Global Fractures and the BRICS Realignment

Global Fractures and the BRICS Realignment

Gregory Mannarino: 8-30-2025

Forget what you think you know about the future of global power. According to market analyst Gregory Mannarino, the anticipated collapse of the current international order isn’t a future prophecy – it’s actively unfolding right before our eyes.

We’re not waiting for the system to break; we’re living through its profound transformation into something entirely new.

Global Fractures and the BRICS Realignment

Gregory Mannarino: 8-30-2025

Forget what you think you know about the future of global power. According to market analyst Gregory Mannarino, the anticipated collapse of the current international order isn’t a future prophecy – it’s actively unfolding right before our eyes.

We’re not waiting for the system to break; we’re living through its profound transformation into something entirely new.

Mannarino’s insightful analysis paints a picture of a world in dynamic realignment, moving swiftly from a unipolar, dollar-dominated landscape to a fragmented, multipolar reality. Here’s a breakdown of the key elements driving this unprecedented shift:

The most striking observation is the emergence of regional fractures. Countries and alliances are increasingly isolating themselves from traditional structures, forming new blocs – what Mannarino provocatively calls “walls” – that represent the nascent outlines of future empires.

This isn’t just about diplomatic squabbles; it’s about fundamental shifts in strategic alignment and economic self-interest.

Beyond trade and payment systems, another crucial strategy employed by key players involves gold.

Both Russia and China are aggressively accumulating gold reserves, seeing it as a vital backstop for their currencies against the inherent instability of the current fiat money system, particularly the dominant U.S. dollar.

Mannarino even likens this national strategy to individuals acting as their own “central banks,” highlighting the importance of personal financial resilience. In a world of increasing instability, hedging against systemic risks by diversifying assets becomes not just a smart move for nations, but for individuals as well.

What does this all mean for us? We are witnessing a dynamic realignment in global power structures, economic systems, and strategic alliances.

The unipolar world governed by a single dominant force is giving way to a multipolar landscape where new centers of power, new currencies, and new economic strategies are emerging. This isn’t a theoretical concept; it’s a living, breathing reality unfolding daily.

Understanding these shifts isn’t just academic; it has profound implications for global stability, economic security, and international relations. The chessboard is being reset, and the game has already begun.

For a deeper dive into these critical insights and a comprehensive understanding of the forces shaping our world, watch the full video from Gregory Mannarino.

Iraq Economic News and Points To Ponder Saturday Afternoon 8-29-25

Dollar Prices On The Baghdad And Erbil Stock Exchanges At The Close

Stock Exchange The US dollar exchange rate rose against the Iraqi dinar on Saturday evening in Baghdad and Erbil as the stock exchange closed.

Baghdad: Selling price: 143,500 dinars for $100. Buying price: 141,500 dinars for $100.

Erbil: Selling price: 142,200 dinars for $100. Buying price: 142,100 dinars for $100

Dollar Prices On The Baghdad And Erbil Stock Exchanges At The Close

Stock Exchange The US dollar exchange rate rose against the Iraqi dinar on Saturday evening in Baghdad and Erbil as the stock exchange closed.

Baghdad: Selling price: 143,500 dinars for $100. Buying price: 141,500 dinars for $100.

Erbil: Selling price: 142,200 dinars for $100. Buying price: 142,100 dinars for $100.https://economy-news.net/content.php?id=59422

Gold Prices Rise Again In Baghdad

Economy | 08/30/2025 Mawazine News - Baghdad - The prices of foreign and Iraqi gold recorded a significant increase on Saturday in the local markets of the capital, Baghdad.

The selling price of one mithqal of 21-karat Gulf, Turkish and European gold in the wholesale markets on Al-Nahr Street was 700,000 dinars, while the purchase price reached 696,000 dinars. This increase comes compared to last Thursday's prices, when the selling price was 686,000 dinars.

The selling price of one mithqal of 21-karat Iraqi gold reached 670,000 dinars, while the purchase price reached 666,000 dinars. https://www.mawazin.net/Details.aspx?jimare=265953

Iraqi Oil Prices Rise In Global Markets

Economy | 10:55 - 08/30/2025 Mawazine News – Baghdad Iraqi oil prices rose on Saturday during daily trading in the global market.

According to data reviewed by Mawazine News, Basra Medium crude rose to $70.11 per barrel, while Basra Heavy crude reached $66.91 per barrel, with a change rate of +0.94% for both.

Regarding global oil prices, British Brent crude recorded $68.12 per barrel, while US West Texas Intermediate crude recorded $64.01 per barrel, with changes rates of -0.59% and -0.50%, respectively. https://www.mawazin.net/Details.aspx?jimare=265947

The Central Bank Of Iraq Issues Instructions And Regulations To Regulate The Electronic Payment Process In Three Aspects.

Banks Economy News – Baghdad Central Bank Governor Ali Al-Alaq announced on Saturday the issuance of instructions and regulations to regulate electronic payments across three aspects. While revealing a mechanism for developing the electronic payment process, he also affirmed that all state institutions are required to use electronic payments, not cash.

Al-Alaq told the official news agency, as received by Al-Eqtisad News, that "electronic payment is witnessing significant development. It is a gateway to the digital transformation towards a digital economy, a larger issue related to economic structure and global interaction, to achieve greater financial inclusion. All of these aspects have become established and advanced strategies."

He pointed out that "the Central Bank, along with the government, the private sector, electronic payment companies, and technology companies, are all engaged in this massive and ongoing effort. We have regulatory and legislative technical initiatives and directions being worked on in coordination between the Central Bank of Iraq and the Iraqi government."

He added, "There is cooperation and coordination with the government through the decision issued by the Council of Ministers requiring all state institutions to use electronic payments instead of cash.

There is also the localization of salaries, which amounts to millions, in addition to public awareness being conducted through electronic payment companies and civil society organizations. There is growing community awareness."

He explained that "progress in electronic payments requires infrastructure, a legislative framework, and community awareness. These are three aspects that are being worked on diligently.

Much of the infrastructure at the Central Bank level has been completed in an advanced manner, fully in line with international practices and legislative frameworks. We have issued numerous instructions and regulations that regulate the process, but we need more in the third aspect, which is community and cultural awareness." https://economy-news.net/content.php?id=59401

Tax Reform Committee: Recording A 20% Revenue Growth

Local The Supreme Committee for Tax Reform confirmed on Saturday that private sector companies' voluntary disclosure activity increased by more than 40%, while revealing a 20% growth in revenues. It noted that cooperation with international institutions contributed to the implementation of tax reform within several parameters.

Khalid Al Jabri, a member of the Supreme Committee for Tax Reform, said: "The Tax Reform Conference for Economic Development and Investment Stimulation, held last week, reflects a broad package of reform measures implemented over the past months."

He noted that "the conference includes a presentation of digital repercussions, including the growth in tax revenues last year compared to the previous year by more than 20%, with growth this year expected to reach between 30 and 35%."

He added, "These repercussions have contributed to revitalizing the commercial registry, through a number of private sector companies' willingness to voluntarily file a declaration. Activity in this area has increased by more than 40%, indicating the presence of an economic movement that has begun to enhance confidence between the General Tax Authority and taxpayers."

He noted that "this confidence has begun to crystallize through the facilitation of business facilitation procedures, which has led to a gradual growth in economic activity."

Al-Jaberi explained that "there is cooperation with international institutions, such as the Center for Tax and Investment in Washington, which has helped the Higher Committee address many of the constraints facing tax reform, in addition to harmonizing Iraqi standards with international standards, with the aim of strengthening the economic environment in Iraq and attracting foreign companies to invest in the country." https://economy-news.net/content.php?id=59429

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 8-30-25

Good Afternoon Dinar Recaps,

Trump vs BRICS: The Hidden Role of US Policy in China’s Expansion

Tensions between the Trump administration and the BRICS bloc have been steadily escalating, with Trump threatening tariffs and taking a confrontational stance toward China and its partners. This marks a sharp departure from the previous U.S. approach, and it is reshaping global dynamics as BRICS expands its influence over nearly 40% of global GDP.

Good Afternoon Dinar Recaps,

Trump vs BRICS: The Hidden Role of US Policy in China’s Expansion

Tensions between the Trump administration and the BRICS bloc have been steadily escalating, with Trump threatening tariffs and taking a confrontational stance toward China and its partners. This marks a sharp departure from the previous U.S. approach, and it is reshaping global dynamics as BRICS expands its influence over nearly 40% of global GDP.

Policy Reversal Shows Trump vs BRICS Approach

While the Biden administration largely dismissed BRICS as a non-threatening coalition, Trump has taken a dramatically different line.

National Security Advisor Jake Sullivan previously remarked:

“We are not looking at the BRICS as evolving into some kind of geopolitical rival to the United States or anyone else.”

By contrast, since winning the 2024 election, Trump has repeatedly threatened tariffs against BRICS countries while criticizing the bloc’s initiatives. His sharp rhetoric has drawn attention, although at times his grasp of the group has appeared limited—Trump once incorrectly claimed Spain was a member, and later admitted uncertainty about China’s role in BRICS:

“I don’t even know that they’re a member of BRICS.”

How Tensions Drive BRICS Expansion

Former U.S. Ambassador to China Nicholas Burns revealed at the Aspen Security Forum that Trump’s aggressive approach toward China and U.S. allies inadvertently fueled BRICS growth.

Burns explained:

“I think they were threatened. I felt it in my bones as I talked to them over the last couple of years.”

According to Burns, Beijing responded by working harder to strengthen BRICS alliances:

“What did they try to do? They tried to build the BRICS up.”

He also noted that allies across Europe, NATO, and the Indo-Pacific were aligned in their efforts to counter China, which reinforced Beijing’s determination to deepen ties within BRICS.

Dollar Challenge Gets Serious

Trump has consistently emphasized his determination to protect the U.S. dollar’s dominance:

“The dollar is king. We’re going to keep it that way.”

But BRICS has been actively building alternative financial systems, including:

The New Development Bank

The BRICS PAY system

Regional settlement mechanisms designed to reduce reliance on the U.S. dollar

With new members such as Egypt, Ethiopia, Iran, and the UAE, BRICS now represents a formidable coalition pushing for de-dollarization.

Burns explained that Trump’s tariff threats, combined with the strength of allied coordination, left China feeling cornered:

“The Chinese were threatened by the strength of the allies pushing together against them.”

Future Relations Look Complicated

Economist Richard Wolff offered a stark assessment of what these developments could mean for U.S. influence:

“In a way, the United States peaked, its empire peaked, and it is now being challenged. Pay attention to the BRICS.”

Burns added his own warning about Trump’s approach to U.S. partners:

“You can’t make our allies feel subservient to the United States.”

As BRICS continues to expand—now accounting for roughly 40% of the world’s population and economic output—Trump’s aggressive stance may inadvertently accelerate membership growth and further strengthen the bloc’s challenge to U.S. global leadership.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

8-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

8-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Saturday Morning 8-29-25

The Return Of American Companies To Iraq: Guarantees Of Transparency And Security Balance The Risks Of Corruption And Chinese Influence.

Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi commented on Friday (August 29, 2025) on the return of giant American companies to work in Iraq after years of withdrawal, considering it a step that indicates an improvement in the investment climate.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that the return of the American company "Chevron" from the Nasiriyah field in Dhi Qar Governorate comes after a previous wave of withdrawals by a number of major foreign companies.

