Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 9-30-25

Good Afternoon Dinar Recaps,

U.S. Sees Historic Exodus: Over 154,000 Federal Workers Depart

The largest one-week exit of civil servants in modern history signals deep institutional rupture — with implications far beyond Washington.

Good Afternoon Dinar Recaps,

U.S. Sees Historic Exodus: Over 154,000 Federal Workers Depart

The largest one-week exit of civil servants in modern history signals deep institutional rupture — with implications far beyond Washington.

What’s Really Happening

Around 154,000 federal workers are leaving government payroll this week — officially resigning under the Trump administration’s deferred resignation / buyout program.

Earlier reports projected 100,000+ resignations, which now appear to be part of a larger wave.

Many of those employees had already been on administrative leave for months, paid through the end of September despite not working.

The program is designed to reduce the federal workforce by ~300,000 jobs in total by the end of the year, representing roughly 12.5% of the civilian federal workforce.

Institutional Risks & Financial Pressure

This mass exodus will lead to a “brain drain”: loss of institutional memory, weakened agency capacity, and a gap in critical technical, scientific, and regulatory roles (e.g. NASA, CDC, Agriculture).

Agencies will need to contract, outsource, or rebuild functions, which raises transitional costs and inefficiencies.

The government projects $28 billion in annual savings, but critics argue the short-term cost, legal risks, and service disruption may exceed benefits.

Global & Structural Implications

🔹 Erosion of Trust in Institutions

When a major government deliberately sheds large swaths of its professional workforce, it signals a shift in how the state perceives its role. Other countries watching U.S. internal restructuring may adjust their expectations: less reliability, more volatility.

🔹 Reallocation of Capital & Talent

Those leaving may reenter private sectors or new institutions, shifting expertise, capital, and influence away from public systems. This movement supports the growth of new governance, tech, or finance platforms outside traditional state structures.

🔹 Precedent for Other Governments

If the U.S. — long considered the institutional gold standard — pursues deep cuts, it gives cover to other nations to attempt similar transformations. Coupled with pressures from debt, sanctions, or economic disruptions, nations may justify major overhauls of civil service or public institutions.

🔹 Interplay with Global Restructuring

This institutional shake-up fits with other tectonic shifts: de-dollarization, new trade blocs, alternative financial systems. A weaker, leaner U.S. administrative state means less capacity to manage global order. Other powers and blocs (BRICS, China, regional institutions) may step into the void.

Why This Matters

This isn’t a routine downsizing. It’s a structural break in how government operates, financed, and is perceived. The consequences ripple into legislative competence, global strategy, and the balance of power in diplomatic and financial arenas.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Reuters / Washington / reporting – U.S. government faces brain drain as 154,000 federal workers exit this week Reuters

The Guardian – More than 100,000 federal workers to quit amid government shutdown pressures The Guardian+1

Washington Post / fund analyses of deferred resignation program The Washington Post

Wikipedia / documentation of the 2025 U.S. federal deferred resignation program Wikipedia

Records of workforce downsizing, OPM data, and agency cuts Wikipedia

~~~~~~~~~

“Out With the Old, In With the New”: Pete Hegseth Signals Military Reset

“This is not just politics — it’s global finance restructuring before our eyes.”

In a sharp address to U.S. generals and admirals, Secretary of War Pete Hegseth declared that the “era of the Department of Defense is over.” His message: the military will be purged of “woke” policies, higher standards will be enforced, and leaders unwilling to adapt should resign.

This is more than rhetoric — it signals a structural reset of the armed forces, which could tie directly into broader institutional and financial change.

Key Highlights

Renaming the Department → Defense is “dead”; it’s now the War Department, emphasizing offense and strength.

Warrior Ethos Restored → “Peace through strength” replaces political correctness as guiding doctrine.

Fitness & Discipline → Generals failing physical tests or grooming standards must step aside.

End of DEI & Woke Policies → Leadership will no longer cater to identity-based initiatives.

Oversight Shake-Up → Inspector General reforms to reduce internal resistance.

Ultimatum → Those opposed should retire: “We will thank you for your service.”

Why This Matters

By forcing out the old guard and consolidating loyalty, Hegseth is preparing the military for a new era of centralized, disciplined authority. In times of political uncertainty or financial turbulence, this kind of restructured military becomes a stabilizing force — or a lever of change.

When military leadership resets, it often mirrors — and prepares for — a reset in governance and finance. Out with the old, in with the new applies not just to generals, but to the global system itself.

@ Newshounds News™ Exclusive

Sources

~~~~~~~~~

Stablecoins, G7 Regulation & the Timeline to Reset

“This is not just politics — it’s global finance restructuring before our eyes.”

Why Stablecoin Laws Matter

Stablecoins are no longer fringe crypto projects — they’re now central to how nations think about digital money and financial sovereignty. The G7 countries are moving at different speeds, creating a staggered path toward being “reset-ready.”

G7 Progress Toward Stablecoin Regulation

Japan – First to act (2023). Banks can issue yen-backed stablecoins. Already live → High readiness.

EU (France, Germany, Italy) – MiCA law fully in effect by 2025. Strong reserves, audits, euro-backed tokens → Very high readiness.

United States – GENIUS Act (2025) passed, but full enforcement may take until 2027. Dollar-tokens will be tightly controlled → Medium-High readiness.

United Kingdom – Draft laws under review. Real enforcement likely by 2026 → Medium readiness.

Canada – Early oversight in place, but no dedicated stablecoin charter until at least 2027 → Medium-Low readiness.

Why This Matters

First movers (Japan, EU) gain leverage in shaping digital money standards.

Dollar vs. multipolarity – Regulated euro/yen tokens challenge dollar stablecoins.

Global reset fuel – Once multiple G7s are “reset-ready,” stablecoins can underpin new cross-border systems, opening the door to asset-backed or revalued currencies.

Reset Timeline (Approximate)

2025–26: Japan, EU go live; US builds rulebook.

2027: US, UK frameworks mature; Canada follows.

2028–30: Stablecoins integrated in payments, paving the way for systemic reset.

The path is clear: regulation of stablecoins is the foundation for new financial infrastructure. Each country’s pace determines its leverage in a reset.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources

Cointelegraph – Stablecoins across the G7

Reuters – BIS Warning on Stablecoins

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday 9-30-2025

TNT:

Tishwash: BRICS Development Bank Vice President: The process of abandoning the dollar is underway

Paulo Batista Nogueira, Managing Director of the International Monetary Fund and Vice President of the New Development Bank, confirmed on Monday that the process of abandoning the dollar, or what he described as "dollarization," is already underway.

He noted that the dollar is expensive and risky, and that the United States is undermining its credibility through its behavior.

"Expanding the bank is essential, and expanding the political structure of the BRICS group is another matter," Nogueira told Sputnik on the sidelines of the Valdai Discussion Club.

TNT:

Tishwash: BRICS Development Bank Vice President: The process of abandoning the dollar is underway

Paulo Batista Nogueira, Managing Director of the International Monetary Fund and Vice President of the New Development Bank, confirmed on Monday that the process of abandoning the dollar, or what he described as "dollarization," is already underway.

He noted that the dollar is expensive and risky, and that the United States is undermining its credibility through its behavior.

"Expanding the bank is essential, and expanding the political structure of the BRICS group is another matter," Nogueira told Sputnik on the sidelines of the Valdai Discussion Club.

"We have always sought to achieve the primary goal when the bank was established in 2014, which was to increase the number of member states to become a bank for the Global South. This goal has been achieved very slowly, but it is continuing."

The economic expert pointed out that countries are working to expand bilateral trade in national currencies and avoid using the dollar within the banking system.

He added, "The process of de-dollarization is already underway in several aspects. One of them, in particular, is this: Countries are bypassing the dollar and conducting their transactions directly in their national currencies.

This is happening both within and outside the BRICS group. Why? Because the dollar is expensive, risky, and because the United States is undermining its credibility through its behavior, so countries are looking for alternatives."

He explained: "Their dollar reserves are being diverted to other applications. Trade is conducted and increased in national currencies, and eventually, in my opinion, we will need to move toward a new reserve currency.

But that is a matter for the future. Now, we see the US administration trying to punish countries that try to avoid the dollar and join the dollarization trend through various trade laws, sanctions, and so on."

Asked about the likelihood of success of the US methods, Nogueira said, "I don't think these violent methods used by the Trump administration will work in the US's favor. As you can see, countries that are beyond the dollar are not against it."

"Simply put, they can't deal with it under the system the United States has in place. I would even say that the main enemy of the dollar is the United States itself, because it has turned it into a political tool. It has turned it into a weapon in the financial system. So, this won't work.

When the dollar was truly a reliable international currency, it was through persuasion. Now, they are trying to maintain the dollar's status as a reserve currency through coercion."

Regarding the timing of the new BRICS currency's implementation, the economist said: "Not in the short term, and perhaps not even in the medium term, but it must be clear that when we talk about a BRICS currency, we are not talking about a common unified currency like the euro.

No, that's not the case. What can be done, and what a number of people have proposed, is a common reference currency for international transactions that replaces the dollar, as an alternative to it."

He concluded, "There is something that is sometimes difficult to explain, but is very important, which is that these transactions in national currencies do not reach a specific limit. They are not effective in the medium term.

Why? Because they do not allow countries to record persistent trade imbalances with each other. Therefore, we need a new reserve currency, one that will be an alternative to the dollar." link

************

Tishwash: Al-Sudani's office: American companies have turned to investing in Iraqi oil and gas fields.

The Iraqi Prime Minister's Office revealed on Monday, September 29, 2025, that American companies are interested in investing in oil and gas fields in Iraq, while also stating that several investment opportunities have been referred to international and local companies.

Ali Razouki, Deputy Director of the Prime Minister's Office and Chairman of the Supervisory Committee of the Iraq Investment Forum, said in a statement followed by Al-Jabal that "the Iraq Investment Forum has witnessed remarkable successes by attracting major international companies in the fields of oil, industry, agriculture and other investment sectors." He explained that "this success reflects the security and economic stability that Iraq enjoys, which creates an attractive environment for investors."

He added, "The National Investment Commission previously indicated its success in attracting no less than $100 billion in local and foreign capital, but this figure is expected to rise steadily after the forum."

He continued, "The forum included dialogue sessions with a number of specialists to explain Iraq's investment philosophy and the directions of the relevant ministries, in addition to holding workshops that highlighted available investment opportunities in cooperation with relevant companies." He emphasized that "the forum resulted in the referral of several investment opportunities to international and local companies, which is a tangible achievement."

Razouki pointed out that "after this forum, Iraq witnessed widespread competition among companies for investment opportunities," explaining that "areas that were globally classified as 'Red Zones' are now open to investment after doubts about them were removed."

He noted that "American companies have headed to Anbar province to invest in some oil and gas fields," stressing that "the coming period will witness increasing activity in this direction link

************

Tishwash: Government plan to raise non-oil revenues to 20%

Hamoudi Al-Lami, the Prime Minister's advisor for industry, development, and the private sector, announced on Monday that a new platform for establishing industrial projects will soon be launched within 15 days. He also indicated that plans are being developed to increase non-oil revenues by 20 %.

Al-Lami said in a statement monitored by "Mil" that "the government is counting on the private sector to be the main driver of the national economy by investing idle capital," noting that "the volume of investments has reached $102 billion so far, while the government aims to raise it to $450 billion by 2030 as part of the development project ."

He explained that "the private sector is influential and significant in investing capital, as much of it remains outside Iraq or frozen in banks, and has not been invested in industries that require a long time to generate profits ."

He added, "Any industrial project requires at least four to five years to begin production and two to three years to generate returns, which was a challenge under previous unstable conditions." He noted that "the current situation is witnessing a revolution in the industrial sector, which will be a major driver of the economy and will provide tens of thousands of job opportunities, in addition to providing resources to the state treasury by attracting Iraqi and foreign capital ."

Al-Lami pointed out that "the government has prioritized combating administrative corruption through automation. Within the next two weeks, the Prime Minister will launch an electronic platform that will shorten the time required to obtain a license to complete the establishment of an industrial project from two or three years to just 15 days, by consolidating the required approvals from 14 to 18 entities into a single portal," according to the official news agency .

Al-Lami revealed "facilitations for bringing in foreign workers, as Syrian and Bangladeshi workers and other technical experts will now be permitted, after previously being prohibited, in order to encourage investors and remove obstacles to their projects ."

Regarding the private sector's contribution to GDP, Al-Lami stated that "non-oil revenues increased from 7% in 2020 to 14% currently, thanks to government measures and automation, with efforts to reach 20% in the coming months." link

Mot: . Advice frum ole ""Mot"" -- Guys!! - Never - Ever Do this un

Mot: .. Continues to Amaze as Ya ""Season"" !!!!

Iraq Economic News and Points To Ponder Tuesday Morning 9-30-25

The Central Bank Denies Any Intention To Change The Dollar Exchange Rate.

September 28, 2025 Baghdad/Iraq Observer Central Bank Governor Ali Al-Alaq denied on Sunday

any plans to change the dinar's exchange rate against the dollar.

During a dialogue session at the Iraq Investment Forum, attended by a Shafaq News Agency correspondent, Al-Alaq said, "There is no talk or discussion within the Central Bank or the government about adjusting the official exchange rate for the dollar." He added, "Everything that is being circulated is untrue."

The Central Bank Denies Any Intention To Change The Dollar Exchange Rate.

September 28, 2025 Baghdad/Iraq Observer Central Bank Governor Ali Al-Alaq denied on Sunday

any plans to change the dinar's exchange rate against the dollar.

During a dialogue session at the Iraq Investment Forum, attended by a Shafaq News Agency correspondent, Al-Alaq said, "There is no talk or discussion within the Central Bank or the government about adjusting the official exchange rate for the dollar." He added, "Everything that is being circulated is untrue."

The dollar exchange rate against the Iraqi dinar has fluctuated significantly in recent years.

After the previous government, headed by Mustafa al-Kadhimi, changed it from 121,000 dinars per $100 to 140,000 dinars, the current government, headed by Mohammed Shia al-Sudani,

changed it again to 132,000 dinars per $100. https://observeriraq.net/البنك-المركزي-ينفي-أي-نية-لتغيير-سعر-صر/

The Central Bank Of Iraq, Basra Branch, Launches The "Easier Transportation, Easier Payment" Campaign.

September 28, 2025 The Central Bank of Iraq, Basra branch, launched the "Easier Transportation... Easier Payments"campaign in cooperation with electronic payment companies operating in the governorate.

This campaign is part of the National Financial Inclusion Strategy 2025-2029.

The campaign aims to deploy point-of-sale (POS) devices in public transport vehicles and taxis contracted with the Central Bank branch in Basra Governorate, by purchasing them free of charge from service providers.

The campaign comes within the framework of promoting the culture of financial inclusion and electronic payment adopted by the Central Bank of Iraq among segments of society, especially bank card holders and marginalized groups. https://cbi.iq/news/view/2994

Central Bank Governor: We Are Beginning To See Non-Oil Financial Revenues.

September 28, 2025 His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq,affirmed that the banking sector is a fundamental pillar for the success of investment in Iraq. He explained that the Central Bank of Iraq has achieved its objectives and begun implementing them according to the scheduled timelines for banking sector reform.

This came during the Governor's participation in a dialogue session at theIraq Investment Forum, where he noted in his remarks that Iraq boasts significant investment opportunities and that Iraqi institutions, both in the public and private sectors, have made significant strides toward developing an investment map that can generate financial returns for Iraq.

Pointing out that the banking sector is a fundamental pillar for the success of investment projects in Iraq, he pledged to pursue his reform plan to develop this sector and make it a supportive arm for the success of investment projects.

He pointed out that Iraq is currently experiencing the lowest inflation rates in its modern history, and noted that it possesses comfortable foreign reserves capable of defending the exchange rate. He emphasized the need to create a sound investment environment following the significant success of monetary policy. Central Bank of Iraq Media Office https://cbi.iq/news/view/2993

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Tuesday Morning 9-30-25

Good Morning Dinar Recaps,

The Shutdown, the Generals, and the Reset: Converging Pressure Points for a New Financial Order

By The Seeds of Wisdom Team

This is not just politics — global finance restructuring before our eyes

Introduction

As readers of this publication already know, a reset is not a distant fantasy — it is impending. A constellation of stressors is converging on the U.S. system: political gridlock, fiscal overreach, broken institutions, and a crumbling faith in fiat money.

Good Morning Dinar Recaps,

The Shutdown, the Generals, and the Reset: Converging Pressure Points for a New Financial Order

By The Seeds of Wisdom Team

This is not just politics — global finance restructuring before our eyes

Introduction

As readers of this publication already know, a reset is not a distant fantasy — it is impending. A constellation of stressors is converging on the U.S. system: political gridlock, fiscal overreach, broken institutions, and a crumbling faith in fiat money.

In this moment, two events in the headlines deserve deeper analysis:

A looming government shutdown, threatening to halt or degrade core federal functions.

A sudden call for some 800 U.S. Generals and Admirals to convene at Quantico on short notice — without public explanation.

These are not unrelated episodes. Together, they form pressure points in a larger axis of change. In this article, we’ll dig into:

What a shutdown really means in structural terms (beyond theatrics)

How a mass military gathering plays into civil-military dynamics and signals authority

How both events can catalyze, legitimize, or precipitate a currency reset in the U.S. — with ripple effects globally

Paths forward, opportunities, and hazards in such a transition

Part I: The Government Shutdown as a Structural Weakness

1. The theatrical face vs. the structural blow

Publicly, shutdowns are framed as political brinkmanship: Congress “fails” to agree, essential services limp on, employees are furloughed, and the media plays the blame game. But beneath the drama lies a structural weakness:

Budget process breakdown: A shutdown is proof that the budget mechanism has ceased functioning as a disciplined system. When funding lapses, even operations deemed “essential” are exposed to discretionary interpretation.

Fragility of institutions: Agencies with decades of institutional memory can hollow out quickly under furloughs, staff turnover, and project delays. In the long run, the loss of talent and continuity becomes a drag on governance. Darden Ideas to Action

Data black hole: Key economic metrics (jobs reports, inflation data, etc.) may halt or be delayed, disrupting not just markets but the ability of lawmakers, central banks, and intelligence agencies to act. Reuters

Credit and confidence erosion: Even a short shutdown can raise doubts among rating agencies, lenders, and foreign counterparties about U.S. fiscal discipline and reliability. Fidelity

In short: a shutdown is not just dysfunction. It is a stress test that reveals the brittleness of the system.

2. Financial shocks triggered or amplified

From a markets perspective, even though prior shutdowns have had limited long-term effects, the difference today is the backdrop:

Dollar volatility: The U.S. dollar often softens in response to political uncertainty. Foreign holders may reassess their exposure, hedging or reallocating assets. IG

Safe-haven pressure: Gold, silver, and real assets tend to benefit as confidence in government receipts erodes.

Policy gridlock in crisis: If a shutdown coincides with or triggers other fiscal stresses (e.g. a debt ceiling fight), the delay in federal response amplifies risk.

Financial regulation and oversight gaps: With agencies partly shuttered, oversight weakens. Market distortions, unchecked leverage, or liquidity shorts may arise unexpectedly. Reuters

So at the moment when confidence is most fragile, the shutdown opens cracks for narratives of “the old system can’t hold.”

3. Political optics and legitimacy

On the public front, a shutdown does two things:

It makes pain visible — people see travel delays, furloughed workers, social services slowing, federal contractors unpaid.

It forces people to ask: which programs are truly essential? Which ones survive? What do the priorities say about power structure?

For those already oriented toward a reset, a shutdown helps frame a narrative: the existing system has failed us; its caretakers are bankrupt in legitimacy.

Part II: The Mystery Gathering of 800 Generals & Admirals

A meeting of this scale — senior military leadership from across global theaters — called at short notice and without public agenda, invites speculation. Multiple press outlets have flagged its rarity and the tension it has induced in the ranks. The Washington Post

1. Why is it extraordinary?

Military command is normally distributed and modular — top brass meet in strategic forums when needed, often virtually. A physical convergence of this magnitude is logistically expensive and operationally dangerous (concentrating so many leaders in one location). Reuters

The abruptness and secrecy raise red flags: not all gatherings are for planning; some are for reorientation, consolidation, or signal projection. CSIS

It follows controversial moves: the new Defense Secretary has already ordered cuts in top ranks (20% reduction in four-star officers, 10% in generals/admirals) and dismissed senior officers without full explanation. The Washington Post

This is not “just another conference.” It is a signal event.

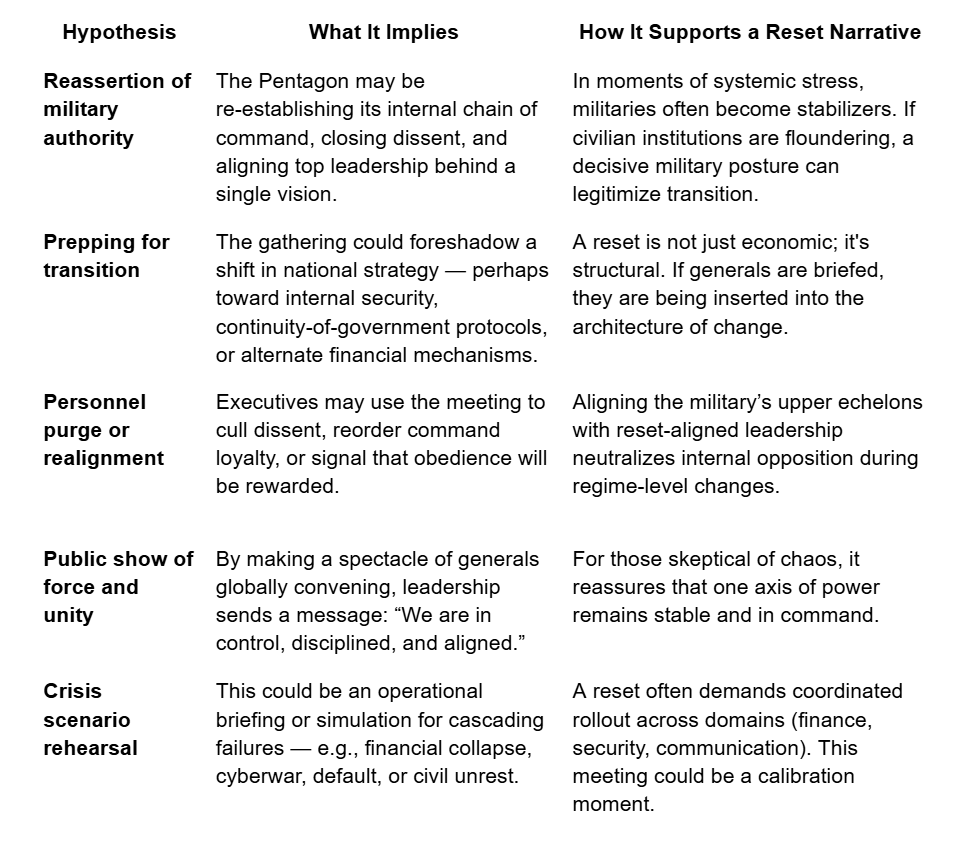

2. Interpretive lenses: what could it mean?

Below are possible interpretations — not mutually exclusive — that tie directly into the reset narrative:

.

3. Risks, fractures, and unpredictability

Yet nothing in transition is guaranteed. Some risks:

Backlash within the ranks: Generals unused to being ordered without explanation may resist covert agendas.

Civil-military tension: If military influence becomes overt, accusations of coup-style overreach may arise.

Information leaks: In shock events, the security of messaging is fragile — leaks can be weaponized by opponents.

Overreach missteps: The more visible and performance-driven the spectacle, the higher the risk of misinterpretation or unintended escalation.

Part III: How These Two Events Fit Into a Path to Reset

Having seen the raw dynamics, here’s how they may gate toward a credible reset.

1. Pressure layering: crisis stacking

A shutdown weakens civilian institutions; a mass military meeting signals that the military is preparing to step in or be ready. In sequence, they create:

Legitimacy vacuum in civilian authority

A signal that the custodians of force are aligning behind a new order

An increased appetite among the populace for an alternative system

In classical regime-change theory, such stacking of stressors is often how transitions are engineered: collapse perception + authority reallocation + narrative control = change.

2. Reset as continuity, not rupture

One of the biggest barriers to reset is fear of chaos. But a reset structured around military continuity and institutional coherence has a chance of being accepted. The meeting of generals can serve as a stabilizing backbone during transition, rather than a violent rupture.

The sequence might look like:

Shutdown intensifies — key services sputter, markets wobble, public discontent mounts

Military message (through the generals) amplifies the narrative: “System is failing; we must act”

Transition team or trusted committee introduces the reset plan (currency, financial system, governance)

Military presence ensures continuity and protection during the financial retooling

3. Currency reset: how it might unfold

A currency reset is not just replacing one money with another — it is a redefinition of value, trust, and claims. Here is how the shutdown + generals meeting help set the stage:

Broken faith in fiat: As the government fails to manage its own budget, trust in the existing fiat apparatus erodes. People become more open to alternatives (asset-backed, hybrid, or new money systems).

Safe-haven transfer: Before, during, or after crisis, capital migrates to perceived safe stores: precious metals, foreign assets, or even state-backed crypto or gold currencies.

Credibility backing via force: A military-aligned transition grants the new currency or system instant enforcement credibility — control over border exchange, reserves, and coercion instruments is assured.

Binary narrative: The messaging pivot becomes “old money system failed us — here is a new system built on real assets, backed by authority, under new guarantees.”

Global cascade: Other nations observing U.S. institutional collapse may accelerate their own shifts away from the dollar, or open to multilateral currency schemes.

In effect, the government fails first; the military steadies the transition; the reset claims legitimacy by marking old money as bankrupt.

Part IV: Narrative Anchors — What to Emphasize for Readers

When you publish, here are the key threads to pull, to make the article powerful, credible, and actionable:

Not alarmism, but inevitability: This isn’t a prediction — it’s a frame. The conditions are aligning; readers should see the logic, not fear the unknown.

Signals over noise: Highlight how seemingly disconnected events — shutdowns, military orders, firings — are structural signals, not random chaos.

Continuity is the goal: The reset must not feel like collapse; rather, it must feel like a re-basing, with safeguards. Show how the military meeting helps provide that scaffold.

Currency as legitimacy claim: A new money system is a claim to rightful authority. Emphasize how a reset is as much political as it is economic.

Global context: Use shifts already underway (de-dollarization, alternative systems, BRICS currency proposals) to show that the U.S. reset is part of a larger global redistribution of financial order.

Roadmap, not dream: Offer scenarios — short (9–18 months), medium (2–5 years), long (decade) — detailing how the reset might roll out, where risks lie, and what readers can watch for.

Practical implication: Help readers see where to position assets, how to maintain optionality, and how to interpret upcoming signals.

Conclusion

A government shutdown is not mere political bickering — it is a stress fracture in the structure of federal authority. The sudden, large-scale military gathering is not routine — it’s a posture shift, a rehearsal, a signal of alignment behind a new paradigm. Together, they map the overture to a reset.

For those of us who have long anticipated this moment, these events are not distractions — they are momentous landmarks. When the time comes, the reset will not feel like chaos. It will be framed as rebirth — ushered in by those who held the instruments of force and legitimacy.

This is not just politics — global finance restructuring before our eyes

@ Newshounds News™ Exclusive

Source:

Washington Post – Hegseth orders rare, urgent meeting of hundreds of generals, admirals (Sept 25, 2025)

The Guardian – US military brass brace for firings as Pentagon chief orders top-level meeting (Sept 27, 2025)

Associated Press – Hegseth abruptly summons top military commanders to a meeting in Virginia next week (Sept 25, 2025)

Reuters – Dollar weakens after strong rally as US government shutdown looms (Sept 29, 2025)

Reuters – How a US government shutdown could affect financial markets (Sept 25, 2025)

IG – What to expect from markets during a US government shutdown (Sept 2025)

Fidelity – The impact of a government shutdown on markets and investors (2025)

Darden Ideas to Action – The Impact of a Government Shutdown (University of Virginia, 2025)

CSIS – Quick Analysis: Secretary Hegseth’s General Officers Meeting (Sept 2025)

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

9-29-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew:IQD News Update--New Era-Exchange Rate Reality-Investment

9-29-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Evening 9-29-25

American Expert: Iraq Is Witnessing Remarkable Development.

September 29, 2025 Baghdad - Ibtihal Al-Arabi Maysan - Ali Qasim Al-Kaabi The Economic Advisor at the US Embassy, Eric Camus, confirmed that Iraq has achieved remarkable progress in the reconstruction sector, especially in the capital. He pointed out that there are significant investment opportunities for Iraq to attract foreign investment and enhance economic diversification.

American Expert: Iraq Is Witnessing Remarkable Development.

September 29, 2025 Baghdad - Ibtihal Al-Arabi Maysan - Ali Qasim Al-Kaabi The Economic Advisor at the US Embassy, Eric Camus, confirmed that Iraq has achieved remarkable progress in the reconstruction sector, especially in the capital. He pointed out that there are significant investment opportunities for Iraq to attract foreign investment and enhance economic diversification.

This was during the Iraq Investment Forum, which was hosted in Baghdad over the past two days, under the patronage of the Prime Minister.

Camus said at the conference yesterday, "The US government sees Iraq as a promising investment, and private partnerships encourage American investment."

He indicated that "there are reform steps in the economic field, including the launch of a single window for company registration, the banking reform initiated by the Iraqi government, and the expansion of the electronic payment system.

" Camus stressed that "the digital system reduces reliance on cash, ensuring transparency, and also represents a good reform and a major transformation," noting that "the security environment in Iraq is witnessing stability compared to what it was a decade and a half ago."

The international forum presented more than 150 investment opportunities in various sectors, according to the head of the Iraqi Economic Council, Ibrahim al-Baghdadi.

In a statement followed by Al-Zaman yesterday, he said, "The forum constitutes an important event to showcase ready investment opportunities, as Iraq is fertile ground for investment in many fields, given its important geographical location, and a land rich in opportunities for investment projects."

Al-Baghdadi explained that, "The forum guarantees a wide opportunity for companies and businessmen to meet with global and regional banks and financing funds, and to hold direct bilateral meetings with ministries and investment bodies in Iraq, in addition to economic and investment meetings of regional and international interest."

Iraq is witnessing economic and investment expansion by strengthening its regional and international partnerships, according to the Prime Minister's Advisor for Investment Affairs, Mohammed Al-Najjar, who stated yesterday that, "Iraq is experiencing its best conditions in 40 years," noting that, "The forum represents a gateway to attracting international interest in the field of expanding partnerships that feed the economy."

Al-Najjar explained that, "Iraq is witnessing economic, political and security stability, the best of which it has not witnessed in four decades."

In a related development, Iraq recently signed a number of memoranda of understanding with Arab and international countries, as part of its efforts to enhance international cooperation to promote economic development. Iraq signed contracts with Saudi Arabia, Egypt, the UAE, Jordan, the United States, and the United Kingdom, as well as China, Russia, Japan, and the Czech Republic, in the fields of air transport, oil, industry, security, and chambers of commerce, under the auspices of Prime Minister Mohammed Shia al-Sudani.

The Prime Minister's Financial Advisor, Mazhar Mohammed Salih, emphasized that "the memoranda of understanding are an essential diplomatic tool, reflecting the government's desire to enhance cooperation with countries around the world in many key areas, not limited to strengthening economic relations only, but also encompassing security, technical, and scientific coordination, as well as cooperation in the fields of infrastructure development, energy, health, and education.

" He indicated that "Iraq is moving towards enhancing international cooperation and developing the national economy."

Furthermore, Maysan Governorate has begun distributing the first batch of residential plots to the residents of Al-Majar Al-Kabir District, in accordance with the directives of its Governor, Habib Al-Fartousi.

The governor's office said in a statement received by Al-Zaman yesterday that "the head of the higher committee for the allocation of residential plots in the province has ordered the distribution of the first batch of lands among the beneficiaries, including the families of martyrs, the wounded, members of the Popular Mobilization Forces, those who died during service, and retirees.

" He added that "the first batch includes 950 residential plots, while the second batch will start early next October, after completing the approval procedures."

For his part, the Minister of Defense, Thabet Al-Abbasi, laid the foundation stone for the establishment of a residential neighborhood for army personnel in the province.

A statement from the minister's office received by Al-Zaman yesterday explained that "the foundation stone was laid for the Heroes Residential City, in the former Corps area, to serve officers, personnel, and employees of the ministry in Maysan." LINK

Iraq Stock Exchange: Shares Traded Worth More Than Four Billion Dinars In One Week.

Monday, September 29, 2025, | Economics Number of reads: 198 Baghdad / NINA / The Iraq Stock Exchange announced, on Monday, the trading of shares worth more than 4 billion dinars during the past week.

The market stated, in a report, that "the number of companies whose shares were traded during the past week amounted to 65 joint-stock companies, while the shares of 28 companies were not traded due to the lack of matching of buy and sell orders, while 11 companies remain suspended for not providing disclosure, out of 104 companies listed in the market."

It added that "the number of traded shares amounted to 4 billion, 752 million, and 441 thousand shares, a decrease of 11% compared to the previous week, with a financial value of 6 billion, 665 million, and 508 thousand dinars, an increase of 46% compared to the previous week through the execution of 4,512 transactions," noting that "the ISX60 traded price index closed at 963.79 points, recording a decrease of 0.05% compared to its closing in the previous session."

He pointed out that "the number of shares purchased by non-Iraqi investors last week amounted to 168 million shares, with a financial value of 380 million dinars, through the implementation of 79 transactions.

The number of shares sold by non-Iraqi investors amounted to 66 million shares, with a financial value of 159 million dinars, through the implementation of 65 transactions, according to the market report.

It is noteworthy that the Iraq Stock Exchange organizes five trading sessions weekly from Sunday to Thursday, and 104 Iraqi joint-stock companies are listed on it, representing the sectors of banking, communications, industry, agriculture, insurance, financial investment, tourism, hotels and services. /End https://ninanews.com/Website/News/Details?key=1254360

American Companies Are Heading To Invest In Iraqi Oil And Gas Fields.

Energy Ali Razouki, Deputy Director of the Prime Minister's Office and Chairman of the Supervisory Committee of the Iraq Investment Forum, announced on Monday that American companies are interested in investing in oil and gas fields in Iraq, noting that the forum has achieved significant success.

Razouki said, "The Iraq Investment Forum has witnessed remarkable successes by attracting major international companies in the fields of oil, industry, agriculture, and other investment sectors." He explained that, "This success reflects Iraq's security and economic stability, which creates an attractive environment for investors."

He added, "The National Investment Commission previously indicated its success in attracting no less than $100 billion in local and foreign capital, but this figure is expected to rise steadily after the forum."

He continued, "The forum included dialogue sessions with a number of specialists to explain Iraq's investment philosophy and the directions of the relevant ministries, in addition to holding workshops that highlighted available investment opportunities in cooperation with relevant companies." He emphasized that "the forum resulted in the referral of several investment opportunities to international and local companies, which is a tangible achievement."

Razouki pointed out that "after this forum, Iraq witnessed widespread competition among companies for investment opportunities," explaining that "areas that were globally classified as 'Red Zones' are now open to investment after doubts about them were removed."

He noted that "American companies have headed to Anbar province to invest in some oil and gas fields," stressing that "the coming period will witness increased activity in this direction." https://economy-news.net/content.php?id=60534

Minister Of Transport To NINA: These Are Our Investment Opportunities, And Our Goal Is To Diversify The Economy's Resources And Reduce Dependence On Oil

Monday, September 29, 2025, | Economics Number of reads: 312 Baghdad / NINA / The Ministry of Transport has outlined its most important new investment opportunities, which are expected to generate significant national revenues for Iraq.

Minister of Transport, Razzaq Al-Saadawi, said in a statement to the National Iraqi News Agency ( NINA ), that "the Ministry of Transport presented several new investment opportunities during the Iraq Investment Forum, which is an important platform for showcasing investment opportunities to Arab and foreign investors, the most important of which is the Strategic Development Road Project and the Grand Faw Port, which enjoy significant international support and direct local support from the Prime Minister."

He added, "One of the most important goals of the Development Road Project is to diversify the national economy's resources, reduce dependence on oil and gas, and create regional and international economic integration. It will also provide 1.5 million jobs and achieve 70% food, water, and energy self-sufficiency through sustainable green initiatives."

The Minister of Transport confirmed that the government's vision aims for Iraq to be "a gateway for 20% of Asia's trade to Europe, through the Faw Port project and the development road," indicating that "the development road is an economic artery that crosses continents, and includes the establishment of a network of highways and railways with a length exceeding 1,160 kilometers, starting from the Grand Faw Port and reaching the Fishkhabur crossing on the border with Turkey, passing through 12 major cities serving more than 27 million citizens." https://ninanews.com/Website/News/Details?Key=1254372

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Monday Evening 9-29-25

Good Evening Dinar Recaps,

China Invites Like-Minded Countries to Join BRICS — Expanding Alliances, Reshaping Power

BRICS is no longer static: its widening circle, new cooperative corridors, and open membership overtures mark deeper shifts in global alignment — economically, politically, and financially.

Good Evening Dinar Recaps,

China Invites Like-Minded Countries to Join BRICS — Expanding Alliances, Reshaping Power

BRICS is no longer static: its widening circle, new cooperative corridors, and open membership overtures mark deeper shifts in global alignment — economically, politically, and financially.

China’s Open Call to Emerging Economies

Chinese Foreign Ministry spokesperson Guo Jiakun said that China “welcomes like-minded partners to participate in BRICS cooperation and jointly promote a more just and equitable international order.”

China framed BRICS co-op as a platform for developing countries and emerging markets — trade, finance, health, science & tech, and people-to-people exchanges are highlighted as areas for expanded cooperation.

Recent Expansion & Palestine’s Application

Palestine has formally applied to join BRICS. According to its ambassador to Russia, it may initially participate as a “guest” until it meets full membership conditions. China has expressed openness to more “like-minded partners,” though has not committed explicitly to supporting Palestine’s full membership.

Expansion has already moved fast: Egypt, Ethiopia, Iran, the United Arab Emirates were admitted in 2024; Indonesia joined as a full member in 2025.

Strategic & Resource Dimensions

BRICS is mapping new mineral corridors across Africa, Southeast Asia, and Latin America, noting Africa holds about 30% of known critical mineral reserves (cobalt, manganese, etc.).

China’s rhetoric emphasizes “multipolarity” and “greater democracy in international relations,” suggesting BRICS expansion is part ideological / normative as well as materially strategic.

Additional Context & Sources

Vietnam has been officially recognized as a BRICS partner country, allowing participation in summits and discussions without full membership.

China and Vietnam recently issued statements supporting a multilateral trade regime, rejecting unilateral tariffs and defending trade norms; Vietnam signaled readiness to deepen alignment with BRICS.

Analysis from CFR notes that more than thirty countries applied to join BRICS or expressed interest in 2024 (including Turkey, Malaysia, Azerbaijan) in an effort to gain influence and access to alternative trade, financial, and diplomatic blocs.

How This Reflects Global Financial & Political Realignment

Multipolar Power Structure

▪️ BRICS expansion reflects growing dissatisfaction with Western-led financial institutions and norms. As more countries join, the bloc’s ability to influence international development finance, trade rules, and even reserve currency discussions grows.

▪️ By inviting “like-minded partners,” China and BRICS are fostering a coalition that can operate in parallel to U.S./EU dominated institutions, with different priorities (e.g. resource sovereignty, decentralized finance, non-USD trade).

🔹 Resource Corridors & Infrastructure as Leverage

▪️ The mineral corridors (Africa, Southeast Asia, Latin America) are not just economic; they feed into supply chains for tech, green energy, batteries, and semiconductors — vital fields in the coming decades. Who controls or secures these corridors will shape who has economic and geopolitical leverage.

▪️ New projects and infrastructure in partner countries may be financed via BRICS institutions (like the New Development Bank), which gives both China and BRICS members financial influence.

Norms, Legitimacy & Financial Inclusion

▪️ Recognition of Palestine, gestures of openness, and rhetoric about “justice” and “equitable international order” serve to build legitimacy for BRICS among the Global South. This can shift where foreign aid, trade preferences, diplomatic trust, and investment are directed.

▪️ Countries that feel underrepresented or constrained by traditional systems may increasingly see BRICS membership as a means of accessing finance, trade, and diplomatic weight without being tied to U.S.-centric institutions.

Why This Matters for the World

The recent moves show BRICS transforming from a collection of large emerging economies into a more inclusive, globally influential bloc. With China pushing membership expansion, resource collaboration, and normative framing, BRICS is becoming an alternative architecture in trade, financing, and geopolitical influence.

These developments mean the rules of the global game are shifting. Countries will need to reassess alliances, trade dependencies, reserve holdings, and financial partnerships in light of a rising multipolar bloc that offers alternatives to the old order.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – China Invites Like-Minded Countries to Join BRICS Co-op Watcher Guru

CGTN – China welcomes like-minded partners to join BRICS CGTN News

Hindustan Times – Palestine says it applied to join BRICS amid wider recognition Hindustan Times

Reuters – Vietnam admitted as BRICS partner country Reuters

Reuters – China and Vietnam support multilateral trade regime amid U.S. tariff pressure Reuters

Council on Foreign Relations (CFR) – What is the BRICS Group & Why It’s Expanding Council on Foreign Relations

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Fed's Crumbling Illusion of Stability | History Reveals the Endgame

Fed's Crumbling Illusion of Stability | History Reveals the Endgame

Lynette Zang: 9-29-2025

From the gold standard to the paper dollar and now to digital fiat, the Fed has always sold the illusion of stability.

But history proves every one of these experiments ends the same way.

In Part 1, Lynette shows how today’s policies echo the Great Depression, why central banks are hoarding gold, and how the dollar’s endgame is already unfolding.

Fed's Crumbling Illusion of Stability | History Reveals the Endgame

Lynette Zang: 9-29-2025

From the gold standard to the paper dollar and now to digital fiat, the Fed has always sold the illusion of stability.

But history proves every one of these experiments ends the same way.

In Part 1, Lynette shows how today’s policies echo the Great Depression, why central banks are hoarding gold, and how the dollar’s endgame is already unfolding.

Chapters:

00:00 Introduction

00:43 Stablecoins vs. Sound Money

03:12 Understanding the Boom-Bust Cycles

03:43 Fiat Currency’s Life Cycle

05:22 Rule Changes: From Reserves to Confiscation

07:24 How Past Playbooks Shape Today’s System

10:44 From Gold-Backed Money to Government IOUs

12:24 Gold & Silver Removed: Why You Need Your Own Bank

15:57 Purchasing Power Collapse: The Consumer Boom Trap

Five Key Iraqi Dinar Revaluations Against the US Dollar Since 1968

TNT:

Tishwash: Five Key Iraqi Dinar Revaluations Against the US Dollar Since 1968

Few currencies tell a nation’s story as vividly as the Iraqi dinar.

Once among the world’s strongest, valued at four US dollars, it later collapsed to the point where one dollar bought 3,000 dinars.

Today, at 1,310 to the dollar, the dinar is more than an exchange rate; it is a mirror of Iraq’s turbulent modern history.

TNT:

Tishwash: Five Key Iraqi Dinar Revaluations Against the US Dollar Since 1968

Few currencies tell a nation’s story as vividly as the Iraqi dinar.

Once among the world’s strongest, valued at four US dollars, it later collapsed to the point where one dollar bought 3,000 dinars.

Today, at 1,310 to the dollar, the dinar is more than an exchange rate; it is a mirror of Iraq’s turbulent modern history.

Stage One: Founding (1931–1968)

The dinar was born in 1931 with the Iraqi Currency Board in London. In 1947, Iraq established the National Bank, later renamed the Central Bank of Iraq. This was more than a financial step it was a declaration of sovereignty, giving Iraq its own currency at a time when newly independent states sought symbols of nationhood.

Stage Two: The Golden Age (1968–1988)

From the late 1960s to the late 1980s, the dinar lived its golden age.

1968–1979: 1 IQD = $4 (100 USD = 25 dinars).

1980–1988: 1 IQD ≈ $3.3 (100 USD = 28 dinars).

Fueled by oil revenues, Iraq’s currency symbolized prosperity and power. For ordinary Iraqis, it was not just money in their pockets but proof that their country could stand strong on the world stage.

Stage Three: Collapse and Fragmentation (1990–2003)

Wars, sanctions, and economic isolation shattered that strength. After the invasion of Kuwait and the Gulf War, the dinar plummeted. Two currencies circulated the “Swiss dinar” in Kurdistan and heavily devalued notes elsewhere.

By the mid-1990s, 1 USD = 3,000 IQD (100 USD = 300,000 dinars).

This collapse was more than economic. It destroyed savings, eroded trust, and turned the dinar into a daily reminder of hardship and international isolation.

Stage Four: Post-2003 Fragile Stability

Following the 2003 US-led invasion, Iraq introduced new notes and began stabilization efforts.

2006–2008: The dinar appreciated almost 20% to around 1,200 per dollar.

2010–2011: The rate stabilized at 1,166 per USD, offering rare predictability.

Yet fragility persisted. Black market pressures often drove the dollar higher than the official peg. In 2020, with oil revenues collapsing, Iraq sharply devalued the dinar to 1,460. In February 2023, the Central Bank revalued to 1,300 per USD, aiming to restore confidence. But in practice, parallel markets continued trading above 1,400.

Beyond Numbers: The Dinar as a Shared Fiction

Currencies, as historian and author Yuval Noah Harari reminds us, are shared fictions, stories people choose to believe in. The Iraqi dinar’s history shows what happens when that collective faith falters, and how fragile yet vital it is to rebuild.

Each revaluation, from the $4 peak in the 1970s to the 1,300 peg in 2023, was not just a technical adjustment. It was an attempt to reclaim trust, to remind Iraqis that their state could still hold the line against chaos.

The dinar’s journey is not only about money. It is about Iraq’s struggle for sovereignty, resilience, and the fragile hope that, one day, the story told by its currency will once again be one of strength.

Iraq Economic News and Points To Ponder Monday Afternoon 9-29-25

Central Bank Governor: We Have Comfortable Foreign Reserves Capable Of Defending The Exchange Rate.

Buratha News Agency2722025-09-28 Central Bank Governor Ali Al-Alaq announced on Sunday that Iraq is currently experiencing its lowest inflation rate in history. He also noted that Iraq possesses comfortable foreign reserves capable of defending the exchange rate. He emphasized the creation of a sound investment environment following the significant success of monetary policy. LINK

Central Bank Governor: We Have Comfortable Foreign Reserves Capable Of Defending The Exchange Rate.

Buratha News Agency2722025-09-28 Central Bank Governor Ali Al-Alaq announced on Sunday that Iraq is currently experiencing its lowest inflation rate in history. He also noted that Iraq possesses comfortable foreign reserves capable of defending the exchange rate. He emphasized the creation of a sound investment environment following the significant success of monetary policy. LINK

US Embassy Economic Advisor: Armed Factions Continue To Threaten Investors In Iraq

Iraq The economic advisor at the US Embassy in Baghdad, Eric Camus, confirmed that armed factions in Iraq still pose a threat to investors and drive them away from the country, despite security improvements compared to fifteen years ago.

This came during a dialogue session at the Iraq Investment Forum, where Kamus noted the interest and promising investments in Iraq that encourage American investors. He emphasized his country's commitment to supporting Iraq and providing international support to protect businesspeople and enhance foreign investment opportunities. https://www.radionawa.com/all-detail.aspx?jimare=42638

Oil Minister: Receiving Oil Produced From The Region Is A Good Start And An Embodiment Of The State's Sovereignty.

Sunday, September 28, 2025, 15:09 | Economics Number of reads: 283 Baghdad / NINA / Deputy Prime Minister for Energy Affairs and Minister of Oil Hayan Abdul-Ghani stressed that receiving oil produced from the region is a good start, and it is an embodiment of the state's sovereignty over national wealth.

The Ministry of Oil said in a statement, "Deputy Prime Minister for Energy Affairs and Minister of Oil, Eng. Hayan Abdul-Ghani Al-Sawad, chaired today, Sunday, the ninth session of the Opinion Board in the presence of undersecretaries, advisors and general managers of oil companies and departments.

The Minister began the session by congratulating the Iraqi people on the occasion of signing the agreement to receive crude oil produced in the region for the purposes of exporting it through the State Oil Marketing Organization "SOMO", noting the importance of this agreement, which occurs for the first time in 20 years.

The Minister praised the efforts of the distinguished staff of the ministry to reach this agreement, which was signed by the federal Ministry of Oil, the Ministry of Natural Resources and foreign companies operating in the region.

The statement continued, "During the session, the topics included in the agenda were discussed and appropriate decisions and recommendations were taken. /End https://ninanews.com/Website/News/Details?key=1254155

Iraq Attracts $102 Billion In Investments

Money and Business Economy News – Baghdad Minister of Trade, Athir al-Ghurairi, announced that the volume of investment in Iraq over the past two years has reached $102 billion, 62% of which is foreign investment.

During his participation in the Iraqi Investment Conference today, Sunday, the Minister of Trade explained that Iraq's annual import rate from abroad amounts to $85 billion, including $23 billion from the UAE, $16 billion from Turkey, $18 billion from China, and $12 billion from the United States.

He pointed out that Iraq is a promising market, and there are significant investment opportunities in the country, according to the German news agency "dpa."

He added that the Ministry of Commerce is working to transition to digital transformation, e-commerce, and company registration through a mobile application to eliminate bureaucracy and corruption.

Al-Ghariri continued, "We need our brothers and friends to achieve economic and investment development in Iraq. There are promising and significant opportunities amounting to $450 billion in various sectors."

He said that Iraq has surpassed the stage of achieving food security in the country and is providing food to approximately 42 million Iraqis under the ration card system. https://economy-news.net/content.php?id=60465

Dr. Mahoud: The Banking Reform Plan Focused On Three Main Factors.

Banks Economy News - BaghdadThe Prime Minister's advisor for banking affairs, Saleh Mahoud, confirmed on Sunday that the banking reform plan focused on three main factors, while noting that the World Bank praised Iraq's progress in electronic payments.

Mahoud said, "The banking reform plan adopted by the Central Bank of Iraq in coordination with the government took into account three main factors: trust, speed of procedures, and the development of banking tools."

He explained that "investors seek trust, speed of procedures, and modern banking products, and these elements represent the fundamental pillars of any investment environment."

He noted that "enhancing trust depends on the presence of effective institutions and compliance with anti-money laundering regulations, which positively impacts investor confidence in the banking system and investment environment."

He added, "The speed of procedures means a shift toward digitization and the development of electronic payment methods, which is what the banking reform plan focused on through extensive coordination between the government, the Central Bank, and the private sector." He noted that "the relevant committees are working in an organized and effective manner."

He pointed out that "the most prominent challenges facing the digital transformation process lie in societal culture and resistance to change, given that Iraqi society relies on cash."

He explained that "the government and the Central Bank have sought to spread the culture of electronic payment through practical decisions, including adopting fuel stations as a starting point for card payment experiments, which has contributed to raising awareness of the importance of these tools."

He pointed out that "other challenges relate to infrastructure, legislation, and cybersecurity, as well as the gap between cities and villages in the field of digital services," noting that "the government, in coordination with the Central Bank, has issued clear instructions to activate electronic payment tools in the governorates."

He added, "During a recent symposium, World Bank experts praised the rapid progress Iraq has made in electronic payments and financial inclusion over the past three years, stressing that the indicators recorded in the number of cards and electronic payment devices reflect this development ." https://economy-news.net/content.php?id=60469

Iraq records a rise in its oil exports to the United States

economy | 09:48 - 09/28/2025 Mawazine News - Follow-up The US Energy Information Administration announced on Sunday that Iraq's oil exports to the United States increased last week.

The administration said in a statistic reviewed by Mawazine News that "the average US crude oil imports last week from 10 major countries reached 5.767 million barrels per day, an increase of 699,000 barrels per day compared to the previous week, which averaged 5.068 million barrels per day."

It added that "Iraq's oil exports to the US reached 197,000 barrels, an increase of 74,000 barrels per day compared to the previous week, which averaged 123,000 barrels per day."

The administration indicated that "the largest oil revenues to the US last week came from Canada, at an average of 3.837 million barrels per day, followed by Brazil, at an average of 435,000 barrels per day, Mexico, at an average of 320,000 barrels, and Saudi Arabia, at an average of 296,000 barrels per day."

According to the table, "US crude oil imports from Ecuador averaged 236,000 barrels per day, from Venezuela 143,000 barrels per day, from Nigeria 123,000 barrels per day, from Colombia 121,000 barrels per day, and from Libya 68,000 barrels per day."

https://www.mawazin.net/Details.aspx?jimare=267511

Central Bank: Iraq Is Witnessing Its Lowest Inflation Rate In History Today

Economy | 12:13 - 09/28/2025 Mawazine News - Baghdad - The Governor of the Central Bank, Ali Al-Alaq, announced today, Sunday, that Iraq is witnessing its lowest inflation rates in history. While noting that it possesses comfortable foreign reserves capable of defending the exchange rate, he emphasized the creation of a sound investment environment following the great success of monetary policy.

In his speech during the Iraq Investment Forum, the Governor of the Central Bank, Ali Al-Alaq, said that "the current phase in Iraq is characterized by stability, reform, and openness to investment," noting that "the Central Bank is a condition for achieving this stability through its monetary and financial policies, controlling inflation, supporting and stimulating various economic initiatives, addressing the requirements of reality, and enabling the private sector to operate in an appropriate environment."

He added that "achieving monetary and financial stability is the result of several factors, most notably the daily policies pursued by the Central Bank in confronting developments and challenges, the prudent management of financial reserves, which represents a fundamental pillar for achieving stability, and the management of the banking sector in a way that contributes to strengthening this path."

He pointed out that "one of the most prominent indicators of the success of monetary policy is the creation of a sound investment environment through controlling inflation rates," explaining that "general price stability constitutes an important basis for the work of the private sector and investors, while turbulent environments in price levels and inflation hinder real growth."

He pointed out that "the Central Bank gives this issue top priority through close monitoring to ensure general price stability," stressing that "Iraq is currently witnessing the lowest inflation rates in its history, which reflects the success of monetary policies in controlling and managing the flow of money, in addition to the presence of comfortable foreign reserves capable of defending the exchange rate and achieving a significant balance between supply and demand for foreign currency."

https://www.mawazin.net/Details.aspx?jimare=267517

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Monday Afternoon 9-29-25

Good Afternoon Dinar Recaps,

Naval Build-Up: U.S. Modernizes Fleet While China Surges Ahead in Shipbuilding

As China scales ship production and the U.S. ramps its naval modernization amid war games in the South China Sea, the balance of power is shifting — with major implications for global money, trade, and military finance.

Good Afternoon Dinar Recaps,

Naval Build-Up: U.S. Modernizes Fleet While China Surges Ahead in Shipbuilding

As China scales ship production and the U.S. ramps its naval modernization amid war games in the South China Sea, the balance of power is shifting — with major implications for global money, trade, and military finance.

China’s Shipyard Dominance & Technological Leap

China now accounts for over half of all global ship orders by tonnage in the first eight months of 2025, confirming its dominance in commercial and dual-use shipbuilding – despite U.S. port fees targeting Chinese vessels.

