Goldilocks' Comments and Global Economic News Friday AM 1-5-24

Goldilocks' Comments and Global Economic News Friday AM 1-5-24

Good Morning Dinar Recaps,

The World Economic Forum's Annual Meeting 2024 takes place 15-19 January 2024.

The 54th Annual Meeting of the World Economic Forum will provide a crucial space to focus on the fundamental principles driving trust, including transparency, consistency and accountability.

This Annual Meeting will welcome over 100 governments, all major international organizations, 1000 Forum’s Partners, as well as civil society leaders, experts, youth representatives, social entrepreneurs, and news outlets.

Goldilocks' Comments and Global Economic News Friday AM 1-5-24

Good Morning Dinar Recaps,

The World Economic Forum's Annual Meeting 2024 takes place 15-19 January 2024.

The 54th Annual Meeting of the World Economic Forum will provide a crucial space to focus on the fundamental principles driving trust, including transparency, consistency and accountability.

This Annual Meeting will welcome over 100 governments, all major international organizations, 1000 Forum’s Partners, as well as civil society leaders, experts, youth representatives, social entrepreneurs, and news outlets. https://www.weforum.org/agenda/2024/01/how-to-follow-the-annual-meeting-2024/

~~~~~~~~~~

Freight rates for ocean cargo have soared after an attempted attack on Wednesday and a bid to hijack a Maersk ship last Sunday forced shipping companies to suspend plans to restart transits through the Red Sea. https://www.asiafinancial.com/ocean-freight-fees-shoot-up-after-new-red-sea-ship-attacks

~~~~~~~~~~

"Interest rate differentials are an important factor in the global economy. They can affect the flow of capital between countries, the value of currencies, and the profitability of investments."

An interest rate differential is basically two different interest rates in two different countries or currencies. At this point, we are witnessing several different ones across the globe.

These interest rate differentials affect values and exchange rates in trade. It is creating a problem for hedge funders wanting to make clear trade bids on the Forex Markets based on a value they can profit from in the trade.

Uncertain interest rates is beginning to create a level of uncertainty for hedge funders attempting to position themselves for profit on the Forex Currency Market in Cross Border International Trading.

Uncertainty in the market creates pullbacks from investors that bring down the flow of money creating less demand and value for currencies utilized in trades.

A great example of this is the use of the dollar in oil trades being replaced by local currencies in the East. As these new volumes increase because of interest rate differentials, countries holding more value over time will be the ones utilized in trades going forward.

These new demands will increase value over time on chosen currencies with lower interest rates resulting in more value in the exchange of goods and services. Look for currency interventions this year to begin the process of leveling off the playing field through narrowing interest rate differentials.

© Goldilocks

Risk Link

Menafn Link

👆Look for currency interventions to begin this year when interest rates around the world begin to move on par with one another.

© Goldilocks

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

"Tidbits From TNT" Friday Morning 1-5-2024

TNT:

CandyKisses: The Central Bank announces expected decisions to support the Iraqi dinar

The Central Bank of Iraq revealed, on Friday, measures and decisions expected to support the dinar and maintain its strength against other currencies, and other measures that will positively affect the exchange rate, while noting that it has taken measures in the field of phasing out the electronic platform.

The assistant director general of the investment department at the Central Bank of Iraq, Mohammed Younis, told the official agency, that "the Central Bank will monitor and follow up all banks, and customer complaints that come back to it in case banks are forced to transfer customer accounts to US dollars," stressing that "this subject is easy to follow and monitor, and banks that do not comply with this decision will be held accountable."

TNT:

CandyKisses: The Central Bank announces expected decisions to support the Iraqi dinar

The Central Bank of Iraq revealed, on Friday, measures and decisions expected to support the dinar and maintain its strength against other currencies, and other measures that will positively affect the exchange rate, while noting that it has taken measures in the field of phasing out the electronic platform.

The assistant director general of the investment department at the Central Bank of Iraq, Mohammed Younis, told the official agency, that "the Central Bank will monitor and follow up all banks, and customer complaints that come back to it in case banks are forced to transfer customer accounts to US dollars," stressing that "this subject is easy to follow and monitor, and banks that do not comply with this decision will be held accountable."

Younis added, "This decision and the decisions that will follow in the coming days are all in the interest of supporting the Iraqi dinar and increasing confidence in it," noting that "what confirms the strength of the dinar and the public's confidence in it is the continuation of the Central Bank of Iraq and its failure to perform any need of various sectors, as it is now funding the sectors of commerce, electronic payment, travel and other sectors."

He pointed out that "the coming days will be more measures in the field of meeting all the needs of the market, supporting the Iraqi dinar and maintaining its strength against other currencies," noting that "the Central Bank, within its new procedures, prevented banks from automatic transfer of customer accounts in dollar to Iraqi dinars, without the consent of the customer, and allowed customers to open accounts in different currencies."

"What is new in updating the procedures is that it allowed companies that have contracts with the state to receive their incoming remittances, including the salaries of workers, as well as ongoing contracts on grants and loans in accordance with the Council of Ministers," Younis noted, "The other point is also in this new decision, is to allow banks to agree with their customers to bring their incoming remittances in cash to Iraq."

He stressed that "these measures will positively affect the exchange rate in the market, and will increase the supply of the dollar, and contribute to serving and supporting important sectors in the economy, including the sectors of exporters and the sector of companies operating in the government field and in the field of infrastructure development and strategic projects, in addition to supporting civil society organizations that contribute to the humanitarian and charitable field in Iraq."

Younis explained, "The main goal behind this update or these instructions is to expand the largest possible segment of obtaining the cash dollar by meeting its current needs of this dollar, as these instructions were expanded from the beneficiaries of the cash dollar, including civil society organizations, and these measures supported an important segment of the economy, the exporters sector, as it allowed them to obtain 40 percent of the remittances received as a result of their exports and receipt in cash."

He pointed out that "the decision clearly specified the mechanisms for its implementation by banks, and focused on the subject of incoming transfers, as it allows the receipt of some categories of their incoming remittances in cash," explaining that "this decision is related to the incoming remittances and not the cash sale of dollars for travelers, as the cash sale to travelers will continue as it is now, in addition to meeting the needs of customers and companies through this decision, and therefore will reflect positively on the exchange rate in the coming days."

Younis stressed that "there are no restrictions applied to banks in the field of money transfer, because there are procedures in the field of phasing out the Central Bank of Iraq platform by supporting interests to open accounts in foreign banks abroad, and the role of the Central Bank is short to enhance these balances and to follow up on transfers."

He concluded, "There are no restrictions on the transfer of funds in various currencies within the foreign currency banking system, but this decision is related to the cash dollar (cash withdrawal)."

https://www.nrttv.com/ar/detail3/21249

************

CandyKisses: Political gathering: The recent escalation in Iraq must accelerate the exit of the Americans

Baghdad Today - Nineveh

Today, Friday (January 5, 2024), Abbas Fadel, a leader in the networked gathering, called for an emergency parliamentary session of the Iraqi parliament.

Fadel told Baghdad Today that "the escalation represented by the bombing of a headquarters of the Popular Mobilization Forces in Baghdad must be an incentive to expel US forces and implement the decision issued by parliament in 2020."

He added that "what happened yesterday is no less serious than the airport incident, as the target party is an official body that orders the authority and the Iraqi state, so holding an emergency session of parliament to expedite a vote on the rapid exit of US forces, and the implementation of this decision by the government directly."

The American side claimed responsibility for the bombing of the headquarters of the Popular Mobilization Forces in Baghdad, which killed a number of leaders, including the jihadist assistant of Harakat al-Nujaba, Abu Taqwa al-Saidi.

************

TishwashL Urgent Al-Sudani: The justifications for the existence of the international coalition have ended and a bilateral committee has been established to schedule its withdrawal from Iraq

The Commander-in-Chief of the Armed Forces, Prime Minister Muhammad Shiaa al-Sudani, announced the formation of a bilateral committee to schedule the withdrawal of international coalition forces from Iraq.

On Friday morning, Al-Sudani attended the memorial ceremony held by the Popular Mobilization Forces on the fourth anniversary of the martyrdom of Al-Nasr leaders and their comrades in 2020.

Al-Sudani pointed out, in his speech, that the attack that led to the martyrdom of the deputy head of the Popular Mobilization Forces, the martyr Jamal Jaafar Al-Ibrahim (Abu Mahdi Al-Muhandis), and the guest of Iraq, General Hajj Qassem Soleimani, represented a blow to all the customs, charters and laws that govern the relationship between Iraq and the United States. It was a heinous and unjustified crime.

He stated that the government is in the process of setting the date for the start of the work of the bilateral committee to make arrangements to permanently end the presence of the international coalition forces in Iraq, and that there will be no neglect of everything that would complete national sovereignty over the land and skies of Iraq.

He pointed out that "four years ago, at the dawn of January 3, 2020, the American administration committed a heinous act by killing an Iraqi military commander, the deputy head of the Popular Mobilization Forces, Jamal Jaafar Al-Ibrahim, and Abu Mahdi Al-Muhandis," noting that "the assassination of Iraq's guest, General “Qassem Soleimani represented a double blow to Iraq, its traditions and customs, and an attack on two countries.”

He pointed out that "Iraq has a strategic partnership agreement and diplomatic relations with America, and in this way the main principles of international relations and what was stipulated in the United Nations Charter regarding equality of sovereignty between states and the prohibition of the use of force in international relations were violated," noting that "Iraq lost a man whose main concern was "In his years, Iraq will be free and independent."

He stated, "The martyr Abu Mahdi Al-Muhandis recalled his legacy of struggle and jihad, and advanced the ranks to defend Iraq from the evils of ISIS terrorists, and rose up under the shadow of the religious authority's fatwa to lead the people of the mobilization in those difficult days."

Al-Sudani continued, "Our government has developed projects, plans, and goals to raise living standards and reduce poverty rates. We have stressed that this year will be a year of achievements. Efforts to fight corruption will continue, with all the powers and legislation the government possesses. We have completed the provincial council elections, which have been stalled for years, to enhance political stability." .

He said, "Our region has been living in a tense situation since October 7 of last year, due to the aggressive and criminal policies practiced by the occupation authorities against the Palestinians in Gaza and the occupied territories. We warned that the continuation of brutal practices in Gaza will have serious repercussions on the region and the world, and we are beginning to feel its effects today." In many countries of the region.

The Prime Minister promised, "The most serious incidents are those that have been repeated more than once in Iraq, with the international coalition forces carrying out attacks against the headquarters of the Popular Mobilization Forces," stressing that "the Popular Mobilization Forces represent an official presence affiliated with the state, subject to it, and an integral part of our armed forces."

He explained, "We have repeatedly emphasized that in the event of a violation or transgression by any Iraqi party, or if Iraqi law is violated, the Iraqi government is the only party that has the right to follow up on the merits of these violations," indicating that "the government is the authority authorized to enforce the law, Everyone must work through it, and no one can infringe on Iraq’s sovereignty.”

Al-Sudani condemned "the attacks that target our security forces, and go beyond the spirit and letter of the mandate that created the international coalition," stressing "the government's ability and willingness to take appropriate decisions to preserve Iraq's sovereignty, security, and stability, as it lies at the core of its responsibilities, obligations, and constitutional duties."

He also affirmed “the firm and principled position in ending the existence of the international coalition after the justifications for its existence have ended,” revealing that “we are in the process of setting the date for the start of the dialogue through the bilateral committee that was formed to determine the arrangements for the end of this presence, and it is a commitment that the government will not back down from, and will not neglect anything that would lead to it.” Completing national sovereignty over the land, sky and waters of Iraq.”

He concluded his speech by saying, "The foundation of loyalty and gratitude for the blood of the martyrs and their sacrifices requires all of us to respect the state and its constitutional institutions." link

Mot: .. and then I Remembered!!! ~~~~

Mot: . One of Those Moments - when – siiiggghhhhhh

News, Rumors and Opinions Friday AM 1-5-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 5 Jan. 2024

Compiled Fri. 5 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Thurs. 4 Jan. Bruce: Two sources say Tier4b (Us, the Internet Group) notification would happen any time between now and Monday 8 Jan. Late this afternoon one source said all RV releases started this weekend – Bond Holders, Tiers A,B, Fines and Penalties, CMKX, Farm Claims, Prosperity Packages, etc.

Thurs. 4 Jan. Wolverine Call: “I have had good info. Looks like we are ready. Lots of movement in Reno. I know whales traveling to Reno to get paid and some whales have got paid. These are AAA whales (high level). I was on the audio when that came out. Things are happening. Remain faithful. Hope to hear from Admiral. Nesara/Gesara group is ready to get this thing moving. I wish I could tell you more, but it is confidential.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 5 Jan. 2024

Compiled Fri. 5 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset:

Thurs. 4 Jan. Bruce: Two sources say Tier4b (Us, the Internet Group) notification would happen any time between now and Monday 8 Jan. Late this afternoon one source said all RV releases started this weekend – Bond Holders, Tiers A,B, Fines and Penalties, CMKX, Farm Claims, Prosperity Packages, etc.

Thurs. 4 Jan. Wolverine Call: “I have had good info. Looks like we are ready. Lots of movement in Reno. I know whales traveling to Reno to get paid and some whales have got paid. These are AAA whales (high level). I was on the audio when that came out. Things are happening. Remain faithful. Hope to hear from Admiral. Nesara/Gesara group is ready to get this thing moving. I wish I could tell you more, but it is confidential.

Wolverine Cont…..God is with us. When the Admiral gives the Green Light there won’t be a dry eye in the house. We will cry. I will cry. The stress has been incredible due to the targeting on me and my family. I want this so much to get this released to move our lives forward and for us to help humanity. When the Admiral gives Green Light, I am sure notifications will come out automatically. What info I got was official. It is happening. They thanked me for the work I have done. God bless you all.”

For some time the Iraqi Dinar has been trading upward on the back screens of the Forex.

By Jan. 1 2024 the new Dinar in-country Rate was revalued and being used within Iraq, while the fiat US Federal Dollar was outlawed in the country.

From 1932 to 1949 the Iraqi Dinar was worth $4.86. Under Suddam it was $3.48.

Sources from the USA, Australia and China all confirmed that this is the week for the release. …Amiel Alston

Many reports have come in about local bank branches being converted into Exchange and Redemption Centers, with a reduction of staff and bank personnel revealing that they will no longer be functioning as a bank.

Thurs. 4 Jan. Botswana plans currency depreciation: https://www.herald.co.zw/botswana-plans-currency-depreciation/

~~~~~~~~~~

Thurs. 4 Jan. 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#

The RV has happened in Iraq for the Dinar and they have been paying their citizens on back pay, military pay and HCL with the new in-country Dinar Rate.

The Iraqi Dinar was not yet on the front screens of the Forex, but it was supposed to start Sun. 7 Jan. That’s the first business day in Iraq.

Bank screens were showing solid rates, while the rates were flashing on Redemption Center front screens. When they stop blinking and go solid on the rates then it’s RV time.

Two sources say notification to set redemption appointments for Tier4b (Us, the Internet Group) can happen any time between now and Monday 8 Jan.

Late this afternoon one source said all releases started this weekend – Bond Holders, Tiers A,B, Fines and Penalties, CMKX, Farm Claims, Prosperity Packages, etc.

Today Thurs. 4 Jan. the update on Restitution and Reclamation (R&R) payments was that notification would start one week after we got our 800 numbers to make appointments for our exchanges.

Ages 61 and above get a R&R lump sum payment. Ages 42-61 should get their R&R paid monthly over two years. SS increase starts in Jan.

Yesterday Wed. 3 Jan. some Bond Holders received notification that they would have access to funds in 4-5 days. They would receive 1% and then the rest after 90 days.

Read full post here: https://dinarchronicles.com/2024/01/05/restored-republic-via-a-gcr-update-as-of-january-5-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East Many people sending me things, things about 2026. I don't think they're going to wait till 2026. I don't think whoever explained you this, he read it wrong...If it start to float it's going to go quick. We just need to float it...If they did like they said and took off the dollar from the market, from the streets, things going to go quick...I agree with them that it's going to go up gradually but it's not going to take two or three years to reach 1 to 1...

Frank26 Question: "When the rate is changed IYO will the Iraqi citizens be exchanging their 3-zero notes in country before the rate is on Forex?" Iraqi citizens don't care about Forex. You care about Forex. Because that's one of the vehicles/platforms that's going to float the currency and go up in value internationally. But inside a dinar is a dinar. Whatever the rate is that they establish, it could be $0.10, it could be a $1.00...that is what they will use inside of their country not outside.

A Brief Recap Of America’s 2023 Fiscal Train Wreck

A Brief Recap Of America’s 2023 Fiscal Train Wreck

Notes From the Field By Simon Black January 3, 2024

Jacques Turgot must have cried himself to sleep the night that he reviewed the French government’s annual financial report in early 1775. The numbers were gruesome; France was so heavily indebted by the mid-1770s that the entire nation was on the verge of a major financial crisis.

But Turgot was smart. Borderline brilliant. So, if anyone could turn things around and restore France to its former glory, it was him. Turgot was born in the 1720s when France was still the clear, dominant superpower in the world… wealthy, admired, and strong. But decades of overspending had created a massive national debt.

By the time he took over as Controller-General in the summer of 1774, the French public debt was so high that just making interest payments consumed most of the tax revenue.

A Brief Recap Of America’s 2023 Fiscal Train Wreck

Notes From the Field By Simon Black January 3, 2024

Jacques Turgot must have cried himself to sleep the night that he reviewed the French government’s annual financial report in early 1775. The numbers were gruesome; France was so heavily indebted by the mid-1770s that the entire nation was on the verge of a major financial crisis.

But Turgot was smart. Borderline brilliant. So, if anyone could turn things around and restore France to its former glory, it was him. Turgot was born in the 1720s when France was still the clear, dominant superpower in the world… wealthy, admired, and strong. But decades of overspending had created a massive national debt.

By the time he took over as Controller-General in the summer of 1774, the French public debt was so high that just making interest payments consumed most of the tax revenue.

This meant that the government had to go even deeper into debt every year just to fund its most basic operations, thus making the problem exponentially worse.

Turgot knew how to fix it. And then had the balls to do it.

He advocated for major reforms, including steep budget cuts and free trade. He demanded the church and nobility to pay taxes (workers, artisans, and merchants already did).

He wanted to dismantle the medieval version of unions, known as guilds, to allow French citizens the freedom to work without regulation.

And he wanted to abolish the remnants of the feudal system, enabling freedom and opportunity across the country.

These were all logical proposals that could have solved France’s debt crisis. So naturally they were all rejected.

In fact, Turgot’s proposals, as sensible as they were, made him the most hated guy in France.

The royals hated him for curtailing their lavish lifestyle. The parliament hated him for his budget cuts. The church and nobles hated him for demanding they pay taxes too. The unions hated him for reducing their power.

Honestly, it’s kind of amazing that Turgot didn’t get suddenly suicided like Epstein. Though he did find himself thrown out on his keister and out of a job by the spring of 1776.

Coincidentally, 1776 was also the year that Benjamin Franklin formally requested financial support from France to support the American Revolution.

Turgot would have rejected that request flat-out. France simply didn’t have the money to fund someone else’s war.

But with the former-minister now in his forced retirement, the French government happily obliged Franklin’s request and shoveled billions of dollars out the door-- money that they didn’t have.

We all know how the story ends: the French Revolution, the Reign of Terror, Napoleon, etc. And this is far from an isolated tale; history books are filled with stories of once-dominant superpowers who indebt themselves into weakness and decay.

I am not a pessimistic person. In fact, I consider myself wildly optimistic about the future; our species has seen its share of horrendous crises… yet we always manage to ascend higher.

This time is not different. Despite the challenges that the world faces, and despite the complete idiots who run the show, humanity will continue to surpass its previous peaks.

But at the same time, it would be completely naive to ignore the obvious lessons of history about how excess debt ultimately destroys a nation’s economic power.

I’ve been spreading this message for years: many of the world’s most advanced nations are in this position-- like Japan, Italy, etc. And of course, the United States.

The US national debt actually reached a new milestone of $34 trillion on the very last day of the year (2023).

Bear in mind that the national debt at the beginning of the year was $31.4 trillion. So, the debt increased by a whopping $2.6 trillion over the course of the 2023 calendar year.

Now, back in 2020 and 2021, the US government could borrow money at just 1% interest.

But interest rates surged throughout 2023 to 4%, 5%, and more. This means that the $2.6 trillion in new debt that the government borrowed will cost taxpayers AT LEAST $100 billion in additional interest… PER YEAR. ($2.6 trillion x 4% = $104 billion annually)

It’s no wonder that 2023 saw a record $900 BILLION in gross interest paid on the US national debt. And this year’s interest on the national debt will likely surpass $1.2 trillion.

2023 was one for the record books in many other ways as well.

There was the debt ceiling crisis at the beginning of the year-- in which the guy with five decades of experience refused to negotiate with the other side, leading the country to the brink of default.

Naturally they didn’t actually solve the problem. So, at the last minute they kicked the can down the road to January 1, 2025-- just 364 days from now.

This was followed by a downgrade of the US sovereign debt rating, and then another downgrade of the US sovereign debt outlook (which are technically two different things).

The guy with five decades of experience reacted with genuine confusion… which is understandable considering he doesn’t know where he is half the time.

But even those around him, including Treasury Secretary Janet “Expert” Yellen, and the eminently articulate Secretary of Doublespeak, Karine Jean-Pierre, rejected the downgrades as “puzzling” and “entirely unwarranted”.

The voice of reason last year came from the Congressional Budget Office, which seems to at least have some grasp of the situation.

Whereas in mid-2022, the CBO had forecast a 10-year deficit of $15.7 trillion, by early 2023 they had to revise their projection downward to an $18.8 trillion deficit.

It probably didn’t help that US federal tax revenue declined significantly in 2023, down to $4.4 trillion from $4.9 trillion the year before.

A decline in tax revenue is hardly a surprise given the never-ending onslaught of new regulations that make it more difficult for people to work and do business.

Yesterday I wrote to you about the nearly 100 pages of regulation that requires small business owners to file a new report to the federal government each year.

Never mind that businesses already must file the exact same information to the IRS. No, they want to double your compliance burden by requiring you to send the same information-- in a different reporting format-- to a second government agency.

If that weren’t enough, in December the Labor Department published a new proposal to heavily regulate apprenticeship programs; the proposal went on for nearly EIGHT HUNDRED PAGES and includes rules about body-positive PPE (personal protective equipment) and mandating bathrooms that correspond to gender identity.

So, if you have interns who identify as polygender, demiflux, and autigender (all real terms), get ready to build three new bathrooms for they/them.

Naturally this whole situation is a complete train wreck. At least France in the 1770s had someone with the brains and the balls to raise the red flag… even though he was summarily dismissed.

Today the ‘experts’ in charge seem willfully, blissfully ignorant… which gives rational, thinking people every reason to have a Plan B.

Simon Black, Founder Sovereign Man

https://www.sovereignman.com/trends/a-brief-recap-of-the-americas-2023-fiscal-train-wreck-148554/

Goldilocks' Comments and Global Economic News Thursday Evening 1-4-24

Goldilocks' Comments and Global Economic News Thursday Evening 1-4-24

Good Evening Dinar Recaps,

Banking Announcement:

HSBC Launches Tokenized Gold

"One of the largest bullion dealers in London, HSBC Holding, has launched tokenized physical gold trading on its single-dealer platform. The new capability will keep ownership records of the physical gold on a distributed ledger. The new service works with the bank’s Orion platform—which issues digital assets—and its digital custody service, slated to go live in 2024."

HSBC Bank is offering the ability to buy gold tokenized assets. The benefit of this Digital Ledger Program is that you can buy small quantities of gold and build on your portfolio as you have the money to do so.

Your gold will be held on a Digital Ledger service allowing you to hold physical gold through a banking system. This indicates a shift in our monetary system. A system whereby gold backs both our markets and our banking system going forward. Is a clear indication that we are moving out of a Fiat system and into a Gold Standard Economy.

© Goldilocks

Goldilocks' Comments and Global Economic News Thursday Evening 1-4-24

Good Evening Dinar Recaps,

Banking Announcement:

HSBC Launches Tokenized Gold

"One of the largest bullion dealers in London, HSBC Holding, has launched tokenized physical gold trading on its single-dealer platform. The new capability will keep ownership records of the physical gold on a distributed ledger. The new service works with the bank’s Orion platform—which issues digital assets—and its digital custody service, slated to go live in 2024."

HSBC Bank is offering the ability to buy gold tokenized assets. The benefit of this Digital Ledger Program is that you can buy small quantities of gold and build on your portfolio as you have the money to do so.

Your gold will be held on a Digital Ledger service allowing you to hold physical gold through a banking system. This indicates a shift in our monetary system. A system whereby gold backs both our markets and our banking system going forward. Is a clear indication that we are moving out of a Fiat system and into a Gold Standard Economy. https://gfmag.com/banking/hsbc-launches-tokenized-gold/

© Goldilocks

~~~~~~~~~~

Iraq is in the process of bringing in non-banked financial institutions into the new digital banking system.

They are achieving this goal through a series of educational offerings surrounding new banking reforms that will help this transition into the banking sector from those outside of it.

© Goldilocks

https://cbi.iq/news/view/2495

~~~~~~~~~~

Recently, we have been receiving several pieces of news that give indication that currencies will begin to float up this year.

Will they float to their real value in 2024?

This remains to be seen. It is more important that this year of transition be one whereby exchange rates are tested on the markets and weigh in their worth through the banking system against other currencies.

It is a process whereby the synchronization of the entire Global Economy is currently in play.

We already know that the Indian Rupee has come out and voiced that they expect their currency to trade against the US dollar at 80 to 82 cents by the end of the year. Many countries are expected to bring in their projections soon.

It is important that we develop strategies on what to do in exchanging our currencies as more news develops.

© Goldilocks

~~~~~~~~~~

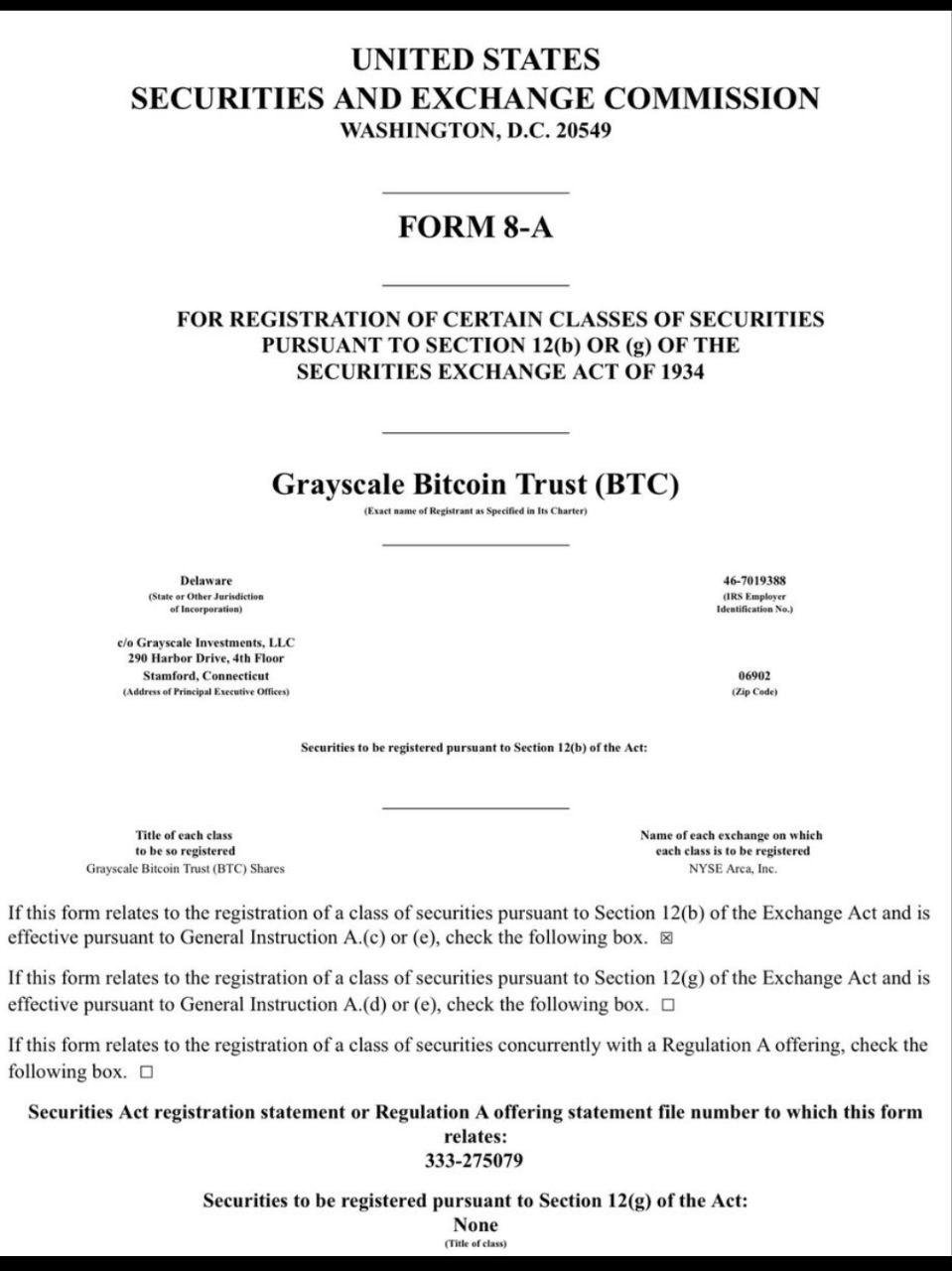

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

GRAYSCALE BITCOIN TRUST (BTC)

~~~~~~~~~~

IMF Chief Says Fed Is ‘Definitely’ Securing Soft Landing, Warns of Fragmentation

~~~~~~~~~~

Unlocking the potential of regulated digital assets

As the regulatory frameworks for the tokenisation of securities continue to evolve, market participants need to get to grips with the requirements of new asset classes and new ways of managing existing asset classes.

Fostering real change will be a process and the industry is likely to take an incremental approach, experimenting with distributed ledger technology and digital asset processes in regulated environments to build a resilient, compliant, and sustainable digital asset space.

https://www.ledgerinsights.com/bnp-paribas-regulated-digital-assets/

~~~~~~~~~~

Basel Committee Proposes Revised Criteria for Stablecoins' Risk Treatment

https://www.coinlive.com/news-flash/402190

~~~~~~~~~~

Ethereum’s Role in Tokenization: From ICOs to Tokenized Securities

Ethereum, the second-largest blockchain by market capitalization, has played a pivotal role in revolutionizing the way assets are owned and exchanged through tokenization.

This process involves representing real-world assets, such as physical goods, securities, and intellectual property, as digital tokens on a blockchain like Ethereum (https://www.binance.com/en-NG/price/ethereum).

These tokens can then be easily traded, fractionalized, and managed, opening up a vast array of possibilities. The Nation Newspaper Link

~~~~~~~~~~

JUST IN: VanEck files registration of securities with SEC for its spot Bitcoin ETF. @WatcherGuru

~~~~~~~~~~

Watch for the crypto markets and the currency markets to move in tandem with each other throughout this year as they find their real values based upon real numbers supporting these two asset classes through gold.

Solid numbers allow the Quantum Financial System of Technologies to operate with specific/real numbers designed to level the playing field securely, efficiently, and fairly.

© Goldilocks

~~~~~~~~~~

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

VANECK BITCOIN TRUST

~~~~~~~~~~

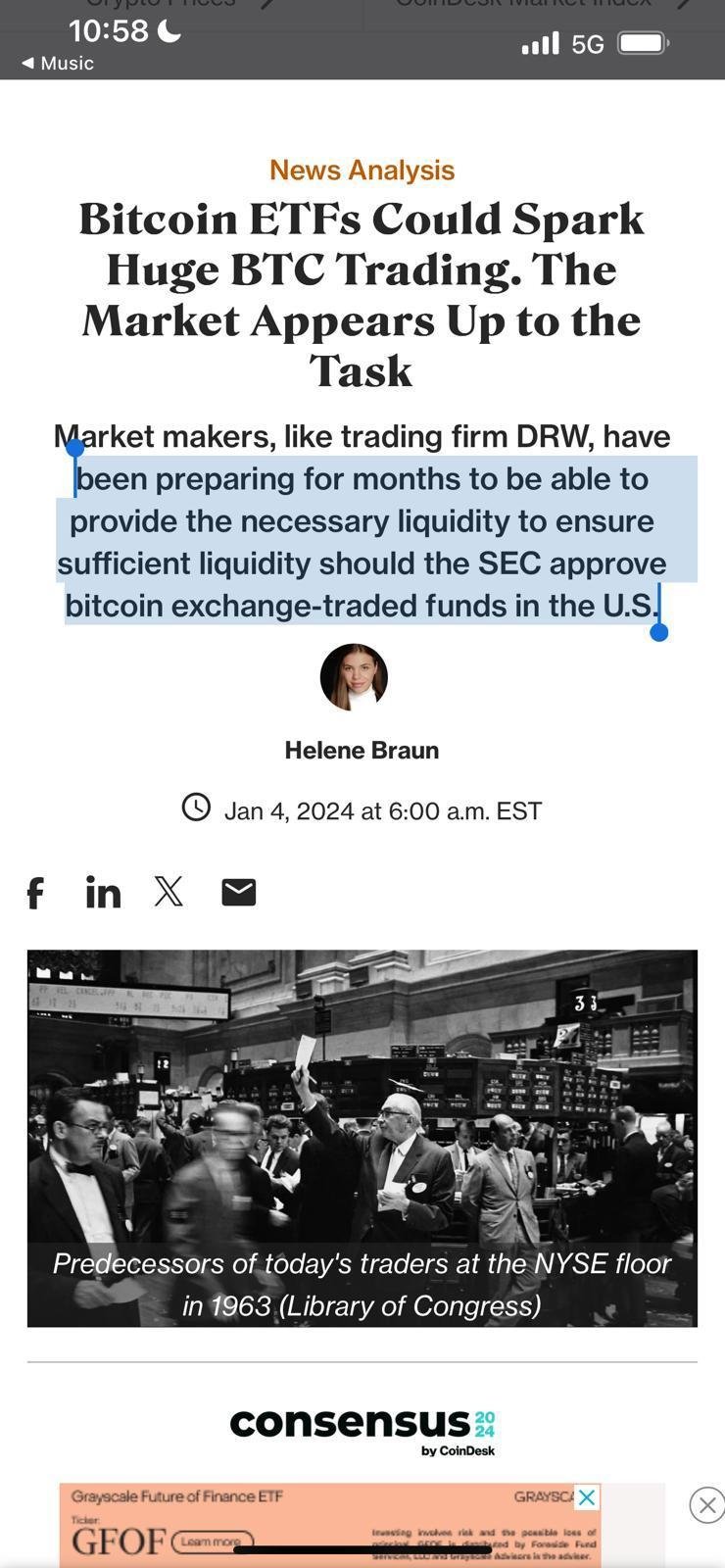

MARKET MAKERS HAVE BEEN PREPARING FOR MONTHS TO ENSURE THE CRYPTO MARKET HAS ENOUGH LIQUIDITY FOR THE FLOOD OF INVESTMENT MONEY THAT WILL POUR INTO THE CRYPTO MARKET IF THE BTC ETF APPROVAL IN NEXT FEW DAYS

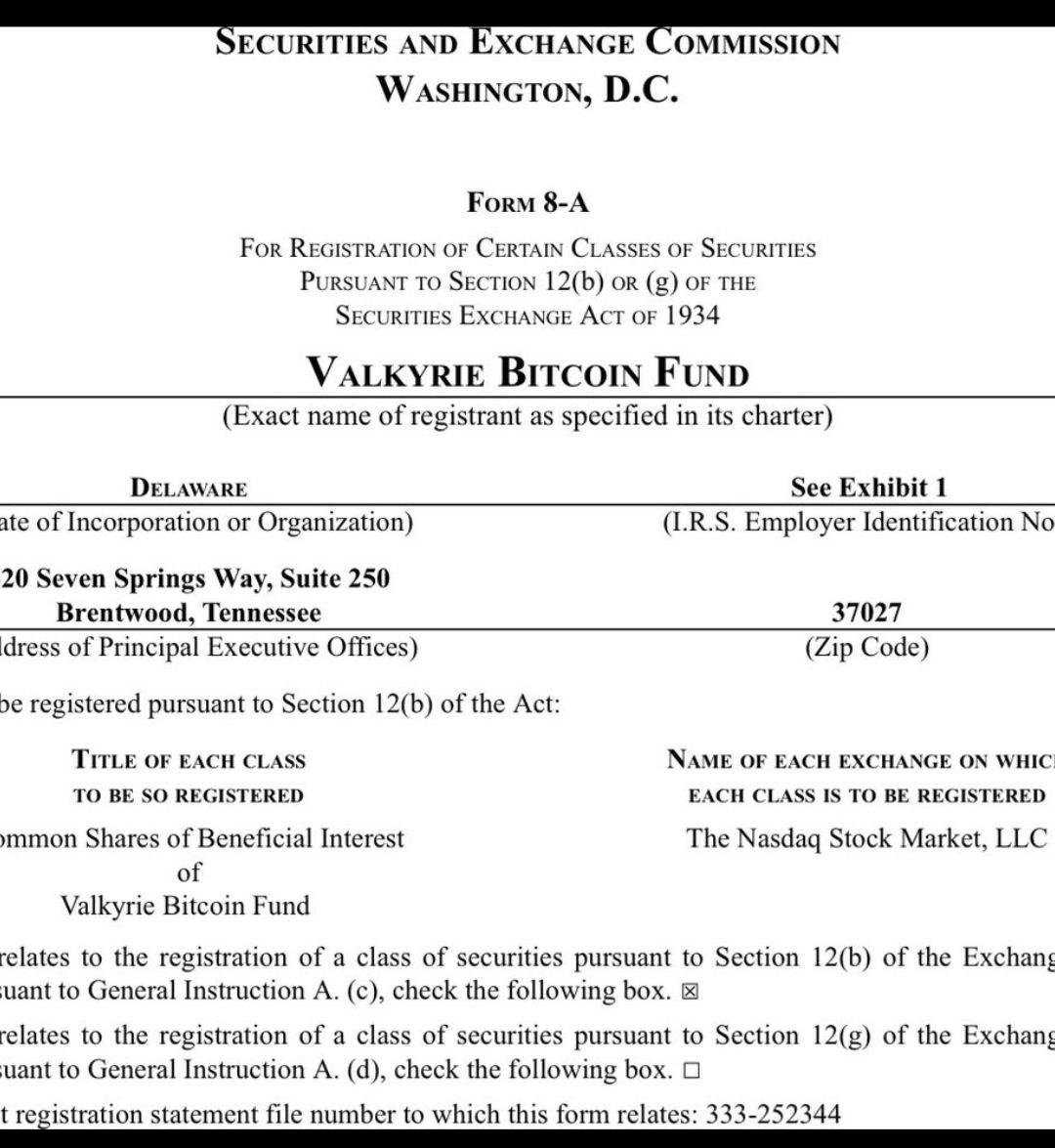

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

VALKYRIE BITCOIN FUND

~~~~~~~~~~

Are you starting to get the picture with all of these spot Bitcoin ETFs?

Do you see how they are about to transition the global markets into a digital economy?

We have been talking about this the last few weeks.

@ Goldilocks

~~~~~~~~~~

A report published by research firm Matrixport opining that the spot bitcoin ETF applications in queue would be rejected was widely disseminated by news outlets and caused widespread panic and massive liquidations across the entire space.

These were the largest liquidation levels since the infamous “Cointelegraph Intern” post several months ago that caught short sellers offside. The founder of Matrixport claimed that the dissemination of their analysis was outside of the firm’s control and was simply the opinion of one of the firm’s analysts.

Cointelegraph Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here: Awake-In-3D

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here

On January 3, 2024 By Awake-In-3D

Buckle up GCR-Land… If the first few days of 2024’s financial events are any indication of the rest of the year, it’s going to be game over.

The onset of 2024 has seen a significant downturn in the global financial markets, marking the worst start in decades. Here’s a detailed breakdown of the key events impacting the financial landscape and why each is a cause for concern:

From Stocks and Bonds to Cryptos and Gold: Perfect RV/GCR Storm 24 Already Here

On January 3, 2024 By Awake-In-3D

Buckle up GCR-Land… If the first few days of 2024’s financial events are any indication of the rest of the year, it’s going to be game over.

The onset of 2024 has seen a significant downturn in the global financial markets, marking the worst start in decades. Here’s a detailed breakdown of the key events impacting the financial landscape and why each is a cause for concern:

1. Stocks and Bonds Suffer Largest Rout in Decades

Stocks and bonds experienced their most significant global decline to start the year since 1999. This decline was also marked by the largest daily drop in global capitalization since December 2022.

The simultaneous decline in both stocks and bonds marks the most substantial global drop to start the year since 1999. This indicates widespread investor unease and can be a sign of underlying economic instability.

2. Dollar Soars

The value of the dollar has not fallen at the start of a calendar year since 2012, but its start in 2024 represents the most substantial rally since 1997.

While a strong dollar can be beneficial in some contexts, its significant rally suggests a flight to safety and could indicate a lack of confidence in other assets and currencies, potentially signaling global economic uncertainty.

3. Weak Economic Data Persists

The manufacturing sector has been in contraction for the 15th consecutive month, indicating ongoing economic challenges. Additionally, signs of strain are emerging in the labor market.

Continued contraction in the manufacturing sector for the 15th consecutive month, along with labor market strains, indicates prolonged economic challenges, potentially leading to reduced consumer spending and business investment.

4. FOMC Minutes Less Dovish

The Federal Open Market Committee’s (FOMC) recent meeting minutes were less accommodating than expected, leading to reduced likelihood of a rate cut in March.

The Federal Reserve’s less accommodative stance, as indicated in the FOMC meeting minutes, suggests a potential shift in monetary policy. This could signal higher interest rates and reduced market support, impacting borrowing costs and economic growth.

5. Stocks Fail to Rebound

Stocks have shown no signs of recovery, risking the end of a nine-week winning streak, with significant losses in small caps and the tech-heavy Nasdaq index.

The lack of a stock market rebound threatens to end a nine-week winning streak, indicating a potential loss of investor confidence and market stability, which can further impact consumer sentiment and business investment.

6. Treasury Yields Tumble

Yields on government bonds experienced a significant decline, with the 10-year Treasury yield briefly testing above 4.00% before quickly retracting.

A significant decline in government bond yields can indicate a flight to safety and a lack of confidence in other investment opportunities, potentially signaling concerns about future economic performance.

7. Crypto Volatility

Cryptocurrencies experienced a flash-crash, with Bitcoin plunging 7% before rebounding, while Ethereum remained in negative territory for the year.

The volatility in cryptocurrency markets, especially the significant flash-crash in Bitcoin and Ethereum, raises questions about the stability and maturity of these alternative assets, impacting investor confidence and broader market sentiment.

8. Oil Prices Surge

Oil prices surged higher due to escalating violence in the Middle East, impacting global markets.

Rising oil prices due to escalating Middle East violence can lead to increased production costs and consumer prices, potentially impacting global economic growth and market stability.

9. Gold Weakens

The value of gold declined as the dollar strengthened, affecting the precious metal’s market performance.

The decline in gold prices, often seen as a safe-haven asset, alongside a strengthening dollar, could reflect reduced concerns about economic uncertainty, potentially impacting investor risk perceptions and market stability.

10. European Selling Pressure

There are indications of significant selling pressure from European markets, raising questions about the potential impact on global equities.

Significant selling pressure from European markets can signal broader concerns about global economic conditions, potentially leading to increased market volatility and reduced investor confidence.

Fasten Your Seat Belt!

These events collectively mark a challenging and turbulent start to the year for global financial markets, impacting various asset classes and raising serious concerns among investors and analysts about the overall health of the global financial system.

Yet readers of GCR Real-Time News already know what this is all about.

Supporting article: https://www.zerohedge.com/markets/global-bonds-stocks-suffer-biggest-rout-start-year-1999

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/from-stocks-and-bonds-to-cryptos-and-gold-perfect-rv-gcr-storm-24-already-here/

More News, Rumors and Opinions Thursday PM 1-4-2024

Iran Expresses Interest in a Unified Currency with BRICS

January 3 – Sputnik

Iran’s Deputy Foreign Minister, Mahdi Safari, expressed interest on January 3 in creating a unified currency with BRICS nations, aiming to establish Tehran as a key banking center for the group.

Safari also praised the New Development Bank, established by BRICS in 2014, for its role in supporting joint projects and international cooperation among member states.

“We are interested in creating a unified currency in the BRICS group, and this could be very effective.

Iran Expresses Interest in a Unified Currency with BRICS

January 3 – Sputnik

Iran’s Deputy Foreign Minister, Mahdi Safari, expressed interest on January 3 in creating a unified currency with BRICS nations, aiming to establish Tehran as a key banking center for the group.

Safari also praised the New Development Bank, established by BRICS in 2014, for its role in supporting joint projects and international cooperation among member states.

“We are interested in creating a unified currency in the BRICS group, and this could be very effective.

By using national currencies, the process of eliminating the use of the dollar in commercial exchanges begins, and we are interested in continuing this process,” Safari stated in an interview with Sputnik.

https://dinarchronicles.com/2024/01/03/iran-expresses-interest-in-a-unified-currency-with-brics/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Sandy Ingram The Iraqi dinar is not on the Forex market, yet. The Iraqi dinar is an exotic currency, as is the Vietnam dong... Currencies are traded in pairs on the Forex Market. The 3 main types... majors, minors and exotics...The more liquid an asset the easier and more efficient it is to turn it back into cash. Major currency pairs have the highest trading volume... Exotic currencies...are not traded that often. There is little technical analysis or data available to support trading decisions for exotic currencies...

Frank26 Question: "The war is likely escalating in the Middle East. When Iran gets involved will this negatively affect the rate? the float?" IMO the war is affecting more the relationships between counties in the Middle East...As far as it affecting the monetary reform of the Iraqi dinar that's in a sealed envelope...figuratively speaking. It has nothing to do with the war. Once that envelope is opened, it would definitely/probably have some cause and effect on the float, in the basket. Because what countries are in those baskets? Yeah, the ones that might be affected but I don't think it'd be affected in a negative way. War has a tendency to (snap) speed things up.

************

KTFA:

Clare: The Foreign Ministry condemns the bombing of the PMF headquarters in Baghdad: Iraq reserves the right to take a firm stance

1/4/2023

The Ministry of Foreign Affairs expressed its “strong condemnation of the blatant attack” that targeted an Iraqi security headquarters today, Thursday.

A statement issued by the ministry stated that "the attack on a security formation linked to the Commander-in-Chief of the Armed Forces and subject to the authority of the state is a dangerous escalation."

The statement stressed that "Iraq reserves the right to take a firm stance and take all measures that deter anyone who tries to harm its land and security forces." LINK

Sir_Shawn: So this incidence by the US Army, IMO kills two birds with one bombing. You remove one of the bad guys while the US gets blamed for interfering with Iraqi sovereignty thous leading to the removal of the remaining military coalition forces from Iraq due to the violations of Iraqi sovereignty. Now Iraq has come full circle and has regained their Control of their oil revenues, monetary system and soon the departure of all non-Iraqi military from Iraq. Iraq has no reason to delay the reinstatement of their currency to the Glory Days. IMO… time will tell…

So It Begins... WAVES OF CORPORATE LAYOFFS AS THE WORLD ECONOMY FREEFALLS FASTER.

Greg Mannarino: 1-4-2024

Jim Willie: The Corporate and Treasury Bond Bubbles Are Bursting

Arcadia Economics: 1-4-2024

Over the past 2 years the financial markets have watched the Federal Reserve raise interest rates over 5%, while at the same time the Treasury is pumping out debt faster than ever.

We've all known for a long time that it can't go on forever, and in today's show, Jim Willie of The Hat Trick Letter talks about how the corporate, sovereign, and treasury bond bubbles are in the process of bursting now.

He explains how we got to this point, what's happening now, and what he's expecting in 2024. And to find out more, click to watch the video now!

Get Ready To Spend Two Years In Prison

Get Ready To Spend Two Years In Prison

Notes From the Field By Simon Black January 2, 2024

If you happen to be a small business owner in the Land of the Free, you are looking at potentially two years in prison if you don’t comply with a new law that just took effect yesterday.

It started nearly five years ago, in the spring of 2019.

Back then, a member of Congress from the state of New York-- a career politician with five decades of experience named Carolyn Maloney-- introduced a new bill to the House of Representatives called the Corporate Transparency Act, or CTA.

At first her bill didn’t go anywhere.

But the following summer, during the peak Covid insanity of 2020, the CTA was jammed into the nearly 1,500-page National Defense Authorization Act (NDAA), i.e. the military budget that Congress is required to pass each year.

Get Ready To Spend Two Years In Prison

Notes From the Field By Simon Black January 2, 2024

If you happen to be a small business owner in the Land of the Free, you are looking at potentially two years in prison if you don’t comply with a new law that just took effect yesterday.

It started nearly five years ago, in the spring of 2019.

Back then, a member of Congress from the state of New York-- a career politician with five decades of experience named Carolyn Maloney-- introduced a new bill to the House of Representatives called the Corporate Transparency Act, or CTA.

At first her bill didn’t go anywhere.

But the following summer, during the peak Covid insanity of 2020, the CTA was jammed into the nearly 1,500-page National Defense Authorization Act (NDAA), i.e. the military budget that Congress is required to pass each year.

The NDAA (and hence the CTA along with it) were passed on January 1, 2021. And now, three years later, the CTA has formally taken effect.

Now, the whole premise behind the Corporate Transparency Act is the classic boogeyman premise that evil criminals and terrorists use US corporations and LLCs to conduct their illicit activities, so therefore the government wants more rules, regulations, and reporting for US companies.

This is the same simple-minded hysteria that we always hear about how criminals and terrorists use BTC, therefore it should be tightly regulated by hapless government bureaucrats.

Obviously, it’s true that criminals can and do use it -- or US business entities like Delaware LLCs-- to commit their crimes.

Criminals also use iPhones, Facebook, Gmail, Dell laptops, JP Morgan Chase bank accounts, Ford F-150 pickup trucks, Amazon gift cards, and Verizon Wireless to commit their crimes.

But in this case, in the infinite wisdom of Congress, it’s business entities that are being singled out for additional scrutiny.

So, because criminals sometimes use US business entities to launder money, every law-abiding US citizen with a completely legitimate business now must jump through all sorts of hoops and reporting requirements.

And if you fail to report, you’re looking at two years in prison.

There are so many things about this that are completely stupid.

First off, the United States legal code already has dozens of anti-money laundering laws and regulations on the books. Seriously, dozens.

Yet clearly if Congress saw the need to pass a NEW anti-money laundering law (the CTA), then it stands to reason that those existing laws are ineffective… and hence should be repealed.

But that’s not how the government operates. They don’t strike off ineffective laws. They just keep piling more laws and rules on top of the old ones, creating a mountain of regulation for small businesses to navigate.

And I’m saying “small business” on purpose because that’s who is specifically targeted by the CTA.

Large, publicly traded companies are specifically exempt from reporting under the CTA. So are hedge funds, banks, and other large financial entities. Curiously, tax-exempt charities are also exempt.

So the Corporate Transparency Act deliberately goes after the little guy. Goldman Sachs, Black Lives Matter, and Facebook/Meta are exempt. Bob’s Hot Dog Stand is not.

And this is where it gets really ridiculous. One of the big requirements of the CTA is that small business owners must file a new report to the federal government each year to disclose the company’s shareholders.

But current federal law already requires LLCs to provide this information to the IRS each year. So, the CTA has essentially created a double-burden to send the exact same information-- but in a different format-- to multiple agencies within the Treasury Department.

You can’t make this stuff up.

And exactly what agency does Bob’s Hot Dog Stand have to report to? It’s called FinCEN, which stands for the Financial Crimes Enforcement Network.

Think about the message they’re sending here; it’s as if owning a business in the United States of America is now some sort of f*ck!ng crime that needs to be reported.

For its part, FinCEN issued nearly ONE HUNDRED PAGES of regulations about how to comply with the CTA. Yes, I’m serious. The Corporate Transparency Act itself was ‘only’ about 20 pages. FinCEN’s rules are five times as long.

And, once again, failure to comply carries steep monetary and criminal penalties, including up to two years in prison.

Even this penalty is idiotic. Think about it-- is some guy who launders money for some criminal gang or drug cartel really going to be deterred by the prospect of a two-year prison sentence? Probably not.

It’s far more likely that some completely innocent small business owner has his/her life turned upside down for non-compliance… because, as they always say, “ignorance of the law is not an excuse.”

Look, no one is arguing that criminals don’t often rely on US-registered businesses to conduct illegal activities.

The point is-- what is the priority here?

The United States government is in an extremely precarious financial condition; calendar year 2023 saw the national debt increase by a whopping $2.5 trillion, totaling roughly $34 trillion as of today.

The debt is so large that annual gross interest payments are about to reach $1 trillion, which takes up a huge chunk of federal tax revenue. And this interest expense keeps growing at an alarming rate.

Forecasts from both the White House and the Congressional Budget Office show that, by 2031, interest expense, along with mandatory entitlement spending like Social Security, will consume the entirety of federal tax revenue.

Everything else we think of as the US federal government-- from military spending to non-existent border security-- will have to be funded by more debt… which just makes the problem worse.

That fiscal cliff is just seven years away. Then, two years later in 2033, Social Security’s primary trust fund will run out of money and require a multi-trillion-dollar bailout.

The ONLY way out of this mess is to have an economic renaissance in the United States which prioritizes productivity and growth.

It’s simple math; if real (i.e. inflation-adjusted) GDP grows by 3% instead of 2%, all of these problems will melt away over time. The federal government will be swimming in tax revenue, Social Security will be properly funded, and the US could re-assert itself as the global economic leader.

The solution is straightforward, and the US private sector has the capability to do it.

But then the government passes bonehead legislation like this that makes it more difficult, more cumbersome to own a business in America.

Hunter Biden will likely never see the inside of a prison cell. But if you’re one of the millions of small business owners that are critical to US economic growth, you’re now officially at risk if you do not comply.

Simon Black, Founder Sovereign Man

PS.: If you own a business, the first report isn’t due until the end of this year. Premium members-- we’ll soon be releasing a comprehensive guide about how/when/where to report to help make it as easy as possible for you. Stay tuned. https://www.sovereignman.com/blog/

BRICS Expansion OFFICIAL: Saudi Arabia Joins As Russia Plans Economic Reset

BRICS Expansion OFFICIAL: Saudi Arabia Joins As Russia Plans Economic Reset

Sean Foo: 1-3-2024

The BRICS bloc has officially expanded with 5 new members including Saudi Arabia, Iran and the UAE. BRICS today is poised to challenge the G7 and flip the economic order on its head.

With Russia as the chairperson in 2024, expect to see more moves in the oil market and de-dollarization.

Here's what you must know.

BRICS Expansion OFFICIAL: Saudi Arabia Joins As Russia Plans Economic Reset

Sean Foo: 1-3-2024

The BRICS bloc has officially expanded with 5 new members including Saudi Arabia, Iran and the UAE. BRICS today is poised to challenge the G7 and flip the economic order on its head.

With Russia as the chairperson in 2024, expect to see more moves in the oil market and de-dollarization.

Here's what you must know.

"Tidbits From TNT" Thursday 1-4-2024

TNT:

Tishwash: Security deployment and closure of the gates of the Green Zone in Baghdad

Press sources reported, today, Thursday, that the gates of the Green Zone in the capital, Baghdad, began closing, after the bombing that targeted the capital.

She said, "The security forces began closing the gates of the Green Zone in the capital, Baghdad, in anticipation of any emergency," noting, "There is a heavy security deployment within the vicinity of the Green Zone." link

TNT:

Tishwash: Security deployment and closure of the gates of the Green Zone in Baghdad

Press sources reported, today, Thursday, that the gates of the Green Zone in the capital, Baghdad, began closing, after the bombing that targeted the capital.

She said, "The security forces began closing the gates of the Green Zone in the capital, Baghdad, in anticipation of any emergency," noting, "There is a heavy security deployment within the vicinity of the Green Zone." link

Tishwash: Iraq considers targeting the PMF headquarters in Baghdad a "terrorist act" and holds the international coalition responsible for the attack

Today, Thursday (January 4, 2024), the spokesman for the Commander-in-Chief of the Armed Forces, Major General Yahya Rasool, described the targeting of the Popular Mobilization Forces headquarters in Baghdad as a “terrorist act,” while holding the international coalition forces responsible for this unjustified attack.

Rasoul said in a statement received by “Baghdad Today”: “In a blatant attack and a blatant violation of Iraq’s sovereignty and security, a drone carried out an act no different from terrorist acts, targeting one of the security headquarters in the capital, Baghdad, today, Thursday, which led to casualties in... This incident is completely unacceptable.”

He added, "The Iraqi Armed Forces hold the International Coalition Forces responsible for this unprovoked attack on an Iraqi security body operating in accordance with the powers granted to it by the Commander-in-Chief of the Armed Forces, which undermines all understandings between the Iraqi Armed Forces and the International Coalition Forces."

He stressed, "We consider this targeting a dangerous escalation and assault on Iraq, far from the spirit and letter of the mandate and the work for which the international coalition was created in Iraq."

Earlier today, a security source reported that the death toll from the bombing of the Popular Mobilization Forces headquarters had risen to 8 members, including two martyrs.

The source told "Baghdad Today", "The initial toll of targeting a headquarters belonging to the Popular Mobilization Forces in the Palestine Street area, east of the capital, Baghdad, rose to 8, including two martyrs."

While another source spoke to "Baghdad Today", that "the person targeted in the bombing that targeted one of the headquarters of the Popular Mobilization Forces is Abu Taqwa Al-Saeedi, commander of the 12th Brigade (Najab Movement 1-)."

He added, "There is no truth to the injury of the Secretary-General of the Popular Mobilization Forces, Lieutenant General Abu Muhammed Al-Halafi." link

************

Tishwash: From the dollar to the dinar... Iraqis complain about the deterioration of their salaries

“I have been waiting for about four months to receive my full salary from the bank, but every time I receive half of it and have to wait two or three weeks until I receive another payment,” says Sakar Mustafa, an Iraqi journalist who works independently with international institutions.

She explains to “ Raise Your Voice ” that “her salary ranges between 1,500 and 2,000 US dollars, depending on the work she performs, but what the bank disburses to her does not exceed 1,000 dollars, which is a very small amount that is not sufficient for all of her monthly expenses, represented by house rent and school tuition.” Bills and transportation.

“I spoke to the bank, and they informed me that they had received instructions to disburse salaries according to their capabilities, and currently they do not have the full liquidity to disburse it in full in dollars,” Mustafa continues.

She confirms that "her salary either arrives incomplete, or is transferred to the Iraqi dinar at the official rate set by the government (1,320 dinars per dollar), at a time when the exchange rate in the parallel market is 1,520 dinars per dollar."

On December 31, the Central Bank of Iraq announced the identification of the categories that receive their transfers in US dollars, which are: diplomatic missions, all international organizations and agencies operating in Iraq, and non-governmental civil society organizations registered in the General Secretariat of the Council of Ministers, in the event that the foreign donor stipulates that they pay sums of money. Foreign transfers received in the dollar currency inside Iraq.

In addition to government contracts in effect in the US dollar currency, ongoing contracts for grants, loans, and foreign agreements, and 40% of the remittances received by Iraqi exporters resulting from their exports abroad.

Since the end of 2022, Iraq has been witnessing an exchange rate crisis, represented by the fluctuation of dinar prices against the dollar and other foreign currencies, and inflation in the prices of goods and services in local markets.

The crisis deepened in 2023, with a significant decline in the price of the dinar against the dollar in the parallel market.

One of the solutions developed by the government is to force merchants to deal in the Iraqi dinar in their local transactions, so that the Central Bank of Iraq adopted the electronic platform in the currency auction to limit the smuggling of the dollar from the country and increase the value of the dinar.

The Central Bank activated the second phase of adopting the platform, with the aim of subjecting individual financial transfers and credit cards, activating electronic payment, reducing dependence on cash, and allowing Iraqi banks to import all currencies, including the dollar, to meet the needs of their customers.

But these solutions did not end the crisis in salaries for Iraqi employees working with foreign institutions.

"arbitrary action"

From the beginning of last December until the 20th of December, Iraqi banks, both governmental and private, have imported 255 million US dollars to meet the needs of their customers, according to the latest Central Bank statistics, published by the official news agency .

Economist Hammam Al-Shamaa told “Raise Your Voice,” saying, “Reducing the exchange rate in the parallel market to the official exchange rate will not be achieved in the short or even long term. There are many obstacles that prevent this.”

He wonders: “Does Iraq have enough foreign currencies and dollars if oil prices fall? Can it pump into the markets an amount of dollars that would lead to equality or matching between the official and parallel prices?”

“The answers are left to the future,” adds Al-Shamaa, who considered that “the Central Bank’s insistence on dealing with employee salaries paid in dollars based on the official exchange rate is an arbitrary and unfair measure for employees who receive US currency. This measure will not have a significant impact on the markets, as there will be a decline.” In remittances, resort to banking offices or black money transfers.”

Economist Nabil Jabbar Al-Tamimi points out that “there is a defect in the Central Bank’s dealings with external transfers from oil companies and institutions, media institutions, diplomatic bodies and oil companies, as well as other employee beneficiaries, who receive their salaries in dollars, and complain about the large difference between the price of... Official and parallel exchange if their salaries are converted into dinars.”

He told “Raise Your Voice”: “The cases you mentioned are exceptional, and are not an excuse to stop the campaign to end dollarization represented by the excessive use of the dollar in the local market, and the fate of the dollar exchange rate in the end is to stabilize at the official rate or something close to it within months.”

At the same time, Al-Tamimi believes that “the public interest requires acceptance of the state’s decisions, despite their problems.” link

Mot: . I'm Trying - Really -- Its sooo Hard!!! – siigghhhhhh

Mot: . And....there it is

News, Rumors and Opinions Thursday Morning 1-4-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 4 Jan. 2024

Compiled Thurs. 4 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

For some time the Iraqi Dinar has been trading upward on the back screens of the Forex. By Jan. 1 2024 the new Dinar in-country Rate was being used within Iraq, while the fiat US Federal Dollar was outlawed in the country.

A Bond Paymaster with connections in Miami and Geneva expected the Bond Holders to have liquidity and Tier4b to set appointments by Thurs. 4 Jan. A Banker felt the Tier4b would also be able to set appointments by Thurs. 4 Jan.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Thurs. 4 Jan. 2024

Compiled Thurs. 4 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

For some time the Iraqi Dinar has been trading upward on the back screens of the Forex. By Jan. 1 2024 the new Dinar in-country Rate was being used within Iraq, while the fiat US Federal Dollar was outlawed in the country.

A Bond Paymaster with connections in Miami and Geneva expected the Bond Holders to have liquidity and Tier4b to set appointments by Thurs. 4 Jan. A Banker felt the Tier4b would also be able to set appointments by Thurs. 4 Jan.

20 Dec. Zim Bonds, Amiel Alston (RUMORS)

1. Understanding what is a Promissory Note: the Zim Bonds are in fact Promissory Notes and legally cannot be refused.

2. The Zim Bonds are “Asset-Backed” Rate according the United States Treasury (UST) Supporting ARCHIVED Documentation.

3. It’s illegal to alter any Bond as it’s bonded with the “promise to pay the bearer”. People need to look up the definition of the word BOND” it’s that simple. This is exactly what is written on the Zim Bonds. Fact.

4. The reason why the 2008-2009 Zimbabwean dollar notes/bills, also called the Agro Cheques or AA Blue Bonds, are the most unique and crucial of all the Bonds and the phenomenal roll will it play. Fact (The reason the Cabal’s mainstream media keeps it absolute silent!)

5. The UN Conference on Trade and Development’s report in 2010 advocated for a global reserve system based on a “basket” of currencies, which would create a more stable and predictable international monetary system. This was the catalyst for what we termed our current Global Currency Reset (GCR) over 13 years ago. Fact.

6. The Zimbabwean 2008-2009 notes/bills are included in the First Basket Currencies to revaluate (RV)!

7. We are waiting for the Iraqi Dinar to RV for the Zim Bonds to pay out as the dinar is also included in the First Basket. Once an asset-backed currency becomes an international standard, e.g. the Iraqi dinar, other countries will follow suit to trade with it. That is where the Iraq Dinar comes in, this currency is the catalyst for everything!

8. Zimbabwe is re-dollarizing (reviving) their own currency and they recently pegged their Zim dollar to gold, meaning your Zim Bonds will also be gold-backed.

9. The Reserve Bank of Zimbabwe (RBZ), injected the gold-backed digital tokens (GBDT) known as Zimbabwe Gold (ZiG). This GBDT is prepared and will be used via the QFS to pay you for your Zim Bonds.

10. Each country’s gold bars have serial numbers on them. The new currency issued by the Treasury departments (of sovereign nations) will also have serial numbers that will correspond with the serial numbers of each gold bar from each sovereign nation stored at the SGE. The stolen gold will be restored into the QFS and your Zim Bond is the tool to achieve it.

11. The Royal Bank of Zimbabwe $835,000,082,302,000,000 (13 metric tons of in ground gold estimated to yield $14 billion per annum by RBZ going forward) Central Bank Zimbabwe is the richest in the world. Fact.

Read full post here: https://dinarchronicles.com/2024/01/04/restored-republic-via-a-gcr-update-as-of-january-4-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 2023 was the year of preparation for the monetary reform to be revealed. We are now in that position. We are now in the position that the monetary reform is being revealed to the citizens of Iraq. One of the things that is happening, and I pray that it happens faster, is the value of the Iraqi dinar is going up every day causing the dollar to go down...down...down... Once they reach a certain plateau that they're looking for then they're going to float the currency. That's why they've educated the citizens of Iraq about the float...

Walkingstick [Iraqi banks] are having a stampede of people going in because of the understanding of the monetary reform education. Direct deposit accounts were opened for the citizens that didn't have any accounts...they opened up about 1 million...and they're not done yet...These bank accounts are extremely important for the monetary reform...These accounts are for payments that will be made to the citizens...salaries given to the citizens, for any retirement salaries given...for HCL payments...What they are doing is extremely important for the monetary reform process...

IT'S OVER: U.S. Federal Debt Hit $34 TRILLION As Interest Payments Skyrocket To $1.5 TRILLION

Lena Petrova: 1-3-2024

LIVE! Blasts Inside Iran Send Crude HIGHER. Job Openings CRATER. Manufacturing FREEFALL.

Greg Mannarino: 1-4-2024