Seeds of Wisdom RV and Economic Updates Sunday Afternoon 7-13-25

Good Afternoon Dinar Recaps,

BRICS Moves to Local Currency Trading: Is the BRICS Currency Dead?

In a notable shift from earlier ambitions, BRICS member states have opted to expand trade settlements in local currencies, shelving plans for a unified BRICS currency—at least for now. The topic was not on the agenda at the 17th BRICS summit held on July 6–7, and Brazil’s Ambassador to India, Kenneth Felix Haczynski da Nobrega, has since confirmed that no BRICS currency is being planned to challenge the U.S. dollar.

Good Afternoon Dinar Recaps,

BRICS Moves to Local Currency Trading: Is the BRICS Currency Dead?

In a notable shift from earlier ambitions, BRICS member states have opted to expand trade settlements in local currencies, shelving plans for a unified BRICS currency—at least for now. The topic was not on the agenda at the 17th BRICS summit held on July 6–7, and Brazil’s Ambassador to India, Kenneth Felix Haczynski da Nobrega, has since confirmed that no BRICS currency is being planned to challenge the U.S. dollar.

Local Currencies Rise, While BRICS Currency Stalls

According to Egyptian Prime Minister Mostafa Madbouly, local currency usage among BRICS countries is steadily growing, with bilateral settlements already in motion. This de-dollarization strategy is aimed at easing foreign exchange pressures and fostering more balanced trade relationships within the bloc.

“The BRICS group is moving toward wider implementation of local currency trade, starting bilaterally and potentially expanding to multilateral use,” said Madbouly.

Despite earlier rhetoric—particularly from Russia, one of the strongest proponents of a new BRICS currency—the bloc appears to be postponing plans for a common tender. The reason? A lack of regulatory and legal infrastructure to support such an ambitious initiative, along with doubts about whether a new currency could gain the international trust needed to thrive in global forex markets.

De-Dollarization Quietly Advances Without New Currency

While de-dollarization remains a major theme for the alliance, the 2025 summit largely avoided direct discussions about launching a BRICS currency. Analysts believe this cautious approach reflects both internal political dynamics—including Russia’s evolving relationship with U.S. President Donald Trump—and the complexities involved in forming a transnational currency system.

Although the BRICS currency proposal continues to resurface in policy circles and media narratives, member states appear more interested in the pragmatic benefits of local currency settlements than in the speculative risks of launching a new monetary instrument.

Conclusion: Strategic Pause, Not Permanent Retreat

For now, BRICS is prioritizing incremental financial integration through national currencies rather than leaping into the unknown with a new unified currency. However, the door remains open. As Ambassador da Nobrega suggested, the idea isn’t dead—just deferred.

The path forward may involve strengthening bilateral arrangements, building regulatory consensus, and gradually laying the groundwork for a unified financial alternative to the dollar-dominated system—should geopolitical conditions and internal cohesion align in the future.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Sunday 7-13-2025

TNT:

Tishwash: Al-Sudani receives the US Chargé d'Affaires to discuss bilateral relations and the regional situation.

Prime Minister Mohammed Shia Al-Sudani received, today, Sunday (July 13, 2025), the US Chargé d'Affaires to Iraq to discuss bilateral relations and the regional situation.

Al-Sudani's media office stated in a statement received by Baghdad Today that "the latter received the Chargé d'Affaires of the United States Embassy in Iraq, Stephen Fagin, where they discussed bilateral relations between the two countries and reviewed the most prominent files of joint cooperation in various fields."

TNT:

Tishwash: Al-Sudani receives the US Chargé d'Affaires to discuss bilateral relations and the regional situation.

Prime Minister Mohammed Shia Al-Sudani received, today, Sunday (July 13, 2025), the US Chargé d'Affaires to Iraq to discuss bilateral relations and the regional situation.

Al-Sudani's media office stated in a statement received by Baghdad Today that "the latter received the Chargé d'Affaires of the United States Embassy in Iraq, Stephen Fagin, where they discussed bilateral relations between the two countries and reviewed the most prominent files of joint cooperation in various fields."

The statement added that "the meeting discussed the overall situation in the region and the need for the international community to take immediate steps to prevent the region from sliding into a cycle of war." link

Tishwash: Al-Sudani: There is no Iranian management of Iraqi affairs.

Prime Minister Mohammed Shia al-Sudani confirmed on Saturday that there is no Iranian control over Iraqi affairs, while pointing to the possibility of an agreement between Iran and the United States.

Al-Sudani said in a television interview, "There is no Iranian control over Iraqi affairs, not even a part of them."

Regarding the possibility of a deal between Iran and the United States, Al-Sudani said, "Our impression from meetings with the Iranians is that they are eager to make an agreement."

He pointed to his government's "success in reducing corruption link

************

Tishwash: Erbil is delaying the process and giving Baghdad a few days to resolve the salary crisis – Barzani's headquarters

"Last chance" to find a way out

Barzani's office announced on Saturday that the Kurdistan Democratic Party's (KDP) political bureau had decided to give Baghdad a final opportunity of several days to resolve the salary and financial dues crisis.

This came after Foreign Minister Fuad Hussein returned from a round of talks with federal parties in the capital, Baghdad, bearing promises of a settlement soon.

In the name of God, the most gracious, the most merciful

Regarding the disagreements between the Kurdistan Region and the federal Iraqi government regarding the settlement of salaries, budget, and financial dues to the Kurdistan Region, the Politburo of the Kurdistan Democratic Party (KDP) held a meeting today to take the necessary stance.

However, Dr. Fuad Hussein also returned to Kurdistan today after holding a series of talks with Iraqi political parties. He informed the KDP Politburo that the political parties, figures, and the federal Iraqi government have pledged to resolve this issue and address the issue of sending salaries and financial dues to the Kurdistan Region within the next few days.

Based on their requests and promises, and in order to continue the dialogue in a calm atmosphere and with due consideration for the situation and the public interest, we decided to grant the federal Iraqi government in Baghdad a final opportunity to find a solution that would ensure a settlement to this problem.

This is based on our firm belief in preferring to resolve differences through mutual understanding, as long as the path to dialogue remains open. link

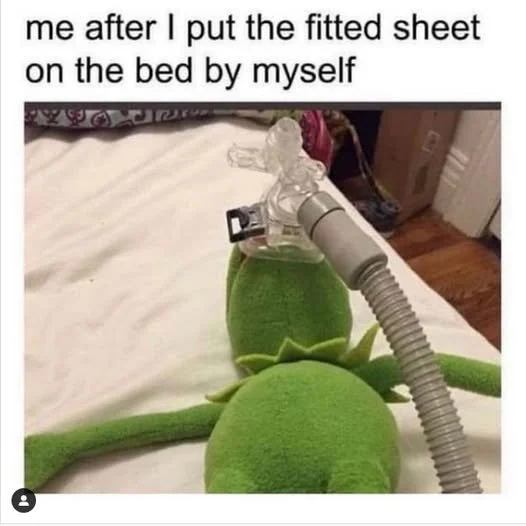

Mot: Getting HOT out there it is!!!

.. This Was Meeeeee Last Night!!!!

Iraq Economic News and Points To Ponder Sunday Morning 7-13-25

A Semi-Final Agreement With The Region To Begin Exporting Oil

July 12, 2025 Baghdad - Qusay Munther Oil Minister Hayan Abdul Ghani revealed that a near-final agreement has been reached with the Kurdistan Region to resume oil exports via the Turkish port of Ceyhan. He noted that negotiations have reached their final stages after resolving most of the contentious issues between the two parties, with the exception of the issue of domestic consumption, which remains under discussion.

A Semi-Final Agreement With The Region To Begin Exporting Oil

July 12, 2025 Baghdad - Qusay Munther Oil Minister Hayan Abdul Ghani revealed that a near-final agreement has been reached with the Kurdistan Region to resume oil exports via the Turkish port of Ceyhan. He noted that negotiations have reached their final stages after resolving most of the contentious issues between the two parties, with the exception of the issue of domestic consumption, which remains under discussion.

Abdul Ghani said in a statement yesterday that “the budget specified quantities of crude oil that must be delivered from the Kurdistan Regional Government to the federal government for export. It stipulated the delivery of 400,000 barrels per day to the federal government, specifically to the State Oil Marketing Organization (SOMO), for export via the Iraqi-Turkish pipeline.” ]

He stressed that “during this period, intensive talks and negotiations took place to implement this initial agreement or what was stipulated in the budget law.

Based on these negotiations, the budget law was amended to expedite the implementation of the agreement and deliver the quantities according to the amendments. $16 was set for each barrel produced by the region as an advance payment, with the appointment of a consulting company within a clear scope of work to price the production of a barrel of oil in each field separately.”

He pointed out that “this agreement and amendment were presented to the regional government and received real approval from all parties,” indicating that “there are some issues that have hindered the implementation of this agreement, including the issue of the budget law and within the audit agreements between the Financial Supervision Bureaus in the federal and regional governments, where it was agreed to set the amount of refining or internal consumption at 46 thousand barrels per day, but the region is currently demanding that this amount be 65 thousand, which constitutes a violation of the budget law.”

Stressing that (almost all paragraphs were agreed upon except for this paragraph, and we hope that in the final stages the region will agree to the amount that was agreed upon within the Financial Supervision Bureau in the federal government and the region with the aim of implementing this agreement),

Abdul Ghani explained that (from our side as the federal government, the Turkish side and the Kurdish side were informed of our readiness to receive and export this amount, and I was in a meeting with the Turkish Minister of Energy, who confirmed that Ankara is ready to resume the process of exporting oil through the Iraqi-Turkish pipeline towards Ceyhan, but we are waiting for the brothers in the region to deliver this amount of oil so that it can be exported).

He continued, saying, "The federal government is now losing approximately 300,000 barrels per day, because the amount produced by the region is counted as part of Iraq's OPEC quota, even though the federal government does not benefit from this amount." On a related note, Iraq ranked 12th globally in proven natural gas reserves for 2025, according to the American magazine.

The magazine said in a report that (Russia, Iran and Qatar combined possess 51 percent of the world's proven natural gas reserves, totaling about 3.7 quadrillion cubic feet out of 7.3 quadrillion cubic feet available worldwide), and pointed out that (Iraq ranked 12th globally in proven natural gas reserves this year, amounting to 111 billion and 522 million cubic feet, which is equal to 1.61 percent of the world's reserves), adding that (Russia ranked first globally in proven natural gas reserves, amounting to 1 trillion and 688 billion and 228 million cubic feet, followed by Iran in second place with 1 trillion and 183 billion and 19 million cubic feet, and Qatar came in third with 850 billion and 98 million cubic feet).

The report continued, "The United States of America came in fourth place with the largest proven natural gas reserves, 322 billion and 234 million cubic feet, and Saudi Arabia came in fifth place with 303 billion and 284 million cubic feet of natural gas." LINK

Iraq Opens Up To Shell To Implement Major Energy Projects.

July 12, 2025 Baghdad - Qusay Munther Prime Minister Mohammed Shia al-Sudani affirmed that the Iraqi government is opening its doors to major international companies, most notably Shell, to implement strategic projects in the energy sector.

He emphasized that the government's vision and development plans align with the company's proposals for gas investment and modernizing the oil sector's infrastructure, serving Iraq's interests and enhancing self-sufficiency.

Investment Opportunities

A statement received by Al-Zaman yesterday said that "Al-Sudani received the Deputy CEO of Shell Oil Company, Richard Howe, and during the meeting, they discussed aspects of cooperation in the field of developing the energy sector and investment opportunities to contribute to achieving the common interest of both parties."

Al-Sudani affirmed that "the government is harnessing all capabilities and efforts to implement major projects in light of contracts concluded with international companies, especially those related to gas investment and achieving self-sufficiency in its production.

" He stressed that "Shell's proposals in the field of developing and reforming the oil sector are convergent with the government's vision and plans.

" Al-Sudani pointed out that "the government is open to cooperating with all companies that possess the technology, experience and competence, in order to implement important projects to develop the energy sector and modernize its infrastructure.

" For his part, the Deputy CEO of Shell Company affirmed that "Iraq is a mature environment for investment," reiterating "his company's keenness to develop gas investment from Basra, as well as projects to develop exploration blocks in Dhi Qar and the western region, in a way that enhances and raises the level of energy production in Iraq."

Meanwhile, the Ministry of Electricity revealed that all administrative, technical, and logistical requirements related to the import of Turkmen gas have been completed, following the Cabinet's approval to activate the import contract.

Ministry spokesman Ahmed Moussa said in a statement yesterday that "the ministry has completed all administrative, technical, and logistical requirements related to the import of Turkmen gas to compensate for the shortage in Iranian gas."

He continued, "The agreement was submitted to the Prime Minister's Office and received Cabinet approval at its last session."

He stressed that "the ministry is awaiting the completion of the procedures of the Commercial Bank of Iraq related to opening credit and transferring the necessary funds to purchase the gas, which will cover part of the current deficit, estimated at 14 to 15 million cubic meters, contributing to the operation of stations with a capacity exceeding 2,000 megawatts.

" He continued by saying that "the power generation stations are currently operating in a stable condition, after completing maintenance on the generating units and increasing their production capacity to the maximum."

He pointed out that "the long-term agreements concluded by the ministry have achieved their goals in ensuring the sustainability of the stations' operations.

However, the full release of gas remains the most important factor for continuing operations at optimal efficiency, as operating on alternative fuels reduces production efficiency." The Cabinet, in its last session, approved the activation of the gas supply contract from Turkmenistan to supply 14 to 15 million cubic meters per day, achieving an additional energy capacity of 2,000 megawatts.

A Comprehensive Approach

Meanwhile, OPEC Secretary General Haitham Al-Ghais predicted that the world's need for more energy will increase over the next decade. Al-Ghais stressed, on the sidelines of his participation in the OPEC International Symposium, which is being held at its headquarters in the Austrian capital, that "there is a great need to pump huge investments into the energy mix, with an emphasis on a comprehensive approach that includes the use of modern technology, reducing harmful emissions, and taking into account the needs of the oil market, especially those of non-energy-exporting countries."

