MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

8-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraqi Dinar News-An Inevitable Strategic Plan Digital-Finance

8-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Saturday Morning 8-29-25

The Return Of American Companies To Iraq: Guarantees Of Transparency And Security Balance The Risks Of Corruption And Chinese Influence.

Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi commented on Friday (August 29, 2025) on the return of giant American companies to work in Iraq after years of withdrawal, considering it a step that indicates an improvement in the investment climate.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that the return of the American company "Chevron" from the Nasiriyah field in Dhi Qar Governorate comes after a previous wave of withdrawals by a number of major foreign companies.

The Return Of American Companies To Iraq: Guarantees Of Transparency And Security Balance The Risks Of Corruption And Chinese Influence.

Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi commented on Friday (August 29, 2025) on the return of giant American companies to work in Iraq after years of withdrawal, considering it a step that indicates an improvement in the investment climate.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that the return of the American company "Chevron" from the Nasiriyah field in Dhi Qar Governorate comes after a previous wave of withdrawals by a number of major foreign companies.

These withdrawals were due to the growing risks of corruption, a lack of experience in public administration, a weak ability to absorb the flow of aid funds, in addition to sectarian issues and a lack of political will to combat corruption.

Al-Marsoumi explained that massive embezzlement, fraudulent procurement, money laundering, oil smuggling, and widespread bureaucratic bribery have led to a flight of investment and the country's position at the bottom of international corruption rankings, hindering effective state-building and service delivery.

On the other hand, the return of American companies is linked to several factors, most notably the US desire to counterbalance China's massive influence in the Iraqi oil and gas sector.

The guarantees provided by the Iraqi government regarding transparency, contract stability, and

security also served as an important incentive. According to Al-Marsoumi,

Chevron's return came after Baghdad agreed to three conditions presented by the American companies:

"consistency," which guarantees the completion of the facilities associated with the projects;

"security," which includes employee safety and sound business and legal practices; and

"procedural facilitation," which ensures the deal remains intact regardless of any future government changes.

The new contract stipulates that the company will receive a share of the project's revenues

after production begins, reflecting a new model that Iraq is seeking to adopt to attract major investors. https://baghdadtoday.news/282045-.html

Achieving Self-Sufficiency In Refined Gasoline.. Oil: Opening Of The (FCC) Unit In The Basra Refinery Soon.

Yesterday, 13:44 Baghdad - INA - Hassan Al-Fawaz The Ministry of Oil revealed on Friday the

imminent opening of the FCC unit at the Basra refinery, confirming that Iraq will achieve self-sufficiency in refined gasoline, while hinting at the possibility of reducing petroleum product prices.

The Undersecretary of the Ministry of Oil for Distribution Affairs, Ali Maaraj, told the Iraqi News Agency (INA):

"The oil refineries have currently reached a state of sufficiency in kerosene and gas oil," noting that

"the coming days will witness the opening of the (FCC) unit in the Basra refinery, and Iraq will reach the stage of self-sufficiency in improved gasoline and export of gas oil."

He pointed out that "Iraq currently imports quantities of gasoline, and it is certain that when national refineries achieve self-sufficiency, this will be reflected in the prices of petroleum products and derivatives, especially gasoline sold locally, given that only the operating costs of the refineries are charged. https://ina.iq/ar/economie/242089-fcc.html

A Positive Sign: Iraq Maintains Its B-/B Credit Rating From Standard & Poor's.

Standard & Poor's announced on Tuesday that Iraq has maintained its credit rating at B-/B with a stable outlook. Information/Baghdad.. The agency stated in a report received by Al-Maalouma Agency that "Iraq's rating remained at B-/B with a stable outlook, a positive sign that reflects the strength of the national economy and the continued confidence of international institutions in the financial path and government reforms."

It pointed out that "Iraq's economic stability is supported by an improvement in oil revenues by an annual rate of approximately 1.9% during 2025-2028, with the continuation of government measures to manage public debt and enhance foreign reserves, which contributes to maintaining financial balance and supporting confidence in the national economy."

She noted that "Iraq continues to meet its regular financial commitments, with a relative improvement in deficit indicators, in addition to the stability of the exchange rate and the high levels of reserves at the Central Bank, which enhances the strength of the country's external position."

https://almaalomah.me/news/108547/economy/إشارة-إيجابية-العراق-يحافظ-على-تصنيفه-الائتماني-عند-b-b-من-و

Oil Prices Fall, Heading For Their First Monthly Loss Since April.

economy | 09:07 - 08/29/2025 Mawazine News - Follow-up Oil prices fell, heading towards a monthly loss in August, amid concerns about a global supply glut, along with escalating geopolitical tensions, led by US moves to end the war in Ukraine.

Brent crude for November delivery traded near $68 a barrel, losing about 5% of its value during the month, while West Texas Intermediate crude fell towards $64.

This decline is driven by investor concerns that global supplies will exceed demand levels in the coming quarters, which could lead to a resurgence of oil inventories.https://www.mawazin.net/Details.aspx?jimare=265888

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 8-30-25

Good Morning Dinar Recaps,

Congressional Delegation Advances US-Europe Alliance on Crypto, Policy, and Security

On August 29, 2025, U.S. House Committee on Financial Services Chairman French Hill announced that he and Rep. Vicente Gonzalez led a bipartisan delegation to Italy, Switzerland, and Germany from August 20–28.

The mission focused on strengthening U.S.-European ties on financial regulation and security, with lawmakers meeting senior officials from both government and industry to discuss:

Good Morning Dinar Recaps,

Congressional Delegation Advances US-Europe Alliance on Crypto, Policy, and Security

On August 29, 2025, U.S. House Committee on Financial Services Chairman French Hill announced that he and Rep. Vicente Gonzalez led a bipartisan delegation to Italy, Switzerland, and Germany from August 20–28.

The mission focused on strengthening U.S.-European ties on financial regulation and security, with lawmakers meeting senior officials from both government and industry to discuss:

Digital assets

Tokenization

Monetary policy

Transatlantic security cooperation amid Russia’s war in Ukraine

Hill emphasized:

“In each of the three countries, the lawmakers discussed matters related to the expanding market for digital assets, tokenization, conduct of monetary policy, and the transatlantic partnership issues regarding national security.”

Stablecoin Policy, Tokenization, and Next Steps

The delegation also briefed European partners on recent U.S. policy changes, particularly the landmark stablecoin legislation, and exchanged views on monetary policy. Hill stressed that these conversations reinforced the importance of deepening U.S.-Europe cooperation at a moment when financial regulation and security are increasingly interconnected.

He added:

“We briefed our European partners on the digital asset policy landscape following the passage of landmark stablecoin legislation, and we shared views on the conduct of monetary policy and next steps in ensuring transatlantic security.”

Gonzalez Highlights Bipartisan Unity and Personal Engagement

Rep. Gonzalez underscored the bipartisan nature of the trip, thanking European financial leaders for engaging on digital asset regulation and monetary policy.

A personal highlight for Gonzalez was his meeting with Pope Leo XIV, describing it as a deeply meaningful experience. He said the pope’s message of cooperation added a unique moral and human dimension to the delegation’s work.

