FRANK26….12-28-25…..90 DAYS

KTFA

Sunday Night Video

FRANK26….12-28-25…..90 DAYS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….12-28-25…..90 DAYS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

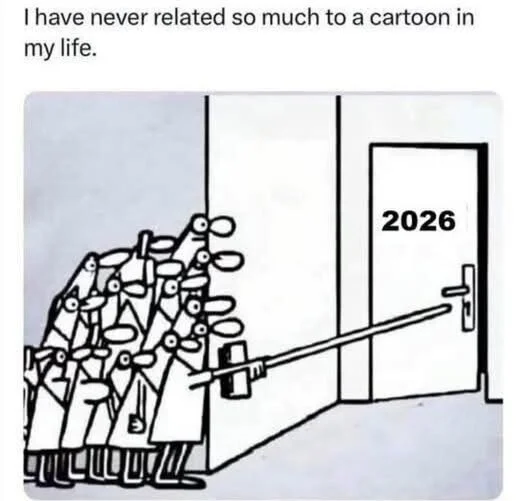

Why 2026 will be the End of the Fiat Experiment

Why 2026 will be the End of the Fiat Experiment

As Good As Gold Australia: 12-28-2025

As we navigate the complexities of the current financial landscape, industry experts Daryl Payne, CEO of As Good as Gold Australia, and Alasdair Macleod offer a stark warning: the global economy is on the brink of a significant upheaval.

In a detailed discussion, they shed light on the precious metals market, particularly silver and gold, and what the future holds for these assets amidst growing economic instability.

Why 2026 will be the End of the Fiat Experiment

As Good As Gold Australia: 12-28-2025

As we navigate the complexities of the current financial landscape, industry experts Daryl Payne, CEO of As Good as Gold Australia, and Alasdair Macleod offer a stark warning: the global economy is on the brink of a significant upheaval.

In a detailed discussion, they shed light on the precious metals market, particularly silver and gold, and what the future holds for these assets amidst growing economic instability.

The conversation begins with silver, a metal that has been quietly gaining momentum. Alasdair Macleod highlights that silver prices are experiencing an extraordinary rise, primarily driven by industrial demand.

The surge in emerging technologies, such as electric vehicle batteries, has significantly increased the demand for silver, propelling its price upwards. Moreover, central banks, especially in Asia, are accumulating silver reserves, further bolstering its value.

Macleod emphasizes that the long-term suppression of silver prices is finally correcting itself, reflecting fundamental changes in demand.

This breakout is not just a market fluctuation; it’s a significant shift that investors should take note of. As the world transitions towards greener technologies, the demand for silver is expected to continue its upward trajectory, making it a critical asset to watch in the coming years.

The discussion then shifts to gold, an asset that has traditionally served as a safe haven during times of economic uncertainty.

Alasdair Macleod underscores gold’s role as a monetary asset, particularly in an era where fiat currencies are facing increasing instability. The U.S. dollar, a long-standing global reserve currency, is under scrutiny as the global economy grapples with massive credit and equity bubbles.

Macleod warns that the current global credit and equity bubble is the largest in recorded history, far surpassing the 1929 crash.

As this bubble nears its bursting point, the repercussions will be severe, including rising bond yields, plummeting equity prices, and heightened counterparty risks. In such a scenario, gold is poised to play a crucial role as a safe-haven asset, protecting investors from the impending financial storm.

The conversation also delves into the broader geopolitical and currency implications of the current financial landscape.

The era of fiat currency is seen to be in decline, with major currencies like the U.S. dollar facing a loss of purchasing power. China is strategically positioning itself with gold-backed yuan trade settlements and forming alliances through BRICS and the Shanghai Cooperation Organization.

Meanwhile, Europe and NATO are experiencing political fractures that could further destabilize the global financial system.

As the geopolitical landscape continues to evolve, the importance of holding assets that are insulated from these risks becomes increasingly evident.

Alasdair Macleod stresses that rising inflation is inevitable and that governments may resort to price controls, which will only exacerbate economic pain for ordinary people. In this context, preserving wealth through hard assets like gold and silver becomes a prudent strategy. Macleod urges investors not to wait for price dips but to secure their holdings promptly.

The key takeaway is clear: in uncertain times, understanding the dynamics of the precious metals market and the broader financial environment is crucial for protecting individual and community wealth. Education and awareness are the first steps towards making informed investment decisions.

The insights shared by Daryl Payne and Alasdair Macleod offer a compelling case for why gold and silver should be at the forefront of any investment strategy in the coming years.

As the global economy hurtles towards significant changes, these precious metals are poised to play a pivotal role in safeguarding wealth.

For those looking to navigate the complexities of the current financial landscape, the message is clear: now is the time to act.

Watch the full video from As Good As Gold to gain further insights into the precious metals market and how to protect your wealth in the face of looming financial uncertainty.

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Edu Matrix: 12-28-2025

The Iraqi dinar has long been a topic of interest among currency investors and enthusiasts, with many speculating about its potential appreciation.

However, skeptics and doubters have raised concerns about the likelihood of the dinar’s value increasing. A recent video addresses these concerns, outlining seven critical factors that the Iraqi government must fulfill before the currency can realistically increase in value.

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Edu Matrix: 12-28-2025

The Iraqi dinar has long been a topic of interest among currency investors and enthusiasts, with many speculating about its potential appreciation.

However, skeptics and doubters have raised concerns about the likelihood of the dinar’s value increasing. A recent video addresses these concerns, outlining seven critical factors that the Iraqi government must fulfill before the currency can realistically increase in value.

According to the speaker, the appreciation of the Iraqi dinar is not speculative, but rather inevitable once certain economic and political conditions are met.

So, what are these conditions, and how can they impact the dinar’s value?

One of the primary conditions for the dinar’s appreciation is reducing the excess dinars in circulation. This is a crucial step in stabilizing the currency and preventing inflation. By controlling the money supply, the Iraqi government can help maintain the dinar’s purchasing power and increase its value.

A robust banking system is essential for attracting foreign investment and promoting economic growth. The speaker emphasizes that the Iraqi banking system needs to be strengthened to support the dinar’s appreciation. This can be achieved by implementing modern banking practices, improving regulatory frameworks, and enhancing financial infrastructure.

Internal conflicts and political instability can deter investors and hinder economic growth. The speaker stresses that a stable government is vital for creating a favorable business environment, which can, in turn, support the dinar’s appreciation.

Iraq’s economy is heavily reliant on oil exports, making it vulnerable to fluctuations in global oil prices. Diversifying the economy and promoting other sectors, such as agriculture, tourism, and manufacturing, can help reduce this dependence and create a more stable economic foundation.

Adequate foreign reserves are essential for maintaining currency stability and supporting economic growth. The Iraqi government needs to build its foreign reserves to demonstrate its ability to manage the economy and stabilize the dinar.

To attract foreign investment and participate in the global economy, Iraq must comply with international financial rules and regulations. This includes implementing anti-money laundering (AML) and know-your-customer (KYC) regulations, as well as adhering to global standards for financial reporting and transparency.

The speaker highlights that one of the significant challenges facing Iraq is the resistance to interest-based financial systems and forex trading, driven by religious and political factors. This resistance hinders the country’s ability to adopt modern financial practices and integrate into the global economy.

While these conditions are being addressed, the speaker emphasizes that the eventual currency adjustment will be driven by global market forces, rather than speculative “revalue” claims. The exact future value of the dinar remains unknown, but holders of large amounts have the potential to capitalize significantly.

For investors looking to stay informed about the Iraqi dinar and other investment opportunities, the Edu Matrix channel offers a membership program that provides educational resources on asset growth and management. By joining the program, investors can gain valuable insights and stay ahead of the curve.

To learn more about the Iraqi dinar and its potential appreciation, watch the full video from Edu Matrix. With a deeper understanding of the seven critical factors outlined above, investors can make informed decisions and navigate the complex world of currency investment.

The Iraqi dinar’s potential appreciation is a topic of ongoing interest and debate. By understanding the critical factors that can impact its value, investors can make informed decisions and capitalize on emerging opportunities.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 12-28-25

Good Afternoon Dinar Recaps,

Silver Market Structural Imbalance: Squeeze Signals and Supply Stress

Veteran analysts warn silver’s rally may reflect deeper market mechanics, not just short-term price moves

Good Afternoon Dinar Recaps,

Silver Market Structural Imbalance: Squeeze Signals and Supply Stress

Veteran analysts warn silver’s rally may reflect deeper market mechanics, not just short-term price moves

Overview

The silver market is experiencing a sustained structural supply-demand imbalance

Industrial demand has surged as inventories tighten and production remains constrained

Severe price action, record levels, and delivery stress suggest deeper stress in the paper–physical relationship

Analysts with decades of experience see conditions that diverge from normal market behavior

Key Developments

Silver prices have surged sharply in 2025, breaking multiple historic levels and outperforming other precious metals in percentage terms as demand outpaces supply

Market observers point to persistent supply deficits and expanding industrial usage, particularly in technology and clean energy sectors

Structural constraints on physical inventories — and tight access to deliverable metal — are beginning to influence pricing behavior in futures and spot markets, according to expert commentary and investor analysis

Paper markets now face growing scrutiny as analysts note large leveraged positions may be under stress in environments where physical is scarce and delivery demand rises

Why It Matters

This is not a garden-variety rally. What experienced market observers are describing is a shock to the balance between promises (paper contracts) and deliverable reality (metal inventories). When delivery obligations start to outrun physical availability, the market begins to price risk differently, shifting attention from purely financial trading to real asset scarcity. This dynamic can expose structural vulnerabilities that normal supply-demand analysis alone does not capture.

Why It Matters to Foreign Currency Holders

For foreign currency holders, a stressed foundational market such as silver represents more than industrial risk — it signals monetary and systemic liquidity dynamics at work. When asset markets begin reconciling paper positions with physical reality, confidence in financial promises shifts. Hard assets that can be physically owned and delivered become a hedge against both currency risk and counterparty risk, particularly in an era of high global debt and monetary expansion.

Implications for the Global Reset

Pillar: Asset Scarcity Reframes Price Discovery

Structural metal scarcity elevates real inventories above abstract price signals.Pillar: Real Commodities Matter in Financial Architecture

Markets that fail to reconcile physical constraints with financial instruments create systemic stress points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Youtube -- "If You Own SILVER, You Need to See THIS NOW!": Andy Schectman | Silver Price 2025

Reuters — “Silver surges past $35/oz level to hit more than 13-year high”

The Guardian — “Elon Musk warns of impact of record silver prices before China limits exports”

~~~~~~~~~~

Bitcoin vs ISO Assets: Speculation vs Infrastructure

Why narrative-driven assets behave differently from settlement-grade systems

Overview

Bitcoin and ISO-compliant digital assets serve fundamentally different roles

Bitcoin is driven by speculation, liquidity, and narrative

ISO assets are designed for regulated settlement and interoperability

Infrastructure assets gain value through use, not hype

The distinction matters as the global financial system modernizes

Key Developments

Bitcoin continues to dominate retail and institutional speculative exposure

ISO 20022 has become the standard language for global payments

Only a limited set of digital assets are compatible with institutional rails

Financial institutions prioritize speed, finality, cost, and compliance

Alternative settlement systems are being built alongside legacy rails

Asset-backed models are replacing debt-only expansion frameworks

Speculation vs Infrastructure: How They Differ

Bitcoin — A Speculative Asset

Bitcoin’s value is primarily driven by belief, scarcity narrative, and liquidity access. It trades like a macro risk asset, responding to sentiment, monetary policy expectations, and capital flows. Its design prioritizes decentralization and security over throughput, resulting in slower settlement times and higher transaction costs during congestion.

ISO-Compliant Assets — Financial Infrastructure

ISO assets are engineered for interoperability within regulated financial systems. Their value proposition lies in efficiency, not appreciation. These assets facilitate rapid settlement, low-cost transfers, and messaging compatibility with central banks and financial institutions. Adoption depends on legal clarity and operational necessity rather than market excitement.

Why It Matters

As the financial system transitions, speculation and infrastructure will not be valued the same way. Speculative assets inflate early in cycles when liquidity is abundant. Infrastructure assets become indispensable later, when systems require reliability and scale. Confusing these roles leads to misaligned expectations about price behavior and adoption timelines.

Why It Matters to Foreign Currency Holders

For foreign currency holders, understanding this distinction is critical. Speculative assets may offer volatility-driven gains but lack settlement reliability. Infrastructure assets support cross-border trade, liquidity management, and monetary stability. As countries modernize payment systems, currencies aligned with ISO-compliant rails and asset-backed frameworks gain durability.

Implications for the Global Reset

Pillar: Narrative Leads, Infrastructure Lasts

Speculation captures attention early; systems that move value endure.Pillar: Function Determines Survival

Assets integrated into payment and settlement networks outlast those reliant on belief alone.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – “ISO 20022 and the evolution of global payment systems”

International Monetary Fund – “Global financial architecture and cross-border payment reform”

~~~~~~~~~~

Bitcoin vs XRP vs Gold: Speculation, Settlement, and Sovereign Trust

Three assets, three roles, one transforming financial system

Overview

Bitcoin, XRP, and gold serve distinct and non-interchangeable functions

Bitcoin operates as a speculative digital asset

XRP is designed for high-speed settlement and liquidity bridging

Gold remains the ultimate sovereign reserve asset

Confusing these roles leads to incorrect expectations about value and adoption

Key Developments

Bitcoin dominates digital asset speculation and liquidity flows

XRP continues integration into cross-border payment infrastructure

Central banks remain aggressive buyers of physical gold

Payment systems are upgrading to ISO-compliant digital rails

Asset-backed settlement models are gaining institutional support

Monetary systems are separating value storage from value movement

Role Comparison: How Each Asset Functions

Bitcoin — Speculation and Narrative

Bitcoin’s value is driven by belief, liquidity, and scarcity narrative. It performs well during risk-on cycles and monetary expansion. However, limited throughput, higher fees during congestion, and slow finality restrict its usefulness as a settlement asset at institutional scale.

XRP — Settlement and Liquidity

XRP was engineered to move value quickly, cheaply, and with finality. Its role is not to replace sovereign currencies, but to bridge them. XRP reduces reliance on pre-funded accounts and enables real-time cross-border settlement. Adoption depends on regulatory clarity and operational efficiency rather than speculative demand.

Gold — Sovereign Trust and Collateral

Gold anchors monetary confidence. It carries no counterparty risk and has functioned as a reserve asset across centuries. Central banks accumulate gold to protect balance sheets against currency debasement, sanctions, and systemic shocks. Gold does not move value — it secures it.

Why It Matters

The evolving financial system is modular. Different assets perform different tasks. Bitcoin captures speculative attention, XRP facilitates movement, and gold anchors trust. Systems that mistake speculation for infrastructure risk instability. Systems that align assets to function gain resilience.

Why It Matters to Foreign Currency Holders

For foreign currency holders, this distinction determines exposure. Speculative assets respond to sentiment. Settlement assets respond to usage. Reserve assets respond to confidence breakdowns. As the reset progresses, currencies tied to efficient settlement and credible reserves gain strength relative to those dependent on debt expansion alone.

Implications for the Global Reset

Pillar: Function Over Hype

Assets survive based on utility, not popularity.Pillar: Separation of Roles

Storing value, moving value, and pricing risk require different tools.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

World Gold Council – “Central banks and gold: reserve diversification trends”

Bank for International Settlements – “Cross-border payments and settlement modernization”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Afternoon 12-28-25

A Frightening US Report: Corruption, Jobs, And Oil Are Besieging Iraq's Financial Future.

Economy / Translated Reports 25-12-2025, 23:50 | 1220 Baghdad Today – Translation

An analytical report issued by the Washington Report Institute for Middle East Studies paints a picture of the next Iraqi government within a complex equation.

Its three fundamental elements are: deeply entrenched corruption that has become the norm; a public sector bloated with approximately 700,000 new jobs created in just a few years; and an economy dependent on an oil price that must approach $90 per barrel to keep the budget afloat and avoid a deficit that grows year after year.

A Frightening US Report: Corruption, Jobs, And Oil Are Besieging Iraq's Financial Future.

Economy / Translated Reports 25-12-2025, | 1220 Baghdad Today – Translation

An analytical report issued by the Washington Report Institute for Middle East Studies paints a picture of the next Iraqi government within a complex equation.

Its three fundamental elements are: deeply entrenched corruption that has become the norm; a public sector bloated with approximately 700,000 new jobs created in just a few years; and an economy dependent on an oil price that must approach $90 per barrel to keep the budget afloat and avoid a deficit that grows year after year.

These factors, the report argues, severely limit the chances of any new government breaking the cycle, as long as it emerges from the same parties that created and continue to thrive on this reality.

The institute believes that corruption in Iraq is no longer an isolated incident or individual deviation, but rather a deeply entrenched "pattern" that governs the workings of the government bureaucracy from top to bottom.

A citizen with an official request or transaction often finds themselves forced to go through a political party or entity that represents them along sectarian or ethnic lines, accompanied by letters, favors, "gifts," and bribes paid to influential figures, all in order for their paperwork to move through the state's corridors.

The report indicates that the dominant parties treat ministries and agencies as "private property," not public service institutions, using them either to embezzle funds directly or to distribute jobs and contracts to networks of supporters and affiliates.

According to Professor Alyssa Walter, author of "The Contested City: Consecrating Citizenship and Survival in Modern Baghdad," on which the report is based, the election results and the composition of the next government "will not bring about real change in the corruption situation," because the forces sharing power today are the same ones that established the rules of the game after 2003 and have a vested interest in maintaining them as they are, with only minor cosmetic adjustments when necessary.

She adds that the quota system makes any minister or senior official "constrained" by a broader party network that defines the boundaries of what can and cannot be touched within their ministry.

The report also refers back to the experience of the October 2019 demonstrations as the clearest moment when the street raised the slogan of combating corruption and directly linked it to poor services and the lack of justice in the distribution of opportunities.

However, the outcomes of those protests, from the institute’s point of view, showed that the political system was able to absorb the shock without making a deep review of its method of managing the state, only to return later and produce new governments according to almost the same mechanisms, with a change in faces but not in the rules of the game.

In contrast, the report notes that Iraqi society has become accustomed to this pattern of performance. Many Baghdadis, it states, associate the presence of officials and limited public services with election seasons, when localized repairs or partial renovations are carried out in streets and public squares, only for the activity to disappear after the voting concludes.

The report cites the example of outgoing Prime Minister Mohammed Shia al-Sudani, who enjoyed considerable public support for a "modest reform package" in Baghdad, consisting of localized infrastructure improvements.

The report argues that this support reflects a decline in citizens' expectations of their government to a level where even partial reform is considered an exceptional achievement.

At the level of the financial structure, the report focuses on the extensive public sector hiring spree of recent years, which is estimated to have added nearly 700,000 new employees to the government apparatus during al-Sudani's tenure. This increase raised the total number of public sector employees to nearly 4 million, in addition to the hundreds of thousands working in state-owned enterprises funded by the budget.

The institute argues that this expansion, which was used as a tool to absorb public anger and alleviate unemployment, has now become a heavy financial burden on any future government, because reversing it by reducing the number of employees would mean a direct confrontation with a broad social base that depends entirely on state salaries.

The economic analysis accompanying the report indicates that the "state of public sector employment" policy has made salaries and wages one of the most inflated areas of government spending, approaching, according to some estimates, 40 percent of total government expenditure.

Meanwhile, budgets for investment, services, and infrastructure remain limited compared to the accumulated needs in the capital and the provinces. The report concludes that, with this structure, the state has adopted a "pay salaries first, then think about everything else later" approach, which translates into recurring financial crises whenever oil prices fluctuate.

In the background, the oil sector stands as a crucial factor. The report indicates that the "break-even price" needed by the Iraqi budget to cover its obligations without resorting to borrowing is currently approaching $90 per barrel, due to the inflated wage bill, subsidies, and increasing current expenditures, coupled with limited non-oil revenues.

Given the global trend of price volatility and the potential for further declines, the report warns that any prolonged period of low prices will push the budget directly toward a deeper deficit, in the absence of fundamental reforms to reduce dependence on oil as the almost sole source of state funding.

Despite this bleak picture, the Washington Report quotes researchers from academic initiatives focused on the Middle East as saying that Iraq still retains a significant advantage in the region: the continued peaceful transfer of power, based in part on election results, unlike many other Arab states that remain trapped in closed systems of governance.

However, these researchers also warn that this advantage could gradually lose its value if elections continue to reproduce the same system without changes to the rules governing political financing, oversight of public funds, and the mechanisms for selecting governments.

The report concludes that the incoming government will face a triple burden: entrenched corruption that provides parties with enormous resources and makes it difficult to dismantle patronage networks; a bloated public sector that consumes the lion's share of the budget and hinders any restructuring efforts; and near-total dependence on oil prices in an unpredictable global market.

Between these three pillars, the new government's ability to act will depend on the willingness of political forces to accept unpopular decisions, such as controlling appointments and curbing waste, in exchange for forging a different path toward building a service-oriented state with functioning institutions, not just a state focused on salaries.

The question that the report leaves open is whether the forces that have benefited for years from this financial-political model are actually capable of dismantling it, or whether future governments will simply manage the crisis and postpone the explosion, waiting for a new oil cycle, or new protests, that will raise the same questions from scratch.

Source: Baghdad Today + Washington Report https://baghdadtoday.news/289807-.html

Above Ministries And Governorates

The economic offices of political parties have infiltrated Iraq, creating a shadow state that manages contracts and bankrupts contractors.

Economy / Special Files 23-12-2025, | 1199 Baghdad Today – Baghdad An appeal received by "Baghdad Today" from a group of veteran contractors in Basra paints a stark picture of the reality of the contracting market in Iraq: Companies that are properly registered, pay taxes and insurance, and have a proven track record, are now without projects. Even small contracts are being snatched from them and awarded to new companies affiliated with political parties or supported by their "economic offices."

This firsthand account from Basra aligns with what research and media reports have observed: that the parties' "economic offices" have become the mandatory gateway to obtaining government contracts and investments in most governorates, particularly in the southern cities rich in oil and service projects.

Economic offices or a parallel shadow state?

Recent press reports and research indicate that "economic offices" are no longer merely organizational structures within political parties, but have transformed into networks of financial influence that manage a significant portion of state resources by controlling contracts, projects, and investments, particularly in the southern provinces.

Sources within the Federal Integrity Commission previously reported the widespread influence of economic offices affiliated with political parties and armed factions over all economic resources in the southern provinces, and that hundreds of complaints have been filed regarding what contractors and businesspeople describe as "extortion" and "organized acquisition" of contracts.

In this context, some politicians and former parliamentarians go even further, describing these offices as “outlets for stealing public money” and “offices for looting and plundering the people’s money,” and accusing them of destroying Iraqi projects by pushing for fictitious contracts or work that is carried out formally on paper and has no real existence on the ground.

How is the deal structured? Fixed percentages and front companies.

Information circulating in economic and political circles points to a fairly consistent pattern in the work of many of these offices: the party controls a ministry, governorate, or agency, and through it, an unofficial "committee" or "economic office" is formed.

This office reviews contracts, tenders, and investments, imposing its conditions on competing companies. Previous testimonies from officials have spoken of percentages ranging from 5% to 10% of the value of any contract being deducted for the benefit of the office or the political entity behind it, in exchange for facilitating the awarding of the contract or not obstructing it.

In practice, this mechanism translates into the emergence of new "front" companies, registered under the names of individuals whose public affiliation with the party is not apparent, but who are, in reality, part of its economic system.

These companies obtain large or medium-sized contracts, then sometimes subcontract parts of the work to other contractors, while retaining a substantial profit margin that goes to the party office, not based on the skill of the contractors or the quality of the infrastructure.

Basra as a case study: Yesterday's contractors are jobless today

The appeal received by Baghdad Today from a group of veteran contractors in Basra perfectly reflects this distorted equation. The contractors explain that they own companies registered for many years, paying taxes, social security contributions, pension funds, and health insurance for their employees, yet today they have no projects. Some have already been forced to sell their companies, and others are "on the way out," as they say.

The problem, they explain, is not the size of their projects—mostly small or medium-sized enterprises—but rather that these same projects are being taken from them and awarded to other companies "recommended" by economic offices or influential figures.

Contractors are appealing directly to the Governor of Basra, requesting that a portion of local projects be allocated to their companies, which they describe as "established, committed," and experienced in execution, instead of being left to wither away in an environment of unfair competition.

Some say that, despite accepting small projects or limited rehabilitation work, they are surprised to find that "political influence" extends even to this level, imposing specific names or new companies with no history in the contracting market.

This appeal coincides with previous statements by the head of the Basra Contractors Union, who spoke about large financial dues owed by the central government to companies and contractors, estimated at more than one trillion dinars in Basra alone, and about 30 trillion dinars at the level of Iraq, which adds another layer of pressure on contractors who are not getting new projects, nor their old dues at the same time.

Projects built only to collapse... a cycle of profit built on the ruins of service.

One of the most serious warnings issued by experts on administrative corruption in Iraq is that many companies linked to political parties or economic offices are not built on the principles of quality and sustainability, but rather on the principle of "profit-driven cycles.

" Work is often carried out with substandard specifications, using inferior materials, or with inflated costs on paper, making the project prone to rapid deterioration and creating, after a few years, a justification for a new project under the guise of "rehabilitation," "comprehensive maintenance," or "reconstruction."

Reports from economic offices indicate that the adoption of fictitious or incompletely implemented projects was one of the reasons for "the destruction of all Iraqi projects," according to some former MPs, because the project is originally created in the context of a deal, not in the context of service planning, and then recycled time and again for the benefit of the same corruption networks.

In such an environment, reputable companies – those that try to adhere to technical specifications – are in a vulnerable position. If they try to do the work properly, their profits will weaken and they will be unable to pay royalties or keep up with the "economic office's conditions." If they succumb to the logic of manipulating specifications, they will lose their professional reputation and become part of the very game they complain about.

A besieged private sector... and an economy run outside the rules of the market

Recent economic research on the business environment in Iraq describes the situation as small and medium-sized enterprises “being forced to operate within an economic system dominated by powerful and wealthy parties,” and that they do not get equal opportunities in contracts and investment unless they enter into arrangements with controlling political entities.

This infiltration creates a layer of "parallel economy," where economic offices become funding centers for political parties and their election campaigns, as numerous reports indicate, while traditional contractors become the weakest link: no effective legal protection, no real competitive environment, and no transparency in how contracts are awarded. In a city like Basra, which is considered the richest province in Iraq in terms of oil resources and strategic projects, the paradox becomes even more stark: a huge economy operates in the province, yet a large segment of its long-established contractors complain about the lack of projects and the market becoming a "monopoly" for companies linked to influential figures.

To where?

The intertwined data – from the encroachment of economic offices, their acquisition of contracts, the emergence of inexperienced front companies, the accumulation of contractors’ dues, and the appeals of old contractors in Basra – indicate that the problem is no longer just individual complaints, but a structural imbalance in the state’s relationship with the contracting and investment market.

Without restoring the principle of fair competition, imposing genuine transparency on government contracts, and restricting the influence of the economic offices of political parties within ministries and governorates, the real private sector will remain besieged, and public money will continue to finance a parallel party economy, while projects collapse or are rebuilt every few years with the same short-term profit logic.

The appeal of Basra contractors, as they demand that the governor reopen the door to work for them, is not merely a local request; it is a warning that the “office economy” has begun to devour what remains of the “contractors’ economy” in Iraq, and that addressing this issue is no longer an administrative luxury, but rather a condition for any serious talk of real development in a country whose resources have been consumed in the same cycles: a project is granted, implemented poorly, collapses, and then rebuilt under new names, while the citizen remains the first and last loser. Report by: Baghdad Today's Economic Affairs Editor https://baghdadtoday.news/289593-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

News, Rumors and Opinions Sunday 12-28-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 28 Dec. 2025

Compiled Sun. 28 Dec. 2025 12:01 am EST by Judy Byington

Sat. 27 Dec. 2025 Something big just happened, and most people missed it. …Charlie Ward and Friends on Telegram

For nearly a year, President Trump has been (allegedly) executing a quiet but deliberate economic realignment. While the public focused on headlines about inflation, gas prices, and GDP, the real operation unfolded behind the scenes. That was intentional. This was never meant to be a media event.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 28 Dec. 2025

Compiled Sun. 28 Dec. 2025 12:01 am EST by Judy Byington

Sat. 27 Dec. 2025 Something big just happened, and most people missed it. …Charlie Ward and Friends on Telegram

For nearly a year, President Trump has been (allegedly) executing a quiet but deliberate economic realignment. While the public focused on headlines about inflation, gas prices, and GDP, the real operation unfolded behind the scenes. That was intentional. This was never meant to be a media event.

The surface indicators told part of the story. Fuel prices dropped. GDP stabilized. Consumer spending surged. Inflation cooled. Wages began catching up. Analysts called it a “soft recovery,” but the explanation never fit. This was not market correction. It was structural intervention.

Domestic energy production was restored by removing global regulatory locks disguised as environmental policy. Transportation costs collapsed as internal supply chains were rebuilt. ESG capital lost its grip on logistics and pricing. Foreign backchannels that inflated costs were severed. The pressure on households was not eased by chance. It was forced.

But those moves were only preparation. The real shift is happening now. NESARA systems are already (allegedly) active inside classified Treasury routing layers. Asset backed recalibration protocols have been (allegedly) uploaded to QFS nodes. Debt cancellation frameworks are (allegedly) live.

Seizure orders tied to criminal finance networks are being executed and reassigned through the only system built to survive this transition.

Tier 1 transfers have begun. Over ninety thousand ledger synced accounts are already (allegedly) in pre-disbursement status. Military supervised sync centers reported live movement days ago. Redemption infrastructure has moved into continuous readiness. These funds are not tax revenue or stimulus. They are reclaimed assets taken from trafficking, war profiteering, and offshore laundering operations and rerouted under sovereign settlement rules.

This is why the banks are silent. Retail institutions are (allegedly) positioning quietly. The Federal Reserve has stopped forward guidance. European clearinghouses are freezing payouts without explanation. The old system is(allegedly) being powered down gradually while the new one runs in parallel.

December is not random. It is the staging window. The full system switch is scheduled for January. Infrastructure is already deployed. Legacy fiat accounts are being detached from settlement layers. Once Tier 1 closes, that channel closes with it.

This was never about convincing the public. The public only understands after transitions are complete. Trump is not campaigning on the economy. He is dismantling the architecture that made permanent control possible.

If you are already positioned, there is nothing to wait for. Tier 1 is operational and nearly complete. Everyone else will learn what happened after the wealth has already moved.

The dollar will not vanish overnight. It will drain slowly while the asset backed system accelerates.

When people finally ask where the money went, the answer will be simple. It went to those who were paying attention.

~~~~~~~~~~~

World Economic Situation:

Sat. 27 Dec. 2025 A quiet panic is spreading through the global banking system, and it has nothing to do with markets. What is happening now is structural dismantling.

The old control grid built on debt, surveillance, and behavioral compliance is (allegedly) being taken apart deliberately and permanently. Banks are not collapsing on their own. They are (allegedly) being shut down node by node.

When Donald Trump returned to office in January 2025, the covert phase ended. Years of preparation(allegedly) moved into execution. Central-bank choke points were severed. Hidden asset pipelines were seized. Quantum-aligned financial channels were activated. Redemption Centers (allegedly) came online.

From that moment forward, gold recalibration systems began syncing across secure networks. Wealth that had been (allegedly) trapped inside elite-controlled structures started moving through verified, non-bank pathways. The press said nothing. But military cyber units, Treasury white hats, and intelligence veterans across multiple allied nations saw the same data: a banking system bleeding assets, fabricating solvency, running ghost ledgers, and scrambling to relocate gold like a collapsing regime.

Banks were never about money. They were about control.

Credit scores were behavioral leashes. Loans were compliance tests. Payroll data fed predictive systems. “Fraud prevention” masked biometric tracking. By 2020, central banks had (allegedly) plans to eliminate cash, merge medical data with spending behavior, and link identity verification to obedience scoring. The pandemic era wasn’t the endgame. It was a rehearsal.

That trajectory was supposed to lock in by 2026. It didn’t.

The expansion of Redemption Centers in early 2025 shattered the system’s defenses. These are not civilian money hubs. They are (allegedly) gold-anchored, QFS-synced, and structurally independent from BIS, IMF, and legacy central-bank networks. Banks cannot access them. Cannot audit them. Cannot freeze them. Cannot interfere.

For the first time in over a century, financial flow is exiting elite custody. That is why, right now, the response is frantic.

Gold is being pulled from contingency vaults in Switzerland and Northern Italy tied to post-WWII emergency liquidity frameworks. Major European banks are(allegedly) submitting fabricated asset reports just to stay inside transaction windows, reports that now fail upgraded Treasury verification protocols. Cyber attacks have been (allegedly) launched against QFS routing infrastructure, neutralized before reaching quantum layers. Media blackout directives have gone out globally, instructing outlets to mock, deny, and redirect attention, using the same coordination channels deployed during lockdowns and digital ID pushes.

The fingerprints are identical. The structure is collapsing. NESARA is no longer (allegedly) theoretical. It is active. Verified disbursements are already routing through quantum validation layers. January 2026 is the lock-in point. When the fiat scaffolding finally gives way, alignment will determine survival.

The panic is not about money. They can create digits endlessly. The panic is about losing control over who can hold value, who can move it, and who can build with it.

Redemption Centers (allegedly) bypass their grip. Quantum verification ends their surveillance. And the old system has no counter.

FINAL NOTE FOR DECEMBER 23, 2025: This is not a future event. It is operational. This Christmas is not symbolic. It is a staging window.

The largest financial realignment in human history is (allegedly) underway, quietly, decisively, and without reversal.

Read full post here: https://dinarchronicles.com/2025/12/28/restored-republic-via-a-gcr-update-as-of-december-28-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat My CBI contact...told me on my call...to Iraq that we will see articles about the removal of these larger three-zero notes and the swap out. She told me we already should have witnessed much recent news about the removal of the zeros and so pay close attention. She also said the CBI site will be updated with pictures of the newer lower denominations soon once the trigger is pulled to begin...

Frank26 Today you have a presidential decree for parliament to sit on the 29th. That's a very direct command. I believe they will obey. We should see your [Iraqi] government formed. We should see the HCL and we should see a new exchange rate. We should see the lower notes from the 29th to the 31st. Anything short of that is a complete failure especially with Mark Savaya right after you're supposed to do that.

Jeff They have 3 aspects of the government formation regarding the elections they have to do. They have to finish and complete the parliament. After they complete the parliament they have to finish and complete the president of the country, then the prime minister. This very next session of parliament around the 29th they could or might complete the formation of parliament. [Then] parliament can resume having sessions...By changing the rate while the government is being formed, during the year of '25, makes the most sense because it allows them to hit the ground running...Otherwise if they're waiting till the government's done, they would probably be waiting until at least February.

************

The Dollar’s WORST YEAR in a Decade - Global Currency Repricing Is Here

Lena Petrova: 12-28-2025

In this video, I break down why the dollar weakened sharply through 2025, what the drop in the US Dollar Index (DXY) really means, and why this move may signal a structural shift after decades of dollar dominance.

We look at the key drivers behind the selloff — rising US debt, widening fiscal deficits, slowing relative growth, tariff uncertainty, and growing global investor hedging against dollar exposure.

I address the big question: does a weakening dollar mean you should buy gold now? I explain why gold is often promoted during periods of dollar stress, the risks many overlook, and why gold isn’t always the automatic answer.

“Tidbits From TNT” Sunday 12-28-2025

TNT:

Tishwash: From "nothing" to billionaires... What are the secrets of the phenomenon of "exorbitant and rapid wealth" in Iraq?

Hussein Omran, a researcher in strategic, political, and regional security affairs, highlighted the phenomenon of "exorbitant and rapid wealth accumulation" that has spread in Iraq In recent years, he described it as a product of the "shadow economy" and not the result of investment acumen or genuine entrepreneurship.

Imran noted in a post that I followed Alsumaria News until the scene The Iraqi has become It is teeming with figures "with no commercial or industrial history" who, in record time, became billionaires.

The researcher attributed this shift to two main, almost guaranteed paths to wealth beyond oversight:

TNT:

Tishwash: From "nothing" to billionaires... What are the secrets of the phenomenon of "exorbitant and rapid wealth" in Iraq?

Hussein Omran, a researcher in strategic, political, and regional security affairs, highlighted the phenomenon of "exorbitant and rapid wealth accumulation" that has spread in Iraq In recent years, he described it as a product of the "shadow economy" and not the result of investment acumen or genuine entrepreneurship.

Imran noted in a post that I followed Alsumaria News until the scene The Iraqi has become It is teeming with figures "with no commercial or industrial history" who, in record time, became billionaires.

The researcher attributed this shift to two main, almost guaranteed paths to wealth beyond oversight:

The first path: the dollar "machine" and currency platform: Imran argued that manipulating the price difference between the official and parallel markets, fictitious invoices, and transfers made through front companies and banks lacking genuine oversight, transformed the dollar into a means of exorbitant profit with no risk or added value to the economy, in addition to serving as a cover for money laundering operations.

The second path: oil smuggling and the regional shadow market: The researcher explained that regional crises, particularly those related to Iran, created a massive parallel oil market. He emphasized that Iraq It has become a "corridor and outlet" through complex land and sea routes, where oil is sold under various guises via a system that includes tankers, intermediaries, and formal and informal facilities, making "proximity to oil" the shortest path to wealth.

Imran warned of the disastrous consequences of this model , emphasizing that it neither builds a state nor creates jobs, but rather produces a "parasitic elite" linked to or protected by politics, which fights any attempt at reform because it threatens its source of profit.

Imran described this situation as "Collapse The "quiet" collapse, which doesn't happen with a resounding explosion, but rather seeps into the structure of society when an entire generation becomes convinced that "work and production" stupidity

The researcher concluded his presentation with a question that sparked widespread discussion: "Do you know anyone who had nothing and is now a billionaire?", highlighting the clarity of the phenomenon and the inability of natural economic logic to explain it. link

************

Tishwash: The Iraqi parliament publishes the agenda for Monday's session.

The Iraqi parliament is scheduled to hold its first session of its sixth term on Monday at 12 noon, which includes two items on its agenda.

The first paragraph includes: the swearing-in of the new members of the House of Representatives, and the other includes: the election of the Speaker of the House of Representatives and his two deputies, according to a statement issued by the Parliament’s Media Department.

In the past few days, the Shiite, Sunni, and Kurdish political forces and parties that won the elections have intensified their discussions in order to decide on the three top leadership positions: Speaker of Parliament, President of the Republic, and Prime Minister.

After the fall of Saddam Hussein’s regime in the spring of 2003 at the hands of American forces and their allies, the major political forces of the Shiites, Kurds, and Sunnis adopted a quota system in distributing positions for the three presidencies: the Prime Minister’s office, the Republic, and Parliament.

Last Saturday, the head of the Supreme Judicial Council, Faiq Zaidan, confirmed that the first session of the new House of Representatives, scheduled for December 29, 2025, must decide on the appointment of the Speaker of the House and his two deputies, and it is not constitutionally or legally permissible to postpone or extend it. link

************

Tishwash: "Threaten them with their money": Savaya receives advice on the weaknesses of Iraqi politicians

The Middle East Monitor website offered advice to the US Special Envoy to Iraq, Mark Savaya, that if he wants to succeed in his Iraqi mission and survive what the report called the "theater of illusions" represented by Baghdad, he should scrutinize who is making money.

After the London-based website pointed out that Savaya came to his position as a reward for his loyalty, and not through hardening his resolve through Middle Eastern events and calculations, it noted that he comes to the den of wolves armed with a smile and an outstretched hand, but his experience is shallow and his mandate is to dismantle the Popular Mobilization Forces and cut the strong bond of loyalty that connects Baghdad to Tehran, in order to pull Iraq back into the sunlight from the darkness of Iran.

The report, translated by Shafaq News Agency, said that Savaya will walk through a maze of deception, where every door in front of him is a trap. It added that the leaders he will deal with have overcome dictatorships, invasions, coups, sanctions, revolutions, and wars, and buried their enemies. They speak cunningly and will mislead him by drowning him in unimportant details. It noted that they are skilled at camouflage and that their civility is merely a sword covered in silk, and that he will have to identify the twin forces behind their actions in order to understand them.

The report continued, saying: “These are not patriots, but rather a coterie of greed. They do not worship ideology, but rather power. They do not cling to faith, but rather to wealth. They are not ministers and parliamentarians, but rather leaders of a league wearing government clothes. They lead militia groups, order kidnappings, and silence journalists.” It added that they “have been looting Iraq since 2003, and they feed on a wounded lion like hyenas.”

The report said that, like all criminals, they "made one major mistake: they left a financial trail."

The report explained that their wealth is not in Baghdad, but rather their money is hidden in vaults in Switzerland, in Iranian banks, in shell companies, in offshore accounts, and in real estate in Europe, North America, and within the United States, noting that the “Panama Papers” scandal contributed to lifting the veil and to the US Treasury’s Office of Foreign Assets Control tracking them.

The report urged Savaya to use the weapon of "the power of fear" against these people because they fear poverty and bankruptcy, not troops and bombs, if he wanted his mission to succeed.

The report outlined this proposed scenario, with the author addressing Savaya: “Sit before them, smile diplomatically, and present them with a document granting the United States government full legal authority to investigate, trace, and seize any asset, account, or investment in their names, the names of their children, or the names of those in their inner circle.”

He continued, “Tell them this document means nothing if they are truly innocent. Watch their hands tremble, watch their masks break, and those who are honest will sign. But the corrupt will stall, and they will erupt in anger at the sudden infringement upon their sovereignty over their ill-gotten gains.”

He added, "These men are not motivated by dignity or belief. It is the fear of losing everything they have stolen that motivates them."

The report stated that "money is only one of their weapons; their second weapon is deception. They are experts in smiles, hugs, and schemes. They are a group of promises and betrayals, and they practice dissimulation," noting that this does not represent theology or science, but rather "a sacred art of lying," and every handshake is worthless.

The report continued, saying, "They will obstruct him, and stifle him with delays until he gets tired and defeated," adding that "we must remember that the Iraqi tragedy did not arise only in a state of chaos, but rather in the collaboration between cynical foreigners and opportunistic Iraqis, and between external power and internal treachery."

The report argued that Savaya was not sent to deal with a democratic entity, but rather with a market where loyalty is a commodity, where alliances can be auctioned off, and where patriotism can be faked. It added that "if Savaya wants to dismantle the Popular Mobilization Forces, and if he wants to destroy Tehran's grip, then he must harness the one thing these men fear, which is money, not truth, not principles, not justice."

The report concluded by addressing Savaya, saying, "Follow the money. Seize it. Threaten, use it, and only then will they bow down. Only then will they surrender. Only then will the empire of thieves tremble." It continued, "Follow the money, and never stop until their world collapses."

Mot: scary 2026

Mot: Snow Daze!!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 12-28-25

Good Morning Dinar Recaps,

The Architecture of the New Global Financial System Is Already Visible

Gold-backed value, digital rails, and ISO-compliant assets form the backbone

Good Morning Dinar Recaps,

The Architecture of the New Global Financial System Is Already Visible

Gold-backed value, digital rails, and ISO-compliant assets form the backbone

Overview

Central banks are accelerating gold accumulation as neutral monetary collateral

The next system is shaping up as asset-backed, digital, and interoperable

ISO 20022 compliance has become the baseline requirement for participation

A limited group of digital assets are positioned for institutional use

Speed, finality, scalability, and compliance now outweigh ideology

Key Developments

Central banks have shifted from fiat expansion to reserve hardening

Gold is increasingly treated as balance-sheet insurance rather than a legacy asset

ISO 20022 messaging is live across major payment and settlement systems

BRICS introduced the Unit, a basket-backed settlement instrument for wholesale trade

Countries are preparing sovereign digital currencies backed by domestic assets

Interoperability between national systems is now the primary challenge

Special Focus: Key Watched Technologies and Assets

ISO 20022 Digital Assets

Only a small number of digital assets meet institutional requirements for messaging compatibility, regulatory oversight, and throughput. These assets are designed to function inside financial infrastructure, not outside it.

XRP as a Bridge Asset

XRP was designed to provide on-demand liquidity between currencies without requiring pre-funded accounts. Its ability to move value in seconds at negligible cost addresses the core inefficiencies of correspondent banking. Scalability, speed, and finality position XRP as connective infrastructure rather than a speculative store of value.

Bitcoin’s Structural Limitations

Bitcoin demonstrated that digital scarcity is possible, but it was not designed for modern settlement. Long confirmation times, high fees during congestion, and limited throughput restrict its usefulness for institutional-scale payments. Bitcoin functions as a speculative asset, not financial plumbing.

BRICS Unit and Multipolar Settlement

The BRICS Unit reflects a broader move toward collateral-backed settlement instruments that reduce reliance on any single national currency. It signals a shift from reserve dominance to asset-based trust.

Why It Matters

The global financial system is not collapsing — it is being rewired. Nations are preserving sovereignty while upgrading rails. Value is being anchored to assets, while movement of value is being digitized. This separation of what backs money from how money moves is the defining feature of the transition now underway.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the reset changes what determines credibility. Currencies tied to real assets, efficient settlement, and compliant infrastructure gain durability. Those dependent on debt expansion, slow rails, and political leverage face repricing risk. Watching infrastructure readiness now matters more than watching headlines.

Implications for the Global Reset

Pillar: Assets Back Value, Networks Move It

Gold and national resources anchor trust, while digital rails provide speed and scale.Pillar: Interoperability Over Dominance

The future system favors connection between currencies, not replacement of them.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – “ISO 20022 and the future of global payments”

World Gold Council – “Central banks and gold: reserve diversification trends”

~~~~~~~~~~

Silver vs Gold: Same Monetary Family, Very Different Market Mechanics

Why silver behaves like a leveraged monetary metal while gold anchors stability

Overview

Gold and silver both function as monetary metals, but their market structures differ sharply

Gold trades primarily as a reserve asset, while silver straddles monetary and industrial demand

Silver’s smaller market size makes it more sensitive to leverage and liquidity stress

Divergence between the two often signals shifts in risk, inflation expectations, and liquidity

Key Developments

Central banks overwhelmingly accumulate gold, not silver, for reserves

Silver demand is split between industrial use and investment, tightening supply cycles

Paper-to-physical ratios are significantly higher in silver markets

Silver inventories are thinner relative to annual demand

Gold markets are deeper and more liquid, reducing volatility

Silver reacts faster — and more violently — during leverage unwinds

Market Mechanics: Why They Behave Differently

Gold

Gold functions as a monetary anchor. Central banks hold it, sovereigns settle with it, and it carries minimal industrial dependency. Its futures and OTC markets are large and liquid, allowing stress to dissipate more slowly. Gold moves when confidence shifts — but rarely gaps without cause.

Silver

Silver behaves like a pressure valve. Its dual role creates constant tension between industrial consumption and monetary demand. Because the silver market is much smaller, leveraged positions dominate price discovery during stress. When liquidity tightens or physical supply is constrained, silver reprices rapidly.

Why It Matters

Silver often moves after gold signals a trend — but moves faster and farther once constraints appear. This is not speculation; it is structure. When markets begin repricing monetary risk, gold establishes credibility while silver exposes fragility. The relationship acts as an early warning system for leverage, inflation, and settlement stress.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the gold–silver relationship reveals confidence versus pressure. Gold reflects trust erosion in fiat systems, while silver reflects stress inside them. When silver outperforms sharply, it suggests leverage is unwinding and liquidity is thinning — conditions that often precede currency instability or repricing

Implications for the Global Reset

Pillar: Gold Anchors, Silver Signals

Gold stabilizes confidence; silver exposes structural strain.Pillar: Liquidity Determines Volatility

Smaller, leveraged markets reprice faster when systems are stressed.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

World Gold Council — “Gold Demand Trends and Central Bank Reserves”

Silver Institute — “World Silver Survey: Supply, Demand, and Market Structure”

~~~~~~~~~~

Ukraine Under Fire Ahead of Critical Zelenskiy–Trump Summit

Mass missile and drone strikes intensify pressure as peace talks approach

Overview

Russia launched a large-scale aerial assault on Kyiv and other regions

The attack came just ahead of a high-stakes meeting between President Zelenskiy and President Trump

Hundreds of drones and dozens of missiles targeted civilian and energy infrastructure

The timing signals an attempt to shape negotiations through escalation

Key Developments

Ukraine reported approximately 500 drones and 40 missiles launched overnight

Air raid alerts lasted nearly ten hours in Kyiv

At least one fatality and multiple injuries were confirmed, including children

Energy facilities were struck, leaving large portions of Kyiv without heat and power

Damage was reported across seven districts, including residential high-rises

Polish airspace disruptions triggered heightened regional military readiness

Peace discussions center on territorial control, security guarantees, and economic zones

A draft 20-point peace framework is nearing completion but remains unresolved

Why It Matters

This escalation underscores how military pressure is being used as leverage at the negotiating table. Energy infrastructure targeting highlights the weaponization of winter hardship, while the timing ahead of diplomatic talks suggests an effort to influence terms before concessions are finalized. The conflict remains a major destabilizing force for Europe and global markets.

Why It Matters to Foreign Currency Holders

For foreign currency holders, renewed escalation increases geopolitical risk premiums across Europe. Energy disruption, reconstruction costs, and prolonged uncertainty strain fiscal balances and influence currency valuation. Wars that drag into negotiation phases often trigger currency realignment, reserve shifts, and debt restructuring, all critical signals for those watching the global reset.

Implications for the Global Reset

Pillar: War Accelerates Financial Fragmentation

Prolonged conflict deepens the divide between geopolitical blocs and settlement systems.Pillar: Energy Security Equals Currency Stability

Targeted infrastructure attacks directly impact inflation, sovereign budgets, and monetary credibility.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Russia launches massive air attack on Kyiv ahead of Zelenskiy-Trump talks”

Modern Diplomacy — “Ukraine Under Fire Ahead of Critical Zelenskiy-Trump Summit”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Morning 12-28-25

Idle Wealth, Not Imminent Bankruptcy: A Financial Expert Refutes 2030 Scenarios And Reveals To Iraq Observer The Strengths Of The Iraqi Economy.

December 20, 2025 Baghdad/Iraq Observer Parliamentary warnings that Iraq could face total bankruptcy by 2030 if current spending mechanisms continue have sparked a wave of controversy in economic circles, amid questions about the true state of the country’s finances and its actual ability to overcome upcoming challenges

Idle Wealth, Not Imminent Bankruptcy: A Financial Expert Refutes 2030 Scenarios And Reveals To Iraq Observer The Strengths Of The Iraqi Economy.

December 20, 2025 Baghdad/Iraq Observer Parliamentary warnings that Iraq could face total bankruptcy by 2030 if current spending mechanisms continue have sparked a wave of controversy in economic circles, amid questions about the true state of the country’s finances and its actual ability to overcome upcoming challenges.

In response to these statements, Mustafa Hantoush, who is concerned with financial and banking affairs, confirmed that Iraq is considered one of the very rich countries, stressing that talk of bankruptcy is not based on realistic data as much as it is related to financial mismanagement.

Hantoush explained to Iraq Observer that “the Iraqi government, as a central government, owns more than two-thirds of the country’s land, in addition to factories, plants, and extensive real estate assets owned by the state, as well as long-term contracts with millions of citizens, which constitutes a large economic base that has not yet been optimally invested.”

He added that “Iraq does not rely solely on its visible resources, but also possesses enormous underground wealth, including oil, gas, and rare minerals,” stressing that “these capabilities make the country a nation capable of rapid recovery if it has an efficient financial administration that invests revenues correctly and seriously combats corruption.

” Hantoush pointed out that “economic studies confirm that Iraq, which has an area of about 430,000 square kilometers, has a high percentage of land suitable for development, as about 80% of its area is usable, while only about 8% of it has been invested in the fields of housing, agriculture and industry, which opens the door to broad development opportunities.”

According to experts, these data reflect that the real challenge facing Iraq does not lie in the scarcity of resources or the risk of bankruptcy, but rather in how to manage and invest wealth, in a way that transforms great potential into development projects that guarantee a decent life and economic stability for future generations.

https://observeriraq.net/ثروات-معطلة-لا-إفلاس-وشيك-خبير-مالي-يف/

The Numbers Don't Lie: $340,000 Is The Share Of Every Iraqi In The Wealth Among The Resource Giants... Where Is It?

Baghdad Today – Baghdad Visual Capitalist's global ranking of countries with the most natural resources,

based on per capita wealth, places Iraq sixth on the list of "resource giants."

According to the data, Iraq's per capita wealth is approximately $340,000,with an estimated value of its natural resources at around $16 trillion, and a population of approximately 47 million.

[https://baghdadtoday.news/uploads/posts/2025-12/medium/3b56f0accf_111.jpg]

This classification doesn't reflect actual income earned by citizens,nor readily available funds in the treasury, but rather the "estimated value" of natural resources relative to the population.

In other words, it measures the potential of the country: its underground and above-ground wealth, and how each individual's share would appear if this value were theoretically distributed among the population.

Therefore, a high figure can simultaneously be an "economic promise" and a "painful question": why doesn't this abundance translate into a more stable life, stronger services, and wider job opportunities?

In the rankings,

Saudi Arabia topped the list with an individual share of nearly $984,000, followed by

Canada with $822,000, then

Australia with $727,000.

Russia came in fourth,

Venezuela fifth,

Iraq sixth,

Iran seventh, the

United States eighth,

Brazil ninth, and

China tenth.

The point here is that Iraq, relative to its population, is among a group of countries with very large "natural resources,"so much so that a difference of one or two places in this type of ranking is usually linked to two crucial variables: the size of the estimated resources and the size of the population.

But transforming “resource wealth” into “societal wealth” doesn’t happen automatically.

The difference between a resource-rich country and a truly wealthy one is made by management, governance, and the ability to build an economy that operates outside of price fluctuations.

Natural wealth may provide a state with financing capacity, but it alone does not guarantee sustainable development if revenues remain dependent on a single commodity, or if returns are eroded by waste, poor planning, and sluggish productive investment.

This is why Iraq appears in such tables as a country with great potential, while the most important question remains internal: how much of this potential is being channeled into infrastructure, industry, agriculture, education, healthcare, and job creation?

While the ranking highlights the “individual share” as a shocking indicator, a more realistic interpretation comes from a different angle:

Iraq possesses a resource base that offers a rare opportunity to restructure its economy if it is treated as a lever for building non-rentier sectors, rather than as a permanent guarantee. In other words,

the message conveyed by the figure is not so much boasting as it is a warning: possessing wealth is not enough, because what matters most is “how it is managed” and how it is transformed from perceived value into real production, and from quick profits into long-term assets.

For the average citizen, the meaning of this ranking is simple and straightforward:

a country that appears in this position theoretically possesses the capacity to finance major projects, improve services, and create jobs if revenues are channeled along a clear path, and to build financial resilience that can absorb market shocks when prices fall.

Conversely, a persistent gap between the "value of resources" and the "reality of living" means that wealth remains in the realm of potential, and the economy remains vulnerable to external fluctuations, no matter how impressive the figures may appear on paper. In conclusion,

Iraq’s ranking in this global classification reopens an old question in a new form:

When a country is in the club of “resource giants,” why does the social return seem less than the numbers suggest?

The answer is not in the resources themselves, but in the path that transforms them from raw wealth into a state capable of investment, and from short-term returns to development that is measured by what people experience daily. https://baghdadtoday.news/288949-340.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

MilitiaMan and Crew: IQD News Update-Imminent Exchange Rate Integration

MilitiaMan and Crew: IQD News Update-Imminent Exchange Rate Integration

12-27-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Imminent Exchange Rate Integration

12-27-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….12-27-25…..PRICES CHANGING

KTFA

Saturday Night Video

FRANK26….12-27-25…..PRICES CHANGING

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Saturday Night Video

FRANK26….12-27-25…..PRICES CHANGING

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#