is an American political decision more than it is an economic decision, according to the soft war that is being carried out under the influence of the strength of interests between the United States and China.”

Eid pointed out during his interview with Shafaq News Agency, "The decline of America's military and commercial presence in Iraq left a security, economic and political vacuum that was controlled by Iran and China, which quickly filled that vacuum and seized the opportunity to penetrate Iraq, which is considered the fifth largest oil reserve in the world."

He continues in his analysis, "Within the multiplicity of interests and the American-Iranian conflict over hegemony and influence in Iraq, China has infiltrated through its soft power, to control the general trade market and export its industries and products to Iraq at competitive prices."

The economic researcher continues, "After the United States had been Iraq's trading partner since its invasion of Iraq in 2003, it is no longer able to compete with China today, which has swallowed up a large part of the trade exchange with Baghdad, which has made America feel threatened."

Eid explains at the end of his talk, "Most of the Iraqi supply and transportation companies are no longer in the hands of major traders, but rather are controlled by economic offices affiliated with militias and parties. These companies are trying, through various means, to smuggle dollars out of Iraq, or through cash exchange operations for the currency, which is what prompted the United States to continue imposing its sanctions on private companies and banks operating in Iraq."

It is noteworthy that the Central Bank of Iraq has issued several decisions since the beginning of 2023 that would maintain the stability of the general monetary and economic situation and confront the risks of fluctuations in the exchange rate of the Iraqi dinar against the US dollar, in addition to facilitating import and export operations by opening new horizons with international banks, including Chinese banks.

Among the decisions of the Central Bank of Iraq is to enhance the balances of Iraqi banks that have accounts with Chinese banks in Chinese yuan, as dealing in yuan directly without the mediation of the US dollar contributes to facilitating and accelerating financial transactions, and will reduce import costs and protect against the risks of fluctuating exchange rates within Iraq.

3 options for the Central Bank of Iraq

In turn, the economic expert, Mustafa Hantoush, says, “The Federal Reserve’s accusation of Iraq of (inflating remittances), i.e. transferring money in exchange for the entry of goods at a value less than the value of the transferred money or the non-entry of goods at all, here the Central Bank was unable to answer or defend because the Central Bank has not linked the Central Bank’s remittances to the goods that enter through the border crossings like all countries of the world for 20 years. In addition to that, the absence of this linkage causes a loss of no less than 5 billion dollars annually due to the failure to collect real (customs and taxes), and international accusations against Iraq of money laundering and currency smuggling.”

Hantoush added to Shafaq News Agency, "After this accusation from the Federal Reserve and the inability of the Central Bank to defend itself, there are several options before the Central Bank of Iraq, including quickly establishing a link between remittances and border crossings, contracting with a new company to flow remittances from Iraq to China (within the Central Bank), and transferring dollars instead of Chinese yuan through Iraqi banks owned by (foreign investors) that have accounts in (Citibank) and (JP Morgan), which may cause those banks to control 90 percent of the currency window, and a near halt to the work of the Iraqi banking system." LINK

************

Clare: The framework gives the Sunnis the last chance to name the parliament speaker: no postponement after that

7/14/2024

The Coordination Framework, which brings together the ruling Shiite political forces in the country, set today, Sunday, July 20, as the date to decide on naming a new speaker for the Iraqi parliament, stressing that after this date, the matter will be left to the members of the House of Representatives to choose for themselves who they see as suitable for this position.

The leader in the framework, Aid Al-Hilali, told Shafaq News Agency, "The Coordination Framework forces gave the Sunni political forces a deadline until July 20, i.e. after the end of the Ashura rituals, to decide their position and agree among themselves on the file of electing the parliament speaker."

He added that "if the Sunni political forces do not agree among themselves, a session will be held to elect the Speaker of the House of Representatives, in the first session of the legislative term, and the matter will be left to the representatives, and whichever candidate gets the highest number of votes will be the new president," stressing that "there is no postponement in this, as the framework forces want to resolve the issue quickly, as it has had a negative impact on legislative and oversight work."

Since the Federal Supreme Court (the highest judicial authority in Iraq) decided in November 2023 to terminate the membership of former Parliament Speaker Mohammed al-Halbousi, the political parties and forces have not been able to name a new Parliament Speaker due to the differences between them. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The FITR...it's a transaction activity platform that's interesting because they are exchanging and trading funds that come under the category of cross currency swapping and they are including now the Iraqi dinar. Why would you Mr. Country whoever-you-are, why would you want to be involved with the Iraqi dinar? Why would you want to do any type of transaction activity with the FITR when you're dealing with a currency that has no value? Obviously there is a value. Obviously they know more than we know. This currency swapping is a very very significant thing.

Guru Mnt Goat In talking to my CBI contact ...I was told there is a master plan they are following to get to the reinstatement... The point that was made to me...is that the IQD should already be reinstated if nothing else to what it was prior to 1990, then to let it float and the market will drive it like any other foreign currency that is traded...

************

Once You Get Money Upgrade These 15 Things Immediately

Alux: 2023

In this Alux.com video we will be answering the following questions:

What should you upgrade once you get rich?

What things rich people buy that make sense?

What are the best things to buy when you're rich?

00:00 – Intro

00:38 - Your face

01:57 - Your physical strength

04:01 - Your bed: mattress, pillows, linens

05:32 - Your food

06:47 - Your schedule

08:27 -Your location

09:24 - Convenience

10:42 - House Cleaning Services + Subscription for Essentials

11:43 - Time with your family

12:39 - Your teachers

14:21 - Your stories and adventures

15:57 - Your charity work

17:04 - Your wardrobe

18:04 - Your subscriptions

19:01 - Upgrade Your Life by Downgrading your Taxes

Economist’s “News and Views” Sunday 7-14-2024

Stocks At ‘1929’ Peak; 'Storm' About To Hit, Force Fed Capitulation | Tavi Costa

David Lin: 7-13-2024

Tavi Costa, Portfolio Manager at Crescat Capital, discusses the dangers of stock market valuations, the coming steepening of the yield curve, the deteriorating economy, and the Fed's response to current macroeconomic conditions.

0:00 - Intro

2:00 - Yield curve steepening

10:45 - Currencies

Stocks At ‘1929’ Peak; 'Storm' About To Hit, Force Fed Capitulation | Tavi Costa

David Lin: 7-13-2024

Tavi Costa, Portfolio Manager at Crescat Capital, discusses the dangers of stock market valuations, the coming steepening of the yield curve, the deteriorating economy, and the Fed's response to current macroeconomic conditions.

0:00 - Intro

2:00 - Yield curve steepening

10:45 - Currencies

12:20 - Bull vs. Bear steepener

18:40 - Financial vs. “real” assets

20:57 - Fed cuts

24:00 - China’s “gold rush”

26:47 - Gold price outlook

29:50 - Dollar outlook

32:30 - Which “real asset” will outperform?

37:00 - Mining industry

47:30 - Gold’s price “floor”

Japan Dumps $22B USD In Desperate Currency Rescue, US Instructs EU To Cut Away China Investments

Sean Foo: 7-13-2024

Japan has had enough and begins its currency intervention. The Bank of Japan dumps $22 Billion dollars in order to prop up the Yen, but this is pointless.

Meanwhile, the economic war is escalating with the US telling Europe to cut investments into China. Here's what you must know!

Timestamps & Chapters:

0:00 Japan's Desperate Currency Rescue

2:45 BOJ Hiding From Janet Yellen

5:29 US Tells EU To Stop Investing In China

8:31 America's True Agenda

11:17 Economic War Escalate

US Pressure on Africa to Choose World Bank Over China: What is going on?

Fastepo: 7-14-2024

Over the past two decades, China has significantly expanded its infrastructure projects across nearly every African country. This involvement includes massive investments in roads, railways, ports, and other critical infrastructure, amounting to over $140 billion in loans for various projects.

As of 2020, around 49 African countries had signed agreements under China's Belt and Road Initiative (BRI), highlighting the extensive reach of these projects.

China-Africa trade surged from $11.67 billion in 2000 to $257.67 billion in 2022, making China the leading trading partner for many African countries, surpassing traditional partners like the UK and the US.

Chinese FDI flows to Africa rose from $75 million in 2003 to a peak of $5 billion in 2021. Western critics, popularized the term "debt-trap diplomacy" to describe China's strategy.

This term suggests that China provides loans for infrastructure projects that recipient countries cannot afford to repay, ultimately allowing China to exert strategic control over these nations. Examples often cited include Zambia and Uganda.

Zambia, for instance, is heavily indebted to China, with approximately $5.05 billion owed, which is about 30% of its total external debt and roughly 20% of its GDP. In Uganda, there are fears that the Entebbe International Airport could be taken over by China due to the terms of their loan agreements.

However, this perspective is contested. Proponents argue that China's investments have brought significant infrastructure improvements and economic benefits to Africa. They note that many Chinese projects have created jobs, enhanced business opportunities, and facilitated connectivity.

For instance, Chinese telecommunications company Huawei has expanded digital connectivity across 40 African countries. Furthermore, Chinese-built railways, like the one connecting Nairobi to Mombasa in Kenya, are seen as critical to boosting local economies.

Critics from the West argue that these benefits are overshadowed by the long-term economic risks and the lack of transparency in Chinese loan agreements. They assert that the opacity and potentially exploitative nature of these loans can undermine the sovereignty and financial stability of African nations. In contrast, defenders of China's involvement highlight the historical context of Western colonialism and the ongoing need for infrastructure in Africa, which Western countries have not adequately addressed.

They argue that labeling Chinese investments as "debt-trap diplomacy" oversimplifies the complex economic relationships and the mutual benefits derived from these projects. In this video, we delve into the heart of China's relationship with Africa, investigating why many African countries favor partnerships with China over those with Western nations.

Additionally, we discuss the initiatives by the European Union and the United States—Global Gateway and Build Back Better World (B3W)—and how these compare to China's efforts.

“Tidbits From TNT” Sunday Morning 7-14-2024

TNT:

Tishwash: Al-Sudani invites Saudi and Egyptian businessmen to invest in hotels and entertainment facilities

On Saturday, July 13, 2024, Prime Minister Mohammed Al-Sudani held a meeting with a delegation of Egyptian and Saudi businessmen, inviting them to invest in hotels and entertainment facilities.

Al-Sudani received, according to a statement from his office, which was reviewed by "Ultra Iraq", a delegation of Egyptian, Saudi and Iraqi businessmen, including; Chairman of the Board of Directors of TMG Company Hisham Talaat Moustafa, Chairman of the Board of Directors of Al-Muhaidib Group Suleiman Abdul Qader Al-Muhaidib, CEO of the group Essam Abdul Qader, Director of Development in the group Raed Ibrahim Al-Madhiem, Director of Al-Maysara Group Yasser Qasim Zagher, and businessman Ahmed Talaat Hani,

TNT:

Tishwash: Al-Sudani invites Saudi and Egyptian businessmen to invest in hotels and entertainment facilities

On Saturday, July 13, 2024, Prime Minister Mohammed Al-Sudani held a meeting with a delegation of Egyptian and Saudi businessmen, inviting them to invest in hotels and entertainment facilities.

Al-Sudani received, according to a statement from his office, which was reviewed by "Ultra Iraq", a delegation of Egyptian, Saudi and Iraqi businessmen, including; Chairman of the Board of Directors of TMG Company Hisham Talaat Moustafa, Chairman of the Board of Directors of Al-Muhaidib Group Suleiman Abdul Qader Al-Muhaidib, CEO of the group Essam Abdul Qader, Director of Development in the group Raed Ibrahim Al-Madhiem, Director of Al-Maysara Group Yasser Qasim Zagher, and businessman Ahmed Talaat Hani,

All of whom are specialized in real estate development and the establishment of integrated and smart residential cities, in the presence of the Saudi Ambassador to Iraq Abdulaziz bin Khalid Al-Shammari."

Hisham Talaat Moustafa is one of the most prominent businessmen and politicians in Egypt. He was sentenced to death for his conviction in the murder of Lebanese singer Suzanne Tamim. The Cairo Criminal Court then sentenced him to 15 years in prison instead of the death penalty , before Abdel Fattah el-Sisi's regime decided to pardon him and release him from prison.

Al-Sudani called on "Egyptian and Saudi company owners to invest in the field of tourist resorts, hotels and entertainment facilities, as Iraq has many diverse tourist destinations," indicating that "development and progress in Iraq serve the economic interests of the rest of the Arab countries."

He pointed out that "Iraq is witnessing rapid growth and a phase of recovery, and there are many promising investment opportunities, especially in the field of housing and new city projects, as the country needs about 3 million housing units," stressing that "the government is moving towards building integrated cities that include all sectors, services, entertainment and commercial facilities, and are linked to the capital, Baghdad, by an advanced network of transportation routes."

Al-Sudani explained that "the government has offered projects for 5 new cities for investment in Baghdad and some governorates, and it is moving towards launching 11 new cities, just as it supports successful investment experiences," noting that "what is important about modern cities is that they contribute to solving the housing crisis, especially for low-income groups."

******************

Tishwash:Chinese CETC Group expresses interest in Iraq's infrastructure and economic projects

The Chinese CETC Group, specializing in energy, construction technology, and infrastructure, expressed to PM Mohammed Shia Al-Sudani its desire to participate in Iraq's infrastructure and economic projects.

According to a statement from the Prime Minister's office, Al-Sudani received a delegation from the prominent Chinese group. He highlighted the government's economic approach of embracing "productive partnerships and enhancing Iraq's investment environment to attract global companies."

Moreover, the Iraqi Prime Minister stressed that the government aims to "attract investments and strengthen partnerships with the Iraqi private sector by providing supportive guarantees."

The Chinese delegation expressed their interest in expanding cooperation with both the Iraqi public and private sectors across various economic and investment fields.

Notably, Iraq and China are partners in many areas. Iraq is one of the top oil suppliers to China, and Chinese companies operate in various sectors in Iraq, including oil and gas extraction and school construction. Additionally, both countries are cooperating on the Belt and Road Initiative and the Development Road project. link

***************

Tishwash: Iraq in Talks With US Treasury Over Banks, Dollar Restrictions (bloomberg)

Iraq has engaged in discussions in Washington with representatives from the US Treasury to address dollar restriction issues, Iraqi Foreign Minister Fuad Hussein said during a press conference aired on state-run media al-Iraqiya.

Describing the meetings as “very useful,” Hussein indicated that they would continue. Topics slated for upcoming discussions include further talks on the list of Iraqi banks under US sanctions and the status of accumulated Iranian funds in Iraq. “There are serious steps to resolve these issues,” Hussein said.

Iraq experienced dollar shortages last year after the New York Fed began scrutinizing transfers to Iraqi banks more closely. Iranian businesses and individuals have long used banks in neighboring Iraq to access the greenback and get around US sanctions.

Iraq’s central bank pledged to restrict all internal commercial transactions as of this year, in an apparent attempt to curb dealings of the dollar outside Iraq’s banking sector and limit its smuggling abroad.

Last week, the exchange rate for the dollar against the Iraqi dinar in the unofficial market rose from 1,450 to nearly 1,500 dinars per dollar. Local news agencies, citing a lawmaker, attributed this increase to measures by the Federal Reserve, which halted transactions from dollars to yuan aimed at supporting Iraq’s foreign trade. link

**************

Tishwash: Why did Iraq stop dealing in the Chinese yuan?

The Parliamentary Finance Committee revealed the reasons behind Iraq’s suspension of dealing in the Chinese yuan, while indicating that many of the Central Bank’s procedures are governed by American will.

Committee member Moeen Al-Kazemi said in a press statement that "the US Federal Bank imposed on Iraq to stop dealing in the Chinese yuan, under the pretext that there was manipulation in some transfers or certain problems occurred, indicating that "Iraq's money, as we know, is included in the US Federal Bank as a result of the sale of oil at an amount of 3.5 million barrels per day, and this money enters the Federal Bank and is not transferred to Iraq in cash. It witnessed a transfer to Iraq through corruption transfers from the Central Bank and the Federal Declaration."

Al-Kadhimi continued, "Many of the central bank's measures for the government are governed by American will, and this will may be explained by administrative and financial reasons, not financing terrorism, and others," and he announced that "the reasons are political with the aim of pressuring the Iraqi government."

Is the Chinese currency canceled?

Al-Kadhimi stressed that "the merchant and the Central Bank must have multiple options and not only deal in dollars, so this suspension is temporary and not permanent," noting that "the committee will ask the Central Bank to address the issue and have a diverse price basket, so that the options are more for the Central Bank and Iraqi merchants."

Al-Kadhimi stated earlier that "China's remittances in yuan have been temporarily suspended until auditing mechanisms are found."

He continued, "During the past period, there have been major manipulations of China's affairs." link

**************

Mot.... Buying New FURniture in da Future - Tips!!!! Dog colored furniture

Mot: He Tries - He Really Does!! –

News, Rumors and Opinions Sunday AM 7-14-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 July 2024

Compiled Sun. 14 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: Opinions/Rumors

Judy Note: Numerous sources report that the Rodriguez monies (destined for humanitarian use) of the Global Currency Reset were released on Thurs. 11 July. Other monies including the St. Germaine Trust would likely be released sometime next week. Some Bond Holders and large Groups have been paid. Bankers have a booklet titled “Global Currency Reset” instructing them on how they can adjust to the gold/ asset-backed system.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 July 2024

Compiled Sun. 14 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: Opinions/Rumors

Judy Note: Numerous sources report that the Rodriguez monies (destined for humanitarian use) of the Global Currency Reset were released on Thurs. 11 July. Other monies including the St. Germaine Trust would likely be released sometime next week. Some Bond Holders and large Groups have been paid. Bankers have a booklet titled “Global Currency Reset” instructing them on how they can adjust to the gold/ asset-backed system.

Fri. 12 July 2024: The Imminent Global Currency Reset and NESARA GESARA: Black Swan Event, QFS, EBS, The Insolvency of 9 Nations & Global Market Crash – American Media Group (amg-news.com)

Sat. 13 July 2024 Imminent NESARA Trigger: Worldwide Banks to Shift to Precious Metals, Erasing All Credit Card, Mortgage, and Loan Debts Globally! – Gazetteller

Sat. 13 July 2024 Rodriguez Estate Manager Jeff Rahm (go to 46 min. mark): Weekend News with MarkZ. 07/13/2024 (youtube.com) https://www.youtube.com/live/KiwzpYT3bGI?si=Z-nblkbtyEkbWjOG

MarkZ has Jeff Rahm on his show. He claims to be the asset manager for the Rodriquez Estate and has proof of such.

The Rodriguez Family Estate came from King Solomon’s Temple. The Estate holds much value – it’s a 4 followed by 140 zeroes.

The gold is mainly stored in a Philippine 27 mile tunnel filled with gold bars, (plus rubies, diamonds, pearls), the gold bars stacked ten feet thick, ten feet high to the ceiling.

The Rodriguez Estate monies are to be used for Humanitarian purposes including for the Philippine people.

Jeff says the sleeper in the foreign currency crowd is the Bolivar – he says it’s going at

Bond Holders are being paid. Large entities are being paid. There was all kinds of evidence that Dinar, Dong and Zim exchanges/ redemption will be next week.

~~~~~~~~~~~

Global Financial Crisis:

Sat. 13 July 2024: Two of the largest banks in the US, JP Morgan Chase and Wells Fargo, are declaring a staggering $3.5 billion in debts that customers can’t pay back.

Sat. 13 July 2024: Banks Shutting Down. Banks closed 539 local branches across the country in the first half of the year – leaving more and more Americans without access to basic financial services. If this rate continues for the rest of 2024, it will mean more than 1,000 branches wiped from malls, and town and city centers. Bank of America closed the most branches, a total of 90 in just six months. Wells Fargo shut down 62 banks. Chase shut down 53 banks. TD Bank shut down 52 banks. The 17th Letter (JFK Jr.) on Telegram https://t.me/The_17_Letter_Q

Sat. 13 July 2024: 40 Banks Shut Down in Sudden ‘Vanishing Act’ – Absorbed Into Larger Lenders As Economy Teeters in China: Report. Banks are collapsing at an unprecedented rate in China due to a major downturn in the country’s property market, poor risk controls and other issues. In the week ending on June 24th, 40 smaller banks were sucked up by larger institutions, a vanishing act incomparable even to the savings and loan crisis of the 1980’s and 90’s, reports The Economist. Thirty-six of the 40 failed institutions were all absorbed into one giant lender: Liaoning Rural Commercial Bank, which was set up by regulators in September to manage bad banks. https://dailyhodl.com/2024/07/12/40-banks-abruptly-shut-down-in-vanishing-act-absorbed-into-larger-lenders-as-economy-teeters-in-china-report/

Read full post here: https://dinarchronicles.com/2024/07/14/restored-republic-via-a-gcr-update-as-of-july-14-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick [Iraqi bank friend Aki update] Aki...wanted to report there is a big run on the banks of Iraq right now by the Iraqi citizens. They're pouring into the banks. It's not happening in Aki's bank [Which is in Michigan] it's happening over in Iraq. What's going on is it was, last Tuesday, they announced to the Iraqi citizens, you have a new currency coming. So all of a sudden people started pouring in the following day on Wednesday and Thursday...'We are giving you a new currency,' is what triggered this.

Frank26 Question: "Do you think the HCL on the 14th?" I can't pick a date of anything but I can tell you this much, in my heart, quickly, now, this month. The HCL requires a new exchange rate. After the 14th I think a lot of windows are going to be opened up.

************

The CBI is Making Some Changes

Edu Matrix: 7-13-2024

The CBI is Making Some Changes - From eCommerce Business Licenses to Merging the Country's Largest Bank for a Uniform Financial Foundation

MAJOR BRICS NEWS: Multipolarity Wins as the Bloc Forms BRICS Parliament to Unite Emerging Economies

Lena Petrova: 7-13-2024

Economist’s “News and Views” Saturday 7-13-2024

Financial Blow Up: Little Time Left Before Wheels Come Off System Warns David Morgan

Daniela Cambone: 7-12-2024

"So now all they want is control, saying, 'I own you because you have to pay me interest. And when you can't pay interest, what happens? They take over the property,'" warns David Morgan, founder of The Morgan Report.

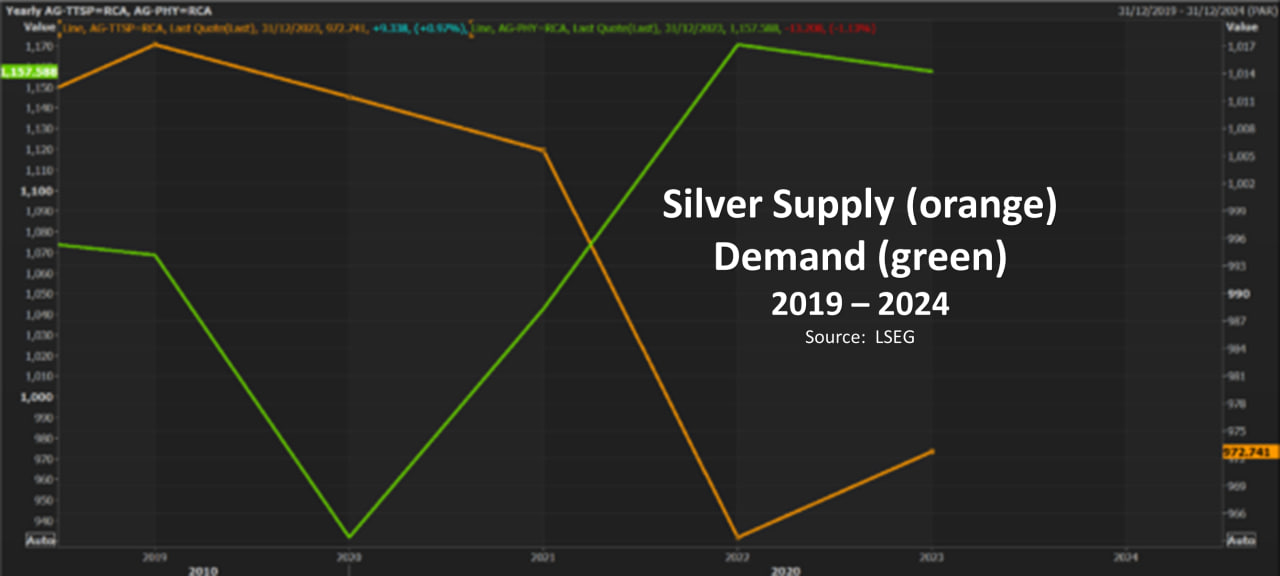

He emphasizes that we don’t have much time left to address these issues. However, he expresses his optimism about the silver market. "Silver's not at an all-time high, but it's at an 11-year high or close to it," says Morgan.

He explains to Daniela Cambone that strong monetary demand for silver, combined with steady or increasing industrial demand, could lead to a situation where both forces compete for the same supply, potentially driving prices higher.

Financial Blow Up: Little Time Left Before Wheels Come Off System Warns David Morgan

Daniela Cambone: 7-12-2024

"So now all they want is control, saying, 'I own you because you have to pay me interest. And when you can't pay interest, what happens? They take over the property,'" warns David Morgan, founder of The Morgan Report.

He emphasizes that we don’t have much time left to address these issues. However, he expresses his optimism about the silver market. "Silver's not at an all-time high, but it's at an 11-year high or close to it," says Morgan.

He explains to Daniela Cambone that strong monetary demand for silver, combined with steady or increasing industrial demand, could lead to a situation where both forces compete for the same supply, potentially driving prices higher.

"Around 60% of the silver market is driven by industrial demand, especially in areas like solar energy and electric vehicles.

As currency wars and financial instability continue, the monetary demand for silver could increase significantly."

BRICS Launched Intra-bank Payment System, Crashing USD & SWIFT System!

We Love Africa: 7-12-2024

Has BRICS accidentally ended dollar dominance? BRICS has launched an intra-bank payment system, posing a significant challenge to the supremacy of the US dollar.

This development could lead to a decline from which the dollar may not recover. However, this shift is not unexpected; BRICS has been working for years to achieve this goal.

As the dollar's decline becomes more imminent and its value continues to drop, one must ask: Does the United States have any plans to revive its currency?

More importantly, is it even possible for the US to revive the dollar at this stage, even if it wants to? Let’s find out.

JPMorgan, Bank Of America & Citigroup Are in Big Trouble

Atlantis Report: 7-13-2024

The 2008 financial crisis significantly impacted the global economy, revealing vulnerabilities in the banking sector and leading to government intervention.

The collapse of Lehman Brothers and subsequent bailouts highlighted the need for strong regulatory frameworks to prevent similar crises.

In response, major banks were required to create "living wills."

These living wills ensure that even the largest banks can be dismantled in an orderly manner, reducing risks to the broader economy. However, recent reports from the Fed and the FDIC have raised concerns about the adequacy of these plans for three major American banks. JPMorgan, Bank Of America & Citigroup Are in Big Trouble

“Tidbits From TNT Saturday 7-13-2024

TNT:

CandyKisses: Sources: The Governor of the Central Bank of Iraq made an unannounced visit to Washington on the Chinese yuan

Informed sources revealed on Saturday that the Governor of the Central Bank of Iraq Ali Al-Alaq is making an unannounced visit to United States to discuss with officials in Washington about the US Federal Reserve's decision to stop Baghdad's dealings with the Chinese yuan.

The sources told Shafaq News that the relationship left for Washington last Tuesday to meet with officials of the Federal Bank and the US Treasury.

She added that Al-Alaq is discussing with US officials the decision to stop dealing Iraq in the Chinese yuan, indicating that the Governor of the Central Bank is also discussing during his visit the required obligations regarding Iraqi banks deprived of dealing with the dollar.

TNT:

CandyKisses: Sources: The Governor of the Central Bank of Iraq made an unannounced visit to Washington on the Chinese yuan

Informed sources revealed on Saturday that the Governor of the Central Bank of Iraq Ali Al-Alaq is making an unannounced visit to United States to discuss with officials in Washington about the US Federal Reserve's decision to stop Baghdad's dealings with the Chinese yuan.

The sources told Shafaq News that the relationship left for Washington last Tuesday to meet with officials of the Federal Bank and the US Treasury.

She added that Al-Alaq is discussing with US officials the decision to stop dealing Iraq in the Chinese yuan, indicating that the Governor of the Central Bank is also discussing during his visit the required obligations regarding Iraqi banks deprived of dealing with the dollar.

The visit of the Governor of the Central Bank of Iraq Ali Al-Alaq to Washington coincides with a significant jump in the exchange rate of the dollar against the dinar, and more than two months after the visit of Prime Minister Mohamed Shia Al-Sudani to the United States.

************

Iraqi military delegation visits Washington regarding security agreement

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein revealed today, Friday, that an Iraqi military delegation will soon visit Washington to hold security talks.

Hussein said in a press conference held in the US capital, Washington, that "our visit to Washington was to attend the NATO summit at the invitation of the American side, and on the sidelines of the summit we held intensive meetings with leaders of several countries, and we held a meeting with the US Treasury Department to discuss issues related to monetary policy and banking signs."

He added that "a military delegation will visit Washington to hold talks on the security agreement concluded between Iraq and the United States."

He continued: "We discussed the future of the international mission in NATO meetings in cooperation with the Iraqi Ministry of Defense." link

************

Tishwash: Foreign Minister from Washington: US Treasury positively assessed Central Bank's efforts

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein confirmed that the US Treasury Department evaluated the efforts of the Central Bank positively, while indicating that a military delegation will visit Washington to hold security talks.

"Our visit to Washington was to attend the NATO summit at the invitation of the US side, and on the sidelines of the summit we held intensive meetings with leaders of several countries, and we held a meeting with the US Treasury to discuss issues related to monetary policy and banking signs," Hussein said in a press conference held in the US capital Washington, attended by the Iraqi News Agency (INA).

He added that "the US Treasury positively evaluated the efforts of the Central Bank," indicating that "a military delegation will visit Washington to hold talks on the security agreement concluded between Iraq and the United States."

He continued: "We discussed the future of the international mission in NATO meetings in cooperation with the Iraqi Ministry of Defense." lin

************

Tishwash: Financial expert to Iraq Observer: Western Union has set a ceiling for its money transfers from Iraq and has not stopped them completely

Financial and banking expert Mustafa Hantoush believes that Western Union Banking Company has set a ceiling for sending money transfers from Iraq and has not suspended them permanently.

Hantoush told Iraq Observer, “Western Union has reduced the size of its money transfers. For example, instead of transferring an amount of $1,000, it will become $500.”

He added, "The Central Bank has not issued any official statement regarding the suspension of Western Union Company for money transfers from Iraq," noting that this information must be verified from its primary source, which is the Central Bank."

Local news agencies reported that the world's largest money transfer company, Western Union, has stopped its money transfers from Iraq without providing further details, at a time when the dollar is witnessing a continuous rise. Meanwhile, a prominent financial source who preferred to remain anonymous told Iraq Observer that the matter is related to setting a ceiling for money transfers issued by Western Union from Iraq, ruling out a final halt.

The financial markets in Iraq are witnessing a state of instability in the exchange rate of the dollar against the Iraqi dinar, as it has been approaching 150,000 for days, in anticipation of the visit of the Governor of the Central Bank of Iraq to the United States of America.

Economic researcher Ziad Al-Hashemi said in a tweet on the X platform: The governor of the Central Bank was sent to New York to discuss the issue of the failure of yuan transfers to China, which the Central Bank relied heavily on to sell dollars and provide the dinar needed to feed the government’s finances.

He added: The causes of the problem remaining unresolved and the strong parties hovering around the Central Bank and searching for the dollar, without accountability, neutrality or internal Iraqi restrictions, will make all the pledges that Al-Alaq will present without any real value, as the same person has previously presented the same pledges throughout the past ten years, and the same problem is still ongoing without a solution, according to him. link

************

Mot: Stay Cooooool !!!!!

Mot: .. Yes - Taking sum Time to Reflect m

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 7-13-24

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Minimal registration requirements

Edun warned that companies might exploit minimal registration requirements to falsely claim they are licensed, undermining market integrity. Highlighting the potential for regulatory arbitrage, he urged the SEC to implement top-notch corporate governance practices, swiftly identify and disclose conflicts and adhere to global best practices.

The minister also encouraged the newly inaugurated SEC board members to adopt innovative strategies to regulate the country’s capital market effectively. He stressed the importance of staying informed and proactive amid rapid developments in artificial intelligence, digital currency and overall digital transitions.

“Unlike basic industries with settled technologies, the financial sector is rapidly evolving with innovations in fintech, AI and crypto. To provide necessary approvals and guidance, the SEC must stay informed and adaptable.”

SEC pledges innovation and growth

In response, the Chairman of the SEC board, Mairiga Katuka, assured the minister that the board would leverage its collective expertise, innovation and passion to drive growth.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

RIPPLE's APPEAL TO CENTRAL BANKS: SPEED, SECURITY, AND DIGITAL INNOVATION

—Ripple’s appeal to central banks lies in its promise of speed, security, and digital innovation, challenging traditional banking methods with blockchain technology for instant global transfers.

—Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers.

Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies.

Central banks are considering Ripple for its speed, security, and modern appeal. Traditional transfer methods, once slow and cumbersome, can now be transformed into swift, secure blockchain transactions. Moreover, Ripple enables transaction settlements in fractions of a second instead of days, with cryptographic security ensuring maximum protection. This innovation has even the most conservative bankers excited about the possibilities Ripple brings to the table.

By adopting Ripple solutions, central banks have the opportunity to transition into new-age technological platforms instead of being perceived as outdated institutions. This could bring a fundamental change in the way we conduct global transactions more efficiently and securely.

The adoption of CBDCs on Ripple’s platform has the potential to revolutionize the financial industry. Central banks now stand at a crossroads, with the opportunity to lead the digital transformation of finance.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

HEDRA HASHGRAPH LEADS BLOCKCHAIN INNOVATION WITH NEW SCALABILITY BREAKTHROUGH

—The Hedera Foundation has launched two pilot Request for Proposals (RFPs) aimed at addressing specific ecosystem needs, inviting global developers to apply for grants.

—The initiative aims to enhance transparency and collaboration, providing up to 10 million HBAR in support, to accelerate the growth and development of the Hedera ecosystem.

On Thursday, July 11, the HBAR Foundation announced its pilot Request for Proposal (RFP) to deliver a more transparent and community-supported element to grant giving. Hedera stated that they are piloting two separate RFPs for building solutions thereby meeting specific ecosystem needs. Besides, this development comes as Hedera has been leading in crypto development activity, per the CNF update.

The Hedera Foundation is launching two pilot RFPs aimed at addressing specific needs within the ecosystem. they have also invited developers from across the globe to apply for these grants, with the selection process incorporating open and public community input.

The goal of this pilot is to gather insights from the initial RFPs to enhance and formalize the foundation’s grant program. This would ultimately accelerate the growth and development of the Hedera ecosystem.

We’re excited to announce the launch of our pilot Request For Proposal (RFP) process to to deliver a more transparent, #Hedera community-supported element to grant giving 🤝 pic.twitter.com/VNnatTK5GY

— HBAR Foundation (@HBAR_foundation) July 11, 2024

Hedera Targets Lending Markets With RFP Pilots

The pilot initiative will include two distinct RFPs designed to meet specific requirements:

Credit Market Development: This grant will follow the structure of a standard THF development grant, with funding allocated based on the completion of well-defined development milestones.

Credit Market Liquidity: This grant will be modeled after a network utilization incentive pool. The incentive pool will be evergreen and may be replenished based on ecosystem needs.

The Foundation is initially committing up to 10 million HBAR in support, available to eligible teams. Given the evergreen nature of the pool, project teams can apply multiple times depending on their liquidity needs. Each proposal must align with specific growth objectives, and applicants are required to outline milestones and goal KPIs. The Hedera Foundation also mentioned some of the benefits of conducting the pilot which include:

Increased Transparency and Clarity: By clearly outlining funding intentions, the Hedera Foundation (THF) can provide more timely updates to the community about key priorities. This approach offers further clarity to teams who may not qualify for a grant, not due to inadequacy but because their proposals might not align with the network’s most pressing needs.

Enhanced Ecosystem Collaboration and Diversification of Ideas: By inviting broader participation, THF aims to foster greater collaboration between itself, applicants, and the community, all working together to find better solutions. Additionally, creating more opportunities for builders to share their visions, ideas, and educational insights directly with the community before launching products or platforms will add significant value throughout the development cycle.

Moreover, the Hedera blockchain has been part of some key projects. As reported by Crypto News Flash, Sweden’s central bank tested its retail banking solutions on the Hedera network. Additionally, consulting giant Deloitte also joined hands with Hedera to build next-generation blockchain solutions, per the CNF update.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

DWS MOVES TOWARD FIRST GERMAN-REGULATED EURO STABLECOIN

German asset management company DWS has launched a new company in a step towards creating the first German-regulated cryptocurrency.

Deutsche Bank-owned DWS announced the launch of the company as part of their wider plan to go live with the new euro stablecoin next year, marking a significant step for the European financial sector considering DWS manages assets worth €941 billion.

The cryptocurrency is set to be regulated by Germany’s Federal Financial Supervisory Authority (BaFin) as DWS looks to be the first company being granted a German e-money licence for a stablecoin.

The newly created company, AllUnity, is a collaboration between DWS, Flow Traders, and Galaxy Digital, working together to introduce the new stablecoin.

Stefan Hoops, CEO of DWS, commented that the stablecoin will gain interest from a broad range of clients, including digital asset investors and industrial applications.

“In the short term, we expect demand from investors in digital assets, but by the medium term we expect wider demand, for instance from industrial companies working with ‘internet of things’ continuous payments,” Hoops stated.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

JAPAN'S CURRENCY HAS STEADILY LOST VALUE AGAINST THE USD OVER THE LAST 12 MONTHS

Japan likely conducted a $22 billion intervention yesterday to support its currency.

Japan spent a record $62 billion in May to prop up the yen.

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Ripple’s Appeal to Central Banks: Speed, Security, and Digital Innovation

"Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers."

"Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies."

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

CENTRAL BANKS ARE BUYING GOLD TO PREPARE FOR A NEW GOLD STANDARD

"Record buying of gold by central banks, which are matching their gold reserves relative to GDP with other countries, revived the debate about the possibility of a reboot of the current monetary system based on a new gold standard."

"Global central banks have been buying record amounts of gold since the beginning of 2022. The pace and regularity with which central banks accumulate gold is unprecedented, as they have been mostly sellers of the precious metal throughout history. This extraordinary demand for gold by central banks, the largest in 55 years, is attributed to a desire to diversify their reserves and reduce dependence on the dollar."

"But beyond the intrinsic capacity of physical gold to maintain its value in the face of economic uncertainty, some indicators suggest that this accumulation of gold by central banks is just the prelude to a restart of the international monetary system and a possible return to the gold standard."

"The bad monetary policies that caused the housing bubble and the way fiat currencies have been managed since the 2008 crisis, depreciating the dollar and exporting US domestic problems to the rest of the world, along with economic sanctions on countries not aligned with Western geopolitical and economic interests, have undermined the credibility of the international monetary system. An alternative based on a new, multipolar, more stable and less inflationary gold standard seems closer than ever, and global central banks want to be included."

@ Newshounds News™

Read more: 11onze

~~~~~~~~~

JPMorgan Chase, Wells Fargo Suffer $3,500,000,000 in Losses As US Banks Report Massive Surge in Bad Debt

Two of the largest banks in the US are declaring a loss on a staggering $3.5 billion in debts that customers can’t pay back.

JPMorgan Chase says its net charge-offs, which are delinquent debts that banks do not expect to receive, hit $2.2 billion in the second quarter of the year.

That’s a $200 million increase from the previous quarter and an $800 million increase from Q2 of 2023.

Meanwhile, Wells Fargo says its net charge-offs surged from $764 billion in Q2 of 2023 to $1.3 billion last quarter – a 70% increase.

Although the pace of inflation has reduced, Wells Fargo’s chief financial officer Michael Santomassimo tells the New York Times that many customers are clearly struggling as their credit card balances rise and savings dwindle.

“[Inflation is] still cumulatively having a bit impact. The folks on the lower end of the wealth or income spectrum are struggling more than folks that are on the higher end.”

In addition to its charge-offs, JPMorgan declared an additional $500 million in losses from failing mortgage investments.

US banks have been sounding the alarm on its customers’ growing credit card balances and issues in the commercial real estate industry since last year.

In its new report, Wells Fargo says it earned a Q2 profit of $4.9 billion, although the bank’s shares tumbled 6% on Friday after net interest income fell short of estimates.

JPMorgan Chase reported a quarterly profit of $13.1 billion as its stock hovers near its all-time high.

@ Newshounds News™

Read more: DailyHodl

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Saturday AM 7-13-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 13 July 2024

Compiled Sat. 13 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumor/Opinions)

Thurs. 11 July Bruce: Tier4b would get our notifications either Sat, Sun or Monday 15 July to make appointments before or by Tues. 16 July. Another source said everything would start Sat. night and culminate on Sunday 14 July.

Fri. 12 July 2024 Wolverine: “The Thurs. 11 July 2024 (allegedly) meeting in Reno released the Global Currency Reset.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 13 July 2024

Compiled Sat. 13 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumor/Opinions)

Thurs. 11 July Bruce: Tier4b would get our notifications either Sat, Sun or Monday 15 July to make appointments before or by Tues. 16 July. Another source said everything would start Sat. night and culminate on Sunday 14 July.

Fri. 12 July 2024 Wolverine: “The Thurs. 11 July 2024 (allegedly) meeting in Reno released the Global Currency Reset.”

Yesterday Thurs. 11 July 2024 we had a wonderful talk with Princess Elizabeth Rodriguez Ruiz. She is the real deal, as I have seen the private documentation that is confidential, showing all the proof needed as to her true identity. She has sent me all the proof of her bloodline to the Marcos family which is part of the Chinese Elders/Dynasty.

Yesterday Thurs. 11 July 2024 there was a 3-hour meeting in Reno. It was successful. I have been told they were approved to release the funds.

Suddenly, a few hours later, I got information that payments were being released and Reno was paying, from several sources.

THE SOVEREIGN Committee and the FEDERAL government OF the United States of America just “approved” T4A and B PAYMENTS and this has started in RENO NEVADA, MIAMI, FL AND OTHER EAST COAST STATES.

Today Fri. 12 July 2024 at noon on the EAST coast payments have been made to groups of small holders.

RENO is working on Tier 4 payments from half a day. They are releasing funds from the 1% to even out the bond trade balance.

About two hours ago, I received a call from a huge whale, saying he received his notification. I asked if he was sure, and he let me look at it, and it came from his platform to have ready his CIS papers, his passport to go for his appointment, so he can be blessed.

Notifications are coming out for bondholders.

Most of you are currency holders and I have not received any news. However, if bondholders are getting paid, then Tier 4b is right around the corner.

I received an audio from a high source a good friend, he said, “They are paying Wolvie! Reno has started!”

Medbeds are just about ready. They are waiting for the green light to get healed.

A lot of people are going to Area 51. These are the RV people, just RV people, I do not know if they are driving or flying there, or how.

For Colombia they have to Bogota to the military base. I am sure they will have it all arranged for all of us to go to the proper location.

I have a friend in a private contact getting paid, he is getting billions and billions, and will use this to help millions of people, and help his family for many years to come, but the rest goes to humanity.

I just got word that Pentecostal group is about to go!

Do not get fixed on dates, you will see it on the notifications like thief in the night. For the bonds, it just happened, so it will just happen. All this Intel that just came in, it just happened, and I did not expect things to roll so quickly with Intel, audio and phone calls.

We are on the cusp of this now. I will be going overseas soon, so I will not be on any calls. I may be gone for two or more days. It is all happening. God Bless all of you, take care guys. Wolverine.

NOTE: Wolverine asked Elizabeth if Reno is now open and are people getting paid. I am hearing this from a lot of Intel providers. She agrees.

~~~~~~~~~~~~

Fri. 12 July 2024 NESARA GESARA Reformations:

NESARA / GESARA is the most groundbreaking reformations to sweep the world in the entire history of the world.

All foreigners will be required to return home in order for them to receive their GESARA Payments.

NESARA does the following:

Zero’s out all Credit Card, Mortgage and other bank and loan transaction debts.

Abolishes the Internal Revenue Service and the Income Tax.

IRS employees will be transferred to the US Treasury National Sales Tax area.

The Federal Reserve will be absorbed into the US Treasury.

Creates a 14% – 17% National Sales Tax, applied to NEW ITEMS only for government revenue. Some of it goes to states, rest to new national government.

Used items sold will not be taxed. Food & Medicines will not be taxed.

Sets up Restitution Payments for those victimized by Chattel Property Bonds. Those Aged 61 and over will receive a lump sum payment. Those Aged 41 to 60 will receive scheduled payments set time and sign work contract. Those Aged 29-40 will have to sign a Work Contract to receive their funds. Initiates a Universal Basic Income or UBI for those 16-29 years old.

An increase for retired Senior Citizens up to 3x current SSN amount up to $5,000.00

Creates a new US Treasury Rainbow Currency that is Asset Backed.

Forbids the sale of American Birth Certificates as chattel property bonds.

Initiates a new US Treasury Banking System in alignment with Constitutional Law.

Restores Personal Financial Privacy.

Ceases All Military Activities Worldwide.

Establishes World Peace.

Releases enormous sums of money to be used for Humanitarian Purposes.

Enables the release of over 6,000 patents of suppressed technologies including free energy devices, anti-gravity and medical bed technologies.

Read full post here: https://dinarchronicles.com/2024/07/13/restored-republic-via-a-gcr-update-as-of-july-13-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Bruce [via WiserNow] ... email...came out to the redemption center leaders...describing the fact that...we'd be notified either Saturday, Sunday or Monday......I'm excited about this weekend.

Henig Tweet from From the Director of the Accessions Division of the WTO: #Iraq's Working Party will be formally resumed on 18 July after 16yrs. Had a productive prep meeting w/Baghdad's team in advance of their arrival in GVA. Glad to see their readiness & excitement for this historic meeting. Grateful for the dedication & hard work of the Iraqi team.

************

LIVE! ECONOMIC MELTDOWN WILL CONTINUE TO PUSH THE STOCK MARKET HIGHER.

Greg Mannarino: 7-12-2024

It's Time To Bail On The System | John Rubino

John Rubino discusses the latest rally in gold and silver. Hope of Fed easing along with political chaos appear to be pushing metals higher.

Massive debt issues are so entrenched in the U.S. financial system that regardless of the outcome of the U.S. presidential election, financial catastrophe is inevitable, he says.

And he argues that it's imperative to get out of the financial system and hold hard assets.

INTERVIEW TIMELINE:

0:00 Intro

1:28 Gold & silver update

9:12 Housing market

13:51 Political chaos

More News, Rumors and Opinions Friday PM 7-12-2024

TNT:

Trade confirms the imminent opening of 3 central markets in Baghdad

The Ministry of Trade confirmed, today, Friday, that the General Company for Central Markets has prepared a well-thought-out plan to resume its activity, noting the imminent opening of 3 markets in Baghdad as part of a comprehensive plan to open 19 sites.

Director General of the Central Markets Company, Zahra Al-Kilani, told the Iraqi News Agency (INA): "The plan includes concluding partnership contracts and contracts to open marketing outlets with private sector companies specialized in this field, as the focus was on Baghdad Governorate, and there are marketing outlets that will have priority in opening to reach the final stages." Al-Kilani added that "the central market of Al-Amel neighborhood, Al-Salihiya market, and also Al-Shaab market will be opened very soon, and there will also be some markets with some commercial character, including Al-Rashid Central Market, Al-Khalani Building."

TNT:

Trade confirms the imminent opening of 3 central markets in Baghdad

The Ministry of Trade confirmed, today, Friday, that the General Company for Central Markets has prepared a well-thought-out plan to resume its activity, noting the imminent opening of 3 markets in Baghdad as part of a comprehensive plan to open 19 sites.

Director General of the Central Markets Company, Zahra Al-Kilani, told the Iraqi News Agency (INA): "The plan includes concluding partnership contracts and contracts to open marketing outlets with private sector companies specialized in this field, as the focus was on Baghdad Governorate, and there are marketing outlets that will have priority in opening to reach the final stages."

Al-Kilani added that "the central market of Al-Amel neighborhood, Al-Salihiya market, and also Al-Shaab market will be opened very soon, and there will also be some markets with some commercial character, including Al-Rashid Central Market, Al-Khalani Building."

She stressed that "the company has begun concluding contracts in Nineveh, Kirkuk, Kut and Basra, and the rest of the other markets will witness campaigns to rehabilitate them again," noting that "the General Company for Central Markets owns 19 central markets throughout Iraq, in addition to other sites, warehouses, complexes and shares that it owns with other companies of the ministry." link

************

Tishwash: Saudi Arabia is Iraq's new commercial destination.. Economist predicts the future

Economic experts expected, on Thursday, the growth of trade between Iraq and Saudi Arabia in the coming period, while stressing the importance of developing trade exchange between the two countries, as Saudi Arabia has one of the strongest economies in the Middle East.

Ghazi Faisal, director of the Iraqi Center for Strategic Studies, said in a statement followed by Mawazine News, "Saudi Arabia represents one of the giant regional economies, as its annual GDP is approaching one trillion dollars, and during the past decades it has invested in the field of minerals in addition to gas and oil, as it is the first producer of oil in the world, and it is also an important investor in agriculture and industry, and it previously offered Iraq to invest in agriculture in the south of the country, but pressures from forces opposing openness to Saudi Arabia have disrupted the project."

Faisal added, "Today there is an important openness to Saudi Arabia, as an agreement was signed since the time of former Prime Minister Haider al-Abadi, and the Iraqi-Saudi Economic Council was formed, which holds joint meetings, and Iraq opened up to Saudi investors in various fields."

Faisal pointed out that "Saudi Arabia is a major player in international economic relations and an important member of the G20 group of economic powers in the world, so it is important for Iraq to open up to the Kingdom and benefit from its capabilities."

In comparison with neighboring countries, the director of the Iraqi Center for Strategic Studies explained that "Turkey's products differ in nature, due to the abundance of water and land. It is an important agricultural and industrial country, and trade exchange with Turkey will remain indispensable."

As for Iran, according to Fassal, it is "an important country commercially, but it is shackled by economic sanctions, as it suffers from restrictions on the movement of currency for trade with Iran, which causes the existence of a parallel market in Iraq and black transfers and other issues that burden the Iraqi economy with major problems."

It is known that Iraqi markets depend on Turkey and Iran to meet their needs for goods, as the volume of trade exchange between Iraq and Turkey reached $20 billion according to Turkish President Recep Tayyip Erdogan, while Iran intends to reach this number by 2027. link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The moment the value goes up where is the Iraqi dinar, where is that exchange rate going internationally? ...Forex. It's going to the community that is starving for this currency...In doing so the value will go up in what's called a float.

Militia Man The Central Bank...is probably telling people [exchange companies], if you don't do this [play by the rules] you're going to have a big problem...Those 1200 entities that were talking about going on strike got a reality check. Because could you imagine holding massive amounts of US dollars when you could be holding dinar and they change the value of the currency to show their purchasing power when they drop the three zeros? It's going to bring value. It's not a lop like a lot of people keep thinking...It doesn't bring any value. A lop is like a reverse split...It's silly.

************

U R G E N T BREAKING NEWS Iraq's Secret Transactions in Chinese Yuan

Edu Matrix: 7-12-2024

THE US DOLLAR DOWNFALL WILL RAPIDLY WORSEN FROM HERE... IMPORTANT UPDATES.

Greg Mannarino: 7-12-2024

Seeds of Wisdom RV and Economics Updates Friday Afternoon 7-12-24

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

"CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

"Federal legislation is urgently needed to create a pathway for a regulatory framework that will protect American investors and possibly the financial system from future risk.”

"Dr. Roger Marshall, the Republican Senator from Kansas, brought up the turf war between the SEC and the CFTC over who gets to regulate digital assets, and asked Behnam, “Wouldn’t it be simpler if we put this whole thing under the CFTC's jurisdiction?”

@ Newshounds News™

Read more: Kitco

~~~~~~~~~