10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026: Awake-In-3D

10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026

On January 2, 2024 By Awake-In-3D

Based on careful analysis and historical patterns, the following factors indicate a potential for significant increases in gold prices versus fiat currencies over the next few years.

1. Today’s Gold Bull Market Trajectory

The current bull market for gold, which began in 2015, suggests that the price could increase by 1,435% over the proceeding 11 years (from 2015), pointing to a potential value of fiat $10,000-$15,000 per Troy ounce by the end of 2026.

10 Reasons For Gold Surpassing $10,000 Fiat Dollars By 2026

On January 2, 2024 By Awake-In-3D

Based on careful analysis and historical patterns, the following factors indicate a potential for significant increases in gold prices versus fiat currencies over the next few years.

1. Today’s Gold Bull Market Trajectory

The current bull market for gold, which began in 2015, suggests that the price could increase by 1,435% over the proceeding 11 years (from 2015), pointing to a potential value of fiat $10,000-$15,000 per Troy ounce by the end of 2026.

The current gold bull market began in 2015 and projected to continue through 2026. Chart Source: Blue Hill Research

2. Historical Gold Bull Markets Comparison

When comparing the current gold market to past trends, a strong similarity is seen, indicating the likelihood of significant price increases.

3. Moderated Gold Bull Market Assumptions

The analysis takes a balanced approach, looking at average gains and time frames from past bull markets to give a realistic view of what might happen in the future.

4. Mathematical Progression

Simple math shows that as the price of gold goes up, each additional fiat $1,000 increase becomes easier in percentage terms, which could lead to prices surpassing fiat $15,000.

5. Projected Annualized Gains

By looking at the average gains from previous bull markets, a steady increase in gold’s value over time is historically significant and anticipated.

6. Decreasing Percentage Increase

As gold prices rise, the percentage increase for each $1,000 gain becomes smaller, making it more achievable to reach higher prices.

As the price of gold goes up, the percentage increase for each additional $1,000 gain becomes smaller. For example, if the price goes from $2,000 to $3,000, it’s a 50% increase.

However, if it goes from $3,000 to $4,000, it’s only a 33.33% increase. This means that as gold prices rise, it becomes easier for the price to make larger jumps.

The decreasing percentage increase makes it more achievable for gold prices to reach higher levels as they continue to rise.

7. Market Behavior and Analysis

A detailed study of past market behavior and comparison with previous bull markets gives confidence in predicting that gold’s price could exceed fiat $10,000 per ounce by 2026.

8. Potential for Exceeding Projections

The model for projecting the fiat $15,000 price is flexible, allowing for the possibility of actual gains surpassing expectations, meaning gold could potentially be worth even more.

9. Support from Supply and Demand

While less detailed, the basic principles of supply and demand support the overall idea that gold prices will increase, potentially surpassing fiat $10,000 per ounce.

10. Plausibility Scenario

Based on historical analysis and mathematical findings, it seems likely that the price of gold could reach fiat $15,000 per ounce within the next 36 months, reinforcing the potential of surpassing fiat $10,000 by 2026.

Looking ahead, these reasons provide a strong, plausible foundation for a logical increase in gold’s value above fiat $10,000 per ounce by 2026.

This insight can help everyone understand the potential future trajectory of gold’s value against fiat currencies.

Add in the current geopolitical power shifts continuing throughout 2024 and beyond, and the deteriorating financial system we see unfolding today and the case for fiat $10,000+ gold becomes even more probable.

Supporting articles:

NOTE: THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE FINANCIAL ADVISE. READERS ARE ADVISED TO CONSULT WITH PROFESSIONALS BEFORE MAKING FINANCIAL DECISIONS.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/10-reasons-for-gold-surpassing-10000-fiat-dollars-by-2026/

More News, Rumors and Opinions Wednesday PM 1-3-2024

KTFA:

Clare: Iraqi Finance announces the distribution of retirees' salaries for the month of January

1/3/2024

Today, Wednesday, the Ministry of Finance/Accounting Department launched financing the salaries of civil and military retirees for the month of January 2024.

In a statement today, the Ministry directed the administrations of Al-Rafidain and Al-Rasheed Banks and the National Retirement Authority to expedite the completion of procedures for paying the salaries of civilian retirees via electronic payment cards.

In its statement, the Ministry also called on all civilian and military retirees who will receive text messages to visit bank branches and ATM outlets in Baghdad and the provinces to receive their salaries. LINK

KTFA:

Clare: Iraqi Finance announces the distribution of retirees' salaries for the month of January

1/3/2024

Today, Wednesday, the Ministry of Finance/Accounting Department launched financing the salaries of civil and military retirees for the month of January 2024.

In a statement today, the Ministry directed the administrations of Al-Rafidain and Al-Rasheed Banks and the National Retirement Authority to expedite the completion of procedures for paying the salaries of civilian retirees via electronic payment cards.

In its statement, the Ministry also called on all civilian and military retirees who will receive text messages to visit bank branches and ATM outlets in Baghdad and the provinces to receive their salaries. LINK

Clare: An economist supports comprehensive banks: The era of specialization has ended

1/3/2024 Baghdad

Today, Wednesday, the economic expert, Mahmoud Dagher, considered that the era of public banks has “ended” and only a little of it remains, while he expressed his support for comprehensive banks.

In an interview with Al-Iqtisad News, Dagher said, “The global banking system ended, not a short time ago, the existence of specialized banks and began the transition to the comprehensive bank that carries out full banking operations, using its deposits and capital to finance these operations.”

He added, "The era of public banks has also ended and very little of it remains in some countries, as all banks have turned into joint-stock companies with the same specialization exercising operations similar to other banks. Rather, the specialized ones have begun to aim to transform into banking operations such as localization and regular lending in order to be able to continue." .

The economic expert explained, “The state has also increased its support for specialized banks and their capital, which does not ensure capital adequacy,” adding, “I support merging the banks in the hope that they will have a longer life to operate instead of delaying.” LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man The United States Treasury, the US Federal Reserve Bank, the Bank of International Settlements, World Trade Organization, the EU, many different entities have been working with Iraq to get her to go to an international standard. The stage is set for Iraq to be international...Everybody should know that and it's not just a simple Dinar Guru situation, it's actually the largest financial entities in the world are the ones that are giving us this information. I hope you take that to heart and pay attention to it.

Walkingstick They didn't print new coins. The old coins they had are still good. That might be one of the reasons why IMO they're going to incorporate it along with the lower denoms at the same time...They have not manufactured any new coins. The CBI is going to use the old coins. Those coins are sitting in the CBI vault...You can throw away fiat. You can throw away paper, the 3-zero notes, but it would be dumb to throw away precious medals. It doesn't have Saddam on it...Coins don't.

*************

TNT:

Tishwash: Parliamentarian: America controls international courts to pass their decisions

A member of the House of Representatives, Thaer Makhif, considered, on Wednesday, that the international courts and the UN Security Council are an American creation to pass Washington’s decisions, while he stressed that it is impossible to convict the United States of America in the case of the assassination of Al-Nasr leaders through them.

In an interview with the Maalouma Agency, Makhif said, “The goal of this policy is to continue the abuse and condemnation of the Arab countries, while it turns a blind eye to the violations of Washington and the Zionist entity,” noting that “the American policy has drawn a hostile map to weaken Iraq to infinity.”

He continued, "There are many decisions that Washington is pushing for in order to serve the Zionist entity and its goals inside the country," pointing out that "weakening Iraq directly is tantamount to weakening all Arab countries."

He added, fearfully during his speech: “One of the dual decisions passed by the UN Security Council is to condemn Iraq for its war on Kuwait, and not to condemn America for the occupation of the country until now,” pointing out that “the international courts and the UN Security Council are an American creation to pass Washington’s decisions that serve their own interests."

The UN Security Council continues not to condemn Washington for its violations and the continued systematic bombing against security forces and civilians, in addition to not condemning it for the bombing of Al-Nasr leaders, despite the presence of much evidence and admission by its former president of carrying out the operation. link

Credit Crisis Gets Even Worse As 50 Million People Stop Paying Creditors

Atlantis Report: 1-3-2024

Despite official narratives of an economic recovery, the day-to-day reality for many Americans is characterized by mounting financial stress and an increasing inability to meet financial obligations. The credit crisis gripping the United States has reached a distressing milestone, with a staggering 50 million individuals now defaulting on loan payments, as the credit crisis gets even worse.

The Most Valuable Investment in 2024 - Robert Kiyosaki

Roberty Kiyosaki: 1-3-2024

Robert Kiyosaki, alongside experts from the precious metals industry, including Andy Schectman, Dana Samuelson, Jim Clark, and Charles Goyette, delve into the significance of gold and silver as investment options. They discuss the historical context of the US dollar and explore how global economic shifts could influence personal wealth. The guests share their knowledge and personal experiences, emphasizing the role of precious metals in safeguarding assets.

Economist's "News and Views" Wednesday 1-3-2024

The Great Taking: Understanding the Shift in Global Debt | A Deep Dive into Financial Collateral

Lynette Zang: 1-2-2024

From Nixon taking us off the gold standard in 1971 to the current supercycle of consistently lowering interest rates, Lynette Zang, Chief Market Analyst at ITM Trading, breaks down the intricacies of "The Great Taking."

Learn how debt accumulation and central bank actions have led to the greatest wealth transfer in history – "The Great Taking." Discover the insights from the book that unveils the system's abuse and soaring debt levels.

Join the conversation on the impending challenges of 2024 and beyond.

The Great Taking: Understanding the Shift in Global Debt | A Deep Dive into Financial Collateral

Lynette Zang: 1-2-2024

From Nixon taking us off the gold standard in 1971 to the current supercycle of consistently lowering interest rates, Lynette Zang, Chief Market Analyst at ITM Trading, breaks down the intricacies of "The Great Taking."

Learn how debt accumulation and central bank actions have led to the greatest wealth transfer in history – "The Great Taking." Discover the insights from the book that unveils the system's abuse and soaring debt levels.

Join the conversation on the impending challenges of 2024 and beyond.

CHAPTERS:

0:00 The Great Taking

7:00 M2

12:46 Dark Cloud Over America

21:25 Wealth Transfer Tool

25:48 Devaluing Peso

28:00 Legal Owners

38:50 Argentina Privatizations

WITHOUT MORE FED. PROPPING UP OF THIS MARKET, THIS ENTIRE THING WILL MELT DOWN.

Greg Mannarino: 1-3-2024

250 - 500 Banks Will Fall In 2024

Atlantis Report: 1-2-2024

In the ever-evolving financial sector landscape, a foreboding prediction looms over the horizon as analysts and experts foresee the potential downfall of a substantial number of banks in the year 2024. 250 to 500 banks are facing the risk of failure. The implications of such a scenario extend beyond mere numerical statistics, signaling a potential shift in the banking industry's stability.

Goldilocks' Comments and Global Economic News Wednesday AM 1-3-24

Goldilocks' Comments and Global Economic News Wednesday AM 1-3-24

Good Morning Dinar Recaps,

Intel:

Today {01/02/23), Dee and I did get confirmed in a meeting with our CBI contact that the Iraqi Dinar is currently trading through electronic mechanisms.

As their currency expands into the International stage this year, they do expect to have a currency with a higher value as the year progresses.

This is a learning curve for them as well as other currencies around the world as many of them began the process of trading in their own currencies on an official level today.

We did schedule a meeting with our contact and other members of their IT Department for later this week or early next week.

© Goldilocks

Goldilocks' Comments and Global Economic News Wednesday AM 1-3-24

Good Morning Dinar Recaps,

Intel:

Today {01/02/23), Dee and I did get confirmed in a meeting with our CBI contact that the Iraqi Dinar is currently trading through electronic mechanisms.

As their currency expands into the International stage this year, they do expect to have a currency with a higher value as the year progresses.

This is a learning curve for them as well as other currencies around the world as many of them began the process of trading in their own currencies on an official level today.

We did schedule a meeting with our contact and other members of their IT Department for later this week or early next week.

© Goldilocks

~~~~~~~~~~

The next Gold Standard will be Digital.

© Goldilocks

~~~~~~~~~~

Indian rupee may rise to 81/$ by 2024 end amid robust inflow hopes: Goldman Sachs MoneyControl Link

👆 It's a process my friends.

~~~~~~~~~~

The President of Venezuela hopes that Venezuela will join BRICS in 2024.

Another major oil player.

He also said that BRICS is the future of humanity.

Commodities…

Read: https://x.com/goldtelegraph_/status/1742265496400207918?s=46

~~~~~~~~~~

SEC could inform spot Bitcoin ETF applicants of approval by Jan. 3.

Firms may be notified on Tuesday or Wednesday to prepare for a Jan. 10 launch.

https://cryptoslate.com/sec-could-inform-spot-bitcoin-etf-applicants-of-approval-by-jan-3/

~~~~~~~~~~

Blackrock Names JPMorgan as Authorized Participant for Spot Bitcoin ETF Despite Jamie Dimon Wanting to Ban Crypto Bitcoin News Link

~~~~~~~~~~

RBI says All India Fincl Institutions now national development banks Informist Media Link

~~~~~~~~~~

Goldman Sachs Exec Predict Growth For Digital Assets In 2024 News BTC Link

~~~~~~~~~~

Has the US Abdicated Global Digital Leadership? CEPA Link

~~~~~~~~~~

UPI new rules: 5 major changes that come into effect from January 1, 2024 AsiaNetNews Link

~~~~~~~~~~

The US plays the Role of Top Cop, Establishing Global Crypto Standards

Regulators worldwide have been intensifying efforts to establish formal laws for digital currencies in 2023. While many regions have passed laws with potentially tough penalties, the U.S. stands out for taking some of the harshest legal actions against major players in the crypto industry.

The U.S. Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC (https://en.wikipedia.org/wiki/Commodity_Futures_Trading_Commission)), Department of Justice, and Treasury’s Financial Crimes Enforcement Network (FinCEN) have actively enforced penalties and fines against crypto companies.

https://ciolook.com/the-us-plays-the-role-of-top-cop-establishing-global-crypto-standards/

~~~~~~~~~~

SEC may notify approved ETF issuers by early next week, ahead of January 10 launch: Reuters

"Asset managers who met their end of year deadline may be able to launch by the Jan. 10 decision deadline, according to Reuters, citing people familiar with the process. Those include the aforementioned firms, along with Valkyrie, Bitwise, WisdomTree, Franklin Templeton, BlackRock, VanEck, and Invesco."

These are some big names in the investment field. Companies like these individually have the ability to move the markets in and of themselves. Here, we have seven of them pledging to support the new "spot Bitcoin ETF." This is an asset that will be placed in Global Markets around the world to shift our economy into the digital space.

A wave of buying is expected when this decision comes out on January 10th, 2024. Not to mention all the money these companies will place inside this one asset supporting movement upwards in the crypto space due to the acceptance of Bitcoin serving as a bridge into the new digital asset-based trading system whereby tokenized assets will become the norm.

This shift into a digital economy will bring with it a lot of liquidity from those who have been investing outside of the Financial System anticipating this move into the markets. The Block Link

© Goldilocks

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

On January 2, 2024 By Awake-In-3D

As we step into a new year, the ghost of the 2008 global monetary crisis still looms large over the fiat financial system.

More than fifteen years have passed, yet the financial earthquake that shook the world in 2008 was never fixed. It was merely “papered over” setting the stage for a grand, catastrophic finale that will bring down the great global fiat currency debt system experiment which began in 1971 (when the United States ended it’s peg to gold).

The 2008 crisis wasn’t just another financial downturn; it represented a seismic shift that transcended the confines of specific assets or sectors.

Revisiting the 2008 Global Monetary Crisis because it’s Coming Back with a Vengeance this Year

On January 2, 2024 By Awake-In-3D

As we step into a new year, the ghost of the 2008 global monetary crisis still looms large over the fiat financial system.

More than fifteen years have passed, yet the financial earthquake that shook the world in 2008 was never fixed. It was merely “papered over” setting the stage for a grand, catastrophic finale that will bring down the great global fiat currency debt system experiment which began in 1971 (when the United States ended it’s peg to gold).

The 2008 crisis wasn’t just another financial downturn; it represented a seismic shift that transcended the confines of specific assets or sectors.

Unlike an asset bubble like the 2000 dot-com crisis, which primarily affected specific industries, the 2008 meltdown was a global monetary catastrophe.

It went beyond the devaluation of a few assets; even fundamentally sound assets had to be repriced lower due to a severe shortage of cash to purchase them. This scarcity of funds led to a worldwide liquidity crisis, impacting the circulation of money throughout the international financial system.

What made the 2008 crisis different was its global character. The crisis extended beyond the United States, affecting the global financial landscape through the Eurodollar market.

The Eurodollar market, despite its name, is not about Europe; it involves the circulation of US dollars outside the United States and played a pivotal role in the crisis. The shortage of dollars in this international market had a far-reaching impact, leading to a liquidity crisis that affected the worldwide circulation of money.

European banks were ensnared in this dollar shortage, resulting in a tidal wave of fund outflows, which went beyond bad loans and represented a struggle for liquidity in the global financial system.

Fast forward to 2024, and the aftershocks of 2008 are still being felt.

The government-induced economic shockwaves of the COVID-19 pandemic have only served to exacerbate the existing challenges stemming from the 2008 crisis.

Central banks continue to grapple with the long-term repercussions, with discussions and actions indicating ongoing concerns about a return to the gloomy aftermath of the crisis.

These actions are not just economic adjustments; they reflect a persistent worry about the prolonged impact of the crisis on the global economy.

To the non-financial reader, it’s crucial to recognize that the 2008 global monetary crisis isn’t just a historical event—it’s an ongoing issue with profound implications for the stability and functioning of the global financial system.

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

"Tidbits From TNT" Wednesday Morning 1-3-2024

TNT:

Tishwash: Officially...Saudi Arabia begins its full membership in the BRICS group

Saudi television announced today, Tuesday, that the Kingdom announced the official start of its full membership in the BRICS group.

BRICS, which until today included Russia, Brazil, India, China and South Africa, announced during its summit in Johannesburg last August that Saudi Arabia, along with the UAE, Egypt, Iran, Argentina and Ethiopia, would join the group starting in 2024.

Saudi Foreign Minister Faisal bin Farhan said during his participation in the Johannesburg summit that ““Saudi Arabia enjoys strong friendships, trade relations and strategic partnerships with the BRICS Council countries,” adding that Saudi Arabia stresses “the importance of activating collective and multilateral action and is keen to exercise its responsibilities to sustain international cooperation.”

TNT:

Tishwash: Officially...Saudi Arabia begins its full membership in the BRICS group

Saudi television announced today, Tuesday, that the Kingdom announced the official start of its full membership in the BRICS group.

BRICS, which until today included Russia, Brazil, India, China and South Africa, announced during its summit in Johannesburg last August that Saudi Arabia, along with the UAE, Egypt, Iran, Argentina and Ethiopia, would join the group starting in 2024.

Saudi Foreign Minister Faisal bin Farhan said during his participation in the Johannesburg summit that ““Saudi Arabia enjoys strong friendships, trade relations and strategic partnerships with the BRICS Council countries,” adding that Saudi Arabia stresses “the importance of activating collective and multilateral action and is keen to exercise its responsibilities to sustain international cooperation.”

Russia assumed the presidency of the BRICS group this year, and Russian President Vladimir Putin said in a speech on this occasion: ““Egypt, Iran, the Emirates, Saudi Arabia, and Ethiopia have joined BRICS as new full members. ” This convincingly demonstrates the growing prestige of this group and its strengthening role in global affairs. We will take all possible steps to facilitate the harmonious integration of new participants into all forms of its activities.” link

Tishwash: Iran Becomes A Member Of BRICS, With Hopes And Challenges

Iran officially became a member of the China-led BRICS economic organization on Monday, as it seeks to overcome the impact of US sanctions and overcome it isolation.

In its policy of finding shelter under Chinese and Russian-dominated international organizations, Iran achieved full membership in the Shanghai Cooperation Organization in July 2022 and concurrently pursued entry into the BRICS group. Following an official invitation, Iran announced its acceptance into BRICS on August 24, 2023, with the official membership commencing on January 1, 2024.

Iran's Foreign Ministry spokesman, Nasser Kanaani, announced the news on Monday as an important achievement for Tehran, emphasizing the potential for economic potential BRICS can offer. Ehsan Khandouzi, Iran's Finance and Economic Affairs Minister, expressed hope for global engagement and for increased trade opportunities with BRICS countries, despite US sanctions.

Iranian officials, who feel the need to calm domestic anxieties about the economic crisis gripping the country since 2018, routinely tell citizens that BRICS could challenge the dominance of the US dollar, and alleviate the financial crisis brought about by the US sanctions. Despite these assertions, domestic markets know that the Chinese themselves heavily rely on the US dollar for trade. Lack of confidence in the foreign and economic policies of the government has played a major role in the 12-fold devaluation of the Iranian rial against major currencies since 2018.

In Iran’s domestic political dynamics, BRICS is presented as a mechanism and an opportunity to challenge the United States and boost trade.

Despite these perspectives, skepticism remains about the practical benefits of Iran's BRICS membership, especially concerning economic implications. Geopolitical tensions, such as Russia's invasion of Ukraine and China's strained relations with the United States, complicate BRICS' role as a counterweight to the West.

During the BRICS summit in August 2023, Iranian President Ebrahim Raisi and Chinese President Xi Jinping emphasized bilateral cooperation and opposition to “American unilateralism.” While some individuals are optimistic, Tehran observers doubt practical benefits, emphasizing the need to address relations with the US and resolve the dispute about Iran’s nuclear program for meaningful membership impact. Former UN diplomat Kourosh Ahmadi has warned against illusions about potential benefits from SCO and BRICS, suggesting such beliefs could be more harmful than not being members at all.

Challenges

Not all BRICS members may be equally enthusiastic about Iran's inclusion, and not every existing member supported Iran's decision to join. Additionally, the impact of US secondary sanctions, restricting Iran's global business activities, may not be substantially alleviated by BRICS participation, especially given the organization's alignment with China and Russia, both with their own serious economic challenges and disputes with the West.

Nevertheless, Iran's energy sector is expected to experience significant changes with BRICS membership, particularly due to its major role in gas and oil production. Joining BRICS is seen as a strategic move to enhance energy trade and collaboration, especially with China and Russia. Anticipated benefits for Iran include increased energy exports, investment in energy infrastructure, and potential relief from US sanctions through the use of national currencies in energy trading.

While Iran aims to leverage BRICS membership to weaken sanctions, boost its economy, and access broader markets, experts caution that economic gains may be limited without a nuclear deal with the West. The uncertainties about the effectiveness and cohesion of BRICS policies also raise questions about the immediate and long-term benefits of Iran's membership.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF), a global monitor on money laundering, announced on Friday that it has made no modifications to its blacklist, which includes Iran, Myanmar, and North Korea. Iranian economist Mohammad Mehdi Behkish has emphasized potential difficulties in business transactions with BRICS countries if the FATF issue is not resolved. He has also underscored that, despite additional countries joining BRICS, the economic significance of the United States to China will surpass that of all BRICS nations, emphasizing the necessity of easing financial restrictions for Iran to fully benefit from BRICS membership.

It is claimed that Iran's membership in BRICS represents a strategic alliance with China and Russia, with opportunities for enhanced infrastructure investment and commerce. The goal to change the dynamics of the global energy market and lessen reliance on the US currency in energy-related transactions is supported by China and Russia. Higher energy exports and the possible use of national currencies as a hedge against US sanctions are anticipated benefits. However, Iran or any other country, needs revenues in hard currencies for most imports, and replacing the US dollar in energy exports does not seem to be a wise policy.

Moreover, considering the significant trade volumes they maintain with the United States, some BRICS members would be reluctant to take on economic risks in their dealings with Iran. This complicated situation highlights the numerous difficulties and factors that go along with Iran's involvement in BRICS, calling for a systematic and careful strategy to deal with these complications. link

************

Tishwash: The Iraqi dinar is outside the list of the 15 worst-performing currencies against the dollar in 2023

The Lebanese pound was the worst-performing currency in 2023, as it fell by nearly 90% against the dollar, according to Bloomberg data.

As for the Argentine peso, it ranked second on the list, recording a decline of 78%, followed by the Nigerian naira, which declined by about 50% against the dollar at the end of last year.

The list below that did not witness the presence of the Iraqi dinar:

It is worth noting that dataBloombergThe official currency rates are based on central banks. link

Mot: ....... at Times -- the Drama Continues -- then Ya Wakes Up!!!

Mot: .. the Best

News, Rumors and Opinions Wednesday 1-3-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 3 Jan. 2024

Compiled Wed. 3 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

On Mon. 1 Jan. 2024 the Global Currency Reset was believed to have taken place, the fiat US Petro Dollar went into collapse and was no longer being used for international trade, while the Federal USD became illegal in Iraq and would be illegal everywhere else after Feb. 20 2024.

On Tues. 26 Dec. GESARA was softly (allegedly) announced publicly to select media outlets through the Starlink Satellite system, which made it legal. GESARA has (allegedly started between all governments worldwide. NESARA is now (allegedly liquid under the USN. The money is(allegedly flowing.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Wed. 3 Jan. 2024

Compiled Wed. 3 Jan. 2024 12:01 am EST by Judy Byington

Global Currency Reset: (RUMORS)

On Mon. 1 Jan. 2024 the Global Currency Reset was believed to have taken place, the fiat US Petro Dollar went into collapse and was no longer being used for international trade, while the Federal USD became illegal in Iraq and would be illegal everywhere else after Feb. 20 2024.

On Tues. 26 Dec. GESARA was softly (allegedly) announced publicly to select media outlets through the Starlink Satellite system, which made it legal. GESARA has (allegedly started between all governments worldwide. NESARA is now (allegedly liquid under the USN. The money is(allegedly flowing.

Tues. 2 Jan. Goldilocks: Our first round of liquidity for the markets and the banking system under the SOFR lending system pays out early this week. …Japan (allegedly did an in-country test on the QFS on Christmas Day; India and a handful of other countries are doing an International pilot test on the QFS starting Tues. 2 Jan. Pilot tests usually run at least 30 days that will take us to Tues. 30 Jan. On that 30 Jan. the rest of the world will(allegedly begin rolling out their connections to the QFS and utilizing the system. Each phase along the way will have a set of countries no longer using the US dollar in trade as the World Reserve Currency. This does not mean that all of them will make that decision, but it will level the playing field for countries around the world that want to start utilizing their own currencies. These new demands will increase the value of all the currencies involved inside this transition creating a Global Currency Reset through new trading volumes making their way into the Global Market. Watch the water. https://wolfstreet.com/2024/01/01/status-of-us-dollar-as-global-reserve-currency-and-usd-exchange-rates-long-slow-uneven-decline-continues/

Goldilocks: On Mon. 1 Jan. the BRICS memberships of Saudi Arabia, Egypt, the United Arab Emirates, Iran and Ethiopia officially took effect. The countries were invited to join the group in August 2023 after the 15th BRICS Summit in Johannesburg, South Africa. https://www.thestandard.com.hk/breaking-news/section/3/211951/Five-countries-formally-join-BRICS#

Tues. 2 Jan. Salty Mtn: Today I went into Chase Bank, which I only use for my business. I have not been inside for 5 or 6 months, and I do have an assigned banker, since I maintain a certain balance. I normally use the Drive Thru since I always have my dog with me. The whole interior has changed. I had to ask where to go. They put up a wall of glass with a door at each end. Today they were putting up scanners at each entrance. I found a banker and asked why the changes. I was taken into a glass cubicle to get my business taken care of, and I asked if the changes are going to be used for RV. I got a shocked look. She said banking in future won’t have a live person across the desk. I told her I had foreign currency. She then said 16 individuals finished training on Saturday in foreign currency and handling of clients. She said they expected only a 8-10 day event at our location.

Tues. 2 Jan. Ariel: Elon Musk Isn’t Wrong: The Gold Standard. The BRICS Nations. The Iraqi Dinar Reinstatement. Iran & Russia trade agreements for the stablecoin backed by gold. We are officially in the ring with the Cabal. Sword, helmet, and shield.