The Return Of American Companies To Iraq: Guarantees Of Transparency And Security Balance The Risks Of Corruption And Chinese Influence.

Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi commented on Friday (August 29, 2025) on the return of giant American companies to work in Iraq after years of withdrawal, considering it a step that indicates an improvement in the investment climate.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that the return of the American company "Chevron" from the Nasiriyah field in Dhi Qar Governorate comes after a previous wave of withdrawals by a number of major foreign companies.

These withdrawals were due to the growing risks of corruption, a lack of experience in public administration, a weak ability to absorb the flow of aid funds, in addition to sectarian issues and a lack of political will to combat corruption.

Al-Marsoumi explained that massive embezzlement, fraudulent procurement, money laundering, oil smuggling, and widespread bureaucratic bribery have led to a flight of investment and the country's position at the bottom of international corruption rankings, hindering effective state-building and service delivery.

On the other hand, the return of American companies is linked to several factors, most notably the US desire to counterbalance China's massive influence in the Iraqi oil and gas sector.

The guarantees provided by the Iraqi government regarding transparency, contract stability, and

security also served as an important incentive. According to Al-Marsoumi,

Chevron's return came after Baghdad agreed to three conditions presented by the American companies:

"consistency," which guarantees the completion of the facilities associated with the projects;

"security," which includes employee safety and sound business and legal practices; and

"procedural facilitation," which ensures the deal remains intact regardless of any future government changes.

The new contract stipulates that the company will receive a share of the project's revenues

after production begins, reflecting a new model that Iraq is seeking to adopt to attract major investors. https://baghdadtoday.news/282045-.html

Achieving Self-Sufficiency In Refined Gasoline.. Oil: Opening Of The (FCC) Unit In The Basra Refinery Soon.

Yesterday, 13:44 Baghdad - INA - Hassan Al-Fawaz The Ministry of Oil revealed on Friday the

imminent opening of the FCC unit at the Basra refinery, confirming that Iraq will achieve self-sufficiency in refined gasoline, while hinting at the possibility of reducing petroleum product prices.

The Undersecretary of the Ministry of Oil for Distribution Affairs, Ali Maaraj, told the Iraqi News Agency (INA):

"The oil refineries have currently reached a state of sufficiency in kerosene and gas oil," noting that

"the coming days will witness the opening of the (FCC) unit in the Basra refinery, and Iraq will reach the stage of self-sufficiency in improved gasoline and export of gas oil."

He pointed out that "Iraq currently imports quantities of gasoline, and it is certain that when national refineries achieve self-sufficiency, this will be reflected in the prices of petroleum products and derivatives, especially gasoline sold locally, given that only the operating costs of the refineries are charged. https://ina.iq/ar/economie/242089-fcc.html

A Positive Sign: Iraq Maintains Its B-/B Credit Rating From Standard & Poor's.

Standard & Poor's announced on Tuesday that Iraq has maintained its credit rating at B-/B with a stable outlook. Information/Baghdad.. The agency stated in a report received by Al-Maalouma Agency that "Iraq's rating remained at B-/B with a stable outlook, a positive sign that reflects the strength of the national economy and the continued confidence of international institutions in the financial path and government reforms."

It pointed out that "Iraq's economic stability is supported by an improvement in oil revenues by an annual rate of approximately 1.9% during 2025-2028, with the continuation of government measures to manage public debt and enhance foreign reserves, which contributes to maintaining financial balance and supporting confidence in the national economy."

She noted that "Iraq continues to meet its regular financial commitments, with a relative improvement in deficit indicators, in addition to the stability of the exchange rate and the high levels of reserves at the Central Bank, which enhances the strength of the country's external position."

https://almaalomah.me/news/108547/economy/إشارة-إيجابية-العراق-يحافظ-على-تصنيفه-الائتماني-عند-b-b-من-و

Oil Prices Fall, Heading For Their First Monthly Loss Since April.

economy | 09:07 - 08/29/2025 Mawazine News - Follow-up Oil prices fell, heading towards a monthly loss in August, amid concerns about a global supply glut, along with escalating geopolitical tensions, led by US moves to end the war in Ukraine.

Brent crude for November delivery traded near $68 a barrel, losing about 5% of its value during the month, while West Texas Intermediate crude fell towards $64.

This decline is driven by investor concerns that global supplies will exceed demand levels in the coming quarters, which could lead to a resurgence of oil inventories.https://www.mawazin.net/Details.aspx?jimare=265888

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 8-30-25

Good Morning Dinar Recaps,

Congressional Delegation Advances US-Europe Alliance on Crypto, Policy, and Security

On August 29, 2025, U.S. House Committee on Financial Services Chairman French Hill announced that he and Rep. Vicente Gonzalez led a bipartisan delegation to Italy, Switzerland, and Germany from August 20–28.

The mission focused on strengthening U.S.-European ties on financial regulation and security, with lawmakers meeting senior officials from both government and industry to discuss:

Good Morning Dinar Recaps,

Congressional Delegation Advances US-Europe Alliance on Crypto, Policy, and Security

On August 29, 2025, U.S. House Committee on Financial Services Chairman French Hill announced that he and Rep. Vicente Gonzalez led a bipartisan delegation to Italy, Switzerland, and Germany from August 20–28.

The mission focused on strengthening U.S.-European ties on financial regulation and security, with lawmakers meeting senior officials from both government and industry to discuss:

Digital assets

Tokenization

Monetary policy

Transatlantic security cooperation amid Russia’s war in Ukraine

Hill emphasized:

“In each of the three countries, the lawmakers discussed matters related to the expanding market for digital assets, tokenization, conduct of monetary policy, and the transatlantic partnership issues regarding national security.”

Stablecoin Policy, Tokenization, and Next Steps

The delegation also briefed European partners on recent U.S. policy changes, particularly the landmark stablecoin legislation, and exchanged views on monetary policy. Hill stressed that these conversations reinforced the importance of deepening U.S.-Europe cooperation at a moment when financial regulation and security are increasingly interconnected.

He added:

“We briefed our European partners on the digital asset policy landscape following the passage of landmark stablecoin legislation, and we shared views on the conduct of monetary policy and next steps in ensuring transatlantic security.”

Gonzalez Highlights Bipartisan Unity and Personal Engagement

Rep. Gonzalez underscored the bipartisan nature of the trip, thanking European financial leaders for engaging on digital asset regulation and monetary policy.

A personal highlight for Gonzalez was his meeting with Pope Leo XIV, describing it as a deeply meaningful experience. He said the pope’s message of cooperation added a unique moral and human dimension to the delegation’s work.

Gonzalez affirmed his commitment to continue working with Hill and other committee leaders to ensure alignment between U.S. domestic priorities and international partnerships:

“I thank the leadership of Europe’s leading financial institutions for meeting with our bipartisan delegation to discuss key issues on monetary policy and digital assets.”

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

Project ATLAS Unveiled: UAE’s Bold Leap into Decentralized AI and Blockchain

Gewan Holding, part of Abu Dhabi’s NG9 Holding, has partnered with decentralized infrastructure pioneer Iopn to accelerate the development of sovereign AI, blockchain, and digital identity solutions in the United Arab Emirates.

Introducing Project ATLAS

Gewan Holding has entered into a strategic partnership with Iopn, a pioneer in decentralized infrastructure, to launch Project ATLAS—an ambitious initiative aimed at advancing sovereign artificial intelligence (AI), blockchain, and digital identity in the UAE.

At the core of this collaboration is the deployment of a sovereign AI stack powered by Nvidia GPUs and anchored by Iopn’s OPN Chain.

The new infrastructure integrates high-performance AI computing with a sovereign digital identity layer, enabling compliant, scalable operations across governance, finance, healthcare, and real estate. In addition, the OPN Chain supports:

Real-world asset (RWA) tokenization

Biometric authentication

Modern payment systems

These capabilities are designed to unlock liquidity and provide regulated access to global capital markets.

A Strategic Partnership for Sovereignty

Alaa Al Ali, Group CEO of NG9 Holding, highlighted the strategic nature of the initiative:

“Our collaboration with Iopn and the launch of Project ATLAS is not just about building technology—it’s about securing sovereignty and enabling the UAE to shape the digital future.”

Project ATLAS, which stands for Advance Tokenized Liquid-cooled AI Stack, is being developed by Iopn in partnership with Betabytes, an official Nvidia Cloud Partner. It will operate as a sovereign-grade AI data center, forming a key pillar within the broader Iopn ecosystem of digital financial infrastructure, tokenization, and AI-driven innovation.

Amer Al Osh, Chief Development Officer at Gewan Holding, added that the project reinforces digital sovereignty while unlocking new economic opportunities, ensuring that the UAE continues to set global benchmarks in AI and Web3 innovation.

Building a Unified Digital Ecosystem

Mojtaba Asadian, CEO of Iopn, described the OPN Chain as the cornerstone of a unified ecosystem for sovereign identity, financial infrastructure, and AI:

“With NG9 Holding’s support and initiatives like Project ATLAS, we are building sovereign-grade digital infrastructure that empowers nations to harness AI and Web3 on their own terms.”

The announcement also introduced the launch of the Gewan AI Hub, created to accelerate AI adoption across industries. This initiative complements the UAE’s national digital transformation strategy while reinforcing the role of Iopn’s ecosystem.

Looking Ahead

Together, Gewan Holding and Iopn aim to position the UAE as a global gateway for sovereign AI and blockchain solutions. Additional initiatives under Project ATLAS are expected to be revealed in the coming months.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

US Leadership Pushes Bitcoin Strategy as Debate Over Digital Reserve Currency Intensifies

The United States is deepening its commitment to Bitcoin mining and accumulation, even as critics highlight its inefficiencies compared to ISO20022-compliant digital assets like XRP, XLM, HBAR, and QNT. The move raises questions about whether Bitcoin is being positioned as a reserve asset or a geopolitical hedge against de-dollarization.

Trump Family, Lawmakers Signal Strong Bitcoin Support

Reports confirm that Trump Media & Technology Group purchased $2 billion worth of bitcoin in July, reinforcing speculation that the U.S. government may view the digital asset as part of its broader reserve strategy.

Meanwhile, two of President Trump’s sons launched American Bitcoin Miner in March, an entity 80% owned by Hut 8. The firm is preparing for a September stock market listing and has already acquired 16,299 Antminers S21, with plans to expand to a total computing power of 25 EH/s, placing it among the top four U.S. miners.

Currently, the United States controls about 35% of global hashrate, far ahead of Russia (17%) and China (15%). Supporters argue this establishes U.S. “sovereignty” over Bitcoin’s infrastructure.

At the legislative level, Senator Cynthia Lummis continues to push her proposed “Bitcoin Act”, which envisions selling part of America’s gold reserves to accumulate 1 million bitcoins.

Energy and Infrastructure Debate

Bitcoin mining advocates argue the industry can stabilize energy grids by absorbing surplus electricity and providing real-time load shedding. Texas has already integrated miners into its grid management, allowing operators to cancel new gas plant projects while maintaining resilience.

Supporters in Europe argue nuclear surplus power could be redirected into mining, though critics note that other digital assets with faster settlement speeds and higher utility could deliver greater value without the heavy energy burden.

A Geostrategic Bet — or a Risk?

With U.S. debt exceeding $37 trillion and foreign buyers, including BRICS nations, reducing exposure to the dollar, Washington faces mounting pressure to maintain reserve status for U.S.-backed assets.

Some see Bitcoin as a stateless, uncensorable hedge, while others view it as a stopgap measure compared to utility-driven, ISO20022-compliant assets better suited for cross-border payments, tokenization, and digital infrastructure.

Former White House advisor Bo Hines stated:

“I remain very confident that the American government remains very favorable to the idea of acting quickly to accumulate bitcoins for its strategic reserve.”

Still, skepticism remains. Unlike XRP, HBAR, or QNT—each designed for high-speed, scalable global settlement—Bitcoin remains slow, energy-intensive, and limited in utility beyond being a store of value.

The Bigger Picture

While U.S. policymakers and the Trump circle appear to be betting heavily on Bitcoin, questions linger over whether this strategy truly prepares the nation for the next-generation financial system.

Across the world, BRICS, the UAE, Japan, and South Korea are exploring blockchain strategies centered on tokenization, CBDCs, and interoperable digital infrastructure—areas where Bitcoin plays little role.

For many analysts, the real long-term race may not be about which country can mine the most Bitcoin, but which digital assets will power tokenized finance, real-time payments, and sovereign digital identity frameworks.

Bitcoin vs ISO20022-Compliant Assets

Feature Bitcoin (BTC) ISO20022 Assets (XRP, XLM, HBAR, QNT)

Transaction Speed ~10 minutes per block 2–5 seconds

Energy Use Very high (proof-of-work mining) Minimal (consensus mechanisms)

Utility Store of value only Payments, tokenization, smart contracts, identity

Scalability Limited (~7 transactions/sec) High (thousands per second possible)

Compliance & Integration Not ISO20022-compliant Fully ISO20022-compliant

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 8-29-25

Good Afternoon Dinar Recaps,

50+ Countries Want to Join BRICS: US Global Power Faces Collapse

The defining geopolitical question of 2025 is no longer if but how many nations want to join BRICS. At the time of writing, more than 50 countries have signaled interest, with 23 submitting formal applications and another 28 expressing informal interest. The latest to step forward is Vietnam, underscoring how BRICS expansion has become a global phenomenon reshaping power dynamics.

Good Afternoon Dinar Recaps,

50+ Countries Want to Join BRICS: US Global Power Faces Collapse

The defining geopolitical question of 2025 is no longer if but how many nations want to join BRICS. At the time of writing, more than 50 countries have signaled interest, with 23 submitting formal applications and another 28 expressing informal interest. The latest to step forward is Vietnam, underscoring how BRICS expansion has become a global phenomenon reshaping power dynamics.

🔹 Current BRICS Membership

BRICS has grown from its original five members to 11 full members. The most recent additions include:

Indonesia (January 2025)

Saudi Arabia (July 2025)

Egypt, Ethiopia, Iran, and the UAE (earlier expansions)

With these inclusions, BRICS now represents nearly half the world’s population and over 41% of global GDP. Beyond members, the alliance has also established partnerships with Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, and Uzbekistan.

This network shows that BRICS is building more than a trade bloc—it is constructing a parallel system of alliances and institutions outside Western dominance.

🔹 Europe’s Bold Moves Toward BRICS

Despite Western pressure, several European nations are eyeing membership:

Belarus – the most vocal candidate, citing sanctions relief.

Serbia – the first European nation to express interest.

Turkey – a NATO member now openly pursuing BRICS ties.

This demonstrates that BRICS is not merely an alliance of the “Global South” but one that is starting to fracture Europe’s unity under Western influence.

🔹 Asia and Africa Lead Expansion

The strongest wave of new interest comes from Asia and Africa, with countries such as:

Azerbaijan, Bahrain, Bangladesh, Burkina Faso, Cambodia, Chad, Colombia, Congo, Equatorial Guinea, Honduras, Laos, Kuwait, Morocco, Myanmar, Nicaragua, Pakistan, Palestine, Senegal, South Sudan, Sri Lanka, Syria, Venezuela, Zimbabwe, and more.

Vietnam’s entry highlights a sovereignty-driven shift, as many nations seek alternatives to dollar-based trade systems.

🔹 The July 2025 Rio Summit

At the Rio Summit, leaders debated the pace of expansion.

China, Russia, and Iran push for rapid enlargement.

Brazil and India prefer a slower, consensus-based approach.

Brazil’s President Lula da Silva captured the moment:

“We are witnessing an unprecedented collapse of multilateralism.”

Meanwhile, U.S. President Donald Trump dismissed the developments, declaring:

“BRICS is dead.”

Yet the facts suggest the opposite: BRICS is growing rapidly.

🔹 Key Takeaway

The BRICS expansion wave signals nothing short of a global realignment of power. With over 50 nations vying for entry, BRICS is becoming the counterweight to U.S. hegemony.

Trump’s tariff threats may slow trade, but they cannot stop the structural transformation already underway. The more countries that join BRICS, the stronger the momentum for de-dollarization and multipolar finance—a fundamental shift the U.S. cannot easily reverse.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 8-29-25

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Al-Jaberi told the Iraqi News Agency (INA):

"The current reforms have transformed the banking sector from being restricted and deprived of dealing in dollars to a sector capable of opening correspondent banks and restoring its international relations, which will directly reflect on improving banking services and stimulating economic activity in Iraqi markets."

He added, "Iraqi banks welcomed these reforms because they are an indispensable necessity.

The banking sector is suffering from numerous problems, and a comprehensive reform is needed to ensure the ability to conduct international transactions and ensure the freedom to trade in dollars."

He explained that "the investment environment in Iraq has become attractive thanks to the

security stability, and this has prompted investors to enter the Iraqi market."

He explained that "investors are always looking for two basic answers: the status of the banking sector and the country's tax system. If reassurance is achieved in these two aspects, investments begin to flow."

Al-Jaberi pointed out that "banking reforms will lead to broader relationships with correspondent banks,

putting Iraq on the path to opening up to the global market and

facilitating the transfer of funds in line with international standards."

He continued, "Financial technology and digital transformation are a fundamental pillar of these reforms, as they are not limited to banking policies alone, but rather encompass all aspects of banking operations.

This positively impacts all economic sectors, such as agriculture, industry, and tourism, and contributes to facilitating the movement of funds and trade both domestically and internationally."

Earlier, Central Bank Governor Ali Al-Alaq confirmed that the banking reform plan would boost international confidence and restore relations with correspondent banks. https://ina.iq/ar/economie/241869-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Friday Morning 8-29-25

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

🔹 CFTC’s Announcement

Acting CFTC Director Caroline Pham confirmed that U.S. clients can once again tap into offshore trading opportunities through the long-standing FBOT registry.

“Starting now, the CFTC welcomes back Americans who want to trade efficiently and safely under CFTC regulations, and opens up U.S. markets to the rest of the world. It’s just another example of how the CFTC will continue to deliver wins for President Trump as part of our crypto sprint.” – Caroline Pham

The FBOT framework, in place since the 1990s, allows registered offshore exchanges to provide U.S. access across asset classes, now extended explicitly to crypto.

🔹 Impact on U.S. Crypto Markets

Liquidity Boost: Offshore access is expected to increase market depth and reduce regional silos.

Binance Case Study: The world’s largest exchange, Binance, remains off-limits to most U.S. users except through its limited affiliate, Binance.US. The CFTC’s move could pave the way for broader participation.

Investor Choice: U.S. traders, often restricted to “walled garden” platforms, may soon benefit from a more competitive and global marketplace.

🔹 Trump’s Crypto Sprint in Action

The announcement follows President Trump’s repeated calls to bring crypto companies back to U.S. soil and secure American leadership in digital assets.

Between 2021 and 2024, unclear rules drove many crypto firms offshore, with the majority of trading volume moving outside U.S. borders. The CFTC’s reforms aim to reverse this trend, positioning the U.S. as a friendlier jurisdiction for digital finance.

🔹 Industry Perspective

Edwin Mata, attorney and CEO of tokenization platform Brickken, stressed that ambiguity in past regulations had created unnecessary legal risk for crypto firms:

Clearer rules will lower compliance burdens.

Companies can operate in the U.S. without fear of “regulation by enforcement.”

More projects will stay onshore, fueling U.S. innovation.

🔹 Next Steps

The CFTC is now accepting public feedback on its crypto framework. Its goal:

Protect investors and markets,

Avoid creating barriers that push innovation offshore.

This marks one of the most significant shifts in U.S. crypto oversight since 2021, potentially reshaping where and how Americans trade digital assets.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Mastercard Launches First Stablecoin Transactions in Africa and the Middle East

The world of crypto payments is steadily moving from experimentation to real-world adoption. This week’s development comes from Mastercard and Circle, who have joined forces to bring stablecoin settlements into mainstream banking flows across Africa, the Middle East, and Eastern Europe.

🔹 A Bold Expansion: USDC & EURC in Banking Flows

Mastercard now enables settlements in USDC and EURC for acquirers in the EEMEA region (Eastern Europe, Middle East, Africa).

Circle has integrated USDC into Finastra’s Global PAYplus platform, opening access to 50 countries and $5 trillion in potential flows.

Early adopters include Arab Financial Services (Bahrain) and Eazy Financial Services (Saudi Arabia).

For Kash Razzaghi, Circle’s Chief Business Officer, the initiative is a turning point:

“Our expanded partnership with Mastercard will enable wider reach, global access, and scaled impact, so that USDC can become as ubiquitous as traditional payments.”

🔹 Mastercard’s Strategy: Bridging Fiat and Blockchain

Mastercard is no longer just a credit card network. The company is actively positioning itself as a global bridge between banks and digital assets, leveraging stablecoins to unify fiat and blockchain systems.

Key initiatives include:

Crypto Credential – identity authentication for blockchain transactions.

Crypto Secure – fraud detection tailored to crypto payments.

MTN integration – enabling multi-asset digital settlements.

Partnerships with Bybit and S1lkPay, offering direct USDC payments via crypto cards.

Dimitrios Dosis, Mastercard’s EEMEA President, emphasized the company’s commitment:

“We know trust is essential to scale, and we are proud to play a leading role by leveraging our decades of experience in security and compliance in the stablecoin universe.”

🔹 The Bigger Picture: Circle’s Global Offensive

Five facts highlighting the scale of Circle & Mastercard’s move:

+90% annual growth of USDC, now at $65.2B market cap.

28% share of the dollar-backed stablecoin market.

Zero fees for USDC/USD conversions on OKX.

50 countries connected through Finastra’s settlement rails.

4 Korean banks in talks with Circle on a potential digital won issuance.

Beyond payments, Circle is aiming higher: the company has filed for a U.S. banking license to transform USDC into a native part of the financial system.

🔹 Why This Matters

This collaboration is more than just a technical integration:

It places stablecoins inside the banking infrastructure, not just at the edges of crypto exchanges.

It strengthens regulatory trust in stablecoins by leveraging Mastercard’s compliance systems.

It signals the beginning of a world where stablecoins like USDC can serve as a monetary backbone for digital economies.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Final List of XRP ETF Awaiting SEC Approval: Dates, Filings, And Deadlines

The SEC’s final decisions on multiple spot XRP ETF proposals are expected between October and December 2025, with analysts predicting approval could unlock billions in inflows — potentially surpassing Bitcoin and Ethereum ETFs in size.

At present, eleven XRP ETF proposals are under review, spanning from major asset managers to crypto-native firms. Bloomberg Intelligence data shows a mix of spot ETFs, futures ETFs, and leveraged products awaiting final SEC rulings.

🔹 ProShares Ultra XRP ETF (Approved & Live)

Filed: January 17, 2025

Approval: July 2025 (NYSE Arca)

Launch: July 18, 2025

Details: First approved XRP ETF, offering 2x leveraged exposure to XRP futures.

🔹 Grayscale XRP ETF

Filed: Sept 5, 2024 (Prospectus), Jan 30, 2025 (Form 19b-1)

Deadlines: April 6, May 21, Aug 19, 2025

Final SEC Decision: October 18, 2025

🔹 Grayscale Avalanche Trust for XRP (Conversion)

Filed: Aug 25, 2025 → ETF conversion bid (Form 19b-1 March 25, 2025)

Deadlines: May 31, July 15, Oct 13, 2025

Final SEC Decision: December 12, 2025

🔹 21Shares XRP ETF

Filed: Nov 1, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 22, Aug 20, 2025

Final SEC Decision: October 19, 2025

🔹 Bitwise XRP ETF

Filed: Oct 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 25, Aug 23, 2025

Final SEC Decision: October 20, 2025

🔹 Canary Capital XRP ETF

Filed: Oct 8, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 WisdomTree XRP ETF

Filed: Dec 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 12, May 27, Aug 25, 2025

Final SEC Decision: October 25, 2025

🔹 CoinShares XRP ETF

Filed: Jan 24, 2025 (Prospectus), Feb 10, 2025 (Form 19b-4)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 Franklin Templeton XRP ETF

Filed: March 11, 2025 (Prospectus), March 13, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: May 3, June 17, Sept 15, 2025

Final SEC Decision: November 14, 2025

🔹 Rex & Osprey XRP ETF

Filed: Jan 21, 2025 (Prospectus), March 13, 2025 (Form 19b-4)

Status: SEC decision was delayed after July 25, 2025, pending further review.

🔹 Volatility Shares XRP ETFs

Filed: May 21, 2025 (Form N-1A)

Products: 1x XRP Futures ETF, 2x Leveraged XRP ETF, Inverse -1x XRP ETF

Status: Initial decision expected July 2025, but SEC delayed.

🔹 Key Takeaway

The SEC’s final decisions on XRP spot ETFs are clustered around October–December 2025. Approval would open institutional floodgates, possibly positioning XRP as the third-largest ETF market in crypto — or even leapfrogging Bitcoin and Ethereum in adoption.

📌 Note: Cboe BZX Exchange has filed 19b-4 forms on behalf of Bitwise, 21Shares, WisdomTree, Franklin Templeton, and Canary Capital to list XRP spot ETFs.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 8-29-2025

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

He added, "The company provides side-loading services using modern equipment and specialized personnel, and has received excellent ratings from the vessels it has handled." He noted that "joining the international list will contribute to increasing the number of incoming vessels, increasing revenues, and expanding the scope of maritime services to keep pace with the requirements of global trade ."

Al-Fartousi pointed out that "this achievement comes as part of the General Company for Iraqi Ports' strategy to improve the quality of its services and strengthen Iraq's position on the international maritime transport map . link

Tishwash: President of the Republic: There is an urgent need to pass the oil and gas law.

President Abdul Latif Jamal Rashid stressed that there is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues, to solve the existing problems.

The President said in a televised interview: "The Arab-Kurdish Cultural Center is an important step towards strengthening common rapprochement through studying common history and destiny."

He explained: "The relationship between the federal government and the Kurdistan Regional Government is good in all areas, and the existing differences are originally between the provinces and the federal government, and what is common to them is greater than the differences."

He stressed: "There is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues to solve the existing problems, and unfortunately, Parliament has not succeeded in passing the important oil and gas law."

He pointed out: "It is the government's duty to provide salaries for all employees, and we have a major problem in government expenditures from salaries, as they reach more than 80% of the state's revenues, while in other developed countries they do not reach more than 6%, and we must solve this problem."

He added: "We must ensure free and fair elections, and prevent the exploitation of power and its resources for electoral purposes. We, in the four presidencies, agreed on a document to be electoral regulations to be adopted by the Electoral Commission and other bodies concerned with organizing them."

He stressed that there is no truth to the postponement of elections or the formation of an emergency government, and we must ensure our people's confidence in holding fair elections on time. We in Iraq are proud that all electoral processes took place on time without delay.

The President stressed that the world is facing a major water crisis as a result of climate change, including Iraq. We must obtain a fair share from neighboring countries, stop our waste, and use modern irrigation and agricultural methods.

He stressed: "The continued aggression on Gaza has a negative impact on the entire region, and our position in Iraq is clear and not new, in our support for the Palestinian people in achieving their full legitimate rights to self-determination. The aggression must now stop, humanitarian aid must be delivered, and famine must be stopped." link

************

Tishwash: KRG Delegation to Visit Baghdad for Talks on Resuming Oil Exports to Turkey

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the SOMO.

A high-level delegation from the Kurdistan Regional Government’s (KRG) Ministry of Natural Resources, accompanied by representatives of oil companies operating in the region, is set to visit Baghdad next week to discuss the resumption of oil exports through the Turkish port of Ceyhan.

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the State Organization for Marketing of Oil (SOMO).

According to Subhi, the main objective of the meeting is to reach a binding agreement that would allow oil exports to restart, as several companies have expressed reluctance to move forward without a written arrangement.

A final deal is widely expected to be achieved in the upcoming talks, particularly as oil production in the Kurdistan Region has recently increased.

The planned discussions follow a visit by a delegation from Iraq’s Ministry of Oil and SOMO to the Turkish port of Ceyhan last week. During that visit, the Iraqi side finalized technical procedures and secured an understanding with Turkey regarding the export of oil from the Kurdistan Region.

Oil exports through the Iraq-Turkey Pipeline have been suspended since March 2023 following a ruling by the International Chamber of Commerce (ICC) that halted independent Kurdish oil sales. Oil exports have long been a contentious issue between the KRG and the federal government, impacting the region's economic stability and development.

The suspension has significantly affected the KRG revenue, which heavily depends on oil exports. This has led to financial challenges for the region. Efforts to resolve the issue through negotiations between the KRG and the federal government are ongoing. lin

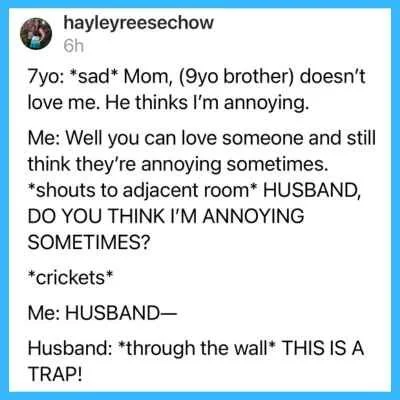

Mot: . Posts About Married Life in August 2025

Iraq Economic News and Points To Ponder Thursday Evening 8-28-25

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Brent crude futures fell 31 cents, or 0.46%, to $67.74 by 00:27 GMT, and West Texas Intermediate (WTI) crude futures fell 36 cents, or 0.56%, to $63.79, after rising more than 1% in the previous session.

The U.S. Energy Information Administration said on Wednesday that U.S. crude inventories fell by 2.4 million barrels in the week ending August 22, compared to analysts' expectations in a Reuters poll for a draw of 1.9 million barrels. / https://ninanews.com/Website/News/Details?key=1248817

The Ministry Of Oil Announces The Final Statistics For July Exports And Revenues.

Thursday, August 28, 2025 | Economic Number of reads: 161 Baghdad / NINA / The Ministry of Oil announced, today, Thursday, the total oil exports and revenues achieved for last July, according to the final statistics issued by the State Oil Marketing Company (SOMO).

The ministry said in a statement: "The quantity of crude oil exports, including condensates, amounted to (104) million and (750) thousand and (788) barrels, with revenues amounting to (7) billion and (184) million and (804) thousand dollars."

It added: "The total quantities of crude oil exported for last July from oil fields in central and southern Iraq amounted to (104) million and (255) thousand and (143) barrels, while exports from the Qayyarah field amounted to (495) thousand and (645) barrels." https://ninanews.com/Website/News/Details?key=1248904

Basra Crude Prices Rise

Time: 2025/08/27 Reading: 495 times {Economic: Al Furat News} Prices of Basra heavy and medium crude oil rose on Wednesday, despite stable oil prices in global markets.

Basra Heavy crude prices rose 49 cents, or 0.49%, to $67.12, while Middle East crude prices rose 49 cents, or 0.39%, to $70.57.

Oil prices stabilized after falling in the previous session, as the market awaits the impact of new US tariffs on India in retaliation for its purchases of Russian supplies. The price of Brent crude reached $67.24, while the price of US crude reached $63.25. LINK

After A Previous Increase, Gold Maintains Stability.

Economy | 08/28/2025 Mawazine News - Follow-up Gold prices remained stable on Thursday, as investors awaited influential US data expected to determine the Federal Reserve's interest rate outlook.

Spot gold was steady at $3,390.27 per ounce by 02:57 GMT, after touching its highest level since August 11 earlier in the session, while US futures for December delivery were steady at $3,447.40 per ounce.

Traders are awaiting the Personal Consumption Expenditures (PCE) price index, due on Friday. This is the Federal Reserve's preferred inflation gauge.

Economists expect the index to rise 2.6% in July, the same pace as the previous month.

The probability of a 25 basis point rate cut at the next Fed policy meeting is more than 88%, noting that gold typically benefits from a low interest rate environment.

Among other precious metals, silver rose 0.3% to $38.72 per ounce, while platinum was steady at $1,348.07, and palladium rose 0.3% to $1,095.26. https://www.mawazin.net/Details.aspx?jimare=265848

The Development Bank Launches The First Unmanned Smart Branch In Iraq.

Wednesday, August 27, 2025, 5:53 PM | Economic Number of readings: 96 Baghdad / NINA / The International Development Bank announced today, Wednesday, the launch of the first smart branch of its kind in Iraq.

The bank said in a statement: "It has launched the first smart branch of its kind in Iraq, which enables banking transactions to be completed completely without the need for employees and available 24 hours a day, seven days a week, in a step that reflects the bank's commitment to digital transformation and promoting innovation in the Iraqi banking sector."

The statement added that "the new branch is located inside the General Administration Building of the International Development Bank on Abu Nawas Street in Baghdad, to be available to all customers as the first integrated digital banking experience in the country."

It continued: "The smart branch enables customers to complete their various banking transactions within minutes, whether for individuals, companies, businessmen, investors, entrepreneurs, or content creators, through an integrated package of digital services that include opening bank accounts and deposits, withdrawing and depositing funds, depositing bank checks and requesting the issuance of checkbooks, requesting the issuance of bank cards, transferring funds between accounts, in addition to purchasing gold ounces, printing account statements, settling loans, receiving content creator profits, and other innovative services."

The bank explained that "the branch allows customers to speak directly with customer service employees via audio and video, ensuring a more interactive and flexible banking experience and identifying customer needs immediately."

According to the statement, Wissam Al-Amri, Marketing Director at the International Development Bank, said, "The launch of the smart branch reflects the bank's commitment to placing customers at the heart of our priorities by providing innovative and easy-to-use banking solutions that enable them to manage their financial needs efficiently and at any time."

The statement concluded, "With this pioneering step, the International Development Bank consolidates its position as the first Iraqi bank to launch a smart branch, keeping pace with global developments in the banking sector and affirming its commitment to providing the best financial solutions to its customers." /End https://ninanews.com/Website/News/Details?key=1248758

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/