A Government Shutdown Begins After Talks Break Down

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

The duration of the shutdown has come increasingly into focus as "the question of the hour," as Veda Partners co-founder Henrietta Treyz noted Tuesday. Another round of votes in the Senate were quickly scheduled for Wednesday.

Senate Majority Whip John Barrasso also told reporters that votes could be scheduled throughout the weekend.

The shutdown — the first since a seven-week stoppage during Trump's first term — began at 12:01 a.m. ET as the new fiscal year began. That last shutdown took place in 2018-19 and broke the record for the longest in American history.

Federal agencies will now implement their contingency plans and send hundreds of thousands of government workers home to wait out a stalemate.

Economic effects might be noticeable quickly as government spending largely ceases and economic data gets delayed, starting this Friday with what was scheduled to be a jobs report from the Bureau of Labor Statistics. These impacts could be mitigated if the stoppage ends promptly.

Trump on Tuesday also promised to heighten the potential effects of a shutdown — in part to pressure Democrats — saying "we can do things during the shutdown that are irreversible."

He added later in the day "a lot of good can come down from shutdowns. We can get rid of a lot of things that we didn't want."

The shutdown is also not the only Washington policy focus for investors Wednesday. Markets will also be digesting new tariffs, as promised duties of 100% on a slice of pharmaceutical products and 25% duties on heavy-duty trucks are scheduled to go into effect.

This week also marked the last formal day on the job for government employees who accepted a Department of Government Efficiency program earlier this year called "fork in the road" that induced tens of thousands to leave government service.

Investors trying to make sense of these varied crosscurrents coming from Washington will likely be most attuned to how long this shutdown lasts and whether policymakers can find any off-ramps to end the gridlock.

What a government shutdown is likely to look like

The stalemate could produce unpredictable economic impacts, some of which could be felt quickly and others that could grow with each passing day.

Much of the immediate market focus is on the government's economic data.

The Bureau of Labor Statistics (BLS) is one of the government's main collectors of data and will "completely cease operations," according to its contingency plan, and temporarily go from a workforce of 2,055 to just a single full-time employee.

The agency's fulsome calendar of economic releases will grind to a stop — starting with Friday’s report on employment known within the financial world as the monthly jobs report.

The plan is similar at other sources of government economic data as the Commerce Department is set to cease operations at both the U.S. Census Bureau and Bureau of Economic Analysis.

One new feature around this shutdown that could add more economic uncertainty is a White House promise to consider mass firings if there is no deal.

TO READ MORE: LINK

“Tidbits From TNT” Wednesday Morning 10-1-2025

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement.

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement. link

Tishwash: Rafidain Bank: 81 branches adopt the comprehensive banking system.

Rafidain Bank announced on Tuesday that 81 branches have joined the comprehensive banking system. The bank stated in a statement that "81 branches have joined the comprehensive banking system, following the entry of the Hudhayfah bin Al-Yaman branch and the General Secretariat of the Council of Ministers branch into the integrated electronic service."

He added, "The implementation of a comprehensive banking system is a critical strategic step, as it enables the transition from traditional paper transactions to modern electronic operations, which contributes to increasing operational efficiency, accelerating transaction completion, and enhancing transparency and accuracy in service delivery."

The bank also stated that "the adoption of this system is in line with the latest global banking practices, constitutes a fundamental pillar for improving the quality of services provided to customers, and paves the way for the development of innovative financial products that reflect the digital transformation in the Iraqi banking sector."

The statement also noted that "the integration of branches into the comprehensive banking system will have a direct impact on customers by reducing transaction processing time, reducing error rates, and providing more secure and flexible digital channels, providing customers with an advanced banking experience that meets their daily needs." link

************

Tishwash: Trade: Conferences with Gulf countries to activate the private sector

In line with government plans and programs designed to stimulate the private sector and enhance its role in the country's development plans, the Ministry of Commerce announced its intention to hold conferences with a number of Gulf countries with the aim of developing partnerships with the private sector and maximizing the country's financial resources.

The ministry's official spokesperson, Mohammed Hanoun, told Al-Sabah that the ministry has included in its plans and policies the activation of international economic and trade relations, in addition to launching new memoranda of understanding with a number of countries, particularly the Kingdom of Saudi Arabia, the States of Kuwait and the United Arab Emirates, to enhance cooperation and support the international private sector. He added that the next phase will witness the organization of joint conferences and seminars with these countries, which have expressed their willingness to cooperate with Iraq in this field.

He indicated that these activities will establish clear foundations for formulating policies related to international relations related to the private sector and investments, which will contribute to maximizing the country's resources without placing an additional burden on government budgets.

Hanoun explained that Iraq's recent accession to the World Trade Organization will contribute to the implementation of decisions and laws related to the economy, food security, and support for local products, in line with local market requirements. This is in line with the government's approach to prioritizing the private sector and activating it to work alongside the public sector. He confirmed that his ministry has submitted new draft laws to the House of Representatives that will strengthen international economic and trade relations.

He pointed out that the Ministry has succeeded in automating all its procedures and transitioning to digital work in various fields, particularly those related to the private sector. It has created a new electronic platform called "Al-Tajer" to facilitate the process of registering merchants and obtaining their licenses.

In the same context, the Ministry of Commerce spokesperson revealed that many Gulf investors and businessmen, most notably Kuwait, Saudi Arabia, and the UAE, have expressed their willingness to enter into investment partnerships with Iraq. He explained that digital transformation will be an attractive factor for them, as it will facilitate the formulation of plans and policies, free from complex administrative routine.

He emphasized the importance of electronic platforms, as they will enable transactions to be completed and approvals obtained within record timeframes, enhancing the investment climate while simultaneously providing international companies and investors with a more flexible operating environment. link

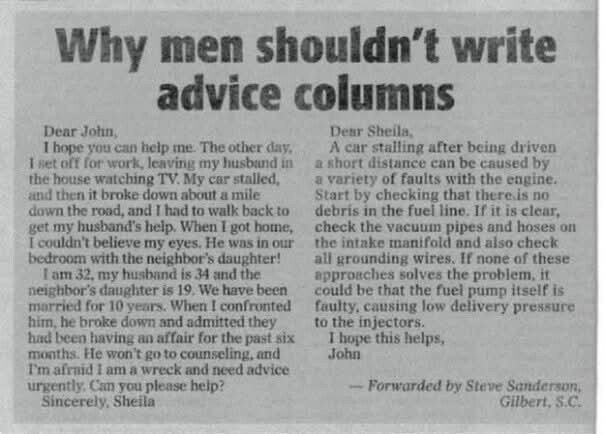

Mot: .. sooooo -- Thats How They Did it!!!!

Mot: They Say - MEN SHOULDN'T WRITE ADVICE COLUMNS!!

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Tuesday Evening 9-30-25

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Why BRICS Seeks Alternatives to Bretton Woods Institutions

BRICS critics say the IMF and World Bank are Western-dominated, with voting structures, loan conditions, and policy preferences favoring U.S. and European interests.

Loans from those institutions often come with policy strings, governance conditions, structural adjustments, which developing states see as infringing on sovereignty.

