News, Rumors and Opinions Friday 1-23-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 23 Jan. 2026

Compiled Fri. 23 Jan. 2026 12:01 am EST by Judy Byington

The Plan …Quantum Financial System on Telegram

NESARA / GESARA: Implementation of global debt relief and financial restructuring.

QFS fully implemented.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Fri. 23 Jan. 2026

Compiled Fri. 23 Jan. 2026 12:01 am EST by Judy Byington

The Plan …Quantum Financial System on Telegram

NESARA / GESARA: Implementation of global debt relief and financial restructuring.

QFS fully implemented.

Federal Reserve dissolved, IRS placed under the new U.S. Treasury Department.

• No taxes on food or medicine.

• No taxes on salaries, used houses, or cars.

Thurs. 22 Jan. 2026 Bruce, The Big Call 667-770-1866, pin123456#, 667-770-1865

Trump was positioning Iran to be part of the GCR. Iran still has some clean up issues in their banks. Trump has told both to get the reset released by Sun. or Mon 26 Jan. 2026.

Yesterday the Redemption Center screens had 48 currencies on the screens going up in value compared to the US Dollar.

Bond Holders were told they would have hydrated funds by Fri. or Sat. 24 Jan. 2026.

Some groups in Tier3 have received at least part of their funds.

Tier4b (us, the Internet Group) should be notified for appointments Sat., Sun., or Mon 24, 25, 26 Jan. 2026.

The India Rupee and Vietnamese Dong were both on the Central Bank of Iraq screen.

The Venezuela Bolivar was pending on bank screens.

~~~~~~~~~~

Global Financial State:

Thurs. 22 Jan. 2026 $21 Trillion dollars is missing from the US Government. That’s $65,000 per person, as much as the National Debt.

This means the Federal Reserve and their banks are (allegedly) transacting money outside the law, as are the private contractors running the payment system and Wall Street firms selling government securities without full disclosure…Nesara Gesara Exposed on Telegram

Thurs. 22 Jan. 2026 Elon Musk and Senator Mike Lee just shared a thread showing US Government is using our Social Security to fund anything they need extra money for.

Senator Tommy Tuberville CONFIRMS they spend our Social Security, “It’s all a scam — what happens, it comes up here, we spend it. This is all a scam. I mean, we got people that’s getting ready to retire that’s gonna try to live off $2k-$3k, Impossible. It’s impossible.Because what happens, it comes up here, we spend it. We’re $35 trillion in debt. We don’t have any money. We’re d**d broke. And then taxpayers have $2 trillion in credit card debt. We are in huge trouble. In this body, we had better start figuring that out because we’re gonna have a run on this city here soon, and there’s gonna be about a 150 million people coming up here saying, where’s our damn money that we paid in?” …Gesara Nesara on Telegram

Read full post here: https://dinarchronicles.com/2026/01/23/restored-republic-via-a-gcr-update-as-of-january-23-2026/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man We should be very confident and very optimistic...The 'hush' to me is purposeful...and the signals and reassurances are constantly being laid out. We have to watch and see how they pull this off and what they show us next...

Frank26 The CBI actually came out and said, 'We are complete. We have completed the monetary reform of our country.' We all know what that means, it's going to add purchasing power by lifting the three zeros from the exchange rate...We're waiting for the certification from the IMF, United States Treasury and from the board of directors. 2 of those 3, that's the United States of America. You think we're not going to give them the certification? ...They've got to certify it so everybody says [the rate] is legit...It is good to finally be told the truth by the CBI.

Walkingstick Article: "The Board of Directors of the Center for Banking Studies discusses activating international partnerships to support banking reform in Iraq" Quote: "These efforts are in line with... addressing the challenges of compliance with FATF, Basel and IFRS requirements, thereby...improving the readiness of Iraqi banks to integrate into the international financial system." This is coming from the ones at the CBI that make all the decisions on the monetary reform, on the new exchange rate. This is the board of directors that tell Alaq what to do and what to say. These are the straight directors from the board of directors directing Alaq to say these words. These are the one in negotiations with the Untied States of America...

Japan's Bond SHOCK - Debt Market IMPLOSION Is Collapsing Global Economies

Lena Petrova: 1-22-2026

For decades, Japan’s bond market was the definition of stability. That illusion just shattered. This week, Japan’s 40-year government bond yield surged past 4% for the first time ever, triggering a shockwave across global markets.

In this video, we break down why Japan’s ultra-long bonds are suddenly collapsing, how Prime Minister Sanae Takaichi’s snap election and aggressive fiscal plans spooked investors, and why this isn’t just Japan’s problem.

Rising Japanese yields are already pushing up U.S. Treasury rates, shaking equities, lifting gold, and threatening a massive yen carry-trade unwind.

Japan is the largest holder of U.S. debt — and when its capital starts moving, the entire world feels it.

👉 Is this the start of a global bond market reset?

👉 Can the Bank of Japan stop the damage — or make it worse?

Seeds of Wisdom RV and Economics Updates Friday Morning 1-23-26

Good Morning Dinar Recaps,

BOARD OF PEACE LAUNCHED: TRUMP UNVEILS NEW GLOBAL DIPLOMACY FRAMEWORK AT DAVOS

An alternative peace architecture emerges as traditional institutions strain

Good Morning Dinar Recaps,

BOARD OF PEACE LAUNCHED: TRUMP UNVEILS NEW GLOBAL DIPLOMACY FRAMEWORK AT DAVOS

An alternative peace architecture emerges as traditional institutions strain

Overview

At the World Economic Forum 2026 in Davos, President Donald Trump formally launched and signed the charter for the “Board of Peace,” a new multinational diplomatic initiative designed to address global conflict resolution and post-war reconstruction. The signing conference on January 22, 2026, brought together a coalition of participating nations willing to commit politically and financially to a new peace mechanism operating alongside — but not under — existing institutions like the United Nations.

The move signals a shift toward coalition-based diplomacy, reflecting growing dissatisfaction with legacy global governance structures amid escalating geopolitical fragmentation.

Key Developments

Charter signed in Davos by President Trump and representatives from over 20 participating countries

The Board of Peace is initially focused on Gaza, with scope to expand into other global conflict zones

Membership reportedly requires a substantial financial commitment, underscoring intent for operational capacity rather than symbolic diplomacy

Trump positioned the board as a results-driven alternative framework, emphasizing reconstruction, security coordination, and long-term stabilization

Several traditional Western powers declined participation, highlighting fractures within the existing rules-based order

Why It Matters

The Board of Peace represents a structural workaround to stalled multilateralism

Signals declining confidence in the UN’s ability to manage modern conflicts effectively

Introduces a parallel diplomatic architecture driven by willing coalitions rather than universal consensus

Reflects a broader trend toward modular global governance, where power is exercised through flexible alliances

Why It Matters to Foreign Currency Holders

New diplomatic blocs often precede new funding mechanisms, settlement frameworks, and asset flows

Coalition-led reconstruction efforts may bypass traditional Bretton Woods channels

Alternative governance structures can accelerate currency diversification and reserve realignment

For those holding foreign currencies anticipating a global reset, this reflects early-stage institutional reconfiguration

Implications for the Global Reset

Pillar 1: Diplomatic Architecture Reset

The Board of Peace underscores a move away from centralized, universal institutions toward selective, commitment-based governance, reshaping how global power is exercised.

Pillar 2: Financial & Institutional Realignment

Mandatory funding commitments and reconstruction mandates hint at new financial pipelines, potentially operating outside IMF–World Bank frameworks.

This is not just diplomacy — it’s global governance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The White House – “President Trump Ratifies Board of Peace in Historic Ceremony”

CBS News – “Trump launches ‘Board of Peace’ at Davos amid global skepticism”

Forbes – “Trump Introduces Board of Peace, Proposes New Global Conflict Framework”

~~~~~~~~~~

BRICS and Gold: Morgan Stanley Identifies the Dollar’s Most Serious Challenger

Why the reserve battle may not be currency vs. currency at all

Overview

According to analysis from Morgan Stanley, the global financial system is entering a multipolar transition — but not in the way many expect. While BRICS nations continue expanding de-dollarization strategies, the bank argues the U.S. dollar has no true currency rival capable of fully replacing it. Instead, Morgan Stanley identifies gold as the dollar’s most credible challenger, closely tied to BRICS strategy and accelerating geopolitical shifts.

Rather than building a unified BRICS currency, emerging economies are restructuring reserve composition, increasingly favoring tangible, sanction-resistant assets over dollar-denominated instruments.

Key Developments

Morgan Stanley states the dollar remains resilient due to the absence of a viable replacement currency

Gold identified as the primary challenger, not the yuan, euro, or a BRICS unit

BRICS nations have become the world’s largest net gold buyers since 2022

Central banks across BRICS have increased gold reserves by more than 30% over five years

Trade wars, sanctions, and tariff escalation are accelerating reserve diversification

European leaders, including France’s president, are openly discussing closer engagement with BRICS frameworks

Why It Matters

Reserve power is shifting from currency dominance to asset credibility

Gold accumulation reflects declining trust in politically exposed fiat systems

De-dollarization is occurring through balance sheets, not declarations

The global system is evolving toward asset-backed credibility rather than monetary hegemony

Why It Matters to Foreign Currency Holders

Gold accumulation often precedes currency realignment and valuation changes

Reduced reliance on dollar reserves increases demand for alternative settlement assets

Foreign currency holders anticipating a global reset benefit when fiat confidence weakens

Asset-backed strategies historically support re-pricing events during systemic transitions

Implications for the Global Reset

Pillar 1: Reserve Architecture Transformation

The challenge to the dollar is no longer about replacing it with another currency, but reducing its monopoly role through gold and real-asset accumulation.

Pillar 2: Multipolar Asset Strategy

As BRICS and others pivot toward gold, the system moves closer to neutral reserve assets that sit outside political control, reshaping global finance.

This is not just about currencies — it’s about what the world trusts to store value.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS: Morgan Stanley Reveals the Biggest Challenger to the US Dollar”

Morgan Stanley – “Global Rates & FX Outlook: Toward a Multipolar Financial System”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 1-23-26

Dollar Heads For Sharp Weekly Drop As Yen Slides

2026-01-23 02:55 Shafaq News The yen stayed under pressure after the Bank of Japan held rates steady on Friday, as expected, while the U.S. dollar headed for its steepest weekly drop since June as geopolitical tensions and abrupt policy shifts around Greenland unsettled investors.

The yen was slightly weaker at 158.54 following the BOJ's rate decision and after it raised its economic and inflation forecasts, highlighting the central bank's readiness to continue hiking still-low borrowing costs.

Dollar Heads For Sharp Weekly Drop As Yen Slides

2026-01-23 02:55 Shafaq News The yen stayed under pressure after the Bank of Japan held rates steady on Friday, as expected, while the U.S. dollar headed for its steepest weekly drop since June as geopolitical tensions and abrupt policy shifts around Greenland unsettled investors.

The yen was slightly weaker at 158.54 following the BOJ's rate decision and after it raised its economic and inflation forecasts, highlighting the central bank's readiness to continue hiking still-low borrowing costs.

Last month, the BOJ raised its policy interest rate to a 30-year high but that has not helped the frail yen. Traders are concerned that a break beyond 160 per dollar could prompt Tokyo to step into the currency market to support the yen.

Moh Siong Sim, FX strategist at OCBC, said the market was hoping the yen's weakness might trigger a more forceful BOJ response but the central bank maintained the same rhetoric - an outcome that was pretty neutral for markets.

"After all, yen indirectly fits into the economic projections if the weakness is sustained," he said.

The spotlight will now be on comments from Governor Kazuo Ueda to gauge when the next hike will come and whether there is any hawkish tilt to support the yen. Ueda will hold a news conference to explain the decision at 0630 GMT.

"Governor Ueda in his remarks will likely lean into a more hawkish direction, which may keep the next meetings ‘live’ for a further policy rate hike," said Fred Neumann, chief Asia economist at HSBC.

"The Board appears to be leaning more hawkish as well, with one dissenter at today's meeting indicating that further policy rate hikes are on the table."

The yen has been under relentless pressure since Sanae Takaichi took over as Japan's prime minister in October, dropping more than 4% on fiscal concerns and hovering near levels that have spurred verbal warnings and intervention fears.

A bond market rout this week underscored investor nerves about Japan's fiscal position as Takaichi called a snap election for February and promised tax cuts, sending Japanese government bond yields to record highs. They have recovered somewhat since then but investors remain skittish.

Carol Lye, portfolio manager at Brandywine Global, said the authorities have to come up with a more concrete plan to calm the markets. "If there's no action, then it's just words. It's not going to anchor the market down."

"And until they do, I think there's still room for the JGBs across the entire curve to continue being volatile. The rate hikes are also not coming in quickly enough."

DOLLAR SELLING MOMENTUM

The shifting geopolitical landscape has weighed on sentiment this week as Trump said he had secured U.S. access to Greenland in a deal with NATO that came as he backed off tariff threats against Europe and ruled out taking the autonomous territory of Denmark by force.

The dollar has borne the brunt of investor angst in the currency markets as U.S. assets were pummelled at the start of the week amid the intensifying geopolitical tensions.

The dollar index , which measures the U.S. currency against six units, was at 98.366 after dropping 0.58% in the previous session, on course for a 1% slide, its worst weekly performance since June 2025.

The euro was steady at $1.1746, hovering near the three-week high it touched earlier this week, while sterling fetched $1.3496, near a two-week high hit in the previous session.

The Australian dollar was steady at $0.6841, while the New Zealand dollar was 0.3% weaker at $0.59105.

Thierry Wizman, global FX & rates strategist at Macquarie Group, said while a Greenland deal solves the immediate problem of tariffs and invasion, it doesn't solve the core issue of the seeming alienation of allies from one another.

"And that's not a good place to be if you want to preserve the USD's reserve-currency status.”

(Reuters) https://www.shafaq.com/en/Economy/Dollar-heads-for-sharp-weekly-drop-as-Yen-slides

Precious Metals Surge To Records As Investors Flee US Assets

Economy & Business Breaking Gold 2026-01-23 Shafaq News Gold notched another record high on Friday, while silver and platinum also extended gains to hit all-time peaks, powered by diminishing confidence in U.S. assets on account of geopolitical tensions and economic uncertainty.

Spot gold was up 0.4% at $4,957.10 per ounce, as of 0536 GMT, after scaling a record $4,966.59 earlier in the day.

U.S. gold futures for February delivery added 0.9% to $4,958.30 per ounce.

"Faith in the U.S. and its assets have been shaken, maybe permanently, and this is driving money into precious metals. So the word rupture has been thrown around. I don't think that's an exaggeration," said Kyle Rodda, a senior market analyst at Capital.com.

The dollar index hovered near a more than two-week low on Friday, having fallen 1% in the course of the week, making greenback-priced metals cheaper for overseas buyers, while Wall Street's main indexes saw a sharp sell-off earlier in the week as investors were spooked by fresh tariff threats from U.S. President Donald Trump on the EU, before recovering.

EU leaders heaved a sigh of relief over Trump's U-turn on Greenland as they met for an emergency summit in Brussels late on Thursday while issuing a warning that they were ready to act if Trump threatens them again.

The U.S. president for his part said he had secured total and permanent U.S. access to Greenland in a deal with NATO.

The details of any agreement remain unclear and Denmark insisted its sovereignty over the island isn't up for discussion.

Spot silver surged 2.8% to $98.87 an ounce, after hitting a record high of $99.34 earlier.

"The underlying story to silver is one about the outperformance of silver versus gold and its industrial applications," Rodda added.

Markets anticipate the Fed will deliver two quarter-percentage point rate cuts in the latter half of 2026, raising non-yielding gold's appeal. FEDWATCH

Spot platinum gained 0.8% to $2,650.90 per ounce after hitting a record $2,684.43 earlier, while palladium lost 0.6% to $1,908.02. (REUTERS) https://www.shafaq.com/en/Economy/Precious-metals-surge-to-records-as-investors-flee-US-assets

Oil Rebounds As Trump Renews Iran Threat

Economy & Business Oil 2026-01-23 Shafaq News Oil prices rebounded on Friday after U.S. President Donald Trump renewed threats against major Middle Eastern producer Iran, raising concerns of military action that could disrupt supplies.

Brent crude futures for March rose 35 cents, or 0.55%, to $64.41 a barrel. U.S. West Texas Intermediate crude rose 33 cents, or 0.56%, to $59.69 a barrel as of 0243 GMT.

Both contracts slumped about 2% on Thursday. They rebounded after Trump told reporters aboard Air Force One the U.S. has an "armada" heading toward Iran but hoped he would not have to use it, as he renewed warnings to Tehran against killing protesters or restarting its nuclear program.

Warships including an aircraft carrier and guided missile destroyers will arrive in the Middle East in the coming days, a U.S. official said. Iran is the fourth-largest producer in the Organization of the Petroleum Exporting Countries and a major exporter to China, the world's second-largest oil consumer.

Brent and WTI are set for weekly gains of about 0.6% after prices climbed earlier in the week on Trump's threats to invade Greenland, potentially destabilising the trans-Atlantic alliance, but dropped on Thursday as he pulled back on any military action.

Trump stepped back after saying Denmark, which controls the Arctic island, NATO and the U.S. had reached a deal that would allow "total access" to Greenland.

Prices also softened on Thursday following bearish government data showing stockpiles in the U.S., the world's biggest oil user, climbed last week amid slowing fuel demand.

U.S. Energy Information Administration data released on Thursday said crude inventories climbed by 3.6 million barrels for the week ending January 16, more than the 1.1-million-barrel rise predicted by analysts in a Reuters poll.

This also exceeded the 3-million-barrel build that market sources said the American Petroleum Institute (API) trade group reported on Wednesday.

Both U.S. agencies released their reports a day later than usual due to the U.S. Martin Luther King Jr. holiday on Monday. (Reuters) https://www.shafaq.com/en/Economy/Oil-rebounds-as-Trump-renews-Iran-threat

IRGC Says It Foiled Foreign-Backed Plot To Destabilize Iran

2026-01-23 Shafaq News- Tehran Iran’s Islamic Revolutionary Guard Corps (IRGC) Intelligence Organization said it thwarted “a coordinated foreign-backed plan aimed at fueling unrest and terrorist activity inside Iran,” according to a statement reported by Iranian media outlets.

In its third public statement on the issue, the IRGC intelligence arm said the alleged plot was organized following the 12-day war with Israel and involved the formation of an external command structure linking intelligence services from “10 hostile countries.” The organization said the plan sought to combine internal unrest, armed group activity, and external pressure to create a serious security threat to the country.

The Iranian security agencies, IRGC said, carried out a series of preventive intelligence operations between late June and early January, focusing on domestic unrest and armed group movements led to the arrest or summons of 735 individuals accused of links to “anti-security networks,” the guidance of around 11,000 people deemed vulnerable to involvement in unrest, and the seizure of 743 unlicensed weapons. It also claimed that 46 individuals connected to foreign intelligence services were identified and brought under control.

The IRGC alleged that the unrest involved multiple tactics, including the infiltration of violent actors into protest crowds, foreign political and security support for mobilization efforts, manipulation of social media platforms to incite violence, and the use of individuals with criminal backgrounds.

Since the cross-border war with Israel, Iran’s judiciary and intelligence agencies have reported a series of cases involving what they describe as espionage networks or cells linked to Israel’s Mossad, though authorities have released limited details. Officials have also said that at least ten people accused of spying for Mossad have been executed during this period. https://www.shafaq.com/en/Middle-East/IRGC-says-it-foiled-foreign-backed-plot-to-destabilize-Iran

“Tidbits From TNT” Friday Morning 1-23-2026

TNT:

Tishwash: Minister of Finance Meets With World Bank Delegation

Iraq’s Minister of Finance met yesterday with the World Bank delegation for the Middle East and North Africa to discuss cooperation opportunities and economic reform in Iraq.

With a shared vision of economic reform and expansion of major development programmes, Iraq’s visible commitment to streamlining banking procedures to create an attractive environment for investments, enhancing the role of the private sector to reduce imports, and maximising non-oil revenues by automating tax and customs systems and enhancing public treasury resources was at the centre of the discussions.

TNT:

Tishwash: Minister of Finance Meets With World Bank Delegation

Iraq’s Minister of Finance met yesterday with the World Bank delegation for the Middle East and North Africa to discuss cooperation opportunities and economic reform in Iraq.

With a shared vision of economic reform and expansion of major development programmes, Iraq’s visible commitment to streamlining banking procedures to create an attractive environment for investments, enhancing the role of the private sector to reduce imports, and maximising non-oil revenues by automating tax and customs systems and enhancing public treasury resources was at the centre of the discussions.

Minister Mohammed highlighted the leading role of the private sector as a strategic objective in Iraq’s economic development to ensure the resilience of the Iraqi economy, alongside the importance of partnerships with international institutions to advance the national economic landscape.

The World Bank’s International Bank for Reconstruction and Development (IBRD)

and the International Development Association (IDA) have 23 projects in Iraq with a total commitment of $ 6.64 billion dollars including in areas such as infrastructure, health, and transport. link

Tishwash: Parliament will hold a session next week to elect the president of the republic.

A parliamentary source revealed on Thursday the date of the session to elect the President of the Republic in the Iraqi Parliament, indicating that the date came after several meetings with the political blocs.

The source told Shafaq News Agency that "the Speaker of Parliament held meetings with the political blocs to convene a session to elect the President of the Republic within the specified constitutional timeframe."

He added that "the session will be held either on Monday or Tuesday of next week, before the end of the constitutional deadline," explaining that "before the session to elect the president of the republic, there will be a parliamentary session held on Sunday to discuss the security situation and securing the Iraqi borders, in the presence of the Ministers of Interior and Defense and the security leaders, and that the session will be private and closed."

The Iraqi Parliament Presidency announced in the middle of this month the names of the candidates who met the legal requirements to run for the position of President of the Republic of Iraq, based on the provisions of Article (4) of the Law on the Provisions of Nomination for the Position No. (8) of 2012, and their number reached 15 candidates.

Later, the Federal Court ruled on the appeals of the candidates for the position, and reinstated 4 names as candidates for the position, bringing the final number to 19 candidates. link

*************

Tishwash: A meeting and dinner brings together Al-Sudani and Savaya in Baghdad

An informed source revealed on Thursday that Trump's envoy, Mark Savva, arrived in Baghdad, where he was received by Prime Minister Mohammed Shia al-Sudani at his office.

The source told Video News Agency that al-Sudani and Savva held an official meeting and also dined together during the meeting, which took place at the Prime Minister's office. link

************

Tishwash: Trump appreciates Iraq's efforts in supporting regional stability during this sensitive period.

US President Donald Trump praised Iraq's efforts in supporting stability in the region during this sensitive period.

The Prime Minister's Media Office stated in a statement, a copy of which was received by Al-Furat News, that: "Prime Minister Mohammed Shia Al-Sudani received, today, Thursday, the US President's Special Envoy to Syria, Thomas Barak, during which the situation in the region and developments in the Syrian arena were discussed."

Al-Sudani stressed "the importance of security in Syria for Iraq and the region, and the need for cooperation in order to establish stability and ensure the unity of Syrian territory."

He also noted the "constructive partnership between Iraq and the United States in combating terrorism, laying the foundations for economic cooperation and sustainable development, and supporting bilateral and regional efforts for prosperity in Iraq and the region."

For his part, Barak conveyed to Al-Sudani, according to the statement, the appreciation of the US President for the Iraqi government’s efforts in supporting stability in the region and managing Iraq’s positions during this sensitive stage.

He also praised the steps taken by the Sudanese government and the performance of the Iraqi security forces in combating terrorism, as well as Iraq’s openness to international investments and the establishment of economic interdependence, which constituted an important factor for stability. link

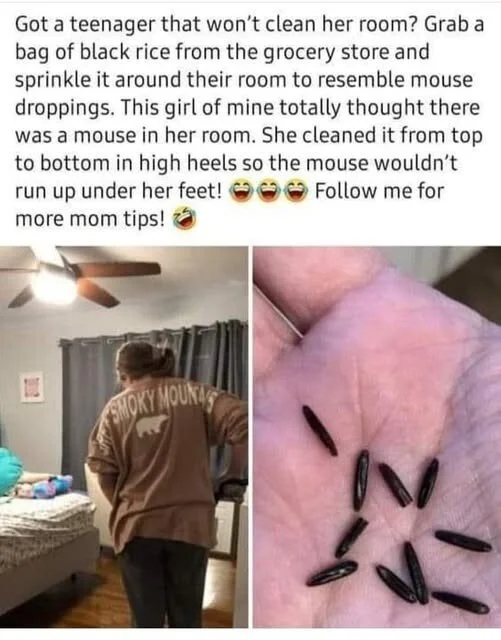

Mot: Some Problems are Soooo Easy to Solve!!!!

Mot: Ya Need to Be Clever While Raising the Wee Folks!!!

Iraq Economic News and Points To Ponder Thursday Evening 1-22-26

The Central Bank Of Iraq Sold Approximately $70 Billion In Hard Currency During The First 10 Months Of 2025.

Money and Business Economy News – Baghdad The Central Bank of Iraq revealed on Thursday that its sales of hard currency amounted to about $70 billion during the first 10 months of 2025.

The bank stated in a statistic that its sales of hard currency during the first 10 months of last year amounted to $67 billion and 272 million.

The Central Bank Of Iraq Sold Approximately $70 Billion In Hard Currency During The First 10 Months Of 2025.

Money and Business Economy News – Baghdad The Central Bank of Iraq revealed on Thursday that its sales of hard currency amounted to about $70 billion during the first 10 months of 2025.

The bank stated in a statistic that its sales of hard currency during the first 10 months of last year amounted to $67 billion and 272 million.

He added that sales were distributed between foreign remittances amounting to 64 billion and 969 million dollars, and also to cash sales amounting to 2 billion and 303 million dollars.

She pointed out that these sales during the ten months of last year amounted to $67 billion and 272 million, and increased by 7.5% compared to the same period in 2024, which amounted to $62 billion and 581 million https://economy-news.net/content.php?id=64853

Government Initiative To Establish An Investment Fund With France With A Capital Of $100 Million

Money and Business Economy News – Baghdad The Prime Minister’s advisor and Executive Director of the Iraq Development Fund, Mohammed Al-Najjar, announced on Wednesday the signing of a memorandum of understanding with a French bank, noting that this will pave the way for the establishment of a joint investment fund with a capital of $100 million.

Al-Najjar told the Iraqi News Agency, as reported by “Al-Eqtisad News”: “The memorandum of understanding signed with the state-owned bank (BPI France), which is an institution that owns assets and operates in the fields of foreign trade finance and development lending, will open great doors for the national economy,” indicating that “the first of these doors is the establishment of an Iraqi fund for joint investments.”

He explained that "the new fund will allow French companies to invest in Iraq with a contribution from the fund, and will also enable Iraqi investors wishing to invest in France to use the same mechanism," noting that "the agreement opens an unprecedented way for small and medium-sized French companies to enter the Iraqi market, while providing guarantees for foreign investments."

Al-Najjar added that "the expected capital of the fund will start at $50 million, and it is planned to rise to $100 million through contributions from various parties," noting that "the next stage will witness the capital being put in place with a contribution from Iraq and France, while opening the door for Iraqi and other investors to enter the fund."

He noted that "investments will be concentrated in vital sectors including the environment and water sector, infrastructure, digital transformation, and smart agriculture."

Al-Najjar added that "this agreement will effectively contribute to encouraging trade with Iraq in multiple fields, especially in the field of financial management," stressing that "the Fund's signing of this memorandum is one of the most important strategic steps taken so far to enhance the investment environment and localize international expertise." https://economy-news.net/content.php?id=64819

Goldman Sachs Raises Its Gold Price Forecast For The End Of 2026

Money and Business Economy News — Follow-up Goldman Sachs raised its forecast for the price of gold by the end of 2026 to $5,400 an ounce, compared to previous forecasts of $4,900 an ounce, attributing this to the diversification of investments by the private sector and central banks in emerging markets.

Gold hit an all-time high of $4,887.82 an ounce on Wednesday. The precious metal, considered a safe haven, has jumped more than 11% since the beginning of 2026, continuing its strong upward trend after rising 64% last year.

Goldman Sachs said in a note, "We expect that private diversification buyers, whose purchases are aimed at hedging against global policy risks and which led to the sudden rise in our price forecasts, will not liquidate their gold holdings in 2026, effectively raising the starting point for our price forecasts," according to Reuters. https://economy-news.net/content.php?id=64840

Al-Rafidain Warns Against Fake Pages And Websites Impersonating It.

banks Economy News – Baghdad Rafidain Bank warned on Thursday against fake pages and websites impersonating it. The bank confirmed in a statement received by "Al-Eqtisad News" that "all of the bank's official pages on social media platforms are verified with the blue checkmark, and no other pages are relied upon for obtaining news, information, or instructions issued by the bank."

He called on citizens to "refrain from dealing with unofficial pages or fake websites that impersonate the bank's name and logo, and we urge you to report any suspicious page to avoid misleading or exploiting citizens."

He explained that he continues "to publish everything related to his services exclusively through his verified platforms, and calls on everyone to check for the blue checkmark to ensure that the correct information is received." https://economy-news.net/content.php?id=64852

(SOMO): A Plan To Maximize The Value Of Iraqi Oil By Diversifying Markets

The State Oil Marketing Company (SOMO) announced on Wednesday a plan to maximize the value of Iraqi oil by diversifying markets, while indicating that it has adopted a flexible and well-thought-out system for export movement in line with the global market.

The company’s general manager, Ali Nizar Al-Shatri, told the Iraqi News Agency (INA): “The Oil Marketing Company relies on an integrated system of accurate data that includes export levels, shipping flows, and supply and demand trends in the main markets, which allows for flexible and well-thought-out planning of export movements in line with global market conditions in coordination with the Organization of (OPEC).”

He added that "the company coordinates through regular official and technical channels with member states, including data exchange, participation in technical meetings and specialized committees, and continuous communication regarding market developments and emerging challenges."

He emphasized that "this coordination ensures a collective commitment to agreed-upon policies and strengthens trust among producing countries, which positively impacts the balance of supply and demand and the stability of the global oil market."

He explained that "the role of the State Oil Marketing Company (SOMO) is not limited to the commercial aspect alone, but extends to contributing to market stability and protecting Iraq's interests within an international system based on cooperation and coordination to achieve common goals that serve both producers and consumers."

He continued, "The State Oil Marketing Company (SOMO) prepares daily, weekly, and monthly reports monitoring the market situation in terms of supply and demand and geopolitical developments. Based on these studies, decisions are made to ensure the success of the marketing process, while taking into account the organization's objectives of achieving stability in the global market." He pointed out that "SOMO faces a fundamental challenge in achieving a delicate balance between the national economy's needs in terms of oil revenues and Iraq's collective responsibility as an active member of the OPEC+ alliance to maintain global market stability."

He explained that "the Iraqi economy relies heavily on oil revenues to finance the general budget, support essential services, and implement development projects, which places continuous pressure on maximizing returns."

He added that "any ill-considered increase in oil supply could lead to downward pressure on prices, negatively impacting overall revenues, even if exported quantities increase."

He added that "the company faces challenges related to fluctuations in global demand, geopolitical conditions, and changes in energy policies of consuming countries, in addition to the need to maintain Iraq's reliability as a committed partner within the alliance."

He pointed out that "adherence to quotas and voluntary production cuts is not viewed as a burden, but rather as a strategic tool and investment to ensure market stability in the medium and long term, achieving more sustainable returns compared to short-term gains, thus serving the interests of Iraq and both producing and consuming countries."

Al-Shukri emphasized that "the State Oil Marketing Company (SOMO) is working in coordination with the Ministry of Oil and relevant authorities to maximize the value of Iraqi oil by diversifying markets, improving marketing terms, and increasing operational efficiency. This ensures the best possible revenue within the agreed-upon limits, serving both Iraq's interests and the stability of the global oil market." https://ina.iq/en/economy/44974-somo-a-plan-to-maximize-the-value-of-iraqi-oil-by-diversifying-markets.html#:~:text=(SOMO)%3A%20A%20plan,yesterday

Iraq Moves To Revive Hamrin Oil Field With US Partner

2026-01-22 Shafaq News– Kirkuk Iraq’s Northern Oil Company discussed on Thursday investing in and developing the Hamrin oil field with US-based HKN Energy.

In a statement, the Company explained that talks focused on technical, economic, and contractual terms under Iraq’s licensing framework, including upgrades to surface facilities, improved reservoir management, and higher production efficiency.

Hamrin, which stretches across Kirkuk and Saladin province, is among northern Iraq’s long-underdeveloped fields. In mid-2025, the Iraq Oil Ministry signed a memorandum of understanding with HKN Energy to develop the field, targeting output of about 60,000 barrels per day and the capture of associated gas for power generation, according to ministry statements. The Oil Ministry did not immediately comment. https://www.shafaq.com/en/Economy/Iraq-moves-to-revive-Hamrin-oil-field-with-US-partner

Taxing Everything That’s Nailed Down

Taxing Everything That’s Nailed Down

Notes From the Field By James Hickman (Simon Black) January 22, 2026

In the ancient town of Casinum—modern-day Cassino, Italy—parts of a Roman amphitheater still stand after nearly 2,000 years. Carved into the stone, in Latin, is an inscription that translates to: "Ummidia Quadratilla, daughter of Caius, built the amphitheatre and temple for the people of Casinum at her expense."

Ummidia Quadratilla was a wealthy Roman businesswoman who funded multiple public works, all out of her own pocket. Her name was carved in stone for eternity. When she died, she was respected enough that the younger Pliny wrote admiringly about her.

Taxing Everything That’s Nailed Down

Notes From the Field By James Hickman (Simon Black) January 22, 2026

In the ancient town of Casinum—modern-day Cassino, Italy—parts of a Roman amphitheater still stand after nearly 2,000 years. Carved into the stone, in Latin, is an inscription that translates to: "Ummidia Quadratilla, daughter of Caius, built the amphitheatre and temple for the people of Casinum at her expense."

Ummidia Quadratilla was a wealthy Roman businesswoman who funded multiple public works, all out of her own pocket. Her name was carved in stone for eternity. When she died, she was respected enough that the younger Pliny wrote admiringly about her.

The Romans (and Greeks before them) called this practice euergetes—wealthy citizens funding infrastructure projects in exchange for public recognition. Rich people actually competed with one another to see who could give more since public generosity elevated one’s status.

The most generous would have parades thrown in their honor— though naturally they would have to pay for the parade.

Today’s attitudes towards taxpayers are entirely different. Politicians are constantly inventing new ways to extract more and more from people, and then publicly shame the people who pay the most money.

They call their biggest tax payers “greedy” for following the very tax code that politicians write, and then demand they pay their "fair share" without ever defining how much that is.

In tax year 2022 (the most recent data that the IRS has published), the top 0.001% of taxpayers in America paid, on average, nearly $60 million each. The top 0.0001% (about 150 people) paid in the hundreds of millions and even billions of dollars each.

(By comparison, the average taxpayer contributes about $7,333.)

You’d think that politicians would be grateful and supportive of people who write such enormous checks to the government. I mean, they ought to name an aircraft carrier for someone who consistently pays billion-dollar tax bills.

Yet, again, politicians vilify and shame them. This is a bizarre, almost cannibalistic approach. Any private business would treat its top customers with respect and dignity. At a minimum they wouldn’t vilify the individuals who pay the most money.

But guess what? Successful people are extremely mobile. It’s 2026, not 1026. No one is a medieval serf anymore, tied to the land.

California is learning this lesson the hard way. The state already has one of the highest income tax rates in America—13.3% at the top bracket.

Wealthy people have long tolerated California’s high income taxes as the price they pay for living in a place with great weather.

Yet now California voters are considering a ballot measure to impose a "one-time" 5% wealth tax on billionaires—a levy on their total assets, retroactive to January 1, 2026.

And that was finally enough. Billionaires are getting out of Dodge, because they’re not dumb enough to think that this tax will be a “one-time” thing.

The United Kingdom is experiencing something similar.

For over 200 years, the UK had a "non-dom" regime that allowed wealthy foreigners living in Britain to avoid UK taxes on their overseas income. It was one of the few things remaining in recent years which made Britain attractive to international wealth.

In March 2024, the Conservative government announced they would abolish it. The Labour government confirmed the change after winning the July election, and the regime officially ended in April 2025.

The mere announcement triggered an exodus. Over 10,000 millionaires left the UK in 2024, and thousands more followed in 2025.

They brought their money with them. No more big spending, no more employees, no more economic activity.

So what does a desperate government do when the wealthy flee?

They tax everything that's nailed down.

Here’s a great example: Britain’s Labour government recently announced plans to double the tax rate on local bars and pubs.

These establishments are already being squeezed from every direction. The government charges duty on beer, plus VAT, plus special taxes on every pint sold.

Now the Labour government is raising those tax rates by 30 to 70%, starting this April.

The response? Over 1,000 pubs have banned Labour MPs from their establishments. Prime Minister Keir Starmer got barred from one of his local pubs in London. Signs reading "No Labour MPs" are appearing in windows across the country.

But I wouldn't count on this changing anything. Remember, the UK government couldn't even be bothered to investigate the years-long grooming gang scandal until public outrage forced Prime Minister Starmer's hand—he'd initially dismissed calls for an inquiry as a 'far-right bandwagon.'

It’s all so insulting.

Bear in mind that the British government is re housing 36,000 asylum seekers in hotels at £145 per night—all at taxpayer expense.

Plus, local councils spent £52 million on diversity and inclusion officers over the past three years. Britain is still sending foreign aid to India—a country with its own space program.

Meanwhile 10 million pensioners, i.e. actual British people, lost their winter fuel payments so that the government could save £1.5 billion.

It really boggles the mind. Before raising taxes, shouldn't governments examine how they're spending the money they already take in?

The fundamental problem is that government programs, once created, are almost impossible to end. There's never an honest reckoning; spending just keeps rising, forcing governments to keep searching for new revenue.

Naturally they always want to tax the rich... But eventually “the rich” skip town, so the government starts taxing every that can’t relocate. Pubs. Property. Small businesses. The middle class.

This is why tax mitigation is part of any sensible Plan B.

It's not unpatriotic to expect the government to spend money wisely. Any rational person—not even as a Plan B, but as a Plan A—should explore legal means to minimize their tax burden.

That could mean moving from a high-tax state like California or New York to a no-income-tax state like Texas or Florida.

Maximizing retirement account contributions—a self-directed Solo 401(k) alone lets you shelter up to $69,000 per year.

For Americans willing to live abroad, the Foreign Earned Income Exclusion can shield up to $132,900 from federal taxes.

Banning politicians from the local pub might feel good. But the most rational way to respond— when the government isn’t even willing to stop funding outright fraud— is to follow the rules of their own tax code to minimize the amount of your money that they’ll waste.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Investors are Dumping US Treasuries Citing too much Risk

Investors are Dumping US Treasuries Citing too much Risk

Lena Petrova: 1-22-2026

The global financial landscape is at a critical turning point, and the reverberations are being felt far beyond the world of high finance.

A growing unease among European institutions and other global investors regarding the stability of US Treasuries has sparked a potentially seismic shift away from the US dollar as the world’s primary reserve currency.

Investors are Dumping US Treasuries Citing too much Risk

Lena Petrova: 1-22-2026

The global financial landscape is at a critical turning point, and the reverberations are being felt far beyond the world of high finance.

A growing unease among European institutions and other global investors regarding the stability of US Treasuries has sparked a potentially seismic shift away from the US dollar as the world’s primary reserve currency.

This trend, driven by escalating political tensions between the US and Europe, poses a significant threat to the global financial system, with far-reaching implications for markets, fiscal health, and international relations.

For decades, US Treasuries have been considered the ultimate safe haven asset, trusted by pension funds, central banks, and long-term investors worldwide. However, recent developments suggest that this trust is beginning to erode.

Denmark’s academic pension fund has announced its intention to fully exit US Treasuries by the end of the month, citing political risks and unsustainable US fiscal discipline as key reasons. While this move may seem small in absolute market terms, it signals a broader loss of confidence that could have a domino effect among global investors.

The impact is already being felt in Japan, where rising yields at home are incentivizing investors to repatriate capital, further pressuring US borrowing costs.

The weakening US dollar, rising US Treasury yields, and increased global financial volatility all point toward a potential structural shift away from the dollar’s dominance. This is not merely a financial event; it’s a profound geopolitical realignment with serious consequences for global markets, US fiscal health, and international relations.

The stakes are high, particularly for the European Union, which, despite its economic troubles, cannot afford a crisis triggered by a Treasury selloff.

Yet, the EU is increasingly considering the weaponization of its US asset holdings as leverage in political disputes. This t*t-for-tat game of financial brinksmanship is fraught with risk, and the consequences of a misstep could be catastrophic.

The implications of a decline in the dollar’s status as a global reserve currency are far-reaching. A loss of confidence in US Treasuries could trigger a deep and lasting upheaval in the global financial system, with widespread implications for borrowing costs, mortgage rates, and public finances in the US. Global markets would also be affected, as the stability and predictability that the dollar has provided for so long begin to erode.

As Lena Petrova’s insightful video highlights, the warning signs are clear. The willingness among global investors to divest from US Treasuries is growing, driven by a rational reassessment of the risks involved. If this trend continues, the consequences will be severe and long-lasting.

In conclusion, the global financial landscape is on the brink of a significant transformation. The potential collapse of the US dollar’s status as a global reserve currency poses a significant threat to the stability of global markets, US fiscal health, and international relations.

As investors, policymakers, and global citizens, it’s essential that we understand the implications of this shift and prepare for the challenges that lie ahead.

For a more in-depth analysis of this critical issue, be sure to watch Lena Petrova’s full video, which provides further insights and information on this developing story.

As the situation continues to unfold, one thing is clear: the future of the global financial system hangs in the balance, and the consequences of inaction could be severe.

Seeds of Wisdom RV and Economics Updates Thursday Afternoon 1-22-26

Good Afternoon Dinar Recaps,

New Trade Map Emerges as Nations Adjust to U.S. Tariff Pressure

Davos signals accelerating shift toward a multipolar trade order

Good Afternoon Dinar Recaps,

New Trade Map Emerges as Nations Adjust to U.S. Tariff Pressure

Davos signals accelerating shift toward a multipolar trade order

Overview

Global leaders gathering at the World Economic Forum (WEF) 2026 in Davos are openly acknowledging that the post-Cold War trade architecture is fracturing. In response to renewed U.S. tariff pressure and policy unpredictability, countries are actively redrawing trade routes, accelerating regional agreements, and diversifying away from U.S.-centric dependency.

This emerging “new trade map” reflects structural change — not temporary hedging.

Key Developments

1. Trade Diversification Accelerates

Officials confirmed that countries are prioritizing regional and bilateral trade frameworks to reduce exposure to U.S. tariffs. Canada expanded cooperation with China on electric vehicles and agricultural exports, while Europe finalized long-delayed agreements with South American partners.

2. Davos Tone Shifts From Coordination to Insulation

Instead of reinforcing global trade cooperation, Davos discussions centered on risk insulation, supply-chain redundancy, and sovereign leverage, signaling declining confidence in unified global trade governance.

3. Declining U.S. Share of Global Trade

Analysts warned that repeated tariff shocks could permanently reduce the U.S. share of global trade flows, pushing commerce toward BRICS+, regional blocs, and non-Western settlement frameworks.

4. BRICS and Regional Blocs Gain Momentum

As Western trade unity weakens, BRICS and plurilateral agreements are increasingly viewed as stabilizing alternatives — particularly for emerging and developing economies.

Why It Matters

Trade systems underpin monetary systems. When trade fragments, currency usage, settlement mechanisms, and reserve strategies fragment with it. The Davos shift confirms that globalization is not ending — it is re-routing.

Why It Matters to Foreign Currency Holders

For holders anticipating currency realignment:

Trade diversification supports multi-currency settlement

Reduced U.S. trade dominance weakens exclusive dollar demand

Regional trade pacts often precede currency repricing or recalibration

Trade realignment is often a precursor, not a byproduct, of monetary reset.

Implications for the Global Reset

Pillar 1: Multipolar Trade Infrastructure

The erosion of a single dominant trade hub supports a multipolar monetary environment, where no single currency monopolizes settlement.

Pillar 2: Structural, Not Cyclical Change

This is not a trade cycle — it is systemic realignment, reshaping how value moves across borders.

This is not trade volatility — it’s trade architecture being rewritten in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — New trade map takes shape in Davos as world adjusts to Trump tariffs

World Economic Forum coverage via Reuters — Davos trade policy reporting

~~~~~~~~~~

BRICS Expansion Accelerates as New Members Prepare to Join in 2026

Partner-country system fuels strategic growth beyond Western institutions

Overview

BRICS is preparing for another phase of strategic expansion in 2026, as more than 50 countries express interest and over 20 formal applications are already under review. Rather than rushing full membership, the bloc is deploying a partner-country framework designed to manage growth while preserving cohesion.

What began in 2006 as a four-nation concept has evolved into a multi-tiered economic alliance that now includes 11 full members and 10 partner nations, reflecting a broader shift among emerging economies toward cooperation outside traditional Western-led systems.

Key Developments

Over 50 countries have expressed interest in BRICS participation

10 partner nations recognized under the new engagement framework

11 full members now comprise the core bloc

India assumes BRICS presidency in 2026, overseeing expansion decisions

Partner-country system allows gradual integration before full membership

Partner-Country Framework Expands Reach

At the 2024 Kazan Summit in Russia, BRICS introduced a new partner-country tier to manage expansion efficiently. Ten nations were recognized under this framework: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, Uzbekistan, and Vietnam.

Vietnam’s formal acceptance in early 2026 finalized the initial partner list. This status allows participation in BRICS initiatives, summits, and working groups without immediate voting rights, providing a phased pathway toward deeper integration.

Indian Prime Minister Narendra Modi summarized the strategic direction clearly:

“India would give a new form to the BRICS grouping during its presidency in 2026.”

Current Members and Applicant Nations

The BRICS bloc now consists of 11 full members:

Brazil, China, Egypt, Ethiopia, India, Indonesia, Iran, Russia, Saudi Arabia, South Africa, and the United Arab Emirates.

Indonesia’s accession in January 2025 marked the first Southeast Asian entry, reinforcing BRICS’ global diversification.

Countries seeking full membership or under evaluation include Algeria, Azerbaijan, Bahrain, Bangladesh, Pakistan, Serbia, Sri Lanka, Syria, Turkey, Venezuela, and Zimbabwe — a list spanning multiple regions and economic profiles.

Victoria Panova, Head of the BRICS Expert Council—Russia, clarified the intent:

“BRICS aims to make a fairer world order. Expansion is not an aim in itself.”

India’s Leadership Role in 2026

India officially assumed the BRICS presidency on January 1, 2026, marking its fourth term in leadership. The presidency theme centers on resilience, innovation, cooperation, and sustainability, signaling a cautious but purposeful expansion strategy.

India will host the 18th BRICS Summit, where final decisions on new full members are expected. Officials describe India’s stance as calibrated, prioritizing unity within the growing bloc over rapid enlargement.

South African Finance Minister Enoch Godongwana confirmed expansion momentum:

“There is a second batch of countries that are going to be added to BRICS.”

Economic Weight and Global Influence

BRICS nations now account for roughly 39% of global GDP (PPP) and represent nearly half of the world’s population. The bloc’s New Development Bank has deployed more than $32 billion across 96 projects, offering alternatives to IMF and World Bank financing structures.

For many applicant nations, BRICS represents financial optionality — not ideological alignment — amid dissatisfaction with Western-dominated institutions and conditional lending models

Why It Matters

Expansion strengthens multipolar economic governance

Partner-country tier prevents fragmentation while enabling growth

Emerging markets gain institutional leverage outside Western systems

Consensus-based decision-making preserves bloc stability

BRICS growth reflects structural realignment, not short-term politics.

Why It Matters to Foreign Currency Holders

Expansion increases local-currency trade pathways

New members often pursue reserve diversification strategies

Reduced reliance on dollar-centric systems supports revaluation narratives

Gradual integration aligns with long-horizon Global Reset positioning

Foreign currency holders are watching the architecture, not the headlines.

Implications for the Global Reset

Pillar 1: Institutional Multipolarity

BRICS expansion accelerates the shift away from single-center global governance toward regional and bloc-based frameworks.

Pillar 2: Currency and Trade Optionality

New members and partners increase demand for non-dollar settlement mechanisms, reinforcing long-term monetary diversification.

This is not just politics — it’s global finance restructuring before our eyes.

Strategic Takeaway

BRICS is scaling deliberately, not recklessly, using partnership tiers to reshape global cooperation without destabilizing existing systems.

When the old gatekeepers stall, new doors get built

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS: New Members to Join in 2026 Strategic Expansion”

Reuters – “BRICS Expansion Draws Dozens of Countries Seeking Alternative Alliances”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Echo X: This is Big, Connect the Dots

Echo X: This is Big, Connect the Dots

1-21-2026

Echo 𝕏 @echodatruth

After speaking at the World Economic Forum, Donald Trump said he looks forward to signing the Market Structure Bill to unlock financial freedom for Americans, or China will dominate this market.

Then the White House Crypto Czar David Sacks confirms it:

“Once market structure legislation passes, banks will get fully into crypto…

Echo X: This is Big, Connect the Dots

1-21-2026

Echo 𝕏 @echodatruth

After speaking at the World Economic Forum, Donald Trump said he looks forward to signing the Market Structure Bill to unlock financial freedom for Americans, or China will dominate this market.

Then the White House Crypto Czar David Sacks confirms it:

“Once market structure legislation passes, banks will get fully into crypto…

They’ll be deep in the stablecoin business to offer yield and stay competitive.”

Here’s what most people are missing

This is NOT Banks vs Crypto.

It’s Centralized Middlemen vs Decentralized Access.

What the bill actually unlocks:

Community banks & credit unions onboarding digital assets

Regulated on-ramps into DeFi

Stablecoin yield earned on-chain, not parked on centralized exchanges

Capital in motion, not idle custodial yield

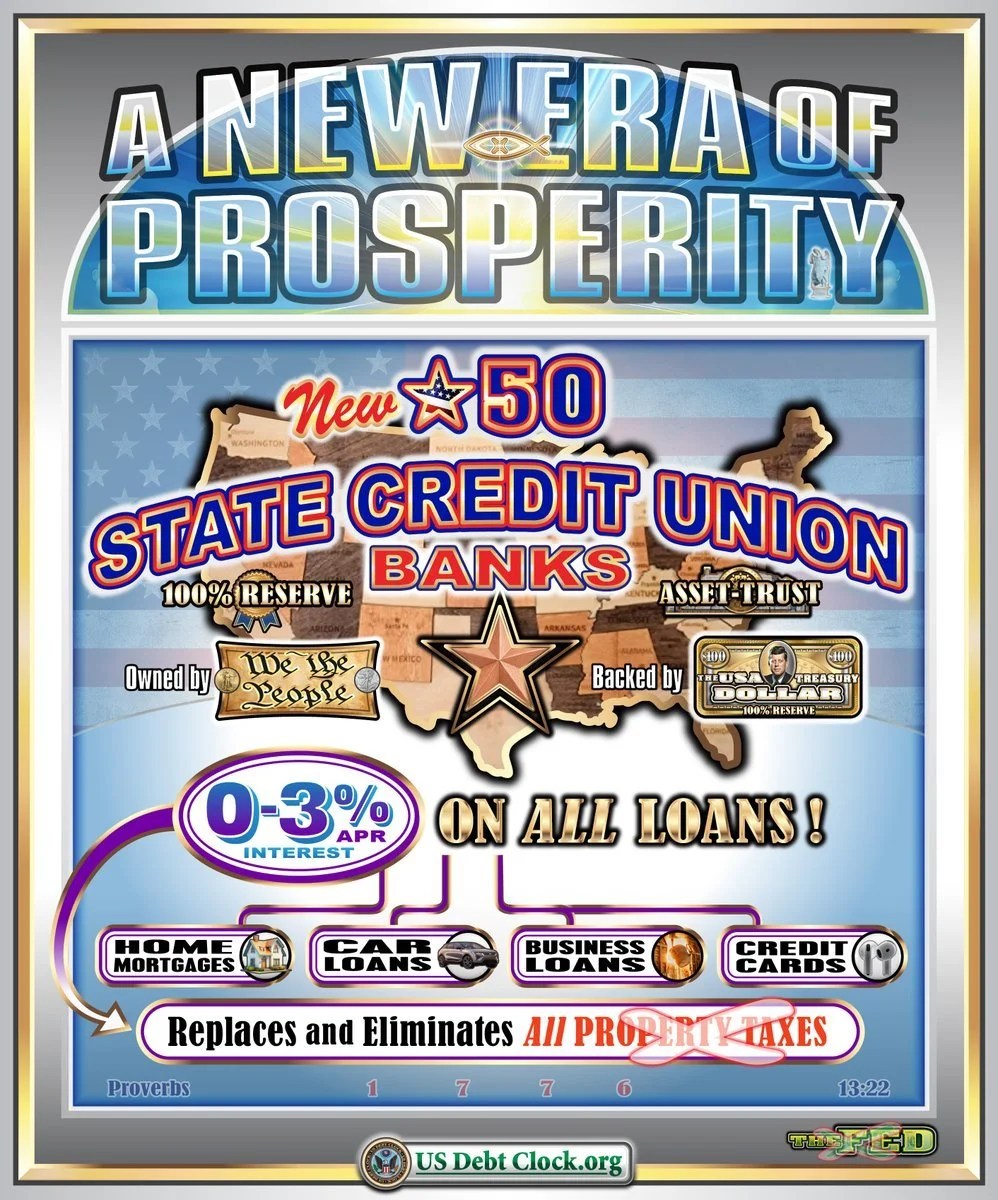

Credit unions don’t have shareholders.

They’re owned by the people.

That means:

Higher yields

Lower fees

Direct access to DeFi

No need to trust a centralized exchange acting like a bank

Meanwhile, some centralized exchanges are pretending to fight banks…

while quietly partnering with big banks and recreating the same old system.

If you’re earning 3–4% on a centralized exchange,

wait until community banks + DeFi rails go live.

This is mainstream integration, but done the right way.

The rails are being laid.

The gatekeepers are losing control.

Know What You Hold!

Trump at Davos: https://twitter.com/i/status/2013994123951251626

US Debt Clock: usdebtclock.org

News, Rumors and Opinions Thursday 1-22-2026

Paul Gold Eagle: We are Witnessing a Monetary Reset

1-22-2026

This is a monetary reset not market speculation.

Trust has been broken and people see that Fiat Currency is the biggest Ponzi scheme of all.

Fiat Currency is backed by “The Full Faith and Credit”

The US alone is racking up a Trillion in debt approximately every 100 days.

It’s roughly 3 Billion a day to service the debt.

Paul Gold Eagle: We are Witnessing a Monetary Reset

1-22-2026

This is a monetary reset not market speculation.

Trust has been broken and people see that Fiat Currency is the biggest Ponzi scheme of all.

Fiat Currency is backed by “The Full Faith and Credit”

The US alone is racking up a Trillion in debt approximately every 100 days.

It’s roughly 3 Billion a day to service the debt.

Fractional Reserve Banking

This is where Banks create money out of debt.

Since March 2020 Banks don’t even need to hold the 10% reserve anymore.

The system is backed by NOTHING

FIAT CURRENCY IS A PONZI SCHEME

Andy Schectman: https://twitter.com/i/status/2014215160819601799

https://dinarchronicles.com/2026/01/22/paul-gold-eagle-we-are-witnessing-a-monetary-reset/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick Article: "The Board of Directors of the Center for Banking Studies discusses activating international partnerships to support banking reform in Iraq" Quote: "These efforts are in line with... addressing the challenges of compliance with FATF, Basel and IFRS requirements, thereby...improving the readiness of Iraqi banks to integrate into the international financial system." This is coming from the ones at the CBI that make all the decisions on the monetary reform, on the new exchange rate. This is the board of directors that tell Alaq what to do and what to say. These are the straight directors from the board of directors directing Alaq to say these words. These are the one in negotiations with the Untied States of America...

Frank26 [Update from an Iraqi] MR. D: My wife is Iraqi and she said, 'Did you see the picture [of Trump, Savaya and the old dinar note]?'...She said the picture has a cultural significance...We saw there were 3 military coins in front of Donald Trump. The army, the navy and the US marine Corps coins. Those were the 3 we recognized. Behind that was the dinar with Saddam Hussein on it. The significance of that was it was a 5 dinar, "Swiss note". She said that in itself was culturally significant because what they're telling the people is the president is in support of the Iraqi people and he was sending a message to the politicians that they needed to get their currency straight, start supporting their people, that they were going to receive one of two things... [Post 1 of 2...stay tuned]

Frank26 "...the easy way which is the revaluation, the country was going to be put in peace, the people were going to become very prosperous. Or the hard way, which is we have the Army coin, which is black and gold, the Naval coin, which is white and blue and the Marine Corps coin which is red and gold. That was in front of the president...This is all over the Aribic media. They've got the message as to what Donald Trump is saying...You can take the carrot, revaluate your currency...Culturally the messaging is good. Donald Trump is the ultimate communicator. When he does these things he's sending a message very clearly. According to what my wife said, within the Arabic Middle East, the message has gotten out. He wants the Iranians out. He wants the Iraqi people set free to have their financial stability..." FRANK: I want to thank you and your wife. You guys were very instrumental in helping us... [Post 2 of 2]

Silver's Move Hasn't Even Started | Gregory Mannarino

Liberty and Finance: 1-21-2026

Gregory Manarino argues that silver remains profoundly undervalued because its pricing sits atop an overleveraged debt market that functions like a pressure cooker with the lid clamped down by policy intervention.

He explains how suppressed interest rates, paper derivatives, and central bank balance sheet expansion distort price discovery, using the contrast between physical metal ownership and paper contracts as a plain language example of systemic fragility.

From there, he frames the US financial system as infrastructure built on perpetual debt expansion, where the Fed Treasury complex acts as both buyer and lender of last resort, crowding out genuine market signals.

Manarino extends this analysis to emerging mechanisms such as tokenization and stablecoins, describing them as new plumbing layered onto an already unstable foundation rather than true reform.

The economic consequence, he warns, points toward currency debasement, further wealth concentration, and a sharp repricing of real assets like silver once the debt market finally asserts gravity over illusion.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Silver market update

12:00 Debt situation

27:27 The path forward

Seeds of Wisdom RV and Economics Updates Thursday Morning 1-22-26

Good Morning Dinar Recaps,

Trump Cancels EU Tariffs After Greenland Framework Deal

De-escalation at Davos eases markets — but EU caution and trade politics remain in play

Good Morning Dinar Recaps,

Trump Cancels EU Tariffs After Greenland Framework Deal

De-escalation at Davos eases markets — but EU caution and trade politics remain in play

Overview

President Donald Trump announced at the World Economic Forum (WEF) in Davos that he will cancel planned tariffs on European Union and NATO countries that had been set to take effect in February. The reversal followed Trump’s statement that he and NATO Secretary General Mark Rutte have reached a “framework of a future deal” on Greenland and the broader Arctic region. The announcement was viewed by markets as a de-escalation of trade and geopolitical risk, triggering rallies in stocks and easing transatlantic tensions — at least temporarily.

Key Developments

1. Tariff Threats Withdrawn After Framework Talks

Trump confirmed that the tariffs — originally intended to pressure Denmark and other European allies over their opposition to U.S. influence in Greenland — will not be imposed on February 1 as previously threatened. He framed this as the result of productive discussions with NATO leadership on Arctic cooperation.

2. Markets React Positively

Financial markets responded sharply to the tariff cancellation. Major U.S. equity indices rose, and safe-haven pressures eased, as investors interpreted the move as a reduction in short-term geopolitical and trade risk.

3. EU Response: Caution and Concern

European leaders and institutions had previously strongly condemned Trump’s tariff threats, with European Commission officials calling the original plan a “mistake” and warning that any coercive trade measures would harm transatlantic relations. Even after the tariff cancellation, the EU emphasized that sovereignty and respect for international trade norms must be upheld, and work on ratifying broader trade agreements may remain paused or subject to review due to the episode.

Why It Matters

This reversal marks a significant softening of one of the most acute trade flashpoints between the U.S. and Europe in years. While it temporarily defuses the threat of a tariff battle that could have spilled into a broader trade conflict, the underlying strategic tensions around Arctic security and alliance cohesion remain unresolved. The incident underscores how geopolitical bargaining can ripple through trade policy, influence markets, and affect policy coordination among major economic powers.

Why It Matters to Foreign Currency Holders

For foreign currency holders monitoring reset and realignment signals:

Tariff threats and reversals affect risk sentiment, often driving shifts into safe-haven currencies and assets.

Ongoing U.S.–EU diplomatic friction, even when de-escalated, can fuel demand for reserve diversification.

The Arctic’s strategic importance and evolving cooperation frameworks could influence long-term commodity flows and capital allocation, which in turn affect currency valuations.

Periods of elevated geopolitical risk tend to coincide with currency volatility and repositioning in global portfolios.

Implications for the Global Reset

Pillar 1: Geoeconomic Policy Intertwined with Security

Trade tools like tariffs are increasingly used within broader security negotiations — a shift that blurs lines between economic policy and strategic competition.

Pillar 2: Transatlantic Trust and Monetary Stability

While the tariff threat has been withdrawn, European caution signals that institutional trust has been tested, potentially weakening cooperative frameworks that support stable currency relationships and economic integration.

This is not merely tariff news — it is a signal of how geopolitical leverage shapes global economic architectures.

This is not a permanent peace — it’s a tactical retreat that leaves underlying strategic tensions unaddressed.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Instant market reaction as Trump withdraws tariff threat after Greenland framework deal

Mint – EU considers suspending trade deal amid tariff controversy

~~~~~~~~~~

Putin Signals Russia Could Contribute $1 Billion to Trump’s “Board of Peace”

Russia considers using frozen assets to back U.S.-led peace initiative — a geopolitical pivot with economic ripples

Overview

Russian President **Vladimir Putin said Moscow could provide $1 billion — from Russian assets currently frozen abroad — to support U.S. President Donald Trump’s newly proposed “Board of Peace” initiative. The board was recently unveiled at the World Economic Forum in Davos as part of a broader plan to manage peace, reconstruction, and coordination in Gaza following a ceasefire. Putin’s comments came during a meeting of Russia’s Security Council, as officials weigh the cost, mechanics, and strategic implications of joining the initiative.

Key Developments

1. Putin Offers $1 Billion From Frozen Russian Assets

President Putin stated that Russia could supply $1 billion toward the Board of Peace — a payment reportedly tied to securing a permanent membership seat on the body. He suggested the funds could come from Russian assets currently frozen in the United States, pending further review by the foreign ministry.

2. Security Council Instructed to Study Proposal

Putin said he had directed Russia’s foreign ministry to review the proposal in detail and consult strategic partners before making a formal commitment. The assessment will consider how participation aligns with Russian foreign policy priorities and international positioning.

3. Board of Peace Context and Funding Mechanism

The Board of Peace is a U.S.-promoted international body aimed at coordinating peace, funding, and reconstruction efforts — originally focused on Gaza. Permanent membership reportedly entails a $1 billion contribution, though invited states can participate initially without payment. Several nations have already been contacted, and the board’s mandate could extend beyond the Middle East.

Why It Matters

Putin’s offer — tentative as it may be — signals a rare moment of potential cooperation between the U.S. and Russia on a high-profile international governance project, despite deep tensions over Ukraine and wider geopolitical rivalry. If realized, the move could shift diplomatic perceptions and introduce new financial dynamics into peacebuilding efforts that historically have been led by multilateral institutions like the United Nations.

Putin’s emphasis on using frozen assets adds layers of complexity, as it intersects with sanctions regimes, sovereign claims on foreign-held funds, and broader strategic leverage between major powers.

Why It Matters to Foreign Currency Holders

For currency holders watching reset and realignment signals:

A high-profile international initiative with state financial contributions can influence investor risk sentiment, especially if linked to asset mobilization from frozen reserves.

Use of frozen foreign assets in geopolitical diplomacy may shift perceptions of sovereign credit, reserve stability, and external balance sheet risks.

Cooperative signaling between geopolitical rivals — even tentative — can reduce systemic risk premia and affect currency valuations tied to safe-haven status.

Periods of diplomatic innovation often translate into capital flow shifts and repricing across fixed income and FX markets.

Implications for the Global Reset

Pillar 1: New Models of “Global Governance Funding”