Awake-In-3D: The Connection Between Inflation, Financial Collapse and Our GCR

Awake-In-3D:

The Connection Between Inflation, Financial Collapse and Our GCR

On July 15, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Despite constant attempts to prop up the system through Central Bank policy interventions, the built-in doom loop of fiat currency debt systems literally guarantees their inevitable collapse. The stability of our global fiat currency debt system relies on a constant erosion of the value of money. It’s called INFLATION and it’s typically presented by mainstream financial media as something that simply exists in an economy as a normal component of any monetary system. This narrative is false.

Frankly speaking, inflation is created by fiat currencies and the monetary authorities that control them. This article outlines the truth behind inflation and its essential role in sustaining our credit-dependent fiat system and economy. The very design of fiat currency systems is that they sacrifice the many in favor of the few.

Awake-In-3D:

The Connection Between Inflation, Financial Collapse and Our GCR

On July 15, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

Despite constant attempts to prop up the system through Central Bank policy interventions, the built-in doom loop of fiat currency debt systems literally guarantees their inevitable collapse. The stability of our global fiat currency debt system relies on a constant erosion of the value of money. It’s called INFLATION and it’s typically presented by mainstream financial media as something that simply exists in an economy as a normal component of any monetary system. This narrative is false.

Frankly speaking, inflation is created by fiat currencies and the monetary authorities that control them. This article outlines the truth behind inflation and its essential role in sustaining our credit-dependent fiat system and economy. The very design of fiat currency systems is that they sacrifice the many in favor of the few.

What You Will Learn from This Article:

The crucial role of inflation in sustaining our credit-dependent economy

The impact of accumulating debt and the dangers of interest accrual

Traditional monetary policy options for expanding credit and their drawbacks

Why inflation is used to reduce the burden of rising debt so that more debt can be created

The sacrifices made by savers and common workers in the face of inflation

The impending collapse triggered by rising global risks and inflation

The unsustainable nature of our current economic paradigm

How Our GCR will eliminate all of the above

The Problem with Debt

Fiat currency debt systems are inherently flawed and destined for collapse. By relying on constantly increasing levels of debt to sustain themselves, these systems possess a built-in self-destruct mechanism that cannot be deactivated. The constant need for credit expansion (debt) and inflation to keep the system functioning creates an ever-growing burden that eventually becomes unmanageable. As debt accumulates and interest accrues, the economy and financial system reach a tipping point where borrowing becomes unaffordable, interest rates skyrocket, and the bubble bursts.

One of the major issues with debt is that it accumulates interest over time. The more we borrow, the more interest we owe. If our income doesn’t increase accordingly, there comes a point where all our extra money goes towards paying off debt, and we can no longer borrow more. This situation leads to a recession, where the economy slows down, and people struggle to make ends meet.

Policy Solutions and Their Drawbacks

To overcome the limits of credit expansion, there are a few policy options available. The government can borrow large sums of money and distribute cash to households. However, this leads to more government debt and borrowing constraints in the long run. Another option is for the central bank to lower interest rates, allowing consumers to refinance old debt at lower rates. While this can provide temporary relief, it doesn’t address the underlying issues. But inflation does!

The Role of Inflation: It Is Deliberately Created to Allow More Debt Creation

The most significant “solution” used by Central Banksters and Elitist policy-makers for continuing debt creation and keeping the fiat system alive is inflation. By increasing the amount of money in circulation and pushing up prices, inflation reduces the burden of existing debt. Let’s take the example of a home mortgage. Over time, as wages increase due to inflation, the fixed mortgage payment becomes a smaller portion of income. Inflation essentially erodes the value of money, making it easier for borrowers to pay off their debts.

Financial Sacrifices are Pushed Onto Everyday People

While inflation helps debtors, it comes at a cost to savers and common workers. Savers see the value of their savings diminish over time due to inflation. As interest rates are lowered to promote borrowing and spending, savers struggle to keep up with rising prices. Additionally, inflation forces common workers into higher risk investments to make up for the eroded value of their labor. This puts them at a disadvantage compared to the wealthy, who have better access to high-value assets.

Diverted Capital and Productivity

The constant need for higher-risk speculation to keep up with inflation leads to a misallocation of capital. Instead of investing in productive areas that boost economic growth, capital flows towards speculative risk markets. This results in a neglect of vital sectors like infrastructure, which ultimately harms the overall economy. The pursuit of short-term gains takes precedence over long-term stability.

The Coming Collapse

As global risks increase, borrowing becomes more expensive, and interest rates rise. This leads to a decline in borrowing and a spiraling economy. The effects of rising inflation become more pronounced, causing a breakdown in the system. The inflated speculative bubbles burst, leaving behind a trail of economic devastation.

It is an Unsustainable Paradigm

The current paradigm of a steady and sustainable economy is built on fallacies. Globalization and financialization, which were once deflationary forces, have reached their limits. Real-world inflation is eating away at discretionary spending, while the bursting of high-risk, speculative bubbles further erodes wealth. Our system is on the brink of collapse, yet those in power have no sustainable options other than doubling down on their own failed policies.

Our GCR Solution: A Financial System Reset Employing Asset-Backed Currencies

In light of the inherent flaws and impending collapse of our current fiat currency debt system, it becomes clear that a radical transformation is necessary. Enter the reality of a Financial System Reset, which advocates for the implementation of an asset-backed currency system, under a Global Currency Reset (Our GCR).

Monetary Value Preservation: Asset-backed currencies form the foundation of a robust and stable financial system. Unlike fiat currencies, which can be artificially created or destroyed, asset-backed currencies derive their value from tangible assets, such as gold or other commodities. This intrinsic value provides a solid basis for currency stability, reducing arbitrary inflation or deflation.

By keeping debt in check and eliminating the need for constant inflation, an asset-backed currency system ensures that purchasing power and value remain preserved. The erosion of currency value, which burdens savers and common workers in the current system, is mitigated, fostering economic fairness and stability.

Fair Trade: Furthermore, an asset-backed currency system operates on a level playing field globally. Cross-border trade and currency exchange rates are based on genuine value, promoting fair and transparent transactions. This equitable framework facilitates international commerce, allowing nations to engage in trade without the unfair advantages or disadvantages imposed by fiat currencies.

Fair Wages: One of the significant advantages of an asset-backed currency system is the equalization of living and working wages between nations. This addresses the issue of forced immigration and eliminates incentives for slave labor manufacturing. By aligning wages across borders, the system promotes a more just and sustainable global economy, reducing exploitation and inequality.

No Need for Central Banksters: Another compelling benefit of a Financial System Reset with asset-backed currency is the elimination of the need for central banks and their monetary policies, which often result in unethical wealth transfer. In this new system, the power of central banks is curtailed, as the stability and value of the currency are derived directly from tangible assets. This decentralization fosters a more democratic and accountable financial system, free from the manipulation and concentration of wealth often associated with central banking practices.

In conclusion, a Financial System Reset with the implementation of an asset-backed currency system, such as a Global Currency Reset (GCR), offers a compelling solution to the inherent flaws and self-destruct mechanism of our current fiat currency debt system. By introducing such a transformation, we can establish a financial framework that ensures stability, preserves purchasing power, promotes fairness in international trade, equalizes wages globally, and eliminates the unethical wealth transfer perpetuated by central banks.

Related Ai3D Articles

The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

https://ai3d.blog/the-connection-between-inflation-financial-collapse-and-our-gcr/

Awake-In-3D: ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

Awake-In-3D

ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

On July 14, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The United States is hurtling towards a catastrophic financial debt disaster, as shocking evidence reveals a deepening crisis. With soaring interest rates, record-breaking interest payments, and the potential for debt servicing costs to surpass major government expenditures, the nation stands on the brink of a geo-economic collapse.

Treasury Secretary Janet Yellen’s dismissal of concerns only adds fuel to the fire as the endgame fast approaches. Is America now facing a global downfall of its own making?