He revealed that "the organization is issuing its forecast report for the first time during the organization's international symposium, as it provides forecasts on the interconnected and interrelated issues related to the development of the oil market, and provides important information that benefits policymakers, decision-makers, experts, and companies. LINK

Iraq Ranks 12th In The World In Gas Reserves.

Energy Economy News - Follow-up Iraq ranked 12th globally in proven natural gas reserves by 2025, according to the American magazine CEOWorld.

The magazine stated in a report that Russia, Iran, and Qatar combined hold 51% of the world's proven natural gas reserves, totaling approximately 3.7 quadrillion cubic feet out of the 7.3 quadrillion cubic feet available worldwide.

According to the report, Iraq ranked 12th globally in proven natural gas reserves in 2025, amounting to 111 billion and 522 million cubic feet, representing 1.61% of the world's reserves.

The magazine added in its report that Russia ranked first globally in proven natural gas reserves, amounting to 1,688 billion, 228 million cubic feet, followed by Iran with 1,183 billion, 19 million cubic feet, and Qatar with 850 billion, 98 million cubic feet.

The report continued, stating that the United States of America came in fourth with the largest proven natural gas reserves, at 322 billion and 234 million cubic feet, while Saudi Arabia came in fifth with 303 billion and 284 million cubic feet of natural gas.

A quadrillion is equal to one million billion. https://economy-news.net/content.php?id=57270

Basra crude achieves weekly gains despite lower closing prices.

energy Economy News – Baghdad Basra crude oil posted weekly gains as global oil prices rose, despite a decline in the final closing session on Friday.

Basra Heavy crude closed down $1.29 to $67.29 a barrel, but posted weekly gains of $1.18, or 1.78%.

Basra Medium crude also fell by $1.29 in its last session, closing at $69.11 per barrel, but recorded weekly gains of $1.28, or 1.85%.

Globally, Brent crude rose 2.5% over the week, while West Texas Intermediate crude is on track to gain about 1.6% compared to last week's close. https://economy-news.net/content.php?id=57261

Parliament Calls On The Ministry Of Finance To Expedite The Submission Of Budget Schedules

Buratha News Agency 11920 25-07-12 The Parliamentary Finance Committee called on the Minister of Finance, Taif Sami, on Saturday to expedite sending the budget tables for the year 2025 to the House of Representatives for approval, as stated in an official document issued by the committee, “Based on the provisions of Article (77/Second) of the Federal General Budget Law of the Republic of Iraq for the fiscal years (2023 - 2024 - 2025) No. (13) of the year 2023, which obligated the government to send the budget tables for the current fiscal year before the end of last year, and since the federal general budget is for three years, Article (13) of the Federal Financial Management Law No. (1) of 2019 does not address current government spending, as well as not benefiting from the emergency reserve allocations account to spend it on emergency situations that the country is likely to be exposed to until the budget tables are approved in the year / 2025.”

She added, "Therefore, we urge you to expedite the submission of the 2025 budget schedules to the Iraqi Parliament for approval, signaling the start of legal government spending and disbursement, and enabling state institutions to fulfill their obligations." https://burathanews.com/arabic/news/462645

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Sunday Morning 7-13-25

Good Morning Dinar Recaps,

Ripple National Trust Bank Targets Fed Access—Is RLUSD About to Go Full Scale?

Ripple has taken a decisive step toward cementing its role in the U.S. financial system with a formal application to create Ripple National Trust Bank, a federally regulated institution aimed at strengthening the foundation for its stablecoin initiative, Ripple USD (RLUSD).

Good Morning Dinar Recaps,

Ripple National Trust Bank Targets Fed Access—Is RLUSD About to Go Full Scale?

Ripple has taken a decisive step toward cementing its role in the U.S. financial system with a formal application to create Ripple National Trust Bank, a federally regulated institution aimed at strengthening the foundation for its stablecoin initiative, Ripple USD (RLUSD).

Federal Trust Charter Signals Institutional Maturity

Filed with the U.S. Office of the Comptroller of the Currency (OCC) earlier this month under control number 2025-Charter-342347, Ripple’s application seeks a national trust bank charter. If approved, Ripple National Trust Bank would be headquartered in New York City at 111-119 W. 19th Street, 6th Floor, operating under charter number 25364.

Ripple is requesting trust powers, enabling the bank to offer federally supervised digital asset custody and fiduciary services. Brian Spahn, based at Ripple’s San Francisco office, is listed as the company’s point of contact for the application. The public comment period for the application runs through August 1.

Dual Licensing: RLUSD Under State and Federal Oversight

This move reinforces Ripple’s intention to implement a dual licensing model for its stablecoin RLUSD—combining state oversight by the New York Department of Financial Services (NYDFS) with potential federal regulation via the OCC.

Ripple CEO Brad Garlinghouse emphasized the strategy on X:

“True to our long-standing compliance roots, Ripple is applying for a national bank charter from the OCC. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.”

Positioning for GENIUS Act Compliance

Ripple’s filing comes at a pivotal time as stablecoin regulation gains momentum in the United States. The GENIUS Act, recently passed by the Senate and awaiting House approval, would require stablecoins to be fully dollar-backed, subject to AML/KYC compliance, and operated under clear federal standards. Ripple’s strategic application aligns it with the upcoming regulatory framework, giving RLUSD a potential first-mover advantage under new law.

Targeting a Federal Reserve Master Account

In addition to the OCC application, Ripple’s subsidiary, Standard Custody & Trust Company, has applied for a Federal Reserve master account—a critical infrastructure move that would allow RLUSD reserves to be held directly with the Federal Reserve. This would significantly enhance the security and transparency of RLUSD’s backing and distinguish it from private-market competitors.

Garlinghouse added:

“This access would allow us to hold RLUSD reserves directly with the Fed and provide an additional layer of security to future-proof trust in RLUSD.”

Conclusion

Ripple’s application for a national trust bank charter and pursuit of Fed access represent a watershed moment in the evolution of compliant digital assets. If approved, Ripple National Trust Bank could set a new industry benchmark for regulated stablecoins, reinforcing both investor trust and systemic credibility at a time when U.S. crypto policy is undergoing rapid transformation.

