Iraq Economic News and Points To Ponder Thursday Morning 10-2-25

Financial Stability Dilemma

Catastrophic Figures: Iraq Is Drowning In Debt. Dangerous Indicators Portend A Bleak Future For The Economy.

Baghdad Today – Baghdad Iraq's public finances are experiencing a critical phase, with government policies intersecting with accumulating obligations and increasing economic pressures.

This situation is no longer simply a matter of numbers; it has become a test of economic governance and the state's ability to balance operational spending with sustainable financing.

Financial Stability Dilemma

Catastrophic Figures: Iraq Is Drowning In Debt. Dangerous Indicators Portend A Bleak Future For The Economy.

Baghdad Today – Baghdad Iraq's public finances are experiencing a critical phase, with government policies intersecting with accumulating obligations and increasing economic pressures.

This situation is no longer simply a matter of numbers; it has become a test of economic governance and the state's ability to balance operational spending with sustainable financing.

Official data indicates that domestic debt reached approximately 87 trillion dinars by mid-2025, while a proposal to issue new bonds worth 5 trillion dinars to pay contractors' dues is looming, potentially raising the figure to approximately 97 trillion dinars.

According to legal readings, any unforeseen expansion of domestic debt requires strict controls and legislation to prevent it from becoming a long-term burden.

Economist Nabil Al-Marsoumi warned in a statement on his Facebook page, followed by Baghdad Today, of the alarming rise in domestic debt. He noted that "the Ministerial Council for the Economy recommended issuing bonds worth 5 trillion dinars to pay contractors' dues, which some sources indicate amount to 7 trillion dinars.

If the government approves this recommendation, it will raise the domestic debt to more than 97 trillion dinars." This warning reflects genuine concern about excessive reliance on domestic debt instruments to finance operational obligations rather than productive projects.

In-depth legal analyses confirm that the continuation of this financing pattern will weaken the monetary authority, raise inflation, reduce private sector financing, and increase the burden of debt service, which reached 9.3 trillion dinars in 2024.

In parallel, economist Manar Al-Obaidi previously offered a critical assessment of other economic policies, which he believes have contributed to deepening the deficit despite massive oil revenues of nearly $300 billion between 2022 and 2024.

Al-Obaidi notes that "the decision to devalue the dinar from 1,450 to 1,310 to the dollar increased state expenditures by about 40 trillion dinars and exacerbated the fiscal deficit," in addition to the jump in current expenditures from 104 to 125 trillion dinars and the increase in the wage bill from 43 to 60 trillion dinars over two years.

According to him, the domestic debt rose from 69 to more than 85 trillion dinars by mid-2025, relying primarily on the liquidity of public and private banks, which depleted their resources and impacted economic activity. Comparative legal research shows that such policies in similar countries lead to inflated debt without achieving real growth.

The Prime Minister's financial advisor, Mazhar Mohammed Salih, offers a more reassuring official reading in previous press statements.

Salih asserts that "the ratio of external and domestic public debt does not exceed 33% of GDP, an indicator that places Iraq within a comfortable and low-risk global credit rating.

" He adds that "domestic debt amounts to 85 trillion dinars, half of which is invested in the Central Bank of Iraq's investment portfolio, and the remainder is held by government banks and the public in bonds and transfers."

He explains that "external debt does not exceed 8% of GDP, most of which are long-term loans for the reconstruction of liberated areas." He also points out that Iraq has written off approximately $100 billion of its external debt under the Paris Club agreement, and that the remainder will be paid off by 2028 with the final foreign private sector debt of $2.7 billion.

According to independent research estimates, this ratio makes Iraq less vulnerable to risks compared to similar countries, but it does not mean that uncontrolled domestic borrowing will be safe.

The result is that Iraq faces three clear paths: the first is represented by Al-Marsoumi's warnings of domestic debt ballooning to approximately 97 trillion dinars if new bonds are issued;

the second is expressed by Al-Obaidi through a critical assessment of fiscal policies that have undermined stability despite the oil abundance; and

the third is Saleh's official reading, which confirms that overall debt ratios remain within globally safe standards. Comparative analyses suggest that the challenge lies not in the size of the debt alone, but in how to manage it and link it to sustainable development plans that ensure that borrowing funds are transformed into productive investments rather than a renewable burden.

Ultimately, issuing new bonds to pay contractors' dues is not a simple financial choice, but rather a decision that requires a balance between meeting urgent obligations and maintaining long-term financial stability.

The logical conclusion is that the government needs a clear public debt strategy that combines fiscal discipline with development planning, to prevent financing tools from becoming shackles that shackle a fragile economy rather than saving it.

Source: Baghdad Today Monitoring and Follow-up Department https://baghdadtoday.news/284215-.html

An Oil Expert Explains The Importance Of The Baghdad-Kurdistan Agreement And Its Impact On The Global Market.

Economic: Al Furat News} Oil expert Furat al-Moussawi considered the oil agreement between Baghdad and the Kurdistan Region a strategic and important agreement that paves the way for future legislation of a new oil and gas law. He noted that the next three months will be a litmus test of the extent of all parties' commitment to its provisions.

The useful summary... You can find important news on the Euphrates News channel on Telegram

During his appearance on the "Free Talk" program on Al Furat TV, Al-Moussawi said, "Iraq has suffered for more than twenty years from financial and economic problems that have affected the salaries of the region's employees," noting that "there are clear clauses in the agreement and others that remain ambiguous."

He pointed out that "Iraq has been restricted in expanding industrial and development projects due to a production quota described as unfair, as its production ceiling has been set at 4.6 million barrels per day since 2018."

Al-Moussawi explained that "Iraq attempted to negotiate with OPEC to increase its oil quota, but the negotiations did not achieve the desired results due to the quantities produced in the region outside SOMO's quota.

These quantities were deducted from Iraq's OPEC quota and set at 1.4 million barrels from October 2024 until the end of October 2025, which harmed Iraq's financial revenues and reputation within the organization."

The expert discussed the demands of oil companies operating in the region, stating that "one of these demands was addressed by setting $16 as an approximate average figure, with an international company to determine the transportation and cost costs to pay those companies' dues, amounting to approximately $1 billion, which was transferred to the federal government."

He added, "The previous contract between the region and foreign companies was based on production-sharing, but a compromise formula was reached that allowed for the writing of a new law.

Eight companies also requested to sign new contracts with the Baghdad government to guarantee their rights, with the federal government paying the companies $16 in kind through deducting oil quantities, not in cash. This was considered an achievement for those companies, with the agreement to postpone payment of the $1 billion."

Despite the agreement's importance, Al-Moussawi described it as "cautious due to its potential financial and legal risks," noting that "Turkey seeks to cancel the Ceyhan pipeline and conclude a new agreement by the end of 2026, while Iraq has rushed to pump the region's oil through the existing pipeline to increase its negotiating leverage with Ankara."

He added, "The region's oil companies are looking to sign formal international agreements with the federal government," stressing that "Iraq will participate in the upcoming OPEC meeting on October 5, where it was agreed to raise its quota to 4 million and 220 thousand barrels per day, including between 800 and 900 thousand barrels for domestic consumption, with full commitment to the quota to strengthen its position in subsequent negotiations to increase it."

Al-Moussawi explained that "Iraq views the Ceyhan pipeline as a strategic option for diversifying export outlets and preventing any smuggling attempts," noting that "the region's oil quantities will be counted toward Iraq's OPEC quota," noting that "oil derivative prices in the region are very high due to the reliance on private refineries."

He concluded his remarks by stressing that "setting the 50% share for the region is not the end of the road, as Baghdad will work to raise it to 70% and also supply the region with kerosene and gasoline to ease the burden on citizens." LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Who Do We Hold Accountable?

Who Do We Hold Accountable?

The loss and squandering of non-oil revenues in numbers: Billions And Abundant Resources Are Being Swallowed Up By Corruption Networks.

Baghdad Today – Baghdad The issue of non-oil revenues in Iraq is one of the most important issues, revealing the depth of the structural dependence on oil.

The state treasury remains almost entirely tied to oil revenues, while other resources are supposed to be the primary tributary to ensuring financial stability.

Who Do We Hold Accountable?

The loss and squandering of non-oil revenues in numbers: Billions And Abundant Resources Are Being Swallowed Up By Corruption Networks.

Baghdad Today – Baghdad The issue of non-oil revenues in Iraq is one of the most important issues, revealing the depth of the structural dependence on oil.

The state treasury remains almost entirely tied to oil revenues, while other resources are supposed to be the primary tributary to ensuring financial stability.

************************************

Constitutional deliberations indicate that excessive reliance on a single resource weakens the principle of economic justice and disrupts the mechanisms for equitable wealth distribution.

According to Ministry of Finance data, the percentage of non-oil revenues rose from 7 percent in 2023 to 9 percent in 2024, and then to 10 percent by July 2025.

These are official figures, which economist Nabil al-Marsoumi asserts on his Facebook page, monitored by Baghdad Today, are the most accurate and reliable. However, they remain modest when compared to the potential in sectors such as tourism, ports, and border crossings.

Monitoring data indicates that this gap does not reflect a shortage of resources, but rather a crisis in collection mechanisms.

In the religious tourism sector, one of the most prominent potential sources of income, millions of visitors enter Iraq annually, with the Arbaeen pilgrimage exceeding four million foreign visitors. According to preliminary research data, average spending ranges between one and two billion dollars annually, while reports indicate direct and indirect revenues exceeding nine billion dollars in 2023.

However, the treasury's share of these funds is extremely limited due to the vast informal economy and weak tax collection. Constitutional law experts argue that the absence of strict tax legislation on tourism services deprives the state of legitimate entitlements and leaves it hostage to the informal market.

This limits direct revenues to a few tens of millions of dollars, while possible collection through smart mechanisms could reach hundreds of millions.

Field studies indicate that this shortcoming is not related to weak demand, but rather to the absence of institutional tools capable of fair collection.

Border crossings and customs represent a stark example of the discrepancy between reality and potential.

According to various legal estimates, border crossings should constitute the state's second-largest source of revenue after oil, but corruption and fraud consume a significant portion of the revenue.

Official customs revenues in 2025 amounted to approximately 2.7 trillion dinars, with expectations of reaching 3 trillion by the end of the year, equivalent to approximately $2.3 billion.

*****************************

However, international oversight reports indicate that customs losses could reach as much as 30 percent of revenues. If this loss were eliminated through comprehensive automation and the integration of collection with electronic payment, the proceeds could easily rise to $2.9 billion annually.

Comparative analyses indicate that Iraq is the only regional exception, losing a third of its customs revenues despite its extensive network of border crossings.

Iraqi ports, in turn, present a similar picture. According to critical readings of constitutional jurisprudence, port revenues fall within sovereign resources that are supposed to be centrally managed in accordance with the principle of transparency.

In the first quarter of 2025, ports generated revenues exceeding 314 billion dinars, equivalent to approximately $240 million over three months, meaning annual revenues approach $1 billion.

However, this figure remains below actual potential, as improving handling management, increasing operational efficiency, and linking electronic invoicing with customs could increase revenues to $1.15 billion annually.

Institutional estimates indicate that Iraq is losing a portion of its resources due to the lack of a unified port collection system, which further widens the gap between reality and potential.

When compared to the Gulf states, the magnitude of the difference becomes clear. Research studies indicate that Saudi Arabia, through Vision 2030, has succeeded in increasing the contribution of non-oil revenues to more than 40 percent of the budget by developing tourism, imposing a value-added tax, and developing non-oil industries.

The UAE has transformed its economy into a global hub for aviation, tourism, real estate, and financial services, until the oil contribution declined to less than 30 percent of GDP.

Qatar, on the other hand, has harnessed liquefied natural gas revenues while simultaneously building service and investment sectors that have boosted sustainable revenues.

According to contemporary intellectual approaches, these experiences would not have been possible without stable institutions and accumulated experience in managing public resources.

Iraq, by contrast, has remained stagnant despite possessing similar, and perhaps even broader, assets, such as massive religious tourism, extensive border crossings, and strategic seaports. In-depth legal analyses confirm that structural obstacles have prevented the exploitation of these resources, most notably administrative and financial corruption, which causes significant revenue leakage; the absence of a long-term strategic vision, which renders short-term policies hostage to political consensus; weak infrastructure, a widespread informal economy; and political and security instability, which undermines investor confidence and prevents stable economic policies.

Comparative experience demonstrates that these obstacles are not inevitable, as other countries in the region have overcome them through gradual and cumulative reforms.

********************************

In conclusion, Iraq does not lack resources, but rather the institutional will to transform them into actual revenues for the state treasury. While the official share of non-oil revenues has risen to 10 percent, it remains modest compared to the 40 percent achieved by Saudi Arabia or the 30 percent achieved by the UAE.

If Iraq succeeds in overcoming the obstacles of corruption and red tape and adopts a genuine strategic plan, it could double its non-oil resources to nearly $5 billion annually in the short term, and raise their share to more than 20 percent of total revenues within a few years.

According to intersecting political-economic estimates, this path is contingent on radical reforms that redefine the relationship between the state and the economy and free public finances from the grip of oil rents.

Source: Baghdad Today Monitoring and Follow-up Department https://baghdadtoday.news/284288-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

“Tidbits From TNT” Thursday Morning 10-2-2025

TNT:

Tishwash: $6.1B boost: Iraq signs 64 partnership contracts for industry

Iraq’s Industrial Week kicked off Wednesday at Baghdad International Fair, bringing together local and foreign companies from both the public and private sectors.

At the opening ceremony, Industry and Minerals Minister Khaled Battal highlighted that the government has completed more than 86% of its industrial program, and laid the groundwork for 27 new factories.

TNT:

Tishwash: $6.1B boost: Iraq signs 64 partnership contracts for industry

Iraq’s Industrial Week kicked off Wednesday at Baghdad International Fair, bringing together local and foreign companies from both the public and private sectors.

At the opening ceremony, Industry and Minerals Minister Khaled Battal highlighted that the government has completed more than 86% of its industrial program, and laid the groundwork for 27 new factories.

He also pointed out that the ministry signed 64 partnership contracts worth 9 trillion dinars ($6.1 billion) with local and foreign investors in strategic industries, including fertilizers, phosphates, iron, and steel. Talks are ongoing for an additional 33 contracts.

Noting that the week-long fair will continue through October 7, Battal described it as an economic and social platform that connects industrialists with policymakers, ''helping obstacles removal to industrial projects.”

“Key challenges facing national industry include shortages of electricity and gas, border crossing issues, and aging factories,” the minister underlined, adding that Iraq has achieved self-sufficiency in cement, producing over 37 million tons in 2024.

Production has also increased for chlorine used in water treatment, electrical transformers, and other industrial goods.

