8 Questions on the Banking Panic of 2023

8 Questions on the Banking Panic of 2023

Posted March 14, 2023 by Ben Carlson

On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy:

Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is. We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

I have lots of questions:

1. Is This The Fed’s Fault?

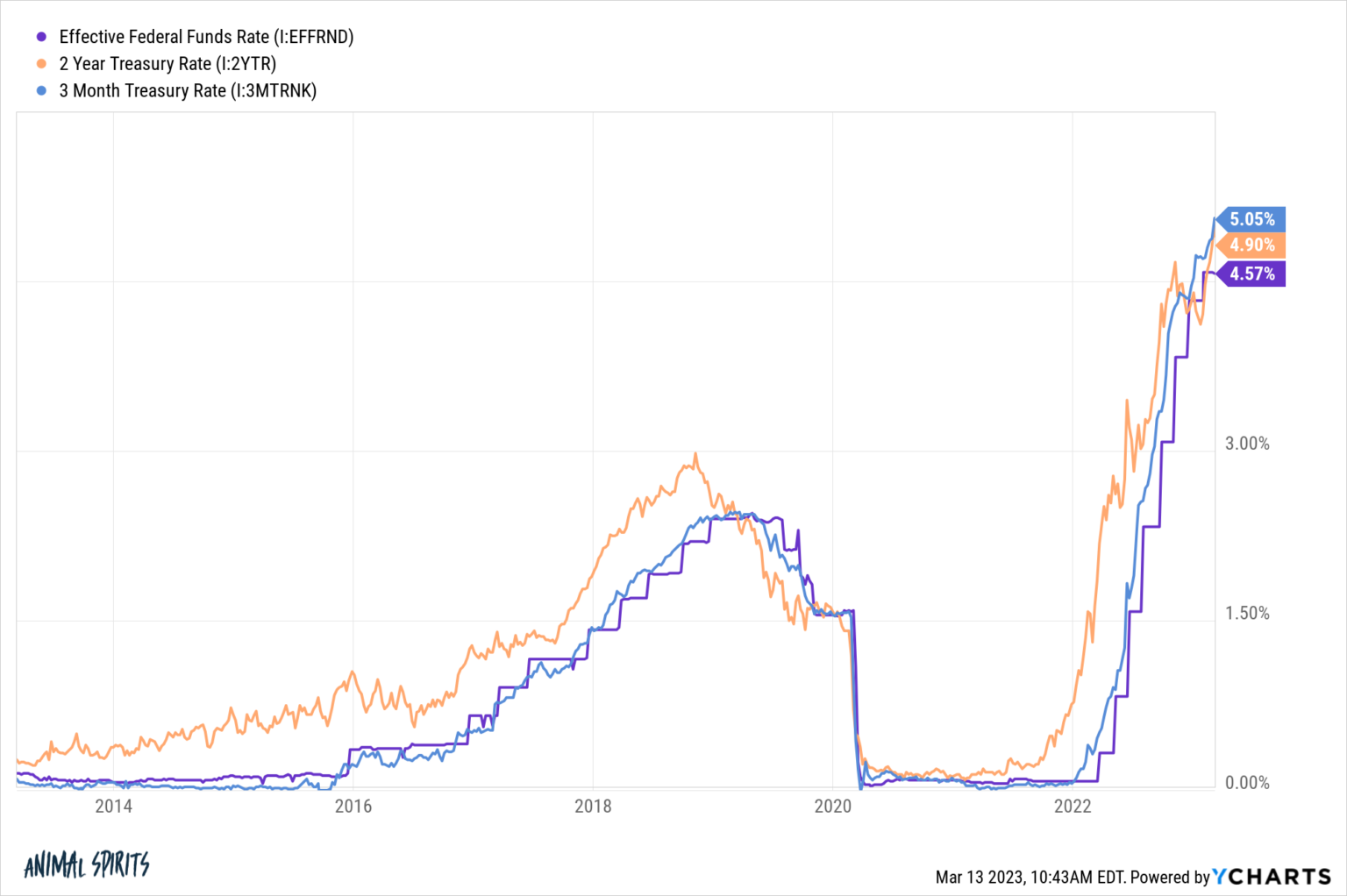

The Fed certainly played a role. It’s obvious in retrospect that they held rates too low for too long but they compounded that mistake by raising rates too far too fast:

Something was bound to break by going from 0 to 60 so quickly.

Silicon Valley Bank executives deserve a lot of blame too. They mismanaged their interest rate and liquidity risk, they had a concentrated set of clients and those clients all rushed to the exit doors at the same time. There are plenty of other banks that held up just fine with rapidly rising interest rates.

It’s never just one thing when something like this blows up.

The tech sector obviously doesn’t have a firm grasp on the financial sector just yet. But the Fed has blood on its hands here too.

2. Is the Fed done raising rates?

It’s amazing how quickly inflation has gone from being the biggest worry to a potential afterthought. The Fed still has price stability as a mandate and we’re not done fighting the war on inflation.

I just don’t see how they can remain so aggressive in the face of a banking crisis.

I don’t know if this bank run will have a material impact on the economy but it had to spook the Fed.

It was the failure of Continental Illinois in the early-1980s that made the Paul Volcker-led Fed realize they probably went too far with rate hikes.

3. Why Are Interest Rates Collapsing?

To continue reading, please go to the original article here:

https://awealthofcommonsense.com/2023/03/8-questions-on-the-banking-panic-of-2023/