Gonzalez affirmed his commitment to continue working with Hill and other committee leaders to ensure alignment between U.S. domestic priorities and international partnerships:

“I thank the leadership of Europe’s leading financial institutions for meeting with our bipartisan delegation to discuss key issues on monetary policy and digital assets.”

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

Project ATLAS Unveiled: UAE’s Bold Leap into Decentralized AI and Blockchain

Gewan Holding, part of Abu Dhabi’s NG9 Holding, has partnered with decentralized infrastructure pioneer Iopn to accelerate the development of sovereign AI, blockchain, and digital identity solutions in the United Arab Emirates.

Introducing Project ATLAS

Gewan Holding has entered into a strategic partnership with Iopn, a pioneer in decentralized infrastructure, to launch Project ATLAS—an ambitious initiative aimed at advancing sovereign artificial intelligence (AI), blockchain, and digital identity in the UAE.

At the core of this collaboration is the deployment of a sovereign AI stack powered by Nvidia GPUs and anchored by Iopn’s OPN Chain.

The new infrastructure integrates high-performance AI computing with a sovereign digital identity layer, enabling compliant, scalable operations across governance, finance, healthcare, and real estate. In addition, the OPN Chain supports:

Real-world asset (RWA) tokenization

Biometric authentication

Modern payment systems

These capabilities are designed to unlock liquidity and provide regulated access to global capital markets.

A Strategic Partnership for Sovereignty

Alaa Al Ali, Group CEO of NG9 Holding, highlighted the strategic nature of the initiative:

“Our collaboration with Iopn and the launch of Project ATLAS is not just about building technology—it’s about securing sovereignty and enabling the UAE to shape the digital future.”

Project ATLAS, which stands for Advance Tokenized Liquid-cooled AI Stack, is being developed by Iopn in partnership with Betabytes, an official Nvidia Cloud Partner. It will operate as a sovereign-grade AI data center, forming a key pillar within the broader Iopn ecosystem of digital financial infrastructure, tokenization, and AI-driven innovation.

Amer Al Osh, Chief Development Officer at Gewan Holding, added that the project reinforces digital sovereignty while unlocking new economic opportunities, ensuring that the UAE continues to set global benchmarks in AI and Web3 innovation.

Building a Unified Digital Ecosystem

Mojtaba Asadian, CEO of Iopn, described the OPN Chain as the cornerstone of a unified ecosystem for sovereign identity, financial infrastructure, and AI:

“With NG9 Holding’s support and initiatives like Project ATLAS, we are building sovereign-grade digital infrastructure that empowers nations to harness AI and Web3 on their own terms.”

The announcement also introduced the launch of the Gewan AI Hub, created to accelerate AI adoption across industries. This initiative complements the UAE’s national digital transformation strategy while reinforcing the role of Iopn’s ecosystem.

Looking Ahead

Together, Gewan Holding and Iopn aim to position the UAE as a global gateway for sovereign AI and blockchain solutions. Additional initiatives under Project ATLAS are expected to be revealed in the coming months.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

US Leadership Pushes Bitcoin Strategy as Debate Over Digital Reserve Currency Intensifies

The United States is deepening its commitment to Bitcoin mining and accumulation, even as critics highlight its inefficiencies compared to ISO20022-compliant digital assets like XRP, XLM, HBAR, and QNT. The move raises questions about whether Bitcoin is being positioned as a reserve asset or a geopolitical hedge against de-dollarization.

Trump Family, Lawmakers Signal Strong Bitcoin Support

Reports confirm that Trump Media & Technology Group purchased $2 billion worth of bitcoin in July, reinforcing speculation that the U.S. government may view the digital asset as part of its broader reserve strategy.

Meanwhile, two of President Trump’s sons launched American Bitcoin Miner in March, an entity 80% owned by Hut 8. The firm is preparing for a September stock market listing and has already acquired 16,299 Antminers S21, with plans to expand to a total computing power of 25 EH/s, placing it among the top four U.S. miners.

Currently, the United States controls about 35% of global hashrate, far ahead of Russia (17%) and China (15%). Supporters argue this establishes U.S. “sovereignty” over Bitcoin’s infrastructure.

At the legislative level, Senator Cynthia Lummis continues to push her proposed “Bitcoin Act”, which envisions selling part of America’s gold reserves to accumulate 1 million bitcoins.

Energy and Infrastructure Debate

Bitcoin mining advocates argue the industry can stabilize energy grids by absorbing surplus electricity and providing real-time load shedding. Texas has already integrated miners into its grid management, allowing operators to cancel new gas plant projects while maintaining resilience.

Supporters in Europe argue nuclear surplus power could be redirected into mining, though critics note that other digital assets with faster settlement speeds and higher utility could deliver greater value without the heavy energy burden.

A Geostrategic Bet — or a Risk?

With U.S. debt exceeding $37 trillion and foreign buyers, including BRICS nations, reducing exposure to the dollar, Washington faces mounting pressure to maintain reserve status for U.S.-backed assets.

Some see Bitcoin as a stateless, uncensorable hedge, while others view it as a stopgap measure compared to utility-driven, ISO20022-compliant assets better suited for cross-border payments, tokenization, and digital infrastructure.

Former White House advisor Bo Hines stated:

“I remain very confident that the American government remains very favorable to the idea of acting quickly to accumulate bitcoins for its strategic reserve.”

Still, skepticism remains. Unlike XRP, HBAR, or QNT—each designed for high-speed, scalable global settlement—Bitcoin remains slow, energy-intensive, and limited in utility beyond being a store of value.

The Bigger Picture

While U.S. policymakers and the Trump circle appear to be betting heavily on Bitcoin, questions linger over whether this strategy truly prepares the nation for the next-generation financial system.

Across the world, BRICS, the UAE, Japan, and South Korea are exploring blockchain strategies centered on tokenization, CBDCs, and interoperable digital infrastructure—areas where Bitcoin plays little role.

For many analysts, the real long-term race may not be about which country can mine the most Bitcoin, but which digital assets will power tokenized finance, real-time payments, and sovereign digital identity frameworks.

Bitcoin vs ISO20022-Compliant Assets

Feature Bitcoin (BTC) ISO20022 Assets (XRP, XLM, HBAR, QNT)

Transaction Speed ~10 minutes per block 2–5 seconds

Energy Use Very high (proof-of-work mining) Minimal (consensus mechanisms)

Utility Store of value only Payments, tokenization, smart contracts, identity

Scalability Limited (~7 transactions/sec) High (thousands per second possible)

Compliance & Integration Not ISO20022-compliant Fully ISO20022-compliant

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Friday Afternoon 8-29-25

Good Afternoon Dinar Recaps,

50+ Countries Want to Join BRICS: US Global Power Faces Collapse

The defining geopolitical question of 2025 is no longer if but how many nations want to join BRICS. At the time of writing, more than 50 countries have signaled interest, with 23 submitting formal applications and another 28 expressing informal interest. The latest to step forward is Vietnam, underscoring how BRICS expansion has become a global phenomenon reshaping power dynamics.

Good Afternoon Dinar Recaps,

50+ Countries Want to Join BRICS: US Global Power Faces Collapse

The defining geopolitical question of 2025 is no longer if but how many nations want to join BRICS. At the time of writing, more than 50 countries have signaled interest, with 23 submitting formal applications and another 28 expressing informal interest. The latest to step forward is Vietnam, underscoring how BRICS expansion has become a global phenomenon reshaping power dynamics.

🔹 Current BRICS Membership

BRICS has grown from its original five members to 11 full members. The most recent additions include:

Indonesia (January 2025)

Saudi Arabia (July 2025)

Egypt, Ethiopia, Iran, and the UAE (earlier expansions)

With these inclusions, BRICS now represents nearly half the world’s population and over 41% of global GDP. Beyond members, the alliance has also established partnerships with Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, and Uzbekistan.

This network shows that BRICS is building more than a trade bloc—it is constructing a parallel system of alliances and institutions outside Western dominance.

🔹 Europe’s Bold Moves Toward BRICS

Despite Western pressure, several European nations are eyeing membership:

Belarus – the most vocal candidate, citing sanctions relief.

Serbia – the first European nation to express interest.

Turkey – a NATO member now openly pursuing BRICS ties.

This demonstrates that BRICS is not merely an alliance of the “Global South” but one that is starting to fracture Europe’s unity under Western influence.

🔹 Asia and Africa Lead Expansion

The strongest wave of new interest comes from Asia and Africa, with countries such as:

Azerbaijan, Bahrain, Bangladesh, Burkina Faso, Cambodia, Chad, Colombia, Congo, Equatorial Guinea, Honduras, Laos, Kuwait, Morocco, Myanmar, Nicaragua, Pakistan, Palestine, Senegal, South Sudan, Sri Lanka, Syria, Venezuela, Zimbabwe, and more.

Vietnam’s entry highlights a sovereignty-driven shift, as many nations seek alternatives to dollar-based trade systems.

🔹 The July 2025 Rio Summit

At the Rio Summit, leaders debated the pace of expansion.

China, Russia, and Iran push for rapid enlargement.

Brazil and India prefer a slower, consensus-based approach.

Brazil’s President Lula da Silva captured the moment:

“We are witnessing an unprecedented collapse of multilateralism.”

Meanwhile, U.S. President Donald Trump dismissed the developments, declaring:

“BRICS is dead.”

Yet the facts suggest the opposite: BRICS is growing rapidly.

🔹 Key Takeaway

The BRICS expansion wave signals nothing short of a global realignment of power. With over 50 nations vying for entry, BRICS is becoming the counterweight to U.S. hegemony.

Trump’s tariff threats may slow trade, but they cannot stop the structural transformation already underway. The more countries that join BRICS, the stronger the momentum for de-dollarization and multipolar finance—a fundamental shift the U.S. cannot easily reverse.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 8-29-25

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Al-Jaberi told the Iraqi News Agency (INA):

"The current reforms have transformed the banking sector from being restricted and deprived of dealing in dollars to a sector capable of opening correspondent banks and restoring its international relations, which will directly reflect on improving banking services and stimulating economic activity in Iraqi markets."

He added, "Iraqi banks welcomed these reforms because they are an indispensable necessity.

The banking sector is suffering from numerous problems, and a comprehensive reform is needed to ensure the ability to conduct international transactions and ensure the freedom to trade in dollars."

He explained that "the investment environment in Iraq has become attractive thanks to the

security stability, and this has prompted investors to enter the Iraqi market."

He explained that "investors are always looking for two basic answers: the status of the banking sector and the country's tax system. If reassurance is achieved in these two aspects, investments begin to flow."

Al-Jaberi pointed out that "banking reforms will lead to broader relationships with correspondent banks,

putting Iraq on the path to opening up to the global market and

facilitating the transfer of funds in line with international standards."

He continued, "Financial technology and digital transformation are a fundamental pillar of these reforms, as they are not limited to banking policies alone, but rather encompass all aspects of banking operations.

This positively impacts all economic sectors, such as agriculture, industry, and tourism, and contributes to facilitating the movement of funds and trade both domestically and internationally."

Earlier, Central Bank Governor Ali Al-Alaq confirmed that the banking reform plan would boost international confidence and restore relations with correspondent banks. https://ina.iq/ar/economie/241869-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Friday Morning 8-29-25

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

🔹 CFTC’s Announcement

Acting CFTC Director Caroline Pham confirmed that U.S. clients can once again tap into offshore trading opportunities through the long-standing FBOT registry.

“Starting now, the CFTC welcomes back Americans who want to trade efficiently and safely under CFTC regulations, and opens up U.S. markets to the rest of the world. It’s just another example of how the CFTC will continue to deliver wins for President Trump as part of our crypto sprint.” – Caroline Pham

The FBOT framework, in place since the 1990s, allows registered offshore exchanges to provide U.S. access across asset classes, now extended explicitly to crypto.

🔹 Impact on U.S. Crypto Markets

Liquidity Boost: Offshore access is expected to increase market depth and reduce regional silos.

Binance Case Study: The world’s largest exchange, Binance, remains off-limits to most U.S. users except through its limited affiliate, Binance.US. The CFTC’s move could pave the way for broader participation.

Investor Choice: U.S. traders, often restricted to “walled garden” platforms, may soon benefit from a more competitive and global marketplace.

🔹 Trump’s Crypto Sprint in Action

The announcement follows President Trump’s repeated calls to bring crypto companies back to U.S. soil and secure American leadership in digital assets.

Between 2021 and 2024, unclear rules drove many crypto firms offshore, with the majority of trading volume moving outside U.S. borders. The CFTC’s reforms aim to reverse this trend, positioning the U.S. as a friendlier jurisdiction for digital finance.

🔹 Industry Perspective

Edwin Mata, attorney and CEO of tokenization platform Brickken, stressed that ambiguity in past regulations had created unnecessary legal risk for crypto firms:

Clearer rules will lower compliance burdens.

Companies can operate in the U.S. without fear of “regulation by enforcement.”

More projects will stay onshore, fueling U.S. innovation.

🔹 Next Steps

The CFTC is now accepting public feedback on its crypto framework. Its goal:

Protect investors and markets,

Avoid creating barriers that push innovation offshore.

This marks one of the most significant shifts in U.S. crypto oversight since 2021, potentially reshaping where and how Americans trade digital assets.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Mastercard Launches First Stablecoin Transactions in Africa and the Middle East

The world of crypto payments is steadily moving from experimentation to real-world adoption. This week’s development comes from Mastercard and Circle, who have joined forces to bring stablecoin settlements into mainstream banking flows across Africa, the Middle East, and Eastern Europe.

🔹 A Bold Expansion: USDC & EURC in Banking Flows

Mastercard now enables settlements in USDC and EURC for acquirers in the EEMEA region (Eastern Europe, Middle East, Africa).

Circle has integrated USDC into Finastra’s Global PAYplus platform, opening access to 50 countries and $5 trillion in potential flows.

Early adopters include Arab Financial Services (Bahrain) and Eazy Financial Services (Saudi Arabia).

For Kash Razzaghi, Circle’s Chief Business Officer, the initiative is a turning point:

“Our expanded partnership with Mastercard will enable wider reach, global access, and scaled impact, so that USDC can become as ubiquitous as traditional payments.”

🔹 Mastercard’s Strategy: Bridging Fiat and Blockchain

Mastercard is no longer just a credit card network. The company is actively positioning itself as a global bridge between banks and digital assets, leveraging stablecoins to unify fiat and blockchain systems.

