Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Notes From the Field By James Hickman (Simon Black) February 16, 2026

In January 1933, a farmer named Wallace Kramp was about to lose everything. A lender in Wood County, Ohio was foreclosing on his farm over an $800 mortgage he couldn't pay.

Kramp wasn't a bad farmer. It was actually the government’s fault: during World War I, the US government had urged farmers to plant as much as they could to feed the troops and war-torn Europe.

Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Notes From the Field By James Hickman (Simon Black) February 16, 2026

In January 1933, a farmer named Wallace Kramp was about to lose everything. A lender in Wood County, Ohio was foreclosing on his farm over an $800 mortgage he couldn't pay.

Kramp wasn't a bad farmer. It was actually the government’s fault: during World War I, the US government had urged farmers to plant as much as they could to feed the troops and war-torn Europe.

Families like the Kramps borrowed money and used the loan proceeds to expand production. But then the war ended; European agriculture recovered, and demand for US agriculture vanished. But the American farmers’ debts didn't.

By the early 1930s, wheat that had sold for $2 a bushel during the war was going for 25 cents. Nearly 750,000 farms went bankrupt between 1930 and 1935.

These weren't giant agribusinesses. They were small, family farms.

Kramp, at least, got lucky. On January 26th 1933, his assets were up for bankruptcy auction... and Kramp's neighbors showed up to bid a combined total of $14. Then they handed everything back to him so that he could keep his property.

But most farmers weren't so lucky, and they lost everything.

That's why, a few months later, Congress passed the Agricultural Adjustment Act of 1933. The idea was to pay farmers to reduce production, prop up crop prices, and keep family farmers on their lands.

The original budget was $100 million— about $2.5 billion in today's dollars— and it was supposed to be a temporary measure.

That was 93 years ago.

But, big surprise, the "temporary" program never went away. And the Agricultural Adjustment Act of 1933 evolved into the modern farm bill— a sprawling piece of legislation that Congress renews every five years, now costing roughly $1.5 trillion per decade.

More importantly, the struggling family farmers it was meant to protect have been replaced by massive agricultural conglomerates.

For example, they receive billions to grow corn. And that subsidized corn flows into the processed food supply— much of it as high-fructose corn syrup which ends up in practically everything Americans eat and drink.

The modern farm bill then funds SNAP benefits (Supplemental Nutrition Assistance Program, aka food stamps) for more than 40 million people.

Ironically, soft drinks— full of that high fructose corn syrup— are the single largest category of SNAP purchases.

Processed foods have fueled epidemic levels of obesity, diabetes, and heart disease. The United States spends nearly $5 trillion per year on healthcare, with the government picking up roughly two-thirds of the tab through Medicare, Medicaid, and other programs.

So taxpayers subsidize Big Ag’s corn production. Then further subsidize the purchase of junk food made from that corn. Then further subsidize the medical care for Americans who become unhealthy from all of that processed food.

This is what I'd call the government spending spiral— a self-reinforcing doom loop where each dollar spent justifies even more spending.

And this isn’t even the most corrosive layer of the spending spiral... because at every step, the industries involved— agricultural conglomerates, food manufacturers, healthcare providers, insurance companies— lobby Congress to keep the money flowing.

PepsiCo alone spent $2.8 million last year lobbying to keep their highly processed junk food eligible for food stamps.

You can see the pattern— these companies benefit from ample taxpayer funded subsidies, then recycle a portion of those proceeds back into the political machine to prop up the candidates who vote in favor of those subsidies.

This is why Congress— with an approval rating under 15%— somehow maintains a 90%+ reelection rate for incumbents: their campaigns are funded by the very graft that they vote for!

The federal government now spends roughly $7 trillion per year— roughly double from ten years ago.

What exactly did Americans get for the extra trillions in government spending? Are roads smoother? Schools better? Healthcare more affordable?

None of the above. In fact, despite a 100% increase in spending, schools, healthcare, and infrastructure have all become worse.

It’s truly staggering how much all of this spending is creating a drag on the US economy.

But it works both ways: cutting spending and eliminating subsidies reverses the spiral and moves things in the right direction.

Last week we told you that RFK Jr. helped to eliminate junk food subsidies in several states. And Pepsi— suddenly devoid of a government teet to suckle— responded by slashing prices to make up that lost revenue.

In other words, they cut subsidies and prices fell. Immediately.

It’s amazing to think how a "temporary" farm program from 1933 is still costing American taxpayers 93 years later.

Just imagine what would happen if the spiral ran the other way.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

(When) The Iraqi Dinar Revalued, Don’t Lose it all

(When) The Iraqi Dinar Revalued, Don’t Lose it all

Dinar For Dummies: 2-16-2026

The long-awaited revaluation of the Iraqi dinar is anticipated to bring significant financial windfalls to investors who have held onto this currency since its devaluation.

For entrepreneurs like Steven, who has been invested in the Iraqi dinar since 2011, the prospect of a revaluation is both exhilarating and daunting.

In a recent video discussion, Steven shared his expertise on the critical steps investors should take to not only protect their newfound wealth but also manage it responsibly.

(When) The Iraqi Dinar Revalued, Don’t Lose it all

Dinar For Dummies: 2-16-2026

The long-awaited revaluation of the Iraqi dinar is anticipated to bring significant financial windfalls to investors who have held onto this currency since its devaluation.

For entrepreneurs like Steven, who has been invested in the Iraqi dinar since 2011, the prospect of a revaluation is both exhilarating and daunting.

In a recent video discussion, Steven shared his expertise on the critical steps investors should take to not only protect their newfound wealth but also manage it responsibly.

According to Steven, the sudden influx of wealth can be overwhelming, bringing with it a host of emotional and financial challenges.

To navigate these challenges successfully, Steven stresses the importance of preparation before the revaluation occurs. He advises investors to assemble a trusted team of professionals in advance to mitigate stress and maximize the benefits of their investment.

Steven outlines three key professionals that every investor should have on their team to manage their wealth effectively: a Certified Public Accountant (CPA), a wealth protection attorney, and a financial advisor.

Steven also emphasizes the need for discretion regarding the revaluation news. Limiting who knows about the increased wealth is vital to protect personal security and privacy.

He recommends assembling the team early and, if possible, having all professionals under one roof for better coordination.

While the exact timing of the revaluation remains uncertain, Steven feels it is imminent. He urges viewers to prepare now, not later, to avoid stress and mistakes. His overall message is one of prudent preparation, caution, and responsibility to protect and multiply the investment wisely.

To ensure you’re prepared for the Iraqi dinar revaluation, start by assembling your team of professionals today. Don’t wait until it’s too late – the clock is ticking. Watch the full video from Dinar For Dummies for further insights and information on navigating the revaluation process.

By taking proactive steps now, you can safeguard your wealth, minimize stress, and make the most of this significant financial opportunity.

https://dinarchronicles.com/2026/02/16/dinar-for-dummies-the-iraqi-dinar-revalued-dont-lose-it-all/

“Tidbits From TNT” Monday 2-16-2026

TNT:

Tishwash: The coordinating framework is looking for an alternative to Maliki.

Iraqi parliamentarian: Election of a president is unlikely without prior political agreement

As pressure mounts to convene a parliamentary session to elect a new president, an Iraqi parliamentarian warned that the process could falter without a prior political agreement. Meanwhile, with the US vetoing Nouri al-Maliki's candidacy remaining in place, a leader in the Hikma Movement revealed that the coordinating body is working to identify a new candidate acceptable to all parties.

Sunday, February 15, 2026 – Iraqi MP Faisal Al-Issawi told Kurdistan 24: “There is intense pressure within Parliament to hold a session dedicated to electing the President of the Republic during this week

TNT:

Tishwash: The coordinating framework is looking for an alternative to Maliki.

Iraqi parliamentarian: Election of a president is unlikely without prior political agreement

As pressure mounts to convene a parliamentary session to elect a new president, an Iraqi parliamentarian warned that the process could falter without a prior political agreement. Meanwhile, with the US vetoing Nouri al-Maliki's candidacy remaining in place, a leader in the Hikma Movement revealed that the coordinating body is working to identify a new candidate acceptable to all parties.

Sunday, February 15, 2026 – Iraqi MP Faisal Al-Issawi told Kurdistan 24: “There is intense pressure within Parliament to hold a session dedicated to electing the President of the Republic during this week, but there is no tangible political agreement so far, and it is difficult to proceed with the session without consensus.”

Al-Issawi pointed out that the Speaker of the House of Representatives addressed the Federal Supreme Court to request clarification regarding Article (72)/ Paragraph Two/ Clause (B) of the Constitution, which relates to the continuation of the President of the Republic in his duties and setting a date for the election of his successor, stressing that everyone is waiting for the court’s response.

The data indicates that the main obstacle to electing a president lies in the failure to resolve the issue of the prime ministerial candidate within the "coordination framework." According to the Iraqi constitution, the candidate of the largest parliamentary bloc must be tasked with forming the government immediately after the presidential election, thus linking the two positions to each other as a single package.

In this context, Sami Al-Jizani, a member of the Wisdom Movement, stated that "the coordination framework is continuing its political efforts to break the current deadlock, especially in light of the sensitive circumstances and challenges facing the region."

Al-Jizani revealed an "anticipated political breakthrough in the next few days through the introduction of an alternative candidate," explaining that "this candidate will be chosen by consensus of the framework's forces, and must be acceptable and non-controversial at the local, regional, and international levels."

Al-Jizani added that just as the Shiite forces contributed to supporting the Sunni component to decide the election of the Speaker of Parliament, efforts are now focused within the "Shiite House" to overcome internal differences.

Although Nouri al-Maliki remains the only official candidate of the Coordination Framework for the premiership at the moment, American reservations and the refusal to assign him have pushed the Framework's forces towards searching for alternative options to ensure the government's passage.link

***************

Tishwash: The Iraqi parliament resorts to the Federal Court to resolve the issue of the presidency... document

The Speaker of the Iraqi Parliament, Hebat al-Halbousi, has submitted a request to the Supreme Federal Court to interpret a constitutional provision related to the election of the President of the Republic, given the inability to hold a session with a quorum for this purpose.

According to an official document issued by the Presidency of the House of Representatives, published by Shafaq News Agency, the request is based on the texts of the Constitution and the Federal Court Law, and aims to interpret Article (72/Second/B), which stipulates that the President of the Republic shall continue to exercise his duties after the end of his term until a new president is elected within thirty days from the date of the first session of the House of Representatives.

The document explained that the election of the President of the Republic was not achieved within the constitutional period, despite the House of Representatives continuing to hold its sessions, due to the lack of a legal quorum in more than one session dedicated to this purpose.

The request indicated that the council continues to hold its sessions according to the usual agenda, without including the item of electing the president of the republic, due to the lack of the required quorum, and asked the Federal Court to state the legal opinion on this matter.

The Iraqi constitution stipulates that the president must be elected within a period not exceeding 30 days from the date of the first session of the House of Representatives.

Taking into account this period from the first session held on December 29, 2025, the constitutional time limit ended on the night of January 28, 2026. link

Tishwash: No turning back on the ASYCUDA... The government calls on traders to accept the new reality

The Iraqi government called on Sunday (February 15, 2026) for those objecting to the implementation of the ASYCUDA system and customs tariffs to accept the new reality and comply with the law. Speaking on behalf of the government, spokesperson Bassem Al-Awadi explained that this system, which is implemented in more than 100 countries, will be applied in Iraq under international and UN supervision. He added that part of the ASYCUDA implementation is linked to Iraq's international obligations in the areas of combating money laundering, currency and goods smuggling, and international trade. He further stated that after 2003, Iraq relied on a process he termed "arbitrary" in managing customs and taxes, and that the time has come to change this process.

Al-Awadi stated in an interview with the official channel, which was followed by 964 Network , that “during the past few days with the beginnings of the implementation of the ASYCUDA system, there was some delay in the ports and many goods were delayed. According to the government’s estimates, some of them were delayed normally and others were delayed abnormally. When the government implemented the ASYCUDA system, this does not mean that there is a problem between it and the traders, but this step is an organizational process.”

Al-Awadi added, “In order to facilitate the movement of goods and make things easier for the private sector and Iraqi traders, the Iraqi government decided to zero out the government’s percentage of goods in warehouses - these warehouses are a joint facility between the ports and maritime transport, and also in cooperation with the private sector - so the government’s fees were zeroed out, and also 50% of the fees of the investing partner were zeroed out.”

Al-Awadi pointed out that “in light of the recent atmosphere that we all experienced, and the many rumors that try to make the government and the Iraqi state in general seem like something poised to harm the private sector or harm the people, and this is something that does not exist,” indicating that “the private sector and the merchant class are witnesses to the level of interaction that the government has undertaken, and in the end, only the truth will prevail.”

Al-Awadi pointed out that “trade from 2003 until today, especially with regard to taxes and customs, was more like arbitrariness. In simple terms, things were done in the form of a small container with 3 million and a large container with 4 million, regardless of what was inside the container. This was an old method that was imposed by the reality of the change after 2003, and it continued due to the repercussions and recent events.”

Al-Awadi stressed that “the ASYCUDA system is a United Nations system and was not brought by the Iraqi government. It is implemented in 102 countries around the world and is linked to the United Nations Convention against Torture (UNCTAD). Part of the implementation of ASYCUDA is linked to Iraq’s international obligations in the areas of combating money laundering, smuggling of currency and goods, and international trade.”

The government spokesman stressed that “this system is not targeting a specific class, and the rumors that speak of a lack of liquidity in the Iraqi state and that is why it went towards this system are untrue. All of this is incorrect, because the process of trade, accounting and customs since 2003 was an arbitrary emergency process, and in the end, now this year or next year or after 3 years, everyone knows that these temporary matters must end and we must move towards the right things.”

Al-Awadi explained that “this new system (ASYCUDA) has been implemented, and we do not have (Quranic texts nor angels). It is an electronic automation system, operated by Iraqi teams under international and UN supervision.” He pointed out that “over time and after implementation, if there is any kind of injustice that may befall an economic class, group, or a specific type of goods, there are unions and federations of the Iraqi private sector and spokespeople for them, and the door of the Prime Minister and the Iraqi government is open to them, and it is possible to address any injustice that may affect merchants or other classes.” link

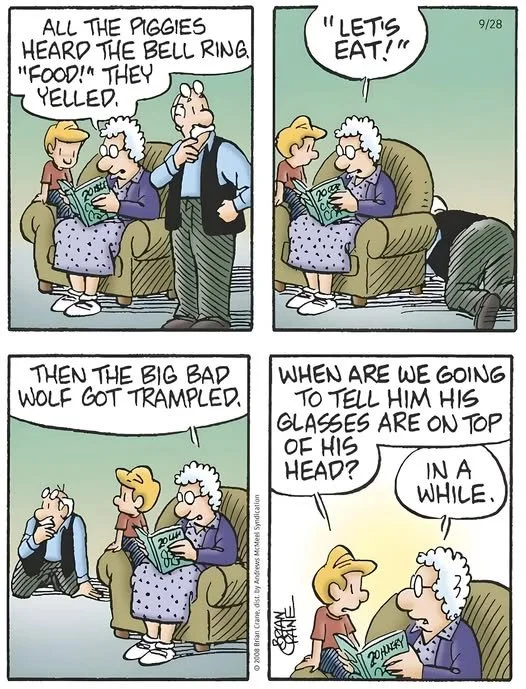

Mot: .. Special Time with ole ""Earl""

Mot: Its a Seasoned Thingy!!!!

News, Rumors and Opinions Monday 2-16-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 16 Feb. 2026

Compiled Mon. 16 Feb. 2026 12:01 am EST by Judy Byington

Global Currency Reset:

Sun. 15 Feb. 2026 HISTORIC BOND REDEMPTION 2026: THE FORGOTTEN WEALTH THAT COULD SHAKE THE GLOBAL SYSTEM …Ezra Cohen on Telegram

Buried for decades. Discredited by design. Locked behind vault doors and silence. Historic bonds are not dusty antiques. They are sovereign promises tied to gold, land, and real reserves that were never fully honored.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Mon. 16 Feb. 2026

Compiled Mon. 16 Feb. 2026 12:01 am EST by Judy Byington

Global Currency Reset:

Sun. 15 Feb. 2026 HISTORIC BOND REDEMPTION 2026: THE FORGOTTEN WEALTH THAT COULD SHAKE THE GLOBAL SYSTEM …Ezra Cohen on Telegram

Buried for decades. Discredited by design. Locked behind vault doors and silence. Historic bonds are not dusty antiques. They are sovereign promises tied to gold, land, and real reserves that were never fully honored.

As the financial world trembles under unsustainable debt, these instruments are being pulled back into the conversation. Not as myths. Not as collectibles. But as potential leverage against a fiat system built on expansion without backing.

THE VAULTED TRUTH

Before central banks dominated global finance, nations issued handwritten certificates backed by tangible wealth. Monarchs, treasuries, and empires signed binding obligations promising repayment in gold or secured assets.

These were the original bonds. They predate modern debt markets. They existed before currencies became detached from intrinsic value. Many were never redeemed. Instead of repayment, the world transitioned into paper money systems that allowed credit creation without hard limits.

The old obligations became inconvenient. So they were sealed away, legally disputed, politically ignored, and publicly dismissed.

WHAT ARE HISTORIC BONDS

Historic bonds are government issued debt certificates created decades or even centuries ago, often backed by gold or land reserves. Printed on parchment, embossed with official seals, and signed by state authorities.

Frequently cited examples include Chinese Dragon Bonds issued during the Qing era, German pre World War II bonds linked to reparations, Philippine Victory Notes issued after World War II, and bonds tied to post World War I restructuring agreements. They were not symbolic. They represented real value.

WHY THEY WERE NOT HONORED: After World War II, the Bretton Woods framework centralized financial power and gradually shifted the world toward fiat currency.

Honoring massive gold linked obligations would have required transferring substantial wealth back to sovereign holders and legacy trusts. It would have exposed layers of synthetic debt stacked over unresolved sovereign promises.

So the narrative changed. If it is old, it is invalid. If it is not in the digital system, it does not matter. But age alone does not cancel a contract.

WHO HOLDS THEM: Most people will never see a historic bond. Some remain in private safes, generational trusts, royal archives, and sovereign foundations. Certain tribal councils and legacy families claim custodianship of forgotten national wealth instruments.

If even a fraction of these claims were verified and legally enforced, the implications would ripple across global balance sheets.

WHY THEY MATTER NOW: Because they represent a challenge to unchecked debt expansion. Redemption of legitimate instruments could force re evaluation of sovereign liabilities, reserve disclosures, and the relationship between gold and currency. It shifts the debate from printed credit to verifiable backing. From abstraction to substance.

FRAUD WARNING: Where mystery exists, scams follow. Digital only certificates, unverifiable prosperity packages, and bonds with no documented chain of custody flood online spaces. No lineage. No original signatures. No embossing. No legal documentation. No value. Authenticity requires documented history, notarization, and enforceable recognition under international law.

FINAL THOUGHT: Historic bonds symbolize unresolved chapters of global finance.

Whether they become catalysts for reform or remain locked in litigation depends on verification, law, and geopolitical will. History is not always erased. Sometimes it is sealed in vaults, waiting for the moment when someone demands that a promise backed by gold be honored.

Read full post here: https://dinarchronicles.com/2026/02/16/restored-republic-via-a-gcr-update-as-of-february-16-2026/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Boots On The Ground Omar What has not been officially announced? #1 the new exchange rate to fill in the gap of all this [monetary reform] they're talking about. #2 A reinstatement or international float. #3 A public statement that the dinar is now globally traded. Those require a formal CBI announcement and they haven't issued that yet...The wiring is done. The switch hasn't been flipped.

Militia Man Gatekeepers are getting exactly what they want, a controlled, credible transition to a more market reflective system...They're telling us in full force we're doing these things. The political noise is...the right hand. Left hand, pay attention. [Like a magic trick].

Mnt Goat Articles: “IRAQ HAS ‘HUGE PLAN’ TO TRANSFORM BANKING SECTOR, SAYS CBI GOVERNOR”; “MASROUR BARZANI PRAISES AL-ALAQ’S MEASURES TO IMPROVE THE BANKING SYSTEM IN IRAQ” ...We all should know that even during the election deadlock and amidst all the ongoing saga associated with it, the independent Central Bank is still moving forward with reforms in the background.

US Treasury Changing $10K Cash Reporting Rule?

Lynette Zang: 2-14-2026

Is the US Treasury lowering the $10K cash reporting rule?

In this Q&A, Lynette breaks down the truth behind the $10,000 Currency Transaction Report (CTR) threshold — plus answers questions about Basel III, gold rehypothecation, and growing banking system rumors.

Chapters:

0:00 Introduction

0:15 $10,000 Cash Withdrawal Rule – Is It Changing?

2:06 Basel III Rumor: Are Banks Banned from Rehypothecating Gold & Silver?

4:50 Why Trust in Paper Gold Is Breaking Down

5:29 Is North Dakota Outside the Federal Reserve System?

7:34 How to Be Outside the Federal Reserve System

8:13 U.S. Mint Suspends Silver Sales – What It Really Means

9:15 Paper Silver vs. Physical Silver – Who Controls Price?

10:26 When the Physical Market Breaks the Paper Price

11:01 Structural Shift in Silver & Gold Price Discovery

11:34 Why Owning Physical Gold and Silver Matters

12:02 Silver Is the Fuse, Gold Is the Anchor

Seeds of Wisdom RV and Economics Updates Monday Morning 2-16-26

Good Morning Dinar Recaps,

India Expands Cross-Border Payment Power Under RBI Oversight

Full Authorization Signals India’s Push Toward Integrated Global Settlement Rails

Good Morning Dinar Recaps,

India Expands Cross-Border Payment Power Under RBI Oversight

Full Authorization Signals India’s Push Toward Integrated Global Settlement Rails

Overview

India has taken another decisive step in strengthening its financial infrastructure. In-Solutions Global Ltd has received full authorization from the Reserve Bank of India (RBI) to operate across online, offline, and cross-border payment aggregation under the country’s updated regulatory framework.

The approval enables the company to deliver a unified merchant payments stack spanning domestic and international transactions — reinforcing India’s ambition to lead in regulated digital payments innovation.

Key Developments

• In-Solutions Global Ltd now holds comprehensive authorization as a payment aggregator.

• Approval covers online, physical (offline), and cross-border transactions.

• The move aligns with India’s modernized payments regulatory structure.

• Merchants gain access to integrated domestic and international settlement capabilities.

India already operates one of the world’s most advanced real-time domestic payment ecosystems. Expanding regulated cross-border aggregation strengthens its ability to influence regional and global payment corridors.

Why It Matters

Cross-border payments remain one of the most expensive and friction-heavy components of global finance. By expanding regulated payment aggregation under central bank supervision, India is:

• Increasing settlement efficiency

• Enhancing compliance oversight

• Strengthening monetary control over outbound and inbound flows

• Positioning itself as a major fintech infrastructure hub

This is sovereign-led modernization — not deregulated experimentation.

Why It Matters to Foreign Currency Holders

• More efficient cross-border rails can shift trade settlement behavior.

• Regulated infrastructure increases transparency in international transactions.

• Strong central bank oversight preserves currency stability during digital expansion.

• Expanded payment corridors can influence regional trade dynamics.

Payment rails shape capital flow. Capital flow shapes currency power.

Implications for the Global Reset

Pillar 1: Infrastructure Sovereignty

India is reinforcing central bank authority while expanding digital capability.

Pillar 2: Cross-Border Modernization

Integrated merchant stacks reduce reliance on fragmented correspondent banking systems.

Structural resets do not happen overnight — they begin with infrastructure upgrades like this.

This is not just a fintech approval — it is sovereign payment strategy in motion.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

U.S. Banking Leaders Engage White House on Crypto Market Structure

Digital Asset Regulation Moves From Periphery to Policy Core

Overview

Digital asset regulation is entering a new phase in the United States. A White House crypto market structure meeting convened major banking trade organizations including the American Bankers Association, Bank Policy Institute, and Independent Community Bankers of America.

The discussion focused on crafting regulatory frameworks that balance innovation in digital assets with financial system stability.

Key Developments

• Banking trade groups participated directly in policy dialogue.

• Discussions centered on crypto market structure and regulatory clarity.

• Emphasis was placed on protecting financial safety while fostering innovation.

• Institutional banking voices are now shaping digital asset rules.

This represents a notable shift from earlier years when crypto operated largely outside traditional banking consensus.

Why It Matters

Regulatory clarity determines whether digital assets integrate into the financial core — or remain on the margins.

By engaging policymakers:

• Banks are signaling willingness to participate in digital finance.

• Regulators are acknowledging crypto as part of systemic finance.

• Collaboration reduces the likelihood of fragmented or reactionary rulemaking.

• The groundwork is being laid for structured digital asset integration.

This is no longer a fringe conversation — it is structural financial policy.

Why It Matters to Foreign Currency Holders

• Regulatory certainty reduces volatility in digital markets.

• Integration of crypto rails into banking strengthens systemic stability.

• Clear frameworks encourage institutional capital participation.

• Stable digital settlement infrastructure can influence global liquidity flows.

Monetary transformation without regulation creates chaos. Regulation without innovation creates stagnation. This meeting signals an attempt to balance both.

Implications for the Global Reset

Pillar 1: Institutional Legitimization

Crypto is moving inside the policy tent rather than operating outside it.

Pillar 2: Controlled Digital Transition

Regulated integration ensures that traditional banks remain central to monetary infrastructure even as digital rails expand.

Financial resets occur when rules, rails, and institutions realign. This is part of that alignment.

This is not just a meeting — it is digital finance entering formal governance.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

ICBA Statement – Banking Trades on White House Crypto Market Structure Meeting

Crypto Valley Journal -- White House Mediates CLARITY Act Yield Dispute Without Result

~~~~~~~~~~

BRICS Moves Toward Independent Metals Exchange and Gold-Backed Trade System

Special Economic Zones to Anchor New Pricing Power Outside Western Financial Control

Overview

The BRICS bloc is accelerating plans to launch a dedicated Precious Metals Exchange, marking another strategic step toward financial independence from Western-dominated systems.

Russian Deputy Foreign Minister Sergey Ryabkov confirmed on February 14, 2026, that the exchange will operate within special economic zones across member nations. The initiative will function alongside a BRICS gold currency pilot and a proposed grain exchange.

The objective is clear: establish independent pricing mechanisms and reduce exposure to sanctions, tariffs, and volatility tied to Western financial infrastructure.

Key Developments

• The BRICS Precious Metals Exchange has been designated a priority initiative by Russian officials.

• The platform will operate through special economic zones present across most BRICS nations.

• A grain exchange is also under development as part of the broader commodity strategy.

• The initiative builds upon agreements endorsed at the 2024 Kazan Summit.

Ryabkov stated that the exchange would be “a very important initiative” and emphasized its strategic relevance amid sanctions pressure.

Russian Finance Minister Anton Siluanov added that creating a metals trading mechanism within BRICS would foster “fair and equitable competition based on exchange principles.”

BRICS Gold Developments and Pricing Independence

The metals exchange aligns with broader gold initiatives already underway.

The bloc launched a gold-backed settlement pilot known as the “Unit” on October 31, 2025. The structure reportedly consists of 40% gold backing and 60% member currencies.

BRICS gold prices surged above $5,600 per ounce in January 2026 before stabilizing within projected ranges between $4,500 and $5,500. Officials are positioning the exchange as a vehicle to:

• Reduce dependence on SWIFT messaging systems

• Limit exposure to Western commodities exchanges such as the London Metal Exchange

• Enable settlement in national currencies

• Strengthen autonomy in cross-border trade

Ryabkov stated that while American sanctions and tariffs pose risks, member nations are not prepared to “succumb to pressure.”

The metals exchange is expected to include gold, platinum, diamonds, rare earth minerals, and potentially other strategic commodities.

Implementation Timeline

Officials have not announced a firm launch date. However, Russian statements indicate a target of reaching operational status by 2030.

The initiative is part of a broader architecture shift endorsed during the 2024 BRICS summit in Kazan, which included:

• Alternative payment platforms

• Settlement systems in national currencies

• Reinsurance mechanisms for intra-bloc trade

Together, these components represent a coordinated effort to reshape commodity pricing power and settlement infrastructure.

Why It Matters

Commodity exchanges determine global pricing benchmarks.

If BRICS establishes a functional, liquid metals exchange operating outside Western systems, it could:

• Influence global gold pricing dynamics

• Shift settlement patterns away from dollar-denominated trade

• Increase leverage for commodity-producing nations

• Reduce sanctions vulnerability

Pricing power is financial power.

Why It Matters to Foreign Currency Holders

• A gold-linked settlement framework alters reserve dynamics.

• Independent pricing benchmarks could challenge London- and New York-based exchanges.

• Commodity-backed trade corridors strengthen non-dollar settlement ecosystems.

• Gradual infrastructure rollout reduces sudden market shock while preparing structural change.

This is not merely about metals trading — it is about control over valuation mechanisms.

Implications for the Global Reset

Pillar 1: Commodity Pricing Sovereignty

A BRICS exchange introduces alternative benchmark formation outside Western exchanges.

Pillar 2: Settlement Diversification

Gold-linked instruments and national currency settlement reduce reliance on dollar-based clearing systems.

Financial resets begin when pricing systems shift. Commodity markets are foundational to that structure.

This is not just trade policy — it is a strategic rebalancing of global financial infrastructure.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "BRICS Precious Metals Exchange: Member Nations Move Toward Launch"

TASS -- "BRICS countries discuss creation of precious metals exchange and grain platform"

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Morning 2-16-26

Nouri Al-Maliki’s New Doctrine For Power: Pragmatism Over Defiance?

2026-02-14 Shafaq News On January 24, 2026, the Shiite Coordination Framework (CF), currently the largest bloc in Iraq’s parliament, named former Prime Minister Nouri Al-Maliki as its nominee for the country’s next premier, reopening one of Iraq’s most consequential political debates. The response was immediate. Debate intensified in Baghdad, regional capitals recalculated their positions, and Washington issued warnings.

Iraq once again stands at a familiar crossroads, this time under heavier internal strain and sharper external scrutiny. The question is not simply whether Al-Maliki is returning, but whether he returns unchanged or as a political figure reshaped by conflict, experience, and years outside executive office.

Nouri Al-Maliki’s New Doctrine For Power: Pragmatism Over Defiance?

2026-02-14 Shafaq News On January 24, 2026, the Shiite Coordination Framework (CF), currently the largest bloc in Iraq’s parliament, named former Prime Minister Nouri Al-Maliki as its nominee for the country’s next premier, reopening one of Iraq’s most consequential political debates. The response was immediate. Debate intensified in Baghdad, regional capitals recalculated their positions, and Washington issued warnings.

Iraq once again stands at a familiar crossroads, this time under heavier internal strain and sharper external scrutiny. The question is not simply whether Al-Maliki is returning, but whether he returns unchanged or as a political figure reshaped by conflict, experience, and years outside executive office.

Pragmatism over Pride

Sovereignty once defined Al-Maliki’s political vocabulary. During his two terms between 2006 and 2014, he projected a sharp, defiant posture, frequently framing his leadership as resistance to foreign interference, particularly from the United States. His second term (2010–2014) in particular unfolded amid visible tension with Washington, reinforcing the image of a leader intent on consolidating national authority despite mounting political costs.

The environment in 2026 differs markedly. US President Donald Trump has openly warned against Al-Maliki’s return, signaling the possibility of severe measures. Speaking to Shafaq News, political analyst Ahmed Youssef referred to Washington’s explicit objection, noting that Trump described Al-Maliki’s reappointment as a path that could return Iraq to “poverty and comprehensive chaos,” invoking the period when ISIS seized major provinces before Iraq declared victory in 2017.

The implications extend beyond rhetoric as Iraq’s economy remains structurally vulnerable. Its banking channels, oil revenue mechanisms, and access to international financial systems remain deeply intertwined with global institutions.

Any US sanctions or reduction in support would carry tangible domestic consequences, affecting currency stability, military cooperation, and reconstruction financing. “A confrontation with Washington today would not be confined to speeches; it would seep into Iraqi daily life,” Youssef warned.

Inside Iraq, reactions have been defensive. Aref Al-Hammami, a senior figure in the State of Law Coalition (SLC) headed by Al-Maliki, described any retreat from the candidacy under foreign pressure as “a political setback affecting all components of the country,” underscoring that Iraq is a sovereign state. The message was direct: external objections should not determine internal political decisions.

The caution, however, is more visible across the broader political arena. Abdulrahman Al-Jazaeri, head of the political bureau of the Tribal Movement in Iraq, pointed to a subtle but important shift within the CF. The next prime minister, he argued, should enjoy “regional acceptability,” citing reservations expressed by major figures within the Framework, including the Al-Hikma Movement led by Ammar Al-Hakim and Asaib Ahl Al-Haq headed by Qais Al-Khazali.

Al-Maliki’s own rhetoric reflects that recalibration. Faced with Trump’s warnings, he has avoided confrontation. Rather than revive the language of resistance, he has focused on “stability,” “investment,” “job opportunities,” and “completing reconstruction.” The shift appears calculated —an effort, as Ahmed Youssef assessed, to reassure external actors while navigating domestic contestation.

‘’Al-Maliki still represents a period rejected by segments of both the Iraqi public and parts of the international community,’’ he observed, noting that even though the language may be softer, the structural constraints remain.

Arming the State

If sovereignty defines one axis of scrutiny, the Popular Mobilization Forces (PMF) —inseparable from Al-Maliki’s political legacy— define another.

Formed in 2014 following a fatwa by top Shiite cleric Ayatollah Ali Al-Sistani amid an unprecedented security collapse, the PMF played a decisive role in confronting ISIS. Its membership stands at around 200,000, comprising about 70 factions from various religious and ethnic backgrounds, though it remains predominantly Shiite. The Iraqi parliament later formalized these factions under the PMF Law, designating the force as a supporting body alongside the Iraqi Armed Forces, both under the authority of the prime minister as commander-in-chief.

Al-Maliki emerged as one of the PMF’s most prominent political defenders, and his previous tenure became closely associated with its rise as an influential actor within Iraq’s security architecture. After the 2025 parliamentary elections, however, his language shifted. He now refers to “restricting arms to the state” and ensuring “one army comprising all components under the command of the commander-in-chief of the armed forces.” At the same time, he rejected reports of dissolving the PMF, maintaining that any development should preserve its strength and reinforce its combat readiness rather than weaken it.

Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

Speaking to Shafaq News, Aref Al-Hammami portrayed this framing as national and reassuring, arguing that it does not target any specific group. Discussions over weapons held by factions, he added, fall within an “internal, fraternal relationship” that can be addressed domestically.

Meanwhile, political observer Abu Mithaq Al-Massari interpreted the adjustment not as a reversal but as an elevation of state-centered rhetoric suited to a sensitive political phase. Al-Maliki has not distanced himself from the PMF; he has repositioned the discussion.

For international partners, domestic rivals, and an Iraqi public fatigued by overlapping chains of command, the weapons file remains central. Any incoming government will be assessed by its ability to assert coherent security authority. The shift, therefore, is not a retreat from the PMF but an effort to embed it more clearly within the framework of centralized state power.

Realpolitik on Rails

Syria presents another test of tone and approach. In earlier years, Al-Maliki’s position toward Ahmad Al-Sharaa, known as Abu Mohammad Al-Julani when he led Haya’at Tharir Al-Sham, was unequivocal. He labeled him a terrorist, reflecting Iraqi anxieties over Al-Sharaa's previous role within ISIS in Iraq, the cross-border militancy, and the spillover of Syria’s conflict into Iraqi territory.

That stance aligned with a broader security-first posture shaped by the aftermath of 2011 and the rise of armed groups operating across porous borders.

Following the 2025 elections, the tone shifted. Al-Maliki signaled openness toward engagement with regional actors, including Syria. The adjustment does not abandon security concerns. Rather, it reflects recalculation shaped by geography and necessity. The Iraqi–Syrian border remains a zone of vulnerability, where infiltration risks, energy corridors, oil routes, and humanitarian transit converge.

Iraqi officials indicated that Baghdad seeks strategic stability that preserves internal sovereignty while enabling structured dialogue with Damascus based on national interests. The regional environment has also evolved. Some Arab states, particularly Gulf countries, have recalibrated their posture toward Syria, while US priorities shifted during the Trump phase. At home, pressure favors border stabilization over rhetorical confrontation, steering policy from individual labeling toward state-to-state management. Read more: Nouri Al-Maliki: A name that still divides and tests the politics of memory

Quiet Tehran Ties

Al-Maliki has long been viewed as maintaining close ties with Tehran, particularly during the ISIS occupation of large parts of Iraq, when security coordination intensified.

Iranian officials have signaled support for any candidate agreed upon within the CF without publicly endorsing a specific name, effectively offering political cover without overt sponsorship. As Al-Maliki’s recent public messages concentrate more on institutional stability and state authority —and place less visible emphasis on external alliances— the recalibration appears deliberate.

Openly foregrounding ties with Tehran risks amplifying domestic polarization and complicating relations with Sunni and Kurdish factions, as well as Washington. Strategically, the approach suggests balance rather than rupture. The relationship with Iran remains intact, but it is conveyed with greater discretion.

A Return Shaped by Experience

Al-Maliki is not an emerging political figure testing authority. He governed for eight years and left office during one of the most turbulent chapters in Iraq’s modern history. The collapse of provinces, the war against ISIS, and years of internal polarization defined his tenure.

He now seeks not to consolidate authority for the first time, but to restore political legitimacy —a distinction that carries weight. In his second term, he spoke from the position of incumbent authority. Today, he operates as a candidate navigating objections: domestic fragmentation, Shiite hesitation, American warnings, and speculation about sanctions.

The experience of power and the cost of crisis appear to have reshaped his tone. Confrontation carries consequences. Institutional paralysis carries consequences, and economic rupture definitely carries consequences.

His recent discourse reflects a political actor more attentive to balance than confrontation. This is not a declared ideological revision, but a recalibrated method. Whether that recalibration signals a deeper transformation or merely strategic repositioning remains the defining question.

What is clear is that 2026 is not 2012. Al-Maliki’s path back to power runs not through the vocabulary of his past, but through careful management of Iraq’s present.

Read more: Al-Maliki sounds different this time — the worldis not convinced yet

Written and edited by Shafaq News staff.

https://www.shafaq.com/en/Report/Nouri-Al-Maliki-s-new-doctrine-for-power-Pragmatism-over-defiance

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

2-15-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

2-15-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….2-15-26….BANK STORY

KTFA

Sunday Night Video

FRANK26….2-15-26….BANK STORY

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie and Omar in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….2-15-26….BANK STORY

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie and Omar in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Edu Matrix:

The world of finance is ever-changing, with trends and opportunities emerging and fading with the passing days.

For investors looking to stay ahead of the curve, understanding the current landscape is crucial. In a recent Edu Matrix video, financial expert Sandy Ingram shared her insights into the upcoming currency profit opportunities over the next 30 days, delving into the intricacies of foreign exchange markets, precious metals, and the cryptocurrency landscape, particularly Bitcoin.

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Edu Matrix:

The world of finance is ever-changing, with trends and opportunities emerging and fading with the passing days.

For investors looking to stay ahead of the curve, understanding the current landscape is crucial. In a recent Edu Matrix video, financial expert Sandy Ingram shared her insights into the upcoming currency profit opportunities over the next 30 days, delving into the intricacies of foreign exchange markets, precious metals, and the cryptocurrency landscape, particularly Bitcoin.

Let’s dive into the key takeaways from her analysis and explore the potential opportunities and risks in various investment sectors.

Sandy Ingram emphasizes the significance of diversifying one’s investment portfolio, particularly through the acquisition of precious metals like silver and gold.

She advocates for a strategy of buying small amounts of these metals on a regular basis. This approach not only helps in mitigating risks associated with market volatility but also allows investors to accumulate wealth over time.

Furthermore, she suggests considering direct shipment of these metals to one’s home once a certain threshold is reached, providing a tangible asset that can be held securely.

One of the more intriguing investment opportunities highlighted by Sandy is in the Venezuelan real estate market. Due to the country’s economic turmoil, land and homes are available at remarkably low prices, presenting what Sandy describes as a window for savvy investors.

Drawing parallels with Iraq, she notes that the U.S. is playing a role in overseeing Venezuelan oil sales to ensure that the revenue generated is used legitimately and to prevent a complete economic collapse. This intervention has led to billions of dollars in oil revenue flowing back into Venezuela, potentially signaling a recovery and making it an attractive time for real estate investments.

The near-term outlook for the U.S. dollar is expected to be soft, driven by stabilizing or potentially declining interest rates in the U.S. This weakening of the dollar could have a ripple effect, leading to the strengthening of several other currencies.

Sandy points out that currencies such as the Japanese yen, euro, Chinese yuan, Indian rupee, and commodity-linked currencies like the Australian and Canadian dollars may benefit from this shift.

Understanding the factors driving these changes, including interest rate expectations and trade developments, is crucial for investors looking to capitalize on currency fluctuations.

The discussion on Bitcoin centers around its recent decline, attributed to high interest rates making safer assets more attractive, profit-taking by large investors, regulatory uncertainty, and a steady or slightly stronger U.S. dollar.

Currently, investors are cautious, often preferring traditional assets over cryptocurrencies until clearer economic signals emerge. This cautious stance presents both challenges and opportunities for those invested in or looking to enter the cryptocurrency market.

The financial landscape is complex and multifaceted, with opportunities and risks present across various sectors. Sandy’s insights from the Edu Matrix video provide a comprehensive overview of the current trends in foreign exchange markets, precious metals, real estate, and cryptocurrencies.

By understanding these dynamics and diversifying investments accordingly, investors can better navigate the challenges and capitalize on the opportunities that lie ahead. For those looking to deepen their understanding and stay informed, watching the full Edu Matrix video is a valuable next step.

News, Rumors and Opinions Sunday 2-15-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 15 Feb. 2026

Compiled Sun. 15 Feb. 2026 12:01 am EST by Judy Byington

Black Swan Event Global Financial Crash Imminent

To Be Replaced By Global Currency Reset

Prepare For Ten Days of Darkness

Temporary Martial Law

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 15 Feb. 2026

Compiled Sun. 15 Feb. 2026 12:01 am EST by Judy Byington

Black Swan Event Global Financial Crash Imminent

To Be Replaced By Global Currency Reset

Prepare For Ten Days of Darkness

Temporary Martial Law

Judy Note: You are urged to prepare for a Black Swan Global Financial crash on the horizon that would have a huge impact across the world.

(RUMORS)

Since first taking office in 2016 President Trump has (allegedly) recovered from the Deepstate Cabal, trillions in stolen gold across the World and had it (allegedly) placed in a new US Treasury on an Indian Reservation near Reno, Nevada.

On Wed. 11 Feb. at the White House, Trump (allegedly) Nationalized the privately owned-by- foreign bankers Federal Reserve. That would take down the privately owned IRS. The government will be (allegedly) funded through Tariffs and a 14% sales tax on new items only. None on medicine or food.

Right now Trump was (allegedly) implementing GESARA NESARA (freedom from debt laws) across the World that gave The People’s taxpayer monies back to The People. Eight billion people and all banks across the Globe (allegedly) were in the middle of a Global Currency Reset to gold/asset-backed currency.

In preparation for the expected Global financial implosion event, the BRICS Alliance (Brazil, Russia, India, China and South Africa), along with President Trump’s Global Military Alliance, has already(allegedly) instigated a global currency transition from fiat money to gold/asset-backed currency on a new Global Financial System.

The Global Currency Reset of 209 countries has been in the making since the bankruptcy of US Inc.’s Federal Reserve fiat Dollar in 2008.

Because of the (allegedly) bankruptcy of the Federal Reserve fiat Dollar, many banks are closing because their money was not asset backed Basel 4 compliant.

Since Friday 3 Feb. 2023 all Basel 4 Compliant banks were expected to go public with the new Gold / Commodity-backed currency International Rates as required by the GESARA Law.

FIAT money is backed by a country’s government instead of a physical commodity or financial instrument. This means most coin and paper currencies that are used throughout the world are FIAT money. This includes the US Dollar, British Pound, Euro and SA Rand.

All Basel 4 compliant countries will(allegedly) then put out their new currencies and take the old money in, so the FIAT Dollar will become obsolete outside of the US and millions hidden will become worthless.

The world will use the FIAT and then transition over to the precious metals / commodity backed currencies and the USD / Sterling Pound and Euro will have no value whatsoever anymore.

The use of the FIAT will (allegedly) be used for up to 90 days (Feb. / March / April) parallel with the new United States Note (USN). They may cut it off of by April 30th or soon thereafter.

No FIAT currency or any other form of currency or cash can (allegedly) be deposited into the QFS without going through an exchange process and having a digital gold certificate assigned. Without the gold certificate the computer will not recognize it as money.

The redemption of Zim Bonds(allegedly) creates a transaction where the gold certificates are activated and put into your account(s) in the QFS.

At the end of the Ten Days of Communication Darkness you (allegedly) will be invited into a Redemption Center to set up your new money account called a “wallet.” All the funds in your present bank account (allegedly) already have been mirrored onto the new Global Financial System. As such, no one but yourself can access your new and secure bank account on the Star Link System. New physical gold/asset-backed US Notes will be available in ATMs.

~~~~~~~~~~~

Sat. 14 Feb. 2026 Alliance Plan: …Charlie Ward and Friends on Telegram

NESARA/GESARA Debt Relief Implementation

QFS implemented

Federal Reserve dead, IRS under new US Treasury Department

New tax system where only a 14% tax is charged on new items, no taxes on food or medicine, salaries, used houses or cars, etc.

Read full post here: https://dinarchronicles.com/2026/02/15/restored-republic-via-a-gcr-update-as-of-february-15-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Boots On The Ground Omar TV talking about Iraq has modernized the dinar...The CBI has repeatedly said the monetary reform project is in its final stage...so yes, the infrastructure of the dinar has been modernized. Is Iraq connected to all international banks? Not in the sense of global FX launch but yes in the term of technical connectivity...All compliant Iraqi banks can send and receive international transfers. Iraq is connected to global correspondent banking networks...They're describing the technical prerequisites for FX normalization - not the final step itself.

Mnt Goat The CBI is finally breaking the parallel market and this time ‘for good’. As we all know the “ASYCUDA” system was implemented in full swing recently. This system forces legitimacy of trade transactions. Remember that under the currency auctions merchants could lie and falsify papers of purchasing fake goods in order to get dollars out of the CBI. With ASYCUDA this just tightened the noose even more on the parallel market to the point where these money changes are going out of business. Funds going to Iran are also drying up.

************

BREAKING: Stocks Crash as Yen Carry Trade Unwinds!

Steven Van Metre: 2-15-2026

If you are invested in the stock market, you need to hear this because what is happening in Japan right now is starting to crash the stock market and with hedge fund turning bullish on the Yen—and massively short the stock market at the same time, this next drop could be even worse.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 2-15-26

Good Afternoon Dinar Recaps,

Crypto Liquidity Stress Signals Banking Oversight Tightening

Digital asset withdrawals pause as Federal Reserve prepares regulatory shift

Good Afternoon Dinar Recaps,

Crypto Liquidity Stress Signals Banking Oversight Tightening

Digital asset withdrawals pause as Federal Reserve prepares regulatory shift

Overview

Financial markets are witnessing renewed liquidity stress within the crypto lending sector, with at least one digital asset lender suspending withdrawals amid Bitcoin price volatility.

At the same time, the U.S. Federal Reserve is expected to appoint a veteran Wall Street regulator to oversee supervision and regulation — a move that could significantly tighten oversight of traditional banking risk profiles.

Together, these developments highlight growing sensitivity across both digital and traditional financial systems.

Key Developments

1. Crypto Lender Suspends Withdrawals

Market turbulence and Bitcoin price weakness triggered at least one crypto lending platform to pause customer withdrawals, underscoring ongoing fragility in leveraged digital asset models.

Liquidity mismatches and collateral volatility remain structural vulnerabilities in the sector.

2. Digital Finance Risk Transmission

Crypto markets are increasingly interconnected with traditional finance through custody banks, ETFs, derivatives, and liquidity providers.

Stress in digital lending can ripple into broader funding markets.

3. Federal Reserve Signals Stronger Oversight

The Federal Reserve is reportedly preparing to appoint a seasoned Wall Street regulator to head supervision — a move interpreted as reinforcing capital standards, liquidity monitoring, and systemic safeguards.

4. Banking Risk Profiles Under Review

As interest rate cycles stabilize, regulators are turning attention to hidden balance sheet vulnerabilities, commercial real estate exposure, and market-linked lending channels.

Why It Matters

This is a dual-system stress signal:

• Digital asset liquidity remains unstable

• Traditional banking regulation is tightening

• Risk appetite may recalibrate

• Investor confidence remains sensitive

When both crypto and banking supervision move simultaneously, markets interpret it as systemic recalibration.

Why It Matters to Foreign Currency Holders

Currency holders should monitor:

• Dollar liquidity demand during volatility

• Capital flight into safe-haven assets

• Regulatory impacts on cross-border capital flows

• Payment system stability concerns

Liquidity events often precede broader currency repricing cycles.

Implications for the Global Reset

Pillar 1: Financial System Stress Testing

Crypto market disruptions serve as real-time laboratories for liquidity fragility within modern finance.

Pillar 2: Regulatory Reinforcement Phase

Heightened bank oversight suggests policymakers are proactively guarding against contagion risk before systemic cracks widen.

This is not merely crypto turbulence — it reflects evolving guardrails in a transforming financial architecture.

The reset is not chaos — it is controlled recalibration.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Crypto Lender Suspends Withdrawals Amid Bitcoin Weakness”

Reuters — “Fed Expected to Appoint Veteran Regulator to Oversee Bank Supervision”

~~~~~~~~~~

Governments Move Social Benefits and Bonds Onchain

Tokenized debt and digital UBI programs signal structural shift in public finance delivery

Overview

Governments are increasingly exploring blockchain-based delivery of social benefits and tokenized sovereign debt, marking a significant modernization of public finance infrastructure.

According to Julie Myers Wood, CEO of Guidepost Solutions, any social benefit currently distributed through analog systems should be evaluated for digital onchain delivery due to efficiency, transparency, and audit advantages.

From the Republic of the Marshall Islands to financial hubs like Hong Kong and Thailand, tokenized instruments are moving from theory to live implementation.

Key Developments

1. Marshall Islands Launches Onchain UBI Program

The Republic of the Marshall Islands launched a Universal Basic Income (UBI) program in November 2025, distributing quarterly payments directly to citizens via mobile wallets.

The program operates alongside the issuance of a tokenized government bond framework.

2. Tokenized Sovereign Bond Backed by U.S. Treasuries

The Marshall Islands issued the USDM1 bond, a tokenized debt instrument backed 1:1 by short-term U.S. Treasuries.

Guidepost Solutions advised on compliance and sanctions frameworks for the issuance, ensuring regulatory alignment.

Tokenized bonds reduce settlement times and eliminate costly intermediaries traditionally involved in clearing and custody.

3. Rapid Growth in Tokenized Treasury Market

Data from Token Terminal shows the tokenized U.S. Treasury market has grown more than 50x since 2024, highlighting accelerating institutional adoption.

Forecasts from Taurus SA suggest the broader tokenized bond market could reach $300 billion in coming years.

4. Compliance and AML Remain Core Challenges

Despite efficiency gains, governments must address:

• Anti-money laundering (AML) compliance

• Know-your-customer (KYC) verification

• Sanctions enforcement mechanisms

Regulatory guardrails remain critical to prevent misuse while scaling public onchain finance.

Why It Matters

This development represents more than fintech innovation — it is a potential restructuring of sovereign finance and public benefit distribution.

Onchain administration provides:

• Faster settlement

• Lower transaction costs

• Transparent audit trails

• Direct citizen access

Governments could reduce bureaucratic friction while increasing accountability.

Why It Matters to Foreign Currency Holders

For global reset observers, tokenized sovereign instruments influence:

• Public debt market structure

• Treasury demand dynamics

• Cross-border settlement systems

• Financial inclusion metrics

If sovereign debt increasingly migrates onchain, settlement infrastructure and liquidity channels may fundamentally evolve.

Implications for the Global Reset

Pillar 1: Digital Sovereign Finance Infrastructure

Tokenized bonds backed by traditional assets bridge legacy finance with blockchain rails, accelerating hybrid financial architecture.

Pillar 2: Direct-to-Citizen Monetary Channels

Onchain social benefit distribution reduces dependency on intermediary banking networks and increases transparency.

The transition toward digital sovereign issuance is gradual but transformational.

This is not simply blockchain experimentation — it is the modernization of state-level financial plumbing.

As governments digitize debt and benefits, the architecture of monetary delivery itself begins to evolve.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Diplomacy Takes Priority in U.S.–Iran Nuclear Talks

Negotiations emphasized over military escalation amid regional tension

Overview

U.S. officials have publicly emphasized that diplomacy — not military action — is the preferred path forward regarding Iran’s nuclear program.

This strategic posture comes amid heightened tensions but signals a deliberate effort to prioritize negotiation frameworks over escalation.

The approach directly influences geopolitical stability, energy markets, and global risk modeling.

Key Developments

1. Public Commitment to Diplomatic Resolution

Senior U.S. officials reiterated that reaching a negotiated agreement remains the administration’s preferred outcome.

Military options remain available, but diplomacy is currently prioritized.

2. Mediation Channels Active

Talks are being facilitated through regional mediators, reinforcing the international effort to prevent escalation and maintain stability in the Middle East.

3. Energy Market Sensitivity

Any disruption in U.S.–Iran relations affects global oil supply expectations.

Diplomacy lowers the probability of sudden supply shocks.

4. Broader Regional Implications

A stable negotiation path reduces the risk of retaliatory actions across proxy theaters and preserves cross-border investment stability.

Why It Matters

Geopolitical risk directly influences:

• Oil pricing volatility

• Defense sector positioning

• Safe-haven currency demand

• Capital flow stability

Diplomacy reduces systemic shock risk in global markets.

Why It Matters to Foreign Currency Holders

Currency markets react quickly to Middle East risk signals.

A diplomatic stance:

• Eases pressure on energy-importing nations

• Reduces inflation shock probabilities

• Stabilizes global bond yields

• Softens risk-off flows into the dollar and gold

Peace signaling often supports broader market equilibrium.

Implications for the Global Reset

Pillar 1: De-Escalation as Stability Anchor

Reducing military escalation risk lowers volatility premiums embedded across global financial systems.

Pillar 2: Energy Market Equilibrium

Stable diplomacy supports predictable oil flows, which anchor inflation and monetary policy planning worldwide.

This is not simply foreign policy positioning — it is systemic risk management in a fragile multipolar transition.

Diplomacy, when sustained, becomes an economic stabilizer.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

TASS — “US Prioritizes Diplomatic Agreement on Iran’s Nuclear Program”

Reuters — “US Signals Preference for Diplomacy in Iran Nuclear Discussions”

~~~~~~~~~~

Russia Fast-Tracks Digital Ruble to Challenge Dollar Dominance in BRICS

CBDC push accelerates cross-border trade ambitions as internal banking skepticism surfaces

Overview

Russia is accelerating development of the digital ruble as part of a broader strategy to reduce reliance on the U.S. dollar within BRICS trade settlements.

Officials suggest the digital ruble is designed primarily as an international settlement tool, potentially enabling cross-border trade among BRICS nations outside traditional dollar-clearing systems.

With several BRICS members actively developing central bank digital currencies (CBDCs), Moscow is positioning its e-ruble as a foundational piece of emerging multipolar payment infrastructure.

Key Developments

1. Digital Ruble Positioned as International Project

Timur Aitov of the Russian Chamber of Commerce described the digital ruble as “first and foremost an international project,” reinforcing that its priority use case is cross-border trade settlement rather than domestic retail payments.

China is reportedly viewed as a potential early participant in accepting the digital ruble for bilateral trade.

2. BRICS CBDC Coordination Expands

Several BRICS nations are currently piloting CBDCs, and discussions around interoperability are intensifying.

The Reserve Bank of India recently issued communication encouraging BRICS members to explore CBDC linkage frameworks, a topic expected to surface at the upcoming summit in New Delhi.

3. Russia’s Largest Bank Voices Caution

Sberbank CEO German Gref expressed skepticism about retail applications of the digital ruble.

While supportive of cross-border trade usage, Gref questioned the necessity of a CBDC for individuals, suggesting its most rational application lies strictly in intergovernmental and inter-alliance trade flows.

4. Sanctions Resilience Remains Core Driver

The acceleration of the digital ruble is widely viewed as part of Russia’s broader strategy to mitigate sanctions exposure and reduce dollar dependency.

By leveraging CBDC infrastructure, Russia aims to insulate trade corridors from Western financial controls.

Why It Matters

The digital ruble push reflects a structural shift in how sovereign currencies may operate in the future.

If integrated into BRICS trade networks, the e-ruble could:

• Reduce dollar settlement reliance

• Increase bilateral currency trade

• Strengthen sanctions resilience

• Expand CBDC interoperability experimentation

This is part of a broader global movement toward state-controlled digital settlement rails.

Why It Matters to Foreign Currency Holders

For currency observers, this development influences:

• Dollar reserve dominance debates

• CBDC cross-border settlement adoption

• Energy trade pricing mechanisms

• Geopolitical monetary fragmentation

If BRICS nations link CBDCs successfully, parallel settlement systems could expand alongside traditional banking channels.

Implications for the Global Reset

Pillar 1: Digital Sovereign Currency Infrastructure

The digital ruble represents a test case for how CBDCs may facilitate alliance-based trade outside legacy clearing systems.

Pillar 2: Dollar System Alternatives Expand

While not an immediate dollar replacement, coordinated BRICS CBDC discussions signal incremental diversification of settlement architecture.

The key question is not whether the digital ruble replaces the dollar — but whether interoperable CBDCs collectively reshape cross-border financial plumbing over time.

This is not merely fintech experimentation — it is geopolitical monetary engineering.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “Russia Fast-Tracks Digital Ruble to Break Dollar’s Grip on BRICS”

Reuters — “Russia Advances Digital Ruble Pilot for Cross-Border Trade”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps