The Global Dollar Reserve Currency Era Just Ended

The Global Dollar Reserve Currency Era Just Ended

Arcadia Economics: 2-11-2026

The global economy is undergoing a significant transformation, with far-reaching implications for the world’s financial systems, trade dynamics, and precious metals markets.

In a recent discussion, Vince Lanci highlighted the eroding status of the US dollar as the global reserve currency, a trend that is gaining momentum and has profound consequences for the global economy.

The Global Dollar Reserve Currency Era Just Ended

Arcadia Economics: 2-11-2026

The global economy is undergoing a significant transformation, with far-reaching implications for the world’s financial systems, trade dynamics, and precious metals markets.

In a recent discussion, Vince Lanci highlighted the eroding status of the US dollar as the global reserve currency, a trend that is gaining momentum and has profound consequences for the global economy.

The acknowledgment by Marco Rubio that the US dollar is losing its dominance as the global reserve currency marks a significant shift in the global economic landscape.

The recent trade agreement between Brazil and China, where they opted to transact in their own currencies rather than the dollar, exemplifies this trend.

As regional reserve currencies begin to replace the dollar’s singular dominance, the US’s ability to enforce sanctions and maintain economic control globally is being undermined.

This multipolar global economy is characterized by a decline in the dollar’s influence, and the emergence of new regional reserve currencies. As a result, countries are seeking alternatives to the dollar for international transactions, reducing their dependence on the US currency.

This development has significant implications for the global economy, as it challenges the US’s long-standing economic hegemony.

The discussion also shed light on the precious metals market, particularly gold and silver. A crucial distinction was made between monetary and nonmonetary gold.

While all gold is inherently monetary, only gold in specific forms and purity is classified as monetary gold. In contrast, gold used in jewelry or industrial applications is termed nonmonetary gold.

Interestingly, the US’s export of nonmonetary gold often results in foreign countries converting it into monetary gold, effectively transferring US economic gold to foreign monetary gold reserves.

The increasing gold purchases by Tether, a stablecoin issuer, suggest strategic positioning in response to global financial uncertainties. Tether’s accumulation of gold beyond its immediate needs signals a growing recognition of the metal’s importance as a safe-haven asset.

This development is particularly noteworthy, given the ongoing economic and geopolitical tensions that are driving investors towards precious metals.

The conversation also touched on recent market movements in precious metals and commodities, noting normal price behaviors and speculating on potential near-term trends in silver and gold prices.

As the global economy continues to evolve, the demand for precious metals is likely to increase, driven by investors seeking safe-haven assets and countries looking to diversify their reserves.

In an interview with Jim McDonald of Kuene Silver, the company’s significant silver reserves and potential leverage to future silver price increases were highlighted. As mining companies like Kuene Silver play an increasingly important role in the precious metals market, their ability to capitalize on fluctuating metal prices will be closely watched.

In conclusion, the shifting global economic landscape is having a profound impact on the precious metals market, particularly gold and silver.

As the US dollar’s dominance as the global reserve currency continues to erode, countries and investors are turning to alternative assets, including precious metals.

The implications of this trend are far-reaching, and will likely continue to shape the global economy and precious metals markets in the years to come.

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 2-11-26

Good Morning Dinar Recaps,

How Trump Could Turn Puerto Rico into the Singapore of the Caribbean

Energy reform, governance shifts, and trade law constraints shape the island’s economic future

Good Morning Dinar Recaps,

How Trump Could Turn Puerto Rico into the Singapore of the Caribbean

Energy reform, governance shifts, and trade law constraints shape the island’s economic future

Overview

Puerto Rico’s high electricity costs are not primarily driven by fuel scarcity — they are driven by policy structure. Despite the United States being the world’s largest LNG exporter, Puerto Rico has faced barriers to sourcing domestic liquefied natural gas due to Financial Oversight Board decisions and longstanding federal shipping laws.

Following leadership changes under President Donald Trump, approval for U.S. LNG sourcing moved forward. However, the Jones Act continues to require U.S.-flagged vessels for domestic maritime shipping, creating costly detours and inflating energy prices.

The broader question is whether structural reform could reposition Puerto Rico as a low-tax, energy-efficient financial and trade hub — the “Singapore of the Caribbean.”

Key Developments

1. LNG Access Approved — Structural Constraints Remain

Puerto Rico had previously been blocked from directly sourcing U.S. LNG under Financial Oversight Board decisions tied to fiscal restructuring under PROMESA. After board reshaping, U.S. LNG sourcing received approval.

However, the Jones Act mandates that goods shipped between U.S. ports must travel on U.S.-built, U.S.-flagged, and U.S.-crewed vessels. Because there are limited LNG carriers meeting those requirements, Puerto Rico often faces higher logistical costs.

2. Policy-Driven Power Inflation

The United States exports significant LNG globally, yet Puerto Rico may pay more for energy due to routing inefficiencies and regulatory layers. Higher electricity prices:

Raise manufacturing and operating costs

Reduce investment competitiveness

Suppress capital inflows

Constrain long-term growth

The issue is not supply — it is governance architecture.

3. Governance as an Economic Lever

Puerto Rico’s Financial Oversight and Management Board, established under PROMESA, has broad authority over fiscal and infrastructure decisions. Leadership direction and federal alignment influence:

Energy procurement strategy

Utility restructuring

Infrastructure investment

Public-private energy projects

Reform in governance mechanisms could accelerate modernization and reduce price distortion.

4. Strategic Repositioning Potential

If energy costs are reduced and regulatory friction eased, Puerto Rico could leverage:

Strategic geographic location between North and South America

U.S. legal framework and dollar backing

Tax incentives for business and capital migration

LNG-based power stabilization

These elements could position the island as a financial, logistics, and digital commerce hub in the Caribbean basin.

Why It Matters

Energy pricing is foundational to economic stability. When law overrides efficient market access, price signals distort capital allocation.

Lower-cost, reliable energy:

Strengthens manufacturing competitiveness

Encourages foreign direct investment

Stabilizes fiscal projections

Enhances currency-backed confidence

Conversely, structurally inflated costs suppress growth even when resources are abundant.

Why It Matters to Currency Holders

For currency holders and global reset observers:

Energy reform strengthens dollar-backed territories

Governance alignment influences regional trade flows

Shipping law constraints illustrate how statutory frameworks shape economic velocity

Infrastructure modernization impacts capital migration trends

Puerto Rico’s trajectory could influence broader discussions about U.S. territorial economic restructuring and trade law modernization.

Implications for the Global Reset

Primary Pillar: Finance

Energy efficiency directly impacts fiscal balance, capital efficiency, and long-term debt sustainability.

Secondary Pillars: Law · Governance · Trade & Infrastructure

This is fundamentally a systems issue. Legal structures — not supply shortages — determine pricing outcomes. Reforming statutory constraints could unlock growth without requiring new resource discovery.

The larger lesson extends beyond Puerto Rico: governance architecture can either amplify abundance or restrict it.

If structural reforms align with market access, Puerto Rico could transition from constrained territory to regional economic catalyst.

