Seeds of Wisdom RV and Economics Updates Monday Afternoon 10-27-25

Good Afternoon Dinar Recaps,

Markets Poised for Structural Realignment

Trade detente and cooling inflation signal the dawn of a new financial order

Good Afternoon Dinar Recaps,

Markets Poised for Structural Realignment

Trade detente and cooling inflation signal the dawn of a new financial order

Global markets are entering what analysts increasingly describe as a structural turning point. Two developments — a U.S.–China trade thaw and the steady easing of inflation worldwide — are creating the conditions for a major financial realignment.

Together, they suggest that the turbulence of recent years may be giving way to a re-anchored global system built on pragmatic cooperation, diversified reserves, and new capital flows.

The Convergence: Trade + Inflation Reset

Trade optimism returns: Renewed diplomatic and economic talks between Washington and Beijing have reduced tariff fears and revived industrial demand.

Inflation cooling globally: Data from the U.S., Eurozone, and Asia show steady disinflation, giving policymakers room to pivot from restrictive to supportive stances.

Commodities and currencies reprice: Copper, oil, and industrial metals are firming; the yuan and other Asian currencies have strengthened on confidence in regional growth.

Investor behavior shifts: Portfolio flows are turning back toward equities and emerging markets after years of defensive positioning.

Why It Matters

Systemic implications: The simultaneous easing of inflation and trade tension could reset how capital moves across borders, challenging the dollar-centric dominance that defined the post-2008 era.

Corporate recalibration: Firms are beginning to rebuild global supply networks, reducing fragility and diversifying manufacturing bases — a structural change, not a short-term reaction.

Policy coordination: For the first time in years, major economies may find common ground between fiscal expansion and monetary flexibility.

In essence:

“This is not just politics — it’s global finance restructuring before our eyes.”

Emerging Signals of a New Order

Resurgent BRICS trade corridors gaining institutional depth through gold- and commodity-based settlements.

G7 central banks signaling gradual rate normalization while exploring multi-currency liquidity lines.

Digital asset integration accelerating as cross-border payment infrastructure modernizes.

These shifts suggest the world may be edging toward a blended system — one where legacy Western financial institutions coexist with new frameworks emerging from Asia and the Global South.

The Strategic Outlook

The months ahead will test whether optimism translates into sustained global rebalancing.

If trade détente endures and inflation stabilizes, the world could move toward a more multipolar but integrated financial landscape — one less dependent on unilateral policy, and more driven by pragmatic collaboration.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times – Global stocks rally on US-China trade optimism

Reuters – Stocks rally, safe-havens retreat on trade deal optimism

The Australian – Markets to finish 2025 strongly amid US-China trade breakthrough, inflation beat