Key initiatives include:

Crypto Credential – identity authentication for blockchain transactions.

Crypto Secure – fraud detection tailored to crypto payments.

MTN integration – enabling multi-asset digital settlements.

Partnerships with Bybit and S1lkPay, offering direct USDC payments via crypto cards.

Dimitrios Dosis, Mastercard’s EEMEA President, emphasized the company’s commitment:

“We know trust is essential to scale, and we are proud to play a leading role by leveraging our decades of experience in security and compliance in the stablecoin universe.”

🔹 The Bigger Picture: Circle’s Global Offensive

Five facts highlighting the scale of Circle & Mastercard’s move:

+90% annual growth of USDC, now at $65.2B market cap.

28% share of the dollar-backed stablecoin market.

Zero fees for USDC/USD conversions on OKX.

50 countries connected through Finastra’s settlement rails.

4 Korean banks in talks with Circle on a potential digital won issuance.

Beyond payments, Circle is aiming higher: the company has filed for a U.S. banking license to transform USDC into a native part of the financial system.

🔹 Why This Matters

This collaboration is more than just a technical integration:

It places stablecoins inside the banking infrastructure, not just at the edges of crypto exchanges.

It strengthens regulatory trust in stablecoins by leveraging Mastercard’s compliance systems.

It signals the beginning of a world where stablecoins like USDC can serve as a monetary backbone for digital economies.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Final List of XRP ETF Awaiting SEC Approval: Dates, Filings, And Deadlines

The SEC’s final decisions on multiple spot XRP ETF proposals are expected between October and December 2025, with analysts predicting approval could unlock billions in inflows — potentially surpassing Bitcoin and Ethereum ETFs in size.

At present, eleven XRP ETF proposals are under review, spanning from major asset managers to crypto-native firms. Bloomberg Intelligence data shows a mix of spot ETFs, futures ETFs, and leveraged products awaiting final SEC rulings.

🔹 ProShares Ultra XRP ETF (Approved & Live)

Filed: January 17, 2025

Approval: July 2025 (NYSE Arca)

Launch: July 18, 2025

Details: First approved XRP ETF, offering 2x leveraged exposure to XRP futures.

🔹 Grayscale XRP ETF

Filed: Sept 5, 2024 (Prospectus), Jan 30, 2025 (Form 19b-1)

Deadlines: April 6, May 21, Aug 19, 2025

Final SEC Decision: October 18, 2025

🔹 Grayscale Avalanche Trust for XRP (Conversion)

Filed: Aug 25, 2025 → ETF conversion bid (Form 19b-1 March 25, 2025)

Deadlines: May 31, July 15, Oct 13, 2025

Final SEC Decision: December 12, 2025

🔹 21Shares XRP ETF

Filed: Nov 1, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 22, Aug 20, 2025

Final SEC Decision: October 19, 2025

🔹 Bitwise XRP ETF

Filed: Oct 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 25, Aug 23, 2025

Final SEC Decision: October 20, 2025

🔹 Canary Capital XRP ETF

Filed: Oct 8, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 WisdomTree XRP ETF

Filed: Dec 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 12, May 27, Aug 25, 2025

Final SEC Decision: October 25, 2025

🔹 CoinShares XRP ETF

Filed: Jan 24, 2025 (Prospectus), Feb 10, 2025 (Form 19b-4)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 Franklin Templeton XRP ETF

Filed: March 11, 2025 (Prospectus), March 13, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: May 3, June 17, Sept 15, 2025

Final SEC Decision: November 14, 2025

🔹 Rex & Osprey XRP ETF

Filed: Jan 21, 2025 (Prospectus), March 13, 2025 (Form 19b-4)

Status: SEC decision was delayed after July 25, 2025, pending further review.

🔹 Volatility Shares XRP ETFs

Filed: May 21, 2025 (Form N-1A)

Products: 1x XRP Futures ETF, 2x Leveraged XRP ETF, Inverse -1x XRP ETF

Status: Initial decision expected July 2025, but SEC delayed.

🔹 Key Takeaway

The SEC’s final decisions on XRP spot ETFs are clustered around October–December 2025. Approval would open institutional floodgates, possibly positioning XRP as the third-largest ETF market in crypto — or even leapfrogging Bitcoin and Ethereum in adoption.

📌 Note: Cboe BZX Exchange has filed 19b-4 forms on behalf of Bitwise, 21Shares, WisdomTree, Franklin Templeton, and Canary Capital to list XRP spot ETFs.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 8-29-2025

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

He added, "The company provides side-loading services using modern equipment and specialized personnel, and has received excellent ratings from the vessels it has handled." He noted that "joining the international list will contribute to increasing the number of incoming vessels, increasing revenues, and expanding the scope of maritime services to keep pace with the requirements of global trade ."

Al-Fartousi pointed out that "this achievement comes as part of the General Company for Iraqi Ports' strategy to improve the quality of its services and strengthen Iraq's position on the international maritime transport map . link

Tishwash: President of the Republic: There is an urgent need to pass the oil and gas law.

President Abdul Latif Jamal Rashid stressed that there is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues, to solve the existing problems.

The President said in a televised interview: "The Arab-Kurdish Cultural Center is an important step towards strengthening common rapprochement through studying common history and destiny."

He explained: "The relationship between the federal government and the Kurdistan Regional Government is good in all areas, and the existing differences are originally between the provinces and the federal government, and what is common to them is greater than the differences."

He stressed: "There is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues to solve the existing problems, and unfortunately, Parliament has not succeeded in passing the important oil and gas law."

He pointed out: "It is the government's duty to provide salaries for all employees, and we have a major problem in government expenditures from salaries, as they reach more than 80% of the state's revenues, while in other developed countries they do not reach more than 6%, and we must solve this problem."

He added: "We must ensure free and fair elections, and prevent the exploitation of power and its resources for electoral purposes. We, in the four presidencies, agreed on a document to be electoral regulations to be adopted by the Electoral Commission and other bodies concerned with organizing them."

He stressed that there is no truth to the postponement of elections or the formation of an emergency government, and we must ensure our people's confidence in holding fair elections on time. We in Iraq are proud that all electoral processes took place on time without delay.

The President stressed that the world is facing a major water crisis as a result of climate change, including Iraq. We must obtain a fair share from neighboring countries, stop our waste, and use modern irrigation and agricultural methods.

He stressed: "The continued aggression on Gaza has a negative impact on the entire region, and our position in Iraq is clear and not new, in our support for the Palestinian people in achieving their full legitimate rights to self-determination. The aggression must now stop, humanitarian aid must be delivered, and famine must be stopped." link

************

Tishwash: KRG Delegation to Visit Baghdad for Talks on Resuming Oil Exports to Turkey

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the SOMO.

A high-level delegation from the Kurdistan Regional Government’s (KRG) Ministry of Natural Resources, accompanied by representatives of oil companies operating in the region, is set to visit Baghdad next week to discuss the resumption of oil exports through the Turkish port of Ceyhan.

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the State Organization for Marketing of Oil (SOMO).

According to Subhi, the main objective of the meeting is to reach a binding agreement that would allow oil exports to restart, as several companies have expressed reluctance to move forward without a written arrangement.

A final deal is widely expected to be achieved in the upcoming talks, particularly as oil production in the Kurdistan Region has recently increased.

