Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Notes From the Field By James Hickman (Simon Black) February 16, 2026

In January 1933, a farmer named Wallace Kramp was about to lose everything. A lender in Wood County, Ohio was foreclosing on his farm over an $800 mortgage he couldn't pay.

Kramp wasn't a bad farmer. It was actually the government’s fault: during World War I, the US government had urged farmers to plant as much as they could to feed the troops and war-torn Europe.

Another “Temporary” Spending Bill That Still Costs Americans 93 Years Later

Notes From the Field By James Hickman (Simon Black) February 16, 2026

In January 1933, a farmer named Wallace Kramp was about to lose everything. A lender in Wood County, Ohio was foreclosing on his farm over an $800 mortgage he couldn't pay.

Kramp wasn't a bad farmer. It was actually the government’s fault: during World War I, the US government had urged farmers to plant as much as they could to feed the troops and war-torn Europe.

Families like the Kramps borrowed money and used the loan proceeds to expand production. But then the war ended; European agriculture recovered, and demand for US agriculture vanished. But the American farmers’ debts didn't.

By the early 1930s, wheat that had sold for $2 a bushel during the war was going for 25 cents. Nearly 750,000 farms went bankrupt between 1930 and 1935.

These weren't giant agribusinesses. They were small, family farms.

Kramp, at least, got lucky. On January 26th 1933, his assets were up for bankruptcy auction... and Kramp's neighbors showed up to bid a combined total of $14. Then they handed everything back to him so that he could keep his property.

But most farmers weren't so lucky, and they lost everything.

That's why, a few months later, Congress passed the Agricultural Adjustment Act of 1933. The idea was to pay farmers to reduce production, prop up crop prices, and keep family farmers on their lands.

The original budget was $100 million— about $2.5 billion in today's dollars— and it was supposed to be a temporary measure.

That was 93 years ago.

But, big surprise, the "temporary" program never went away. And the Agricultural Adjustment Act of 1933 evolved into the modern farm bill— a sprawling piece of legislation that Congress renews every five years, now costing roughly $1.5 trillion per decade.

More importantly, the struggling family farmers it was meant to protect have been replaced by massive agricultural conglomerates.

For example, they receive billions to grow corn. And that subsidized corn flows into the processed food supply— much of it as high-fructose corn syrup which ends up in practically everything Americans eat and drink.

The modern farm bill then funds SNAP benefits (Supplemental Nutrition Assistance Program, aka food stamps) for more than 40 million people.

Ironically, soft drinks— full of that high fructose corn syrup— are the single largest category of SNAP purchases.

Processed foods have fueled epidemic levels of obesity, diabetes, and heart disease. The United States spends nearly $5 trillion per year on healthcare, with the government picking up roughly two-thirds of the tab through Medicare, Medicaid, and other programs.

So taxpayers subsidize Big Ag’s corn production. Then further subsidize the purchase of junk food made from that corn. Then further subsidize the medical care for Americans who become unhealthy from all of that processed food.

This is what I'd call the government spending spiral— a self-reinforcing doom loop where each dollar spent justifies even more spending.

And this isn’t even the most corrosive layer of the spending spiral... because at every step, the industries involved— agricultural conglomerates, food manufacturers, healthcare providers, insurance companies— lobby Congress to keep the money flowing.

PepsiCo alone spent $2.8 million last year lobbying to keep their highly processed junk food eligible for food stamps.

You can see the pattern— these companies benefit from ample taxpayer funded subsidies, then recycle a portion of those proceeds back into the political machine to prop up the candidates who vote in favor of those subsidies.

This is why Congress— with an approval rating under 15%— somehow maintains a 90%+ reelection rate for incumbents: their campaigns are funded by the very graft that they vote for!

The federal government now spends roughly $7 trillion per year— roughly double from ten years ago.

What exactly did Americans get for the extra trillions in government spending? Are roads smoother? Schools better? Healthcare more affordable?

None of the above. In fact, despite a 100% increase in spending, schools, healthcare, and infrastructure have all become worse.

It’s truly staggering how much all of this spending is creating a drag on the US economy.

But it works both ways: cutting spending and eliminating subsidies reverses the spiral and moves things in the right direction.

Last week we told you that RFK Jr. helped to eliminate junk food subsidies in several states. And Pepsi— suddenly devoid of a government teet to suckle— responded by slashing prices to make up that lost revenue.

In other words, they cut subsidies and prices fell. Immediately.

It’s amazing to think how a "temporary" farm program from 1933 is still costing American taxpayers 93 years later.

Just imagine what would happen if the spiral ran the other way.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

“Tidbits From TNT” Monday 2-16-2026

TNT:

Tishwash: The coordinating framework is looking for an alternative to Maliki.

Iraqi parliamentarian: Election of a president is unlikely without prior political agreement

As pressure mounts to convene a parliamentary session to elect a new president, an Iraqi parliamentarian warned that the process could falter without a prior political agreement. Meanwhile, with the US vetoing Nouri al-Maliki's candidacy remaining in place, a leader in the Hikma Movement revealed that the coordinating body is working to identify a new candidate acceptable to all parties.

Sunday, February 15, 2026 – Iraqi MP Faisal Al-Issawi told Kurdistan 24: “There is intense pressure within Parliament to hold a session dedicated to electing the President of the Republic during this week

TNT:

Tishwash: The coordinating framework is looking for an alternative to Maliki.

Iraqi parliamentarian: Election of a president is unlikely without prior political agreement

As pressure mounts to convene a parliamentary session to elect a new president, an Iraqi parliamentarian warned that the process could falter without a prior political agreement. Meanwhile, with the US vetoing Nouri al-Maliki's candidacy remaining in place, a leader in the Hikma Movement revealed that the coordinating body is working to identify a new candidate acceptable to all parties.

Sunday, February 15, 2026 – Iraqi MP Faisal Al-Issawi told Kurdistan 24: “There is intense pressure within Parliament to hold a session dedicated to electing the President of the Republic during this week, but there is no tangible political agreement so far, and it is difficult to proceed with the session without consensus.”

Al-Issawi pointed out that the Speaker of the House of Representatives addressed the Federal Supreme Court to request clarification regarding Article (72)/ Paragraph Two/ Clause (B) of the Constitution, which relates to the continuation of the President of the Republic in his duties and setting a date for the election of his successor, stressing that everyone is waiting for the court’s response.

The data indicates that the main obstacle to electing a president lies in the failure to resolve the issue of the prime ministerial candidate within the "coordination framework." According to the Iraqi constitution, the candidate of the largest parliamentary bloc must be tasked with forming the government immediately after the presidential election, thus linking the two positions to each other as a single package.

In this context, Sami Al-Jizani, a member of the Wisdom Movement, stated that "the coordination framework is continuing its political efforts to break the current deadlock, especially in light of the sensitive circumstances and challenges facing the region."

Al-Jizani revealed an "anticipated political breakthrough in the next few days through the introduction of an alternative candidate," explaining that "this candidate will be chosen by consensus of the framework's forces, and must be acceptable and non-controversial at the local, regional, and international levels."

Al-Jizani added that just as the Shiite forces contributed to supporting the Sunni component to decide the election of the Speaker of Parliament, efforts are now focused within the "Shiite House" to overcome internal differences.

Although Nouri al-Maliki remains the only official candidate of the Coordination Framework for the premiership at the moment, American reservations and the refusal to assign him have pushed the Framework's forces towards searching for alternative options to ensure the government's passage.link

***************

Tishwash: The Iraqi parliament resorts to the Federal Court to resolve the issue of the presidency... document

The Speaker of the Iraqi Parliament, Hebat al-Halbousi, has submitted a request to the Supreme Federal Court to interpret a constitutional provision related to the election of the President of the Republic, given the inability to hold a session with a quorum for this purpose.

According to an official document issued by the Presidency of the House of Representatives, published by Shafaq News Agency, the request is based on the texts of the Constitution and the Federal Court Law, and aims to interpret Article (72/Second/B), which stipulates that the President of the Republic shall continue to exercise his duties after the end of his term until a new president is elected within thirty days from the date of the first session of the House of Representatives.

The document explained that the election of the President of the Republic was not achieved within the constitutional period, despite the House of Representatives continuing to hold its sessions, due to the lack of a legal quorum in more than one session dedicated to this purpose.

The request indicated that the council continues to hold its sessions according to the usual agenda, without including the item of electing the president of the republic, due to the lack of the required quorum, and asked the Federal Court to state the legal opinion on this matter.

The Iraqi constitution stipulates that the president must be elected within a period not exceeding 30 days from the date of the first session of the House of Representatives.

Taking into account this period from the first session held on December 29, 2025, the constitutional time limit ended on the night of January 28, 2026. link

Tishwash: No turning back on the ASYCUDA... The government calls on traders to accept the new reality

The Iraqi government called on Sunday (February 15, 2026) for those objecting to the implementation of the ASYCUDA system and customs tariffs to accept the new reality and comply with the law. Speaking on behalf of the government, spokesperson Bassem Al-Awadi explained that this system, which is implemented in more than 100 countries, will be applied in Iraq under international and UN supervision. He added that part of the ASYCUDA implementation is linked to Iraq's international obligations in the areas of combating money laundering, currency and goods smuggling, and international trade. He further stated that after 2003, Iraq relied on a process he termed "arbitrary" in managing customs and taxes, and that the time has come to change this process.

Al-Awadi stated in an interview with the official channel, which was followed by 964 Network , that “during the past few days with the beginnings of the implementation of the ASYCUDA system, there was some delay in the ports and many goods were delayed. According to the government’s estimates, some of them were delayed normally and others were delayed abnormally. When the government implemented the ASYCUDA system, this does not mean that there is a problem between it and the traders, but this step is an organizational process.”

Al-Awadi added, “In order to facilitate the movement of goods and make things easier for the private sector and Iraqi traders, the Iraqi government decided to zero out the government’s percentage of goods in warehouses - these warehouses are a joint facility between the ports and maritime transport, and also in cooperation with the private sector - so the government’s fees were zeroed out, and also 50% of the fees of the investing partner were zeroed out.”

Al-Awadi pointed out that “in light of the recent atmosphere that we all experienced, and the many rumors that try to make the government and the Iraqi state in general seem like something poised to harm the private sector or harm the people, and this is something that does not exist,” indicating that “the private sector and the merchant class are witnesses to the level of interaction that the government has undertaken, and in the end, only the truth will prevail.”

Al-Awadi pointed out that “trade from 2003 until today, especially with regard to taxes and customs, was more like arbitrariness. In simple terms, things were done in the form of a small container with 3 million and a large container with 4 million, regardless of what was inside the container. This was an old method that was imposed by the reality of the change after 2003, and it continued due to the repercussions and recent events.”

Al-Awadi stressed that “the ASYCUDA system is a United Nations system and was not brought by the Iraqi government. It is implemented in 102 countries around the world and is linked to the United Nations Convention against Torture (UNCTAD). Part of the implementation of ASYCUDA is linked to Iraq’s international obligations in the areas of combating money laundering, smuggling of currency and goods, and international trade.”

The government spokesman stressed that “this system is not targeting a specific class, and the rumors that speak of a lack of liquidity in the Iraqi state and that is why it went towards this system are untrue. All of this is incorrect, because the process of trade, accounting and customs since 2003 was an arbitrary emergency process, and in the end, now this year or next year or after 3 years, everyone knows that these temporary matters must end and we must move towards the right things.”

Al-Awadi explained that “this new system (ASYCUDA) has been implemented, and we do not have (Quranic texts nor angels). It is an electronic automation system, operated by Iraqi teams under international and UN supervision.” He pointed out that “over time and after implementation, if there is any kind of injustice that may befall an economic class, group, or a specific type of goods, there are unions and federations of the Iraqi private sector and spokespeople for them, and the door of the Prime Minister and the Iraqi government is open to them, and it is possible to address any injustice that may affect merchants or other classes.” link

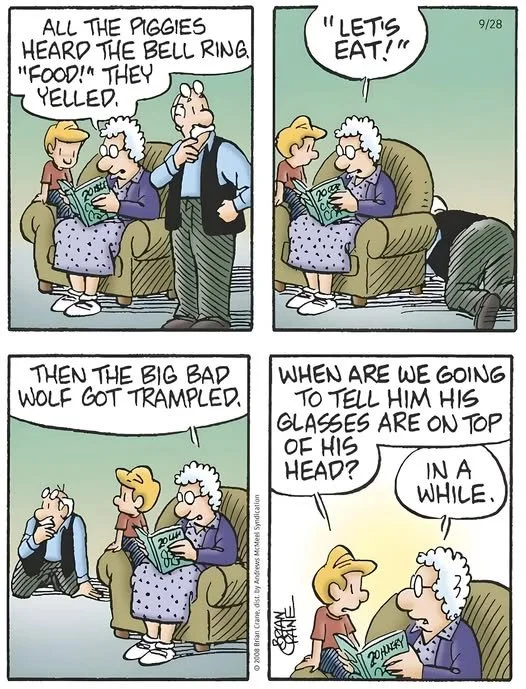

Mot: .. Special Time with ole ""Earl""

Mot: Its a Seasoned Thingy!!!!

Seeds of Wisdom RV and Economics Updates Monday Morning 2-16-26

Good Morning Dinar Recaps,

India Expands Cross-Border Payment Power Under RBI Oversight

Full Authorization Signals India’s Push Toward Integrated Global Settlement Rails

Good Morning Dinar Recaps,

India Expands Cross-Border Payment Power Under RBI Oversight

Full Authorization Signals India’s Push Toward Integrated Global Settlement Rails

Overview

India has taken another decisive step in strengthening its financial infrastructure. In-Solutions Global Ltd has received full authorization from the Reserve Bank of India (RBI) to operate across online, offline, and cross-border payment aggregation under the country’s updated regulatory framework.

The approval enables the company to deliver a unified merchant payments stack spanning domestic and international transactions — reinforcing India’s ambition to lead in regulated digital payments innovation.

Key Developments

• In-Solutions Global Ltd now holds comprehensive authorization as a payment aggregator.

• Approval covers online, physical (offline), and cross-border transactions.

• The move aligns with India’s modernized payments regulatory structure.

• Merchants gain access to integrated domestic and international settlement capabilities.

India already operates one of the world’s most advanced real-time domestic payment ecosystems. Expanding regulated cross-border aggregation strengthens its ability to influence regional and global payment corridors.

Why It Matters

Cross-border payments remain one of the most expensive and friction-heavy components of global finance. By expanding regulated payment aggregation under central bank supervision, India is:

• Increasing settlement efficiency

• Enhancing compliance oversight

• Strengthening monetary control over outbound and inbound flows

• Positioning itself as a major fintech infrastructure hub

This is sovereign-led modernization — not deregulated experimentation.

Why It Matters to Foreign Currency Holders

• More efficient cross-border rails can shift trade settlement behavior.

• Regulated infrastructure increases transparency in international transactions.

• Strong central bank oversight preserves currency stability during digital expansion.

• Expanded payment corridors can influence regional trade dynamics.

Payment rails shape capital flow. Capital flow shapes currency power.

Implications for the Global Reset

Pillar 1: Infrastructure Sovereignty

India is reinforcing central bank authority while expanding digital capability.

Pillar 2: Cross-Border Modernization

Integrated merchant stacks reduce reliance on fragmented correspondent banking systems.