~~~~~~~~~~~

Tues. 2 Jan. 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#

Last night Mon. 1 Jan. there was a call which said that the UST was sending out an email to ALL Banks and RC’s at 10 am this morning Tues. 2 Jan.

Since 11 pm last night Mon. 1 Jan. there has been chatter about the World Court and the Common Law language that needed to be in the GCR. Today Tues. 3 Jan. we found out that had been done.

Today Tues. 2 Jan. we talked to a Wells Fargo Manager and he said that everything was done.

A Bond PM with connections in Miami and Geneva expected the Bond Holders to have access and liquidity Wed. 3 Jan. or Thurs. 4 Jan.

The same PM said that Tier 4b (Us, the Internet Group) should also get their notifications in that same time frame – Wed. 3 Jan. or Thurs. 4 Jan.

One bank said Wed. 3 Jan. or Thurs. 4 Jan.

The NESARA, GESARA and the new gold/asset-backed US Note formal announcements were expected on or before Thurs. 11 Jan. 2024.

Since Mon. 1 Jan. 2024 Iraq has been doing exchanges inside Iraq at the new Iraqi Dinar in-country rate.

In Iraq the US Federal fiat Dollar is dead. They want them to transition to the new lower denoms.

It was believed that the ban to exchange the Dinar at the new Dinar international rate would come off on Wed. 3 Jan.

There were nine currencies in the first basket that would go up in value with the Global Currency Rest. Among them were the Iraqi Dinar, Vietnamese Dong, Zimbabwe Zim, Indonesia Rupiah, Israeli Shackle, Afghani and Venezuela Bolivar. Of the rest, half would stay the same, while the other half would go down in value.

Read full post here: https://dinarchronicles.com/2024/01/03/restored-republic-via-a-gcr-update-as-of-january-3-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East Question: "Is the rate and the [lower] currency gonna come out together?" I think yes. This is why I think yes. First, because they cannot change an exchange rate with a big numbers [rate] and Second, they cannot change a [lower] currency with the small exchange rate...If you change, you've gotta change both. If you take the 3-zeros from the currency, you're gonna have to take the 3-zeros out of the exchange rate in the same time. That's what I think.

Pimpy Question: "What's the difference between a dirty float and a managed float?" You have a fixed rate like we have now... where they come out and say you get 1320 dinar for a dollar, fixed. Then you have two types of floats...Free Float - that means a market determines the value no ifs, ands, or buts. The market determines the value. That's a free float. A managed float is the same as a dirty float. That means the Central Bank of Iraq will watch what happens in the free market, like Forex, but if it goes too far in one direction...then they intervene. They'll do something to control the exchange rate to keep it from getting out of whack.

Banks, Bullion, & BRICS in 2024 | LIVE w/ Andy Schectman

Liberty and Finance: 1-2-2024

What's next for banks, bullion, and BRICS in 2024? Get your questions answered LIVE by Andy Schectman, CEO & president of Miles Franklin Precious Metals.

LIVE! Direct Petro-Dollar Threat! SAUDI ARABIA OFFICIALLY JOINS BRICS. Expect MORE WAR!

Greg Mannarino: 1-2-2024

Economist's "News and Views" Tuesday 1-2-2024

The Fed Will Lose Control In 2024 | Mario Innecco

Liberty and Finance: 1-1-2023

Expect more inflation in 2024, says Mario Innecco, as central banks lose control of consumer prices.

Gold is signaling trouble ahead and just made a new high for a monthly, quarterly, and yearly closing price.

The Fed Will Lose Control In 2024 | Mario Innecco

Liberty and Finance: 1-1-2023

Expect more inflation in 2024, says Mario Innecco, as central banks lose control of consumer prices.

Gold is signaling trouble ahead and just made a new high for a monthly, quarterly, and yearly closing price.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Gold in 2023

3:20 Dollar/Swiss franc

6:33 Rejection of

8:30 The move to gold

10:25 Geopolitical conflicts

12:10 Innecco’s 2024 forecast

13:20 Fed is trapped

14:30 Preparedness

Something Is Wrong... BOND MARKET IS SELLING OFF! STOCKS SET TO DROP AT THE OPEN.

Greg Mannarino: 1-2-2024

Can The Fed Avert A Crisis In 2024? This Is What They Must Do | Stanford's John Taylor

David Lin: 1-2-2024

John Taylor, Professor of Economics at Stanford University, discusses the ideal monetary policy the Fed should undertake, which should follow the Taylor Rule.

0:00 - Intro

3:00 - Monetary policy: back on track?

7:00 - Taylor Rule

15:50 - Economic outlook

18:00 - Causes of inflation

21:10 - Long-run growth rate

22:54 - Unemployment rate

25:40 - How to create a soft landing

27:26 - Criticism for the Taylor Rule

30:00 - How much will the Fed cut?

32:10 - Why did the Fed get "off track"?

35:20 - Fiscal policy

36:30 - John Taylor's teaching career

38:50 - Risks to the global economy

More News, Rumors and Opinions Tuesday Afternoon 1-2-2024

Five More Countries Formally Join BRICS

January 1, 2024

Five countries formally join BRICS

The BRICS memberships of Saudi Arabia, Egypt, the United Arab Emirates, Iran and Ethiopia officially took effect on Monday.

The countries were invited to join the group in August 2023 after the 15th BRICS Summit in Johannesburg, South Africa.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS, an important platform for cooperation among emerging markets and developing countries, has received numerous membership requests in recent years.

Five More Countries Formally Join BRICS

January 1, 2024

Five countries formally join BRICS

The BRICS memberships of Saudi Arabia, Egypt, the United Arab Emirates, Iran and Ethiopia officially took effect on Monday.

The countries were invited to join the group in August 2023 after the 15th BRICS Summit in Johannesburg, South Africa.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS, an important platform for cooperation among emerging markets and developing countries, has received numerous membership requests in recent years.

Source: The Standard

https://dinarchronicles.com/2024/01/01/five-more-countries-formally-join-brics/

KTFA:

Clare: Parliamentary Finance: The current year’s budget will change significantly

1/2/2024 Baghdad: Shaima Rashid

The Parliamentary Finance Committee announced that the 2024 budget will witness changes in its operational and investment parts.

Committee member Jamal Cougar said in an interview with Al-Sabah: “The 2024 budget will make many changes and it will be something different in terms of resources and estimates of oil prices and expenditures, as is the case with its plans as it is a new year that will carry new projects.” Stating that "amounts have been determined for some projects, and either they have been spent or will be spent in the near future, and these projects will be produced. There are also new appointments that occurred in the previous budget, and these are all variables that were not present in the 2023 budget."

Koger added, “Every year, the operating budget increases, while changes occur in the investment budget,” stressing that “when the government presented a budget for three consecutive years, the first goal was to continue spending beyond the first of January and ensure that we are not exposed to problems stopping the fiscal year and work in accordance with The principle of spending is one out of 12 until a new budget is approved.”

The representative continued, “Parliament granted the government the authority to continue spending the 2023 budget until it is completed and begin the 2024 budget without interruption,” expecting that “the government will not change anything in the 2024 budget, and since it did not spend the previous budget in the required manner, it will not need loans in the new budget.” ". LINK

************

Clare: The Sudanese advisor clarifies a basic condition for amending the tripartite general budget

1/2/2024

The economic and financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed today, Tuesday, that the federal government has the right to amend some variables in the tripartite general budget if necessary.

Saleh told {Al-Furat News} that: “If the executive authority finds a basic need to amend some variables in the current tripartite general budget, the House of Representatives can be approached for the purpose of obtaining a legislative decision regarding the amendment requested by the executive authority.”

Saleh added, "An amendment can then be made to some paragraphs of the legally approved budget if so desired."

It is noteworthy that Prime Minister Muhammad Shiaa Al-Sudani announced that the government would continue efforts to amend the budget law. In order to separate the salaries file from any complications surrounding the financial files between the federal government and the Kurdistan Regional Government of Iraq.

From: Raghad Dahham LINK

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The monetary reform is successful. All they need to do now is give them the new exchange rate and the new currency that they've been talking to them about. It's successful. That's why everybody's signing contracts left and right and pouring into Iraq...You honestly think the contracts are being signed at a program rate? Of course not...

Yada The removal of the dollar will increase the value of the dinar from the reissued rate and none of the international contracts would be worth anything if the rate was not adjusted. We are in the midst of seeing that now... Understanding where Iraq came from, what they had to do go get back to international standard, and watching it come to pass as needed is key to confidence we are about see it transpire.

************

BRICS MASSIVE EXPANSION: Russia Is Chair In 2024, New Strategic Members, Focus Areas For New Year

Lena Petrova: 1-2-2024

Goldilocks' Comments and Global Economic News Tuesday AM 1-2-24

Goldilocks' Comments and Global Economic News Tuesday AM 1-2-24

Good Morning Dinar Recaps,

Do you remember those SOFR lending rates that came into effect Globally for the markets and banking system on July 1st, 2023? You know, those that are backed by gold?

The old lending system called Libor operated under uncollateralized units of account in overnight trading to provide liquidity.

SOFR is collateralized by US Treasuries bringing in a more accurate system of lending and liquidity based on real values and cannot be manipulated.

US Treasury Notes such as a US 10 Year Treasury Note pays out at new rates every six months even though it may have a 2,5, 10-year or more duration. And, it pays the face value to the holder at maturity.

Our first round of liquidity for the markets and the banking system under the SOFR lending system pays out early this week.

Goldilocks' Comments and Global Economic News Tuesday AM 1-2-24

Good Morning Dinar Recaps,

Do you remember those SOFR lending rates that came into effect Globally for the markets and banking system on July 1st, 2023? You know, those that are backed by gold?

The old lending system called Libor operated under uncollateralized units of account in overnight trading to provide liquidity.

SOFR is collateralized by US Treasuries bringing in a more accurate system of lending and liquidity based on real values and cannot be manipulated.

US Treasury Notes such as a US 10 Year Treasury Note pays out at new rates every six months even though it may have a 2,5, 10-year or more duration. And, it pays the face value to the holder at maturity.

Our first round of liquidity for the markets and the banking system under the SOFR lending system pays out early this week.

© Goldilocks

Investopedia Link

~~~~~~~~~~

"Oil traders around the world are gradually shifting away from using the US dollar

Recent reports say major economic powerhouses have used alternative currencies in oil trades in recent times

Most oil deals in the last year have been settled primarily in the Chinese yuan"

For these reasons, many countries are beginning to call for a market-based determination on the dollar.

A market-based determination is a careful analysis that compares prices of one asset to another.

In this case, we are looking at a comparable analysis among other countries' currencies in the use of buying and selling oil with currencies other than the dollar.

This type of price analysis will determine exchange rate changes needing to be done to coordinate reasonable values between countries.

Watch the water.

© Goldilocks

IBS News Link

~~~~~~~~~~

This is the year of determining new valuation prices of all currencies around the world.

© Goldilocks

~~~~~~~~~~

New Year’s message from President Christine Lagarde

https://youtu.be/-NhSnQ7gwG0?feature=shared

~~~~~~~~~~

Just a reminder, Japan did an in-country test on the QFS on Christmas Day.

India and a handful of other countries are doing an International pilot test on the QFS starting today. Pilot tests usually run at least 30 days that will take us to January 30th, 2024.

On January 30th, 2024, the rest of the world will begin rolling out their connections to the QFS and utilizing the system.

Each phase along the way will have a set of countries no longer using the US dollar in trade as the World Reserve Currency.

This does not mean that all of them will make that decision, but it will level the playing field for countries around the world that want to start utilizing their own currencies.

These new demands will increase the value of all the currencies involved inside this transition creating a Global Currency Reset through new trading volumes making their way into the Global Market.

Watch the water.

© Goldilocks

Wolfstreet Link

~~~~~~~~~~

Banking Announcement:

The Banking (Capital) (Amendment) Rules 2023 (BCAR), the Banking (Disclosure) (Amendment) Rules 2023 (BDAR), the Banking (Exposure Limits) (Amendment) Rules 2023 (BELAR), and the Banking (Liquidity) (Amendment) Rules 2023 (BLAR) were gazetted today (December 29) to implement the latest capital standards and associated disclosure requirements promulgated by the Basel Committee on Banking Supervision (BCBS) under the Basel III reforms, together with other related updates for the prudential regulation of banks in Hong Kong.

https://www.info.gov.hk/gia/general/202312/29/P2023122800453.htm

~~~~~~~~~~

The gold standard was a part of the global economy for nearly half a century. The United Kingdom introduced it in 1861. Back then, countries used to secure their currency against this precious yellow metal. However, the system couldn’t work for fiat currencies for a long time due to many reasons.

But now, the gold standard seems to be coming back with cryptocurrencies. That’s right, a large number of cryptocurrencies are now being underpinned by gold. Again, there are many reasons leading to this event. From the investors’ perspective, it’s important to gain a complete understanding of it. So let’s delve deeper and see what’s giving a push to these crypto variants.

https://www.thecoinrepublic.com/2023/12/31/understanding-gold-backed-cryptocurrency-its-role-in-trading/

~~~~~~~~~~

BRICS Announcement:

The BRICS memberships of Saudi Arabia, Egypt, the United Arab Emirates, Iran and Ethiopia officially took effect on Monday.

The countries were invited to join the group in August 2023 after the 15th BRICS Summit in Johannesburg, South Africa. The Standard Link

~~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks Forum

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

2024 May Finally Be Our RV/GCR Year : Awake-In-3D

2024 May Finally Be Our RV/GCR Year

On January 1, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

BRICS Alliance is overtaking the global Oil, Gold, Energy and Financial System landscape and their Gold/Asset-backed Trade Currency will decimate the Fiat Currency Financial System

In the rapidly evolving geopolitical landscape of global trade and finance, 2024 is proving to be a pivotal year marked by significant shifts in energy, currency usage, and financial alliances.

At the center of these transformations lies the rapidly growing and influential consortium known as BRICS, comprising Brazil, Russia, India, China, and South Africa.

2024 May Finally Be Our RV/GCR Year

On January 1, 2024 By Awake-In-3D

In RV/GCR, Fiat Debt System Collapse

BRICS Alliance is overtaking the global Oil, Gold, Energy and Financial System landscape and their Gold/Asset-backed Trade Currency will decimate the Fiat Currency Financial System

In the rapidly evolving geopolitical landscape of global trade and finance, 2024 is proving to be a pivotal year marked by significant shifts in energy, currency usage, and financial alliances.

At the center of these transformations lies the rapidly growing and influential consortium known as BRICS, comprising Brazil, Russia, India, China, and South Africa.

However, when we zoom out and take a closer look at how global oil, energy, and gold producing countries are also folding into the BRICS Alliance, it becomes clear that the Western Alliance, led by the United States and Europe is facing an existential threat that will likely replace the dominance of the US Dollar and the global fiat currency system once and for all.

If successful, this new gold/asset based trade currency would likely decimate the global fiat currency system and initiate a substantial revaluation of currencies (RV) in the Forex market. The USD and Euro would become essentially useless against the vast BRICS+ Alliance.

As BRICS continues to expand, the impact of its control over global energy, gold, and GDP will reshape the geopolitical and financial world order this year.

Furthermore, if BRICS+, combined with OPEC and the SCO (Shanghai Cooperation Organization) all agree to utilize an asset-backed, common trade currency, an RV (revaluation) of global currencies will occur unlike anything seen in financial and economic history.

Breaking Down New 2024 Geopolitical Alliances – Iraq is in the Neutral Camp

BRICS is the heart of what I call the East-South Alliance. Six new countries will join today (January 1st, 2024) and fourteen additional countries (marked with an * in the table below) have formally applied to join this year.

By looking at a combination of the existing BRICS, their new members and applicants, the OPEC Oil Alliance, and members of the SCO (Shanghai Cooperation Organization), the amount of Oil, other Energy resources (Natural Gas, Coal, etc.), Gold mining production, and combined GDP, the big picture comes fully into focus.

The West Alliance is relative to Oil, Other Energy and Gold production consisting the the USA, some European nations, Canada, Australia, etc.

The Neutral Nations (non-allied with West or South-East) are Oil/Energy/Gold producing nations sitting on the fence. Yet all of the Neutral countries are affiliated with OPEC at one level of participation or another.

Most notably, this includes Iraq and Mexico.

OPEC (Organization of Petroleum Exporting Countries). SCO (Shanghai Cooperation Organization). NDB (BRICS New Development Bank).

Global Oil/Energy Trade and US Dollar Currency Shifts

The traditional dominance of the US dollar in global trade is being challenged as Russia and China forge an ever-closer energy trade relationship, notably bypassing the use of the dollar.

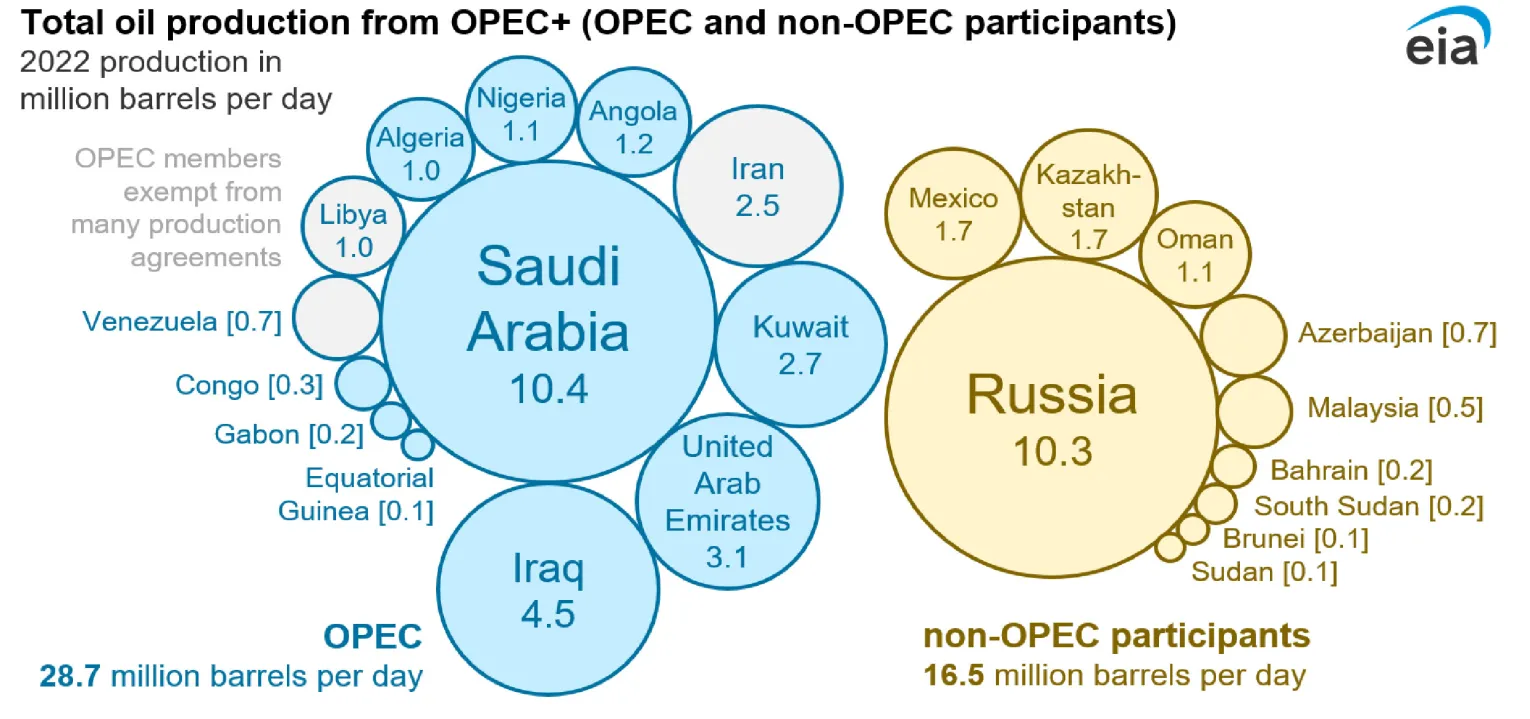

As BRICS expands, their East-South Alliance will control 55% of global oil production

In tandem, there is a growing trend towards local currency usage in trade transactions, a move that is gaining traction among countries worldwide.

The growing BRICS Alliance will include 9 OPEC member nations in 2024. Image source: US Energy Information Administration

China, in particular, is spearheading this shift by encouraging Gulf nations, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, to utilize the Shanghai Petroleum and Natural Gas Exchange for yuan-based oil and gas trade settlement.

The BRICS+ East-South Alliance will control 64% of all LNG, Coal, etc. Energy resources. (Mtoe = Million Tons Oil Equivalent)

Moreover, as BRICS expands with the inclusion of Saudi Arabia and the United Arab Emirates, the use of local currencies in trade is expected to surge.

This aligns with China’s call for greater emphasis on local currency cooperation payment tools and platforms, signaling a pivotal moment in the diversification of global trade settlement mechanisms.

The Role of Precious Metals and a New BRICS’ Trade Currency

The potential development of a new trading currency, likely backed by precious metals and base metals, is gaining traction.

If successful, this new gold/asset based trade currency would likely decimate the global fiat currency system creating a revaluation of currencies (RV) in the Forex markets. The USD and Euro would be essentially useless.

The BRICS+ East-South Alliance is set to control 56% of total Gold Mining and Production in 2024

This shift is supported by Saudi Arabia’s strategic investment in global mining assets, particularly in minerals like copper, as part of its Vision 2030 to diversify the economy.

With an estimated mineral endowment worth $1.3 trillion, Saudi Arabia’s potential establishment of gold refineries and its strong ties with China, the largest producer of gold, position the nation as a key player in this evolving landscape.

The recent agreement between China and Saudi Arabia to set up a currency swap line worth around $7 billion further underscores the growing financial ties between these influential nations.

As central bank digital currencies rise in prominence and the development of domestic mining resources by BRICS member countries advances, 2024 is poised to be a transformative year, marking a shift in the global monetary system.

Financial Realignment and the Petrodollar’s Decline

The long-standing connection between the dollar and global energy markets, rooted in historical agreements dating back to the mid-20th century, is facing unprecedented challenges.

The reinvestment of petrodollars into US assets, particularly Treasury bonds, is undergoing a transformation as nations increasingly divest from their US treasuries in favor of alternative assets like gold.

The freezing of around $300 billion of sovereign Russian assets by the United States and its allies in 2022 has further accelerated this trend.

The BRICS+ East-South Alliance will dominate 56% of global GDP. More than enough economic power to launch a new, gold-backed trade currency to challenge the US dollar and the Euro in 2024.

Notably, there has been a significant increase in oil transactions settled in currencies other than the dollar, marking a departure from the traditional petrodollar system.

With Saudi Arabia’s and the UAE’s entry into BRICS and with strategic initiatives to diversify their economy beyond oil, there is a clear signal that the influence of the petrodollar will certainly diminish in the coming years.

Bottom Line

While we wait for IRAQ to jump off the fence and official pick a side in the new global alliance landscape, global currencies are undergoing increasing strain, and the traditional petrodollar system faces serious challenges.

The rise of BRICS is reshaping the global energy, gold, and financial landscape in 2024.

The consortium’s influence, combined with strategic initiatives by key players like China and Saudi Arabia, is signaling a fundamental realignment in global trade and finance.

The year 2024 is positioned to be a turning point, ushering in new dynamics that will have far-reaching implications for the future of international trade, currencies and finance.

Supporting References

BRICS Membership: https://www.msn.com/en-us/money/markets/breaking-14-more-countries-lined-up-to-join-brics/ar-AA1lzggd

OPEC vs. OPEC+ Nations: https://www.eia.gov/todayinenergy/detail.php?id=56420

Global Oil Production: https://tradingeconomics.com/country-list/crude-oil-production

Global Gold Production: https://www.gold.org/goldhub/data/gold-production-by-country

Global Economic Data: https://www.imf.org/external/datamapper/datasets

Global LNG Production: https://yearbook.enerdata.net/natural-gas/world-natural-gas-production-statistics.html

Total Global Energy Industry Production: https://yearbook.enerdata.net/total-energy/world-energy-production.html

AIIB: https://www.aiib.org/en/about-aiib/governance/members-of-bank/index.html

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/is-2024-finally-our-rv-gcr-year-it-certainly-looks-promising/