Meanwhile, the General Company for Iron and Steel displayed its products at the fair. Marketing Director Mohammad Subih emphasized that Iraqi rebar production matches European standards, highlighting that the ISO-certified plant produces up to 600,000 tons annually, with plans to export to neighboring countries. link

************

Tishwash: Iraqi banks between the "dollar transfers complex" and the "dream of a regional financial center": A new vision for the changing Middle East economy

In a region experiencing major transformations, from economic corridor projects to reconstruction plans, from geopolitical shifts to the so-called "New Middle East" plans, Iraq finds itself facing both a historic opportunity and fateful challenges.

A bold banking and economic vision is needed here, seeking to transform Iraqi banks from marginal players to key players in economic decision-making and building an attractive investment environment.

A rapidly changing Middle East

Economic expert Saif al-Halfi told Iraq Observer that the Middle East is currently undergoing profound transformations, including mega-projects and new economic corridors. Baghdad stands at a historic gateway that requires a fundamental shift in the way the financial sector is managed. What is required is not just an injection of capital or the introduction of modern payment systems, but rather the establishment of an integrated legal and institutional vision that protects financing and opens the way for development initiatives.

Only then can Iraq capitalize on its strategic geographic location, the Faw Port, the Development Road project, and its oil, gas, and human resources to become a financial and commercial hub at the heart of the region.

The first challenge: Capital and institutional reform.

The first step Al-Halfi refers to is raising the capital of Iraqi banks and strengthening their resilience to risks. This is a plan the government has implemented in cooperation with the Central Bank and with the assistance of the global consulting firm Oliver Wyman. The decision was made to raise the capital of banks to 400 billion dinars. Although this decision appears to be an accounting measure, it lays a new foundation for building a stronger banking sector that is more integrated with the regional and international economies.

He adds that institutional reform, the dismantling of large shareholdings, and the introduction of automation and modern systems are not sufficient on their own, but they are an indispensable condition for transitioning from the stage of survival to the stage of competition and expansion.

The Second Challenge: From Dollar Captivity to Diversified Financing

Al-Halfi acknowledges that banking activity in Iraq still relies almost entirely on foreign remittances in dollars. This reality makes banks more like large exchange houses than true financial institutions. International experience confirms that banks only flourish when they transform into "real financiers" of the national economy through lending and adopting diverse strategies.

The economic expert suggests that expansion should be based on five main paths: "The first is personal and housing loans to meet citizens' needs. The second is financing small and medium-sized enterprises, as they are the largest engine of employment and growth.

This is in addition to loans to large companies, especially those listed on the Iraq Stock Exchange or seeking to be listed. Syndicated loans to finance oil, electricity, refinery, and residential projects, provided the Central Bank is flexible in granting licenses.

Fifth, financing international trade, including letters of credit and participation in foreign projects such as oil refining in more active markets." These mechanisms, if implemented boldly, will open the door to a qualitative transformation in the Iraqi economy, away from the "dollar complex."

Challenge 3: The Electronic Payment Revolution

In parallel with financing and lending, electronic payment is emerging as a fundamental pillar of the new financial world. Al-Halfi believes that Iraqi banks must accelerate the provision of modern and diverse banking products, such as credit cards, debit cards, prepaid cards, charge cards, and even secured credit cards. Diversifying these products will not only contribute to enhancing financial inclusion and reducing reliance on cash, but will also enhance the financial system's ability to combat money laundering and boost investor and customer confidence alike.

What is required of the Iraqi government

however, is that banks alone cannot fight this battle. What is required, according to the economic expert, is to expedite the enactment of modern laws to protect loans and electronic transactions, in addition to establishing specialized banking courts to quickly resolve disputes, and establishing an expedited judiciary to ensure the stability of transactions.

He stresses the importance of establishing a credit guarantee scheme for small and medium-sized loans, in which the state participates in guaranteeing loans to reduce financing risks, thus encouraging banks to lend instead of relying on external transfers.

The historic opportunity

presents a mix of challenges and opportunities. On the one hand, Iraqi banks face the accumulation of overreliance on the dollar, weak capital, and delayed legislation. On the other hand, Iraq possesses a unique geographical location and massive strategic projects, as well as natural and human resources that could transform it into a regional financial center if exploited wisely.

Al-Halfi poses a pivotal question: Will Iraqi banks remain captive to remittances, or will they transform into genuine financial institutions that contribute to building a diversified and robust economy?

The answer, it seems, cannot be delayed. Today's Middle East does not wait for the hesitant, and if Iraq does not race against time to reform its banking sector, it may find itself excluded from the map of the new Middle East. link

************

Tishwash: Jordan-Iraq Bank branch opened in Erbil

Jordan-Iraq Bank is expanding its branch network with the opening of a new branch in Erbil.

In a strategic move that reflects Jordan Bank Group's vision to strengthen its regional presence and consolidate its position as a leading financial institution, the bank announced the opening of its new branch in Erbil, the capital of the Iraqi Kurdistan Region.

Saleh Hamad said the opening is part of a well-designed expansion plan aimed at establishing the bank's presence in the Iraqi market and expanding its banking services to meet customer needs according to the highest international standards.

The Erbil branch provides a qualitative addition to the Bank of Jordan's regional corridor as it provides a comprehensive financial system that supports economic activity and opens up new opportunities for sustainable growth.

The Group is also committed to contributing to the development of the banking environment in Iraq and financial development through advanced digital solutions that improve the quality of service and support the development of the business environment in Iraq.

Erbil is gaining strategic importance as an active economic center and a major gateway for trade and investment, making it a key stage in the bank's plans to expand its presence in Iraq.

This expansion will allow for wider coverage of key markets and provide comprehensive banking services, strengthening Jordan Bank's position as a leading banking institution in the region that can empower various economic sectors to access advanced financial solutions, increase investment opportunities and revitalize the business environment.

Jordan Bank's expansion plans are based on a rich banking heritage and strong experience spanning more than 65 years, which has contributed to and will continue to build a comprehensive financial group with an extensive network of branches in Jordan, Palestine, Syria, Bahrain and Iraq.

The Bank continues to invest in the development of advanced digital systems, positioning itself as a leading regional financial institution capable of managing banking transformation, strengthening economic integration and establishing itself as a driver of development and stimulation of growth locally and regionally link

Mot: I Used to Worry bout it!!! --- Now ~~~

Mot: Yeppers - My Peoples!!!!

Iraq Economic News and Points To Ponder Wednesday Evening 10-1-25

The Exchange Rate Declined In Local Markets In Baghdad.

Economy | 11:42 - 01/10/2025 Mawazine News – Baghdad The exchange rate of the dollar against the dinar decreased this Wednesday morning in Baghdad markets.

The dollar price witnessed a decrease with the opening of the Al-Kifah and Al-Harithiya stock exchanges to 141,500 dinars for every $100, while yesterday morning it recorded 141,600 dinars for every $100.

The Exchange Rate Declined In Local Markets In Baghdad.

Economy | 11:42 - 01/10/2025 Mawazine News – Baghdad The exchange rate of the dollar against the dinar decreased this Wednesday morning in Baghdad markets.

The dollar price witnessed a decrease with the opening of the Al-Kifah and Al-Harithiya stock exchanges to 141,500 dinars for every $100, while yesterday morning it recorded 141,600 dinars for every $100.

In exchange shops in local markets in Baghdad, the selling price of the dollar decreased to 142,500 dinars for every $100, and the buying price to 140,500 dinars for every $100. https://www.mawazin.net/Details.aspx?jimare=267659

Gold Hits New Record High

Stock Exchange Gold prices rose to a record high on Wednesday, supported by a weaker dollar and safe-haven demand following the U.S. government shutdown, while weak jobs data reinforced expectations of an interest rate cut by the Federal Reserve this month.

As of 10:55 GMT, spot gold was up 0.2% at $3,866 per ounce, after hitting an all-time high of $3,895 earlier in the session. U.S. gold futures for December delivery rose 0.5% to $3,893.

The dollar weakened, opening up new opportunities for a basket of other major currencies, making dollar-denominated gold more accessible to foreign buyers. https://economy-news.net/content.php?id=60607

Oil Prices Rise Slightly After Sharp Declines Over The Past Two Days.

Time: 2025/10/01 Reading: 90 times {Economic: Al Furat News} Oil prices stabilized in early trading on Wednesday, following two consecutive days of losses, as investors assessed potential OPEC+ plans to increase production next month amid expectations of shrinking US crude oil inventories.

Brent crude futures for December delivery rose 12 cents to $66.15 a barrel, while U.S. West Texas Intermediate crude rose 12 cents to $62.49 a barrel.

Oil prices fell more than 3% on Monday, the largest daily drop since August 1, and fell at least 1.5% on Tuesday. LINK

A New Branch Of The Bank Of Jordan In Basra

Wednesday, October 1, 2025, | Economics Number of reads: 284 Basra / NINA / A new branch of the Bank of Jordan was opened in Basra Governorate, in the presence of the Chairman of the Financial and Administrative Committee, Dr. Shukr Mahmoud Al-Amri, and the General Manager of the Bank Group, Saleh Rajab Hammad, at the Grand Millennium Hotel - Al-Farahidi Hall.

Al-Amri stressed: "The opening of the branch represents a qualitative addition to the infrastructure in the field of modern banking services, and opens broad horizons to attract investments and support the private sector, which contributes to the development of the local economy.

He added: "Basra, with its economic potential and attractive environment, is a promising destination for investors at the local, regional and international levels, indicating that this step comes in support of the banking sector and the enhancement of economic activity in the governorate. / End https://ninanews.com/Website/News/Details?key=1254669

The Prime Minister's Advisor Sets Six Criteria For Selecting Iraq Development Fund Projects.

Money and Business Economy News – Baghdad Mohammed Al-Najjar, Advisor to the Prime Minister for Investment Affairs and Executive Director of the Iraq Development Fund, explained on Wednesday the criteria for selecting Iraq Development Fund projects, stressing that education, water, and the environment are priorities among the Fund's projects.

Al-Najjar said, in an interview with the Iraqi News Agency, followed by "Al-Iqtisad News," that "there are a set of criteria for selecting projects. The first is the amount of human capital that will be created through the project, including operators, engineers, and experts.

The second criterion is to engage in solving any of the crises that Iraq is going through, so that it can be resolved. We do not enter projects simply because they are profitable."

He added, "Another criterion is the possibility of involving the private sector in the project, as it must contribute no less than 80%, in order to optimally utilize capital, spread it across a large number of projects, and create investment outlets, as the private sector has significant funds outside the banking system and the economy."

He continued, "The fourth criterion is environmental impact, the fifth is economic impact, and the sixth is the ability of the company we partner with to finance and obtain international funding."

He explained that "most projects, if they are from a foreign party, we try to pair them with an Iraqi investor, to give the Iraqi investor the opportunity to learn the administrative capabilities possessed by the foreign investor."

He pointed out that "the Fund is not a legal entity that grants exemptions or incentives. Iraqi law does not grant these powers to the Fund; rather, they fall under the Parliament's purview.

With the approaching elections and the legislative process stalled pending the formation of a new government, we will seek in the next session to grant incentive powers to relevant institutions, such as the Investment Authority, to develop the Iraqi economy."

He explained, "The Fund sees the project and its importance, as there are no divisions similar to those of the state. However, our priority programs are education, water, and the environment, and the projects we excel at are those that require state support but can generate profits."

He pointed out that "a large part of the fund's purpose is to establish a social stratum whose goal is to find ways to engage young people, who constitute the largest percentage. However, so far, implementation will be slow, despite the presence of major initiatives from the current government. Therefore, we need to launch projects that include young people as a key component."

https://economy-news.net/content.php?id=60595

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 10-1-25

Good Afternoon Dinar Recaps,

BRICS Dollar Devaluation Path Strengthens With New Payment Systems

As BRICS builds alternative payment rails and leans on gold reserves, the move toward a multipolar financial order accelerates — with profound geopolitical and economic consequences.

Good Afternoon Dinar Recaps,

BRICS Dollar Devaluation Path Strengthens With New Payment Systems

As BRICS builds alternative payment rails and leans on gold reserves, the move toward a multipolar financial order accelerates — with profound geopolitical and economic consequences.

Payment Infrastructure Advances: Beyond Talk to Action

BRICS is pushing forward with BRICS Pay, a decentralized cross-border payment messaging system designed to bypass Western-controlled networks like SWIFT, allowing member nations to transact in local currencies.

During the Rio de Janeiro deliberations, the bloc proposed a guarantee fund to support local payments and integrate them into BRICS Pay.

These systems aren’t theoretical — they are intended to make dollar-free trade routable, reliable, and scalable across BRICS and select partner states.

De-Dollarization Backed by Gold & Local Currency Trade

🔹 Gold as a Pillar

BRICS nations now hold over 6,000 tons of gold — nearly 20–21% of global central bank reserves. Russia and China lead, owning ~74% of the bloc’s gold reserves.

The gold buffer acts as a shield against sanctions, dollar volatility, and external pressure while anchoring confidence in new payment systems.

🔹 Local Currency Settlement

Trade between BRICS nations increasingly uses national currencies instead of the U.S. dollar, reducing the need for dollar liquidity or FX hedging.

The New Development Bank (NDB) now plans to issue its first Indian rupee-denominated bond, aiming to raise ~$400–$500 million in India, as part of a strategy to internationalize BRICS member currencies.

Challenges & Friction in the Shift

🔹 Institutional & Network Effects

The U.S. dollar remains deeply entrenched in global trade: used in nearly 90% of FX trades and ~48% of SWIFT payments.

De-dollarization faces headwinds: liquidity fragmentation, exchange risk, and the higher cost of managing multiple currency rails.

🔹 Uneven Commitment Among Members

India has publicly stated de-dollarization is “not part of India’s financial agenda”, emphasizing bilateral local-currency trade instead.

Some BRICS members remain wary of overextending—too rapid a shift could destabilize economies, especially those with debt pegged to USD or who still rely heavily on U.S. trade and investment.

How This Fits Into Broader Global Restructuring

🔹 Redistribution of Financial Power

By operating an independent payment network and backing it with gold, BRICS is carving out financial sovereignty zones less subject to U.S. pressure or SWIFT control.

🔹 Erosion of Dollar Leverage

As BRICS transactions move off dollar rails, demand for USD as a settlement, reserve, and liquidity asset may decline — weakening the mechanisms by which the U.S. exerts financial influence.

🔹 Multipolar Payment Networks

Instead of one monolithic financial system, we may see overlapping networks (BRICS Pay, CIPS, mBridge, regional CBDC links), each with their own control nodes, rules, and dominant currencies. The world becomes less unified and more plural in financial architecture.

🔹 Gold & Currency Strategy as Influence Tools

Holding gold gives BRICS credibility; issuing debt in local currencies gives them leverage. These instruments become tools of diplomacy and alignment, not just balance sheet items.

Key Takeaway

BRICS is not just talking about breaking dollar dominance — it is constructing the alternatives. Payment systems, gold reserves, and currency internationalization converge in a push to remake global finance. What once seemed speculative is now engineering realignment of power.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – BRICS Dollar Devaluation Path Strengthens With New Payment Systems Watcher Guru

InvestingNews – How Would a New BRICS Currency Affect the US Dollar? Investing News Network (INN)

Nestmann – The BRICS De-Dollarization & What It Means for Gold The Nestmann Group

Brasil de Fato – BRICS leaders propose alternative payment system to SWIFT Brasil de Fato

Reuters / News – BRICS-backed NDB plans first rupee-denominated bond Reuters

Wikipedia – BRICS Pay Wikipedia

Carnegie / Policy analyses – Challenges to de-dollarization and structural headwinds CIRSD

Additional academic insight – Geopolitical Tensions & Financial Networks: Strategic Shifts Toward Alternatives arXiv

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Wednesday Morning 10-1-25

Good Morning Dinar Recaps,

Day One of a U.S. Government Shutdown — What It Signals for Global Power and Finance

As federal operations grind to a halt, the shockwaves go beyond Washington — this moment may accelerate how capitals, markets, and alliances recalibrate.

Good Morning Dinar Recaps,

Day One of a U.S. Government Shutdown — What It Signals for Global Power and Finance

As federal operations grind to a halt, the shockwaves go beyond Washington — this moment may accelerate how capitals, markets, and alliances recalibrate.

What We Know: Shutdown Begins Amid Deep Political Divide

On October 1, 2025, the U.S. government entered a shutdown after Republicans and Democrats failed to reach agreement on a $1.7 trillion funding package, with healthcare subsidies among the core conflicts.

The shutdown is the 15th since 1981, but this one carries added weight: President Trump is pushing aggressive restructuring of the federal workforce and government programs.

Immediate effects include:

▪️ Federal employees furloughed without pay, while some on administrative leave had already been paid through the end of September.

▪️ Military personnel, research programs, air travel, and social services disrupted or delayed.

▪️ Analysts estimate a $400 million per day cost, spotlighting the economic stakes.

Political Context & Risks

The impasse reflects intense polarization: Republicans frame the shutdown as leverage to force concessions, especially over government size; Democrats call the tactic reckless.

Public opinion is fractured — the political gamble is that no one wants to “lose” by appearing weak.

Longer shutdowns risk eroding confidence: businesses, foreign governments, and markets may begin to question U.S. reliability as a stable economic anchor.

How This Connects to Global Restructuring

🔹 Institutional Fragility & Credibility

When the U.S.—long seen as a bastion of institutional continuity—allows a shutdown to paralyze parts of government, it weakens perceptions of its capacity to govern. That perception shift can shift financial flows, risk assessments, and alliances.

🔹 Capital Flight & Market Volatility

Uncertainty spurs capital movements. Investors may retreat from U.S. treasuries or dollar exposures, pushing them toward alternative safe havens, gold, or non-dollar debt instruments.

🔹 Power Vacuums & Alternative Financial Systems

A distracted U.S. may signal opportunity to China, BRICS, and others to deepen parallel institutions, trade blocs, and currency alternatives while U.S. domestic focus is on internal strife.

🔹 Debt & Fiscal Stress Amplified

Already burdened by a $37.5 trillion national debt, a shutdown reduces revenue, increases borrowing costs, and tightens the margin for maneuver. Other nations watching may accelerate their own strategic alternatives.

Key Takeaway

Day one of the U.S. shutdown is more than a domestic political crisis — it’s a structural stress test of America’s global role. As institutions slow, markets tremble, and credibility cracks, the architecture of global finance and power tilts ever more toward a multipolar future.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Modern Diplomacy – U.S. Government Shutdown Begins Amid Deep Political Divide Modern Diplomacy

(Contextual references from institutional debt trends, global risk assessment, and comparative reaction patterns)

~~~~~~~~~

Russia’s Nuclear Technology Playbook for the Global South

By providing reactors, training, and financing, Russia is positioning itself as an energy patron — a role with geopolitical weight and financial leverage in the multipolar era.

Russia’s Strategy in the Global South

Russia is promoting its nuclear technology as a tool for long-term development and energy security, presented as low-carbon, stable power for growing economies.

At the Global Atomic Forum (part of World Atomic Week), President Putin emphasized shifting public attitudes toward nuclear energy and the expanding view of nuclear power as a developmental necessity rather than a niche or controversial option.

Russia’s pitch is holistic: not just building reactors, but offering complete packages—fuel supply, waste management, staff training, financing, and local industry development.

Russia recently formalized a planning agreement with Ethiopia to build a nuclear plant, including roadmap development and technical capacity building.

Challenges and Resistance

🔹 Technical, safety & regulatory hurdles

New nuclear projects require rigorous oversight, often needing alignment with the International Atomic Energy Agency (IAEA) standards. Some partner countries lack regulatory infrastructure.

Public skepticism and concerns about cost overruns, radioactive waste, and nuclear accidents remain major political obstacles.

🔹 Competition & donor dependence

Several global and regional actors—China, France, the U.S.—compete for influence through conventional energy projects (renewables, gas), which may appear safer or more politically acceptable.

Countries relying on Russian nuclear assistance may become dependent on Russian supply chains, maintenance, and economic terms, giving Moscow leverage in diplomacy, trade, or sanctions evasion.

Restructuring Implications & Strategic Alignments

🔹 New Patronage Network

Russia is re-weaving relationships in the Global South by positioning itself as a strategic energy backer. These infrastructure ties often translate into political loyalty and alignment in voting blocs, trade agreements, and financial pacts.

🔹 Financing & Currency Anchors

Nuclear projects cost tens of billions. The financing machinery—loans, guarantees, supply chains—can be aligned with non-USD systems or tied to regional banking structures (e.g. BRICS or state development banks). This shifts capital flows and undermines dollar dominance.

🔹 Legitimacy Through Development

Russia frames its approach as cooperation, not domination. By helping energy-poor states industrialize, it gains moral and diplomatic soft power, contrasting its Western adversaries’ “conditional aid” narratives.

🔹 Energy Security & Geopolitical Leverage

States with shaky grid systems see nuclear power as strategic infrastructure. Russia supplying that infrastructure gives it leverage over energy dependency, supply interruptions, and bilateral influence in conflicts.

🔹 Multipolar Energy Order

As more nations look beyond Western energy firms for support and finance, the architecture of global energy and its financial backbone becomes more plural. Russia’s nuclear push is one axis of this shift.

Why This Matters

Russia’s nuclear diplomacy isn’t just technical or energy policy — it’s part of a reconfiguration of global power and finance. By embedding itself into the energy systems of developing states, Russia secures influence, builds financial dependencies outside Western structures, and accelerates the move toward a more pluralistic global order.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Modern Diplomacy – Russia’s Nuclear Technology Playbook for the Global South Modern Diplomacy

OrePulse – Russia’s Nuclear Energy Advocacy & Partnerships Ore Pulse

Reuters – Russia, Ethiopia sign document calling for construction of nuclear plant Reuters

Chatham House – Russia using Soviet playbook to de-Westernize global order Chatham House

Forbes – Rosatom’s nuclear deals as geopolitical advantage Forbes

CSIS – Reactions in Global South to Russian nuclear threats CSIS

Financial Times – Russia ambitions to lead global nuclear projects Financial Times

~~~~~~~~~

Stablecoins Under Fire: U.S. Tokenization Push vs. EU Multi-Issuance Ban Threat

The tug of war over stablecoins in the U.S. and Europe reflects how the next chapter of money is being written — and who will control the rails, rules, and power behind it.

U.S. Moves: Tokenization & Regulatory Softening

The SEC is exploring allowing blockchain-based versions of stocks (tokenized equities) to trade on crypto exchanges, signaling more openness to merging traditional finance with digital finance.

Nasdaq has formally asked the SEC for a rule change to permit regulated exchanges to trade tokenized stocks under equivalent execution and documentation rules.

Separately, SEC staff signaled they will not recommend enforcement action for advisers using state trust companies to custody crypto when certain safeguards are met.

These developments suggest the U.S. is actively pushing the boundary on tokenization and asset digitization — potentially positioning itself as the regulatory anchor for future digital-asset finance.

Europe’s Pushback: Ban on Multi-Issuance Stablecoins

The European Systemic Risk Board (ESRB) recommended a ban on “multi-issuance” stablecoins (i.e. stablecoins issued jointly across borders or jurisdictions) to prevent financial stability risks.

The ESRB flagged concerns about liquidity mismatches: in a stress event, investors may all redeem stablecoins in jurisdictions with stronger protections, straining those reserves.

The European Central Bank (ECB) and other bodies are pushing for strong equivalence regimes so foreign stablecoin issuers must meet EU regulatory standards — particularly around reserve backing, redemption rights, and cross-border operations.

This is part of a broader concern: the EU wants to guard its financial space from unregulated dollar-pegged tokens like USDC or USDT, whose issuers lie mostly beyond EU control.

How These Developments Fit Into Global Restructuring

🔹 Competing Visions for Money & Authority

The U.S. approach leans toward innovation + regulatory clarity, enabling tokenization of assets and digital finance expansion. Europe's approach leans toward caution + containment, particularly for cross-border or non-EU issuance. These contrasting strategies show a struggle over who defines the rules of digital money.

🔹 De-Dollarization & Currency Alternatives

If Europe restricts dollar-pegged stablecoins, it may accelerate adoption of euro-backed digital currencies or stablecoins issued under EU rules — thereby weakening the dominance of dollar-based tokens in European markets.

🔹 Rail Control & Financial Infrastructure

Stablecoin issuance models define who controls the rails: who mints, redeems, oversees reserves, settles cross-border flows. As the U.S. advances tokenization and Europe clamps down on cross-jurisdiction issuance, the contest is over which financial infrastructures will prevail in the new era.

🔹 Sovereignty, Compliance & Risk

Countries will favor stablecoin networks they can regulate, supervise, and audit. Issuers with multi-jurisdiction models may lose access or be forced to fragment operations. This pressures stablecoin companies to localize — reinforcing multipolar financial architectures.

Key Takeaway

The stablecoin battleground isn’t just technical — it’s a frontline in redefining money, power, and financial sovereignty. U.S. regulatory openings and EU tightening are not just policy moves — they are structural shifts that determine who controls the next generation of money systems.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Cointelegraph – SEC weighs plan to allow blockchain-based stock trading Cointelegraph

Cointelegraph – EU watchdog pushes stablecoin ban: Report Cointelegraph

Reuters / news – European banks form company to launch euro stablecoin Reuters

PYMNTS – ECB Seeks Ban on Multi-Issuance Stablecoins PYMNTS.com

FinanceFeeds – EU Regulator Weighs Ban on Circle, Paxos Stablecoins FinanceFeeds

Other references: Nasdaq’s rule change request Cointelegraph; SEC custody openness Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

A Government Shutdown Begins After Talks Break Down

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

The duration of the shutdown has come increasingly into focus as "the question of the hour," as Veda Partners co-founder Henrietta Treyz noted Tuesday. Another round of votes in the Senate were quickly scheduled for Wednesday.

Senate Majority Whip John Barrasso also told reporters that votes could be scheduled throughout the weekend.

The shutdown — the first since a seven-week stoppage during Trump's first term — began at 12:01 a.m. ET as the new fiscal year began. That last shutdown took place in 2018-19 and broke the record for the longest in American history.

Federal agencies will now implement their contingency plans and send hundreds of thousands of government workers home to wait out a stalemate.

Economic effects might be noticeable quickly as government spending largely ceases and economic data gets delayed, starting this Friday with what was scheduled to be a jobs report from the Bureau of Labor Statistics. These impacts could be mitigated if the stoppage ends promptly.

Trump on Tuesday also promised to heighten the potential effects of a shutdown — in part to pressure Democrats — saying "we can do things during the shutdown that are irreversible."

He added later in the day "a lot of good can come down from shutdowns. We can get rid of a lot of things that we didn't want."

The shutdown is also not the only Washington policy focus for investors Wednesday. Markets will also be digesting new tariffs, as promised duties of 100% on a slice of pharmaceutical products and 25% duties on heavy-duty trucks are scheduled to go into effect.

This week also marked the last formal day on the job for government employees who accepted a Department of Government Efficiency program earlier this year called "fork in the road" that induced tens of thousands to leave government service.

Investors trying to make sense of these varied crosscurrents coming from Washington will likely be most attuned to how long this shutdown lasts and whether policymakers can find any off-ramps to end the gridlock.

What a government shutdown is likely to look like

The stalemate could produce unpredictable economic impacts, some of which could be felt quickly and others that could grow with each passing day.

Much of the immediate market focus is on the government's economic data.

The Bureau of Labor Statistics (BLS) is one of the government's main collectors of data and will "completely cease operations," according to its contingency plan, and temporarily go from a workforce of 2,055 to just a single full-time employee.

The agency's fulsome calendar of economic releases will grind to a stop — starting with Friday’s report on employment known within the financial world as the monthly jobs report.

The plan is similar at other sources of government economic data as the Commerce Department is set to cease operations at both the U.S. Census Bureau and Bureau of Economic Analysis.

One new feature around this shutdown that could add more economic uncertainty is a White House promise to consider mass firings if there is no deal.

TO READ MORE: LINK

“Tidbits From TNT” Wednesday Morning 10-1-2025

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement.

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement. link

Tishwash: Rafidain Bank: 81 branches adopt the comprehensive banking system.

Rafidain Bank announced on Tuesday that 81 branches have joined the comprehensive banking system. The bank stated in a statement that "81 branches have joined the comprehensive banking system, following the entry of the Hudhayfah bin Al-Yaman branch and the General Secretariat of the Council of Ministers branch into the integrated electronic service."

He added, "The implementation of a comprehensive banking system is a critical strategic step, as it enables the transition from traditional paper transactions to modern electronic operations, which contributes to increasing operational efficiency, accelerating transaction completion, and enhancing transparency and accuracy in service delivery."

The bank also stated that "the adoption of this system is in line with the latest global banking practices, constitutes a fundamental pillar for improving the quality of services provided to customers, and paves the way for the development of innovative financial products that reflect the digital transformation in the Iraqi banking sector."

The statement also noted that "the integration of branches into the comprehensive banking system will have a direct impact on customers by reducing transaction processing time, reducing error rates, and providing more secure and flexible digital channels, providing customers with an advanced banking experience that meets their daily needs." link

************

Tishwash: Trade: Conferences with Gulf countries to activate the private sector

In line with government plans and programs designed to stimulate the private sector and enhance its role in the country's development plans, the Ministry of Commerce announced its intention to hold conferences with a number of Gulf countries with the aim of developing partnerships with the private sector and maximizing the country's financial resources.

The ministry's official spokesperson, Mohammed Hanoun, told Al-Sabah that the ministry has included in its plans and policies the activation of international economic and trade relations, in addition to launching new memoranda of understanding with a number of countries, particularly the Kingdom of Saudi Arabia, the States of Kuwait and the United Arab Emirates, to enhance cooperation and support the international private sector. He added that the next phase will witness the organization of joint conferences and seminars with these countries, which have expressed their willingness to cooperate with Iraq in this field.

He indicated that these activities will establish clear foundations for formulating policies related to international relations related to the private sector and investments, which will contribute to maximizing the country's resources without placing an additional burden on government budgets.

Hanoun explained that Iraq's recent accession to the World Trade Organization will contribute to the implementation of decisions and laws related to the economy, food security, and support for local products, in line with local market requirements. This is in line with the government's approach to prioritizing the private sector and activating it to work alongside the public sector. He confirmed that his ministry has submitted new draft laws to the House of Representatives that will strengthen international economic and trade relations.

He pointed out that the Ministry has succeeded in automating all its procedures and transitioning to digital work in various fields, particularly those related to the private sector. It has created a new electronic platform called "Al-Tajer" to facilitate the process of registering merchants and obtaining their licenses.

In the same context, the Ministry of Commerce spokesperson revealed that many Gulf investors and businessmen, most notably Kuwait, Saudi Arabia, and the UAE, have expressed their willingness to enter into investment partnerships with Iraq. He explained that digital transformation will be an attractive factor for them, as it will facilitate the formulation of plans and policies, free from complex administrative routine.

He emphasized the importance of electronic platforms, as they will enable transactions to be completed and approvals obtained within record timeframes, enhancing the investment climate while simultaneously providing international companies and investors with a more flexible operating environment. link

Mot: .. sooooo -- Thats How They Did it!!!!

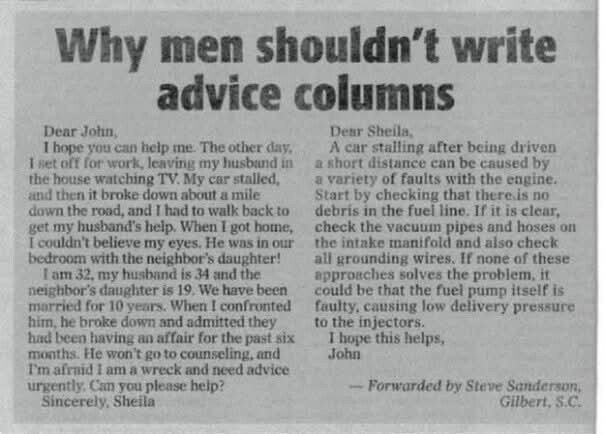

Mot: They Say - MEN SHOULDN'T WRITE ADVICE COLUMNS!!

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Tuesday Evening 9-30-25

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Why BRICS Seeks Alternatives to Bretton Woods Institutions

BRICS critics say the IMF and World Bank are Western-dominated, with voting structures, loan conditions, and policy preferences favoring U.S. and European interests.

Loans from those institutions often come with policy strings, governance conditions, structural adjustments, which developing states see as infringing on sovereignty.

In response, BRICS has already built the New Development Bank (NDB) and Contingent Reserve Arrangement (CRA), as alternative financial mechanisms.

What BRICS Face in Building a Rival

🔹 Scale & Capital Constraints

The IMF has resources exceeding $1 trillion, while NDB’s approved loan book is far smaller (circa $30 billion).

Member states compete to have their national currencies used in lending, creating friction in unified currency strategy.

🔹 Institutional Credibility & Network Effects

IMF and World Bank have decades of institutional trust, deep data infrastructure, large global talent pools, and legal frameworks that new institutions must build from scratch.

BRICS success hinges on whether they can offer assistance without harsh conditionality, attracting countries disillusioned with Western institutions.

Recent Signals: Reform and Pushback

In July 2025, BRICS finance ministers made a unified proposal to reform the IMF: reallocating voting quotas to better reflect emerging economies, and challenging European dominance over leadership roles.

Earlier, Russia had urged BRICS to establish its own IMF-style institution as a counter to Western influence.

The CRA (Contingent Reserve Arrangement) is a preexisting framework among BRICS to provide liquidity support, viewed already as a partial competitor to IMF.

How This Could Reshape Global Alignments

🔹 Redistribution of Financial Power

If BRICS can scale its banks and mechanisms, capitals and credit decisions may shift away from Washington, London, and Brussels toward emerging centers in Asia, Africa, and Latin America.

🔹 Alternative Conditions & Sovereignty

Loans without strict Western policy prescriptions would be more attractive to borrowers seeking autonomy. That would shift the bargaining power in global finance toward borrower states and away from donor nations.

🔹 Multipolar Financial Order

A working BRICS rival would encourage blocs like Africa, Latin America, ASEAN, and Middle Eastern states to link with multiple financial systems rather than depending on a single “Western” architecture.

🔹 Accelerated De-Dollarization

As BRICS institutions lend in local currencies and support non-USD denominated systems, reliance on the U.S. dollar for reserves, loans, and trade settlement could weaken in some corridors.

🔹 Network & Legal Ecosystems

For a truly effective rival, BRICS must build legal, data, risk, auditing, regulatory, and governance frameworks — essentially a parallel financial infrastructure.

Why This Matters

The idea of BRICS creating a real rival to IMF/World Bank is more than academic — it is about who controls global credit, who sets financial norms, and where capital flows. As more countries experience the burden of Western conditionality, BRICS’ alternatives grow more attractive. The outcome could be a world where multiple financial centers coexist, each with its own rails, influence, and currencies.

This potential shift underscores a deeper transformation: the restructuring of the global financial world order before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – Could BRICS Create a Rival to the IMF and World Bank? Watcher Guru

Wikipedia – BRICS Contingent Reserve Arrangement (CRA) Wikipedia

Wikipedia – New Development Bank (NDB) Wikipedia

Reuters – BRICS finance ministers unify on IMF reforms Reuters

Reuters – Russia calls for alternative to IMF Reuters

~~~~~~~~~

Top BRICS Countries With the Highest Gold Reserves in 2025

Gold reserve accumulation by BRICS is more than a financial strategy — it’s a signaling move in the remaking of global monetary influence.

BRICS’ Gold Holdings: Who Leads & Why It Matters

As of 2025, BRICS nations collectively hold over 6,000 metric tons of gold, amounting to roughly 20–21% of global central bank gold reserves.

Russia leads with 2,335.85 tons; China follows closely with 2,298.53 tons.

India ranks third within BRICS at 879.98 tons. Brazil and South Africa hold more modest reserves: 129.65 and 125.47 tons respectively.

Russia and China together control about 74% of BRICS’ gold reserves, giving them disproportionate leverage within the bloc.

Why Gold Is Central to the BRICS Strategy

🔹 Hedge against currency volatility

Gold provides a tangible store of value that is not tied to any one fiat currency. In times of sanctions or dollar weakness, these reserves serve as a stabilizer for national balance sheets.

🔹 Backing for emerging financial vehicles

If BRICS pushes forward on ideas like a common currency, or gold-linked settlement systems, these reserves are the credibility behind those proposals.

🔹 Sign of financial sovereignty

Aggressive accumulation—despite sanctions or geopolitical pressure—signals determination to reduce dependency on Western financial systems.

Broader Impacts & Alignments

🔹 Shifting reserve structure globally

While BRICS is solidifying its gold base, traditional reserve holders (U.S., Europe) still control large gold reserves. The U.S., for example, holds about 8,133.5 tons per World Gold Council/IMF gold data.

That gap remains large, but the rate of increase and redistribution is key: growth among emerging powers changes the marginal influence of gold in global finance.

🔹 Fueling de-dollarization and alternative monetary schemes

As BRICS holds more gold and strengthens alternative infrastructure (e.g. tokenization, blockchain payments, local currency trade), the rationale behind dependence on the U.S. dollar comes under increasing strain.

🔹 Power inside BRICS & candidate alignment

Countries with heavier gold reserves (Russia, China) will have more influence in shaping BRICS policy: who joins, what financial systems are built, how loans and investments flow. Nations seeing opportunities or exclusion may align based on where they see the most leverage.

🔹 Potential for a gold-anchored BRICS currency

There is speculation that BRICS may develop a new common currency, possibly backed by or linked to gold. Such a move would reposition gold from a reserve metal to basis for a functioning cross-border monetary instrument.

Why This Matters

Gold accumulation is not passive — it is a deliberate infrastructural investment in financial autonomy, currency power, and status in a multipolar world. BRICS countries are setting up a foundation for a system less beholden to Western-dominated institutions and the dollar.

This shift is part of a broader re-engineering of global finance: new blocs, new rails, new legitimacy.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru — Top BRICS Countries With the Highest Gold Reserves in 2025 Watcher Guru

FastBull — BRICS accelerates dedollarization with over 6,000 tons of gold FastBull

Nestmann — The BRICS De-Dollarization & What It Means for Gold The Nestmann Group

InternationalInvestment/Bullion Analytics — Top Gold Reserve Countries in 2025 International Investment

GoldHub / World Gold Council — Central bank gold reserves by country World Gold Council

Reuters — How much gold will China need to diversify reserves? Reuters

Financial Times survey — Central banks plan to boost gold reserves and trim dollar holdings ft.com

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Evening 9-30-25

The Dollar Rose Against The Dinar In Baghdad.

Stock Exchange Economy News – Baghdad The US dollar exchange rate rose in Baghdad markets on Tuesday morning. The dollar exchange rate rose on the Al-Kifah and Al-Harithiya stock exchanges, reaching 141,650 Iraqi dinars per $100. On Monday, the exchange rate stood at 141,400 Iraqi dinars per $100.

The Dollar Rose Against The Dinar In Baghdad.

Stock Exchange Economy News – Baghdad The US dollar exchange rate rose in Baghdad markets on Tuesday morning. The dollar exchange rate rose on the Al-Kifah and Al-Harithiya stock exchanges, reaching 141,650 Iraqi dinars per $100. On Monday, the exchange rate stood at 141,400 Iraqi dinars per $100.

Foreign exchange rates in Baghdad's local markets rose, with the selling price reaching 142,750 Iraqi dinars per $100, and the buying price reaching 140,750 dinars per $100. https://economy-news.net/content.php?id=60548

Gold Hits New Record High

Time: 2025/09/30 08:35:30 Reading: 105 times {Economic: Al Furat News} Gold hit a new high on Tuesday, heading for its best monthly performance since August 2011, supported by strong demand for safe havens amid fears of a potential US government shutdown and growing expectations of interest rate cuts.

Spot gold rose 0.4% to $3,848.65 per ounce, while US futures for December delivery rose 0.6% to $3,877 per ounce. In September alone, gold prices rose 11.6%, the best monthly jump in 14 years.

In contrast, spot silver settled at $46.93 per ounce, up 18.2% since the beginning of the month, on track for its best monthly performance since July 2020. While platinum fell 0.8% to $1,588.70 an ounce, palladium fell 0.7% to $1,258.60. LINK

Oil Prices Fall As Oversupply Concerns Mount

Economy | 09:05 - 09/30/2025 Mawazine News - Follow-up Oil prices fell on Tuesday, amid expectations of a further increase in OPEC+ production and the resumption of oil exports from the Kurdistan Region of Iraq via Turkey, which reinforced concerns about a global supply glut.

Brent crude futures for November delivery fell 54 cents, or 0.8%, to $67.43 a barrel, while the more active December contract fell 53 cents to $66.56 a barrel. US West Texas Intermediate crude fell 50 cents, or 0.8%, to $62.95 a barrel.

This decline follows losses on Monday, when both Brent and WTI fell more than 3%, their largest daily decline since early August. https://www.mawazin.net/Details.aspx?jimare=267602

The First Tanker Carrying Oil From Kurdistan Will Be Loaded At The Port Of Ceyhan Next Thursday

Energy Economy News – Baghdad Two oil industry sources told Reuters that 700,000 barrels of Iraqi Kurdistan oil are scheduled to be loaded onto the tanker Valisina at the Turkish port of Ceyhan on October 2.

The two sources, who spoke on condition of anonymity, added that the Valisina will be the first tanker to carry Iraqi Kurdistan crude after the resumption of oil flows from the semi-autonomous region via Türkiye on September 27.

Iraqi Oil Minister Hayan Abdul Ghani said last Friday that the agreement between the Iraqi federal government, the Kurdistan Regional Government, and foreign oil producers operating in the region will allow between 180,000 and 190,000 barrels of oil per day to flow to the Turkish port of Ceyhan.

For his part, the Iraqi Undersecretary of the Ministry of Oil stated that the resumption of oil flows from the Kurdistan Region will contribute to raising the country's exports to approximately 3.6 million barrels per day in the coming days. He explained that Iraq's production and export levels will remain within its OPEC quota of 4.2 million barrels per day.

Crude oil flows through a pipeline from the Kurdistan Region of Iraq to Türkiye resumed for the first time in two and a half years, following an interim agreement that ended the deadlock. https://economy-news.net/content.php?id=60562

Rafidain: 81 Branches Adopt The Comprehensive Banking System

Economy | 09:27 - 09/30/2025 image Mawazine News – Baghdad Rafidain: 81 branches adopt the comprehensive banking system https://www.mawazin.net/Details.aspx?jimare=267605

Integrity: Digital Transformation Contributes To Reducing Corruption And Maximizing State Revenues.

Local The Chairman of the Federal Integrity Commission, Mohammed Ali Al-Lami, stressed on Tuesday the importance of state institutions automating their procedures and shifting towards governance and digitization, particularly in sectors related to enhancing and maximizing state revenues.

During his meeting with Thamer Qasim Daoud, Director General of the General Authority of Customs, Al-Lami highlighted the importance of concerted efforts by state institutions to preserve public funds, ensure they are not wasted, and spend them on their allocated resources.

He commended all efforts dedicated to protecting the national economy, preventing the smuggling of illegal goods and tax evasion, and preventing any harm to the national product.

He stressed the need to focus on proactive preventative measures to combat corruption, noting that one of the most important mechanisms for protecting and preserving public funds is transparency in work procedures, to prevent the risks of corruption before they occur.

He praised the efforts of state institutions to automate all their procedures and transition from manual, paper-based work to digitizing those procedures, noting that this contributes significantly to reducing corruption and narrowing its channels.

For his part, the Director General of the General Authority of Customs praised the cooperation and coordination between the regulatory authorities and those operating at the ports in monitoring the exit of goods and commodities through border crossings, working to collect customs duties on imported goods, preventing smuggling, and protecting the national product.

He stressed the need to prevent corruption in this important sector and not to provide exemptions or customs facilities that violate laws and regulations. https://economy-news.net/content.php?id=60565

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com