Bloomberg Economics – Inflation trajectory and central-bank signaling

~~~~~~~~~

Riyadh Hosts Global Alliance for Palestinian Two-State Solution

Middle East diplomacy regains momentum as Saudi Arabia steps into a leadership role

Riyadh this week hosted a Global Alliance coordination summit aimed at reviving the long-stalled Palestinian–Israeli two-state framework. Co-chaired by Saudi Arabia, Norway, and the European Union, the meeting brought together over 40 diplomatic envoys to discuss humanitarian support, reconstruction, and governance planning for a potential future Palestinian state.

Diplomatic Turning Point

Regional leadership shift: Saudi Arabia is asserting itself as a primary diplomatic hub, reshaping the balance once dominated by Western mediators.

Institutional framework: The alliance proposes a standing secretariat to manage aid, infrastructure, and economic development within Palestinian territories.

Peace through economics: Economic stabilization is seen as a prerequisite for security — a model already tested through the Abraham Accords and Gulf diversification strategies.

Why It Matters

Restructuring of alliances: The Riyadh meeting signals a multipolar approach to Middle East peace, blending Western, Arab, and European participation under a shared umbrella.

Financial architecture in motion: A two-state economic plan would require new financing channels — likely through BRICS-linked development banks or Gulf sovereign funds — bypassing older IMF/World Bank structures.

Strategic Implications

If the alliance holds, the economic underpinning of peace could integrate the Middle East into a broader Eurasian trade corridor — connecting Gulf capital, Asian infrastructure, and European technology.

This could realign financial flows toward energy-neutral development, a key element of the emerging post-dollar financial reset.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Monday 10-27-2025

TNT:

Tishwash: Expert: Iraqi banks are required to keep pace with cross-border payments

A banking expert confirmed that the recent development in international payment systems using the digital renminbi represents a strategic turning point in global trade, and opens new horizons for import, export and foreign loan settlements.

Expert Faiq Al-Obaidi told (Al-Zaman) yesterday that (this development requires Iraqi banking administrations to quickly keep pace with the new system and provide intensive training on its working mechanisms, to ensure the banks' ability to deal efficiently with cross-border digital payments

TNT:

Tishwash: Expert: Iraqi banks are required to keep pace with cross-border payments

A banking expert confirmed that the recent development in international payment systems using the digital renminbi represents a strategic turning point in global trade, and opens new horizons for import, export and foreign loan settlements.

Expert Faiq Al-Obaidi told (Al-Zaman) yesterday that (this development requires Iraqi banking administrations to quickly keep pace with the new system and provide intensive training on its working mechanisms, to ensure the banks' ability to deal efficiently with cross-border digital payments

Al-Obaidi explained that (the monetary authority is required to issue clear instructions and controls, and grant approvals to banks participating in the new system, especially since most Iraqi banks have taken the initiative to open accounts in Chinese currency Which prepares the financial infrastructure to benefit from this digital revolution).

The People's Bank of China announced that the digital renminbi (Chinese yuan) cross-border settlement system will be fully linked with the ten member states of the Association of Southeast Asian Nations and six countries in the Middle East.Observers believed yesterday that (38 percent of the volume of global trade will exceed the SWIFT system, which is dominated by the United States, and the system will enter directly into what they described as the digital renminbi moment).

For its part, The Economist magazine said yesterday that (this step constitutes a battle for the front bulwark of the Bretton Woods 2.0 system), adding that (blockchain-based technology is rewriting the basic code of the global economy, while increasing settlement speed and reducing costs in an unprecedented way), and explained that (the traditional SWIFT system suffers from a delay of 3 to 5 days in cross-border payments, While the Chinese digital bridge reduced the settlement time to only 7 seconds).

In the first test between Hong Kong and Abu Dhabi, a company paid a supplier in the Middle East using the digital renminbi, and the money did not pass through six intermediary banks, but was received directly through a distributed ledger, reducing processing fees by 98 percent.

In a two-country, two-park project between China and Indonesia, an industrial bank used digital renminbi to complete the first cross-border payment, and the process took just 8 seconds from order confirmation to funds arriving, 100 times faster than traditional methods.

This technical superiority prompted 23 central banks around the world to join the digital bridge test, with energy traders in the Middle East reducing settlement costs by 75 percent.

Experts confirmed yesterday that (this technical superiority made the traditional settlement system dominated by the dollar appear immediately backward, and that the technology not only allows immediate tracking, but also automatically applies anti-money laundering rules), and they pointed out that (China is gradually building its financial sovereignty), and they added (when the United States tried to impose sanctions on Iran through the SWIFT system, China had already established a closed loop of renminbi payments in Southeast Asia.

The volume of cross-border settlement in renminbi in ASEAN countries amounted to more than 5.8 trillion yuan in 2024, an increase of 120 percent compared to 2021, while ix countries, including Malaysia and Singapore, included the renminbi in their foreign currency reserves, and Thailand completed its first oil deal using the digital renminbi.

According to the circulated data, (the wave of eliminating the dominance of the dollar prompted the Bank for International Settlements to say that China is redefining the rules of the game in the era of digital currencies), and the data pointed out that (the digital renminbi is not just a payment tool, but rather carries the Chinese Belt and Road strategy), stressing that (in projects such as the China-Laos Railway and the Jakarta-Bandung Railway, the digital renminbi has been integrated with the navigation system),

Emphasizing that (European car companies use the digital renminbi to settle shipping via the polar route, while China increases trade efficiency by 400 percent), and pointing out that (this strategy makes the dominance of the US dollar systematically threatened for the first time), the data stressed that (87 percent of the world's countries have completed adapting their systems to the digital renminbi, and the volume of cross-border payments has exceeded 1.$2 trillion, and China has built a digital payments network covering 200 countries, concluding that this silent financial revolution is not just monetary sovereignty, but determines who controls the lifeblood of the global economy in the future. link

************

Tishwash: Al-Sudani issues directives to financial and banking institutions

Prime Minister Mohammed Shia al-Sudani directed, on Sunday (October 26, 2025), government and private financial and banking institutions to enhance cooperation with Arab and foreign investors, in a manner that serves Iraq's interests and supports the building of a strong, diversified, and sustainable economy.

Al-Sudani's media office stated in a statement received by "Baghdad Today" that "this came during his attendance at the opening ceremony of the Arab Bank –Iraq, in which Iraqi, Arab and foreign capital contributes," stressing that "the opening of this bank represents an embodiment of investors' confidence in the Iraqi economy and the attractive business environment that has been established during the past period." Pointing out that the bank's presence represents a strategic addition to the national banking sector and a model for modern financial institutions capable of providing advanced services and financing sustainable development projects.

The Prime Minister explained that "the success of this project requires cooperation between Arab Bank–Iraq, national banks, government agencies, and the private sector, in order to employ financial capabilities and banking expertise to support the government's development programs and projects."

He stressed that "the government is continuing to reform the financial and banking system and transform from a single rentier economy to a diversified and sustainable economy that depends on investing in natural resources".

He explained that "these reforms were implemented despite their great social and political costs, and contributed to raising the level of reliability with international financial institutions and creating a safe and attractive financial environment for investment."

He added, "Iraq is witnessing a phase of real development and broad investment opportunities in various sectors, stressing the need for modern digital banking services that meet the needs of individuals and institutions and keep pace with global development in banking".

Al-Sudani concluded by stressing that integration between Iraqi financial institutions and Arab and foreign investors represents a fundamental step towards enhancing economic growth and consolidating financial stability in the country. link

************

Tishwah: Rafidain Bank: Partnership with the Central Bank and the Payments Council is a Successful Model for Managing Financial Transformation

Rafidain Bank announced on Sunday that its partnership with the Central Bank and the Payments Council represents a successful model for managing financial transformation, while indicating its commitment to moving towards an integrated digital financial system.

The bank stated in a statement received by Al-Rabia News Agency: "The bank's Director General, Ali Karim Hussein Al-Fatlawi, participated in the regular meeting of the Iraqi National Payments Council, which was held at the headquarters of the Central Bank of Iraq, headed by the Governor of the Central Bank, Ali Mohsen Al-Allaq, and attended by representatives of ministries, government institutions, and the financial and banking sectors."

According to the statement, Al-Fatlawi said, "The bank is proceeding with confident strides in its strategic partnership with the Central Bank and the National Payments Council to develop the digital payments infrastructure and consolidate the transition towards a national economy based on financial inclusion and technological innovation."

He emphasized that "the bank is working to strengthen its role as a key driver of the digital transformation of the Iraqi banking sector by investing in modern financial technologies and expanding the electronic payment services network, in line with the national vision led by the Central Bank and the Payments Council to build a more efficient and transparent financial system."

He explained that "the bank attaches great importance to developing the technological infrastructure of its banking systems, enhancing cybersecurity and data protection, and spreading the culture of financial awareness among citizens, especially youth and students, as they are the targeted generation for the transition to digital banking services."

He pointed out that "the close partnership between the Central Bank, the Payments Council, and Rafidain Bank represents a successful model of institutional integration in managing financial and digital transformation in Iraq," stressing that "the bank will continue to play its leading role in empowering the national banking sector and expanding the base of financial inclusion, thus enhancing economic stability and serving sustainable development." link

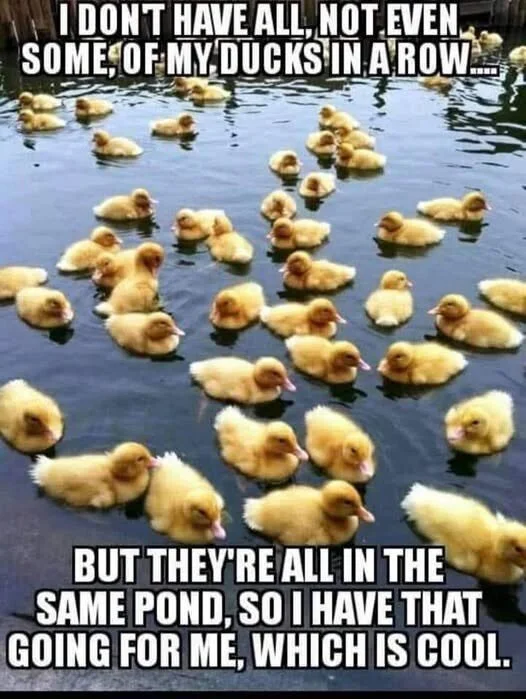

Mot: Things That Make Ya Go -- Hmmmmmmm!!!

Mot: Getting Closer I Is!!!!

Seeds of Wisdom RV and Economics Updates Monday Morning 10-27-25

Good Morning Dinar Recaps,

Global Equities Surge on U.S.–China Trade Optimism

Markets rally worldwide as investors sense a thaw in global tensions

Global markets opened the week with strong momentum as optimism grew over renewed trade cooperation between the United States and China. Hints of a potential trade framework — coupled with encouraging inflation data — have pushed investors back into equities and risk assets.

Good Morning Dinar Recaps,

Global Equities Surge on U.S.–China Trade Optimism

Markets rally worldwide as investors sense a thaw in global tensions

Global markets opened the week with strong momentum as optimism grew over renewed trade cooperation between the United States and China. Hints of a potential trade framework — coupled with encouraging inflation data — have pushed investors back into equities and risk assets.

Key Market Movements

Asia leads the charge: Japan’s Nikkei 225 surged over 2.5%, and South Korea’s KOSPI rose nearly 3%, buoyed by tech-sector strength.

European indexes followed suit, with the FTSE 100 and DAX climbing as investors rotated out of defensive positions.

Gold and bonds declined, signaling a return of risk appetite.

Currencies shifted: the Chinese yuan strengthened, while the U.S. dollar was mixed across major pairs.

Commodities such as copper rose on expectations of increased industrial demand.

Why It Matters

Trade thaw = global growth pulse: Reducing U.S.–China trade risk restores confidence in supply chains, manufacturing, and corporate investment.

Capital flow rotation: Investors are moving from safe havens into growth assets — a structural signal of shifting global sentiment.

Global Financial Reset connection: The emerging trade détente is more than diplomacy — it’s part of a restructuring of the global financial architecture:

“This is not just politics — it’s global finance restructuring before our eyes.”

The Bigger Picture

If sustained, trade normalization could help rebuild global capital flows, re-anchor commodity pricing, and boost confidence in emerging markets. But the rally’s durability hinges on whether promises translate into formal agreements and continued inflation moderation.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times – Global stocks rally on US-China trade optimism

Reuters – Stocks rally, safe-havens retreat on trade deal optimism

Bloomberg Market Wrap – Asia leads risk rally on trade thaw and inflation relief

~~~~~~~~~

Year-End Outlook Brightens: Inflation Eases, Trade Progress Lifts Confidence

Analysts forecast a strong finish to 2025 as twin headwinds subside

After months of uncertainty, two major drivers — softening inflation and trade détente — are reshaping the global outlook. Market sentiment has shifted decisively toward optimism as investors anticipate policy easing and stronger earnings growth heading into year-end.

Key Indicators Supporting the Rally

Inflation cools: U.S. CPI and European inflation prints both came in below forecasts, reinforcing expectations of central bank rate cuts.

Trade relief: U.S.–China negotiations appear to be advancing, calming fears of tariff escalation and supply bottlenecks.

Corporate outlook improves: Multinationals are revising forward guidance upward as input costs decline.

Emerging-market capital inflows are accelerating, reflecting renewed confidence in cross-border growth.

Why It Matters

Policy flexibility returns: Lower inflation gives central banks space to pivot toward growth-supportive stances.

Stronger global linkages: Fewer trade barriers encourage capital mobility and resource reallocation — a hallmark of systemic realignment.

RESET connection: Together, inflation moderation and trade cooperation mark a shift in the monetary order, supporting your consistent theme:

“This is not just politics — it’s global finance restructuring before our eyes.”

Risks to Watch

Persistent services inflation could stall policy easing.

Trade deals may face political delays or reversals ahead of election cycles.

Market optimism may be overextended if corporate earnings fail to justify valuations.

Strategic View

The alignment of easing inflation and improved trade conditions suggests a foundation for a more balanced, multipolar financial system. For investors, it signals a likely shift from defensive strategies toward innovation, infrastructure, and resource assets that benefit from global reintegration.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

The Australian – Markets to finish 2025 strongly amid US-China trade breakthrough, inflation beat

Reuters – Global markets wrap: Inflation easing boosts risk sentiment

Bloomberg Economics – Inflation trajectory and central-bank signaling

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Morning 10-27-25

The Prime Minister Directs Financial And Banking Institutions To Cooperate With Arab And Foreign Investors.

Yesterday, 22:48 Baghdad – INA Prime Minister Mohammed Shia al-Sudani directed financial and banking institutions, on Sunday, to cooperate with Arab and foreign investors to serve Iraq and support the economy.

The Prime Minister's media office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani attended the opening of the Arab Bank-Iraq, which is contributed by Iraqi, Arab and foreign capital."

The Prime Minister Directs Financial And Banking Institutions To Cooperate With Arab And Foreign Investors.

Yesterday, 22:48 Baghdad – INA Prime Minister Mohammed Shia al-Sudani directed financial and banking institutions, on Sunday, to cooperate with Arab and foreign investors to serve Iraq and support the economy.

The Prime Minister's media office stated in a statement received by the Iraqi News Agency (INA), that "Prime Minister Mohammed Shia al-Sudani attended the opening of the Arab Bank-Iraq, which is contributed by Iraqi, Arab and foreign capital."

Al-Sudani stressed, according to the statement, that "the opening of this bank, with the contribution of an elite group of Arab and foreign investors, both individuals and institutions, represents a clear affirmation of confidence in the Iraqi economy, the work accomplished during the past period, and the business environment that is attractive to investment."

He explained that "the presence of the Arab Bank of Iraq represents a strategic addition to the national banking sector, and is a model for the modern, effective banking institutions we aspire to, capable of providing advanced services that contribute to financing sustainable development."

He emphasized the "need to stimulate the financing of diverse investment projects and opportunities, in light of the presence of a bold and capable Iraqi private sector that understands the intricacies of the investment environment."

Al-Sudani pointed out that "it is important for there to be cooperation between the Arab Bank-Iraq, national banking institutions, government agencies, the private sector, and Arab and foreign investors, in order to utilize existing financial capabilities and banking expertise to support government programs and development projects." https://ina.iq/ar/economie/246554-.html

Rafidain: Partnership With The Central Bank And The Payments Council Is A Successful Model For Managing Financial Transformation.

Yesterday, 20:35 Baghdad – INA Rafidain Bank announced on Sunday that its partnership with the Central Bank and the Payments Council is a successful model for managing financial transformation, while indicating a move toward an integrated digital financial system.

The bank said in a statement received by the Iraqi News Agency (INA), "The bank's general manager, Ali Karim Hussein Al-Fatlawi, participated in the regular meeting of the Iraqi National Payments Council, which was held at the headquarters of the Central Bank of Iraq, headed by the Central Bank Governor, Ali Mohsen Al-Allaq, and attended by representatives of ministries, government institutions, and the financial and banking sectors."

Al-Fatlawi said, according to the statement, that "the bank is proceeding with confidence in its strategic partnership with the Central Bank and the National Payments Council to develop the digital payments infrastructure and consolidate the transition to a national economy based on financial inclusion and technological innovation.

" He stressed that "the bank is working to strengthen its role as a key driver of the digital transformation of the Iraqi banking sector by investing in modern financial technologies and expanding the electronic payment services network, in line with the national vision led by the Central Bank and the Payments Council to build a more efficient and transparent financial system.

" He explained that "the bank attaches great importance to developing the technological infrastructure of its banking systems, enhancing cybersecurity and data protection, and spreading the culture of financial awareness among citizens, especially youth and students, as they are the targeted generation in the transition to digital banking services."

He pointed out that "the close partnership between the Central Bank, the Payments Council, and Rafidain Bank represents a successful model of institutional integration in managing financial and digital transformation in Iraq," stressing that "the bank will continue to play its leading role in empowering the national banking sector and expanding the base of financial inclusion, enhancing economic stability and serving sustainable development." https://ina.iq/ar/economie/246545-.html

The Governor Of The Central Bank Of Iraq Meets With The Director Of GIZ In Iraq

October 26, 2025 His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, received in Baghdad the Country Executive Director of the German Agency for International Cooperation (GIZ) in Iraq, Mr. Axel Klaphak.

The meeting discussed the agency's projects in the fields of finance, entrepreneurship, skills development, and financial infrastructure.

His Excellency the Governor began by discussing the "Strengthening Public Finance and Financial Markets (FFM)" projects.

Project Manager Tobias Langa and FFM Project Advisor Hussein Al-Maamouri provided a comprehensive explanation of

how to increase financing and borrowing for small and medium-sized entrepreneurial projects and facilitate procedures.

Executive Director Mr. Kalbhaka expressed his deep gratitude to His Excellency the Governor of the Central Bank

for his essential and effective role in supporting small and medium-sized enterprises in Iraq by providing financing and facilitating procedures. Central Bank of Iraq Media Office https://cbi.iq/news/view/3027

The Governor Of The Central Bank Receives The CEO Of Al Baraka Bank Bahrain.

October 26, 2025 His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, received in Baghdad the General Manager and CEO of Al Baraka Bank Bahrain, Dr. Adel Salem, and his accompanying delegation.

His Excellency discussed the recent reforms in the Iraqi banking sector and their impact on enhancing confidence in the banking environment and financial transactions.

Mr. Salem discussed opportunities for expansion in the Iraqi market and ways to enhance joint banking cooperation with Gulf banks, with the possibility of opening doors to cooperation with the bank through training and qualification for Iraqi bank employees to gain successful experiences between the two parties. Central Bank of Iraq Media Office https://cbi.iq/news/view/3028

The Governor Of The Central Bank Of Iraq Chairs The Regular Meeting Of The Iraqi National Payments Council.

October 26, 2025 His Excellency the Governor of the Central Bank of Iraq and Chairman of the Iraqi Payments Council, Mr. Ali Mohsen Al-Alaq, chaired the regular meeting of the Iraqi National Payments Council.

The meeting was held at the headquarters of the Central Bank of Iraq and attended by council members, including central bank officials, representatives of ministries and government agencies, and the private sector, in addition to representatives of financial and banking institutions, such as public and private banks and electronic payment service providers.

During the meeting, several important topics were discussed, most notably the Central Bank of Iraq's initiatives to develop the technical, legislative, and regulatory infrastructure for payment systems and financial technologies.

Discussions focused on ways to expand the adoption of electronic payment tools and channels in ministries, government institutions, and the private sector, in line with the government's strategic vision in this regard.

Council members emphasized the importance of supporting efforts aimed at spreading financial and banking awareness and culture among all segments of society, as well as the importance of protecting society from cyber risks and raising awareness of the dangers of financial and digital fraud.

The Chairman and members of the Council discussed the level of development of the digital infrastructure and financial services provided by government banks, as they are among the fundamental pillars of digital transformation and the development of financial services.

The recommendations focused on expanding the use of payment and financial technology in the education sectors, ways to support students and youth, and supporting financial and banking awareness initiatives directed at them.

It is noteworthy that the Iraqi Payments Council aims to coordinate efforts and achieve cooperation in the areas of national payments and electronic payments between legislative and regulatory authorities, executive institutions in the public and private sectors, and financial and banking sector institutions. Central Bank of Iraq Media Office https://cbi.iq/news/view/3026

Al-Sudani Issues Directives To Financial And Banking Institutions.

Baghdad Today - Baghdad Prime Minister Mohammed Shia al-Sudani directed, on Sunday (October 26, 2025), governmental and private financial and banking institutions to enhance cooperation with Arab and foreign investors, in a way that serves the interests of Iraq and supports the building of a strong, diversified, and sustainable economy.

Al-Sudani's media office stated in a statement received by Baghdad Today that "this came during his attendance at the opening ceremony of the Arab Bank - Iraq, in which Iraqi, Arab and foreign capital contributes," stressing that "the opening of this bank represents an embodiment of investor confidence in the Iraqi economy and the attractive business environment that has been established during the past period, pointing out that the presence of the bank is a strategic addition to the national banking sector and a model for modern financial institutions capable of providing advanced services and financing sustainable development projects."

The Prime Minister explained that "the success of this project requires cooperation between the Arab Bank of Iraq, national banks, government agencies, and the private sector, in order to leverage financial capabilities and banking expertise to support government programs and development projects."

He stressed that "the government is proceeding with reforming the financial and banking system and transforming it from a single-source rentier economy to a diversified and sustainable economy based on natural resource investment.

He explained that "these reforms were implemented despite their significant social and political costs, and contributed to raising the level of credibility with international financial institutions and creating a safe and attractive financial environment for investment.

" He added, "Iraq is witnessing a phase of real development and vast investment opportunities across various sectors, emphasizing the need for modern digital banking services that meet the needs of individuals and institutions and keep pace with global developments in banking."

Al-Sudani concluded by emphasizing that integration between Iraqi financial institutions and Arab and foreign investors represents a fundamental step toward enhancing economic growth and consolidating financial stability in the country. https://baghdadtoday.news/285990-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 10-26-25

Good Afternoon Dinar Recaps,

ASEAN 2025: Malaysia Summit Marks a Turning Point for Global Order

When Southeast Asia convenes, the future of trade, diplomacy and monetary flows is being rewritten.

Good Afternoon Dinar Recaps,

ASEAN 2025: Malaysia Summit Marks a Turning Point for Global Order

When Southeast Asia convenes, the future of trade, diplomacy and monetary flows is being rewritten.

Leaders, Expansion & a Crowded Agenda

The Association of Southeast Asian Nations (ASEAN) summit in Kuala Lumpur from October 26–28, 2025 will bring together heavy-weight global figures: Donald Trump (USA), Li Qiang (China), Sanae Takaichi (Japan), Lee Jae‑myung (South Korea), Luiz Inácio Lula da Silva (Brazil) plus others from South Africa, Canada, Australia and New Zealand.

Notably, Timor‑Leste will officially become the bloc’s 11th full member — the first expansion since the 1990s.

The agenda is packed: economic integration, the Myanmar crisis, South China Sea disputes, U.S.–China rivalry, Gaza’s fallout, and a booming online-scam industry.

Why This Matters

● Regional economic architecture in flux – With membership expansion and global leaders present, ASEAN is evolving from a regional forum into a strategic geopolitical player.

● Trade & settlement pathways shifting – As Asia becomes more central, monetary flows and digital-settlement frameworks will increasingly bypass traditional Western hubs.

● Global financial reset underway – The summit’s scale and diversity of issues reflect a transition toward multipolar financial systems, where power is not rooted solely in the West or the dollar.

● Symbolism becoming structure – Timor-Leste’s accession and the presence of global heads signal that the infrastructure of global finance (trade routes, digital rails, reserve assets) is being reconfigured.

The Bigger Picture: Out with the Old, In with the New

The ASEAN 2025 summit isn’t just a diplomatic gathering — it’s a marker of how global economics and finance are morphing:

Legacy settlement systems built around Western-led currency and payment rails face competition from Asia-driven arrangements and digital alternatives.

The inclusion of new members and agendas beyond “just trade” show that alignment is shifting — politics, finance and technology are converging.

Institutions, treaties, and digital platforms being discussed now will underpin tomorrow’s liquidity networks, reserve architectures and financial flows.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “What to expect from Southeast Asian leaders’ summit as Trump attends”

Reuters – “East Timor officially becomes ASEAN’s 11th member”

The Diplomat – “What to Expect From the Upcoming ASEAN Summit in Malaysia”

~~~~~~~~~

BRICS Payment Surge: Yuan-Rails Rewrite the Monetary Map

How the Cross‑Border Interbank Payment System (CIPS) and yuan-lending boom are reshaping global finance.

The Transformation in Motion

The BRICS bloc and China in particular are quietly building a parallel payment and monetary system:

● China’s CIPS now connects 1,700+ banks in over 100 countries, clearing approximately ¥175 trillion (~US $24 trillion) in 2024 — up ~43 % year-on-year.

● China’s overseas renminbi (RMB) lending, deposits and bond investments have surged to over RMB 3.4 trillion (~US $480 billion) in five years — a clear step in de-dollarising trade and financing.

● The Bank for International Settlements (BIS) and others have flagged this trend as a structural shift in global liquidity rather than a transient event.

Why It Matters

• Redesigning the Reserve Architecture:

• The dominance of the U.S. dollar and Western-led rails (e.g., SWIFT) is being challenged by a system that routes value directly through yuan-cleared networks.

• Liquidity Flows Redefined:

• Institutional, trade and sovereign flows are now beginning to respond to networks centred on the yuan and CIPS — not just the dollar-centric system.

• Toward a Global Financial Reset:

• This is more than currency diversification. It’s the creation of an alternative global monetary plumbing, enabling a multipolar value-transfer architecture beyond legacy systems.

• Analogy:

• Just as the internet replaced postal letters, CIPS + yuan-finance may replace correspondent-bank wires — faster, global, programmable.

Key Implications

● Trade-finance realignment: China is settling increasing volumes in yuan — including LNG imports, soybeans and loans in commodity-rich countries — reducing dollar dependency.

● Banking infrastructure on the move: Major global banks (e.g., HSBC Hong Kong) have joined CIPS, signalling institutional support for this rail.

● Emerging-market leverage: BRICS and partner nations see this rail as a way to sidestep sanctions risk and gain greater financial sovereignty.

● Systemic resilience: A diversified global settlement system weakens single-point dependency on the dollar and creates alternatives when geopolitical pressures intensify.

The Bigger Picture: Out with the Old, In with the New

The contours of a new global financial system are emerging:

A shift from fiat-centric, dollar-settlement pipelines toward multi-currency rails under sovereign and institutional control.

Payment networks built on programmable rails, where value moves as instantly and reliably as data.

While the dollar remains dominant for now, the architecture behind it is changing — and these developments mark the inflection point of the global reset.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Grows as 1,700 Banks Process 175 Trillion Chinese Yuan Payments”

FT.com – “Overseas renminbi lending surges as China steps up campaign to de-dollarise”

Reuters – “China central bank urges state-owned businesses to prioritise yuan in overseas expansion”

Reuters – “China talks up digital yuan in push for multi-polar currency system”

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Sunday 10-26-2025

TNT:

Tishwash: US envoy: Iraq is improving day by day and there are no limits to its capabilities

US President Mark Savaya's envoy sent a message to Iraq.

"I want to make Iraq great again," Savaya told the Chaldean Press.

He pointed out that he would like to "achieve peace and stability in the country by building strong bridges with the United States", explaining that "Iraq is improving day by day, without limits to its capabilities"

TNT:

Tishwash: US envoy: Iraq is improving day by day and there are no limits to its capabilities

US President Mark Savaya's envoy sent a message to Iraq.

"I want to make Iraq great again," Savaya told the Chaldean Press.

He pointed out that he would like to "achieve peace and stability in the country by building strong bridges with the United States", explaining that "Iraq is improving day by day, without limits to its capabilities". link

Tishwash: Masrour Barzani: Article 140 of the Constitution must be implemented as it is after the elections

#Article 140

The Prime Minister of the Kurdistan Regional Government, Masrour Barzani, confirmed that the Kurdistan Democratic Party is preparing to implement several goals following the parliamentary elections scheduled in Iraq, noting work to implement Article 140 of the Constitution.

Masrour Barzani said in a speech during his participation in an election carnival dedicated by the Kurdistan Democratic Party to candidates from the Kirkuk and Garmian regions, today, Saturday, October 25, 2025, that "Article 140 of the Constitution must be implemented as it is, and the constitutional provisions and articles must be applied as they are," adding: "We will no longer accept injustice." This time we will go to Baghdad to fight for our constitutional rights.

Masrour Barzani stated that "Kirkuk is the heart of Kurdistan", and "we are ready to sacrifice our blood and souls to return them to the embrace of Kurdistan", noting that "the people of Kirkuk must know that the one who sacrificed himself for Kirkuk throughout history is the Kurdistan Democratic Party".

The Prime Minister of the Kurdistan Regional Government and Vice President of the Kurdistan Democratic Party continued, "The injustice practiced against the Kurdistan Region is also practiced against Kirkuk, because Kirkuk is part of Kurdistan", stressing: "Kirkuk must return, and Khanaqin must return, as well as Makhmouz Zammar and Sinjar" to the embrace of Kurdistan.

Masrour Barzani recalled the statement of the President of the Kurdistan Region, Nechirvan Barzani, that "the party will win a million votes in these elections", saying: "We are able to obtain a million votes, and we are able to regain Kirkuk and win as the largest political party in Iraq".

The Prime Minister of the Kurdistan Regional Government touched on the situation in Kirkuk, and the level of services and life there, stressing that "if Kirkuk is run by the Parti, it will become a model of peaceful coexistence on the global level", and "whoever is loyal to Kirkuk must be characterized by actions and not just carrying slogans." He called on the people of the governorate to go to the polls and vote for his party, which bears the symbol 275, in the upcoming elections.

Masrour Barzani stressed that Iraq's stability and development are reflected in Kurdistan, saying: "If security and stability are available in Iraq and its people are able to live in prosperity, Kurdistan will certainly achieve greater progress," stressing that "we will not allow Iraq to return to centralization and dictatorship," and "we must head to Baghdad to stand up to the plans being hatched against the Kurdistan Region." link

************

Tishwash: Iran Declares Major Private Bank Bankrupt Amid Deepening Financial Strain

The collapse of Ayandeh Bank exposes deep cracks in Iran’s financial system, with experts warning more failures could follow amid sanctions and weak oversight.

Iran has declared on Saturday one of its largest private banks, Ayandeh Bank, bankrupt, with its assets absorbed by the state-owned Melli Bank, marking one of the most dramatic collapses in the country’s modern banking history.

The move comes as Tehran grapples with renewed international sanctions and mounting economic instability.

Founded in 2012, Ayandeh Bank once operated 270 branches nationwide—150 of them in Tehran—but had recently been crippled by mounting debt.

According to Iran’s ISNA news agency, the bank’s accumulated losses had reached the equivalent of $5.2 billion, with debts of roughly $2.9 billion.

On Saturday, long lines of anxious depositors formed outside the bank’s shuttered branches in Tehran, with police deployed to maintain order.

State television quoted Melli Bank director Abolfazl Najarzadeh confirming that “the transfer from Ayandeh Bank to Melli Bank is now complete,” assuring customers their deposits would be protected.

Iranian Economy Minister Ali Madanizadeh attempted to calm public fears on Thursday, saying customers “had nothing to worry about.” However, Central Bank officials blamed “bad debts” and risky self-financing projects for the collapse.

Central Bank representative Hamidreza Ghaniabadi told the IRNA news agency that over 90 percent of Ayandeh Bank’s funds were lent to affiliated entities or bank-managed projects that failed to generate returns.

Among its most extravagant ventures was the Iran Mall—one of the world’s largest shopping centers—complete with cinemas, luxury stores, and an ice rink.

The failure of Ayandeh Bank underscores the fragility of Iran’s financial system, heavily burdened by mismanagement, corruption, and years of sanctions that have isolated the country from international markets.

Several other private and semi-state banks—including Sarmayeh, Day, Sepah, Iran Zamin, and Melal—are reportedly facing severe liquidity challenges.

The crisis unfolds against the backdrop of renewed United Nations sanctions, reimposed in September after months of fruitless diplomacy aimed at reviving the 2015 nuclear agreement.

Those sanctions—referred to as a “snapback” mechanism—were reinstated following Israeli and U.S. strikes on Iranian nuclear sites in June, further tightening the economic noose around Tehran.

Economists say the banking sector’s instability reflects broader structural weaknesses in Iran’s economy, where inflation exceeds 40 percent and the national currency continues to plummet against the US dollar.

Observers from the industry warn that more bank failures could follow unless authorities enforce stricter financial oversight and attract foreign investment—both unlikely amid current geopolitical tensions. link

Tishwash: Sum Times I Can't Help Meself - I –

Tishwash: . Ripley!!! -- ooooooh Ripley!! -- ""Bath Time""

Seeds of Wisdom RV and Economics Updates Sunday Morning 10-26-25

Good Morning Dinar Recaps,

Ripple Prime: The Quiet Revolution in Global Finance -- The Digital Wall Street Is Here

How Ripple’s strategic acquisition is reshaping cross-border settlements and unlocking digital liquidity.

Good Morning Dinar Recaps,

Ripple Prime: The Quiet Revolution in Global Finance -- The Digital Wall Street Is Here

How Ripple’s strategic acquisition is reshaping cross-border settlements and unlocking digital liquidity.

The Strategic Move

● Ripple Labs, the blockchain giant behind XRP, has officially launched Ripple Prime—a professional-grade liquidity and settlement platform designed for institutional clients. The development follows Ripple’s acquisition of Hidden Road Partners, a global brokerage and prime services firm specializing in digital assets.

● According to reports from Reuters, Coindesk, and The Block, the move gives Ripple direct access to deep institutional liquidity pools, bridging traditional finance and blockchain markets under a single unified settlement rail.

● Garlinghouse’s vision: Ripple CEO Brad Garlinghouse emphasized that Ripple Prime will “unlock enterprise-grade liquidity for tokenized assets and payments”, positioning the firm as a cornerstone of future global finance infrastructure.

Why It Matters

● Institutional On-Ramp to Blockchain Finance

Ripple Prime’s integration with Hidden Road opens the door for major financial institutions to access on-demand liquidity (ODL) directly, without relying on legacy correspondent banking systems.

🌱 This transition signals the gradual migration of settlement infrastructure from centralized banks to blockchain networks.

● Accelerating Tokenized Asset Settlement

The partnership enables near-instant cross-border settlements in any fiat or crypto pair, dramatically reducing the friction and cost of moving value globally.

🌱 This is a critical pillar of the financial reset — instant, trustless settlement across asset classes.

● Bridging Old and New Systems

Ripple’s network now sits at the intersection of central bank digital currency (CBDC) infrastructure and private liquidity platforms.

🌱 Such hybrid models are essential for building a multi-polar financial order that no longer depends solely on the U.S. dollar.

The Bigger Picture: A New Financial Architecture

Ripple Prime’s debut aligns with a broader structural shift:

BRICS nations are advancing gold- and commodity-backed digital trade systems.

The IMF is exploring new settlement architectures using tokenized assets.

Western fintech firms like Ripple are positioning to mediate the convergence between traditional banks, CBDCs, and decentralized networks.

In essence: Ripple Prime represents not just another crypto product — but a core building block of a borderless liquidity layer, paving the way for a new global financial framework.

Ripple Prime is not just a rebrand — it’s a blueprint for a new economic structure.

This is not just politics or crypto hype — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Ripple launches institutional trading platform Ripple Prime

Coindesk – Ripple Expands Institutional Liquidity with Hidden Road Deal

The Block – Ripple’s Next Phase: Ripple Prime and the Institutional Bridge

FX Empire -- XRP News Today: Ripple Prime Launch Ignites XRP Demand Outlook

~~~~~~~~~

Zelle’s Next Leap: Stablecoins Bring Banking Into the Blockchain Era

America’s biggest bank-owned payment network takes its first step toward a borderless digital money system.

The Announcement

Early Warning Services (EWS) — the consortium behind Zelle, jointly owned by major U.S. banks like JPMorgan, Wells Fargo, and Bank of America — announced on October 24, 2025, that it will begin using stablecoins to power international payments.

The goal: bring Zelle’s hallmark speed and convenience in domestic transfers to cross-border money movement, connecting 2,500 financial institutions worldwide under one digital payment rail.

Key Details

● Leveraging stablecoins: EWS will utilize stablecoins to enable instant global transactions, taking advantage of new regulatory clarity provided by the GENIUS Act (July 2025).

● Goal: Build a faster, safer, and cheaper alternative for international remittances, reducing reliance on traditional correspondent banks.

● Network reach: The rollout will cover all 2,500 financial institutions already using the Zelle network.

● Unconfirmed details: It’s still unclear whether EWS will issue its own stablecoin or adopt a regulated third-party token such as USDC or PayPal USD.

● Market disruption: The move positions Zelle to directly compete with Western Union, MoneyGram, and PayPal, potentially redefining the remittance industry.

Industry Implications

This marks a pivotal moment: legacy banks are entering blockchain finance through one of their most successful payment systems.

Analysts note that by integrating stablecoins, Zelle is effectively bridging traditional bank infrastructure with digital settlement networks — the very mechanism driving the new financial architecture envisioned by Ripple, the IMF, and BRICS-aligned systems.

“This is not just about payments — it’s about interoperability between old money and programmable digital cash,” one fintech strategist told Forklog.

Why This Matters

● Out with the Old: Traditional SWIFT-based transfers may soon be replaced by tokenized, instant settlements built on distributed ledger systems.

● In with the New: Stablecoin integration by a U.S. bank consortium shows how regulated digital assets are now being woven into mainstream finance.

● Toward a Financial Reset: When institutions like Zelle’s banking network adopt blockchain rails, it signals the migration of global liquidity into a transparent, programmable system — a key step toward a global financial reset built on digital settlement layers rather than fiat intermediaries.

● Analogy: Much like the telegraph gave way to the internet, this shift represents the “Internet of Value” — money moving at the speed of information.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Ledger Insights – Bank-owned Zelle to launch stablecoin-based cross-border payments

Forklog – Zelle Payment Network Integrates Stablecoins for Cross-Border Transfers

Payments Journal – Zelle’s Stablecoin Could Mark Its Entry to Cross-Border Payments

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Morning 10-26-25

The Most Notable Achievement In 2025

Economic 10/26/2025 Yasser Al-Mutawali In an evaluative look at the most prominent achievements of the year 2025, in my estimation as someone interested in and observing economic affairs, is the launch of Iraq's Vision 2050, as a pioneering step, albeit theoretically, on the path to sound construction and development.

The Most Notable Achievement In 2025

Economic 10/26/2025 Yasser Al-Mutawali In an evaluative look at the most prominent achievements of the year 2025, in my estimation as someone interested in and observing economic affairs, is the launch of Iraq's Vision 2050, as a pioneering step, albeit theoretically, on the path to sound construction and development.

This step comes as Iraq is experiencing difficult times due to numerous economic, political and social challenges,

in addition to international variables that require the mobilization of all capabilities to deal with them decisively.

To clarify, it is necessary to point out the following approach, where the vision in the free liberal system is parallel to the long-term plan in the totalitarian system, especially with an equal time period or at least the approximation between them from 20 years and up.

The difference lies in the means of implementation.

The vision is defined by the state and implemented through a collaborative effort between the state and the private sector, with the private sector bearing the lion's share of implementation.

Meanwhile, the plan is developed by the state and implemented solely by its institutions.

Here, you can observe the differences in the results and objectives.

We leave that to your interpretation.

Perhaps ambition motivates us to ensure that the state proceeds with implementing the vision’s programs and objectives, while providing the requirements, controls, foundations, and entities for implementation, rather than remaining a temporary slogan or within the concept of burning stages.

This assessment comes as we are now in the last quarter of 2025, and the remaining period includes the upcoming elections, which will inevitably establish a new government and a new parliament.

Herein lies the reservation regarding the possibility of the vision being implemented, as we are accustomed to any future government erasing any trace of its predecessor.

Therefore, I said we hope that the vision will not be a temporary slogan.

We indicated in our previous article that Iraq Vision 2050 is a vision for building Iraq and is not limited to a specific governmental phase.

Therefore, it requires that any future government proceed with its implementation.

We find it necessary to clarify important aspects that contribute to the contents and objectives of the vision.

This is achieved by focusing on extremely important aspects, foremost among which is the priority given to infrastructure to successfully implement the Vision's projects.

This is followed by focusing on attracting foreign investments to implement the Vision's programs by offering the necessary facilities and incentives, and not being stubborn about the wealth we possess to enrich it.

Here I point out that the Saudi Vision 2030 experience, despite its potential and wealth, has focused on attracting global investments to boost the Kingdom's imports.

It is useful to benefit from the experiences of our Arab and regional brothers and friends, as well as from global experiences in building their countries.

Therefore, Iraq Vision 2050 has been considered the most prominent achievement of the year 2025.

We call for supporting the momentum of this vision's success to build a new Iraq that lives up to its reputation, status, and potential to create prosperity and bring happiness to its people. https://alsabaah.iq/122683-.html

Antitrust Conference Outlines Fair Market Economy

Economic 10/26/2025 Baghdad: Hussein Thaghab The second annual conference of the Competition and Anti-Monopoly Council, which kicked off last Thursday in Baghdad, provided a high-level dialogue platform bringing together decision-makers, researchers, and experts to discuss ways to develop a fair competitive environment that contributes to strengthening the national economy and consolidating the principles of transparency and sustainability.

The conference, sponsored by Prime Minister Mohammed Shia al-Sudani and organized by the Council in cooperation with the Ministry of Higher Education and Scientific Research, witnessed broad participation from representatives of ministries, government agencies, professional unions and syndicates, and the private sector, in addition to a group of academics and international organizations.

Competition Affairs Specialist.

Economic transition

In his speech at the conference, the Prime Minister's representative, Counselor Dr. Abdul Hussein Al-Anbaky, said:

"The government attaches great importance to the issue of competition and the prevention of monopoly, and has implemented the relevant law, which has resonated greatly, given its importance in the economy's transition to a significant new phase."

Al-Anbaky added that monopoly leads to declining performance and negatively impacts market development, noting that competition reduces costs, and the more we move toward general competition, the more we will achieve realistic price levels based on supply and demand.

Strengthening the reality of reform

Chairman of the Competition and Anti-Monopoly Council, Dr. Ahmed Younis Qasim, explained that the government's implementation of Law No. 14 of 2010 in 2023 has achieved a shift within the local market, particularly as it is part of the government's program, which enhances the reality of economic reform and creates an ideal environment within the local labor market.

He pointed out that the transition to a free economy requires sound policies at a time when the economic system is linked to oversight and competition.

He explained that implementing the law contributes to supporting production, strengthening the national labor market,

and aligns with the government's efforts to achieve sustainable economic development.

It also supports small and medium-sized enterprises.

Addressing monopoly problems

Younis pointed out that the council is working to combat any monopolistic behavior and is cooperating with public and private institutions to address monopoly issues.

He noted that the council is working to open branches in several governorates to expand its scope of activity in supporting the national economy.

Younis emphasized that Iraq has an active presence in Arab and international competition and antitrust councils, and that we are working to exchange expertise in cooperation with global competition bodies.

Promoting a culture of competition

For his part, Deputy Secretary-General of the Council of Ministers, Farhad Nimatullah Hussein, called for strengthening institutional coordination between government agencies and the private sector to foster a transparent and open economic environment. He noted that fostering a culture of competition contributes to supporting investment, developing markets, and achieving sustainable development.

Hussein added that the government recognizes that competition is a driver of the economy and supports efforts to create a suitable business environment. He noted that the government has worked to enact laws that activate the local market and prevent competition and monopoly.

Justice in opportunities

In this context, economic expert Hisham Khaled Abbas considered promoting competition and preventing monopolies an important step adopted by the government over the past two years, as it provides the labor market with true stability and prevents monopolies to ensure fair distribution of opportunities within the national labor market.

Abbas added that the national economy is entering a new phase, which will require those seeking to work in the growing Iraqi labor market to prove their worth.

The Iraqi labor market is considered one of the most important markets in the world, with its unique features that make it virtually unique among international markets.

Competition between actors

For her part, Natalie Khaled, ESCWA Competition and Consumer Protection Project Coordinator, commended Iraq's efforts to build a modern institutional system that contributes to developing the legal and regulatory frameworks for competition.

Khaled stated that competition among actors strengthens competitive systems and limits hegemonic practices, emphasizing that the Arab region is witnessing a widespread anti-monopoly culture, which plays a role in creating a favorable environment for work and investment.

Khaled expressed her support for the directives and legislation that prevent monopolies, especially in light of the existence of a common Arab vision that prohibits such practices and enhances competition in Arab countries.

Goods quality

Meanwhile, Dr. Saba Talib, a competition and monopoly expert, explained that since 2003, the political system has transformed from a dictatorial to a democratic pluralist system, accompanied by a shift in the economic system from a planned (socialist) to a (capitalist) system.

This transformation was not carried out in scientifically calculated steps, which negatively affected the economy and led to a state of turmoil and chaos and the creation of a group of economic blocs that began to control the economy and the general level of prices and affected the general atmosphere of competition in the country.

This led to some businessmen controlling basic economic joints and controlling the quality of goods as well as the origins of those goods.

The first to be affected was the citizen (the consumer), as this situation led to the entry of low-quality goods at high prices. The main reason is the failure to separate the economic sector from the political influences of parties. And political blocs.

market economic policy

She pointed out that the conference focused on discussing market issues and how to achieve fair competition within it, activating the Competition and Anti-Monopoly Council Law No. 14 of 2010, confronting the challenges facing the Iraqi market, proposing appropriate solutions to enforce the aforementioned law, and implementing a market economic policy that makes competition fair to attract investment.

It was emphasized that dialogue and cooperation between the relevant parties should continue to keep pace with modern economic and technological transformations, ensuring the establishment of a fair and prosperous market environment in Iraq.

Fair competition employment

For his part, Dr. Maitham Adham Al-Zubaidi, Vice Chairman of the Competition and Anti-Monopoly Council, considered the conference a milestone in Iraq's economic reform process, not only because it brought together local and international officials and experts under one roof, but also because it refocused attention on a fundamental issue that is often overlooked: the use of fair competition as a lever for sustainable development. Al-Zubaidi added that

Building a balanced market

the conference represents a shift from traditional discourse on reform to a more in-depth discussion on how to build a balanced market governed by efficiency, not monopoly, and transparency, not self-interest.

He explained that its focus on the role of Competition and Anti-Monopoly Law No. 14 of 2010, pro-competition policies, and competitive neutrality between the public and private sectors reflects a growing awareness that the economy is not built solely on administrative orders and theorizing, but rather on a regulatory and procedural environment that unleashes legitimate competition, stimulates innovation, and prevents economic centralization.

He explained that the inclusion of topics on digital transformation and artificial intelligence in the dialogue sessions indicates a true awareness of the future challenges facing markets in e-commerce and digital marketing platforms, and the need to align legislation with the knowledge economy.

He stressed that the conference strengthened institutional dialogue between the government and the private sector, in a direction that places competition at the heart of economic justice policies through the participation of conference sessions with pharmaceutical office suppliers, insurance services companies, and interaction. With audience questions. https://alsabaah.iq/122682-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

MilitiaMan and Crew: IQD News Update-Dinar Coin-Exchange Rate-Stability

MilitiaMan and Crew: IQD News Update-Dinar Coin-Exchange Rate-Stability

19-25-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Dinar Coin-Exchange Rate-Stability

19-25-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Saturday Afternoon 10-25-25

Foreign Banks Are Violating The Law By Controlling Iraqi Banks.

October 23, 2025 Last updated: October 23, 2025 Al-Mustaqilla/- Economic sources revealed, in an investigation conducted by the Independent Press Agency, high foreign bank shareholdings in private Iraqi banks.

This raises questions about the extent to which these banks comply with Iraqi laws governing banking sector ownership.

Foreign Banks Are Violating The Law By Controlling Iraqi Banks.

October 23, 2025 Last updated: October 23, 2025 Al-Mustaqilla/- Economic sources revealed, in an investigation conducted by the Independent Press Agency, high foreign bank shareholdings in private Iraqi banks.

This raises questions about the extent to which these banks comply with Iraqi laws governing banking sector ownership.

Official data shows that some foreign banks hold stakes in Iraqi banks that exceed the legal limits, indicating potential violations. Prominent examples include:

• National Bank of Iraq: Jordan Capital Bank owns 62% of its shares, along with Cairo Amman Bank with 9.9%, and the Palestinian Arcadia Investment Fund with 5%.

• Al-Mansour Iraqi Bank: Qatar National Bank owns a 54% stake in the bank.

• Bank of Baghdad: The Kuwait Jordan Bank owns 52% of its shares.

• Arab Bank of Iraq: Arab Bank of Jordan controls 63.77% of the bank’s shares.

• Iraqi Credit Bank: The National Bank of Kuwait owns 92% of the bank’s shares, which raises significant controversy over foreign control of the banking sector.

• Iraqi Commercial Islamic Bank: Kuwait Finance House Bank S.A.E. owns 85% of the bank’s shares.

These high ratios indicate that foreign banks have almost complete control over a number of Iraqi banks, which contravenes Iraqi law, which restricts foreign bank ownership of local banks and limits their influence.

The Iraqi banking sector is considered a vital sector for the national economy, contributing significantly to project and investment financing and reflecting the stability of the financial market.

However, foreign banks' holdings of ratios exceeding legal limits pose risks to economic sovereignty and threaten Iraqi banks' ability to make independent decisions without external interference.

Economic observers stress the need to review banking laws and regulations and establish strict oversight mechanisms to ensure a balance between foreign investment and the preservation of national financial sovereignty, especially in light of the continued expansion of foreign banks in the Iraqi market. https://mustaqila.com/البنوك-الأجنبية-تتجاوز-القانون-في-الس/

Central Bank Governor From Duhok University: Financial Inclusion Is A Key Pillar Of Sustainable Development

October 23, 2025 His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, emphasized that financial inclusion represents a fundamental pillar for achieving sustainable economic and social development. He pointed out that enabling citizens to access formal financial services contributes to promoting social justice and building trust with financial institutions.

This came during His Excellency's speech at the Financial Inclusion Conference, organized by the University of Duhok, College of Administration and Economics, under the theme

"Towards a Sustainable and Promising Financial Environment Through Empowering and Adopting Modern Electronic Payment Technologies and Promoting Financial Inclusion."

His Excellency explained that the Central Bank is working within the framework of the National Financial Inclusion Strategy 2025–2029 to expand the base of beneficiaries of financial services, empower women and youth, and promote the transition to electronic payments. He emphasized the

Central Bank's continued development of the digital payments infrastructure, support for financial innovation, and promote financial literacy in cooperation with universities and educational institutions.

The conference featured a large exhibition featuring numerous banking and non-banking financial institutions.

It also included an extensive discussion session on financial inclusion and its impact on monetary and fiscal policy, as well as the government's role in raising financial inclusion indicators and enhancing economic stability. Central Bank of Iraq Media Office https://cbi.iq/news/view/3022

British Report: Modernizing Iraq's Underdeveloped Banking System Is A Priority.

Energy and Business Iraq breaking banking system 2025-10-23 Shafaq News - Baghdad The British magazine "Global Finance" revealed on Thursday that economic diversification in Iraq is limited, considering that modernizing the "backward" banking system is a priority for the country.

In a report on the performance of central banks in the Middle East, seen by Shafaq News Agency, the magazine said,

"Iraq's GDP growth is expected to recover in 2025 after two consecutive years of recession, driven primarily by a recovery in oil production.]

" It noted that "the economy remains heavily dependent on hydrocarbons, which constitute 95% of government revenues making it vulnerable to fluctuations in global oil prices."

She added, "Although economic diversification has long been on the agenda, real progress has been limited.

In response, the Central Bank of Iraq is promoting what it describes as'developmental central banking,'focusing on directing credit toward strategic sectors, such as agriculture and industry, to expand the country's economic base." The report explained that "modernizing Iraq's underdeveloped banking system is another priority.

Reforms are underway in state-owned banks, along with initiatives aimed at reducing the use of cash."

In May 2024, new regulations were issued for digital banks and electronic payment companies, prompting several new players to enter the market.

According to the report, "Despite efforts to combat money laundering and terrorist financing, the Central Bank still faces severe compliance challenges, and many Iraqi banks remain restricted from dollar transactions due to concerns about illicit financial flows to sanctioned entities."

The magazine noted in its report that "in early 2025, authorities uncovered a new scheme involving prepaid Visa and Mastercard products used to transfer funds to Iranian-backed militias.

In response, the Central Bank of Iraq set a monthly cross-border transfer cap of $300 million and capped individual cardholder transactions at $5,000." https://shafaq.com/ar/اقتصـاد/تقرير-بريطاني-تحديث-النظام-المصرفي-المتخلف-بالعراق-يعد-ولوية

The Center For Banking Studies Organizes A Training Workshop On National And Sectoral Assessment Procedures.

October 23, 2025 The Center for Banking Studies at the Central Bank of Iraq organized a specialized training workshop on Thursday titled"National and Sectoral Assessment Procedures," with theparticipation of a number of employees from banks and financial institutions.

The workshop aimed to enhance participants' capabilities in understanding national risk assessment mechanisms and analyzing sectoral aspects related to banking operations, thus contributing to improving the performance of financial institutions in accordance with international standards for combating money laundering and terrorist financing.

This workshop is part of the Center for Banking Studies' annual training program, which seeks to develop the human resources working in the banking sector and enhance their readiness to keep pace with technological and regulatory developments in the financial sector.

The Center emphasized that organizing such workshops reflects theCentral Bank of Iraq's commitment to promoting a professional banking culture and consolidating institutional work practices based on efficiency and professionalism. https://cbi.iq/news/view/3023

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 10-25-25

Seeds of Wisdom RV and Economics Updates Friday Afternoon 10-24-25

Good Afternoon Dinar Recaps,

The DeFi Spine of the Global Reset: How Flare, Ripple, and BRICS Gold Systems Are Converging

From tokenized liquidity to gold-backed trade, a two-tier financial system quietly takes shape.

A quiet but monumental transformation is underway across global finance — one not defined by central banks alone, but by the convergence of decentralized and sovereign digital systems.

Good Afternoon Dinar Recaps,

BRICS Gold Revolution: China and India’s Record Discoveries Redefine Monetary Power

Massive new gold finds in China and India mark a pivotal shift in BRICS’ challenge to dollar dominance.

A Historic Surge in BRICS Gold Reserves

BRICS nations are rewriting the global gold narrative. With China and India uncovering record-breaking reserves, the bloc’s combined gold holdings now account for roughly 20% of total global reserves, signaling a strategic transformation in international finance.

China’s Hunan Province Discovery — Geological surveys confirm 1,100 tonnes of gold, valued at nearly $83 billion, potentially surpassing South Africa’s famed South Deep mine.

India’s New Deposits — Though precise figures remain undisclosed, experts note that India’s timing alongside China amplifies BRICS’ united momentum in commodity-backed finance.

Gold prices surged above $2,700 per ounce following the announcements, reflecting global confidence in tangible, asset-based stability.

Central Banks Signal a Shift in Strategy

Global economists note that this is less about gold becoming more valuable — and more about the dollar becoming less so. As Professor Adrian Saville of the Gordon Institute explains:

“It’s not that gold is worth more; it’s that the dollar is worth less.”

This sentiment echoes across central banks increasingly diversifying away from fiat currencies toward physical reserves. The People’s Bank of China and Reserve Bank of India are reportedly increasing their bullion allocations in step with BRICS-led reserve diversification.

Why It Matters

Reshaping the Reserve Standard: Physical gold accumulation by BRICS members weakens dollar hegemony and strengthens commodity-backed monetary trust.

Parallel Settlement Systems: By anchoring value to tangible reserves, BRICS can build a multi-currency settlement framework independent of Western-controlled systems like SWIFT.

Foundation for a Financial Reset: This coordinated gold strategy represents an early stage of the global financial reset — a multipolar model built on assets, not debt.

Toward a New Global Financial System

China’s discovery alone could dramatically reduce its gold import dependence, altering international trade flows. When coupled with India’s find, this creates a foundation for BRICS’ gold-backed trade architecture, reducing reliance on volatile dollar-based settlements.

As these reserves enter circulation, BRICS nations are effectively backing their currencies with tangible assets, setting the stage for a parallel monetary system — one less vulnerable to inflationary debt cycles and geopolitical sanctions.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – BRICS Historic Gold Surge as India & China Just Found Record Mines

Bloomberg – Gold Prices Surge on Chinese and Indian Discoveries

IMF – Global Financial Stability Report 2025: Shifting Ground Beneath the Calm

~~~~~~~~~