Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Unfortunately, these cons are common

Tamara Gane Updated Sun, June 22, 2025

Family vacations are exciting, but they can also present an opportunity for scam artists. Just ask a mom named Haylee who booked 11 flights on American Airlines for an upcoming cruise.

She explained in a recent TikTok video that both her daughter and niece are on the autism spectrum. She called the airline to check to see if accommodations like early boarding were available to make their travel day easier.

Woman Swindled Out Of Thousands Of Dollars In Airline Scam

Unfortunately, these cons are common

Tamara Gane Updated Sun, June 22, 2025

Family vacations are exciting, but they can also present an opportunity for scam artists. Just ask a mom named Haylee who booked 11 flights on American Airlines for an upcoming cruise.

She explained in a recent TikTok video that both her daughter and niece are on the autism spectrum. She called the airline to check to see if accommodations like early boarding were available to make their travel day easier.

A Call Gone Wrong

Haylee looked up the number for American Airlines. At least, that was her intention. In the video, she said, “I guess I must’ve not clicked the number because it rerouted the page."

Unaware that anything was amiss, she clicked the first number. A male voice answered the phone, asking for the flight confirmation numbers for the family’s upcoming trip.

An Offer That Seemed Too Good To Be True

Once he had the confirmation numbers, he was able to look up the flight information. He read it back to them, along with the last four digits of the two credit cards used to book the flights. This assured Haylee he was legit but unfortunately, this information is accessible to anyone with a person’s last name and confirmation number.

The man told Haylee he could give her a discount of $150 per ticket, priority boarding, and seats in the front of the plane. But there was a catch. According to Haylee, he said:

“I have to refund both of the cards, which could take 7-20 business days.

After he claimed to have processed the refund on the two cards, he informed her that he would put the flight on a single card. The new total would be $5,250, a $1,600 discount off the original flight cost.

A Suspicious Email

Haylee provided the man with some additional information, including her credit card number. He charged the card and sent her a confirmation email.

This is when Haylee realized something was wrong. The email said it was from “flight trip.” She thought she’d called American Airlines, so this didn’t make sense.

She quickly opened her American Airlines app. Her original flights were there. No changes had been made. At that point, Haylee realized she’d been scammed.

She immediately locked her credit cards and disputed the charge with her company.

How To Avoid Falling For A Similar Scam

Unfortunately, this is a common con. So common that the Federal Trade Commission (FTC) has an entire page devoted to scammers impersonating airline representatives. This is how they suggest you keep your personal information and your credit card numbers safe:

TO READ MORE: https://www.yahoo.com/creators/lifestyle/story/woman-swindled-out-of-thousands-of-dollars-in-airline-scam-022249321.html

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill — how to spot forgeries linked to this technique

Christy Bieber Tue, July 1, 2025 Moneywise

Kevin Costello, owner of Siam Imports, had a bad experience recently receiving payment with cash. A customer came into his store and paid with a fake $100 bill, but it turned out that the bill was actually a legitimate bill made into a counterfeit — and he failed to catch it.

"I had a couple other girls in here at the same time, so I didn’t really closely look at the $100, which if I would have did that I could [have] probably prevented it,” Costello said. One reason he didn't identify the issue on the spot: The counterfeit $100 was made using a clever technique thieves are favoring recently.

Hawaii Store Owner Duped By Fake $100 Made With Real $1 Bill — how to spot forgeries linked to this technique

Christy Bieber Tue, July 1, 2025 Moneywise

Kevin Costello, owner of Siam Imports, had a bad experience recently receiving payment with cash. A customer came into his store and paid with a fake $100 bill, but it turned out that the bill was actually a legitimate bill made into a counterfeit — and he failed to catch it.

"I had a couple other girls in here at the same time, so I didn’t really closely look at the $100, which if I would have did that I could [have] probably prevented it,” Costello said. One reason he didn't identify the issue on the spot: The counterfeit $100 was made using a clever technique thieves are favoring recently.

Unfortunately, Costello isn't the only one to receive payment with phony money, as counterfeiting cases are on the rise in Hawaii, where he owns his business. Fake bills can cost business owners a lot of money, so it's important to understand the dangers of this crime as well as how to identify fake bills — even if the counterfeiting is done well

Bleached Money On The Rise In Hawaii

According to Honolulu police, counterfeiting and forgery rose 16.5% in the past year.

While this counterfeiting can take on different forms, one popular method — and the one that applied to the bill Costello collected — involves taking $1 bills, bleaching them and reprinting them to look like real $100 bills.

"We’re seeing more and more of these bleaching of dollar bills and then they’re being printed with 50 or 100 on them,” Tina Yamaki, president of Retail Merchants of Hawaii, said.

One reason this approach is becoming common is that it can be really hard to detect. “It still feels kind of like a paper bill because you’re still using the same, you know, paper. It’s like if you throw money through the wash. Right? It still feels like a bill, but we’re seeing a lot more people now holding it up to the light, finding out that the [counterfeit detection] pens don’t always work,” Yamaki said.

It's not just Hawaii where there is a concern. According to the Federal Reserve, around one in 40,000 bills is counterfeit, with high-denomination ($50 and $100) bills accounting for most of the fake money

While this is a significant decline in counterfeit funds since 2006, when around one in 10,000 notes was thought to be fraudulent, this still means that as much as $30 million in fraudulent money is cycling through the economy.

How To Spot Fake Money

Costello feels that his mistake in accepting the fake $100 was driven by the fact that he simply didn't take the time to look carefully enough at the bill. "Take the extra couple seconds, actually, all it would’ve took,” Costello said.

TO READ MORE: https://www.yahoo.com/news/hawaii-store-owner-duped-fake-113100847.html

Fort Worth Teacher, 28, Loses $32K Fraud vs Scam

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

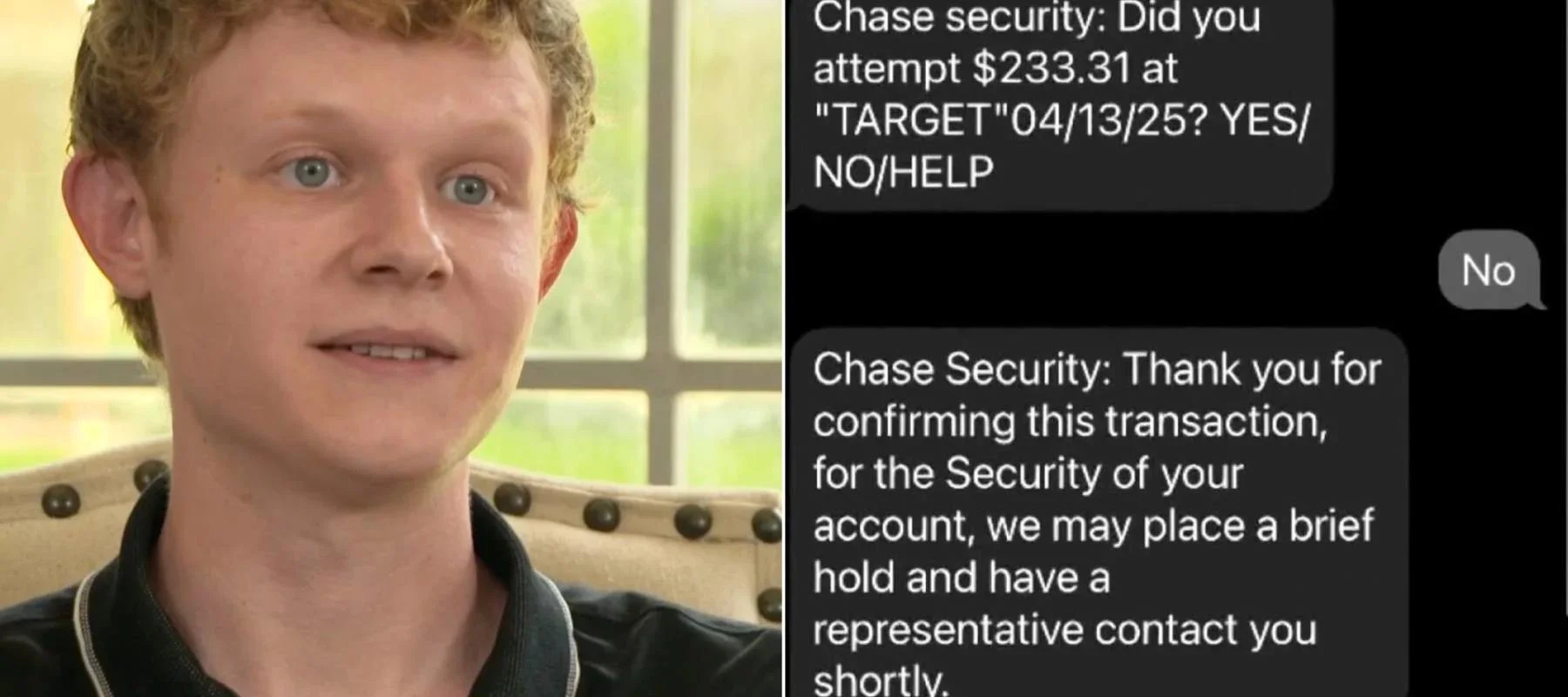

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Fort Worth Teacher, 28, Loses $32K After Scammers Tricked Him Into Sharing His Personal Banking Information

Cory Santos Sun, June 29, 2025 Moneywise

After spending years saving money in the hopes of starting a family, Russell Leahy and his wife are now forced to live paycheck to paycheck. Leahy, a 28-year-old teacher from Fort Worth, Texas, recently lost $32,000 to scammers who tricked him into revealing sensitive financial information.

"It was my entire life savings," Leahy told WFAA. "I had literally never felt like the wind had been taken out of my sails before. I'd never really felt like I was going to pass out before, but it really felt like the end of the world for me."

Leahy was reportedly contacted by scammers who claimed to be representatives of Chase Bank. The supposed bank reps called to inform Leahy that his account had been compromised and that he needed to protect his finances by moving the cash into a secure account. All it took were a few text messages and some counterfeit banking information in order to appear genuine.

"I couldn't even believe how sophisticated it was," Leahy told WFAA.

Now, the newlywed is trying to warn people about the scam that cost him everything in the hopes of preventing others from falling for the same scheme.

Fraud vs. a scam

Unfortunately for Leahy, the situation went from bad to worse when he contacted Chase Bank to report the incident. According to WFAA, the bank told Leahy that his account isn’t covered by fraud protection, arguing that Leahy was the victim of a scam and not financial fraud.

In making this distinction, Chase Bank returned just over $2,000 to Leahy’s account, which is merely a fraction of his total loss. When WFAA contacted Chase Bank for comment, the bank offered clarification on the distinction between fraud and a scam.

"Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission," the bank stated in its emailed reply.

A scam, on the other hand, is "a deceptive scheme or trick used to cheat someone out of their money or other valuable assets,” which is what happened to Leahy.

Chase Bank’s response likely isn’t what Leahy wanted to hear, but that hasn’t stopped him from sharing his story in order to prevent others from making the same mistakes.

"I'd rather I be the sacrificial lamb for the rest of these people and maybe save other people's money from being stolen," he said. "I'm really hoping to look ahead and move on with my life and not have to start over from scratch."

How to avoid falling for similar scams

TO READ MORE: https://www.yahoo.com/lifestyle/articles/fort-worth-teacher-28-loses-110000179.html

How Much Should You Share With Your Kids About Your Finances?

How Much Should You Share With Your Kids About Your Finances? Experts Weigh In

Nicole Spector Wed, June 25, 2025 GOBankingRates

Most of us were raised without any formal education in personal finance. This alone can hold us back. But for many of us, it’s worse than that — we didn’t have much of an understanding of what was going on with money in our own homes while we were growing up. Maybe we sensed, or were told, that the money situation at home was “bad” or “good” or “stressful.” But that’s not education — that’s emotion.

Now, as parents, we want our children to have it better than we did. That means equipping them with the right tools to navigate the world of personal finance when they’re older. So what, exactly, should we share with our kids about our finances?

How Much Should You Share With Your Kids About Your Finances? Experts Weigh In

Nicole Spector Wed, June 25, 2025 GOBankingRates

Most of us were raised without any formal education in personal finance. This alone can hold us back. But for many of us, it’s worse than that — we didn’t have much of an understanding of what was going on with money in our own homes while we were growing up. Maybe we sensed, or were told, that the money situation at home was “bad” or “good” or “stressful.” But that’s not education — that’s emotion.

Now, as parents, we want our children to have it better than we did. That means equipping them with the right tools to navigate the world of personal finance when they’re older. So what, exactly, should we share with our kids about our finances?

Your Money Values

“The first place my mind goes when thinking about your question is, share your money values,” said Brian Lawrence, partner and financial advisor at North Ridge Wealth Advisors. “Teaching values can start at a young age and last until they leave for college, or whatever the next step might be after high school.”

