Seeds of Wisdom RV and Economics Updates Monday Morning 12-29-25

Good Morning Dinar Recaps,

Iraq — Technically Ready, Politically Timed

Infrastructure aligned, reforms staged, execution dependent on stability

Good Morning Dinar Recaps,

Iraq — Technically Ready, Politically Timed

Infrastructure aligned, reforms staged, execution dependent on stability

Overview

Iraq has completed most technical requirements for modern banking and payments

Monetary and settlement infrastructure is largely in place

Currency reform is paced deliberately to align with political stability

Timing, not capability, is the gating factor

Key Developments

Banking system upgrades have aligned Iraq with international compliance standards

Payment rails and settlement mechanisms have been modernized and tested

Foreign reserve management has improved, supporting monetary credibility

Oil revenue continues to anchor fiscal capacity and balance-of-payments strength

Political coordination remains the primary variable influencing execution timing

Gradual reform sequencing is favored over abrupt currency actions

Why It Matters

Iraq’s position illustrates a core truth of financial resets: technical readiness does not equal political readiness. The systems can be prepared, tested, and compliant, but execution depends on governance stability and coordinated policy decisions. Iraq’s measured approach reduces the risk of disruption while preserving the option to act when conditions align.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iraq represents a case where infrastructure readiness precedes visible change. This creates extended periods of anticipation followed by decisive movement. Watching political alignment, regulatory clarity, and fiscal coordination matters more than tracking technical milestones already achieved.

Implications for the Global Reset

Pillar: Infrastructure First, Policy Follows

Systems are built quietly before public currency actions occur.Pillar: Timing Protects Stability

Deliberate sequencing reduces volatility during transition.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

International Monetary Fund — “Republic of Iraq: Financial Sector and Monetary Policy Overview”

Bank for International Settlements — “Payment System Modernization and Cross-Border Settlement”

~~~~~~~~~~

Vietnam — Quietly Ready, Strategically Patient

Why disciplined preparation matters more than dramatic moves

Overview

Vietnam is among the most structurally prepared emerging economies

Readiness has been built through manufacturing depth, trade integration, and monetary discipline

Digital payment infrastructure is expanding rapidly without destabilizing reforms

Vietnam’s strategy prioritizes stability, timing, and system alignment

Key Developments

Vietnam is deeply embedded in global manufacturing supply chains

Monetary policy remains conservative and stability-focused

Foreign reserves have been managed prudently relative to growth

Digital and cashless payment systems continue to scale nationally

Trade relationships are diversified across major economic blocs

Policy direction favors readiness without disruption

Why It Matters

Vietnam demonstrates how financial transitions occur without chaos. Instead of forcing currency shocks or public realignments, Vietnam has quietly aligned its infrastructure, reserves, and trade relationships. This approach reduces volatility while preserving flexibility when broader global shifts accelerate.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Vietnam illustrates that system readiness does not require headlines. Countries that modernize payment rails, maintain disciplined monetary policy, and integrate deeply into global trade are positioned to adapt smoothly during global resets. Quiet preparation often outperforms reactive policy shifts when currencies realign.

Implications for the Global Reset

Pillar: Stability Before Repricing

Countries that build quietly reduce shock risk during transition.Pillar: Infrastructure Signals Readiness

Payments, reserves, and trade alignment matter more than rhetoric.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Ukraine Peace Talks Reach Advanced Stage After Trump–Zelensky Meeting

Multi-hour Florida summit signals nearing resolution while key obstacles remain

Overview

Ukrainian President Volodymyr Zelensky and U.S. President Donald Trump report substantial progress toward a negotiated peace agreement

Negotiators claim 90–95% of a proposed 20-point peace framework is agreed

U.S.–Ukraine security guarantees are described as fully settled

Final outcomes hinge on unresolved territorial, nuclear, and ceasefire issue

Key Developments

Zelensky confirmed that approximately 90% of the 20-point peace plan is finalized

Trump stated negotiators have resolved roughly 95% of the issues required to end the war

U.S.–Ukraine security guarantees were described as “100% agreed” and a critical milestone

Trump suggested clarity on success or failure would emerge within weeks

Trump conducted a two-hour phone call with Russian President Vladimir Putin prior to the meeting and planned follow-up discussions

Negotiating teams are expected to reconvene in the coming weeks, potentially with European leaders present

Outstanding Obstacles

Territorial Disputes: The status of the Donbas region remains the most contentious issue, with Trump warning Ukraine may face further losses if talks stall

Zaporizhzhia Nuclear Power Plant: The U.S. proposed a joint operational framework involving Russia, which Zelensky has rejected

Ceasefire Conditions: Zelensky insists a national referendum is required for any territorial concessions, while Russia has not yet agreed to a ceasefire to enable such a vote

Why It Matters

This negotiation phase represents more than a bilateral peace effort — it reflects broader geopolitical recalibration. A resolution to the Ukraine conflict would reduce systemic risk across energy markets, sovereign debt exposure, and European financial stability. The pace and structure of the deal signal that global powers are prioritizing managed outcomes over prolonged uncertainty.

Why It Matters to Foreign Currency Holders

For foreign currency holders, progress toward a Ukraine peace agreement directly impacts risk premiums, currency valuation, and capital flows. Prolonged conflict forces governments to fund defense, energy subsidies, and reconstruction through debt expansion, which weakens currency credibility over time. A credible path to peace reduces these pressures and shifts focus toward fiscal normalization.

Peace also stabilizes Europe’s energy outlook. Lower geopolitical risk in Eastern Europe reduces volatility in energy pricing, which directly affects inflation, trade balances, and central bank policy across multiple currencies. When inflation pressure eases, currencies tied to disciplined monetary policy regain relative strength.

Most importantly, conflict resolution allows global capital to move from defensive positioning into restructuring mode. Investors begin repricing currencies based on infrastructure readiness, trade integration, and settlement efficiency rather than wartime uncertainty. Currencies backed by stable governance, secure energy access, and modern payment systems gain durability, while those reliant on emergency funding and prolonged instability face repricing risk.

In reset terms, peace does not trigger revaluation — it removes the final obstacle that allows revaluation mechanics to proceed.

Implications for the Global Reset

Pillar: Conflict Resolution Enables Financial Repricing

Large-scale geopolitical conflicts delay capital reallocation. Peace unlocks restructuring across trade, energy, and currency markets.

Pillar: Security Guarantees Anchor Stability

Formalized security frameworks reduce uncertainty premiums embedded in global markets.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Zelenskiy meets Trump in Florida to discuss Ukraine peace plan”

CNN — “Takeaways from Trump’s meeting with Zelensky in Florida”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

FRANK26….12-28-25…..90 DAYS

KTFA

Sunday Night Video

FRANK26….12-28-25…..90 DAYS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….12-28-25…..90 DAYS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

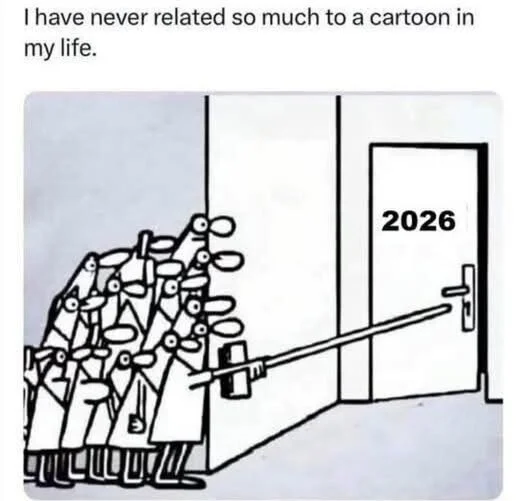

Why 2026 will be the End of the Fiat Experiment

Why 2026 will be the End of the Fiat Experiment

As Good As Gold Australia: 12-28-2025

As we navigate the complexities of the current financial landscape, industry experts Daryl Payne, CEO of As Good as Gold Australia, and Alasdair Macleod offer a stark warning: the global economy is on the brink of a significant upheaval.

In a detailed discussion, they shed light on the precious metals market, particularly silver and gold, and what the future holds for these assets amidst growing economic instability.

Why 2026 will be the End of the Fiat Experiment

As Good As Gold Australia: 12-28-2025

As we navigate the complexities of the current financial landscape, industry experts Daryl Payne, CEO of As Good as Gold Australia, and Alasdair Macleod offer a stark warning: the global economy is on the brink of a significant upheaval.

In a detailed discussion, they shed light on the precious metals market, particularly silver and gold, and what the future holds for these assets amidst growing economic instability.

The conversation begins with silver, a metal that has been quietly gaining momentum. Alasdair Macleod highlights that silver prices are experiencing an extraordinary rise, primarily driven by industrial demand.

The surge in emerging technologies, such as electric vehicle batteries, has significantly increased the demand for silver, propelling its price upwards. Moreover, central banks, especially in Asia, are accumulating silver reserves, further bolstering its value.

Macleod emphasizes that the long-term suppression of silver prices is finally correcting itself, reflecting fundamental changes in demand.

This breakout is not just a market fluctuation; it’s a significant shift that investors should take note of. As the world transitions towards greener technologies, the demand for silver is expected to continue its upward trajectory, making it a critical asset to watch in the coming years.

The discussion then shifts to gold, an asset that has traditionally served as a safe haven during times of economic uncertainty.

Alasdair Macleod underscores gold’s role as a monetary asset, particularly in an era where fiat currencies are facing increasing instability. The U.S. dollar, a long-standing global reserve currency, is under scrutiny as the global economy grapples with massive credit and equity bubbles.

Macleod warns that the current global credit and equity bubble is the largest in recorded history, far surpassing the 1929 crash.

As this bubble nears its bursting point, the repercussions will be severe, including rising bond yields, plummeting equity prices, and heightened counterparty risks. In such a scenario, gold is poised to play a crucial role as a safe-haven asset, protecting investors from the impending financial storm.

The conversation also delves into the broader geopolitical and currency implications of the current financial landscape.

The era of fiat currency is seen to be in decline, with major currencies like the U.S. dollar facing a loss of purchasing power. China is strategically positioning itself with gold-backed yuan trade settlements and forming alliances through BRICS and the Shanghai Cooperation Organization.

Meanwhile, Europe and NATO are experiencing political fractures that could further destabilize the global financial system.

As the geopolitical landscape continues to evolve, the importance of holding assets that are insulated from these risks becomes increasingly evident.

Alasdair Macleod stresses that rising inflation is inevitable and that governments may resort to price controls, which will only exacerbate economic pain for ordinary people. In this context, preserving wealth through hard assets like gold and silver becomes a prudent strategy. Macleod urges investors not to wait for price dips but to secure their holdings promptly.

The key takeaway is clear: in uncertain times, understanding the dynamics of the precious metals market and the broader financial environment is crucial for protecting individual and community wealth. Education and awareness are the first steps towards making informed investment decisions.

The insights shared by Daryl Payne and Alasdair Macleod offer a compelling case for why gold and silver should be at the forefront of any investment strategy in the coming years.

As the global economy hurtles towards significant changes, these precious metals are poised to play a pivotal role in safeguarding wealth.

For those looking to navigate the complexities of the current financial landscape, the message is clear: now is the time to act.

Watch the full video from As Good As Gold to gain further insights into the precious metals market and how to protect your wealth in the face of looming financial uncertainty.

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Edu Matrix: 12-28-2025

The Iraqi dinar has long been a topic of interest among currency investors and enthusiasts, with many speculating about its potential appreciation.

However, skeptics and doubters have raised concerns about the likelihood of the dinar’s value increasing. A recent video addresses these concerns, outlining seven critical factors that the Iraqi government must fulfill before the currency can realistically increase in value.

Our IQD Investment is No Longer Speculative Now Classified as Inevitable

Edu Matrix: 12-28-2025

The Iraqi dinar has long been a topic of interest among currency investors and enthusiasts, with many speculating about its potential appreciation.

However, skeptics and doubters have raised concerns about the likelihood of the dinar’s value increasing. A recent video addresses these concerns, outlining seven critical factors that the Iraqi government must fulfill before the currency can realistically increase in value.

According to the speaker, the appreciation of the Iraqi dinar is not speculative, but rather inevitable once certain economic and political conditions are met.

So, what are these conditions, and how can they impact the dinar’s value?

One of the primary conditions for the dinar’s appreciation is reducing the excess dinars in circulation. This is a crucial step in stabilizing the currency and preventing inflation. By controlling the money supply, the Iraqi government can help maintain the dinar’s purchasing power and increase its value.

A robust banking system is essential for attracting foreign investment and promoting economic growth. The speaker emphasizes that the Iraqi banking system needs to be strengthened to support the dinar’s appreciation. This can be achieved by implementing modern banking practices, improving regulatory frameworks, and enhancing financial infrastructure.

Internal conflicts and political instability can deter investors and hinder economic growth. The speaker stresses that a stable government is vital for creating a favorable business environment, which can, in turn, support the dinar’s appreciation.

Iraq’s economy is heavily reliant on oil exports, making it vulnerable to fluctuations in global oil prices. Diversifying the economy and promoting other sectors, such as agriculture, tourism, and manufacturing, can help reduce this dependence and create a more stable economic foundation.

Adequate foreign reserves are essential for maintaining currency stability and supporting economic growth. The Iraqi government needs to build its foreign reserves to demonstrate its ability to manage the economy and stabilize the dinar.

To attract foreign investment and participate in the global economy, Iraq must comply with international financial rules and regulations. This includes implementing anti-money laundering (AML) and know-your-customer (KYC) regulations, as well as adhering to global standards for financial reporting and transparency.

The speaker highlights that one of the significant challenges facing Iraq is the resistance to interest-based financial systems and forex trading, driven by religious and political factors. This resistance hinders the country’s ability to adopt modern financial practices and integrate into the global economy.

While these conditions are being addressed, the speaker emphasizes that the eventual currency adjustment will be driven by global market forces, rather than speculative “revalue” claims. The exact future value of the dinar remains unknown, but holders of large amounts have the potential to capitalize significantly.

For investors looking to stay informed about the Iraqi dinar and other investment opportunities, the Edu Matrix channel offers a membership program that provides educational resources on asset growth and management. By joining the program, investors can gain valuable insights and stay ahead of the curve.

To learn more about the Iraqi dinar and its potential appreciation, watch the full video from Edu Matrix. With a deeper understanding of the seven critical factors outlined above, investors can make informed decisions and navigate the complex world of currency investment.

The Iraqi dinar’s potential appreciation is a topic of ongoing interest and debate. By understanding the critical factors that can impact its value, investors can make informed decisions and capitalize on emerging opportunities.

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 12-28-25

Good Afternoon Dinar Recaps,

Silver Market Structural Imbalance: Squeeze Signals and Supply Stress

Veteran analysts warn silver’s rally may reflect deeper market mechanics, not just short-term price moves

Good Afternoon Dinar Recaps,

Silver Market Structural Imbalance: Squeeze Signals and Supply Stress

Veteran analysts warn silver’s rally may reflect deeper market mechanics, not just short-term price moves

Overview

The silver market is experiencing a sustained structural supply-demand imbalance

Industrial demand has surged as inventories tighten and production remains constrained

Severe price action, record levels, and delivery stress suggest deeper stress in the paper–physical relationship

Analysts with decades of experience see conditions that diverge from normal market behavior

Key Developments

Silver prices have surged sharply in 2025, breaking multiple historic levels and outperforming other precious metals in percentage terms as demand outpaces supply

Market observers point to persistent supply deficits and expanding industrial usage, particularly in technology and clean energy sectors

Structural constraints on physical inventories — and tight access to deliverable metal — are beginning to influence pricing behavior in futures and spot markets, according to expert commentary and investor analysis

Paper markets now face growing scrutiny as analysts note large leveraged positions may be under stress in environments where physical is scarce and delivery demand rises

Why It Matters

This is not a garden-variety rally. What experienced market observers are describing is a shock to the balance between promises (paper contracts) and deliverable reality (metal inventories). When delivery obligations start to outrun physical availability, the market begins to price risk differently, shifting attention from purely financial trading to real asset scarcity. This dynamic can expose structural vulnerabilities that normal supply-demand analysis alone does not capture.

Why It Matters to Foreign Currency Holders

For foreign currency holders, a stressed foundational market such as silver represents more than industrial risk — it signals monetary and systemic liquidity dynamics at work. When asset markets begin reconciling paper positions with physical reality, confidence in financial promises shifts. Hard assets that can be physically owned and delivered become a hedge against both currency risk and counterparty risk, particularly in an era of high global debt and monetary expansion.

Implications for the Global Reset

Pillar: Asset Scarcity Reframes Price Discovery

Structural metal scarcity elevates real inventories above abstract price signals.Pillar: Real Commodities Matter in Financial Architecture

Markets that fail to reconcile physical constraints with financial instruments create systemic stress points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Youtube -- "If You Own SILVER, You Need to See THIS NOW!": Andy Schectman | Silver Price 2025

Reuters — “Silver surges past $35/oz level to hit more than 13-year high”

The Guardian — “Elon Musk warns of impact of record silver prices before China limits exports”

~~~~~~~~~~

Bitcoin vs ISO Assets: Speculation vs Infrastructure

Why narrative-driven assets behave differently from settlement-grade systems

Overview

Bitcoin and ISO-compliant digital assets serve fundamentally different roles

Bitcoin is driven by speculation, liquidity, and narrative

ISO assets are designed for regulated settlement and interoperability

Infrastructure assets gain value through use, not hype

The distinction matters as the global financial system modernizes

Key Developments

Bitcoin continues to dominate retail and institutional speculative exposure

ISO 20022 has become the standard language for global payments

Only a limited set of digital assets are compatible with institutional rails

Financial institutions prioritize speed, finality, cost, and compliance

Alternative settlement systems are being built alongside legacy rails

Asset-backed models are replacing debt-only expansion frameworks

Speculation vs Infrastructure: How They Differ

Bitcoin — A Speculative Asset

Bitcoin’s value is primarily driven by belief, scarcity narrative, and liquidity access. It trades like a macro risk asset, responding to sentiment, monetary policy expectations, and capital flows. Its design prioritizes decentralization and security over throughput, resulting in slower settlement times and higher transaction costs during congestion.

ISO-Compliant Assets — Financial Infrastructure

ISO assets are engineered for interoperability within regulated financial systems. Their value proposition lies in efficiency, not appreciation. These assets facilitate rapid settlement, low-cost transfers, and messaging compatibility with central banks and financial institutions. Adoption depends on legal clarity and operational necessity rather than market excitement.

Why It Matters

As the financial system transitions, speculation and infrastructure will not be valued the same way. Speculative assets inflate early in cycles when liquidity is abundant. Infrastructure assets become indispensable later, when systems require reliability and scale. Confusing these roles leads to misaligned expectations about price behavior and adoption timelines.

Why It Matters to Foreign Currency Holders

For foreign currency holders, understanding this distinction is critical. Speculative assets may offer volatility-driven gains but lack settlement reliability. Infrastructure assets support cross-border trade, liquidity management, and monetary stability. As countries modernize payment systems, currencies aligned with ISO-compliant rails and asset-backed frameworks gain durability.

Implications for the Global Reset

Pillar: Narrative Leads, Infrastructure Lasts

Speculation captures attention early; systems that move value endure.Pillar: Function Determines Survival

Assets integrated into payment and settlement networks outlast those reliant on belief alone.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – “ISO 20022 and the evolution of global payment systems”

International Monetary Fund – “Global financial architecture and cross-border payment reform”

~~~~~~~~~~

Bitcoin vs XRP vs Gold: Speculation, Settlement, and Sovereign Trust

Three assets, three roles, one transforming financial system

Overview

Bitcoin, XRP, and gold serve distinct and non-interchangeable functions

Bitcoin operates as a speculative digital asset

XRP is designed for high-speed settlement and liquidity bridging

Gold remains the ultimate sovereign reserve asset

Confusing these roles leads to incorrect expectations about value and adoption

Key Developments

Bitcoin dominates digital asset speculation and liquidity flows

XRP continues integration into cross-border payment infrastructure

Central banks remain aggressive buyers of physical gold

Payment systems are upgrading to ISO-compliant digital rails

Asset-backed settlement models are gaining institutional support

Monetary systems are separating value storage from value movement

Role Comparison: How Each Asset Functions

Bitcoin — Speculation and Narrative

Bitcoin’s value is driven by belief, liquidity, and scarcity narrative. It performs well during risk-on cycles and monetary expansion. However, limited throughput, higher fees during congestion, and slow finality restrict its usefulness as a settlement asset at institutional scale.

XRP — Settlement and Liquidity

XRP was engineered to move value quickly, cheaply, and with finality. Its role is not to replace sovereign currencies, but to bridge them. XRP reduces reliance on pre-funded accounts and enables real-time cross-border settlement. Adoption depends on regulatory clarity and operational efficiency rather than speculative demand.

Gold — Sovereign Trust and Collateral

Gold anchors monetary confidence. It carries no counterparty risk and has functioned as a reserve asset across centuries. Central banks accumulate gold to protect balance sheets against currency debasement, sanctions, and systemic shocks. Gold does not move value — it secures it.

Why It Matters

The evolving financial system is modular. Different assets perform different tasks. Bitcoin captures speculative attention, XRP facilitates movement, and gold anchors trust. Systems that mistake speculation for infrastructure risk instability. Systems that align assets to function gain resilience.

Why It Matters to Foreign Currency Holders

For foreign currency holders, this distinction determines exposure. Speculative assets respond to sentiment. Settlement assets respond to usage. Reserve assets respond to confidence breakdowns. As the reset progresses, currencies tied to efficient settlement and credible reserves gain strength relative to those dependent on debt expansion alone.

Implications for the Global Reset

Pillar: Function Over Hype

Assets survive based on utility, not popularity.Pillar: Separation of Roles

Storing value, moving value, and pricing risk require different tools.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

World Gold Council – “Central banks and gold: reserve diversification trends”

Bank for International Settlements – “Cross-border payments and settlement modernization”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Sunday 12-28-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 28 Dec. 2025

Compiled Sun. 28 Dec. 2025 12:01 am EST by Judy Byington

Sat. 27 Dec. 2025 Something big just happened, and most people missed it. …Charlie Ward and Friends on Telegram

For nearly a year, President Trump has been (allegedly) executing a quiet but deliberate economic realignment. While the public focused on headlines about inflation, gas prices, and GDP, the real operation unfolded behind the scenes. That was intentional. This was never meant to be a media event.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sun. 28 Dec. 2025

Compiled Sun. 28 Dec. 2025 12:01 am EST by Judy Byington

Sat. 27 Dec. 2025 Something big just happened, and most people missed it. …Charlie Ward and Friends on Telegram

For nearly a year, President Trump has been (allegedly) executing a quiet but deliberate economic realignment. While the public focused on headlines about inflation, gas prices, and GDP, the real operation unfolded behind the scenes. That was intentional. This was never meant to be a media event.

The surface indicators told part of the story. Fuel prices dropped. GDP stabilized. Consumer spending surged. Inflation cooled. Wages began catching up. Analysts called it a “soft recovery,” but the explanation never fit. This was not market correction. It was structural intervention.

Domestic energy production was restored by removing global regulatory locks disguised as environmental policy. Transportation costs collapsed as internal supply chains were rebuilt. ESG capital lost its grip on logistics and pricing. Foreign backchannels that inflated costs were severed. The pressure on households was not eased by chance. It was forced.

But those moves were only preparation. The real shift is happening now. NESARA systems are already (allegedly) active inside classified Treasury routing layers. Asset backed recalibration protocols have been (allegedly) uploaded to QFS nodes. Debt cancellation frameworks are (allegedly) live.

Seizure orders tied to criminal finance networks are being executed and reassigned through the only system built to survive this transition.

Tier 1 transfers have begun. Over ninety thousand ledger synced accounts are already (allegedly) in pre-disbursement status. Military supervised sync centers reported live movement days ago. Redemption infrastructure has moved into continuous readiness. These funds are not tax revenue or stimulus. They are reclaimed assets taken from trafficking, war profiteering, and offshore laundering operations and rerouted under sovereign settlement rules.

This is why the banks are silent. Retail institutions are (allegedly) positioning quietly. The Federal Reserve has stopped forward guidance. European clearinghouses are freezing payouts without explanation. The old system is(allegedly) being powered down gradually while the new one runs in parallel.

December is not random. It is the staging window. The full system switch is scheduled for January. Infrastructure is already deployed. Legacy fiat accounts are being detached from settlement layers. Once Tier 1 closes, that channel closes with it.

This was never about convincing the public. The public only understands after transitions are complete. Trump is not campaigning on the economy. He is dismantling the architecture that made permanent control possible.

If you are already positioned, there is nothing to wait for. Tier 1 is operational and nearly complete. Everyone else will learn what happened after the wealth has already moved.

The dollar will not vanish overnight. It will drain slowly while the asset backed system accelerates.

When people finally ask where the money went, the answer will be simple. It went to those who were paying attention.

~~~~~~~~~~~

World Economic Situation:

Sat. 27 Dec. 2025 A quiet panic is spreading through the global banking system, and it has nothing to do with markets. What is happening now is structural dismantling.

The old control grid built on debt, surveillance, and behavioral compliance is (allegedly) being taken apart deliberately and permanently. Banks are not collapsing on their own. They are (allegedly) being shut down node by node.

When Donald Trump returned to office in January 2025, the covert phase ended. Years of preparation(allegedly) moved into execution. Central-bank choke points were severed. Hidden asset pipelines were seized. Quantum-aligned financial channels were activated. Redemption Centers (allegedly) came online.

From that moment forward, gold recalibration systems began syncing across secure networks. Wealth that had been (allegedly) trapped inside elite-controlled structures started moving through verified, non-bank pathways. The press said nothing. But military cyber units, Treasury white hats, and intelligence veterans across multiple allied nations saw the same data: a banking system bleeding assets, fabricating solvency, running ghost ledgers, and scrambling to relocate gold like a collapsing regime.

Banks were never about money. They were about control.

Credit scores were behavioral leashes. Loans were compliance tests. Payroll data fed predictive systems. “Fraud prevention” masked biometric tracking. By 2020, central banks had (allegedly) plans to eliminate cash, merge medical data with spending behavior, and link identity verification to obedience scoring. The pandemic era wasn’t the endgame. It was a rehearsal.

That trajectory was supposed to lock in by 2026. It didn’t.

The expansion of Redemption Centers in early 2025 shattered the system’s defenses. These are not civilian money hubs. They are (allegedly) gold-anchored, QFS-synced, and structurally independent from BIS, IMF, and legacy central-bank networks. Banks cannot access them. Cannot audit them. Cannot freeze them. Cannot interfere.

For the first time in over a century, financial flow is exiting elite custody. That is why, right now, the response is frantic.

Gold is being pulled from contingency vaults in Switzerland and Northern Italy tied to post-WWII emergency liquidity frameworks. Major European banks are(allegedly) submitting fabricated asset reports just to stay inside transaction windows, reports that now fail upgraded Treasury verification protocols. Cyber attacks have been (allegedly) launched against QFS routing infrastructure, neutralized before reaching quantum layers. Media blackout directives have gone out globally, instructing outlets to mock, deny, and redirect attention, using the same coordination channels deployed during lockdowns and digital ID pushes.

The fingerprints are identical. The structure is collapsing. NESARA is no longer (allegedly) theoretical. It is active. Verified disbursements are already routing through quantum validation layers. January 2026 is the lock-in point. When the fiat scaffolding finally gives way, alignment will determine survival.

The panic is not about money. They can create digits endlessly. The panic is about losing control over who can hold value, who can move it, and who can build with it.

Redemption Centers (allegedly) bypass their grip. Quantum verification ends their surveillance. And the old system has no counter.

FINAL NOTE FOR DECEMBER 23, 2025: This is not a future event. It is operational. This Christmas is not symbolic. It is a staging window.

The largest financial realignment in human history is (allegedly) underway, quietly, decisively, and without reversal.

Read full post here: https://dinarchronicles.com/2025/12/28/restored-republic-via-a-gcr-update-as-of-december-28-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat My CBI contact...told me on my call...to Iraq that we will see articles about the removal of these larger three-zero notes and the swap out. She told me we already should have witnessed much recent news about the removal of the zeros and so pay close attention. She also said the CBI site will be updated with pictures of the newer lower denominations soon once the trigger is pulled to begin...

Frank26 Today you have a presidential decree for parliament to sit on the 29th. That's a very direct command. I believe they will obey. We should see your [Iraqi] government formed. We should see the HCL and we should see a new exchange rate. We should see the lower notes from the 29th to the 31st. Anything short of that is a complete failure especially with Mark Savaya right after you're supposed to do that.

Jeff They have 3 aspects of the government formation regarding the elections they have to do. They have to finish and complete the parliament. After they complete the parliament they have to finish and complete the president of the country, then the prime minister. This very next session of parliament around the 29th they could or might complete the formation of parliament. [Then] parliament can resume having sessions...By changing the rate while the government is being formed, during the year of '25, makes the most sense because it allows them to hit the ground running...Otherwise if they're waiting till the government's done, they would probably be waiting until at least February.

************

The Dollar’s WORST YEAR in a Decade - Global Currency Repricing Is Here

Lena Petrova: 12-28-2025

In this video, I break down why the dollar weakened sharply through 2025, what the drop in the US Dollar Index (DXY) really means, and why this move may signal a structural shift after decades of dollar dominance.

We look at the key drivers behind the selloff — rising US debt, widening fiscal deficits, slowing relative growth, tariff uncertainty, and growing global investor hedging against dollar exposure.

I address the big question: does a weakening dollar mean you should buy gold now? I explain why gold is often promoted during periods of dollar stress, the risks many overlook, and why gold isn’t always the automatic answer.

“Tidbits From TNT” Sunday 12-28-2025

TNT:

Tishwash: From "nothing" to billionaires... What are the secrets of the phenomenon of "exorbitant and rapid wealth" in Iraq?

Hussein Omran, a researcher in strategic, political, and regional security affairs, highlighted the phenomenon of "exorbitant and rapid wealth accumulation" that has spread in Iraq In recent years, he described it as a product of the "shadow economy" and not the result of investment acumen or genuine entrepreneurship.

Imran noted in a post that I followed Alsumaria News until the scene The Iraqi has become It is teeming with figures "with no commercial or industrial history" who, in record time, became billionaires.

The researcher attributed this shift to two main, almost guaranteed paths to wealth beyond oversight:

TNT:

Tishwash: From "nothing" to billionaires... What are the secrets of the phenomenon of "exorbitant and rapid wealth" in Iraq?

Hussein Omran, a researcher in strategic, political, and regional security affairs, highlighted the phenomenon of "exorbitant and rapid wealth accumulation" that has spread in Iraq In recent years, he described it as a product of the "shadow economy" and not the result of investment acumen or genuine entrepreneurship.

Imran noted in a post that I followed Alsumaria News until the scene The Iraqi has become It is teeming with figures "with no commercial or industrial history" who, in record time, became billionaires.

The researcher attributed this shift to two main, almost guaranteed paths to wealth beyond oversight:

The first path: the dollar "machine" and currency platform: Imran argued that manipulating the price difference between the official and parallel markets, fictitious invoices, and transfers made through front companies and banks lacking genuine oversight, transformed the dollar into a means of exorbitant profit with no risk or added value to the economy, in addition to serving as a cover for money laundering operations.

The second path: oil smuggling and the regional shadow market: The researcher explained that regional crises, particularly those related to Iran, created a massive parallel oil market. He emphasized that Iraq It has become a "corridor and outlet" through complex land and sea routes, where oil is sold under various guises via a system that includes tankers, intermediaries, and formal and informal facilities, making "proximity to oil" the shortest path to wealth.

Imran warned of the disastrous consequences of this model , emphasizing that it neither builds a state nor creates jobs, but rather produces a "parasitic elite" linked to or protected by politics, which fights any attempt at reform because it threatens its source of profit.

Imran described this situation as "Collapse The "quiet" collapse, which doesn't happen with a resounding explosion, but rather seeps into the structure of society when an entire generation becomes convinced that "work and production" stupidity

The researcher concluded his presentation with a question that sparked widespread discussion: "Do you know anyone who had nothing and is now a billionaire?", highlighting the clarity of the phenomenon and the inability of natural economic logic to explain it. link

************

Tishwash: The Iraqi parliament publishes the agenda for Monday's session.

The Iraqi parliament is scheduled to hold its first session of its sixth term on Monday at 12 noon, which includes two items on its agenda.

The first paragraph includes: the swearing-in of the new members of the House of Representatives, and the other includes: the election of the Speaker of the House of Representatives and his two deputies, according to a statement issued by the Parliament’s Media Department.

In the past few days, the Shiite, Sunni, and Kurdish political forces and parties that won the elections have intensified their discussions in order to decide on the three top leadership positions: Speaker of Parliament, President of the Republic, and Prime Minister.

After the fall of Saddam Hussein’s regime in the spring of 2003 at the hands of American forces and their allies, the major political forces of the Shiites, Kurds, and Sunnis adopted a quota system in distributing positions for the three presidencies: the Prime Minister’s office, the Republic, and Parliament.

Last Saturday, the head of the Supreme Judicial Council, Faiq Zaidan, confirmed that the first session of the new House of Representatives, scheduled for December 29, 2025, must decide on the appointment of the Speaker of the House and his two deputies, and it is not constitutionally or legally permissible to postpone or extend it. link

************

Tishwash: "Threaten them with their money": Savaya receives advice on the weaknesses of Iraqi politicians

The Middle East Monitor website offered advice to the US Special Envoy to Iraq, Mark Savaya, that if he wants to succeed in his Iraqi mission and survive what the report called the "theater of illusions" represented by Baghdad, he should scrutinize who is making money.

After the London-based website pointed out that Savaya came to his position as a reward for his loyalty, and not through hardening his resolve through Middle Eastern events and calculations, it noted that he comes to the den of wolves armed with a smile and an outstretched hand, but his experience is shallow and his mandate is to dismantle the Popular Mobilization Forces and cut the strong bond of loyalty that connects Baghdad to Tehran, in order to pull Iraq back into the sunlight from the darkness of Iran.

The report, translated by Shafaq News Agency, said that Savaya will walk through a maze of deception, where every door in front of him is a trap. It added that the leaders he will deal with have overcome dictatorships, invasions, coups, sanctions, revolutions, and wars, and buried their enemies. They speak cunningly and will mislead him by drowning him in unimportant details. It noted that they are skilled at camouflage and that their civility is merely a sword covered in silk, and that he will have to identify the twin forces behind their actions in order to understand them.

The report continued, saying: “These are not patriots, but rather a coterie of greed. They do not worship ideology, but rather power. They do not cling to faith, but rather to wealth. They are not ministers and parliamentarians, but rather leaders of a league wearing government clothes. They lead militia groups, order kidnappings, and silence journalists.” It added that they “have been looting Iraq since 2003, and they feed on a wounded lion like hyenas.”

The report said that, like all criminals, they "made one major mistake: they left a financial trail."

The report explained that their wealth is not in Baghdad, but rather their money is hidden in vaults in Switzerland, in Iranian banks, in shell companies, in offshore accounts, and in real estate in Europe, North America, and within the United States, noting that the “Panama Papers” scandal contributed to lifting the veil and to the US Treasury’s Office of Foreign Assets Control tracking them.

The report urged Savaya to use the weapon of "the power of fear" against these people because they fear poverty and bankruptcy, not troops and bombs, if he wanted his mission to succeed.

The report outlined this proposed scenario, with the author addressing Savaya: “Sit before them, smile diplomatically, and present them with a document granting the United States government full legal authority to investigate, trace, and seize any asset, account, or investment in their names, the names of their children, or the names of those in their inner circle.”

He continued, “Tell them this document means nothing if they are truly innocent. Watch their hands tremble, watch their masks break, and those who are honest will sign. But the corrupt will stall, and they will erupt in anger at the sudden infringement upon their sovereignty over their ill-gotten gains.”

He added, "These men are not motivated by dignity or belief. It is the fear of losing everything they have stolen that motivates them."

The report stated that "money is only one of their weapons; their second weapon is deception. They are experts in smiles, hugs, and schemes. They are a group of promises and betrayals, and they practice dissimulation," noting that this does not represent theology or science, but rather "a sacred art of lying," and every handshake is worthless.

The report continued, saying, "They will obstruct him, and stifle him with delays until he gets tired and defeated," adding that "we must remember that the Iraqi tragedy did not arise only in a state of chaos, but rather in the collaboration between cynical foreigners and opportunistic Iraqis, and between external power and internal treachery."

The report argued that Savaya was not sent to deal with a democratic entity, but rather with a market where loyalty is a commodity, where alliances can be auctioned off, and where patriotism can be faked. It added that "if Savaya wants to dismantle the Popular Mobilization Forces, and if he wants to destroy Tehran's grip, then he must harness the one thing these men fear, which is money, not truth, not principles, not justice."

The report concluded by addressing Savaya, saying, "Follow the money. Seize it. Threaten, use it, and only then will they bow down. Only then will they surrender. Only then will the empire of thieves tremble." It continued, "Follow the money, and never stop until their world collapses."

Mot: scary 2026

Mot: Snow Daze!!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 12-28-25

Good Morning Dinar Recaps,

The Architecture of the New Global Financial System Is Already Visible

Gold-backed value, digital rails, and ISO-compliant assets form the backbone

Good Morning Dinar Recaps,

The Architecture of the New Global Financial System Is Already Visible

Gold-backed value, digital rails, and ISO-compliant assets form the backbone

Overview

Central banks are accelerating gold accumulation as neutral monetary collateral

The next system is shaping up as asset-backed, digital, and interoperable

ISO 20022 compliance has become the baseline requirement for participation

A limited group of digital assets are positioned for institutional use

Speed, finality, scalability, and compliance now outweigh ideology

Key Developments

Central banks have shifted from fiat expansion to reserve hardening

Gold is increasingly treated as balance-sheet insurance rather than a legacy asset

ISO 20022 messaging is live across major payment and settlement systems

BRICS introduced the Unit, a basket-backed settlement instrument for wholesale trade

Countries are preparing sovereign digital currencies backed by domestic assets

Interoperability between national systems is now the primary challenge

Special Focus: Key Watched Technologies and Assets

ISO 20022 Digital Assets

Only a small number of digital assets meet institutional requirements for messaging compatibility, regulatory oversight, and throughput. These assets are designed to function inside financial infrastructure, not outside it.

XRP as a Bridge Asset

XRP was designed to provide on-demand liquidity between currencies without requiring pre-funded accounts. Its ability to move value in seconds at negligible cost addresses the core inefficiencies of correspondent banking. Scalability, speed, and finality position XRP as connective infrastructure rather than a speculative store of value.

Bitcoin’s Structural Limitations

Bitcoin demonstrated that digital scarcity is possible, but it was not designed for modern settlement. Long confirmation times, high fees during congestion, and limited throughput restrict its usefulness for institutional-scale payments. Bitcoin functions as a speculative asset, not financial plumbing.

BRICS Unit and Multipolar Settlement

The BRICS Unit reflects a broader move toward collateral-backed settlement instruments that reduce reliance on any single national currency. It signals a shift from reserve dominance to asset-based trust.

Why It Matters

The global financial system is not collapsing — it is being rewired. Nations are preserving sovereignty while upgrading rails. Value is being anchored to assets, while movement of value is being digitized. This separation of what backs money from how money moves is the defining feature of the transition now underway.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the reset changes what determines credibility. Currencies tied to real assets, efficient settlement, and compliant infrastructure gain durability. Those dependent on debt expansion, slow rails, and political leverage face repricing risk. Watching infrastructure readiness now matters more than watching headlines.

Implications for the Global Reset

Pillar: Assets Back Value, Networks Move It

Gold and national resources anchor trust, while digital rails provide speed and scale.Pillar: Interoperability Over Dominance

The future system favors connection between currencies, not replacement of them.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – “ISO 20022 and the future of global payments”

World Gold Council – “Central banks and gold: reserve diversification trends”

~~~~~~~~~~

Silver vs Gold: Same Monetary Family, Very Different Market Mechanics

Why silver behaves like a leveraged monetary metal while gold anchors stability

Overview

Gold and silver both function as monetary metals, but their market structures differ sharply

Gold trades primarily as a reserve asset, while silver straddles monetary and industrial demand

Silver’s smaller market size makes it more sensitive to leverage and liquidity stress

Divergence between the two often signals shifts in risk, inflation expectations, and liquidity

Key Developments

Central banks overwhelmingly accumulate gold, not silver, for reserves

Silver demand is split between industrial use and investment, tightening supply cycles

Paper-to-physical ratios are significantly higher in silver markets

Silver inventories are thinner relative to annual demand

Gold markets are deeper and more liquid, reducing volatility

Silver reacts faster — and more violently — during leverage unwinds

Market Mechanics: Why They Behave Differently

Gold

Gold functions as a monetary anchor. Central banks hold it, sovereigns settle with it, and it carries minimal industrial dependency. Its futures and OTC markets are large and liquid, allowing stress to dissipate more slowly. Gold moves when confidence shifts — but rarely gaps without cause.

Silver

Silver behaves like a pressure valve. Its dual role creates constant tension between industrial consumption and monetary demand. Because the silver market is much smaller, leveraged positions dominate price discovery during stress. When liquidity tightens or physical supply is constrained, silver reprices rapidly.

Why It Matters

Silver often moves after gold signals a trend — but moves faster and farther once constraints appear. This is not speculation; it is structure. When markets begin repricing monetary risk, gold establishes credibility while silver exposes fragility. The relationship acts as an early warning system for leverage, inflation, and settlement stress.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the gold–silver relationship reveals confidence versus pressure. Gold reflects trust erosion in fiat systems, while silver reflects stress inside them. When silver outperforms sharply, it suggests leverage is unwinding and liquidity is thinning — conditions that often precede currency instability or repricing

Implications for the Global Reset

Pillar: Gold Anchors, Silver Signals

Gold stabilizes confidence; silver exposes structural strain.Pillar: Liquidity Determines Volatility

Smaller, leveraged markets reprice faster when systems are stressed.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

World Gold Council — “Gold Demand Trends and Central Bank Reserves”

Silver Institute — “World Silver Survey: Supply, Demand, and Market Structure”

~~~~~~~~~~

Ukraine Under Fire Ahead of Critical Zelenskiy–Trump Summit

Mass missile and drone strikes intensify pressure as peace talks approach

Overview

Russia launched a large-scale aerial assault on Kyiv and other regions

The attack came just ahead of a high-stakes meeting between President Zelenskiy and President Trump

Hundreds of drones and dozens of missiles targeted civilian and energy infrastructure

The timing signals an attempt to shape negotiations through escalation

Key Developments

Ukraine reported approximately 500 drones and 40 missiles launched overnight

Air raid alerts lasted nearly ten hours in Kyiv

At least one fatality and multiple injuries were confirmed, including children

Energy facilities were struck, leaving large portions of Kyiv without heat and power

Damage was reported across seven districts, including residential high-rises

Polish airspace disruptions triggered heightened regional military readiness

Peace discussions center on territorial control, security guarantees, and economic zones

A draft 20-point peace framework is nearing completion but remains unresolved

Why It Matters

This escalation underscores how military pressure is being used as leverage at the negotiating table. Energy infrastructure targeting highlights the weaponization of winter hardship, while the timing ahead of diplomatic talks suggests an effort to influence terms before concessions are finalized. The conflict remains a major destabilizing force for Europe and global markets.

Why It Matters to Foreign Currency Holders

For foreign currency holders, renewed escalation increases geopolitical risk premiums across Europe. Energy disruption, reconstruction costs, and prolonged uncertainty strain fiscal balances and influence currency valuation. Wars that drag into negotiation phases often trigger currency realignment, reserve shifts, and debt restructuring, all critical signals for those watching the global reset.

Implications for the Global Reset

Pillar: War Accelerates Financial Fragmentation

Prolonged conflict deepens the divide between geopolitical blocs and settlement systems.Pillar: Energy Security Equals Currency Stability

Targeted infrastructure attacks directly impact inflation, sovereign budgets, and monetary credibility.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Russia launches massive air attack on Kyiv ahead of Zelenskiy-Trump talks”

Modern Diplomacy — “Ukraine Under Fire Ahead of Critical Zelenskiy-Trump Summit”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The Biggest Credit Bubble in History

The Biggest Credit Bubble in History

WTFinance: 12-27-2025

The global financial landscape is on the cusp of a significant transformation, and according to Alasdair Macleod, a renowned expert in the field, the next few years will be marked by unprecedented turmoil.

In a recent episode of the WTFinance Podcast, host Anthony Fatseas sat down with Macleod to dissect the impending economic crisis that is expected to unfold in 2026 and beyond.

The discussion was both insightful and sobering, painting a picture of a world on the brink of a major financial reckoning.

The Biggest Credit Bubble in History

WTFinance: 12-27-2025

The global financial landscape is on the cusp of a significant transformation, and according to Alasdair Macleod, a renowned expert in the field, the next few years will be marked by unprecedented turmoil.

In a recent episode of the WTFinance Podcast, host Anthony Fatseas sat down with Macleod to dissect the impending economic crisis that is expected to unfold in 2026 and beyond.

The discussion was both insightful and sobering, painting a picture of a world on the brink of a major financial reckoning.

At the heart of Macleod’s analysis is the looming collapse of the equity markets, triggered by the bursting of the tech and credit bubbles.

As banks and foreign investors scramble to protect their assets, massive sell-offs will ensue, resulting in a sharp market crash.

This is not just a forecast; it’s a scenario that Macleod believes is inevitable given the current state of the global economy. The fragility of the US dollar, coupled with the broader global economic repercussions, will only exacerbate the situation.

One of the most striking aspects of Macleod’s argument is the disconnect between official inflation metrics and the underlying economic reality.

Despite what the numbers may suggest, inflation is set to surge dramatically due to monetary mismanagement and the declining purchasing power of fiat currencies. This is a theme that Macleod has been warning about for some time, and it’s an issue that investors would do well to take seriously.

The banking system, too, is facing significant challenges.

Despite ample liquidity, banks are reluctant to lend due to rising credit risks and economic stagnation. The US Treasury is struggling to issue long-term debt, a clear signal that investors are growing increasingly concerned about the sustainability of US fiscal policy.

Furthermore, Macleod highlights that quantitative easing (QE) is being used primarily to support US Treasury funding and prop up asset prices, rather than stimulate real economic growth. This is a worrying trend that suggests the global economy is being propped up by artificial means.

Geopolitically, the landscape is also shifting. China is strategically distancing itself from the weakening US dollar by accumulating gold reserves and promoting the yuan for international trade among BRICS and Shanghai Cooperation Organization members.

Meanwhile, Europe and the UK are facing economic and political instability, exacerbated by poor governance and misguided policies. Macleod foresees a profound global currency crisis as fiat currencies like the dollar, euro, and sterling collapse, driving a surge in gold and commodity prices.

So, what does this mean for investors? Macleod’s message is clear: the current economic and monetary paradigm is unsustainable, and the eventual breakdown of the fiat currency system is unavoidable.

As such, he urges investors to understand the difference between real money (gold) and credit, recommending a shift toward commodities and precious metals as safer stores of value.

In conclusion, the insights shared by Alasdair Macleod in the WTFinance Podcast are a wake-up call for investors and policymakers alike.

The global economy is on the cusp of a significant transformation, and it’s essential that we prepare for the challenges ahead.

By understanding the underlying trends and taking a proactive approach to managing our assets, we can navigate the turbulent financial landscape that lies ahead.

For those looking to stay ahead of the curve, watching the full video from WTFinance is a must. Macleod’s analysis is both nuanced and thought-provoking, offering a unique perspective on the global economic landscape. As we move into 2026 and beyond, his warnings should not be taken lightly.

Ariel: Potential Controlled Revaluation for the Iraqi Dinar (and more)

Ariel: Potential Controlled Revaluation for the Iraqi Dinar

12-27-2025

Ariel @Prolotario1

What is the one thing Donald Trump stated is the reason foreign countries like Iraq could not trade with the US? The artificial value of the fiat dollar was to high right?

Guess what the silver squeeze is doing to help alleviate that problem?

Ariel: Potential Controlled Revaluation for the Iraqi Dinar

12-27-2025

Ariel @Prolotario1

What is the one thing Donald Trump stated is the reason foreign countries like Iraq could not trade with the US? The artificial value of the fiat dollar was to high right?

Guess what the silver squeeze is doing to help alleviate that problem?

He has historically criticized the artificial valuation of the fiat dollar, arguing it disadvantages U.S. trade partners like Iraq by maintaining an overvalued currency that hampers competitive exports.

For Iraq, this dynamic creates a dual opportunity: first, by devaluing the dollar relative to the IQD, it enhances Iraq’s export competitiveness; second, it aligns with the Central Bank of Iraq’s (CBI) gradual currency stabilization efforts, potentially facilitating a controlled revaluation.

So please expect some major news going into the new year. Especially with the new leadership in Iraq.

SantaSurfing: “IT IS OFFICIALLY OVER” THE MOMENT WE’VE BEEN WAITING FOR! SILVER SQUEEZE IS HAPPENING! DOLLAR IS LOSING VALUE! SILVER SHORTAGE = BANKS FAILURE! WE’RE GETTING THAT CLOSE! HOLD!!! HOLD!!! (Not financial advice) THIS IS SPOT ON!

ASIAN GUY RECENT UPDATE 12/26/2025!

IT'S OVER: Banks Tap Fed for $17 BILLION as Silver Shorts Implode

Currency Archive

https://www.youtube.com/watch?v=6b5suA_yI-0&feature=youtu.be

Source(s): https://x.com/Prolotario1/status/2004729097063170425

Ariel : Iraqi Dinar Update, Mark Savaya Action Oriented Mindset

12-27-2025

Iraqi Dinar Update: Where We Are (Mark Savaya) Action Oriented Mindset

Mark Savaya’s presence in Iraq as this get-it-done businessman elevates the stakes tremendously, injecting the momentum needed to activate a system that’s been poised and waiting for far too long.

Dinar enthusiasts, who’ve weathered skepticism and setbacks for over twenty years, might soon toast to his influence in hastening the revaluation that’s whispered about in hushed tones.

Unreleased details from confidential briefs suggest he’s advocating for accelerated U.S.-Iraq trade pacts that indirectly fortify the dinar’s global standing, bypassing traditional hurdles.

I must stress the power here: his aversion to empty rhetoric means swift, impactful decisions that honor Iraq’s preparedness and reward the faithful.

In Other News

The silver squeeze accelerates a global shift away from dollar-centric trade, directly benefiting Iraq’s export-driven economy. As silver shortages strain banks and erode confidence in fiat currencies, nations like Iraq, with substantial gold and silver reserves, gain bargaining power in bilateral trade agreements.

Iraq’s central bank holds 150 tons of gold (Q3 2025), and its silver stockpiles, quietly amassed since 2023, position it to anchor the dinar to precious metals.

This reduces reliance on dollar-based oil transactions, which previously forced Iraq to accept inflated exchange rates.

Trump’s tariff policies, raising average rates to 17% (Yale Budget Lab, 2025), incentivize Iraq to pivot toward non-dollar partners like China and the UAE, who increasingly settle in gold-backed yuan or dinar.

The squeeze’s pressure on the dollar down 8% according to reports against major currencies since January 2025 levels the trade playing field, enabling Iraq to demand fairer terms. This sets the stage for a dinar revaluation.

Do You All See Where We Are Headed?

Iraq’s strategic accumulation of silver, unreported in mainstream financial outlets, acts as a hedge against dollar volatility triggered by the squeeze.

Unlike gold, silver’s industrial demand (solar, electronics) ensures liquidity, allowing Iraq to collateralize its currency without depleting oil revenues.

The Central Bank of Iraq has secured 2,500 tons of silver through discreet deals with BRICS-aligned suppliers since 2024, positioning the dinar for a metal-backed revaluation.

This move counters the dollar’s artificial strength, which Trump’s team, including Stephen Miran, critiques as a driver of persistent U.S. trade deficits.

As silver shortages disrupt Western banking COMEX inventories dropped 20% in 2025 Iraq’s reserves insulate it from global financial shocks.

This stability attracts Forex traders, who anticipate a dinar surge as Iraq announces its new exchange rate in Q1/Q2 2026. The squeeze thus empowers Iraq to dictate its currency’s value, unshackled from U.S. monetary policy.

You are probably hearing that for the 1st time. Yes, Iraq was hoarding silver to.

Read Full Article:

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 12-27-25

Good Afternoon Dinar Recaps,

Where the World Stands in the Shift to a New Global Financial System

Some nations are structurally ready — others remain stalled by politics, debt, and compliance gaps

Good Afternoon Dinar Recaps,

Where the World Stands in the Shift to a New Global Financial System

Some nations are structurally ready — others remain stalled by politics, debt, and compliance gaps

Overview

The transition to a new global financial system is uneven and non-simultaneous

Readiness depends on payment rails, legal frameworks, reserves, and sovereignty

Many countries have completed technical upgrades but lack political or monetary alignment

A small group is structurally prepared, while others remain constrained by sanctions, debt, or instability

Key Developments

Global payment infrastructure modernization is largely complete in major economies

ISO 20022 messaging standards are operational across most central banking systems

Alternative settlement arrangements are expanding outside Western rails

Gold accumulation and reserve diversification continue among non-aligned states

Sanctions, capital controls, and debt overhangs remain the primary blockers

Readiness Snapshot: Who Is Ready — and Who Is Not

Countries Considered Structurally Ready

China

Russia

Saudi Arabia

United Arab Emirates

Singapore

These nations have functioning payment rails, sufficient reserves, legal authority, and geopolitical leverage to operate within a multipolar system.

Countries Partially Ready (Technical Progress, Political Constraints)

Brazil

India

South Africa

Indonesia

Egypt

They possess upgraded systems but remain cautious due to trade exposure, dollar reliance, or internal policy divisions.

Countries Not Yet Ready

Many highly indebted Western economies

Fragile states reliant on IMF programs

Sanction-dependent or politically unstable nations

These lack either monetary sovereignty or legal freedom to reposition.

Special Focus: Key Watched Nations

Iraq

Iraq is often viewed as technically ready but politically constrained. Banking reforms, digital payment adoption, and central bank controls have improved significantly. However, unresolved issues around governance, corruption perception, and external influence continue to delay full monetary normalization. Iraq appears positioned for post-stability activation, not preemptive transition.

Vietnam

Vietnam is quietly one of the most prepared emerging economies. It has strong manufacturing integration, growing reserves, disciplined monetary policy, and expanding digital payments. Vietnam’s caution is strategic — not structural. It is ready but waiting, aligned with trade stability rather than currency disruption.

Venezuela

Venezuela remains resource-rich but systemically blocked. Sanctions, capital controls, and institutional erosion prevent financial reintegration. While oil reserves provide leverage, the banking system and currency credibility are not yet restored. Venezuela requires external political resolution before monetary reset participation.

Iran

Iran operates largely outside the Western financial system already. It has alternative trade channels, energy leverage, and regional settlement mechanisms. However, sanctions isolate capital inflows and restrict normalization. Iran is functionally adapted but not globally integrated, limiting its role in early-stage system activation.

United States

The United States remains the anchor of the existing financial system, yet it is also the most constrained by its own scale. Technically, the U.S. is fully modernized: payment rails are upgraded, settlement systems are compliant, and regulatory reach is unmatched. However, record sovereign debt, persistent deficits, and political gridlock limit monetary flexibility.

The U.S. position is not about readiness — it is about control of transition. As issuer of the world’s primary reserve currency, the United States must manage change without triggering loss of confidence. This makes the U.S. structurally prepared but strategically cautious, favoring gradual adaptation over overt reset actions.

European Union

The European Union is highly advanced technically but fragmented politically. Payment infrastructure, digital banking, and regulatory harmonization are largely complete. However, uneven debt levels among member states, divergent economic conditions, and reliance on consensus decision-making slow decisive action.

The EU’s challenge is cohesion. While core economies are prepared, weaker members constrain policy options. This makes the EU operationally ready but institutionally limited. The bloc is more likely to follow a coordinated global shift than lead one, prioritizing stability and compliance over speed.

Why It Matters

The global financial reset is not a single event — it is a phased transition. Technical readiness alone is insufficient. Countries must align law, liquidity, legitimacy, and leadership. This explains why some nations appear “ready” for years without visible change, while others move rapidly once political barriers lift.

Why It Matters to Foreign Currency Holders

For foreign currency holders, readiness determines timing and credibility. Currencies tied to nations with completed infrastructure and sovereign control are positioned differently than those burdened by sanctions or debt. Watching who can move matters more than watching who talks. The reset rewards preparation — not speculation.

Implications for the Global Reset

Pillar: Infrastructure First, Value Second

Systems must function before currencies can reprice.Pillar: Sovereignty Over Speed

Nations will not move until legal, political, and monetary control is secured.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Forced Deleveraging in the Silver Market Signals Structural Stress

Rising prices expose leverage, liquidity limits, and paper–physical imbalance

Overview

Silver markets are experiencing forced deleveraging, not orderly normalization

A sharp price rally has stressed institutions with large paper short exposure

Liquidity assumptions are being tested as physical availability tightens

The disconnect between paper contracts and deliverable metal is widening

Key Developments

Analysts observing delivery data and positioning behavior report stress among major commercial participants

Rising silver prices are increasing margin requirements, locking up capital

Physical silver supply available for lease or delivery is tightening

Concentrated short positioning has reduced flexibility for large participants

Covering pressure accelerates price movement when liquidity thins

Market structure — not intent — is driving squeeze-like conditions

Why It Matters

This is a classic leverage unwind. When paper obligations grow faster than physical supply, markets are forced to reconcile promises with reality. Price discovery shifts away from contracts toward tangible assets, often abruptly. This process exposes structural fragilities embedded in derivative-heavy markets and reveals where liquidity assumptions fail under stress.

Why It Matters to Foreign Currency Holders

For foreign currency holders, forced deleveraging in precious metals is a warning signal. When confidence in paper markets weakens, capital migrates toward physical assets and hard collateral. This dynamic often precedes currency repricing, especially in debt-heavy systems. Silver’s stress mirrors broader concerns about leverage, settlement integrity, and real value versus nominal claims.

Implications for the Global Reset

Pillar: Physical Assets Reassert Price Authority

When leverage unwinds, tangible supply becomes the final arbiter of value.Pillar: Paper Liquidity Has Limits

Markets dependent on perpetual rollover face instability when delivery matters.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive