More News,, Rumors and Opinions Saturday Night 1-6-2024

KTFA:

Frank26: "THE DECISION WAS TO ADD VALUE TO THE CURRENCY OF IRAQ.......... WITH MANY MONETARY REFORM MECHANISMS!!!".............F26

FROM EDDIE: CBI on news saying they have taken measures and decisions on supporting the dinar and maintaining its value against other currencies in the world talking about how CBI fully supports and back dinar and how it will be holding its own against other currencies. Saying this will positively affect the exchange rate.

Frank26: Eddie I am excited that they are giving you deeper information about the monetary reform and how it’s going to add value to your currency and I love how they keep saying in the coming days let’s see what happens around 15 January. God bless you, my buddy. END....F26

KTFA:

Frank26: "THE DECISION WAS TO ADD VALUE TO THE CURRENCY OF IRAQ.......... WITH MANY MONETARY REFORM MECHANISMS!!!".............F26

FROM EDDIE: CBI on news saying they have taken measures and decisions on supporting the dinar and maintaining its value against other currencies in the world talking about how CBI fully supports and back dinar and how it will be holding its own against other currencies. Saying this will positively affect the exchange rate.

Frank26: Eddie I am excited that they are giving you deeper information about the monetary reform and how it’s going to add value to your currency and I love how they keep saying in the coming days let’s see what happens around 15 January. God bless you, my buddy. END....F26

Frank26 Cont….. The Central Bank announces upcoming decisions to support the Iraqi dinar

1/5/2023

Today, Friday, the Central Bank of Iraq revealed anticipated measures and decisions to support the dinar and maintain its strength against other currencies, and other measures that will positively affect the exchange rate, while indicating that it has taken measures in the field of gradually ending the electronic platform.

Assistant Director General of the Investment Department at the Central Bank of Iraq, Muhammad Younis, told the official agency, “The Central Bank will monitor and follow up on all banks and customer complaints that are received by it if the banks are forced to convert customer accounts to the US dollar,” stressing that, “ This issue is easy to follow and monitor, and banks that do not adhere to this decision will be held accountable.”

Younis added, “This decision and the decisions that will follow it in the coming days are all in the interest of supporting the Iraqi dinar and increasing confidence in it,” (BY ADDING VALUE TO THE NATIONAL CURRENCY -F26) noting that “what confirms the strength of the dinar and the public’s confidence in it is the continuation of the Central Bank of Iraq and its failure to fulfill any of its various needs.” Sectors, as it now finances the commerce, electronic payment, travel and other sectors.”

He pointed out, "In the coming days, there will be more measures in the field of meeting all market needs, supporting the Iraqi dinar and maintaining its strength against other currencies," noting that "the Central Bank, as part of its new procedures, prevented banks from automatically converting customer accounts in the dollar currency to the Iraqi dinar." Without the customer’s consent, customers were allowed to open accounts in different currencies.”

Younis noted, “What is new in updating the procedures is that it allowed companies that have contracts with the state to receive their incoming transfers, including workers’ salaries, as well as ongoing contracts for grants and loans in accordance with the Council of Ministers,” adding, “The other point is also in this decision.” What is new is allowing banks to agree with their customers to bring their incoming remittances in cash to Iraq.

He stressed, “These measures will positively affect the exchange rate in the market, will increase the supply of the dollar, and contribute to serving and supporting important sectors in the economy, including the exporting sectors and the sector of companies operating in the government field and in the field of infrastructure development and strategic projects, in addition to supporting Civil society organizations that contribute to the humanitarian and charitable field in Iraq.

Younis explained, “The main goal behind this update or these instructions is to expand the largest possible segment of people to obtain the cash dollar by meeting their current needs for this dollar, as these instructions expanded the number of entities that benefit from the cash dollar, including civil society organizations, and supported these measures.” An important segment of the economy is the exporters’ sector, as it allowed them to obtain 40 percent of the remittances received as a result of their exports and receive them in cash.”

He pointed out, “The decision clearly defined the mechanisms for its implementation by banks, and focused on the issue of incoming transfers, as it allows some groups to receive their incoming transfers in cash,” explaining that “this decision relates to incoming transfers and not the cash sale of dollars to travelers, as the cash sale to travelers will continue.” As is the case now, in addition to meeting the needs of customers and companies through this decision, and thus it will reflect positively on the exchange rate in the coming days.”

Younis stressed, “There are no restrictions applied to banks in the field of money transfer, (ARTICLE 8!!! -F26) because there are procedures in the field of gradually ending the Central Bank of Iraq platform by supporting interests to open accounts in foreign banks abroad, and the role of the Central Bank is limited to enhancing these balances.” And follow up on transfers.