Consider the everyday — or even once-a-year — things you do with money that reflect your financial values. “The conversations can be as simple as saying, ‘We are a family that pays our bills on time’; ‘Our family doesn’t buy unnecessary things’; or ‘This family saves money so we can buy things that really matter, or go on special trips,'” Lawrence said. “The list is endless. And discussion should be welcome to help children understand ‘Why.'”

How Money Grows

Victor Wang, CEO at Stockpile, pointed out that many of us tell our kids, “Money doesn’t grow on trees,” but stop there. We should go further and show them where and how money does grow.

“Introducing concepts like compound interest and investing can help them understand the value of patience and long-term thinking,” Wang said. “You can start by explaining that when you invest money, it doesn’t just sit there. It can grow over time because the money you earn, through returns or dividends, can help you earn even more. Using simple examples or visual aids, like a chart or an online calculator, can make this concept clear and engaging for kids.”

Wang encouraged taking it a step further by showing your kids how you invest — whether through a retirement account or investing app.

“When kids see that investing is something you do little by little over time — not a one-off thing or some big gamble — they start to see that growing money is about patience and sticking with it,” he said. “Encouraging them to start small, maybe by saving part of their allowance or birthday money, and watching it grow bit by bit can help them feel excited and confident about handling their own money down the road.”

Your Relationship Between Work and Earnings

Kids, especially those too young to get summer jobs, may not clearly connect the dots about how their needs or wants are fulfilled by your income. You shouldn’t hold your hard work over their heads, but you should open a conversation about the concept of earning money by working.

TO READ MORE: https://www.yahoo.com/lifestyle/articles/much-share-kids-finances-experts-131606912.html

7 Unforeseen Financial Obligations You Take On When You Retire

7 Unforeseen Financial Obligations You Take On When You Retire

John Csiszar Mon, May 13, 2024

Once you retire, you want your financial life to be as uneventful as possible. If you’re like most retirees, you’ll be living on a combination of investment income and Social Security benefits, and that income will be relatively fixed and predictable.

This means that unexpected financial obligations can cause serious distress, as it might be hard to find a way to pay for them without going into debt. To avoid falling into this situation, it’s best to plan ahead and build a bigger emergency fund before you retire so that none of these expenses send you into a financial tailspin.

7 Unforeseen Financial Obligations You Take On When You Retire

John Csiszar Mon, May 13, 2024

Once you retire, you want your financial life to be as uneventful as possible. If you’re like most retirees, you’ll be living on a combination of investment income and Social Security benefits, and that income will be relatively fixed and predictable.

This means that unexpected financial obligations can cause serious distress, as it might be hard to find a way to pay for them without going into debt. To avoid falling into this situation, it’s best to plan ahead and build a bigger emergency fund before you retire so that none of these expenses send you into a financial tailspin.

General Healthcare Expenses

It’s a fact of life that at least statistically, healthcare expenses rise as you age. The problem in terms of budgeting for retirement is that there’s no way to know just how high those costs will go. For this reason, it’s best to head into retirement expecting these so-called “unexpected” healthcare costs and to budget on the high side if at all possible.

Elderly Parents

Even if you retire at 65, it’s entirely possible that your parents are still alive, and it’s also possible or even probable that they will need your assistance in some way. Oftentimes, this assistance comes in the form of financial aid. If you’re already struggling to live on your retirement budget, having to take care of your elderly parents might be enough to break the bank.

As you approach retirement, however, you’ll likely have a good idea of how much financial support you might have to provide for your elderly parents, and it’s important to incorporate this into your budget, if possible.

Long-Term Care

In addition to rising general healthcare expenses, many retirees will have to plan for long-term care. Research shows that up to 70% of adults 65 and older will need long-term care in their lifetimes, so it’s definitely an expense you should anticipate could arise after you retire. The national average median cost for long-term care ranges from $2,058 for adult day health care to $9,733 for a private room in a nursing home, according to Genworth.

Although it’s hard to budget for large expenses, knowing they are coming can help in the planning process. One of the avenues you might consider is getting long-term care insurance before you need it.

Adult Children

https://finance.yahoo.com/news/7-unforeseen-financial-obligations-retire-120029536.html

Read the Fine Print - Buyer Beware!!

Read the Fine Print - Buyer Beware!!

Maurie Backman Mon, June 23, 2025 Moneywise

Georgia roofer is out $12,000 after State Farm approved homeowner's claim — then refused to pay out in full

When Cumming, Georgia, homeowner Venkat Garikapati's roof sustained heavy wind damage in 2021, he filed a claim with his home insurance company, State Farm, to have it fixed.

However, State Farm only approved the replacement of 38 shingles and estimated the cost at $1,422.15 — less than Garikapati's $2,500 deductible — and closed the claim without paying, according to Atlanta News First. But Garikapati's roofer, David Garner, disputed the insurance company's assessment.

Read the Fine Print - Buyer Beware!!

Maurie Backman Mon, June 23, 2025 Moneywise

Georgia roofer is out $12,000 after State Farm approved homeowner's claim — then refused to pay out in full

When Cumming, Georgia, homeowner Venkat Garikapati's roof sustained heavy wind damage in 2021, he filed a claim with his home insurance company, State Farm, to have it fixed.

However, State Farm only approved the replacement of 38 shingles and estimated the cost at $1,422.15 — less than Garikapati's $2,500 deductible — and closed the claim without paying, according to Atlanta News First. But Garikapati's roofer, David Garner, disputed the insurance company's assessment.

"It was torn all to pieces," Garner told the local broadcaster of the roof's condition. "More than 70 shingles were creased or missing."

Garner, along with a public adjuster, spent years trying to prove to State Farm that Garikapati's roof needed a full replacement to avoid further damage and leaking, reports Atlanta News First. State Farm kept denying the claim before finally approving a full roof replacement on April 25, 2024 — more than three years after the original claim.

"They are never shy on collecting the monthly premium at all, but to get this approved took quite a long time," Garikapati said.

Garner went ahead and did the work. But after the initial "actual cash value" check cleared, State Farm refused to pay the replacement cost in full, citing a clause in Garikapati's insurance policy that stipulates a repair or replacement must be completed within two years of the date of loss to receive additional payments.

As a result, Garner is out $12,000 — and he blames State Farm fully.

Local roofer in the lurch

When a contractor does work on a home and isn't paid for it, they may be able to place a lien on the home. However, Garner doesn't want to do that to Garikapati.

"It's not the homeowner's fault that this is taking place," Garner said.

Despite the clause in Garikapati's insurance policy, Atlanta News First reports an attachment to State Farm's approval estimate stated: "Replacement cost benefits will be issued contingent completed of roof replacement and submission of photos, submission of photos, certificate of completion and or signed contract agreement with service provider."

But when Garner submitted the paperwork, he said State Farm wouldn't pay up.

"What am I supposed to do?" Garner asked. "I've already built the roof. I paid for the materials. I paid for the labor. Everything's done."

Garikapati filed a complaint with the Georgia Office of Insurance and Safety Fire Commissioner in January, per Atlanta First News, but that went nowhere.

“The whole reason this claim took a long time to get approved is because deny and delay, deny and delay,” Garner said.

Atlanta News First says it looked at recent complaints filed with the commissioner’s office and found that State Farm, the state's biggest insurer, had 892 complaints in 2024, up 126% from 2022. It also found that Allstate had 770 complaints, up 77% from 2022, while Progressive had 557, up 49% from 2022.

TO READ MORE: https://finance.yahoo.com/news/georgia-roofer-12-000-state-120000790.html

Philadelphia Man Lost Over $1M In Back-To-Back Scams

Philadelphia Man Lost Over $1M In Back-To-Back Scams — Here Are The Red Flags To Watch Out For

Vawn Himmelsbach Tue, June 24, 2025 Moneywise

Joe Subach was just trying to send some money to a friend. But one phone call later, with a woman named ‘Daisy,’ and his financial situation was forever changed.

Subach was the victim of two back-to-back scams — one that even involved him handing over his precious metals to money mules — that drained him of a whopping $1 million.

Philadelphia Man Lost Over $1M In Back-To-Back Scams — Here Are The Red Flags To Watch Out For

Vawn Himmelsbach Tue, June 24, 2025 Moneywise

Joe Subach was just trying to send some money to a friend. But one phone call later, with a woman named ‘Daisy,’ and his financial situation was forever changed.

Subach was the victim of two back-to-back scams — one that even involved him handing over his precious metals to money mules — that drained him of a whopping $1 million.

“I worked 43 hard years for that,” he told NBC10 News Philadelphia.

It started out with a simple online search for Apple’s customer support number to get help sending money to a friend via Apple Pay. When he called the number, a woman picked up and said her name was Daisy, from Apple.

What he didn’t realize until later — when it was too late — is that he called a phony number and Daisy was a fraudster.

How the back-to-back scams worked

In this case, Subach was the victim of a double fraud, starting with a customer service scam and then progressing into a romance scam.

When he first called the number, he says ‘Daisy’ told him that his account had been hacked and his identity had been compromised. She then told him he needed to buy gift cards, scratch off the backs and send her the numbers, which was part of the process to protect his money.

But the scam didn’t end there. Daisy told Subach that they’d have to monitor his phone 24/7.

“And so, her number was scrolling at the top of my phone the whole time,” he told NBC10.

Over the next few months, the customer service scam evolved into a romance scam where the two would text every day — even cooking meals at the same time and sharing photos of their food.

After earning his trust, ‘Daisy’ took the scam one step further by offering to protect all of his assets.

“I told her I have gold and silver with Equity Trust Company,” Subach told NBC10. ‘Daisy’ then told him to take all of his gold and silver out of his depository and she’d have someone come to his house and pick it up. Subach said he loaded his own gold and silver — valued at $780,000 — into the back of the vehicle.

The person driving the vehicle was likely a money mule, a person who is recruited to transfer stolen or illicit funds (or, in this case, precious metals).

“We look at the money mule dynamic in two different buckets,” Nicole Senegar, the FBI assistant special agent in charge in Philadelphia, told NBC10, explaining that sometimes they are in on the scam, taking a cut, but in other cases they can be unwitting victims.

According to the United States Attorney’s Office, “Fraudsters rely on money mules to facilitate a range of fraud schemes, including those that predominantly impact older Americans, such as lottery fraud, romance scams and grandparent scams.”

How to protect yourself

TO READ MORE: https://www.yahoo.com/lifestyle/articles/philadelphia-man-lost-over-1m-121700131.html

Investigators Say Anyone Can Be Vulnerable To Fraud

Investigators Say Anyone Can Be Vulnerable To Fraud

San Diego Seniors Lost $108 Million To Scams In 2024 — And Investigators Say Anyone Can Be Vulnerable To Fraud

Christy Bieber Mon, June 23, Moneywise

San Diego residents in their golden years should be enjoying the balmy weather and beaches, but instead, many are worrying about how to recover lost funds or survive financially after being scammed. Victims include retired professionals, says Michael Rod, an FBI supervisory agent in San Diego Count. Two such victims whom reported over $2 million stolen in the past two weeks. “Doctors, lawyers, judges, pilots, engineers, all have fallen victim to this stuff, like very smart, intelligent people,” Rod told ABC 10 News San Diego.

That's why scams are often underreported.

Investigators Say Anyone Can Be Vulnerable To Fraud

San Diego Seniors Lost $108 Million To Scams In 2024 — And Investigators Say Anyone Can Be Vulnerable To Fraud

Christy Bieber Mon, June 23, Moneywise

San Diego residents in their golden years should be enjoying the balmy weather and beaches, but instead, many are worrying about how to recover lost funds or survive financially after being scammed. Victims include retired professionals, says Michael Rod, an FBI supervisory agent in San Diego Count. Two such victims whom reported over $2 million stolen in the past two weeks. “Doctors, lawyers, judges, pilots, engineers, all have fallen victim to this stuff, like very smart, intelligent people,” Rod told ABC 10 News San Diego.

That's why scams are often underreported.

The FBI reports that last year, at least 1,300 San Diego residents aged 60 and older lost an average $80,000 each to fraudsters — a total $108 million, but that’s just the tip of the iceberg. Many victims are embarrassed and don't report when they've been targeted.

Rod now leads a new initiative dedicated to helping protect older residents in San Diego County from such scams: the San Diego Elder Justice Task Force. The task force is made up of local law enforcement agencies, the FBI, the District Attorney’s Office and Adult Protective Services.

"It's a first-of-the-kind model,” explained Rod, who is currently serving as task force commander.

It’s urgent work as elder fraud is on the rise nationwide — $4.8 billion in losses last year, according to the FBI. Residents of California, Florida, and Texas lost the most money, according to the FBI.

Not only is more money being stolen, but criminals are getting more brazen.

Scammers get bold, as criminals send couriers to pick up money

As ABC 10 News reports, one audacious scam is occurring almost daily in San Diego, as overseas criminals ensnare innocent victims in a tech support or overpayment scam, and then send a courier to their house to pick up cash.

Dale Marsh, a Carlsbad resident, was nearly a victim of this very crime after receiving a text from a phone number thanking him for purchasing Norton antivirus products.

He called the number to explain he hadn't made the purchase, and spoke to a “very polished, very professional, very non-threatening, very corporate, business-like” rep named Roger who told Marsh he'd have to enter $500 into an online form to have funds sent back to his bank account.

Marsh followed the instructions but then “Roger” claimed he had "accidentally" transferred $50,000 to Marsh’s account and that he would lose his job unless he sent a courier to Marsh to collect the $50,000 back immediately.

Fortunately, Marsh's wife heard this all from another room and called the police, so when the courier showed up in a Dodgers hat, he was greeted with a fake $50,000 as well as an arrest.

TO READ MORE: https://www.yahoo.com/news/san-diego-seniors-lost-108-210000102.html

5 Effective Ways To Stop Impulse-Buying And Save Money

5 Effective Ways To Stop Impulse-Buying And Save Money

Learn how to shop more intentionally (without feeling deprived)

Shira Gill | Organizing Expert

These tips will help you slow your roll when it comes to impulse buying, live more sustainably, and save a boatload of money. File that under #winwin.

Tip One: Practice Using What You Own

5 Effective Ways To Stop Impulse-Buying And Save Money

Learn how to shop more intentionally (without feeling deprived)

Shira Gill | Organizing Expert

These tips will help you slow your roll when it comes to impulse buying, live more sustainably, and save a boatload of money. File that under #winwin.

Tip One: Practice Using What You Own

Over the past few months I’ve been shocked at how often I feel the urge to buy something that I already own a perfectly good version of, including, but not limited to: lip balm, cozy sweaters, and pretty ceramic mugs.

I’ve been getting in the practice of noting the desire for the item in question, and then looking in my own home to see if I own something that could serve the exact same purpose.

This simple habit shift has prevented me from buying more than a handful of items I truly had no need for. Money saved, lessons learned.

Tip Two: Leverage The Power Of The Pause

In a culture that promotes instant gratification, even a brief pause can be a powerful tool in the fight against impulse buying.

Try writing down or snapping a photo of items you want before pulling the trigger.

I’ve found that when I do this I typically quickly forget about whatever thing I thought I desperately needed in the moment. Poof, it’s gone.

TO READ MORE: https://www.yahoo.com/lifestyle/story/5-effective-ways-to-stop-impulse-buying-and-save-money-014936616.html

What Do I Do Now?

What Do I Do Now?

Quentin Fottrell Sat, June 21, 2025

My sister and her husband died within days of each other. Their banks won’t let me access their safe-deposit boxes. What Do I Do Now?

Dear Quentin,

My sister and her husband passed away within a year of each other. I’m blessed that they had the foresight to have a will and living trust that, as the successor trustee, has made dispensing the trust assets much easier.

What Do I Do Now?

Quentin Fottrell Sat, June 21, 2025

My sister and her husband died within days of each other. Their banks won’t let me access their safe-deposit boxes. What Do I Do Now?

Dear Quentin,

My sister and her husband passed away within a year of each other. I’m blessed that they had the foresight to have a will and living trust that, as the successor trustee, has made dispensing the trust assets much easier.

My sister had a business safe-deposit box at her bank. The safe-deposit box is not listed as personal property and is not part of the trust.

However, I could access two other safe-deposit boxes in my sister’s name with her death certificate. The bank denied me access to her business box, saying it was not part of the trust and was opened in the name of her now-defunct business. The bank suggested filing a claim for unclaimed property in the state where I reside.

My brother-in-law also had a checking account for his medical corporation. The bank said I would be unable to access the funds with his death certificate and trust documents. The bank’s advice was the same as for my sister’s business safe-deposit box: File a claim with the state for abandoned property.

Our trust attorney said the cost of attempting to access the medical-business checking account ($11,000) might not be worth it.

My concern is that my sister may have placed three generations of wedding rings, and other family heirlooms in the safe-deposit box. Would I need to file an action in probate court to access the business safe-deposit box and business checking account or wait? Californian Sister

Dear Sister,

There are three complications to your dilemma.

First, access to these safe-deposit boxes may be complicated by the differing rules of each individual bank, and the fact that they may be in the name of the corporation rather than the individual. But if they are the sole owner of the box, the administrator or executor of your sister and brother-in-law’s estate would be able to access them with the right paperwork.

Second, if your sister died before your brother-in-law, his heirs will inherit his assets.

Hire a trust and estate lawyer who has experience in this field. You are taking advice from an attorney who has told you they do not have expertise in this area. So if this is a treasure hunt, you’re already knowingly walking in the wrong direction.

My answer is predicated on the assumption that your brother-in-law died first, but two deaths and two probate cases within a year complicate the process and may draw it out for many more months.

TO READ MORE: https://finance.yahoo.com/news/sister-her-husband-died-within-105900206.html

The US Likely Has 8 Years—At Most—Before Crisis

The US Likely Has 8 Years—At Most—Before Crisis

Notes From the Field By James Hickman (Simon Black) June 19, 2025

Yesterday afternoon the US government published its annual report stating plainly that America has eight years left before a major financial crisis.

This is not hyperbole. This is not conjecture. This is not some wild conspiracy theory.

In fact, eight years until a crisis is probably the BEST CASE SCENARIO unless Congress takes serious action soon.

The US Likely Has 8 Years—At Most—Before Crisis

Notes From the Field By James Hickman (Simon Black) June 19, 2025

Yesterday afternoon the US government published its annual report stating plainly that America has eight years left before a major financial crisis.

This is not hyperbole. This is not conjecture. This is not some wild conspiracy theory.

In fact, eight years until a crisis is probably the BEST CASE SCENARIO unless Congress takes serious action soon.

That’s because the most critical trust fund in the Social Security system (called OAS, or “Old Age Survivors) will be fully depleted.

That’s precisely what it says in the 2025 Annual Report of the Board of Trustees of Social Security, signed by the US Secretary of Treasury just yesterday.

And once that OAS Trust Fund runs out of money, the report states that Social Security benefits will be immediately and permanently cut by at least 23%. And then the benefit cuts will likely become worse over time.

This will constitute a broken promise to 70+ million Americans who spent decades paying into a system that was supposed to be solvent by the time they retire.

Now, Social Security’s biggest trust fund running out of money in 2033 would be problematic enough.

But on top of that— by 2033, the total US national debt will be $52 TRILLION according to Congressional Budget Office (CBO) estimates. And the CBO notoriously underestimates deficits... so in all likelihood the national debt will be event greater.

$52 trillion is so large that the government could easily be spending 40% of all tax revenue just to pay interest on the national debt.

Think about that. Not on defense. Not on infrastructure. Not even on the bloated entitlement programs Washington refuses to reform. Just interest.

These two things together— a massive annual interest bill combined with Social Security’s insolvency— will likely combine to a gargantuan fiscal crisis in the US. It’s eight years away.

Amazingly, politicians are not concerned. There is very little will to cut federal spending, or make necessary reforms that would allow Social Security to continue operating.

Foreign governments and central banks, on the other hand, clearly understand this problem.

They see how difficult it will be for the US to pay its debts in the not-so-distant future. And that’s why so many foreign institutions are dumping their US dollars and US government bonds.

In other words, foreigners are losing confidence in the US government, so they’re cashing out.

One of the biggest beneficiaries of this trend has been gold; we’ve been talking about this for a couple of years— as foreign governments and central banks dump their US dollars, they have been buying up record amounts of gold bullion.

This isn’t some ideological crusade—it’s a rational move for foreign governments and central banks; gold is liquid, fungible (i.e. standardized), globally recognized, and the market can absorb massive capital flows— hundreds of billions of dollars or more.

This is how they diversify to protect themselves from what will likely happen down the road in the US. You can do the same.

We have pointed out many times, however, that foreign governments and central banks buy gold. They do not buy gold companies.

This key difference has created a major disconnect between the price of gold (which is near a record high) and the valuations of gold companies (many of which are laughably cheap).

We have been writing about this trend for nearly two years, during which time the portfolio of gold companies (and other real asset businesses) has performed exceptionally well.

In our 4th Pillar investment research service, we pinpointed companies with world-class assets, great management, strong balance sheets, and dirt-cheap valuations. Then we shared them with subscribers.

The results speak for themselves:

One of our top picks is up 153% in just three months.

Another surged 146% over the past eleven months.

Two more have gained 133% and 51% respectively in just a few months.

Most other companies have delivered steady gains of “only” 27–34%.

For the sake of transparency we’ve had precisely ONE precious metals related company go the other way—it’s down 27%. But the fundamentals are solid, and with key catalysts on the horizon, we see it as even more undervalued now.

And in our most recent issue, we spotlighted a profitable gold company trading for less than the cash on its balance sheet.

Talk about limited downside—you could buy the whole company, get all your money back in cash, and still own a cash-flowing gold business for free.

We are exceptionally proud of this research and the returns that we deliver to our subscribers.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC