Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Good evening Dinar Recaps,

The World Trade Organization has been working on reforms for some time. In the past, it has been believed that this organization has favored the larger countries. Attempts have been made to reconcile some of the mechanisms to create a "More Level Playing Field" among the smaller countries.

In 2024, a renewed mechanism is at play to settle some disputes among countries feeling the need to call into question certain trades that have been favored towards larger countries over their own.

With the upcoming 13th Ministerial Conference (MC13) in February, a meeting with several representatives from around the world to talk and implement a new mechanism put into place called the "appellate mechanism."

The appellate mechanism is governed by seven people who will make decisions on disputes that are called into question. Last year, I shared with you how foreign exchange rates were being reformed within the WTO. Now, we are witnessing many trade products being brought to the table for adjustments throughout this year.

Goldilocks' Comments and Global Economic News Friday Evening 1-26-24

Good evening Dinar Recaps,

The World Trade Organization has been working on reforms for some time. In the past, it has been believed that this organization has favored the larger countries. Attempts have been made to reconcile some of the mechanisms to create a "More Level Playing Field" among the smaller countries.

In 2024, a renewed mechanism is at play to settle some disputes among countries feeling the need to call into question certain trades that have been favored towards larger countries over their own.

With the upcoming 13th Ministerial Conference (MC13) in February, a meeting with several representatives from around the world to talk and implement a new mechanism put into place called the "appellate mechanism."

The appellate mechanism is governed by seven people who will make decisions on disputes that are called into question. Last year, I shared with you how foreign exchange rates were being reformed within the WTO. Now, we are witnessing many trade products being brought to the table for adjustments throughout this year.

You might want to start trying to understand what a "unit of measure" and "storer of value" is in gold. Our new currency values will be determined by these references.

The term "unit of value" was recently used on the Debt Clock, and it is giving us a clue as to how our new monetary system is going to measure monetary values going forward that will give us a Global Currency Reset based on these new values.

Each week, "Freedom Fighter" opens up a room for discussion utilizing the Debt Clock as a source for topics giving us clues about the new monetary system. The symbol or coins above was on the last discussion and gives us an idea of where the powers that be are taking us inside the new monetary system.

© Goldilocks

GoldFellow

US Debt Clock

Congress Link 1

Congress Link 2

~~~~~~~~~~

25 JAN, 18:50 Russia, Ukraine show readiness to cooperate IAEA

The diplomatic engagement continues, Grossi added

UNITED NATIONS, January 26. /TASS/.

The governments of Russia and Ukraine demonstrate readiness to cooperate with the International Atomic Energy Agency (IAEA), the organization’s Director General Rafael Grossi said after a UN Security Council briefing on the Zaporozhye Nuclear Power Plant (ZNPP).

"Yes, I would say by and large, yes," the IAEA chief said when asked whether the IAEA was getting the cooperation it needs from the Russian and the Ukrainian authorities.

"Of course, there are moments of frustration, mine and theirs, I guess, because sometimes, when I say things they don’t appreciate, or they would prefer me to say differently. There is tension there, but this is a little bit what the IAEA is all about," the official continued.

However, the diplomatic engagement continues, Grossi added. "I think, this is what we need. We need diplomacy," he said. https://tass.com/world/1737561

~~~~~~~~~~

Will the bank term funding program be extended?

The Federal Reserve is likely to allow its Bank Term Funding Program to expire on March 11, 2024, rather than renew the banking crisis-era lending program, according to commentary from Wrightson ICAP. Dec 26, 2023 Seeking Alpha

~~~~~~~~~~

What is bank term funding program?

Program: To provide liquidity to U.S. depository institutions, each Federal Reserve Bank would make advances to eligible borrowers, taking as collateral certain types of securities. 2 days ago

Federal Reserve

~~~~~~~~~~

What is the band term funding program?

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. Federal Reserve

~~~~~~~~~~

Now, let's take a look at why the "Bank Term Funding Program" that's going away providing liquidity to our banks is so important. We have talked about this over two weeks ago, but I have yet to hear many people explain the importance of this in moving towards the new system.

Will it be easy? No, but it will be worth it.

On March 11th, 2024, this will be a shift in capital requirements to sustain our banking system going forward from BTFP to Basel 3. It will put a tremendous stress on gold in making this shift.

Let's put some of the pieces together. By that time, we will have tokenized assets that are backed by gold and other commodities already on the market trading in the new Digital Asset-Based Trading System.

This will create a demand for gold to go into a real value and our tokenized assets across all sectors of the market to move into their new prices because of it. It includes the Forex Market where you and I hold many of our currencies from around the world.

Since our assets across all Market sectors have been inflated for such a long time, it will require value adjustments to take place shifting our financial system from a stock market to a commodity Market led system.

Here, our stock market and banking system will be synchronized and coordinated by our new Basel 3 requirements. It won't take place all in one day, but the process will begin. Federal Reserve

© Goldilocks

~~~~~~~~~~

CFTC Customer Advisory Cautions the Public to Beware of Artificial Intelligence Scams | CFTC

~~~~~~~~~~

CFTC Staff Releases Request for Comment on the Use of Artificial Intelligence in CFTC-Regulated Markets | CFTC

~~~~~~~~~~

Prices of New Houses Drop to 2-Year Low | Wolf Street

~~~~~~~~~~

This is why XRP kills swift 😳 #crypto #xrp #bitcoin #shorts

https://youtube.com/shorts/uio4NySWBD0?feature=shared

~~~~~~~~~~

Plaid is Everywhere in Fintech Today | Fintech Nexus

~~~~~~~~~~

Release No.: IC-35117 <-SEC pdf file Date: Jan. 26, 2024

Details: Notice of Applications for Deregistration under Section 8(f) of the Investment Company Act of 1940

BNY Mellon International Securities Funds, Inc. 811-07502

Corbin Multi-Strategy Fund, LLC 811-22517

EQ Premier VIP Trust 811-10509

Fiera Capital Series Trust 811-23220

JPMorgan Insurance Trust 811-07874

Strategas Trust 811-23608

~~~~~~~~~~

Tucker Carlson Interviews Governor Greg Abbot on the Border Crisis in Texas

Confirmed: 10 states have sent NG or other law enforcement to protect our border!

"There have been about 10 [states] so far that have sent National Guard or other law enforcement. They now are joined together with us and this is a fight for the future of America," Abbott said.

https://t.me/c/1545617426/74292

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

On January 23, 2024 By Awake-In-3D

In RV/GCR

I rest my case. There’s frequent member discussion on my Telegram Channel about how US Treasuries are no longer accepted by foreign markets. Yet, the facts indicate exactly the opposite.

Just yesterday, I asked my readers to await the results of several US Treasury auctions this week.

Consequently, today’s 2-Year Treasury auction solidly shows that not only are US Debt instruments being accepted worldwide, foreign demand is at record levels.

GCR Land ‘Intel’ Claiming International Acceptance of US Treasuries (Debt) Has Stopped is Flat Out Not True

On January 23, 2024 By Awake-In-3D

In RV/GCR

I rest my case. There’s frequent member discussion on my Telegram Channel about how US Treasuries are no longer accepted by foreign markets. Yet, the facts indicate exactly the opposite.

Just yesterday, I asked my readers to await the results of several US Treasury auctions this week.

Consequently, today’s 2-Year Treasury auction solidly shows that not only are US Debt instruments being accepted worldwide, foreign demand is at record levels.

A notable 65.3% of the auction was bought by foreign investors, termed ‘Indirects’. This is the highest percentage since the previous summer and well above the six-auction average.

So when the Guru News Network tells us that the US is bankrupt and US Treasuries are dead in the water internationally, our first action should be to simply go to the Treasury Auction website and check the facts. Nearly all financial data is publicly available as verification.

Here’s the details of today’s 2-Year Treasury Auction.

Solid Auction Signals Strong International Demand

Today’s 2-year Treasury auction highlighted a significant confidence in the US Treasuries, especially among foreign buyers.

Despite potential concerns regarding the upcoming Federal Open Market Committee (FOMC) meeting and Treasury Refunding, the auction proved successful.

Key Auction Outcomes

Sale Amount: The US sold $60 billion in 2-year notes today (January 23, 2024).

Interest Rate: The notes were sold at an interest rate of 4.365%. This was in line with expectations and slightly higher than last month’s rate.

Demand: The bid-to-cover ratio was 2.571. Although this is a slight decrease from last month and below the recent average, it remains within the healthy range seen over the past decade.

Demand for US Treasury Debt Instruments is at an all time high. Today’s 2-Year auction confirms this fact.

Foreign Interest Peaks

High Foreign Participation: A notable 65.3% of the auction was bought by foreign investors, termed ‘Indirects’. This is the highest percentage since the previous summer and well above the six-auction average.

Implications: Such strong foreign participation indicates a continued trust in the stability and reliability of US Treasury securities.

Domestic Participation and Market Impact

Direct and Dealer Participation: Direct bidders bought 19.9% of the auction, slightly below the average. Dealers took the smallest portion since the previous fall, at 14.8%.

Stable Market Response: The auction did not significantly impact the market. The 10-year Treasury yield remained stable at 4.14% following the auction.

This recent Treasury auction underscores the strong international confidence in US Treasuries (Bills, Notes, and Bonds).

Despite some market uncertainties, the high level of foreign buyer participation reflects the ongoing appeal of US Treasury securities as a stable investment.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

More News, Rumors and Opinions Friday Afternoon 1-26-2024

Thoughts From Holly:

This is how I have been told things go;

It’s RV

Then (corporate) government take down

EBS/EAS

Nesara

Rv funds the Republic which they can then stand up. The Government take down is done publicly and does away with the corporation and federal reserve. The republic has the US treasury which is backed by gold and the gold standard is implemented.

-Holly

Thoughts From Holly:

This is how I have been told things go;

It’s RV

Then (corporate) government take down

EBS/EAS

Nesara

Rv funds the Republic which they can then stand up. The Government take down is done publicly and does away with the corporation and federal reserve. The republic has the US treasury which is backed by gold and the gold standard is implemented.

-Holly

TNT:

CandyKisses: Al-Khazali: The withdrawal of foreign forces from Iraq is an important step in the right direction

Baghdad Today - Baghdad

The Secretary-General of Asaib Ahl al-Haq, Qais al-Khazali, commented on Thursday (January 25, 2024), on the Baghdad-Washington agreement, stressing "the need to prevent procrastination and procrastination with the exit of the coalition forces." "

************

CandyKisses: Al-Sudani confirms Iraq's progress towards major development and strategic projects

Baghdad Today - Baghdad

The Prime Minister, Mohammed Shia Al-Sudani, confirmed on Thursday (January 25, 2024) that Iraq is moving towards major development and strategic projects.

According to a statement of his office received by "Baghdad Today", that the Sudanese "received, this evening, a delegation of secretaries and governors of Arab capitals, headed by the Secretary-General of the Organization of Arab Towns Abdul Rahman Hisham Al- Asfour and welcomed, at the beginning of the meeting, the Arab guests, and their meeting, which was held in Baghdad after a break of more than three decades, "stressing" Baghdad's permanent readiness and ability to host all its guests, whether they are Arab brothers or friends."

Al-Sudani stressed that "Iraq is moving towards development projects, major strategies and productive economic partnerships," noting that "the government in Iraq has placed at the top of its priorities the comprehensive upgrading of Baghdad and the rest of the Iraqi cities, as well as openness to the successful experiences of brothers and friends, in terms of relying on technology and advanced methods on urban development and all service sectors."

He pointed out that "at a time when we are looking for the best ways to develop and upgrade our cities, Gaza stands out before us because of the systematic destruction, devastation and lack of the most basic means of livelihood, due to the aggression and inhumane crimes committed by the occupation authorities against our Palestinian people there, reiterating its support for the establishment of the Gaza Strip Support and Reconstruction Fund after the cessation of aggression, an initiative launched by Iraq during the Cairo Peace Summit 2023, which was held last October And he was very welcomed."

***********

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 There are three things that the Davos meeting was demanding that they do. 1. Do you have liquidity to back up your currency? Yeah, they showed it. 2. Do you have supervision/overview of your monetary reform? That's why the United States Treasury was explaining and then the IMF. Ok good. 3. Can you monitor your banks? ...Yeah. That is good enough with us. You are Basel 3 compliant...This is huge.

Mnt Goat Remember again this is not all about us investors. It is about the Iraqi people and their lives. We will only benefit too because we helped invest our money in Iraq in their time of need... I have never seen such a rate of progress since the end of the wars in 2003 and I entered this investment.

"Goldilocks Economy?" Really? HOW ABOUT NO! ITS AN ECONOMIC NIGHTMARE...

Greg Mannarino: 1-26-2024

This New Law Will Cause A Catastrophic Wave Of Bank Failures

Atlantis Report: 1-26-2024

The banking industry is facing a major threat from a new law that aims to prevent another financial crisis and protect consumers from abusive and predatory practices by banks and other financial institutions.

However, the law also imposes strict and costly regulations and requirements on banks.

The law also gives more power and authority to the regulators to supervise and sanction banks that fail to comply with the law. While the law may have noble intentions, it may also have unintended and disastrous consequences for the banking industry and the economy.

Economist's "News and Views" Friday 1-26-2024

Bill Holter: We’re Heading Toward An Event That Forces The Fed’s Hand

Arcadia Econimcs: 1-25-2024

On one hand the White House and the Federal Reserve officials are holding to the mantra that the economy is still strong and roaring.

On the other hand even the Fed is forecasting rate cuts this year, while the White House usually fails to mention that a lot of the GDP growth we're seeing would disappear pretty quickly if the Treasury wasn't running some alarmingly increasing deficits.

So today Bill Holter stops by to separate fact from fiction. He talks about why he feels there's a liquidity event coming that will force the Fed to lower interest rates, what he's seeing in terms of a shift in what the world is considering the 'risk-free' asset, and the latest on the growing mismatch between the amount of silver that's being used vs. what's produced.

Bill Holter: We’re Heading Toward An Event That Forces The Fed’s Hand

Arcadia Econimcs: 1-25-2024

On one hand the White House and the Federal Reserve officials are holding to the mantra that the economy is still strong and roaring.

On the other hand even the Fed is forecasting rate cuts this year, while the White House usually fails to mention that a lot of the GDP growth we're seeing would disappear pretty quickly if the Treasury wasn't running some alarmingly increasing deficits.

So today Bill Holter stops by to separate fact from fiction. He talks about why he feels there's a liquidity event coming that will force the Fed to lower interest rates, what he's seeing in terms of a shift in what the world is considering the 'risk-free' asset, and the latest on the growing mismatch between the amount of silver that's being used vs. what's produced.

To hear the whole interview, click to watch the video now!

LIVE! U.S. GDP Numbers Are MIRACULOUS! And The Are Also 100% FAKE... IMPORTANT UPDATES.

Greg Mannarino: 1-25-2024

Russia & China’s dedollarisation tactics exposed - LFTV Ep 157

Kinesis Money: 1-26-2024

In this week’s episode of Live from the Vault, Andrew Maguire delivers crucial updates on the accelerating dedollarisation process and the impending gold price reevaluation - and explains how it will also impact silver.

The London whistleblower takes listeners through insider info on central bank activity, revealing game-changing events that might affect traders in the US and around the world, and analyses what’s happening in the markets right now.

Timestamps:

00:00 Start

01:45 How will dedollarisation affect the gold price?

14:00 The disparities between Eastern and Western central bank gold holdings

22:30 How gold price reevaluation will impact US traders trapped in COMEX

25:00 How gold price reevaluation will impact global traders

30:15 How gold price reevaluation will impact silver

34:30 What’s happening right now in the markets

"Tidbits From TNT" Friday Morning 1-26-2024

TNT:

CandyKisses: Al-Fatlawi: Iraqi policy is continuing to remove the occupation forces from the country

Information / Baghdad.

Ali al-Fatlawi, a member of the Fatah Alliance, said that Iraq is on the way to removing the combat forces of the US occupation, while maintaining diplomatic cooperation like other countries that work on this principle.

Al-Fatlawi told Al-Maalouma that "Iraq's policy is proceeding on the right real track to end the US presence in the country and remove the occupation forces from military bases."

He added that "the removal of the occupation forces from Iraq opens the door to the continuation of diplomatic cooperation, as any Arab or foreign regional country does, provided that the combat presence of US forces inside Iraq is ended." TNT:

CandyKisses: Al-Fatlawi: Iraqi policy is continuing to remove the occupation forces from the country

Information / Baghdad.

Ali al-Fatlawi, a member of the Fatah Alliance, said that Iraq is on the way to removing the combat forces of the US occupation, while maintaining diplomatic cooperation like other countries that work on this principle.

Al-Fatlawi told Al-Maalouma that "Iraq's policy is proceeding on the right real track to end the US presence in the country and remove the occupation forces from military bases."

He added that "the removal of the occupation forces from Iraq opens the door to the continuation of diplomatic cooperation, as any Arab or foreign regional country does, provided that the combat presence of US forces inside Iraq is ended."

TNT:

CandyKisses: Al-Fatlawi: Iraqi policy is continuing to remove the occupation forces from the country

Information / Baghdad.

Ali al-Fatlawi, a member of the Fatah Alliance, said that Iraq is on the way to removing the combat forces of the US occupation, while maintaining diplomatic cooperation like other countries that work on this principle.

Al-Fatlawi told Al-Maalouma that "Iraq's policy is proceeding on the right real track to end the US presence in the country and remove the occupation forces from military bases."

He added that "the removal of the occupation forces from Iraq opens the door to the continuation of diplomatic cooperation, as any Arab or foreign regional country does, provided that the combat presence of US forces inside Iraq is ended."

He pointed out that "America has cards to play against countries that oppose its path and project in the region, and Iraq has taken a decision to remove the occupying forces from the country, where it works through its cards to exert pressure to ensure the achievement of its goals, but the matter cannot pass on the Iraqis as they will not obey any pressure exerted by Washington towards them."

Tishwash: Russia: Baghdad informed us of Washington's readiness to withdraw its forces from Iraq

The special envoy of the Russian President for the Syrian settlement, Alexander Lavrentiev, said that Iraq informed the Russian side of the United States’ readiness to withdraw its forces from Iraq.

In an interview with Novosti, Lavrentiev said that the question now is how long this will take and how the process of withdrawing American military personnel will take place.

He added, "Our Iraqi colleagues told us about this matter, and they informed us that the American ambassador in Baghdad announced his country's readiness to implement this measure - to meet the request of the Iraqi side, which was confirmed by a parliamentary decision. For my part, I asked our Iraqi friends in particular whether their request had been rejected, and they answered that the United States agreed." .

According to the Russian envoy, the Iraqi side confirmed that it is ready to maintain order throughout Iraq practically, and does not need external military support.

Regarding the American withdrawal, Lavrentiev said: “This could happen within a month or two, as happened in Afghanistan, or it could extend for years, and it could be done in a way in which military units are withdrawn and security forces from private companies are deployed in their place. Thus, it will seem that there is no "There are foreign military units, but there will be a foreign military presence." link

************

CandyKisses: Parliamentary Finance: We are close to ending the phenomenon of "parallel markets" and prices are heading down

Baghdad today - Baghdad

The Parliamentary Finance Committee confirmed today, Wednesday (January 24, 2024), that Iraq is close to resolving the crisis of the high dollar exchange rate and ending the phenomenon of "parallel markets."

Committee member Moeen Al-Kazemi said, in an interview with "Baghdad Today," that "the Iraqi government and the central bank were able to truly control the exchange rate of the dollar and prevent its rise, after taking various steps and decisions over the past months that led to the gradual decline of the dollar in the parallel markets." .

He added, "Work is currently underway to end the so-called (parallel markets) and we are approaching that. The dollar will not be exchanged except at the rate approved by the Central Bank of Iraq, and this matter requires a short time," pointing out that "the decline in the parallel markets "It will continue gradually over the coming days."

Earlier, the Central Bank of Iraq announced in a statement that it had decided as of January to "limit all commercial and other transactions to Iraqi dinars instead of dollars" inside the country, in an attempt to control exchange rates in parallel markets.

Yesterday, Tuesday (January 23, 2024), a member of the Parliamentary Economy Committee, MP Periar Rashid, monitored the danger of the "parallel market" in Iraq.

Rashid said in an interview with "Baghdad Today" that "many factors contributed to the creation of the parallel market for the exchange of the dollar in Iraq, which is currently far from the official rate set by the Central Bank at about 20,000 dinars per $ 100 (the official rate is 132,000 dinars per $100)."

Rashid pointed out that "the gap between the parallel and the official puts strong pressure on the markets and increases the rate of price rise," stressing that "his committee will hold a series of sessions with the Central Bank starting next week in order to coordinate towards supporting the markets and responding to the requirements of companies and traders in order to reduce prices as much as possible."

He explained that "supporting banks and openness in the labor market and production is a priority during the next stage," stressing that "increasing national production will reduce the demand for hard currency and push to reduce the parallel market, and this is what we are seeking to achieve at the present time."

Mot: ... its a Marital Thingy - I Thinks!!!

Mot: .. soooo - How Long as It been???

News, Rumors and Opinions Friday AM 1-26-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 26 Jan. 2024

Compiled Fri. 26 Jan. 2024 12:01 am EST by Judy Byington

Judy Note: It appears from the below Intel from Wolverine and Bruce that Tier 4b (us, the Internet Group) will be receiving emails that have information on how we can set currency exchange and Zim Bond redemption appointments anywhere from Sat. 27 Jan. through Tues. 30 Jan. and those appointments will run until Thurs. 15 Feb. 2024.

Thurs. 25 Jan. Wolverine: “Reno said the gold-backed dollar was introduced last night at 4:47 am. All 86 platforms were now loaded with money and ready to launch. We expect the official launch to go live on Fri. 26 Jan, but around the world the first payment runs will take place from Mon. 29 Jan. at 9am EST.” …

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 26 Jan. 2024

Compiled Fri. 26 Jan. 2024 12:01 am EST by Judy Byington

Judy Note: It appears from the below Intel from Wolverine and Bruce that Tier 4b (us, the Internet Group) will be receiving emails that have information on how we can set currency exchange and Zim Bond redemption appointments anywhere from Sat. 27 Jan. through Tues. 30 Jan. and those appointments will run until Thurs. 15 Feb. 2024.

Thurs. 25 Jan. Wolverine: “Reno said the gold-backed dollar was introduced last night at 4:47 am. All 86 platforms were now loaded with money and ready to launch. We expect the official launch to go live on Fri. 26 Jan, but around the world the first payment runs will take place from Mon. 29 Jan. at 9am EST.” …

Wolverine Cont….. “All paying banks will (allegedly) begin to pay at the same time after the signatory Holders receive the 800 number in their email to call and receive instructions. There are more than 400,000 emails. For payments first would be Zimbabwe Blue and Derivatives.” …“Obviously getting started means government first, then businesses and individuals. If they are finished before 15 Feb. 2024 we can be happy.”

~~~~~~~~~~~

Thurs. 25 Jan. 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#, 667-770-1865

400,000 emails to go out in groups during a 18 hour period

Two different sources and a Redemption Center agreed on the timing of the release of 800 numbers: Sat 27 Jan. through Tues. 30 Jan. with emphasis on Sat. 27 Jan.

Bond Holders to get their email Fri. 26 Jan.

~~~~~~~~~~~~

Global Financial Crisis:

Feds To Allow Emergency Bank Lending Program to Expire on Mon. 11 March 2024: https://www.reuters.com/markets/us/fed-allow-emergency-bank-lending-program-expire-march-11-2024-01-25/

US Government files notice to sell $130 million worth of Bitcoin seized from Silk Road.

Read full post here: https://dinarchronicles.com/2024/01/26/restored-republic-via-a-gcr-update-as-of-january-26-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Article "Parliamentary Finance: We are close to ending the phenomenon of “parallel markets” and prices are heading to decline" You guys are running out of ways telling the citizens that they're about to get their new exchange rate...Next week the CBI has a meeting on this very subject!

Militia Man They're working currently underway to end the so-called parallel markets. Article quote "The dollar will not be exchanged except at the rate approved by the Central Bank of Iraq.' The office exchange rate, give 10 to 20 points one side or the other of that 1310. Quote "The parallel markets will gradually decline and cease over the next few days.' I'm fairly certain if they apply a Real Effective Exchange rate, gradually is going to be a thing of the past. But we'll see how it works out.

BANK RUNS ALERT: European Central Bank Monitors Social Media For Red Flags, Has Liquidity Concerns

Lena Petrova: 1-25-2024

Trouble Brewing In The Banking System | Michael Oliver & Bret Oliver

Liberty and Finance: 1-25-2024

The Bank Term Funding program comes to an end in March. "Watch the bank stocks," says Bret Oliver. He expects a further crisis in the banking system. Michael Oliver says amid such a crisis, the Fed will have to ease because they "can't let the banks fail."

INTERVIEW TIMELINE:

0:00 Intro

1:30 Gold & silver update

6:14 Stock market update

13:59 Banking system

21:00 Bitcoin

25:00 Momentum Structural Analysis

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Good evening Dinar Recaps,

We are approaching a sink-or-swim situation. The Banking System has prepared well for the up-and-coming volatility inside the markets and banking system with new capital requirements to minimize many of the fluctuations that are about to come our way in every sector of the market.

New Tokenized Assets are creating new Protocols and opportunities to bring in money spent outside of the banking system. These new assets will be governed through artificial intelligence in many cases capable of helping investors navigate through the new landscape of the new digital economy.

As these forces are brought together, price distortions will come into the new financial system seeking new algorithmic support levels. It will be the new support levels that will determine new prices on the road ahead of us as Global Markets begin to transition into a Global Currency Reset capable of measuring and controlling these new rates through new Quantum Technologies.

© Goldilocks

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Thursday Evening 1-25-24

Good evening Dinar Recaps,

We are approaching a sink-or-swim situation. The Banking System has prepared well for the up-and-coming volatility inside the markets and banking system with new capital requirements to minimize many of the fluctuations that are about to come our way in every sector of the market.

New Tokenized Assets are creating new Protocols and opportunities to bring in money spent outside of the banking system. These new assets will be governed through artificial intelligence in many cases capable of helping investors navigate through the new landscape of the new digital economy.

As these forces are brought together, price distortions will come into the new financial system seeking new algorithmic support levels. It will be the new support levels that will determine new prices on the road ahead of us as Global Markets begin to transition into a Global Currency Reset capable of measuring and controlling these new rates through new Quantum Technologies.

© Goldilocks

~~~~~~~~~~

SEC opens comment period on proposal that would allow options trading on BlackRock's spot bitcoin ETF | The Block

~~~~~~~~~~

Fintech, Including Crypto, Is Reshaping How Funds Flow Worldwide | Forbes

~~~~~~~~~~

XRP BANKS CONFIRMED✅ 👀 #xrp #btc #crypto

https://youtube.com/shorts/pduFSdScfRs?feature=shared

~~~~~~~~~~

Millions to be left without access to cash as bank branch closures speed up at ‘alarming rate’ | GB News

~~~~~~~~~~

INVESTMENT COMPANY ACT OF 1940 Release No. 35097 / January 24, 2024 | Pdf Link

Release No.:IC-35097 Date: Jan. 24, 2024 Details:

Order Under Section 8(f) of the Investment Company Act of 1940 Declaring that Applicant has Ceased to be an Investment Company

AOG Institutional Diversified Master Fund 811-23765 Order: Rel No. IC-35097

AOG Institutional Diversified Tender Fund 811-23766 Order: Rel No. IC-35098

ASYMmetric ETFs Trust 811-23622 Order: Rel No. IC-35099

BlackRock 2022 Global Income Opportunity Trust 811-23218 Order: Rel No. IC-35100

BlackRock Florida Municipal 2020 Term Trust 811-21184 Order: Rel No. IC-35101

BlackRock Muni New York Intermediate Duration Fund, Inc. 811-21346 Order: Rel No. IC-35102

BlackRock Municipal 2020 Term Trust 811-21181 Order: Rel No. IC-35103

BlackRock New York Municipal Bond Trust 811-21037 Order: Rel No. IC-35104

Cushing Mutual Funds Trust 811-23293 Order: Rel No. IC-35105

Eaton Vance Tax-Managed Buy-Write Strategy Fund 811-22380 Order: Rel No. IC-35106

Goldman Sachs Credit Income Fund 811-23498 Order: Rel No. IC-35107

Invesco BLDRS Index Funds Trust 811-21057 Order: Rel No. IC-35108

Kayne Anderson NextGen Energy & Infrastructure, Inc. 811-22467 Order: Rel No. IC-35109

Mutual of America Variable Insurance Portfolios, Inc. 811-23449 Order: Rel No. IC-35110

Nuveen Corporate Income November 2021 Target Term Fund 811-23075 Order: Rel No. IC-35111

Nuveen Select Tax Free Income Portfolio 2 811-06622 (Order: Rel No. IC-35112

Nuveen Select Tax Free Income Portfolio 3 811-06693 Order: Rel No. IC-35113

~~~~~~~~~~

👆 If you own any of these investments above, you may want to take a look at them. Be sure to read that one page PDF file.

This is not financial advice, you just may simply want to take this to your wealth manager to see if there's anything you need to do with these assets.

Things are changing my friends.

@ Goldilocks

~~~~~~~~~~

What is Bitcoin Halving & How Does it Affect BTC's Price?

"Bitcoin halving events have historically been associated with price increases. This is because the reduced rate of new Bitcoin creation can cause scarcity, potentially driving up demand and, as a result, the price."

Do you see how the timing of this event and why the major players in the game such as Black Rock have invested on the ground floor of this spot Bitcoin ETF opportunity?

Bitcoin tends to be the leader in the digital economy, and those invested in digital assets during this rise will reap the benefits. This includes our new Digital Asset Based Trading System.

Each sector of the market that has transitioned or on their way to transitioning into the new digital economy will experience cause and effects on the decisions being made during this time.

© Goldilocks

AXI Link

Buy Bitcoin

~~~~~~~~~~

A critical area that requires reform in the WTO is equity. The current system is often criticised for favouring developed countries over developing countries, leading to an imbalance in global trade relations. ORF Link

~~~~~~~~~~

👆 This is why the WTO has been in economic reforms as of late. Attempts are being made to level the playing field.

~~~~~~~~~~

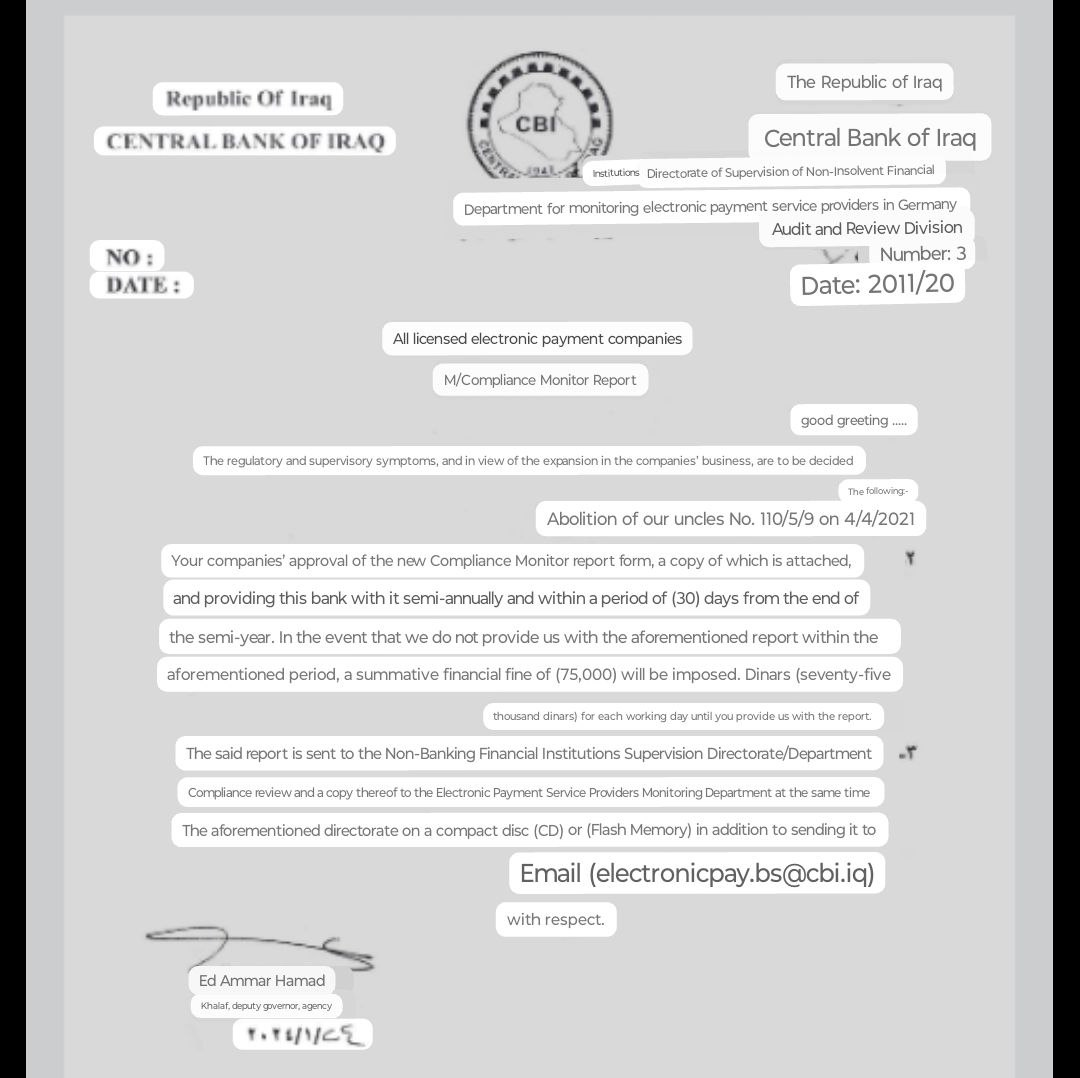

For regulatory and supervisory purposes and in view of the expansion in the work of all licensed electronic payment companies, the following was decided.. https://cbi.iq/news/view/2507

~~~~~~~~~~

🔴 BANK RUNS ALERT: European Central Bank Monitors Social Media For Red Flags, Has Liquidity Concerns https://youtu.be/EuBHi8lTj3Q?feature=shared

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Bank Runs: The ECB’s Ridiculous Blame on Social Media : Awake-In-3D

Bank Runs: The ECB’s Ridiculous Blame on Social Media

On January 24, 2024 By Awake-In-3D

Overlooking the Real Issue

The European Central Bank (ECB) has recently shifted its focus to monitoring social media, blaming it for triggering bank runs.

This perspective is a clear misdirection. It overlooks the underlying instability of the global fiat financial system, the true root cause of potential bank runs.

Bank Runs: The ECB’s Ridiculous Blame on Social Media

On January 24, 2024 By Awake-In-3D

Overlooking the Real Issue

The European Central Bank (ECB) has recently shifted its focus to monitoring social media, blaming it for triggering bank runs.

This perspective is a clear misdirection. It overlooks the underlying instability of the global fiat financial system, the true root cause of potential bank runs.

Social Media as a Scapegoat

By focusing on social media as the cause of bank runs, the ECB is ignoring the larger issue.

The real problem lies in the inherent weaknesses of the fiat financial system. This system is burdened by unsustainable debt, leading to a lack of confidence among depositors.

The 2023 Bank Runs: A Deeper Look

Consider the bank runs of 2023. The ECB’s narrative blames social media for spreading panic, leading to massive withdrawals from banks like Credit Suisse.

However, this simplistic view fails to acknowledge the underlying financial instability and lack of trust in the financial system.

Questioning ECB’s Liquidity Measures

The ECB’s response includes increasing surveillance of social media and adjusting liquidity measures like the Liquidity Coverage Ratio (LCR).

Yet, these actions seem superficial. They do not address the deeper issues plaguing the financial system, such as the reliance on debt and the devaluation of fiat currencies.

Global Reaction: The ECB Makes No Sense

Globally, financial regulators are debating the resilience of banks under current regulations. Yet, there’s a stark contrast in perspectives.

While the ECB focuses on social media, other regulators are examining the fundamental flaws in the financial system.

Ignoring the Elephant in the Room

The ECB’s stance is akin to ignoring the elephant in the room. By blaming social media for financial instability, they’re diverting attention from the more significant issue – the fragility of the global fiat financial system.

The Need for a Systemic Overhaul

What’s needed is not just better social media monitoring or tweaked liquidity ratios. It’s a systemic overhaul of the financial system. The shift should be towards a system based on tangible assets, moving away from the fiat currency model.

My Thoughts: The True Path to Financial Stability

As the ECB continues to blame external factors like social media, it becomes increasingly clear that a more profound change is necessary.

The path to true financial stability lies in acknowledging the inherent weaknesses of the current fiat financial system and returning to an asset-backed, sound money policy.

Stay tuned to GCR Real-Time News for insightful analysis on these crucial economic developments.

Supporting article: Reuters – ECB asks some lenders to monitor social media for early signs of bank runs -sources

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/bank-runs-the-ecbs-ridiculous-blame-on-social-media/

More News, Rumors and Opinions Thursday Afternoon 1-25-2024

KTFA:

Clare: It has not been held since 1945.. Baghdad will host the Oil and Gas Conference in the Arab World next Saturday

1/25/2024

It is hoped that the capital, Baghdad, will host, next Saturday, the Oil and Gas Conference in the Arab World, which will last for two days.

The Secretary-General of the Federation of Arab Engineers, Adel Al-Hadithi, said, “The conference is the first in the field of oil and gas held by the Federation of Arab Engineers in the modern era, as the last conference was held in Alexandria in 1945,” according to the government newspaper Al-Sabah.

KTFA:

Clare: It has not been held since 1945.. Baghdad will host the Oil and Gas Conference in the Arab World next Saturday

1/25/2024

It is hoped that the capital, Baghdad, will host, next Saturday, the Oil and Gas Conference in the Arab World, which will last for two days.

The Secretary-General of the Federation of Arab Engineers, Adel Al-Hadithi, said, “The conference is the first in the field of oil and gas held by the Federation of Arab Engineers in the modern era, as the last conference was held in Alexandria in 1945,” according to the government newspaper Al-Sabah.

Al-Hadithi explained, “Researchers and specialists in this field from (Egypt, Lebanon, Jordan, Syria, Qatar, and Libya) will participate in the conference, in addition to the host country, Iraq.”

Al-Hadithi pointed out, “The conference will discuss over two days and in four sessions, topics (oil wealth in the Arab world, optimal investment of oil wealth, optimal exploitation of energy sources and environmental protection, and manufacturing of crude oil in the Arab world with the aim of maximizing its value.”) LINK

**************

Clare: Three Arab countries enter the scope of the “BRICS+” group

1/25/2024

The scope of the BRICS group expanded to include 6 new countries, including 3 Arab countries.

Economic data showed that “the contribution of the BRICS+ group to the global GDP last year amounted to 32.1%, while the contribution of the G7 group was 29.9%.”

With the official accession of Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE to BRICS+, “the group’s contribution to the global economy will rise to 35%, and the oil reserves managed by the group’s countries will reach approximately 45%.”

The “BRICS+” group possesses reserves of rare earth metals that are approximately 30 times greater than those of the G7, and this puts the global renewable energy sector under the group’s full control.

Experts believe that “the efforts of the BRICS+ group to abandon the dollar in the global economy will have negative repercussions on the entire G7 group, and on the United States in particular.”

Until the end of last year, BRICS+ included Russia, Brazil, China, India, and South Africa, before Egypt, Iran, the Emirates, Saudi Arabia, and Ethiopia joined it starting in the new year.

The group is working to "formulate a multipolar international political and economic system, and break the hegemony of the West led by the United States, while the economic aspect constitutes the backbone of the group." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Quote from Deputy Prime Minister and Foreign Minister Fuad Hussein: “Iraq’s endeavor to occupy its natural position in the region and the international community”. ...Part of what it means for us investors in the dinar is to realize that when they mention international community, they are talking global...liberating Iraq from the war years. It is a FACT they cannot operate effectively in the global arena without a tradable currency on the currency exchanges, such as FOREX. Iraq is also at the sheer brink of a final announcement into the World Trade Organization (WTO), which we know they want back their dinar in the process...I believe that when you put all the FACTS together you can clearly see where they are leading Iraq and it is down a very nice road of prosperity and abundance...

Militia Man Revenue streams are increasing. They're promoting the private sector which is going to create thousands and thousands of jobs...These 10 cities they're going to build it's going to be a lot of construction. They're not going to do that at 1310. If it costs you 1310 dinars for every dollar for every screw that might cost a buck a screw. Try to build a country with 1310. It's not going to happen...

Note: It is possible this was a mistake at a branch or possible mistake by a teller. But we will watch for any more updates that may come in the future. Time will tell. But, very encouraging! Thanks to those who share with us ~The Dinar Recaps Team

Bank Story for Dinar and Zim

Go to the 33 mark and listen….Bank Story About 15 minutes long.

Simply Linn: 1-25-2024

Info about possible exchanging, thoughts double dipping and bank screens.

$300 BILLION Theft: The West Is Moving Towards Seizing $300 Billion In Russian Frozen Assets

Lena Petrova: 1-25-2024

"Tidbits From TNT" Thursday 1-25-2024

TNT:

Tishwash: Baghdad hosts the oil and gas conference next week 1/25

Next Saturday, Baghdad will host a two-day oil and gas conference in the Arab world.

The Secretary-General of the Federation of Arab Engineers, Dr. Adel Al-Hadithi, explained that “the conference is the first in the field of oil and gas held by the Federation of Arab Engineers in the modern era, since the last conference was held in Alexandria in 1945,” indicating that “researchers and specialists in this field from (Egypt) Lebanon, Jordan, Syria, Qatar, and Libya will participate in the conference

In addition to the host country, Iraq. Al-Hadithi pointed out that “the conference will discuss, over two days and four sessions, topics (oil wealth in the Arab world, optimal investment of oil wealth, optimal exploitation of energy sources and environmental protection, and manufacturing of crude oil in the Arab world with the aim of maximizing its value) link

TNT:

Tishwash: Baghdad hosts the oil and gas conference next week 1/25

Next Saturday, Baghdad will host a two-day oil and gas conference in the Arab world.

The Secretary-General of the Federation of Arab Engineers, Dr. Adel Al-Hadithi, explained that “the conference is the first in the field of oil and gas held by the Federation of Arab Engineers in the modern era, since the last conference was held in Alexandria in 1945,” indicating that “researchers and specialists in this field from (Egypt) Lebanon, Jordan, Syria, Qatar, and Libya will participate in the conference

In addition to the host country, Iraq. Al-Hadithi pointed out that “the conference will discuss, over two days and four sessions, topics (oil wealth in the Arab world, optimal investment of oil wealth, optimal exploitation of energy sources and environmental protection, and manufacturing of crude oil in the Arab world with the aim of maximizing its value) link

CandyKisses: Japan's Toyota wants to restore its car factories in Iraq

Economy Baghdad News

Japan's Toyota Motor Industries announced on Wednesday its desire to restore factories and car services in Iraq.

This came during a meeting between a delegation of Toyota, the authorized distributor of Toyota cars in Iraq, with Iraqi Trade Minister Atheer Al-Ghariri, according to a statement seen by "Economy News".

A statement by the Ministry of Commerce quoted Al Ghurairi as confirming during the meeting that the ministry is looking forward to cooperating and achieving real and realistic work with companies specialized in the field of cars, including Toyota, by entering into partnership contracts and successful investments with the General Company for Automotive and Machinery Trading to advance its capabilities and develop the skills and capabilities of its employees.

"The ministry will work to strengthen and activate the work of cooperation committees and joint agreements between the two parties," al-Ghuriri said.

For his part, Sardar Bibani said that "Toyota Iraq is the exclusive main distributor of Toyota, Lexus and Hino trucks, and we hope to return factories and services in Iraq to serve our dear country."

The Director of Operations of Toyota in Japan said that our vision for Iraq is greater than what has been achieved and we need to work with Iraq with the official guarantee of factories and the network of official agents and building manpower and infrastructure, praising "the role of the Commercial Attaché in Japan in the procedures of meetings, listening to views and delivering them to decision-makers in the ministry

************

Tishwash: An American spokesman reveals the details of ending the international coalition’s mission in Iraq

A US State Department spokesman confirmed that Washington and Baghdad are "close" to agreeing to start the work of the Supreme Military Committee in preparation for transforming the mission of the US-led International Coalition to Defeat ISIS into bilateral relations.

The spokesman told Al-Hurra website: “As we announced in August 2023, we are looking forward to moving forward with (the formation of) the Higher Military Commission (or HMC for short), because it reflects the United States’ deep commitment to regional stability and Iraqi sovereignty.”

The spokesman added, "The United States and Iraq are close to agreeing on the start of the Supreme Military Committee dialogue, which was previously announced in August."

The spokesman stressed that "HMC is a point to discuss the transition of the international coalition to defeat ISIS to steadfast bilateral security relations between Iraq and the United States."

He stated, "The two parties will discuss how the mission can develop within a time frame according to several factors, including the threat from ISIS, the operational environment, and the capabilities of the Iraqi forces."

The spokesman concluded his statement to Al-Hurra by saying: "We have talked about this matter for months, and the timing has nothing to do with the recent attacks. The United States will reserve its full right to defend itself during the talks."

Al-Hurra website says that the spokesman’s confirmation came in response to a request for comment regarding reports published by Reuters and CNN that talked about the launch of negotiations between Washington and Baghdad regarding the American presence in Iraq.

Yesterday, Wednesday, the Iraqi Foreign Ministry received a letter it described as “important” from the US government, conveyed by Ambassador Elena Romanski, indicating that the Prime Minister “will study this message,” according to what the Iraqi Foreign Minister announced.

Subsequently, Al-Sudani chaired a meeting of the Ministerial Council for National Security, in the presence of the Minister of Foreign Affairs, during which developments in the security situation in Iraq were discussed.

Four sources told Reuters yesterday, Wednesday, that the United States and Iraq are about to begin talks on ending the mission of the US-led military coalition in Iraq and how to replace it with bilateral relations, a step in a process that was halted due to the war in the Gaza Strip.

Iraq, one of the few countries that is an ally of both Tehran and Washington, has witnessed an escalation in mutual attacks between armed factions and American forces since the outbreak of the war in Gaza, as the factions seek to put pressure on the United States because of its support for Israel.

American forces in Syria and Iraq were subjected to about 150 attacks launched by factions allied with Iran, and the United States launched a series of attacks in response to what it was exposed to, the last of which was on Tuesday.

The escalating violence prompted the Iraqi Prime Minister, Muhammad Shia al-Sudani, to call for the speedy exit of the Washington-led coalition forces through negotiations, a process that was about to begin last year, but the war in Gaza led to its faltering, according to what was reported by Reuters.

Washington did not want to negotiate a possible withdrawal while it was under attacks, as it feared that any change in the mission would appear to occur under pressure, which would embolden regional rivals, including Iran, according to Reuters.

Two sources told Reuters that calculations had changed amid the realization that the attacks would likely not stop and that the current situation was leading to a steady escalation.

An American official told the same agency that the committee will allow for a joint assessment of the Iraqi security forces' ability to fight ISIS "and determine the nature of the bilateral security relationship."

The attacks are carried out by Iraqi armed factions with close ties to Iran, most of whom are not represented in parliament or the government, but have influence over the decision-making process.

Iraqi and American officials hope that the formal start of the talks will contribute to easing political pressure on the Sudanese government and perhaps reduce attacks on American forces, according to Reuters. link

Mot: .... He Deserves a HUGE Tip!!!!

Mot: .... UH OOOOOOOH!!!!

News, Rumors and Opinions Thursday AM 1-25-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 25 Jan. 2024

Compiled Thurs. 25 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Intel providers appeared to be either under NDAs, or were not receiving, nor giving out Intel.

As of Tues. 23 Jan. banks across the World not Basel III compliant (had gold/asset-backed currency), were (allegedly) set to be closed – which would soon lead to a Global Financial Collapse.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 25 Jan. 2024

Compiled Thurs. 25 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Intel providers appeared to be either under NDAs, or were not receiving, nor giving out Intel.

As of Tues. 23 Jan. banks across the World not Basel III compliant (had gold/asset-backed currency), were (allegedly) set to be closed – which would soon lead to a Global Financial Collapse.

The Deep State Cabal was in hopes such a financial disaster would force the World into their Great Reset to non-asset-backed digital currencies where they would have complete control over the population.

The Chinese Elders and BRICS Nations had other plans. The Elders have already(allegedly) released funds that have liquefied gold/asset-backed currencies of sovereign nations in a Global Currency Reset.

Tues. 23 Jan. Wolverine: I hope everyone is excited I am excited! Things are definitely happening. Things I can’t say. God has heard our cry and heard our suffering. Finally, God is answering our prayers. Soon it will be our turn to celebrate. For bondholders there will be no green light it will just happen! For currencies, you will get notifications and I will release the opera. There is a lot happening in Zurich, Reno, other platforms. I have been on a lot of emotional calls and these are NOT small players, they are huge players, i.e.; St. Germaine, huge foundations. Remain in faith. Believe this is happening! We always said things would start on a Tuesday and we are seeing that already! I have been told tomorrow is a good day!!!! Pentecostal is doing great. God Bless you. Never, ever lose hope. Love you guys. Wolverine “Huge Players” – RV/GCR Update(s) from Wolverine via Bearded_PatriotUSA 1-24-24 | Dinar Chronicles

Global Financial Crash:

David Webb, former hedge fund manager and Wall Street insider, uncovered the “Great Takeover,” and exposed the Central Banks’ plan to take everything from everyone. He described The Great Reset to non-asset-backed digital monies as “a scheme to subjugate humanity by seizing all securities, bank deposits, and debt-financed assets.”

Read full post here: https://dinarchronicles.com/2024/01/25/restored-republic-via-a-gcr-update-as-of-january-25-2024/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 What happens when there is a demand for a specific supply? It runs out quickly. Or it goes up in value quickly. The simplest thing, toilet paper, became so valuable when the covid hit us...If I was Sudani I'd give the lower denoms and the new exchange rate and instantly the dinar goes into a basket with other currencies around the world to float. The definition of supply and demand is going to take that float to the REER (Real Effective Exchange Rate). How are they going to reach the REER? By supply and demand.

Sandy Ingram [The Development Road Project] is major, let me explain why - This is going to change ports of call and the international shipping routes...The Suez Canal route is 6,400 miles, 14 days and cost $4.5 billion per day...The Development Road Project is...only 745 miles...That means the costs drop dramatically if you put the shipment on trucks or rail...Once you get into the Mediterranean Sea you can deliver your shipment to anywhere in Europe. That is the importance of this Development Road Project...

Your Money Amid Global Turmoil, Banking Secrets & More | Q&A with Lynette Zang

1-24-2024

Question 1: 0:36 When the treasury/debt market implodes, what will happen to the various government money market funds which have short-term money in them? And will you be able to get your money out without a loss?

Question 2: 3:13 I recently heard George Gammon talk about the ongoing bank issues, and that the fed bailout is continuing quietly, even more than it was last summer. Do you think the bank issues are due to the fed interest rate hikes or to the change in Basel agreement with the amount of assets on hand increasing to cover risk? What is going on behind the scenes?

Question 3: 6:40 If by next December the ten-year yield hits ten plus percent, would that be enough to collapse the world financial system?

Question 4: 9:07 If at some point the price of gold or silver rises sharply and I want to sell to pay off my mortgage, will I have to pay capital gains tax first?

Question 5: 10:10 I hear from many sources to get your money out of the bank. Where is it recommended to put your money other than gold and silver? Are the Money Market accounts safer than the checking and savings accounts?