He concluded by saying, "There are no restrictions on money transfers in different currencies within the banking system in foreign currencies. Rather, this decision relates to the cash dollar (cash withdrawal)." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY: CBI on news saying they have taken measures and decisions on supporting the dinar and maintaining its value against other currencies in the world talking about how CBI fully supports and back dinar and how it will be holding its own against other currencies. Saying this will positively affect the exchange rate. FRANK: I am excited that they are giving you deeper information about the monetary reform and how it’s going to add value to your currency and I love how they keep saying in the coming days let’s see what happens around 15 January.

Mnt Goat The CBI is still closely monitoring the parallel rate...the parallel rate is expected to decline sometime in early January and at least match the CBI “official” rate. At that time the CBI will revalue the “official” rate to much closer to if not at 1000. Then again drive the parallel market to match it. This may take some time but I am being told they are talking weeks and not months... my CBI contact tells me we are almost here now and with the opening and spending of the 2024 budget and currency swaps with other neighboring countries for trade, it should finally break the parallel market and end it.

BRICS One Step Closer To Wiping Out The US Dollar

Taylor Kenny: 1-6-2024

In this video, we break down how BRICS growth could impact 2024, how it could potentially wipe out the US dollar, and why it matters to you.

CHAPTERS:

00:00 Shifting Global Power Dynamics

01:00 BRICS Update 2024

03:07 Russia To Host BRICS ’24

05:04 Why Does This Matter To You?

07:11 Protection From The Dollar Value

Goldilocks' Comments and Global Economic News Saturday AM 1-6-24

Goldilocks' Comments and Global Economic News Saturday AM 1-6-24

Good morning Dinar Recaps,

"In response to a surge in attacks on merchant ships, 18 significant shipping companies have opted to avoid transiting the Red Sea, as reported by the International Maritime Organization (IMO). IMO Secretary-General Arsenio Dominguez informed the UN Security Council on Wednesday that a substantial number of companies have rerouted their vessels around Africa to mitigate the impact of attacks on seafarers."

“While we continue to hope for a sustainable resolution in the near future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network,” it added.

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Saturday AM 1-6-24

Good morning Dinar Recaps,

"In response to a surge in attacks on merchant ships, 18 significant shipping companies have opted to avoid transiting the Red Sea, as reported by the International Maritime Organization (IMO). IMO Secretary-General Arsenio Dominguez informed the UN Security Council on Wednesday that a substantial number of companies have rerouted their vessels around Africa to mitigate the impact of attacks on seafarers."

“While we continue to hope for a sustainable resolution in the near future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network,” it added. K News Link Port Calls Link

~~~~~~~~~~

The moment we see a revalued price on gold, at some level all currencies will be partially gold-backed.

© Goldilocks

~~~~~~~~~~

A full revaluation of the gold price to its real value will give us a fully gold-backed system.

© Goldilocks

~~~~~~~~~~

Bank Indonesia (BI) has confirmed plans to move ahead with exploring a central bank digital currency (CBDC) in 2024, with full-scale trials in partnership with leading commercial banks.

Coin Geek Link

~~~~~~~~~~

Two Banking Announcements:

* Basel Committee finds Mexico compliant with its Net Stable Funding Ratio standard and large exposures framework, and largely compliant with its Liquidity Coverage Ratio.

* Assessments find Switzerland largely compliant with the Committee's Net Stable Funding Ratio standard and large exposures framework. https://www.bis.org/press/p231213.htm

~~~~~~~~~~

"Mortgage demand plummets again despite drop in interest rates"

Let me give you an idea of just how big the Mortgage Market really is: Residential Mortgage Market Size: Residential $13.864 trillion. This is not counting Corporations and Business offices.

The Housing Market is still in the process of resetting their prices to coordinate their values with the Banking System's new Basel 3 Capital requirements being implemented on January the 16th, 2024.

Look for new market valuations to form in the near term inside this multi-trillion-dollar business. Coordinating real-world values between the markets and the banking system is a phase of the global economic reset that is just beginning to come to a head.

© Goldilocks

FOXBusiness Link

BankingStrategist Link

~~~~~~~~~~

Washington, D.C. — Commissioner Christy Goldsmith Romero, sponsor of the Commodity Futures Trading Commission’s Technology Advisory Committee (TAC), today announced a detailed agenda for the TAC’s live-streamed January 8, 2024 public meeting at the CFTC’s headquarters.

“Debate around issues of emerging technology for financial markets is enhanced by the Commission’s engagement with the broad and diverse group of technology experts who serve on the TAC, and I am grateful for their service,” said CFTC Commissioner Goldsmith Romero.

“Technology issues are critically important. Artificial intelligence can be transformative, but only if implemented responsibly, in a way that protects customers and markets from harm. Cybersecurity risks continue to be an area that keeps people up at night, and requires constant vigilance. I am also very grateful for the Subcommittee’s work to study decentralized finance, an area where greater understanding will better inform policy decisions.”

https://www.cftc.gov/PressRoom/PressReleases/8846-24

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

"Tidbits From TNT" Saturday 1-6-2024

TNT:

CandyKisses: Absolute parliamentary support for Sudan's steps to end the US presence

Information / Baghdad.