@ Newshounds News™

Source: Bitcoin.com

~~~~~~~~~

Trump Slaps 30% Tariffs on All Goods from EU and Mexico

In a dramatic escalation of trade tensions, President Donald Trump has announced sweeping 30% tariffs on all goods imported from Mexico and the European Union, set to take effect on August 1. The move, which follows failed negotiations with both trading blocs, has prompted immediate diplomatic backlash and threats of retaliation.

Trump’s Tariff Orders Target Migration, Drug Flow, and Trade Imbalances

The tariff announcements were made via two official letters posted on Trump’s Truth Social account. In the case of Mexico, the president cited the country's role in facilitating undocumented migration and the flow of illicit drugs into the United States as justification. For the EU, he pointed to what he called a persistent trade imbalance with the United States.

These new measures supersede earlier tariff rates, including:

A previous 25% tariff on Mexican goods announced earlier this year.

A 20% tariff on EU imports implemented in April.

Goods imported under the US-Mexico-Canada Agreement (USMCA) are exempted from the new tariffs.

Wider Global Tariff Wave Hits 20+ Countries

This latest move is part of a broader tariff campaign initiated by the Trump administration. Earlier this week, the White House also announced:

New tariffs on goods from Japan, South Korea, Canada, Brazil, and others.

A 50% tariff on copper, targeting strategic raw materials.

These actions signal a return to Trump’s aggressive “America First” trade doctrine, focusing on repatriating supply chains, combating perceived trade inequities, and targeting nations seen as non-cooperative on U.S. economic or geopolitical interests.

International Response: EU and Mexico Push Back

The reaction from both trading partners has been swift and firm.

European Commission President Ursula von der Leyen condemned the measure and signaled the EU’s readiness to respond:

“The European Union will take the necessary steps to safeguard its interests, including the adoption of proportionate countermeasures if required,” von der Leyen stated.

Despite the threat of tariffs, she also left the door open for diplomacy, saying the bloc remains willing to “continue working towards an agreement by August 1.”

Mexico, for its part, described the tariffs as “unfair,” but has yet to announce whether retaliatory actions are forthcoming.

Geopolitical and Market Implications

These tariffs may ripple across global markets already grappling with monetary tightening, currency volatility, and geopolitical realignments.

The timing is critical—coming as the U.S. Federal Reserve faces pressure over its interest rate stance, and as emerging economies like BRICS continue their push for de-dollarization and alternative trade alliances. With inflationary pressures still a concern and commodity prices rising, the global supply chain could face renewed disruption.

Conclusion

President Trump’s latest tariff strategy represents a significant realignment of U.S. trade priorities, setting the stage for a turbulent second half of 2025. Whether these moves will achieve the administration’s goals—or spark retaliatory economic conflict—remains to be seen.

@ Newshounds News™

Source: Al Jazeera

~~~~~~~~~

US Democrats Declare “Anti-Crypto Corruption Week,” Slam Trump’s Deceptive Crypto Bills

In a sharp political escalation, Democrats in the U.S. House of Representatives have declared next week “Anti-Crypto Corruption Week,” introducing legislation aimed at blocking what they describe as corrupt, pro-Trump crypto initiatives. The announcement comes as a direct rebuke to the Republican-led "Crypto Week" agenda, which includes the GENIUS Act, the CLARITY Act, and the Anti-CBDC bill.

Waters and Lynch Take Aim at Trump’s “Crypto Grift”

On Friday, Congresswoman Maxine Waters, ranking Democrat on the House Financial Services Committee, along with Congressman Stephen Lynch, unveiled the Anti-Crypto Corruption Week resolution. They accused former President Donald Trump of using crypto legislation as a vehicle for personal enrichment and political favoritism.

“These bills would make Congress complicit in Trump’s unprecedented crypto scam – one that has personally enriched himself […] all while defrauding investors,” Waters stated in an official release.

The Democratic lawmakers argue that Trump and his family have exploited crypto opportunities to extract over $1.2 billion in personal gains, all while undermining consumer protection and investor safeguards.

A Direct Rebuttal to Republican-Led Crypto Agenda

The declaration of Anti-Crypto Corruption Week is timed to coincide with Crypto Week, scheduled for the week of July 14, when several major crypto bills are expected to be debated, including:

GENIUS Act – aimed at stablecoin regulation.

CLARITY Act – a market structure framework for digital assets.

Anti-CBDC Bill – designed to prohibit the Federal Reserve from issuing a digital dollar.

Democrats labeled these proposals as “dangerous,” claiming they serve the interests of crypto insiders and Trump’s inner circle, rather than average American consumers.

Democratic Amendments Seek to Block Crypto Bills

To counter what they see as predatory legislation, Democrats have proposed:

Nearly 30 amendments to the CLARITY Act to mitigate consumer harm.

Direct challenges to stablecoin frameworks in the GENIUS Act.

Objections to the Anti-CBDC Bill, citing fears it will “devastate Americans’ financial lives.”

Democrats warn that the Republican push to block a U.S. central bank digital currency (CBDC) could weaken federal oversight and empower bad actors in the crypto space.

Congressman Lynch: Republicans Are “Doing the Bidding of the Crypto Industry”

In an unusually combative tone, Congressman Stephen Lynch criticized GOP leaders for backing pro-crypto policies without addressing the risks.

“My Republican colleagues are eager to continue doing the bidding for the crypto industry while conveniently ignoring the vulnerabilities and opportunities for abuse that exist in crypto,” Lynch said.

Conclusion

The Anti-Crypto Corruption Week campaign marks a new phase in the partisan battle over crypto regulation. Democrats are attempting to cast a spotlight on what they allege is Trump-era profiteering, while Republicans continue to advocate for regulatory clarity and crypto innovation.

With the GENIUS, CLARITY, and Anti-CBDC bills poised for House consideration, the coming weeks could prove decisive for the future of digital asset policy in the United States.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Websitetext

Thank you Dinar Recaps

MilitiaMan and Crew: Iraq Dinar News- Iraq's Economic Revival

MilitiaMan and Crew: Iraq Dinar News- Iraq's Economic Revival

7-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

In today’s video, we dive into the fascinating world of the Iraqi dinar and its implications for Iraq's economy.

We're exploring recent honors bestowed upon the Iraq Chamber of Commerce by the International Chamber of Commerce, signifying a new era of international recognition and collaboration.

MilitiaMan and Crew: Iraq Dinar News- Iraq's Economic Revival

7-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

In today’s video, we dive into the fascinating world of the Iraqi dinar and its implications for Iraq's economy.

We're exploring recent honors bestowed upon the Iraq Chamber of Commerce by the International Chamber of Commerce, signifying a new era of international recognition and collaboration.

We'll also discuss the pivotal role of the Iraq Public Prosecution Authority in maintaining economic integrity and transparency, especially in light of recent efforts by the Oil Minister to ensure the timely disbursement of contractor salaries. This is a critical step in fostering a stable environment for investment and growth.

Additionally, we’ll break down the latest agreements between Erbil and Baghdad, which are set to enhance cooperation and stability between the Kurdistan Region and the federal government. These agreements are vital for the reconstruction and development of Iraq, paving the way for a new era of economic prosperity.

Finally, we’ll introduce the New Reconstruction Development Bloc, a significant initiative aimed at revitalizing Iraq's infrastructure and boosting economic growth through innovative projects and international partnerships.

Iraq Economic News and Points To Ponder Saturday Afternoon 7-12-25

Iraq Has About $100 Billion In Its Coffers: Withheld Reserves And Citizens Left Out Of The Equation - Urgent

Economy / Special Files Yesterday, | 7429 Baghdad Today – Baghdad In a country where people's suffering is measured by the dollar exchange rate, and where development is reduced to questions about electricity, water, and jobs, a staggering figure stands out in international institution reports:

$106.7 billion in Iraq's foreign exchange reserves,

placing it third in the Arab world after Saudi Arabia and the UAE.

Iraq Has About $100 Billion In Its Coffers: Withheld Reserves And Citizens Left Out Of The Equation - Urgent

Economy / Special Files Yesterday, | 7429 Baghdad Today – Baghdad In a country where people's suffering is measured by the dollar exchange rate, and where development is reduced to questions about electricity, water, and jobs, a staggering figure stands out in international institution reports:

$106.7 billion in Iraq's foreign exchange reserves,

placing it third in the Arab world after Saudi Arabia and the UAE.

But behind this glittering figure lies an unanswered question:

Is this money truly available to Iraqis, or

is it frozen in accounts that can only be moved with the permission of the US Treasury?

The truth, as confirmed by experts, is that the

bulk of these reserves are deposited in American banks, and the

Iraqi government can only use them within narrow margins, subject to international approval, specifically from Washington.

Economic expert Haider Al-Sheikh told Baghdad Today on Thursday (July 10, 2025) that cash liquidity in Iraq is "fully available, whether in dinars or dollars," noting that "foreign exchange reserves have exceeded $106 billion, while gold reserves have exceeded 163 tons, making Iraq fourth in the Arab world after Saudi Arabia, Lebanon, and Algeria."

Al-Sheikh added, "This abundance came after years of sharp declines during the COVID-19 pandemic,

when oil prices collapsed.

However, the subsequent rise in prices and the change in the dollar exchange rate helped rebuild the cash reserve and raise reserves to unprecedented levels."

Advanced ranking in the Arab region

According to data from the International Monetary Fund (IMF), Iraq ranked third in the Arab world in terms of foreign exchange reserves, ahead of countries such as Libya, Algeria, Qatar, Egypt, Kuwait, and Morocco.

The rankings are as follows:

Saudi Arabia: $449 billion

UAE: $210 billion

Iraq: $106.7 billion

Libya: $80 billion

Algeria: $72 billion

Qatar: $69 billion

Egypt: $47.1 billion

Kuwait: $41 billion

Morocco: $32.8 billion

Jordan: $21 billion

A promising market on paper, but constrained in reality.

The sheikh points out that the increase in reserve size gives Iraq "great economic attractiveness,"

making it a target for competition among major countries for investment opportunities,

such as the United States, China, Japan, and France,

due to its vast resources and sensitive geographic location.

But this attraction, experts believe, is hampered by a

fragile administrative reality, an

unstable legal environment, and a

volatile political climate.

This makes the flow of funds into Iraq a thorny process,

requiring more than hard numbers and cash reserves;

it requires a genuine will to reform.

And yet, despite these impressive figures, the question still lingers in the minds of Iraqi citizens:

When will state funds become tools for their service?

While the state is piling billions into banks abroad, the

majority of the population is still struggling to secure the basic necessities of life,

amid high unemployment, rising prices, and deteriorating services.

The deeper problem is that this massive reserve, which is supposed to be the country's safety valve,

is not actually in hand.

Rather, the bulk of it is deposited in foreign banks, specifically the US Federal Reserve, and is subject to strict controls that prevent Iraq from using it freely or employing it in development or emergency projects without complex international approvals.

According to observers, ultimately, any financial figure is worthless unless it is translated into living reality.

While the state celebrates its ranking on reserve lists,

citizens are not looking for a ranking but rather an outcome:

Will this money be used

to protect the dinar?

To support prices?

To build factories?

To free the market from dependency?

Or will it remain a mere mortgaged asset,

from which Iraqis see nothing but

slogans of sovereignty and

headlines in international reports? https://baghdadtoday.news/278315-106.html

Al-Nusairi: The Central Bank Is Leading The Banking Sector Toward Comprehensive Reform, Economic Stimulation, And Sustainable Development.

Uses Economy News – Baghdad Economic and banking advisor Samir Al-Nusairi affirmed that the Central Bank continues to lead the Iraqi banking sector in accordance with its third strategy and its comprehensive banking reform project for the next two years,

based on a continuous daily work system in cooperation with international consulting and auditing companies currently operating with the aim of achieving banking reform and moving banks to a stage of contributing to stimulating the economy, revitalizing the economic cycle, achieving economic growth, and transforming banks into a lever for sustainable development.

Al-Nusairi explained in an interview with Al-Eqtisad News that

in order to motivate banks and develop banking operations so they can fulfill their duties stipulated in the Banking Law and the applicable instructions and executive regulations issued by the Central Bank, and serve the national economy and customers,

it is necessary to carefully

implement the reform measures outlined for them, as well as to

re-review, evaluate, and classify banks. ‘

Al-Nusairi pointed out that there are international standard criteria for classifying central banks that are agreed upon in most countries, such as

controlling inflation,

economic growth,

monetary stability,

independence, and the

extent to which economic goals are achieved.

Since central banks are subject to classification and

since they are the ones that monitor and supervise banks, the classification of Iraqi banks must be based on international standard criteria approved in most countries,

the basis of which is

compliance with international banking standards,

enhancing financial inclusion,

encouraging competition,

preventing monopoly in the banking market,

providing opportunities for shareholders and investors to obtain profitable and sustainable returns,

accelerating digital transformation, and a rapid transition to a solid national economy.

He explained that the reform, evaluation, and classification of the banking sector should be based on criteria of capital, assets, liquidity, profitability, and risk management.

Additional programs should be adopted that are consistent with the Iraqi reality, such as approving the banks' operating results and final accounts for the last five years,focusing on analyzing assets, revenues, expenses, capital adequacy, indicators of capital investment, cash credit granted and its sectoral distribution, ‘

The return on capital ratio, return on assets, liquidity ratio, and the extent of banks' compliance with applicable banking instructions, particularly activating the national strategy for bank lending to finance small and medium-sized enterprises and

applying environmental, social, and corporate governance standards. https://economy-news.net/content.php?id=57222

TIR Moves Iraq To Advanced Ranks In Global Trade

Economy 2025-07-11 | 1,478 views confirmed The General Authority of Customs the continued successful and seamless implementation of the international TIR system at a number of border crossings,a move it described as strategic.

It indicated that this move will advance Iraq to advanced levels in the field of international trade.

The Director of Transit at the General Authority of Customs, Ihab Talib, told the official agency, followed by Sumaria News, that

“the Authority has begun implementing the TIR system at all Iraqi border crossings,

in coordination with the International Road Transport Union (IRU), noting that

“the system comes within an agreement signed with the General Company for Land Transport,

which represents the guarantor of this project.” ‘

He added, "The implementation of this system represents a true activation of the transit system and aims to capitalize on Iraq's strategic location as a link between Europe and the Middle East."

He added, "The procedures are proceeding smoothly and in coordination with all relevant parties."

He added that the TIR system

will contribute to Iraq's advancement in international trade and

will help develop the transportation, technical, and logistics infrastructure sectors. He explained that

the project complements the Development Road Project, which the Iraqi government seeks to implement as part of a comprehensive plan to improve regional trade. https://www.alsumaria.tv/news/economy/533128/التير-ينقل-العراق-لمراتب-متقدمة-بالتجارة-العالمية

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 7-12-25

Good Afternoon Dinar Recaps,

Areas Where BRICS Challenges the USA — And Where It Falls Short

As the global economic balance continues to shift, BRICS—once seen as a symbolic bloc—has grown into a formidable coalition with ambitions to challenge the U.S.-led financial order. With expanded membership and an aggressive de-dollarization push, BRICS is reshaping global dialogue on trade, energy, and economic sovereignty. But does it have the cohesion and tools to match its ambitions?

Good Afternoon Dinar Recaps,

Areas Where BRICS Challenges the USA — And Where It Falls Short

As the global economic balance continues to shift, BRICS—once seen as a symbolic bloc—has grown into a formidable coalition with ambitions to challenge the U.S.-led financial order. With expanded membership and an aggressive de-dollarization push, BRICS is reshaping global dialogue on trade, energy, and economic sovereignty. But does it have the cohesion and tools to match its ambitions?

Areas Where BRICS Challenges the U.S. Dollar’s Dominance

1. De-Dollarization: A Bold Economic Agenda

At the forefront of BRICS’ economic strategy is its de-dollarization effort. Member nations are actively working to reduce reliance on U.S.-based financial systems by conducting bilateral trade in local currencies. This shift reflects a strategic priority: to strengthen domestic economies while reducing exposure to Washington’s fiscal leverage.

Local currencies first. The U.S. dollar, later.

This trend, if sustained, poses a direct threat to the dollar’s global reserve status, undermining its dominance in international settlements.

2. Strategic Control Over Global Resources

BRICS countries command a massive share of global natural resources:

Russia, Iran, and the UAE: Oil and natural gas leaders

Brazil: A global agricultural and food export powerhouse

South Africa: Rich in gold, platinum, and rare earth minerals

China: Global leader in manufacturing and rare earth supplies

If these nations settle trade in their own currencies, the U.S. dollar’s global usage could decline dramatically.

Together, this bloc represents a significant force in energy, agriculture, and mining, challenging U.S. supply chain influence.

Where BRICS Still Falls Short

1. No Real Alternative to the U.S. Dollar

Despite talk of a unified BRICS currency, no concrete monetary alternative exists. Member nations have failed to agree on a single tender, with each preferring to elevate its own national currency. As a result, they continue to rely on the U.S. dollar for international trade, especially in dealings with non-member nations.

Without a unified currency or financial architecture, BRICS remains tethered to the very system it seeks to disrupt.

2. Internal Political and Strategic Divisions

BRICS unity is often more optical than operational:

India and China: Ongoing border and trade tensions

Russia: Under sweeping Western sanctions and economic isolation

Egypt & Ethiopia: Limited global economic influence

South Africa & Brazil: Non-confrontational toward the West

UAE: Maintains deep financial ties with the U.S. and Europe

These geopolitical and economic fractures limit BRICS’ ability to act as a cohesive counterweight to the West, particularly in areas requiring unified policy or shared infrastructure.

Conclusion

While BRICS continues to challenge key aspects of U.S. economic dominance, the bloc’s internal divisions and lack of monetary alternatives restrict its global transformation potential—for now. However, its resource control and political momentum suggest it remains a powerful force to watch in the evolving multipolar world order.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits from TNT” Saturday 7-12-2025

TNT:

Tishwash: The Iraqi Chamber of Commerce was honored with the award for the best performing national committees worldwide.

The International Chamber of Commerce honored the Iraqi Chamber of Commerce with the award for the best performing national committees worldwide.

The Federation of Iraqi Chambers of Commerce stated in a statement received by the Iraqi News Agency (INA), that "in a qualitative achievement, the International Chamber of Commerce honored the Iraqi Chamber of Commerce with an award given to the best performing national committees worldwide,"

Indicating that "this honor came as a result of the efficient and effective implementation of the annual plan for the years 2024-2025, which reflects Iraq's commitment to strengthening its international position on the global trade map."

TNT:

Tishwash: The Iraqi Chamber of Commerce was honored with the award for the best performing national committees worldwide.

The International Chamber of Commerce honored the Iraqi Chamber of Commerce with the award for the best performing national committees worldwide.

The Federation of Iraqi Chambers of Commerce stated in a statement received by the Iraqi News Agency (INA), that "in a qualitative achievement, the International Chamber of Commerce honored the Iraqi Chamber of Commerce with an award given to the best performing national committees worldwide,"

Indicating that "this honor came as a result of the efficient and effective implementation of the annual plan for the years 2024-2025, which reflects Iraq's commitment to strengthening its international position on the global trade map."

He added, "On the sidelines of the annual week, the first anniversary of Iraq's official accession to the International Chamber of Commerce was celebrated, marking an important step towards building strategic partnerships and enhancing the business environment in Iraq.

The International Chamber of Commerce was founded in 1919 in Paris, and Iraq obtained full membership in 2024.

It is noteworthy that the Federation of Iraqi Chambers of Commerce - the Iraqi National Committee of the International Chamber of Commerce (ICC Iraq) participated in the annual International Chamber of Commerce (ICC Week) in Paris, from June 17 to 20, 2025, which brought together more than 60 countries from various national committees around the world. The annual week included several activities:

1- World Trade Policy Conference.

2- World Day of National Committees Strategies.

3- Specialized workshops on arbitration topics and the agri-food initiative.

4- The annual meeting of the International Chamber of Commerce World Council.

5- Workshop on the International Entrepreneurship Center.

6- Regional meeting for West Asia and North Africa.

It is noteworthy that the Ministry of Foreign Affairs - represented by the Iraqi Embassy in Paris and the Ministry of Trade - Department of Foreign Economic Relations supported Iraq's accession to the International Chamber of Commerce and continues to follow up on the activities of the Iraqi National Committee's program for the International Chamber of Commerce. link

************

Tishwash: Commerce: Implementing a package of qualitative initiatives to boost the national economy.

The Ministry of Trade announced, on Friday, the implementation of a package of qualitative initiatives to advance the national economy and stimulate sustainable growth.

Ministry spokesman Mohammed Hanoun said, "The Ministry, in coordination with the Private Sector Development Council, has prioritized creating a stable and investment-friendly economic environment by addressing challenges and facilitating procedures for investors and entrepreneurs in line with the requirements of the national economy."

He added, "Based on the Iraqi government's directives to support the business environment and enhance partnerships between the public and private sectors, the Ministry of Trade, through the Private Sector Development Council and the Private Sector Development Department, continues to implement a package of qualitative initiatives and effective measures aimed at advancing the national economy and stimulating sustainable growth."

He explained that "the measures taken include strengthening channels of joint dialogue between representatives of the public and private sectors to develop practical solutions to the challenges facing the business environment, reviewing and updating commercial and regulatory legislation with the aim of simplifying procedures and stimulating local and foreign investment, in addition to launching programs to support small and medium enterprises and providing financing and training packages to support entrepreneurs."

Hanoun pointed to the possibility of supporting digital transformation and developing electronic services to facilitate commercial and investment transactions and enhance the principles of transparency and economic governance by publishing periodic reports on economic performance indicators and the business environment, creating an appropriate investment, legal, and financial climate for major partnerships, and encouraging quality investments in vital sectors. He also stressed the importance of working hard to improve Iraq's ranking in international business environment indicators by implementing global best practices in facilitating the establishment of companies and protecting investors.

Hanoun affirmed that "the Ministry of Trade is committed to supporting the private sector and empowering it to be a key partner in building a diversified and sustainable economy and achieving comprehensive economic development that positively impacts citizens' lives." He called for continued cooperation and integration between all state institutions and the private sector to create a competitive economic environment that contributes to stimulating growth and providing job opportunities. link

************

Tishwash: Iraqi ministerial committee on Erbil-Baghdad budget issues holds first meeting

Iraq’s newly formed ministerial committee tasked with resolving outstanding disputes between Erbil and Baghdad held its first meeting on Wednesday, focusing on key financial and energy issues, including oil exports, domestic consumption, and public sector salaries in the Kurdistan Region.

The meeting, chaired by Deputy Prime Minister and Minister of Planning Mohammed Ali Tamim, brought together federal and Kurdistan Regional Government (KRG) representatives to address stalled budget transfers and oil obligations, according to a planning ministry statement.

“A review of the two papers submitted by the federal government and the [Kurdistan] Region, where both papers addressed a number of vital topics, foremost among them the oil export file and its regulatory mechanisms, the volume of local consumption of oil products, as well as the region's delivery of the federal treasury's share of non-oil revenues, in addition to discussing the localization of Kurdistan Region employees' salaries” were discussed, the statement said.

On Monday, a senior KRG delegation arrived in Baghdad to resume talks with federal officials over the prolonged financial dispute, which has led to repeated salary delays in the Kurdistan Region. The committee was established on Tuesday following the visit, per a directive by Iraqi Prime Minister Mohammed Shia’ al-Sudani.

The planning ministry said the committee stressed “the importance of continuing technical and administrative discussions regarding these files with the aim of reaching quick, fair, and realistic solutions and treatments that guarantee the rights of Kurdistan Region employees, similar to their colleagues in the rest of the Iraqi provinces, within the framework of the state's unified financial policy.”

Tensions between Erbil and Baghdad flared in late May when Iraq’s federal finance ministry halted all budget transfers to the KRG, including payments for public employee salaries. The ministry claimed the KRG had exceeded its 12.67 percent share of the 2025 federal budget and failed to deliver its designated share of oil to SOMO.

The situation has been exacerbated by the ongoing suspension of oil exports through the Iraq-Turkey pipeline, which has remained offline since March 2023 following an international arbitration ruling.

The committee is tasked with aligning both sides’ demands and drafts to pave the way for a formal agreement. link

Mot: Ya Gotta Love ole ""Nelson""

Mot: Second Nap

Seeds of Wisdom RV and Economic Updates Saturday Morning 7-12-25

Good Morning Dinar Recaps,

Fed Chair Jerome Powell Considers Resigning: What’s Next for Crypto?

Federal Reserve Chairman Jerome Powell is reportedly considering stepping down before the end of his term — a move that could significantly impact U.S. interest rate policy and trigger a new wave of momentum in the crypto markets.

Good Morning Dinar Recaps,

Fed Chair Jerome Powell Considers Resigning: What’s Next for Crypto?

Federal Reserve Chairman Jerome Powell is reportedly considering stepping down before the end of his term — a move that could significantly impact U.S. interest rate policy and trigger a new wave of momentum in the crypto markets.

Pulte Responds: “The Right Decision for America”

William J. Pulte, Chairman of the Board of Fannie Mae and Freddie Mac, responded publicly to the reports, expressing strong support for Powell’s potential resignation. Posting on his official X account, Pulte stated:

“I’m encouraged by reports that Jerome Powell is considering resigning. I think this will be the right decision for America, and the economy will boom.”

While Powell has not officially confirmed any plans to resign, multiple sources have pointed to growing friction between the Fed and the Trump administration as a likely catalyst.

Policy Divide: Powell vs. Trump

The tension between Fed Chair Powell and President Donald Trump has escalated in recent months. Trump has repeatedly called for aggressive interest rate cuts, arguing that a looser monetary policy is necessary to match the current strength of the U.S. economy.

In a recent TruthSocial post, President Trump stated:

“Tech Stocks, Industrial Stocks, Nasdaq hit all-time highs! Crypto is through the roof, Nvidia is up 47% since Trump tariffs. The USA is taking in hundreds of billions of dollars in tariffs... The Fed should rapidly lower rates to reflect this strength.”

However, Chair Powell has resisted such demands, warning that recent tariffs could actually increase inflationary pressure and that monetary policy should remain cautious, especially in the face of a weakening U.S. dollar.

Market Implications: Rate Cuts & Crypto Surge

Should Powell resign, President Trump would likely appoint a successor aligned with his pro-growth, low-rate agenda. Analysts believe this would increase the likelihood of multiple rate cuts before the end of 2025, providing an additional tailwind for risk-on assets.

Crypto markets have already entered a bullish phase, bolstered by expanding global liquidity and easing monetary conditions. Additional rate cuts could accelerate this momentum significantly.

The potential leadership change at the Fed represents more than a political reshuffle — it could become a pivotal event for both traditional financial markets and the digital asset ecosystem.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

BIS Research Finds Tokenized Government Bonds Have Tighter Spreads

The Bank for International Settlements (BIS) has released new research indicating that tokenized government bonds—while still a small slice of the overall bond market—are demonstrating significantly tighter bid-ask spreads and potential advantages in liquidity, issuance efficiency, and accessibility.

Key Findings From the BIS Bulletin

The BIS analyzed 15 tokenized bonds issued by sovereigns, supranational institutions, and government agencies, totaling $1.9 billion—a fraction of the estimated $80 trillion global government bond market.

Improved Liquidity:

Mean bid-ask spread on tokenized bonds: 19 basis points

Mean bid-ask spread on traditional bonds: 30 basis points

The tighter spreads suggest superior liquidity and possibly more efficient price discovery for tokenized instruments.

Why Are Tokenized Bonds More Liquid?

The research points to several contributing factors:

Integration with Central Securities Depositories (CSDs): Tokenized bonds issued via integrated platforms are more easily accessible to institutional investors.

Investor experimentation: Anecdotal evidence suggests that investors are showing active interest in these digital instruments.

Lower minimum investment thresholds:

Tokenized bonds average: $110,000

Conventional bonds average: $185,000

Lower entry costs broaden the investor pool and support tighter spreads.

Yields and Premium Pricing

While some tokenized bonds have traded at premium prices—implying lower yields—the BIS cautions that the evidence remains idiosyncratic, with no definitive trend yet established.

“The jury is still out” on whether tokenized bonds offer consistent yield advantages.

Advantages of Digital Bond Issuance

Tokenized or “digital-native” government bonds present a range of potential benefits:

Faster settlement and reduced counterparty risk through Delivery vs Payment (DvP) models

Smart contract automation to reduce servicing and back-office costs

Lower issuance thresholds, encouraging broader market participation

Potential collateral use, which could open significant liquidity channels (though this remains restricted in most jurisdictions)

Challenges and Outlook

Despite the upside, the BIS highlights critical hurdles:

Regulatory uncertainty, especially regarding collateral eligibility

Lack of platform scalability and the need for robust infrastructure

These challenges must be resolved for digital bonds to realize their full potential.

Cost Savings Potential

German tokenization platform Cashlink also weighed in, suggesting digital bonds—especially international and long-term issuances—could reduce costs by up to 1.2% of issuance value over an eight-year bond’s lifetime, primarily due to savings in asset servicing.

Conclusion

The BIS bulletin reinforces the growing appeal of tokenized bonds for both issuers and investors, pointing to better liquidity, lower entry barriers, and operational efficiencies. While still early-stage, the findings support continued interest in digital asset infrastructure—particularly as regulatory frameworks evolve and adoption scales.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

Shanghai Officials Signal Openness to Stablecoins Despite China’s Crypto Ban

In a surprising shift, Chinese state officials in Shanghai are reportedly showing openness toward stablecoin development, signaling a potential divergence from the country’s broader ban on cryptocurrencies.

Strategic Shift in Shanghai

According to Reuters, the Shanghai State-owned Assets Supervision and Administration Commission (SASAC) convened a high-level meeting to discuss strategic responses to digital currencies and stablecoins. Following the meeting, SASAC Director He Qing urged stronger engagement with emerging technologies and deeper research into digital currency frameworks.

“We must demonstrate greater sensitivity to emerging technologies,” He Qing posted on the SASAC’s official channel.

This discussion follows growing domestic pressure from academics and private industry to explore a yuan-backed stablecoin that could compete globally.

China’s Central Bank Joins the Conversation

The People’s Bank of China (PBOC) is also starting to engage in the global stablecoin conversation. In June, PBOC Governor Pan Gongsheng acknowledged that stablecoins represent a transformative shift in global payments infrastructure, especially given the influence of U.S. dollar-backed assets such as Circle’s USDC.

In response to this shift, China’s Securities Times, a state-run outlet, published an editorial on June 23, stating that “the development of stablecoins should be sooner rather than later.”

Hong Kong: A Potential Testing Ground

Due to tight capital controls in mainland China, direct implementation of a yuan-backed stablecoin appears unlikely—for now. However, PBOC adviser Huang Yiping has floated the idea of using Hong Kong’s offshore RMB market to test the concept.

“Hong Kong has an offshore market for the renminbi. If it continues to develop, we could see a stablecoin pegged to the offshore RMB in Hong Kong,” Huang stated.

This would allow China to compete in the international stablecoin arena while avoiding the political and regulatory risks of allowing such assets within its mainland borders.

Conclusion

While China continues to enforce one of the world’s strictest bans on crypto trading and mining, signals from Shanghai authorities, the PBOC, and state media suggest a strategic reevaluation is underway. A yuan-backed stablecoin, launched via Hong Kong, could emerge as a controlled yet competitive response to Western-led digital currencies—particularly those advancing under U.S. financial policy.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

MilitiaMan & Crew: Iraq Dinar News- Economic Landscape-ICC-WTO- Fedwire Funds ISO

MilitiaMan & Crew: Iraq Dinar News- Economic Landscape-ICC-WTO- Fedwire Funds ISO

7-11-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

In today’s video, we dive deep into the fascinating world of the Iraqi Dinar! Discover how this currency is intertwined with Iraq's rich gold reserves, and what impact these reserves have on the national economy.

We’ll also explore the significance of the National Card in Dinar, a crucial financial tool for citizens.

MilitiaMan & Crew: Iraq Dinar News- Economic Landscape-ICC-WTO- Fedwire Funds ISO

7-11-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

In today’s video, we dive deep into the fascinating world of the Iraqi Dinar! Discover how this currency is intertwined with Iraq's rich gold reserves, and what impact these reserves have on the national economy.

We’ll also explore the significance of the National Card in Dinar, a crucial financial tool for citizens.

But that’s not all! We’ll discuss the role of the International Chamber of Commerce (ICC) in promoting trade and investment in Iraq, which influences global perceptions of the Iraqi economy.

We’ll also mention that there is the Federal Supreme Court of Iraq and its pivotal decisions regarding economic policies that may shape the dinar’s revaluation that solves key national issues.

To wrap it all up, we’ll delve into the court decisions may come the same day as the Fedwire ISO 20022 back wall for global bank integrations on 07/14/2025

ISO 20022 is a modern messaging standard that plays a vital role in international transactions, including those involving the Iraqi Dinar.

How does this system affect currency exchange and banking operations? You’ll find out!

Join us for an informative and engaging discussion that connects currency, law, and international commerce in Iraq.

Timestamps:

00:00 - Intro

01:30 - Overview of the Iraqi Dinar

04:15 - Iraq's Gold Reserves Explained

07:50 - The National Card in Dinar

10:20 - Role of the ICC in Iraq's Economy

13:45 - Insights from the Federal Supreme Court

16:30 - Understanding Fedwire ISO 20022 20:00 - Conclusion and Q&A

The Dollar's Worst Year Since 1973 Explained!

The Dollar's Worst Year Since 1973 Explained!

Taylor Kenny: 7-10-2025

The mighty U.S. dollar, long the undisputed king of global finance, has just suffered a truly jarring setback: its worst start to the year since 1973.

This isn’t just a statistical blip; it’s an echo of a tumultuous past, signaling that the very foundations of the dollar’s dominance may be cracking under unprecedented strain.

The year 1973 marked a watershed moment in financial history. The chaos that ensued from President Nixon’s decisive decoupling of the dollar from gold, famously ending the Bretton Woods system, plunged global markets into uncertainty.

The Dollar's Worst Year Since 1973 Explained!

Taylor Kenny: 7-10-2025

The mighty U.S. dollar, long the undisputed king of global finance, has just suffered a truly jarring setback: its worst start to the year since 1973.

This isn’t just a statistical blip; it’s an echo of a tumultuous past, signaling that the very foundations of the dollar’s dominance may be cracking under unprecedented strain.

The year 1973 marked a watershed moment in financial history. The chaos that ensued from President Nixon’s decisive decoupling of the dollar from gold, famously ending the Bretton Woods system, plunged global markets into uncertainty.

Back then, the dollar was ultimately “saved” through a strategic re-alignment, most notably the petrodollar agreement which cemented its role in global oil trade, and a series of aggressive interest rate hikes that shored up its value.

But this time, the world is different, and the traditional lifelines appear to be absent or insufficient. There’s no grand oil deal on the horizon to re-anchor the dollar, nor does it seem politically or economically feasible for central banks to hike rates aggressively enough to counteract the immense pressures building up.

So, what are these pressures that make the current situation far more perilous than its 1973 precursor?

These converging forces lead to a stark conclusion: the “great fiat experiment” – the system of unbacked paper currencies that has defined global finance since 1971 – may be entering its final, most challenging phase.

Without the discipline of a commodity backing like gold, or the unwavering global demand previously underpinned by geopolitical stability and economic dominance, the dollar’s current trajectory raises profound questions about the future of the international financial system itself.

The implications are far-reaching, potentially ushering in a new era of economic instability, rapid inflation, or even a reordering of global financial power. Understanding these complex dynamics is no longer a niche interest; it’s crucial for anyone navigating today’s uncertain economic landscape.

For a deeper dive into these critical insights and what they could mean for your financial future, we highly recommend watching the full video from ITM Trading with Taylor Kenney. Taylor offers invaluable perspectives and detailed analysis on these seismic shifts in the global financial order.

CHAPTERS:

0:00 Dollar Index

1:28 Petrodollar

2:43 De-Dollarization

4:23 Gold’s Rise

6:15 Currency Lifecycles

8:16 Real Tangible Wealth