Awake-In-3D: Mind-blowing US Debt Growth Statistic

Awake-In-3D: Mind-blowing US Debt Growth Statistic

On July 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

US DEBT UP BY SAME AMOUNT IN LAST 5 YEARS AS THE FIRST 221 YEARS

The latest financial crisis started in September 2019 when the US banking system came under serious pressure and the Fed injected major liquidity into the near bankrupt system. Since that time, total US debt has increased by $21 trillion.

Let’s put this into perspective. It took the US 221 years to go from Zero debt in 1776 to $21 trillion in 1997 and just in the last 4 years, debt has gone up by that same $21 trillion.

Awake-In-3D: Mind-blowing US Debt Growth Statistic

On July 20, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

US DEBT UP BY SAME AMOUNT IN LAST 5 YEARS AS THE FIRST 221 YEARS

The latest financial crisis started in September 2019 when the US banking system came under serious pressure and the Fed injected major liquidity into the near bankrupt system. Since that time, total US debt has increased by $21 trillion.

Let’s put this into perspective. It took the US 221 years to go from Zero debt in 1776 to $21 trillion in 1997 and just in the last 4 years, debt has gone up by that same $21 trillion.

Whether this cycle is the end of a 100, 300 or 2000 year era, only future historians will know the answer to.

Awake-In-3D: PAPSS Payment System and AfreximBank Paving Way to Pan-African De-Dollarized Sovereignty

Awake-In-3D:

PAPSS Payment System and AfreximBank Paving Way to Pan-African De-Dollarized Sovereignty

On July 19, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

In a transformative effort, Africa’s financial landscape is undergoing a revolutionary shift, spearheaded by the African Import-Export Bank (AfreximBank) and its groundbreaking Pan-African Payment and Settlement System (PAPSS). This visionary initiative is rapidly propelling the entire African continent away from its historical reliance on US dollars and towards a future where local African currencies take center stage in intra-continental payments and capital investments.

Awake-In-3D:

PAPSS Payment System and AfreximBank Paving Way to Pan-African De-Dollarized Sovereignty

On July 19, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

In a transformative effort, Africa’s financial landscape is undergoing a revolutionary shift, spearheaded by the African Import-Export Bank (AfreximBank) and its groundbreaking Pan-African Payment and Settlement System (PAPSS). This visionary initiative is rapidly propelling the entire African continent away from its historical reliance on US dollars and towards a future where local African currencies take center stage in intra-continental payments and capital investments.

More than just a financial system upgrade, PAPSS and AfreximBank are playing a crucial role in aligning Africa with the ambitious plans of the BRICS Alliance. The BRICS nations are determined to create a massive global trading block that operates independently of the Western Financial System and Monetary Institutions, thereby unlocking Africa’s vast economic potential and fostering genuine financial sovereignty.

With Africa losing an estimated $5 billion annually due to the absence of an intra-African payment system, the need for change has become undeniable. Fragmented payment systems and multiple currencies have hindered cross-border trade within the continent, leaving businesses facing considerable currency exchange challenges and lengthy payment processing times. However, AfreximBank’s PAPSS is a game-changer that seeks to eradicate these obstacles, empowering African nations to conduct instant and secure cross-border transactions in local currencies.

As the African Continental Free Trade Area (AfCFTA) agreement opens up unprecedented opportunities for intra-African trade, the timing of PAPSS’s arrival could not be more opportune. By providing a reliable and cost-effective platform for intra-continental payments, PAPSS is set to fuel economic growth, bolster regional cooperation, and create new avenues for prosperity throughout Africa.

From promoting financial inclusion and empowering small and medium size businesses, to reducing sovereign debts and driving economic growth, the transformative impact of AfreximBank and PAPSS sets the stage for Africa’s financial renaissance on the global stage.

As Africa moves steadily towards becoming an economic powerhouse with the backing of the BRICS alliance, the future holds immense promise for a continent that is finally stepping out from the shadows of foreign currency dominance and embracing its own financial destiny.

Africa’s Intra-African Trade: Challenges and Opportunities

In recent years, the potential for intra-African trade has become a topic of intense discussion among policymakers, economists, and businesses across the continent. Africa is a vast and resource-rich continent with diverse economies, yet its trade with other African countries has been hindered by various challenges, including fragmented payment systems and the reliance on foreign currencies. As a result, the continent has been losing an estimated $5 billion annually, making intra-African trade complex and time-consuming.

The Absence of a Unified Payment System

The lack of a unified payment system has been a significant obstacle to intra-African trade. Africa currently boasts around 42 currencies, each with its own regulatory framework and exchange rates, making cross-border transactions cumbersome and expensive. Business transactions often require conversion from one currency to another, resulting in unnecessary costs and delays.

The Role of AfreximBank: Driving Financial Sovereignty

Recognizing the urgency and importance of addressing these challenges, the African Import-Export Bank (AfreximBank) has taken a pioneering role in reshaping Africa’s financial landscape. Established in 1993, AfreximBank has steadily grown its presence in 52 member countries and has been instrumental in supporting trade finance activities across the continent. Its mission of stimulating African trade and development has driven its commitment to promoting a single payment infrastructure for the continent.

Introducing the Pan-African Payment and Settlement System (PAPSS)

AfreximBank’s vision culminated in the development and commercial launch of the Pan-African Payment and Settlement System (PAPSS). PAPSS is a groundbreaking initiative aimed at enabling instant and secure cross-border payments in local African currencies, thereby reducing reliance on foreign currencies like the US dollar and Euro.

Yes, PAPSS uses the ISO20022 “messaging” standard for inter-bank transfer notifications.

Empowering Businesses with PAPSS

PAPSS provides a real-time payment infrastructure that connects Africa’s central banks, commercial banks, payment service providers, and fintech companies as participants. This revolutionary system allows for immediate validation, compliance checks, and near-instant payment processing within 120 seconds. With PAPSS, businesses can conduct cross-border transactions efficiently, securely, and at a reduced cost.

PAPSS and the African Continental Free Trade Area (AfCFTA)

PAPSS could not have come at a more opportune time. With the implementation of the African Continental Free Trade Area (AfCFTA) agreement, which aims to create a single market for goods and services across the continent, the demand for seamless cross-border transactions is set to skyrocket. PAPSS is poised to play a vital role in facilitating the expected surge in intra-African trade and promoting economic growth.

Driving Financial Inclusion and Empowerment

Beyond enhancing intra-African trade, PAPSS also has significant implications for financial inclusion. As cross-border payments become more accessible, businesses of all sizes can participate in regional and continental trade, stimulating economic growth and job creation. Moreover, PAPSS fosters economic empowerment by reducing transaction costs and improving financial efficiency, particularly for small and medium-sized enterprises (SMEs).

Africa’s Financial Renaissance Begins

Africa’s financial system is on the cusp of a transformative shift, one that will see it moving away from reliance on foreign currencies and embracing the power of its local currencies. AfreximBank’s Pan-African Payment and Settlement System (PAPSS) is a critical step towards achieving this financial sovereignty, unlocking the continent’s vast economic potential, and driving intra-continental trade.

As businesses, governments, and individuals embrace this new era of financial empowerment, Africa’s financial renaissance will become a catalyst for economic growth and prosperity for all.

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: Checkmate (Part 3) – A Currency Duel to Avert a Real War

Awake-In-3D

Checkmate (Part 3) – A Currency Duel to Avert a Real War

On July 19, 2023 By Awake-In-3D

Continued from the Checkmate Series Part 1 and Part 2

In this final article of my three-part Checkmate series, I examine the key players on the chessboard, their roles and motivations, and the significant economic consequences that the Western fiat system players will face if the new Eastern Alliances establish and launch a gold-backed currency. My conclusion is that dueling financial system currency systems is a far more acceptable and stable solution that would likely prevent a actual, real kinetic war. Leading to Our GCR.