The Sadiqoun parliamentary bloc announced on Saturday its full support for Prime Minister Mohamed Shia al-Sudani's steps to end the foreign presence in the country and achieve national autonomy.

MP Rafiq Hashem told Al-Maalouma that "the removal of foreign forces, led by the Americans, from Iraq is the best response to the US terrorist attacks against the headquarters of the Popular Mobilization."

He added that "the US foreign presence has become a threat to the security of Iraq," noting that "the stay of these forces for a longer period is an obstacle to national autonomy."

TNT:

CandyKisses: Absolute parliamentary support for Sudan's steps to end the US presence

Information / Baghdad.

The Sadiqoun parliamentary bloc announced on Saturday its full support for Prime Minister Mohamed Shia al-Sudani's steps to end the foreign presence in the country and achieve national autonomy.

MP Rafiq Hashem told Al-Maalouma that "the removal of foreign forces, led by the Americans, from Iraq is the best response to the US terrorist attacks against the headquarters of the Popular Mobilization."

He added that "the US foreign presence has become a threat to the security of Iraq," noting that "the stay of these forces for a longer period is an obstacle to national autonomy."

He stressed that "the steps of the Prime Minister to end the foreign presence and achieve full national autonomy is a step in the right direction," noting that "the Iraqi people do not want these forces to remain under any title."

Most Iraqi political forces have issued their support to the prime minister on steps to remove US forces from Iraq after a series of attacks against Iraqi security forces.

Tishwash: Al-Sudani pledges that the Iraqi army will be at the forefront of the world's armies

The Commander-in-Chief of the Armed Forces, Prime Minister Muhammad Shiaa Al-Sudani, pledged on Saturday that the Iraqi army would be at the forefront of the world’s armies in terms of combat level and high readiness.

Al-Sudani said in a statement on the occasion of the 103rd anniversary of the founding of the Iraqi army, “Our Iraqi army, which with its sacrifices painted great epics, and protected the land of Iraq with the blood of its people from the evils of aggressors,” adding, “If it were not for those great sacrifices, Iraq would not have enjoyed stability, security, and peace.” .

He added, "These sacrifices always push us forward, double our adherence to our democratic system, and increase our insistence and resolve to build our free and dignified state in which all Iraqis live equally, without distinction or discrimination."

Al-Sudani continued by saying, "Our pledge to you, our heroes in the Iraqi army, is to be supportive of you, to preserve your rights, and to be at the forefront of the armies, in terms of combat level and high readiness."

Today, Saturday, marks the 103rd anniversary of the founding of the first regiment in the Iraqi army on January 6, 1921. It bore the name “Musa Al-Kadhim Regiment.” It was the first nucleus in the army’s long march, and was followed by two air and naval forces, increasing its strength until it became 4 divisions. The first and third divisions were in Baghdad, the second division was in Kirkuk, and the fourth division was in Diwaniyah. link

************

Tishwash: Iranian-Iraqi negotiations to solve the problem of dealing with the dollar: No crisis in the private sector

The head of the Iran-Iraq Joint Chamber of Commerce, Yahya Al-Ishaq, stated today, Saturday (January 6, 2024), that the Iraqi government is trying to resolve the relationship between the dinar and the dollar with regard to Iran and other countries, while indicating the existence of negotiations between the two sides.

In an interview with the ILNA Labor Agency, the head of the Joint Iranian-Iraqi Chamber of Commerce considered these developments a temporary matter and not new for Iran. He explained: “What is happening today in trade relations between Iran and Iraq is not a new matter. About three months ago, the Iraqi government established rules for To regulate the relationship between the dinar and the dollar, according to which all importers of goods to Iraq are obligated to obtain their currency from the Central Bank of Iraq at the official rate, as this was previously done through exchange offices in the country.

He added: “Given the limitations faced by importers of goods from Iran in obtaining dollars in the official market, they buy dollars from the free market and exchange them through exchange offices, where the price difference is about 20%, and this may increase problems for Iranian merchants.”

Al-Ishaq confirmed that “the Iraqi government is trying to resolve the relationship between the dinar and the dollar with regard to Iran and other countries,” noting that “there are negotiations between the Central Bank of Iran and its Iraqi counterpart in this regard.”

He continued, "Iraq's problems with Turkey in this regard have recently been resolved, and with regard to Iran, it is very likely that they will be resolved as well, so that the commercial flow of Iranian merchants to Iraq will not face any problem, and these solutions will help the Iraqis achieve the desired system and consolidate the commercial flow of Iranians in "Same time."

The head of the Joint Chamber of Commerce between Iran and Iraq denied reports about the impact of these developments on the local currency market in Iran and said: “The monetary relationship between Iran and Iraq is divided into two parts. The first includes financial exchanges for the public sector in Iran and Iraq, which includes exports of gas, electricity, and the like, and the other It is the monetary relationship between the private sector in the two countries.

He concluded by saying: “The private sector in Iran and Iraq has not faced a crisis in trade so far and has suffered few losses. Currently, the level of export flows to Iraq is almost stable, and even in the past eight months, Iran’s exports to Iraq have increased by 34% compared to In the same period last year, it reached $6 billion, and this number is expected to rise to reach $11 billion by March 20 (the beginning of the Iranian New Year link

Mot: .... They Say ~ where theres a will theres a way

Mot: .... Yes!!! -- It Was!!!........

News, Rumors and Opinions Saturday 1-6-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 6 Jan. 2024

Compiled Sat. 6 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

Thurs. 4 Jan. Bruce: Two sources say Tier4b (Us, the Internet Group) notification would happen any time between now and Monday 8 Jan. Late this afternoon one source said all RV releases started this weekend – Bond Holders, Tiers A,B, Fines and Penalties, CMKX, Farm Claims, Prosperity Packages, etc.

Thurs. 4 Jan. Wolverine Call: “Lots of movement in Reno. I know AAA High Level Whales who were traveling to Reno to get paid and some Whales have been paid. I wish I could tell you more, but it is confidential. What info I got was official. It is happening.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 6 Jan. 2024

Compiled Sat. 6 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

Thurs. 4 Jan. Bruce: Two sources say Tier4b (Us, the Internet Group) notification would happen any time between now and Monday 8 Jan. Late this afternoon one source said all RV releases started this weekend – Bond Holders, Tiers A,B, Fines and Penalties, CMKX, Farm Claims, Prosperity Packages, etc.

Thurs. 4 Jan. Wolverine Call: “Lots of movement in Reno. I know AAA High Level Whales who were traveling to Reno to get paid and some Whales have been paid. I wish I could tell you more, but it is confidential. What info I got was official. It is happening.”

For some time the Iraqi Dinar has been (allegedly) trading upward on the back screens of the Forex. By Jan. 1 2024 the new Dinar in-country Rate was revalued and being used within Iraq, while the fiat US Federal Dollar was outlawed in the country.

Thurs. 11 Jan. formal public announcement of NESARA, GESARA.

Wed. 17 Jan. formal public announcement of the new gold/asset-backed US Note.

By Tues. 30 Jan. countries across the Globe would be fully integrated into the Quantum Financial System.

Russia, China Quantum Satellite Computer Test Successful: https://www.tomshardware.com/tech-industry/quantum-computing/russia-and-china-successfully-test-quantum-communication-over-satellite-encrypted-communication-for-brics-countries

Global Financial Crisis:

BRICS: US Dollar continues 20 year decline: https://watcher.guru/news/brics-us-dollar-continues-20-year-decline-amid-global-shift

Chinese shadow banking giant Zhongzhi Enterprise Group Co. has filed for bankruptcy after saying it’s insolvent. Beijing’s First Intermediate People’s Court decided to accept the case, according to a statement on the court’s Wechat account Friday. https://www.reuters.com/business/finance/chinese-court-accepts-wealth-manager-zhongzhis-bankruptcy-application-2024-01-05/

Tesla to recall 1.6 mn cars in China to fix steering software: https://insiderpaper.com/tesla-to-recall-1-6-mn-cars-in-china-to-fix-steering-software-regulator/

Central Banks bought 44 Trillion in Gold in November: https://twitter.com/GoldTelegraph_/status/1743317326227734745?t=PdtKWBCK0gBUn4u_7-dCsw&s=19

Read full post here: https://dinarchronicles.com/2024/01/06/restored-republic-via-a-gcr-update-as-of-january-6-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Bruce [via WiserNow] Now, the bank screens...are going solid rates on front and back screens and are showing on our redemption center screens - on the back screen, solid - but the front screens are still flashing ... Now, what's interesting about that is that the theory is that when those front screens stop blinking and go solid on these rates, that it would be “go time” - that we would get the green light. So I have a feeling they'll be blinking up until the Treasury says go...

Sandy Ingram What would it take for the Iraqi dinar to strengthen against the US dollar? The answer lies in economic development and stability. The Development road project...aims to boost Iraq's GDP by improving infrastructure, fostering foreign investment and stimulating economic growth...With the right steps and sustained growth the dinar's narrative can only get stronger.

Rafi Farber: 1,200 Tonnes of Gold Have Disappeared From ETFs Since 2020, Poured Into Private Stacks

Arcadia Economics: 1-5-2024

2023 is over, and the drain of physical gold from the ETFs and other paper funds sped up significantly last year. That leads to one basic question. Where is it all going?

Since 2020, about 1,200 tonnes are unaccounted for, and about 800 tonnes of that was drained just In 2023. Some of it may have gone to central banks, but stackers are responsible for a good portion of the drain.

It's a very good sign that fewer are playing around with metal derivatives and going for the real thing. Meanwhile, stresses in the overnight repo market continue to worsen.

As 2024 begins, nearly $2 trillion are being traded for Treasuries every night, while the Federal Reserve continues to shrink the monetary base and dump more Treasuries on the market through quantitative tightening.

These are two trains going in the opposite direction on the same track, and they will collide at some point soon.

The Banks Are Not OK

The Banks Are Not OK

By Tyler Durden Thursday, Dec 28, 2023

Authored by Michael Wilkerson via The Epoch Times,

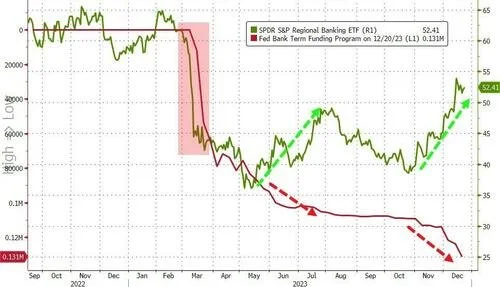

It has been nine months since the spectacular and sudden collapse of Silicon Valley Bank.

After witnessing three of the four largest bank failures in U.S. history in 2023, the attention of the media and the markets has turned elsewhere. Banking crisis? It is as though it never happened. Having fallen by some 40 percent in March, the NASDAQ Bank Index has recovered to within 15 percent of its high from February. In the last few months, nearly all markets have gone on a bull run, including bank stocks.

Yet, and despite the relative quiet, the banking sector is not in great shape. Here are some of the reasons why.

The Banks Are Not OK

By Tyler Durden Thursday, Dec 28, 2023

Authored by Michael Wilkerson via The Epoch Times,

It has been nine months since the spectacular and sudden collapse of Silicon Valley Bank.

After witnessing three of the four largest bank failures in U.S. history in 2023, the attention of the media and the markets has turned elsewhere. Banking crisis? It is as though it never happened. Having fallen by some 40 percent in March, the NASDAQ Bank Index has recovered to within 15 percent of its high from February. In the last few months, nearly all markets have gone on a bull run, including bank stocks.

Yet, and despite the relative quiet, the banking sector is not in great shape. Here are some of the reasons why.

Banks continue to lose deposits. According to data from the Federal Deposit Insurance. Corp. (FDIC), U.S. banks have now lost deposits for six consecutive quarters. While the pace has slowed from the first quarter of 2023, in which nearly $500 billion of deposits were removed from the banking system, approximately $190 billion of deposits have been withdrawn in the last two quarters. Indeed, U.S. banks have lost a net $1.1 trillion of deposits since the beginning of 2022 when interest rates began to rise.

With customer deposits growing scarce, U.S. banks are instead relying on emergency funding lines from the Federal Reserve Banks and the Federal Home Loan Bank (FHLB) system. FHLB bond capital raising, of which the proceeds are used to fund the banks, is up 89 percent year over year through November and looks set to reach $1.1 trillion for 2023. Use of the Bank Term Funding Program, the emergency line put in place by the Fed in March 2023, reached an all-time high last week at $131.3 billion.

This does not reflect normal market operations.

This is a sign that the bank funding markets aren’t operating properly, and that the regulators are stepping in to help prop up the system.

[ZH: Additionally, that bailout program from The Fed is due to end in March. What happens then?]

The growing gap between the rate on the Federal Reserve’s nascent funding facility and what the central bank pays institutions parking reserves suggests officials will let the program expire in March, according to Wrightson ICAP.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

What happens then?]

So much for the liabilities side. But banks face challenges on the asset side as well.

Unrealized losses on investment securities, which is the same problem that got SVB into trouble a year ago, continue to rise. U.S. banks reported unrealized losses of over $684 billion in the third quarter, up 22 percent from the second quarter. Of these unrealized losses on securities, $294 billion are categorized as available for sale (AFS), as opposed to held to maturity (HTM), whereby the bank intends to hold the asset and (hopefully) recapture principle at the end of the term.

The high amount of AFS suggests that if interest rates remain “higher for longer,” then a portion of these losses will begin to realize in 2024 as they are sold by the banks. This will pressure profitability and capital levels.

To continue reading, please go to the original article here:

Goldilocks' Comments and Global Economic News Friday Evening 1-5-24

Goldilocks' Comments and Global Economic News Friday Evening 1-5-24

Good Evening Dinar Recaps,

Our $34 Trillion Debt Is Turning the States to Gold

~~~~~~~~~~

Republican lawmakers and the White House agreed last June to temporarily lift the nation's debt limit, staving off the risk of what would be a historic default. That agreement lasts until January 2025. Here are some answers to questions about the new record national debt.

US national debt hits record $34 trillion as Congress gears up for funding fight

~~~~~~~~~~

Maersk suspends shipping through key Red Sea maritime trade route ‘until further notice’

~~~~~~~~~~

South Korean blockchain Klaytn onboards gold RWA DeFi platform

Klaytn said the platform, launched alongside an accompanying cryptocurrency, provides what it claims to be the first tokenized gold available on DeFi outside of the Ethereum ecosystem.

~~~~~~~~~~

Goldilocks' Comments and Global Economic News Friday Evening 1-5-24

Good Evening Dinar Recaps,

Our $34 Trillion Debt Is Turning the States to Gold The New York Sun Link

~~~~~~~~~~

Republican lawmakers and the White House agreed last June to temporarily lift the nation's debt limit, staving off the risk of what would be a historic default. That agreement lasts until January 2025. Here are some answers to questions about the new record national debt.

US national debt hits record $34 trillion as Congress gears up for funding fight ABC News Link

~~~~~~~~~~

Maersk suspends shipping through key Red Sea maritime trade route ‘until further notice’ CNN Link

~~~~~~~~~~

South Korean blockchain Klaytn onboards gold RWA DeFi platform

Klaytn said the platform, launched alongside an accompanying cryptocurrency, provides what it claims to be the first tokenized gold available on DeFi outside of the Ethereum ecosystem. The Block Link

~~~~~~~~~~

From Black Gold to Tech Marvel: Coal's New Role in Electronics OilPrice Link

~~~~~~~~~~

US Labor Market Summarized: (This is the revised report - a lot of mistakes don't you think)

1. 10 out of the last 11 jobs reports revised lower

2. ~25% of jobs gains in 2023 ultimately revised away

3. Government jobs accounted for 25% of December jobs gains

4. Part-time jobs UP 762,000, full-time jobs DOWN 1.5 million in December

5. Full-time job gains are FLAT for 2023 while part-time is up sharply

6. Inflation-adjusted earnings ~3% BELOW 2021 levels

But still, the initial jobs number beats expectations and prints headlines before being revised lower.

How is this a "soft landing.?"

Twitter Link

CNN Link

BIS Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Petrodollar Collapse Accelerating in 2024, The Fuse Has Been Lit – Andy Schectman

Petrodollar Collapse Accelerating in 2024, The Fuse Has Been Lit – Andy Schectman

Kitco News: 1-5-2024

Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, interviews Andy Schectman, President and Owner of Miles Franklin, who discusses the official addition of five new members to the BRICS bloc as of January 1st.

Schectman warns that the expanded alliance, which includes Saudi Arabia, accelerates the collapse of the petrodollar and ultimately leads to the demise of the dollar as the global reserve currency.

He explores why countries are dumping U.S. debt and stockpiling gold.

Schectman also gives his outlook on the BRICS common currency and shares his forecasts on gold and Bitcoin.

Petrodollar Collapse Accelerating in 2024, The Fuse Has Been Lit – Andy Schectman

Kitco News: 1-5-2024

Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, interviews Andy Schectman, President and Owner of Miles Franklin, who discusses the official addition of five new members to the BRICS bloc as of January 1st.

Schectman warns that the expanded alliance, which includes Saudi Arabia, accelerates the collapse of the petrodollar and ultimately leads to the demise of the dollar as the global reserve currency.

He explores why countries are dumping U.S. debt and stockpiling gold.

Schectman also gives his outlook on the BRICS common currency and shares his forecasts on gold and Bitcoin.

00:00 – Introduction

02:42 - BRICS Expansion and Influence

04:30 - The Petrodollar System

17:11 - De-Dollarization & the Saudi Significance

36:40 - Countries Dumping U.S. Debt, Dollar

44:12 - U.S. Response to De-dollarization

53:15 - BRICS & Common Currency

57:50 - The Role of Gold and Central Banks

01:07:50 – Bitcoin

Understanding How Governments and Banks Hide Economic Realities: Zimbabwe

Understanding How Governments and Banks Hide Economic Realities

Lynette Zang: 1-4-2024

This is an update on Zimbabwe’s current hyperinflation status after the June 2023 overnight currency reset, and how a change in accounting reduced the official inflation rate.

Because of this inflation, high net worth individuals and businesses drove brisk demand for the gold coins and ZiG Zimbabwe’s gold backed CBDC, to protect wealth held in fiat money assets.

Understanding the tricks governments and central banks use to hide the truth from the public enables people to see through the lies and make educated choices that puts their best interest first.

Understanding How Governments and Banks Hide Economic Realities

Lynette Zang: 1-4-2024

This is an update on Zimbabwe’s current hyperinflation status after the June 2023 overnight currency reset, and how a change in accounting reduced the official inflation rate.

Because of this inflation, high net worth individuals and businesses drove brisk demand for the gold coins and ZiG Zimbabwe’s gold backed CBDC, to protect wealth held in fiat money assets.

Understanding the tricks governments and central banks use to hide the truth from the public enables people to see through the lies and make educated choices that puts their best interest first.

CHAPTERS:

00:00 Happy New Year

01:39 Zimbabwe Inflation Update

10:40 Gold Coins To The Rescue

22:47 Rebasing The GDP

30:09 Recap

More News, Rumors and Opinions Friday PM 1-5-2024

KTFA:

Clare: Trade: Baghdad International Fair will include the participation of 20 countries and more than 800 international companies

1/4/2023 Baghdad - INA - Hassan Al-Fawaz

The Ministry of Commerce confirmed today, Thursday, that the 47th edition of the Baghdad International Fair will include the participation of 20 countries and more than 800 international companies, while indicating that the exhibition halls are sold out.

KTFA:

Clare: Trade: Baghdad International Fair will include the participation of 20 countries and more than 800 international companies

1/4/2023 Baghdad - INA - Hassan Al-Fawaz

The Ministry of Commerce confirmed today, Thursday, that the 47th edition of the Baghdad International Fair will include the participation of 20 countries and more than 800 international companies, while indicating that the exhibition halls are sold out.

Director General of the General Company for Exhibitions and Commercial Services in the Ministry, Mustafa Al-Ani, told the Iraqi News Agency (INA): “Under the patronage of Prime Minister Muhammad Shia’ Al-Sudani, the 47th edition of the Baghdad International Fair will be opened in a few days and under the supervision and follow-up of the Minister of Commerce, Atheer Al-Ghurairi, after... Completing the required preparations in the exhibition’s pavilions and corridors.”

He explained, "This session will be different from the previous one, as 20 countries and more than 800 international and local companies will participate in it," noting that "this economic forum will have important repercussions on the economic reality in all aspects."

He added, "The Kingdom of Saudi Arabia participated with more than 140 companies, in addition to the fact that this session will include the participation of companies from countries that have not previously participated in Baghdad, such as the Czech Republic, Azerbaijan, and other countries," pointing out that "the number of reserved halls reached 17 halls, in addition to... The total rented space reached 20,000 square meters of indoor space and 4,000 square meters of outdoor space.”

He added, "The exhibition halls are completely exhausted with local and international participation, and this is happening for the first time since 2003," noting that "state institutions are present in this session, such as the Ministries of Industry, Health, Communications, Science and Technology, as well as the Ministry of Commerce."

He continued, "Guests from countries at the level of ministers and ambassadors, senior officials in the Iraqi state, and senior businessmen and industrial sectors will be present at this session."

He stressed, "The international session of the Baghdad Exhibition comes within the framework of the government's interest in Iraq's openness to the countries of the world and the region, as this forum will constitute an important reflection in Iraq's economic and industrial reality and is an opportunity to exchange experiences and meet the market's need for goods, services and expertise offered by international and local companies." LINK

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 We are in the waiting phase. Simply in a waiting phase. That's all. There isn't, this needs to be done, that needs to be done, That T crossed, That I dotted. No. We are in a waiting phase.

Walkingstick All systems for the monetary reform are in place, they're just not linked yet. The uplink is not on yet...Many months ago the CBI told her banks to be prepared to be ready on January 1, 2024 because of all the banking system would be in place before '24...What they're doing right now is they're telling the citizens what they need to hear for the next step of the monetary reform...Once the lower denoms are announced the exchange inside Iraq will move even more quickly. You know how - through a float. Citizens want this movement to occur now. Citizens want their purchasing power.

************

TNT:

Tishwash: The US State Department calls on the Iraqi government to hold accountable those responsible for attacks on its forces

The US State Department called on the Iraqi government to hold accountable those responsible for the attacks on US forces in the country, noting that US forces are present in Iraq at the request of its government.

US State Department spokesman Matthew Miller said in a press statement, “American forces are present at the invitation of the Iraqi government, and the Iraqi government must hold accountable the perpetrators of attacks against it, whoever they may be.”

Mather Miller added, "The Iraqi government must take further steps to protect the American forces present there based on its invitation." link

LIVE! The US Economy WORSENS FASTER... Bond Market ROLLERCOASTER Ride. "The Great Taking?"

Greg Mannarino: 1-5-2024

Housing Market Entering Crash Cycle: What You Need to Know: Awake-In-3D

Housing Market Entering Crash Cycle: What You Need to Know

On January 4, 2024 By Awake-In-3D

The U.S. residential real estate market is now facing a significant downturn, and here’s why you should pay attention. This is in addition to the ongoing scenario playing out in commercial real estate crisis.

Recent data reveals a sudden increase in the number of new homes for sale, and home builders are selling off their inventory, raising concerns about a possible crash.

This means that the ‘active inventory’ of homes on the market is spiking upwards.

Housing Market Entering Crash Cycle: What You Need to Know

On January 4, 2024 By Awake-In-3D

The U.S. residential real estate market is now facing a significant downturn, and here’s why you should pay attention. This is in addition to the ongoing scenario playing out in commercial real estate crisis.

Recent data reveals a sudden increase in the number of new homes for sale, and home builders are selling off their inventory, raising concerns about a possible crash.

This means that the ‘active inventory’ of homes on the market is spiking upwards.

More Homes on the Market – What Does It Mean?

In November 2023, around 590,000 new homes were sold, but that’s a 12.2% drop from October. The price of these homes fell to $434,000, which is 12.5% less than what it was a year ago.

Now, at the end of November, there were 451,000 new homes up for sale – that’s a lot! In fact, it’s enough to meet the demand for about 9.2 months, which is a big deal and signals huge problems developing in the residential real estate market.

Builders are Selling More – Is That a Problem?

Yes, it is.

Home builders, who usually build and sell houses, have suddenly started selling more houses than before. This wasn’t expected, and it could be a sign that they are worried about the market.

They used to keep some houses to control prices, but now they’re liquidating them quickly, and that’s not normal.

History Tells Us This is a Big Problem

Whenever we’ve seen lots of new homes in the market like this in the past, it often coincided with significant economic troubles. So, this history lesson tells us that we might be in for a tough time in the housing market.

Why Prices are Dropping and Where

The price of these new homes has fallen, especially in places like California. In some areas, prices have dropped by 15% or more! This is happening because there are too many homes available compared to people who are looking to buy a home.

What About Mortgage Rates?

Mortgage rates, or how much it costs to borrow money to buy a home, are also important.

Right now, rates are at 6.5%, which is not too high, but it’s not too low either. In the meantime, new mortgage applications are at record lows not seen in decades.

This means that home sellers will begin dropping prices like never before. It tends to happen slowly at first, then all of a sudden as sellers capitulate and become desperate to sell their homes.

What Does This Mean for You?

If you’re thinking about buying or selling a home, this situation could impact you. Prices might continue to drop, and it might be harder to sell a house.

On the other hand, if you’re looking to buy, it could be a good time to find a more affordable home.

The real estate market is going through some big changes, and it’s essential to be aware of them. Keep an eye on the news and any updates about the housing market in your area. If you’re planning to make a move in the real estate world, understanding these changes can help you make smarter decisions.

Supporting Data

Historical Context

Historical patterns show that elevated levels of new homes in the market, as seen in November, tend to coincide with severe recessions.

National Level

Active listings reached a three-year high at 752,000 in November 2023.

New single-family home sales in November were at a seasonally adjusted annual rate of 590,000.

U.S. Census Bureau’s November 2023 Data

Median sales price for the 590,000 new homes sold was $434,000.

Number of new houses for sale at the end of November was 451,000, indicating a 9.2 months supply.

California

Statewide, a spike in new homes hit the market in November.

Prices in various counties, including San Francisco, San Mateo, Alameda, Butte, Contra Costa, experienced significant drops, contributing to six of the largest price drops in the state.

The entire state of California has a lack of active listings, contributing to the broader issue of an active listing shortage nationwide.

Texas

Active listings in Texas surpassed 2019 levels, with Austin having 5,800 active listings as of the end of November.

Williamson County, Texas, experienced a peak-to-trough price drop of 16%, putting it in the crash territory.

New York

New York County, New York, saw the largest peak-to-trough price drop at 22%.

Pennsylvania

Cambria County, Pennsylvania, witnessed a peak-to-trough price drop of 14%.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/housing-market-entering-crash-cycle-what-you-need-to-know/

Dollar Dumping & Credit Crisis In 2024 | Alasdair Macleod (Parts 1 & 2 )

Dollar Dumping & Credit Crisis In 2024 | Alasdair Macleod (Part 1)

Liberty and Finance: 1-3-2024

If interest rates fall, Dollar dumping will accelerate. Foreigners have already started selling the Dollar, says Alasdair Macleod, head of research at Gold Money.

"It's becoming increasingly apparent that the US government is stuck in a debt trap," he says.

He expects a credit crisis in 2024. The entire financial system is built on credit, he says, so a credit crisis will impact everyone.

Dollar Dumping & Credit Crisis In 2024 | Alasdair Macleod (Part 1)

Liberty and Finance: 1-3-2024

If interest rates fall, Dollar dumping will accelerate. Foreigners have already started selling the Dollar, says Alasdair Macleod, head of research at Gold Money.

"It's becoming increasingly apparent that the US government is stuck in a debt trap," he says.

He expects a credit crisis in 2024. The entire financial system is built on credit, he says, so a credit crisis will impact everyone.

2024: A Year Of Geopolitical Crisis | Alasdair Macleod (Part 2)

Liberty and Finance: 1-5-2024

The BRICS countries continue to grow and gain influence. Dollar dominance is under threat in 2024, says Alasdair Macleod, head of research at Gold Money.

He expects the BRICS to finally develop a gold-backed currency to bypass the Dollar.

Amid further Dollar devaluation, he expects gold will rise. But he notes that gold rising in price simply means the Dollar is falling in value.