The Federal Reserve Just Hijacked American Democracy

The Federal Reserve Just Hijacked American Democracy

March 16, 2023 Simon Black, Founder Sovereign Research & Advisory

You know the old joke-- “Predictions are hard… especially about the future.” And it’s true, nobody has a crystal ball. But it’s astonishing to see just how horribly wrong the people in charge can be in their predictions, especially about the very near future.

You probably remember Joe Biden famously insisted in the summer of 2021 that the Taliban was “highly unlikely” to take over Afghanistan.

The Federal Reserve Just Hijacked American Democracy

March 16, 2023 Simon Black, Founder Sovereign Research & Advisory

You know the old joke-- “Predictions are hard… especially about the future.” And it’s true, nobody has a crystal ball. But it’s astonishing to see just how horribly wrong the people in charge can be in their predictions, especially about the very near future.

You probably remember Joe Biden famously insisted in the summer of 2021 that the Taliban was “highly unlikely” to take over Afghanistan.

Boy did he turn out to be wrong.

Only a few weeks later, the Taliban was in control of the entire country... and the world watched in utter astonishment as US military helicopters evacuated embassy personnel from Kabul in one of the most shameful episodes in modern American history.

Not to be outdone, it appears that the Federal Reserve has just had its own Afghanistan moment.

It was only Tuesday of last week that the Fed Chairman testified before a committee of concerned senators who thought the Fed may be tightening monetary policy (i.e. raising interest rates) too quickly.

This was a valid concern; rapid interest rate hikes DO create a LOT of risks. And one of those risks is that asset prices-- especially bond prices-- plummet in value.

This risk is particularly problematic for banks because they tend to invest their customer deposits in bonds.

In fact, now that the Fed has tightened its monetary policy so quickly, banks across the US have more than $600 billion in unrealized losses on their bond portfolios. This is a pretty major problem… because that $600 billion is ultimately YOUR money.

And it’s not like the Fed doesn’t have access to this information; after all, the Fed supervises nearly EVERY bank in the US financial system.

And yet last week the Fed Chairman completely rejected this risk, telling worried senators flat out that “nothing about the data suggests to me that we’ve tightened too much. . .”

In other words, he believed the Fed’s rapid interest rate hikes posed ZERO risk.

Talk about a terrible prediction; just THREE DAYS LATER, one of the largest banks in the US imploded, multiple bank runs unfolded across the country, the bond market fell into turmoil, and the Fed had to essentially guarantee the entire US banking system in order to restore confidence. (More on that in a moment.)

The mental image of bank runs in America, just days after the Chairman dismissed any risk, is the Fed’s equivalent of the Afghanistan debacle. It’s shameful.

But what’s REALLY concerning is the Fed’s response to this panic-- their de facto guarantee of the entire US banking system. Because ultimately they just put YOU on the hook for the potential bond losses of every bank in America. I’ll explain--

After Silicon Valley Bank went bust, the FDIC announced that they will guarantee ALL deposits at the bank.

This is a departure from the FDIC’s normal pledge to guarantee deposits of up to $250,000, and their decision drew a lot of ire from pundits and politicians across the ideological spectrum. Many people concluded that the FDIC’s pledge was tantamount to a “taxpayer-funded bailout.”

But that assessment is wrong. Anyone who is intellectually honest and well-informed will easily understand that the FDIC is not funded by taxpayers. The FDIC is funded by charging fees to its member banks.

So when the FDIC decided to guarantee every depositor at Silicon Valley Bank, including those with balances exceeding $250,000, it means they’re bailing out SVB’s wealthy customers at the expense of big Wall Street banks.

But most people seem to have missed the real story… because the ACTUAL bailout is coming from the Fed, not the FDIC.

Despite the Chairman’s terrible prediction in front of the Senate Banking Committee last week, the Fed now seems keenly aware of the risks in the US banking system. They realize that there are LOTS of other banks that are sitting on massive unrealized losses, just like SVB.

So in order to prevent these banks from going under, the Fed invented a new facility they’re calling the “Bank Term Funding Program”, or BTFP.

But the BTFP is really just an extraordinary lie designed to make you think that the banking system is safe. They might as well have called it, “Believe This Fiction, People”, and I’ll show you why.

Whenever people borrow money from banks, we normally have to provide some sort of collateral. Banks make home equity loans using real estate as collateral. They make car loans where the car is collateral. Manufacturing businesses borrow money using factory equipment as collateral.

Well, banks do the same thing when they borrow money. And sometimes banks will even borrow money from the Federal Reserve. This is actually one of the reasons why the central bank exists-- to act as a “lender of last resort” if banks need an emergency loan.

And when banks borrow money from the Fed, they have to post collateral too.

Instead of automobiles and houses, though, banks use their financial assets as collateral-- specifically their bonds.

This is actually codified by law (12 CFR 201.108) whereby Congress lists specific assets that the Fed can accept as collateral when making loans to banks. The list is basically different types of bonds.

But this is the root of the problem. Banks are in financial trouble because their bond portfolios have lost so much value. Some banks (like SVB) are even insolvent because of this.

So, through the BTFP, the Fed will now accept banks’ sagging bond portfolios as collateral, but loan the bank MORE money than the bond portfolios are worth.

Let’s say you’re an insolvent bank that invested, say, $100 billion in bonds. Those bonds are now worth $85 billion, and your bank is about to go under. “NO PROBLEMO!” says the Fed.

The bank simply posts their bond portfolio (which is only worth $85 billion) as collateral, and the Fed will loan the bank the full $100 billion… as if those losses never occurred.