Awake-In-3D:

Checkmate (Part 3) – A Currency Duel to Avert a Real War

On July 19, 2023 By Awake-In-3D

Continued from the Checkmate Series Part 1 and Part 2

In this final article of my three-part Checkmate series, I examine the key players on the chessboard, their roles and motivations, and the significant economic consequences that the Western fiat system players will face if the new Eastern Alliances establish and launch a gold-backed currency. My conclusion is that dueling financial system currency systems is a far more acceptable and stable solution that would likely prevent a actual, real kinetic war. Leading to Our GCR.

China’s Role as the “Tactical” Game Player

As tensions escalate, China remains strategically prepared to join the financial war. China has been cautious in destabilizing the dollar to protect its export interests, but now it recognizes the threat to emerging economies, particularly those in Africa and Latin America. Embracing a gold-backed currency and a preemptive attack on the dollar would align with China’s motivations to safeguard its economic interests.

As the BRICS nations lay the groundwork for a gold-backed trade currency that challenges the dominance of the dollar, China’s strategic response becomes crucial in this unfolding global economic transformation.

In this article, we explore how China has carefully assessed the economic consequences of the proposed gold-backed currency and its potential impact on the US dollar. Drawing from the analysis of General Qiao Liang, a high-ranking figure in China’s military intelligence, we uncover China’s motivations and strategies to preemptively counter the perceived threats against emerging economies. With China ready to mount an attack on the dollar by embracing a gold standard, the balance of power in the global financial landscape may soon experience a seismic shift.

Assessing the Threat

China has long been threatened by the US over access to markets, but with the advent of the BRICS gold-backed currency proposal, the stakes have been raised. However, China appears to have anticipated potential economic consequences and evaluated the experiences of nations like Russia during periods of sanctions. General Qiao Liang’s analysis sheds light on the US’s previous actions with respect to foreign national debts, indicating a pattern of weakening and destabilizing economies through strategic manipulation of interest rates.

A Target on Dollar-Indebted Nations

While China itself does not rely on borrowing dollars, it recognizes that the real threat lies in the impact on dollar-indebted nations that participate in trade with China. The US’s likely strategy of raising interest rates even after taming inflation could aim to bring these nations back under American control. This poses a significant challenge for emerging economies in Africa, Latin America, and other regions that have received substantial Chinese investment.

The Preemptive Attack on the Dollar

To address this potential threat, China has devised a preemptive attack on the dollar by exposing its weakness as a fiat currency. With the power to do so since the Lehman crisis, China and Russia now have the means to challenge the dollar’s status quo. As they plan a return to the gold standard for trade and their own currencies, the BRICS nations seek to counter the US’s strategy of “harvesting” assets in foreign countries.

The Role of the New Development Bank

The New Development Bank, headquartered in Shanghai, is poised to play a pivotal role in China’s response. Offering credit in yuan or the new BRICS currency at lower interest rates, the bank can help alleviate the strains imposed on BRICS members by rising US interest rates. This strategic move strengthens the BRICS’ position and enhances their ability to withstand potential sanctions.

China’s Motivation and Strategy

Understanding China’s motivations and strategies is vital to grasp the implications of this evolving economic landscape. While some may question General Qiao Liang’s analysis, it is evident that his views are ingrained in China’s government thinking. This positions China to join forces with Russia in a concerted attack on the dollar’s fiat nature and advocate for a return to a gold standard for trade, thereby challenging the existing global financial order.

As the BRICS nations lay the groundwork for a new gold-backed trade currency, China’s proactive response becomes a critical factor in the unfolding global economic transformation. By assessing potential threats and drawing insights from General Qiao Liang’s analysis, China is prepared to counter the US’s strategies aimed at emerging economies. Embracing a gold standard for trade and their currencies, China and Russia signal their readiness to challenge the dominance of the dollar and push for a more equitable and stable financial system. The stage is set for a momentous shift in the global economic landscape, with gold re-assuming its ancient role as a bedrock of value and stability in an ever-changing financial world.

Russia’s Role as the “Strategic” Game Player

The world stands at the precipice of a potential global conflict as tensions escalate between Russia, America, and their respective allies. While the focus has primarily been on military maneuvers and proxy wars, a new front is emerging – a financial war with far-reaching implications. In this article, we explore the origins of the current trade currency plans, which originated in Russia, and the role of China as events unfold. As NATO tightens its grip on Eastern Europe, Putin faces an intractable dilemma, with compromise seemingly impossible. To avert a catastrophic global conflict, Russia appears to prioritize undermining the dollar’s dominance, while China is ready to join in this strategic battle. A financial war may offer a way forward, but the consequences for the global economy remain uncertain.

The Genesis of the New Trade Currency Plan

The idea of a new trade currency with a gold-backed system originated in Russia, marking a shift in focus away from China. Until recently, China hesitated to destabilize the currencies of Western nations due to her significant export interests. However, escalating tensions over Taiwan, coupled with America’s plans to raise interest rates and bankrupt BRICS members, have led to a dramatic deterioration in Sino-US relations. The specter of direct conflict between Russia and America over Ukraine and China’s potential entanglement in a Taiwan conflict makes it imperative to avert World War 3.

NATO’s Determination and Russia’s Response

NATO, under the influence of the US, is determined to defeat Russia, remove Putin from power, and gain control of Russia’s vast natural resources. Proxy wars, such as the one in Ukraine, have so far failed to achieve NATO’s goals. As the theater of operational strategy shifts to Poland and the Baltics, the build-up of military personnel and missiles in the region becomes evident. Putin is unlikely to accept compromise, as it would require withdrawing missiles and American bases from Eastern and Central Europe, a non-negotiable condition for Russia’s security.

A Conundrum for the Biden Administration and America

For President Biden, backing down in Eastern Europe would carry severe political consequences, especially after the Afghanistan withdrawal. The influence of neo-conservatives in American policy-making adds further pressure to defeat Putin, expand US influence, and isolate China. Russia’s peace terms are unacceptable to America, leaving both sides at a standstill with potential dire consequences.

Undermining the Dollar’s Dominance

Given the impasse, Russia’s priority seems to be undermining the dollar’s dominance, presenting an economic front to counter America’s aggression. Attacking the dollar financially could weaken the alliance’s military capabilities and create divisions among its members. Additionally, a Russian attack on currencies’ credibility would benefit Russia’s financial position, which is already facing pressure.

The Uncertain Outcome

Engaging in a financial war offers a relatively discreet option, avoiding an official declaration of victory or the need for post-war reconciliation. While it remains unclear whether undermining the dollar would avert a nuclear conflict, it is evident that the world teeters dangerously close to the brink. The consequences for the global economy are uncertain, and the potential for price inflation and financial instability looms large.

As geopolitical tensions reach boiling point, the prospect of a financial war emerges as an alternative to direct conflict. Originating in Russia and embraced by China, this unconventional approach aims to undermine the dollar’s dominance and challenge America’s aggression indirectly. A delicate balance hangs in the air, and the global economy faces an uncertain future. Averting World War 3 requires careful navigation, with the financial landscape becoming an uncharted battleground in the struggle for power and control. The coming days will reveal whether a financial war can offer a reprieve or if the world inches ever closer to catastrophe.

Golden Stability: A New Currency System to Prevent Further Physical Conflict Escalation

Amidst escalating global tensions, the proposal for a new gold-backed trade currency gains momentum. Originating in Russia and designed to facilitate cross-border trade settlement, this currency aims to provide a stable, institutionally acceptable alternative to fiat currencies. With the groundwork laid by Sergei Glazyev, the currency could soon become a reality, pending approval in August. Let’s examine the key elements of this new currency and its potential impact on participating nations, focusing on long-term practicality and the preservation of economic stability. As the stage is set for a financial transformation, the focus shifts to gold as the foundation for a new era of secure and credible trade finance.

Building a Politically Acceptable, Inclusive and Peaceful Solution

The proposed trade currency is strategically designed to garner support from all involved nations and alliances serving as a practical solution for realizing the ambitions of the Russian-Chinese axis. By facilitating an Asian industrial revolution encompassing Africa and Latin America, free from external interference, the new, gold-backed currency aligns with the aspirations of all participating countries.

A Path to Non-Inflationary Economic Growth

The new trade currency aims to provide a foundation for trade finance and cross-border settlements based on sound money principles. By tying credit growth to economic activity and gold, the currency seeks to avoid inflationary consequences and maintain purchasing power. Gold’s role as a substitute will impart pricing certainty to trade and investment, leading to stable, low-interest rates and fostering economic development in emerging economies.

Potential for Greater Currency Stability

Participating nations may place greater emphasis on their own currencies’ stability, seeking a safe haven from the consequences of the dollar’s fiat nature. As the new currency gains acceptance, Russia may consider returning the ruble to its own gold standard, with China potentially following suit with the renminbi.

An Inherent Currency Resilience

Designed with a 40% gold backing, the new currency adheres to the principles set by Sir Isaac Newton, providing a metallic monetary standard. As confidence in the scheme grows, participating central banks may retain minimal gold reserves, swapping the balance for the new currency. This approach would bolster their balance sheet equity and add to the currency’s credibility.

The proposal for a new gold-backed trade currency heralds a potential financial transformation in cross-border trade and settlement. Designed to be politically acceptable and practical for participating nations, the currency promises a path to non-inflationary economic growth and greater currency stability. By placing gold at the heart of the financial system, this currency seeks to safeguard against the pitfalls of fiat currencies and usher in a new era of financial stability. As August approaches, the world awaits the outcome of this groundbreaking proposal and its potential to redefine global finance.

The Consequences for Western Fiat Currencies and Their Debt System

The historical relationship between money and gold has been undeniable, with gold serving as the anchor of value for centuries. However, the detachment of credit from gold in recent times has had profound consequences for the global financial system. Let’s examine the implications of reintroducing gold into currency systems, particularly in the context of a new BRICS gold-backed currency. As the Asian superpowers seek stability and independence from fiat currencies, a seismic shift in the global economic landscape is imminent. Yet what will be the potential effects on major currencies, economies, interest rates, as gold returns to its rightful place in the financial world?

The Historical Gold-Dollar Divergence

In the post-Bretton Woods era, fiat currencies have steadily lost value relative to gold, exemplified by the dollar’s 98% depreciation. The erosion of purchasing power has surpassed the 2% annual target set by official policies, underscoring the importance of gold as a stable medium of exchange. The potential introduction of a new gold-backed BRICS currency could accelerate the devaluation of fiat currencies, triggering a race for tangible assets and further undermining their credibility.

The Underappreciated Role of Gold in Financial Markets

Throughout history, gold’s role as money has been poorly understood in financial markets, leading to misguided assumptions about its true value. Despite being treated as a trading counter, gold’s return as the anchor for credit values among Asian hegemons will force a reassessment of its significance. The move towards a gold-backed currency will bring stability to export values and create a conducive environment for low-interest rates, benefiting the economies of participating nations.

Significant Implications for Western Fiat Currencies

The introduction of a BRICS gold-backed currency will have far-reaching consequences for western fiat currencies, including the dollar, euro, and pound.

The Dollar’s Predicament: The reliance on inward foreign investment has enabled the US to fund continuous trade deficits and government debt. However, a shift to a gold-backed currency could lead to central banks exchanging their dollar reserves for the new currency, triggering devaluation and foreign liquidation of Treasuries. Rising bond yields and funding costs for the government are inevitable, posing significant funding hurdles.

Eurozone Turmoil: A gold-backed BRICS currency may drive Germany towards sound money regimes, exacerbating economic and political divisions within the eurozone. The euro’s credibility, already strained, will face further challenges, leading to potential recapitalization needs for the ECB and national central banks.

The UK’s Dilemma: The UK, burdened with a debt trap similar to the US, also suffers from increasing taxes and limited gold reserves. As the international financial center, London will be at the epicenter of the fiat currency crisis, complicating any efforts to escape the fiat currency trap.

The Call for a Return to “Classical” Economics

The emergence of a gold-backed currency and its implications will expose the inadequacy of Keynesian (constant fiat currency creation out of thin air) macroeconomics, which has shaped policies during the fiat currency era. Western governments must embrace classical economic theories and adapt swiftly to the changing economic landscape. The combination of credit crunch from the bank credit cycle and deteriorating fiat currency purchasing power will lead to rising interest rates, challenging the traditional control exerted by central banks.

Wrap Up

The return of gold as a cornerstone of the global financial system signifies a momentous shift in the balance of economic power. The introduction of a BRICS gold-backed currency and potential adoption by Russia and China could lead to a cascading effect on fiat currencies worldwide. As investors seek tangible assets and foreign exchanges witness a weakening of major fiat currencies, The United States, Europe and other Western governments will be forced to reassess their debt-based economic and monetary policies.

This transition will require a departure from Keynesian economics and a return to classical, sound money principles, laying the groundwork for a resilient, fair and stable global financial economic landscape.

This would be Our GCR.

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/checkmate-part-3-a-currency-duel-to-avert-a-real-war/

Awake-In-3D: Checkmate (Part 2) – A Global US Dollar Divorce and Re-Monetizing Gold to Support Our RV/GCR

Awake-In-3D:

Checkmate (Part 2) – A Global US Dollar Divorce and Re-Monetizing Gold to Support Our RV/GCR

On July 18, 2023 By Awake-In-3D

Continued from Checkmate (Part 1)

The world’s financial landscape is undergoing a seismic shift, departing from the traditional US dollar-centric system towards a multi-polar era.

In this new epoch, various currencies are vying for dominance, and central banks are exploring innovative solutions such as central bank digital currencies (CBDCs). This tectonic movement is driving a re-monetization of gold and fueling speculation of gold’s revaluation against existing fiat currencies, particularly the US dollar and the Euro. In this latest installment of my “Checkmate GCR” article series, we explore the reasons and facts behind this global transition, and how it could reshape the entire monetary order.

Awake-In-3D:

Checkmate (Part 2) – A Global US Dollar Divorce and Re-Monetizing Gold to Support Our RV/GCR

On July 18, 2023 By Awake-In-3D

Continued from Checkmate (Part 1)

The world’s financial landscape is undergoing a seismic shift, departing from the traditional US dollar-centric system towards a multi-polar era.

In this new epoch, various currencies are vying for dominance, and central banks are exploring innovative solutions such as central bank digital currencies (CBDCs). This tectonic movement is driving a re-monetization of gold and fueling speculation of gold’s revaluation against existing fiat currencies, particularly the US dollar and the Euro. In this latest installment of my “Checkmate GCR” article series, we explore the reasons and facts behind this global transition, and how it could reshape the entire monetary order.

The once-unchallenged supremacy of the US dollar in the global financial system is beginning to wane. As Zoltan Poszar, the former Credit Suisse expert, points out, we are witnessing a “monetary divorce” from the US dollar hegemony, leading to a more multi-polar world. This shift is driven by factors such as de-dollarization, the rise of central bank digital currencies, and the strategic goals of nations to reduce dependency on the dollar and diversify their reserves.

What You Will Learn Here in Part 2:

De-dollarization in a multi-polar financial world

The re-monetization and re-valuation of gold in the changing financial system landscape

Gold’s increasing importance in a changing geo-economic landscape

Central bank digital currencies (CBDCs) as a potential game-changer

The rise of correspondent central banks and its implications

De-dollarization and a Multi-polar World

The concept of “Bretton Woods III” signifies a shift away from the traditional unipolar world, dominated by the US dollar. Instead, the global economy is embracing a multi-polar approach, where various currencies gain significance. This paradigm shift is driven by Western countries seeking to reduce reliance on Chinese supply chains and Eastern nations aiming to de-risk their relationships with Western financial institutions and the US dollar.

