“Tidbits From TNT” Saturday Morning 8-30-2025

TNT:

Tishwash: Iraqi Embassy in Washington: Iraq is not affiliated with any country.

The Iraqi Embassy in Washington affirmed that Iraq enjoys full sovereignty and has the right to conclude agreements and memoranda of understanding in accordance with the provisions of its constitution and national laws, and in a manner consistent with its supreme interests.

The embassy explained, in a statement issued in response to the remarks of the US State Department spokesperson, that Baghdad maintains friendly and cooperative relations with many countries around the world, including the United States and neighboring countries, and is keen to build these relations on the basis of mutual respect and shared interests.

TNT:

Tishwash: Iraqi Embassy in Washington: Iraq is not affiliated with any country.

The Iraqi Embassy in Washington affirmed that Iraq enjoys full sovereignty and has the right to conclude agreements and memoranda of understanding in accordance with the provisions of its constitution and national laws, and in a manner consistent with its supreme interests.

The embassy explained, in a statement issued in response to the remarks of the US State Department spokesperson, that Baghdad maintains friendly and cooperative relations with many countries around the world, including the United States and neighboring countries, and is keen to build these relations on the basis of mutual respect and shared interests.

She stressed that Iraq "is not subservient to the policies of any country," and that its decisions stem from its independent national will.

In this context, the embassy noted that the security agreement recently signed with Iran is part of bilateral cooperation to maintain security and control the shared border, contributing to the stability of both countries and the security of the region. link

Tishwash: The Central Bank of Iraq: Infrastructure, legislation, and community awareness to promote electronic payments.

Central Bank Governor Ali Al-Alaq announced on Saturday the issuance of instructions and regulations to regulate electronic payments across three aspects.

While revealing a mechanism for developing the electronic payment process, he also affirmed that all state institutions are required to use electronic payments, not cash.

Al-Alaq said in a statement to the official agency, followed by ( IQ ): “Electronic payment is witnessing significant development, and it is a gateway to the digital transformation towards a digital economy for a larger issue related to the economic structure and global interaction, to achieve greater financial inclusion, and all of these aspects have become fixed and advanced strategies.”

He pointed out that "the Central Bank, along with the government, the private sector, electronic payment companies, and technology companies, are all engaged in this massive and ongoing effort. We have regulatory and legislative technical initiatives and directions being worked on in coordination between the Central Bank of Iraq and the Iraqi government."

He added, "There is cooperation and coordination with the government through the decision issued by the Council of Ministers requiring all state institutions to use electronic payments instead of cash.

There is also the localization of salaries, which amounts to millions, in addition to public awareness being conducted through electronic payment companies and civil society organizations. There is growing community awareness."

He explained that "progress in electronic payments requires infrastructure, a legislative framework, and community awareness. These are three aspects that are being worked on diligently.

Much of the infrastructure at the Central Bank level has been completed in an advanced manner, fully in line with international practices and legislative frameworks. We have issued numerous instructions and regulations that regulate the process, but we need more in the third aspect, which is community and cultural awareness." link

************

Tishwash: Oil Minister: Signing a contract with the American company Schlumberger to increase production from the Akkas field to 100 million cubic feet per day.

Today, Thursday (August 28, 2025), Deputy Prime Minister for Energy Affairs and Minister of Oil, Eng. Hayan Abdul-Ghani Al-Sawad, chaired the eighth session of the Opinion Board at the Ministry’s headquarters, with the participation of undersecretaries, advisors, and general managers.

During the meeting, the Minister said that the Ministry has achieved self-sufficiency in gas oil and kerosene, and is continuing work on completing the FCC projects in Basra and improving naphtha in Kirkuk, with the aim of achieving self-sufficiency in gasoline during the current year.

He pointed to the opening of the grease refinery at the Northern Refineries Company, which will meet approximately 70% of the country's needs, directing refinery companies to develop these projects to achieve full self-sufficiency.

Abdulghani also announced the signing of a contract with Schlumberger to increase production rates in the Akkas field to 100 million standard cubic feet per day, in addition to signing an agreement in principle with the American company Chevron to develop four exploration blocks in the Dhi Qar oil field and the Balad oil field.

The session discussed a number of topics on the agenda, and made decisions and recommendations aimed at developing the oil sector and enhancing cooperation with specialized international companies link

Mot: Not Funny!!! ~~~ LOL

Mot: . an ole ""Motisum"" fur da Weekend!!!!

The Groundwork for the New Economic System

The Groundwork for the New Economic System

Gregory Mannarino: 8-27-2025

Do you ever get the feeling that the economic and political gears are grinding in a way that feels… intentional? That what’s happening isn’t just a series of random events, but part of a much larger, orchestrated transition?

Financial analyst Gregory Mannarino isn’t just watching the news; he’s dissecting a profound, and he argues, deliberate transition towards a new systemic order. In his latest thought-provoking video, Mannarino lays bare a critical analysis of our current landscape, revealing how the very structure of our society is being reshaped right before our eyes.

The Groundwork for the New Economic System

Gregory Mannarino: 8-27-2025

Do you ever get the feeling that the economic and political gears are grinding in a way that feels… intentional? That what’s happening isn’t just a series of random events, but part of a much larger, orchestrated transition?

Financial analyst Gregory Mannarino isn’t just watching the news; he’s dissecting a profound, and he argues, deliberate transition towards a new systemic order. In his latest thought-provoking video, Mannarino lays bare a critical analysis of our current landscape, revealing how the very structure of our society is being reshaped right before our eyes.

One of the most striking insights Mannarino presents is the idea that the current system is strategically engineered to foster dependency. By making us deeply reliant on the existing framework, the architects of this change are, in his view, paving the way for a smoother, albeit unsettling, shift into a new economic and political structure.

These aren’t isolated incidents; Mannarino frames them as interconnected components of a grand design, all serving to facilitate the move to a different framework.

But perhaps the most profound transformation Mannarino discusses is what he calls the “final act” in a broader series exploring systemic changes. This refers to the accelerating fusion of corporate power with government authority.

Imagine a world where the lines between immense corporate entities and the governing bodies are not just blurred, but virtually erased. This isn’t merely collaboration; it’s a deep, systemic integration that has enormous implications for our freedoms, our economy, and the very fabric of society. This convergence signifies a shift of immense proportions, fundamentally altering who holds power and how decisions are made.

Mannarino stresses that his analysis isn’t a one-off warning; it’s a comprehensive series, with each part building upon previous insights to create a complete understanding of this evolving landscape. He urgently encourages viewers to engage deeply, as piecemeal understanding simply won’t suffice.

However, he expresses concern that only about a quarter of his audience is actively absorbing the full scope of this critical information. In an era where information overload is common, it’s easy to skim the surface. But Mannarino’s message is clear: understanding this evolving landscape isn’t just academic; it’s crucial for preparing for future realities shaped by these transformative forces.

This isn’t just a forecast; it’s a critical juncture in systemic evolution. Mannarino’s call to deeper engagement serves as both a warning and an invitation to equip yourself with the knowledge needed to navigate the profound changes ahead.

Ready to dive deeper and understand the true forces at play?

MilitiaMan and Crew: Iraq Dinar News Update-REER Support-$500 Billion-K2-Rafidain

MilitiaMan and Crew: Iraq Dinar News Update-REER Support-$500 Billion-K2-Rafidain

8-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update-REER Support-$500 Billion-K2-Rafidain

8-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

“Tidbits From TNT” Monday Morning 8-25-2025

TNT:

Tishwash: Can budget tables save Iraq from a financial crisis? An expert answers.

Political and economic circles are anticipating the budget tables will be submitted to Parliament within the next two months, amid questions about their ability to address a potential financial crisis.

In this context, economic expert Salah Nouri explained to {Euphrates News} that "the success of these schedules depends on several key factors, most notably the nature of the spending schedules. If an austerity portfolio focuses on only necessary expenditures, it may mitigate the severity of the crisis."

TNT:

Tishwash: Can budget tables save Iraq from a financial crisis? An expert answers.

Political and economic circles are anticipating the budget tables will be submitted to Parliament within the next two months, amid questions about their ability to address a potential financial crisis.

In this context, economic expert Salah Nouri explained to {Euphrates News} that "the success of these schedules depends on several key factors, most notably the nature of the spending schedules. If an austerity portfolio focuses on only necessary expenditures, it may mitigate the severity of the crisis."

He added, "It also requires resolving issues with the US Federal Reserve to ensure the full transfer of oil revenues."

Nouri stressed the "necessity of maintaining the planned oil selling price in the general budget, which reaches $70 per barrel," noting that "taking these factors into account will be a decisive factor in the budget's ability to confront financial challenges and ensure economic stability for the country. link

Tishwash: Association of Banks: Payment points increased to 60,000, and more than 18 million electronic cards were issued.

The Iraqi Private Banks Association announced on Sunday the issuance of more than 18 million electronic payment cards across the country, while noting that the number of payment points has increased to approximately 60,000.

Ali Tariq, executive director of the Iraqi Private Banks Association, told the Iraqi News Agency (INA), "The issuance of electronic cards in the country is witnessing a significant increase, particularly following government decisions to promote electronic payments and oblige government and private institutions to collect electronically."

He explained that "the number of cards issued has exceeded 18 million in Iraq, while the number of electronic payment points has increased from 7,000 to approximately 60,000, with further increases expected in the coming period."

He added, "Banks continue to support various projects," explaining that "financial ceilings for small, medium, and large projects are determined by each financial institution based on the nature of the project, its capital, and the number of employees link

************

Tishwash: Iraqi markets teeter between the official and parallel currencies. A relentless struggle drives up the exchange rate.

It appears that government measures and the Central Bank's attempts to control the dollar exchange rate have not achieved complete success, as exchange rates continue to witness significant fluctuations in the markets, amid increasing pressures resulting from unofficially covered demand, smuggling operations, and the complications of recent customs decisions.

The US dollar exchange rate rose in the markets of Baghdad and Erbil, the capital of the Kurdistan Region, after successive declines witnessed in recent days, raising concerns among citizens and traders alike.

The Al-Kifah and Al-Harithiya stock exchanges in Baghdad recorded 141,600 dinars for $100, while the selling price in exchange shops in local markets recorded 142,500 dinars for $100, after the dollar recorded 139,000 dinars for $100 this month.

Experts believe that the continued fluctuation reflects the limited impact of government measures and the Central Bank, as unofficial market factors, such as demand related to trade with neighboring countries and smuggling through ports, continue to pressure the stability of the dinar.

These people point out that addressing the crisis requires broader solutions than just financial decisions, including reforming the customs system, strengthening control over border crossings, and revitalizing non-oil economic sectors to reduce excessive reliance on the dollar.

Expectations of Rise

In turn, economic expert Ahmed Abd Rabbo expects a further rise in the dollar exchange rate, noting that the previous decline was a result of the downturn witnessed in the markets, which created a state of anxiety in financial transactions.

Abd Rabbo told Al-Mada that "the talk about the suspension of some remittances and problems with online shopping led to a rush on the dollar in the parallel market, which will lead to a renewed rise in the price."

He added that "stabilizing the dollar price requires practical plans and real market control, so that the Central Bank can understand the problems and seek effective solutions through the banking system," stressing that "such steps will contribute to controlling prices and calming the market."

He pointed out that "seriously addressing the factors affecting supply and demand, in addition to monitoring parallel market movements, are key to achieving real stability in the dollar price."

Traders point out that the gap between the official and parallel markets still exists, which opens the door to daily speculation and makes any temporary decline vulnerable to rapid dissipation. While citizens are optimistic about any decline in the exchange rate, concerns remain about a renewed rise, accompanied by a new wave of inflation that will put pressure on the livelihood of Iraqi families.

Three main factors

For his part, financial and banking expert Abdul Rahman Al-Shaikhly attributed the reasons for the fluctuations in the dollar exchange rate in Iraq to three main factors, stressing that these factors work together to increase pressure on the market.

Al-Shaikhly explained to Al-Mada that "the first reason is the scarcity of supply compared to the increasing demand, which creates a state of tension in the exchange market."

He added, "The second reason is the insistence of many traders on importing their goods from neighboring banned countries, especially in light of the Central Bank's occasional delay in providing dollars to importers through official outlets. The third reason is the price difference between the official market and the parallel market, which has encouraged speculators to take advantage of this disparity, especially in light of the current increase in demand."

He stressed that "understanding these reasons and taking measures to control supply and demand, in addition to monitoring price differences between markets, represents an important step towards stabilizing the dollar price in Iraqi markets."