It’s a complete lie. Everyone is pretending that the banks haven’t lost any money to give you a false sense of confidence in the financial system. “Believe the Fiction, People.”

Remember that banks in the US have more than $600 billion in unrealized bond losses right now. And that number will keep increasing if interest rates continue to rise.

So this means that the Fed has essentially guaranteed that entire $600+ billion. Commercial banks won’t lose a penny -- they can now pass their financial risks down to the Federal Reserve.

This isn’t a bailout… it’s a time bomb.

We can keep our fingers crossed and hope that this time bomb never explodes. But if it does, the Federal Reserve is going to be looking at hundreds of billions in losses… which would trigger devastating consequences for the US dollar.

This means that everyone who uses US dollars… including every man, woman, and child in America, is ultimately on the hook for the potential consequences of the BTFP.

And that’s what is so remarkable about this: the Fed just made this decision all on its own.

Congress didn’t pass a law. There were no hearings, no judicial oversight, no votes.

Instead, several unelected bureaucrats who have been consistently wrong got together in a room and decided to guarantee $600+ billion in bank losses… and stick the American people with the consequences.

This is the same organization that said in February 2021 that there was no inflation.

The same organization that said in July 2021 that inflation was transitory and would pass in a few months.

The same organization that said in June 2022 that they finally understand “how little we understand about inflation.”

The same organization that said THREE DAYS before SVB’s collapse that “nothing about the data” suggested any risks with their policy actions.

The Fed has been wrong at every critical point over the past few years. And they’ve now unilaterally signed up every single person in America to a $600+ billion bank bailout without so much as a courtesy phone call to Congress.

This is apparently what Democracy means in America today.

We’ve all been subjected to endless vitriol over the past few years with people on all sides howling that “Democracy is under attack.”

Well, we just watched an unelected committee of central bankers hijack democracy and stick the American people with a potential $600+ billion bank bailout.

To your freedom, Simon Black, Founder Sovereign Research & Advisory

https://www.sovereignman.com/trends/the-federal-reserve-just-hijacked-american-democracy-146308/

Scientists Explain How Intelligence Is Linked To Wealth

Scientists Explain How Intelligence Is Linked To Wealth

Today 22:55 Information / Baghdad... Some time ago, Sweden had an army formed by conscripts and before enrolling in the army, Swedish conscripts had to pass mathematical IQ tests. Thus, the data of 59,387 men in the 70s and 80s of the last century appeared in the hands of scientists.

The researchers then obtained data from the Swedish Tax Office on the average annual salary of these men between the ages of 35 and 45 when they were in most professional jobs. Scientists compared this data with that.

A strange picture turned out: up until a certain point, higher intelligence was directly linked to higher earnings.

Scientists Explain How Intelligence Is Linked To Wealth

Today 22:55 Information / Baghdad... Some time ago, Sweden had an army formed by conscripts and before enrolling in the army, Swedish conscripts had to pass mathematical IQ tests. Thus, the data of 59,387 men in the 70s and 80s of the last century appeared in the hands of scientists.

The researchers then obtained data from the Swedish Tax Office on the average annual salary of these men between the ages of 35 and 45 when they were in most professional jobs. Scientists compared this data with that.

A strange picture turned out: up until a certain point, higher intelligence was directly linked to higher earnings.

But at the top—among the ultra-high-earning 5 percent—surplus income did not depend on IQ (although this group's IQ remained above average).

After the minimum annual salary of €60,000, the researchers explained, there is no significant difference in mental abilities, although income levels differ widely.

Among the wealthy 1%, slightly lower intelligence is reported, even though this group of people earns twice as much income as their closest competitors.

This study is consistent with data from other studies, which did not find many Einsteins in the "upstairs" room.

According to a study by economists at the University of Lausanne, the average IQ of an average manager in a large company is 111 points. This indicator is considered above average, but not outstanding. For example, Bill Gates and Steve Hawking had IQs above 140. Actress Nicole Kidman scored over 130.

A study by Oxford University found that if the entire society were divided into 100 groups, with the first being the complete idiot and the 100th being the genius, the average CEO of a large company would rank 83rd.

So what do you miss to become a billionaire?

How do we explain this contradiction? Scientists have provided several answers to this question.

First Explanation: It is entirely possible that the cleverest acted like the monkey from a well-known fable in that he could speak, but was silent so as not to be forced into action.

In other words, the more advanced citizens do not want to earn more, because they already have enough of everything. Why should they bear the extra burden?

The meaning of this lifestyle is to find a balance between work and leisure, and between personal and social life.

So the lack of brilliance of the mind at the top of the pyramid of success can be compensated for by great ambitions.

The other explanation is that brains alone are not enough to develop a highly successful business.

Emotional intelligence is required. This is called charisma.

For example, leadership qualities, passion, and the ability to build a team around himself. This is what makes Elon Musk unique, who, without being a genius, revolutionized technological entrepreneurship.

And the third explanation is family resources - this is the reward that can compensate for the lack of abilities.

And it's not so much about heredity (although intelligence is often passed on from parents to children), but about the benefits that come from growing up in a good social environment.

For example, some psychologists believe that the difference in students' educational success is 30% in the mental abilities and 20% in the parents' resources.

And another factor that should not be underestimated is luck.

And sometimes being in the right place at the right time is much more important than being able to understand what the factor of the Euclidean cycle is (mathematicians understand that, but the rest of us don't have to rack their brains).

And in general, even if nature did not endow you with an outstanding mind, you can compensate for this deficiency with high motivation, hard work, diligence and leadership qualities.

This is quite enough to ascend to the highest levels of the social hierarchy. ended 25 n

https://almaalomah.me/news/scientific/علماء-يوضحون-مدى-ارتباط-الذكاء-بالثراء

To read more current and reliable Iraqi news please visit BondLady’s Corner:

8 Questions on the Banking Panic of 2023

8 Questions on the Banking Panic of 2023

Posted March 14, 2023 by Ben Carlson

On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy:

Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is. We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

I have lots of questions:

8 Questions on the Banking Panic of 2023

Posted March 14, 2023 by Ben Carlson

On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy:

Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is. We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

I have lots of questions:

1. Is This The Fed’s Fault?

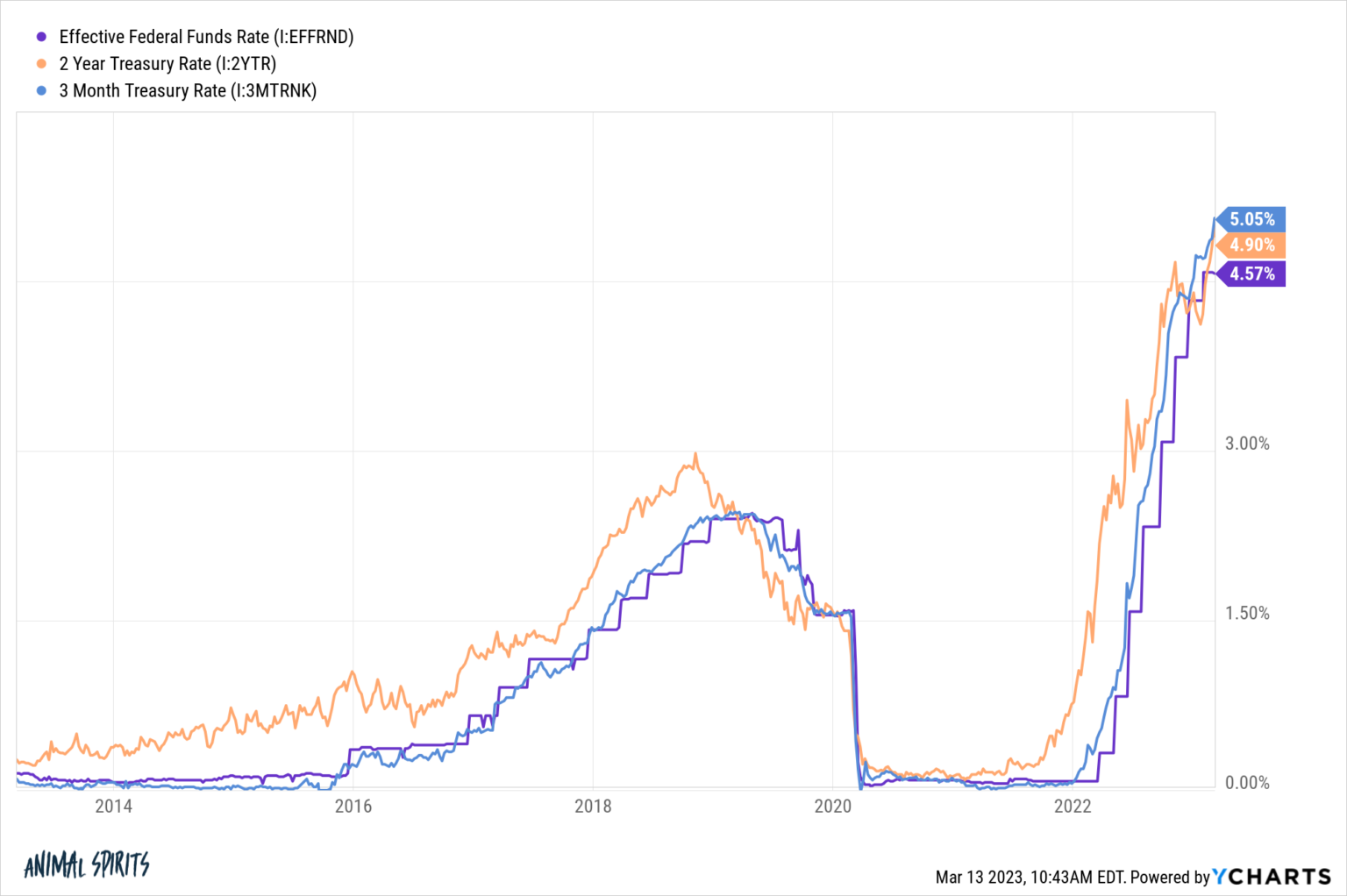

The Fed certainly played a role. It’s obvious in retrospect that they held rates too low for too long but they compounded that mistake by raising rates too far too fast:

Something was bound to break by going from 0 to 60 so quickly.

Silicon Valley Bank executives deserve a lot of blame too. They mismanaged their interest rate and liquidity risk, they had a concentrated set of clients and those clients all rushed to the exit doors at the same time. There are plenty of other banks that held up just fine with rapidly rising interest rates.

It’s never just one thing when something like this blows up.

The tech sector obviously doesn’t have a firm grasp on the financial sector just yet. But the Fed has blood on its hands here too.

2. Is the Fed done raising rates?

It’s amazing how quickly inflation has gone from being the biggest worry to a potential afterthought. The Fed still has price stability as a mandate and we’re not done fighting the war on inflation.

I just don’t see how they can remain so aggressive in the face of a banking crisis.

I don’t know if this bank run will have a material impact on the economy but it had to spook the Fed.

It was the failure of Continental Illinois in the early-1980s that made the Paul Volcker-led Fed realize they probably went too far with rate hikes.

3. Why Are Interest Rates Collapsing?

To continue reading, please go to the original article here:

https://awealthofcommonsense.com/2023/03/8-questions-on-the-banking-panic-of-2023/

The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

Gabrielle Olya Mon, February 28, 2022,

In today’s “Financially Savvy Female” column, we chat with Urban Adams, an investment advisor at Dynamic Wealth Advisors and the father of three young adult daughters. Here, he shares the financial lessons he taught them, his advice for other parents who want to raise financially savvy females and how being the father of daughters affected how he advises others in his practice.

The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

Gabrielle Olya Mon, February 28, 2022,

In today’s “Financially Savvy Female” column, we chat with Urban Adams, an investment advisor at Dynamic Wealth Advisors and the father of three young adult daughters. Here, he shares the financial lessons he taught them, his advice for other parents who want to raise financially savvy females and how being the father of daughters affected how he advises others in his practice.

What are the most important financial lessons you taught your daughters?

There are quite a few I taught them, [but the most important were] 1) wants versus needs, 2) saving for larger purchases, 3) independence by having their own money, and 4) awareness of what was saved for college for them.

Whenever a financial lesson to be taught presented itself, I would discuss it with them individually or as a group. More specifically, one example was opening checking accounts for them at the local credit union when they each turned 13. This got them comfortable with using a debit card, managing the balance, spending, etc. When each got their first job with W-2 income, I helped them open a Roth IRA to begin saving for retirement.

As the father of daughters, it was important for me to set them on a path to being financially independent. I have told my daughters numerous times over the years (they are 18, 19 and 21 now) that I will teach them the tools to be financially independent — with the aim of not having to be dependent on a mate or partner.

More personally, I’ve told them many times over the years that the only male they would ever be financially dependent on was me — and I was teaching them the lessons that would help them avoid being dependent on anyone.

When should parents start talking to their daughters about money?

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/4-most-important-pieces-advice-190012038.html

Look for These Major Financial Red Flags Before Depositing Your Next Check

$80,000 Money Scam? Look for These Major Financial Red Flags Before Depositing Your Next Check

Gabrielle Olya Tue, March 14, 2023 GOBankingRates

When Joe Schulz*, a small-business owner based in New Jersey, received a new customer order from a company based in Dubai, he felt that something may be off. It turned out his instincts were right, as his company was targeted for what turned out to be a fake check scheme that could have cost him nearly $80,000. Here’s his story.

$80,000 Money Scam? Look for These Major Financial Red Flags Before Depositing Your Next Check

Gabrielle Olya Tue, March 14, 2023 GOBankingRates

When Joe Schulz*, a small-business owner based in New Jersey, received a new customer order from a company based in Dubai, he felt that something may be off. It turned out his instincts were right, as his company was targeted for what turned out to be a fake check scheme that could have cost him nearly $80,000. Here’s his story.

A Suspicious Order

Schulz’s company specializes in making custom clothing and merchandise. Though he usually works with major brands, he occasionally does work with smaller companies. However, when a promotional company based in Dubai — where it’s warm year-round — placed an order for 200 custom coats, he felt that something may be off. Nevertheless, he moved forward with the order.

“They sent us the logo and we sent them a mock up for approval, and they said that they were going to wire the money from their United States-based warehouse in Pennsylvania,” he said. “They asked for our bank account information to make a deposit.”

However, the company ended up “accidentally” depositing too much.

“They deposited a check for $93,000 while the order was for $14,000,” Schulz said.

Signs of a Scam

After the deposit was made, the Dubai-based company sent Schulz an email stating that they made a wrong deposit of $93,000. They told Schulz to verify that the check had cleared — which it had — and asked him to wire back the difference between the deposit and the order amount — a whopping $79,000.

“Right away, we started looking into it,” Schulz said. “I saw that the check was cashed into our account and that the money was already available in the bank. But I looked at the check and it was from a construction supply company based in Indiana.”

Schulz did some research into the company listed on the check and found that it was a company that likely dealt with large orders, so a $93,000 deposit wouldn’t raise any immediate flags.

To continue reading, please go to the original article here:

https://news.yahoo.com/almost-scammed-80k-suspicious-check-130024847.html

If SVB Is Insolvent, So Is Everyone Else

If SVB Is Insolvent, So Is Everyone Else

Simon Black March 13, 2023

On Sunday afternoon, September 14, 2008, hundreds of employees of the financial giant Lehman Brothers walked into the bank’s headquarters at 745 Seventh Avenue in New York City to clear out their offices and desks. Lehman was hours away from declaring bankruptcy. And its collapse the next day triggered the worst economic and financial devastation since the Great Depression.

The S&P 500 fell by roughly 50%. Unemployment soared. And more than 100 other banks failed over the subsequent 12 months. It was a total disaster.

If SVB Is Insolvent, So Is Everyone Else

Simon Black March 13, 2023

On Sunday afternoon, September 14, 2008, hundreds of employees of the financial giant Lehman Brothers walked into the bank’s headquarters at 745 Seventh Avenue in New York City to clear out their offices and desks. Lehman was hours away from declaring bankruptcy. And its collapse the next day triggered the worst economic and financial devastation since the Great Depression.

The S&P 500 fell by roughly 50%. Unemployment soared. And more than 100 other banks failed over the subsequent 12 months. It was a total disaster.

This bank, it turned out, had been using their depositors’ money to buy up special mortgage bonds. But these bonds were so risky that they eventually became known as “toxic securities” or “toxic assets”.

These toxic assets were bundles of risky, no-money-down mortgages given to sub-prime “NINJAs”, i.e. borrowers with No Income, No Job, no Assets who had a history of NOT paying their bills.

When the economy was doing well in 2006 and 2007, banks earned record profits from their toxic assets.

But when economic conditions started to worsen in 2008, those toxic assets plunged in value… and dozens of banks got wiped out.

Now here we go again.

Fifteen years later… after countless investigations, hearings, “stress test” rules, and new banking regulations to prevent another financial meltdown, we have just witnessed two large banks collapse in the United States of America-- Signature Bank, and Silicon Valley Bank (SVB).

Now, banks do fail from time to time. But these circumstances are eerily similar to 2008… though the reality is much worse. I’ll explain:

1) US government bonds are the new “toxic security”

Silicon Valley Bank was no Lehman Brothers. Whereas Lehman bet almost ALL of its balance sheet on those risky mortgage bonds, SVB actually had a surprisingly conservative balance sheet.

According to the bank’s annual financial statements from December 31 of last year, SVB had $173 billion in customer deposits, yet “only” $74 billion in loans.

I know this sounds ridiculous, but banks typically loan out MOST of their depositors’ money. Wells Fargo, for example, recently reported $1.38 trillion in deposits. $955 billion of that is loaned out.

That means Wells Fargo has made loans with nearly 70% of its customer’s money, while SVB had a more conservative “loan-to-deposit ratio” of roughly 42%.

Point is, SVB did not fail because they were making a bunch of high-risk NINJA loans. Far from it.

SVB failed because they parked the majority of their depositors’ money ($119.9 billion) in US GOVERNMENT BONDS.

This is the really extraordinary part of this drama.

US government bonds are supposed to be the safest, most ‘risk free’ asset in the world. But that’s totally untrue, because even government bonds can lose value. And that’s exactly what happened.

Most of SVB’s portfolio was in long-term government bonds, like 10-year Treasury notes. And these have been extremely volatile.

In March 2020, for example, interest rates were so low that the Treasury Department sold some 10-year Treasury notes at yields as low as 0.08%.

But interest rates have increased so much since then; last week the 10-year Treasury yield was more than 4%. And this is an enormous difference.

If you’re not terribly familiar with the bond market, one of the most important things to understand is that bonds lose value as interest rates rise. And this is what happened to Silicon Valley Bank.

SVB loaded up on long-term government bonds when interest rates were much lower; the average weighted yield in their bond portfolio, in fact, was just 1.78%.

But interest rates have been rising rapidly. The same bonds that SVB bought 2-3 years ago at 1.78% now yield between 3.5% and 5%… meaning that SVB was sitting on steep losses.

They didn’t hide this fact.

Their 2022 annual report, published on January 19th of this year, showed about $15 billion in ‘unrealized losses’ on their government bonds. (I’ll come back to this.)

By comparison, SVB only had about $16 billion in total capital… so $15 billion in unrealized losses was enough to essentially wipe them out.

Again-- these losses didn’t come from some mountain of crazy NINJA loans. SVB failed because they lost billions from US government bonds… which are the new toxic securities.

2) If SVB is insolvent, so is everyone else… including the Fed.

This is where the real fun starts. Because if SVB failed due to losses in its portfolio of government bonds, then pretty much every other institution is at risk too.

Our old favorite Wells Fargo, for example, recently reported $50 billion in unrealized losses on its bond portfolio. That’s a HUGE chunk of the bank’s capital, and it doesn’t include potential derivative losses either.

Anyone who has purchased long-term government bonds-- banks, brokerages, large corporations, state and local governments, foreign institutions-- are all sitting on enormous losses right now.

The FDIC (the Federal Deposit Insurance Corporation, i.e. the primary banking regulator in the United States) estimates unrealized losses among US banks at roughly $650 billion.

$650 billion in unrealized losses is similar in size to the total subprime losses in the United States back in 2008; and if interest rates keep rising, the losses will continue to increase.

What’s really ironic (and a bit comical) about this is that the FDIC is supposed to guarantee bank deposits.

In fact they manage a special fund called Deposit Insurance Fund, or DIF, to insure customer deposits at banks across the US-- including the deposits at the now defunct Silicon Valley Bank.

But the DIF’s balance right now is only around $128 billion… versus $650 billion (and growing) unrealized losses in the banking system.

Here’s what really crazy, though: where does the DIF invest that $128 billion? In US government bonds! So even the FDIC is suffering unrealized losses in its insurance fund, which is supposed to bail out banks that fail from their unrealized losses.

You can’t make this stuff up, it’s ridiculous!

Now there’s one bank in particular I want to highlight that is incredibly exposed to major losses in its bond portfolio.

In fact last year this bank reported ‘unrealized losses’ of more than $330 billion against just $42 billion in capital… making this bank completely and totally insolvent.

I’m talking, of course, about the Federal Reserve… THE most important central bank in the world. It’s hopelessly insolvent, and FAR more broke than Silicon Valley Bank.

What could possibly go wrong?

3) The ‘experts’ should have seen this coming

Since the 2008 financial crisis, legislators and bank regulators have rolled out an endless parade of new rules to prevent another banking crisis.

One of the most hilarious was the new rule that banks had to pass “stress tests”, i.e. war game scenarios to see whether or not banks would be able to survive certain fluctuations in macroeconomic conditions.

SVB passed its stress tests with flying colors. It also passed its FDIC examinations, its financial audits, and its state regulatory audits. SVB was also followed by dozens of Wall Street analysts, many of whom had previously issued emphatic BUY ratings on the stock after analyzing its financial statements.

But the greatest testament to this absurdity was the SVB stock price in late January.

SVB published its 2022 annual financial report after the market closed on January 19, 2023. This is the same financial report where they posted $15 billion in unrealized losses which effectively wiped out the bank’s capital.

The day before the earnings announcement, SVB stock closed at $250.04. The day after the earnings call, the stock closed at $291.44.

In other words, despite SVB management disclosing that their entire bank capital was effectively wiped out, ‘expert’ Wall Street investors excitedly bought the stock and bid the price up by 16%. The stock continued to soar, reaching a high of $333.50 a few days later on February 1st.

In short, all the warning signs were there. But the experts failed again. The FDIC saw Silicon Valley Bank’s dismal condition and did nothing. The Federal Reserve did nothing. Investors cheered and bid the stock

And this leads me to my next point:

4) The unraveling can happen in an instant.

A week ago, everything was still fine. Then, within a matter of days, SVB’s stock price plunged, depositors pulled their money, and the bank failed. Poof.

The same thing happened with Lehman Brothers in 2008. In fact over the past few years we’ve been subjected to example after example of our entire world changing in an instant.

We all remember that March 2020 was still fairly normal, at least in North America. Within a matter of days people were locked in their homes and life as we knew it had fundamentally changed.

5) This is going to keep happening.

Long-time readers won’t be surprised about this; I’ve been writing about these topics for years-- bank failures, looming instability in the financial system, etc.

Late last year I recorded a podcast explaining how the Fed was engineering a financial meltdown by raising interest rates so quickly, and they would have to choose between a rock and a hard place, i.e. higher inflation versus financial catastrophe.

This is the financial catastrophe, but it’s just getting started. Like Lehman Brothers in 2008, SVB is just the tip of the iceberg. There will be other casualties-- not just in banks, but money market funds, insurance companies, and even businesses.

Foreign banks and institutions are also suffering losses on their US government bonds… and that has negative implications on the US dollar’s reserve status.

Think about it: it’s bad enough that the US national debt is outrageously high, that the federal government appears to be a bunch of fools incapable of solving any problem, and that inflation is terrible.

Now on top of everything else, foreigners who bought US government bonds are suffering tough losses as well.

Why would anyone want to continue with this insanity? Foreigners have already lost so much confidence in the US and the dollar… and financial losses from their bond holdings could accelerate that trend.

This issue is particularly of mind now that China is flexing its international muscle, most recently in the Middle East making peace between Iran and Saudi Arabia. And the Chinese are starting to actively market their currency as an alternative to the dollar.

But no one in charge seems to understand any of this.

The guy who shakes hands with thin air insisted this morning that the banking system is safe. Nothing to see here, people.

The Federal Reserve-- which is the ringleader of this sad circus-- doesn’t seem to understand anything either.

In fact Fed leadership spent all of last week insisting that they were going to keep raising interest rates.

Even after last week’s banking crisis, the Fed probably still hasn’t figured it out. They appear totally out of touch with what’s really happening in the economy. And when they meet again next week, it’s possible they’ll raise rates even higher (and trigger even more unrealized losses).

So this drama is far from over.

To your freedom, Simon Black, Founder Sovereign Research & Advisory

https://www.sovereignman.com/trends/if-svb-is-insolvent-so-is-everyone-else-146244/

Bank Runs, Now & Then

Bank Runs, Now & Then

Posted March 12, 2023 by Ben Carlson

Silicon Valley Bank, the 16th biggest bank in the country, was closed on Friday. It was the second-biggest bank failure in U.S. history. As recently as November 2021, the market cap of the company was more than $44 billion. That equity is now essentially worthless.

There is a lot to this story but it really boils down to an old-fashioned bank run. A flood of withdrawals from depositors destroyed the bank. If everyone with a Planet Fitness membership showed up at the gym at the exact same time there would be chaos at the squat racks. It would be impossible for anyone to work out and the gym model wouldn’t work.

Bank Runs, Now & Then

Posted March 12, 2023 by Ben Carlson

Silicon Valley Bank, the 16th biggest bank in the country, was closed on Friday. It was the second-biggest bank failure in U.S. history. As recently as November 2021, the market cap of the company was more than $44 billion. That equity is now essentially worthless.

There is a lot to this story but it really boils down to an old-fashioned bank run. A flood of withdrawals from depositors destroyed the bank. If everyone with a Planet Fitness membership showed up at the gym at the exact same time there would be chaos at the squat racks. It would be impossible for anyone to work out and the gym model wouldn’t work.

The same thing applies to banks. If everyone goes to get their money out on the same day, it’s going to be hard for a bank to survive.

There could be plenty of different ways this plays out but I find myself captivated by the process of a bank run.

The SVB ordeal caused me to revisit my old copy of The Panic of 1907 by Robert Bruner and Sean Carr.

It’s a wonderful account of one of the biggest and most influential financial crises in history.

The Panic of 1907 would probably be more famous if it wasn’t overshadowed by the Great Depression just a couple of decades later.

It lasted 15 months and saw GDP decline an estimated 30% (even more than the Great Depression).

Commodity prices crashed. Bankruptcies exploded. The stock market fell 50%. Industrial production dropped by more than at any time in history up to that point. The unemployment rate went from 2.8% to 8%.

Trust in the financial system went out the window as banks failed left and right. In October and November of 1907 alone, 25 banks and 17 trust companies went under.

John Pierpont Morgan more or less single-handedly saved the U.S. banking system by being a one-man central bank when none existed at the time.

He not only bullied the other banks into putting money in the system to save many of the failing banks but helped slow the pace of bank runs by instructing bank tellers to count out money as slowly as possible to stem the tide of withdrawals (it actually worked).

The banking system is more electronic today so that strategy wouldn’t work anymore. There was a financial institution in 1907 that experienced a “silent” bank run that took place over the course of 4 months.

Silicon Valley Bank basically went under in 24-48 hours once word spread that they might be in trouble.

The free flow of information today is one of the biggest differences between now and the Panic of 1907. There was also no Federal Reserve of FDIC insurance back then.

I’m not banking on a system-wide calamity the likes of 1907 this time around (fingers crossed) but there are some psychological similarities between the bank runs of the early 20th century and what we saw this week.

To continue reading, please go to the original article here:

https://awealthofcommonsense.com/2023/03/bank-runs-now-then/

What Happens to Your Money if Your Bank Fails?

What Happens to Your Money if Your Bank Fails?

Jenny Rose Spaudo Mon, March 13, 2023

With the aftermath of the third largest bank failure in U.S. history upon us following the collapse of Silicon Valley Bank late last week, concerns about what happens to customers’ money when a bank has to close down are abundant. According to the Federal Deposit Insurance Corporation (FDIC), there have been 561 total bank failures from 2001 through 2022. The good news is, prior to 2023’s surge in bank failures, the majority took place during the Great Recession and its aftermath from 2008 through 2011. Zero bank failures occurred in 2021 and 2022.

What Happens to Your Money if Your Bank Fails?

Jenny Rose Spaudo Mon, March 13, 2023

With the aftermath of the third largest bank failure in U.S. history upon us following the collapse of Silicon Valley Bank late last week, concerns about what happens to customers’ money when a bank has to close down are abundant. According to the Federal Deposit Insurance Corporation (FDIC), there have been 561 total bank failures from 2001 through 2022. The good news is, prior to 2023’s surge in bank failures, the majority took place during the Great Recession and its aftermath from 2008 through 2011. Zero bank failures occurred in 2021 and 2022.

However, just because most people’s banks don’t fail doesn’t mean it can’t or won’t happen to you. So what happens to your money in that case? And what can you do to avoid the risks of bank failure? Here’s what the experts have to say.

What Happens When a Bank Fails

The vast majority of banks are insured by the FDIC, although some choose smaller deposit insurers. If an FDIC-insured bank fails, the government-backed agency protects consumers’ money by selling the bank to another financial institution or paying depositors directly up to $250,000.

If your bank is sold, your money is typically available in your new account within two business days and your terms and conditions stay the same, said Levon Galstyan, CPA at Oak View Law Group.

“However, it may take longer if a large number of depositors are affected by the bank’s failure,” he added.

Direct Deposits, Pending Transactions and Bills After a Bank Failure

What if you have direct deposits set up through your current employer? If your bank is acquired, you shouldn’t need to take any action. Your deposits should be redirected automatically to your account at your new bank.

However, if there’s a delay and your accounts aren’t immediately transferred to another bank, you might need to reach out to your employer and have them temporarily redirect your paycheck to another account.

“In any case, it’s a good idea to keep track of your direct deposit information and to update it as necessary if you change banks or if there are any changes to your bank account information,” said Galstyan. “This can help ensure that your direct deposits continue to be credited to the correct account and that you have access to your funds in a timely manner.”

Keep in mind that direct deposits and pending transactions differ during a bank failure.

To continue reading, please go to the original article here:

https://news.yahoo.com/happens-money-bank-fails-154603575.html

How to Protect Your Money, Even If You're Not Rich

How to Protect Your Money, Even If You're Not Rich

Rosemary Carlson Sun, March 12, 2023

Asset protection planning is the process of building barriers around your assets, whether those assets are personal or business, to keep them safe from litigation, creditor claims, seizure and burdensome taxes. It's a vital and completely legal component of both financial planning and estate planning. There are a number of key tools you can utilize to accomplish the goal of protecting your assets. A financial advisor can help you structure and organize your assets so that they are more likely to achieve your financial goals.

How to Protect Your Money, Even If You're Not Rich

Rosemary Carlson Sun, March 12, 2023

Asset protection planning is the process of building barriers around your assets, whether those assets are personal or business, to keep them safe from litigation, creditor claims, seizure and burdensome taxes. It's a vital and completely legal component of both financial planning and estate planning. There are a number of key tools you can utilize to accomplish the goal of protecting your assets. A financial advisor can help you structure and organize your assets so that they are more likely to achieve your financial goals.

What Is Asset Protection Planning?

Contrary to what many people think, asset protection planning is not just for the wealthy. The estates of anyone, in any income group, can be sued or suffer from hefty taxation. These strategies can mitigate the effect of creditor claims and other issues on your wealth.

If you want and need to protect your assets, you have to be proactive. It's too late to employ asset protection strategies after a child is hurt on your property and the child's parents sue you or you are at fault in a serious car accident. You want to set up an asset protection plan before any of these things happen to you.

While many people can benefit from setting up an asset protection plan, not everyone can. If you have a lot of debt and few assets and you are subject to a lawsuit, it may be better to take bankruptcy than set up an asset protection plan. That's because it's only worth it if you have significant assets, though some events cannot be protected against. These include tax liens, mechanics liens, alimony judgments and child support claims.

Who Should Have an Asset Protection Plan?

Anyone can put an asset protection plan into place. A plan benefits the following people the most:

While even those with a modest net worth should at least consider asset protection, it's especially important for anyone with a significant amount of assets.

Anyone with a significant, recurring amount of credit card debt.

Homeowners who are underwater on their mortgage. In other words, if your mortgage balance is greater than the value of your home, you need to consider an asset protection plan.

Anyone whose profession carries with it a high probability of liability. Doctors and lawyers are some common examples.

Some assets are not at the mercy of your creditors, such as retirement accounts under the protection of the Employee Retirement Income Security Act of 1974 (ERISA). You may also legally preserve at least a portion of your home equity. Homes may be put in another individual's name. Bank accounts can be transferred to offshore banks to preserve their value.

How Does an Asset Protection Plan Work?

To continue reading, please go to the original article here:

https://news.yahoo.com/protect-money-even-youre-not-140024588.html

6 Reasons You Shouldn’t Procrastinate on Your Taxes

6 Reasons You Shouldn’t Procrastinate on Your Taxes

Federal taxes aren’t due until April 18 in 2023, and you might be tempted to wait until the last minute to file. But putting off filing your taxes may not be the best decision. Here are all the reasons why you shouldn’t procrastinate on this yearly chore.

You’ll Have Time to Choose the Right Tax Prep Software

If you wait until the deadline to file your taxes, chances are you’ll settle on the same tax software you used last year. There’s no time to comparison shop when you’re up against the clock. So, you’ll likely end up paying more to file your taxes, or you won’t get the free features you could have.

6 Reasons You Shouldn’t Procrastinate on Your Taxes

Federal taxes aren’t due until April 18 in 2023, and you might be tempted to wait until the last minute to file. But putting off filing your taxes may not be the best decision. Here are all the reasons why you shouldn’t procrastinate on this yearly chore.

You’ll Have Time to Choose the Right Tax Prep Software

If you wait until the deadline to file your taxes, chances are you’ll settle on the same tax software you used last year. There’s no time to comparison shop when you’re up against the clock. So, you’ll likely end up paying more to file your taxes, or you won’t get the free features you could have.

One affordable, user-friendly option to consider this year is TaxAct. In addition to its free file option for simple returns, TaxAct offers Deluxe, Premier and Self-Employed tax prep products. This is essentially the same tiered system offered by the other major services, except each of TaxAct’s federal filing products is priced noticeably below many top competitors.

TaxAct also provides live expert help to all filers for free. The service, called Xpert Assist, gives you unlimited live assistance from tax experts. They’ll answer any questions you may have, and they’ll also perform a quick review before you finish filing. TaxAct makes it easy to import last year’s returns if you used another tax service, and most tax forms are also easily importable.

You’ll Have More Time To Double-Check Your Return

It can be easy to forget about a deduction when putting together your tax return. If you start working on it early, you’ll have more time to review it and correct information if needed to ensure you get all the deductions you’re entitled to.

In addition to missing out on deductions, you’re more likely to make errors if you’re in a rush.

To continue reading, please go to the original article here:

https://www.gobankingrates.com/taxes/filing/reasons-shouldnt-procrastinate-taxes/

11 Female Financial Leaders Share the Best Money Advice They Ever Received

11 Female Financial Leaders Share the Best Money Advice They Ever Received

Jaime Catmull Fri, March 10, 2023

With a plethora of money advice out there, it can be hard to know what’s actually good advice and what you can skip. So to find tips you can trust, I spoke to women who work in the financial industry about the best advice they personally have received. Here are their favorite pieces of money advice.

11 Female Financial Leaders Share the Best Money Advice They Ever Received

Jaime Catmull Fri, March 10, 2023

With a plethora of money advice out there, it can be hard to know what’s actually good advice and what you can skip. So to find tips you can trust, I spoke to women who work in the financial industry about the best advice they personally have received. Here are their favorite pieces of money advice.

Tanya Van Court, Founder and CEO, Goalsetter

“No matter how much money you make, you can have a wealthy mindset. People with a wealthy mindset use their dollars to build their own wealth instead of using their dollars to make others wealthy.

That means having an attitude towards money that is more focused on how you can multiply it versus how you will spend it. For example, I have two friends who both have the same salary.

One spends that money on rent, a nice car, designer clothes and lives paycheck to paycheck. The other has a mortgage and rents out some of the space to subsidize the payment, buys cars at auction and then resells them for a higher price, and never pays full price for clothes. By doing this, she is freeing up a lot of money that can be invested and will grow over time to serve her in the future.”

Samantha Melting, Senior Vice President and Head of Consumer Bank, Synchrony

“The best advice I have ever received is to invest in you by paying yourself first. When you make yourself the priority, you are investing in your future self and positioning yourself to be financially resilient for whatever comes your way. Doing this has also created a positive relationship with money for me. It has given me opportunities to make smart decisions, reach new goals and reduce the stress of unexpected financial challenges.”

Jessica Bieligk, Chief Commercial Officer, Paceline

“The best financial advice I’ve received was from my parents. It was to always spend within my means and to approach my finances the same way I approach my career, my relationships and my well-being — set goals, show up, be intentional and be consistent. If you carve out a little bit of time (each day or each week) to stay engaged in your finances, like most wellness goals, it becomes muscle memory and allows you to achieve more than you thought possible.

Whether you’re talking about physical health or financial wellness (the two are inextricably linked, by the way), the science shows that we improve health outcomes by improving healthy behaviors.”

Michelle Brownstein, CFP, Senior Vice President of the Private Client Group, Personal Capital

To continue reading, please go to the original article here:

https://news.yahoo.com/10-female-financial-leaders-share-120031850.html