Re-monetization of Gold

One of the key themes emerging in this monetary divorce is the resurgence of gold as a viable monetary asset. Nations that are not geopolitically aligned with the US are increasingly diversifying their reserves and shunning US Treasuries in favor of gold. This trend indicates a growing desire to achieve monetary sovereignty and distance themselves from the uncertainties associated with the US dollar.

The re-monetization of gold is a compelling aspect of the ongoing transition towards a multi-polar world and away from the US dollar-centric global financial system. As countries seek monetary sovereignty and reduce their dependence on the dollar, gold emerges as a strategic and time-tested asset, capable of providing stability and protection amidst economic uncertainties.

While the potential revaluation of gold against existing fiat currencies remains speculative, the growing demand for gold from central banks and the strategic moves made by countries to diversify their reserves speak volumes about gold’s allure in the changing financial landscape.

As the world navigates this transformative period, the role of gold in the global economy may continue to evolve, opening new possibilities and challenges. The journey towards a more multi-polar financial system is underway, and gold’s glimmering path to stability and security is one that warrants close attention from policymakers, investors, and financial observers alike.

Re-valuation of Gold Against Fiat Currencies

As the global fiat currency debt system undergoes a monetary divorce from the US dollar, speculation is rife about a potential revaluation of gold against existing fiat currencies, especially the US dollar and the Euro.

The increasing demand for gold from central banks and the growing trend of countries buying gold instead of accumulating dollars suggest a possible shift in the relative value of gold compared to fiat currencies. If this trend continues, it could lead to a reassessment of gold’s worth in relation to traditional paper currencies.

While it is essential to approach these possibilities with caution, the re-monetization of gold and the shifting dynamics of the global financial system warrant careful observation. Gold’s historical significance and its intrinsic value make it an asset that cannot be easily dismissed, and its potential revaluation may have far-reaching consequences for the entire monetary order.

Gold as a Strategic Hedge

The changing dynamics of global trade and finance have led countries to rethink their approach to financial security. With the re-monetization of gold, central banks can diversify their holdings and insulate their economies from potential shocks in the global financial system.

Moreover, as the world moves toward a multi-polar approach to currencies, gold emerges as a valuable hedge against currency fluctuations. This flexibility grants nations greater control over their financial destiny and mitigates risks associated with over-reliance on a single currency.

Central Bank Digital Currencies (CBDCs) as Cross-border Payment Game-changers

CBDCs represent a disruptive force in the global financial system. As countries explore the possibilities of creating their own digital currencies, the need for correspondent central banks arises. This network of correspondent central banks could potentially provide an alternative system for international transactions, lessening dependence on Western financial centers and the US dollar.

Correspondent central banks may soon become an integral part of the international financial system. By facilitating direct settlement of transactions between central banks, they offer an alternative to the current dollar-based system. This shift could have profound implications for dollar funding and rates markets.

For instance, CBDCs can play a significant role in boosting the internationalization of the Chinese Renminbi (RMB). Countries planning or piloting CBDCs are often linked to the People’s Bank of China (PBOC) through swap lines. The growing share of RMB in trade finance and commodity settlements suggests that the currency’s importance will likely increase in the years to come.

What it Means

The global fiat currency debt system is indeed experiencing a monetary divorce from the US dollar. As countries diversify their reserves and explore alternatives like central bank digital currencies, gold is poised to regain its historical status as a monetary anchor. The emergence of a multi-polar world is reshaping the financial landscape, creating a catalyst for gold to be revalued against existing fiat currencies, particularly the US dollar and the Euro.

As we navigate this transformative period in monetary history, it is crucial to understand the factors propelling this shift and the potential consequences for the global financial system. The journey ahead is both uncertain and full of promise, and the revaluation of gold may be the fulcrum upon which the future of the global economy pivots.

To be continued in Checkmate (Part 3) …

Related Articles:

Checkmate (Part 1) – How the BRICS Gold Currency will Force USA/Europe to an RV/GCR

The Global Financial System is Being Restructured to Create a New Asset-Backed Currency System

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: Checkmate (Part 1) – How the BRICS Gold Currency will Force USA/Europe to an RV/GCR

Awake-In-3D:

Checkmate (Part 1) – How the BRICS Gold Currency will Force USA/Europe to an RV/GCR

On July 17, 2023 By Awake-In-3D

The introduction of the new gold-backed currency by the BRICS nations represents a pivotal moment in global finance, setting the stage for a potential seismic shift that could ultimately force the United States and Europe to adopt their own gold-backed currencies. As the BRICS consortium spearheads this move towards a sound money system, the impact on major fiat currencies, particularly the US dollar and the Euro, is bound to be profound.

The emergence of a credible gold-backed currency challenges the very foundation of the global fiat currency debt system, which has been plagued by persistent devaluation and erosion of purchasing power. With participating central banks exchanging their reserve dollars for the new gold-backed currency, the dollar’s devaluation is inevitable, prompting foreign entities to reduce their exposure to the beleaguered fiat currency.

Awake-In-3D:

Checkmate (Part 1) – How the BRICS Gold Currency will Force USA/Europe to an RV/GCR

On July 17, 2023 By Awake-In-3D

The introduction of the new gold-backed currency by the BRICS nations represents a pivotal moment in global finance, setting the stage for a potential seismic shift that could ultimately force the United States and Europe to adopt their own gold-backed currencies. As the BRICS consortium spearheads this move towards a sound money system, the impact on major fiat currencies, particularly the US dollar and the Euro, is bound to be profound.

The emergence of a credible gold-backed currency challenges the very foundation of the global fiat currency debt system, which has been plagued by persistent devaluation and erosion of purchasing power. With participating central banks exchanging their reserve dollars for the new gold-backed currency, the dollar’s devaluation is inevitable, prompting foreign entities to reduce their exposure to the beleaguered fiat currency.

This run on the dollar into gold echoes the events following the suspension of Bretton Woods in 1971, when the market initially seemed unperturbed before the implications became evident, and gold’s price skyrocketed.

As a gold-backed currency gains traction in the BRICS nations and beyond, it becomes increasingly evident that the reliance on fiat currencies for trade and investment is unsustainable. The need for economic stability, interest rate certainty, and a sound monetary foundation will drive the US and Europe to seriously consider adopting their own gold-backed currencies. The revaluation of all international fiat currencies under a balanced, asset-backed monetary system will become increasingly attractive, offering protection against inflation and fostering genuine economic progress.

Such a Global Currency Reset would herald a new era of financial responsibility and prudence, ensuring that currencies are backed by tangible assets and not subject to the whims of central banks. Investors and nations worldwide would be more inclined to adopt gold as a safe haven, adding further pressure on the US and Europe to transition towards a sound money system. As the world witnesses the success of the gold-backed currency model in the BRICS nations, the momentum for a global adoption of this monetary framework would become irresistible, ushering in a new era of financial stability and prosperity for all economies on a level playing field.

The Proposed BRICS Gold-Backed Currency Threatens the Western Fiat Debt System

The emergence of a new gold-backed currency by the BRICS nations presents a serious challenge to the global fiat currency debt system. As the foundation of this alternative currency is laid, the stage is set for gold’s revaluation against existing fiat currencies, particularly the US dollar and the Euro. The mechanics behind the establishment of the gold-backed currency and its potential implications for major currencies, economies, interest rates, and investor behavior are critical aspects to consider in understanding this paradigm shift in the global financial landscape. Policymakers and investors alike must reassess their economic strategies to adapt to the forthcoming changes, making way for a more resilient and stable financial future.

This multi-part article details the impending challenge to the global fiat currency debt system posed by the emergence of a new gold-backed currency. As the BRICS nations lead the way in introducing this alternative, the global financial landscape is set for a seismic shift, with gold poised to be revalued against existing fiat currencies, especially the US dollar and the Euro. This comprehensive analysis highlights the mechanics behind the establishment of the new gold-backed currency and its potential impact on major currencies, economies, interest rates, and investor behavior.

Key Details to be Unpacked in this Article Series

The Global Fiat Currency Debt System:

The historical detachment of credit from gold and its consequences for the global financial system.

The devaluation of fiat currencies relative to gold since the end of the Bretton Woods system.

The implications of the 2% annual target for currency purchasing power and its actual erosion.

The Emergence of a New Gold-Backed Currency:

The role of the BRICS nations in leading the transition towards a gold-backed currency.

The significance of gold as a stable medium of exchange in contrast to fiat currencies.

The potential consequences for western fiat currencies, including the US dollar, euro, and pound.

Understanding the Mechanics:

The mechanics of how participating central banks will exchange reserve dollars for the new gold-backed currency.

The devaluation of the dollar as central banks and foreign entities seek to reduce exposure.

The impact on interest rates, bond yields, and funding costs for the US government and other western nations.

Reassessing Economic Policies:

The need for western governments to embrace classical economic theories amid the changing economic landscape.

The potential challenges for the Eurozone and the credibility of the euro.

The implications for the UK pound and its limited gold reserves.

Gold as the Anchor for Credit Values:

The historical under-appreciation of gold’s role in financial markets and its return as a key anchor for credit values.

The stability gold-backed currencies can bring to export values and interest rates.

The impact on the global financial system and investor behavior as gold becomes a sought-after asset.

Checkmate (Part 1): The Rise of a New Gold-Backed Currency Challenging the Global Fiat Debt System

As the world’s major economies join forces to challenge the dominance of the dollar and the euro, a groundbreaking announcement has gone largely unnoticed by mainstream media. Russia and China, determined to break free from the grip of fiat currency, are laying the groundwork for a new gold-backed trade currency that will revolutionize the global financial landscape. In this article, we delve into the mechanics behind this ambitious project, exploring how it could reshape the global economy and bring about a revaluation of gold against existing fiat currencies, particularly the US dollar and the Euro. As the movement gains momentum and key alliances are formed, we may soon witness the dawn of a new era, one where gold re-assumes its ancient role as a bedrock of value and stability in the ever-changing financial world.

The idea of a new gold-backed currency has recently been propelled into the limelight by an announcement made during a BRICS meeting in Johannesburg. The proposal, which aims to create a currency supported by 41 influential economies, poses a significant threat to fiat currencies, particularly the US dollar and the Euro. While mainstream media has largely ignored this development, it carries immense implications for the global financial system.

Why a Gold-Backed Currency is Desirable

The appeal of a gold-backed currency lies in its potential to undermine fiat currencies, which have often been detrimental to oil-producing nations. Additionally, individuals holding gold are expected to experience an increase in wealth. The decision to introduce such a currency, supported by BRICS members Brazil, Russia, India, China, and South Africa, carries implications far beyond their immediate borders.

The Evolution Away from Fiat

The shift away from fiat currency has been underway for quite some time, with de-dollarization being a key objective for Asian economic giants. Observers have noticed a steady migration of gold from the West to the East, with China and Russia increasing their gold mine output and central banks across Asia accumulating substantial gold reserves. This accumulation indicates a concerted effort to safeguard their currencies in the face of a potential demise of the US dollar.

The Role of Sergei Glazyev

Sergei Glazyev, a key figure in Russia’s macroeconomic policy, has been instrumental in laying the groundwork for the gold-backed currency project. As a board member of the Eurasian Economic Union Commission, Glazyev was entrusted by Putin to design a trade settlement currency for the EAEU. His early proposals involved a basket of commodities, but it became clear that gold would be the most practical and stable solution.

A Trojan Horse for Something Bigger

What may have initially seemed like a currency proposal limited to the SCO and EAEU members has expanded to include BRICS nations. The ambitious plan aims to create a supersized trading block, combining the SCO, EAEU, and BRICS. With their combined population and GDP, this formidable alliance poses a significant challenge to the Western alliance’s hegemony, centered around the US dollar.

The US Treasury’s Response

The US Treasury has been quick to respond to the potential threat posed by the gold-backed currency. Janet Yellen, the US Treasury Secretary, flew to Beijing to discuss the implications of the proposal and its potential impact on the US economy. The US is wary of any shift away from the dollar’s dominance, as it could impact their ability to finance budget deficits and influence global trade.

The Mechanics of the Gold-Backed Currency

The successful implementation of a gold-backed currency requires meticulous planning and cooperation among the participating nations. While some skeptics dismiss the idea, citing practical challenges and a lengthy timeline, others believe that events will unfold more rapidly than anticipated.

Creating the Foundation

Before introducing the new currency, the participating nations must lay the foundation for its smooth operation. This includes setting up the necessary institutions and mechanisms for trade settlement, currency exchange, and gold storage.

Gold Reserves and Valuation

A key aspect of the new currency is its gold backing, which must be substantial enough to inspire confidence and provide stability. The participating nations will need to increase their gold reserves, and the value of gold against existing fiat currencies, particularly the US dollar and the Euro, will need to be reevaluated.

Consolidating Trade Partners

To ensure the success of the gold-backed currency, the participating nations must consolidate their trade partnerships. By forming a formidable bloc that encompasses most of Asia, Africa, and Latin America, they can collectively challenge the dominance of the dollar and the Euro in global trade.

Challenges and Opportunities

Implementing a new gold-backed currency will not be without challenges. Some of the hurdles include convincing member states to participate fully, managing currency exchange rates, and navigating potential geopolitical conflicts. However, the benefits of a stable, gold-backed currency could far outweigh the challenges, leading to increased economic resilience and global influence.

What It Means

The rise of a new gold-backed currency supported by influential economies such as China and Russia poses a serious challenge to the global fiat currency debt system. As the groundwork for this ambitious project is laid, it is becoming increasingly clear that events will unfold more rapidly than anticipated. This currency shift could lead to the revaluation of gold against existing fiat currencies, particularly the US dollar and the Euro, while also reshaping the global economic landscape. Whether this new gold-backed currency will emerge as a formidable challenger to the existing financial order remains to be seen, but its potential implications cannot be ignored. As the world moves towards a new era of monetary policies, one thing is certain: the reintroduction of gold as a bedrock of value and stability has always supported economic prosperity, equal opportunity and wealth creation in free-market financial systems.

To be continued in Checkmate (Part 2) …

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/checkmate-part-1-how-the-brics-gold-currency-will-force-usa-europe-to-an-rv-gcr/

Awake-In-3D: ENDGAME (Part 2) – United States Drowning in Debt Tsunami

Awake-In-3D:

ENDGAME (Part 2) – United States Drowning in Debt Tsunami

On July 15, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

[ Continued from: Endgame (Part 1) ]

As interest rates skyrocket and the United States careens towards a debt tsunami, shocking evidence reveals an alarming reality. With a record-breaking $652 billion in gross debt interest already accumulated in just nine months, the nation grapples with a 25% surge compared to the previous year.

The Federal Reserve’s frantic attempts to rectify its past mistakes have only fueled the deficit, with interest rates soaring and borrowing costs escalating. Brace yourself for the catastrophic consequences as interest payments on the staggering $32.3 trillion debt threaten to surpass major government expenditures. The United States stands at the precipice of financial ruin, demanding immediate action to save the sinking ship.

Awake-In-3D:

ENDGAME (Part 2) – United States Drowning in Debt Tsunami

On July 15, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

[ Continued from: Endgame (Part 1) ]

As interest rates skyrocket and the United States careens towards a debt tsunami, shocking evidence reveals an alarming reality. With a record-breaking $652 billion in gross debt interest already accumulated in just nine months, the nation grapples with a 25% surge compared to the previous year.

The Federal Reserve’s frantic attempts to rectify its past mistakes have only fueled the deficit, with interest rates soaring and borrowing costs escalating. Brace yourself for the catastrophic consequences as interest payments on the staggering $32.3 trillion debt threaten to surpass major government expenditures. The United States stands at the precipice of financial ruin, demanding immediate action to save the sinking ship.

What You Will Learn Here in Part 2

The United States is already accumulating a record-breaking $652 billion in gross debt interest in the first nine months of the current fiscal year.

This figure represents a staggering 25% increase compared to the interest expense payment in the same period a year ago, reaching $521 billion.

Soaring interest rates, driven by the Federal Reserve’s attempt to rectify its policy failure of keeping rates at zero for too long while injecting trillions into asset bubbles, have been a key driver of the deficit.

The Federal Reserve has raised its benchmark rate by 5% since March last year, resulting in higher borrowing costs for the US government.

As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on newly issued debt obligations.

The weighted average interest for total outstanding debt has risen from 1.80% to 2.76% within a year, and it could surpass 4% in one year if rates continue to rise.

If interest rates continue to climb, interest payments on the total US debt of $32.3 trillion could reach $1.3 trillion within 12 months, potentially surpassing other major government expenditures such as social security.

The United States is facing an imminent financial debt disaster, as evidenced by alarming figures in the latest Treasury Monthly Statement. This article delves into the definitive evidence that highlights the severity of the situation. The key factors contributing to the crisis include soaring interest rates, escalating interest payments, and the potential for interest on the debt to surpass other major government expenditures.

Record Accumulation of Gross Debt Interest

In the first nine months of the current fiscal year, the United States has accumulated a record $652 billion in gross debt interest. This figure represents a staggering 25% increase compared to the interest expense payment in the same period a year ago, which amounted to $521 billion. The escalating interest payments indicate the growing burden of servicing the national debt.

Soaring Interest Rates and Federal Reserve Actions

The Federal Reserve’s attempt to reverse its policy failure of 2020 and 2021 has led to soaring interest rates. The Fed’s decision to keep rates at zero for too long while injecting trillions into asset bubbles has contributed to the current crisis. The Federal Reserve has raised its benchmark rate by 5% since March last year, resulting in higher borrowing costs for the US government.

Impact on Deficit and Debt

Soaring interest rates have become a key driver of the budget deficit. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt. The weighted average interest for total outstanding debt has risen from 1.80% to 2.76% within a year, and if rates continue to rise, it could surpass 4% in one year.

Implications of Rising Interest Payments

If interest rates continue to climb, interest payments on the total US debt of $32.3 trillion could reach $1.3 trillion within 12 months. This would potentially make interest on the debt the largest government expenditure, surpassing social security payments. The escalating interest payments will have significant implications for the US economy and the federal budget.

Concerns and Arguments

Treasury Secretary Janet Yellen has downplayed concerns about higher rates, highlighting the historically low ratio of interest payments to GDP after adjusting for inflation. However, this argument overlooks the potential decline in GDP after the next recession, while US debt remains high and continues to grow. The statements made by Yellen fail to acknowledge the gravity of the situation and the long-term consequences of the escalating debt burden.

The Only Way Out is Our GCR

The United States is on the brink of a financial debt disaster, with soaring interest rates, escalating interest payments, and the potential for interest on the debt to surpass other major government expenditures. The record accumulation of gross debt interest and the implications for the federal budget are clear signs of the severity of the crisis. It is crucial for the US to address the escalating debt burden and explore sustainable solutions to ensure the stability of the economy and the country’s financial future.

Our GCR is coming straight at us.

Related Ai3D Articles

ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

The Connection Between Inflation, Financial Collapse and Our GCR

The Inescapable Financial System Collapse and The Elitist Reset Solution

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/endgame-part-2-united-states-drowning-in-debt-tsunami/

Awake-In-3D: The Connection Between Inflation, Financial Collapse and Our GCR

Awake-In-3D:

The Connection Between Inflation, Financial Collapse and Our GCR

On July 15, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Despite constant attempts to prop up the system through Central Bank policy interventions, the built-in doom loop of fiat currency debt systems literally guarantees their inevitable collapse. The stability of our global fiat currency debt system relies on a constant erosion of the value of money. It’s called INFLATION and it’s typically presented by mainstream financial media as something that simply exists in an economy as a normal component of any monetary system. This narrative is false.

Frankly speaking, inflation is created by fiat currencies and the monetary authorities that control them. This article outlines the truth behind inflation and its essential role in sustaining our credit-dependent fiat system and economy. The very design of fiat currency systems is that they sacrifice the many in favor of the few.

Awake-In-3D:

The Connection Between Inflation, Financial Collapse and Our GCR

On July 15, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Despite constant attempts to prop up the system through Central Bank policy interventions, the built-in doom loop of fiat currency debt systems literally guarantees their inevitable collapse. The stability of our global fiat currency debt system relies on a constant erosion of the value of money. It’s called INFLATION and it’s typically presented by mainstream financial media as something that simply exists in an economy as a normal component of any monetary system. This narrative is false.

Frankly speaking, inflation is created by fiat currencies and the monetary authorities that control them. This article outlines the truth behind inflation and its essential role in sustaining our credit-dependent fiat system and economy. The very design of fiat currency systems is that they sacrifice the many in favor of the few.

What You Will Learn from This Article:

The crucial role of inflation in sustaining our credit-dependent economy

The impact of accumulating debt and the dangers of interest accrual

Traditional monetary policy options for expanding credit and their drawbacks

Why inflation is used to reduce the burden of rising debt so that more debt can be created

The sacrifices made by savers and common workers in the face of inflation

The impending collapse triggered by rising global risks and inflation

The unsustainable nature of our current economic paradigm

How Our GCR will eliminate all of the above

The Problem with Debt

Fiat currency debt systems are inherently flawed and destined for collapse. By relying on constantly increasing levels of debt to sustain themselves, these systems possess a built-in self-destruct mechanism that cannot be deactivated. The constant need for credit expansion (debt) and inflation to keep the system functioning creates an ever-growing burden that eventually becomes unmanageable. As debt accumulates and interest accrues, the economy and financial system reach a tipping point where borrowing becomes unaffordable, interest rates skyrocket, and the bubble bursts.

One of the major issues with debt is that it accumulates interest over time. The more we borrow, the more interest we owe. If our income doesn’t increase accordingly, there comes a point where all our extra money goes towards paying off debt, and we can no longer borrow more. This situation leads to a recession, where the economy slows down, and people struggle to make ends meet.

Policy Solutions and Their Drawbacks

To overcome the limits of credit expansion, there are a few policy options available. The government can borrow large sums of money and distribute cash to households. However, this leads to more government debt and borrowing constraints in the long run. Another option is for the central bank to lower interest rates, allowing consumers to refinance old debt at lower rates. While this can provide temporary relief, it doesn’t address the underlying issues. But inflation does!

The Role of Inflation: It Is Deliberately Created to Allow More Debt Creation

The most significant “solution” used by Central Banksters and Elitist policy-makers for continuing debt creation and keeping the fiat system alive is inflation. By increasing the amount of money in circulation and pushing up prices, inflation reduces the burden of existing debt. Let’s take the example of a home mortgage. Over time, as wages increase due to inflation, the fixed mortgage payment becomes a smaller portion of income. Inflation essentially erodes the value of money, making it easier for borrowers to pay off their debts.

Financial Sacrifices are Pushed Onto Everyday People

While inflation helps debtors, it comes at a cost to savers and common workers. Savers see the value of their savings diminish over time due to inflation. As interest rates are lowered to promote borrowing and spending, savers struggle to keep up with rising prices. Additionally, inflation forces common workers into higher risk investments to make up for the eroded value of their labor. This puts them at a disadvantage compared to the wealthy, who have better access to high-value assets.

Diverted Capital and Productivity

The constant need for higher-risk speculation to keep up with inflation leads to a misallocation of capital. Instead of investing in productive areas that boost economic growth, capital flows towards speculative risk markets. This results in a neglect of vital sectors like infrastructure, which ultimately harms the overall economy. The pursuit of short-term gains takes precedence over long-term stability.

The Coming Collapse

As global risks increase, borrowing becomes more expensive, and interest rates rise. This leads to a decline in borrowing and a spiraling economy. The effects of rising inflation become more pronounced, causing a breakdown in the system. The inflated speculative bubbles burst, leaving behind a trail of economic devastation.

It is an Unsustainable Paradigm

The current paradigm of a steady and sustainable economy is built on fallacies. Globalization and financialization, which were once deflationary forces, have reached their limits. Real-world inflation is eating away at discretionary spending, while the bursting of high-risk, speculative bubbles further erodes wealth. Our system is on the brink of collapse, yet those in power have no sustainable options other than doubling down on their own failed policies.

Our GCR Solution: A Financial System Reset Employing Asset-Backed Currencies

In light of the inherent flaws and impending collapse of our current fiat currency debt system, it becomes clear that a radical transformation is necessary. Enter the reality of a Financial System Reset, which advocates for the implementation of an asset-backed currency system, under a Global Currency Reset (Our GCR).

Monetary Value Preservation: Asset-backed currencies form the foundation of a robust and stable financial system. Unlike fiat currencies, which can be artificially created or destroyed, asset-backed currencies derive their value from tangible assets, such as gold or other commodities. This intrinsic value provides a solid basis for currency stability, reducing arbitrary inflation or deflation.

By keeping debt in check and eliminating the need for constant inflation, an asset-backed currency system ensures that purchasing power and value remain preserved. The erosion of currency value, which burdens savers and common workers in the current system, is mitigated, fostering economic fairness and stability.

Fair Trade: Furthermore, an asset-backed currency system operates on a level playing field globally. Cross-border trade and currency exchange rates are based on genuine value, promoting fair and transparent transactions. This equitable framework facilitates international commerce, allowing nations to engage in trade without the unfair advantages or disadvantages imposed by fiat currencies.

Fair Wages: One of the significant advantages of an asset-backed currency system is the equalization of living and working wages between nations. This addresses the issue of forced immigration and eliminates incentives for slave labor manufacturing. By aligning wages across borders, the system promotes a more just and sustainable global economy, reducing exploitation and inequality.

No Need for Central Banksters: Another compelling benefit of a Financial System Reset with asset-backed currency is the elimination of the need for central banks and their monetary policies, which often result in unethical wealth transfer. In this new system, the power of central banks is curtailed, as the stability and value of the currency are derived directly from tangible assets. This decentralization fosters a more democratic and accountable financial system, free from the manipulation and concentration of wealth often associated with central banking practices.

In conclusion, a Financial System Reset with the implementation of an asset-backed currency system, such as a Global Currency Reset (GCR), offers a compelling solution to the inherent flaws and self-destruct mechanism of our current fiat currency debt system. By introducing such a transformation, we can establish a financial framework that ensures stability, preserves purchasing power, promotes fairness in international trade, equalizes wages globally, and eliminates the unethical wealth transfer perpetuated by central banks.

Related Ai3D Articles

The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

https://ai3d.blog/the-connection-between-inflation-financial-collapse-and-our-gcr/

Awake-In-3D: ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

Awake-In-3D

ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

On July 14, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The United States is hurtling towards a catastrophic financial debt disaster, as shocking evidence reveals a deepening crisis. With soaring interest rates, record-breaking interest payments, and the potential for debt servicing costs to surpass major government expenditures, the nation stands on the brink of a geo-economic collapse.

Treasury Secretary Janet Yellen’s dismissal of concerns only adds fuel to the fire as the endgame fast approaches. Is America now facing a global downfall of its own making?

Awake-In-3D

ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

On July 14, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The United States is hurtling towards a catastrophic financial debt disaster, as shocking evidence reveals a deepening crisis. With soaring interest rates, record-breaking interest payments, and the potential for debt servicing costs to surpass major government expenditures, the nation stands on the brink of a geo-economic collapse.

Treasury Secretary Janet Yellen’s dismissal of concerns only adds fuel to the fire as the endgame fast approaches. Is America now facing a global downfall of its own making?

What You Will Learn Here in Part 1

Government outlays in the United States have surged by 15% in June alone, reaching $646 billion.

Tax receipts have plummeted by 9.2%, resulting in a 7.3% drop in government receipts year-to-date.

The US budget deficit nearly tripled in June, reaching $228 billion compared to the previous year.

The cumulative deficit for the first nine months of the fiscal year stands at $1.393 trillion, the third highest on record.

The escalating debt burden threatens the stability of the US economy and its global standing.

Higher deficits increase reliance on borrowing and lead to rising interest payments, straining the federal budget.

In the latest monthly US Budget Deficit report, alarming figures reveal a deepening financial crisis for the United States. Government outlays surged by 15% to $646 billion in June, a staggering increase of almost $100 billion from the previous year. Meanwhile, tax receipts have plummeted by 9.2% from $461 billion to $418 billion, marking the largest drop in tax revenues without entering a recession. This article delves into the dire consequences of these developments, shedding light on the imminent financial debt disaster that the United States faces.

Surging Government Outlays and Shrinking Tax Revenues

Government outlays have experienced an unprecedented surge, rising by 15% in June alone. Tax receipts have suffered a substantial decline of 9.2%, resulting in a 7.3% drop in government receipts year-to-date, the largest since the June 2020 recession. The substantial increase in government spending coupled with diminishing tax revenues has contributed to the ballooning budget deficit.

The Budget Deficit has Tripled vs. Official Estimates

In June, the US budget deficit nearly tripled from $89 billion to $228 billion compared to the previous year. This significant deficit surpasses the consensus estimate of $175 billion, indicating a deepening financial crisis. The unexpected incremental $50 billion deficit raises questions about the allocation of funds and potential money laundering activities.

Cumulative Deficit is Third Highest on Record

The cumulative deficit for the first nine months of the fiscal year is already the third highest on record. Surpassed only by the government pandemic shutdown crisis of 2020 and 2021, the fiscal 2022 year-to-date deficit stands at $1.393 trillion, marking a 170% increase compared to the same period last year. These alarming figures highlight the urgency of addressing the growing debt burden – a return to gold-backed money and a Global Currency Reset (GCR).

From Financial Debt Disaster to Our GCR

The escalating debt burden threatens the stability of the US economy and its global standing. Higher deficits increase the reliance on borrowing, leading to rising interest payments that strain the federal budget. The United States is seriously facing insolvency and potential crash of the US Dollar – not to mention a total collapse of the global fiat debt currency system.

The United States finds itself rapidly approaching a financial debt disaster as surging government outlays and shrinking tax revenues contribute to a widening budget deficit. With the cumulative deficit already ranking as the third highest on record, how much longer can the current financial system survive without Our GCR?

[To be continued in Endgame Part 2]

Related Ai3D Articles:

After 51 Years the Global Fiat Currency System is Due for a Grand Reset

Commercial Real Estate: A Likely Trigger for Fiat Financial System, then US Dollar Collapse

Debt Jubilees: A Last Resort Before The Global Financial Collapse

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/endgame-part-1-united-states-plunging-headlong-into-financial-debt-disaster/

Awake-In-3D: North Carolina Votes for Gold – Sound Money Movement Continues

Awake-In-3D:

North Carolina Votes for Gold – Sound Money Movement Continues

On July 14, 2023 By Awake-In-3D

North Carolina is the latest U.S. State to take up the charge towards sound monetary independence. As all of us in RV/GCR Land watch and wait for the logical conclusion of the Global Fiat Financial System, individual U.S. States continue on the path towards their own Gold Monetary Standards. Do the State’s fiscal and legislative governments know something that the Federal Reserve and US Treasury continues to ignore?

With the recent vote in favor of studying an in-state bullion depository, the state is joining a growing movement among US states seeking protection from the volatile federal fiat US dollar. As states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold, it’s time to ask: is it time for North Carolina to take control of its financial destiny? Find out why the push for state gold standards is gaining momentum and what it could mean for the future of the USA economy.

Awake-In-3D:

North Carolina Votes for Gold – Sound Money Movement Continues

On July 14, 2023 By Awake-In-3D

North Carolina is the latest U.S. State to take up the charge towards sound monetary independence. As all of us in RV/GCR Land watch and wait for the logical conclusion of the Global Fiat Financial System, individual U.S. States continue on the path towards their own Gold Monetary Standards. Do the State’s fiscal and legislative governments know something that the Federal Reserve and US Treasury continues to ignore?

With the recent vote in favor of studying an in-state bullion depository, the state is joining a growing movement among US states seeking protection from the volatile federal fiat US dollar. As states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold, it’s time to ask: is it time for North Carolina to take control of its financial destiny? Find out why the push for state gold standards is gaining momentum and what it could mean for the future of the USA economy.

What You Will Learn from this Article:

The recent vote in favor of studying an in-state bullion depository in North Carolina.

The growing movement among US states towards establishing independent gold standards as protection from the federal fiat US dollar.

How states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold.

The reasons why diversifying investment portfolios with precious metals like gold and silver can safeguard against inflation, debt defaults, and stock market volatility.

The potential benefits of establishing a gold bullion depository for North Carolina and other states.

The introduction of bills in multiple states to restore the use of gold and silver as legal tender.

The significance of financial independence and the potential consequences of relying solely on the federal fiat US dollar.

The next steps for North Carolina’s proposed legislation and its potential impact on the state’s financial future.

The broader implications of the state gold standards movement and its impact on the US economy.

In a definitive move towards financial independence, the North Carolina House of Representatives has voted in favor of studying the establishment of an in-state bullion depository. This decision is part of a larger trend among several US states, including Texas, Ohio, Missouri, Mississippi, and Oklahoma, to protect themselves from the uncertainties of the federal fiat US dollar by establishing independent gold standards. With Tennessee already signing a law allowing the purchase and storage of physical gold and silver, it is clear that states are recognizing the importance of diversifying their investment portfolios and safeguarding against inflation, debt defaults, and stock market downturns.

The Need for Financial Security

Like many other states, North Carolina’s reserve funds are heavily exposed to low-yielding debt paper, such as corporate bonds, municipal bonds, CDs, treasuries, and money market funds. While these instruments may appear stable, they carry risks such as inflation and the erosion of real value over time, compounded by negative real interest rates. Recognizing the need to protect against these risks, North Carolina has prioritized exploring the benefits of establishing a gold bullion depository.

The Power of Gold and Silver

By including an allocation to physical gold and silver in their investment portfolios, responsible states can enhance their ability to weather financial uncertainties. Precious metals have historically served as a safeguard against inflation, debt defaults, and stock market volatility. Not only do they provide a hedge against these risks, but they have also shown to enhance investment returns while reducing overall volatility. With the potential for economic uncertainty on the horizon, it is prudent for states like North Carolina to consider the advantages of incorporating gold and silver into their financial strategies.

A Growing Movement

North Carolina is not alone in its pursuit of sound and constitutional money. This year, several other states, including Alaska, Iowa, West Virginia, South Carolina, Maine, Missouri, Minnesota, Tennessee, Montana, Idaho, Wyoming, and Kansas, have introduced bills to restore the use of gold and silver as legal tender. This movement reflects a growing recognition among states that relying solely on the federal fiat US dollar may not provide the necessary protection against financial risks.

Next Steps for North Carolina

House Bill 721, introduced by Rep. Mark Brody, has already received favorable support in the North Carolina House of Representatives. The bill, which calls for a study into establishing an in-state bullion depository, was approved by a vote of 73-40. It will now undergo a hearing before the Senate Rules and Operations committee. If successful, North Carolina will join the ranks of states taking proactive measures to secure their financial future.

What It Means

As states like North Carolina seek greater financial independence, the establishment of independent gold standards through in-state bullion depositories has emerged as a compelling solution. By diversifying their investment portfolios with precious metals, states can protect against inflation, debt defaults, and stock market volatility. The growing movement for state gold standards, exemplified by North Carolina and other states, highlights the increasing recognition that relying solely on the federal fiat US dollar may not be the most prudent approach. It is time for states to take control of their financial destiny and prioritize the exploration of gold and silver as a means of safeguarding their economies.

Related Posts

Click here learn more about every U.S. States’ legislative activities involving gold and silver as legal tender: Sound Money Defense League

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/north-carolina-votes-for-gold-sound-money-movement-continues/

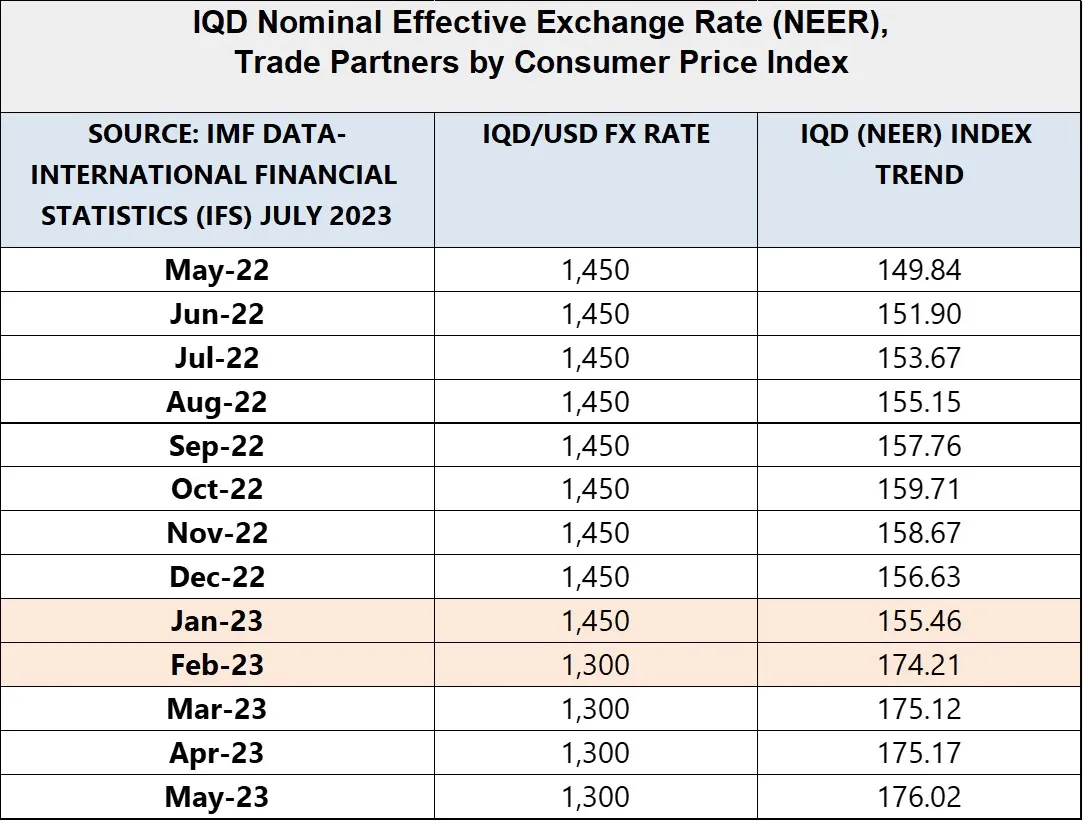

Awake-In-3D: The Truth About the IQD and NEER – What You Need to Know

Awake-In-3D:

The Truth About the IQD and NEER – What You Need to Know

On July 13, 2023 By Awake-In-3D

Many RV/GCR Land rumor mills are leading us to believe that the NEER (Nominal Effecitve Exchange Rate) of the IQD is somehow an exchange rate crystal ball for an IQD RV. While NEER sounds esoteric and super technical, it is really quite simple to understand. Let’s get to the bottom of this, shall we?

The IQD’s NEER is not an Exchangeable Rate: It’s an Indexed Economic Measurement