In response, BRICS has already built the New Development Bank (NDB) and Contingent Reserve Arrangement (CRA), as alternative financial mechanisms.

What BRICS Face in Building a Rival

🔹 Scale & Capital Constraints

The IMF has resources exceeding $1 trillion, while NDB’s approved loan book is far smaller (circa $30 billion).

Member states compete to have their national currencies used in lending, creating friction in unified currency strategy.

🔹 Institutional Credibility & Network Effects

IMF and World Bank have decades of institutional trust, deep data infrastructure, large global talent pools, and legal frameworks that new institutions must build from scratch.

BRICS success hinges on whether they can offer assistance without harsh conditionality, attracting countries disillusioned with Western institutions.

Recent Signals: Reform and Pushback

In July 2025, BRICS finance ministers made a unified proposal to reform the IMF: reallocating voting quotas to better reflect emerging economies, and challenging European dominance over leadership roles.

Earlier, Russia had urged BRICS to establish its own IMF-style institution as a counter to Western influence.

The CRA (Contingent Reserve Arrangement) is a preexisting framework among BRICS to provide liquidity support, viewed already as a partial competitor to IMF.

How This Could Reshape Global Alignments

🔹 Redistribution of Financial Power

If BRICS can scale its banks and mechanisms, capitals and credit decisions may shift away from Washington, London, and Brussels toward emerging centers in Asia, Africa, and Latin America.

🔹 Alternative Conditions & Sovereignty

Loans without strict Western policy prescriptions would be more attractive to borrowers seeking autonomy. That would shift the bargaining power in global finance toward borrower states and away from donor nations.

🔹 Multipolar Financial Order

A working BRICS rival would encourage blocs like Africa, Latin America, ASEAN, and Middle Eastern states to link with multiple financial systems rather than depending on a single “Western” architecture.

🔹 Accelerated De-Dollarization

As BRICS institutions lend in local currencies and support non-USD denominated systems, reliance on the U.S. dollar for reserves, loans, and trade settlement could weaken in some corridors.

🔹 Network & Legal Ecosystems

For a truly effective rival, BRICS must build legal, data, risk, auditing, regulatory, and governance frameworks — essentially a parallel financial infrastructure.

Why This Matters

The idea of BRICS creating a real rival to IMF/World Bank is more than academic — it is about who controls global credit, who sets financial norms, and where capital flows. As more countries experience the burden of Western conditionality, BRICS’ alternatives grow more attractive. The outcome could be a world where multiple financial centers coexist, each with its own rails, influence, and currencies.

This potential shift underscores a deeper transformation: the restructuring of the global financial world order before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – Could BRICS Create a Rival to the IMF and World Bank? Watcher Guru