Awake-In-3D

ENDGAME (Part 1) – United States Plunging Headlong into Financial Debt Disaster

On July 14, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The United States is hurtling towards a catastrophic financial debt disaster, as shocking evidence reveals a deepening crisis. With soaring interest rates, record-breaking interest payments, and the potential for debt servicing costs to surpass major government expenditures, the nation stands on the brink of a geo-economic collapse.

Treasury Secretary Janet Yellen’s dismissal of concerns only adds fuel to the fire as the endgame fast approaches. Is America now facing a global downfall of its own making?

What You Will Learn Here in Part 1

Government outlays in the United States have surged by 15% in June alone, reaching $646 billion.

Tax receipts have plummeted by 9.2%, resulting in a 7.3% drop in government receipts year-to-date.

The US budget deficit nearly tripled in June, reaching $228 billion compared to the previous year.

The cumulative deficit for the first nine months of the fiscal year stands at $1.393 trillion, the third highest on record.

The escalating debt burden threatens the stability of the US economy and its global standing.

Higher deficits increase reliance on borrowing and lead to rising interest payments, straining the federal budget.

In the latest monthly US Budget Deficit report, alarming figures reveal a deepening financial crisis for the United States. Government outlays surged by 15% to $646 billion in June, a staggering increase of almost $100 billion from the previous year. Meanwhile, tax receipts have plummeted by 9.2% from $461 billion to $418 billion, marking the largest drop in tax revenues without entering a recession. This article delves into the dire consequences of these developments, shedding light on the imminent financial debt disaster that the United States faces.

Surging Government Outlays and Shrinking Tax Revenues

Government outlays have experienced an unprecedented surge, rising by 15% in June alone. Tax receipts have suffered a substantial decline of 9.2%, resulting in a 7.3% drop in government receipts year-to-date, the largest since the June 2020 recession. The substantial increase in government spending coupled with diminishing tax revenues has contributed to the ballooning budget deficit.

The Budget Deficit has Tripled vs. Official Estimates

In June, the US budget deficit nearly tripled from $89 billion to $228 billion compared to the previous year. This significant deficit surpasses the consensus estimate of $175 billion, indicating a deepening financial crisis. The unexpected incremental $50 billion deficit raises questions about the allocation of funds and potential money laundering activities.

Cumulative Deficit is Third Highest on Record

The cumulative deficit for the first nine months of the fiscal year is already the third highest on record. Surpassed only by the government pandemic shutdown crisis of 2020 and 2021, the fiscal 2022 year-to-date deficit stands at $1.393 trillion, marking a 170% increase compared to the same period last year. These alarming figures highlight the urgency of addressing the growing debt burden – a return to gold-backed money and a Global Currency Reset (GCR).

From Financial Debt Disaster to Our GCR

The escalating debt burden threatens the stability of the US economy and its global standing. Higher deficits increase the reliance on borrowing, leading to rising interest payments that strain the federal budget. The United States is seriously facing insolvency and potential crash of the US Dollar – not to mention a total collapse of the global fiat debt currency system.

The United States finds itself rapidly approaching a financial debt disaster as surging government outlays and shrinking tax revenues contribute to a widening budget deficit. With the cumulative deficit already ranking as the third highest on record, how much longer can the current financial system survive without Our GCR?

[To be continued in Endgame Part 2]

Related Ai3D Articles:

After 51 Years the Global Fiat Currency System is Due for a Grand Reset

Commercial Real Estate: A Likely Trigger for Fiat Financial System, then US Dollar Collapse

Debt Jubilees: A Last Resort Before The Global Financial Collapse

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/endgame-part-1-united-states-plunging-headlong-into-financial-debt-disaster/

Awake-In-3D: North Carolina Votes for Gold – Sound Money Movement Continues

Awake-In-3D:

North Carolina Votes for Gold – Sound Money Movement Continues

On July 14, 2023 By Awake-In-3D

North Carolina is the latest U.S. State to take up the charge towards sound monetary independence. As all of us in RV/GCR Land watch and wait for the logical conclusion of the Global Fiat Financial System, individual U.S. States continue on the path towards their own Gold Monetary Standards. Do the State’s fiscal and legislative governments know something that the Federal Reserve and US Treasury continues to ignore?

With the recent vote in favor of studying an in-state bullion depository, the state is joining a growing movement among US states seeking protection from the volatile federal fiat US dollar. As states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold, it’s time to ask: is it time for North Carolina to take control of its financial destiny? Find out why the push for state gold standards is gaining momentum and what it could mean for the future of the USA economy.

Awake-In-3D:

North Carolina Votes for Gold – Sound Money Movement Continues

On July 14, 2023 By Awake-In-3D

North Carolina is the latest U.S. State to take up the charge towards sound monetary independence. As all of us in RV/GCR Land watch and wait for the logical conclusion of the Global Fiat Financial System, individual U.S. States continue on the path towards their own Gold Monetary Standards. Do the State’s fiscal and legislative governments know something that the Federal Reserve and US Treasury continues to ignore?

With the recent vote in favor of studying an in-state bullion depository, the state is joining a growing movement among US states seeking protection from the volatile federal fiat US dollar. As states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold, it’s time to ask: is it time for North Carolina to take control of its financial destiny? Find out why the push for state gold standards is gaining momentum and what it could mean for the future of the USA economy.

What You Will Learn from this Article:

The recent vote in favor of studying an in-state bullion depository in North Carolina.

The growing movement among US states towards establishing independent gold standards as protection from the federal fiat US dollar.

How states like Texas, Ohio, and Tennessee have already taken steps to secure their economies with gold.

The reasons why diversifying investment portfolios with precious metals like gold and silver can safeguard against inflation, debt defaults, and stock market volatility.

The potential benefits of establishing a gold bullion depository for North Carolina and other states.

The introduction of bills in multiple states to restore the use of gold and silver as legal tender.

The significance of financial independence and the potential consequences of relying solely on the federal fiat US dollar.

The next steps for North Carolina’s proposed legislation and its potential impact on the state’s financial future.

The broader implications of the state gold standards movement and its impact on the US economy.

In a definitive move towards financial independence, the North Carolina House of Representatives has voted in favor of studying the establishment of an in-state bullion depository. This decision is part of a larger trend among several US states, including Texas, Ohio, Missouri, Mississippi, and Oklahoma, to protect themselves from the uncertainties of the federal fiat US dollar by establishing independent gold standards. With Tennessee already signing a law allowing the purchase and storage of physical gold and silver, it is clear that states are recognizing the importance of diversifying their investment portfolios and safeguarding against inflation, debt defaults, and stock market downturns.

The Need for Financial Security

Like many other states, North Carolina’s reserve funds are heavily exposed to low-yielding debt paper, such as corporate bonds, municipal bonds, CDs, treasuries, and money market funds. While these instruments may appear stable, they carry risks such as inflation and the erosion of real value over time, compounded by negative real interest rates. Recognizing the need to protect against these risks, North Carolina has prioritized exploring the benefits of establishing a gold bullion depository.

The Power of Gold and Silver

By including an allocation to physical gold and silver in their investment portfolios, responsible states can enhance their ability to weather financial uncertainties. Precious metals have historically served as a safeguard against inflation, debt defaults, and stock market volatility. Not only do they provide a hedge against these risks, but they have also shown to enhance investment returns while reducing overall volatility. With the potential for economic uncertainty on the horizon, it is prudent for states like North Carolina to consider the advantages of incorporating gold and silver into their financial strategies.

A Growing Movement

North Carolina is not alone in its pursuit of sound and constitutional money. This year, several other states, including Alaska, Iowa, West Virginia, South Carolina, Maine, Missouri, Minnesota, Tennessee, Montana, Idaho, Wyoming, and Kansas, have introduced bills to restore the use of gold and silver as legal tender. This movement reflects a growing recognition among states that relying solely on the federal fiat US dollar may not provide the necessary protection against financial risks.

Next Steps for North Carolina

House Bill 721, introduced by Rep. Mark Brody, has already received favorable support in the North Carolina House of Representatives. The bill, which calls for a study into establishing an in-state bullion depository, was approved by a vote of 73-40. It will now undergo a hearing before the Senate Rules and Operations committee. If successful, North Carolina will join the ranks of states taking proactive measures to secure their financial future.

