The Organic U.S. Constitution must be Revived in the Approaching Financial Reset (GCR): Awake-In-3D

The Organic U.S. Constitution must be Revived in the Approaching Financial Reset (GCR)

On December 2, 2023 By Awake-In-3D

Our debt and fiscal manipulation under the current fiat currency system is beyond fixing. The only way out is through a total financial system reset and replacement – and a revival of the organic U.S. Constitution.

I hope the reset brings back the monetary and fiscal responsibility as set out in the organic U.S. Constitution.

The wisdom of its framework are more financially relevant today than ever before.

The Organic U.S. Constitution must be Revived in the Approaching Financial Reset (GCR)

On December 2, 2023 By Awake-In-3D

Our debt and fiscal manipulation under the current fiat currency system is beyond fixing. The only way out is through a total financial system reset and replacement – and a revival of the organic U.S. Constitution.

I hope the reset brings back the monetary and fiscal responsibility as set out in the organic U.S. Constitution.

The wisdom of its framework are more financially relevant today than ever before.

The U.S. Constitution emphasizes the critical role of the citizenry – We the People – in valuing, accepting, upholding, and defending the Constitution’s sovereign, fiscal framework and rules.

The organic U.S. Constitution was meticulously crafted to safeguard against the abuse of government overspending that could lead the United States into financial bankruptcy.

Its design aimed to establish a fiscally responsible government with limited powers and prevent the erosion of individual liberties.

By enumerating a specific set of functions for the federal government to perform, the Constitution set clear boundaries.

It did not provide explicit authorization for the government to interfere in areas such as agriculture, housing, healthcare, energy, education, transportation, or retirement.

The framers of the Constitution never envisioned an expansive federal government involved in citizens’ economic affairs. They understood that a government’s powers must be confined to those specifically described in the Constitution itself.

They recognized that exceeding these boundaries would be an arbitrary stride towards out-of-control government.

They emphasized the importance of adhering strictly to the Constitution’s provisions and respecting its limitations.

It emphasizes the critical role of the citizenry – We the People – in valuing, accepting, upholding, and defending the Constitution’s monetary authority and rules.

To prevent government abuse of overspending and the resulting financial bankruptcy, we need to revive our moral, fiscal compass and embrace the principles of limited government enshrined in the Constitution.

We must recognize the inherent dangers of excessive debt and elect leaders who will dismantle unsustainable wealth-transfer programs.

Only through a Constitutional revival can we restore the vision of our founders and live as free individuals under a federal government that is solely focused on defending our lives, liberty, and property.

In essence, the U.S. Constitution serves as a framework for preventing government overspending and financial bankruptcy.

A framework that has been ignored and discarded for far too long.

It establishes clear limits on federal powers, emphasizes the importance of individual liberties, and relies on the moral commitment of the people to uphold its sovereign, fiscal principles.

By adhering to its provisions we can ensure a fiscally responsible government that safeguards our nation’s financial stability and secures our individual freedoms.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Surprise! Iraq’s Oil Law (HCL) and Russia’s Takeover of Kurdistan Oil: Awake-In-3D

Surprise! Iraq’s Oil Law (HCL) and Russia’s Takeover of Kurdistan Oil

On December 2, 2023 By Awake-In-3D

The evolution of Iraq’s new Oil Law will forever alter Middle Eastern geopolitics and global energy markets, particularly of interest are Russia’s strategic moves to enhance its influence in the Kurdistan oil region.

Iraq is considering a new oil and gas law that may be approved after local elections in December 2023.

The oil law, under discussion for over 15 years, would allow foreign companies to share in Iraq’s oil production.

If ratified, the law would enable production-sharing agreements between the government and foreign oil firms.

Surprise! Iraq’s Oil Law (HCL) and Russia’s Takeover of Kurdistan Oil

On December 2, 2023 By Awake-In-3D

The evolution of Iraq’s new Oil Law will forever alter Middle Eastern geopolitics and global energy markets, particularly of interest are Russia’s strategic moves to enhance its influence in the Kurdistan oil region.

Iraq is considering a new oil and gas law that may be approved after local elections in December 2023.

The oil law, under discussion for over 15 years, would allow foreign companies to share in Iraq’s oil production.

If ratified, the law would enable production-sharing agreements between the government and foreign oil firms.

Additionally, oil export earnings would be distributed among governorates based on their GDP per capita, and each governorate could independently grant oil concessions and exploration contracts.

Iraq, a key OPEC member, possesses significant crude oil reserves, and the proposed law aims to manage resource sharing and exploration agreements with foreign entities.

The new unified oil law in Iraq, set to govern oil and gas production, highlights a shift in influence favoring Russia and China over the Western Alliance.

The long journey toward a new unified oil law in Iraq, expected to govern oil and gas production, underscores a notable geopolitical shift favoring Russia and China over the USA and its Western Alliance.

The start of what’s happening today began back in September 2017, following a non-binding vote on independence for the semi-autonomous Kurdistan region in northern Iraq.

The U.S. and its Western allies had promised full independence to the Kurds in exchange for their support against ISIS.

However, the promise was not fulfilled, as Iran and Turkey intervened to prevent the Kurds from gaining independence, and the U.S. did not intervene.

Russia, adhering to its longstanding foreign policy of projecting influence in regions of chaos, sought to expand its presence in the Middle East, particularly in Iraq.

Hindered by the U.S. presence in the south, Russia turned its attention to the semi-autonomous Kurdistan region.

Russia effectively assumed control of Kurdistan’s oil sector through a multifaceted approach.

First, it provided the Kurdistan Regional Government (KRG) with $1.5 billion in financing through forward oil sales payable over the next three to five years.

Second, Russia secured an 80 percent working interest in five potentially significant oil blocks in the region, accompanied by investments and technical support.

Third, Russia obtained a 60 percent ownership stake in the crucial KRG pipeline, committing to invest $1.8 billion to increase its capacity to one million barrels per day.

The second phase of Russia’s strategy involved sowing discord between northern and southern Iraq.

By acting as a mediator and encouraging the Kurds to demand higher payments from the south while independently selling oil, primarily through its ally Turkey, Russia fueled tensions.

The resulting chaos played into Russia’s goal of extending its influence into southern Iraq.

The geopolitical landscape further shifted with the U.S. downsizing its presence in the Middle East and Russia and China making inroads through initiatives like the Belt and Road Initiative.

Consequently, southern Iraq moved into the sphere of influence of Russia and China, while northern Kurdish Iraq found itself increasingly isolated.

On August 3 of the current year, Iraq’s new Prime Minister, Mohammed Al-Sudani, declared that the unified oil law, centrally administered from Baghdad, would govern all oil and gas production and investments in both Iraq and its semi-autonomous Kurdistan region, constituting “a strong factor for Iraq’s unity.”

A senior Kremlin official later emphasized that by excluding the West from energy deals in Iraq, the end of Western hegemony in the Middle East would represent a decisive chapter in the West’s decline.

Overall, the timeline of events and Russia’s multifaceted intervention illustrate a significant geopolitical realignment, signaling enhanced influence for Russia and China at the expense of the Western Alliance.

Details and Timeline for IQD Nerds

In essence, Russia’s involvement in Kurdistan’s oil region was a strategic response to geopolitical opportunities, exploiting regional tensions and economic vulnerabilities to establish a significant and influential presence in the Kurdish oil economy.

1) Background (September 2017)

It all began with a non-binding vote on independence for the semi-autonomous Kurdistan region in September 2017. The U.S. and its Western allies had pledged support for Kurdish independence in exchange for assistance against ISIS. However, the promise was not fulfilled, leading to disillusionment among the Kurds.

2) Russian Expansion into Kurdistan (Post-2017)

Russia, with a historical foreign policy of projecting influence in regions of chaos, saw an opportunity to expand its presence in the Middle East. The presence of the U.S. in southern Iraq prevented Russia from establishing a foothold there. Instead, Russia turned its attention to the semi-autonomous Kurdistan region, where the Kurds, feeling abandoned by the West, were in need of support and financial assistance.

3) Russia executed a multifaceted strategy to gain control over Kurdistan’s oil economy.

Russia provided the Kurdish Regional Government (KRG) with $1.5 billion in financing through forward oil sales payable over the next three to five years. This financial support was crucial for the KRG, which was facing economic challenges due to the political dispute with southern Iraq.

Russia secured an 80 percent working interest in five potentially significant oil blocks in the region. This not only provided Russia with access to valuable oil reserves but also established a significant presence in Kurdistan’s oil exploration and production sector.

Russia acquired a 60 percent ownership stake in the vital KRG pipeline, committing to invest $1.8 billion to increase its capacity to one million barrels per day. This move gave Russia control over the infrastructure essential for transporting oil from Kurdistan to external markets.

4) Russia exploited existing tensions between northern and southern Iraq to further its agenda.

Russia acted as a mediator, encouraging the Kurds to demand higher payments from the southern government. This tactic aimed to create financial disputes and dissatisfaction between the two regions.

Russia supported the Kurds in quietly selling oil independent of Baghdad, primarily through Turkey, with which Russia had close ties. This move not only provided economic benefits to the Kurds but also heightened tensions with the southern government.

5) Changing Geopolitical Landscape

The broader geopolitical context played a crucial role.

The U.S.’s downsizing of its presence in the Middle East and the growing influence of Russia and China in the region created an environment where southern Iraq moved into the sphere of influence of Russia and China.

6) Unified Oil Law Framework Announced (August 2023)

The recent developments culminate in Iraq’s new Prime Minister, Mohammed Al-Sudani, announcing that the unified oil law, centrally administered from Baghdad, will govern all oil and gas production and investments in both Iraq and its semi-autonomous Kurdistan region.

This pronouncement solidifies central control and signifies a significant shift in power dynamics.

The new Oil Law, as outlined by the Prime Minister, further cements central control and aligns with Russia’s broader objectives in the Middle East.

Supporting articles:

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/surprise-iraqs-oil-law-hcl-and-russias-takeover-of-kurdistan-oil/

Iraq and BRICS – The RV Writing is Now on the Wall: Awake-In-3D

Iraq and BRICS – The RV Writing is Now on the Wall

On November 30, 2023 By Awake-In-3D

In RV/GCR

There is a popular phrase in the smart investments community: “There are no certainties, there are only probabilities”.

Applying this to the IQD, the probabilities of an RV just moved a lot higher.

Joining the BRICS alliance would offer Iraq economic stability, enhanced trade relations, and a stronger bargaining position in the global economic and foreign currency exchange landscape.

A recent series of strategic and geopolitical moves involving Iraq, particularly the centralization of oil governance, Russia’s influence in Kurdistan, and China’s economic inroads, suggest a realistic scenario where Iraq formally joins the BRICS alliance to establish its economic power and IQD currency strength.

Iraq and BRICS – The RV Writing is Now on the Wall

On November 30, 2023 By Awake-In-3D

In RV/GCR

There is a popular phrase in the smart investments community: “There are no certainties, there are only probabilities”.

Applying this to the IQD, the probabilities of an RV just moved a lot higher.

Joining the BRICS alliance would offer Iraq economic stability, enhanced trade relations, and a stronger bargaining position in the global economic and foreign currency exchange landscape.

A recent series of strategic and geopolitical moves involving Iraq, particularly the centralization of oil governance, Russia’s influence in Kurdistan, and China’s economic inroads, suggest a realistic scenario where Iraq formally joins the BRICS alliance to establish its economic power and IQD currency strength.

The move towards a unified oil law (more on this in an upcoming article), orchestrated in collaboration with Russia’s interests, signifies a shift away from Western influence in Iraq’s oil sector.

As Iraq pivots toward a more strategic economic approach, it’s common ground with BRICS nations, who advocate for multipolarity and resist Western dominance, continues to grow.

Here’s why:

Russia and China are strategically securing control over Iraq’s oil resources, particularly the Eridu oil field in Block 10, which is the largest discovery in Iraq in the last 20 years.

Lukoil, a Russian company, aims to take complete control of this oil-rich area by acquiring Inpex’s 40 percent stake in Block 10.

Russia’s influence in Iraq’s oil industry has expanded, notably with its effective takeover of Kurdistan’s oil and gas industry.

Furthermore, China’s extensive economic engagement, including the Belt and Road Initiative and preferential oil agreements, positions Iraq within a sphere of influence that aligns with the BRICS ethos.

Related article: Iraq Breaking Away from USA to Forge New Ties with Russia and China: Great News for IQD RV

Joining the BRICS alliance would offer Iraq economic stability, enhanced trade relations, and a stronger bargaining position in the global economic and foreign currency exchange landscape.

Additionally, considering the BRICS Alliance’s discussions around alternatives to the U.S. dollar as a global reserve currency, Iraq is likely considering a more diversified and resilient currency strategy within the BRICS framework.

