Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Banking Announcement:

"HKEX Confirms Decision to Allow Issuers to Hold Treasury Shares. Allowing Hong Kong-incorporated issuers to hold treasury shares will give them 'greater flexibility in managing their capital structure.'"

These changes will take effect on June 11th, 2024. It will give Hong Kong companies more control over their capital.

During down times for their company, this will enable them to have an asset that will neutralize some of the capital flows needed during times of great economical challenges such as the one going on now.

© Goldilocks

Goldilocks' Comments and Global Economic News Wednesday Evening 4-17-24

Good Evening Dinar Recaps,

Banking Announcement:

"HKEX Confirms Decision to Allow Issuers to Hold Treasury Shares. Allowing Hong Kong-incorporated issuers to hold treasury shares will give them 'greater flexibility in managing their capital structure.'"

These changes will take effect on June 11th, 2024. It will give Hong Kong companies more control over their capital.

During down times for their company, this will enable them to have an asset that will neutralize some of the capital flows needed during times of great economical challenges such as the one going on now. Morgan Lewis

© Goldilocks

~~~~~~~~~

The tokenization and expansion of tokenized assets is well underway. Currently, we are seeing the expansion of Regulations on a Global scale. Along with this movement, payment structures and laws are being established for them.

Support mechanisms are being added two companies and various other institutions that will increase the net worth of companies going forward through Government issuance of assets backed by gold.

The new QFS is unlike any Financial System we have had before. This one is more comprehensive and inclusive of support mechanisms used by Governments to help sustain our economies during a crisis.

Of course, the backing of gold will supply the needed support going forward for the execution of this new set of Quantum Financial Technologies.

Perhaps, this is the reason why Governments are buying so much gold, and the certainty of a bull market in Commodities such as gold have never been more needed than it is now.

We are simply at the beginning stages of a bull run in gold, gold is a World Reserve Asset that is recognized by all countries. And, the need for it in use case scenarios appears to have no end. Gold Avenue

"All roads lead to gold, and digital gold will set us free."

© Goldilocks

~~~~~~~~~

Government Announcement:

"Top U.S. House Lawmakers Meet on Stablecoin Bill"

The House Financial Services Committee are currently meeting on what the next steps are going to be for pushing the legislative process forward on Stablecoins.

The Stablecoins will enable the world to pay for tokenized assets through digital mechanisms going forward.

There is an urgency to push these bills forward. Once MICA is complete at the end of May, countries around the world will have a working regulation process to finish their own testing of protocols and interface them on the Quantum Financial System.

At that point, we will witness the transition of our Global Economy transition into a Digital Financial System. This will reset many of the price actions on the markets and their correlating protocols with the banks. It will include all sectors of the market. Youtube Coindesk

© Goldilocks

~~~~~~~~~

Markup of H.R. 5535, H.R. 802, H.R. 7437, H.R. 7440, H.R. 7428, H.R. 4206, H.R. 4116. | Youtube

~~~~~~~~~

"There’s no plan for one massive ledger. Instead, there will be multiple unified ledgers. Tokenization reduces the need for messaging, cutting transaction delays, costs and reconciliations. By using smart contracts, programmability can enable automation, transforming the role of intermediaries to governance."

What is the concept of unified ledger?

"A Unified ledger brings together central bank digital currencies (CBDC), tokenized deposits, and tokenized assets onto common platforms." Ledger Insights

~~~~~~~~~

UK Finance announced that the Regulated Liability Network (RLN) has entered a new phase of experimental trials in the UK. The RLN aims to create a common ‘platform for innovation’ including tokenized deposits (https://www.ledgerinsights.com/tokenized-deposits/) alongside conventional deposits using a shared ledger. All of the largest British banks are participating: Barclays, Citi, HSBC, Lloyds, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money as well as card firms Mastercard and Visa. Ledger Insights

~~~~~~~~~

World Economic Forum Announcement:

Today the World Economic Forum published a report on wholesale central bank digital currencies (wCBDC). The paper briefly summarizes many of the wCBDC initiatives and hones in on top level use cases and how a wholesale CBDC could address long standing industry challenges. Ledger Insights

~~~~~~~~~

Transcript of Global Financial Stability Report April 2024 Press Briefing | IMF

~~~~~~~~~

BRICS Announcement:

“More than 40 states are applying for membership in BRICS. And every month the number of such countries increases. This indicates that such a free, flexible form of interaction within the BRICS is very attractive ,” the politician said. | TV Brics

~~~~~~~~~

PayPal's Stablecoin For Cross-Border Payments Is Big News | Payments Journal

~~~~~~~~~

The Powerful AI Shaping the World: Meet Aladdin | Thinkpol News

~~~~~~~~~

Liquidity from global equity markets fuelling fresh investment in gold | Siasat Daily

~~~~~~~~~

~~~~~~~~~

“We expect the market to consolidate prior to the halving and then expect the overall bull markets to continue,” they added. Bitcoin halvings are programmed to occur automatically every 210,000 blocks — roughly every four years. Mar 19, 2024 | The Block

~~~~~~~~~

"Bundesbank partners MIT for CBDC privacy research." | Ledger Insights

👆 More on this tomorrow...

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Good Evening Dinar Recaps,

Yesterday, Hong Kong regulators adopted both spot Bitcoin ETF and spot Ether ETF. In 2021, mainland China and cryptocurrency trading was banned. Since that time, China has been working diligently to regulate this industry.

And now, China's largest family is in process of funding the above projects. "ChinaAMC, Harvest Global and Bosera International are among those that have been given the green light to issue ETFs."

China AMC is the first Exchange Traded Fund manager in China, and they are the investment manager of the Asian Bond Fund China Fund.

ETFs track a specific set of index assets allowing you to invest in many Assets in that particular sector. ETFs allow you to invest in a grouping of companies and digitize them in a group fund.

This process allows sectors of the market to be joined together in a single asset group class bringing the new digital economy inside the marketplace.

Goldilocks' Comments and Global Economic News Tuesday Evening 4-16-24

Good Evening Dinar Recaps,

Yesterday, Hong Kong regulators adopted both spot Bitcoin ETF and spot Ether ETF. In 2021, mainland China and cryptocurrency trading was banned. Since that time, China has been working diligently to regulate this industry.

And now, China's largest family is in process of funding the above projects. "ChinaAMC, Harvest Global and Bosera International are among those that have been given the green light to issue ETFs."

China AMC is the first Exchange Traded Fund manager in China, and they are the investment manager of the Asian Bond Fund China Fund.

ETFs track a specific set of index assets allowing you to invest in many Assets in that particular sector. ETFs allow you to invest in a grouping of companies and digitize them in a group fund.

This process allows sectors of the market to be joined together in a single asset group class bringing the new digital economy inside the marketplace.

Inside a Global Market, this allows Trading to take place between our Eastern countries and Western countries at the push of a button in a matter of seconds.

The Clearing House Interbank Payments System (CHIPS) is now ISO 20022 compliant allowing this Global messaging system to clarify trades between the East and the West going forward.

For large banking transactions in the US, CHIPS is the most used for trades in cross-border International trading.

This is why the Markets in Crypto Assets regulatory process ending by the end of May is so important. MICA will become the standard by which many countries formulate their own regulatory process in trade.

Ripple and the SEC are currently involved in final negotiations. It is expected that they will come up with an agreement to settle this week.

Ripple would allow settlement of trades to take place within seconds between the East and West through their Network.

So much is coming together at once. It is important that we put the pieces together to see how close we are to the ability to transact on the new QFS. Nothing can happen until all moving parts are working together.

Ripple has agreed to implement a new Stablecoin that represents the US dollar. This coordinated effort will allow Global trading systems to fulfill payment transactions through the XRP settlement coin within seconds.

The SEC has put Ripple through rigorous scrutiny for the last few years. It is basically a coin that has gone through the regulatory process already and awaiting it's approval to move forward on the International stage.

Stablecoin laws are already on the table in Congress to clarify new protocols inside the new digital asset based trading system. As we witness all of these coordinated efforts move into their implementation stage, it is important for us to recognize and acknowledge the work that has been done globally for the last decade or so to make this possible.

For the last 3 years, this room has witnessed our new QFS being built from the ground up. Our baby has grown up and getting ready to move out into the world. CNBC Esma Europa Investopedia Sortly Linkedin Wikipedia

© Goldilocks

~~~~~~~~~

Currently, our markets are moving into what is called a reflation trade. This happens when price actions begin to reflect more correlations with inflation prices than true fundamentals.

This is why we're having to realign or reset our markets along with banking system to synchronize our new Quantum Financial System with authentic values only Gold can provide.

When our new tokenized assets begin to reflect values based on gold prices, it will move our markets into authentic price actions going forward. Barons

© Goldilocks

~~~~~~~~~

During Iraq's visit to the US, they talked about a comprehensive economic relationship. In essence, this is a free trade agreement.

A free trade agreement is cooperation between two countries that develops trade relations and investment opportunities on an International level.

Trade deals increase imports and exports between two countries. This has the ability to bring into line exchange rates accomplishing less risk on both parties normalizing their trade exchanges between each other.

In other words, a free trade agreement with Iraq would bring an equilibrium of exchange rates between our countries allowing this trade relationship to move our currencies into a real value between us. Youtube Carlson School Trade Small Business Investopedia Wikipedia

WATCH THE WATER.

© Goldilocks

~~~~~~~~~

Next Bitcoin Halving 2024 Date & Countdown [BTC Clock]

~~~~~~~~~

Ripple Vs. SEC Update: Expert Says Both Parties Have Reached A Settlement Agreement | Bitcoinist

~~~~~~~~~

Iraq maintains its 30th rank with the largest gold reserves - Iraqi News

~~~~~~~~~

~~~~~~~~~

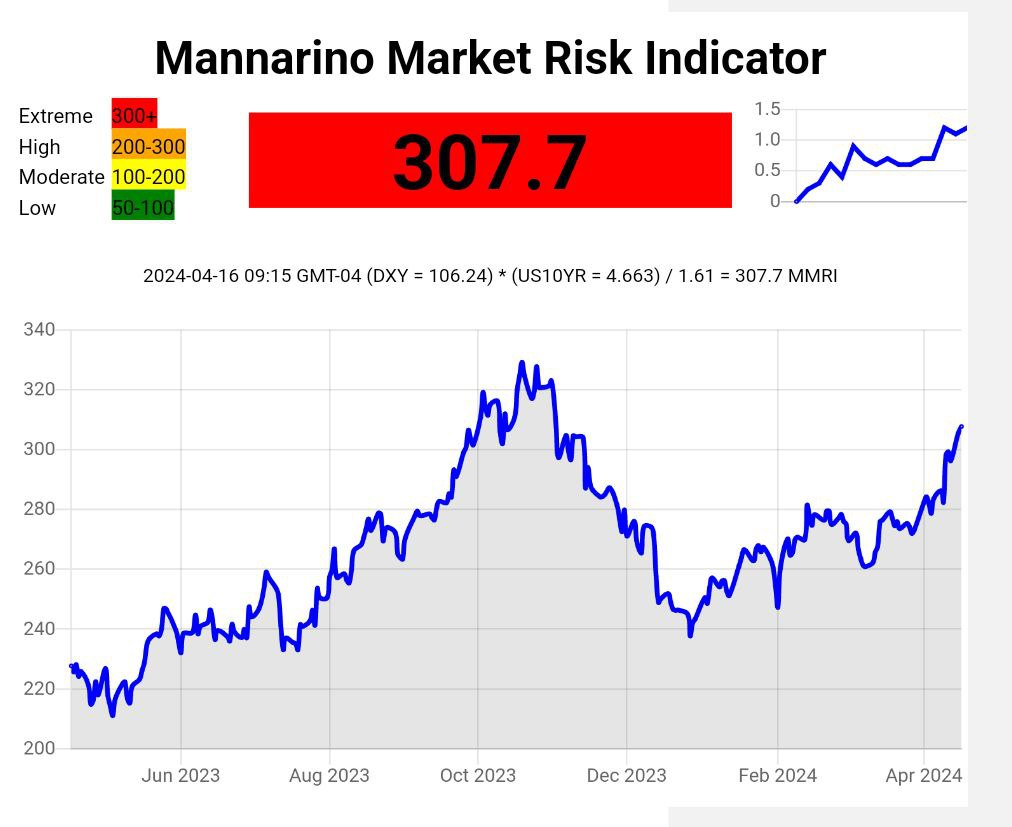

👆 If risk in this market is not contained, we are going to see a meltdown. Thus, the reason why I shared with you the next 3 to 5 weeks will be a challenge for the market in finding new price patterns.

It is important to not get so fixated on what's going on with the market except for the debt sectors of the market. The real action is going on behind the scenes, and we cover that each day.

~~~~~~~~~

What Is Bitcoin Halving?

The Bitcoin Halving is when Bitcoin's mining reward is split in half. It takes the blockchain network about four years to open 210,000 more blocks, a standard set by the blockchain's creators to continuously reduce the rate at which the cryptocurrency is introduced.

The first reward was 50 bitcoin. Previous halving dates were:

Nov. 28, 2012, to 25 bitcoins

July 9, 2016, to 12.5 bitcoins

May 11, 2020, to 6.25 bitcoins

The next halving is expected to occur in April 2024, when the block reward will fall to 3.125 BTC.

As of March 2024, about 19.65 million bitcoins were in circulation, leaving just around 1.35 million to be released via mining rewards. Investopedia

~~~~~~~~~

RIPPLE XRP EU & U.K. ARE GETTING READY⚠️🚨XRP HOLDERS WILL GET RICH | Youtube

~~~~~~~~~

You Won’t Believe What Nostradamus Predicted For 2024! | Youtube

~~~~~~~~~

The US Commitment to Iraq is Revealed Iraqi PM Visits the White House | Youtube

~~~~~~~~~

Hearing Entitled: Agency Audit: Reviewing CFPB Financial Reporting & Transparency | Youtube

~~~~~~~~~

Ripple Proposes Native Lending Protocol to Expand XRP Earning Opportunities - Times Tabloid - Latest Cryptocurrency News, Bitcoin (BTC) News, Ethereum (ETH) News, Shiba Inu (SHIB) News, Ripple's XRP News | Times Tabloid

~~~~~~~~~

RIPPLE XRP | BIS JUST ANNOUNCED THE NEW SYSTEM | PAY ATTENTION | Youtube

~~~~~~~~~

BIS Announcement of the new Financial System:

"Finternet: The BIS vision that underpins the Unified Ledger tokenization push" Ledger Insights

👆 more on this tomorrow...

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 4-15-24

Goldilocks' Comments and Global Economic News Monday Evening 4-15-24

Good Evening Dinar Recaps,

Bureau of Land Management Announcement:

The Bureau of Land Management insures that fair taxpayer return and accountability for oil and gas operations are adhered to on public lands.

The BLM entered their proposal into a final rule. This final rule goes into the Federal Register and cannot be implemented no sooner than 30 days from its publication.

The Final Rule is as follows...

* The Fluid Mineral Leases and Leasing Process rule.

"This rule reinforces the BLM’s leadership role in energy development by:

1 ensuring responsible leasing and diligent development to minimize conflicts with other resources while ensuring the BLM can continue to manage public lands for multiple uses;

2 implementing key fiscal reforms, including updating royalty rates, rental rates, and minimum bids on BLM-managed public lands; and

3 modernizing bonding requirements for leasing, development, and production to ensure taxpayers do not bear the cost of orphaned wells on public lands."

Goldilocks' Comments and Global Economic News Monday Evening 4-15-24

Good Evening Dinar Recaps,

Bureau of Land Management Announcement:

The Bureau of Land Management insures that fair taxpayer return and accountability for oil and gas operations are adhered to on public lands.

The BLM entered their proposal into a final rule. This final rule goes into the Federal Register and cannot be implemented no sooner than 30 days from its publication.

The Final Rule is as follows...

* The Fluid Mineral Leases and Leasing Process rule.

"This rule reinforces the BLM’s leadership role in energy development by:

1 ensuring responsible leasing and diligent development to minimize conflicts with other resources while ensuring the BLM can continue to manage public lands for multiple uses;

2 implementing key fiscal reforms, including updating royalty rates, rental rates, and minimum bids on BLM-managed public lands; and

3 modernizing bonding requirements for leasing, development, and production to ensure taxpayers do not bear the cost of orphaned wells on public lands."

As we transition into a cleaner environment, this set of rules has reached its final protocols in the oil and gas sector of our markets. It gives us a pathway forward in one of the largest sectors of our Market that needed to be transitioned on a Global scale.

Now, these updated guidelines on the infrastructure of oil and gas will allow Congress to enact new laws to guide future behavioral guidelines to ensure a cleaner environment going forward. BLM 1 BLM 2

© Goldilocks

~~~~~~~~~

Ripple Stablecoin Announcement: Ripple is launching a dollar-backed stablecoin.

Although we do not have a formal announcement just yet, Ripple's new stablecoin is in process of being regulated through the European's MICA regulatory process.

It is in process of being reviewed through the SEC and CFTC as we speak. This new Stablecoin will have the full backing of the US Treasury and other asset support in the US.

The ability to use this bridge asset in cross border international trading will allow the Stablecoin's representation of the US dollar to be put on a Level Playing Field with other countries in Global Trade. It will allow us to remain in Global Trade without having to sign over our Sovereignty to other nations to do our bidding for us. Coin Telegraph

This new Ripple Stablecoin will be backed by specifically:

* U.S. DOLLAR DEPOSITS

* SHORT-TERM U.S. TREASURIES

* OTHER CASH EQUIVALENTS

© Goldilocks

👆 I guess having to sign the BRICS Nations treaty will no longer be necessary for us. 😉

~~~~~~~~~

The conflict in the Middle East is expected to crash the crude oil Market in the Strait of Hormuz.

I like to think of a crash as moving into real values as shifts in our Global Economy are currently taking place especially in the energy sector of our Market.

You can expect volatility in the next 3 to 5 weeks and with the oil markets. The Middle East is beginning to utilize their own currencies instead of the Petro Dollar in Trade making the dollar lower in its value as oil prices rise to their new values based upon new Global Trade relations within local currency support mechanisms.

This shift is taking place as new laws are going into effect in our own oil markets here in the United States. It is why the movement into electronic cars, uranium, and other resources are so important to develop.

The Oil Market is a massive transition point for the Global Economy. These events not only affects the price of the dollar, but it will begin to affect the prices on many of the currencies people hold going forward.

As our markets move into real values these next three to five weeks, we are expecting a shift in Global patterns regarding our virtual assets at the same time.

When we reach June, the US Federal Reserve Board is expected to lower interest rates raising the value of our gold and tokenized assets, along with stablecoins, backed by gold support mechanisms for the new digital economy. CNBC Linkedin Youtube

Can you see this synchronicity in all of this yet? Many resets are taking place all at once.

© Goldilocks

~~~~~~~~~

The Real Estate and Commercial Markets are currently going through a major reset.

These assets are being Tokenized by Gold making them no longer a liability, but an asset that would otherwise account for a downfall in commercial Real Estate prices.

They will go to a real value, but it will be based upon new price measurements under Gold Standard Protocols. Chain Link N26

© Goldilocks

~~~~~~~~~

👆The effects of Evergrande, on the Global Markets, may have just found it's saving grace.

~~~~~~~~~

Breaking News:

Hong Kong Bitcoin ETF and Ethereum ETF has just been approved.

© Goldilocks

~~~~~~~~~

With all of the Middle Eastern tensions taking place at the current time.

What do you think would happen if these countries were to buy their own bonds instead of US bonds?

You do the math.

© Goldilocks

~~~~~~~~~

What happens if Ripple becomes its own bank as a bridge asset?

What if this currency becomes part of the Special Drawing Rights basket of currencies with the IMF?

Can you say World Reserve Cryptocurrency! IMF Investopedia

© Goldilocks

~~~~~~~~~

Breaking News:

Hong Kong Bitcoin ETF and Ethereum ETF has just been approved. CNBC

© Goldilocks

~~~~~~~~~

~~~~~~~~~

The 'opportunity of a lifetime' may unfold for gold and silver this week, - MarketWatch

~~~~~~~~~

US CFTC unveils plan to treat ag swaps like others | Reuters

~~~~~~~~~

LONDON (Reuters) - Developing national digital currencies are at risk due to a lack of legal powers to issue them in most of the world, the head of the global central bank umbrella body, the Bank for International Settlements, warned on Wednesday.

While countries generally have laws on banknotes, coins and credit balances, an IMF paper in 2020 showed that close to 80% of central banks are either not allowed to issue a digital currency under their existing laws, or the legal framework is unclear. Finance Yahoo

~~~~~~~~~

Federal Reserve Vice Chair Lael Brainard issued a reality check on those awaiting a digital dollar, saying that creating a central bank digital currency (CBDC) in the U.S. would likely take as long as five years. Finance Yahoo

~~~~~~~~~

According to the latest data from the U.S. Commodity Futures Trading Commission (CFTC), the speculative net positions in the silver market have increased to 53.2K.

This marks a slight uptick from the previous reported figure of 53.1K, indicating a growing interest in silver among market participants.The CFTC’s report provides valuable insights into the market sentiment and positioning of investors in the silver market.

With the recent increase in speculative net positions, it suggests a positive outlook on silver prices among traders.Investors and analysts closely monitor these reports to gauge market sentiment and make informed decisions on their trading strategies.

The data was last updated on 12 April 2024, providing a snapshot of the current market dynamics in the silver sector.The material has been provided by InstaForex Company InstaForex

~~~~~~~~~

BREAKING NEWS Iraqi PM in Washington DC 2 | Youtube

~~~~~~~~~

Zimbabwe's New Currency Update Rate 13.56 GiZ to $1.00 | Youtube

~~~~~~~~~

Dee and I are in the process of setting up a meeting with our CBI Banker contact, who now has leadership ties to the Foreign Remittance Department in Iraq, on changes taking place inside their gold market. Gold is rising in Iraq.

© Goldilocks

☝️MESSAGE FROM FREEDOM FIGHTER ON THIS ANNOUNCEMENT

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 4-14-24

Goldilocks' Comments and Global Economic News Sunday Evening 4-14-24

Good evening Dinar Recaps,

Yesterday – Isreal 2 m ago 15:32 Shortly before news that Iran had started firing drones at Israel, a short video speech by Benjamin Netanyahu was posted on his X handle. There, the prime minister said Israel had been preparing for years for a possible direct attack by Iran and its defense systems were deployed and prepare for any scenario. Here’s a link to that video and the official translation that accompanied it.

~~~~~~~~~

Yesterday – Isreal Israel war updates: Iran launches drones at Israel as tensions soar. Iranian forces seize ship with ties to Israel in Strait of Hormuz amid escalating tension. |

~~~~~~~~~

BREAKING: Iran Launches Strikes On Israel (Brace For Surging Oil!) |

~~~~~~~~~

Goldilocks' Comments and Global Economic News Sunday Evening 4-14-24

Good evening Dinar Recaps,

Yesterday – Isreal 2 m ago 15:32 Shortly before news that Iran had started firing drones at Israel, a short video speech by Benjamin Netanyahu was posted on his X handle. There, the prime minister said Israel had been preparing for years for a possible direct attack by Iran and its defense systems were deployed and prepare for any scenario. Here’s a link to that video and the official translation that accompanied it. Bloomberg

~~~~~~~~~

Yesterday – Isreal Israel war updates: Iran launches drones at Israel as tensions soar. Iranian forces seize ship with ties to Israel in Strait of Hormuz amid escalating tension. | USA Today

~~~~~~~~~

BREAKING: Iran Launches Strikes On Israel (Brace For Surging Oil!) | Youtube

~~~~~~~~~

Thus, nations that are actively at war experience a higher level of currency volatility compared to those not engaged in conflict. How global events affect the forex market. | Investopedia

~~~~~~~~~

You have heard me say it before. Currency values have been known to change during wartime throughout history. Is history about to repeat itself? We are about to find out.

© Goldilocks

~~~~~~~~~

Gold & silver breaking out! | Youtube

~~~~~~~~~

"Focused on economic reforms. Sudanese: The goal of our visit to Washington is to activate the strategic framework agreement" | Search 4 Dinar | US Embassy

~~~~~~~~~

"'China is about to start bidding' — Will Hong Kong Bitcoin ETFs spark the halving rally?"

The approval of Hong Kong's spot Bitcoin ETF this week is expected to be a catalyst for Bitcoin adoption and a huge driver of Bitcoin's price going forward.

This week is the Bitcoin halving. It will cut the supply of this cryptocurrency in half creating a scarcity effect making this asset "Digital Gold."

When the price of Bitcoin goes up, it is long been known that the rest of the cryptocurrencies on the market begin to rise along with it.

Hong Kong is expected to approve both Bitcoin ETF and Ether ETF on April 15th, 2024. This is tomorrow.

The ability to move money from the East to the West digitally at prices raising to their real values backed by gold and other commodities inside these tokenized assets is about to change the business world forever.

This is a historical event of unlimited magnitudes making its way into our banking system and trading system. It will change the way we do business and our way of living in countless ways.

The transition of our new Financial System in terms of International status and ability to move money is about to make history.

From Wall Street to the Shanghai Exchange, the new Digital Asset Based Trading System is creating a foundation for a new digital economy. Coin Telegraph CNBC

Buckle up, the plane in the world of Global Digital Financing is about to take off.

"All roads lead to gold, and "digital gold" will set us free."

© Goldilocks

~~~~~~~~~

"Shanghai exchange sets trading limits on gold, copper futures as prices rally"

This past week, there was a huge rally in Gold and Copper. It was so great that limits had to be applied on its growth potential in the Future's Market.

Also, limits were placed on the Oil Market as well during this process. The Energy Transition is expected to be volatile, and trading limits such as these are temporarily applied to keep speculators from taking advantage of spot prices that can influence the price on the movement in these assets slowing the process down.

This tells us that the Banking, Markets, and Commodity sectors of the Market are preparing for our Energy Transition with actual steps showing us their intention for its fulfillment.

These new critical measures will create new paths and new price pressures on the Commodity Markets. Their price controls will enable a reset in the Bull run of our Metal Markets to take place efficiently and effectively.

This is a good indicator that our transition from the Stock Market to the Commodity Market is about to commence. Economic Times

"All roads lead to gold, and 'digital gold' will set us free."

© Goldilocks

~~~~~~~~~

There are three sectors of the Market I have been watching on the US Debt Clock: oil, gold, and silver.

The "oil to solar" power has been filled in at this time. You just can't make these coincidences up. US Debt Clock

© Goldilocks

~~~~~~~~~

~~~~~~~~~

The current growth wave can be broken down into two drivers. The first is the demand for Bitcoin and Ethereum. | FX Empire

~~~~~~~~~

Ripple vs SEC: Parties File Joint Sealing Proposal | CNN

~~~~~~~~~

Commercial Real Estate loans amount to about $5 trillion. Not all CRE sectors are in trouble. At one end of the spectrum: Industrial is still in good shape. At the other end of the spectrum: office is in terrible shape. Somewhere in the middle: There have been some big defaults in multifamily, but the sector is in much better shape than office. | WolfStreet

~~~~~~~~~

~~~~~~~~~

MARKETS A LOOK AHEAD: NOW... EXPECT A DIRECT "ATTACK" (FF) ON THE US. Mannarino | Youtube

~~~~~~~~~

We have a number of potential catalysts this week to shake up the markets.

© Goldilocks

~~~~~~~~~

The Central Bank of Iraq decided to approve a request to extend the deadline for receiving requests from brokerage companies to buy and sell foreign currencies of category ( C ) through the merger. | CBI

~~~~~~~~~

From Gold or Copper, Commodities Are 'Best Play' Amid Huge Gains | Business Insider

~~~~~~~~~

Amazon Pay plans to offer credit on UPI | Financial Express

~~~~~~~~~

America’s Bonds Are Getting Harder to Sell - WSJ

~~~~~~~~~

Zimbabwe new currency faces odds amid economic woes - The East African

~~~~~~~~~

US consumer sentiment declines in April, inflation expectations rise | Business Standard

~~~~~~~~~

The London Metal Exchange banned deliveries of any Russian supplies of aluminum, copper and nickel.

Many are underestimating the implications of this.

Russia represents:

- 6% of global nickel supply

- 5% of aluminum

- 4% of copper

The metals world is changing.

Read: https://x.com/goldtelegraph_/status/1779592521011839080?s=46

~~~~~~~~~

Russia holds the second largest mine gold reserves worldwide. | Statista

~~~~~~~~~

It Happens In 5 days... | Youtube

~~~~~~~~~

Anyone who does not believe that cryptocurrency has anything to do with the new Digital Banking System is in the Dark Ages.

After next week, we are going to see massive adoption of Bitcoin ETF and Ethereum ETF beyond just the United States of America Markets.

The new drivers of the new economy are Bitcoin and Ethereum at this point, this does not mean they will hold that position over time. It just means they are the first movers.

The liquidity that is about to come in the cryptocurrency market through this Bitcoin halving cannot be understated.

We are witnessing our bridge into the new Digital Banking System. As I have stated before, this is the first RV we are currently and still moving into at this point. This is Phase 1.

Phase 2 will encompass many changes to the Gold and Silver Markets going forward that will support and back our second RV. Our paper currency.

Credit Valuation Adjustments will be taking place on every level of our new Financial System going forward.

Remember, the new Financial system has many layers to it. Each layer stacks one on top of the other to support each other. The moment of truth is here. As one Financial System falls, the building blocks to the new Digital Economy are about to be tested.

This Bitcoin halving will make this asset scarce. The week ahead of us will have many volatile moments in digital assets ending in the culminating event of a halving for Bitcoin. You will hear many people refer to this week's events of turning our Digital Economy into Digital Gold.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Friday Evening 4-12-24

Goldilocks' Comments and Global Economic News Friday Evening 4-12-24

Good evening Dinar Recaps,

Reserve Bank of India Announcement:

India's recent rollout of their Unified Payments Interface (UPI) service this year has been revealing some gaps in their Forex Market.

To fix this issue, a new rule was placed on the Indian Rupee causing concerns through speculators on the price of its value. And,

The RBI is working on:

* Unauthorised FX platforms

* Inadequate price transparency

* Access to government securities

* Encouraging more global participation by Indian players.

The Reserve Bank of India is in process of reforms that will help bridge some of these gaps in the Retail Market. Several countries around the world utilize the service in foreign currency exchange, and the revamping of their service will help it move more smoothly with more accuracy. Inc42 Livemint

© Goldilocks

~~~~~~~~~

Goldilocks' Comments and Global Economic News Friday Evening 4-12-24

Good evening Dinar Recaps,

Reserve Bank of India Announcement:

India's recent rollout of their Unified Payments Interface (UPI) service this year has been revealing some gaps in their Forex Market.

To fix this issue, a new rule was placed on the Indian Rupee causing concerns through speculators on the price of its value. And,

The RBI is working on:

* Unauthorised FX platforms

* Inadequate price transparency

* Access to government securities

* Encouraging more global participation by Indian players.

The Reserve Bank of India is in process of reforms that will help bridge some of these gaps in the Retail Market. Several countries around the world utilize the service in foreign currency exchange, and the revamping of their service will help it move more smoothly with more accuracy. Inc42 Livemint

© Goldilocks

~~~~~~~~~

Can Ripple's XRP Be a Gold-Backed Stablecoin? Black Swan Capitalist Predicts | Binance

As you can see from this chart, Stablecoins in different countries have different names that define and reference their use because of them.

The BIS is calling on countries to come up with a similar reference point that will bring into alignment their ability to trade with one another. How these countries' digital coins, that represent their currency, will help in the measurement of their worth in trade going forward.

These measures include:

* licensing

* reserve asset management

* redemption rights

* capital adequacy

* consumer protection, governance

* risk management

* cyber security

* anti-money laundering

Basically, the BIS is asking countries to come up with a "Mission Statement." A mission statement will help these countries have a common goal and purpose for their existence. It will help to define their culture, goals, and values. BIS

© Goldilocks

~~~~~~~~~

"CHINA MAINLAND OPENS UP REPO MARKET TO MORE OFFSHORE INVESTORS"

A Repo Market is the ability to secure a loan and repay it the next day with interest building capital for the investor who place bids on these assets in the Chinese Market.

China is beginning to open their Market to offshore accounts desiring to trade with them. Many traders are seizing this opportunity with China's connection to the BRICS Nations and their continued desire to support their economy by gold.

These actions make their Market an appealing place to trade due to a growing return on investment that used to not be in play making their markets appealing to Global Investors. Regulation Asia Investopedia KWN

© Goldilocks

~~~~~~~~~

The demand for fossil fuel is waning as the demand for silver is beginning to rise. Solar power and electric vehicles will be the driving force on the price of silver going forward.

Silver is used to prop up the banking system, and we now have silver shorts taking place that will begin to eat up its profits on this monetary metal.

The transition into renewable energy has begun. Many energy reforms have been in process these last few years with oil and solar power.

Look for a bull run in the commodity sector of our Market to begin moving our economy forward at any moment. Some would say that it has already begun, but you have not seen anything yet. Economic Times FX Street

© Goldilocks

~~~~~~~~~

Silver price cannot be capped! | Youtube

~~~~~~~~~

MESSAGE FROM SAM OLIVER ON SILVER

MP3 AUDIO

Recording Attached below-

~~~~~~~~~

Gold on the Blockchain? Russia’s Surprise Move! | Youtube

~~~~~~~~~

Dfinity Foundation Launches Onchain Accelerator Platform – Blockchain Bitcoin News

~~~~~~~~~

Stablecoins Seeing Adoption Cross-Border Settlement Mechanism | Bitcoin World

~~~~~~~~~

Prudential Regulation Authority Business Plan 2024/25 | Bank of England

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Thursday Evening 4-11-24

Goldilocks' Comments and Global Economic News Thursday Evening 4-11-24

Good Evening Dinar Recaps,

Announcement of the CHIPS Migration to ISO20222 Messaging:

"The adoption of this format by CHIPS (Clearing House Interbank Payment System) enhances the efficiency of payments processing, The Clearing House (TCH) said in a news release on Wednesday (April 10), two days after the migration.

It also lets participants and end-user customers gain value from enriched data content like extended remittance information. It lets users query structured message formats for multiple purposes, such as sanctions and compliance screening.

According to the release, the network wrapped its first day of operations on the ISO20022 message format having released 555,345 payments for a value of $1.81 trillion."

Goldilocks' Comments and Global Economic News Thursday Evening 4-11-24

Good Evening Dinar Recaps,

Announcement of the CHIPS Migration to ISO20222 Messaging:

"The adoption of this format by CHIPS (Clearing House Interbank Payment System) enhances the efficiency of payments processing, The Clearing House (TCH) said in a news release on Wednesday (April 10), two days after the migration.

It also lets participants and end-user customers gain value from enriched data content like extended remittance information. It lets users query structured message formats for multiple purposes, such as sanctions and compliance screening.

According to the release, the network wrapped its first day of operations on the ISO20022 message format having released 555,345 payments for a value of $1.81 trillion."

The Clearing House Interbank Payments System (CHIPS) is the largest Clearing House Payment System in the US. It is the largest private-sector, high-value clearing, and settlement system in the world.

On April 8th, 2024 the CHIPS Network successfully migrated to the ISO 20022 messaging system. This allows foreign currency exchanges to be traded on the new digital banking system.

Along with our transactions, there will be a clear message informing both sides of a trade what the exchange is all about with directions for the completion of the transaction. Pymnts Investopedia The Clearinghouse

© Goldilocks

~~~~~~~~~

"The Financial Stability Institute (FSI) in a detailed report issued on April 9th, 2024, has emphasized the necessity of a coordinated regulatory approach to Stablecoins across different jurisdictions."

The Financial Stability Institute is calling for the unification of governing laws for Stablecoins throughout the US, UK, and the EU.

Global Regulations are needed for licensing, consumer protection, and AML in 7 jurisdictions.

Markets in Crypto Assets (MICA) are currently in the process of Global Regulations through the European Union. CoinGape Investopedia

© Goldilocks

~~~~~~~~~

"BRICS refers to certain emerging market countries—Brazil, Russia, India, China, South Africa, and more—that seek to establish deeper ties between member nations and cooperate on economic expansion, including trade. The countries act as a counterbalance to traditional Western influence."

When the BRICS Nations become strong enough to have a trading influence equal to or greater than the Western Culture, there will be bilateral agreements "only" as a reason for us to sign documents in the near term.

This is expected to change in about two decades when the BRICS Nations are expected to be strong enough to overtake the dollar. The transition of the dollar is expected to be a slow process. In the meantime, the Dollar Act is in the process of moving through Congress to support this transition.

To have a (digital) currency strong enough to challenge the dollar or equal within its dominance able to level the playing field for the BRICS Nations, they will more than likely have a gold-backed digital trading coin that will give them the capacity to do so.

At that time or before, the United States will be under a Gold Standard and part of the new leveling playing field. Congress Investopedia ISS Africa

© Goldilocks

~~~~~~~~~

What is the latest on #BRICS currencies? | Youtube

~~~~~~~~~

Who controls the price of gold in 2024? | Youtube

👆 is gold about to decouple from the dollar?

~~~~~~~~~

Breaking Ripple News:

Uphold Confirms FedNow Integration for XRP Transactions. Uphold lets users withdraw XRP instantly to US bank accounts using FedNow, easing crypto-to-fiat conversions. | Crypto Adventure 4 days ago

~~~~~~~~~

Markets in Crypto-Assets Regulation (MiCA) | Esma Europa

~~~~~~~~~

Markets in Crypto-assets (MiCA) – New EU law on crypto-assets | Twobirds

~~~~~~~~~

Is Europe’s MiCA a Template for Global Crypto Regulation? | Coindesk

~~~~~~~~~

Global Banking Announcement:

US Treasury and PBOC to Conduct Joint Financial Shock Exercises By Manesh Samtani, exercises will help establish lines of communication between US and Chinese regulators and identify areas of potential cross-border contagion and other risks | MSN

~~~~~~~~~

Derivatives Services Bureau Announcement:

London, Tuesday 9 April 2024 – The Derivatives Service Bureau (DSB), the global golden source of reference data for Over the Counter (OTC) derivatives, today released the latest data on industry readiness for European UPI (Unique Product Identifier) regulatory reporting requirements, which are part of the EU EMIR Refit Regulations.

The European Union will implement UPI reporting from 29 April 2024 as the second G20 jurisdiction, following the US who went live from 29 January 2024, and ahead of the UK effective date in September 2024. | DSB

~~~~~~~~~

Do you see what's happening? We are currently working on Global Payment Systems for the new QFS.

@Goldilocks

~~~~~~~~~

Hong Kong spot Bitcoin ETF Announcement:

HONG KONG (Reuters) - "Spot bitcoin exchange-traded funds could be launched in Hong Kong this month with the first approvals likely to be announced next week, two people familiar with the matter said." | MSN

~~~~~~~~~

FYI

Since I trade on the markets, you do know I will be very aware the instant our markets flip completely over to the new digital asset-based trading system. This will be all sectors of the market and the value changes that come with it including Forex. 😉

© Goldilocks

~~~~~~~~~

~~~~~~~~~

President Joe Biden has promised Israel "ironclad" US support amid fears that Tehran could launch reprisals for an attack that killed senior Iranians. | BBC

~~~~~~~~~

How Much GOLD Is In Home Depot Sand? | Youtube

~~~~~~~~~

We are at the place where Credit Valuation Adjustments are about to begin.

The process will be monitored and assessed throughout most of this year and as new changes take place.

Look for all sectors of the market to be involved in this process such as banking systems and Forex.

Central Banks all over the world continue to focus on accumulating gold. Utilizing Gold as a World Reserve Asset makes this asset a matter of time before a country or countries of significant influence will build upon it's fixed value into their currency.

The BRICS Nations have been looking to do this for some time in the creation of and use of a trading currency that would appeal to all countries around the world.

Sprinkle a little gold dust on this new currency, and you will have a standard by which all trading protocols can be measurable on the QFS and utilized as a bridge asset through a digital asset backed by GOLD such as XRP. Risk Net

© Goldilocks

~~~~~~~~~

Next week, the World Bank and the IMF are meeting in Washington DC for their Spring Meetings 2024. This year, the meetings will be compressed between 17th and 19th April, with some ancillary events happening between Monday 15th and Friday 20th. the schedule of events can be found here. 👇

Schedule | World Bank

~~~~~~~~~

Gold & Silver Making MASSIVE Moves! Banks Are STACKING Lots Of Gold! | Youtube

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Wednesday Evening 4-10-24

Goldilocks' Comments and Global Economic News Wednesday Evening 4-10-24

Good Evening Dinar Recaps,

"Last week the Bank for International Settlements dropped a bombshell of an announcement where it launched Project Agorá, along with seven central banks, which will focus on the tokenisation of wholesale central bank money and commercial bank deposits on programmable platforms."

The race towards International payments has begun. We currently have Global Regulations being tested in Europe and soon to be implemented through MICA. These assets have grown out of the ability to do so because of Protocol 20, whereby, the interfacing of International Digital Networks have been given the green light to expand into Global connections capable of doing trades with Tokenized Assets at the push of a button.

The next step is to move towards Cross-Border International Trading. Several countries have began the process of regulating Stablecoins which is a representation of a country's currency. These regulations will speed up the velocity of money and opportunity for companies to grow at a much faster pace.

Goldilocks' Comments and Global Economic News Wednesday Evening 4-10-24

Good Evening Dinar Recaps,

"Last week the Bank for International Settlements dropped a bombshell of an announcement where it launched Project Agorá, along with seven central banks, which will focus on the tokenisation of wholesale central bank money and commercial bank deposits on programmable platforms."

The race towards International payments has begun. We currently have Global Regulations being tested in Europe and soon to be implemented through MICA. These assets have grown out of the ability to do so because of Protocol 20, whereby, the interfacing of International Digital Networks have been given the green light to expand into Global connections capable of doing trades with Tokenized Assets at the push of a button.

The next step is to move towards Cross-Border International Trading. Several countries have began the process of regulating Stablecoins which is a representation of a country's currency. These regulations will speed up the velocity of money and opportunity for companies to grow at a much faster pace.

As each country moves toward manufacturing their own goods and services over time, this will create less bottleneck situations at our shipping ports and more opportunities for jobs within each country for their people.

Shipping port volumes have been increasing it the last few years until the pandemic hit, and to lower these prices on goods traveling around the world more manufacturing jobs at home is being encouraged and shorter routes between countries are being mapped out. This will decrease inflation, and it will increase the Gold Backed Tokenized Assets used on the shipping ports to trade between countries.

Inflation tends to devalue a currency, and our ability to reduce cost in our shipping industry through more efficient mechanisms will move the pendulum of 80% trade around the world to a much smaller percentage.

Our ability to decrease inflation through digitizing our shipping ports and decrease premium prices on their movement will go a long way in adding more value to our currencies globally.

Bis Coin Speaker The Banker IMF Investopedia

Watch the water.

© Goldilocks

~~~~~~~~~

Tokenized Assets and the trading of Gold and Silver are beginning to pick up the pace. We have a shortage in Silver that continues to climb.

The demand for the Metal Markets are beginning to put price pressures on our Gold and Silver products.

Can you imagine what this is going to do to our Tokenized Assets such as Stablecoins? Kitco Bloomberg

© Goldilocks

~~~~~~~~~

The Bureau of Industry and Security recently provided the "freight forwarders" in the shipping industry guidance on the imports and exports between countries.

The Bureau of Industry and Security is currently getting involved in particular with "Correcting and Clarifying Export Controls Issued on Advanced Computing and Semiconductor Manufacturing Items."

Let's take a closer look at why freight forwarding guidance is important. It will promote clear guidance on foreign and domestic products being moved across countries near and abroad.

One of their more important roles as of late is to help companies tackle foreign currency exchange rates. They will help determine prices as they change due to developing circumstances.

This set of guidance represents the final rules that allow implementation of freight forwarders guidance to move forward with these new changes. Mondaq Braumiller Law JD Supra

WATCH THE WATER...

© Goldilocks

~~~~~~~~~

IRAQ

General Commission for Taxes: Strategic Direction

for Prioritized Reforms -A pdf located in Goldilocks' room here:

https://t.me/c/1545617426/76462

HLSEA2024011.PDF

Iraq is beginning to expand their revenue in country. This necessitates the progressive wage earner tax reforms outlined in the PDF above.

This expansion and clearer guidelines made on taxable income for the government, companies, and people are being redefined as we speak.

The transition into technical mechanisms will make this possible going forward. The new digital economy is now being interfaced in Iraq's new digital framework. IMF

© Goldilocks

~~~~~~~~~

The markets have suffered three legs down in the last few days. This is usually a great time to buy before Markets move three legs up.

But, an interesting thing happened today. The lack of buyers kept me from participating in the game because of the noticeable numbers of investors not following normal Market patterns.

This does not look good for tomorrow, the next day, and following unless buyers start coming into the market. My stance is a wait and see. If others are doing the same, we may have an alert status and moment of caution for the markets.

More and more countries are beginning to trade in their local currencies, and it's hard to know just yet if this is beginning to have an effect on the dollar.

I will report more as I go along and find out more details.

© Goldilocks

~~~~~~~~~

VELOCITY OF M1

This is our most recent money velocity chart. It ranges from 1960 to late March of this year. It is showing us a rising money velocity as of late. This does not mean we are doing well.

When you have too much money chasing too few goods, you have what is called a demand-pull inflation chart in front of you.

This makes sense to people who buy their groceries and come in with less goods using more money to buy them.

This may be sold as a good thing soon, but you know that it is not because of your grocery bill.

I am sharing this with you today to give you an idea of how difficult it is to invest in today's economy with all of these fundamentals no longer following correlated patterns as they used to do so.

To minimize the above data flows, we may see a false flag come into play to soften some of these money flows and coordinate some of these chart patterns. Wikipedia

This is why a Global Currency Digital-Asset Reset is needed.

© Goldilocks

~~~~~~~~~

The CPI index reading came out much higher than expected according to several resources.

This is believed to be a reason to raise interest rates among some economists while others are stating that lower interest rates will be what allows us to move into the new digital economy with new support levels.

Countries are divided on this issue as well. We are witnessing some countries lower their interest rates already while the United States keeps their interest rates the same.

This will create a trade war between countries as prices at our shipping ports will be affected.

Volatility is expected inside the marketplace as the East and West go to war in trade.

The winner takes all...

© Goldilocks

~~~~~~~~~

CPI comes in hotter than expected dashing rate cut hopes...Ira’s Morning Flash Video for 4 10 2024 | Youtube

~~~~~~~~~

Exploring Japan's Potential To Lead Global Cryptocurrency Trends - Dataconomy

~~~~~~~~~

A freight forwarder is a firm specializing in the arrangement of cargo on behalf of shippers. In most cases, freight forwarders provide a variety of supply chain services, including: Ocean or air freight transportation. Inland transportation from origin and/or to destination. | Crowley

~~~~~~~~~

Hong Kong Said Likely to Approve Spot Bitcoin (BTC) Exchange-Traded Funds Next Week: Reuters | Coindesk

👆 more on this tomorrow.

~~~~~~~~~

The 'war of chan' to dominate semiconductors around the world is intensifying day by day. The U.S. g.. - MK

~~~~~~~~~

U.S.-China trade fight ramps up with EVs and green tech - Fast Company

~~~~~~~~~

Biden unveils $6.6bn for Taiwan’s TSMC to ramp up US chip production | Technology | Al Jazeera

~~~~~~~~~

Exchange Rates and their Measurement | Reserve Bank of Australia

~~~~~~~~~

Silver laughed off an attempt to slam the price lower on the announcement of higher than expected Inflation numbers.

This is a NEW type of behavior in the Rigged COMEX Silver market and one that is very, very encouraging.

This means that the additional shorts needed for today's initial slam WERE NOT ABLE TO BE COVERED which makes the Commercial's Silver Short Problem that much bigger!

THIS IS THE END GAME!

SILVER ALERT! Silver Brushes off Attempted Price Slam on CPI! APPROACHES UNOBTAINIUM! (Bix Weir) | Youtube

~~~~~~~~~

New worries America on verge of losing petrodollar privilege | FX Street

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic Tuesday Evening 4-9-24

Goldilocks' Comments and Global Economic Tuesday Evening 4-9-24

Good Evening Dinar Recaps,

"Credit valuation adjustment is a change to the market value of derivative instruments to account for counterparty credit risk. It represents the discount to the standard derivative value that a buyer would offer after taking into account the possibility of a counterparty's default."

With so many companies and countries going into bankruptcy these days, I have to look at credit valuation adjustments in order to make some of my trades.

Foreign currency is a part of the Derivatives Market. I will know when these actual changes take place.

© Goldilocks

~~~~~~~~~

"This bank, on behalf of the Ministry of Finance, will offer bonds under the name ( Injaz Bonds ) to the public starting from 4/15/2024 until 5 / 15 / 2024"

Public bonds help to build the infrastructure of a country's businesses, and they go a long way in supporting a country's currency.

Getting public involvement in increasing the value of their own currency will help Iraq maintain a sustainable economy going forward.

Goldilocks' Comments and Global Economic Tuesday Evening 4-9-24

Good Evening Dinar Recaps,

"Credit valuation adjustment is a change to the market value of derivative instruments to account for counterparty credit risk. It represents the discount to the standard derivative value that a buyer would offer after taking into account the possibility of a counterparty's default."

With so many companies and countries going into bankruptcy these days, I have to look at credit valuation adjustments in order to make some of my trades.

Foreign currency is a part of the Derivatives Market. I will know when these actual changes take place. Risk

© Goldilocks

~~~~~~~~~

"This bank, on behalf of the Ministry of Finance, will offer bonds under the name ( Injaz Bonds ) to the public starting from 4/15/2024 until 5 / 15 / 2024"

Public bonds help to build the infrastructure of a country's businesses, and they go a long way in supporting a country's currency.

Getting public involvement in increasing the value of their own currency will help Iraq maintain a sustainable economy going forward.

Public bonds like these help to establish and secure a country's Sovereignty. This is a part of the process of Iraq reclassifying their currency.

Not long ago the CBI revealed to us that it would begin March 31st, 2024. They said it would be a gradual change. I copied the article for your review again on this matter.

"Based on the of the Board of Directors of this Bank number (191) of 2003 it was decided to give the mediation companies buying and selling foreign currencies under category (C) a period of time to merge to be classified as (A) or (b) until 3-31-24." CBI IMF

© Goldilocks

~~~~~~~~~

"The HKMA has been researching CBDCs since 2017 to understand their benefits and potential applications. As part of the “Fintech 2025” strategy announced in 2021, the HKMA has placed increased emphasis on strengthening its research work to increase Hong Kong’s readiness in issuing CBDCs at both wholesale and retail levels."

Hong Kong is currently exploring industry standards for their digital money. They are currently on Phase 2 of HKMA's e-HKD testing initiative.

Currently, Hong Kong is in process of developing standards on their ability to exchange information through smart contract designs. A smart contract ensures money is available on both sides of a trade.

These new mechanisms and protocols include sensitive and private information that needs to be protected on the retail side of a transaction. HKMA

© Goldilocks

~~~~~~~~~

"Bitcoin halving countdown: Crypto expert discusses opportunities and challenges" | Investing

~~~~~~~~~

Ripple CEO: Crypto market to double in size to $5 trillion in 2024 | CNBC

~~~~~~~~~

Bitcoin and Ripple. Pairing the assets together. What? Not going to zero now. MacroAxis AvaTrade

~~~~~~~~~

China is about to enable currency swap with 29 other countries and they will use their local currency instead of the US dollar. | Reuters

👆 Goldilocks pointed to this article

~~~~~~~~~

[I uploaded the following pds attached to this email - If they are easily uploaded - please add otherwise just leave them off. I added the link to the room if they want to see them. Please delete this message]

Goldilocks posted 5 pdfs in their telegram room today:

1. Final_Report_on_certain_technical_standards_under_MiCA_First_Package

https://t.me/c/1545617426/76381

👆MICA DRAFT REPORT

2. MiCA_Consultation_Paper_-_RTS_market_abuse_and_GLs_on_investor_protection_and_operational_resilience

https://t.me/c/1545617426/76383

👆MICA CONSULTATION PAPER

3. openFile.pdf

https://t.me/c/1545617426/76385

👆In line with the Group of 20 (G20) commitment to reform over-the-counter (OTC) derivatives markets, the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) have been working with the Government of the Hong Kong Special Administrative Region and relevant stakeholders on implementing a regulatory regime for the OTC derivatives market in Hong Kong. OTC derivatives reporting is an important component of the OTC derivatives regulatory regime.

We have implemented two phases of mandatory reporting, covering OTC derivatives

transactions in five key asset classes — interest rates, foreign exchange, credit, commodities and equities. The use of Legal Entity Identifier (LEI) has also been mandated and is applicable to all entities on the reporting entity’s side of a transaction.

~~~~~~~~~

4. 20240322e3a1.pdf

https://t.me/c/1545617426/76389

👆Hong Kong is currently working on their reporting measures for their over-the-counter derivatives (OTC) Market that includes foreign currency exchanges.

© Goldilocks

~~~~~~~~~

5. ESMA74-2119945925-1959_Feedback_statement_of_the_Call_for_evidence_on_shortening_the_settlement_cycle.pdf https://t.me/c/1545617426/76390

👆EU shortening the settlement cycle.

~~~~~~~~~

👆The above PDFs give you an idea of how Global Regulatory guidelines are in process of being reviewed and working towards implementation by the end of May.

These drafts will be reviewed and updated for new Protocols in the Banking and Market system.

© Goldilocks

~~~~~~~~~

Treasury Secretary Janet Yellen wrapped up four-day trip to Beijing without much to show for it, acknowledging an unsure future for relations between the U.S. and China.

After a series of economic meetings, it was at least agreed that more communication would take place.

"There is much more work to do," Ms. Yellen said at a Monday news conference. "And it remains unclear what this relationship will endure in the months and years ahead." Fox Business

~~~~~~~~~

~~~~~~~~~

UK's FCA and Bank of England launch consultation for Digital Securities Sandbox - FinTech Futures: Fintech news Bank of England

~~~~~~~~~

What Jamie Dimon Said about Long-Term Inflation, Fed Interest Rates (“2% to 8% or even more”), and QE/QT (it’s Risky) | Wolf Street

~~~~~~~~~

TSMC to make state-of-the-art chips in US after multibillion subsidy pledge | Technology sector | The Guardian

~~~~~~~~~

Gold is rapidly becoming the World Reserve Asset.

© Goldilocks

~~~~~~~~~

Gold. Tradable foreign currencies, such as the USD or euro (EUR). Special drawing rights (SDRs) to obtain foreign exchange or reserve assets from IMF members. Jan 8, 2024 | Investopdia

~~~~~~~~~

XRP: The best 21 minutes of your life is contained inside this video...

It just came out today. Something many of us have known for a long time.

It will change your life. | Youtube

~~~~~~~~~

Lummis: Crypto Will Erupt as Big Issue in U.S. Senate Races Including Banking Chair Brown's | CoinDesk

~~~~~~~~~

Stablecoins Are Seeing Adoption as a Cross-Border Settlement Mechanism: Bernstein | CoinDesk via @coindesk

~~~~~~~~~

Gold rallies to new records on worldwide tensions, central bank buying | Axios

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Monday Evening 4-8-24

Goldilocks' Comments and Global Economic News Monday Evening 4-8-24

Good Evening Dinar Recaps,

"Enthusiastic members of the XRP community are rejoicing over a recent development that could significantly influence the future of the Ripple-supported token. A fresh research paper by the European Corporate Governance Institute (ECGI) has reinforced the classification of XRP as a utility token, aligning with a U.S. federal court ruling in July 2023."

Today, the European Union begins testing it's instant payment service on MICA. It is expected that Ripple is a part of this transaction due to its ability to transact two assets between each other within seconds.

This makes Ripple a recognized Network capable of making instant payment settlements possible. Europe is currently testing and regulating the new Global Crypto Standards and/or Regulations that will apply to digital economies wherever they are.

Goldilocks' Comments and Global Economic News Monday Evening 4-8-24

Good Evening Dinar Recaps,

"Enthusiastic members of the XRP community are rejoicing over a recent development that could significantly influence the future of the Ripple-supported token. A fresh research paper by the European Corporate Governance Institute (ECGI) has reinforced the classification of XRP as a utility token, aligning with a U.S. federal court ruling in July 2023."

Today, the European Union begins testing it's instant payment service on MICA. It is expected that Ripple is a part of this transaction due to its ability to transact two assets between each other within seconds.

This makes Ripple a recognized Network capable of making instant payment settlements possible. Europe is currently testing and regulating the new Global Crypto Standards and/or Regulations that will apply to digital economies wherever they are.

I do find this interesting that a change of this magnitude is happening on the same day as an eclipse. An eclipse symbolizes hidden truths being revealed and a movement into higher learning. TimesTabloid

Times of India Crypto Weekly

This truly is a Biblical moment.

© Goldilocks

~~~~~~~~~

Economy News – Baghdad

The Central Bank of Iraq decided to launch Enjaz bonds worth 1.5 trillion dinars in implementation of the Financial Budget Law for the years 2023-2025.

According to a document, issued by the Central Bank, obtained by “Economy News”, “the issuance of public debt bonds is offered to the public in the name of completion bonds in the amount of 1.5 trillion dinars,” noting that the Central Bank issues this bond on behalf of the Ministry of Finance.

The document confirmed that the bonds in the first two categories 500 thousand dinars at an interest of 6.5% per year are paid every 6 months for two years while the second One million dinars with an interest of 8.5% paid every six months for four years.

The sale of the bonds begins on April 15, 2024 to May 15, 2024, the document added.

Injaz bonds are the highest benefit after the reconstruction and build bonds, which reached an interest rate of 7% per year. Search4Dinar

~~~~~~~~~

"EBA analysis found that the models used by banks produce a lower risk rating for high carbon than low carbon sectors."

The European Banking Authority is finding that capital requirements need to shift from outdated fossil fuel regulatory preferences to newly updated risk assets that will carry us into the future.

The new tokenized assets in process of being regulated will help bridge this gap and make this transition in the energy sector of the market a possibility.

As these new Banking and Market reforms are adjusted, we will see new ratio and price developments form inside the new digital economy. It will allow us to interface new price arrangements on the QFS.

Regulation Asia CNBC

© Goldilocks

~~~~~~~~~

The "energy sector" is currently in reforms inside the new banking system. When these new prices are adjusted to meet ratios capable of moving us into future prices, they will be able to be correlated/interfaced onto the new digital markets.

This is a major component of our economy, and it's repricing event will enable us to have a foundation going forward to support the global economy.

Look for new prices in gold, silver, and gas to solar to form on the debt clock. These foundational aspects of our economy have to be formulated to help us move forward inside of a revalued market based on new digital assets that will carry us forward. FT US Debt Clock

© Goldilocks

~~~~~~~~~

Message from Sam Oliver on GOLD

~~~~~~~~~

Remember, the Central Banks are the buyers of last resorts. As the CB steps in to buy Gold when the Retail Market no longer can, it will be a signal the currencies have reached a bottom enabling them to utilize Gold as a standard that can now be calculated in bringing the Currency Market back up into real values. This is the Global Currency Reset. Wikipedia.

© Goldilocks

~~~~~~~~~

One last thing, when the price of gold is so high that only the Central Banks can begin to control the price of it over the retail Market, it will be a good time for them to be able to change prices under a managed float under fixed rates of gold allowing them to synchronize gold to new (digital) currency values.

© Goldilocks

~~~~~~~~~

All roads lead to digital gold, and digital gold will set us free.

© Goldilocks

~~~~~~~~~

Cross-Border Payment Announcement:

A report from the World Bank back in 2021 has resurfaced, under which it identified Ripple’s XRP and Stellar’s XLM as ideal stablecoins for cross-border payments.

World Bank claimed in its report that the two tokens “enable faster and more efficient cross-border payments relative to correspondent banking.” | Crypto-News-f Flash

~~~~~~~~~

LONDON, April 4 (Reuters) - Global securities watchdog IOSCO on Thursday proposed detailed guidance on how regulators should supervise stock exchanges more closely to negate risks from changes in business practices. | MSN

~~~~~~~~~

The instant payments regulation will allow people to transfer money within ten seconds at any time of the day, including outside business hours, not only within the same country but also to another EU member state. The regulation takes into consideration particularities of non-euro area entities. | Consilium Europa

~~~~~~~~~

Jamie Dimon Issues an Economic Warning | NY Times

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Goldilocks' Comments and Global Economic News Sunday Evening 4-7-24

Goldilocks' Comments and Global Economic News Sunday Evening 4-7-24

Good Evening Dinar Recaps,

Been in contact with many of my sources throughout the day from Technical Developers to Banking contacts.

My understanding is that we are progressing well with the MICA regulations which stands for Markets in Crypto Assets.

These regulations will allow us to move forward with the new digital economy, and we are still on target to finish these by the end of May.

These are much-needed changes to the banking system that will allow us to move forward with new Banking and Market values. I would not expect anything to happen this month due to these updates.

I hope you have a wonderful weekend. Take this time to enjoy your family and friends. These things mean so much more than anything we will receive monetarily going forward.

© Goldilocks

~~~~~~~~~

Goldilocks' Comments and Global Economic News Sunday Evening 4-7-24

Good Evening Dinar Recaps,

Been in contact with many of my sources throughout the day from Technical Developers to Banking contacts.

My understanding is that we are progressing well with the MICA regulations which stands for Markets in Crypto Assets.

These regulations will allow us to move forward with the new digital economy, and we are still on target to finish these by the end of May.

These are much-needed changes to the banking system that will allow us to move forward with new Banking and Market values. I would not expect anything to happen this month due to these updates.

I hope you have a wonderful weekend. Take this time to enjoy your family and friends. These things mean so much more than anything we will receive monetarily going forward.

© Goldilocks

~~~~~~~~~

“These reforms improve the integrity and stability of domestic and global derivatives markets,” said Commissioner Johnson.

On April 9, Market Risk Advisory Committee Meeting of the CFTC will be convening on reforms of the derivatives markets which includes Forex.

There are other items on the agenda for this meeting, but this is the one that concerns most of us in this room. CFTC

Yes, the forex is still doing their reforms on foreign currency.

© Goldilocks

~~~~~~~~~

Iraq is in the process of signing bilateral agreements that will support their infrastructure through their shipping ports.

This move will help Iraq to spend their money locally and support their own economy. Projects such as this will help justify new values on their Iraqi Dinar.

The agreement allows Iraq to level up their economy. It gives them a consistent and continued sustainable income to help many sectors of their Market grow and sustain themselves with a higher level of living.

It is decisions like these that allow a currency to feel and experience price pressures that are needed to raise its value for the good of the community and all that trade with them. Arab News

Watch the water.

© Goldilocks

~~~~~~~~~

"Global trade is likely peaking now. According to a report by the St. Louis Federal Reserve Bank."

Many countries are beginning to manufacture products in their own country that used to be imported from others.

The last three Presidents have chosen not to make any changes to the judges that govern the World Trade Organization. This is being called an existential threat to the Global Economy.

For some time, the World Trade Organization has needed to change percentages in weight given to certain countries gaining momentum in trading relationships. Many of these changes are being refactored at the present time and expect to formulate new ratios by the end of the year.

These new ratios being calculated don't keep us from a gradual incline in some of these currencies that are being placed on a More Level Playing Field with other countries until they reach an RV status.

Many of these changes needing to take effect will come about from new regulations, rather than, a rules-based decision that was made at Bretton Woods 2 in 1944.

This brings us up to where we are now, the regulation of our new digital economy will bring about the needed changes in trade relation weight ratios for our currencies around the world based on supply and demand going forward.

These new digital regulated (ie MICA) changes will form new price patterns on each country's currencies and reset our Global Mechanisms to meet the needs of countries choosing to use their local currencies and trade over the dollar going forward.

When the World Trade Organization completes its new calculations to reform a new Global Trading Economy, Bretton Woods 3 will come into being.

There should be an announcement of this new agreement by Bretton Woods 3 that will lead us into much-needed changes around the world. JD Supra Council on Foreign Relations St Louis Fed

NOW, do you see why I keep asking you to WATCH THE WATER.

© Goldilocks

~~~~~~~~~

~~~~~~~~~

Specific foreign exchange derivatives include: foreign currency forward contracts, foreign currency futures, foreign currency swaps, currency options, and foreign exchange binary options. These instruments are called derivatives because their value is derived from an underlying asset, a foreign currency. Springer

~~~~~~~~~

If you missed the Saturday Night Live breakdown of Goldilocks last night, you can listen to it here!

Goldilocks' Telegram Room

or Click to Listen Here [ Add attached mp3 here] SNL Freedom-Jester 4-6-24.mp3

~~~~~~~~~

The Trade Winds Are Turning: Insights into the 2024 National Trade Estimate | CSIS

~~~~~~~~~

Room for rules-based global trade remains, but WTO showing signs of geopolitical tension | Engineering News

~~~~~~~~~

USTR Issues Communication To WTO Members On Climate, Trade | RT News

~~~~~~~~~