Structural resets do not happen overnight — they begin with infrastructure upgrades like this.

This is not just a fintech approval — it is sovereign payment strategy in motion.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

U.S. Banking Leaders Engage White House on Crypto Market Structure

Digital Asset Regulation Moves From Periphery to Policy Core

Overview

Digital asset regulation is entering a new phase in the United States. A White House crypto market structure meeting convened major banking trade organizations including the American Bankers Association, Bank Policy Institute, and Independent Community Bankers of America.

The discussion focused on crafting regulatory frameworks that balance innovation in digital assets with financial system stability.

Key Developments

• Banking trade groups participated directly in policy dialogue.

• Discussions centered on crypto market structure and regulatory clarity.

• Emphasis was placed on protecting financial safety while fostering innovation.

• Institutional banking voices are now shaping digital asset rules.

This represents a notable shift from earlier years when crypto operated largely outside traditional banking consensus.

Why It Matters

Regulatory clarity determines whether digital assets integrate into the financial core — or remain on the margins.

By engaging policymakers:

• Banks are signaling willingness to participate in digital finance.

• Regulators are acknowledging crypto as part of systemic finance.

• Collaboration reduces the likelihood of fragmented or reactionary rulemaking.

• The groundwork is being laid for structured digital asset integration.

This is no longer a fringe conversation — it is structural financial policy.

Why It Matters to Foreign Currency Holders

• Regulatory certainty reduces volatility in digital markets.

• Integration of crypto rails into banking strengthens systemic stability.

• Clear frameworks encourage institutional capital participation.

• Stable digital settlement infrastructure can influence global liquidity flows.

Monetary transformation without regulation creates chaos. Regulation without innovation creates stagnation. This meeting signals an attempt to balance both.

Implications for the Global Reset

Pillar 1: Institutional Legitimization

Crypto is moving inside the policy tent rather than operating outside it.

Pillar 2: Controlled Digital Transition

Regulated integration ensures that traditional banks remain central to monetary infrastructure even as digital rails expand.

Financial resets occur when rules, rails, and institutions realign. This is part of that alignment.

This is not just a meeting — it is digital finance entering formal governance.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

ICBA Statement – Banking Trades on White House Crypto Market Structure Meeting

Crypto Valley Journal -- White House Mediates CLARITY Act Yield Dispute Without Result

~~~~~~~~~~

BRICS Moves Toward Independent Metals Exchange and Gold-Backed Trade System

Special Economic Zones to Anchor New Pricing Power Outside Western Financial Control

Overview

The BRICS bloc is accelerating plans to launch a dedicated Precious Metals Exchange, marking another strategic step toward financial independence from Western-dominated systems.

Russian Deputy Foreign Minister Sergey Ryabkov confirmed on February 14, 2026, that the exchange will operate within special economic zones across member nations. The initiative will function alongside a BRICS gold currency pilot and a proposed grain exchange.

The objective is clear: establish independent pricing mechanisms and reduce exposure to sanctions, tariffs, and volatility tied to Western financial infrastructure.

Key Developments

• The BRICS Precious Metals Exchange has been designated a priority initiative by Russian officials.

• The platform will operate through special economic zones present across most BRICS nations.

• A grain exchange is also under development as part of the broader commodity strategy.

• The initiative builds upon agreements endorsed at the 2024 Kazan Summit.

Ryabkov stated that the exchange would be “a very important initiative” and emphasized its strategic relevance amid sanctions pressure.

Russian Finance Minister Anton Siluanov added that creating a metals trading mechanism within BRICS would foster “fair and equitable competition based on exchange principles.”

BRICS Gold Developments and Pricing Independence

The metals exchange aligns with broader gold initiatives already underway.

The bloc launched a gold-backed settlement pilot known as the “Unit” on October 31, 2025. The structure reportedly consists of 40% gold backing and 60% member currencies.

BRICS gold prices surged above $5,600 per ounce in January 2026 before stabilizing within projected ranges between $4,500 and $5,500. Officials are positioning the exchange as a vehicle to:

• Reduce dependence on SWIFT messaging systems

• Limit exposure to Western commodities exchanges such as the London Metal Exchange

• Enable settlement in national currencies

• Strengthen autonomy in cross-border trade

Ryabkov stated that while American sanctions and tariffs pose risks, member nations are not prepared to “succumb to pressure.”

The metals exchange is expected to include gold, platinum, diamonds, rare earth minerals, and potentially other strategic commodities.

Implementation Timeline

Officials have not announced a firm launch date. However, Russian statements indicate a target of reaching operational status by 2030.

The initiative is part of a broader architecture shift endorsed during the 2024 BRICS summit in Kazan, which included:

• Alternative payment platforms

• Settlement systems in national currencies

• Reinsurance mechanisms for intra-bloc trade

Together, these components represent a coordinated effort to reshape commodity pricing power and settlement infrastructure.

Why It Matters

Commodity exchanges determine global pricing benchmarks.

If BRICS establishes a functional, liquid metals exchange operating outside Western systems, it could:

• Influence global gold pricing dynamics

• Shift settlement patterns away from dollar-denominated trade

• Increase leverage for commodity-producing nations

• Reduce sanctions vulnerability

Pricing power is financial power.

Why It Matters to Foreign Currency Holders

• A gold-linked settlement framework alters reserve dynamics.

• Independent pricing benchmarks could challenge London- and New York-based exchanges.

• Commodity-backed trade corridors strengthen non-dollar settlement ecosystems.

• Gradual infrastructure rollout reduces sudden market shock while preparing structural change.

This is not merely about metals trading — it is about control over valuation mechanisms.

Implications for the Global Reset

Pillar 1: Commodity Pricing Sovereignty

A BRICS exchange introduces alternative benchmark formation outside Western exchanges.

Pillar 2: Settlement Diversification

Gold-linked instruments and national currency settlement reduce reliance on dollar-based clearing systems.

Financial resets begin when pricing systems shift. Commodity markets are foundational to that structure.

This is not just trade policy — it is a strategic rebalancing of global financial infrastructure.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "BRICS Precious Metals Exchange: Member Nations Move Toward Launch"

TASS -- "BRICS countries discuss creation of precious metals exchange and grain platform"

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Morning 2-16-26

Nouri Al-Maliki’s New Doctrine For Power: Pragmatism Over Defiance?

2026-02-14 Shafaq News On January 24, 2026, the Shiite Coordination Framework (CF), currently the largest bloc in Iraq’s parliament, named former Prime Minister Nouri Al-Maliki as its nominee for the country’s next premier, reopening one of Iraq’s most consequential political debates. The response was immediate. Debate intensified in Baghdad, regional capitals recalculated their positions, and Washington issued warnings.

Iraq once again stands at a familiar crossroads, this time under heavier internal strain and sharper external scrutiny. The question is not simply whether Al-Maliki is returning, but whether he returns unchanged or as a political figure reshaped by conflict, experience, and years outside executive office.

Nouri Al-Maliki’s New Doctrine For Power: Pragmatism Over Defiance?

2026-02-14 Shafaq News On January 24, 2026, the Shiite Coordination Framework (CF), currently the largest bloc in Iraq’s parliament, named former Prime Minister Nouri Al-Maliki as its nominee for the country’s next premier, reopening one of Iraq’s most consequential political debates. The response was immediate. Debate intensified in Baghdad, regional capitals recalculated their positions, and Washington issued warnings.

Iraq once again stands at a familiar crossroads, this time under heavier internal strain and sharper external scrutiny. The question is not simply whether Al-Maliki is returning, but whether he returns unchanged or as a political figure reshaped by conflict, experience, and years outside executive office.

Pragmatism over Pride

Sovereignty once defined Al-Maliki’s political vocabulary. During his two terms between 2006 and 2014, he projected a sharp, defiant posture, frequently framing his leadership as resistance to foreign interference, particularly from the United States. His second term (2010–2014) in particular unfolded amid visible tension with Washington, reinforcing the image of a leader intent on consolidating national authority despite mounting political costs.

The environment in 2026 differs markedly. US President Donald Trump has openly warned against Al-Maliki’s return, signaling the possibility of severe measures. Speaking to Shafaq News, political analyst Ahmed Youssef referred to Washington’s explicit objection, noting that Trump described Al-Maliki’s reappointment as a path that could return Iraq to “poverty and comprehensive chaos,” invoking the period when ISIS seized major provinces before Iraq declared victory in 2017.

The implications extend beyond rhetoric as Iraq’s economy remains structurally vulnerable. Its banking channels, oil revenue mechanisms, and access to international financial systems remain deeply intertwined with global institutions.

Any US sanctions or reduction in support would carry tangible domestic consequences, affecting currency stability, military cooperation, and reconstruction financing. “A confrontation with Washington today would not be confined to speeches; it would seep into Iraqi daily life,” Youssef warned.

Inside Iraq, reactions have been defensive. Aref Al-Hammami, a senior figure in the State of Law Coalition (SLC) headed by Al-Maliki, described any retreat from the candidacy under foreign pressure as “a political setback affecting all components of the country,” underscoring that Iraq is a sovereign state. The message was direct: external objections should not determine internal political decisions.

The caution, however, is more visible across the broader political arena. Abdulrahman Al-Jazaeri, head of the political bureau of the Tribal Movement in Iraq, pointed to a subtle but important shift within the CF. The next prime minister, he argued, should enjoy “regional acceptability,” citing reservations expressed by major figures within the Framework, including the Al-Hikma Movement led by Ammar Al-Hakim and Asaib Ahl Al-Haq headed by Qais Al-Khazali.

Al-Maliki’s own rhetoric reflects that recalibration. Faced with Trump’s warnings, he has avoided confrontation. Rather than revive the language of resistance, he has focused on “stability,” “investment,” “job opportunities,” and “completing reconstruction.” The shift appears calculated —an effort, as Ahmed Youssef assessed, to reassure external actors while navigating domestic contestation.

‘’Al-Maliki still represents a period rejected by segments of both the Iraqi public and parts of the international community,’’ he observed, noting that even though the language may be softer, the structural constraints remain.

Arming the State

If sovereignty defines one axis of scrutiny, the Popular Mobilization Forces (PMF) —inseparable from Al-Maliki’s political legacy— define another.

Formed in 2014 following a fatwa by top Shiite cleric Ayatollah Ali Al-Sistani amid an unprecedented security collapse, the PMF played a decisive role in confronting ISIS. Its membership stands at around 200,000, comprising about 70 factions from various religious and ethnic backgrounds, though it remains predominantly Shiite. The Iraqi parliament later formalized these factions under the PMF Law, designating the force as a supporting body alongside the Iraqi Armed Forces, both under the authority of the prime minister as commander-in-chief.

Al-Maliki emerged as one of the PMF’s most prominent political defenders, and his previous tenure became closely associated with its rise as an influential actor within Iraq’s security architecture. After the 2025 parliamentary elections, however, his language shifted. He now refers to “restricting arms to the state” and ensuring “one army comprising all components under the command of the commander-in-chief of the armed forces.” At the same time, he rejected reports of dissolving the PMF, maintaining that any development should preserve its strength and reinforce its combat readiness rather than weaken it.

Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

Speaking to Shafaq News, Aref Al-Hammami portrayed this framing as national and reassuring, arguing that it does not target any specific group. Discussions over weapons held by factions, he added, fall within an “internal, fraternal relationship” that can be addressed domestically.

Meanwhile, political observer Abu Mithaq Al-Massari interpreted the adjustment not as a reversal but as an elevation of state-centered rhetoric suited to a sensitive political phase. Al-Maliki has not distanced himself from the PMF; he has repositioned the discussion.

For international partners, domestic rivals, and an Iraqi public fatigued by overlapping chains of command, the weapons file remains central. Any incoming government will be assessed by its ability to assert coherent security authority. The shift, therefore, is not a retreat from the PMF but an effort to embed it more clearly within the framework of centralized state power.

Realpolitik on Rails

Syria presents another test of tone and approach. In earlier years, Al-Maliki’s position toward Ahmad Al-Sharaa, known as Abu Mohammad Al-Julani when he led Haya’at Tharir Al-Sham, was unequivocal. He labeled him a terrorist, reflecting Iraqi anxieties over Al-Sharaa's previous role within ISIS in Iraq, the cross-border militancy, and the spillover of Syria’s conflict into Iraqi territory.

That stance aligned with a broader security-first posture shaped by the aftermath of 2011 and the rise of armed groups operating across porous borders.

Following the 2025 elections, the tone shifted. Al-Maliki signaled openness toward engagement with regional actors, including Syria. The adjustment does not abandon security concerns. Rather, it reflects recalculation shaped by geography and necessity. The Iraqi–Syrian border remains a zone of vulnerability, where infiltration risks, energy corridors, oil routes, and humanitarian transit converge.

Iraqi officials indicated that Baghdad seeks strategic stability that preserves internal sovereignty while enabling structured dialogue with Damascus based on national interests. The regional environment has also evolved. Some Arab states, particularly Gulf countries, have recalibrated their posture toward Syria, while US priorities shifted during the Trump phase. At home, pressure favors border stabilization over rhetorical confrontation, steering policy from individual labeling toward state-to-state management. Read more: Nouri Al-Maliki: A name that still divides and tests the politics of memory

Quiet Tehran Ties

Al-Maliki has long been viewed as maintaining close ties with Tehran, particularly during the ISIS occupation of large parts of Iraq, when security coordination intensified.

Iranian officials have signaled support for any candidate agreed upon within the CF without publicly endorsing a specific name, effectively offering political cover without overt sponsorship. As Al-Maliki’s recent public messages concentrate more on institutional stability and state authority —and place less visible emphasis on external alliances— the recalibration appears deliberate.

Openly foregrounding ties with Tehran risks amplifying domestic polarization and complicating relations with Sunni and Kurdish factions, as well as Washington. Strategically, the approach suggests balance rather than rupture. The relationship with Iran remains intact, but it is conveyed with greater discretion.

A Return Shaped by Experience

Al-Maliki is not an emerging political figure testing authority. He governed for eight years and left office during one of the most turbulent chapters in Iraq’s modern history. The collapse of provinces, the war against ISIS, and years of internal polarization defined his tenure.

He now seeks not to consolidate authority for the first time, but to restore political legitimacy —a distinction that carries weight. In his second term, he spoke from the position of incumbent authority. Today, he operates as a candidate navigating objections: domestic fragmentation, Shiite hesitation, American warnings, and speculation about sanctions.

The experience of power and the cost of crisis appear to have reshaped his tone. Confrontation carries consequences. Institutional paralysis carries consequences, and economic rupture definitely carries consequences.

His recent discourse reflects a political actor more attentive to balance than confrontation. This is not a declared ideological revision, but a recalibrated method. Whether that recalibration signals a deeper transformation or merely strategic repositioning remains the defining question.

What is clear is that 2026 is not 2012. Al-Maliki’s path back to power runs not through the vocabulary of his past, but through careful management of Iraq’s present.

Read more: Al-Maliki sounds different this time — the worldis not convinced yet

Written and edited by Shafaq News staff.

https://www.shafaq.com/en/Report/Nouri-Al-Maliki-s-new-doctrine-for-power-Pragmatism-over-defiance

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

2-15-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-CBI INDEPENDENCE- REER is a MONETARY TOOL

2-15-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Edu Matrix:

The world of finance is ever-changing, with trends and opportunities emerging and fading with the passing days.

For investors looking to stay ahead of the curve, understanding the current landscape is crucial. In a recent Edu Matrix video, financial expert Sandy Ingram shared her insights into the upcoming currency profit opportunities over the next 30 days, delving into the intricacies of foreign exchange markets, precious metals, and the cryptocurrency landscape, particularly Bitcoin.

Venezuelan Oil Revenue Currencies Likely to Rise against the USD in the Next 30 Days

Edu Matrix:

The world of finance is ever-changing, with trends and opportunities emerging and fading with the passing days.

For investors looking to stay ahead of the curve, understanding the current landscape is crucial. In a recent Edu Matrix video, financial expert Sandy Ingram shared her insights into the upcoming currency profit opportunities over the next 30 days, delving into the intricacies of foreign exchange markets, precious metals, and the cryptocurrency landscape, particularly Bitcoin.

Let’s dive into the key takeaways from her analysis and explore the potential opportunities and risks in various investment sectors.

Sandy Ingram emphasizes the significance of diversifying one’s investment portfolio, particularly through the acquisition of precious metals like silver and gold.

She advocates for a strategy of buying small amounts of these metals on a regular basis. This approach not only helps in mitigating risks associated with market volatility but also allows investors to accumulate wealth over time.

Furthermore, she suggests considering direct shipment of these metals to one’s home once a certain threshold is reached, providing a tangible asset that can be held securely.

One of the more intriguing investment opportunities highlighted by Sandy is in the Venezuelan real estate market. Due to the country’s economic turmoil, land and homes are available at remarkably low prices, presenting what Sandy describes as a window for savvy investors.

Drawing parallels with Iraq, she notes that the U.S. is playing a role in overseeing Venezuelan oil sales to ensure that the revenue generated is used legitimately and to prevent a complete economic collapse. This intervention has led to billions of dollars in oil revenue flowing back into Venezuela, potentially signaling a recovery and making it an attractive time for real estate investments.

The near-term outlook for the U.S. dollar is expected to be soft, driven by stabilizing or potentially declining interest rates in the U.S. This weakening of the dollar could have a ripple effect, leading to the strengthening of several other currencies.

Sandy points out that currencies such as the Japanese yen, euro, Chinese yuan, Indian rupee, and commodity-linked currencies like the Australian and Canadian dollars may benefit from this shift.

Understanding the factors driving these changes, including interest rate expectations and trade developments, is crucial for investors looking to capitalize on currency fluctuations.

The discussion on Bitcoin centers around its recent decline, attributed to high interest rates making safer assets more attractive, profit-taking by large investors, regulatory uncertainty, and a steady or slightly stronger U.S. dollar.

Currently, investors are cautious, often preferring traditional assets over cryptocurrencies until clearer economic signals emerge. This cautious stance presents both challenges and opportunities for those invested in or looking to enter the cryptocurrency market.

The financial landscape is complex and multifaceted, with opportunities and risks present across various sectors. Sandy’s insights from the Edu Matrix video provide a comprehensive overview of the current trends in foreign exchange markets, precious metals, real estate, and cryptocurrencies.

By understanding these dynamics and diversifying investments accordingly, investors can better navigate the challenges and capitalize on the opportunities that lie ahead. For those looking to deepen their understanding and stay informed, watching the full Edu Matrix video is a valuable next step.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 2-15-26

Good Afternoon Dinar Recaps,

Crypto Liquidity Stress Signals Banking Oversight Tightening

Digital asset withdrawals pause as Federal Reserve prepares regulatory shift

Good Afternoon Dinar Recaps,

Crypto Liquidity Stress Signals Banking Oversight Tightening

Digital asset withdrawals pause as Federal Reserve prepares regulatory shift

Overview

Financial markets are witnessing renewed liquidity stress within the crypto lending sector, with at least one digital asset lender suspending withdrawals amid Bitcoin price volatility.

At the same time, the U.S. Federal Reserve is expected to appoint a veteran Wall Street regulator to oversee supervision and regulation — a move that could significantly tighten oversight of traditional banking risk profiles.

Together, these developments highlight growing sensitivity across both digital and traditional financial systems.

Key Developments

1. Crypto Lender Suspends Withdrawals

Market turbulence and Bitcoin price weakness triggered at least one crypto lending platform to pause customer withdrawals, underscoring ongoing fragility in leveraged digital asset models.

Liquidity mismatches and collateral volatility remain structural vulnerabilities in the sector.

2. Digital Finance Risk Transmission

Crypto markets are increasingly interconnected with traditional finance through custody banks, ETFs, derivatives, and liquidity providers.

Stress in digital lending can ripple into broader funding markets.

3. Federal Reserve Signals Stronger Oversight

The Federal Reserve is reportedly preparing to appoint a seasoned Wall Street regulator to head supervision — a move interpreted as reinforcing capital standards, liquidity monitoring, and systemic safeguards.

4. Banking Risk Profiles Under Review

As interest rate cycles stabilize, regulators are turning attention to hidden balance sheet vulnerabilities, commercial real estate exposure, and market-linked lending channels.

Why It Matters

This is a dual-system stress signal:

• Digital asset liquidity remains unstable

• Traditional banking regulation is tightening

• Risk appetite may recalibrate

• Investor confidence remains sensitive

When both crypto and banking supervision move simultaneously, markets interpret it as systemic recalibration.

Why It Matters to Foreign Currency Holders

Currency holders should monitor:

• Dollar liquidity demand during volatility

• Capital flight into safe-haven assets

• Regulatory impacts on cross-border capital flows

• Payment system stability concerns

Liquidity events often precede broader currency repricing cycles.

Implications for the Global Reset

Pillar 1: Financial System Stress Testing

Crypto market disruptions serve as real-time laboratories for liquidity fragility within modern finance.

Pillar 2: Regulatory Reinforcement Phase

Heightened bank oversight suggests policymakers are proactively guarding against contagion risk before systemic cracks widen.

This is not merely crypto turbulence — it reflects evolving guardrails in a transforming financial architecture.

The reset is not chaos — it is controlled recalibration.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Crypto Lender Suspends Withdrawals Amid Bitcoin Weakness”

Reuters — “Fed Expected to Appoint Veteran Regulator to Oversee Bank Supervision”

~~~~~~~~~~

Governments Move Social Benefits and Bonds Onchain

Tokenized debt and digital UBI programs signal structural shift in public finance delivery

Overview

Governments are increasingly exploring blockchain-based delivery of social benefits and tokenized sovereign debt, marking a significant modernization of public finance infrastructure.

According to Julie Myers Wood, CEO of Guidepost Solutions, any social benefit currently distributed through analog systems should be evaluated for digital onchain delivery due to efficiency, transparency, and audit advantages.

From the Republic of the Marshall Islands to financial hubs like Hong Kong and Thailand, tokenized instruments are moving from theory to live implementation.

Key Developments

1. Marshall Islands Launches Onchain UBI Program

The Republic of the Marshall Islands launched a Universal Basic Income (UBI) program in November 2025, distributing quarterly payments directly to citizens via mobile wallets.

The program operates alongside the issuance of a tokenized government bond framework.

2. Tokenized Sovereign Bond Backed by U.S. Treasuries

The Marshall Islands issued the USDM1 bond, a tokenized debt instrument backed 1:1 by short-term U.S. Treasuries.

Guidepost Solutions advised on compliance and sanctions frameworks for the issuance, ensuring regulatory alignment.

Tokenized bonds reduce settlement times and eliminate costly intermediaries traditionally involved in clearing and custody.

3. Rapid Growth in Tokenized Treasury Market

Data from Token Terminal shows the tokenized U.S. Treasury market has grown more than 50x since 2024, highlighting accelerating institutional adoption.

Forecasts from Taurus SA suggest the broader tokenized bond market could reach $300 billion in coming years.

4. Compliance and AML Remain Core Challenges

Despite efficiency gains, governments must address:

• Anti-money laundering (AML) compliance

• Know-your-customer (KYC) verification

• Sanctions enforcement mechanisms

Regulatory guardrails remain critical to prevent misuse while scaling public onchain finance.

Why It Matters

This development represents more than fintech innovation — it is a potential restructuring of sovereign finance and public benefit distribution.

Onchain administration provides:

• Faster settlement

• Lower transaction costs

• Transparent audit trails

• Direct citizen access

Governments could reduce bureaucratic friction while increasing accountability.

Why It Matters to Foreign Currency Holders

For global reset observers, tokenized sovereign instruments influence:

• Public debt market structure

• Treasury demand dynamics

• Cross-border settlement systems

• Financial inclusion metrics

If sovereign debt increasingly migrates onchain, settlement infrastructure and liquidity channels may fundamentally evolve.

Implications for the Global Reset

Pillar 1: Digital Sovereign Finance Infrastructure

Tokenized bonds backed by traditional assets bridge legacy finance with blockchain rails, accelerating hybrid financial architecture.

Pillar 2: Direct-to-Citizen Monetary Channels

Onchain social benefit distribution reduces dependency on intermediary banking networks and increases transparency.

The transition toward digital sovereign issuance is gradual but transformational.

This is not simply blockchain experimentation — it is the modernization of state-level financial plumbing.

As governments digitize debt and benefits, the architecture of monetary delivery itself begins to evolve.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Diplomacy Takes Priority in U.S.–Iran Nuclear Talks

Negotiations emphasized over military escalation amid regional tension

Overview

U.S. officials have publicly emphasized that diplomacy — not military action — is the preferred path forward regarding Iran’s nuclear program.

This strategic posture comes amid heightened tensions but signals a deliberate effort to prioritize negotiation frameworks over escalation.

The approach directly influences geopolitical stability, energy markets, and global risk modeling.

Key Developments

1. Public Commitment to Diplomatic Resolution

Senior U.S. officials reiterated that reaching a negotiated agreement remains the administration’s preferred outcome.

Military options remain available, but diplomacy is currently prioritized.

2. Mediation Channels Active

Talks are being facilitated through regional mediators, reinforcing the international effort to prevent escalation and maintain stability in the Middle East.

3. Energy Market Sensitivity

Any disruption in U.S.–Iran relations affects global oil supply expectations.

Diplomacy lowers the probability of sudden supply shocks.

4. Broader Regional Implications

A stable negotiation path reduces the risk of retaliatory actions across proxy theaters and preserves cross-border investment stability.

Why It Matters

Geopolitical risk directly influences:

• Oil pricing volatility

• Defense sector positioning

• Safe-haven currency demand

• Capital flow stability

Diplomacy reduces systemic shock risk in global markets.

Why It Matters to Foreign Currency Holders

Currency markets react quickly to Middle East risk signals.

A diplomatic stance:

• Eases pressure on energy-importing nations

• Reduces inflation shock probabilities

• Stabilizes global bond yields

• Softens risk-off flows into the dollar and gold

Peace signaling often supports broader market equilibrium.

Implications for the Global Reset

Pillar 1: De-Escalation as Stability Anchor

Reducing military escalation risk lowers volatility premiums embedded across global financial systems.

Pillar 2: Energy Market Equilibrium

Stable diplomacy supports predictable oil flows, which anchor inflation and monetary policy planning worldwide.

This is not simply foreign policy positioning — it is systemic risk management in a fragile multipolar transition.

Diplomacy, when sustained, becomes an economic stabilizer.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

TASS — “US Prioritizes Diplomatic Agreement on Iran’s Nuclear Program”

Reuters — “US Signals Preference for Diplomacy in Iran Nuclear Discussions”

~~~~~~~~~~

Russia Fast-Tracks Digital Ruble to Challenge Dollar Dominance in BRICS

CBDC push accelerates cross-border trade ambitions as internal banking skepticism surfaces

Overview

Russia is accelerating development of the digital ruble as part of a broader strategy to reduce reliance on the U.S. dollar within BRICS trade settlements.

Officials suggest the digital ruble is designed primarily as an international settlement tool, potentially enabling cross-border trade among BRICS nations outside traditional dollar-clearing systems.

With several BRICS members actively developing central bank digital currencies (CBDCs), Moscow is positioning its e-ruble as a foundational piece of emerging multipolar payment infrastructure.

Key Developments

1. Digital Ruble Positioned as International Project

Timur Aitov of the Russian Chamber of Commerce described the digital ruble as “first and foremost an international project,” reinforcing that its priority use case is cross-border trade settlement rather than domestic retail payments.

China is reportedly viewed as a potential early participant in accepting the digital ruble for bilateral trade.

2. BRICS CBDC Coordination Expands

Several BRICS nations are currently piloting CBDCs, and discussions around interoperability are intensifying.

The Reserve Bank of India recently issued communication encouraging BRICS members to explore CBDC linkage frameworks, a topic expected to surface at the upcoming summit in New Delhi.

3. Russia’s Largest Bank Voices Caution

Sberbank CEO German Gref expressed skepticism about retail applications of the digital ruble.

While supportive of cross-border trade usage, Gref questioned the necessity of a CBDC for individuals, suggesting its most rational application lies strictly in intergovernmental and inter-alliance trade flows.

4. Sanctions Resilience Remains Core Driver

The acceleration of the digital ruble is widely viewed as part of Russia’s broader strategy to mitigate sanctions exposure and reduce dollar dependency.

By leveraging CBDC infrastructure, Russia aims to insulate trade corridors from Western financial controls.

Why It Matters

The digital ruble push reflects a structural shift in how sovereign currencies may operate in the future.

If integrated into BRICS trade networks, the e-ruble could:

• Reduce dollar settlement reliance

• Increase bilateral currency trade

• Strengthen sanctions resilience

• Expand CBDC interoperability experimentation

This is part of a broader global movement toward state-controlled digital settlement rails.

Why It Matters to Foreign Currency Holders

For currency observers, this development influences:

• Dollar reserve dominance debates

• CBDC cross-border settlement adoption

• Energy trade pricing mechanisms

• Geopolitical monetary fragmentation

If BRICS nations link CBDCs successfully, parallel settlement systems could expand alongside traditional banking channels.

Implications for the Global Reset

Pillar 1: Digital Sovereign Currency Infrastructure

The digital ruble represents a test case for how CBDCs may facilitate alliance-based trade outside legacy clearing systems.

Pillar 2: Dollar System Alternatives Expand

While not an immediate dollar replacement, coordinated BRICS CBDC discussions signal incremental diversification of settlement architecture.

The key question is not whether the digital ruble replaces the dollar — but whether interoperable CBDCs collectively reshape cross-border financial plumbing over time.

This is not merely fintech experimentation — it is geopolitical monetary engineering.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “Russia Fast-Tracks Digital Ruble to Break Dollar’s Grip on BRICS”

Reuters — “Russia Advances Digital Ruble Pilot for Cross-Border Trade”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Afternoon 2-15-26

Iraq's Liquidity Crisis Threatens Public Sector Salaries And Pensions

2026-02-15 Shafaq News- Baghdad Iraq’s financial resources are no longer sufficient to secure public sector salaries and pensions, informed sources told Shafaq News on Sunday, as the government withdrew about $18B from official banks.

The sources noted that the Iraqi cabinet withdrew nearly 20 trillion Iraqi dinars (approximately $13.2B) from Rafidain Bank, between 7 and 8 trillion dinars ($4.6–5.3 billion) from Rasheed Bank, and about $7 billion from another bank. Additional funds were also drawn from the industrial and agricultural banks to finance salary payments in recent months.

Iraq's Liquidity Crisis Threatens Public Sector Salaries And Pensions

2026-02-15 Shafaq News- Baghdad Iraq’s financial resources are no longer sufficient to secure public sector salaries and pensions, informed sources told Shafaq News on Sunday, as the government withdrew about $18B from official banks.

The sources noted that the Iraqi cabinet withdrew nearly 20 trillion Iraqi dinars (approximately $13.2B) from Rafidain Bank, between 7 and 8 trillion dinars ($4.6–5.3 billion) from Rasheed Bank, and about $7 billion from another bank. Additional funds were also drawn from the industrial and agricultural banks to finance salary payments in recent months.

These measures have significantly depleted liquidity in state-owned banks and increased the likelihood of payment delays unless urgent financial solutions are implemented. “The crisis could further strain Iraq’s fragile finances, particularly amid mounting concerns over mismanagement, waste of public funds, and suspected irregularities in certain issues,” they said, pointing to the need for urgent reform measures to safeguard financial stability and ensure the timely disbursement of salaries and pensions.

Since December, Iraq’s state-owned banks, particularly Rafidain and Rasheed, have suspended government lending programs due to declining liquidity and weak credit planning, informed sources previously told Shafaq News. The disruption coincided with delayed salary disbursements earlier this year, fueling public concern over the government’s ability to sustain payroll obligations amid mounting fiscal pressure and reliance on short-term liquidity measures.

Read more: Liquidity shortage delays Iraqi salaries: Experts warn of prolonged financial strain

Dollar Climbs In Baghdad And Erbil

2026-02-15 Shafaq News- Baghdad/ Erbil The US dollar closed Sunday’s trading higher in Iraq, hovering around 151,000 dinars per 100 dollars.

According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 151,000 dinars per 100 dollars, up from the morning session’s 150,700 dinars.

In the Iraqi capital, exchange shops sold the dollar at 151,500 dinars and bought it at 150,500 dinars, while in Erbil, selling prices stood at 150,850 dinars and buying prices at 150,800 dinars.https://www.shafaq.com/en/Economy/Dollar-climbs-in-Baghdad-and-Erbil-8

Gold Prices Stabilize In Baghdad And Erbil Markets

2026-02-15 Shafaq News- Baghdad/ Erbil On Sunday, gold prices hovered around 1.07 million IQD per mithqal in Baghdad and Erbil markets, holding steady, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 1,068,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 1,064,000 IQD.

The selling price for 21-carat Iraqi gold stood at 1,038,000 IQD, with a buying price of 1,034,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 1,070,000 and 1,080,000 IQD, while Iraqi gold sold for between 1,040,000 and 1,050,000 IQD.

In Erbil, 22-carat gold was sold at 1,133,000 IQD per mithqal, 21-carat gold at 1,082,000 IQD, and 18-carat gold at 927,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-stabilize-in-Baghdad-and-Erbil-markets-4-8

Dollar Edges Lower In Baghdad And Erbil

2026-02-15 Shafaq News- Baghdad/ Erbil The US dollar opened Sunday’s trading lower in Iraq, hovering around 151,000 dinars per 100 dollars.

According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 150,700 dinars per 100 dollars, down from the previous session’s 151,250 dinars.

In the Iraqi capital, exchange shops sold the dollar at 151,250 dinars and bought it at 150,250 dinars, while in Erbil, selling prices stood at 150,700 dinars and buying prices at 150,600 dinars.https://www.shafaq.com/en/Economy/Dollar-edges-lower-in-Baghdad-and-Erbil

Iraq’s Basrah Medium Crude Rises 0.62% In January

2026-02-14 Shafaq News- Baghdad Iraq’s Basrah Medium crude averaged $61.28 per barrel in January 2026, up from $60.90 in December, according to OPEC’s monthly report.

The OPEC reference basket also climbed to $62.28 per barrel in January, compared with $61.74 the previous month. Despite the monthly increase, prices remain well below the $77.98 per barrel annual average recorded in 2025.

In spot trading, Basrah Heavy closed at $62.53 per barrel, down 1.29% on the week, tracking broader declines in global benchmarks including Brent and US West Texas Intermediate.

Iraq, OPEC’s second-largest oil producer, exports roughly 70% of its crude to Asia, 20% to Europe, and 10% to the United States. https://www.shafaq.com/en/Economy/Iraq-s-Basrah-Medium-crude-rises-0-62-in-January

Iraq’s Collapsed Economy Is Becoming A Threat To OPEC, Bloomberg Report Says

2020-10-28 Shafaq News / Iraq's collapsed economy could turn into a threat to OPEC, which is struggling to maintain oil prices, as some Iraqis want the government to put them first by pumping more oil.

A report by Bloomberg said that if an important partner like Iraq violates the agreement, it is certain that lesser countries will follow suit.

The report indicated that Iraq, the third-largest oil exporter in the world, is facing an economic collapse after COVID-19 led to a decline in global energy demand and lower prices, causing a financial that the government is unable to pay the salaries.

As by the report, this created a dilemma for Iraqi Oil Minister, Ihsan Abdul-Jabbar, who is now caught between the demands of the ongoing angry protests and the pledges made to OPEC allies.

The American Agency's report highlighted the Iraqi paradox. Reducing exports, according to the report, carries huge economic and political costs for Iraq, while the failure to adhere to OPEC+ agreement might cause a decline in prices, which will, consequently, has downsides on Iraq's financial income.

As one of the five founding members of the Organization of Petroleum Exporting Countries (OPEC), it is unlikely that Iraq would violate the agreement. However, Saudi Arabia, which actively participated in setting the agreement to reduce production, will retaliate by increasing production and pushing oil prices further down, according to the aforementioned report.

The report quotes a person familiar with the matter as saying that Iraqi officials might instead exert pressure on the Saudis to obtain financial aid if crude oil prices remained below the threshold of 45$ a barrel in the first half of 2021.

Oil prices in global markets have been slightly fluctuating recently but improved significantly compared to the early months of the COVID-19 pandemic. The price of a barrel currently ranges between 42 and 45 dollars compared to less than 20 dollars last April.https://www.shafaq.com/en/Economy/Iraq-s-collapsed-economy-is-becoming-a-threat-to-OPEC-Bloomberg-report-says

“Tidbits From TNT” Sunday 2-15-2026

TNT:

Tishwash: Kujer: Fluctuations in oil prices directly impact the budget and the economic reality.

Member of Parliament Jamal Kojar confirmed on Saturday that the fluctuation in global oil prices significantly affects the country's economic and financial situation.

Kujer told Al-Furat News Agency that “a decrease in the price of a barrel of oil by one dollar means a loss to the general budget and the state treasury of about four million dollars, while an increase in the price by one dollar leads to an increase in treasury revenues by the same amount.”

TNT:

Tishwash: Kujer: Fluctuations in oil prices directly impact the budget and the economic reality.

Member of Parliament Jamal Kojar confirmed on Saturday that the fluctuation in global oil prices significantly affects the country's economic and financial situation.

Kujer told Al-Furat News Agency that “a decrease in the price of a barrel of oil by one dollar means a loss to the general budget and the state treasury of about four million dollars, while an increase in the price by one dollar leads to an increase in treasury revenues by the same amount.”

The Iraqi economy relies mainly on revenues from crude oil exports, which makes the general budget highly sensitive to price movements in global markets, whether upward or downward. link

Tishwash: With the start of Ramadan, a breakthrough is expected in the presidential deadlock, with the nomination of the candidate from the largest bloc.

Abdel Samad Zarkoushi, a member of the coordinating framework, predicted on Friday (February 13, 2026) that the candidate of the largest bloc would be appointed during the first days of the holy month of Ramadan.

Al-Zarkoushi told Baghdad Today that “dialogues and meetings of the Coordination Framework forces are continuing almost daily, and there are serious efforts to resolve the issue of the position of President of the Republic,” noting that “important understandings have been reached in the past few days, and are expected to be reflected in next week’s meetings.”

He added that "the readings available to us indicate that the issue of electing the President of the Republic and assigning the candidate of the largest bloc will be resolved in the first days of Ramadan," noting that "the forces of the framework are still holding on to their candidate Nouri al-Maliki for the next government, and there are no changes in this direction."

Al-Zarkoushi confirmed that "the forces of the framework will hold an important meeting next week, perhaps before the month of Ramadan, to discuss several issues, and its outcomes may lead to accelerating the pace of setting a session for the House of Representatives to vote on the President of the Republic, after which the latter will assign the candidate of the largest bloc."

These statements come amid continued political deadlock over the appointment of the President and Prime Minister, following repeated rounds of talks between the Coordination Framework forces and other political forces.

The House of Representatives had failed in previous sessions to achieve the legal quorum necessary to elect the President of the Republic, which led to postponing the decision more than once, amid political tensions and disagreements over the candidates.

According to the Iraqi constitution, the election of the president of the republic precedes the step of assigning the candidate of the largest parliamentary bloc to form the government, which makes this entitlement pivotal in ending the state of paralysis and moving towards forming a new government to manage the next stage. link

************

Tishwash: Artificial rainmaking in Iraq: A costly "technological option" amid drought challenges

In light of the decline in the levels of the Tigris and Euphrates rivers and the dominance of drought in Iraq, “artificial rainmaking” stands out as one of the proposed technical solutions. However, experts warn against considering it a radical solution to the crisis, stressing that confronting water scarcity in Iraq requires integrated management and international coordination to guarantee water quotas.

Despite the rainy season in the country, the water scarcity and drought crisis continues to threaten agricultural lands and vital water resources.

Artificial rainmaking is an aid

Effective solutions, according to experts, require integrated water resources management, modernization of irrigation infrastructure, promotion of water harvesting and storage projects, and improved coordination with neighboring countries to guarantee Iraq’s rights to transboundary rivers. Thus, artificial rainmaking is viewed as a supporting tool within a comprehensive system of solutions, and not as a radical alternative to address water scarcity.

Working mechanism

Artificial rainmaking , or cloud seeding, is a technique that aims to increase rainfall from existing clouds in the atmosphere rather than creating new clouds, and it relies on stimulating clouds to produce rain in specific areas.

The process is usually carried out using equipped aircraft or ground-based generators that release catalysts such as silver iodide, industrial salt, or dry ice (solid carbon dioxide) into or around clouds, which helps to increase the water density in the cloud and stimulate rainfall.

The financial cost of artificial rainmaking projects

However, the application of artificial rainmaking is not easy, as it is financially and technically costly. It requires equipped aircraft, modern equipment, and specialized expertise to determine the timing of injection and the targeting areas. According to reports, the experiences of several countries indicate that artificial rainmaking involves high financial costs that vary according to the form of the project and the extent of its scope. In the United Arab Emirates, for example, the government allocated more than (22) million US dollars to support research and improve cloud seeding technology, within a long-term program to enhance rainfall in desert areas.

The cost of an hour of flight in the program is estimated at about (8) thousand dollars, and about (1100) hours of flight are carried out annually at a cost of approximately (9) million dollars.

In Saudi Arabia, the planning scenarios for the artificial rainmaking program vary over five years, with costs ranging between approximately (82–102) million dollars.

In India, the Cabinet approved a pilot program aimed at conducting cloud seeding experiments on the capital, New Delhi, at a cost of approximately $385,000. This budget is allocated to implement five weather modification experiments aimed at generating artificial rain to reduce air pollution and alleviate drought.

Meanwhile, in the United States, some states, such as Utah, spend annual sums exceeding $700,000 on weather modification programs that include cloud seeding technology, a figure that shows that even projects of a regional scale require large annual budgets.

In general, project costs include flight hours for equipped aircraft, fuel, crew wages, materials used in cloud seeding, and monitoring atmospheric data, making this technology relatively more expensive compared to some water management alternatives such as infrastructure improvement or desalination in some scenarios.

Preparations for implementation

For his part, Environment Minister He Lu, a military officer, revealed his ministry's readiness to begin the artificial rainmaking project.

He pointed out that three visions were put forward to determine the percentage of benefit from the project during the discussion of the file in the Supreme Water Committee.

The military official said that the artificial rainmaking project is not impossible, and that his ministry had presented the project to various councils and committees three years ago.

It was also discussed in the Supreme Water Committee, chaired by the Prime Minister, confirming the full readiness to begin implementation.

He noted that the ministry took the initiative and expressed its technical readiness in terms of expertise and capabilities, but the initiative has not yet been implemented on the ground.

He attributed this delay in implementing the project to another party whose name he did not mention, stressing his ministry’s ability to complete the file and submit it to the government for implementation.

A very expensive project

In this regard, the head of the Green Iraq Observatory, Omar Abdul Latif, said that artificial rainmaking is an important option that can contribute to mitigating the effects of drought , raising water levels, and reviving some of the affected lands.

But he stressed that it is not the only solution to the water crisis in Iraq, and that addressing water challenges should not be reduced to it alone.

Abdul Latif said that artificial rainmaking “has a number of benefits, including contributing to raising water levels, modifying some climatic conditions, and reviving parts of the land that have been exposed to drought, as well as supporting aquatic environments that have been damaged during the past years.”

He explained that the technology can be used if water levels reach very low levels or if the land is exposed to complete drought.

Artificial rainmaking and the appropriate timing

He explained that the success of artificial rainmaking “is directly related to good timing, as the resulting rain may not serve farmers if it comes at times unsuitable for the agricultural seasons, and in some cases may even lead to damage to crops, given that its effect is similar to the effect of natural rain.”

Abdul Latif pointed out that “artificial rainmaking is financially and technically costly, as it requires aircraft and modern technologies to inject clouds and direct them towards specific areas such as rivers, dams, or dry lands.”

He pointed out that “implementing the project requires significant capabilities and advanced technical preparations.”

He explained that the water situation in Iraq remains linked to the rainy seasons.

He warned that “next summer could be difficult if the rainfall does not continue during the coming period.”

He also called for making use of the rainwater through water harvesting, storage and management projects to ensure its use during drought seasons.

He added that the water crisis in Iraq “cannot be reduced to a single solution such as artificial rainmaking.”

He stressed the need to “improve water resources management by the competent authorities, primarily the Ministries of Water Resources and Agriculture and other relevant bodies, in addition to developing management methods and enhancing the efficiency of use.”

He also stressed the importance of “strengthening the negotiating track with neighboring countries, especially Turkey, Iran and Syria, through a specialized and stable negotiating delegation that has a long-term vision that extends for several years, with the aim of guaranteeing Iraq’s water rights and preserving river levels.”

Abdul Latif concluded his statement by emphasizing that “artificial rainmaking can be one of the supporting options within a broader set of solutions that include water harvesting projects and improved water management and planning.”

However, he pointed out that “it should be treated as a complementary and final option within the comprehensive system of solutions for preserving water resources in Iraq.”

Part of a solution package

For his part, environmental researcher Ali Hashem said that “talking about artificial rainmaking as a solution to the drought crisis in Iraq is an inadequate approach and an exaggeration in estimating its results.”

He stressed that this technology “may be a limited support tool, but it is not a radical solution to the problem of water scarcity or to the worsening repercussions of climate change in the country.”

He stressed that “the water crisis in Iraq is complex and multifaceted, and is linked to regional factors and cross-border water policies, in addition to poor internal management, deteriorating infrastructure, and high rates of waste and pollution.”

Hashem pointed out that “focusing on cloud seeding projects as a solution to the crisis may create a misleading impression among the public that quick results can be achieved.”