Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Seeds of Wisdom RV and Economics Updates Sunday Evening 7-7-24

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger? ➖

BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance. ➖RippleNet could replace SWIFT for cross-border transactions. ➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

Good Evening Dinar Recaps,

BRICS Coalition Eyes Ripple for New Financial Order, Is This the Awaited XRP Price Pump Trigger?

➖BRICS coalition explores Ripple/crypto strategy to challenge US dollar dominance.

➖RippleNet could replace SWIFT for cross-border transactions.

➖XRP Ledger offers a decentralized platform for asset-backed currency.

The BRICS coalition, composed of Brazil, Russia, India, China, and South Africa, is considering a Ripple/crypto plan to challenge the US dollar’s global supremacy. This action, according to analysts, has the potential to change the present financial situation.

Leaders like Vladimir Putin and Xi Jinping are showing strong interest in cryptocurrency as a means of countering US financial dominance. An entirely new financial order based on real assets and blockchain technology might emerge from such a development, altering the current petrodollar system.

The XRP Ledger (XRPL), in particular, provides a potential decentralized platform for quick, safe transactions as a result of the technology developed by Ripple. These features make XRPL a promising foundation for a new asset-backed currency, decreasing reliance on central banks while increasing financial transparency.

RippleNet, Ripple’s payment network, is also key in this potential change. It allows for real-time, cross-border transactions, potentially replacing the traditional SWIFT system. RippleNet uses XRP in conjunction with On-Demand Liquidity (ODL) to eliminate the requirement for pre-funded accounts, simplifying international payments.

A new, more transparent, efficient, and less reliant on the US dollar global financial system may emerge from the BRICS coalition’s interest in cryptocurrencies and Ripple’s technology. By embracing a crypto/Ripple approach, the BRICS nations have the potential to completely reshape the world financial environment, with major effects on commerce and banking across borders.

The possible adoption of a Ripple/crypto strategy by the BRICS coalition represents a major advancement in global financial services. Ripple’s decentralized technology might serve as the basis for a new asset-backed currency. This change would make the banking system more efficient and put the US dollar under more pressure.

Read more Crypto News Land

~~~~~~~~~

US House Considers Overturning Biden’s Crypto Custody Veto — This Could Spark Wide Market Rally

"The US House of Representatives could overturn President Joe Biden’s veto of the crypto custody bill next week, sparking a bold recovery across the recently battered crypto market."

“In May, the US House voted to overturn the Securities and Exchange Commission SAB 121 rule that requires regulated firms custodying cryptocurrencies to record their holdings on balance sheets.”

“However, President Biden later vetoed the bill, saying it could affect the ability of the SEC to set up the much-needed guardrails in the industry. The President also noted it would affect the well-being of investors and customers.”

“The bill is now back in the House of Representatives and has been classified as “legislation that may be considered.” The US House can overturn or uphold the President’s veto.”

A two-thirds majority vote from both the Senate and the House is needed to overturn the veto.

Could A Recovery for the Crypto Market Be Brewing?

With the recent decline in Bitcoin and the cryptocurrency market, an overturn of the bill could be just what the market needs to recover.

“The market has already recorded a bold recovery in the last 24 hours, with the global market cap up by 4.3%. All the top-ten cryptos by market cap are also trading in the green today.”

“Bitcoin and Ether have gained by 4.5% and 5.3%, respectively, in the last 24 hours. XRP and Cardano are among the top gainers, with an 8% and 7% gain, respectively.”

@ Newshound News™

Read more: ZY Crypto

~~~~~~~~~

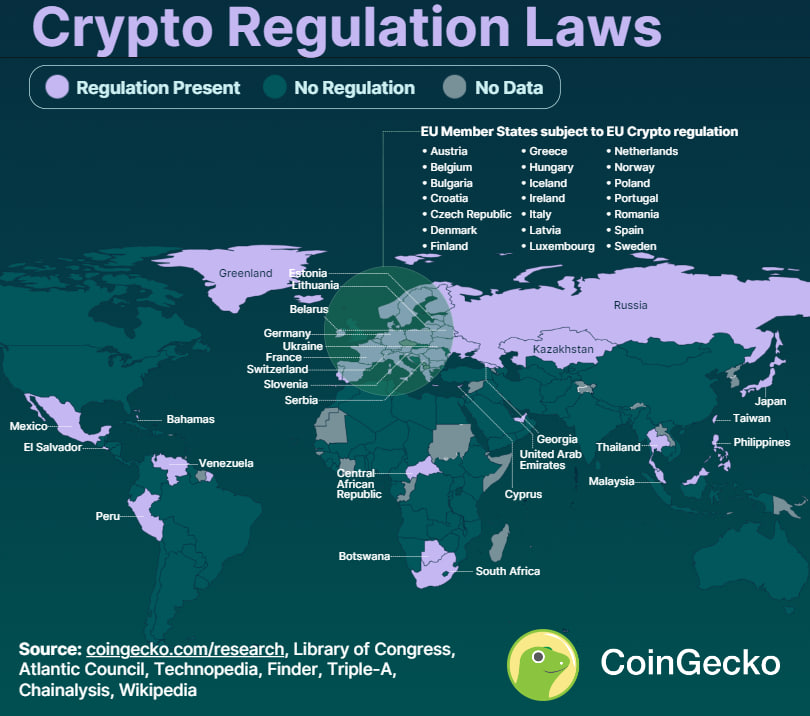

Countries Where Cryptocurrency Is Legal vs Illegal

Where Is Cryptocurrency Legal?

Cryptocurrency is currently legal in 119 countries and four British Overseas Territories. This means more than half of the world's countries have legalized cryptocurrency. 64.7% of countries that have legalized crypto are emerging and developing countries from the Asian and African continents. However, out of the 119 countries that legalized cryptocurrency, 20 (16.8%) have imposed bank bans. These bans restrict financial institutions from interacting with cryptocurrency exchanges or users.

Europe Leads With 39 Countries Recognizing Crypto’s Legitimacy

Europe is at the forefront of global cryptocurrency legalization, with 39 (95.1%) out of 41 analyzed countries acknowledging its legitimacy. North Macedonia is the only European country where cryptocurrency is illegal, while Moldova's status remains unclear.

Out of 31 countries in the Americas, 24 (77.4%) countries recognize cryptocurrency as legal. Bolivia stands as the sole exception, deeming cryptocurrency illegal. Six American countries - Guatemala, Guyana, Haiti, Nicaragua, Paraguay, and Uruguay - have yet to establish their official stance on cryptocurrency.

In Africa, only 17 out of 44 (38.6%) countries have legalized cryptocurrency, while 35 (77.7%) out of 45 countries in Asia recognize cryptocurrency as legal.

How Many Countries Have Defined Crypto Laws?

Only 62 (52.1%) of the 119 countries where cryptocurrency is legal have comprehensive regulations. This number has gone up by 53.2% since 2018 when only 33 jurisdictions had cryptocurrency regulations.

Among the 62 countries with established regulations, 36 (58.0%) are individual countries, 22 (35.5%) are part of the European Union (EU), and 4 (6.5%) are British Overseas Territories. Notably, half of these countries are advanced economies, while the remaining half are emerging and developing economies.

Half of the countries that have legalized cryptocurrency have yet to implement robust regulatory frameworks. This gap between legalization and full regulation raises potential concerns about investor protection and clarity for businesses operating in the cryptocurrency space in those countries.

Instead, several countries have taken the approach of adapting existing regulatory frameworks to encompass cryptocurrencies, rather than establishing entirely new regulations. This approach often involves applying established tax laws and anti-money laundering and counter-financing of terrorism (AML/CFT) laws to cryptocurrency transactions and activities.

Major advanced economies, including France, Japan, and Germany, have successfully established regulatory frameworks for cryptocurrencies.

In contrast, other major advanced economies, such as Italy, the United States, Canada, and the United Kingdom, face challenges in implementing comprehensive cryptocurrency regulations. Multiple governments and financial regulatory bodies in these countries contribute to the complexity of the regulatory process.

EU member states, on the other hand, adhere to EU-wide regulations regarding crypto assets. These regulations provide a more harmonized approach to cryptocurrency regulation within the bloc.

Which Countries Use Cryptocurrency as Legal Tender?

Only two countries, El Salvador and the Central African Republic (CAR), have adopted cryptocurrency as legal tender. Of which, El Salvador remains the only country actively using cryptocurrency as legal tender today.

El Salvador made history in August 2021 by legalizing Bitcoin through the Bitcoin Law. This landmark legislation cemented Bitcoin's acceptance as legal tender with automatic conversion to US dollars. In January 2023, El Salvador took another step towards embracing Bitcoin by passing the Digital Securities Law. This law classifies Bitcoin as a "digital commodity" and all other crypto assets as "securities."

@ Newshound News™

Read more: CoinGecko

~~~~~~~~~

THE UK COULD BE THE FIRST COUNTRY TO DESIGN CBDCs TO HELP THE PEOPLE, NOT THE BANKS

Labour's plan acknowledges the growing case for a state-backed digital pound and emphasizes the need for financial products to reach underserved communities.

"The landslide victory of the UK’s Labour Party in the general election saw little to no mention of Bitcoin, blockchain, or digital assets. However, Labour’s previous statements and plans suggest a cautious yet open stance toward blockchain technology. "

Labour backs Digital Pound, but what could it look like?

“Labour’s financial services plan, “Financing Growth,” acknowledges the growing case for a state-backed digital pound and emphasizes the need for “financial products to reach underserved communities.

“Embrace innovation and fintech as the future of financial services by becoming a global standard-setter for the use of AI in FS, delivering the next phase of Open Banking, defining a roadmap for Open Finance, embracing securities tokenisation and a central bank digital currency, and establishing a regulatory sandbox for financial products to reach underserved communities.”

“The party has fully supported the Bank of England’s ongoing work in this area, indicating a commitment to continue exploring and developing a CBDC.”

The Labour party has “highlighted the importance of addressing key concerns such as privacy, financial inclusion, and stability in designing any potential CBDC.” This indicates Labour “prioritizes public interest and economic stability.”

“Labour’s plan also emphasizes the importance of making the UK a global hub for securities tokenization” and exploring the tokenization of securities. "

"Labour has expressed intentions to advance open banking initiatives, explore the potential of open finance, and establish regulatory sandboxes to test financial products aimed at underserved communities. "

Healthy Skepticism for CBDCs

"As with any attempt to deliver a CBDC, it’s important to remain skeptical due to its potential for governmental overreach and abuse." However, "as one of the few ‘Left Wing’ governments to oversee a CBDC, Labour could offer a unique take on its design."

“Labour’s support for CBDC exploration does not equate to an immediate implementation plan. The party has emphasized the need for thorough consultation and careful consideration of potential impacts” such as privacy concerns associated with CBDCs. “It is clear that FIAT, in its current form, is failing.”

A positive CBDC design would include:

More transparency over government spending

More accessible access to finance for the unbanked

Cheaper and faster international transfers

Reduced costs of Central Bank printing

Increased privacy

A reduction in financial crime

“However, designing a CBDC to offer all these things without the more Orwellian alternatives may require too much of a leap of faith for most. A party with socialist origins, with a forward-thinking and modern technology focus, in the 2024 United Kingdom could theoretically adopt the best of what blockchain offers without overreaching if app priately advised by those in the digital assets industry.”

“We would have one shot at this, and it would have to be designed so that a future government could not alter it to take advantage of its citizens.”

"The coming months and years will be critical in determining whether the UK under Labour leadership can successfully navigate the complex landscape of digital currencies, balancing innovation with stability and public interest. If successful, the UK could emerge as a global leader in the responsible development and implementation of CBDCs, setting a precedent for other nations to follow."

@ Newshound News™

Read more: CryptoSlate

~~~~~~~~~

STABLECOINS AND NATIONAL SECURITY: LEARNING THE LESSONS OF EURODOLLARS

"As Congress struggles to resolve big issues like funding for Ukraine and Israel, the debate over legislation to regulate stablecoins seems like small potatoes. But there is a connection, which is that stablecoins could have national security implications: Unless we strengthen their regulation, they could undermine our ability to use sanctions to advance our national interests.

This was illustrated recently by news that Russian smugglers have used Tether, the largest stablecoin, to avoid Western sanctions and purchase billions of dollars worth of weapons."

"Stablecoins are a type of cryptocurrency that is far more useful as a means of payment than Bitcoin. 1 That is because stablecoins are designed to maintain a constant price in terms of another asset. 2 Stablecoins pegged to the U.S. dollar are more “money-like” than other cryptocurrencies.

They can be used to move value across borders without going through banks, and it is the banking system—and in particular the role of U.S. banks—that is key to the implementation and efficacy of sanctions."

"Stablecoins are in some respects similar to Eurodollars, a financial innovation that helped to create the financial plumbing used to implement sanctions. Both stablecoins and Eurodollars are U.S. dollar-based liabilities that had their origins outside the regulated banking system...

It is the global dominance of the dollar, coupled with the role of U.S. banks in facilitating dollar payments, that gives the U.S. its tremendous financial leverage."

"Could stablecoins undermine that leverage? As with the early days of the Eurodollar market, stablecoin use is minimal today, and so their national security risk may also be minimal. But just as Eurodollar use grew quickly and unexpectedly, stablecoins could also grow.

While they are used principally to trade other crypto assets today, they could become a more widespread means of payment. They have also become popular as a means for people in countries with weak currencies to acquire a dollar substitute.

Moreover, that growth could come even if the U.S. does not take action. That is because many other jurisdictions are creating frameworks to license stablecoins, including Europe, the U.K., Japan, Singapore and the U.A.E. While those frameworks may lead to stablecoins in native currencies, they could also give rise to new dollar-based stablecoins.

@ Newshound News™

Read more: BrookingsEdu

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

BRICS Intra-bank Payment System Launched: What next?

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

BRICS Intra-bank Payment System Launched: What next?

Fastepo: 7-7-2024

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions.

The heads of the central banks from both nations have been working closely to link Iran's SEPAM system with Russia's System for Transfer of Financial Messages (SPFS).

This integration will allow the two countries to conduct trade and financial transactions using their national currencies, the ruble and rial, reducing their reliance on the U.S. dollar and the Western-dominated SWIFT system.

The new system will enable Iranian and Russian banks to issue and accept each other's bank cards, facilitating smoother transactions for businesses and individuals in both countries.

This move is seen as a strategic effort by both nations to mitigate the impact of international sanctions and strengthen their economic ties.

Russia, heavily sanctioned due to its invasion of Ukraine, and Iran, facing long-standing sanctions related to its nuclear program and other issues, are increasingly collaborating to build financial infrastructure independent of Western influence.

The first trade transactions using this new system have already taken place, and both countries are optimistic about the potential to significantly increase their annual bilateral trade, aiming to double it from $4 billion to $8 billion.

This integration is part of a broader effort to create a more resilient and self-sufficient economic partnership between Russia and Iran, further solidifying their alliance against Western economic pressures.

More News, Rumors and Opinions Sunday PM 7-7-2024

TNT:

Tishwash: Central Bank hosts meeting to regulate e-commerce in Iraq

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate e-commerce in Iraq with the participation of the concerned authorities.

During the meeting, the draft e-commerce and consumer protection system was discussed through the controls discussed by the attendees, through the registration procedures and obtaining a license to practice this trade.

The committee contributed to defining the service provider and granting him a license through an electronic platform established by the Ministry of Trade. The committee members stressed the need to establish controls for granting a license to those wishing to practice e-commerce in a manner that preserves the rights of all parties.

The attendees agreed to submit the "system paper" to the Council of Ministers for review and approval to proceed with work on it.

TNT:

Tishwash: Central Bank hosts meeting to regulate e-commerce in Iraq

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, chaired the meeting of the Diwani Order Committee (24079) to regulate e-commerce in Iraq with the participation of the concerned authorities.

During the meeting, the draft e-commerce and consumer protection system was discussed through the controls discussed by the attendees, through the registration procedures and obtaining a license to practice this trade.

The committee contributed to defining the service provider and granting him a license through an electronic platform established by the Ministry of Trade. The committee members stressed the need to establish controls for granting a license to those wishing to practice e-commerce in a manner that preserves the rights of all parties.

The attendees agreed to submit the "system paper" to the Council of Ministers for review and approval to proceed with work on it.

Central Bank of Iraq

Media Office

July 7, 2024 link

**************

Clare: Economist explains why the dollar fluctuates

Economic researcher Alaa Al-Fahd diagnosed, today, Saturday, a factor that caused the dollar price to rise against the Iraqi dinar in the parallel market.

Al-Fahd said in a press interview that "the fluctuations in the dollar exchange rate in the parallel market came as a result of the Central Bank of Iraq taking new measures regarding selling currency to travelers and delivering amounts from the airport exclusively."

He added, "When there are new measures, there are fluctuations in exchange rates," noting that "there are those who try to raise concerns with any new measures taken by the Central Bank in order to benefit some speculators."

The economic researcher pointed out that "the Central Bank has reassured more than once that it will continue to sell the currency and cover all needs, whether for imports or travel, and there are no concerns." link

************

Tishwash: Investment shows the importance of the Singapore Agreement.. What are its details?

The National Investment Commission confirmed, today, Sunday, that the Singapore agreement will accelerate the increase in Iraq's international classification, while clarifying regarding financing projects of local, Arab and foreign investors in Iraq.

The head of the commission, Haider Makiya, said: “The investment classification of emerging countries in 2024, conducted by FDI Intelligence, ranked Iraq fourth, indicating the confidence provided by investment in Iraq, specifically the National Investment Commission, in providing a safe legislative environment for the investor to settle in Iraq and return large capital to implement infrastructure projects and achieve sustainable development.”

He added, "The Singapore Agreement will accelerate and speed up the increase in Iraq's international rating, which is a sovereign rating for the whole world, and thus Iraq's rating will be known when it is good."

He pointed out that "all investors in the world will come without any restrictions or conditions as long as the legislative environment exists and governs their work in Iraq, and thus the process of attracting money to enter it will proceed easily and smoothly."

He pointed out that "project financing may be internal or external. If Iraq joins the international agreements, the process regarding foreign investors will be governed by the agreements. However, if the investor is local or Arab and wants to take financing, he will be subject to Iraqi laws regarding financing." link

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Article: "Prime Minister's Advisor: Iraq in the process of paying off long-term development loans to the World Bank" It looks like Iraq's financial situation is solid as they get effectively. She has so many revenue streams coming on board now it will only get better and the World Bank, the IMF, the UST, etc all know it. Hence, the view of Iraq will bring confidence to the largest Banks and Financial Entities in the world. That was broadcasted globally too.

Frank26 Question: "Do you think they're letting the dinar float into its cap before they release the new rate?" No. You have to release the rate first. Once the rate is released internationally then it can be acquired by the international community. It'll be used in banks...Once the dinar is out there officially in the international market the friction that the Iraqi dinar is going to cause in the financial market will only cause it to get bigger and bigger and bigger in its value/rate internationally. Inside Iraq it doesn't affect it - a dinar is a dinar. The rate inside does not move, only the rate outside.

*************

Iraqi Trade Bank's Progress on Debt Collection

Nader: 7-7-2024

MARKETS A LOOK AHEAD: A NEW PHASE OF HYPER-DEBT HAS ALREADY BEGUN.

Greg Mannarino: 7-7-2024

Some Thoughts On America For Her 248th Birthday

Some Thoughts On America For Her 248th Birthday

Notes From The Field by James Hickman (Simon Black Sovereign Man) July 3, 2024

When the 56 delegates to the Second Continental Congress ratified the Declaration of Independence 248 years ago tomorrow, they were creating much more than a nation. They were giving birth to an idea.

America, at its core, is an idea. And it’s one that ranks as one of the greatest innovations in the history of human civilization, right up there with the wheel, the steam engine, the printing press, and the Internet.

The idea of America wasn’t born in 1776, however. By then it had already evolved over thousands of years.

Some Thoughts On America For Her 248th Birthday

Notes From The Field by James Hickman (Simon Black Sovereign Man) July 3, 2024

When the 56 delegates to the Second Continental Congress ratified the Declaration of Independence 248 years ago tomorrow, they were creating much more than a nation. They were giving birth to an idea.

America, at its core, is an idea. And it’s one that ranks as one of the greatest innovations in the history of human civilization, right up there with the wheel, the steam engine, the printing press, and the Internet.

The idea of America wasn’t born in 1776, however. By then it had already evolved over thousands of years.

The ancient Greeks embraced individual liberty, direct democracy, and a respect for the rule of law.

The Roman republic further refined Greek democracy and developed a more professional legal code. The early Roman Empire embodied peace through strength, ushering in nearly two centuries of geopolitical stability and economic prosperity under the Pax Romana.

The later Byzantine Empire fused Greek and Roman ideas with Judeo-Christian values. And by 1000 AD, the Republic of Venice– borrowing from Rome’s republican form of government– infused an early form of capitalism to this model.

The Dutch republic of the 1600s refined the concept of a powerful, free, capitalist society even further, as did philosophers like Rousseau, Montesquieu, John Locke, and Adam Smith.

So, when the Founding Fathers wrote the Declaration of Independence (and subsequently the US Constitution), they didn’t have to start from scratch; they drew from a rich, 2,000-year intellectual heritage of the giants who came before them.

This means that America is ultimately a composite of the very best ideas that human civilization ever had to offer— and the combined concept was then elevated to unprecedented heights.

Nothing is perfect, and America wasn’t either.

But based on this idea, the United States became the world’s largest economy in less than a century and the dominant global superpower about 80 years later. That is an unparalleled achievement which no other superpower in human history has come close to matching.

It’s also worth pointing out that the majority of the world’s most important innovations, from airplanes and air conditioning to cell phones and chocolate chip cookies, were either born or perfected in America.

Again, none of this is an accident. America’s success is the deliberate outcome from combining the best ideas from 2,000+ years of human civilization… plus some disciplined execution and a little bit of luck.

Obviously, America has weathered challenges as well. The Civil War. The Great Depression. The turmoil of the 1960s.

But its foundation of economic potential, plus a baseline of social cohesion and shared values, have always allowed the nation to overcome… and for the idea of America to persist.

The country is now at an undeniable crossroads, and it’s not just about a single election.

There are obvious signs of national decline: rising inflation, mounting debt, diminished global standing, a loss of government dignity, and stinging embarrassments like the shameful withdrawal from Afghanistan.

Even the idea of America itself is on the ropes; there are powerful forces within government, media, and the education system who seek to redefine America’s core principles.

Capitalism has been demonized and reinvented. Individual liberty has given way to a radical woke ideology. And the concept of limited government is almost a punchline at this point.

Still, there is a plausible scenario in which America’s best days are ahead.

If politicians embrace the principles that originally fueled the country’s prosperity—such as capitalism and laissez-faire productivity—America could experience an economic boom not seen since the Industrial Revolution.

By cutting taxes, slashing anti-capitalist regulation, and embracing the free market, the increase in productivity could be staggering.

This boom would lead to increased tax revenue, i.e. funds which could rebuild the military, secure the southern border, save Social Security, curb inflation, balance the budget, and chip away at the national debt.

As China buckles under the consequences of its central planning and upside-down demographic pyramid (brought on by its idiotic “One Child policy”), the United States could easily reassert its global primacy.

The dollar’s status as the global reserve currency would be unquestioned, and the world could see a new era of global peace and prosperity.

This is not a pipe dream. It’s a genuine possibility.

The other possibility is that the government does nothing to arrest America’s decline.

The debt continues to spiral further out of control. Rising deficits trigger painful inflation. Excessive regulation stifles economic growth, leaving the economy stagnant and performing far below its full potential.

Individuals are constrained by politicians’ incessant and debilitating rules about how to live, what to buy, and what to drive. The social fabric continues to tear apart with idiotic mandates, censorship, wokeness, gaslighting, and a hatred for capitalism.

Unfortunately, that is the road the country is presently on. Yes, it can be fixed. They can change directions. And we certainly hope that happens.

But as we used to say in the military, hope is not a course of action. That’s why we have a Plan B.

Having a Plan B is not being negative or pessimistic. It’s certainly not irrational. And it’s not unpatriotic.

The fierce individuality to NOT bow down to circumstances is exactly what has allowed America to persevere so many times before.

And taking sensible steps to preserve, protect, and defend what you have worked so hard to achieve in life is about as core of an American value as it gets.

James Hickman

James Hickman (aka Simon Black) is an international investor, entrepreneur, and founder of Sovereign Man. His free daily e-letter Notes from the Field is about using the experiences from his life and travels to help you achieve more freedom, make more money, keep more of it, and protect it all from bankrupt governments.

More Articles By James Hickman

https://www.schiffsovereign.com/trends/some-thoughts-on-america-for-her-248th-birthday-151123/

Warren Buffett Said That He Could End America's Deficit Problem 'In Five Minutes'

Warren Buffett Said That He Could End America's Deficit Problem 'In Five Minutes' — here's what he would do

Vishesh Raisinghani Sat, Jul 6, 2024

There’s growing concern about a looming debt crisis in America. High-profile financial figures such as Bridgewater’s Ray Dalio and JP Morgan’s CEO Jamie Dimon have shared their concerns about the record U.S. national debt in recent months.

However, legendary investor Warren Buffett proposed a solution to the nation’s borrowing issue more than a decade ago.

"I could end the deficit in five minutes,” he told CNBC’s Becky Quick in a 2011 interview. “You just pass a law that says that any time there's a deficit of more than 3% of GDP, all sitting members of Congress are ineligible for re-election.”

The Oracle of Omaha believes this simple solution could solve one of America’s more stubborn issues.

Warren Buffett Said That He Could End America's Deficit Problem 'In Five Minutes' — here's what he would do

Vishesh Raisinghani Sat, Jul 6, 2024

There’s growing concern about a looming debt crisis in America. High-profile financial figures such as Bridgewater’s Ray Dalio and JP Morgan’s CEO Jamie Dimon have shared their concerns about the record U.S. national debt in recent months.

However, legendary investor Warren Buffett proposed a solution to the nation’s borrowing issue more than a decade ago.

"I could end the deficit in five minutes,” he told CNBC’s Becky Quick in a 2011 interview. “You just pass a law that says that any time there's a deficit of more than 3% of GDP, all sitting members of Congress are ineligible for re-election.”

The Oracle of Omaha believes this simple solution could solve one of America’s more stubborn issues.

Incentives dictate actions?

Buffett’s longtime business partner the late-Charlie Munger once said, "Show me the incentive, and I will show you the outcome." It’s a philosophy that guides the business decisions and compensation plans across Berkshire Hathaway.

This is probably why Buffett believes a deterrent for the American government and lawmakers could shift the way they spend tax dollars. If lawmakers see their re-elections at risk, they may be more careful about government deficit spending.

This isn’t an unusual idea. Germany has a hard cap on deficit spending which has compelled successive governments to reign in spending over the years.

However, there is no hard cap on America’s deficit. As of May, the federal government has spent $1.2 trillion more than it has collected in fiscal year 2024. In the first quarter of 2024, federal debt as a percent of GDP was 97.3%.

This large debt burden and the lack of spending restraint is causing some economists and investors to worry about a potential debt crisis.

How can ordinary investors protect their wealth if the government is left with no choice but to keep printing more money to pay off the debt and drives inflation and interest rates higher? Wharton Professor Kent Smetters spoke to Business Insider about assets that can be used to hedge against a possible economic downturn in such a scenario. His advice is buying assets that the government would be last in line to default on.

Treasury Inflation-Protected Securities (TIPS)

U.S. treasury bonds are generally considered a low-risk investment because lending money to the U.S. government has been a reliable bet for centuries. However, bond investors are still subject to wealth erosion through inflation — which could spike in a debt crisis. Professor Smetters recommends Treasury Inflation-Protected Securities that offer the safe and stable return of a bond with downside protection.

To Read More: https://finance.yahoo.com/news/warren-buffett-said-could-end-113400320.html

Sunday AM News, Rumors and Opinions 7-7-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 7 July 2024

Compiled Sun. 7 July 2024 12:01 am EST by Judy Byington,

Global Currency Reset: (Opinions/Rumors) Guesses of a Possible Timeline for RV, forward from JR. on Telegram

We are supposed to have RV before NESARA was officially released to public to get accounts set up in the month of July.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 7 July 2024

Compiled Sun. 7 July 2024 12:01 am EST by Judy Byington,

Global Currency Reset: (Opinions/Rumors)

Guesses of a Possible Timeline for RV, forward from JR. on Telegram

We are supposed to have RV before NESARA was officially released to public to get accounts set up in the month of July.

Almost all RV GURUS and Intel have all stated we should only take 10 days to go through all the currency holders before lockdowns (since they are going to be open 24/7 for 10 days) More redemption centers in higher populated areas. Our email confirmations an Ph #s have been given to 5 + websites.

All Intel states were going to have 3 to 10 day lockdown of the internet to reveal to the masses. This is when they announce at the END of that announcement.

They have new QFS accounts that they will have to go in. To get there Quantum account set up at the closest bank or redemption centre in their area.

EMAILS have to come in from now up to no later than Tuesday June 9th to get into the Redemption Centers before the lockdowns.

JULY 20th to start lockdowns for 10 days to get QFS an MED-BEDS released to the world at the very end of this MONTH

~~~~~~~~~~~~~~~

Judy Note: What we think we know as of Sun. 7 July 2024:

There will be an Internet Blackout.

The White Hat Military is in control of the redemption process, which has released funds across the World for the Global Currency Reset.

All banks have signed Non Disclosure Agreements.

The funds come directly from the US Treasury Department of Defense Operations – that go out to Treasury Departments in other countries.

Japan has revalued their currency.

Bond Holders have begun to be paid in Brazil.

Notifications have gone out to Tier 4a, a small group of Tier4b and some Bond Holders.

~~~~~~~~~~

Sat. 6 July 2024 Wolverine. “It has started. It is a process hopefully completed by the 20th. I’m hoping to get the Green Light in a few days.”

Fri. 5 July 2024 Banker: “Well folks it’s not like we haven’t heard this before but, I just got off a call from Hong Kong, London, NYC, Reno, and me. They are indicating that certain bond holder groups are having funds disbursed to paymasters over this weekend and that we as currency holders should remain vigilante for notifications this coming week. An FYI only as banker has not suggested same.

Sat. 6 July 2024: Bombshell Report! This is your Financial Bible | This is the Quantum Financial System Manual of GESARA-NESARA & XRP! – American Media Group (amg-news.com)

~~~~~~~~~~~~

Global Financial Crisis:

Sat. 6 July 2024 This is absolutely insane: Annual US government spending reached a MASSIVE $6.5 trillion in May, just $1.1 trillion below the March 2021 record. The government total outlays have DOUBLED in just a decade. To put this into perspective, this is more than the size of most world economies except the US and China. Meanwhile, the US budget deficit hit $1.7 trillion, or 6.2% of GDP over the last 12 months. In the past, such levels of spending have only occurred during major crises. What’s the long-term plan here?

Sat. 6 July 2024: 90% of all trade between China and Russia is conducted in Ruble or Yuan after ditching the US Dollar.

Read full post here: https://dinarchronicles.com/2024/07/07/restored-republic-via-a-gcr-update-as-of-july-7-2024/

**********

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Key players are ready to get this thing done. It's a very good sign. I honestly believe we're watching history in the making...We're seeing progress like no other...If you're paying attention I think you guys should be really pumped and excited that things are happening.

Sandy Ingram If the Iraqi dinar revalued next week are you ready? ...Understanding this one fact, you will do just fine. The wealthy never never ever spend their bases or the foundation of their wealth. In your case this would be the profits from your Iraqi dinars...Wealthy people invest their initial profits. The first person they hire is a financial advisor. The second...is a tax professional...to make sure Uncle Sam doesn't get large sums of their money. If you do anything else you are in the fast lane to going broke.

**************

Why Iraq Has Two Exchange Rates

Edu Matrix: 7-7-2024

Update Why Iraq Has Two Exchange Rates… Gold Prices IQD VND Rates—Iraq's two exchange rates affect the country's economic progress. This video shares how and why this is important.

Hidden Crisis: Lynette Zang Reveals The Truth About Fintech And Banking Collapse

The Market Sniper: 7-6-2024

“Tidbits From TNT” Sunday Morning 7-7-2024

TNT:

Tishwash: Oil and gas law...the unsolvable knot

The oil and gas law is considered one of the sensitive laws in the Iraqi state, as it is one of the axes of the ongoing conflict between the central and regional governments over oil imports.

The center of the dispute over the law is that the region wants to control oil imports in its lands according to its mood without the control of the federal government, while the political forces do not want to grant this privilege to the region because it gives it a kind of separatist independence, so to speak.

Since the first session of the Iraqi Council of Representatives, in 2005, the draft oil and gas law has been stuck in drawers, as disagreements prevent its approval in its final form.

After 18 years, he announced the formation of a committee to draft the law and present it to the government and the House of Representatives.

TNT:

Tishwash: Oil and gas law...the unsolvable knot

The oil and gas law is considered one of the sensitive laws in the Iraqi state, as it is one of the axes of the ongoing conflict between the central and regional governments over oil imports.

The center of the dispute over the law is that the region wants to control oil imports in its lands according to its mood without the control of the federal government, while the political forces do not want to grant this privilege to the region because it gives it a kind of separatist independence, so to speak.

Since the first session of the Iraqi Council of Representatives, in 2005, the draft oil and gas law has been stuck in drawers, as disagreements prevent its approval in its final form.

After 18 years, he announced the formation of a committee to draft the law and present it to the government and the House of Representatives.

The committee that was formed between Baghdad and Kurdistan to draft a draft law for oil and gas includes the Minister of Oil, the Minister of Natural Resources in the region, the Director General of SOMO, and the advanced staff in the Ministry of Oil, as well as the oil-producing governorates such as Basra, Dhi Qar, Maysan, and Kirkuk.

Iraq exports an average of 3.3 million barrels of crude oil per day, and black gold constitutes more than 90 percent of the Iraqi treasury's resources.

Article 14 relates to oil revenues in the Kurdistan region and their audit by the Federal Oversight Office

The draft Iraqi oil and gas law regulates this vital sector for Iraq and the management of the country's oil fields through one national company, with imports being deposited in one account.

The financial advisor to the Iraqi Prime Minister, Mazhar Muhammad Salih, confirmed in statements that accelerating the adoption of the federal oil and gas project law in the House of Representatives as quickly as possible will establish a stable national road map for investment and production of the country's primary sovereign resource, which is oil and gas.

He explained that "this natural resource contributes directly to Iraq's gross domestic product at a direct rate of approximately 50 percent, and leaves an indirect impact on the total economic activity of our country at a rate of no less than 85 percent."

Saleh said, "Adopting a unified national oil policy, and achieving optimal investment and production in Iraq's oil region, starting from the southern fields up to the northern and regional fields, is an important and strategic matter in the matter of taking advantage of opportunity costs in the optimal and harmonious operation of Iraqi oil policy currently."

The draft oil and gas law in Iraq available to Parliament stipulates that responsibility for managing the country's oil fields must be entrusted to a national oil company, and supervised by a federal council specialized in this subject.

For its part, the Kurdistan Oil Law indicates that the Iraqi government has the right to participate in the management of fields discovered before 2005, but the fields discovered afterward belong to the regional government.

In 2022, the Federal Court in Baghdad ordered the region to deliver the oil produced on its lands to Baghdad, and to cancel contracts that the region had signed with foreign companies. The matter went so far as to invalidate the Baghdad judiciary's contracts with many foreign companies, especially American and Canadian companies.

After years of exporting oil alone via Turkey, the Kurdistan region must adhere, as of late 2023, to the decision of an international arbitration body that gave Baghdad the right to fully manage Kurdistan's oil.

As a result, exports from the region stopped. A temporary agreement signed between Baghdad and Erbil stipulates that Kurdistan oil sales will be made through the Iraqi Oil Marketing Company “SOMO,” while revenues generated from the region’s fields will be deposited in a bank account with the Central Bank of Iraq or one of the banks approved by the Central Bank of Iraq.

A member of the Parliamentary Oil and Gas Committee, MP Durgham al-Maliki, revealed that the coordination framework and the state administration coalition discussed the oil and gas law with Masoud Barzani.

Al-Maliki told Al-Maalouma Agency, “The committee discussed the draft law in a professional manner and completed most of its paragraphs, but the government requested its withdrawal to make amendments to it, indicating that the law is still in the government's possession.”

He promised, "The approval of the annual budgets was disrupted due to oil disputes between the center and the region, indicating that approving the law has become an urgent necessity because of its ability to resolve 90% of the disputes between the region and the center."

He stressed, "The enactment of the law is governed by political agreement, not professional agreement," calling on "political forces to put pressure on the government to send the law for the purpose of legislating it." link

*************

CandyKisses: Member: Iraq ranks 61st in the world in the scale of the safest countries

Baghdad - Mawazine News

Iraq ranked 61st in the world out of 100 listed countries and the seventh safest Arab in the world for the current year 2024.

ACCORDING TO A RATING FROM CEOWORLD MAGAZINE.

Seed by Mawazine News, the safest countries by taking into account different dimensions, these dimensions include safety from violent crime, safety from terrorism, safety of transport, health measures (including diseases), and safety for specific groups such as women; foreign travelers, migrants, expatriates, foreign travelers and migrants.

In 2024, Andorra, located in the Pyrenees mountains between Spain and France, was chosen as the safest country in the world, and despite being one of the smallest and least populated countries in Europe, with a population of only about 82,000 people, it attracts more than 3.5 million visitors from abroad annually, making it the country with the largest number of tourists per capita with points with 97.68 points, followed by the UAE with 97.13 points, followed by the Green Land located in the Americas with 96.98 points, followed by Liechtenstein in Europe with 96.97 points.

Of the 188 countries around the world, Iraq ranked 61st globally, with points of about 82 points out of 100 points.

The index put 5 Arab countries in the safest countries category, Iraq came in seventh place after: the UAE, Saudi Arabia, Bahrain, Kuwait, Jordan, Qatar.

***********

Tishwash: Parliamentary Finance: Oil companies’ dues added to budget tables, government coordination to resume exports

The Parliamentary Finance Committee confirmed the continuation of coordination and communication between the federal government and the Kurdistan Region to resume oil exports through the Turkish port of Ceyhan.

The Vice-Chairman of the Committee, Ikhlas Al-Dulaimi, stated in a statement to the National Iraqi News Agency / NINA /, that "the general budget tables approved by the Council of Representatives are the ones adopted by the government, thus canceling any financial texts and paragraphs mentioned outside it," and pointed out that there are allocations for the costs of oil production and transportation worth 3 trillion and 800 billion dinars, which were added to the general budget tables.

She added, "If an agreement is reached between the federal government and the region to resume oil exports, the federal Ministry of Finance and the Ministry of Oil and Natural Resources in the region will proceed to coordinate to find a mechanism to disburse those amounts and pay the dues of oil companies."

She explained, "The oil companies operating in the Kurdistan Region, the region requests 6 months' amounts and there are contracts signed between the two parties that are difficult to cancel, because they are giant foreign companies that will resort to the judiciary and sue the region and the federal government." link

****************

Mot: .. I Mean Some Peoples

Mot: . They Say !!!!--- Sure Hoping Soooooooooooooooon!!!!

More News, Rumors and Opinions Saturday PM 7-6-2024

Ariel: Iraqi Dinar News: From WTO Website:

During the visit to Baghdad, the Chair was informed that Iraq’s initial market access offers on goods and services would be circulated soon, in preparation for holding the 3rd meeting of the Working Party in the middle of 2024.

Link https://v2.xscodes.icu/english/news_e/news24_e/acc_16jan24_e.htm

The team in the Ministry of Trade will “take real steps that will shorten the path to Iraq’s accession to the World Trade Organization and ultimately benefit from the advantages offered by this accession,” indicated Minister Al Ghurairi.

Ariel: Iraqi Dinar News:

From WTO Website:

During the visit to Baghdad, the Chair was informed that Iraq’s initial market access offers on goods and services would be circulated soon, in preparation for holding the 3rd meeting of the Working Party in the middle of 2024. Link https://v2.xscodes.icu/english/news_e/news24_e/acc_16jan24_e.htm

The team in the Ministry of Trade will “take real steps that will shorten the path to Iraq’s accession to the World Trade Organization and ultimately benefit from the advantages offered by this accession,” indicated Minister Al Ghurairi.

______________________

Parliamentary Committee to Al-Eqtisad News: The Oil and Gas Law is Almost Complete, and This is What We Hope for from Barzani’s Visit to Baghdad

7/4/2024 Baghdad

Member of the Parliamentary Oil and Gas Committee, Zainab Al-Moussawi, revealed today, Thursday, the latest developments in the Oil and Gas Law, while pointing to the impact of Masoud Barzani’s visit to Baghdad on the approval of the law.

Al-Moussawi said in an interview with Al-Eqtisad News: “So far, the draft oil and gas law is almost complete, with a high percentage that may reach 90%, but there are some objections from the Kurds regarding some points, which are summarized in handing over oil imports and exploited and unexploited natural resources to Baghdad, as Erbil refuses to do so.”

She added: “We hope that Masoud Barzani’s visit will be the beginning of resolving the crisis of the law and its legislation after an agreement with the political foundations in Baghdad, which is the Coordination Framework, 𝙖𝙨 𝙖𝙡𝙡 𝙥𝙤𝙡𝙞𝙩𝙞𝙘𝙖𝙡 𝙗𝙡𝙤𝙘𝙨 𝙖𝙧𝙚 𝙢𝙤𝙫𝙞𝙣𝙜 𝙩𝙤𝙬𝙖𝙧𝙙𝙨 𝙡𝙚𝙜𝙞𝙨𝙡𝙖𝙩𝙞𝙣𝙜 𝙩𝙝𝙚 𝙤𝙞𝙡 𝙖𝙣𝙙 𝙜𝙖𝙨 𝙡𝙖𝙬 𝙩𝙝𝙖𝙩 𝙧𝙚𝙜𝙪𝙡𝙖𝙩𝙚𝙨 𝙩𝙝𝙚 𝙘𝙤𝙪𝙣𝙩𝙧𝙮’𝙨 𝙣𝙖𝙩𝙪𝙧𝙖𝙡 𝙧𝙚𝙨𝙤𝙪𝙧𝙘𝙚𝙨”.

The member of the Parliamentary Oil Committee explained that “the Oil and Gas Law contributes to exploiting the largest possible amount of undiscovered oil fields and also contributes to achieving self-sufficiency in petroleum derivatives and optimal exploitation of wasted natural resources estimated at hundreds of billions of dollars that contribute to diversifying the state’s financial resources.”

_______________________

People, do you know how extremely huge these two reports are? This is the best news anyone can ask for that is not referring directly to rate & date while still indirectly giving you at least one of them without being specific. We are so close. Because in the second report regarding the Oil & Gas this is the constitutional rights of the citizens to get a percentage of the oil revenues once it is passed. Do you know how long people have waited to hear this is about to be complete?

This means that the new exchange rate is even closer. Because I have already given you a report about Iraq’s Compliant with international standards that needs to be completed by July 12th.

Report: -Derivative Clearing Organizations DCOs must comply by July 12, 2024. (See Federal Register link below)

The completion of these swap dealer compliance issues in the Forex Market comes at a time when Iraq has just completed their requirements on phase one of their economic reforms.

Phase one is a completion of reforms that have now qualified Iraq for international trade.

Ariel @Prolotario1

https://dinarchronicles.com/2024/07/05/ariel-prolotario1-new-exchange-rate-for-iraq-by-july-12th/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Key players are ready to get this thing done. It's a very good sign. I honestly believe we're watching history in the making...We're seeing progress like no other...If you're paying attention I think you guys should be really pumped and excited that things are happening.

Walkingstick [Iraqi bank friend Aki update] The CBI board of directors decided...to hold meeting with only all of their executives of all their banks...These two or three meeting are going on... This is on the subject of the monetary reform, lower notes, exchange rate, budget ... These next few days are going to be very silent. The press will not cover

it. No one will know anything about it. They will suppress this information...This silence is normal and to be expected right now. [Aki] has seen this quietness before when the CBI was getting ready to make a major move.

************

A 53 Year Old PATTERN Has Been BROKEN...

Lynette Zang: 7-6-2024

Today we are talking about a 52 year old pattern that has been broken and what that really means for the markets and your money...

The Global Economy Is Collapsing As the WORST Case Scenario Unfolds

Atlantis Report: 7-6-2024

The global economy, which was once stable and growing, is now facing serious challenges. Recently, troubling signs have been reported from different parts of the world, indicating problems for the international financial system.

Traditional signs of economic trouble, such as the strong U.S. dollar and decreasing interest rates, are now more evident than ever.

These worrying signs, combined with geopolitical tensions, trade disputes, and increasing debt levels, indicate that the global economy is in trouble. The worst-case scenario is happening right now.

Seeds of Wisdom RV and Economics Updates Saturday Evening 7-6-24

Good Evening Dinar Recaps,

WHAT CAN RLUSD STABLECOIN DO THAT XRP CANT DO?

"Ripple President Monica Long explains the dual role the forthcoming RLUSD stablecoin could play alongside XRP for developers and payment utilities."

1. Some customers will prefer to transact in USD, so the stablecoin is the better method. 2. Sometimes a bridge asset is unnecessary. 3. XRP is a neutral crypto FOR USE as a BRIDGE ASSET. 4. XRP can move more than just currency, RLUSD only moves US dollars.

Good Evening Dinar Recaps,

WHAT CAN RLUSD STABLECOIN DO THAT XRP CANT DO?

"Ripple President Monica Long explains the dual role the forthcoming RLUSD stablecoin could play alongside XRP for developers and payment utilities."

1. Some customers will prefer to transact in USD, so the stablecoin is the better method.

2. Sometimes a bridge asset is unnecessary.

3. XRP is a neutral crypto FOR USE as a BRIDGE ASSET.

4. XRP can move more than just currency, RLUSD only moves US dollars.

"Ripple sees XRP as essential for efficient cross-currency or cross-token settlements, particularly for long-tail assets and currencies. Long cited instances with the sub-Saharan African region, Europe, and the Middle East where costs can be very high amid insufficient liquidity. In these scenarios, fees can exceed 10% of the payment, making XRP crucial for the transactions."

© Newshounds News™

Read more The Crypto Basis

~~~~~~~~~

DONALD TRUMP STATES HE WILL BECOME THE FIRST CRYPTO PRESIDENT

"At a campaign fundraising event in June, former president Donald Trump styled himself as something that would have seemed unlikely not long ago. He said he would be the crypto president," tech executive Trevor Traina, who attended the fundraiser, told Reuters that month."

"By May, he declared that the US should be the industry's global leader in the space."

"The numbers back the point. According to a May report from Public Citizen, the cryptocurrency sector is becoming a titan of political funding that's hard to ignore."

"About half of young voters surveyed by Grayscale said they will consider a candidate's crypto position before voting."

DONALD TRUMP'S STANCE ON CRYPTO SHOULD GET THE ATTENTION OF THE US SENATE WHO HAS YET TO PASS A CRYPTO BILL

© Newshounds News™

Read more: Business Insider

~~~~~~~~~

"Which Banks Are Using Ripple?

Ripple’s network of banking partners has continued to grow as the blockchain expands its global reach and influence. Moreover, the number of potential partners is expected to increase as Ripple Labs tries to move forward from its lengthy legal battle with the U.S. Securities and Exchange Commission (SEC)."

"The following banks are confirmed to have been working with Ripple:

*Santander (USA)

*Canadian Imperial Bank of Commerce (Canada)

*Kotak Mahindra Bank (India)

*Itaú Unibanco (Brazil)

*IndusInd (India)

*InstaReM (Singapore)

*BeeTech (Brazil)

*Zip Remit (Canada)

*LianLian (China)

*RAKBANK (U.A.E.)

*IFX (U.K.)

*TransferGo (U.K.)

*Currencies Direct (U.K.)

*Airwallex (Australia)

*SEB (Sweden)

*SBI Remit (Japan)

*Siam Commercial Bank (Thailand)

*Krungsri (Thailand)

On the flipside Ripple may be a faster and more affordable blockchain network than Bitcoin and Ethereum, but it is outclassed by modern networks like Solana (SOL) regarding speed and efficiency."

© Newshounds News™

Read more: Daily Coin

~~~~~~~~~

VIETNAM INTRODUCES MANDATORY FACIAL RECOGNITION FOR DIGITAL PAYMENTS THAT EXCEED APPROXIMATELY $390

This will be an issue for many US citizens going into the digital age as privacy concerns accompany KYC/AML (know your customer/ anti-money laundering) laws.

"Authorities in Vietnam have introduced a facial recognition requirement for all digital payments of 10 million dong (about $390) or more made in the country. The measure, which has already raised questions about privacy and security, requires all money transfers made through banks or e-wallets to involve face scanning on smartphones via banking applications. According to the State Bank of Vietnam, the obligation aims to “ensure the security of online and bank card payments.”

Newshounds News will be keeping an eye on these new laws and will report on their advancement.

© Newshounds News™

Read more: Agenzia Nova

~~~~~~~~~

BASEL COMMITTEE UPDATE REGARDING CRYPTO RULES FOR BANKS

"The committee is unveiling the standards later in July, culminating a years-long process."

"The Basel Committee met on July 2-3 and made policy decisions on issues that included disclosure of banks’ crypto exposure. A disclosure framework for banks’ crypto assets was proposed in December 2022 and opened for comments in May 2023.

"Updated standards will be published later in July, according to a Bank for International Settlements (BIS) statement."

This article is dated July 3, 2024, up-to-date news regarding BIS and BASEL 3

@ Newshounds News™

Read more: Coin Telegraph

~~~~~~~~~

Venezuela’s Digital Asset Remittances Hit Yearly $460 Million

"Venezuelans have recorded an increased amount of remittances with crypto numbers surging in the last one year."

HIGHLIGHTS

*"Venezuela recorded $5.4 billion in remittances last year."

*"Out of this number, over $460 million were crypto transactions."

*"Global adoption of crypto assets continues to soar with more use cases."

"Venezuelan citizens have recorded a surging number of cryptocurrency remittances with figures above $460 million in the last 12 months. Generally, remittances in the country have grown due to harsh economic conditions that led to huge numbers of migrants. The figure shows a growth in crypto adoption in the last year in Latin America and other jurisdictions."

"Venezuelans Embrace Crypto Remittances"

"Venezuelans have increased their crypto usage for transactions as general figures have spiked in the last year. According to data from the Inter-American Dialogue, Venezuelans remitted about $5.4 billion contributing 6% to the gross domestic product. To put growth in perspective, the figure is almost a 75% surge from 2021. "

"Crypto remittances were up to $461 million, totaling 9% of numbers per Chainalysis data. Manuel Orozco, director of Migration, Remittances, and Development at the Inter-American Dialogue noted that while the figures are high, a large number of migrants cannot afford to send remittances. “The number of Venezuelan migrants that are sending remittances has jumped 50-60%. It’s not a higher percentage because the rest of the migrants cannot yet afford to send money.”"

"Venezuelan remittances spiked after the country faced an economic crisis leading to migration with about 30% of households receiving money from foreign countries. In the last 10 years, over 7 million Venezuelans have left the country sending money back home through digital methods. While traditional remittance methods appear slower and more expensive, crypto assets provide an easier route. However, crypto users back home face certain regulations on some digital asset exchanges with many calling on pro-industry laws."

Globally, Crypto usage has soared. Traditional means of remittances have huge rates attached, while crypto is a much faster and cheaper way to send remittances.

@ Newshound News™

Read more: CoinGape

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Saturday 7-6-2024

28 Countries Joining BRICS: What Next?

Fastepo: 7-5-2024

According to a Russian newspaper, Izvestia, 28 countries have expressed interest in joining BRICS, either as full members or partners.

This information was confirmed by representatives from one of the association's countries during the BRICS Foreign Ministerial Council in Nizhny in Russia. The list includes countries from different continents including Palestine.

However, Palestine, which is not yet fully recognized internationally, has expressed interest in joining as an observer state or partner.

Please note that the timing of this expansion has not yet been confirmed. Some sources, such as the Russian Prime Minister, have mentioned that it will be discussed during the BRICS summit in 2024.

28 Countries Joining BRICS: What Next?

Fastepo: 7-5-2024

According to a Russian newspaper, Izvestia, 28 countries have expressed interest in joining BRICS, either as full members or partners.

This information was confirmed by representatives from one of the association's countries during the BRICS Foreign Ministerial Council in Nizhny in Russia. The list includes countries from different continents including Palestine.

However, Palestine, which is not yet fully recognized internationally, has expressed interest in joining as an observer state or partner.

Please note that the timing of this expansion has not yet been confirmed. Some sources, such as the Russian Prime Minister, have mentioned that it will be discussed during the BRICS summit in 2024.

However, other sources believe that it will be further discussed next year. Regardless of the timing, it is important to discuss this expansion in more detail.

This video will detail all 28 countries interested in joining BRICS and analyze their potential contributions, including how their membership could expand BRICS' influence and economic clout globally.

The analysis will consider the economic, political, and strategic implications of this expansion, providing insights into how BRICS could evolve in the coming years.

Argentina Faces Reality: Renews RMB Currency Lifeline, Expands China Trade For Economic Survival

Sean Foo: 7-6-2024

While Milei preaches dollarization, his economic moves is actually drawing Argentina closer and closer to China. Not only did he secure a vital currency lifeline, he is expanding trade with China with more agricultural exports. Here's why Milei did a dramatic U-turn towards Beijing!

Timestamps & Chapters:

0:00 Milei's U-Turn On China

2:51 Scrambling For Currency Lifeline

6:00 Argentina Needs More China Trade

9:17 China's Latin American Strategy

11:39 Milei Needs Chinese Investments

Bullion Bulletin - JULY 5, 2024

Miles Franklin: 7-5-2024

Bullion Bulletin is a compilation of videos from Andy's week of interviews. In this compilation, you'll find a variety of engaging and informative content featuring expert analysis and discussions.

Jim Rickards: If They Pull This Plug Right Now, There Will be a Reckoning Upon Us

Daniela Cambone: 7-5-2024

“The problem now is if you pull the plug, it will be chaos,” warns Jim Rickards, New York Times bestselling author. In an exclusive interview with Daniela Cambone,

Rickards also states that the U.S. is caught in a financial war, with the U.S. dollar being threatened by BRICS nations and their new currency. Even though the U.S. dollar will remain the world’s reserve currency, the BRICS currency could become a successful trading currency.

“That’s how confidence is lost in the United States, slowly at first and then suddenly. So we're not at the 'suddenly' stage yet, but we're getting really close.”

Watch the powerful interview to learn more about Rickards' thoughts.

“Tidbits From TNT” Saturday 7-6-2024

TNT:

Tishwash: Sudanese congratulates Iranian president-elect

Prime Minister Mohammed Shia al-Sudani stressed, today, Saturday, the importance of continuing coordination between Iraq and Iran at the highest levels and in all fields.

The Prime Minister's Media Office stated in a statement that "Prime Minister Mohammed Shia al-Sudani congratulated Masoud Pezeshkian on his election as President of the Islamic Republic of Iran."

In a telegram sent to Pezeshkian, according to the statement, the Prime Minister expressed his "wishes for his success in his duties," stressing "the depth of relations between the two friendly neighboring countries, and the importance of continuing coordination at the highest levels, in all fields, and in a way that serves common interests." link

TNT:

Tishwash: Sudanese congratulates Iranian president-elect

Prime Minister Mohammed Shia al-Sudani stressed, today, Saturday, the importance of continuing coordination between Iraq and Iran at the highest levels and in all fields.

The Prime Minister's Media Office stated in a statement that "Prime Minister Mohammed Shia al-Sudani congratulated Masoud Pezeshkian on his election as President of the Islamic Republic of Iran."

In a telegram sent to Pezeshkian, according to the statement, the Prime Minister expressed his "wishes for his success in his duties," stressing "the depth of relations between the two friendly neighboring countries, and the importance of continuing coordination at the highest levels, in all fields, and in a way that serves common interests." link

************

Tishwash: US messages to Iraqi leaders: Dollar cash flow may stop

Prominent Kurdish politician, Masoud Barzani, sent messages to Iraqi political leaders, stating that the entry of some factions into the Israeli-Iranian conflict may prevent the flow of cash dollars into Iraq.

Politician Mishaan Al-Jubouri said that Barzani informed the leaders of the Coordination Framework that the American siege will be imposed on Iraq if Washington's interests are attacked.

He added that Barani also informed the leaders of the Coordination Framework that America can stop the flow of dollars to Iraq and cause harm to the country, but Iraq is unable to cause any harm to America link

************

Tishwash: Prime Minister's Advisor: Iraq in the process of paying off long-term development loans to the World Bank

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed today, Saturday, that zeroing out the debts to the International Monetary Fund reflects Iraq's high and solid creditworthiness, while indicating that Iraq is in the process of paying off long-term development loans to the World Bank.

Saleh told the Iraqi News Agency (INA): "Iraq has entered into about 5 programs with the International Monetary Fund since 2004 until the end of 2018, including 3 credit readiness programs, and all of them were characterized by providing loans whose function was to support the state of stability and economic reform in Iraq in two directions. The first: loan programs, as Iraq received loans from the International Monetary Fund to help it overcome economic crises, as these loans included supporting the general budget and financing economic stability programs, especially during the war on ISIS terrorism."

He added: "As for the other direction: in the field of economic reforms, as the International Monetary Fund usually stipulates that countries that receive loans implement certain economic reforms. In the case of Iraq, these reforms included improving the management of public finances and the banking sector, enhancing transparency, combating corruption, and reforming the energy sector."

He pointed out that "these loans did not exceed $5 billion per loan, and the actual withdrawal from them will not exceed $3 billion or more in each case, and according to a repayment program that takes place every 6 months with grace periods of two years before repayment with a moderate annual interest that usually does not exceed 4.5%, and the terms of these loans do not exceed five years."

He pointed out that "Iraq has repaid the loans that were withdrawn during the past twenty years according to regular payment mechanisms and are close to zeroing out unless they are all zeroed out today, which reflects the high and solid creditworthiness of the Republic of Iraq in repayment before the international financial community in particular and towards multilateral international financial organizations in general."

He continued: "But certainly there are long-term development loans that belong to the World Bank that are still in place, which is another development financial organization, and are worth a few billion and are in the process of repayment, and some of them are still in the process of committing to withdrawing them to spend them on completing development projects contracted with the World Bank, and they are also long-term soft loans."

He stressed that "cooperation relations continue between Iraq and the International Monetary Fund in various fields, including providing technical advice and supporting economic policies," noting that "the relationship between Iraq, the International Monetary Fund and the World Bank is important for achieving economic stability and sustainable development in the country."

He pointed out that "Iraq has been a founding member of the International Monetary Fund and the World Bank since 1945." link

************

Tishwash: The Iraqi Private Sector and Improving the Investment Environment in the National Development Plan 2024-2028

During the past three months, the Ministry of Planning and the specialized work teams have made efforts to prepare and prepare the National Development Plan 2024-2028, the draft ofD which addressed in detail the main challenges facing the Iraqi private sector and the main objectives aimed at achieving its effective contribution to improving the investment environment.

While I agree with what is stated in the plan, we emphasize the need to add the basic pillars stated in the private sector development strategy.

For the years 2014-2030, and in particular its three time periods, its four pillars, its four pillars, what has been achieved since its launch in 2014, and what has not been achieved.

It is also necessary to state what has been achieved from Iraq’s Vision 2030, which clearly outlined the path to achieving a “strong and developing private sector.”

In addition to determining what has been achieved during the implementation of previous national development plans and the economic, financial and banking reform strategy included in the government program of the current government and what is the real role through which the private sector should contribute with government participation and support in managing the overall economy. This requires providing a legislative environment and a stable business environment and focusing on the axes that aim to build sound preliminaries for the transition to a complete economic reform. This is what we all agree on, but this requires the government and the private sector in all its banking, industrial, agricultural, energy, health, construction, tourism and service sectors to participate and cooperate in implementing the transitional, medium and long-term economic reform strategy.

This means involving the private sector in a greater role in economic decision-making and leading the market institutionally and legislatively through the following:

1- Contributing with the government to improving the business environment in Iraq and providing an encouraging investment climate to attract national and foreign capital in accordance with the government’s program and encouraging and stimulating the achievement of partnerships between the public and private sectors in financing and developing development projects that have achieved implementation rates.

Good and its allocations are included in the general budgets of 2024 and 2025

2- Contributing with the government to creating a new legislative environment based on Article (25) of the Permanent Constitution, the strategies and laws related to economic reform, the private sector development strategy, its pillars and specific contents, in a way that ensures its activation and leadership of the market in the future.

3- Maintaining and activating the partnership, dialogue and cooperation between the private sector and the government by taking rapid measures to activate the Private Sector

Development Council and start its work under the chairmanship of the Prime Minister, enacting a special law for it and forming a joint advisory council from the government and private sectors linked to the council that includes experts from the various economic sectors nominated by the council members and provides its advice and works according to a special system approved by the council.

4- Contributing with the government in developing policies, mechanisms and strategies and participating in following up on their implementation to resolve the transition to time-programmed stages to a market economy.

5- Working with the government to provide additional sources of funding for the state’s general budget by adopting the development and diversification of resources towards raising

the percentage of resources other than oil in the gross domestic product, by activating the real economy and diversifying sources of national income.

6- Work to encourage the establishment and development of small, medium and micro enterprises in order to achieve comprehensive and sustainable development, including the formation of specialized institutions for this purpose and issuing a special law to develop and advance these projects and determine their economic feasibility and benefit from the Riyada initiative launched by the Prime Minister and the National Lending Strategy launched by the Central Bank on 5/25/2024.

7- Cooperation in financing and ensuring the implementation of central plans to provide infrastructure to encourage and develop the private sector in industry, trade, agriculture, tourism, health, energy, construction, strengthening and services.

8- Activating the role of specialized banks and private banks to provide soft loans to the national private sector, as well as finding solutions to the problems of taxes and accumulated interest incurred by owners of projects that have stopped production, and setting a short- and medium-term financial policy.

9- Coordination and cooperation with the relevant ministries and financial and statistical institutions, especially the Ministries of Planning and Finance, in building a financial and statistical information base and ensuring its transparency. link

************

Mot: Things Like This -Ya Just Can't Make up!!!!

Mot: Hah - They Say its Gunna Beeeee Hot!!!!

News, Rumors and Opinions Saturday AM 7-6-2024