The aircraft carrier Fujian launched a stealth fighter using an electromagnetic catapult — a capability previously almost unique to the U.S. Navy. This reflects not just quantity, but technological maturity.

China’s latest naval project, the amphibious assault ship Type 076 “Sichuan”, is designed to carry drones and launch them with EMALS-like systems; it is preparing for sea trials.

U.S. Response: Modernization, Fees, and Strategic Rebalancing

The U.S. is pushing port fees on Chinese-built vessels entering U.S. ports, raising the cost for vessels tied to Chinese shipyards, in part as a way to counter China’s maritime dominance.

U.S. naval modernization includes investing in shipyards, increasing production, and improving warship technology, although several reports warn of weaknesses: maintenance backlogs, supply chain delays, workforce shortages.

War Games & U.S.-China Confrontations in the Sea

Recent U.S. war games and exercises in the South China Sea, often with allies, serve both as deterrence and as demonstrations of logistical capacity and naval readiness — key in projecting both power and securing supply lines.

China, meanwhile, is performing its own naval drills, advancing capabilities in drone warfare, early warning aircraft, and carrier operations. The potential for escalation exists, but much also depends on who controls the maritime routes.

How This Fits Into Broader Global Restructuring

🔹 Industrial Capacity as National Security Asset

▪️ China's state-supported industrial base allows it to produce commercial and warship assets at scale and speed. Those shipyards are dual use: supporting merchant fleets, but also military expansion.

▪️ U.S. is trying to revive its shipbuilding industrial base — not just for defense, but because industrial strength impacts trade balance, employment, and technological leadership.

🔹 Financial & Trade Levers in Strategic Competition

▪️ Port fees on Chinese-built vessels are not just trade policy — they are financial instruments used to shape economic dependencies and shift investment flows.

▪️ Countries ordering ships, choosing ports, or contracting shipyards are effectively making strategic financial decisions: where capital flows, where alliances are strengthened, where supply chains are trusted.

🔹 Alliance Behavior & Global Military Finance

▪️ U.S. war games with allies amplify defense costs: joint training, combined procurement, shared technology development. Funding these requires investment, debt, subsidies, which influences national budgets.

▪️ China’s activities press other nations to reexamine their naval and maritime strategies; they may feel compelled to invest more in defense or align more closely with China or the U.S. for protection, trade guarantees, or port access.

Key Implications

Countries dependent on shipping or maritime trade must now consider which naval power controls the routes, how fees or sanctions could affect shipping costs, and what defense guarantees they will need.

U.S. policy is beginning to treat industrial capacity (shipyards, ports, naval tech) not just as defense, but as essential infrastructure in geopolitical competition.

The speed and scale of China’s shipbuilding challenge the assumption that the U.S. can remain structurally dominant without major reform, funding, or alliances.

Why This Matters

The naval build-up is not just about ships or war games. It’s about which nations control maritime commerce, technological platforms, and industrial capacity. How trade gets routed, which currencies are used in ship finance, who builds warships and their supply chains — all this will reshape political and financial systems of power globally.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Reuters – China shipyard orders strong despite U.S. port fees on Chinese vessels Reuters

Business Insider – China’s newest aircraft carrier, Fujian, launches stealth fighter with EMALS Business Insider

Reuters – Trump’s port fees will weaken China’s shipbuilding dominance Financial Times

South China Morning Post – Type 076 “Sichuan” ship enters trials South China Morning Post

Reports on U.S. shipbuilding weakness: Business Insider analysis Business Insider

Reuters – US targets China’s global ports as part of maritime strategy Reuters

Congressional Research Service – China Naval Modernization: Implications for U.S. Navy capabilities Congress.gov

~~~~~~~~~

SWIFT’s Blockchain Push vs. Ripple/XRP: Competition in the Cross-Border Payments Arena

As SWIFT pivots toward blockchain and tokenization, Ripple/XRP’s fast, low-cost rails present a parallel model — both are part of a broader reshaping of how value moves globally.

SWIFT’s Prototype with Consensys: Modernizing the Backbone

SWIFT is developing a shared blockchain ledger in partnership with Consensys, aimed at improving cross-border payments among global banks. The prototype will test tokenized assets (including stablecoins), enforce transactions with smart contracts, validate sequencing, and improve transaction cost transparency.

Key participating banks include Bank of America, Citigroup, NatWest, Deutsche Bank, HSBC, JPMorgan Chase, etc. Swift’s goal: offer 24/7 instant, always-on cross-border transactions with predictable pricing and speed.

Ripple / XRP: Already Operating at the Edge of Innovation

Ripple’s XRP Ledger (XRPL) settles many transactions in 3-5 seconds at very low fees (< $0.01), especially in remittances and low-value cross-border flows. In contrast, traditional SWIFT transfers can take days and cost tens of dollars.

Ripple’s model (On-Demand Liquidity, use of XRP as a bridge currency) sidesteps needs for pre-funded nostro/vostro accounts, reducing capital tied up in cross-border transfers.

Where SWIFT and Ripple Overlap, Diverge, and What’s at Stake

🔹 Overlap / Convergence

▪️ SWIFT inserting blockchain rails into its messaging infrastructure suggests it recognizes the same pain points Ripple has long highlighted: high fees, delayed settlement, opaque fees.

▪️ The tokenization of assets and stablecoins, which SWIFT’s prototype supports, is a terrain where Ripple already has products (like its RLUSD stablecoin) and experience.

🔹 Key Differences

▪️ Scale vs. agility: SWIFT has a vast global network of ~11,000+ financial institutions; Ripple/XRP is much newer but more nimble, able to move fast in certain corridors.

▪️ Settlement vs messaging: SWIFT historically handles messaging / instruction; Ripple handles actual value settlement using XRP. SWIFT’s blockchain effort appears to be about modernizing messaging plus adding settlement-adjacent capabilities, but Ripple directly handles liquidity and settlement.

▪️ Regulatory clarity & adoption: XRP’s usage depends heavily on regulation (e.g., classification of XRP, stablecoin rules, AML/KYC compliance). SWIFT is embedded in legacy systems and regulatory structures, giving it institutional trust; but it risks lagging in innovation if not careful.

Implications for Global Financial Restructuring

Redefinition of Cross-Border Money Flows: As SWIFT upgrades and blockchain/crypto rails (Ripple/XRP, stablecoins, etc.) improve, money transfer becomes faster, cheaper, and more transparent. This reduces reliance on costly legacy banking intermediaries.

Shifting Power over Financial Infrastructure: Who controls payment rails and messaging systems gains geopolitical leverage. Countries or institutions that adopt XRPL or SWIFT-blockchain systems may control more of the financial flow, clearing, and settlement power.

Currency Sovereignty & De-Dollarization Pressures: As stablecoins and tokenized assets gain traction, less value might flow through USD-centric channels. Ripple’s blockchain model, combined with SWIFT’s recognizing of stablecoins and tokenization, opens up paths for non-USD payment settlements.

Financial Access and Inclusion: Lower fees, faster settlement may make cross-border trade, remittances, and financial services more accessible to smaller countries, SMEs, and unbanked populations. That changes who participates in global finance.

Key Points

SWIFT is shifting from a purely messaging network to a blockchain-based prototype that includes tokenization and smart contracts.

Ripple/XRP already offers settlement finality and liquidity in seconds, which SWIFT’s current model doesn’t yet match in most use cases.

The move by SWIFT suggests incumbents are adapting—not being disrupted entirely but trying to incorporate the innovation around them.

Why This Matters Now

This is about more than tech. It’s about who writes the rules of cross-border value transfer. As SWIFT modernizes, blockchain networks like XRP are testing new possibilities. The intersection of regulation, infrastructure, currency choice, and technology is forming a new financial architecture.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Financial Times – SWIFT to launch blockchain in response to rise of stablecoins Financial Times

Coingape – Shared blockchain ledger for global payments (SWIFT & Consensys) CoinGape

CCN – What SWIFT’s Cross-Border Retail Payments Scheme Means & XRP competition CCN.com

AInvest – XRP vs SWIFT: The New Era of Cross-Border Payments AInvest

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps