Seeds of Wisdom RV and Economic Updates Thursday Morning 8-21-25

Good Morning Dinar Recaps,

Fed Governor Tells Bankers DeFi Is ‘Nothing to Be Afraid Of’

Federal Reserve Governor Christopher Waller urged policymakers and bankers not to fear decentralized finance (DeFi) and stablecoins, calling them drivers of innovation in the U.S. payments system.

Waller reassured both his peers and the private banking sector that crypto payments operating outside traditional banking infrastructure are not inherently risky.

Good Morning Dinar Recaps,

Fed Governor Tells Bankers DeFi Is ‘Nothing to Be Afraid Of’

Federal Reserve Governor Christopher Waller urged policymakers and bankers not to fear decentralized finance (DeFi) and stablecoins, calling them drivers of innovation in the U.S. payments system.

Waller reassured both his peers and the private banking sector that crypto payments operating outside traditional banking infrastructure are not inherently risky.

“There is nothing scary about this just because it occurs in the decentralized finance or DeFi world — this is simply new technology to transfer objects and record transactions,” he said at the Wyoming Blockchain Symposium 2025.

He emphasized that leveraging smart contracts, tokenization, or distributed ledgers for everyday transactions should be viewed as a natural evolution of payment services rather than a threat.

Federal Reserve’s Shift Toward Embracing Crypto

In April 2025, the Fed withdrew 2022 guidance that had discouraged banks from engaging in crypto and stablecoin activities.

Last week, the Fed also ended its risk-heavy “novel activities supervision program” that oversaw crypto-related activity.

Fed Vice Chair Michelle Bowman recently suggested Fed staff be allowed to hold small amounts of crypto to better understand the technology.

Waller’s comments highlight the Fed’s ongoing pivot toward integrating digital assets into the U.S. financial system.

Waller as Potential Next Fed Chair

Waller’s views carry additional weight as he is considered a front-runner to replace Jerome Powell when Powell’s term ends in May 2026.

President Donald Trump has reportedly pressured Powell to resign early.

If nominated and confirmed, Waller could become the next crypto-friendly Fed chair, shaping U.S. monetary and payment policy during a transformative era.

Making Crypto Relatable

Waller compared stablecoin transactions to ordinary debit card purchases.

Buying a memecoin with stablecoins works the same way as tapping a debit card to buy groceries, he explained.

In both cases, money is transferred and a transaction record is generated — whether it’s a paper receipt or a blockchain ledger.

This analogy framed crypto payments as intuitive and familiar, rather than radical.

GENIUS Act: Key for Stablecoin Adoption

Waller praised the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act as an “important step” for adoption.

Stablecoins, he argued, could strengthen the dollar’s global role, particularly in high-inflation countries and regions with limited access to physical dollars.

They also improve both retail and cross-border payments.

Stablecoin Market Outlook

Current stablecoin market size: $280 billion

U.S. Treasury projects the market will reach $2 trillion by 2028 — a 615% increase.

Growth will be accelerated by a clear regulatory framework and stablecoin issuers’ demand for U.S. Treasury bills.

Market leaders today: Tether (USDT) at $167B and Circle (USDC) at $67.5B (CoinGecko data).

Bottom Line:

Waller’s remarks mark a major philosophical shift from the Fed, positioning DeFi and stablecoins not as threats but as essential innovations. With the GENIUS Act laying the regulatory foundation and the stablecoin market primed for explosive growth, the U.S. is signaling that the future of payments will be digital, dollar-backed, and blockchain-enabled.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Beacon Network: A New Global System to Track Crypto Fraud

A powerful new initiative is reshaping the fight against crypto crime. The Beacon Network — backed by major exchanges, financial companies, and regulators — enables the rapid detection and freezing of stolen blockchain funds.

Key points:

The network brings together Coinbase, Binance, Kraken, Robinhood, PayPal, Anchorage Digital, Ripple, and leading security researchers like ZachXBT and SEAL.

Supported by law enforcement and regulatory authorities in multiple countries.

Designed as a “kill chain” system for digital assets, moving from detection to blocking in minutes, not days.

Already blocked over $1 million in fraud-related crypto transactions.

Why it matters:

Since 2023, more than $47 billion in crypto has been linked to scams, hacks, and fraud.

Traditional investigations lag behind the speed of blockchain transfers, making recovery nearly impossible after funds are dispersed.

The Beacon Network enables real-time alerts when stolen funds hit participating platforms, allowing them to be frozen before they vanish.

First successes:

$1.5 million recovered from an international fraud scheme.

$800,000 in fraudulent deposits frozen before withdrawal.

Safeguards and reliability:

Only verified investigators and partners can report illicit activity.

Each report must be backed by evidence and accountability, reducing the risk of abuse.

Next steps:

Expand partnerships to widen coverage across global exchanges and financial networks.

Focus on tracking funds tied to North Korean hacker groups and combating terrorist financing.

Strengthen protections for victims of large-scale fraud.

The Beacon Network represents a turning point: crypto’s leading players and regulators uniting to make the ecosystem safer and more transparent, leaving criminals fewer places to hide.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

U.S. Patent Shows XRP Registered as a Payment Method in the United States

A United States trademark registration for XRP as a payment method has resurfaced, sparking both excitement and confusion in the crypto community.

The document, issued by the U.S. Patent and Trademark Office (USPTO) in December 2013 under Registration Number 4,458,993, is authentic but does not carry the sweeping implications some community figures suggest.

The XRP Trademark: What It Really Means

Filed by OpenCoin, Inc. (now Ripple Labs) on May 17, 2013

Registered under International Class 36 for financial services

Defines XRP as a means of providing secure payment options in both traditional and digital currencies across a global computer network

Ripple listed its first commercial use of XRP as March 1, 2013

The filing protects the name “XRP” as a service mark for financial services — not government recognition of XRP itself as a legal payment method

Multiple independent sources confirm the registration details, including Justia Trademarks, USPTO’s TSDR system, and academic references such as the UC Davis Law Review. The registration remains active, with Ripple maintaining regular renewals.

Community Reaction vs. Reality

Some XRP community influencers have suggested the trademark proves the U.S. patented XRP as a payment method or gave it official government backing in 2013.

Influencer Amelia and others claimed it was a sign of U.S. recognition.

JackTheRippler echoed similar interpretations.

However, the reality is straightforward: Ripple itself filed the trademark to protect the XRP name, much like its more recent filing for its stablecoin RLUSD.

The registration does not represent U.S. government endorsement or regulatory approval.

Why It Still Matters

While not proof of government recognition, the trademark highlights Ripple’s early legal foresight in securing XRP’s intellectual property protections.

Ripple currently holds 39 U.S. patents, with 18 granted and 62% active.

The 2013 XRP filing reflects Ripple’s long-standing strategy to legally defend its financial technologies.

✅ Key Takeaway: XRP’s 2013 USPTO trademark filing demonstrates Ripple’s early commitment to securing its brand legally. It does not, however, signal U.S. government approval of XRP as a national payment system.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: Iraq Dinar News Update-Integration Global Financial System

MilitiaMan and Crew: Iraq Dinar News Update-Integration Global Financial System

8-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update-Integration Global Financial System

8-20-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Wednesday Afternoon 8-20-25

An Economist Predicts The Next Government Will Change The Dollar Exchange Rate, And Explains The Reasons.

Time: 2025/08/20 Read: 1,860 times {Economic: Al Furat News} Economists expect the next government to resort to an official devaluation of the Iraqi dinar against the US dollar as a potential solution to address mounting financial burdens, most notably the massive government payroll.

Economic expert Nabil Al-Marsoumi told Al Furat News Agency that "the salary bill accounts for the largest portion of oil revenues, leaving little for upgrading infrastructure or basic services."

An Economist Predicts The Next Government Will Change The Dollar Exchange Rate, And Explains The Reasons.

Time: 2025/08/20 Read: 1,860 times {Economic: Al Furat News} Economists expect the next government to resort to an official devaluation of the Iraqi dinar against the US dollar as a potential solution to address mounting financial burdens, most notably the massive government payroll.

Economic expert Nabil Al-Marsoumi told Al Furat News Agency that "the salary bill accounts for the largest portion of oil revenues, leaving little for upgrading infrastructure or basic services."

Al-Marsoumi believes that devaluing the currency will provide greater financial revenues in dinars, which will help the government cover salary expenses.

He added that this option may be one of the necessary measures that the new government may take, especially in light of the current oil prices that threaten to close the country's economic development prospects.

Experts emphasize that sustainable solutions lie in diversifying sources of public revenue and not relying entirely on oil, in order to ensure the stability of the Iraqi economy in the long term. LINK

The Dollar Rises Again, Reaching Around 142,200

economy | 08/20/2025 Mawazine News - Baghdad - The dollar exchange rate rose on Wednesday (August 20, 2025) on the Iraqi Stock Exchange and money exchanges.

The US dollar exchange rate recorded 142,200 dinars for every $100 in morning trading on the main stock exchange in the capital, Baghdad.

The exchange rate in local markets in Baghdad reached 143,250 dinars for sale, while the purchase price reached 141,250 dinars. https://www.mawazin.net/Details.aspx?jimare=265412

The Central Bank Is Witnessing Foreign Transfer Operations In All Currencies.

Economy | 08/20/2025 Mawazine News - Baghdad - The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Wednesday, the coverage of almost all major currencies, while indicating that the Central Bank is witnessing foreign exchange operations in all currencies smoothly and with high fluidity.

Al-Alaq said, "The foreign exchange process has witnessed significant development during the past two years, whether in terms of method, approach, and organization, or through direct communication and direct transfer between Iraqi banks and approved correspondent banks."

He added, "This expansion is not only in the number of correspondent or transferring banks, but also in the number of currencies," noting that "the Central Bank covers almost all currencies used by Iraq for the purpose of large-scale trade."

He stressed that "the Central Bank is today witnessing transfer operations in almost all major currencies, and they are carried out smoothly and with high fluidity." https://www.mawazin.net/Details.aspx?jimare=265410

An Expert Warns Against Adjusting The Dollar Exchange Rate And Outlines A Solution To Address The Decline In Oil Prices.

Time: 2025/08/20 Reading: 945 times {Economic: Al Furat News} Economic expert Salah Nouri confirmed on Wednesday that adjusting the dollar exchange rate falls within the purview of the Central Bank of Iraq, noting that this measure is a monetary policy tool aimed at achieving economic stability and combating inflation or deflation.

Nouri stressed to Al Furat News Agency "the need to achieve harmony between the monetary policy managed by the Central Bank and the fiscal policy undertaken by the Ministry of Finance through the general budget."

The economic expert explained that raising the dollar exchange rate—i.e., devaluing the dinar—increases the amount of Iraqi dinars the Ministry of Finance receives from the Central Bank to cover budget expenditures. However, he warned that this measure leads to a decline in the purchasing power of citizens, especially those with limited income.

In contrast, Nouri explained that depreciating the dollar—i.e., increasing the purchasing power of the dinar—reduces the amount of dinars the Ministry of Finance receives, creating difficulties in implementing the general budget, particularly the operational portion. He pointed out that the decline in global oil prices further complicates this problem, as it impacts the state revenues needed to finance the budget.

The economic expert noted that many governments around the world are adopting austerity measures in public spending, particularly regarding unnecessary benefits, to ensure the sustainability of the general budget and meet only basic needs. Nouri concluded his statement by emphasizing that such measures are a necessary solution to support the budget in light of the current economic challenges. LINK

Al-Sudani Directs The Formation Of A Joint National Team To Prepare An Integrated Strategy For The Financial And Banking Sector.

Wednesday, August 20, 2025, | Politics Number of readings: 350 Baghdad / NINA / Prime Minister Mohammed Shia Al-Sudani directed the formation of a joint national team to prepare an integrated strategy for the financial and banking sector.

A statement from the Prime Minister's Office stated that in line with the government's directives aimed at strengthening Iraq's financial and economic position at the international level, the Prime Minister directed the formation of a joint national team, headed by the Governor of the Central Bank of Iraq, and including representatives from the Ministries of Finance, Oil, and Planning, specialized economic and financial institutions, in addition to the Prime Minister's Office, the Securities and Exchange Commission, and representatives of the Iraqi banking sector.

He explained that this national team will work to prepare an integrated strategy that includes clear and measurable goals, with periodic reports being submitted to the competent authorities, and direct coordination with major international credit rating agencies, especially (Fitch, S&P, Moody's) with the aim of improving Iraq's sovereign credit rating.

The team will also pay special attention to strengthening governance tools, managing financial risks, and developing the business environment in line with the economic reform plans adopted by the government.

He added that this directive comes within the framework of the government's vision to adopt a comprehensive national strategy aimed at improving Iraq's sovereign credit rating, which contributes to enhancing international confidence in the national economy, and opening broader horizons for direct and indirect foreign investments.

The government affirms that this step represents a clear commitment to its reform approach and its keenness to achieve economic stability, support the stability of the financial system, and provide an attractive investment environment that contributes to diversifying sources of income and reducing dependence on oil as the sole main resource. /End https://ninanews.com/Website/News/Details?Key=1247349

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Wednesday Afternoon 8-20-25

Good Afternoon Dinar Recaps,

India’s Rupee Goes Global Instead of Single BRICS Currency Plan

India’s BRICS global rupee initiatives are reshaping international trade as New Delhi officially abandons the idea of a single BRICS currency in favor of bilateral agreements. The Reserve Bank of India (RBI) has been signing direct settlement agreements, enabling transactions in rupees without dollar conversion.

Good Afternoon Dinar Recaps,

India’s Rupee Goes Global Instead of Single BRICS Currency Plan

India’s BRICS global rupee initiatives are reshaping international trade as New Delhi officially abandons the idea of a single BRICS currency in favor of bilateral agreements. The Reserve Bank of India (RBI) has been signing direct settlement agreements, enabling transactions in rupees without dollar conversion.

This represents India’s systematic move to ditch dollar dependence through partnerships with countries like the Maldives and the UAE, positioning the rupee’s global ambitions as a more practical alternative to the proposed BRICS currency that never materialized.

India’s Global Rupee Strategy Replaces BRICS Currency Plans

The single BRICS currency proposal cooled after the July 2025 BRICS summit in Rio de Janeiro produced no concrete framework. Instead, leaders shifted focus to bilateral trade agreements in local currencies—a solution seen as more realistic.

A landmark development came in November 2024, when the RBI signed an agreement with the Maldivian Monetary Authority, allowing transactions to be settled directly in rupees and rufiyaa.

This bypasses dollar-based networks, making transactions faster and cheaper, while boosting the rupee’s regional influence.

According to RBI Deputy Governor Sanjay Malhotra, India has already implemented similar frameworks with the UAE, and negotiations are ongoing with other Asian and African countries.

This demonstrates a clear internationalization of the rupee, with the potential to reshape regional trade flows.

How BRICS India Trade Settlements Work

India’s settlement system eliminates dollar conversion by creating direct bilateral clearing mechanisms.

Example: A Maldivian company importing Indian rice can pay in rufiyaa, which is automatically converted into rupees through RBI-authorized systems.

This approach is more feasible than a multilateral BRICS currency, requiring less infrastructure and relying on bilateral trust.

Benefits include reduced foreign exchange exposure, lower conversion fees, and less vulnerability to sanctions.

India’s Global Rupee Expansion and Competition

India’s global rupee initiative is expanding beyond its current agreements, with multiple countries in Asia and Africa negotiating to join.

India’s bilateral approach competes directly with China’s yuan internationalization, which emphasizes multilateral adoption.

Meanwhile, Russia has promoted ruble usage with regional allies, but with limited global traction.

This sets the stage for currency competition within BRICS: rupee (bilateral), yuan (multilateral), and ruble (regional).

Strategic Benefits of India Ditching the Dollar

India’s move away from dollar reliance carries several strategic advantages:

Monetary autonomy – avoiding external pressure from U.S. dollar fluctuations while preserving internal policy control.

Lower costs – significantly reducing transaction costs for BRICS and India-linked trade.

Sanctions resilience – shielding partners from the risks of dollar-based financial systems.

Geoeconomic power – expanding rupee usage strengthens India’s leverage with trade partners.

This strategy positions India against China’s yuan push, but by taking a different path—bilateral agreements rather than multilateral frameworks.

Future of BRICS Currency Alternatives

While the unified BRICS currency plan has stalled, member nations are advancing individual currency strategies:

India – bilateral rupee settlements.

China – multilateral yuan adoption.

Russia – regional ruble agreements.

Together, these approaches may displace the dollar more effectively than a single BRICS currency ever could.

The success of India’s rupee internationalization depends on expanding bilateral agreements and building long-term trust with trading partners. By prioritizing practical implementation over complex negotiations, India’s rupee push could deliver faster, more significant results than the original BRICS common currency proposal.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Morning 8-20-25

OPEC Oil Refining Capacity: What Is Iraq's Ranking?

Economy 2025-08-19 | 583 views Alsumaria News – Economy oil refining capacity continues OPEC its five-year upward trend, with new refineries being built or existing capacity being expanded.

The organization's latest annual statistics, published by the Washington-based Energy Research Unit, showed thatoil refining capacity in member states increased by 18.5%, or 2.2 million barrels per day,

during the period from 2020 to 2024.

OPEC Oil Refining Capacity: What Is Iraq's Ranking?

Economy 2025-08-19 | 583 views Alsumaria News – Economy oil refining capacity continues OPEC its five-year upward trend, with new refineries being built or existing capacity being expanded.

The organization's latest annual statistics, published by the Washington-based Energy Research Unit, showed thatoil refining capacity in member states increased by 18.5%, or 2.2 million barrels per day,

during the period from 2020 to 2024.

OPEC 's oil refining capacity increased by 0.5%, or 71,000 barrels per day, in 2024,

bringing the total to 14.14 million barrels per day.

The share of the 12 OPEC member states in total global refining capacity increased from 11.8% in 2020 to 13.6% in 2024, with global capacity reaching 103.8 million barrels per day last year.

On the other hand, refinery production in OPEC countries increased by 5%,

or 411,000 barrels per day, to reach 8.921 million barrels per day in 2024,

compared to about 8.511 million in 2023.

This means that OPEC's refinery utilization rate —refinery production divided by total refining capacity—will not exceed 63% in 2024, according to the Energy Research Unit's analysis.

Developments In Oil Refining Capacity In OPEC Countries

accounted Saudi Arabia for nearly a quarter of OPEC's oil refining capacity in 2024,

with its refining capacity remaining unchanged at 3.291 million barrels per day (bpd) from 2023.

The Kingdom's refining capacity increased by 12.5%, or 364,000 barrels per day,

between 2020 and 2024, according to OPEC's annual report. ranked Iran second among OPEC countries,

with its refining capacity set to stabilize at 2.237 million barrels per day in 2024.

Iran's refining capacity has not seen significant changes over the past five years,

remaining at around 2.2 million barrels per day, or slightly higher since 2020.

Venezuela ranked third among OPEC countries, with its crude refining capacity set to remain stable at 2.154 million barrels per day in 2024, the same level as in 2020.

Refining Capacity In Kuwait, Iraq And The UAE

Kuwait has taken fourth place in OPEC's oil refining capacity, with its capacity increasing by pproximately 36,000 barrels per day, reaching 1.451 million barrels per day by 2024.

Kuwait's refining capacity has seen a significant jump of 81%,

or 651,000 barrels per day, since 2020, thanks to the operation of the Al-Zour refinery,

according to comparative data analyzed by the Energy Research Unit.

ranked Iraq fifth, with its refining capacity remaining stable at 1.266 million barrels per day in 2024, unchanged from 2023.

However, Iraq's refining capacity has jumped by 67%, or 508,000 barrels per day, since 2020.

The UAE ranked sixth in terms of refining capacity,

which remained virtually stable at 1.227 million barrels per day in 2024, unchanged from 2020.

Refining Capacity In Nigeria, Algeria And Libya

Nigeria ranked seventh in OPEC's oil refining capacity,

with its capacity set to increase by just 3,000 barrels per day to 1.125 million barrels per day in 2024.

Nigeria's refining capacity remained below 500,000 barrels per day from 2020 to 2022,

before jumping to 1.22 million barrels per day in 2023.

The main reason for this boom is the operation of the Dangote Refinery (the largest refinery in Africa),

which has a design capacity of approximately 650,000 barrels per day.

Algeria ranked eighth, with its refining capacity remaining stable at 677,000 barrels per day in 2024,

unchanged from 2020.

Libya ranked ninth, with its oil refining capacity increasing by 32,000 barrels per day,

reaching 666,000 barrels per day in 2024.

Libya's refining capacity remained stable at 634,000 barrels per day from 2020 to 2023,

according to annual data monitored by the Energy Research Unit.

OPEC Oil Refining Capacity In 2024, From Largest To Smallest

Gabon ranked tenth in OPEC's oil refining capacity, with its refinery capacity remaining stable at 25,000 barrels per day since 2020.

ranked Congo 11th, with its refining capacity remaining stable at 21,000 barrels per day in 2024, unchanged from 2020.

is Equatorial Guinea the only OPEC member state without refineries, according to the Energy Research Unit.

In brief, the oil refining capacity of OPEC countries in 2024 can be arranged as follows:

Saudi Arabia: 3.291 million barrels per day.

Iran: 2.237 million barrels per day.

Venezuela: 2.154 million barrels per day.

Kuwait: 1.451 million barrels per day.

Iraq: 1.266 million barrels per day.

UAE: 1.227 million barrels per day.

Nigeria: 1.125 million barrels per day.

Algeria: 677,000 barrels per day.

Libya: 666,000 barrels per day.

Gabon: 25,000 barrels per day.

Congo: 21,000 barrels per day.

https://www.alsumaria.tv/news/economy/537686/طاقة-تكرير-النفط-في-دول-أوبك-ما-ترتيب-العراق؟

Government Advisor: Oil Will Return To $75 Soon... Here's Why

Time: 2025/08/19 Read: 600 times {Economic: Al Furat News} The Prime Minister's economic advisor, Mazhar Mohammed Saleh, confirmed that the need for oil energy will increase after each cycle of price decline, noting that this increase will restore balance to the energy market, which will push the price of a barrel of oil to an average of no less than $75 higher.

Saleh told Al Furat News: “The need for oil energy will increase after each cycle of price decline due to the rise in production costs in the world’s major producing regions, which will restore balance to the energy market and raise the price of a barrel of oil to an average of no less than $75 per barrel, especially after the market’s glut of cheap oil disappears due to geopolitical turmoil around the world.”

He added, "This is a temporary situation that does not represent a long-term investment strategy in oil energy markets, particularly the US production market, as it is the world's largest oil producer, but at high costs compared to the low-cost production costs of Middle Eastern and Gulf oil." LINK

Economic Media

Economic 08/20/2025 Yasser Al-Mutawali It is necessary to reconsider the selection of figures who speak on economic issues, to ensure the transmission of a clear and attractive image that reflects real potential, thus serving as a tool to enhance trust and attract international cooperation.

The danger of economic discourse lies in its external repercussions, as

it directly contributes to shaping other countries' perceptions of a country's strength or weakness.

Since international relations are built on the size, capabilities, and potential of each country,

the image of the national economy becomes the basis for shared interests.

It goes without saying that a country's strength is largely measured by the strength of its economy,

a key criterion for determining the nature of its economic relations with the world.

In the case of Iraq,

there is a dire need to unify the economic media discourse to enhance the country's reputation

and present it as a significant economic power,

given its untapped wealth and resources, in addition to

its status as an oil-producing country par excellence.

The goal here is to attract investment and build solid economic relations in this manner.

But what happens if a false image of a country's economy is conveyed?

The likely result is a state of uncertainty, especially when

statements conflict and the

language of unification disappears from the discourse,

replacing the image of strength with an impression of weakness.

One of the most prominent causes of this problem is the growing circle of so-called "accidental experts."

These are individuals who

present themselves, or are

presented through certain media outlets,

as economic experts,

without possessing any real qualifications.

An economic expert is not just a title;

it is the result of a long process that begins with an interest in economic affairs,

then progresses to the stage of economic researcher, and

finally to the level of expert, which is

awarded through scientific evaluation by a competent and respected body,

after accumulating

experience and a

deep understanding of economic theories and concepts.

The lack of precise criteria for awarding the title of "expert" has negatively impacted Iraq's international image.

Statements by non-experts have painted a vague picture of the economic reality,

leading to a disdainful view from some countries,

which have come to view Iraq as a country unqualified to build strong economic relations.

Therefore, it is necessary to reconsider the selection of figures who speak on economic issues,

ensuring they convey a clear and attractive image that reflects real potential, thus

serving as a tool for enhancing trust and attracting international cooperation.

The phenomenon of “coincidence experts” can be said to be comparable to malicious rumors in the extent of their negative impact on public opinion, and perhaps even exceed them in Some cases. https://alsabaah.iq/119250-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Wednesday Morning 8-20-25

Good Morning Dinar Recaps,

U.S. Crypto Regulation at a Crossroads: SEC Reforms and Senate Showdown

The landscape of U.S. cryptocurrency regulation is undergoing its most significant shift in years. On one side, SEC Chair Paul Atkins is pledging to rapidly implement the President’s recommendations for a more rules-based, innovation-friendly framework. On the other, Sen. Tim Scott is leading a high-stakes push in Congress to pass a comprehensive crypto market structure bill, facing resistance from Sen. Elizabeth Warren, one of the industry’s fiercest critics.

Together, these developments underscore how the U.S. is rethinking its approach to digital assets—balancing investor protections, innovation, and global competitiveness.

Good Morning Dinar Recaps,

U.S. Crypto Regulation at a Crossroads: SEC Reforms and Senate Showdown

The landscape of U.S. cryptocurrency regulation is undergoing its most significant shift in years. On one side, SEC Chair Paul Atkins is pledging to rapidly implement the President’s recommendations for a more rules-based, innovation-friendly framework. On the other, Sen. Tim Scott is leading a high-stakes push in Congress to pass a comprehensive crypto market structure bill, facing resistance from Sen. Elizabeth Warren, one of the industry’s fiercest critics.

Together, these developments underscore how the U.S. is rethinking its approach to digital assets—balancing investor protections, innovation, and global competitiveness.

SEC Pivot: From Enforcement to Clarity

At the Wyoming Blockchain Symposium, Atkins announced that the SEC will move quickly to adopt the President’s Working Group recommendations. The shift signals a departure from Gary Gensler’s enforcement-heavy era, which critics say pushed many developers overseas.

Key elements of the SEC’s new approach include:

Safe harbor periods for startups to innovate before facing heavy compliance.

Tailored exemptions for digital assets, moving away from “one-size-fits-all” securities rules.

New disclosure frameworks to improve transparency without stifling development.

Atkins stressed that only a small fraction of tokens should be treated as securities, depending on how they are marketed and sold. The goal, he argued, is to curb fraud while encouraging responsible growth in areas like ICOs, airdrops, network rewards, and decentralized apps.

The venture capital community and advocacy groups such as Andreessen Horowitz and the DeFi Education Fund welcomed the reforms, saying clearer rules could help keep innovation in the U.S.

Congressional Battle: Scott vs. Warren

While the SEC takes steps to modernize its regulatory playbook, Congress is locked in a political showdown over the future of crypto legislation.

Sen. Tim Scott (R-SC), joined by Sens. Cynthia Lummis, Bill Hagerty, and Bernie Moreno, has introduced a crypto market structure draft bill with a Sept. 30 deadline.

Scott believes he can win the support of 12 to 18 Senate Democrats, but singled out Sen. Elizabeth Warren (D-MA) as “standing in the way” of bipartisan progress.

The House has already passed its version of a market structure bill 294–134, with support from 78 Democrats, making Senate approval the next hurdle.

Warren, however, has denounced the draft, calling it an “industry handout” that risks giving crypto lobbyists everything they want while imposing weaker safeguards than those required of traditional financial institutions.

The Road Ahead

These parallel developments highlight the crossroads for U.S. crypto regulation:

The SEC’s reforms represent a more collaborative, innovation-focused regulatory model.

The Senate debate pits Scott’s pro-growth coalition against Warren’s consumer-protection stance.

Both paths will shape how the U.S. positions itself in the global digital economy—either as a leader in innovation with balanced oversight, or as a jurisdiction weighed down by partisan divides and regulatory uncertainty.

The next month could prove decisive: the SEC’s rapid rollout of new frameworks, combined with Congress’ looming Sept. 30 deadline, will determine whether the U.S. establishes long-term regulatory clarity—or continues to face gridlock as innovation moves abroad.

@ Newshounds News™

Sources:

~~~~~~~~~

Wyoming Becomes First U.S. State to Issue Its Own Stablecoin: FRNT

Wyoming has made history as the first state in the United States to launch a government-issued stablecoin. The Frontier Stable Token (FRNT) marks a breakthrough in public-sector adoption of blockchain, combining state oversight with private sector innovation.

FRNT Launches on Seven Blockchains

The Wyoming Stable Token Commission has officially launched FRNT, now live on:

Arbitrum

Avalanche

Base

Ethereum

Optimism

Polygon

Solana

FRNT is fully backed by U.S. dollars and short-term Treasuries, with a legally mandated 2% overcollateralization. The token was developed in partnership with industry leaders to ensure security, scalability, and transparency.

Not Yet Available to the Public

Although launched, FRNT is not yet publicly available as final regulatory steps are underway.

On Solana, it will debut via Wyoming’s Kraken.

On Avalanche, it will be integrated through Rain’s Visa card.

Governor Mark Gordon highlighted Wyoming’s leadership in blockchain legislation, with over 45 crypto and digital asset laws passed since 2016.

Transforming Public Finance

Anthony Apollo, Executive Director of the Wyoming Stable Token Commission, emphasized that FRNT represents a paradigm shift:

Instant vendor payments instead of traditional delays

On-chain tax refunds and social benefits

A working model of how governments can use blockchain to make processes faster, smarter, and more efficient

In a July pilot program with Hashfire, FRNT reduced Wyoming’s payment processing time from 45 days to just seconds.

Built with Industry Leaders

FRNT was developed in collaboration with top-tier firms:

LayerZero – Token issuance

Fireblocks – Blockchain infrastructure

Franklin Advisers – Reserve management

Inca Digital – Open-source insights

The Network Firm – Auditing

Real-World Utility Ahead

Through its partnership with Rain, FRNT will soon be spendable anywhere Visa is accepted — including online, in-store, and via Apple Pay and Google Pay.

The Wyoming model shows how government and industry can work together to modernize finance, setting a precedent for other U.S. states and potentially the federal government.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Says Custody Is Critical: Four Pillars for Providers

Key Points

Ripple outlines four principles for digital asset custody providers: compliance, tailored models, resilience, and governance.

Custody is positioned as essential for scaling digital finance, including stablecoins, tokenized assets, and cross-border payments.

Ripple forecasts tokenized assets could reach $18.9 trillion by 2033, with institutional adoption accelerating.

Custody at the Core of Digital Finance

Ripple executives have placed digital asset custody at the center of institutional adoption, unveiling a framework of guiding principles during a joint workshop with the Blockchain Association Singapore (BAS). The workshop also examined stablecoin use and security, reflecting momentum behind tokenizing real-world assets.

Ripple’s Four Pillars for Custody Providers

In a company blog, Ripple’s Rahul Advani (Global Co-Head of Policy) and Caren Tso (Asia-Pacific Policy Manager) identified four critical areas:

Compliance by Design – Meeting strict regulatory demands, such as those from Singapore’s MAS, requiring robust protocols for segregation and recovery of assets.

Tailored Custody Models – Institutions must adopt custody setups that fit their needs, whether third-party, hybrid, or self-custody.

Operational Resilience – In line with frameworks like the EU’s Digital Operational Resilience Act, providers must design workflows that can withstand disruptions and meet recovery standards.

Governance – Strong oversight, segregation of duties, and audit trails are vital to maintain institutional trust.

Custody as a Gateway for Scaling Finance

Ripple emphasized that custody is a “critical entry point” for enterprises scaling into stablecoins, tokenized assets, and cross-border payments.

The BAS workshop also released a best-practices report on stablecoin and cybersecurity standards, highlighting custody’s role in enabling:

Trade finance

Cross-border settlement

Corporate cash flow management

Ripple further noted that custody providers can accelerate adoption through API integrations, AML safeguards, and programmable compliance tools.

Ripple’s Stablecoin & Market Outlook

Ripple highlighted its USD stablecoin (RLUSD), launched under a New York Trust Company Charter. RLUSD is fully dollar-backed, subject to third-party audits, and maintains segregated reserves.

Ripple’s custody platform is designed to help institutions manage tokenized assets under strict legal and operational frameworks.

A Ripple–BCG report projects tokenized assets could hit $18.9 trillion by 2033.

Standard Chartered offers an even higher estimate—$30 trillion by 2034.

Ripple’s own survey shows over 50% of Asia-Pacific firms plan to adopt custody within three years, driven by tokenization growth.

Institutional Momentum

The growing custody and tokenization trend is attracting global financial heavyweights:

Goldman Sachs and BNY Mellon are piloting tokenized money-market funds.

BlackRock, Coinbase, Bank of America, and Citi are also exploring tokenization and digital securities platforms.

@ Newshounds News™

Source: BeInCrypto

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Wednesday Morning 8-20-2025

TNT:

Tishwash: Central Bank: Foreign transfers are proceeding smoothly and seamlessly.

Central Bank Governor Ali Al-Alaq confirmed on Wednesday that nearly all major currencies are covered, noting that the central bank is conducting foreign exchange transactions in all currencies smoothly and with high fluidity.

Al-Alaq said in a statement to the official agency, followed by ( IQ ): “The foreign transfer process has witnessed significant development during the last two years, whether in terms of style, method, and organization, or through direct communication and direct transfer between Iraqi banks and approved correspondent banks.”

TNT:

Tishwash: Central Bank: Foreign transfers are proceeding smoothly and seamlessly.

Central Bank Governor Ali Al-Alaq confirmed on Wednesday that nearly all major currencies are covered, noting that the central bank is conducting foreign exchange transactions in all currencies smoothly and with high fluidity.

Al-Alaq said in a statement to the official agency, followed by ( IQ ): “The foreign transfer process has witnessed significant development during the last two years, whether in terms of style, method, and organization, or through direct communication and direct transfer between Iraqi banks and approved correspondent banks.”

He added, "This expansion is not only in the number of correspondent or transfer banks, but also in the number of currencies," noting that "the Central Bank covers almost all the currencies used by Iraq for large-scale trade."

He stressed that "the Central Bank is currently conducting transfers in almost all major currencies, and they are proceeding smoothly and with high fluidity. link

Tishwash: The last US soldier will leave Ain al-Asad base in mid-September.

An Iraqi security source revealed on Tuesday that the last US soldier will leave Ain al-Asad base in Anbar province, western Iraq, in mid-September, after which the international coalition headquarters at the base will be permanently closed.

The source told Shafaq News Agency that the Ain al-Assad base is scheduled to be permanently closed on September 15, explaining that US forces stationed in western Iraq will move to bases inside Syrian territory, while those in the capital, Baghdad, will move to alternative bases in Erbil in the Kurdistan Region.

The source added that a limited number of American personnel and leaders will remain within the joint forces in Baghdad as needed.

On Monday, the first phase of the withdrawal of US forces from the country to Syrian territory began.

An Iraqi security source told Shafaq News Agency that a US convoy, including trucks carrying military vehicles, had begun moving out of Ain al-Assad base.

Ain al-Asad Air Base is the second largest air base in Iraq after Balad Air Base. It is the headquarters of the US Army's 7th Division and is located 10 kilometers from the Baghdadiyah district in Anbar Governorate.

Earlier, a spokesperson for the US Embassy in Baghdad revealed that a "civilian" partnership between the international coalition and Iraq was close to being signed, coinciding with the planned "military" withdrawal by next September.

The spokesman said in a statement to the agency that the Global Coalition to Defeat ISIS (Operation Inherent Resolve) will transition from its military mission in Iraq to a more traditional bilateral security partnership, stressing the continuation of the coalition's civilian-led efforts at the global level.

He emphasized that this shift does not mean the end of the international coalition's work to defeat ISIS, but rather comes as part of a transition plan to enhance stability in Iraq through security partnerships and ongoing civilian cooperation.

A government source told Shafaq News Agency that Iraq has agreed with the international coalition countries, primarily the United States, on a timetable for ending the coalition's mission.

The timetable stipulates ending its presence with the central government in September 2025, leading to a full withdrawal in September 2026, with the number of its forces gradually reduced to less than 500 personnel, whose presence will be limited to Erbil, while the rest will be transferred to Kuwait. link

**************

Tishwash: The value of Iraq's gold reserves has increased.

An economic observatory announced, on Tuesday, an increase in the value of the reserve.IraqGold prices rose by 4.76% during the first half of this year, as a result of...Gold prices rise Globally.

The Observatory said in a statement seen by Reuters:Alsumaria Newsthat "IraqHe owns 162 tons of gold as part of his national reserve," noting that "the price of a ton of gold was 105 million US dollars in January 2025, and gradually rose to reach 110 million US dollars by the end of June 2025."

He added, "This increase in the price of gold has directly contributed to raising the value of Iraq's gold reserves," stressing that "gold remains one of the most important strategic assets that enhances the country's financial strength.

" The observatory noted that,Gold prices riseGlobally, over the past months, it reflects the volatility of global markets and directly impacts the value of national reserves in many countries, including Iraq.

He explained, "Monitoring gold prices on a regular basis enables Iraq to accurately assess the value of its reserves and make appropriate economic decisions to maintain the stability of the country's purchasing power." link

Mot: Ya KNows!!! -- Sum Daze are Just More Challenging Then Others!! – Siigghhhh

Mot: .. They Say Horse Riders are lazy!!!-- HUH????

Iraq Economic News and Points To Ponder Tuesday Afternoon 8-18-25

Home Savings...Idle Money

Economic 2025/08/19 Dr. Talal Nazim Al-Zuhairi In almost every Iraqi home, there's a corner dedicated to financial security: a metal box, a secret drawer, or even a plastic bag hidden in a wardrobe.

Millions of dinars are kept at home instead of being circulated through the economy via banks or investments, with all the obvious risks this entails, such as theft, fire, or even loss of money due to any emergency.

Home Savings...Idle Money

Economic 2025/08/19 Dr. Talal Nazim Al-Zuhairi In almost every Iraqi home, there's a corner dedicated to financial security: a metal box, a secret drawer, or even a plastic bag hidden in a wardrobe.

Millions of dinars are kept at home instead of being circulated through the economy via banks or investments, with all the obvious risks this entails, such as theft, fire, or even loss of money due to any emergency.

This phenomenon, which has become a common behavior, is not merely an old habit or an individual choice. Rather, it reflects a complex economic and social reality with profound repercussions for the

financial system and the national economy.

The primary reason driving Iraqi families to keep their money at home is the lack of trust in banks.

Previous experiences with

delayed salary payments or

disruptions to electronic systems, in addition to the

complex procedures for withdrawals and deposits,

have created a state of chronic anxiety among depositors.

In the mind of the citizen, keeping cash at home ensures immediate access to their funds when needed,

without falling into a cycle of red tape or facing the possibility of accounts being frozen in times of crisis.

However, there is also a near-total absence of safe and transparent investment channels.

The average citizen, especially those with medium or limited incomes, has only two options:

deposit their money in a bank with a weak return that doesn't keep pace with inflation, or

take the risk of investing in unsecured projects that lack proper research and oversight.

Under this equation, the home becomes more attractive than any financial institution.

When the government announced the salary localization policy,the stated goal was to

integrate a broad segment of employees into the banking system and

facilitate financial transactions through electronic payments and purchases,

while keeping surplus funds in bank accounts rather than withdrawing them in cash.

However, reality has proven that the lack of trust in banks has rendered this policy ineffective.

As soon as salaries are deposited into accounts, the

majority of employees rush to withdraw them in full on the same day,

as if the bank account were merely a temporary stopover.

Money continues to leak out of the banking system as soon as it enters,

re-entering the same household savings cycle.

Thus, the idea of localization has transformed

from a tool for promoting financial inclusion

into a formality that fails to achieve its economic objectives.

The continued withdrawal of funds from the Iraqi banking system and

their continued holding at home

weakens banks' ability to lend and

puts pressure on the government to meet its obligations.

This could

lead to delayed salaries and

force the Central Bank to print more currency,

causing inflation and

weakening purchasing power.

Successful international experiences (such as those in Turkey and Malaysia) have proven that the

solution begins with

rebuilding trust between citizens and banks by

improving services,

providing incentives to savers, and

expanding electronic payments.

To achieve similar results, Iraq needs to:

digitize government salaries and payments;

launch savings and investment instruments

with attractive and secure returns; and

ensure deposit protection. In addition, it needs to

improve the banking infrastructure and

reduce electronic transaction fees. https://alsabaah.iq/119166-.html

The Value Of Iraq's Gold Reserves Has Increased.

Economy 2025-08-19 | 625 views An economic observatory announced on Tuesday that the

value of Iraq's gold reserves rose by 4.76% during the first half of this year, due to gold prices. rising global The observatory said in a statement seen by Sumaria News that "Iraq possesses 162 tons of gold as part of its national reserves," noting that "the price of a ton of gold was $105 million in January 2025, and gradually rose to $110 million by the end of June 2025."

He added, "This increase in the price of gold has directly contributed to

raising the value of Iraq's gold reserves," stressing that "gold remains one of the most important strategic assets that enhances the country's financial strength."

The Observatory noted that "the rise in global gold prices over the past months reflects

fluctuations in global markets and directly impacts the value of national reserves in many countries, including Iraq."

He explained, "Monitoring gold prices on a regular basis enables Iraq to accurately assess the value of its reserves and make appropriate economic decisions to maintain the stability of the country's purchasing power." https://www.alsumaria.tv/news/economy/537713/ارتفاع-قيمة-احتياطي-العراق-من-الذهب

Economists: Public Spending Technology Will Reduce The Budget Deficit

Economic 08/20/2025 Baghdad: The pillar of the emirate In light of the ongoing volatility of crude oil prices in global markets, the government has adopted what is known as the "public spending technique" as a mechanism for managing financial resources and ensuring their optimal allocation.

This technique is based on

planning,

implementing, and

monitoring government spending

to achieve

efficiency and

effectiveness,

align with sustainable development goals, and

meet societal needs.

Alternatives to compensate for the deficiency

The government's financial advisor, Dr. Mazhar Muhammad Salih, stated that the

instability of global crude oil prices and

their decline to below the price set in Budget Law No. (13) of 2023,

which amounted to $70 per barrel,

forced Iraq to search for alternatives to compensate for the shortfall in revenues. He explained that the escalating trade war between the world's two largest economies—the United States, the largest oil producer, and China, the largest importer, with 10 million barrels per day— was the primary reason for this decline.

Saleh explained, in his interview with Al-Sabah, that the United States is investing extensively in shale oil fields with a production cost of no less than $58 per barrel at the break-even point, with a production rate of 15 million barrels per day, in addition to strategic storage needs of up to To 23 million barrels.

In contrast, China imports about 10 million barrels per day, the highest import rate in the world. He emphasized that this reality places international markets before "the most difficult geo-economic equation in their history," which will not stabilize unless a balance is achieved between production cycles and oil assets at a moderate and stable point.

He added that, in light of the above, the Iraqi public finances are working to maximize their revenues

through the time factor in financial collection without delay, by enhancing the government's unified digital account.

Government collections will be digitally collected for the benefit of the public finances' cash budget,

ensuring that all government payments, including wages, services, fees, taxes, and market sector revenues, are received via instant digital payments without delay, with the aim of enhancing spending without delay or resorting extensively to bridge financing through borrowing.

Options and alternatives

The Prime Minister's financial advisor continued that the fiscal policy has set limits on two spending options.

The first is necessary spending, represented by paying salaries, wages, pensions, social welfare, debt services, farmers' support, and fuel, on the one hand, and proceeding with the basic infrastructure projects approved within the government's service program, on the other hand.

He added that the second option is expanding deferred operational spending in the event of an increase in oil prices and the return of oil assets to stability at higher price levels, to implement the approved expenditures according to their importance and the importance of their gradualness.

He stressed that it is a successful flexible fiscal policy supported by a strong monetary policy that

maintains stability with monetary guarantees that provide sustainability of financial spending at the ideal minimum without the country being exposed to any economic contraction.

Administrative Control

For his part, Dr. Imad Al-Ani, an economic expert, explained that financial reform efforts should focus on

increasing the efficiency of allocating government resources by strengthening administrative control systems to control and reduce resources allocated to unproductive operational spending, or what is known as “off-budget spending.”

This is what is meant by public spending technology, meaningthe use of modern technology and advanced methods to better distribute public funds by measuring the returns on this spending,

thus shifting funds

from unproductive public spending

to productive spending with economic and social returns that achieve the well-being of society.

Social services

Al-Ani added to Al-Sabah that the public spending technique also means linking the commitment to

providing support for goods and services to the needy groups in particular,

working to improve the level of social services and the method of providing them, in addition to

focusing on human development and infrastructure.

He pointed out that the composition and structure of public spending, not its level, is what is important in the process of reforming public spending, to the extent that the level of public spending is consistent with economic stability. https://alsabaah.iq/119249-.html

Economist: 99.2% Of Crude Oil Revenues Go To Cover Salaries Alone.

Today's Economy , 10:22 | 298 Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi confirmed on Tuesday (August 19, 2025) that most crude oil revenues go to cover salaries only, warning that this situation undermines the potential for economic development and limits the provision of basic services to the population.

Al-Marsoumi said in a post on his Facebook account, followed by "Baghdad Today," that

"oil revenues are almost entirely allocated to cover salaries, according to the financial accounts published by the Ministry of Finance for the first quarter of 2025.

Crude oil export revenues amounted to approximately 45.283 trillion dinars, while

total salaries paid amounted to 44.946 trillion dinars, with a coverage rate of 99.2%."

He added that these salaries include

employee compensation,

grants and wages,

retirement pensions,

salaries for full-time appointees, and the

social safety net,

warning that this situation undermines the potential for economic development and

limits the provision of basic services to the population.

To address this crisis, the expert outlined two main solutions: the

first is to increase public revenues, whether from oil or non-oil sources, and the second is to reform and restructure the payroll system by addressing private and duplicate salaries, combating corruption, and rationalizing expenditures.

Al-Marsoumi pointed out that if swift action is not taken, the government may be forced to make difficult choices, such as devaluing the dinar or reconsidering government subsidies— decisions that would negatively impact fixed-income earners and the poor. https://baghdadtoday.news/281227-992.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 8-19-25

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Economic Foundation and Global Impact

The economic weight of BRICS is staggering:

China accounts for 19.05% of global GDP

India contributes 8.23% of global GDP

(Source: IMF)

This power is institutionalized through initiatives like the New Development Bank, which funds infrastructure across emerging markets.

An S&P Global analysis notes that the expanded BRICS could control nearly half of worldwide oil production. With Saudi Arabia’s potential inclusion, the bloc would become a true commodities superpower.

Political Coordination and Global Influence

Politically, BRICS has become a platform for resisting Western pressure. Trade tensions and U.S. tariffs have only deepened bloc unity.

Leaders like Brazil’s President Lula da Silva and China’s Xi Jinping continue to push for cooperation against unilateralism.

Professor Jayati Ghosh highlights U.S. inconsistency, noting that even the EU—like BRICS members—continues to purchase Russian oil.

Member Countries and South Africa’s Role

South Africa has leveraged BRICS to amplify Africa’s voice in global trade and reform agendas. The inclusion of Egypt and Ethiopia further strengthens continental representation in strategic platforms.

Chinese President Xi Jinping emphasized that adding new economies injects vitality, representativeness, and influence into BRICS cooperation. Currently, 23 countries have formally applied to join.

Future Direction and Currency Alternatives

BRICS is actively working on alternatives to the U.S. dollar, developing frameworks for bilateral trade in local currencies. Brazilian officials are also exploring the creation of a BRICS currency to reduce dollar dependency.

Beyond finance, BRICS is building cooperation in climate, health, energy, and digital economy initiatives, with the upcoming COP30 summit offering another platform for joint action.

Professor Ghosh notes that U.S. policy unpredictability makes long-term deals with Washington risky, pushing nations toward independent BRICS-led agreements.

Bottom Line: BRICS meaning in globalization has transformed from a trade bloc into a strategic power player, reshaping economics, energy, and geopolitics. With expansion underway and dollar alternatives rising, the bloc is setting the stage for a new global order.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

8-19-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

8-19-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

“Tidbits From TNT” Tuesday Morning 8-19-2025

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

Observers believe this shift may represent a less obvious reshuffle of the US presence, but it could continue to shape the course of politics and security in Iraq. While others believe the bilateral security partnership could give Iraqi forces an opportunity to independently enhance their capabilities to counter terrorism, the ambiguity surrounding the nature of this partnership raises concerns about the continued indirect influence of foreign powers.

Amid these statements, the most prominent question remains: Is the coalition's withdrawal a real step toward Iraq regaining its independent security decision-making, or merely a change in form without any change in reality? link

Tishwash: Demonstration announcement in Basra: We will not remain silent any longer.

The Nahr al-Ezz tribes in the Thaghr district, north of Basra in the far south of Iraq, announced this evening, Monday, a demonstration to demand services and job opportunities, starting on August 24. While warning against neglecting the implementation of rights, they affirmed their commitment to continuing until their rights are fully and undiminished.

This came in a statement by the leader of the Shaghanbi, Al-Bubakhit and Al-Hilijiya tribes movement, Sheikh Ali Sabah Hatem Al-Shaghanbi, received by Shafaq News Agency.

Addressing the people of Basra, the statement said, "Enough is enough. For many years, we have suffered the bitterness of deprivation and marginalization, with no health care, no education, no electricity, no services, and no job opportunities that would preserve the dignity of our youth."

He added, "We previously stood in front of the West Qurna 2 oil fields and raised our voices sincerely, but they met us with silence, disregard, and deadly indifference. Today, we say it loud and clear: Our rights will not be granted; we will seize them by force."

He continued: "We warn anyone who underestimates the will of the people of Nahr al-Ezz: the patience of the patient has limits, and if the patient becomes angry, his revolution will not be stopped by a false promise or a deceptive speech." He stressed: "We, the people of Nahr al-Ezz, will not retreat, and we will not remain silent from today on, and we will continue until we obtain our full and undiminished rights, no matter the cost."

The statement declared, "Our date is Sunday, August 24, a day when everyone will hear the voice of the oppressed, the voice of truth, the voice of the river of glory. And tomorrow is near."

Northern areas of Basra province, particularly the districts of Al-Thaghr and Al-Sadiq, and the Al-Qurna district, have witnessed a series of demonstrations and sit-ins over the past few months, protesting what residents describe as "deliberate marginalization and neglect" by the local and federal governments.

Protesters' demands ranged from improving basic services, providing job opportunities, and addressing the dangerous environmental pollution resulting from oil extraction operations, which have destroyed agricultural areas and spread disease. There have been repeated threats to shut down oil fields if the situation continues to be ignored. link

****************

Tishwash: Iraqi banks eye capital boost extension

An economist expects the capital increase period for Iraqi banks "covered by reform" to be extended.

Economic expert Mustafa Akram Hantoush confirmed on Monday that the Central Bank of Iraq and the Iraqi banking system are going through a critical phase, suggesting that the deadline for increasing the capital of banks subject to reform will likely be extended to three years, instead of the previous deadline of the end of this year.

Hantoush told Shafaq News Agency, "The Central Bank contracted last year with Oliver Wyman to conduct a comprehensive study of the banking sector," noting that "the company has completed its study."

He added, "The preliminary report was submitted three weeks ago, while the final report was recently issued. It included a package of mechanisms to address banking challenges and regulate dollar transactions. These mechanisms are currently under discussion between the Central Bank and the company."

Hantoush pointed out that "the recommendations included raising the capital of all Iraqi banks to 400 billion dinars, in addition to paying $2.4 million over four years for banks, under conditions most notably merger or liquidation, as well as restructuring the capital so that relatives' stake does not exceed 10%."

He pointed out that "these conditions pose a significant challenge to the sanctioned banks, making it difficult to comply with the required increase," emphasizing that "the matter requires discussions between the Central Bank and these banks to reach an acceptable formula."

The economic expert expects that "the Central Bank will open a new dialogue with the consulting firm to reach a compromise, either by extending the capital increase period to more than three years, or by reducing the required amounts to be closer to the capabilities of Iraqi banks." link

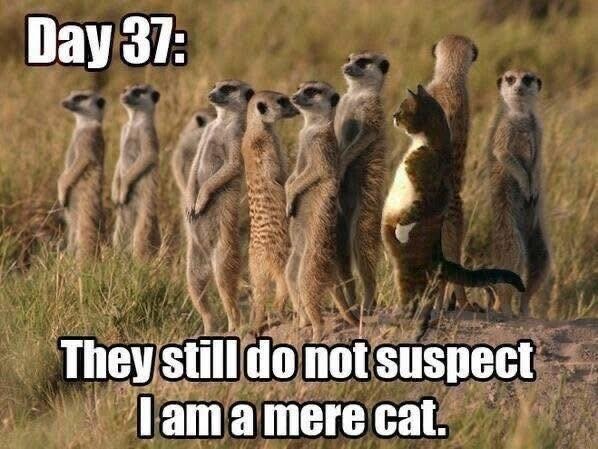

Mot: Now - This is What I Wants!!!!

Mot: .. Fitting In !!!!