Wikipedia – BRICS Contingent Reserve Arrangement (CRA) Wikipedia

Wikipedia – New Development Bank (NDB) Wikipedia

Reuters – BRICS finance ministers unify on IMF reforms Reuters

Reuters – Russia calls for alternative to IMF Reuters

~~~~~~~~~

Top BRICS Countries With the Highest Gold Reserves in 2025

Gold reserve accumulation by BRICS is more than a financial strategy — it’s a signaling move in the remaking of global monetary influence.

BRICS’ Gold Holdings: Who Leads & Why It Matters

As of 2025, BRICS nations collectively hold over 6,000 metric tons of gold, amounting to roughly 20–21% of global central bank gold reserves.

Russia leads with 2,335.85 tons; China follows closely with 2,298.53 tons.

India ranks third within BRICS at 879.98 tons. Brazil and South Africa hold more modest reserves: 129.65 and 125.47 tons respectively.

Russia and China together control about 74% of BRICS’ gold reserves, giving them disproportionate leverage within the bloc.

Why Gold Is Central to the BRICS Strategy

🔹 Hedge against currency volatility

Gold provides a tangible store of value that is not tied to any one fiat currency. In times of sanctions or dollar weakness, these reserves serve as a stabilizer for national balance sheets.

🔹 Backing for emerging financial vehicles

If BRICS pushes forward on ideas like a common currency, or gold-linked settlement systems, these reserves are the credibility behind those proposals.

🔹 Sign of financial sovereignty

Aggressive accumulation—despite sanctions or geopolitical pressure—signals determination to reduce dependency on Western financial systems.

Broader Impacts & Alignments

🔹 Shifting reserve structure globally

While BRICS is solidifying its gold base, traditional reserve holders (U.S., Europe) still control large gold reserves. The U.S., for example, holds about 8,133.5 tons per World Gold Council/IMF gold data.

That gap remains large, but the rate of increase and redistribution is key: growth among emerging powers changes the marginal influence of gold in global finance.

🔹 Fueling de-dollarization and alternative monetary schemes

As BRICS holds more gold and strengthens alternative infrastructure (e.g. tokenization, blockchain payments, local currency trade), the rationale behind dependence on the U.S. dollar comes under increasing strain.

🔹 Power inside BRICS & candidate alignment

Countries with heavier gold reserves (Russia, China) will have more influence in shaping BRICS policy: who joins, what financial systems are built, how loans and investments flow. Nations seeing opportunities or exclusion may align based on where they see the most leverage.

🔹 Potential for a gold-anchored BRICS currency

There is speculation that BRICS may develop a new common currency, possibly backed by or linked to gold. Such a move would reposition gold from a reserve metal to basis for a functioning cross-border monetary instrument.

Why This Matters

Gold accumulation is not passive — it is a deliberate infrastructural investment in financial autonomy, currency power, and status in a multipolar world. BRICS countries are setting up a foundation for a system less beholden to Western-dominated institutions and the dollar.

This shift is part of a broader re-engineering of global finance: new blocs, new rails, new legitimacy.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru — Top BRICS Countries With the Highest Gold Reserves in 2025 Watcher Guru

FastBull — BRICS accelerates dedollarization with over 6,000 tons of gold FastBull

Nestmann — The BRICS De-Dollarization & What It Means for Gold The Nestmann Group

InternationalInvestment/Bullion Analytics — Top Gold Reserve Countries in 2025 International Investment

GoldHub / World Gold Council — Central bank gold reserves by country World Gold Council

Reuters — How much gold will China need to diversify reserves? Reuters

Financial Times survey — Central banks plan to boost gold reserves and trim dollar holdings ft.com

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Evening 9-30-25

The Dollar Rose Against The Dinar In Baghdad.

Stock Exchange Economy News – Baghdad The US dollar exchange rate rose in Baghdad markets on Tuesday morning. The dollar exchange rate rose on the Al-Kifah and Al-Harithiya stock exchanges, reaching 141,650 Iraqi dinars per $100. On Monday, the exchange rate stood at 141,400 Iraqi dinars per $100.

The Dollar Rose Against The Dinar In Baghdad.

Stock Exchange Economy News – Baghdad The US dollar exchange rate rose in Baghdad markets on Tuesday morning. The dollar exchange rate rose on the Al-Kifah and Al-Harithiya stock exchanges, reaching 141,650 Iraqi dinars per $100. On Monday, the exchange rate stood at 141,400 Iraqi dinars per $100.

Foreign exchange rates in Baghdad's local markets rose, with the selling price reaching 142,750 Iraqi dinars per $100, and the buying price reaching 140,750 dinars per $100. https://economy-news.net/content.php?id=60548

Gold Hits New Record High

Time: 2025/09/30 08:35:30 Reading: 105 times {Economic: Al Furat News} Gold hit a new high on Tuesday, heading for its best monthly performance since August 2011, supported by strong demand for safe havens amid fears of a potential US government shutdown and growing expectations of interest rate cuts.

Spot gold rose 0.4% to $3,848.65 per ounce, while US futures for December delivery rose 0.6% to $3,877 per ounce. In September alone, gold prices rose 11.6%, the best monthly jump in 14 years.

In contrast, spot silver settled at $46.93 per ounce, up 18.2% since the beginning of the month, on track for its best monthly performance since July 2020. While platinum fell 0.8% to $1,588.70 an ounce, palladium fell 0.7% to $1,258.60. LINK

Oil Prices Fall As Oversupply Concerns Mount

Economy | 09:05 - 09/30/2025 Mawazine News - Follow-up Oil prices fell on Tuesday, amid expectations of a further increase in OPEC+ production and the resumption of oil exports from the Kurdistan Region of Iraq via Turkey, which reinforced concerns about a global supply glut.

Brent crude futures for November delivery fell 54 cents, or 0.8%, to $67.43 a barrel, while the more active December contract fell 53 cents to $66.56 a barrel. US West Texas Intermediate crude fell 50 cents, or 0.8%, to $62.95 a barrel.

This decline follows losses on Monday, when both Brent and WTI fell more than 3%, their largest daily decline since early August. https://www.mawazin.net/Details.aspx?jimare=267602

The First Tanker Carrying Oil From Kurdistan Will Be Loaded At The Port Of Ceyhan Next Thursday

Energy Economy News – Baghdad Two oil industry sources told Reuters that 700,000 barrels of Iraqi Kurdistan oil are scheduled to be loaded onto the tanker Valisina at the Turkish port of Ceyhan on October 2.

The two sources, who spoke on condition of anonymity, added that the Valisina will be the first tanker to carry Iraqi Kurdistan crude after the resumption of oil flows from the semi-autonomous region via Türkiye on September 27.

Iraqi Oil Minister Hayan Abdul Ghani said last Friday that the agreement between the Iraqi federal government, the Kurdistan Regional Government, and foreign oil producers operating in the region will allow between 180,000 and 190,000 barrels of oil per day to flow to the Turkish port of Ceyhan.

For his part, the Iraqi Undersecretary of the Ministry of Oil stated that the resumption of oil flows from the Kurdistan Region will contribute to raising the country's exports to approximately 3.6 million barrels per day in the coming days. He explained that Iraq's production and export levels will remain within its OPEC quota of 4.2 million barrels per day.

Crude oil flows through a pipeline from the Kurdistan Region of Iraq to Türkiye resumed for the first time in two and a half years, following an interim agreement that ended the deadlock. https://economy-news.net/content.php?id=60562

Rafidain: 81 Branches Adopt The Comprehensive Banking System

Economy | 09:27 - 09/30/2025 image Mawazine News – Baghdad Rafidain: 81 branches adopt the comprehensive banking system https://www.mawazin.net/Details.aspx?jimare=267605

Integrity: Digital Transformation Contributes To Reducing Corruption And Maximizing State Revenues.

Local The Chairman of the Federal Integrity Commission, Mohammed Ali Al-Lami, stressed on Tuesday the importance of state institutions automating their procedures and shifting towards governance and digitization, particularly in sectors related to enhancing and maximizing state revenues.

During his meeting with Thamer Qasim Daoud, Director General of the General Authority of Customs, Al-Lami highlighted the importance of concerted efforts by state institutions to preserve public funds, ensure they are not wasted, and spend them on their allocated resources.

He commended all efforts dedicated to protecting the national economy, preventing the smuggling of illegal goods and tax evasion, and preventing any harm to the national product.

He stressed the need to focus on proactive preventative measures to combat corruption, noting that one of the most important mechanisms for protecting and preserving public funds is transparency in work procedures, to prevent the risks of corruption before they occur.

He praised the efforts of state institutions to automate all their procedures and transition from manual, paper-based work to digitizing those procedures, noting that this contributes significantly to reducing corruption and narrowing its channels.

For his part, the Director General of the General Authority of Customs praised the cooperation and coordination between the regulatory authorities and those operating at the ports in monitoring the exit of goods and commodities through border crossings, working to collect customs duties on imported goods, preventing smuggling, and protecting the national product.

He stressed the need to prevent corruption in this important sector and not to provide exemptions or customs facilities that violate laws and regulations. https://economy-news.net/content.php?id=60565

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 9-30-25

Good Afternoon Dinar Recaps,

U.S. Sees Historic Exodus: Over 154,000 Federal Workers Depart

The largest one-week exit of civil servants in modern history signals deep institutional rupture — with implications far beyond Washington.

Good Afternoon Dinar Recaps,

U.S. Sees Historic Exodus: Over 154,000 Federal Workers Depart

The largest one-week exit of civil servants in modern history signals deep institutional rupture — with implications far beyond Washington.

What’s Really Happening

Around 154,000 federal workers are leaving government payroll this week — officially resigning under the Trump administration’s deferred resignation / buyout program.

Earlier reports projected 100,000+ resignations, which now appear to be part of a larger wave.

Many of those employees had already been on administrative leave for months, paid through the end of September despite not working.

The program is designed to reduce the federal workforce by ~300,000 jobs in total by the end of the year, representing roughly 12.5% of the civilian federal workforce.

Institutional Risks & Financial Pressure

This mass exodus will lead to a “brain drain”: loss of institutional memory, weakened agency capacity, and a gap in critical technical, scientific, and regulatory roles (e.g. NASA, CDC, Agriculture).

Agencies will need to contract, outsource, or rebuild functions, which raises transitional costs and inefficiencies.

The government projects $28 billion in annual savings, but critics argue the short-term cost, legal risks, and service disruption may exceed benefits.

Global & Structural Implications

🔹 Erosion of Trust in Institutions

When a major government deliberately sheds large swaths of its professional workforce, it signals a shift in how the state perceives its role. Other countries watching U.S. internal restructuring may adjust their expectations: less reliability, more volatility.

🔹 Reallocation of Capital & Talent

Those leaving may reenter private sectors or new institutions, shifting expertise, capital, and influence away from public systems. This movement supports the growth of new governance, tech, or finance platforms outside traditional state structures.

🔹 Precedent for Other Governments

If the U.S. — long considered the institutional gold standard — pursues deep cuts, it gives cover to other nations to attempt similar transformations. Coupled with pressures from debt, sanctions, or economic disruptions, nations may justify major overhauls of civil service or public institutions.

🔹 Interplay with Global Restructuring

This institutional shake-up fits with other tectonic shifts: de-dollarization, new trade blocs, alternative financial systems. A weaker, leaner U.S. administrative state means less capacity to manage global order. Other powers and blocs (BRICS, China, regional institutions) may step into the void.

Why This Matters

This isn’t a routine downsizing. It’s a structural break in how government operates, financed, and is perceived. The consequences ripple into legislative competence, global strategy, and the balance of power in diplomatic and financial arenas.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Reuters / Washington / reporting – U.S. government faces brain drain as 154,000 federal workers exit this week Reuters

The Guardian – More than 100,000 federal workers to quit amid government shutdown pressures The Guardian+1

Washington Post / fund analyses of deferred resignation program The Washington Post

Wikipedia / documentation of the 2025 U.S. federal deferred resignation program Wikipedia

Records of workforce downsizing, OPM data, and agency cuts Wikipedia

~~~~~~~~~

“Out With the Old, In With the New”: Pete Hegseth Signals Military Reset

“This is not just politics — it’s global finance restructuring before our eyes.”

In a sharp address to U.S. generals and admirals, Secretary of War Pete Hegseth declared that the “era of the Department of Defense is over.” His message: the military will be purged of “woke” policies, higher standards will be enforced, and leaders unwilling to adapt should resign.

This is more than rhetoric — it signals a structural reset of the armed forces, which could tie directly into broader institutional and financial change.

Key Highlights

Renaming the Department → Defense is “dead”; it’s now the War Department, emphasizing offense and strength.

Warrior Ethos Restored → “Peace through strength” replaces political correctness as guiding doctrine.

Fitness & Discipline → Generals failing physical tests or grooming standards must step aside.

End of DEI & Woke Policies → Leadership will no longer cater to identity-based initiatives.

Oversight Shake-Up → Inspector General reforms to reduce internal resistance.

Ultimatum → Those opposed should retire: “We will thank you for your service.”

Why This Matters

By forcing out the old guard and consolidating loyalty, Hegseth is preparing the military for a new era of centralized, disciplined authority. In times of political uncertainty or financial turbulence, this kind of restructured military becomes a stabilizing force — or a lever of change.

When military leadership resets, it often mirrors — and prepares for — a reset in governance and finance. Out with the old, in with the new applies not just to generals, but to the global system itself.

@ Newshounds News™ Exclusive

Sources

~~~~~~~~~

Stablecoins, G7 Regulation & the Timeline to Reset

“This is not just politics — it’s global finance restructuring before our eyes.”

Why Stablecoin Laws Matter

Stablecoins are no longer fringe crypto projects — they’re now central to how nations think about digital money and financial sovereignty. The G7 countries are moving at different speeds, creating a staggered path toward being “reset-ready.”

G7 Progress Toward Stablecoin Regulation

Japan – First to act (2023). Banks can issue yen-backed stablecoins. Already live → High readiness.

EU (France, Germany, Italy) – MiCA law fully in effect by 2025. Strong reserves, audits, euro-backed tokens → Very high readiness.

United States – GENIUS Act (2025) passed, but full enforcement may take until 2027. Dollar-tokens will be tightly controlled → Medium-High readiness.

United Kingdom – Draft laws under review. Real enforcement likely by 2026 → Medium readiness.

Canada – Early oversight in place, but no dedicated stablecoin charter until at least 2027 → Medium-Low readiness.

Why This Matters

First movers (Japan, EU) gain leverage in shaping digital money standards.

Dollar vs. multipolarity – Regulated euro/yen tokens challenge dollar stablecoins.

Global reset fuel – Once multiple G7s are “reset-ready,” stablecoins can underpin new cross-border systems, opening the door to asset-backed or revalued currencies.

Reset Timeline (Approximate)

2025–26: Japan, EU go live; US builds rulebook.

2027: US, UK frameworks mature; Canada follows.

2028–30: Stablecoins integrated in payments, paving the way for systemic reset.

The path is clear: regulation of stablecoins is the foundation for new financial infrastructure. Each country’s pace determines its leverage in a reset.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources

Cointelegraph – Stablecoins across the G7

Reuters – BIS Warning on Stablecoins

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday 9-30-2025

TNT:

Tishwash: BRICS Development Bank Vice President: The process of abandoning the dollar is underway

Paulo Batista Nogueira, Managing Director of the International Monetary Fund and Vice President of the New Development Bank, confirmed on Monday that the process of abandoning the dollar, or what he described as "dollarization," is already underway.

He noted that the dollar is expensive and risky, and that the United States is undermining its credibility through its behavior.

"Expanding the bank is essential, and expanding the political structure of the BRICS group is another matter," Nogueira told Sputnik on the sidelines of the Valdai Discussion Club.

TNT:

Tishwash: BRICS Development Bank Vice President: The process of abandoning the dollar is underway

Paulo Batista Nogueira, Managing Director of the International Monetary Fund and Vice President of the New Development Bank, confirmed on Monday that the process of abandoning the dollar, or what he described as "dollarization," is already underway.

He noted that the dollar is expensive and risky, and that the United States is undermining its credibility through its behavior.

"Expanding the bank is essential, and expanding the political structure of the BRICS group is another matter," Nogueira told Sputnik on the sidelines of the Valdai Discussion Club.

"We have always sought to achieve the primary goal when the bank was established in 2014, which was to increase the number of member states to become a bank for the Global South. This goal has been achieved very slowly, but it is continuing."

The economic expert pointed out that countries are working to expand bilateral trade in national currencies and avoid using the dollar within the banking system.

He added, "The process of de-dollarization is already underway in several aspects. One of them, in particular, is this: Countries are bypassing the dollar and conducting their transactions directly in their national currencies.

This is happening both within and outside the BRICS group. Why? Because the dollar is expensive, risky, and because the United States is undermining its credibility through its behavior, so countries are looking for alternatives."

He explained: "Their dollar reserves are being diverted to other applications. Trade is conducted and increased in national currencies, and eventually, in my opinion, we will need to move toward a new reserve currency.

But that is a matter for the future. Now, we see the US administration trying to punish countries that try to avoid the dollar and join the dollarization trend through various trade laws, sanctions, and so on."

Asked about the likelihood of success of the US methods, Nogueira said, "I don't think these violent methods used by the Trump administration will work in the US's favor. As you can see, countries that are beyond the dollar are not against it."

"Simply put, they can't deal with it under the system the United States has in place. I would even say that the main enemy of the dollar is the United States itself, because it has turned it into a political tool. It has turned it into a weapon in the financial system. So, this won't work.

When the dollar was truly a reliable international currency, it was through persuasion. Now, they are trying to maintain the dollar's status as a reserve currency through coercion."

Regarding the timing of the new BRICS currency's implementation, the economist said: "Not in the short term, and perhaps not even in the medium term, but it must be clear that when we talk about a BRICS currency, we are not talking about a common unified currency like the euro.

No, that's not the case. What can be done, and what a number of people have proposed, is a common reference currency for international transactions that replaces the dollar, as an alternative to it."

He concluded, "There is something that is sometimes difficult to explain, but is very important, which is that these transactions in national currencies do not reach a specific limit. They are not effective in the medium term.

Why? Because they do not allow countries to record persistent trade imbalances with each other. Therefore, we need a new reserve currency, one that will be an alternative to the dollar." link

************

Tishwash: Al-Sudani's office: American companies have turned to investing in Iraqi oil and gas fields.