What It Means

As states like North Carolina seek greater financial independence, the establishment of independent gold standards through in-state bullion depositories has emerged as a compelling solution. By diversifying their investment portfolios with precious metals, states can protect against inflation, debt defaults, and stock market volatility. The growing movement for state gold standards, exemplified by North Carolina and other states, highlights the increasing recognition that relying solely on the federal fiat US dollar may not be the most prudent approach. It is time for states to take control of their financial destiny and prioritize the exploration of gold and silver as a means of safeguarding their economies.

Related Posts

Click here learn more about every U.S. States’ legislative activities involving gold and silver as legal tender: Sound Money Defense League

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/north-carolina-votes-for-gold-sound-money-movement-continues/

Awake-In-3D: The Truth About the IQD and NEER – What You Need to Know

Awake-In-3D:

The Truth About the IQD and NEER – What You Need to Know

On July 13, 2023 By Awake-In-3D

Many RV/GCR Land rumor mills are leading us to believe that the NEER (Nominal Effecitve Exchange Rate) of the IQD is somehow an exchange rate crystal ball for an IQD RV. While NEER sounds esoteric and super technical, it is really quite simple to understand. Let’s get to the bottom of this, shall we?

The IQD’s NEER is not an Exchangeable Rate: It’s an Indexed Economic Measurement

Foreign currency Spot Exchange Rates refer to the rates at which one currency can be exchanged for another. These rates fluctuate based on factors like supply and demand, economic conditions, and market sentiment.

Awake-In-3D:

The Truth About the IQD and NEER – What You Need to Know

On July 13, 2023 By Awake-In-3D

Many RV/GCR Land rumor mills are leading us to believe that the NEER (Nominal Effecitve Exchange Rate) of the IQD is somehow an exchange rate crystal ball for an IQD RV. While NEER sounds esoteric and super technical, it is really quite simple to understand. Let’s get to the bottom of this, shall we?

The IQD’s NEER is not an Exchangeable Rate: It’s an Indexed Economic Measurement

Foreign currency Spot Exchange Rates refer to the rates at which one currency can be exchanged for another. These rates fluctuate based on factors like supply and demand, economic conditions, and market sentiment.

On the other hand, the NEER (Nominal Effective Exchange Rate) index rate is a measure that evaluates the value of a country’s currency against a basket of other currencies. It takes into account the trade weights of different currencies and provides a broader perspective on the overall value of a currency.

While foreign currency exchange rates focus on the specific exchange rate between two currencies, the NEER index rate provides a weighted average value of a currency against multiple currencies. NEER is more comprehensive and useful for analyzing a country’s competitiveness in international trade.

NEER vs. REER: Understanding the Differences

Before we embark on our exploration of NEER, it is crucial to grasp the difference between NEER and its counterpart, the real effective exchange rate (REER). These two terms are often intertwined, but their disparities are noteworthy.

The concept of an effective exchange rate (EER) serves as the foundation for both NEER and REER. EER represents the movement indication of a domestic currency against a complete basket of global currencies, reflecting the external competitiveness of an economy. NEER, the nominal effective exchange rate, is a weighted average that measures the competitiveness of a country’s currency in the international forex market. On the other hand, REER is the NEER adjusted for inflation differentials between the home country and its trading partners.

NEER: The Nominal Effective Exchange Rate

Let us focus our attention on NEER, the nominal effective exchange rate, and its role in economic analysis. NEER can be defined as the weighted average of a country’s currency needed to purchase foreign currencies. The weight of trading is higher for countries with whom the home country has more significant trade relations. This index measurement provides valuable insights into the relative strength or weakness of a domestic currency against global currencies. Policymakers utilize NEER for policy analysis in international trade, while forex traders employ it for currency arbitrage.

REER: What is an “Adjusted” Exchange Rate?

As we move forward, it is essential to shed light on REER, the real effective exchange rate. REER is a vital concept that forms a part of the Purchasing Power Parity hypothesis. Similar to NEER, REER reflects the strength or weakness of a currency against another currency. However, it cannot be determined in absolute terms and is calculated based on NEER. REER takes inflation differentials into account and serves as a measure to compare the worth of a nation’s currency against other nations. A REER value greater than 100 implies an overrated currency, while a value within 100 indicates an undervalued currency.

Calculating REER

To comprehend the essence of REER, we must understand the formula behind it. REER is determined by considering the average amount of bilateral exchange rates between a nation and its trading partners. This calculation is then adjusted to account for the country’s trade allocation. The resulting figure shows the relative strength or weakness of the currency in a more comprehensive manner. It provides economists and policymakers with a powerful tool to assess the economic status of a country and make informed decisions.

NEER vs. REER:

To understand the difference between NEER and REER, it is crucial to determine what each of these Indexes are measuring. NEER, being the unadjusted weighted average, might seem more straightforward at first glance. However, REER, with its inflation adjustment, provides a more accurate representation of a currency’s real value. While NEER can indicate the competitiveness of a currency in the forex market, REER offers a deeper understanding by accounting for inflation differentials. Therefore, when it comes to assessing a currency’s true strength or weakness, REER takes the lead.

IQD NEER: It is Not a “Hidden” Rate

Misconceptions in RV/GCR Land now surround NEER, leading many to believe that it is a spot exchange rate used for currency exchange. It is NOT!

However, NEER is far more complex and multifaceted than a straightforward exchange rate. It is an index measurement that encompasses a weighted average of multiple foreign currencies. NEER provides valuable insights into a country’s international competitiveness and serves as a critical tool for policymakers and forex traders alike. Understanding NEER’s true nature is essential for making informed decisions in the global economic landscape.

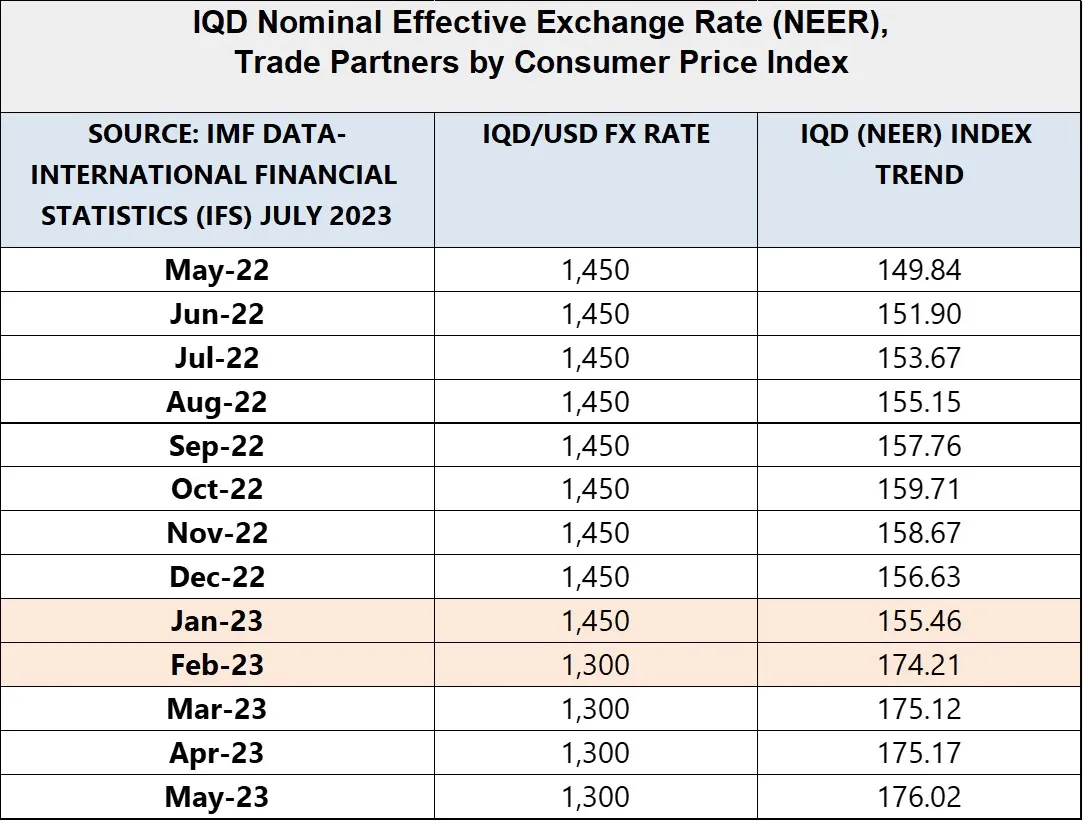

NEER and the Iraqi IQD Explained

Now let’s dig into the NEER Index rate of the IQD. Contrary to popular RV/GCR Land rumor mills, the NEER index numbers for the Iraqi Dinar are not hidden and reported monthly and shown on the IMF’s Financial Data website called the IFS. The trend is moving higher as shown in the chart below.

In February/March of 2023, the Central Bank of Iraq (CBI) changed it’s fixed, nominal currency exchange rate from 1,450 to around 1,300 IQD per one US dollar which strengthened the IQD by approximately 10% against other foreign currencies. Since NEER is calculated based on Iraq’s primary Trading Partner Nations, we can see that over the past few months, the IQD appreciated by about that much, with one exception being the EURO as shown below.

Iraq’s Primary Export Trade Partner Nations and Spot Currency Exchange Rate Changes of Each

China Trade of $10.5 Billion with CNY losing 16% against the IQD

United Arab Emirates Trade of $5.5 Billion with AED losing 10% against the IQD

South Korea Trade of $2.9 Billion with KRW losing 8% against the IQD

USA Trade of $2.4 Billion with USD losing 10% against the IQD

Japan Trade of $1.6 Billion with YEN losing 11% against the IQD

Now that you understand what NEER is based on, when you look at the above trade figures and the fact the IQD spot exchange rate strengthened from 1450 to 1300 (against the US dollar), it makes sense that NEER Index value has been increasing as shown in the charts above. The fact that the NEER rate is far above 100 indicates that the IQD is actually overvalued against its trading partner currencies.

BOTTOM LINE: The latest NEER rate of 172 for the IQD is NOT a Spot Currency Exchange Rate. It’s an INDEXED Trade-Weighted rate based on Iraq’s international trading partners amongst the partner’s basket of currencies.

You can check the NEER Index rates for the IQD here: IMF International Financial Statistics Website

Related Posts

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-truth-about-the-iqd-and-neer-what-you-need-to-know/

Awake-In-3D: Historical GCR Comics – Action Jackson and MacGuyver Tasked with Triggering the RV/GCR

Historical GCR Comics – Action Jackson and MacGuyver Tasked with Triggering the RV/GCR

On July 9, 2023 By Awake-In-3D

In GCR Comics

The year is late 2014 in GCR-Land Time:

The RV and NESARA have been delayed past the promised back wall of the Black Friday super-shopping day in the United States.

Note: the expanded term “GESARA” had not yet come onto the scene in RV/GCR vernacular.

This was incredibly disappointing in Dinar-Land since the major Intel Gurus of the time had all promised us a very good pre-christmas, Black Friday shopping spree using IQD exchange proceeds.

Historical GCR Comics – Action Jackson and MacGuyver Tasked with Triggering the RV/GCR

On July 9, 2023 By Awake-In-3D

In GCR Comics

The year is late 2014 in GCR-Land Time:

The RV and NESARA have been delayed past the promised back wall of the Black Friday super-shopping day in the United States.

Note: the expanded term “GESARA” had not yet come onto the scene in RV/GCR vernacular.

This was incredibly disappointing in Dinar-Land since the major Intel Gurus of the time had all promised us a very good pre-christmas, Black Friday shopping spree using IQD exchange proceeds.

As Christmas 2014 was fast approaching – with no 1-800 Exchange Center Appointments in sight – the Chinese Elders decided to call in the world’s best action heroes to help push the infamous RV Button before the 2015 New Year. This was vitally important to accomplish since it was the unique time of year when the Saint Germaine Global Trust was going to re-open to fund the Prosperity Packages and Farm Claims.

None other than Superstar Carl “Action Jackson” Weathers answered the call of the Elders.

Yet, little did he realize that the Royal-Elder GCR Committee also called in another action superstar to assist in this perilous mission… it was none other than that legendary “Swiss Knife” of humanity, Richard Dean Anderson. Also known as MacGuyver!

[Of course this was before MacGuyver was sent off with the Stargate SG-1 team in order to retrieve the all powerful Extraterrestrial QFS (Quantum Financial System) technology that was stolen by the Goa’uld System Lords. But this is a story for another time…]

So let’s check in on our GCR Heroes during those fateful days in late 2014…

Alas, never did we receive our 1-800 Exchange Center Appointment during those exciting times back in 2014/2015…

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

Awake-In-3D: BRICS New Gold Currency: A Serious Attack on the Fiat Dollar World

Awake-In-3D

BRICS New Gold Currency: A Serious Attack on the Fiat Dollar World

On July 8, 2023 By Awake-In-3D

I firmly believe that a BRICS new currency initiative may be the initiation and direct path forward for the eventual implementation of our RV/GCR scenario. The rise of a new joint currency backed by gold, the growing frustration with the dominance of the US dollar, and the expanding influence of the BRICS countries are reshaping the global economic landscape.

In this article, I discuss the key insights I’ve learned from an in-depth, private-source discussion on the BRICS’ new currency, its potential convertibility into gold, as will as the possible geopolitical and geo-economic consequences.

Awake-In-3D:

BRICS New Gold Currency: A Serious Attack on the Fiat Dollar World

On July 8, 2023 By Awake-In-3D

I firmly believe that a BRICS new currency initiative may be the initiation and direct path forward for the eventual implementation of our RV/GCR scenario. The rise of a new joint currency backed by gold, the growing frustration with the dominance of the US dollar, and the expanding influence of the BRICS countries are reshaping the global economic landscape.

In this article, I discuss the key insights I’ve learned from an in-depth, private-source discussion on the BRICS’ new currency, its potential convertibility into gold, as will as the possible geopolitical and geo-economic consequences.

What You Will Learn from This Article

BRICS’ serious challenge to the dominance of the US dollar and the trend of de-dollarization

The potential convertibility of the new BRICS currency into gold and its implications for the global economy

The geopolitical consequences and tensions among BRICS member countries

The deliberate and calculated approach of BRICS in building up secretariats and think tanks

The expansion of BRICS membership and the role of Gulf countries

The uncertainties surrounding the leadership and coordination within BRICS

The past initiatives of BRICS and the lessons learned for the success of this new currency endeavor.

Valuable insights into the transformative developments surrounding BRICS’ new currency and its potential impact on today’s global fiat currency financial system

BRICS Currency and Growing Frustration

The BRICS currency aims to challenge the dominance of the US dollar in the world. It signifies a frustration with the way the US has used the dollar for its own purposes. BRICS seeks to develop a multi-polar world, reducing the influence of a single country. This frustration has led to an increasing number of countries expressing interest in joining BRICS.

Details of the New Currency

The specifics of how the new currency will evolve are not yet public. However, a roadmap for its development has been planned. The currency is expected to be convertible into gold, possibly using the Shanghai Gold Exchange. Russia and China already treat their growing trade by holding dollars in a gold-convertible account in China’s Central Bank. This model may serve as a template for China and other Gulf countries. BRICS is also utilizing local currencies to settle trade balances through the New Trade Bank, creating a reserve of local currencies.

The Strength of BRICS

BRICS has developed a robust organization with separate secretariats for various sectors, including geopolitics, trade, finance, education, and sports. These secretariats are housed in the BRICS Tower in Shanghai, signifying the early development of a new block of countries that poses a threat to the G7 nations.

BRICS’ New Currency Convertibility into Gold and Potential Expansion

Convertibility into Gold

The new BRICS currency is expected to eventually be convertible into gold. This means that holders of the currency will have the ability to redeem it for physical gold. The exact process of convertibility will likely be implemented gradually, with full convertibility expected by the mid-2020s. China holds an impressive 50,000+ tons of gold, while Russia possesses over 12,000 tons, indicating their significant gold reserves. The Shanghai Gold Exchange has already facilitated the conversion of large amounts of gold, with approximately 25,000 tons passing through the exchange into Chinese households and institutions.

Return to the Gold Standard

The ultimate goal for the new currency is believed to be a full return to the gold standard. This implies that the currency will be fully backed by and redeemable for gold, possibly surpassing the level of the previous gold standard. Such a return is anticipated to occur before 2030, primarily among BRICS Plus members.

Implications for Currency Issuance and Debts

The introduction of a gold-backed BRICS currency would not necessarily curtail the ability of member countries to issue their own currencies. However, an interesting point is that any existing or new member defaulting on loans from Western banks and financial institutions would not hinder their acceptance into BRICS. Consequently, the debt owed to entities like the IMF and the World Bank would effectively be wiped out upon the launch of the new currency.

Involvement of Other Commodities

While the original idea was for the new currency to be backed by a basket of commodities, including oil and rare earths, it seems that the concept has evolved into a gold-backed currency. Gold is now considered the primary backing for the currency. The role of other commodities in the currency remains uncertain.

Expansion of the BRICS Group

The BRICS coalition is likely to expand its membership in the near future. Around 20 countries, including Ethiopia, have expressed interest in joining. However, any new member requires unanimous approval from existing BRICS members. The first round of expansion is expected to be completed within a couple of years, with Gulf countries likely to be included. President Xi of China has made it clear that Gulf countries will have surpluses with China, and invoicing will be done in RMB, suggesting a close relationship between China and these nations.

Domestic Adoption of the Currency

Initially, the BRICS currency will likely be used to facilitate trade between member countries. It may not be immediately adopted as the domestic currency of these countries. The focus is primarily on using the currency for trade financing among BRICS members. However, as more trade is conducted in currencies other than the US dollar, central banks may reconsider the percentage of their reserves held in dollars.

Reactions and American Response

The US response to the development of the BRICS currency remains uncertain. The growing prominence of the new currency and the shift away from the dollar in energy markets could impact the role of the dollar as a global reserve currency. The actions and reactions of the US in response to these changes will be significant to watch.

Geopolitical Consequences and Unity Among BRICS Countries

There are existing tensions and disputes among some BRICS members. For example, China and India have border disputes. When all these countries come together, there will inevitably be jostling for supremacy and leadership. It is unclear if the assumption is that China will take the lead or if it has been technically agreed upon. However, the goal of BRICS is to pursue the greater good and operate on unanimous voting. The focus is on creating a multinational world, which suggests that differences may be put aside for the benefit of the group.

Previous Initiatives and Materialization

Previous ambitious initiatives by BRICS, such as developing a BRICS credit rating agency and creating a BRICS undersea cable, have not materialized as expected. Even the new development bank launched in 2014 remains heavily dependent on the US dollar for its survival, with local currency financing representing a small portion of its portfolio. Despite these setbacks, it is believed that the involvement of BRICS has been a deliberate, slow movement, carefully building up secretariats and think tanks. The lessons learned from past failures may contribute to the success of this new initiative.

The Role of BRICS Secretariat and Mistakes

The establishment of secretariats and think tanks within BRICS indicates a more thorough and thoughtful approach. The current President of the New Development Bank is the ex-president of Brazil, suggesting a movement towards greater significance. The previous plans may not have been well thought out, but BRICS has likely learned from those mistakes.

Coordination and Leadership

It is unclear which country is taking the lead in this initiative. The coordination seems to be mutual among all the countries, with advice flowing from the Secretariat to the leaders. The leader of the Secretariat, who remains unidentified, may play a crucial role in guiding the decision-making process.

Conclusion

It is important to note that this information is based on available data and speculation, as the specifics and outcomes of the BRICS initiative are not officially confirmed. However, the emergence of BRICS’ new currency, potentially backed by gold, signals a significant challenge to the long-standing dominance of the US dollar and the trend of de-dollarization. The possibility of convertibility into gold and the substantial gold reserves of China and Russia add depth to this currency’s potential.

While tensions and disputes exist among BRICS member countries, the pursuit of the greater good and unanimous decision-making characterize the coalition. Past initiatives may not have materialized as planned, but the deliberate approach of building secretariats and think tanks suggests a more thoughtful strategy this time. The expansion of BRICS membership, particularly with the involvement of Gulf countries, further highlights the shifting geopolitical landscape. The true extent of coordination and leadership within BRICS remain a subject of speculation.

We will have to wait and see what actually transpires at the upcoming BRICS Summit in late August. I will certainly be watching closely.

Related Ai3D Posts

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/brics-new-gold-currency-a-serious-attack-on-the-fiat-dollar-world/

Awake-In-3D: GRADUALLY THEN SUDDENLY: The Death of the Fiat Currency System and Birth of Our GCR

Awake-In-3D

GRADUALLY THEN SUDDENLY: The Death of the Fiat Currency System and Birth of Our GCR

On July 7, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Fiat Currency Debt System is hurtling headlong into total collapse. It may start slowly at first, but as a series of financial stress points develop, a chain of events will accelerate into a sudden systemic crash. The recent demise of one Swiss and three US banks is just the tip of the iceberg. The domino effect is already in motion, and it won’t be too long before the entire global financial system crumbles – leading to the birth of Our GCR.

How the Fiat System Collapse will Play Out

Here’s a step-by-step process illustrating how the collapse of the Global Fiat Currency Debt System will likely unfold, culminating in the birth of a new Asset-Backed, Global Currency System – Our GCR:

Awake-In-3D:

GRADUALLY THEN SUDDENLY: The Death of the Fiat Currency System and Birth of Our GCR

On July 7, 2023 By Awake-In-3D

In RV/GCR Articles, Fiat Debt System Collapse Articles

The Fiat Currency Debt System is hurtling headlong into total collapse. It may start slowly at first, but as a series of financial stress points develop, a chain of events will accelerate into a sudden systemic crash. The recent demise of one Swiss and three US banks is just the tip of the iceberg. The domino effect is already in motion, and it won’t be too long before the entire global financial system crumbles – leading to the birth of Our GCR.

How the Fiat System Collapse will Play Out

Here’s a step-by-step process illustrating how the collapse of the Global Fiat Currency Debt System will likely unfold, culminating in the birth of a new Asset-Backed, Global Currency System – Our GCR:

Currency Debasement Leading to Collapse: As the debt burden becomes unsustainable, governments resort to printing more money to meet their obligations. This excess money supply leads to the devaluation of the currency, causing a loss of purchasing power and eroding people’s savings.

High Inflation Leading to Hyperinflation: The devaluation of the currency results in soaring prices for goods and services. High inflation begins to erode the value of money at an alarming rate, making it difficult for people to afford basic necessities. In extreme cases, hyperinflation sets in, where prices skyrocket, and the currency rapidly becomes worthless.

Food and Energy Shortages: The escalating inflation and economic instability disrupt supply chains, leading to shortages of essential commodities such as food and energy. Prices surge even higher, and access to basic necessities becomes increasingly challenging, causing widespread social and economic turmoil.

Debt Defaults Leading to Debt Collapse: As individuals, businesses, and even governments struggle to meet their debt obligations, defaults become rampant. Debt burdens become unmanageable, leading to a collapse of the debt market and financial institutions facing insurmountable losses.

Implosion of Bubble Assets: The bursting of the debt bubble triggers a chain reaction, causing the implosion of bubble assets such as stocks, bonds, and property. These assets, which were previously overinflated due to excessive debt, lose their value rapidly, leaving investors with significant losses.

Global Credit Markets Freeze Up Completely: With the collapse of the debt market, global credit markets freeze up completely. Lenders become unwilling to extend credit, making it nearly impossible for individuals, businesses, and governments to access funding. This lack of credit further exacerbates the economic crisis and stifles economic activity.

Political & Social Turmoil – Civil Unrest: As the economic conditions worsen, political and social unrest ensues. People become frustrated with the deteriorating living standards, rising inequality, and the inability of governments to address the crisis effectively. Protests, demonstrations, and civil unrest become common, straining social cohesion and stability.

Geopolitical Tensions: The economic collapse has far-reaching geopolitical implications. Nations compete for dwindling resources and economic dominance, leading to heightened tensions and conflicts. Geopolitical dynamics undergo a significant shift, as the balance of power in the world is redefined.

The Fall of the Fiat Currency Debt System and the Rise of a Gold-Backed Currency System in the form of a Global Currency Reset (Our GCR): The culmination of the collapse brings an end to the current Fiat Currency Debt System. Governments and financial institutions realize the need for a new system based on more stable foundations. A Global Currency Reset (GCR) is implemented, with a shift toward a gold-backed currency system that provides more confidence and stability in global financial transactions.

The Deceptive Gradual Phase

As the famous writer Ernest Hemingway once said, bankruptcy comes gradually and then suddenly. We are currently in the gradual phase, where the signs of collapse are subtle and easily overlooked. Investors have dismissed the collapse of four banks as a minor headache, remedied by central banks pumping billions of dollars into the system. But don’t be deceived. This phase is our last chance to prepare for what lies ahead. If we wait until the sudden phase hits, panic will paralyze us, and recovery will become an elusive dream. The losses will only worsen, leaving us in a state of utter despair.

The Everything Collapse: A Debt Crisis

So, what exactly will collapse when the Everything Collapse arrives? Primarily, it will be a debt crisis of epic proportions. Global debt has tripled in this century alone, reaching a staggering figure of $3 quadrillion when including derivatives. To put this in perspective, it is 20 times the size of the global GDP. Such a magnitude of debt is bound to wreak havoc on the world economy, causing irreparable damage.

US & European Banks Teetering on the Edge

The risk is not confined to a few isolated incidents; it extends to the very foundations of the financial system. Both US and European banks are teetering on the edge of collapse. In the US, the balance sheets of all banks in relation to Tier 1 capital have reached a 30-year high. This dangerous level puts the entire US banking system in a highly precarious position. To survive, US banks must drastically shrink their balance sheets by demanding loan repayments. The situation in Europe is no better, as Eurozone banks have tightened business credit to the greatest extent since 2011.

Consequences of High Rates and Credit Contraction

The repercussions of high interest rates and forced credit contraction will be far-reaching. Not only will borrowers face mounting pressure, but the banking systems of the US and Europe will also be severely affected. As defaults increase, central banks will resume their money-printing frenzy, perpetuating the vicious cycle. Bank debt will be the primary casualty, leading to a scarcity of credit and a surge in defaults. Central bankers, known for their manipulative tendencies, will resort to unprecedented levels of money printing, further eroding the value of their weak balance sheets.

The Impending Cataclysm

When a credit cycle reaches its final stages, cataclysmic consequences are inevitable. The Everything Collapse will bring forth a chain reaction of events that will leave the world reeling. The collapse of currencies, rampant inflation leading to hyperinflation, shortages of food and energy, debt defaults triggering a collapse in the financial system, and the implosion of bubble assets such as stocks, bonds, and property are just some of the disasters that await us. Social and political unrest will grip nations, while geopolitical tensions will escalate. The once-dominant Global Fiat System will fall, and our asset-backed GCR will rise to prominence.

Bankruptcies

The origins of the word “bankruptcy” shed light on the current state of the global fiat financial system. “Bankruptcy” comes from the Italian term “Banca Rotta,” which means “broken bench.” In 16th-century Italy, bankers conducted their business from a bench or table. When they could no longer fulfill their obligations, their bench was smashed to symbolize their failure.

Recent collapses of US and Swiss banks have exposed the incompetence and lack of risk management among their management teams. These banks made disastrous investment decisions and ignored the warning signs.

Interconnected Dominoes

The global financial system operates as an intricate web, and once one major bank collapses, the domino effect will commence. Central banks will initially respond with unlimited fiat currency printing, attempting to shore up the crumbling system. However, as derivatives start to collapse, the value of this “funny money” will become meaningless.

Related posts:

The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

Commercial Real Estate: A Likely Trigger for Fiat Financial System, then US Dollar Collapse

Awake-In-3D Website: Ai3D GCR RealTimeNews

I’m on Telegram: GCR_RealTimeNews

I’m on Twitter: @Real_AwakeIn3D

Awake-In-3D: IQD History: CBI Governor Speaks Publicly About Currency RV/RD in 2011

Awake-In-3D

IQD History: CBI Governor Speaks Publicly About Currency RV/RD in 2011

On July 6, 2023 By Awake-In-3D

The year 2011 was truly and exciting time in Dinar-Land. The possibility of an RV of the IQD went hyperbolic when Dr. Shabibi, the Governor of the Central Bank of Iraq addressed direct questions on the possibilities of an RD/RV of the Dinar.

He appeared optimistic yet never actually answered the questions. Little did we all know back then that we would still be here waiting for an RD/RV in 2023.

Does anyone here recall how all of the IQD currency dealers of the time would sell “Reserves” allowing one to put IQD on hold. It was like putting gifts on “layaway” at Walmart. Those were the Wild West days of the IQD RV.

Awake-In-3D:

IQD History: CBI Governor Speaks Publicly About Currency RV/RD in 2011

On July 6, 2023 By Awake-In-3D

The year 2011 was truly and exciting time in Dinar-Land. The possibility of an RV of the IQD went hyperbolic when Dr. Shabibi, the Governor of the Central Bank of Iraq addressed direct questions on the possibilities of an RD/RV of the Dinar.

He appeared optimistic yet never actually answered the questions. Little did we all know back then that we would still be here waiting for an RD/RV in 2023.

Does anyone here recall how all of the IQD currency dealers of the time would sell “Reserves” allowing one to put IQD on hold. It was like putting gifts on “layaway” at Walmart. Those were the Wild West days of the IQD RV.

During a discussion held at the US Chamber of Commerce in Washington, DC, in April 2011, Dr. Shabibi, the Governor of the Central Bank of Iraq (CBI) at that time, was questioned about the potential revaluation and redenomination of the Iraqi Dinar (IQD). However, Dr. Shabibi’s responses were notably vague and diplomatic, leaving much to be discerned from his answers.

When asked about the possibility of a revaluation, Dr. Shabibi avoided giving a direct response. He emphasized the importance of controlling inflation and maintaining price stability, noting that the current inflation rate in Iraq was around 5%. He mentioned that various factors, including trade, exports, imports, and balance of payments, influenced currency movement. Dr. Shabibi’s response revolved around the need to track inflation development and other relevant factors before determining any exchange rate movement or potential revaluation.

Regarding the redenomination of the currency, Dr. Shabibi also provided a diplomatic and passive answer. He downplayed the significance of removing three zeros from the currency, stating that it was primarily a measure to facilitate payments and ease counting. He highlighted the historical context of adding three zeros in the 1980s due to high inflation and mentioned that the current situation was different, with inflation under control and the exchange rate managed by the Central Bank. However, he acknowledged that implementing the redenomination required careful planning, including propaganda campaigns and education efforts, with the cooperation of the government and security forces.

It is worth noting that this event took place 12 years ago, and as of 2023, Iraq is still grappling with some of the key issues that Dr. Shabibi spoke about way back then. Yet much progress has certainly been made since then in regards to Iraq’s political, banking and economic reforms. But still, Iraq has yet to redenominate and/or revalue its currency.

See my previous post: Iraqi Finance Deputy: Iraq Not Ready for Currency RD/RV

Dr. Shabibi’s diplomatic and cautious approach to the questions may reflect the complexities and challenges surrounding these monetary decisions. The passage of time underscores the ongoing nature of the issues and the difficulties faced by Iraq in addressing them.

Key points and statistics mentioned by Dr. Shabibi:

IQD Currency Revaluation

Revaluation depends on controlling inflation and maintaining price stability.

The Central Bank closely monitors inflation, which has risen to around 5%.

Factors affecting currency movement include trade, exports, imports, balance of payments, and development-related aspects.

The government focuses more on its budget, while the Central Bank emphasizes inflation control.

Exchange rate movement will be determined by tracking inflation development and other relevant factors.

IQD Currency Redenomination

Redenomination aims to facilitate payments and ease counting, particularly for large figures.

The decision to add three zeros in the 1980’s was driven by high inflation.

Current conditions have changed, with inflation under control and the exchange rate managed by the Central Bank.

Removing the three zeros requires careful implementation, including a propaganda campaign and extensive education efforts.

Cooperation from the government and security forces is essential for successful redenomination.

My Simple Transcript of the Event (watch the video to get the full details)

Date: April 19, 2011

Location: US Chamber of Commerce, Washington, DC

Participant: With respect to the ongoing need for stability in Iraq and its exchange rate, we understand that there is a potential need for a revaluation of the currency to attract domestic and foreign investment. How far do you believe we are from a potential revaluation of the Iraqi currency?

Dr. Shabibi: The answer depends on various factors, particularly the extent to which we can continue controlling inflation. Maintaining price stability is our primary goal, and while there is currently a small inflation rate of around 5%, we are monitoring it closely. If inflation continues, we may need to reconsider the exchange rate and potential revaluation. Other factors that influence currency movement include trade, exports and imports, balance of payments, and other development-related aspects of the economy. However, the question of maintaining price stability is crucial, as it is not a major concern for other entities in the economy. We will track inflation development and other relevant factors to determine the appropriate exchange rate movement.

Participant: I’ve heard a report that Iraq is planning to cut three zeros off the currency, referred to as “redenomination.” Could you provide more information on this?

Dr. Shabibi: The cutting of three zeros should not be exaggerated. Redenomination aims to facilitate payments and ease of counting, especially when dealing with large figures. This decision was not made by a government decree, but rather due to the economic conditions in the 1980s, characterized by high inflation. However, the situation has changed significantly now, with inflation under control and the exchange rate managed by the Central Bank. The presence of zeros creates difficulties in managing the currency. Our plan is to remove the three zeros, but it requires careful implementation, including a propaganda campaign and extensive education efforts. The cooperation of the government and security forces is crucial in this process. We are committed to bringing about the redenomination, taking into consideration the monitoring of the exchange rate and other necessary measures.

Here’s the actual recorded event for you to hear what was said for yourself.

Awake-In-3D Website: Ai3D GCR RealTimeNews

I’m on Telegram: GCR_RealTimeNews

I’m on Twitter: @Real_AwakeIn3D

https://ai3d.blog/iqd-history-cbi-governor-speaks-publicly-about-currency-rv-rd-in-2011/

Awake-In-3D: The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

Awake-In-3D:

The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

On July 6, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

As if out of the script of a Hollywood disaster movie, the US Treasury has increased the national debt by over $850 billion in just one month. I am growing more convinced by the day that the Global Elitists and Banksters are deliberately accelerating the collapse of the Fiat Currency Debt System.

This staggering amount comes after Congress suspended the federal government’s borrowing limit for two years, leading to an alarming rise in debt. As of June 30, the national debt stood at a mind-boggling $32.33 trillion, crossing the $32 trillion mark within a week of the debt ceiling suspension. These numbers are a clear indication that the Fiat Currency Debt System is hurtling towards a total freeze of the global credit markets, creating a crisis of monumental proportions.

Awake-In-3D:

The Fiat Currency Debt System is Heading Towards a Global Credit Market Freeze

On July 6, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

As if out of the script of a Hollywood disaster movie, the US Treasury has increased the national debt by over $850 billion in just one month. I am growing more convinced by the day that the Global Elitists and Banksters are deliberately accelerating the collapse of the Fiat Currency Debt System.

This staggering amount comes after Congress suspended the federal government’s borrowing limit for two years, leading to an alarming rise in debt. As of June 30, the national debt stood at a mind-boggling $32.33 trillion, crossing the $32 trillion mark within a week of the debt ceiling suspension. These numbers are a clear indication that the Fiat Currency Debt System is hurtling towards a total freeze of the global credit markets, creating a crisis of monumental proportions.

What You Will Learn in this Article:

The US Treasury increased the national debt by over $850 billion in just one month.

The national debt crossed $32 trillion within a week of the debt ceiling suspension.

Goldman Sachs projected that the Treasury would need to sell up to $700 billion in T-bills to replenish cash reserves.

Nonmarketable debt increased by $123 billion, while marketable debt rose by $728 billion.

The Treasury General Account (TGA) cash balance increased to $465 billion, falling short of the $550 billion goal.

The Treasury estimates the need to sell $733 billion in marketable securities during the third quarter.

The government tax receipts are dropping, necessitating further borrowing.

Spending cuts in the Fiscal Responsibility Act do not significantly impact total spending.

The Treasury’s borrowing spree drains liquidity from the markets.

Rising interest rates create upward pressure on corporate bonds, mortgages, and other debt instruments.

The national debt poses a significant challenge, and paying interest on it will become problematic if interest rates remain elevated.

Unprecedented Borrowing Rates and Unforeseen Consequences

The pace at which the US Treasury is borrowing money is astonishing. It is far beyond what analysts had projected, even surpassing Goldman Sachs’ estimate of up to $700 billion in T-bills to be sold within six to eight weeks of a debt ceiling deal. Shockingly, this figure was blown through in just four weeks. The Treasury’s reliance on marketable securities, including bonds and notes, has skyrocketed, with a staggering $728 billion increase in marketable debt since June 3, reaching a total outstanding debt of $25.43 trillion. The non-marketable debt also rose by $123 billion, though it constitutes a smaller portion of the overall debt.

Partial Refilling of Treasury General Account and Plummeting Tax Receipts

Despite the massive borrowing spree, the Treasury Department has only managed to partially refill the Treasury General Account (TGA), which essentially functions as the federal government’s checking account. The cash balance in the TGA increased from $23 billion to $465 billion as of June 30. However, this falls short of the Treasury’s $550 billion goal and remains significantly below the desired balance of nearly $600 trillion “consistent with Treasury’s cash balance policy.” Compounding the problem is the drop in government tax receipts, forcing the Treasury to borrow even more to bridge the gap.

The Illusion of Spending Cuts and Soaring Deficits

The concept of spending cuts in the so-called Fiscal Responsibility Act is misleading. In reality, these cuts do not make a dent in actual total spending, leading to the continuation of massive deficits month after month. It is only a matter of time before Congress and the Biden administration abandon the facade of spending cuts to address the next crisis. This pattern paints a grim picture for the future, with ever-increasing deficits and a mounting debt burden.

The Daunting Challenge of Selling Bonds

As the Treasury seeks to cover its current spending and replenish the TGA, it estimates the need to sell $733 billion in marketable securities during the third quarter. However, a pressing concern arises—who will buy all these bonds? With the Federal Reserve preoccupied with the battle against inflation, it cannot artificially stimulate demand through quantitative easing, at least for the time being. Consequently, the Treasury will be compelled to sell bonds at lower prices and higher yields to entice enough demand to absorb the supply. However, this approach will result in higher interest rates, an unfavorable scenario for a government attempting to borrow trillions of dollars. The national debt looms as a ticking time bomb, with its consequences poised to wreak havoc.

Liquidity Drain and Rising Interest Rates

The Treasury’s borrowing spree will significantly drain liquidity from the markets, the inverse of what occurred during the drawdown phases. As liquidity is absorbed, it exerts upward pressure on interest rates across various debt instruments, such as corporate bonds, mortgages, and auto loans. The implications of this liquidity drain and rising interest rates are yet to fully manifest, but it is certain that they will have a profound impact on the global credit markets.

The Looming Crisis: Ignoring the National Debt’s Implications

The national debt has grown to such an extent that it has become a topic of indifference for many. People often shrug off discussions about the debt, considering it a concern for the distant future. However, this complacency is misguided, as the road ahead is shorter than anticipated. Eventually, the consequences of the debt will catch up, leading to an economic catastrophe with far-reaching implications.

The Bottom Line

The Fiat Currency Debt System is hurtling towards a freeze in the global credit markets. The astronomical increase in the US national debt, coupled with the government’s insatiable borrowing spree, presents a clear and present danger. The Treasury’s reliance on selling bonds to cover its spending obligations poses a significant challenge, especially in the absence of artificial demand created by the Federal Reserve. The liquidity drain and rising interest rates further exacerbate the situation, adding to the fragility of the credit markets. It is imperative that immediate action is taken to address this impending crisis, as ignoring the national debt’s implications will only serve to amplify the magnitude of the disaster awaiting us.

Helpful Information: Why Excessive National Debt Poses a Risk to Global Credit Markets in a Fiat Currency System

1. Burden on Government Finances: Excessive national debt puts a tremendous burden on government finances. As the debt increases, the government needs to borrow more to cover its obligations, leading to a higher debt-to-GDP ratio. This raises concerns among investors and creditors about the government’s ability to repay its debts, potentially eroding confidence in the fiat currency system.

2. Crowding Out Effect: When a government has a high level of debt, it needs to allocate a significant portion of its budget towards interest payments. This leaves fewer funds available for essential public services, infrastructure development, and social programs. The crowding out effect occurs when government borrowing diverts funds away from the private sector, reducing the availability of credit for businesses and individuals. This can result in a credit squeeze and hinder economic growth.

3. Reduced Investor Confidence: Excessive national debt can undermine investor confidence in the stability and soundness of a country’s economy. Investors become concerned about the risk of default or currency devaluation, leading to a decline in demand for government bonds and other debt instruments. As a result, the government may struggle to find buyers for its bonds, leading to higher borrowing costs and potentially freezing up the global credit markets.

4. Rising Interest Rates: As the national debt increases, the government becomes more dependent on borrowing from domestic and foreign investors. If there is a perception of increased risk associated with the debt, investors may demand higher interest rates to compensate for the added risk. This can lead to a vicious cycle where higher borrowing costs further strain government finances, making it even more challenging to service the debt. Rising interest rates can also have a ripple effect, affecting consumer borrowing costs, mortgage rates, and business investments, further dampening economic activity.

5. Systemic Risk: Excessive national debt can create systemic risks within the financial system. When governments heavily rely on borrowing to finance their operations, any shock or disruption in the credit markets can have severe repercussions. A freeze in the global credit markets can lead to liquidity shortages, hinder business operations, restrict access to credit for individuals and businesses, and potentially trigger a financial crisis.

6. Undermining Public Trust: In a fiat currency system, where the value of money is not backed by a physical commodity but rather by the trust and confidence of the people, excessive national debt undermines that trust and confidence. The risk of freezing up global credit markets arises from the interdependence of economies and financial systems worldwide. Therefore, it is crucial for governments to address and manage their national debt levels responsibly to maintain stability in the global credit markets and protect the overall health of the fiat currency system.

Awake-In-3D Website: Ai3D GCR RealTimeNews

I’m on Telegram: GCR_RealTimeNews

I’m on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-fiat-currency-debt-system-is-heading-towards-a-global-credit-market-freeze/

Awake-In-3D: Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

Awake-In-3D:

Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

On July 6, 2023 By Awake-In-3D

The global financial system teeters on the brink of disaster, as consumers panic and pawn their possessions while debt servicing challenges reach unprecedented heights. Are these emerging cracks the harbingers of the inevitable collapse of the fiat currency system?

As the world grapples with economic uncertainties, the recent surge in pawn shop searches and the mounting debt servicing crisis in the United States serve as alarming indicators of widening cracks in the global fiat currency system. These signs point towards an inevitable collapse of the existing financial framework.

Awake-In-3D:

Widening Cracks: Continuing Signs of the Fiat Currency Debt System Collapse

On July 6, 2023 By Awake-In-3D

The global financial system teeters on the brink of disaster, as consumers panic and pawn their possessions while debt servicing challenges reach unprecedented heights. Are these emerging cracks the harbingers of the inevitable collapse of the fiat currency system?

As the world grapples with economic uncertainties, the recent surge in pawn shop searches and the mounting debt servicing crisis in the United States serve as alarming indicators of widening cracks in the global fiat currency system. These signs point towards an inevitable collapse of the existing financial framework.

A Short Summary (Just the Facts for a Short Read)

Cracks in the Foundation: The Pawn Shop Surge

Google searches for “pawn shop near me” reached record highs, reflecting financial distress.

The trend started surging in January, exploding in recent months.

Interest in pawn shops is nationwide, with significant interest in the Deep South.

Related search trends such as “pawn shop,” “open pawn shop near me,” and “cash pawn shop near me” are also on the rise.

The Consumer’s Struggle: A Debt Servicing Crisis

Despite tightened credit standards, revolving consumer credit has surged.

Interest rates on credit cards have reached historic highs.

Consumers continue spending despite mounting debt burdens and rising interest payments.

The increase in interest payments is the highest since the 2008-2009 recession.

Nominal credit usage poses potential risks, impacting stock-to-income ratios.

Weakening Economic Indicators: A Warning Sign

Major companies like General Mills and Walgreens Boots Alliance warn of a weakening consumer.

Goldman Sachs analyst Rich Privorosky questions the consumer’s behavior and excess savings.

Companies’ concerns indicate a discrepancy between consumer behavior and economic indicators.

The Federal Reserve’s interest rate hikes aim to limit economic growth.

The Fragility of the Fiat Currency System: An Impending Collapse

The surge in pawn shop searches exposes the vulnerability of the global fiat currency economy.

Mounting debt servicing challenges and weakening consumer bases hint at deeper issues.

The increasing reliance on pawn shops signifies a loss of confidence in traditional financial systems.

The global fiat currency system faces an impending collapse if these issues are left unaddressed.

A Deep Dive (More Details and References for Interested Readers)

The Surge in Pawn Shop Searches Highlights Cracks in the Global Financial System

The recent surge in Google searches for “pawn shop near me” has raised concerns about the stability of the global fiat currency financial system. This trend, which has reached record highs, indicates that cash-strapped Americans may be resorting to pawning items or selling possessions acquired during the Covid boom to cope with the current inflation crisis. Examining the search data and related trends, along with warnings from companies and financial experts, reveals a growing crack in the consumer’s financial stability.

Increasing Interest in Pawn Shops

The search trend for “pawn shop near me” began in January and has experienced explosive growth in recent months, culminating in record highs in early July. The interest in this trend is nationwide, with particularly high levels in the Deep South. Related search queries such as “pawn shop,” “open pawn shop near me,” “pawn shop open,” and “cash pawn shop near me” are also in breakout territory, indicating a significant increase in consumer interest.

Consumer Financial Struggles

The surge in pawn shop searches suggests that the current economic measures and actions underway by the US Federal Reserve Bank , are not effectively addressing consumers’ financial challenges. Americans have faced over two years of negative real wage growth, depleting savings, and accumulating record credit card debt amidst the highest interest rates in a generation. This situation has prompted consumers to explore new avenues for quick cash by selling their possessions.

Cracks in the Consumer

The increasing reliance on pawn shops could be seen as a sign of the consumer’s financial stability cracking. Major companies like General Mills and Walgreens Boots Alliance have recently expressed concerns about a weakening consumer base. Goldman Sachs analyst Rich Privorosky has questioned the discrepancy between consumer behavior and economic indicators, asking whether the era of excess savings has come to an end and consumers are now focused on replenishing their savings.

Implications for the Global Financial System

The surge in searches for pawn shops is a clear indication that consumers are feeling the pressure of the current economic climate. This trend raises concerns about the stability of the global fiat currency financial system, as it suggests that individuals are resorting to alternative measures to secure cash. While it is too early to determine the full impact of these developments, they underscore the fragility of the existing financial system and the need for policymakers to address the underlying issues driving this shift.

The Looming Debt Servicing Crisis: A Troubling Divergence in the US Economy