The planned discussions follow a visit by a delegation from Iraq’s Ministry of Oil and SOMO to the Turkish port of Ceyhan last week. During that visit, the Iraqi side finalized technical procedures and secured an understanding with Turkey regarding the export of oil from the Kurdistan Region.

Oil exports through the Iraq-Turkey Pipeline have been suspended since March 2023 following a ruling by the International Chamber of Commerce (ICC) that halted independent Kurdish oil sales. Oil exports have long been a contentious issue between the KRG and the federal government, impacting the region's economic stability and development.

The suspension has significantly affected the KRG revenue, which heavily depends on oil exports. This has led to financial challenges for the region. Efforts to resolve the issue through negotiations between the KRG and the federal government are ongoing. lin

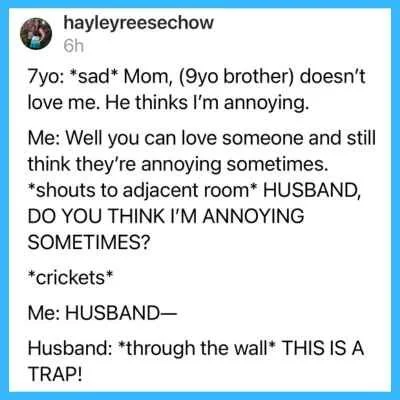

Mot: . Posts About Married Life in August 2025

Iraq Economic News and Points To Ponder Thursday Evening 8-28-25

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Brent crude futures fell 31 cents, or 0.46%, to $67.74 by 00:27 GMT, and West Texas Intermediate (WTI) crude futures fell 36 cents, or 0.56%, to $63.79, after rising more than 1% in the previous session.

The U.S. Energy Information Administration said on Wednesday that U.S. crude inventories fell by 2.4 million barrels in the week ending August 22, compared to analysts' expectations in a Reuters poll for a draw of 1.9 million barrels. / https://ninanews.com/Website/News/Details?key=1248817

The Ministry Of Oil Announces The Final Statistics For July Exports And Revenues.

Thursday, August 28, 2025 | Economic Number of reads: 161 Baghdad / NINA / The Ministry of Oil announced, today, Thursday, the total oil exports and revenues achieved for last July, according to the final statistics issued by the State Oil Marketing Company (SOMO).

The ministry said in a statement: "The quantity of crude oil exports, including condensates, amounted to (104) million and (750) thousand and (788) barrels, with revenues amounting to (7) billion and (184) million and (804) thousand dollars."

It added: "The total quantities of crude oil exported for last July from oil fields in central and southern Iraq amounted to (104) million and (255) thousand and (143) barrels, while exports from the Qayyarah field amounted to (495) thousand and (645) barrels." https://ninanews.com/Website/News/Details?key=1248904

Basra Crude Prices Rise

Time: 2025/08/27 Reading: 495 times {Economic: Al Furat News} Prices of Basra heavy and medium crude oil rose on Wednesday, despite stable oil prices in global markets.

Basra Heavy crude prices rose 49 cents, or 0.49%, to $67.12, while Middle East crude prices rose 49 cents, or 0.39%, to $70.57.

Oil prices stabilized after falling in the previous session, as the market awaits the impact of new US tariffs on India in retaliation for its purchases of Russian supplies. The price of Brent crude reached $67.24, while the price of US crude reached $63.25. LINK

After A Previous Increase, Gold Maintains Stability.

Economy | 08/28/2025 Mawazine News - Follow-up Gold prices remained stable on Thursday, as investors awaited influential US data expected to determine the Federal Reserve's interest rate outlook.

Spot gold was steady at $3,390.27 per ounce by 02:57 GMT, after touching its highest level since August 11 earlier in the session, while US futures for December delivery were steady at $3,447.40 per ounce.

Traders are awaiting the Personal Consumption Expenditures (PCE) price index, due on Friday. This is the Federal Reserve's preferred inflation gauge.

Economists expect the index to rise 2.6% in July, the same pace as the previous month.

The probability of a 25 basis point rate cut at the next Fed policy meeting is more than 88%, noting that gold typically benefits from a low interest rate environment.

Among other precious metals, silver rose 0.3% to $38.72 per ounce, while platinum was steady at $1,348.07, and palladium rose 0.3% to $1,095.26. https://www.mawazin.net/Details.aspx?jimare=265848

The Development Bank Launches The First Unmanned Smart Branch In Iraq.

Wednesday, August 27, 2025, 5:53 PM | Economic Number of readings: 96 Baghdad / NINA / The International Development Bank announced today, Wednesday, the launch of the first smart branch of its kind in Iraq.

The bank said in a statement: "It has launched the first smart branch of its kind in Iraq, which enables banking transactions to be completed completely without the need for employees and available 24 hours a day, seven days a week, in a step that reflects the bank's commitment to digital transformation and promoting innovation in the Iraqi banking sector."

The statement added that "the new branch is located inside the General Administration Building of the International Development Bank on Abu Nawas Street in Baghdad, to be available to all customers as the first integrated digital banking experience in the country."

It continued: "The smart branch enables customers to complete their various banking transactions within minutes, whether for individuals, companies, businessmen, investors, entrepreneurs, or content creators, through an integrated package of digital services that include opening bank accounts and deposits, withdrawing and depositing funds, depositing bank checks and requesting the issuance of checkbooks, requesting the issuance of bank cards, transferring funds between accounts, in addition to purchasing gold ounces, printing account statements, settling loans, receiving content creator profits, and other innovative services."

The bank explained that "the branch allows customers to speak directly with customer service employees via audio and video, ensuring a more interactive and flexible banking experience and identifying customer needs immediately."

According to the statement, Wissam Al-Amri, Marketing Director at the International Development Bank, said, "The launch of the smart branch reflects the bank's commitment to placing customers at the heart of our priorities by providing innovative and easy-to-use banking solutions that enable them to manage their financial needs efficiently and at any time."

The statement concluded, "With this pioneering step, the International Development Bank consolidates its position as the first Iraqi bank to launch a smart branch, keeping pace with global developments in the banking sector and affirming its commitment to providing the best financial solutions to its customers." /End https://ninanews.com/Website/News/Details?key=1248758

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Iraq Economic News and Points To Ponder Thursday Afternoon 8-28-25

Maximizing Revenue

Economic 08/28/2025 Abdul Zahra Muhammad Al-Hindawi When I say that the Iraqi economy is still unilateral and moving on one foot,I do not consider myself the discoverer of electricity, which still represents Iraq's first story! Rather,

everyone knows and acknowledges this, as the non-oil sectors are still crawling on their seats and have not recorded a notable presence in the economic scene, at a time when the state has no choice but to move towards maximizing its revenues, in light of the escalation of expenditures to the point that oil revenues are no longer able to meet the requirements of that spending, whether operational or investment.

So, how can we find other resources to support the budget and thus reduce our dependence on oil?

Maximizing Revenue

Economic 08/28/2025 Abdul Zahra Muhammad Al-Hindawi When I say that the Iraqi economy is still unilateral and moving on one foot,I do not consider myself the discoverer of electricity, which still represents Iraq's first story! Rather,

everyone knows and acknowledges this, as the non-oil sectors are still crawling on their seats and have not recorded a notable presence in the economic scene, at a time when the state has no choice but to move towards maximizing its revenues, in light of the escalation of expenditures to the point that oil revenues are no longer able to meet the requirements of that spending, whether operational or investment.

So, how can we find other resources to support the budget and thus reduce our dependence on oil?

Maximizing revenues necessarily leads to increased financial resources through economic diversification.

The five-year development plan for the years 2024-2028 talks about its goal of raising the contributions of the agriculture, industry and tourism sectors to rates ranging between 2-4%, and improving the collection of direct and indirect taxes, which will contribute to achieving an amount of 79 trillion dinars over five years, compared to more than 600 trillion dinars representing oil revenues, which is a very small percentage.

Hence, it is imperative that all state institutions strive diligently to search for sources to maximize their revenues.

However, this maximization should not be at the expense of the people, and this maximization

should not go entirely to the public treasury (Ministry of Finance).

Rather, there must be an incentive for the entity that has succeeded in finding sources to maximize its resources, so that it has a share of these resources, which it can invest in maintenance, or in developing the resource itself, or granting incentive bonuses to its workers, so that this will be an incentive for others to strive diligently. On this path.

Perhaps among the sources of maximizing the state’s resources are addressing tax evasion, simplifying procedures, controlling border crossings, and investing in infrastructure and strategic projects, such as the development road, the Grand Faw Port project, airports, industrial and economic cities, and most importantly, strengthening, encouraging, and improving partnerships with the private sector, especially after the establishment of the Special Council to manage and develop this sector.

Naturally, this also necessarily requires developing the financial and banking sector, in addition to adopting a digital transformation policy to increase sales, without forgetting the importance of improving human resources management, as it is the main driver and guide for all paths. Development. https://alsabaah.iq/119693-.html

The Ministry of Planning announces the adoption of a mechanism to combat counterfeit gold on a large scale. Buratha News Agency1632025-08-27

The Ministry of Planning announced on Wednesday the adoption of a mechanism to combat counterfeit gold on a large scale, while indicating that the counterfeit gold pieces leaking into the markets do not pose a significant risk.

The spokesperson for the Ministry of Planning, Abdul Zahra Al-Hindawi, told the official agency that “the Central Organization for Standardization and Quality Control in the Ministry of Planning is the body responsible for following up on the granting of licenses to practice goldsmithing and the marking of gold jewelry, where the marking is done through the presence of inspection units at airports (Baghdad Airport, Najaf Airport, Basra Airport, and Kirkuk Airport),” indicating that “these units affiliated with the Central Organization for Standardization and Quality Control inspect and mark any gold shipment entering Iraq directly at the airport, after which a license is granted for trading in the markets.”

He added, "There are committees from the Central Agency for Standardization and Quality Control that conduct continuous visits to inspect goldsmith shops and ensure that the gold in circulation is sound gold, marked with the agency's stamp and is not adulterated. In the event that any violation is detected, such as the presence of adulterated gold or otherwise, legal measures are taken or the violator is referred to the judiciary to take legal action against him."

He explained that "this mechanism has been able to contribute significantly to combating adulterated gold, but there may be some gold pieces that are leaked into the markets and do not pose a significant risk, and they are quickly discovered, even by consumers themselves."

Al-Hindawi also pointed out that "the agency's teams are continuing their work in this area, whether through airport inspections or monitoring goldsmiths' shops. In addition, there are other regulatory bodies, not just the Ministry of Planning, that are concerned with market and economic issues and monitor gold." He noted that "gold represents a significant economic sector, and it is very important that this commodity be monitored extensively and continuously." https://burathanews.com/arabic/economic/464337

Kurdistan deposits 120 billion dinars of non-oil revenues into the federal finance account.

Economy | 08/28/2025 Mawazine News – Baghdad The Ministry of Finance of the Kurdistan Regional Government deposited 120 billion dinars of non-oil revenues into the account of the federal Ministry of Finance.

According to a source in the Ministry of Finance of the regional government, it was explained that "the ministry began yesterday, Wednesday, the procedures for depositing the amount, which were completed today," noting that the amount was deposited into the account of the federal Ministry of Finance at the Erbil branch of the Central Bank of Iraq.

The source added that the Kurdistan Region has fulfilled all its obligations towards Baghdad, and all that remains is for Baghdad to finance the June salaries of the Kurdistan Region's employees in accordance with the agreement.

The Iraqi Council of Ministers had approved on (August 26, 2025) the Ministry of Finance's disbursement of the salaries of the Kurdistan Region for the month of June 2025, "with the regional government paying (120) billion dinars as an installment for non-oil revenues, according to the text of Council of Ministers Resolution No. 636 of 2025."

The Council instructed the joint committees to continue their work and directed the "formation of a legal team" comprising the Prime Minister's legal advisor and the heads of legal departments in the General Secretariat of the Council of Ministers, the Ministry of Finance, and the Federal Board of Supreme Audit, in coordination with representatives of the Kurdistan Regional Government, to "resolve legal disputes related to non-oil revenues, in accordance with the law."

Over the past four months, Kurdistan Region employees have received only one salary: the May salary, which was disbursed on July 24. https://www.mawazin.net/Details.aspx?jimare=265851

Central Bank: Iraq imported goods worth $87 billion in 2024.

Economy | 08/28/2025 Mawazine News – Baghdad The Central Bank revealed the value of Iraq's imports of goods from abroad during 2024.

The bank stated in a statistic monitored by Mawazine News that the value of goods imported from outside Iraq during 2024 amounted to $87 billion.

The bank indicated that "the value of imported goods amounted to $87.410 billion, an increase of 32.78 percent compared to 2023, when the value of Iraqi imports amounted to $65.826 billion."

It indicated that "Asian countries came first in terms of the value of imports, which amounted to $59.045 billion, followed by Western European countries with a value of $11.058 billion."

He added that the statistics showed that "Arab countries came third with a value of $9.073 billion, South American countries came fourth with a value of $4.082 billion, and North American countries came fifth with a value of $2.736 billion."

The bank explained that imports from Eastern Europe amounted to $1.031 billion, from Oceania countries $140 million, from non-Arab African countries $131 million, and finally from Central American countries $114 million.

The bank continued that the most important imports included transportation equipment and machinery worth $33.653 billion, followed by miscellaneous goods worth $13.811 billion, manufactured goods worth $9.965 billion, mineral fuels worth $8.566 billion, and food products worth $4.720 billion. https://www.mawazin.net/Details.aspx?jimare=265872

A Government Bank Launches An Account Statement Service For Visa Purposes.

Banks Economy News – Baghdad Rafidain Bank announced today, Thursday, the launch of its account statement service for visa purposes via the Ur portal, as part of its ongoing efforts to streamline procedures and develop its services.

In a statement received by Al-Eqtisad News, the bank stated that, "In line with its plans to simplify procedures and enhance the path of continuous development, and in cooperation with the Information Technology Department at the Ministry of Finance, the account statement service for visa purposes has been launched via the Ur Government Services Portal."

He added, "The service aims to enable customers to obtain a bank statement detailing their financial transactions and verify their financial capacity when applying for travel visas, in accordance with the requirements of several embassies and relevant authorities, and in a simple and quick electronic manner that reduces the need for direct review."

The bank confirmed that "this service is available to customers who have current, savings, or deposit accounts and whose salaries are domiciled with the bank. Customers must provide identification documents, a national ID card, and an electronic payment card (MasterCard), in addition to accurately entering data and uploading documents to successfully complete the application." https://economy-news.net/content.php?id=59361

The Dollar Exchange Rate Stabilized At 142,200 Dinars.

Economy | 12:18 - 08/28/2025 Mawazine News - Baghdad: The dollar exchange rate stabilized on the two main stock exchanges in Baghdad, Al-Kifah and Al-Harithiya, recording 142,200 dinars per $100, the same rate as yesterday, Wednesday.

Selling prices at exchange shops in local markets in Baghdad remained stable, with the selling price reaching 143,250 dinars per $100, and the buying price reaching 141,250 dinars per $100.

https://www.mawazin.net/Details.aspx?jimare=265854

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Thursday Afternoon 8-28-25

Good Afternoon Dinar Recaps,

BRICS De-Dollarization Reversal: Focus Shifts to Local Currency Trade

The bloc abandons near-term plans for a unified BRICS currency, instead prioritizing local currency settlements and bilateral trade mechanisms.

Shift Away From a Unified Currency

The BRICS de-dollarization strategy has undergone a notable shift. Once expected to launch a single unified currency to rival the U.S. dollar, member states are now focusing on local currency trade systems and strengthening bilateral trade relationships.

Good Afternoon Dinar Recaps,

BRICS De-Dollarization Reversal: Focus Shifts to Local Currency Trade

The bloc abandons near-term plans for a unified BRICS currency, instead prioritizing local currency settlements and bilateral trade mechanisms.

Shift Away From a Unified Currency

The BRICS de-dollarization strategy has undergone a notable shift. Once expected to launch a single unified currency to rival the U.S. dollar, member states are now focusing on local currency trade systems and strengthening bilateral trade relationships.

This marks a reversal of earlier ambitions, reflecting a more measured, risk-averse approach to challenging the dollar’s dominance.

Putin Softens His Position

Russian President Vladimir Putin, once the strongest advocate for a BRICS common currency, has tempered his stance.

At the 2024 Kazan summit, he was seen holding a prototype BRICS banknote called the “Unit.” But more recent remarks suggest the bloc’s goals are narrower:

“The bloc’s goal was not to break away from the U.S.-dominated SWIFT financial system entirely, but rather to reduce the Dollar’s ‘weaponisation’ and promote the use of local currencies for trade between the BRICS members.”

Brazil Confirms No 2025 Currency Timeline

As BRICS president, Brazil confirmed there is no immediate timeline for a unified BRICS currency.

The Rio de Janeiro summit declaration (July 2025) outlined broad cooperation but omitted any currency launch dates.

This caution reflects concerns over market volatility, especially after President Trump’s return to the White House, which triggered currency depreciation across the yuan, ruble, real, rupee, and rand.

India Pushes Back on De-Dollarization

India has taken the firmest position against aggressive de-dollarization.

Foreign ministry spokesperson Randhir Jaiswal stated:

“De-dollarisation is not part of India’s financial agenda.”

Instead, India advocates a “derisking” strategy:

Expanding trade in local currencies (e.g., deals with Russia, UAE, Maldives).

Diversifying trade partners.

Building alternative payment systems to reduce currency conversion risks.

Focus on Practical Mechanisms

With ambitions scaled back, BRICS is emphasizing realistic financial tools:

BRICS Pay digital payment platform.

New Development Bank as a financial stabilizer.

Bilateral trade settlements in national currencies.

This gradualist approach underscores the bloc’s recognition that a radical break from dollar-based finance could destabilize global markets, while local mechanisms offer measured, sustainable progress.

Key Takeaway

BRICS has pulled back from its boldest de-dollarization ambitions, shifting from a unified currency plan to localized trade solutions. By emphasizing stability and bilateral currency use, the bloc signals pragmatism — prioritizing gradual financial diversification over abrupt confrontation with the dollar.

Strategic Implications

Dollar Challenge Delayed: The U.S. dollar’s global dominance faces no immediate threat, but localized settlements still chip away at its monopoly in trade finance.

India as Power Broker: New Delhi’s push for “derisking” positions it as a moderating force, balancing ambition with market stability.

Global Reset in Motion: Even without a BRICS currency, incremental steps toward local trade settlements lay the foundation for alternative financial infrastructures that could reshape global markets in the long run.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economic Updates Thursday Morning 8-28-25

Good morning Dinar Recaps,

112 Crypto Companies Urge Senate to Protect Developers in Market Structure Bill

Coinbase, Kraken, Ripple, a16z, and others press lawmakers to safeguard non-custodial services and open-source developers in upcoming legislation.

Good Morning Dinar Recaps,

112 Crypto Companies Urge Senate to Protect Developers in Market Structure Bill

Coinbase, Kraken, Ripple, a16z, and others press lawmakers to safeguard non-custodial services and open-source developers in upcoming legislation.

Coalition Calls for Clear Protections

A coalition of 112 crypto companies, investors, and advocacy groups has urged the U.S. Senate to include explicit protections for software developers and non-custodial service providers in the pending digital asset market structure bill.

The letter, sent Wednesday to the Senate Banking and Agriculture Committees and led by the DeFi Education Fund, emphasized that the industry spoke “with one voice.” It warned that without protections, developers could be wrongly classified as financial intermediaries under outdated regulatory frameworks.

“Provide robust, nationwide protections for software developers and non-custodial service providers in market structure legislation. Without such protections, we cannot support a market structure bill,” the letter stated.

Signatories include Coinbase, Kraken, Ripple, a16z, Uniswap Labs, and nearly every major U.S. crypto lobbying group, from the Blockchain Association to the Chamber of Digital Commerce.

Regulatory Uncertainty Driving Talent Abroad

Industry leaders cautioned that without strong safeguards, the U.S. risks losing ground in open-source blockchain development.

Citing Electric Capital data, the letter highlighted a steep decline in America’s share of blockchain developers, falling from 25% in 2021 to just 18% in 2025 — a trend largely attributed to regulatory uncertainty.

To prevent innovation from leaving the country, the coalition called for explicit federal protections that would:

Shield blockchain developers from misclassification.

Prevent conflicting state-level regulations.

Build on the bipartisan momentum seen in the CLARITY Act, which passed with overwhelming support.

Legislation Timeline

Senator Cynthia Lummis announced last week that a digital asset market structure bill is expected to reach President Donald Trump’s desk by year-end.

September: Senate Banking Committee review

October: Senate Agriculture Committee review

Ahead of Thanksgiving: Possible Senate vote and delivery to the President

The bill will also clarify how the SEC and CFTC divide oversight of crypto markets, a long-standing point of contention in U.S. regulation.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Kraken Meets With SEC Crypto Task Force to Discuss Tokenized Stocks and Bonds

Exchange giant explores U.S. regulatory framework for trading tokenized equities and ETFs, as traditional exchanges push back.

Kraken’s Tokenization Proposal

Kraken, one of the largest U.S.-based crypto exchanges, met this week with the SEC’s Crypto Task Force to discuss its proposal for a tokenized trading system.

A filing with the SEC shows the meeting focused on potential legal and regulatory frameworks for offering tokenized versions of traditional financial assets — including stocks, bonds, and ETFs — to U.S. investors.

This comes just months after Kraken unveiled its international plans to launch tokenized securities in select non-U.S. markets.

Global Expansion With Tokenized Equities

In May, Kraken announced a partnership with Backed, a tokenized equities issuer, to launch xStocks on the Solana (SOL) blockchain.

xStocks provides tokenized versions of U.S.-listed equities and ETFs.

The project is initially targeting non-U.S. clients, taking advantage of more flexible regulatory environments abroad.

Kraken hopes to eventually bring a regulated version of these offerings into the U.S. market.

Pushback From Traditional Exchanges

The initiative comes at a time when traditional stock exchanges are lobbying regulators to impose strict limits on tokenized equities.

The World Federation of Exchanges (WFE), representing global exchanges and clearing houses, sent a letter to the SEC last week outlining concerns.

WFE CEO Nandini Sukumar criticized tokenized stocks as a potential risk to investors:

“What we are seeing is a blatant attempt to circumvent regulation, with some firms seeking ‘no action’ relief from regulators or deliberately operating through legal grey areas. Most concerning is the risk to retail investors, who may be misled into believing they hold the same rights and protections as traditional shareholders. In many cases, they do not. Investor protection must remain paramount, and regulation must evolve to ensure that new technologies are not used as a mask for risk and opacity.”

Regulatory Crossroads

The SEC faces a critical decision point:

Allow tokenized equities under strict new rules, potentially opening U.S. markets to blockchain-based securities.

Maintain restrictions under pressure from traditional exchanges, which argue tokenization could undermine investor protections.

Kraken’s discussions highlight the growing tension between innovation in blockchain finance and the preservation of traditional market safeguards.

Key Takeaway

Kraken’s push to tokenize stocks and ETFs in the U.S. puts regulators at a crossroads: embrace blockchain-based securities with new safeguards, or restrict them to preserve traditional investor protections. The outcome will shape the future of tokenized finance in America.

@ Newshounds News™

Source: Daily Hodl

~~~~~~~~~

Europe in Ruins: Why the ECB Won’t Save It This Time

Despite years of massive money printing, the eurozone is sinking into stagnation, debt dependency, and economic decline — leaving the European Central Bank powerless to stop the collapse.

A Systemic Crisis Across Europe

It’s not just France under François Bayrou that faces trouble — the entire eurozone is trapped in a systemic crisis. The European Central Bank (ECB), once hailed as the continent’s financial backstop, now finds its tools blunt.

Unlike in 2008, when monetary expansion provided temporary relief, the ECB’s latest injections have created a vicious cycle of stagnation and unsustainable debt that the printing press can no longer solve.

Monetary Expansion Without Growth

ECB data shows that in June 2025, the M2 money supply of the eurozone rose to €15 trillion, up 2.7% year-over-year.

Yet, this expansion delivered almost no real growth, a stark contrast to the U.S., where 4.5% monetary growth still produces ~2.5% GDP growth.

This gap reveals a structural failure:

ECB liquidity fuels unproductive public spending instead of private investment.

States become dependent on ECB bond purchases, depriving the private sector of financing.

Europe’s economic system increasingly resembles a “monetary drip” keeping stagnant economies alive.

The Printing Press as Poison

The ECB’s policies have created a crowding-out effect:

Governments absorb new liquidity, starving entrepreneurs of credit.

Unproductive companies survive thanks to artificially low rates.

Innovative firms struggle, weakening Europe’s long-term competitiveness.

This has led to the “zombification” of Europe’s economies, where outdated structures survive while innovation is suffocated.

The ECB as Fiscal Enabler

The ECB has drifted from its mandate of price stability, instead prioritizing the financing of sovereign debt.

This shift effectively turns the ECB into a fiscal policy instrument, propping up states while ignoring inflation risks.

History warns against this approach: between 1970 and 2011, despite central bank dominance, the world experienced 147 banking crises. Central banks often delay crises but amplify their severity — a cycle the ECB now replicates on a continental scale.

The Dependency Trap

Europe is now caught in a monetary dependency spiral:

Governments depend on ECB refinancing to survive.

ECB bond purchases enable irresponsible fiscal spending.

Economic capacity erodes, making states even more reliant on ECB support.

This cycle is unsustainable. By 2024, global public debt hit $102 trillion, with Europe among the most concerning cases. The continent now generates too little wealth to justify its debt levels. Only continuous ECB money creation maintains the illusion of solvency.

Bitcoin as an Alternative?

The failure of large-scale quantitative easing in Europe underscores the limitations of central bank-driven policies.

Sooner or later, Europe will be forced to confront reality:

Drastic structural reforms — not perpetual monetary injections — are required to restore competitiveness.

In this context, Bitcoin and decentralized assets may emerge as credible alternatives that governments cannot manipulate.

Key Takeaway

The eurozone is trapped in a cycle of debt dependency and stagnation that ECB money printing can no longer mask. Without radical reforms, Europe risks systemic collapse — opening the door for decentralized alternatives like Bitcoin to gain legitimacy as a safeguard against monetary failure.

@ Newshounds News™

Source: Cointribune

~~~~~~~~~

XRP Expands in Asia as Linklogis Taps Ledger for $2.9B Supply Chain

China’s leading fintech firm selects XRPL to power its global supply chain finance platform, unlocking liquidity through tokenization.

XRPL Partners With Linklogis

XRP has secured a major win in Asia after Chinese fintech giant Linklogis announced a partnership with the XRP Ledger (XRPL).

The deal will see Linklogis integrate its supply chain finance platform onto the XRPL mainnet, enabling the circulation and cross-border settlement of digital assets tied to real-world trade flows.

Through the collaboration, trade assets such as invoices and receivables will be tokenized, giving businesses faster access to liquidity while boosting efficiency in global trade finance.

Driving $2.9B in Trade Assets

Linklogis is already a powerhouse in supply chain finance. In 2024, the firm processed RMB 20.7 billion ($2.9 billion) in cross-border assets across 27 countries.

By leveraging XRPL, Linklogis aims to:

Expand business access to funding.

Enhance transparency in trade financing.

Streamline settlements for exporters, importers, and financiers.

The collaboration will also explore stablecoins, smart contracts, and AI integration — broadening innovation in real-world asset (RWA) tokenization within supply chains.

XRPL’s Growing Global Footprint

The partnership strengthens XRP’s reputation as a leader in tokenized finance:

In the past month, XRPL’s tokenized RWA volume grew 22.81%, reaching $305.8 million, ranking it the ninth-largest blockchain by RWA value.

In May 2025, the Dubai Land Department adopted XRPL for real estate tokenization.

Across Latin America (notably Mexico, Brazil, and Argentina), XRP is increasingly used to reduce reliance on the U.S. dollar in cross-border trade.

This rapid adoption signals rising confidence in XRP Ledger as global financial infrastructure, especially in emerging markets looking for alternatives to traditional currencies.

Key Takeaway

XRP’s partnership with Linklogis marks a pivotal step in Asia’s digital finance evolution, embedding XRPL into a $2.9B supply chain platform. With expanding use cases in trade, real estate, and tokenized assets worldwide, XRP is positioning itself as a backbone for the next era of global settlement.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps