Awake-In-3D: Real-World Quantum Computing Powering the QFS and GCR

Awake-In-3D:

Real-World Quantum Computing Powering the QFS and GCR

On October 2, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

The quantum revolution is upon us, and as we inch closer to the implementation of the Quantum Financial System (QFS) and the Global Currency Reset (Our GCR), it is useful to spotlight the critical role that quantum computing play in this monumental transformation.

One standout in the realm of quantum computing is IonQ—a pioneering company that is poised to shape the next-generation global financial management systems using Monte Carlo algorithms, in collaboration with QuantumBasel.

Here’s how IonQ’s quantum computers are examples of real-world quantum computing platforms that could easily form the backbone of the QFS and GCR. I also outline the interesting and aptly-named IonQ-QuantumBasel relationship.

Awake-In-3D:

Real-World Quantum Computing Powering the QFS and GCR

On October 2, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

The quantum revolution is upon us, and as we inch closer to the implementation of the Quantum Financial System (QFS) and the Global Currency Reset (Our GCR), it is useful to spotlight the critical role that quantum computing play in this monumental transformation.

One standout in the realm of quantum computing is IonQ—a pioneering company that is poised to shape the next-generation global financial management systems using Monte Carlo algorithms, in collaboration with QuantumBasel.

Here’s how IonQ’s quantum computers are examples of real-world quantum computing platforms that could easily form the backbone of the QFS and GCR. I also outline the interesting and aptly-named IonQ-QuantumBasel relationship.

IonQ: A Quantum Computing Powerhouse

IonQ has earned its reputation as a trailblazer in the field of quantum computing, and for good reason. The company leverages cutting-edge technology that harnesses the principles of quantum physics to develop quantum computers that are light years ahead of classical computers in terms of speed, efficiency, and processing power.

The Intriguing QuantumBasel Partnership

In the intricate world of global finance, precision, speed, and reliability are paramount. This is where QuantumBasel comes into play. QuantumBasel is a strategic partner of IonQ, with a shared vision of revolutionizing financial management systems through quantum computing. The collaboration between IonQ and QuantumBasel holds the promise of propelling the QFS and GCR to unprecedented heights.

Monte Carlo Algorithms: A Game-Changer in Finance

To appreciate the magnitude of IonQ’s contribution to the QFS and GCR, it is crucial to understand the pivotal role played by Monte Carlo algorithms in financial management. These algorithms simulate a wide range of potential outcomes by incorporating randomness into calculations, allowing for more accurate risk assessment and asset valuation.

Monte Carlo simulations are the bedrock of financial modeling and decision-making, making them indispensable in the world of global finance.

How IonQ Quantum Computing Elevates Monte Carlo Simulations

Quantum computers, like those developed by IonQ, are uniquely equipped to supercharge Monte Carlo simulations.

The fundamental difference between quantum and classical computers lies in the way they process information. Classical computers, with their binary system (0s and 1s), require sequential processing for complex calculations.

Quantum computers, on the other hand, harness the power of qubits, which can exist in multiple states simultaneously. This quantum parallelism enables quantum computers to explore numerous outcomes simultaneously, significantly accelerating Monte Carlo simulations.

The Quantum Leap in Financial Modeling

The IonQ-QuantumBasel partnership signifies a quantum leap in financial modeling and risk assessment. With IonQ’s quantum computers at the helm, Monte Carlo simulations can be executed at speeds previously deemed unattainable.

This leap in processing power translates to real-time risk analysis, dynamic portfolio optimization, and enhanced decision-making capabilities for financial institutions.

Relevant Evidence for Powering the QFS and Our GCR

As the QFS and Our GCR become integral components of the global financial landscape, the collaboration between IonQ and QuantumBasel represent compelling, real-world evidence for what will power a more resilient, secure, and efficient financial management system.

Quantum computing, with its ability to transform Monte Carlo simulations, will pave the way for enhanced risk management, asset valuation, and investment strategies.

IonQ’s quantum computers, alongside QuantumBasel’s expertise, are at the forefront of this quantum financial revolution, promising a brighter and more stable financial future for us all.

Reference Links:

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/real-world-quantum-computing-powering-the-qfs-and-gcr/

***************

Part one: A Real-World QFS Amidst an Imminent Fiat Currency Collapse

https://ai3d.blog/a-real-world-qfs-amidst-an-imminent-fiat-currency-collapse/

Awake-In-3D: A Real-World QFS Amidst an Imminent Fiat Currency Collapse

Awake-In-3D:

A Real-World QFS Amidst an Imminent Fiat Currency Collapse

On October 2, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

In the ever-evolving landscape of global finance, one cannot help but ponder the inevitable shift that is poised to reshape the world’s monetary foundations and where the QFS comes into play.

The global financial system, burdened by catastrophic debt on a global scale, is teetering on the precipice of collapse.

In this impending financial crisis, the Quantum Financial System, or QFS, is set to play a critical role in orchestrating the Global Currency Reset (GCR).

This article explains the intricate workings of the QFS and its pivotal position in replacing the crumbling fiat currency system, especially as Our GCR looms on the horizon.

Awake-In-3D:

A Real-World QFS Amidst an Imminent Fiat Currency Collapse

On October 2, 2023 By Awake-In-3D

In GCR Roadmap: Level 3 Events, RV/GCR

In the ever-evolving landscape of global finance, one cannot help but ponder the inevitable shift that is poised to reshape the world’s monetary foundations and where the QFS comes into play.

The global financial system, burdened by catastrophic debt on a global scale, is teetering on the precipice of collapse.

In this impending financial crisis, the Quantum Financial System, or QFS, is set to play a critical role in orchestrating the Global Currency Reset (GCR).

This article explains the intricate workings of the QFS and its pivotal position in replacing the crumbling fiat currency system, especially as Our GCR looms on the horizon.

Understanding the Current Financial Crisis

To comprehend the significance of the Quantum Financial System (QFS), it is essential to grasp the precarious state of our current financial system.

For decades, the world has operated on a fiat currency system, where the value of paper money and coins is anchored in governmental declarations.

The stability of this system hinges on the trust vested in governments and central banks to prudently manage the money supply – which isn’t working out so well.

However, trust in this fiat currency system has been eroding, and the global economy finds itself ensnared in an unsustainable doom-loop of debt, inflation, and recurrent financial crises.

The Quantum Financial System (QFS) Explained

Enter the Quantum Financial System, or QFS—a groundbreaking financial technology poised to supplant the outdated fiat currency system.

The QFS is not a mere concept; it is a tangible reality that fuses quantum physics with finance, giving birth to a transparent and robust financial ecosystem.

Harnessing the Power of Quantum Physics

At the heart of the QFS lies the enigmatic world of quantum physics—a scientific field that explores the behavior of matter and energy at the most minuscule scales.

Quantum physics introduces a groundbreaking concept: quantum bits, or qubits.

In stark contrast to classical computers, which operate within a binary system (comprising 0s and 1s), quantum computers can exist in multiple states simultaneously. This remarkable property empowers quantum computing to process colossal volumes of data at unprecedented speeds, all while maintaining airtight security.

Key Features of the QFS

Here’s a basic summary of the critical features that render the QFS a paradigm shift in the realm of global finance:

Asset-Backed Currency: The QFS heralds a new era of asset-backed digital currency, tethering each unit of currency to tangible assets like gold or oil. This infusion of real value enhances stability.

Global Network: The QFS establishes a global network, utilizing Decentralized Ledgers, for the seamless transmission of asset-backed money, transcending borders and centralized control—a true international financial system.

Security and Transparency: Quantum encryption technology fortifies security, rendering hacking and fraud nearly insurmountable. Real-time transaction monitoring ensures complete transparency for all parties involved.

End of Corruption: A primary mission of the QFS is to eradicate corruption, usury, and manipulation within the banking system, holding financial institutions accountable to agreed-upon contracts.

Decentralization: In stark contrast to the current centralized system, the QFS operates autonomously, obviating the need for intermediaries and transaction fees, thus making financial transactions more cost-effective for all.

QFS Decentralized Ledgers Explained

Decentralized ledgers are safer, more secure, and better at protecting personal financial liberties in a digital financial system.

They offer increased security through distributed consensus, safeguard personal financial liberties, resist single-point vulnerabilities, ensure transparency and immutability, promote inclusivity, and reduce dependency on intermediaries.

These advantages make decentralized ledger technology a compelling choice for the future of finance.

Here’s a detailed explanation of why decentralized ledgers are preferable in this context:

1) Enhanced Security Through Distributed Consensus

Decentralized ledgers rely on a network of computers (nodes) spread across various geographical locations. To validate and record transactions, a consensus mechanism, such as Proof of Work (PoW) or Proof of Stake (PoS), is employed. This distributed consensus makes it exceedingly difficult for malicious actors to manipulate or compromise the ledger.

In a unified ledger system, a single point of failure or control exists, making it susceptible to hacking, fraud, and unauthorized access. Decentralization disperses this risk, as altering a single node’s record does not affect the entire network, making it more secure.

2) Protection of Personal Financial Liberties

Decentralized ledgers prioritize user autonomy and privacy. When individuals transact on decentralized platforms, they retain control over their financial data and assets. This contrasts with centralized systems, where financial institutions or authorities may exert control over user funds and data.

With decentralized ledgers, individuals can engage in peer-to-peer transactions without the need for intermediaries, reducing the risk of censorship or restrictions on financial activities. This preserves financial liberties and ensures that individuals have the final say over their assets and transactions.

3) Resistance to Single-Point Vulnerabilities

Centralized ledgers are highly vulnerable to single points of failure. If a central authority or institution experiences a technical glitch, a security breach, or operational issues, it can disrupt the entire financial system. In contrast, decentralized systems have no single point of failure. Even if some nodes experience problems, the network as a whole remains operational, ensuring uninterrupted financial services.

4) Transparency and Immutable Records

Decentralized ledgers offer transparency and immutability, making it virtually impossible to alter transaction records once they are added to the blockchain. This transparency builds trust among users, as they can independently verify transactions. In centralized systems, records can be altered or manipulated, potentially leading to disputes and mistrust.

5) Inclusivity and Accessibility

Decentralized ledgers are often more inclusive and accessible to a wider range of individuals, including those who are unbanked or underbanked. They do not require users to go through traditional financial institutions or meet specific criteria to participate. This open access empowers more people to participate in the digital financial system, promoting financial inclusivity.

6) Reduced Dependency on Intermediaries

In centralized systems, users are heavily reliant on intermediaries, such as banks or payment processors, to facilitate transactions. These intermediaries can charge fees, impose restrictions, and create bottlenecks in the financial system. Decentralized ledgers eliminate the need for intermediaries, enabling direct peer-to-peer transactions, reducing costs, and increasing efficiency.

The Crucial Role of QFS in the Global Currency Reset (Our GCR)

As we stand on the precipice of an imminent Global Currency Reset (Our GCR), the QFS assumes a central role in this epochal financial shift. The GCR is a comprehensive strategy aimed at redefining the values of global currencies, ensuring their parity.

Underpinning this ambitious endeavor is the Quantum Financial System, which offers a dependable and transparent platform for currency exchanges.

Wrapping It All Up

In conclusion, the Quantum Financial System is not merely a technological marvel; it is the harbinger of a more stable and secure global financial paradigm.

As the beleaguered fiat currency system grapples with its impending collapse and the GCR approaches, the QFS stands ready to usher in an era of financial stability, security, and transparency.

While the prospect of change can be daunting, the QFS promises a brighter financial future—a future where trust is founded on the bedrock of quantum physics, ensuring a resilient and dependable global financial system.

But There’s More!

A Real-World Example for Powering the Quantum Financial System and Our GCR

Explore how IonQ’s quantum computers are examples of real-world quantum computing platforms that could easily form the backbone of the QFS and Our GCR. I also explain the interesting and aptly-named IonQ-QuantumBasel relationship.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-real-world-qfs-amidst-an-imminent-fiat-currency-collapse/

Awake-In-3D: Why It’s Time to END the FED

Awake-In-3D:

Why It’s Time to END the FED

On October 1, 2023 By Awake-In-3D

The time is now to end the FED! The Federal Reserve, commonly known as the FED, has long been a subject of scrutiny and criticism. Its role in managing the economy and its track record of creating boom-bust cycles have raised concerns among economists and citizens alike.

In this article, I present a compelling argument for canceling the Federal Reserve Bank’s charter in the United States, highlighting the need for a new approach to monetary policy.

Awake-In-3D:

Why It’s Time to END the FED

On October 1, 2023 By Awake-In-3D

The time is now to end the FED! The Federal Reserve, commonly known as the FED, has long been a subject of scrutiny and criticism. Its role in managing the economy and its track record of creating boom-bust cycles have raised concerns among economists and citizens alike.

In this article, I present a compelling argument for canceling the Federal Reserve Bank’s charter in the United States, highlighting the need for a new approach to monetary policy.

The Federal Reserve has been in operation since 1913.

The FED’s policies have contributed to a series of boom-bust cycles and economic crises.

Central banking systems throughout history have caused economic turmoil and instability.

The FED’s actions played a role in triggering the Great Depression of the 1930s.

The dot-com bubble and the housing market collapse in 2008 were influenced by the FED’s policies.

The FED has eroded the value of the dollar, leading to rising prices and diminished purchasing power.

The cumulative rate of U.S. inflation between 1913 and September 2021 is approximately 2,452.6%.

The FED’s practices have contributed to growing wealth inequality in society.

Canceling the Federal Reserve Bank’s charter opens the opportunity for alternative monetary policies prioritizing transparency, accountability, and long-term economic sustainability.

The Problem with the FED

Since its establishment in 1913, the Federal Reserve has been plagued by mismanagement and questionable practices. Its ability to manipulate interest rates and control the money supply has resulted in a series of economic crises. The boom-bust cycles fueled by the FED’s policies have brought about financial instability and wreaked havoc on the American economy.

A History of Failed Central Banking

The history of central banking is riddled with examples of its detrimental effects on economies.

From the Bank of England’s inflationary practices to the hyperinflation under the Bank of North America and the First Bank of the United States, central banks have repeatedly caused economic turmoil.

The Second Bank of the United States, despite its attempts to curtail excessive lending, only led to the nation’s first depression. These experiences demonstrate the inherent flaws and dangers associated with central banking systems.

The FED’s Legacy of Economic Crises

The Federal Reserve’s track record speaks for itself. In the past century, the FED has contributed to numerous financial crises that have had far-reaching consequences.

Whether it was the Great Depression of the 1930s or the more recent dot-com bubble and the housing market collapse in 2008, the FED’s policies have consistently played a role in triggering and exacerbating these crises.

The resulting economic hardships have affected millions of Americans, undermining their financial security and stability.

Devaluation of the Dollar: A Key Reason to End the FED

One of the most alarming aspects of the FED’s operations is the steady devaluation of the U.S. dollar.

According to the U.S. Bureau of Labor Statistics’ inflation calculator, the cumulative rate of inflation between 1913 and September 2021 is approximately 2,452.6%.

This means that what could be purchased with $1 in 1913 would require about $25.53 in 2021 to maintain the same purchasing power.

This devaluation of the dollar over time has resulted in rising prices and decreased the value of savings and wages.

This devaluation has disproportionately affected those on fixed incomes and has contributed to growing wealth inequality in our society.

The Need for a New Approach

It is evident that the current system, with the Federal Reserve at its core, is flawed and detrimental to the well-being of the American people.

To secure a more stable and prosperous future, it is imperative to end the FED and explore alternative monetary policies that prioritize transparency, accountability, and long-term economic sustainability.

Just End the FED: It’s the Right Thing to Do

The time has come to seriously consider canceling the Federal Reserve Bank’s charter and effectively end the FED. It’s history of mismanagement, the recurring boom-bust cycles, the devaluation of the dollar, and the negative impact on the American economy cannot be ignored.

It is crucial to reevaluate our monetary framework and explore alternative solutions that prioritize the best interests of the American people.

By ending the FED, we open the door to a new era of financial stability, economic growth, and prosperity for all.

Contributing article: EJ Antoni and Peter St.Onge via The Epoch Times,

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: Historical Proof That All Fiat Currencies Collapse

Awake-In-3D

Ever wondered why your money seems to buy less and less over time? The culprit could be the system of fiat currencies we're all hooked on. Let's dive into a quick history lesson on the rise and fall of fiat currencies.

Inflation is a nasty side effect of fiat currencies. When governments print more money, it can lead to inflation. This erodes the value of your hard-earned cash.

The history of fiat currencies is a graveyard of failures. For instance, the Roman Empire's Denarius started as pure silver but ended up as just 0.02% silver. Talk about a downgrade!

Let's not forget China's Jiaozi, one of the earliest forms of paper money It began as a receipt for iron deposits but rampant inflation led to its abandonment.

In 18th century France, John Law introduced paper money. After a speculative bubble, the currency collapsed, losing 99% of its value in just five years.

Awake-In-3D

Ever wondered why your money seems to buy less and less over time? The culprit could be the system of fiat currencies we're all hooked on. Let's dive into a quick history lesson on the rise and fall of fiat currencies.

Inflation is a nasty side effect of fiat currencies. When governments print more money, it can lead to inflation. This erodes the value of your hard-earned cash.

The history of fiat currencies is a graveyard of failures. For instance, the Roman Empire's Denarius started as pure silver but ended up as just 0.02% silver. Talk about a downgrade!

Let's not forget China's Jiaozi, one of the earliest forms of paper money It began as a receipt for iron deposits but rampant inflation led to its abandonment.

In 18th century France, John Law introduced paper money. After a speculative bubble, the currency collapsed, losing 99% of its value in just five years.

Closer to home, Zimbabwe saw hyperinflation peak at a whopping 79,600,000,000% in the 21st century. The local currency was abandoned for the US Dollar.

The fate of the global reserve currency, the US Dollar, is uncertain. Once backed by gold and silver, it's now a fiat currency, susceptible to the same pitfalls.

History shows us that fiat currencies inevitably collapse. So next time you look at your money, remember, its value isn't as solid as you might think.

As we journey through the evolving financial landscape, it's crucial to stay informed and prepared. Stay vigilant.

https://ai3d.blog/historical-proof-that-all-fiat-currencies-collapse/

Awake-In-3D | GCR Real-Time News

Historical Proof That All Fiat Currencies Collapse

On September 27, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Continued from Part 1: The Peril of Fiat Currencies

Today, the world operates on a failing system of fiat currencies system, where currencies are not backed by tangible assets like gold but rely on humanity’s trust and confidence in governments.

Governments are drawn to fiat currencies like moths to a flame. They provide a seemingly expedient means of financing present-day expenditures by simply creating new units of currency, unburdened by the constraints of taxation and borrowing. This financial shortcut, however, has historically proven to be a treacherous path.

Throughout history, governments have consistently yielded to the temptation of excessive money printing. As the supply of fiat currency swells, its intrinsic value steadily erodes, leading to a phenomenon we know all too well – inflation. When a fiat currency loses its status as a reliable store of value and medium of exchange, citizens lose faith in it, often seeking refuge in hard assets like gold and silver, or in more stable fiat currencies, such as the US Dollar.

Unprecedented Money Supply Expansion: Central banks have engaged in extensive money printing, leading to concerns about potential inflation and currency devaluation.

Debt Accumulation: Governments have amassed substantial debts, and the ability to service these debts hinges on economic stability and a continuing belief in the currency’s value.

Erosion of Trust: Public trust in fiat currencies depends on responsible fiscal and monetary policies. Political polarization and economic uncertainty have led to questions about the sustainability of these policies.

Inflation and Its Connection to Fiat Currencies

Inflation, defined as an increase in the supply of money, is a critical factor in the history and operation of fiat currencies.

The Role of Inflation: Rising prices, while not guaranteed, often result from an increased money supply. Governments may print more money during crises, and if this new money circulates, it can lead to inflation.

Deflation and Inflation: Fiat money can lead to both inflation and deflation. In times of economic contraction, unpaid debts reduce the money supply, prompting the printing of more money to maintain economic stability.

In our historical journey through the evolution of money, we’ve witnessed the transition from tangible assets to fiat currencies. While the current global fiat currency system offers flexibility and adaptability, it is not without its challenges. The key to its stability lies in responsible governance, prudent fiscal policies, and the preservation of public trust. Understanding the past informs our approach to shaping the future of currencies in an ever-evolving financial landscape.

The Uncertain Fate of the Global Reserve Currency

Even the US Dollar, once anchored by gold and silver, now stands as a fiat currency without such backing. While it has been deployed to stabilize hyperinflation in other nations, its own status remains susceptible to the pitfalls of fiat currency systems.

The Inevitable End of Fiat Currencies

In closing, history imparts a sobering lesson: fiat currencies are invariably characterized by a cycle of ascent and descent, punctuated by episodes of hyperinflation, economic turbulence, and eroding public trust. Governments may initially turn to fiat currency as a quick fix, but the allure of unchecked money printing almost invariably prevails. We would be wise to prepare for the eventual debasement of fiat currencies by safeguarding their wealth through hard assets like gold and silver. The dangers of our current global fiat currency system are real, and our financial well-being may ultimately hinge on our ability to discern these perilous signs and respond judiciously.

Reference: A History of Fiat Currency Failures

Fiat currencies, a government-issued legal tender without intrinsic value, has been an alluring tool for governments throughout history. It offers the tempting ability to transfer wealth from the future to the present, allowing governments to spend beyond their means. Unlike taxation and borrowing, creating new currency seems like an easier route to financing government activities. However, the history of fiat currency is fraught with failures, often linked to government mismanagement and debasement.

1st Century: The Roman Empire

Currency: Denarius

Depreciation: From pure silver to a mere 0.02% silver content.

The denarius, widely used in ancient Rome, serves as one of the earliest examples of fiat currency. Initially made of pure silver, its silver content steadily declined over time. By the time of the Roman collapse, the denarius contained minuscule traces of silver, losing its value as a store of wealth and medium of exchange.

8th Century: Imperial China

Currency: Jiaozi

Depreciation: From a receipt for iron money to hyperinflation and abandonment.

The Chinese invented paper money, with the jiaozi being one of the earliest forms. Initially a receipt for iron money deposits, it was later exchanged among the population as currency. When the government expanded its supply and triggered inflation, the jiaozi was replaced by the qianyin. Subsequent Chinese dynasties experienced similar issues with fiat currencies, leading to a preference for silver.

18th Century: France (John Law’s Experiment)

Currency: Assignat

Depreciation: A loss of 99% of its value within five years.

John Law, a Scotsman, introduced paper money to France in 1716. Initially, it was limited in supply and convertible to gold and silver. However, Law’s Mississippi Company speculative bubble led to excessive money printing, inflation, and the eventual collapse of both the stock price and the paper currency. France returned to a gold and silver-based monetary system.

The Assignat of the French Revolution: During the French Revolution, the National Assembly turned to fiat currency, introducing the assignat. It quickly suffered hyperinflation, losing 99% of its value within five years. This crisis played a role in the rise of Napoleon, who later restored financial order by backing the currency with hard assets.

19th Century: Weimar Germany

Currency: Papiermark

Depreciation: Hyperinflation peaked at 79,600,000,000%.

After abandoning the gold standard during World War I, Germany experienced hyperinflation, with prices doubling every month. The collapse of the German mark created economic turmoil, leading to the introduction of the rentenmark and later the Reichsmark, backed by hard assets.

19th Century: Republic of China

Currency: Fabi

Depreciation: Hyperinflation, economic chaos and eventual replacement.

The Republic of China attempted to transition from a silver standard to fiat currency. Inflation followed, and citizens reverted to using silver, eventually leading to the abandonment of fiat currency.

21st Century: Zimbabwe

Currency: Zimbabwean Dollar

Depreciation: Hyperinflation peaked at 79,600,000,000%.

Land reforms, economic sanctions, and excessive money printing led to hyperinflation in Zimbabwe. Citizens abandoned the local currency for foreign currencies like the US dollar, and the government eventually allowed foreign currency usage.

21st Century: Venezuela

Currency: Bolivar

Depreciation: Hyperinflation and a loss of trust.

Venezuela’s economy, heavily dependent on oil, suffered when oil prices dropped. To combat economic challenges, the government printed more money, leading to hyperinflation. The US dollar became the dominant currency for transactions.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/historical-proof-that-all-fiat-currencies-collapse/

Awake-In-3D: Peril of Fiat Currencies | A History Repeated

Awake-In-3D:

Peril of Fiat Currencies | A History Repeated

On September 26, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Fiat currencies come and go throughout history, with each failure stemming from the overzealous printing of money, debasement, and loss of trust.

While governments may initially resort to fiat currency as an expedient solution, they often find themselves in a cycle of inflation and economic turmoil.

Hard money, such as gold and silver, remains a store of value when fiat currencies falter. As the world’s reserve currency, the US dollar’s stability has even assisted countries in times of hyperinflation.

Awake-In-3D:

Peril of Fiat Currencies | A History Repeated

On September 26, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Fiat currencies come and go throughout history, with each failure stemming from the overzealous printing of money, debasement, and loss of trust.

While governments may initially resort to fiat currency as an expedient solution, they often find themselves in a cycle of inflation and economic turmoil.

Hard money, such as gold and silver, remains a store of value when fiat currencies falter. As the world’s reserve currency, the US dollar’s stability has even assisted countries in times of hyperinflation.

Nevertheless, like all fiat currencies, it too may face a future of uncertainty. Preparedness with hard money serves as a prudent safeguard against the inevitable pitfalls of fiat currency systems.

Money is a fundamental pillar of human civilization, enabling trade, commerce, and economic growth. Over the centuries, the concept of money has undergone a fascinating transformation, evolving from tangible assets like gold and silver to the modern fiat currencies we use today.

Fiat currencies have long held an undeniable allure for governments, offering the tantalizing prospect of transferring wealth from the future to the present with a simple press of the printing press. However, history is replete with examples of the dangers lurking behind these government-backed promises.

The global fiat currency system we rely on today stands perilously close to the edge of the same precipice that countless civilizations have plummeted from before.

We should all be knowledgeable about the ominous parallels between our current system and the failures of fiat currencies throughout history.

The “Genesis” of Fiat Currencies

Fiat currency, in its essence, is a government-issued legal tender that lacks intrinsic value, unlike currencies backed by tangible assets such as gold or silver. The term “fiat” comes from the Latin phrase “fiat lux,” meaning “let there be light,” which is found in the book of Genesis.

Biblical Reference: In Latin, the book of Genesis in the Bible features the phrase “fiat lux,” which means “let there be light.” This linguistic connection highlights the term “fiat,” suggesting the creation of something out of nothing, akin to the creation of currency.

Andrew Dickson White and the Coining of the Term: The term “fiat currency” was popularized by American historian Andrew Dickson White in his 1875 book, “Fiat Money Inflation in France.” White used this term to describe money with no intrinsic value.

Intrinsic Value of Money

Throughout history, various items have served as money, some with intrinsic value and others without. Understanding the concept of intrinsic value is essential to appreciate the evolution of money.

Money with Intrinsic Value: Traditional forms of money include commodities like gold, silver, beaver pelts, and even cigarettes. These items had inherent worth and were widely accepted as mediums of exchange.

Unconventional Forms of Money: Surprisingly, even cowry shells were used as currency for centuries in ancient China and other regions bordering the Indian Ocean. The Chinese character for “money/currency” is believed to be a pictograph of a cowrie shell.

Birth of Paper Money

Paper money revolutionized the concept of currency, introducing a more practical and flexible form of exchange.

Chinese Origins: Paper money was first introduced during the Tang Dynasty (618-907 AD) in China. It gradually evolved from engraved wooden blocks to sophisticated credit mechanisms and promissory notes for trade.

Rise of the Gold Standard: Paper money was initially backed by gold or other tangible assets. For instance, the English government established the Bank of England in 1694, issuing fixed denomination notes, marking the birth of true British banknotes.

Historical Challenges of Gold-Based Currencies

While the gold standard provided stability, it faced challenges when significant new gold deposits were discovered. Historical events, such as Spain’s gold raids and the California gold rush, disrupted the gold-based currency systems.

The gold supply is finite, and significant discoveries were rare. This scarcity led to the occasional destabilization of gold-backed systems.

The Transition to Fiat Currencies

The 20th century witnessed a transition from gold-backed systems to fiat currencies driven by economic realities, including wars and the need for flexible monetary policies.

World Wars and Economic Necessity: The two world wars strained economies and required nations to adopt fiat currencies to finance their efforts. The ability to print money during crises became crucial.

Bretton Woods Agreement: After World War II, the Bretton Woods agreement established the US dollar as the world’s primary reserve currency, backed by gold. Other countries pegged their currencies to the US dollar.

[END OF PART 1]

Part 2 will explain:

Our modern fiat currency system

Inflation and its inherent connection to fiat currencies

A global history of fiat currency failures – beginning with the Roman Empire

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/peril-of-fiat-currencies-a-history-repeated/

Awake-In-3D: Real Money | Why Our Fiat Currency System is Ending

Awake-In-3D

Real Money | Why Our Fiat Currency System is Ending

On September 25, 2023 By Awake-In-3D

For over half a century, our global financial system has relied on fiat currencies, with the US dollar as its centerpiece. However, there is growing evidence that this era of fiat currency is coming to an end. A return to Real Money is the obvious solution.

The debasement of these currencies by governments has become increasingly apparent, leading to a loss of faith in their value.

The future replacement for fiat currencies may lie in a system that respects the legal and historical foundations of money, and ensures stability, trust, and a clear distinction between money and credit (debt).

This is what Our GCR is all about!

Awake-In-3D

Awake-In-3D:

Real Money | Why Our Fiat Currency System is Ending

On September 25, 2023 By Awake-In-3D

For over half a century, our global financial system has relied on fiat currencies, with the US dollar as its centerpiece. However, there is growing evidence that this era of fiat currency is coming to an end. A return to Real Money is the obvious solution.

The debasement of these currencies by governments has become increasingly apparent, leading to a loss of faith in their value.

The future replacement for fiat currencies may lie in a system that respects the legal and historical foundations of money, and ensures stability, trust, and a clear distinction between money and credit (debt). This is what Our GCR is all about!

Awake-In-3D

This loss of faith, combined with the impracticality and limitations of central bank digital currencies (CBDCs), suggests that a new monetary system will soon replace the old.

Throughout history, fiat currencies have ultimately failed. The state theory of money, which underpins these currencies, has proven unsustainable.

Governments have continually abused their power to manipulate and devalue their own currencies.

This pattern has repeated itself time and time again, eroding trust in fiat money. The introduction of CBDCs, proposed as a response to the threat posed by private sector money, is yet another attempt to preserve the failing system.

However, the impracticalities involved in implementing CBDCs, as well as the resistance from existing banking interests, make their success doubtful.

Why Real Money Has No Price

To understand the shortcomings of our current monetary system, it is essential to grasp the true nature of money.

Money serves as a neutral medium of exchange, adjusting the ratios of goods and services.

Contrary to popular belief, money itself does not have a price. Instead, it facilitates the division of labor and represents unspent labor or credit, yet to be used. This understanding of money as unspent labor is crucial in comprehending its value.

Throughout history, real money, such as gold and silver, has derived its value from its transferability and its ability to be exchanged for goods and services.

Real money, unlike fiat currencies, has a clear distinction from credit. It is permanent and free from counterparty risk, whereas credit is temporary and carries inherent risks. The detachment of credit from real money can lead to instability and currency debasement.

Why Cryptocurrencies are Not the Solution as a Fiat System Replacement

While the cryptocurrency revolution has brought attention to the potential transformation of property ownership and highlighted the problems with fiat currencies, it is not the solution to replace real money.

Cryptocurrencies, like bitcoin, may have gained popularity and attracted speculation, but they fall short in fulfilling the role of a currency.

Cryptocurrencies lack the necessary qualities that real money possesses. They are volatile, lacking stability and trust. Additionally, they are not backed by anything tangible or linked to the real economy.

The detachment of cryptocurrencies from the legal and historical foundations of money further undermines their suitability as a replacement for real money.

The Bottom Line

In our RV/GCR journey to a new monetary system, it is crucial to recognize the limitations of cryptocurrencies. While they have their merits, they are not a viable alternative to real money.

The future replacement for fiat currencies may lie in a system that respects the legal and historical foundations of money, and ensures stability, trust, and a clear distinction between money and credit. This is what Our GCR is all about!

As we witness the decline of global fiat currencies, it is essential to learn from history and understand the role of real money for a more sustainable and reliable monetary system.

By understanding the true nature of money, its role as a medium of exchange, and the shortcomings of cryptocurrencies, we can navigate the path towards a more stable and equitable financial future.

It is time to reassess our assumptions, challenge the status quo, and work towards a monetary system that upholds the principles of sound money and economic stability.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/real-money-why-our-fiat-currency-system-is-ending/

Awake-In-3D: Introducing A Unique RV/GCR Roadmap

Awake-In-3D:

Introducing A Unique RV/GCR Roadmap

On September 23, 2023 By Awake-In-3D

Today, we find ourselves at the threshold of a financial transformation unlike any other. I’m excited to announce the launch of the RV/GCR Roadmap, a comprehensive guide that provides a detailed explanation of events leading to the collapse of the Fiat Currency System and what comes after.

In a landscape of sensationalism and over-hyped GCR narratives, this RV/GCR Roadmap serves as a grounded, guiding light. It offers clarity and rational analysis, steering clear of magic bullets or dramatic speculations.

Awake-In-3D:

Introducing A Unique RV/GCR Roadmap

On September 23, 2023 By Awake-In-3D

Today, we find ourselves at the threshold of a financial transformation unlike any other. I’m excited to announce the launch of the RV/GCR Roadmap, a comprehensive guide that provides a detailed explanation of events leading to the collapse of the Fiat Currency System and what comes after.

In a landscape of sensationalism and over-hyped GCR narratives, this RV/GCR Roadmap serves as a grounded, guiding light. It offers clarity and rational analysis, steering clear of magic bullets or dramatic speculations.

Explore Three Levels of Event Insight on the RV/GCR Roadmap

The RV/GCR Roadmap is structured into three distinct levels, each offering a unique perspective on our evolving financial landscape:

Event Level 1: Here, we delve into the current financial events that underpin our journey. These Level 1 events are firmly grounded in reality, free from sensationalism, and based on logical analysis.

Event Level 2: As we progress, we inevitably approach the brink of a total collapse of the current Fiat Financial System. These Level 2 events represent pivotal moments that draw us closer to the reset we’ve long anticipated.

Event Level 3: Amidst the looming collapse, Level 3 events present alternative scenarios for the replacement and Reset of the current fiat currency system. These scenarios are logically plausible, aligning with rational analysis rather than fanciful narratives.

A Rational and Logical Guide to Our RV/GCR Future

My commitment to credibility remains unshaken. Every article and piece of news on GCR Real-time News is extensively researched and substantiated by verifiable references from reliable external sources.

Follow and Track the RV/GCR Journey

I invite you to explore the RV/GCR Roadmap and embark on this transformative financial shift. Navigate the roadmap, gain insights into unfolding events, and grasp the significance of each milestone.

As we all navigate the most significant global financial shift in human history, let’s do so with clarity, facts, and a shared vision of the future that awaits. The RV/GCR Roadmap is your trusted companion on this journey.

Or click here to go to my RV/GCR Roadmap

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: A Fiat Ponzi Scheme Collapse – Time for “System D”

Awake-In-3D:

A Fiat Ponzi Scheme Collapse – Time for “System D”

On September 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Governments, Debt, and the Looming Collapse

In the shadows of global economies, a perilous game is being played—one fueled by unsustainable debt, interventionist policies, and a financial system built on deceit. This is our current world of the Fiat Ponzi Scheme, where governments worldwide are teetering on the edge of self-destruction.

We should all be consciously aware of the key points that expose the fragility of our economic foundations and prepare for the looming collapse that will give birth to Our GCR and historic prosperity.

Awake-In-3D:

A Fiat Ponzi Scheme Collapse – Time for “System D”

On September 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Governments, Debt, and the Looming Collapse

In the shadows of global economies, a perilous game is being played—one fueled by unsustainable debt, interventionist policies, and a financial system built on deceit. This is our current world of the Fiat Ponzi Scheme, where governments worldwide are teetering on the edge of self-destruction.

We should all be consciously aware of the key points that expose the fragility of our economic foundations and prepare for the looming collapse that will give birth to Our GCR and historic prosperity.

Key Aspects of the Fiat Ponzi Scheme

Governments worldwide, including Washington, are on a self-destructive path due to unsustainable debt and interventionist economic policies.

One needs only to study the historical decline of the Roman Empire, burdened with debt and anti prosperity policies, a poignant example of this is today’s Green New Deal in the USA.

In the fiat Ponzi scheme, a constantly depreciating currency, financial deceit and asset value manipulation substitute for sound (asset-backed) money.

Wall Street alone does not have the strength to cause a cataclysmic outcome; it requires the involvement of Washington with its access to a balance sheet running into the tens of trillions.

The central banks and national governments have colluded to fund massive increases in national debt (which just crossed the $33 Trillion level), turning government promises into a gigantic international fiat Ponzi scheme.

Concerns are raised about ultra-high corporate and credit card debt, bank insolvency, and the deep inversion of the spread between two- and ten-year Treasuries.

It is beyond obvious that a massive debt bomb will soon explode, with interest on the U.S. federal debt reaching two trillion dollars annually by the end of next year.

Prosecuting governments for their fiat Ponzi schemes is challenging as most government officials believe in the effectiveness of central banks and the current fiat currency monetary system.

The state monopolizes money, and the introduction of central bank digital currencies (CBDCs) will further control the monetary system.

Florida and Indiana have effectively banned CBDCs as money, and other states may follow suit.

The use of cash, barter, and participation in the “shadow economy” can be strategies to oppose CBDCs and maintain economic independence.

System D* (the shadow economy) is growing faster in many countries than the officially recognized gross domestic product and would be the second-largest economy in the world if considered an independent nation.

The future outcome is undecided, but individuals can influence it by adopting a spirit of adaptability and resourcefulness.

*What is System D?

System D, also known as the “shadow economy” or “informal economy,” refers to a vast network of economic activities that exist outside the official channels of government regulation and oversight.

It encompasses a wide range of informal transactions, including unregistered businesses, cash-based transactions, barter exchanges, and other forms of economic activity that operate outside traditional legal frameworks.

System D typically emerges in response to economic challenges, such as high levels of unemployment, excessive regulations, limited access to formal markets, or a lack of trust in the established financial system.

Participants in the shadow economy often seek alternative means of survival and economic exchange, finding ways to meet their needs and generate income outside the bounds of official regulations and taxation.

It is important to note that the shadow economy can vary significantly in size and characteristics across different countries and regions. Estimates suggest that the size of the shadow economy can be substantial, sometimes rivaling or even surpassing the officially recognized Gross Domestic Product (GDP) of a country.

Fiat Ponzi Scheme Summary

As the cracks in the fiat Ponzi scheme grow wider, it is imperative to recognize the fragility of our economic systems. The unsustainable debt, interventionist policies, and deceitful practices employed by governments worldwide threaten to trigger a catastrophic collapse.

By understanding the key points discussed above, including the fragile foundations of debt and intervention, the substitution of sound money with fiat currency, the role of Wall Street and Washington, the warning signs of debt bombs and inverted curves, and the collusion behind the fiat Ponzi scheme, we can navigate the uncertain future ahead.

It is time to question the status quo and embrace a System D strategy to thrive in a world on the brink of the fiat Ponzi scheme’s unraveling.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/a-fiat-ponzi-scheme-collapse-time-for-system-d/

Awake-In-3D: Japan’s Yen Crisis Grows and It’s Coming for Us

Awake-In-3D

Japan’s Yen Crisis Grows and It’s Coming for Us

On September 17, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The fiat debt system financial meltdown in Japan is deepening. Japan’s Yen crisis shows us what is coming next for Europe and the United States’ fiat currencies. The Yen collapse is Event Level 10 on my soon-to-be-released RV/GCR Roadmap.

This RV/GCR Roadmap is a definitive 18 Event guide to help you navigate the steps towards the collapse of the Global Fiat Financial System and the introduction of a Financial System Reset and Revaluation scenario.

Yet we have to see the current system reach critical failure, and the Japanese Yen Crisis is a major event to watch. Here’s an update to what’s happening in Japan.

Awake-In-3D:

Japan’s Yen Crisis Grows and It’s Coming for Us

On September 17, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The fiat debt system financial meltdown in Japan is deepening. Japan’s Yen crisis shows us what is coming next for Europe and the United States’ fiat currencies. The Yen collapse is Event Level 10 on my soon-to-be-released RV/GCR Roadmap.

This RV/GCR Roadmap is a definitive 18 Event guide to help you navigate the steps towards the collapse of the Global Fiat Financial System and the introduction of a Financial System Reset and Revaluation scenario.

Yet we have to see the current system reach critical failure, and the Japanese Yen Crisis is a major event to watch. Here’s an update to what’s happening in Japan.

Amidst the glittering skyline of Tokyo, a financial tempest is brewing, and its name is Japan’s Yen Crisis. While it may appear as a distant storm on the horizon, its implications extend far beyond Japan’s borders, reaching the heart of the United States and the global financial landscape.

The Unfolding Events Around Japan’s Yen Crisis

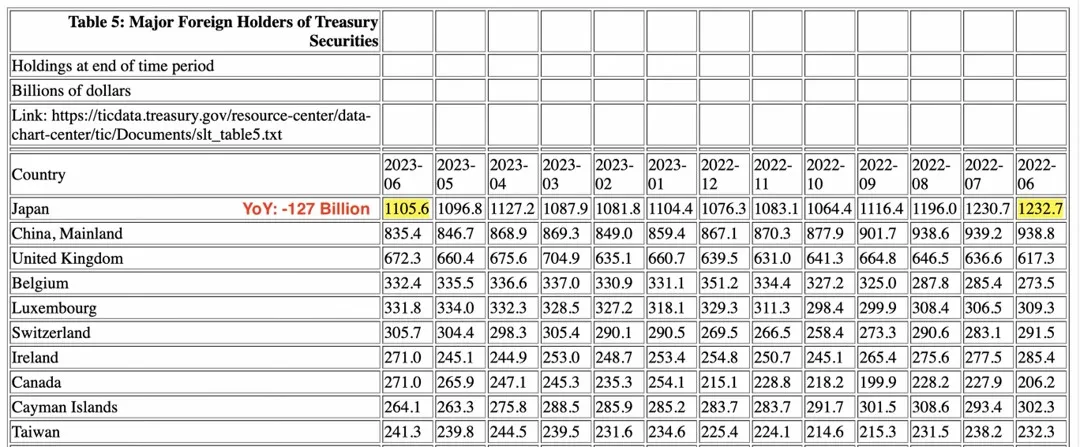

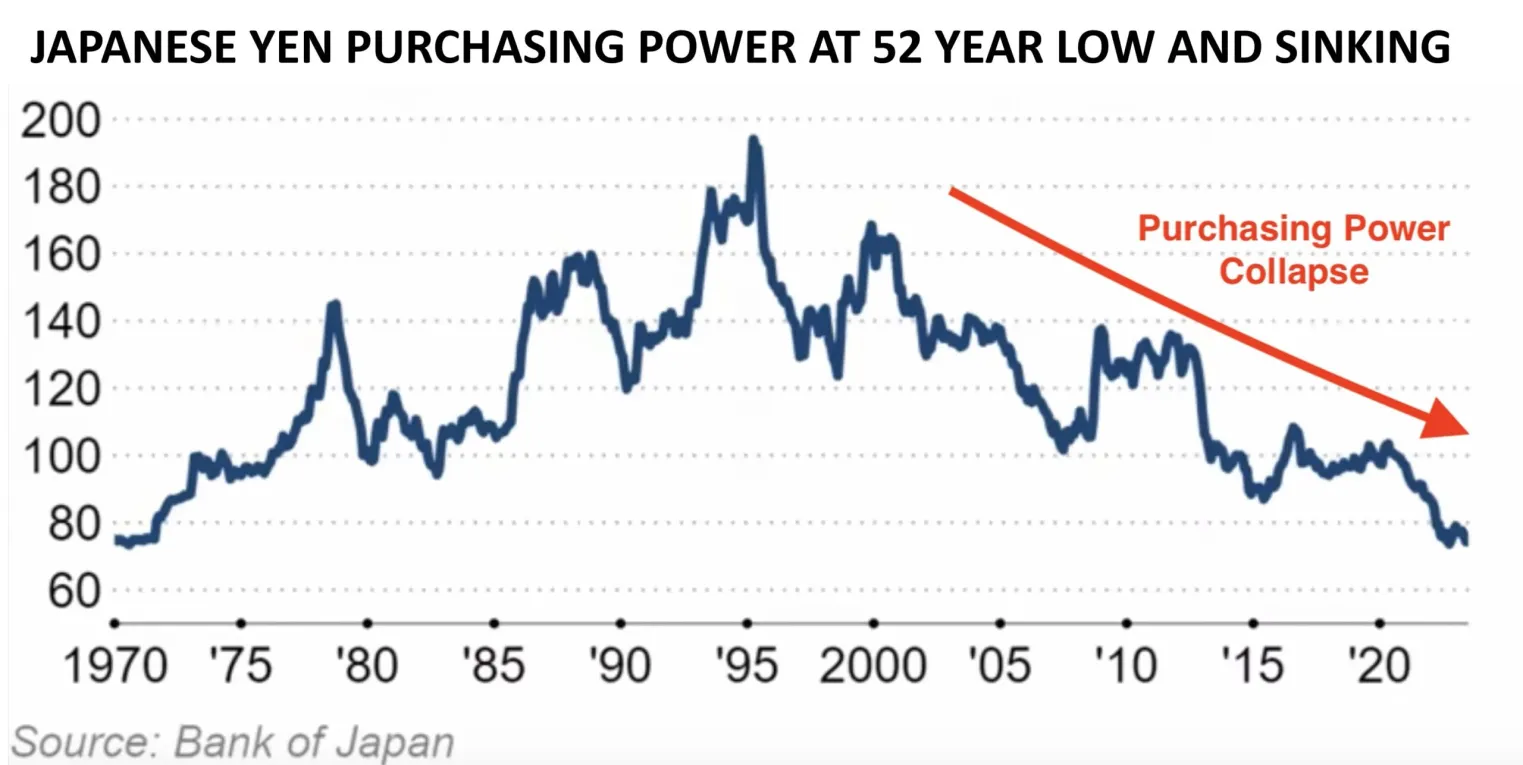

n the epicenter of Tokyo’s bustling streets, Japan’s Yen Crisis looms large. Over the past year, the Japanese Yen has witnessed a precipitous collapse, plummeting by a staggering 11.5 percent against the U.S. Dollar. Japan’s efforts to stem the crisis, including selling off U.S. Dollars, have yielded little success.

What makes this crisis particularly alarming is Japan’s heavy dependence on foreign imports, especially food, fuel, and manufacturing inputs, all priced in U.S. Dollars. Consequently, as the Yen’s value continues to erode, the cost of living in Japan skyrockets.

Updating Japan’s Current Economic Situation

The Japanese Yen has collapsed by over 11.5 percent against the U.S. Dollar in the current year.

Japan has sold over $127 billion worth of US Treasury bonds.

Japan’s inflation rate reached 3.3 percent for June and July.

The Yen’s buying power has dropped from its peak in 1995 back down to 1970s levels.

Japanese real wages fell for the 16th straight month in July.

The price of gold in Japanese Yen has appreciated by 75 percent since the lows in 2020.

The price of gold has surged by 18 percent since January.

U.S. inflation has gone up from 3.2 percent in July to 3.7 percent in August.

Japan’s current Benchmark rate is still at its 2016 levels of minus 0.1 percent.

Japanese exports fell by 0.3 percent in July.

Japan’s pivot away from U.S. treasuries could lead to higher borrowing costs for the United States.

A significant exodus from the U.S. bond market could occur if Japanese investors shift from U.S. treasuries to Japanese bonds.

Japan’s Yen Crisis Threatens the U.S. Treasury Market

While Japan grapples with its Yen Crisis, the U.S. Treasury market stands as one of its most significant casualties. Japan’s necessity to shed its bonds to bolster the Yen poses a grave threat. Should Japan decide to reverse its money printing strategy, the repercussions for the U.S. bond market could be dire.

This situation distinguishes itself from China’s treasury sell-off, driven more by economic imperatives than strategic motives. Japan’s actions are underscored by its astounding $127 billion in bond sales, surpassing even China’s treasury holdings.

The Bank of Japan’s Dilemma

At the heart of Japan’s Yen crisis is a strategy built on relentless money printing to stimulate its economy. The Bank of Japan (BOJ) actively purchases Japanese government bonds to suppress yields, intervening whenever they approach 0.5 percent.

Unlike the Federal Reserve, Japan appears to have no bounds to its money printing. Regrettably, the Japanese Yen bears the brunt of this approach. Goldman Sachs predicts that should the BOJ persist, the Yen could plunge by another 20 points against the U.S. Dollar, further exacerbating the plight of the Japanese populace.

The Looming U.S. Implosion Risk

Japan’s impending reversal could set off a chain reaction with profound global consequences. As Japan raises interest rates, Japanese investors may pivot from U.S. treasuries to Japanese bonds, triggering substantial currency exchange fluctuations.

This could lead to a mass exodus from the U.S. bond market, resulting in higher borrowing costs for the United States. In turn, this perfect storm might precipitate a banking crisis and a long-anticipated recession.

As Japan’s Yen Crisis continues to grow, the world watches with bated breath. The implications of this crisis extend far beyond Japan’s shores, reaching the United States and beyond.

The BOJ’s impending pivot may well be the event that reshapes the global financial landscape, making it a pivotal moment that brings us significantly closer to a Global Financial Reset and Revaluation.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/japans-yen-crisis-grows-and-its-coming-for-us/

Awake-In-3D: The United States is Racing Towards the Inescapable Death Trap of Debt Default

Awake-In-3D:

The United States is Racing Towards the Inescapable Death Trap of Debt Default

On September 5, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Inevitable Fiat Debt System Collapse is Unstoppable

The United States is hurtling towards an imminent collapse of its financial system, and time is running out. Do not be fooled by the currently rising stock markets, low unemployment, rising GDP, and declining core inflation statistics. All of these economic indicators will dramatically reverse over the coming months. These are the last dance-party moves on the proverbial Titanic as the waters engulf level after level of a sinking ship.

Awake-In-3D:

The United States is Racing Towards the Inescapable Death Trap of Debt Default

On September 5, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Inevitable Fiat Debt System Collapse is Unstoppable

The United States is hurtling towards an imminent collapse of its financial system, and time is running out. Do not be fooled by the currently rising stock markets, low unemployment, rising GDP, and declining core inflation statistics. All of these economic indicators will dramatically reverse over the coming months. These are the last dance-party moves on the proverbial Titanic as the waters engulf level after level of a sinking ship.

Given that our entire global monetary system is based on debt, the only thing to watch is the Bond Markets. As Central Bank interest rates continue to rise, all debt payments become increasingly more difficult to maintain. This includes government sovereign debt (Treasury Bonds), business debt (corporate bonds), commercial real estate debt, home mortgage debt, and credit card debt.

The stakes are high, and the consequences will usher in a total monetary system reset.

The following article is a breakdown of complex information, presented in a bulleted format, to help you better understand the critical situation currently unfolding in real time. It’s important to comprehend the impending crash of the fiat currency debt system and the inescapable death trap of financial death approaching.

Key Events in the USA’s Recent Financial Trajectory

The Fed bailed out the repo markets to the tune of hundreds of billions per week.

The Fed was printing inflationary money quicker than Nolan Ryan’s fastball.

America’s debt costs (interest expenses) skyrocketing into an unsustainable $ trillion/year category.

The U.S. has a $33 trillion bar tab.

Yields on US 10-Year USTs rose, impacting the interest expense on Uncle Sam’s debt.

UST supplies (and hence yields) were climbing at a rate not seen in 55 years.

The United States is hurtling towards an unprecedented debt death trap, analogous to a college frat boy recklessly spending on his rich uncle’s credit card. The nation’s ever-increasing deficit spending, rising interest rates, and mounting debt burdens are setting the stage for an inevitable crash of the fiat currency debt system.

Here is a summary of the dangerous trajectory the United States is on,

Deficit Spending and Rising Debt

The United States’ deficit spending is skyrocketing, akin to a frat boy’s extravagant party lifestyle fueled by unlimited credit.

The short-term benefits of deficit spending are overshadowed by long-term consequences that take time to manifest.

The growing deficits and debt burdens are pushing the nation closer to the edge of a debt default.

Rising Interest Rates and Fiscal Dominance

As GDP rises, the Federal Reserve’s response of hiking interest rates resembles the beer-goggle effect, blinding them to the reality of the situation.

The irony of the Fed’s attempt to combat inflation through rate hikes is that it often results in more inflation, leading to a case of “fiscal dominance.”

Rising rates not only stimulate short-term economic growth but also contribute to skyrocketing interest expenses on the nation’s debt.

The Inevitable Monetary Response

The need to cover mounting deficits by printing trillions of dollars out of thin air becomes increasingly evident.

This excessive money printing, intended to avoid a debt catastrophe, sets the stage for an inflationary spiral.

The tragic predictability of this response mirrors historical failures, akin to Pickett’s failed charge at Gettysburg.

Stagflation Looms Ahead

The likelihood of stagflation, a combination of inflation and stagnant economic growth, is becoming a future certainty.

Rising bond yields and rates will have deflationary effects on risk assets (stocks and foreign currency exchange trading), while Main Street economies struggle to refinance their loans previously acquired at much lower interest rates.

The US Dollar’s Fate and the Bond Market

The USD, like the stern of the Titanic, is on a trajectory from a temporary pause to a rapid descent towards the bottom.

The bond market, with yields acting as approaching shark fins, holds crucial implications for the USA’s fiat system financial stability.

Ignoring these looming dangers in favor of distractions only exacerbates the risks posed by the impending crash.

The United States finds itself hurtling towards an inescapable debt collapse, similar to a frat boy’s reckless spending spree. The combination of deficit spending, rising interest rates, and mounting debt burdens creates a dangerous trajectory. As we race towards an inevitable crash of the fiat currency debt system, it is crucial to acknowledge the severity of the situation and take proactive measures for the events ahead.

Supporting article: https://goldswitzerland.com/rising-gdp-rising-yields-a-major-sign-of-uh-oh/

Related articles:

Our GCR continues to draw ever closer. As the days tick by, the United States government’s financial landscape has been a cause for concern, as its spending patterns have led to an escalating debt crisis.

~~~~~~~~~~

Real-World Warning Signs Today of the Fiat Currency Debt System Collapse – Leading to Our RV/GCR

Amid the alarming trends signaling the impending collapse of the global fiat currency debt system, we look forward to a transformative solution that will revolutionize the financial landscape. My discussions and articles here have illuminated the concept of “Our GCR” as a beacon of hope in these uncertain times. This Asset-Backed Global Currency Reset isn’t just a theoretical concept; it’s beginning to unfold before our eyes.

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-united-states-is-racing-towards-the-inescapable-death-trap-of-debt-default/

Awake-In-3D: Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

Awake-In-3D:

Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

On September 5, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Oil Becomes a Weapon as BRICS and OPEC Flex Dominance Over Global Energy Supply – Expect Inflation to Soar Once Again

In a surprising turn of events, a new alliance formed by BRICS (Brazil, Russia, India, China, and South Africa) and OPEC (Organization of the Petroleum Exporting Countries) is reshaping the global energy landscape.

This alliance, which aims to challenge the dominance of Western economies, has weaponized oil as a means to assert their control over global energy supply resources.

As a result, the world is witnessing a surge in oil prices, raising concerns for Western economies and their inflationary pressures.

Awake-In-3D:

Global Energy War Begins as BRICS/OPEC Force Oil Towards $100/Barrel

On September 5, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

Oil Becomes a Weapon as BRICS and OPEC Flex Dominance Over Global Energy Supply – Expect Inflation to Soar Once Again

In a surprising turn of events, a new alliance formed by BRICS (Brazil, Russia, India, China, and South Africa) and OPEC (Organization of the Petroleum Exporting Countries) is reshaping the global energy landscape.

This alliance, which aims to challenge the dominance of Western economies, has weaponized oil as a means to assert their control over global energy supply resources.

As a result, the world is witnessing a surge in oil prices, raising concerns for Western economies and their inflationary pressures.

The shockwaves began when Saudi Arabia and Russia, two key players in the oil market, announced an unexpected extension of production cuts. Saudi Arabia, in a move that caught markets off guard, declared an extension of the voluntary cut of 1 million barrels per day (b/d) for an additional three months, till the end of December. This decision goes well beyond the initial market expectation of just one more month.

The Saudi press agency SPA emphasized that the voluntary cut would be reviewed monthly, allowing for the possibility of further reductions or increased production as deemed necessary. This extension is aimed at reinforcing the precautionary efforts made by OPEC countries to stabilize the oil market.

Following suit, Russia swiftly announced its commitment to extend its reduction of oil exports until the end of the year. As an added surprise, Russia pledged an additional 300kb/d in voluntary oil cuts, which will remain in effect until December 2023. This measure complements the voluntary reduction previously announced by Russia in April 2023, which will last until December 2024.

Similar to Saudi Arabia, Russia emphasized the monthly review of their production cuts, indicating their willingness to deepen the reductions or increase production based on the global market situation.

The impact of this unexpected alliance and their concerted efforts to manipulate oil supply has been profound. Brent Nov’23, a benchmark for global oil prices, surged above $90 for the first time in 2023.

Meanwhile, WTI Oct’23, the U.S. crude oil benchmark, reached its highest price of the year, shaking the hopes of the Federal Reserve for a decline in headline inflation. These price surges reflect the immense power that the BRICS and OPEC alliance wields over the global energy market.

Analysts and experts view this development as a strategic move by BRICS and OPEC to challenge the dominance of Western economies, particularly the United States.

The weaponization of oil demonstrates their determination to assert control over global energy supply resources and reshape the balance of power. By tightening production cuts and driving up oil prices, BRICS and OPEC seek to exert their dominance and weaken Western economies heavily reliant on energy imports.

This shift in global energy dynamics poses a significant challenge for Western economies, including the United States. President Biden, who recently sold a large portion of the U.S. strategic oil reserves, now faces the daunting task of refilling the Strategic Petroleum Reserve (SPR) amidst soaring oil prices.

With projections indicating that oil prices may reach $100, efforts to stabilize domestic energy supply and mitigate rising inflationary pressures become even more crucial.

As BRICS and OPEC forge ahead with their strategy of weaponizing oil, the financial world watches with a mix of anticipation and concern. The once-unassailable dominance of Western economies over global energy resources is being put to the test.

Whether these new alliances succeed in their pursuit of reshaping the energy landscape remains to be seen, but one thing is clear: oil has become a powerful weapon in their hands, capable of reshaping the balance of power in the global economy.

Supporting article: https://www.zerohedge.com/markets/oil-soars-new-2023-high-after-saudis-russia-surprise-extended-expanded-production-cut

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/global-energy-war-begins-as-brics-opec-force-oil-towards-100-barrel/