This is not an energy shortage — it is a governance design question with financial consequences.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

U.S. Maritime Administration — “Jones Act Overview”

https://www.maritime.dot.gov/ports/jones-actU.S. Energy Information Administration (EIA) — “Natural Gas Data & LNG Exports”

https://www.eia.gov/naturalgas/New Fortress Energy — “LNG Operations & Puerto Rico Projects”

https://www.newfortressenergy.com/Puerto Rico Financial Oversight and Management Board (PROMESA) — Official Site

https://oversightboard.pr.gov/

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Wednesday Morning 2-11-26

Good Morning Dinar Recaps,

Fed Signals Cooling Crypto Momentum as Markets Integrate with Traditional Finance

Federal Reserve commentary highlights volatility, regulatory delays, and structural shifts in digital asset markets

Good Morning Dinar Recaps,

Fed Signals Cooling Crypto Momentum as Markets Integrate with Traditional Finance

Federal Reserve commentary highlights volatility, regulatory delays, and structural shifts in digital asset markets

Overview

Federal Reserve Governor Chris Waller stated that the post-election crypto enthusiasm has begun to fade as digital assets become more deeply integrated with traditional finance (TradFi). While dismissing recent price volatility as “part of the game,” Waller pointed to risk recalibration among mainstream financial firms and ongoing regulatory uncertainty as contributing factors.

At the same time, the Federal Reserve is moving forward with plans for limited-access “payment accounts” — also known as “skinny master accounts” — for fintech and crypto firms, signaling a structured but cautious integration of digital finance into the U.S. banking system.

Key Developments

1. Crypto Euphoria Fading

Waller acknowledged that optimism tied to the current U.S. administration has cooled. The surge in institutional participation elevated valuations, but as risk conditions shifted, mainstream financial firms adjusted exposure — triggering broader market pullbacks.

Bitcoin has retraced sharply from its October highs, reflecting volatility that Waller characterized as inherent to the asset class.

2. TradFi Integration Amplifying Market Moves

Increased participation from traditional financial institutions has amplified both upside and downside price movements. As hedge funds, asset managers, and financial firms adjust portfolio allocations, crypto markets now respond more directly to broader liquidity and risk cycles.

This marks a structural transition: crypto is no longer isolated — it is increasingly synchronized with macroeconomic forces.

3. Regulatory Uncertainty Remains

Waller pointed to Congress’s delay in passing a comprehensive crypto market structure bill as a source of uncertainty. Without clear federal guidelines, institutional players remain cautious, affecting capital flows and investor confidence.

Regulatory clarity is becoming a key variable in crypto’s long-term stability.

4. “Skinny Master Accounts” Coming in 2026

The Federal Reserve plans to roll out limited-access payment accounts for fintech and crypto firms this year. These accounts would:

Allow limited interaction with the central banking system

Not earn interest

Have balance caps

The initiative aims to support innovation while protecting financial system stability — a balancing act between modernization and control.

Why It Matters

The Fed’s tone suggests a shift from speculative expansion toward structured integration. As crypto becomes intertwined with traditional finance:

Volatility increasingly mirrors broader macro conditions

Regulatory clarity becomes critical

Central banks move to define boundaries rather than exclude the sector

This is less about banning crypto — and more about absorbing it into the regulated financial architecture.

Why It Matters to Foreign Currency Holders

Digital assets, central bank access frameworks, and regulatory modernization all intersect with the broader restructuring of global finance.

For currency holders:

Integration of crypto into regulated banking reduces systemic unpredictability

Central bank oversight over fintech access suggests tighter monetary control

Payment system modernization aligns with global shifts toward digital settlement systems

This is not a collapse of crypto — it is institutional containment and assimilation.

Implications for the Global Reset

Pillar 1: Monetary Control Modernization

Central banks are redefining how private digital finance interacts with sovereign systems. Payment accounts for crypto firms indicate controlled access rather than exclusion — a sign of strategic adaptation.

Pillar 2: Market Discipline & Risk Repricing

As speculative hype fades, markets are repricing crypto based on liquidity conditions, regulation, and macro risk. This mirrors broader reset themes — capital flowing toward stability, transparency, and oversight.

The transition from enthusiasm to integration marks a maturing phase in digital finance’s role within the global system.

This is not just crypto volatility — it’s the institutional restructuring of digital finance within the global monetary framework.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Cointelegraph — “Fed’s Waller says crypto hype ‘fading’ with TradFi tie-ins”

Reuters — “Federal Reserve officials discuss crypto oversight and payment system access”

~~~~~~~~~~

Macron Sounds Alarm on U.S. Ties, Calls for EU Power Reset

France urges strategic autonomy as Washington and Beijing reshape global power dynamics

Overview

French President Emmanuel Macron has warned that Europe must prepare for renewed friction with the United States, cautioning that any temporary easing of tensions under President Donald Trump should not be mistaken for lasting stability. Speaking to multiple European outlets, Macron described what he called the “Greenland moment” — U.S. pressure over territory, trade, technology, and regulatory power — as a wake-up call for the European Union.

His message is clear: Europe must strengthen its strategic autonomy, reform its economic model, and reduce dependency on external powers.

Key Developments

1. Warning of Renewed Transatlantic Friction

Macron argued that Washington’s posture toward Europe has become increasingly confrontational. He accused the U.S. administration of pursuing policies that undermine EU cohesion and economic sovereignty. Trade disputes, digital regulation enforcement, and tariff threats are expected to intensify if the EU presses forward with its Digital Services Act against major American technology firms.

Macron stressed that appeasement has failed to prevent escalating tensions.

2. The “Double Shock”: U.S. and China

Macron framed Europe’s challenge as a two-front economic and geopolitical test:

China presents what he described as a “trade tsunami,” pressuring Europe’s industrial base through competitive exports and state-backed production capacity.

The United States introduces unpredictability, using tariffs, regulatory pressure, and geopolitical leverage that destabilize European planning.

Together, these forces represent a structural rupture in the global order that Europe must confront collectively.

3. Push for EU Reform and Common Borrowing

Ahead of an EU summit in Belgium, Macron renewed calls for:

Reviving stalled economic reforms

Deepening fiscal coordination

Expanding common EU borrowing mechanisms

Financing large-scale strategic investments

He also reiterated support for a “Made in Europe” industrial strategy to prioritize domestic production and reduce reliance on both the U.S. and China. Macron insists this is about strategic protection — not protectionism.

4. Internal EU Tensions Remain

While Macron’s vision calls for stronger fiscal integration and industrial coordination, resistance from fiscally conservative EU member states remains a major obstacle. The debate centers on whether Europe is ready to evolve from a rules-based economic bloc into a geopolitical power center.

Why It Matters

Macron’s remarks reflect more than a policy disagreement — they signal a broader reassessment of Europe’s place in the global hierarchy.

If the EU accelerates fiscal integration, common borrowing, and industrial preference policies, it would mark a significant shift toward:

Reduced reliance on U.S. monetary dominance

Stronger euro-zone financial architecture

Strategic economic independence

Such moves could reshape capital flows, trade alliances, and the balance of transatlantic influence.

Why It Matters to Foreign Currency Holders

For currency holders and global reset observers, this development is critical:

Increased EU borrowing could strengthen euro-denominated financial instruments

Strategic autonomy efforts may reduce dollar dependence in trade

Industrial consolidation within Europe could shift trade settlement patterns

Transatlantic tensions could influence bond markets and reserve allocation decisions

Europe redefining its relationship with Washington alters global monetary alignment.

Implications for the Global Reset

Pillar 1: Multipolar Monetary Evolution

Macron’s push for reduced dependency and greater EU fiscal coordination aligns with broader trends toward a multipolar financial order. The euro’s strategic positioning could strengthen if integration deepens.

Pillar 2: Sovereign Industrial Realignment

A “Made in Europe” doctrine reflects the growing global shift toward regional manufacturing resilience — a key reset theme seen across the U.S., China, and BRICS economies.

The underlying message is clear: economic blocs are hardening, alliances are recalibrating, and monetary power is increasingly tied to industrial control.

This is not just diplomatic rhetoric — it is structural positioning within a transforming global system.

This is not just transatlantic tension — it’s Europe deciding whether to remain a market or become a geopolitical power.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy — “Macron Sounds Alarm on U.S. Ties, Calls for EU Power Reset”

Reuters — “Macron urges Europe to strengthen strategic autonomy amid U.S. tensions”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Morning 2-11-26

The Federal Court Dismisses The Lawsuit Filed Against The Customs Tariff.

Money and Business Economy News – Baghdad Member of Parliament Mohammed Al-Khafaji announced on Wednesday that the Supreme Federal Court had rejected the lawsuit filed against Resolution 957 concerning customs identification. Al-Khafaji wrote in a post on the social networking site Facebook today that "the lawsuit related to increasing the customs tariff was dismissed due to the lack of a legitimate interest."

The Federal Court Dismisses The Lawsuit Filed Against The Customs Tariff.

Money and Business Economy News – Baghdad Member of Parliament Mohammed Al-Khafaji announced on Wednesday that the Supreme Federal Court had rejected the lawsuit filed against Resolution 957 concerning customs identification. Al-Khafaji wrote in a post on the social networking site Facebook today that "the lawsuit related to increasing the customs tariff was dismissed due to the lack of a legitimate interest."https://economy-news.net/content.php?id=65586

Iraq Advances In The Corruption Perceptions Index Report

Money and Business Economy News – Baghdad Iraq has made progress in the Corruption Perceptions Index report issued by Transparency International, as its score rose for the first time to (28) points, advancing four places, in a step that reflects the increasing pace of reforms and national efforts in the field of integrity and combating corruption.

The Integrity Commission’s media office stated in a statement received by “Al-Eqtisad News” that “this progress is due to a number of ongoing governmental and judicial measures and the efforts of oversight bodies to facilitate procedures within service departments, reduce opportunities for direct contact between the employee and the client, as well as the implementation of the National Strategy for Integrity and Combating Corruption, and the accelerated procedures in the field of digital transformation and e-governance.”

“Iraq’s commitment to international and regional anti-corruption agreements, expanding partnerships with the private sector and civil society, involving youth and women in integrity efforts, achieving advanced levels of electoral integrity, and striving to pass a law on the right to access information have all contributed to strengthening this positive path.”

He noted that "this progress confirms that Iraq is moving steadily towards improving its international standing and consolidating the international community's confidence in its efforts to combat corruption and build more transparent and efficient institutions."

It is noted that the Commission has intensified its cooperation and coordination with Transparency International in its endeavor to advance in the Corruption Perceptions Index issued by the organization. The latest of these activities was a meeting that brought together the head of the Iraqi delegation to the Conference of the States Parties to the United Nations Convention against Corruption, the head of the Federal Integrity Commission, Dr. (Mohammed Ali Al-Lami), with the head of Transparency International, Mr. (François Valérien), in the Qatari capital, Doha.https://economy-news.net/content.php?id=65553

UN: Digital Transformation In Iraq Reduces Corruption Risks And Strengthens Institutional Confidence

INA–Baghdad The United Nations Development Programme’s (UNDP) project to strengthen arbitration and combat corruption in Iraq confirmed on Tuesday that Iraq’s score of 28 out of 100 on the 2025 Corruption Perceptions Index reflects ongoing reform efforts. While noting that the National Anti-Corruption Strategy has enhanced institutional coordination, the project emphasized that Iraq’s expansion in digital public services has contributed to reducing opportunities for corruption.

Project Manager Yama Torabi told the Iraqi News Agency (INA) that Iraq’s score “was not surprising to many Iraqis, given the accumulated effects of corruption on citizens, particularly in obtaining licenses and approvals, accessing public services, and building trust in institutions.

” He added that “the fundamental question is not whether corruption exists, but what this result reveals about Iraq’s current position and its potential for future development.”

Torabi explained that the Corruption Perceptions Index is often misunderstood as a simple numerical ranking, whereas it is, in fact, a confidence indicator reflecting the views of citizens, the business community, investors, and international partners regarding the reliability of state institutions, the consistency of rule enforcement, the reality of accountability, and the sustainability of reforms.

He stressed the importance of the index for Iraq, noting that its direct impact influences the decisions of investors, lenders, and development partners, who rely on it to assess risks and determine the nature of economic engagement—whether short-term or long-term, speculative or productive, and limited or broad-based.

Torabi noted that Iraq has taken clear steps in recent years to strengthen its anti-corruption framework, including the National Anti-Corruption Strategy (2021–2025), which helped align institutions around shared priorities. He also pointed to the preparation of a follow-up strategy for 2025–2030, reflecting the intention to sustain reform efforts.

He observed that perception indicators, including the Corruption Perceptions Index, tend to improve very slowly, particularly at the stage where plans and announcements must be translated into consistent institutional practices.

In this context, he emphasized that institutions such as the Federal Integrity Commission and its counterpart in the Kurdistan Region are expected to go beyond case investigations and contribute to building a comprehensive integrity system encompassing prevention, oversight, coordination, and inter-agency cooperation.

Torabi explained that this shift reflects a broader understanding of corruption as not merely a legal issue but a governance challenge that arises when power remains unchecked, rules are unclear, and enforcement is uneven.

He noted that international experiences show many countries stumble after adopting strategies, before institutions are able to demonstrate equal application of rules across sectors and political phases.

He described Iraq as being in a similarly challenging consolidation phase, highlighting digital transformation as one of the most prominent examples. He stressed that Iraq’s expansion in digital public services—such as passport issuance, national ID cards, and the government portal—has reduced direct interaction, thereby limiting opportunities for corruption, enhancing transparency through standardized procedures, and increasing traceability. He added that these measures have been met with tangible public approval.

Torabi pointed out that international experience confirms digital transformation alone does not enhance credibility unless it is embedded within broader governance reforms. He cited Georgia and Estonia as examples where digitalization was accompanied by administrative and institutional reforms that strengthened discipline and accountability, making technology an essential tool for enforcing institutional rules.

He emphasized that digital transformation is fundamentally a governance choice, explaining that technology can build trust and limit discretionary power when rules are clear and oversight is effective. Conversely, digital systems may replicate existing power imbalances if these conditions are absent.

Torabi underscored the importance of digital public infrastructure that shifts the focus from individual services to integrated foundational systems through which institutional credibility is built on a wider scale. He noted that the Corruption Perceptions Index also reflects the daily concerns of Iraqis regarding equal rule enforcement, the independence of oversight bodies, and the consistency of accountability mechanisms.

He added that these challenges intersect with environmental and climate-related pressures, such as water scarcity, land degradation, and climate investment requirements, which further heighten the need for integrity and transparency in governance. He stressed that Iraq’s low score in the 2025 index highlights a gap between reform intentions and citizens’ lived experience.

Torabi concluded by emphasizing that UNDP’s engagement in Iraq—including its project to strengthen arbitration and combat corruption for environmental justice—focuses on institutionalizing reform, enhancing coordination, and consolidating digital transformation grounded in governance principles.

He noted that while perception indicators respond slowly, their improvement signals real and sustainable reforms, and that the core challenge remains transforming reform momentum into institutional trust and, ultimately, long-term prosperity.

Gold Prices Climb In Baghdad, Steady In Erbil

2026-02-11 Shafaq News- Baghdad/ Erbil Gold prices increased in Baghdad on Wednesday while remaining stable in Erbil, according to a survey by Shafaq News Agency.

In Baghdad’s wholesale markets on Al-Nahr Street, the selling price of one mithqal (approximately five grams) of 21-carat Gulf, Turkish, and European gold reached 1,066,000 IQD, with a buying price of 1,062,000 IQD. The same category had recorded 1,063,000 IQD on Tuesday.

The selling price of 21-carat Iraqi gold stood at 1,036,000 IQD, while the buying price was 1,032,000 IQD.

At retail jewelry shops, 21-carat Gulf gold was offered between 1,065,000 and 1,075,000 IQD per mithqal, whereas Iraqi gold ranged from 1,035,000 to 1,045,000 IQD.

In Erbil, gold rates held steady, with 22-carat gold priced at 1,157,000 IQD per mithqal, 21-carat at 1,105,000 IQD, and 18-carat at 948,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-climb-in-Baghdad-steady-in-Erbil-5-5

Dollar Slips In Baghdad And Erbil

2026-02-11 Shafaq News- Baghdad/ Erbil The US dollar opened Wednesday’s trading slightly lower in Iraq, slipping by 100 dinars in Baghdad and Erbil.

According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 150,100 dinars per 100 dollars, down from Tuesday’s 150,200 dinars.

In the Iraqi capital, exchange shops sold the dollar at 150,500 dinars and bought it at 149,500 dinars.

In Erbil, selling prices stood at 149,850 dinars per 100 dollars and buying prices at 149,750 dinars.

https://www.shafaq.com/en/Economy/Dollar-slips-in-Baghdad-and-Erbil-7-3

“Tidbits From TNT” Wednesday Morning 2-11-2026

TNT:

Tishwash: of the “Asia Pay” e-wallet service in Baghdad

As part of the digital transformation, the electronic wallet service (Asia Pay) was launched today, Tuesday, in a number of Baghdad post offices.

A statement from the Ministry of Communications, followed by (Shafaqna Iraq), stated that “the Ministry of Communications, through the General Company for Post and Savings, launched the electronic wallet service “AsiaPay” at a number of postal locations in the capital.”

The service included the offices of (Baghdad, Al-Intisar, Aden, Al-Dubbat, Al-Jami’a, Palestine, Al-Mahmoudiya, Basmaya).

TNT:

Tishwash: of the “Asia Pay” e-wallet service in Baghdad

As part of the digital transformation, the electronic wallet service (Asia Pay) was launched today, Tuesday, in a number of Baghdad post offices.

A statement from the Ministry of Communications, followed by (Shafaqna Iraq), stated that “the Ministry of Communications, through the General Company for Post and Savings, launched the electronic wallet service “AsiaPay” at a number of postal locations in the capital.”

The service included the offices of (Baghdad, Al-Intisar, Aden, Al-Dubbat, Al-Jami’a, Palestine, Al-Mahmoudiya, Basmaya).

Ease and safety

“AsiaPay is a modern digital e-wallet that allows users to conduct various financial transactions easily and securely.”

He added that “the service is available to all Iraqi citizens after submitting the required documents, and non-Iraqis are required to submit a valid passport with an entry visa or a valid residence card.”

The wallet also offers a wide and diverse range of services, including free deposits without commission and withdrawals with a small commission, as well as the ability to pay government bills directly from the wallet.”

money transfer

He explained that “the service allows money transfers via MoneyGram to more than (200) countries around the world with reduced commissions, in addition to local transfers within Iraq from one wallet to another within “Asia Pay” without any commission, in addition to services for topping up phone and internet credit and purchasing various electronic cards, whether through the application or through authorized agents.” link

************

Tishwash: Five years of waiting... Thousands of angry students take to the streets of Baghdad to demand employment.

The capital, Baghdad, witnessed on Tuesday (February 10, 2026) massive demonstrations by students who have been waiting for appointments for five years, according to what one of the demonstrators told a reporter from "Baghdad Today".

Our correspondent explained that "the numbers are very large, close to a thousand demonstrators, as they gathered in the Alawi area and then headed towards Al-Salihiya, with the main streets closed during their march."

He added that "the protesters have now reached the front of the Iranian embassy and are on their way to the House of Representatives to demand their right to be appointed, as they say." link

***************

Tishwash: Iraq and Sweden discuss reactivating cooperation and holding joint economic forums.

he Undersecretary of the Ministry of Foreign Affairs for Bilateral Relations, Ambassador Mohammed Hussein Bahr Al-Uloom, discussed on Tuesday with the Chargé d'Affaires of the Swedish Embassy in Iraq, Jörgen Lindström, ways to enhance joint cooperation between the two countries.

A statement from the Ministry, received by “Dijlah News”, stated that during the meeting, bilateral cooperation relations between Iraq and the Kingdom of Sweden were reviewed, and prospects for developing them in a way that achieves common interests, in addition to discussing a number of political and economic issues of mutual interest.

For his part, Lindström affirmed his government's commitment to resuming the Swedish embassy's operations from Baghdad in the near future. He also indicated the Swedish government's intention to organize a business forum in Sweden after Ramadan, with a similar forum to be held in Iraq next summer, with the aim of strengthening economic cooperation and encouraging mutual investments between the two countries. link

**************

Tishwash: The Central Bank is preparing to launch a unified electronic payment system with the Kurdistan Region.

The Governor of the Central Bank of Iraq, Ali Al-Alaq, affirmed on Tuesday that developing the electronic payment system and digital transformation has become an urgent necessity to strengthen the Iraqi economy, expressing the bank’s readiness to cooperate and coordinate with the Kurdistan Regional Government to establish a unified and secure electronic payment system that includes all governorates of the country.

Al-Alaq said in a speech during the launch of the regional government's electronic services project that "this system will serve Iraq in general and the region in particular," noting that "excessive reliance on cash is no longer compatible with the requirements of the modern economy."

He added that “building a sophisticated financial system requires secure, fast, reliable and transparent electronic systems that contribute to enhancing confidence in the banking sector and supporting financial stability,” noting that “recent years have witnessed tangible developments in the field of electronic payment through the expansion of the use of bank cards.”

Al-Alaq explained that “financial integration is the cornerstone for developing this sector, through the adoption of new tools that are added to electronic payment systems,” stressing that “digital transformation represents an important launch and a qualitative step in the path of modernizing the financial and banking sectors and promoting the culture of electronic payment in Iraq.”

He continued, saying: “We affirm our full support for all services that contribute to the development of financial services throughout Iraq, including the Kurdistan Region, in the belief that developing the electronic payment system is not an option, but a necessity to strengthen the national economy.”

The Central Bank Governor pointed out that "electronic payment is an ongoing process that requires a strong infrastructure, in addition to raising public awareness of the importance of these transformations," stressing "the continued coordination with the regional government to establish a unified and secure system that serves citizens and institutions alike." link

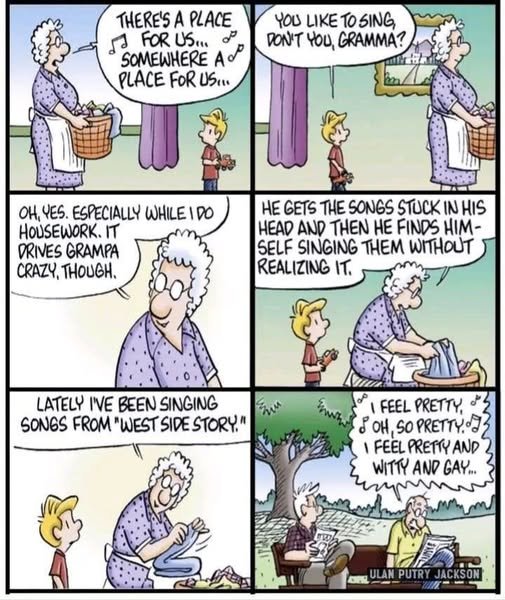

Mot: poor ole ""Earl"" ~~~~

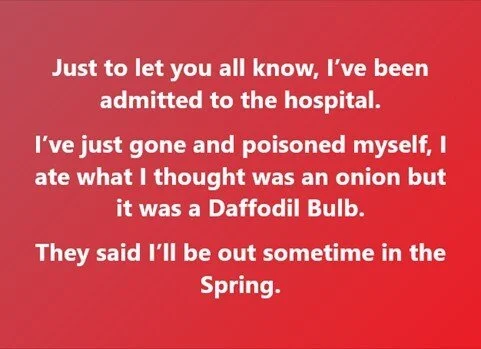

Mot: .. UH OOOOOH!!!!

Seeds of Wisdom RV and Economics Updates Tuesday Evening 2-10-26

Good Evening Dinar Recaps,

EU Escalates Financial Warfare as Sanctions Expand Into Crypto and Digital Finance

Brussels tightens control over digital money as sanctions enter a new phase

Good Evening Dinar Recaps,

EU Escalates Financial Warfare as Sanctions Expand Into Crypto and Digital Finance

Brussels tightens control over digital money as sanctions enter a new phase

Overview

The European Union has unveiled its 20th round of sanctions against Russia, marking a significant expansion into the cryptocurrency and digital finance sector. Announced by European Commission President Ursula von der Leyen on February 6, 2026, the new measures aim to close perceived loopholes that allow Russia to bypass traditional financial restrictions through digital assets.

Key Developments

The sanctions package targets crypto platforms, traders, and digital asset companies accused of facilitating sanctions evasion.

EU officials signaled tighter oversight of how Russian users interact with cryptocurrency services, including possible restrictions on the digital ruble.

Financial sanctions were expanded to include 20 regional Russian banks and select third-country institutions suspected of aiding circumvention.

A full ban on maritime services for Russian crude oil was introduced, with 43 additional shadow-fleet vessels added to sanctions lists.

Trade restrictions now cover over €360 million in EU exports and €570 million in Russian imports, including metals, chemicals, and minerals.

Why It Matters

Sanctions are no longer confined to physical trade and traditional banking. By targeting crypto infrastructure, the EU is acknowledging that digital finance has become systemically important to geopolitical power, sanctions enforcement, and capital mobility. This move signals a broader effort to bring decentralized financial activity under centralized regulatory control.

Why It Matters to Foreign Currency Holders

Expanding sanctions into crypto reinforces the reality that digital assets are now embedded in sovereign policy risk. Increased regulation and surveillance of digital payments may accelerate capital migration toward alternative settlement systems, decentralized finance, or non-Western financial rails — reshaping currency demand and reserve behavior.

Implications for the Global Reset

Pillar 1 – Digital Financial Control

The EU’s actions underscore a push to reassert state authority over digital money, challenging the premise of borderless finance.

Pillar 2 – Fragmentation of the Financial System

As Western regulators tighten controls, parallel financial ecosystems — including DeFi, P2P networks, and non-Western payment systems — are likely to expand.

This is not just sanctions policy — it’s a stress test for the future of digital sovereignty and financial freedom.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

CryptoRank — “EU’s 20th Russia Sanctions Hit Crypto: Brussels Targets Digital Finance”

Reuters — “EU proposes new Russia sanctions targeting banks, oil and crypto-related activity”

~~~~~~~~~~

EU Expands Financial Warfare as Sanctions Target Crypto and Digital Finance

Brussels moves to rein in digital money as sanctions evolve beyond banks and oil

Overview

The European Union has unveiled its 20th sanctions package against Russia, marking a decisive expansion into cryptocurrency platforms and digital assets. Announced by European Commission President Ursula von der Leyen on February 6, 2026, the measures reflect growing concern that digital finance is being used to bypass traditional sanctions enforcement.

Key Developments

The sanctions target crypto platforms, traders, and companies accused of facilitating sanctions evasion by Russian entities.

EU officials signaled tighter monitoring of how Russian users interact with crypto services, with reports suggesting possible restrictions on the Digital Ruble.

Platforms enabling cryptocurrency trading for Russian users may face new operational limits or compliance requirements.

Financial restrictions were expanded to include 20 regional Russian banks and third-country institutions suspected of aiding sanctions circumvention.

The package also introduces a complete ban on maritime services for Russian crude oil, with 43 additional shadow-fleet vessels sanctioned, raising the total to 640.

Why It Matters

Sanctions are no longer confined to physical trade, banking, or energy. By extending restrictions into crypto and digital payments, the EU is signaling that digital finance is now a core battleground in geopolitical conflict. This move underscores growing concern that decentralized financial tools undermine state-level economic controls.

Why It Matters to Foreign Currency Holders

Targeting crypto infrastructure highlights the rising policy risk attached to digital assets and cross-border payments. Increased regulation and surveillance may accelerate the migration of capital toward alternative settlement systems, decentralized finance, or non-Western financial rails — reshaping currency confidence and reserve strategies.

Implications for the Global Reset

Pillar 1 – Centralized Control vs. Decentralized Finance

The sanctions expose the tension between state authority and blockchain-based systems designed to operate beyond borders.

Pillar 2 – Financial System Fragmentation

As Western regulators tighten digital oversight, parallel ecosystems — including P2P markets, OTC trading, and DeFi protocols — are likely to expand outside traditional jurisdictional reach.

This is not just sanctions policy — it’s a stress test for the future of digital sovereignty and monetary control.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

CryptoRank — “EU’s 20th Russia Sanctions Hit Crypto: Brussels Targets Digital Finance”

Financial Times — “EU seeks to ban all Russian crypto transactions”

~~~~~~~~~~

BRICS Energy Dynamics – India Orders 2M Barrels of Venezuelan Oil

New Delhi’s oil procurement highlights shifting alliances and strategic diversification in global energy flows

Overview

India’s state refiners have secured 2 million barrels of Venezuelan crude oil for delivery in April 2026, marking a significant pivot in crude sourcing as New Delhi recalibrates energy ties amid evolving geopolitical and trade pressures. The purchase — made through trading intermediaries with authorization linked to U.S. licensing — underscores a broader effort to diversify away from Russian supplies and reflects the complex intersection of energy, diplomacy, and global alliances.

Key Developments

India’s state refiners Indian Oil Corp (IOC) and Hindustan Petroleum Corp (HPCL) jointly bought 2 million barrels of Venezuelan Merey crude through trading firm Trafigura, for delivery in the second half of April 2026.

The cargo will be shipped on a single very large crude carrier (VLCC), with IOC lifting ~1.5 million barrels and HPCL ~500,000 barrels.

This follows an earlier Venezuelan oil purchase by Reliance Industries, another major Indian refiner, illustrating growing participation from multiple players.

The deal comes as Indian refiners diversify crude sources and reduce reliance on Russian oil, reflecting broader geopolitical and market dynamics.

Why It Matters

Energy procurement decisions of a major oil consumer like India have global strategic ripple effects. Diversifying crude imports influences geopolitical alignments, reduces vulnerability to sanctions-related supply disruptions, and reshapes long-term trading patterns. India’s Venezuelan oil deal — facilitated under special U.S. licensing — also exemplifies how global energy flows are increasingly shaped by geopolitical coordination.

Why It Matters to Foreign Currency Holders

Moves toward diversified crude sourcing affect trade balances, import bill structures, and foreign exchange flows. Importing Venezuelan oil can alter India’s dollar outflows for energy, influence demand for other reserve currencies tied to energy settlement, and factor into long-term currency reserve strategies as nations hedge energy-trade exposure.

Implications for the Global Reset

Pillar 1 – Energy Trade Realignment:

India’s crude diversification reflects a broader transformation in global energy supply chains, where traditional supplier relationships are evolving toward multipolar engagement and strategic autonomy.

Pillar 2 – Geopolitical–Energy Nexus:

The intersection of energy procurement with U.S. policy, Western sanctions regimes, and BRICS dynamics highlights how energy security and geopolitical strategy are increasingly intertwined — reshaping the future of global economic influence.

India’s energy strategy is not just about crude — it’s about positioning in a changing geopolitical and economic order.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 2-10-26

Good Afternoon Dinar Recaps,

Markets Reprice Power and Policy as Europe Enters a New Risk Phase

Political uncertainty drives bond, currency, and capital market recalibration

Good Afternoon Dinar Recaps,

Markets Reprice Power and Policy as Europe Enters a New Risk Phase

Political uncertainty drives bond, currency, and capital market recalibration

Overview

UK and European markets are actively repricing risk as political turbulence, fiscal pressures, and central bank uncertainty collide. Shifts in bond yields and currencies — alongside global spillovers from Japan’s recent election — signal a broader reassessment of growth expectations and policy credibility across advanced economies.

Key Developments

UK borrowing costs rose sharply before easing, reflecting investor unease over fiscal sustainability and political leadership pressures.

Sterling and European assets experienced heightened volatility as markets reacted to mixed signals from policymakers.

Japan’s election outcome triggered global equity strength, influencing capital rotation and currency dynamics beyond Asia.

Investors increasingly priced in divergent policy paths among major economies, highlighting fragmentation in the global financial landscape.

Why It Matters

Bond yields and currency movements are early warning indicators of confidence — or lack thereof — in political and monetary leadership. Europe’s repricing episode underscores how quickly sentiment can shift when fiscal discipline, growth prospects, and governance credibility come into question.

Why It Matters to Foreign Currency Holders

Currency volatility tied to political risk reinforces the importance of diversification and capital mobility. As markets re-evaluate sovereign risk across developed economies, confidence in traditional reserve currencies faces growing tests, accelerating interest in alternative stores of value and settlement systems.

Implications for the Global Reset

Pillar 1 – Sovereign Risk Reassessment

Rising yield sensitivity shows markets are less willing to blindly absorb debt from advanced economies without political clarity.

Pillar 2 – Fragmenting Monetary Confidence

Divergent policy paths and political instability weaken uniform trust in the post-crisis monetary order, fueling the transition toward a more multipolar financial system.

This is not just volatility — it’s the price discovery phase of a changing global order.

Sources

~~~~~~~~~~

India Diversifies Energy Mix: 2M Barrels of Venezuelan Oil Ordered as BRICS Energy Ties Evolve

New energy sourcing moves mark a shift in India’s oil procurement strategy amid broader geopolitical and trade realignments

Overview

India has secured 2 million barrels of Venezuelan crude oil for delivery in the second half of April 2026, as state refiners pursue diversified energy supplies and reduce reliance on traditional sources. The purchases, part of a broader trend of global oil market realignment, come as India balances strategic ties with multiple partners while navigating shifting trade and energy landscapes. The deal underscores India’s evolving energy strategy and its implications for global oil trade patterns.

Key Developments

State refiners Indian Oil Corporation and Hindustan Petroleum (HPCL) jointly bought the 2 million barrels of Venezuelan Merey crude from trading firm Trafigura, scheduled for delivery in April 2026.

This move comes amid efforts to diversify crude imports away from heavier reliance on Russian supplies and toward broader global sources.

Traders noted the oil is being sold under U.S.-issued licenses, after Washington eased restrictions on Venezuelan exports following political changes in Caracas.

Indian refiners are equipped to process heavy Venezuelan crude due to upgraded facilities, reinforcing India’s flexibility in energy sourcing.

Why It Matters

Securing Venezuelan crude reflects India’s strategic intent to diversify energy sources as part of a flexible foreign and economic policy. This helps insulate India from supply shocks, reduces over-dependence on any single supplier, and strengthens energy security at a time of heightened geopolitical competition and shifting global alliances.

Why It Matters to Foreign Currency Holders

Oil import diversification influences foreign exchange reserves, trade balances, and currency demand. Importing Venezuelan crude — especially priced competitively — affects the dynamics of energy payments, potentially altering India’s balance of imports and impacting demand for various reserve currencies.

Reserve diversification weakens single-currency dominance by spreading demand across a broader set of trading partners and payment arrangements.

Implications for the Global Reset

Pillar 1 – Energy Market Realignment:

India’s expanding crude sourcing strategy accelerates diversification trends in global oil trade, challenging established supplier relationships and reducing overreliance on a limited set of producers.

Pillar 2 – Multipolar Economic Strategy:

This shift highlights how emerging economies assert commercial autonomy within geopolitical constraints, balancing relations with Western powers, BRICS partners, and major producers to optimize national interests in a multipolar framework.

India’s energy diversification is not merely commercial — it reflects deeper shifts in how global oil markets and geopolitical alignments are being reconfigured.

Energy flows shift as geopolitics redraws the oil trade map.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Indian Oil, HPCL buy 2 million barrels of Venezuelan oil from Trafigura”

Watcher Guru --- "BRICS Shift: India Orders 2 Million Barrels of Venezuelan Oil"

~~~~~~~~~~

Fitch Warns Poland’s Debt Trajectory Threatens Credit Standing

Rising deficits expose cracks in EU fiscal discipline ahead of elections

Overview

Fitch Ratings has warned that Poland risks a credit rating downgrade unless its government stabilizes rising debt levels, marking a rare turning point for a country whose credit profile has steadily improved since the mid-1990s. With elections scheduled for late-2027, mounting defense spending and social costs are putting sustained pressure on public finances.

Key Developments

Fitch revised Poland’s A- rating outlook from “stable” to “negative,” citing expanding deficits and higher borrowing needs.

Poland’s fiscal deficit is expected to reach around 7% of GDP in 2025, potentially the highest level in the European Union.

Debt levels are not expected to stabilize in the near term, a first since Poland began receiving sovereign credit ratings.

Political fragmentation could complicate efforts to rein in spending and adhere to fiscal consolidation plans.

Fitch signaled the outlook could remain negative for one to two years, with the next formal rating decision due on February 27.

Why It Matters

Sovereign credit ratings are foundational to borrowing costs, investor confidence, and currency stability. Fitch’s warning highlights growing stress fractures within EU fiscal frameworks, as higher defense and social spending collide with slower growth and political constraints.

Why It Matters to Foreign Currency Holders

A potential downgrade would increase borrowing costs and weaken confidence in Polish assets, reinforcing currency volatility risk across emerging Europe. Persistent deficits within EU members challenge assumptions of fiscal uniformity and increase incentives for diversification away from euro-centric exposure.

Implications for the Global Reset

Pillar 1 – Sovereign Debt Sustainability

Poland’s situation underscores how even well-rated economies are vulnerable as debt dynamics deteriorate under geopolitical and social pressures.

Pillar 2 – Credibility of Western Fiscal Governance

Rising deficits and political constraints weaken trust in traditional debt models, accelerating reassessment of sovereign risk across advanced and emerging markets alike.

This is not a local warning — it’s a reminder that debt discipline is becoming the new global fault line.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Fitch says Poland risks rating downgrade without debt stabilisation”

Modern Diplomacy — “Fitch Says Poland Risks Rating Downgrade Without Debt Stabilization”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Tuesday Morning 2-10-26

Good Morning Dinar Recaps,

Barclays Profits Surge as European Banks Reassert Financial Strength

Rising earnings and capital returns signal renewed confidence in Western banking power

Good Morning Dinar Recaps,

Barclays Profits Surge as European Banks Reassert Financial Strength

Rising earnings and capital returns signal renewed confidence in Western banking power

Overview

Barclays has reported a sharp increase in profits alongside expanded capital returns, including higher dividends and share buybacks. The results highlight renewed strength in Europe’s banking sector, reinforcing perceptions of institutional stability at a time when global capital flows are increasingly contested between Western systems and emerging financial blocs.

Key Developments

Barclays posted a significant year-over-year profit increase, outperforming market expectations and strengthening its capital position.

The bank announced expanded shareholder returns through dividends and share buybacks, signaling confidence in balance-sheet resilience.

Management reaffirmed medium-term targets, reflecting optimism about earnings durability despite global economic uncertainty.

Executive compensation increases underscored the bank’s confidence in its strategic direction and financial performance.

Why It Matters

Strong earnings and aggressive capital return policies indicate that major European banks are weathering higher rates, tighter regulation, and geopolitical uncertainty more effectively than many expected. This reinforces confidence in the Western banking model at a time when narratives around financial fragility, debt saturation, and systemic reset are accelerating.

Why It Matters to Foreign Currency Holders

Banking strength in Europe supports currency stability, credit availability, and capital inflows, all of which influence FX confidence. As BRICS nations pursue alternative financial architectures, robust Western bank performance slows — but does not stop — momentum toward diversification away from traditional reserve currencies.

Implications for the Global Reset

Pillar 1 – Banking System Resilience

Barclays’ performance suggests that Western banks remain structurally strong, challenging assumptions of imminent systemic breakdown.

Pillar 2 – Capital Competition

Aggressive shareholder returns highlight ongoing competition for global capital as investors weigh Western financial stability against emerging-market transformation narratives.

This is not just a profit story — it’s a signal that the global financial order is reasserting strength even as it adapts under pressure.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Barclays boosts profit and targets as investment bank rebounds”

Reuters — “Barclays boosts CEO’s pay after strong performance”

~~~~~~~~~~

BRICS Rejects Western Control Over Military AI Systems

Emerging global powers push back on centralized AI military norms as sovereignty becomes a flashpoint

Overview

BRICS members are resisting Western efforts to impose centralized rules over how artificial intelligence is developed and deployed in military systems, emphasizing sovereign control and independent regulatory frameworks. Russian Foreign Minister Sergei Lavrov has publicly stated that BRICS nations will not accept external constraints on their military AI programs, asserting that norms governing AI — particularly in defense — must respect national autonomy and security priorities. This stance is shaping discussions ahead of a planned AI summit in India later this year.

Key Developments

Lavrov emphasized that states have the right to determine their own military AI approaches and criticized efforts by some Western countries to centralize control or set restrictive international standards that could limit national capabilities.

Russia and other BRICS nations view AI governance as a diplomatic priority with security implications, noting that frameworks emerging now will shape future military conduct and international behavior.

India, currently BRICS chair, is set to host an AI summit in early 2026 with participation from multiple bloc members, focusing on establishing norms that reflect sovereign development, cooperation, and transparency outside Western-led initiatives.

Broader global negotiations on military AI governance — such as a recent summit in Spain where both the U.S. and China opted out of a joint declaration on AI use in warfare — show how contested and uneven international AI standards remain.

Why It Matters

As artificial intelligence becomes increasingly integrated into defense technologies, the question of regulation is no longer purely technical — it is a geopolitical contest. BRICS resistance to Western-centric control reflects a larger trend of emerging powers seeking multipolar governance models rather than centralized norms dictated by traditional Western alliances.

Why It Matters to Foreign Currency Holders

Emerging disputes on AI governance could extend to broader technological standards and supply chains, influencing investment flows, tech asset valuations, and currency relationships among nations prioritizing autonomous digital infrastructure over Western economic dependencies.

Reserve diversification weakens single-currency dominance as countries hedge technological and financial risk in a competitive AI landscape.

Implications for the Global Reset

Pillar 1 – Technology Sovereignty:

BRICS positioning on military AI underscores a assertive pursuit of independent technological pathways, challenging the West’s role in setting global norms.

Pillar 2 – Multipolar Security Order:

Contested AI governance highlights the evolving divide between Western regulatory frameworks and alternative security paradigms pursued by rising powers — a defining feature of the emerging multipolar world.

Military AI isn’t just code — it’s a battleground for sovereignty and strategic autonomy.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Business Standard — “Russia will actively support BRICS agenda presented by Indian chair Lavrov”

Sputnik India — “Russia Prepares Key Agenda for India AI Impact Summit 2026: Lavrov”

Reuters — “US, China opt out of joint declaration on AI use in military”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 2-10-2026

TNT:

Tishwash: A "rare" meeting of the State Administration Coalition with the participation of Maliki, Sudani and Bafel Talabani

The State Administration Coalition held an expanded meeting today, Sunday (February 8, 2026), in which the head of the State of Law Coalition, Nouri al-Maliki, the Prime Minister, Mohammed Shia al-Sudani, and the head of the Patriotic Union of Kurdistan, Bafel Talabani, participated, to discuss the latest political developments in the country and the course of understandings between the forces participating in the coalition.

According to a Baghdad Today correspondent, the meeting witnessed extensive discussions on outstanding issues between political forces, and mechanisms to enhance coordination between the caretaker government and the coalition forces, in order to ensure the stability of executive and legislative work, and to proceed with issues of priority to the citizen.

TNT:

Tishwash: A "rare" meeting of the State Administration Coalition with the participation of Maliki, Sudani and Bafel Talabani

The State Administration Coalition held an expanded meeting today, Sunday (February 8, 2026), in which the head of the State of Law Coalition, Nouri al-Maliki, the Prime Minister, Mohammed Shia al-Sudani, and the head of the Patriotic Union of Kurdistan, Bafel Talabani, participated, to discuss the latest political developments in the country and the course of understandings between the forces participating in the coalition.

According to a Baghdad Today correspondent, the meeting witnessed extensive discussions on outstanding issues between political forces, and mechanisms to enhance coordination between the caretaker government and the coalition forces, in order to ensure the stability of executive and legislative work, and to proceed with issues of priority to the citizen.

According to our correspondent, the attendees stressed the importance of maintaining the unity of the State Administration Coalition’s position and addressing any problems through internal dialogue, as well as emphasizing the need to support steps in economic and service-related matters and to fortify the internal political situation against regional and international challenges.

The coalition has not held a meeting at this level for several months, making this meeting a rare one in terms of timing and the nature of the attendees, amid frequent talk of differences in visions among its members regarding a number of political and economic issues. link

Tishwash: Sudanese: Economic reforms have government support

Iraqi Prime Minister Mohammed Shia al-Sudani stressed on Monday that moving towards economic reform is a top priority to strengthen the foundations of the national economy, within the framework of government efforts aimed at modernizing the state's financial structure.

During his chairmanship of the Ministerial Council for the Economy meeting, according to a statement from his media office followed by (Shafaqna Iraq), Al-Sudani pointed out that the reform approach is followed enjoys the consensus and support of the national political forces, as it serves the interest of comprehensive development in the foreseeable future.

Maximizing revenues and restructuring the "Collection Directorate"

The meeting, attended by the ministers of foreign affairs, finance, reconstruction, industry, labor, and water resources, as well as the governor of the central bank, witnessed extensive discussions on mechanisms to reduce expenditures and maximize non-oil revenues.

During the meeting, the council approved the administrative structure and ratified the structure of the “Collection Directorate” affiliated with the Ministry of Finance.

Regarding professional competence, Al-Sudani stressed the need to select qualified and honest individuals to work in this directorate, in order to ensure the achievement of the desired financial goals.

Humanitarian and security exceptions in the fuel file

In a move aimed at addressing urgent service and security needs, the Ministerial Council for the Economy approved an exemption for vital entities from the previously adopted decision to reduce fuel subsidies. This exemption includes security agencies, ensuring their continued ability to fulfill their duties in maintaining the country's stability.

It also included immediate ambulance services, to ensure the smooth flow of emergency medical services to citizens without obstacles.

Periodic review of financial impact

The Prime Minister stressed the need to subject every economic measure to review and evaluation.

Al-Sudani stressed the importance of measuring the “financial and economic impact” of decisions before and during their implementation.

He explained that the government is committed to the reform path, which aims to correct the wrong financial paths and provide a sustainable economic environment, in line with the government program that focuses on services and combating financial and administrative corruption. link

************

Tishwash: An economist proposes innovative solutions to regulate trade in Iraq

Economic expert Manar Al-Obaidi warned on Monday that high customs tariffs and chaos in supply chains threaten trade stability and raise prices, stressing that the solution lies in gradual and flexible regulation .

Al-Ubaidi said in a Facebook post, which was followed by Al-Sa’a Network, that “the real problem is imposing a high tariff on basic goods such as electrical appliances, without a local alternative capable of meeting the demand, which directly affects prices and the consumer .”

He added that "the second problem lies in the nature of some commercial sectors, such as clothing and furniture, which lack clear supply chains, as the small trader plays the role of importer, distributor and seller at the same time, and most of these rely on informal financial channels because they are unable to deal with approved banking systems ."

He pointed out that "practical solutions instead of confrontation would be a temporary and well-considered reduction in tariffs on some basic goods that do not have local alternatives, as well as the establishment of an electronic platform dedicated to small traders for organized purchasing, through which financial authorities would settle payments and official fees, especially in the clothing and furniture sectors as a first phase ."

He continued: “One of the solutions is to move to a more mature stage based on: studying each commodity category separately, determining an appropriate tariff for it, along with designing flexible import, financing and transportation mechanisms that facilitate compliance with the system without stifling commercial activity .”

He pointed out that "continuing in chaos is no longer a viable option, and a harsh leap into ill-conceived organization is not a successful solution either ."

He explained that "real reform is a smart, gradual approach that balances protecting the economy, sustaining trade, and not burdening citizens with the cost of administrative shocks link

Tishwash: When - I Ask!!! -- When!!!!

Tishwash: Don't Worry -- Will be OK Soon!!!

The Piece Of Paper Was Never Suppose To Be Money, What Was Backing It Had The Value

The Piece Of Paper Was Never Suppose To Be Money, What Was Backing It Had The Value

X22 Report: 2-9-2026

Excerpts:

Now the deep state and corrupt politicians, The private World Economic Forum- You can see their agenda is very different for Trump’s agenda…..and the people’s agenda.

Their agenda is to bring us into their new system. Trump ‘s agenda is to bring us into a people system. These are two different systems completely.

The deep state players and central bankers will fight to the very end to try to stop what Trump is about to do.

The Piece Of Paper Was Never Suppose To Be Money, What Was Backing It Had The Value

X22 Report: 2-9-2026

Excerpts:

Now the deep state and corrupt politicians, The private World Economic Forum- You can see their agenda is very different for Trump’s agenda…..and the people’s agenda.

Their agenda is to bring us into their new system. Trump ‘s agenda is to bring us into a people system. These are two different systems completely.

The deep state players and central bankers will fight to the very end to try to stop what Trump is about to do.

Trump is preparing the entire country to make this transition into a new system that does not include the Central Bank system.

This is going to be a very big problem for the deep state players because they depend on the Central Bank system. The Central bankers and deep state players are trying to “down “ the system around Trump. They want to implode the system on Trump’s watch.

The problem is that Trump has a new system to rely on if they down the old system. This system rivals the central bank system and the country in reality could operate without the central banks.

Could Trump actually shift everything quickly to the new system and scale down the government right now and keep everything operational? I do believe it’s absolutely possible.

China tells banks to limit exposure to US Treasuries, fake news backs this up.

We are transitioning and the job numbers are in flux. Trump is making sure as we transition people do not lose their wealth.

The pieces of paper are not money, they are claim checks to the real money, the [CB] tricked the people.

The real money is the gold and silver in the vaults.

Trump is going to bring us back to “Sound Money”

Seeds of Wisdom RV and Economics Updates Monday Evening 2-9-26

Good Evening Dinar Recaps,

NatWest’s Transformational Deal Signals Banks Pivot to Fee-Driven Growth

Major UK lender expands wealth arm as traditional interest income faces headwinds

Good Evening Dinar Recaps,

NatWest’s Transformational Deal Signals Banks Pivot to Fee-Driven Growth

Major UK lender expands wealth arm as traditional interest income faces headwinds

Overview

NatWest Group announced a £2.7 billion acquisition of Evelyn Partners, one of Britain’s largest wealth management firms — the bank’s biggest takeover since the 2008 financial crisis. The move significantly strengthens NatWest’s private banking and wealth management footprint, expanding its assets under management from around £56 billion to £127 billion and diversifying income as traditional bank margins face pressure from lower interest rates.

Key Developments

NatWest will merge Evelyn Partners’ £69 billion in client assets with its existing portfolio, creating one of the UK’s largest wealth platforms.

The deal is expected to boost fee income by over 20% and include a £750 million share buyback, signaling confidence in long-term growth.

Funding will come from existing resources, though the transaction may modestly reduce NatWest’s capital ratios.

Analysts note that while the acquisition diversifies revenue streams, the steep valuation could slightly reduce earnings per share through 2028.

Why It Matters

Banks worldwide are grappling with a prolonged low-rate environment that squeezes net interest margins. NatWest’s strategic pivot toward wealth management — a fee-based and less interest-rate-sensitive business — shows how major lenders are reshaping business models to maintain profitability and shareholder value.

Why It Matters to Markets and Financial Stability

Significant bank consolidations and shifts into wealth management can alter capital allocation, risk exposure, and competitive dynamics in the financial sector. As banks diversify away from traditional lending, markets may see changes in credit flows and investor behavior across banking stocks.

Implications for the Global Reset

Pillar 1 – Financial Sector Realignment: NatWest’s move illustrates banking sector adaptation in a low-growth, low-rate world — a structural theme in the evolving global financial system.

Pillar 2 – Asset Allocation Shifts: As banks expand into wealth services, capital flows may shift from credit-based models toward asset management and investment platforms, influencing how savings are mobilized globally.

NatWest’s acquisition is more than a deal — it’s a sign of banking’s new economics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Escalation in Ukraine: Russian Drone and Missile Attacks Kill Civilians, Target Infrastructure

Violence intensifies amid stalled negotiations, underlining the conflict’s sustained economic and security shockwaves

Overview

On February 8, 2026, Russian forces launched a series of drone and missile strikes across Ukraine, resulting in multiple civilian deaths, including women and children, and extensive damage to energy infrastructure. The intensified attacks come amid ongoing, tentative peace discussions and threaten to undermine broader efforts toward de-escalation. This escalation not only exacerbates human suffering but also carries profound implications for European energy security, military spending, and economic confidence worldwide. (reuters.com)

Key Developments

Russian drone and missile strikes hit multiple regions in Ukraine, killing at least four civilians, including a mother and child, according to regional officials.