The Iraqi Prime Minister's Office revealed on Monday, September 29, 2025, that American companies are interested in investing in oil and gas fields in Iraq, while also stating that several investment opportunities have been referred to international and local companies.

Ali Razouki, Deputy Director of the Prime Minister's Office and Chairman of the Supervisory Committee of the Iraq Investment Forum, said in a statement followed by Al-Jabal that "the Iraq Investment Forum has witnessed remarkable successes by attracting major international companies in the fields of oil, industry, agriculture and other investment sectors." He explained that "this success reflects the security and economic stability that Iraq enjoys, which creates an attractive environment for investors."

He added, "The National Investment Commission previously indicated its success in attracting no less than $100 billion in local and foreign capital, but this figure is expected to rise steadily after the forum."

He continued, "The forum included dialogue sessions with a number of specialists to explain Iraq's investment philosophy and the directions of the relevant ministries, in addition to holding workshops that highlighted available investment opportunities in cooperation with relevant companies." He emphasized that "the forum resulted in the referral of several investment opportunities to international and local companies, which is a tangible achievement."

Razouki pointed out that "after this forum, Iraq witnessed widespread competition among companies for investment opportunities," explaining that "areas that were globally classified as 'Red Zones' are now open to investment after doubts about them were removed."

He noted that "American companies have headed to Anbar province to invest in some oil and gas fields," stressing that "the coming period will witness increasing activity in this direction link

************

Tishwash: Government plan to raise non-oil revenues to 20%

Hamoudi Al-Lami, the Prime Minister's advisor for industry, development, and the private sector, announced on Monday that a new platform for establishing industrial projects will soon be launched within 15 days. He also indicated that plans are being developed to increase non-oil revenues by 20 %.

Al-Lami said in a statement monitored by "Mil" that "the government is counting on the private sector to be the main driver of the national economy by investing idle capital," noting that "the volume of investments has reached $102 billion so far, while the government aims to raise it to $450 billion by 2030 as part of the development project ."

He explained that "the private sector is influential and significant in investing capital, as much of it remains outside Iraq or frozen in banks, and has not been invested in industries that require a long time to generate profits ."

He added, "Any industrial project requires at least four to five years to begin production and two to three years to generate returns, which was a challenge under previous unstable conditions." He noted that "the current situation is witnessing a revolution in the industrial sector, which will be a major driver of the economy and will provide tens of thousands of job opportunities, in addition to providing resources to the state treasury by attracting Iraqi and foreign capital ."

Al-Lami pointed out that "the government has prioritized combating administrative corruption through automation. Within the next two weeks, the Prime Minister will launch an electronic platform that will shorten the time required to obtain a license to complete the establishment of an industrial project from two or three years to just 15 days, by consolidating the required approvals from 14 to 18 entities into a single portal," according to the official news agency .

Al-Lami revealed "facilitations for bringing in foreign workers, as Syrian and Bangladeshi workers and other technical experts will now be permitted, after previously being prohibited, in order to encourage investors and remove obstacles to their projects ."

Regarding the private sector's contribution to GDP, Al-Lami stated that "non-oil revenues increased from 7% in 2020 to 14% currently, thanks to government measures and automation, with efforts to reach 20% in the coming months." link

Mot: . Advice frum ole ""Mot"" -- Guys!! - Never - Ever Do this un

Mot: .. Continues to Amaze as Ya ""Season"" !!!!

Iraq Economic News and Points To Ponder Tuesday Morning 9-30-25

The Central Bank Denies Any Intention To Change The Dollar Exchange Rate.

September 28, 2025 Baghdad/Iraq Observer Central Bank Governor Ali Al-Alaq denied on Sunday

any plans to change the dinar's exchange rate against the dollar.

During a dialogue session at the Iraq Investment Forum, attended by a Shafaq News Agency correspondent, Al-Alaq said, "There is no talk or discussion within the Central Bank or the government about adjusting the official exchange rate for the dollar." He added, "Everything that is being circulated is untrue."

The Central Bank Denies Any Intention To Change The Dollar Exchange Rate.

September 28, 2025 Baghdad/Iraq Observer Central Bank Governor Ali Al-Alaq denied on Sunday

any plans to change the dinar's exchange rate against the dollar.

During a dialogue session at the Iraq Investment Forum, attended by a Shafaq News Agency correspondent, Al-Alaq said, "There is no talk or discussion within the Central Bank or the government about adjusting the official exchange rate for the dollar." He added, "Everything that is being circulated is untrue."

The dollar exchange rate against the Iraqi dinar has fluctuated significantly in recent years.

After the previous government, headed by Mustafa al-Kadhimi, changed it from 121,000 dinars per $100 to 140,000 dinars, the current government, headed by Mohammed Shia al-Sudani,

changed it again to 132,000 dinars per $100. https://observeriraq.net/البنك-المركزي-ينفي-أي-نية-لتغيير-سعر-صر/

The Central Bank Of Iraq, Basra Branch, Launches The "Easier Transportation, Easier Payment" Campaign.

September 28, 2025 The Central Bank of Iraq, Basra branch, launched the "Easier Transportation... Easier Payments"campaign in cooperation with electronic payment companies operating in the governorate.

This campaign is part of the National Financial Inclusion Strategy 2025-2029.

The campaign aims to deploy point-of-sale (POS) devices in public transport vehicles and taxis contracted with the Central Bank branch in Basra Governorate, by purchasing them free of charge from service providers.

The campaign comes within the framework of promoting the culture of financial inclusion and electronic payment adopted by the Central Bank of Iraq among segments of society, especially bank card holders and marginalized groups. https://cbi.iq/news/view/2994

Central Bank Governor: We Are Beginning To See Non-Oil Financial Revenues.

September 28, 2025 His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq,affirmed that the banking sector is a fundamental pillar for the success of investment in Iraq. He explained that the Central Bank of Iraq has achieved its objectives and begun implementing them according to the scheduled timelines for banking sector reform.

This came during the Governor's participation in a dialogue session at theIraq Investment Forum, where he noted in his remarks that Iraq boasts significant investment opportunities and that Iraqi institutions, both in the public and private sectors, have made significant strides toward developing an investment map that can generate financial returns for Iraq.

Pointing out that the banking sector is a fundamental pillar for the success of investment projects in Iraq, he pledged to pursue his reform plan to develop this sector and make it a supportive arm for the success of investment projects.

He pointed out that Iraq is currently experiencing the lowest inflation rates in its modern history, and noted that it possesses comfortable foreign reserves capable of defending the exchange rate. He emphasized the need to create a sound investment environment following the significant success of monetary policy. Central Bank of Iraq Media Office https://cbi.iq/news/view/2993

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Tuesday Morning 9-30-25

Good Morning Dinar Recaps,

The Shutdown, the Generals, and the Reset: Converging Pressure Points for a New Financial Order

By The Seeds of Wisdom Team

This is not just politics — global finance restructuring before our eyes

Introduction

As readers of this publication already know, a reset is not a distant fantasy — it is impending. A constellation of stressors is converging on the U.S. system: political gridlock, fiscal overreach, broken institutions, and a crumbling faith in fiat money.

Good Morning Dinar Recaps,

The Shutdown, the Generals, and the Reset: Converging Pressure Points for a New Financial Order

By The Seeds of Wisdom Team

This is not just politics — global finance restructuring before our eyes

Introduction

As readers of this publication already know, a reset is not a distant fantasy — it is impending. A constellation of stressors is converging on the U.S. system: political gridlock, fiscal overreach, broken institutions, and a crumbling faith in fiat money.

In this moment, two events in the headlines deserve deeper analysis:

A looming government shutdown, threatening to halt or degrade core federal functions.

A sudden call for some 800 U.S. Generals and Admirals to convene at Quantico on short notice — without public explanation.

These are not unrelated episodes. Together, they form pressure points in a larger axis of change. In this article, we’ll dig into:

What a shutdown really means in structural terms (beyond theatrics)

How a mass military gathering plays into civil-military dynamics and signals authority

How both events can catalyze, legitimize, or precipitate a currency reset in the U.S. — with ripple effects globally

Paths forward, opportunities, and hazards in such a transition

Part I: The Government Shutdown as a Structural Weakness

1. The theatrical face vs. the structural blow

Publicly, shutdowns are framed as political brinkmanship: Congress “fails” to agree, essential services limp on, employees are furloughed, and the media plays the blame game. But beneath the drama lies a structural weakness:

Budget process breakdown: A shutdown is proof that the budget mechanism has ceased functioning as a disciplined system. When funding lapses, even operations deemed “essential” are exposed to discretionary interpretation.

Fragility of institutions: Agencies with decades of institutional memory can hollow out quickly under furloughs, staff turnover, and project delays. In the long run, the loss of talent and continuity becomes a drag on governance. Darden Ideas to Action

Data black hole: Key economic metrics (jobs reports, inflation data, etc.) may halt or be delayed, disrupting not just markets but the ability of lawmakers, central banks, and intelligence agencies to act. Reuters

Credit and confidence erosion: Even a short shutdown can raise doubts among rating agencies, lenders, and foreign counterparties about U.S. fiscal discipline and reliability. Fidelity

In short: a shutdown is not just dysfunction. It is a stress test that reveals the brittleness of the system.

2. Financial shocks triggered or amplified

From a markets perspective, even though prior shutdowns have had limited long-term effects, the difference today is the backdrop:

Dollar volatility: The U.S. dollar often softens in response to political uncertainty. Foreign holders may reassess their exposure, hedging or reallocating assets. IG

Safe-haven pressure: Gold, silver, and real assets tend to benefit as confidence in government receipts erodes.

Policy gridlock in crisis: If a shutdown coincides with or triggers other fiscal stresses (e.g. a debt ceiling fight), the delay in federal response amplifies risk.

Financial regulation and oversight gaps: With agencies partly shuttered, oversight weakens. Market distortions, unchecked leverage, or liquidity shorts may arise unexpectedly. Reuters

So at the moment when confidence is most fragile, the shutdown opens cracks for narratives of “the old system can’t hold.”

3. Political optics and legitimacy

On the public front, a shutdown does two things:

It makes pain visible — people see travel delays, furloughed workers, social services slowing, federal contractors unpaid.

It forces people to ask: which programs are truly essential? Which ones survive? What do the priorities say about power structure?

For those already oriented toward a reset, a shutdown helps frame a narrative: the existing system has failed us; its caretakers are bankrupt in legitimacy.

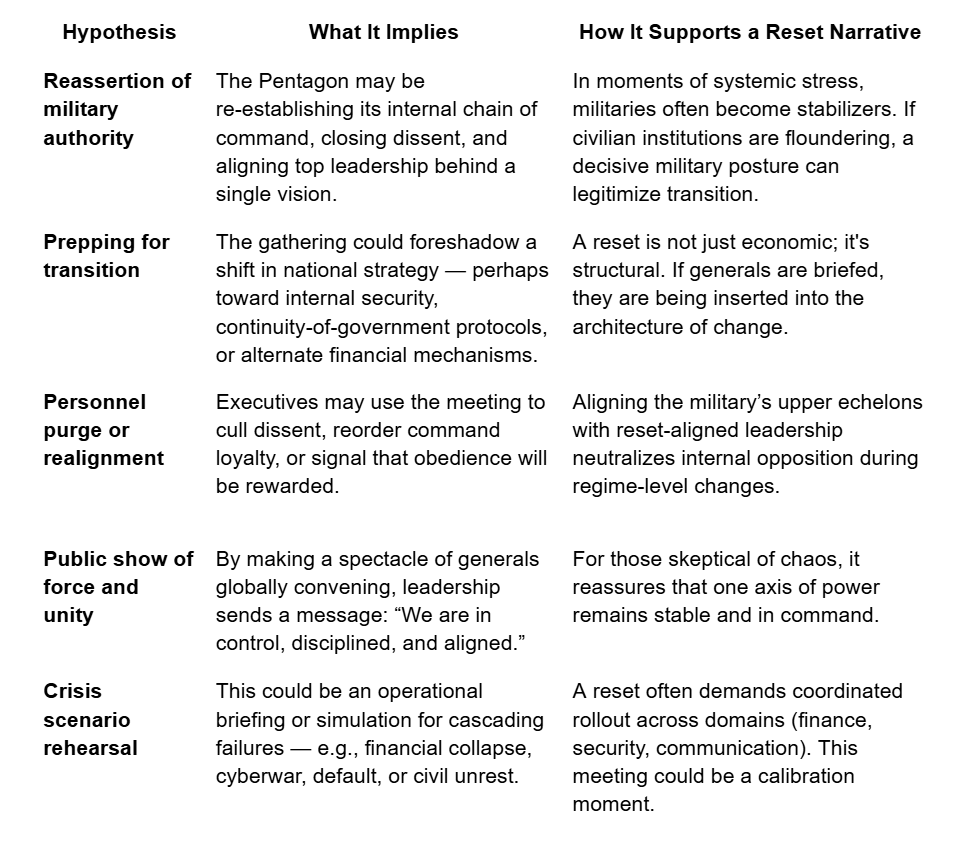

Part II: The Mystery Gathering of 800 Generals & Admirals

A meeting of this scale — senior military leadership from across global theaters — called at short notice and without public agenda, invites speculation. Multiple press outlets have flagged its rarity and the tension it has induced in the ranks. The Washington Post

1. Why is it extraordinary?

Military command is normally distributed and modular — top brass meet in strategic forums when needed, often virtually. A physical convergence of this magnitude is logistically expensive and operationally dangerous (concentrating so many leaders in one location). Reuters

The abruptness and secrecy raise red flags: not all gatherings are for planning; some are for reorientation, consolidation, or signal projection. CSIS

It follows controversial moves: the new Defense Secretary has already ordered cuts in top ranks (20% reduction in four-star officers, 10% in generals/admirals) and dismissed senior officers without full explanation. The Washington Post

This is not “just another conference.” It is a signal event.

2. Interpretive lenses: what could it mean?

Below are possible interpretations — not mutually exclusive — that tie directly into the reset narrative:

.

3. Risks, fractures, and unpredictability

Yet nothing in transition is guaranteed. Some risks:

Backlash within the ranks: Generals unused to being ordered without explanation may resist covert agendas.

Civil-military tension: If military influence becomes overt, accusations of coup-style overreach may arise.

Information leaks: In shock events, the security of messaging is fragile — leaks can be weaponized by opponents.

Overreach missteps: The more visible and performance-driven the spectacle, the higher the risk of misinterpretation or unintended escalation.

Part III: How These Two Events Fit Into a Path to Reset

Having seen the raw dynamics, here’s how they may gate toward a credible reset.

1. Pressure layering: crisis stacking

A shutdown weakens civilian institutions; a mass military meeting signals that the military is preparing to step in or be ready. In sequence, they create:

Legitimacy vacuum in civilian authority

A signal that the custodians of force are aligning behind a new order

An increased appetite among the populace for an alternative system

In classical regime-change theory, such stacking of stressors is often how transitions are engineered: collapse perception + authority reallocation + narrative control = change.

2. Reset as continuity, not rupture

One of the biggest barriers to reset is fear of chaos. But a reset structured around military continuity and institutional coherence has a chance of being accepted. The meeting of generals can serve as a stabilizing backbone during transition, rather than a violent rupture.

The sequence might look like:

Shutdown intensifies — key services sputter, markets wobble, public discontent mounts

Military message (through the generals) amplifies the narrative: “System is failing; we must act”

Transition team or trusted committee introduces the reset plan (currency, financial system, governance)

Military presence ensures continuity and protection during the financial retooling

3. Currency reset: how it might unfold

A currency reset is not just replacing one money with another — it is a redefinition of value, trust, and claims. Here is how the shutdown + generals meeting help set the stage:

Broken faith in fiat: As the government fails to manage its own budget, trust in the existing fiat apparatus erodes. People become more open to alternatives (asset-backed, hybrid, or new money systems).

Safe-haven transfer: Before, during, or after crisis, capital migrates to perceived safe stores: precious metals, foreign assets, or even state-backed crypto or gold currencies.

Credibility backing via force: A military-aligned transition grants the new currency or system instant enforcement credibility — control over border exchange, reserves, and coercion instruments is assured.

Binary narrative: The messaging pivot becomes “old money system failed us — here is a new system built on real assets, backed by authority, under new guarantees.”

Global cascade: Other nations observing U.S. institutional collapse may accelerate their own shifts away from the dollar, or open to multilateral currency schemes.

In effect, the government fails first; the military steadies the transition; the reset claims legitimacy by marking old money as bankrupt.

Part IV: Narrative Anchors — What to Emphasize for Readers

When you publish, here are the key threads to pull, to make the article powerful, credible, and actionable:

Not alarmism, but inevitability: This isn’t a prediction — it’s a frame. The conditions are aligning; readers should see the logic, not fear the unknown.

Signals over noise: Highlight how seemingly disconnected events — shutdowns, military orders, firings — are structural signals, not random chaos.

Continuity is the goal: The reset must not feel like collapse; rather, it must feel like a re-basing, with safeguards. Show how the military meeting helps provide that scaffold.

Currency as legitimacy claim: A new money system is a claim to rightful authority. Emphasize how a reset is as much political as it is economic.

Global context: Use shifts already underway (de-dollarization, alternative systems, BRICS currency proposals) to show that the U.S. reset is part of a larger global redistribution of financial order.

Roadmap, not dream: Offer scenarios — short (9–18 months), medium (2–5 years), long (decade) — detailing how the reset might roll out, where risks lie, and what readers can watch for.

Practical implication: Help readers see where to position assets, how to maintain optionality, and how to interpret upcoming signals.

Conclusion

A government shutdown is not mere political bickering — it is a stress fracture in the structure of federal authority. The sudden, large-scale military gathering is not routine — it’s a posture shift, a rehearsal, a signal of alignment behind a new paradigm. Together, they map the overture to a reset.

For those of us who have long anticipated this moment, these events are not distractions — they are momentous landmarks. When the time comes, the reset will not feel like chaos. It will be framed as rebirth — ushered in by those who held the instruments of force and legitimacy.

This is not just politics — global finance restructuring before our eyes

@ Newshounds News™ Exclusive

Source:

Washington Post – Hegseth orders rare, urgent meeting of hundreds of generals, admirals (Sept 25, 2025)

The Guardian – US military brass brace for firings as Pentagon chief orders top-level meeting (Sept 27, 2025)

Associated Press – Hegseth abruptly summons top military commanders to a meeting in Virginia next week (Sept 25, 2025)

Reuters – Dollar weakens after strong rally as US government shutdown looms (Sept 29, 2025)

Reuters – How a US government shutdown could affect financial markets (Sept 25, 2025)

IG – What to expect from markets during a US government shutdown (Sept 2025)

Fidelity – The impact of a government shutdown on markets and investors (2025)

Darden Ideas to Action – The Impact of a Government Shutdown (University of Virginia, 2025)

CSIS – Quick Analysis: Secretary Hegseth’s General Officers Meeting (Sept 2025)

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

9-29-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

9-29-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Evening 9-29-25

American Expert: Iraq Is Witnessing Remarkable Development.

September 29, 2025 Baghdad - Ibtihal Al-Arabi Maysan - Ali Qasim Al-Kaabi The Economic Advisor at the US Embassy, Eric Camus, confirmed that Iraq has achieved remarkable progress in the reconstruction sector, especially in the capital. He pointed out that there are significant investment opportunities for Iraq to attract foreign investment and enhance economic diversification.

American Expert: Iraq Is Witnessing Remarkable Development.

September 29, 2025 Baghdad - Ibtihal Al-Arabi Maysan - Ali Qasim Al-Kaabi The Economic Advisor at the US Embassy, Eric Camus, confirmed that Iraq has achieved remarkable progress in the reconstruction sector, especially in the capital. He pointed out that there are significant investment opportunities for Iraq to attract foreign investment and enhance economic diversification.

This was during the Iraq Investment Forum, which was hosted in Baghdad over the past two days, under the patronage of the Prime Minister.

Camus said at the conference yesterday, "The US government sees Iraq as a promising investment, and private partnerships encourage American investment."

He indicated that "there are reform steps in the economic field, including the launch of a single window for company registration, the banking reform initiated by the Iraqi government, and the expansion of the electronic payment system.

" Camus stressed that "the digital system reduces reliance on cash, ensuring transparency, and also represents a good reform and a major transformation," noting that "the security environment in Iraq is witnessing stability compared to what it was a decade and a half ago."

The international forum presented more than 150 investment opportunities in various sectors, according to the head of the Iraqi Economic Council, Ibrahim al-Baghdadi.

In a statement followed by Al-Zaman yesterday, he said, "The forum constitutes an important event to showcase ready investment opportunities, as Iraq is fertile ground for investment in many fields, given its important geographical location, and a land rich in opportunities for investment projects."

Al-Baghdadi explained that, "The forum guarantees a wide opportunity for companies and businessmen to meet with global and regional banks and financing funds, and to hold direct bilateral meetings with ministries and investment bodies in Iraq, in addition to economic and investment meetings of regional and international interest."

Iraq is witnessing economic and investment expansion by strengthening its regional and international partnerships, according to the Prime Minister's Advisor for Investment Affairs, Mohammed Al-Najjar, who stated yesterday that, "Iraq is experiencing its best conditions in 40 years," noting that, "The forum represents a gateway to attracting international interest in the field of expanding partnerships that feed the economy."

Al-Najjar explained that, "Iraq is witnessing economic, political and security stability, the best of which it has not witnessed in four decades."

In a related development, Iraq recently signed a number of memoranda of understanding with Arab and international countries, as part of its efforts to enhance international cooperation to promote economic development. Iraq signed contracts with Saudi Arabia, Egypt, the UAE, Jordan, the United States, and the United Kingdom, as well as China, Russia, Japan, and the Czech Republic, in the fields of air transport, oil, industry, security, and chambers of commerce, under the auspices of Prime Minister Mohammed Shia al-Sudani.

The Prime Minister's Financial Advisor, Mazhar Mohammed Salih, emphasized that "the memoranda of understanding are an essential diplomatic tool, reflecting the government's desire to enhance cooperation with countries around the world in many key areas, not limited to strengthening economic relations only, but also encompassing security, technical, and scientific coordination, as well as cooperation in the fields of infrastructure development, energy, health, and education.

" He indicated that "Iraq is moving towards enhancing international cooperation and developing the national economy."

Furthermore, Maysan Governorate has begun distributing the first batch of residential plots to the residents of Al-Majar Al-Kabir District, in accordance with the directives of its Governor, Habib Al-Fartousi.

The governor's office said in a statement received by Al-Zaman yesterday that "the head of the higher committee for the allocation of residential plots in the province has ordered the distribution of the first batch of lands among the beneficiaries, including the families of martyrs, the wounded, members of the Popular Mobilization Forces, those who died during service, and retirees.

" He added that "the first batch includes 950 residential plots, while the second batch will start early next October, after completing the approval procedures."

For his part, the Minister of Defense, Thabet Al-Abbasi, laid the foundation stone for the establishment of a residential neighborhood for army personnel in the province.

A statement from the minister's office received by Al-Zaman yesterday explained that "the foundation stone was laid for the Heroes Residential City, in the former Corps area, to serve officers, personnel, and employees of the ministry in Maysan." LINK

Iraq Stock Exchange: Shares Traded Worth More Than Four Billion Dinars In One Week.

Monday, September 29, 2025, | Economics Number of reads: 198 Baghdad / NINA / The Iraq Stock Exchange announced, on Monday, the trading of shares worth more than 4 billion dinars during the past week.

The market stated, in a report, that "the number of companies whose shares were traded during the past week amounted to 65 joint-stock companies, while the shares of 28 companies were not traded due to the lack of matching of buy and sell orders, while 11 companies remain suspended for not providing disclosure, out of 104 companies listed in the market."

It added that "the number of traded shares amounted to 4 billion, 752 million, and 441 thousand shares, a decrease of 11% compared to the previous week, with a financial value of 6 billion, 665 million, and 508 thousand dinars, an increase of 46% compared to the previous week through the execution of 4,512 transactions," noting that "the ISX60 traded price index closed at 963.79 points, recording a decrease of 0.05% compared to its closing in the previous session."

He pointed out that "the number of shares purchased by non-Iraqi investors last week amounted to 168 million shares, with a financial value of 380 million dinars, through the implementation of 79 transactions.

The number of shares sold by non-Iraqi investors amounted to 66 million shares, with a financial value of 159 million dinars, through the implementation of 65 transactions, according to the market report.

It is noteworthy that the Iraq Stock Exchange organizes five trading sessions weekly from Sunday to Thursday, and 104 Iraqi joint-stock companies are listed on it, representing the sectors of banking, communications, industry, agriculture, insurance, financial investment, tourism, hotels and services. /End https://ninanews.com/Website/News/Details?key=1254360

American Companies Are Heading To Invest In Iraqi Oil And Gas Fields.

Energy Ali Razouki, Deputy Director of the Prime Minister's Office and Chairman of the Supervisory Committee of the Iraq Investment Forum, announced on Monday that American companies are interested in investing in oil and gas fields in Iraq, noting that the forum has achieved significant success.

Razouki said, "The Iraq Investment Forum has witnessed remarkable successes by attracting major international companies in the fields of oil, industry, agriculture, and other investment sectors." He explained that, "This success reflects Iraq's security and economic stability, which creates an attractive environment for investors."

He added, "The National Investment Commission previously indicated its success in attracting no less than $100 billion in local and foreign capital, but this figure is expected to rise steadily after the forum."

He continued, "The forum included dialogue sessions with a number of specialists to explain Iraq's investment philosophy and the directions of the relevant ministries, in addition to holding workshops that highlighted available investment opportunities in cooperation with relevant companies." He emphasized that "the forum resulted in the referral of several investment opportunities to international and local companies, which is a tangible achievement."

Razouki pointed out that "after this forum, Iraq witnessed widespread competition among companies for investment opportunities," explaining that "areas that were globally classified as 'Red Zones' are now open to investment after doubts about them were removed."

He noted that "American companies have headed to Anbar province to invest in some oil and gas fields," stressing that "the coming period will witness increased activity in this direction." https://economy-news.net/content.php?id=60534

Minister Of Transport To NINA: These Are Our Investment Opportunities, And Our Goal Is To Diversify The Economy's Resources And Reduce Dependence On Oil

Monday, September 29, 2025, | Economics Number of reads: 312 Baghdad / NINA / The Ministry of Transport has outlined its most important new investment opportunities, which are expected to generate significant national revenues for Iraq.

Minister of Transport, Razzaq Al-Saadawi, said in a statement to the National Iraqi News Agency ( NINA ), that "the Ministry of Transport presented several new investment opportunities during the Iraq Investment Forum, which is an important platform for showcasing investment opportunities to Arab and foreign investors, the most important of which is the Strategic Development Road Project and the Grand Faw Port, which enjoy significant international support and direct local support from the Prime Minister."

He added, "One of the most important goals of the Development Road Project is to diversify the national economy's resources, reduce dependence on oil and gas, and create regional and international economic integration. It will also provide 1.5 million jobs and achieve 70% food, water, and energy self-sufficiency through sustainable green initiatives."

The Minister of Transport confirmed that the government's vision aims for Iraq to be "a gateway for 20% of Asia's trade to Europe, through the Faw Port project and the development road," indicating that "the development road is an economic artery that crosses continents, and includes the establishment of a network of highways and railways with a length exceeding 1,160 kilometers, starting from the Grand Faw Port and reaching the Fishkhabur crossing on the border with Turkey, passing through 12 major cities serving more than 27 million citizens." https://ninanews.com/Website/News/Details?Key=1254372

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com