Seeds of Wisdom RV and Economic Updates Wednesday Morning 8-20-25

Good Morning Dinar Recaps,

U.S. Crypto Regulation at a Crossroads: SEC Reforms and Senate Showdown

The landscape of U.S. cryptocurrency regulation is undergoing its most significant shift in years. On one side, SEC Chair Paul Atkins is pledging to rapidly implement the President’s recommendations for a more rules-based, innovation-friendly framework. On the other, Sen. Tim Scott is leading a high-stakes push in Congress to pass a comprehensive crypto market structure bill, facing resistance from Sen. Elizabeth Warren, one of the industry’s fiercest critics.

Together, these developments underscore how the U.S. is rethinking its approach to digital assets—balancing investor protections, innovation, and global competitiveness.

Good Morning Dinar Recaps,

U.S. Crypto Regulation at a Crossroads: SEC Reforms and Senate Showdown

The landscape of U.S. cryptocurrency regulation is undergoing its most significant shift in years. On one side, SEC Chair Paul Atkins is pledging to rapidly implement the President’s recommendations for a more rules-based, innovation-friendly framework. On the other, Sen. Tim Scott is leading a high-stakes push in Congress to pass a comprehensive crypto market structure bill, facing resistance from Sen. Elizabeth Warren, one of the industry’s fiercest critics.

Together, these developments underscore how the U.S. is rethinking its approach to digital assets—balancing investor protections, innovation, and global competitiveness.

SEC Pivot: From Enforcement to Clarity

At the Wyoming Blockchain Symposium, Atkins announced that the SEC will move quickly to adopt the President’s Working Group recommendations. The shift signals a departure from Gary Gensler’s enforcement-heavy era, which critics say pushed many developers overseas.

Key elements of the SEC’s new approach include:

Safe harbor periods for startups to innovate before facing heavy compliance.

Tailored exemptions for digital assets, moving away from “one-size-fits-all” securities rules.

New disclosure frameworks to improve transparency without stifling development.

Atkins stressed that only a small fraction of tokens should be treated as securities, depending on how they are marketed and sold. The goal, he argued, is to curb fraud while encouraging responsible growth in areas like ICOs, airdrops, network rewards, and decentralized apps.

The venture capital community and advocacy groups such as Andreessen Horowitz and the DeFi Education Fund welcomed the reforms, saying clearer rules could help keep innovation in the U.S.

Congressional Battle: Scott vs. Warren

While the SEC takes steps to modernize its regulatory playbook, Congress is locked in a political showdown over the future of crypto legislation.

Sen. Tim Scott (R-SC), joined by Sens. Cynthia Lummis, Bill Hagerty, and Bernie Moreno, has introduced a crypto market structure draft bill with a Sept. 30 deadline.

Scott believes he can win the support of 12 to 18 Senate Democrats, but singled out Sen. Elizabeth Warren (D-MA) as “standing in the way” of bipartisan progress.

The House has already passed its version of a market structure bill 294–134, with support from 78 Democrats, making Senate approval the next hurdle.

Warren, however, has denounced the draft, calling it an “industry handout” that risks giving crypto lobbyists everything they want while imposing weaker safeguards than those required of traditional financial institutions.

The Road Ahead

These parallel developments highlight the crossroads for U.S. crypto regulation:

The SEC’s reforms represent a more collaborative, innovation-focused regulatory model.

The Senate debate pits Scott’s pro-growth coalition against Warren’s consumer-protection stance.

Both paths will shape how the U.S. positions itself in the global digital economy—either as a leader in innovation with balanced oversight, or as a jurisdiction weighed down by partisan divides and regulatory uncertainty.

The next month could prove decisive: the SEC’s rapid rollout of new frameworks, combined with Congress’ looming Sept. 30 deadline, will determine whether the U.S. establishes long-term regulatory clarity—or continues to face gridlock as innovation moves abroad.