The Iraqi public had been optimistic about the decline in the dollar price in recent weeks, hoping that this would be reflected in price stability and a decline in commodity costs. However, the ongoing volatility has dispelled these expectations, after the price rose again, affected by the increase in demand that is not officially covered and the slowness of government solutions, which has left the public facing renewed concerns about a new wave of looming inflation. link

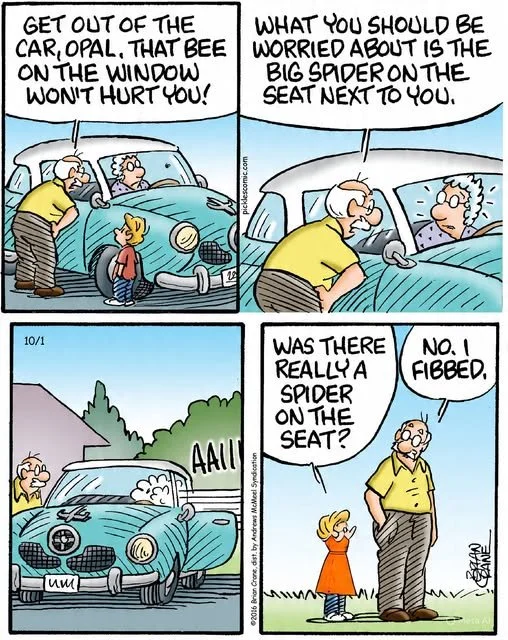

Mot: .. ole ""Opal's"" at it again!!!

MilitiaMan and Crew: Iraq Dinar News Update-WTO-Currency-Investment-Global

MilitiaMan and Crew: Iraq Dinar News Update-WTO-Currency-Investment-Global

8-23-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update-WTO-Currency-Investment-Global

8-23-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Friday Morning 8-22-25

Good morning Dinar Recaps,

Fed Chair Jerome Powell Faces Delicate Balancing Act in Jackson Hole Speech Today

When Federal Reserve Chair Jerome Powell takes the stage today at the annual Jackson Hole, Wyoming economic forum, he will face mounting pressures—from President Trump’s repeated calls for his resignation to a recent stream of worrying economic data.

Good morning Dinar Recaps,

Fed Chair Jerome Powell Faces Delicate Balancing Act in Jackson Hole Speech Today

When Federal Reserve Chair Jerome Powell takes the stage today at the annual Jackson Hole, Wyoming economic forum, he will face mounting pressures—from President Trump’s repeated calls for his resignation to a recent stream of worrying economic data.

Powell, whose term as Fed Chair ends in May 2026, will likely deliver his last major policy speech as head of the central bank. The event, hosted by the Federal Reserve Bank of Kansas City, is closely watched because it provides a stage for Fed officials to signal views on the economy and future monetary policy direction.

Focus on Rates at Jackson Hole

A key issue is whether Powell will hint at the Fed’s next interest rate decision, scheduled for Sept. 17.

President Trump has pushed the Fed to cut rates, citing solid economic data and muted inflation.

Powell, however, has emphasized a “wait and see” approach, especially as the Fed evaluates the impact of tariffs on consumer prices.

Meanwhile, new signals—such as slowing job growth and inflation showing its largest increase in three years—complicate the picture.

Melissa Brown, Managing Director of Investment Decision Research at SimCorp, summed it up:

“You have this political pressure balanced off against the economic pressure, which makes Powell’s job particularly difficult.”

The Fed declined to comment ahead of Powell’s remarks. The Kansas City Fed will livestream the speech Friday at 10 a.m. Eastern Time on YouTube.

Will the Fed Cut Rates?

Powell is expected to avoid confirming whether the Federal Open Market Committee (FOMC) will lower rates in September.

By design, Fed decisions are kept private until officially announced to avoid market disruption and to maintain independence from political pressure.

Before the Sept. 16–17 meeting, the Fed will receive two key reports:

Labor Department jobs report (Sept. 5)

Consumer Price Index (CPI) (Sept. 11)

Recent political tension has risen after the head of the Labor Statistics Bureau was fired in August, following a sharp slowdown in reported job creation—figures that President Trump openly questioned.

Mike Sanders, Head of Fixed Income at Madison Investments, explained:

“I don’t think Powell can push the narrative toward cutting because that leaves him no option but to cut. He has to signal data-dependence.”

Markets, however, are already betting on a cut. FactSet data shows an 88% chance of a 0.25% rate reduction in September.

Last year at Jackson Hole, Powell hinted at cuts, which materialized the following month with a 0.50% rate reduction.

Dual Mandate, Conflicting Signals

Powell also faces the Fed’s dual mandate:

Maximize employment

Maintain stable prices (inflation control)

These mandates often conflict:

Cutting rates may boost job growth but risk higher inflation.

Holding rates steady may stabilize inflation but slow employment growth.

Economist Will Denyer (Gavekal Research) noted the Fed may face a stagflation risk—a combination of slow growth and rising inflation, considered the “Fed’s nightmare scenario.”

Minutes from the July 30 FOMC meeting reveal that some members still worry supply-chain disruptions could keep inflation elevated, confirming that inflation remains a central concern.

Oxford Economics Chief U.S. Economist Ryan Sweet added:

“The labor market will be the swing factor on whether the Fed cuts interest rates in September or not.”

@ Newshounds News™

Source: CBS News

~~~~~~~~~

US House Adds CBDC Ban to Massive Defense Policy Bill

The House has quietly slipped a provision banning the Federal Reserve from issuing a digital currency into an almost 1,300-page defense policy bill, underscoring how the debate over money’s future has become tied to national security legislation.

The move comes through a revision of HR 3838, the House’s version of the National Defense Authorization Act (NDAA), shared Thursday by the House Rules Committee. The language is sweeping: it bans the Federal Reserve from studying, developing, or creating any digital currency.

The House had already passed a separate CBDC-ban bill in July — the Anti-CBDC Surveillance State Act — by a razor-thin margin of 219–210. But that measure faced a steep uphill battle in the Senate. By inserting the ban into the NDAA, lawmakers have effectively hitched it to must-pass national security funding, increasing its odds of survival.

Why It Matters

The NDAA is among the most critical annual bills in Congress, setting defense budgets and military priorities. It is also notorious as a vehicle for non-defense riders that would otherwise stall if brought as standalone measures. By embedding a CBDC prohibition here, House Republicans have dramatically shifted the battleground.

House leaders promised the CBDC ban in July as part of a deal with conservative hardliners.

A group of GOP holdouts had refused to advance three crypto-related bills unless a ban was guaranteed, stalling floor debate for over nine hours — the longest delay in House history.

The logjam broke only after House Majority Leader Steve Scalise pledged that the ban would be added to the NDAA.

What the Provision Does

The language would:

Ban the Federal Reserve from issuing a CBDC or any digital asset.

Block the central bank from offering financial products or services directly to individuals.

Prohibit the Fed from even “testing, studying, developing, creating, or implementing” a digital currency.

Allow a carve-out for stablecoins, clarifying that the bill does not prohibit “any dollar-denominated currency that is open, permissionless, and private.”

Historical Context

Republicans have long targeted CBDCs as a threat to financial privacy and state overreach.

In early 2023, Representative Tom Emmer introduced the CBDC Anti-Surveillance State Act, but it died in the previous Congress.

Emmer has since reintroduced the bill, framing it as aligned with President Donald Trump’s January executive order prohibiting CBDCs.

With its new place in the NDAA, however, the CBDC ban is no longer a fringe fight — it is now tethered to America’s broader defense and security posture.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

CFTC Launches Crypto Sprint With Public Consultation Open Until October 20, 2025

The Commodity Futures Trading Commission (CFTC) has opened its latest “crypto sprint,” a major step in advancing President Trump’s digital asset agenda. This initiative, running through October 20, 2025, invites public feedback from industry leaders, investors, and everyday users to help shape the next phase of U.S. crypto market rules.

Working in tandem with the SEC, the sprint underscores a push for stronger federal oversight of spot trading, signaling that digital assets have become a priority at the highest levels of government.

Focus on Spot Market Oversight

Acting Chairman Caroline D. Pham announced that the sprint will begin immediately, with a focus on:

Federal-level trading rules to strengthen spot market oversight.

Expanded attention to leveraged, margined, and retail trading risks.

Alignment with the SEC’s “Project Crypto”, in direct response to Trump’s call for U.S. leadership in digital assets.

Calling this the start of a “Golden Age of innovation,” Pham urged the industry to embrace both growth and responsible regulation as central to U.S. competitiveness in global digital finance.

Expanding Oversight Beyond Spot Trading

This is the second CFTC crypto sprint in recent weeks:

The first focused specifically on spot trading.

The new phase expands to broader market structure, leverage, and retail-focused products.

Pham emphasized the Commission’s commitment to managing risks without stifling innovation, highlighting coordination with the SEC, the White House, and market stakeholders.

Public Consultation Open Until October 20

Public participation is central to this process. The CFTC is inviting feedback from institutions, builders, and individual investors via its official website. This marks a rare chance for the crypto community to directly shape future U.S. digital asset rules.

Implications for the Market

Bullish case: Clear rules could legitimize the market, attract institutional money, and accelerate mainstream adoption.

Bearish case: Overly strict limits on leverage and retail access — combined with regulatory overlap — could suppress innovation and push projects overseas.

Either way, the CFTC’s sprint represents a pivotal moment: the rules that emerge could define the U.S. crypto market for years to come.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Partners with SBI to Roll Out RLUSD Stablecoin in Japan by Q1 2026

Ripple announced Friday that it will launch its Ripple USD (RLUSD) stablecoin in Japan in partnership with SBI Holdings by the first quarter of 2026. The rollout will be managed through SBI VC Trade, the crypto subsidiary of SBI Holdings.

As of Friday morning, RLUSD holds a market capitalization of $666 million with a 24-hour trading volume of $71 million, according to CoinGecko.

Ripple and SBI’s Strategic Collaboration

Ripple emphasized that Japan is a critical market for the expansion of stablecoin adoption. In the announcement, Tomohiko Kondo, CEO of SBI VC Trade, said:

“SBI Group has been leading the development of the cryptocurrency and blockchain field in Japan. The introduction of RLUSD will not just expand the option of stablecoins in the Japanese market, but is a major step forward in the reliability and convenience of stablecoins in the Japanese market.”

This partnership builds on SBI’s longstanding relationship with Ripple, reinforcing their joint strategy to drive digital asset infrastructure in Asia.

RLUSD: Backed and Growing

Launched in December 2024.

Backed 1:1 by reserves that include:

U.S. dollar deposits

Short-term U.S. government bonds

Other cash equivalents

The stablecoin market overall has seen sharp growth, with the supply of USD-pegged stablecoins hitting $266 billion as of Thursday, up from $256 billion on August 1, according to The Block’s data dashboard.

Expanding Global Reach

Ripple has been positioning RLUSD as a global payments rail:

In June 2025, the Dubai Financial Services Authority approved RLUSD for use within the Dubai International Financial Centre, broadening its international footprint.

The upcoming Japan launch marks another step in Ripple’s ambition to position RLUSD as a reliable, institution-friendly stablecoin in both regional and global markets.

Conclusion

Ripple’s Japan expansion with SBI Holdings demonstrates how stablecoins are moving beyond U.S. markets into regulated, high-demand regions. With Japan’s openness to blockchain innovation and SBI’s leadership role in fintech adoption, the partnership could become a model for stablecoin integration across Asia.

@ Newshounds News™

Source: The Block

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Active Resistance to the Digital Financial Reset

Active Resistance to the Digital Financial Reset

Miles Harris: 8-18-2025

A major change is occurring in the global financial system. Governments and financial institutions describe this change as modernization, efficiency, or digital innovation.

In reality, it is a gradual shift of money, markets, and ownership records into centralized digital systems.

Active Resistance to the Digital Financial Reset

Miles Harris: 8-18-2025

A major change is occurring in the global financial system. Governments and financial institutions describe this change as modernization, efficiency, or digital innovation.

In reality, it is a gradual shift of money, markets, and ownership records into centralized digital systems.

These systems make assets visible in real time, programmable by policy, and subject to rules that can change without the consent of the owner.

Understanding this process is essential for anyone who wants to maintain control over their assets and plan for the future.

00:00 Intro

Legal & Regulatory Changes

Institutional & Infrastructure Developments

Digital Identity Integration

Engineered Liquidity

Events Policy Narratives

Control Layer Indicators

International coordination clues

Planning the Sequence of Actions

A Practical Monitoring System Conclusion

Seeds of Wisdom RV and Economic Updates Tuesday Morning 8-19-25

Good Morning Dinar Recaps,

US Treasury Calls for Public Comment on GENIUS Stablecoin Bill

The U.S. Treasury Department is seeking public input on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law by President Donald Trump in July. The move is part of a broader effort to strengthen U.S. leadership in digital assets while addressing illicit finance risks tied to crypto.

Good Morning Dinar Recaps,

US Treasury Calls for Public Comment on GENIUS Stablecoin Bill

The U.S. Treasury Department is seeking public input on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law by President Donald Trump in July. The move is part of a broader effort to strengthen U.S. leadership in digital assets while addressing illicit finance risks tied to crypto.

************************************

Public Comment Period Open Until Oct. 17

Treasury has invited individuals and organizations to submit comments by October 17.

Feedback should focus on innovative methods to detect and mitigate illicit activity involving digital assets.

Areas of particular interest include:

Anti–money laundering strategies

APIs and blockchain monitoring tools

Artificial intelligence applications

Digital identity verification

Treasury officials will compile and review the public responses before submitting formal reports to the Senate Banking Committee and House Financial Services Committee.

Secretary Bessent: Essential Step for U.S. Leadership

Treasury Secretary Scott Bessent described the consultation process as “essential” for implementing the GENIUS Act and securing American leadership in the digital asset sector.

The law requires the Treasury and Federal Reserve to finalize regulations before full implementation. Under the timeline:

The GENIUS Act will take effect 18 months after being signed (July 2025), or

120 days after final regulations are published — whichever comes first.

Political and Regulatory Timing

The timing suggests that enforcement of the GENIUS Act will not overlap with the 2026 midterm elections, reducing the likelihood of the law being used as a campaign issue.

Broader Crypto Legislation Efforts

The GENIUS Act was one of three major bills advanced during Republicans’ “crypto week” in July:

GENIUS Act – Establishes a regulatory framework for stablecoins

Digital Asset Market Clarity (CLARITY) Act – Aims to provide clearer rules for digital asset markets

Anti-CBDC Surveillance State Act – Pushes back against a government-issued central bank digital currency

*********************************************

The House of Representatives passed all three with bipartisan support. The Senate Banking Committee has indicated it will prioritize crypto market structure, aiming to advance its own version of the CLARITY Act by October.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Tether Appoints Former White House Crypto Council Head Bo Hines as U.S. Strategy Advisor

Stablecoin leader Tether (USDT) has appointed Bo Hines, the former executive director of the White House Crypto Council, as its Strategic Advisor for Digital Assets and U.S. Strategy. The move marks a major step in Tether’s push to establish a regulated presence in the U.S. under the new pro-crypto administration.

Bo Hines Brings Washington Insider Experience

Hines, a Yale-trained attorney and former GOP congressional candidate, played a central role in shaping U.S. crypto policy.

At the White House, he helped secure passage of the GENIUS Act, creating a federal framework for stablecoins.

He also organized a high-level digital assets summit connecting industry leaders with government officials.

After seven months in government service, Hines stepped down in early August before moving to the private sector.

Why the Appointment Matters for Tether

Tether has long operated outside the U.S. regulatory framework. By adding Hines, the company gains:

A direct connection to U.S. policymakers

Expertise in navigating Washington’s legislative and regulatory processes

Strategic positioning to launch a U.S.-compliant stablecoin under the GENIUS Act

Tether CEO Paolo Ardoino confirmed that U.S. expansion plans are “well underway,” calling Hines’s appointment a pivotal step toward meeting institutional and regulatory standards in the world’s largest market.

Tether’s Market Position

Tether issues USDT, the world’s largest stablecoin.

Circulating supply exceeds $166 billion, according to The Block’s data dashboard.

The company’s U.S. strategy signals its ambition to transition from operating on the regulatory margins to becoming a fully integrated player in the American financial system.

@ Newshounds News™

Source: The Block

~~~~~~~~~

*********************************

Ripple Backs Gemini’s IPO Filing With $75M Credit Line, RLUSD Option Included

Ripple has emerged as a key backer of Gemini’s upcoming IPO, providing the exchange with a $75 million credit line that could expand to $150 million. The deal also introduces Ripple’s new stablecoin, RLUSD, as a borrowing option once the initial facility is tapped.

Key Takeaways

Ripple extends $75M credit line to Gemini, with potential to reach $150M and RLUSD as a borrowing option.

Gemini files for IPO under ticker “GEMI,” aiming to become the third U.S. crypto exchange to go public.

The exchange reported a $282.5M net loss in H1 2025, highlighting steep financial headwinds ahead of listing.

RLUSD inclusion signals Ripple’s ambition to challenge Tether (USDT) and Circle (USDC) in the stablecoin market.

Gemini’s IPO Plans

Gemini, which plans to list on Nasdaq under the ticker “GEMI,” disclosed the agreement with Ripple as part of its long-anticipated public offering.

The move positions Gemini to become the third crypto exchange to go public in the U.S., following Coinbase (2021) and Bullish (2025).

However, Gemini’s filing also revealed significant financial challenges:

A $282.5 million net loss in H1 2025, up nearly sevenfold from last year.

Revenue sliding to $67.9 million, down from $74.3 million in the same period of 2024.

Ripple’s Credit Facility Terms

Under the agreement with Ripple Labs, Gemini can:

Borrow in tranches of at least $5 million.

Pay interest rates of 6.5% or 8.5%, with collateral required.

Once borrowing surpasses $75 million, loans can be denominated in RLUSD, providing Ripple’s new stablecoin a direct entry into U.S. exchange infrastructure.

****************************************

No funds have been drawn yet, but the inclusion of RLUSD underscores Ripple’s push to compete with USDT and USDC, which dominate the stablecoin market.

For Gemini, the facility provides fresh liquidity at a critical moment, as investor scrutiny intensifies ahead of its IPO.

Wall Street Giants Back Gemini IPO

The deal is being led by major Wall Street banks, including:

Goldman Sachs

Citigroup

Morgan Stanley

Cantor Fitzgerald

With Academy Securities and AmeriVet Securities acting as co-managers.

Investor appetite for crypto listings is strong:

Circle’s IPO (June 2025) saw shares surge nearly 10x from its $31 offering price before settling at $149.

Bullish’s IPO earlier this week more than tripled from $37 to nearly $70 on its first trading day.

Several other firms — including OKX, Grayscale, and Kraken — are also considering public offerings. Meanwhile, listed giants like Coinbase and MicroStrategy have hit multi-year highs.

Policy Shift Fuels IPO Wave

The IPO momentum comes amid a regulatory climate increasingly favorable to digital assets:

Since President Trump’s return in January 2025, the SEC has dropped most cases against crypto firms.

The administration has advanced a pro-crypto agenda, including:

An executive order urging regulators to remove barriers preventing 401(k) retirement plans from including crypto assets.

Potential reforms that could allow millions of Americans to allocate retirement savings into Bitcoin and other digital assets through regulated channels.

@ Newshounds News™

Source: CryptoNews

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Late Saturday Evening 8-16-25

Iraq Economic News and Points To Ponder Late Saturday Evening 8-16-25

Rafidain Bank Signs An Agreement With An American Company In The Field Of Financial Consulting And Oversight

Banks Economy News – Baghdad Rafidain Bank announced today, Friday, the signing of a professional partnership agreement with an American company in the field of financial consulting and oversight.

Rafidain Bank Director General Ali Karim Hussein Zahir Al-Fatlawi said in a statement published by the Iraqi Embassy in Washington, "In a new strategic step that reflects Iraq's growing financial standing on the international stage, the Iraqi Embassy in Washington witnessed the signing of a professional partnership agreement between Rafidain Bank and K2 Integrity, a global leader in financial and regulatory consulting."

Rafidain Bank Signs An Agreement With An American Company In The Field Of Financial Consulting And Oversight

Banks Economy News – Baghdad Rafidain Bank announced today, Friday, the signing of a professional partnership agreement with an American company in the field of financial consulting and oversight.

Rafidain Bank Director General Ali Karim Hussein Zahir Al-Fatlawi said in a statement published by the Iraqi Embassy in Washington, "In a new strategic step that reflects Iraq's growing financial standing on the international stage, the Iraqi Embassy in Washington witnessed the signing of a professional partnership agreement between Rafidain Bank and K2 Integrity, a global leader in financial and regulatory consulting."

He added that "the agreement includes providing a comprehensive package of services, including combating money laundering and terrorist financing, implementing compliance systems in line with international standards, and strengthening the regulatory infrastructure of Iraqi banks."

He noted that "this cooperation is part of the Iraqi government's strategy to build a strong and transparent financial sector capable of keeping pace with global economic transformations and consolidating Iraq's position as a promising financial center in the region."

He explained that "this partnership represents a qualitative leap forward in the path of banking reform," noting that "the agreement will contribute to strengthening confidence in Iraqi banks and opening broader horizons for cooperation with correspondent banks around the world, supporting the government's goals of building a strong, transparent financial sector that is consistent with international best practices."

This signing comes as an extension of the government's approach to launching strategic projects that enhance Iraq's position as a promising financial center in the region, and consolidate its image as a country capable of keeping pace with global economic transformations with confidence and competence. https://economy-news.net/content.php?id=58801

Rafidain Bank Signs Agreement With US Company Amid Criticism In Congress

Rafidain Bank announced on Friday (August 15, 2025) the signing of a professional partnership agreement with K2 Integrity, an American financial consulting and oversight firm, during a ceremony held at the Iraqi Embassy in Washington.

According to a statement from the bank, the agreement includes a package of services covering anti-money laundering and counter-terrorism financing, the implementation of international compliance systems, and strengthening the regulatory structure of Iraqi banks.

The bank's general manager, Ali Karim Hussein Dhaher Al-Fatlawi, emphasized that the partnership represents "a qualitative leap in the path of banking reform" and will contribute to enhancing confidence in Iraqi banks and opening up broader horizons for international cooperation.

According to the statement, this signing comes within the Iraqi government's strategy to build a strong and transparent financial sector capable of keeping pace with global economic transformations and consolidating Iraq's position as a promising financial center in the region.

However, US Representative Joe Wilson accused Rafidain Bank of conducting financial transactions with the Houthi group in Yemen, describing it as a "terrorist organization." He vowed to work to cut off US funding to Iraq in the upcoming financial allocations legislation and urged the US Treasury to impose sanctions against the bank. https://www.radionawa.com/all-detail.aspx?jimare=42440

Rafidain Bank Confirms: Our Agreement With K2 Integrity Puts Iraq On The Map Of The Global Financial System

Banks Rafidain Bank's General Manager, Ali Karim, emphasized that signing the partnership agreement with K2 Integrity represents a qualitative shift in the bank's journey and the Iraqi financial sector. He noted that this strategic step transforms Rafidain Bank from a traditional local institution to an integrated banking platform directly aligned with international standards.

Al-Fatlawi explained, in an interview with the official agency, followed by Al-Eqtisad News, that the partnership comes with direct support from Prime Minister Mohammed Shia Al-Sudani, and in accordance with Cabinet Resolution No. (23274) of 2023, within the framework of a comprehensive reform vision aimed at restructuring the banking sector, strengthening Iraq's economic and financial sovereignty, and repositioning the country on the map of the international financial system with confidence and transparency.

Al-Fatlawi told (INA): "The partnership agreement with K2 Integrity represents a qualitative shift for Rafidain Bank, which is no longer just a traditional local bank, but has become an institution working to connect Iraq to international banking standards."

He added, "K2 Integrity is a global leader in compliance and anti-money laundering and counter-terrorism financing, and our collaboration sends a clear message that Iraq is serious about reforming its financial institutions and preparing them to open up to the global financial system."

Prime Minister's support

He continued, "This partnership would not have seen the light of day without the great support of Prime Minister Mohammed Shia Al-Sudani, who adopted a serious reform vision to restructure the banking sector. The contract with K2 Integrity came in accordance with Cabinet Resolution No. (23274) of 2023, which reflects that this project is not just an individual initiative of the bank, but rather part of a higher government policy aimed at enhancing transparency and financial sovereignty in Iraq."

Direct gains for citizens

Al-Fatlawi told (INA): "On the local level, this agreement raises the level of compliance and transparency within the bank, and establishes a modern corporate culture based on governance and risk management. As for the citizen, it means more secure banking services, greater protection for their money, and enhanced confidence in an institution that has long been a fundamental pillar of the national economy. Simply put, the citizen will feel that their money is in safe hands subject to global regulatory standards."

Reintegrating Iraq into the international financial system

Regarding the agreement's implications for Iraq's financial reputation, he explained, "Iraq needs to rebuild trust with international institutions, and this agreement is key to that.

Through K2 Integrity's services, we will be able to issue reports according to the highest international standards, which will put us back on the map of the international financial system and give us the ability to open up to global correspondent banks and attract foreign investment. Simply put, we are establishing a new phase in which Iraq is viewed as a country serious about reform, not as a fragile or isolated economy."

Fortifying the economy

Al-Fatlawi emphasized that "the banking sector is the first line of defense for any country's sovereignty. Through this partnership, we are not only improving our services, but also protecting our economy from the risks associated with financial isolation or unjustified accusations, and building institutional capacity that grants us greater independence. This step truly translates the vision of the Prime Minister and the Iraqi government for Rafidain Bank to be part of a broader national project to enhance economic sovereignty."

Regarding Rafidain Bank's future vision after this partnership, Al-Fatlawi told the Iraqi News Agency (INA): "This agreement reflects our ambition to transform into a modern, integrated banking institution, capable of keeping pace with technological and regulatory developments in the world.

We are establishing a brighter and more stable banking future, where citizens trust our ability to manage their money, and international institutions trust our ability to comply with global standards. Simply put, we are laying the foundation for an Iraqi bank with a global identity." https://economy-news.net/content.php?id=58856

Al-Araji Discusses With The US Chargé d'Affaires Enhancing Cooperation And Combating Terrorism.

A wish | 03:15 - 08/16/2025 Mawazine News - Baghdad - National Security Advisor Qasim al-Araji received on Saturday the US Chargé d'Affaires in Iraq, Ambassador Stephen Fagin.

During the meeting, they discussed bilateral relations and ways to enhance cooperation in the field of combating terrorism and exchanging information and expertise.

Al-Araji also reviewed the details of the security memorandum of understanding signed between Iraq and Iran regarding border control and preventing smuggling and infiltration, stressing that Iraq proceeds from its supreme national interests and adopts a policy of balanced openness with countries of the region and the world.

For his part, Fagin renewed his country's support for the policies of the Iraqi government, praising its efforts in returning the displaced. He revealed that an international conference will soon be held in New York to urge countries to withdraw their nationals from the Syrian Al-Hawl camp and fully resolve this issue. https://www.mawazin.net/Details.aspx?jimare=265192

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Powell, Bad Data, and a Fractured Fed in the Shadow of the Trump Admin

Powell, Bad Data, and a Fractured Fed in the Shadow of the Trump Admin

Kitco News: 8-15-2025

The Federal Reserve stands at a critical juncture, navigating a complex landscape of economic data inconsistencies, growing internal dissent, and vocal political pressure regarding its leadership and monetary policy direction.

This intricate scenario was expertly dissected by Danielle DiMartino Booth, a respected voice in monetary policy, during a recent discussion with Jeremy Szafron on Kitco News.

Powell, Bad Data, and a Fractured Fed in the Shadow of the Trump Admin

Kitco News: 8-15-2025

The Federal Reserve stands at a critical juncture, navigating a complex landscape of economic data inconsistencies, growing internal dissent, and vocal political pressure regarding its leadership and monetary policy direction.

This intricate scenario was expertly dissected by Danielle DiMartino Booth, a respected voice in monetary policy, during a recent discussion with Jeremy Szafron on Kitco News.

The central theme of the conversation revolved around the quality of economic data guiding the Fed’s interest rate decisions and the palpable signs of an impending economic slowdown. Booth highlighted how a string of significant data revisions has thrown a wrench into the prevailing narrative of a robust economy, directly impacting the calculus for future rate decisions.

A key revelation from the discussion was the extensive downward revisions to crucial labor market data, particularly payroll figures. These adjustments, Booth noted, paint a starkly different picture than initially presented, weakening the argument for a perpetually strong jobs market.

Compounding this, rising delinquencies in consumer credit—specifically credit cards and student loans—further contradict the notion of a resilient consumer.

These inconsistencies, Booth emphasized, severely complicate the Federal Reserve’s decision-making process. If the underlying data guiding policy is flawed, then the resulting policy might be miscalibrated, risking either overtly tight or excessively loose monetary conditions.

Adding a potent political dimension to the economic discussion, Treasury Secretary Scott Bessent emerged as a vocal advocate for a dramatic shift in monetary policy. Bessent explicitly called for aggressive interest rate cuts, suggesting a lowering of 150 to 175 basis points, with an immediate 50 basis point cut as early as September.

He sharply criticized Fed Chair Jay Powell’s current “data-driven” approach as outdated, advocating for a return to a more proactive “1990s-style” economy where the Fed moved preemptively.

Bessent’s core warning: current monetary policy risks being “too tight for too long,” potentially stifling growth unnecessarily and pushing the economy into a deeper downturn.

Beyond the challenge of unreliable data, the discussion also shone a light on growing internal dissent within the Federal Open Market Committee (FOMC). An “unprecedented number of dissents” signals a widening divide among policymakers regarding the appropriate path for interest rates, indicating a lack of consensus that could further complicate future actions.

This internal friction, coupled with the increasingly public debate over Jerome Powell’s tenure as Fed Chair—with figures like Donald Trump and Scott Bessent openly discussing his potential replacement—raises significant concerns about the Federal Reserve’s cherished independence.

The reputational and political challenges facing the central bank underscore the delicate balance it must maintain between economic imperatives and external pressures.

The Kitco News discussion with Danielle DiMartino Booth paints a complex picture for the Federal Reserve. Plagued by questionable data, facing external political pressure for aggressive rate cuts, and grappling with internal dissent, the Fed stands at a critical juncture.

The choices made in the coming months, both on rates and leadership, will undoubtedly shape the trajectory of the U.S. economy and redefine the central bank’s role in a highly charged political landscape.

“Tidbits From TNT” Saturday 8-16-2025

TNT:

Tishwash: Trump's developments with Baghdad: A "rapid" withdrawal from Iraq before an imminent Israeli strike on Iran

After the US troop withdrawal from Iraq was scheduled to be suspended after the October 11 elections, Iraqi executive and parliamentary sources told Al-Araby Al-Jadeed that a decision was made in Washington to “accelerate” the withdrawal of hundreds of troops from the large Ain al-Assad base in Anbar.

This comes against the backdrop of escalating controversy between the Donald Trump administration and the Iraqi government over the Popular Mobilization Forces (PMF) law, which is no longer a secret. This is in addition to the successive explosion of numerous files, from the dollar to the smuggling of Iranian oil in Basra, as well as security agreements that Baghdad has recently been confused about.

TNT:

Tishwash: Trump's developments with Baghdad: A "rapid" withdrawal from Iraq before an imminent Israeli strike on Iran

After the US troop withdrawal from Iraq was scheduled to be suspended after the October 11 elections, Iraqi executive and parliamentary sources told Al-Araby Al-Jadeed that a decision was made in Washington to “accelerate” the withdrawal of hundreds of troops from the large Ain al-Assad base in Anbar.

This comes against the backdrop of escalating controversy between the Donald Trump administration and the Iraqi government over the Popular Mobilization Forces (PMF) law, which is no longer a secret. This is in addition to the successive explosion of numerous files, from the dollar to the smuggling of Iranian oil in Basra, as well as security agreements that Baghdad has recently been confused about.

The sources expressed their fear that this is related to expectations that are becoming more serious by the day, regarding “the resumption of war between Iran and Israel,” after experts stated that Iraq survived the previous war thanks to a heavy US presence in major Iraqi bases.

Al-Araby Al-Jadeed learned from Iraqi political and governmental sources that the US administration has notified the government of Prime Minister Mohammed Shia al-Sudani of the imminent withdrawal of hundreds of US soldiers and military personnel from the Ain al-Assad base in Anbar province, western Iraq.

The withdrawal is related to the Iraqi-US agreement, which stipulates the gradual withdrawal of US forces operating under the cover of the international coalition fighting ISIS since 2014. However, other sources spoke of US “displeasure” with the Iraqi government’s failure to adhere to understandings and agreements with the US administration.

According to the sources, "a senior advisor to the Iraqi government recently visited Washington and met with American officials, who informed him that the Iraqi government had not fulfilled its commitments to restrict the factions' weapons."

The sources pointed out that "the decision to withdraw a portion of US forces comes in contravention of the previously agreed-upon timetable between Baghdad and Washington for a gradual withdrawal, which was supposed to take place after the parliamentary elections scheduled for next November, meaning it is an emotional response from the US administration," expecting the withdrawal from Ain al-Assad base to begin next month.

Ain al-Asad Air Base is located 200 kilometers west of Baghdad, near the Euphrates River in the town of al-Baghdadi, west of Anbar Governorate, and is the largest US base in Iraq.

Ain al-Asad Air Base currently houses hundreds of American soldiers and military personnel. Along with American forces, the base is shared with the Iraqi Army's 7th Division, part of the Badia and Al-Jazeera Operations Command, which is responsible for Iraq's borders with Jordan and Syria, and parts of the border with Saudi Arabia.

In this context, a member of the Iraqi parliament told Al-Araby Al-Jadeed, “The United States is not satisfied with the performance of the Iraqi prime minister, and is exerting real pressure from all sides. Therefore, there must be real support for this government and prevent the continuation of American interference.” He added to Al-Araby Al-Jadeed, “The decision to withdraw American forces is expected, and may come within the framework of the security threat that may precede any expected Israeli operations in the coming period.

We do not currently know whether the forces will withdraw towards the Harir or Al-Tanf bases, or perhaps to bases in the Gulf, but these hints are merely tools to pressure the current government.”

However, security expert Ahmed Al-Sharifi pointed out, in an interview with Al-Araby Al-Jadeed, that “the American and foreign forces present at the Ain al-Assad base are considered mobile forces, meaning they are not fixed and are constantly moving between three bases: Al-Tanf and Al-Omar in Syria, and Ain al-Assad in Iraq. Each of these bases is linked to the others, which means that the possibility of the withdrawal of American forces from the Ain al-Assad base may be linked to the movement or perhaps the final withdrawal.”

Baghdad and Washington had agreed, at the end of September last year, to an official date for the end of the international coalition's mission against ISIS in the country, no later than the end of September 2025. This date was reached after months of dialogue between the two sides.

This came in the wake of escalating demands from armed factions and Iraqi forces allied with Iran to end its presence, particularly after the US strikes at the time on the headquarters of those factions in response to their attacks on coalition bases inside and outside the country, against the backdrop of the Gaza war. link

************

Tishwash: Rafidain Bank Signs Professional Partnership Agreement with K2 Integrity in Washington

In a new strategic step reflecting Iraq’s growing financial presence on the international stage, the Embassy of the Republic of Iraq in Washington hosted the signing ceremony of a professional partnership agreement between Rafidain Bank and K2 Integrity, a U.S.-based global leader in financial and regulatory consulting. The agreement is based on Iraqi Cabinet Resolution No. (23274) of 2023.

Under the agreement, K2 Integrity will provide a comprehensive package of services, including anti-money laundering and counter-terrorist financing measures, the implementation of compliance systems in line with international standards, and the enhancement of regulatory infrastructure for Iraqi banks.

This cooperation falls within the Iraqi government’s strategy to build a strong and transparent financial sector capable of keeping pace with global economic transformations, reinforcing Iraq’s position as a promising financial hub in the region.

The Embassy of the Republic of Iraq in Washington emphasized that this partnership reflects the strength and continued growth of Iraq–U.S. relations, particularly in the areas of economic diplomacy and strategic partnerships that support sustainable development.

The Embassy reaffirmed its commitment to further deepening these ties, advancing mutual interests, and expanding investment opportunities between the two countries. link

************

Tishwash: Hantoush: Dismantling the parallel market is key to the dollar's return to 135,000.

Financial researcher Mustafa Akram Hantoush emphasized that addressing the exchange rate issue in Iraq requires working on two main aspects: reforming the banking system and dismantling the parallel market. He noted that any partial solutions will not be sufficient to achieve the desired stability.

In an interview with Jarida Platform, Hantoush explained that “the Iraqi banking system suffers from weak competition due to the limited sale of dollars to a limited number of banks, in addition to the fact that most of them face international sanctions.” He indicated that “the current cooperation with Oliver Wyman aims to find practical solutions and increase the banks’ capital.”

He pointed out that "reducing restrictions on the banking system and opening up competition in foreign remittances will contribute to market stability," noting that "the other side of the solution is dismantling the parallel market linked to trade with Iran, where small traders and travelers to sanctioned countries operate."

Hantoush explained that "possible solutions include agreeing with the US Treasury Department on mechanisms for transferring funds, establishing three-way accounts for imported goods, and developing legal formulas for transferring funds to sanctioned countries via payment cards in their local currencies."

He concluded by saying, "Controlling the parallel market could restore the dollar exchange rate to 135,000 dinars per $100, if these steps are implemented comprehensively." link

Mot: Sum Times they Just Get - carried away!!!!

Mot: . Proud I Am!!!!