Strategic Winners and Losers

Winners: Russia and China emerge as strategic winners, consolidating control over Iraq’s oil resources and expanding their economic influence. They benefit from favorable agreements, infrastructure projects, and weakened Western influence.

Losers: Western nations and companies face a decline in influence as Russia and China strategically secure key positions in Iraq’s energy sector. Other regional players not aligned with Russia and China may also lose out on economic opportunities and influence.

The Big Picture Clearly Shows the Writing on the Wall: Iraq Will Join BRICS

The broader strategy involves multiple exploration and development deals between Russian and Chinese firms, granting them a significant geopolitical presence in Iraq.

Both countries are leveraging agreements, such as the Iraq-China Framework Agreement, which provides China with first refusal on oil projects and a 30 percent discount on oil, gas, and petrochemical purchases. China is also allowed to build factories and infrastructure across Iraq, including railway links as part of its Belt and Road Initiative.

The Belt and Road Initiative will directly connect Oil and Gas infrastructure from Turkey, Iran and Iraq to Russia and China. Map source: Xinhua, MERICS

These plans extend to the southeast region of Iraq, connecting to the major oil export hub of Basra. Russia and China aim to establish control over oil and gas fields and transportation hubs in this region.

Major New Projects Favor BRICS – Not the USA/West

Infrastructure projects, such as the approval of funds for Al-Zubair and the construction of a civilian airport in Dhi Qar, demonstrate China’s increasing involvement in Iraq’s development within the framework of oil-for-reconstruction agreements.

Related article: Exxon Gets Booted Out of Iraq!

Overall, this signifies a broader shift in influence away from Western countries in Iraq’s energy sector.

Lukoil’s Acquisition of Inpex’s Stake in Block 10

Significance: Lukoil, a Russian company, aims to take control of Iraq’s Eridu oil field, the largest oil discovery in Iraq in the last 20 years. This move aligns with Russia’s strategy to dominate Iraq’s oil resources, reducing Western influence.

Winners: Russia and China, as they strengthen their control over Iraq’s oil sector.

Losers: Inpex, a major oil company from the U.S. ally Japan, loses its stake in the Block 10 region, marking a decline in Western influence.

Russian Control of Kurdistan’s Oil and Gas Industry

Significance: Russia effectively took over Kurdistan’s oil and gas industry through Rosneft, consolidating influence in a troublesome semi-autonomous region. This maneuver contributes to Russia’s broader plan for dominance in Iraq.

Winners: Russia, as it extends its influence over Kurdistan and weakens ties between the region and the central Iraq government.

Losers: Western interests, as Russian influence in Kurdistan grows.

Iraq-China Framework Agreement

Significance: The agreement gives China first refusal on Iraqi oil, gas, and petrochemical projects, along with a 30 percent discount on purchases. It also allows China to build factories and infrastructure in Iraq, aligning with its Belt and Road Initiative.

Winners: China, securing favorable terms and expanding its economic and infrastructural influence in Iraq.

Losers: Other countries seeking access to Iraq’s energy resources, facing competition and potential exclusion due to China’s preferential treatment.

Infrastructure Projects in Al-Zubair and Dhi Qar

Significance: China’s heavy involvement in infrastructure projects, funded by Iraq, strengthens economic ties and contributes to the oil-for-reconstruction agreement. The projects enhance China’s presence in key regions with significant oil fields.

Winners: China, gaining influence through infrastructure development in strategic areas.

Losers: Other nations and companies competing for similar projects in Iraq, as China secures key infrastructure deals.

Construction of a Civilian Airport in Dhi Qar

Significance: China secures a major contract to build a civilian airport in a region rich in oil fields. This project facilitates economic development and connectivity in an oil-rich area.

Winners: China, expanding its infrastructure projects in areas crucial for oil production.

Losers: Other nations seeking similar contracts and influence in the same region.

Al-Sadr City Development Deal

Significance: Chinese companies are involved in the development of Al-Sadr City, contributing to the oil-for-reconstruction agreement. This deal further cements China’s economic involvement in Iraq.

Winners: China, strengthening its economic ties and presence in key urban areas.

Losers: Competing Western nations and companies aiming for reconstruction and investment projects in Iraq.

Supporting article: https://oilprice.com/Energy/Crude-Oil/Russia-Takes-Control-of-Iraqs-Biggest-Oil-Discovery-for-20-Years.html

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/iraq-and-brics-the-rv-writing-is-now-on-the-wall/

Can 13 Million Tons of Gold Solve Zimbabwe’s Economic Crisis?: Awake-In-3D

Can 13 Million Tons of Gold Solve Zimbabwe’s Economic Crisis?

On November 28, 2023 By Awake-In-3D

In RV/GCR

In a country blessed with an incredible 13 million tons of proven gold reserves, one would assume that Zimbabwe’s economic struggles would be a thing of the past.

However, the reality is far from that optimistic vision. Despite the vast potential of its gold reserves, Zimbabwe continues to grapple with an ongoing economic crisis that seems impervious to the glittering value of this precious metal.

Can 13 Million Tons of Gold Solve Zimbabwe’s Economic Crisis?

On November 28, 2023 By Awake-In-3D

In RV/GCR

In a country blessed with an incredible 13 million tons of proven gold reserves, one would assume that Zimbabwe’s economic struggles would be a thing of the past.

However, the reality is far from that optimistic vision. Despite the vast potential of its gold reserves, Zimbabwe continues to grapple with an ongoing economic crisis that seems impervious to the glittering value of this precious metal.

Even with the world’s 2nd highest gold resources, Zimbabwe’s GDP continues to decline since 201Source: World Bank

According to the Reserve Bank of Zimbabwe (RBZ), fully exploiting the 13 million tons of gold reserves could potentially earn the country over $4 billion annually from gold exports alone.

Yet, despite this enormous wealth lying beneath our feet, Zimbabwe’s economy remains in dire straits.

Throughout the years, efforts have been made to enhance gold production. In 2016, the country’s gold output reached a peak of 27.1 tons, only to plummet to a mere 3.5 tons during the economic crisis of 2008.

However, recent initiatives by the central bank have seen a gradual increase in production, with gold output growing by 72 percent in the first seven months of this year alone.

Today, Zimbabwe is targeting a total mining output of 40 tons of gold in 2023.

The Zimbabwe Mining Development Corporation (ZMDC), which owns several mines with significant potential, should be a catalyst for economic growth. However, these mines have yet to be fully utilized. Artisanal and small-scale miners, who contribute a significant portion of the country’s gold production, face challenges such as lack of regularization and operational security.

While the increase in gold production is indeed promising, it is important to recognize that the solution to Zimbabwe’s economic woes cannot solely rely on the extraction of this precious metal. The challenges facing its economy run deep and require comprehensive solutions that address issues beyond the mining sector.

Investors, both domestic and international, have expressed concerns about policy stability and the ability to repatriate profits. This has hindered the inflow of much-needed capital, despite the potential profitability of gold mining projects.

Zimbabwe must create an environment that fosters investor confidence, ensuring that the fruits of their investment can be repatriated.

Furthermore, the economic crisis in Zimbabwe is not solely due to internal factors.

Global mining infrastructure bottlenecks and subdued commodity prices, particularly for platinum group metals (PGMs) and base metals, further exacerbate our economic challenges.

Current Mining Projects in Zimbabwe Hold Promise

Caledonia Mining Corp is exploring funding options, aiming to raise $250 million for the development of its Bilboes project, potentially becoming Zimbabwe’s largest gold mine. The company, owning the Blanket gold mine in Zimbabwe, may utilize a mix of debt, internal funds, and equity for financing.

The Bilboes project, projected to yield around 170,000 ounces of gold annually, would significantly increase Caledonia’s total bullion output to approximately 250,000 ounces.

Despite Zimbabwe’s economic challenges, including power cuts and hyperinflation, mining investors, including Caledonia, are seeking opportunities in the country.

While Zimbabwe has faced difficulties attracting major investors since the early 2000s, Caledonia is optimistic about investor support for quality projects with good returns. The company is also addressing concerns about repatriating profits and the country’s policy stability.

What is the Estimated Value of 13 Million Tons of Gold?

With gold currently priced around $2,000 per ounce (and climbing), the potential value of Zimbabwe’s gold reserves is substantial.

There are approximately 32,150.7 ounces in a metric ton. Multiplying this by the 13 million tons gives us a total of approximately 418,960,100 ounces of gold in Zimbabwe’s reserves.

Using $2,000 per ounce results in an estimated potential value of Zimbabwe’s gold reserves at around $837,920,200,000 or approximately $838 billion.

This calculation assumes that all the gold can be extracted and sold at the current market price.

Zimbabwe’s economic future lies not only in the glitter of 13 million tons of gold but also in a vibrant and diversified economy that attracts investment, fosters stability, and prioritizes the well-being of its people.

Supporting articles:

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/can-13-million-tons-of-gold-solve-zimbabwes-economic-crisis/

How Would the Price of Gold RV in a New “Gold Standard” Today? This Chart Will Surprise You

How Would the Price of Gold RV in a New “Gold Standard” Today? This Chart Will Surprise You

On November 27, 2023 By Awake-In-3D

In RV/GCR

This is an interesting chart showing what the price of gold would need to be in order to cover the M0, M1, and M2 money supplies for different countries – if they implemented a traditional gold standard today.

The US Dollar would have to be devalued to a whopping $87,767 per ounce of gold to cover the amount of currency in the United States (see chart below).

In other words, the price of gold would revalue (RV) by over 4,300% against the fiat dollar before being anchored to gold.

Of course this assumes that 100% of the M2 currency supply would be convertible to physical gold purportedly held by the US Treasury, which equals over 1 million troy ounces (maybe).

How Would the Price of Gold RV in a New “Gold Standard” Today? This Chart Will Surprise You

On November 27, 2023 By Awake-In-3D

In RV/GCR

This is an interesting chart showing what the price of gold would need to be in order to cover the M0, M1, and M2 money supplies for different countries – if they implemented a traditional gold standard today.

The US Dollar would have to be devalued to a whopping $87,767 per ounce of gold to cover the amount of currency in the United States (see chart below).

In other words, the price of gold would revalue (RV) by over 4,300% against the fiat dollar before being anchored to gold.

Of course this assumes that 100% of the M2 currency supply would be convertible to physical gold purportedly held by the US Treasury, which equals over 1 million troy ounces (maybe).

What is a Traditional Gold Standard?

Before the rise of today’s fiat currency debt system, many nations operated under a currency framework known as the traditional gold standard.

This system linked a country’s currency directly to gold, with each unit of currency representing a specific amount of gold held by the central bank.

The value of the currency was determined by its convertibility into gold.

Individuals had the right to exchange their paper money for actual gold at a fixed exchange rate.

What is M0, M1, and M2 Money Supply?

If you’re unfamiliar with M0, M1, and M2 money supplies, these terms represent different measures of the currency circulating within an country’s economy.

M0 Money Supply

Known as the “narrowest” measure of money supply, M0 encompasses the physical currency in circulation, including coins and notes.

It represents the total value of all physical money held by both the public and the central bank.

M1 Money Supply

M1 expands the definition of money and includes physical currency (M0) along with demand deposits.

Demand deposits are funds held in checking accounts, readily accessible for transactions such as debit card payments or checks.

M2 Money Supply

M2 includes an even broader definition of money. It encompasses M1 (physical currency and demand deposits) as well as various types of savings deposits like money market accounts and time deposits.

M2 represents money that is readily available for spending but may not be as liquid as M1.

Gold Prices to Cover Money Supply in a Gold Standard by Country

This chart provides an analysis of what the price of gold would have to be in order to cover the money supply (M0, M1, or M2) for different countries, should they adopt the traditional gold standard today.

CLICK CHART TO ENLARGE

For instance, consider the case of the United States anchoring its currency to gold and backing its M0 money supply. Gold would RV to $15,317 per ounce. The chart shows the gold price required to cover the total value of all physical currency in circulation.

Similar calculations are shown for M1 and M2 money supplies.

Sources:

Brent Johnson, Santiago Capital

Federal Reserve Bank of St. Louis: “What Is Money Supply?”

Investopedia: “The Gold Standard in Theory and Practice”

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Quantum Banking is Coming: Here’s What You Should Know: Awake-In-3D

Quantum Banking is Coming: Here’s What You Should Know

On November 26, 2023 By Awake-In-3D

What if the power of gold, the age-old foundation of wealth and stability, meets the implementation of quantum banking?

The result would culminate in Quantum Financial System (QFS) to replace the collapsing Fiat Currency System.

As we see the daily evidence of economic uncertainties and growing weakness of the failing fiat debt currency system, the convergence of gold collateral and quantum banking offers a path forward for a stable, secure and transparent financial landscape.

Quantum Banking is Coming: Here’s What You Should Know

On November 26, 2023 By Awake-In-3D

What if the power of gold, the age-old foundation of wealth and stability, meets the implementation of quantum banking?

The result would culminate in Quantum Financial System (QFS) to replace the collapsing Fiat Currency System.

As we see the daily evidence of economic uncertainties and growing weakness of the failing fiat debt currency system, the convergence of gold collateral and quantum banking offers a path forward for a stable, secure and transparent financial landscape.

Quantum Banking Technology is a Real Thing

Powered by quantum technologies and the interest by the world’s largest banks, it holds the promise of a new era in the financial sector.

With this rapid transition, we could easily argue that the current fiat debt currency banking system is reaching its logical conclusion with Quantum Banking as its ultimate replacement.

What exactly is Quantum Banking?

The primary components of quantum banking are the advent development of quantum money and quantum currency.

Quantum Money: Banking OF the People and FOR the People

At the forefront of quantum banking lies the concept of quantum money.

Unlike traditional currency, which relies on physical tokens or digital records, quantum money operates on the principles of quantum physics. It leverages the unique properties of quantum states to create a non-forgeable and tamper-proof monetary foundation.

Quantum money eliminates the need for intermediaries, such as banks, by ensuring secure transactions directly between parties.

The Power of Quantum Currency

Quantum currency takes the concept of quantum money a step further by introducing programmable and dynamic features.

Unlike traditional currencies governed by central banks, quantum currency can be designed with built-in rules and conditions.

These programmable features enable automated compliance and enhanced financial transparency.

Quantum currency also has the potential to mitigate issues like counterfeit bills and money laundering, as its unique properties make it practically impossible to replicate or manipulate.

Quantum Banking Would End 3,000 Years of Centralized Monetary Control

The emergence of quantum banking is revolutionizing the financial sector by providing more secure, efficient, and transparent financial services.

Traditional banking calculations that once took significant time and computational power can now be performed exponentially faster on quantum computers.

Additionally, quantum banking introduces a shift towards decentralized systems.

With the use of quantum technologies, individuals can have greater control over their financial transactions and assets, reducing reliance on centralized intermediaries like banks.

This decentralization empowers individuals to have direct ownership and management of their funds, enhancing financial autonomy and privacy.

What Would a Transition to Quantum Banking Look Like?

As we bear witnesses to the rise of quantum technologies aimed a individualized banking services, the limitations and drawbacks of the current fiat debt currency banking system become increasingly evident to humanity.

The reliance on intermediaries, susceptibility to fraud, and lack of transparency are all issues that quantum banking services aim to address.

The transition to quantum currency and quantum money is gaining momentum, with major global banks actively participating in quantum banking initiatives.

After all, the very foundation of Central Bank Digital Currencies (CBDCs) will virtually eliminate the role of traditional banking by offering direct, central bank accounts to everyday people.

But will private banks such as Wells Fargo, Citibank, HSBC, etc. step up against CBDCs (and the Federal Banking Regulators) to offer private and secure Quantum Banking retail services? All of these banks are actively involved in research, investment and development of Quantum Banking technologies and applications.

Or will a completely different QFS platform come into being that force traditional private banks to adapt to a new era and monetary system to shed their Bankster pedigree?

One thing’s for sure, the advent of quantum banking signifies a paradigm shift in the financial world where Quantum Money and Quantum Currency introduce a new era of secure, programmable, and decentralized financial systems.

As the current fiat debt currency banking system approaches its logical conclusion, the rise of quantum banking offers a compelling alternative.

Supporting articles:

https://newsnreleases.com/2021/12/14/what-is-quantum-money-and-how-does-it-work/

https://binarapps.com/what-is-quantum-currency-how-will-quantum-money-affect-finance/

https://robots.net/fintech/what-is-the-quantum-banking-system/

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-rise-of-quantum-banking-what-you-need-to-know/

The Truth about Basel III and Gold that No One is Talking About in GCR Land: Awake-In-3D

The Truth about Basel III and Gold that No One is Talking About in GCR Land

On November 25, 2023 By Awake-In-3D

In RV/GCR

Learn About the Real Implications for Gold under Basel III Banking Regulations

In recent months, there has been significant confusion and speculation surrounding the relationship between the Basel III Accords, a set of international banking regulations, and gold.

Many have mistakenly believed – or have been mislead to believe – that Basel III establishes gold-backed currencies.

This is not true.

The Truth about Basel III and Gold that No One is Talking About in GCR Land

On November 25, 2023 By Awake-In-3D

In RV/GCR

Learn About the Real Implications for Gold under Basel III Banking Regulations

In recent months, there has been significant confusion and speculation surrounding the relationship between the Basel III Accords, a set of international banking regulations, and gold.

Many have mistakenly believed – or have been mislead to believe – that Basel III establishes gold-backed currencies.

This is not true.

It is crucial to separate fact from fiction and understand the true implications of Basel III on gold.

Basel III, developed by the Basel Committee on Banking Supervision, is a framework of rules designed to strengthen and safeguard the global banking system.

While “safeguarding” the banking system, under the current Fiat Currency Debt System, is likely impossible, that discussion is beyond the scope of this Basel III article.

Basel III’s primary goal is to ensure that banks maintain sufficient capital to protect against risks and unexpected losses – as was the case during the 2008 Great Financial Crisis.

While Basel III does recognize the value and stability of gold, it does not establish gold-backed currencies as some have erroneously claimed.

Under the new regulations, gold is classified as a Tier 1 asset.

What does this mean?

Well, Tier 1 assets (in banking) are considered high-quality and liquid assets that banks can hold to meet regulatory stability requirements.

By assigning a higher value to gold in their capital calculations, banks are allowed to hold more gold as part of their capital reserves.

In simpler terms, it means that gold is seen as a valuable and reliable asset that banks can rely on to meet financial safety standards.

It is important to emphasize that the reclassification of gold under Basel III does not mean that currencies can be directly converted into physical gold at a bank, as was the case during the gold standard era.

Basel III does not establish gold-backed currencies or a new Gold Standard.

The gold standard involved a direct link between currency and a fixed amount of physical gold. Basel III, however, treats gold as a financial asset within the banking system, enhancing its importance in capital calculations and risk management.

While some may speculate about potential implications for gold under the Basel III Accords, it is essential to understand that Basel III’s focus is on banking regulations, not monetary policy.

The reclassification of gold under Basel III primarily affects how banks assess and manage their capital reserves, in an effort to promote stability and resilience within the banking sector.

Basel III’s treatment of gold does not establish gold-backed currencies. Instead, it recognizes gold as a valuable and reliable asset for banks to hold as part of their capital reserves.

This reclassification aims to strengthen the banking system and enhance risk management.

Basel III’s impact on gold lies within the banking sector, reinforcing its significance as a financial asset.

Understanding the nuances of Basel III and its relation to gold is crucial for dispelling misconceptions and being able to hold informed discussions about the future of banking regulations and the role of gold in Our GCR landscape.

Learn more facts about Basel III

Clarifying the Basel III Accords – History, Key Banking Changes, and Impact on Physical Gold

The Basel III Accords, developed as a response to the 2008 financial crisis, have significantly reshaped the global banking sector.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-truth-about-basel-iii-and-gold-that-no-one-is-talking-about-in-gcr-land/

What is the Secret Power of Gold You Were Never Taught in School? Awake-In-3D

What is the Secret Power of Gold You Were Never Taught in School?

On November 24, 2023

By Awake-In-3D

Gold has a secret power. It has long been revered as a reliable store of value, especially in the context of fiat currency systems and never taught in school.

What is the Secret Power of Gold You Were Never Taught in School?

On November 24, 2023

By Awake-In-3D

Gold has a secret power. It has long been revered as a reliable store of value, especially in the context of fiat currency systems and never taught in school.

Source: Wallpaper Safari

Recent data illustrates how gold’s purchasing power has evolved over the past five years, emphasizing its resilience and ability to outperform traditional assets.

Here’s two real-world examples that shed light on gold’s role as a hedge against economic uncertainties.

Example 1: Automobiles and Gold

In December 2018, the price of gold stood at approximately $1,282 per ounce. Fast forward five years, and we observe a significant increase, with the current price hovering around $2,002 per ounce.

This price surge translates into practical advantages when considering major purchases.

For instance, a $50,000 car in 2018 would have required 39 ounces of gold.

In contrast, a $50,000 car in 2023 would demand only 25 ounces of gold.

Looking at it differently, the original 39 ounces of gold from 2018 could now purchase a car valued at $78,000, showcasing gold’s enhanced purchasing power.

Example 2: Single Family Homes and Gold

In 2018, the median home price was around $275,000, necessitating 215 ounces of gold for purchase. Fast forward to the present day, where the median single-family home price has risen to approximately $385,000.

Source: Zillow Research

Not surprisingly, it now takes only 192 ounces of gold to acquire the same home.

Alternatively, one could use the 215 ounces of gold from 2018 to buy a $430,000 home, highlighting the significant appreciation of gold’s value.

Despite these positive indicators, the real estate market is currently experiencing what some experts deem the largest housing market bubble in history.

According to the Shiller Home Value Index, home values have reached a record high level of 225 points.

Drawing parallels with the 2008 Financial Crisis, if housing prices were to decline by 38%, as they did during the last housing bubble crash, the average single-family home price would drop to approximately $240,000 in today’s super bubble housing crash, which some argue has already begun.

Median housing prices fell by 38% in the aftermath of the 2008 Financial Crisis. Yet, we are in an even bigger housing bubble today vs. the early 2000’s. Source: Robert Shiller (Yale University)

This scenario presents a compelling case for gold’s secret role as a financial safe haven and ultimate representation of “real money”.

In the event of a housing market crash, the 120 ounces of gold at today’s prices would be sufficient to purchase a home that would have been valued at $430,000 before the crash.

This underscores gold’s dual benefit of being not only inflation-proof but also an asset that gains significant purchasing power during times of financial crisis.

When we look at the value of gold as a store of wealth in a fiat currency system, the secret becomes clearly revealed.

As financial bubbles begin to burst, gold continues to assert its position as a reliable and versatile asset, verses the continual loss of purchasing power of fiat currencies due to constant inflation and market pricing manipulations.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/what-is-the-secret-power-of-gold-you-were-never-taught-in-school/

Iraq Breaking Away from USA to Forge New Ties with Russia and China: Great News for IQD RV

Iraq Breaking Away from USA to Forge New Ties with Russia and China: Great News for IQD RV

On November 22, 2023 By Awake-In-3D

In RV/GCR

In a series of strategic moves away from U.S. influence, Iraq has solidified its ties with Russia and China, marking a major shift in the geopolitical landscape with significant economic implications.

Perhaps creating the final impetus for a revaluation (RV) of the Iraqi Dinar (IQD).

As the U.S. focuses on the Israel-Hamas War, China and Russia have strategically expanded their presence in Iraq, aiming to capitalize on its potential as a major crude oil producer and a vital link in the logistical network connecting Eurasia to Europe.

Recently, in a key Cabinet meeting chaired by Prime Minister Mohammed Shia Al-Sudani, Iraq took a major step towards increasing its oil production and exports to China.

Iraq Breaking Away from USA to Forge New Ties with Russia and China: Great News for IQD RV

On November 22, 2023 By Awake-In-3D

In RV/GCR

In a series of strategic moves away from U.S. influence, Iraq has solidified its ties with Russia and China, marking a major shift in the geopolitical landscape with significant economic implications.

Perhaps creating the final impetus for a revaluation (RV) of the Iraqi Dinar (IQD).

As the U.S. focuses on the Israel-Hamas War, China and Russia have strategically expanded their presence in Iraq, aiming to capitalize on its potential as a major crude oil producer and a vital link in the logistical network connecting Eurasia to Europe.

Recently, in a key Cabinet meeting chaired by Prime Minister Mohammed Shia Al-Sudani, Iraq took a major step towards increasing its oil production and exports to China.

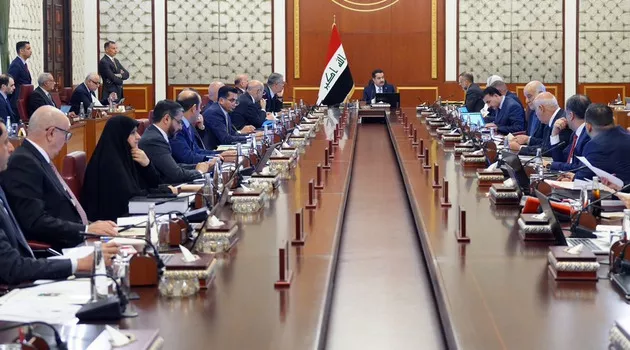

42nd Session of Iraqi Cabinet with Prime Minister Al-Sudani. Source: Iraqi Business News

The Cabinet agreed to boost crude oil exports to China by 50%, raising the daily production capacity of Iraq’s largest oil field, Rumaila, to 1.4 million barrels per day.

This is part of Iraq’s ambitious plan to reach 8 million barrels per day by 2028.

Simultaneously, Iraq pledged full support for the ‘Iraq-China Framework Agreement’ signed in December 2021, resembling the comprehensive ‘Iran-China 25-Year Comprehensive Cooperation Agreement.’ Central to these agreements is China’s priority access to Iraqi oil, gas, and petrochemical projects, coupled with a substantial discount on purchases.

China will also be permitted to establish factories across Iraq, supported by extensive infrastructure development, including crucial railway links aligned with China’s ‘Belt and Road Initiative.’

As these agreements unfold, the presence of Chinese security personnel, backed by Iranian counterparts from firms like Khatam al-Anbia, will be prominent at key project sites.

Furthermore, Russia’s long-term plans to exert influence in Iraq have advanced, with Prime Minister Al-Sudani meeting Russian President Vladimir Putin in Moscow.

Iraqi Prime Minister Al-Sudani Meeting with Russian President Putin on October 10th 2023. Source: Iraqi News

Discussions extended beyond the oil sector to include the future of oil exports from Kurdistan to Turkey, where Russia’s Rosneft plays a pivotal role. Iraq’s Deputy Prime Minister for Energy and Oil Minister also engaged with Gazprom Neft to discuss upcoming oil and gas projects.

These developments signal a major shift in Iraq’s alliances and geopolitical positioning.

As China and Russia deepen their involvement, the Iraqi Dinar could see a strengthening exchange rate, driven by increased oil production, strategic partnerships, and the infusion of foreign investments into the country’s infrastructure.

As this strategic shift continues to play out, we will likely witness a transformed economic landscape for Iraq, perhaps finally leading to a revaluation of Iraqi Dinar.

Supporting articles:

https://www.iraq-businessnews.com/tag/iraq-china-framework-agreement/

https://www.iraqinews.com/iraq/iraqi-pm-al-sudani-meets-with-russian-president-putin-in-moscow/

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

Dollar Going Down: Fiat System Foundation Crumbling Fast: Awake-In-3D

Dollar Going Down: Fiat System Foundation Crumbling Fast

On November 22, 2023

By Awake-In-3D

An alarming decline in the Federal Reserve’s reverse repo facility has raised serious concerns about an impending dollar liquidity crisis.

Dollar Going Down: Fiat System Foundation Crumbling Fast

On November 22, 2023

By Awake-In-3D

An alarming decline in the Federal Reserve’s reverse repo facility has raised serious concerns about an impending dollar liquidity crisis.

30-day U.S. dollar trend vs. other major currencies.

The latest data reveals a severe fall in reverse repo balances, signaling a severe storm brewing in the financial debt markets.

According to the Federal Reserve’s report, the inflows into the reverse repo facility have plummeted below the critical $1 trillion mark for the first time since late summer 2021.

Such a significant drop in liquidity is an ominous sign for the stability of the U.S. dollar and the overall health of the economy.

The reverse repo facility, a vital tool in the Federal Reserve’s arsenal, helps control short-term interest rates and ensures the central bank’s influence over the economy.

Yet, it appears the Fed’s “control and influence” is undergoing a very serious credibility challenge.

Its balance has been shrinking steadily, with cash rapidly flowing out of the facility over recent months.

The once-record peak of $2.554 trillion on December 30, 2022, has dwindled to a mere $993.3 billion on Thursday.

This disturbing trend indicates a drying up of dollar liquidity, which could have far-reaching implications.

Historically, low liquidity has tightened credit conditions, making it harder for businesses, both large and small, to secure funding for expansion and investment.

This, in turn, threatens economic growth and job creation.

The decline in reverse repo balances also raises questions about the Federal Reserve’s efforts to reduce the size of its balance sheet.

With the process expected to continue until the end of 2024, the diminishing cash levels in the reverse repo facility suggest a deeper-rooted challenge lies ahead.

Moreover, market volatility looms large on the horizon.

The diminishing liquidity can trigger liquidity crunches, causing rapid price fluctuations and market disruptions.

Banks will face funding stress, potentially leading to solvency concerns and systemic risks.

The consequences of a dollar liquidity crisis should not be underestimated.

It will result in a tightening grip on credit, increased market turbulence, currency depreciation, and a severe economic plummet.

Supporting article: https://www.reuters.com/markets/rates-bonds/fed-reverse-repos-fall-under-1-trillion-first-time-since-august-2021-2023-11-09/

https://ai3d.blog/dollar-going-down-fiat-system-foundation-crumbling-fast/

Why US Banks Could Crash on March 12th 2024: Awake-In-3D

Why US Banks Could Crash on March 12th 2024

On November 19, 2023 By Awake-In-3D

Connecting the dots of what could be a major Black Swan Event.

When a series of notable US banks faced collapse earlier this year, the US Federal Reserve responded by instituting an emergency loan facility – the Bank Term Funding Program (BTFP) – to provide short-term liquidity and avert a potential systemic banking contagion.

However, with the expiration of this emergency bank bail-out program approaching in early 2024, questions arise about the potentially serious consequences since banks continue to utilize the BTFP today in ever increasing amounts.

Why US Banks Could Crash on March 12th 2024

On November 19, 2023 By Awake-In-3D

Connecting the dots of what could be a major Black Swan Event.

When a series of notable US banks faced collapse earlier this year, the US Federal Reserve responded by instituting an emergency loan facility – the Bank Term Funding Program (BTFP) – to provide short-term liquidity and avert a potential systemic banking contagion.

However, with the expiration of this emergency bank bail-out program approaching in early 2024, questions arise about the potentially serious consequences since banks continue to utilize the BTFP today in ever increasing amounts.

Banks continue to increasingly utilize BTFP Loans – from $80 billion in June to $113 billion this past week. Source: FRED Data

By connecting the dots around a chain of events the potential for a major Black Swan Event comes into view.

The interconnectedness of interest rates, loans, inflation, and financial stability creates a plausible scenario of the Federal Reserve allowing the BTFP to expire, and its significant consequences and who stands to gain most from such an Event.

Clearly the Fed could simply extend the life of the BTFP and keep the bail-out loans flowing.

But are there strategic reasons by powerful interests to let this emergency fund expire as planned and allow banks to fail?

The Chain of Events Leading to the March 2023 Banking Crisis and BTFP Bail-out Program

This chain of events underscores the interconnectedness of interest rates, loans, inflation, and financial stability, ultimately leading to the creation of emergency measures like the BTFP to address the crisis.

1) Low Interest Rates Encourage Banks to Increased Lending

Extended periods of historically low interest rates create a favorable environment for borrowing. Banks are motivated to issue loans to businesses and consumers due to the reduced cost of capital, stimulating economic activity and investment.

2) Low Interest Rates Increase Bond Holdings by Banks

Simultaneously, the prolonged low interest rate environment boosts the value of long-term treasury bonds. Seeking higher returns than those offered by traditional savings accounts or short-term investments, banks increase their holdings of these bonds as assets on their balance sheets.

3) Increased Bank Loans Boost Money Supply

The surge in lending activities by private banks contributes to the expansion of the money supply within the economy. As loans are issued, new money is created, circulating and increasing liquidity.

4) A Growing Money Supply Creates Higher Inflation

The growing money supply, fueled by increased loans, translates into higher demand for goods and services. When the supply of goods cannot keep pace with the heightened demand, prices rise, resulting in inflationary pressures.

5) The Fed Responds to High Inflation by Raising Interest Rates

To curb rising inflation and maintain price stability, the Federal Reserve responds by implementing a series of interest rate hikes. This monetary policy measure is intended to cool down economic activity and reduce inflationary pressures.

6) Rapid Interest Rate Hikes Cause Treasury Bond Depreciation

The Federal Reserve’s swift and aggressive interest rate hikes lead to a sharp depreciation in the value of long-term treasury bonds. Bond prices move inversely to interest rates, causing a decline in the market value of bonds held by banks.

7) Bond Depreciation Creates Unrealized Losses at Banks

The rapid depreciation of bond values results in accumulating unrealized losses on the balance sheets of banks. As the value of their bond holdings decreases, banks face financial challenges and potential capital erosion.

8) High Unrealized Losses Trigger Bank Depositor Concerns

The escalating level of unrealized losses on the balance sheets of banks raises concerns among depositors. The perceived risk of financial instability prompts depositors to fear for the safety of their funds held in these institutions.

9) Rapid Withdrawals Spark Public Panic and Bank Runs

Fueled by anxiety over potential bank failures, depositors initiate rapid withdrawals from their accounts. This sudden and widespread demand for cash triggers public panic and leads to bank runs as individuals seek to safeguard their assets.

10) The Fed Created the BTFP Facility to Prevent a Major Banking Crisis Contagion

In response to the escalating banking crisis and to prevent a broader contagion effect, the Federal Reserve and the US Treasury collaboratively introduce the Bank Term Funding Program (BTFP) in March 2023. The BTFP provides emergency liquidity to depository institutions, offering loans and support to stabilize the financial system, restore confidence, and prevent the crisis from spreading further.

Ending the BTFP: A Strategic Black Swan Event to Quickly Reshape the Financial Landscape

In a surprising move, indications are emerging that the Federal Reserve may allow the Bank Term Funding Program (BTFP) to expire on March 12th, 2024. This decision raises eyebrows, especially considering the ongoing need for emergency funding among banks to stabilize liquidity, a need that became apparent in the wake of the significant banking crisis triggered in March 2023.

Despite the passage of eight months since the inception of the BTFP, banks continue to rely extensively on this emergency lending facility to meet withdrawal demands and ensure financial stability. As of today, Fed loans via the BTFP have risen to $112.7 billion, indicating a continued dependence on this crucial program.

So what is to be gained by allowing the BTFP to expire and triggering a major banking crisis? And who will benefit the most?

The Consequences of Allowing the BTFP To Expire and a Widespread Banking Crisis

Allowing the BTFP to expire could lead to severe consequences, with a major banking crisis looming on the horizon. The potential fallout from such a crisis is a matter of concern not only for the financial sector but for the broader U.S. economy.

Inflation Evisceration

– A banking crisis in 2024 would swiftly dry up bank loans to businesses and consumers, leading to the evisceration of the current high level of persistent inflation. The failure or consolidation of numerous smaller regional banks could trigger a rapid decline in lending, impacting economic activity across the nation.

Decline in Interest Rates and Treasury Bond Yields

– The subsequent decline in inflation would force the Federal Reserve to significantly lower interest rates, dramatically decreasing Treasury Bond Yields. This would benefit the U.S. Treasury tremendously as the interest payments on the $34 trillion U.S. government debt would decline precipitously.

The Big-Boy Banking Country Club

Big banks stand to benefit significantly from the fallout of a banking crisis. As they buy up distressed banks for pennies on the dollar, the financial landscape would witness a consolidation, thinning out the number of independent banks that compete with the major players.

Given that big commercial banks are also under the umbrella of the Federal Reserve, the central bank would wield more influence and control over lending levels. This strategic move could be a concerted effort to keep inflation low and maintain stability within the financial sector.

The Strategic Reason for this Black Swan Event: The Implementation of a U.S. CBDC

Allowing a banking crisis in 2024 by ending the BTFP facility may well be a strategic move by the Fed and big banks.

The Relationship Between Big Banks and the Federal Reserve Bank

Contrary to common misconceptions, the Federal Reserve is not owned by the government or private corporations but by its member banks.

The ownership structure of the U.S. Federal Reserve involves member banks holding shares, and their role as shareholders is unique and distinct.

Member banks of the Federal Reserve System hold stock in their respective Federal Reserve Banks. Each of the 12 regional banks in the Federal Reserve System is separately incorporated.

Despite holding stock, member banks do not possess the same level of control as typical shareholders in public companies. The stock cannot be traded or sold.

Member banks, being shareholders, play a role in electing six of the directors for their District’s Reserve Bank.

In other words, the relationship between the Federal Reserve and the big banks is like a financial country club and the implementation of a Federal Reserve CBDC would consolidate tremendous power and influence for this big boys banking club.

The top 12 Member Banks (Shareholders) in the Federal Reserve System. Source: Federal Reserve Bank

As I have reported in a previous article, a U.S. CBDC will likely face resistance by Congressional Lawmakers.

However, a Black Swan Event, such as a major banking crisis, would certainly create the ideal conditions to hastily pass CBDC legislation, create massive banking industry consolidation and eliminate regional bank competition in one fell swoop.

© GCR Real-Time News

Visit the GCR Real-Time News website and search 100’s of articles here: Ai3D.blog

Join my Telegram Channel to comment and ask questions here: GCR_RealTimeNews

Follow me on Twitter: @Real_AwakeIn3D

https://ai3d.blog/why-us-banks-could-crash-on-march-12th-2024/