@ Newshounds News™

Sources:

~~~~~~~~~

Wyoming Becomes First U.S. State to Issue Its Own Stablecoin: FRNT

Wyoming has made history as the first state in the United States to launch a government-issued stablecoin. The Frontier Stable Token (FRNT) marks a breakthrough in public-sector adoption of blockchain, combining state oversight with private sector innovation.

FRNT Launches on Seven Blockchains

The Wyoming Stable Token Commission has officially launched FRNT, now live on:

Arbitrum

Avalanche

Base

Ethereum

Optimism

Polygon

Solana

FRNT is fully backed by U.S. dollars and short-term Treasuries, with a legally mandated 2% overcollateralization. The token was developed in partnership with industry leaders to ensure security, scalability, and transparency.

Not Yet Available to the Public

Although launched, FRNT is not yet publicly available as final regulatory steps are underway.

On Solana, it will debut via Wyoming’s Kraken.

On Avalanche, it will be integrated through Rain’s Visa card.

Governor Mark Gordon highlighted Wyoming’s leadership in blockchain legislation, with over 45 crypto and digital asset laws passed since 2016.

Transforming Public Finance

Anthony Apollo, Executive Director of the Wyoming Stable Token Commission, emphasized that FRNT represents a paradigm shift:

Instant vendor payments instead of traditional delays

On-chain tax refunds and social benefits

A working model of how governments can use blockchain to make processes faster, smarter, and more efficient

In a July pilot program with Hashfire, FRNT reduced Wyoming’s payment processing time from 45 days to just seconds.

Built with Industry Leaders

FRNT was developed in collaboration with top-tier firms:

LayerZero – Token issuance

Fireblocks – Blockchain infrastructure

Franklin Advisers – Reserve management

Inca Digital – Open-source insights

The Network Firm – Auditing

Real-World Utility Ahead

Through its partnership with Rain, FRNT will soon be spendable anywhere Visa is accepted — including online, in-store, and via Apple Pay and Google Pay.

The Wyoming model shows how government and industry can work together to modernize finance, setting a precedent for other U.S. states and potentially the federal government.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Says Custody Is Critical: Four Pillars for Providers

Key Points

Ripple outlines four principles for digital asset custody providers: compliance, tailored models, resilience, and governance.

Custody is positioned as essential for scaling digital finance, including stablecoins, tokenized assets, and cross-border payments.

Ripple forecasts tokenized assets could reach $18.9 trillion by 2033, with institutional adoption accelerating.

Custody at the Core of Digital Finance

Ripple executives have placed digital asset custody at the center of institutional adoption, unveiling a framework of guiding principles during a joint workshop with the Blockchain Association Singapore (BAS). The workshop also examined stablecoin use and security, reflecting momentum behind tokenizing real-world assets.

Ripple’s Four Pillars for Custody Providers

In a company blog, Ripple’s Rahul Advani (Global Co-Head of Policy) and Caren Tso (Asia-Pacific Policy Manager) identified four critical areas:

Compliance by Design – Meeting strict regulatory demands, such as those from Singapore’s MAS, requiring robust protocols for segregation and recovery of assets.

Tailored Custody Models – Institutions must adopt custody setups that fit their needs, whether third-party, hybrid, or self-custody.

Operational Resilience – In line with frameworks like the EU’s Digital Operational Resilience Act, providers must design workflows that can withstand disruptions and meet recovery standards.

Governance – Strong oversight, segregation of duties, and audit trails are vital to maintain institutional trust.

Custody as a Gateway for Scaling Finance

Ripple emphasized that custody is a “critical entry point” for enterprises scaling into stablecoins, tokenized assets, and cross-border payments.

The BAS workshop also released a best-practices report on stablecoin and cybersecurity standards, highlighting custody’s role in enabling:

Trade finance

Cross-border settlement

Corporate cash flow management

Ripple further noted that custody providers can accelerate adoption through API integrations, AML safeguards, and programmable compliance tools.

Ripple’s Stablecoin & Market Outlook

Ripple highlighted its USD stablecoin (RLUSD), launched under a New York Trust Company Charter. RLUSD is fully dollar-backed, subject to third-party audits, and maintains segregated reserves.

Ripple’s custody platform is designed to help institutions manage tokenized assets under strict legal and operational frameworks.

A Ripple–BCG report projects tokenized assets could hit $18.9 trillion by 2033.

Standard Chartered offers an even higher estimate—$30 trillion by 2034.

Ripple’s own survey shows over 50% of Asia-Pacific firms plan to adopt custody within three years, driven by tokenization growth.

Institutional Momentum

The growing custody and tokenization trend is attracting global financial heavyweights:

Goldman Sachs and BNY Mellon are piloting tokenized money-market funds.

BlackRock, Coinbase, Bank of America, and Citi are also exploring tokenization and digital securities platforms.

@ Newshounds News™

Source: BeInCrypto

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Wednesday Morning 8-20-2025

TNT:

Tishwash: Central Bank: Foreign transfers are proceeding smoothly and seamlessly.

Central Bank Governor Ali Al-Alaq confirmed on Wednesday that nearly all major currencies are covered, noting that the central bank is conducting foreign exchange transactions in all currencies smoothly and with high fluidity.

Al-Alaq said in a statement to the official agency, followed by ( IQ ): “The foreign transfer process has witnessed significant development during the last two years, whether in terms of style, method, and organization, or through direct communication and direct transfer between Iraqi banks and approved correspondent banks.”

TNT:

Tishwash: Central Bank: Foreign transfers are proceeding smoothly and seamlessly.

Central Bank Governor Ali Al-Alaq confirmed on Wednesday that nearly all major currencies are covered, noting that the central bank is conducting foreign exchange transactions in all currencies smoothly and with high fluidity.

Al-Alaq said in a statement to the official agency, followed by ( IQ ): “The foreign transfer process has witnessed significant development during the last two years, whether in terms of style, method, and organization, or through direct communication and direct transfer between Iraqi banks and approved correspondent banks.”

He added, "This expansion is not only in the number of correspondent or transfer banks, but also in the number of currencies," noting that "the Central Bank covers almost all the currencies used by Iraq for large-scale trade."

He stressed that "the Central Bank is currently conducting transfers in almost all major currencies, and they are proceeding smoothly and with high fluidity. link

Tishwash: The last US soldier will leave Ain al-Asad base in mid-September.

An Iraqi security source revealed on Tuesday that the last US soldier will leave Ain al-Asad base in Anbar province, western Iraq, in mid-September, after which the international coalition headquarters at the base will be permanently closed.

The source told Shafaq News Agency that the Ain al-Assad base is scheduled to be permanently closed on September 15, explaining that US forces stationed in western Iraq will move to bases inside Syrian territory, while those in the capital, Baghdad, will move to alternative bases in Erbil in the Kurdistan Region.

The source added that a limited number of American personnel and leaders will remain within the joint forces in Baghdad as needed.

On Monday, the first phase of the withdrawal of US forces from the country to Syrian territory began.

An Iraqi security source told Shafaq News Agency that a US convoy, including trucks carrying military vehicles, had begun moving out of Ain al-Assad base.

Ain al-Asad Air Base is the second largest air base in Iraq after Balad Air Base. It is the headquarters of the US Army's 7th Division and is located 10 kilometers from the Baghdadiyah district in Anbar Governorate.

Earlier, a spokesperson for the US Embassy in Baghdad revealed that a "civilian" partnership between the international coalition and Iraq was close to being signed, coinciding with the planned "military" withdrawal by next September.

The spokesman said in a statement to the agency that the Global Coalition to Defeat ISIS (Operation Inherent Resolve) will transition from its military mission in Iraq to a more traditional bilateral security partnership, stressing the continuation of the coalition's civilian-led efforts at the global level.

He emphasized that this shift does not mean the end of the international coalition's work to defeat ISIS, but rather comes as part of a transition plan to enhance stability in Iraq through security partnerships and ongoing civilian cooperation.

A government source told Shafaq News Agency that Iraq has agreed with the international coalition countries, primarily the United States, on a timetable for ending the coalition's mission.

The timetable stipulates ending its presence with the central government in September 2025, leading to a full withdrawal in September 2026, with the number of its forces gradually reduced to less than 500 personnel, whose presence will be limited to Erbil, while the rest will be transferred to Kuwait. link

**************

Tishwash: The value of Iraq's gold reserves has increased.

An economic observatory announced, on Tuesday, an increase in the value of the reserve.IraqGold prices rose by 4.76% during the first half of this year, as a result of...Gold prices rise Globally.

The Observatory said in a statement seen by Reuters:Alsumaria Newsthat "IraqHe owns 162 tons of gold as part of his national reserve," noting that "the price of a ton of gold was 105 million US dollars in January 2025, and gradually rose to reach 110 million US dollars by the end of June 2025."

He added, "This increase in the price of gold has directly contributed to raising the value of Iraq's gold reserves," stressing that "gold remains one of the most important strategic assets that enhances the country's financial strength.

" The observatory noted that,Gold prices riseGlobally, over the past months, it reflects the volatility of global markets and directly impacts the value of national reserves in many countries, including Iraq.

He explained, "Monitoring gold prices on a regular basis enables Iraq to accurately assess the value of its reserves and make appropriate economic decisions to maintain the stability of the country's purchasing power." link

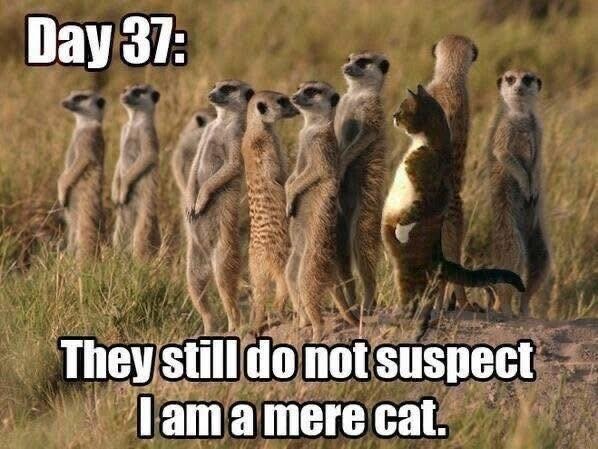

Mot: Ya KNows!!! -- Sum Daze are Just More Challenging Then Others!! – Siigghhhh

Mot: .. They Say Horse Riders are lazy!!!-- HUH????

Iraq Economic News and Points To Ponder Tuesday Afternoon 8-18-25

Home Savings...Idle Money

Economic 2025/08/19 Dr. Talal Nazim Al-Zuhairi In almost every Iraqi home, there's a corner dedicated to financial security: a metal box, a secret drawer, or even a plastic bag hidden in a wardrobe.

Millions of dinars are kept at home instead of being circulated through the economy via banks or investments, with all the obvious risks this entails, such as theft, fire, or even loss of money due to any emergency.

Home Savings...Idle Money

Economic 2025/08/19 Dr. Talal Nazim Al-Zuhairi In almost every Iraqi home, there's a corner dedicated to financial security: a metal box, a secret drawer, or even a plastic bag hidden in a wardrobe.

Millions of dinars are kept at home instead of being circulated through the economy via banks or investments, with all the obvious risks this entails, such as theft, fire, or even loss of money due to any emergency.

This phenomenon, which has become a common behavior, is not merely an old habit or an individual choice. Rather, it reflects a complex economic and social reality with profound repercussions for the

financial system and the national economy.

The primary reason driving Iraqi families to keep their money at home is the lack of trust in banks.

Previous experiences with

delayed salary payments or

disruptions to electronic systems, in addition to the

complex procedures for withdrawals and deposits,

have created a state of chronic anxiety among depositors.

In the mind of the citizen, keeping cash at home ensures immediate access to their funds when needed,

without falling into a cycle of red tape or facing the possibility of accounts being frozen in times of crisis.

However, there is also a near-total absence of safe and transparent investment channels.

The average citizen, especially those with medium or limited incomes, has only two options:

deposit their money in a bank with a weak return that doesn't keep pace with inflation, or

take the risk of investing in unsecured projects that lack proper research and oversight.

Under this equation, the home becomes more attractive than any financial institution.

When the government announced the salary localization policy,the stated goal was to

integrate a broad segment of employees into the banking system and

facilitate financial transactions through electronic payments and purchases,

while keeping surplus funds in bank accounts rather than withdrawing them in cash.

However, reality has proven that the lack of trust in banks has rendered this policy ineffective.

As soon as salaries are deposited into accounts, the

majority of employees rush to withdraw them in full on the same day,

as if the bank account were merely a temporary stopover.

Money continues to leak out of the banking system as soon as it enters,

re-entering the same household savings cycle.

Thus, the idea of localization has transformed

from a tool for promoting financial inclusion

into a formality that fails to achieve its economic objectives.

The continued withdrawal of funds from the Iraqi banking system and

their continued holding at home

weakens banks' ability to lend and

puts pressure on the government to meet its obligations.

This could

lead to delayed salaries and

force the Central Bank to print more currency,

causing inflation and

weakening purchasing power.

Successful international experiences (such as those in Turkey and Malaysia) have proven that the

solution begins with

rebuilding trust between citizens and banks by

improving services,

providing incentives to savers, and

expanding electronic payments.

To achieve similar results, Iraq needs to:

digitize government salaries and payments;

launch savings and investment instruments

with attractive and secure returns; and

ensure deposit protection. In addition, it needs to

improve the banking infrastructure and

reduce electronic transaction fees. https://alsabaah.iq/119166-.html

The Value Of Iraq's Gold Reserves Has Increased.

Economy 2025-08-19 | 625 views An economic observatory announced on Tuesday that the

value of Iraq's gold reserves rose by 4.76% during the first half of this year, due to gold prices. rising global The observatory said in a statement seen by Sumaria News that "Iraq possesses 162 tons of gold as part of its national reserves," noting that "the price of a ton of gold was $105 million in January 2025, and gradually rose to $110 million by the end of June 2025."

He added, "This increase in the price of gold has directly contributed to

raising the value of Iraq's gold reserves," stressing that "gold remains one of the most important strategic assets that enhances the country's financial strength."

The Observatory noted that "the rise in global gold prices over the past months reflects

fluctuations in global markets and directly impacts the value of national reserves in many countries, including Iraq."

He explained, "Monitoring gold prices on a regular basis enables Iraq to accurately assess the value of its reserves and make appropriate economic decisions to maintain the stability of the country's purchasing power." https://www.alsumaria.tv/news/economy/537713/ارتفاع-قيمة-احتياطي-العراق-من-الذهب

Economists: Public Spending Technology Will Reduce The Budget Deficit

Economic 08/20/2025 Baghdad: The pillar of the emirate In light of the ongoing volatility of crude oil prices in global markets, the government has adopted what is known as the "public spending technique" as a mechanism for managing financial resources and ensuring their optimal allocation.

This technique is based on

planning,

implementing, and

monitoring government spending

to achieve

efficiency and

effectiveness,

align with sustainable development goals, and

meet societal needs.

Alternatives to compensate for the deficiency

The government's financial advisor, Dr. Mazhar Muhammad Salih, stated that the

instability of global crude oil prices and

their decline to below the price set in Budget Law No. (13) of 2023,

which amounted to $70 per barrel,

forced Iraq to search for alternatives to compensate for the shortfall in revenues. He explained that the escalating trade war between the world's two largest economies—the United States, the largest oil producer, and China, the largest importer, with 10 million barrels per day— was the primary reason for this decline.

Saleh explained, in his interview with Al-Sabah, that the United States is investing extensively in shale oil fields with a production cost of no less than $58 per barrel at the break-even point, with a production rate of 15 million barrels per day, in addition to strategic storage needs of up to To 23 million barrels.

In contrast, China imports about 10 million barrels per day, the highest import rate in the world. He emphasized that this reality places international markets before "the most difficult geo-economic equation in their history," which will not stabilize unless a balance is achieved between production cycles and oil assets at a moderate and stable point.

He added that, in light of the above, the Iraqi public finances are working to maximize their revenues

through the time factor in financial collection without delay, by enhancing the government's unified digital account.

Government collections will be digitally collected for the benefit of the public finances' cash budget,

ensuring that all government payments, including wages, services, fees, taxes, and market sector revenues, are received via instant digital payments without delay, with the aim of enhancing spending without delay or resorting extensively to bridge financing through borrowing.

Options and alternatives

The Prime Minister's financial advisor continued that the fiscal policy has set limits on two spending options.

The first is necessary spending, represented by paying salaries, wages, pensions, social welfare, debt services, farmers' support, and fuel, on the one hand, and proceeding with the basic infrastructure projects approved within the government's service program, on the other hand.

He added that the second option is expanding deferred operational spending in the event of an increase in oil prices and the return of oil assets to stability at higher price levels, to implement the approved expenditures according to their importance and the importance of their gradualness.

He stressed that it is a successful flexible fiscal policy supported by a strong monetary policy that

maintains stability with monetary guarantees that provide sustainability of financial spending at the ideal minimum without the country being exposed to any economic contraction.

Administrative Control

For his part, Dr. Imad Al-Ani, an economic expert, explained that financial reform efforts should focus on

increasing the efficiency of allocating government resources by strengthening administrative control systems to control and reduce resources allocated to unproductive operational spending, or what is known as “off-budget spending.”

This is what is meant by public spending technology, meaningthe use of modern technology and advanced methods to better distribute public funds by measuring the returns on this spending,

thus shifting funds

from unproductive public spending

to productive spending with economic and social returns that achieve the well-being of society.

Social services

Al-Ani added to Al-Sabah that the public spending technique also means linking the commitment to

providing support for goods and services to the needy groups in particular,

working to improve the level of social services and the method of providing them, in addition to

focusing on human development and infrastructure.

He pointed out that the composition and structure of public spending, not its level, is what is important in the process of reforming public spending, to the extent that the level of public spending is consistent with economic stability. https://alsabaah.iq/119249-.html

Economist: 99.2% Of Crude Oil Revenues Go To Cover Salaries Alone.

Today's Economy , 10:22 | 298 Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi confirmed on Tuesday (August 19, 2025) that most crude oil revenues go to cover salaries only, warning that this situation undermines the potential for economic development and limits the provision of basic services to the population.

Al-Marsoumi said in a post on his Facebook account, followed by "Baghdad Today," that

"oil revenues are almost entirely allocated to cover salaries, according to the financial accounts published by the Ministry of Finance for the first quarter of 2025.

Crude oil export revenues amounted to approximately 45.283 trillion dinars, while

total salaries paid amounted to 44.946 trillion dinars, with a coverage rate of 99.2%."

He added that these salaries include

employee compensation,

grants and wages,

retirement pensions,

salaries for full-time appointees, and the

social safety net,

warning that this situation undermines the potential for economic development and

limits the provision of basic services to the population.

To address this crisis, the expert outlined two main solutions: the

first is to increase public revenues, whether from oil or non-oil sources, and the second is to reform and restructure the payroll system by addressing private and duplicate salaries, combating corruption, and rationalizing expenditures.

Al-Marsoumi pointed out that if swift action is not taken, the government may be forced to make difficult choices, such as devaluing the dinar or reconsidering government subsidies— decisions that would negatively impact fixed-income earners and the poor. https://baghdadtoday.news/281227-992.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 8-19-25

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Good Afternoon Dinar Recaps,

BRICS Meaning in Globalization: From Trade Bloc to Power Player

BRICS meaning in globalization reflects a major shift from Western-dominated trade systems toward a more multipolar world economy. What began as Goldman Sachs’ 2001 investment concept has evolved into a geopolitical force that now challenges traditional global power structures.

Today, BRICS—Brazil, Russia, India, China, and South Africa—controls 37.3% of global GDP and represents over 40% of the world’s population. With new members like Egypt, Ethiopia, Iran, and the UAE, the bloc is extending its influence across trade, politics, and energy.

Economic Foundation and Global Impact

The economic weight of BRICS is staggering:

China accounts for 19.05% of global GDP

India contributes 8.23% of global GDP

(Source: IMF)

This power is institutionalized through initiatives like the New Development Bank, which funds infrastructure across emerging markets.

An S&P Global analysis notes that the expanded BRICS could control nearly half of worldwide oil production. With Saudi Arabia’s potential inclusion, the bloc would become a true commodities superpower.

Political Coordination and Global Influence

Politically, BRICS has become a platform for resisting Western pressure. Trade tensions and U.S. tariffs have only deepened bloc unity.

Leaders like Brazil’s President Lula da Silva and China’s Xi Jinping continue to push for cooperation against unilateralism.

Professor Jayati Ghosh highlights U.S. inconsistency, noting that even the EU—like BRICS members—continues to purchase Russian oil.

Member Countries and South Africa’s Role

South Africa has leveraged BRICS to amplify Africa’s voice in global trade and reform agendas. The inclusion of Egypt and Ethiopia further strengthens continental representation in strategic platforms.

Chinese President Xi Jinping emphasized that adding new economies injects vitality, representativeness, and influence into BRICS cooperation. Currently, 23 countries have formally applied to join.

Future Direction and Currency Alternatives

BRICS is actively working on alternatives to the U.S. dollar, developing frameworks for bilateral trade in local currencies. Brazilian officials are also exploring the creation of a BRICS currency to reduce dollar dependency.

Beyond finance, BRICS is building cooperation in climate, health, energy, and digital economy initiatives, with the upcoming COP30 summit offering another platform for joint action.

Professor Ghosh notes that U.S. policy unpredictability makes long-term deals with Washington risky, pushing nations toward independent BRICS-led agreements.

Bottom Line: BRICS meaning in globalization has transformed from a trade bloc into a strategic power player, reshaping economics, energy, and geopolitics. With expansion underway and dollar alternatives rising, the bloc is setting the stage for a new global order.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

8-19-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update- Banks-Oil-Salaries-Budget-EXR

8-19-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

“Tidbits From TNT” Tuesday Morning 8-19-2025

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

TNT:

Tishwash: The withdrawal of the US coalition... Is the war over or has new influence begun?

The US Embassy in Iraq announced on Monday that the withdrawal of the international coalition from the country does not mark the end of its work against the terrorist organization ISIS, noting that its military mission will transform into a bilateral security partnership with Iraqi security forces.

In statements to Al Jazeera, monitored by Al-Mustaqilla, the embassy confirmed that the international coalition will continue its civilian efforts worldwide, raising questions about the form and extent of future US intervention in Iraq and the extent to which this partnership will impact Iraqi sovereignty.

Observers believe this shift may represent a less obvious reshuffle of the US presence, but it could continue to shape the course of politics and security in Iraq. While others believe the bilateral security partnership could give Iraqi forces an opportunity to independently enhance their capabilities to counter terrorism, the ambiguity surrounding the nature of this partnership raises concerns about the continued indirect influence of foreign powers.

Amid these statements, the most prominent question remains: Is the coalition's withdrawal a real step toward Iraq regaining its independent security decision-making, or merely a change in form without any change in reality? link

Tishwash: Demonstration announcement in Basra: We will not remain silent any longer.

The Nahr al-Ezz tribes in the Thaghr district, north of Basra in the far south of Iraq, announced this evening, Monday, a demonstration to demand services and job opportunities, starting on August 24. While warning against neglecting the implementation of rights, they affirmed their commitment to continuing until their rights are fully and undiminished.

This came in a statement by the leader of the Shaghanbi, Al-Bubakhit and Al-Hilijiya tribes movement, Sheikh Ali Sabah Hatem Al-Shaghanbi, received by Shafaq News Agency.

Addressing the people of Basra, the statement said, "Enough is enough. For many years, we have suffered the bitterness of deprivation and marginalization, with no health care, no education, no electricity, no services, and no job opportunities that would preserve the dignity of our youth."

He added, "We previously stood in front of the West Qurna 2 oil fields and raised our voices sincerely, but they met us with silence, disregard, and deadly indifference. Today, we say it loud and clear: Our rights will not be granted; we will seize them by force."

He continued: "We warn anyone who underestimates the will of the people of Nahr al-Ezz: the patience of the patient has limits, and if the patient becomes angry, his revolution will not be stopped by a false promise or a deceptive speech." He stressed: "We, the people of Nahr al-Ezz, will not retreat, and we will not remain silent from today on, and we will continue until we obtain our full and undiminished rights, no matter the cost."

The statement declared, "Our date is Sunday, August 24, a day when everyone will hear the voice of the oppressed, the voice of truth, the voice of the river of glory. And tomorrow is near."

Northern areas of Basra province, particularly the districts of Al-Thaghr and Al-Sadiq, and the Al-Qurna district, have witnessed a series of demonstrations and sit-ins over the past few months, protesting what residents describe as "deliberate marginalization and neglect" by the local and federal governments.

Protesters' demands ranged from improving basic services, providing job opportunities, and addressing the dangerous environmental pollution resulting from oil extraction operations, which have destroyed agricultural areas and spread disease. There have been repeated threats to shut down oil fields if the situation continues to be ignored. link

****************

Tishwash: Iraqi banks eye capital boost extension

An economist expects the capital increase period for Iraqi banks "covered by reform" to be extended.

Economic expert Mustafa Akram Hantoush confirmed on Monday that the Central Bank of Iraq and the Iraqi banking system are going through a critical phase, suggesting that the deadline for increasing the capital of banks subject to reform will likely be extended to three years, instead of the previous deadline of the end of this year.

Hantoush told Shafaq News Agency, "The Central Bank contracted last year with Oliver Wyman to conduct a comprehensive study of the banking sector," noting that "the company has completed its study."

He added, "The preliminary report was submitted three weeks ago, while the final report was recently issued. It included a package of mechanisms to address banking challenges and regulate dollar transactions. These mechanisms are currently under discussion between the Central Bank and the company."

Hantoush pointed out that "the recommendations included raising the capital of all Iraqi banks to 400 billion dinars, in addition to paying $2.4 million over four years for banks, under conditions most notably merger or liquidation, as well as restructuring the capital so that relatives' stake does not exceed 10%."

He pointed out that "these conditions pose a significant challenge to the sanctioned banks, making it difficult to comply with the required increase," emphasizing that "the matter requires discussions between the Central Bank and these banks to reach an acceptable formula."

The economic expert expects that "the Central Bank will open a new dialogue with the consulting firm to reach a compromise, either by extending the capital increase period to more than three years, or by reducing the required amounts to be closer to the capabilities of Iraqi banks." link

Mot: Now - This is What I Wants!!!!

Mot: .. Fitting In !!!!

Iraq Economic News and Points To Ponder Monday Afternoon 8-18-25

The Central Bank Of Iraq Sold More Than $35 Billion In Sales Over The Past Five Months

Banks Economy News – Baghdad The Central Bank's hard currency sales on Monday amounted to more than $35 billion over the past five months.

The bank stated in a statistic that "the bank's hard currency sales during the first five months of 2025 amounted to $35 billion and 201 million."

The Central Bank Of Iraq Sold More Than $35 Billion In Sales Over The Past Five Months

Banks Economy News – Baghdad The Central Bank's hard currency sales on Monday amounted to more than $35 billion over the past five months.

The bank stated in a statistic that "the bank's hard currency sales during the first five months of 2025 amounted to $35 billion and 201 million."

He continued, "Sales were distributed between external transfers amounting to $30.264 million, international settlements amounting to $3.649 billion, and cash sales amounting to $1.288 billion."

The bank noted that these sales, during the first five months of the current year, amounted to $35.2 billion, a 15.66% increase over the same period last year, which amounted to $30.435 billion. https://economy-news.net/content.php?id=58926

A Slight Rise In The Dollar Price In The Markets Of Baghdad And Erbil

Monday, August 18, 2025 | Economic Number of reads: 188 Baghdad / NINA / The US dollar exchange rate rose slightly, Monday morning, in the markets of Baghdad and Erbil.

The selling price of the dollar in the Al-Kifah and Al-Harithiya stock exchanges recorded 140,950 Iraqi dinars for $100, compared to 140,450 dinars for $100 yesterday, Sunday.

The selling price in the exchange market in the local markets in Baghdad recorded 142,000 dinars for $100, and the buying price was 140,000 dinars for $100.

In Erbil, the dollar recorded a similar rise, as the selling price reached 140,750 dinars for every $100, while the buying price was 140,650 dinars for $100. / End https://ninanews.com/Website/News/Details?key=1246943

Al-Alaq Details Iraq's Banking Reform Plan

Banks Economy News – Baghdad Central Bank Governor Ali Al-Alaq clarified the details of the banking reform plan on Monday, particularly regarding the foreign partner and the plan's objectives.

He emphasized that the foreign partner is not a condition of the reform plan, while noting that the banking reform is based on international laws and standards.

Al-Alaq said, "The banking reform plan is not a surprise, but rather a well-thought-out plan that took more than a year to develop, in coordination with banks and international bodies. It was agreed upon the need to review the Iraqi banking sector after years of practical experience."

He pointed out that, "After the emergence of many problems, an agreement was reached between all parties to adopt a plan that places our banks within international standards and practices, and within the framework of the Central Bank Law and the Iraqi Banking Law.

Therefore, the standards are not innovative, but rather stem from the Central Bank Law and international practices and standards." He explained that, "The goal of these standards is to ensure that the status of banks is stable and secure, that they have the ability to deal externally, and that they are accepted internally and externally."

Regarding enhancing confidence in banks, Al-Alaq explained: "It is often mentioned that the plan included the inclusion of a foreign partner, while the plan, in all its details, did not include this. We are talking about diversified ownership by financial institutions and individuals, and these Iraqi institutions are more deserving of participation."

He continued, "The plan also included the establishment of a fund for Iraqis that would allow a number of local shareholders, and even citizens, to enter into partnerships with banks." He emphasized that "bringing in a foreign partner is not prohibited, but it is not a requirement, as rumored. We publish all the criteria in detail, and this is not mentioned in them."

The Central Bank Governor added, "After a thorough study of the plan and in agreement with international bodies and correspondent banks, we believe that banks that can adhere to these standards will have their dollar transactions lifted and will establish normal relationships with foreign correspondent banks.

Therefore, the matter is optional, and banks that do not wish to participate in this plan have another option, but they must present alternatives that enable them to be accepted locally and internationally."

He pointed out that "one of the outcomes of the plan we are working on is to address the situation of deprived banks. If banks are able to adhere to the agreed-upon local and international standards, restrictions related to dealing in dollars will be lifted from them."

He emphasized that "the plan is designed to benefit banks, and those who believe they are unable to implement it should offer themselves other solutions to address the problem." https://economy-news.net/content.php?id=58922

The Planning Ministry Is Discussing With Sectoral Ministries The Mechanisms For Proposing And Financing Projects With World Bank Loans

Monday, August 18, 2025 | Economic Number of reads: 213 Baghdad / NINA / The Ministry of Planning held its third joint meeting on Monday with a number of sectoral ministries to discuss mechanisms for proposing projects and financing them through World Bank loans.

The meeting was chaired, according to a statement by the ministry, by the Director General of the Sector Planning Department at the ministry, Basem Dhari Mahmoud, with the participation of representatives from the Ministries of Construction, Housing, Municipalities and Public Works, Water Resources, Agriculture, Environment, Education, in addition to the Baghdad Municipality.

The meeting discussed most of the projects submitted by the sectoral agencies and completing their financing ceilings in line with the national development plan and the integrated strategy for education. The projects will be presented and approved during the coming period in coordination with the World Bank, in preparation for their inclusion in the general budget law for next year. https://ninanews.com/Website/News/Details?key=1246992

Gold Prices Rebound From Lows, Eyes On Trump-Zelensky Meeting

Monday, August 18, 2025 | Economic Number of reads: 245 Baghdad / NINA / Gold prices rose on Monday, after hitting their lowest level in two weeks, supported by a decline in US Treasury yields, as investors awaited a meeting between US President Donald Trump, Ukrainian President Volodymyr Zelensky, and European leaders to discuss a peace agreement with Russia.

By dawn today, spot gold rose 0.3% to $3,345.64 per ounce, after recording its lowest level since August 1. US gold futures for December delivery also rose 0.3%, to $3,391.80.

Investors are also awaiting the annual conference of the Federal Reserve (the US central bank) in Jackson Hole, Wyoming.

Economists largely expect the US central bank to announce an interest rate cut in September, its first cut this year, with a second cut possible by the end of the year amid mounting US economic woes.

As for other precious metals, silver rose in spot transactions by 0.3% to $38.08 per ounce, platinum rose by 0.8% to $1,346.61 per ounce, and palladium rose by 1.3% to $1,126.85 per ounce. /End

https://ninanews.com/Website/News/Details?key=1246922

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Monday Afternoon 8-18-25

Good Afternoon Dinar Recaps,

BRICS Members in 2025: Full List, New Member Countries & Global Impact

The BRICS alliance has expanded significantly, now including eleven member nations as of 2025. What began with five founding members has grown into a geopolitical and economic force representing over 40% of the world’s population and 37.3% of global GDP. With Saudi Arabia finalizing its membership in July 2025, BRICS continues to attract nations searching for alternatives to Western-led institutions.

Good Afternoon Dinar Recaps,

BRICS Members in 2025: Full List, New Member Countries & Global Impact

The BRICS alliance has expanded significantly, now including eleven member nations as of 2025. What began with five founding members has grown into a geopolitical and economic force representing over 40% of the world’s population and 37.3% of global GDP. With Saudi Arabia finalizing its membership in July 2025, BRICS continues to attract nations searching for alternatives to Western-led institutions.

Current BRICS Members and Expansion

Originally formed in 2006 by Brazil, Russia, India, and China—later joined by South Africa in 2010—the BRICS bloc has become an anchor for emerging economies.

2024 expansion: Egypt, Ethiopia, Iran, and the United Arab Emirates joined on January 1, 2024.

2025 expansion: Indonesia joined in January 2025, followed by Saudi Arabia in July 2025.

This brings the current BRICS membership to eleven nations.

Chinese President Xi Jinping emphasized:

“Adding new economies will inject new vitality into BRICS cooperation and increase the representativeness and influence of BRICS.”

Which Countries Want to Join BRICS

Interest continues to rise, with 32 countries signaling interest and 23 filing official applications.

The alliance has also created a circle of 13 “partner countries,” including Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, and Uzbekistan.

Top candidates for membership include:

Bahrain

Malaysia

Turkey

Vietnam

Belarus

Sri Lanka

Mexico

Kuwait

Thailand

Uzbekistan

Oil producers such as Bahrain and Kuwait aim to leverage their resources as strategic bargaining chips, while Mexico could deliver Latin American access and Belarus offers an Eastern European foothold.

Thailand stated:

“Joining BRICS would benefit Thailand in many respects and boost prospects of being one of the international economic policy makers.”

Economic Impact of BRICS

The expanded bloc now represents 3.3 billion people and wields 37.3% of global GDP (PPP).

China: 19.05%

India: 8.23%

With Iran, UAE, and Saudi Arabia onboard, BRICS members control nearly half of global oil production and roughly 35% of total oil consumption.

S&P Global noted:

“With Saudi onboard the BRICS grouping would be a commodities powerhouse.”

Meanwhile, the New Development Bank (NDB) has financed over $32 billion across 96 projects since 2016, pioneering local-currency infrastructure loans that reduce reliance on the U.S. dollar.

Challenges Facing BRICS

Despite its growth, the alliance faces internal divisions:

China and Russia are pushing rapid expansion.

Brazil and India are urging a more cautious approach.

This tension has slowed decision-making on new member admissions and economic integration strategies.

Political reactions have been sharp:

U.S. President Donald Trump dismissed the bloc outright: “BRICS is dead.”

UN Secretary-General António Guterres highlighted its appeal to developing nations:

“This system was created by rich countries to benefit rich countries. Practically no African country was sitting at the table of the Bretton Woods Agreement.”

Global Shift

The BRICS expansion underscores a multipolar shift in global governance, giving developing nations new financial and trade pathways outside the traditional Western order. With dozens of nations waiting to join, BRICS is positioning itself as the central counterweight to the U.S.-led system in global finance, energy, and trade.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

8-18-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: Iraq Dinar News Update-K2 Integrity-Oil-Salaries-REER

8-18-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News and Points To Ponder Monday Morning 8-18-25

Philosophy Of Economic Empowerment

Economic 2025/08/18 Abdul Zahra Muhammad Al-Hindawi Months ago, the Ministry of Labor

launched a series of initiatives aimed at transforming social protection beneficiaries from aid recipients to productive members of the labor market.

It also launched intensive efforts to rehabilitate large numbers of young people through training courses that provide them with the skills necessary to integrate into the labor market.

Philosophy Of Economic Empowerment

Economic 2025/08/18 Abdul Zahra Muhammad Al-Hindawi Months ago, the Ministry of Labor

launched a series of initiatives aimed at transforming social protection beneficiaries from aid recipients to productive members of the labor market.

It also launched intensive efforts to rehabilitate large numbers of young people through training courses that provide them with the skills necessary to integrate into the labor market.

Undoubtedly, these policies express the true philosophy behind the concept of economic empowerment for poor families, which represents a shift from the logic of temporary support to sustainable production.

The assistance received by social protection beneficiaries should be a transitional phase,

enabling individuals to overcome their difficult circumstances and reach a stage of self-sufficiency and self-reliance.

Of course, there are groups who cannot be deprived of these benefits,

such as the elderly or those with complex disabilities,

who have lost the ability to meet their basic needs.

Although Iraq's social protection policy has largely succeeded in reducing poverty rates and

saving thousands of families from destitution, it has also created financial and structural challenges.

The increase in the number of families covered by the program to more than two million means that we are talking about nearly a quarter of Iraq's population, which places increasing pressure on the general budget.

Furthermore, some youth groups now view the subsidy salary as a convenient solution that replaces work, given the lack of incentives for development or engagement in the production market.

In the face of these challenges, the Ministry of Labor and Social Affairs has taken action along three integrated paths.

The first is to identify the truly poor, which has contributed to improving inclusion standards and making them more equitable and realistic.

The second path involves clearing the protection network of those who are not entitled to it,

which represents a significant achievement in rationalizing spending and directing support to those who deserve it.

The third path has been directed towards strengthening economic empowerment,

which represents the most important pillar, as it aims to address poverty at its roots.

Empowerment is the transition from the concept of "receiving aid" to "creating opportunity," and from a state of helplessness to a space for production.

Therefore, it requires greater attention from the state and more coordination between the Ministries of Labor, Planning, Education, Finance, and the private sector to support small projects and encourage youth to innovate and produce, instead of relying on and waiting for aid.

The experiences of many countries, such as China, Brazil, India, and Rwanda,

have proven that economic empowerment policies are not only more sustainable,

but also lead to reduced dependence on government support and broad-based economic growth.

What we need today is to reframe our priorities so that empowerment policies become the norm,

and aid becomes a temporary exception.

The future of social justice in Iraq lies not only in the efficient distribution of aid,

but also in our ability to transform beneficiaries into producers, and rependents into economic actors.

This is the essence of the empowerment philosophy, in light of which policies must be reshaped.

https://alsabaah.iq/119086-.html

Al-Ahly First, Baghdad Second... Bank Profits Reveal Foreign Dominance

August 16, 2025 Last updated: August 16, 2025 Al-Mustaqilla/- A document obtained by the Independent Press Agency revealed the profit rates of Iraqi banks during the first half of this year, shedding light on the reality of the banking sector and the dominance of some foreign banks within it.

According to the document, the National Bank of Iraq topped the list of profits, occupying first place, while the Bank of Baghdad came in second, and Mansour Bank came in third.

Data indicates that profits generated by foreign banks operating in Iraq remain substantial,

amounting to hundreds of millions of dollars, even as the local banking sector faces widespread criticism for its poor performance and declining public confidence.

This arrangement comes amid an ongoing crisis of confidence between the public and Iraqi banks,

particularly after a number of banks were placed on US sanctions lists, and others were subjected to liquidation or audit procedures by the Central Bank.

Observers believe that the continued dominance of foreign banks in the Iraqi market reflects the

fragility of the financial structure of local banks and their weak ability to compete.

This requires radical reforms to banking policies and a comprehensive restructuring of the sector

to bolster depositor confidence. https://mustaqila.com/الأهلي-أولاً-وبغداد-ثانياً-أرباح-المص/

The Central Bank Announces The Launch Of A Project Financing Guide.

August 17, 2025 The Central Bank of Iraq announced the launch of a guide to accessing financing for small, medium, and micro enterprises, in cooperation with the German International Cooperation Agency (GIZ) and the Iraqi Private Banks Association.

In his speech during the launch ceremony of the guide,

the Deputy Governor of the Central Bank of Iraq, Dr. Ammar Khalaf, said:

“Iraq has witnessed a multiplicity of lending providers.

The Central Bank of Iraq, through the National Lending Strategy,

has developed a guide that complements this strategy.

It enables entrepreneurs to develop their businesses and provides a mature and informative destination for all loans, providing a new opportunity for easier access and faster procedures for obtaining financing.”

The Deputy Governor noted that the banking reform strategy adopted by the Central Bank of Iraq

will support procedures for accessing project financing according to a clear vision to enhance confidence in the Iraqi banking system.

Central Bank of Iraq Media Office https://cbi.iq/news/view/2959

An Economist Points To Strategic Gains Iraq Is Making In The Oil And Water Sectors.

Economy, | 504 Baghdad Today – Baghdad Economic expert Nabil Al-Marsoumi confirmed on Saturday (August 16, 2025) that the construction of the Iraq-Syria pipeline represents a strategic gain that reduces shipping distances to European markets.

He also pointed out that the joint seawater supply project is the key to achieving huge gains in oil production from Iraq.

Al-Marsoumi said in a post on his Facebook account, followed by Baghdad Today, that

“in 2009, the Ministry of Oil formed a team headed by Engineer Alaa Al-Asadi to discover and inspect the Iraqi-Syrian pipeline from Kirkuk to the Syrian border with the Italian company Saipem,” noting that

“the committee stated in its report that the cost of rehabilitating the pipeline amounted to $780 million,

while the cost of establishing a new pipeline with a length of 888 km, a diameter of 40 inches, and a

capacity of 1.250 million barrels per day reached $11 billion at 2009 prices, and

it is expected that the cost will rise to $14 billion at today’s prices,

especially since the pipeline is completely destroyed.”

He added, Although this pipeline is a strategic gain,

reducing shipping distances to European markets,

reducing dependence on chokepoints in the Arabian Gulf, and

giving Iraq an additional option for exporting north at a time when its only current route,

via the port of Ceyhan in Turkey, is facing severe pressure, transporting crude oil from Kirkuk to southern Iraq for export to the Gulf is still the cheapest route by about $1 per barrel.

This cost will rise to between $3 and $5 per barrel in tariffs and insurance via the Kirkuk-Banias pipeline, in addition to additional capital investments to repair the pipeline." He indicated that

"transportation costs and transit fees will rise significantly if the transport of Kirkuk oil is limited, as the pipeline's capacity will not exceed 300,000 barrels per day."

In another context, the economic expert explained that the China Petroleum Engineering and Construction Corporation (CPECC) won a contract for a seawater pipeline project from processing facilities to various oil fields throughout Basra, valued at $2.524 billion. He pointed out that

"the joint seawater supply project is the key to achieving massive gains in oil production from Iraq.

The seawater project is one of four projects that have been referred to the French company Total as part of the integrated southern project.

It aims to provide 5 million barrels per day, later increasing to 7.5 million barrels per day,

for the purpose of water injection and sustaining oil production in the Basra, Maysan and Dhi Qar fields, and over a length of no less than 1,000 kilometers of fields."

The British newspaper, The Guardian, published a shocking report on how oil companies are using fresh water in oil extraction operations, depriving citizens and agriculture in the country of huge quantities of water, exposing the environment to serious risks, and contributing to the spread of serious diseases.

According to the newspaper, an analysis of satellite images revealed that the Italian company Eni is building a dam on the Basra Canal to divert water to its treatment plants.

Other companies, such as BP and ExxonMobil, are using up to 25% of Iraq's potable water for the same purpose. https://baghdadtoday.news/281029-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Monday Morning 8-18-25

Good Morning Dinar Recaps,

The United States Prepares a Complete Overhaul of DeFi

Regulatory Overhaul on the Horizon

The U.S. Treasury has placed decentralized finance (DeFi) under sweeping review as part of the GENIUS Act, signed in July 2025 by President Donald Trump. The initiative targets the anonymity of DeFi transactions, aiming to combat money laundering and terrorist financing by embedding digital identity verification directly into DeFi smart contracts.

Good Morning Dinar Recaps,

The United States Prepares a Complete Overhaul of DeFi

Regulatory Overhaul on the Horizon

The U.S. Treasury has placed decentralized finance (DeFi) under sweeping review as part of the GENIUS Act, signed in July 2025 by President Donald Trump. The initiative targets the anonymity of DeFi transactions, aiming to combat money laundering and terrorist financing by embedding digital identity verification directly into DeFi smart contracts.

This would require users to prove their identity—via government-issued IDs or even biometric data—before completing transactions.

Coding Compliance Into DeFi

The Treasury’s proposal seeks to integrate KYC (Know Your Customer) requirements into the very code of DeFi protocols. According to its official notice, these identity tools are meant to balance compliance with user privacy, while reducing burdens for financial institutions.

Banks and regulators largely support the move, but many in the crypto community view it as a threat to anonymity and a break from DeFi’s founding principles.

Technology at the Center

The consultation paper highlights four key tools for regulatory enforcement:

Artificial Intelligence

Surveillance APIs

Blockchain Analytics

Digital Identity Systems

By making these technologies native features of DeFi platforms, regulators aim to ensure the law cannot be circumvented through code.

Industry Reactions

Crypto Community: Critics warn of a dangerous precedent, fearing that U.S.-mandated universal KYC could spread globally and stifle innovation. Concerns also focus on data protection risks if personal identifiers are hard-coded into protocols.

Banking Sector: Groups like the Bank Policy Institute (BPI) support the move but also flagged loopholes in the GENIUS Act, warning Congress that some stablecoin issuers could bypass interest-payment restrictions, potentially shifting up to $6.6 trillion in bank deposits into stablecoins.

Key Facts and Timeline

Public consultation launched: August 18, 2025

Comments accepted until: October 17, 2025

Applies to: All DeFi platforms offering services in the U.S.

Targeted enforcement tools: API, AI, blockchain monitoring, digital identity

Political Pushback

Not all policymakers are aligned. Senator Elizabeth Warren argues the GENIUS Act could weaken transparency rather than strengthen it, legitimizing opaque practices under the guise of innovation.

The Bigger Picture

The U.S. strategy represents a paradigm shift: regulation will be embedded in DeFi infrastructure itself. The era of uncontrolled decentralized finance is ending, and the next chapter will test how much freedom DeFi can retain under government scrutiny.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Will U.S. Regulation Kill Decentralized Finance, or Simply Reshape It?

The United States has moved from watching decentralized finance (DeFi) to attempting to engineer regulation directly into its foundations. Under the GENIUS Act, the Treasury is consulting on rules that would insert identity verification and compliance mechanisms into the very code of DeFi smart contracts. The official justification is clear: stop money laundering, curb terrorist financing, and close loopholes that could drain liquidity from traditional banks.

But the deeper question remains — will this end decentralization?

The Case for the “End of DeFi”

For many, the answer is yes — at least within U.S. borders. By requiring:

Portable digital identifiers for every transaction,

KYC baked into smart contracts, and

AI-driven compliance tools tied directly to platforms,

the government would effectively erase the anonymity and permissionless nature that define DeFi. In this model, “decentralized” finance begins to look more like a tokenized extension of the banking system, where innovation bends to regulatory code.

The Counterpoint: DeFi is Global

Yet DeFi was never designed to exist in a single jurisdiction. Code can be deployed anywhere, and users can access protocols across borders. If the U.S. tightens rules, offshore DeFi will continue without these restrictions, keeping anonymity and censorship resistance alive. Other nations may even embrace this shift, hoping to attract the next wave of innovation that America appears to be constraining.

A Two-Track Future

Rather than a complete “end,” what is emerging is a split reality:

Regulated DeFi (CeDeFi):

U.S. and European platforms that integrate KYC and compliance.

Tailored for banks, institutional investors, and regulated entities.

Less innovation, but far more legitimacy in financial markets.

True DeFi (Permissionless):

Offshore or pseudonymous projects that maintain full decentralization.

Higher innovation potential, but riskier for users facing regulatory pushback.

Likely to attract those unwilling to trade away anonymity.

Why the U.S. is Pushing Now

The timing is not accidental. Bank groups warn that up to $6.6 trillion in deposits could flow into stablecoins, destabilizing traditional finance. For regulators, the threat is not just about crime or terrorism — it is about control of capital flows. If trillions shift into DeFi outside the banking system, central banks lose visibility and authority.

Conclusion: Decentralization Won’t Die, But It Will Change

The U.S. is not ending DeFi — it is reshaping it into a regulated, institution-friendly framework. True decentralization will survive, but it may migrate offshore, becoming harder for Americans to access.

The result? Two parallel worlds:

Compliant DeFi for Wall Street.

Permissionless DeFi for the rest of the world.

In this sense, the fight over DeFi’s future is not about technology alone — it is about whether financial sovereignty remains in the hands of individuals, or is recoded into the architecture of regulation.

@ Newshounds News™

Source: AI ChatGPT

~~~~~~~~~

XRP News: Can Ripple Replace Banks Worldwide?

Riccardo Spagni’s viral post reignites debate as Ripple rides legal victories, political endorsements, and market optimism.

A viral post from Riccardo Spagni, the former lead developer of Monero, has thrust XRP back into the spotlight — and reignited one of crypto’s most divisive debates: can Ripple and XRP eventually replace banks?

Ripple Momentum Builds on Legal & Political Wins

The timing of Spagni’s remarks is significant. Ripple has been riding a string of favorable developments, including the SEC formally dropping its lawsuit against the company. The momentum was amplified when President Donald Trump named XRP as a potential part of the U.S. digital asset reserve stockpile — a surprise endorsement that sent ripples across markets.

XRP’s performance reflects this surge in confidence. Rising from under $1 in late 2024 to over $3.60 by mid-2025, XRP has remained one of the year’s strongest tokens, even after retracing from recent highs. Ripple continues to push its narrative of XRP as a global bridge currency, further boosting investor interest.

Critics Push Back: “Replacing Banks is Unrealistic”

Not everyone is convinced. Spagni revealed that a close friend — previously skeptical of crypto — wanted to buy XRP, persuaded by the belief that banks would be gone within two years. While bullish XRP holders welcomed the statement, critics quickly pushed back.

Skeptics argue that XRP cannot truly replace banks, and warn that granting such influence to Ripple risks creating a single point of failure — running counter to blockchain’s promise of decentralization. Some community members dismissed the hype outright, calling it little more than an orchestrated marketing narrative.

Analysts Warn of Downside Pressure

Amid the heated debate, on-chain analyst Ali Martinez issued a cautious note. He observed that XRP has recently slipped below the key $3 support level, which could expose the token to further downside — possibly to $2.60 or even $2 if bearish momentum accelerates.

At the same time, XRP bulls remain undeterred, with some analysts continuing to forecast a potential rally to $4 by year-end. For many newcomers — like the friend in Spagni’s story — optimism appears to outweigh caution.

Ripple’s Marketing Engine in Overdrive

Even Ripple’s harshest critics concede one thing: its marketing machine is unmatched in crypto. Social media engagement around XRP consistently outpaces most other tokens, drawing fresh retail investors into the ecosystem.

But detractors argue this success is fueled by questionable narratives. Some allege that Ripple funds campaigns exaggerating the collapse of banks or the inevitability of XRP as the “global bridge asset.” One critic, known online as Fish Catfish, even suggested investigative journalists should scrutinize Ripple’s media influence more closely.

Outlook

The debate over XRP’s ultimate role is far from settled. Supporters see Ripple as the front-runner for global financial integration, while critics view it as overhyped and fundamentally centralized.

What remains undeniable is that XRP continues to command disproportionate attention in crypto markets — whether as the future of finance, or as one of the industry’s most polarizing tokens.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Investors May Soon Earn 4–7% Annual Yield on XRP Holdings

Flare Labs and Firelight are collaborating to bring decentralized finance opportunities to XRP holders, with projected yields ranging from 4% to 7% annually.

Flare & Firelight Introduce XRP Yield Opportunities

In a recent interview with Scott Melker, Hugo Philion (CEO of Flare Labs) and Jesus Rodriguez (CTO of Sentora and lead at Firelight) revealed details of their joint initiative. The project aims to allow XRP holders to lend, borrow, and generate yield—unlocking new use cases for an asset historically used only for payments.

Philion compared the concept to Ethereum’s MakerDAO, where investors can lock XRP as collateral to mint stablecoins, acquire assets, or provide liquidity to DeFi protocols. He emphasized that Flare’s approach avoids custodial risks by using FXRP, a wrapped version of XRP secured by network validators, enabling non-custodial transfers and lending.

4–7% Yield Potential for Idle XRP

Rodriguez highlighted that internal tests showed potential annual returns of 4% to 7% for XRP holders. He described this as groundbreaking for an asset that has traditionally generated no yield, noting that restaking strategies could further expand XRP’s DeFi capabilities.

Community Divided on Risk vs. Reward

The XRP community has responded with mixed reactions:

Brad Kimes (Digital Perspectives): Called it a milestone that could unlock “the biggest release of idle liquidity in crypto,” comparing it to turning XRP into a bond-like income stream.

Attorney Bill Morgan: Welcomed the yield prospects as a much-needed incentive for long-term holders.

Vet (XRP Ledger validator): Warned that 7% yield may not justify the risks of deploying volatile assets into DeFi strategies, urging the ecosystem to move beyond short-term speculation.

Morgan suggested that the ideal product would allow holders to lock XRP long-term while borrowing safely against it for liquidity, though such solutions remain in development.

With Flare and Firelight pushing ahead, XRP could soon transform from a non-yielding asset into one that provides steady income streams, potentially reshaping its role in global finance.

@ Newshounds News™

Source: The Crypto Basic

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps