“Tidbits From TNT” Thursday Morning 12-11-2025

TNT:

Tishwash: The Iraqi Embassy in Washington welcomes the US House of Representatives' vote to repeal the authorizations for the use of force against Iraq.

The Iraqi Embassy in Washington welcomed the US House of Representatives' vote to repeal the two authorizations for the use of military force against Iraq.

A statement from the Iraqi Embassy read: "The Embassy of the Republic of Iraq in Washington welcomes the US House of Representatives' vote to repeal the 1991 and 2002 authorizations for the use of military force against Iraq and to repeal the War Powers Resolution, a step that strengthens the partnership between Iraq and the United States and supports the bilateral relationship based on dialogue and cooperation." link

Tishwash: The Governor of the Central Bank participates in the Conference on the Future of Financial Markets in Iraq

In the presence of His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, the Financial and Accounting Training Center at the Ministry of Finance in Baghdad held its fifth annual international scientific conference, entitled: "The Future of Financial Markets in Iraq in an Era of Contemporary Transformations."

The conference brought together a select group of experts, academics, and government entities concerned with developing the financial and economic infrastructure. In his opening address, His Excellency the Governor emphasized that the world is currently witnessing an unprecedented phase of profound transformations in its financial and economic structures, where technology, finance, and economic policies intersect to create a rapidly changing and highly complex reality that precludes reliance on traditional models.

He stated, "It is no longer possible to postpone serious consideration of the future of our financial markets, nor to be content with traditional tools. Rather, it has become essential to have institutions capable of responding, transforming, and innovating."

He added that the last two decades have witnessed a comprehensive digital revolution that has altered the nature of economic activities, creating vast opportunities for digitizing transactions, enhancing transparency, developing banking services, and attracting technology investments.

He pointed out that there are various examples confirming that there is no static economic model… rapid transformations have become the rule, not the exception, and that the strength of the global economy today is not measured solely by the size of its natural resources, but also by the ability of its financial markets to adapt, absorb shocks, mobilize savings, and transform them into productive investments.

Heemphasized that developing financial markets in Iraq is a strategic necessity, not merely a reform option, if we want our economy to keep pace with the accelerating global cycle.

The Governor of the Central Bank reviewed the most prominent efforts Iraq has witnessed in recent years to develop its financial infrastructure, foremost among them the efforts to enhance monetary stability, which have been reflected in low inflation levels, as well as the vital role of the bank in stimulating local debt markets and financing the national economy, including bond issuances that have constituted an important source of financing for the general budget during critical phases of the economic cycle.

He explained that these issuances, in cooperation with the Ministry of Finance, the Securities Commission, and the Iraq Stock Exchange, have constituted a fundamental lever for financing the budget over the past two years, contributing an annual average of 5 trillion dinars and covering more than 50% of financing needs.

His Excellency concluded his speech by emphasizing the importance of adopting modern strategies to develop Iraqi financial markets, enhance transparency, expand financing tools, and keep pace with global digital transformations, and that the Central Bank of Iraq supports these steps, which support sustainable economic growth and drive investment in the country.

Central Bank of Iraq,

Media Office,

December 10, 2025 link

************

Tishwash: A government advisor reveals a legal path that allows securing salaries and obligations without the need for parliament.

The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed on Wednesday the possibility of the government resorting to using "short-term advances" to secure salaries and maximum financial obligations, considering this the only legal path available to guarantee public services in light of the current legislative vacuum.

Saleh told Al-Furat News Agency that “the government, in the absence of parliament and with liquidity depleted, does not have the constitutional authority to engage in sovereign borrowing, but it has the legal and legitimate right to use short-term advances from the treasury, financed exclusively by government banks, as part of liquidity management without it being considered sovereign borrowing in the legal sense.”

He added that “this mechanism ensures the securing of priorities, foremost among them salaries, pensions and social welfare, based on the amended Financial Management Law No. 6 of 2019,” noting that “Article (3) of the law authorizes the Ministry of Finance to manage liquidity and reallocate it, while the prohibition on borrowing contained in Article (24) applies to borrowing from outside the government sector exclusively.”

Saleh explained that "this measure represents a legal loophole that allows for a practical mechanism that does not require new legislation, and it is the only available path to ensure the continued funding of basic services until the legislative authority is reconstituted and the regulatory financial laws are issued." link

Tishwash: Borrowing freeze deepens Iraq’s fiscal crisis ahead of 2026

The Iraqi government has no legal authority to borrow currency until a new parliament is seated, the prime minister’s financial adviser warned on Tuesday, as Iraq enters 2026 with no budget and a deepening fiscal crunch.

According to Eco Iraq Observatory, the country’s deficit had already reached 17.7 trillion dinars (around $13.5 billion) by end-September 2025, forcing the government to operate under the restrictive 1/12 spending rule and freezing projects nationwide.

Mudher Mohammed Saleh told Shafaq News that while sovereign borrowing — whether domestic or foreign — is barred without parliamentary approval, the law still permits the use of short-term treasury advances funded exclusively by state-owned banks. These advances, he said, are strictly liquidity-management tools and do not constitute sovereign debt under Federal Financial Management Law No. 6 of 2019.

Article 3 of the law, Saleh explained, authorizes the Ministry of Finance to manage public liquidity and reallocate funds among state institutions “according to financial interest,” whereas Article 24 prohibits all internal or external borrowing unless a specific law is passed by parliament. The restriction, he noted, applies to borrowing from outside the government sector and “does not include financing arrangements within the public sector.”

He added that the law places no limits on short-term financial advances or temporary funding arrangements between government entities, so long as they remain within the scope of liquidity management rather than sovereign borrowing. This framework is currently the “only legal mechanism available” to keep essential state expenditures funded until legislative authority is restored and able to pass the required financial laws.

The Federal Supreme Court ruled last month to dissolve parliament and convert the cabinet into a caretaker government. The court said election day — November 11 — marked the end of parliament’s mandate and its authority to legislate or oversee the executive. Under the ruling, the cabinet’s powers are reduced to managing daily, non-deferrable affairs.

Caretaker governments in Iraq are legally confined to routine operations. They cannot pass new laws, approve multi-year contracts, negotiate long-term investment agreements, or implement structural reforms. In practice, they operate at roughly 20–30 percent of normal administrative capacity.

More than 120 draft laws are currently frozen, along with more than 6,000 pending administrative decisions. Thousands of contracts worth an estimated $8–10 billion — including infrastructure and service projects — also remain suspended, according to a previous Shafaq News report on the post-election vacuum.

The new parliament’s first session is expected after January 9, 2026. Government formation may take an additional three to four months even under favorable conditions, further tightening pressure on state finances and planning bodies. Unlike previous political cycles, both the legislature and the cabinet have halted full operations until the new parliament convenes. link

************

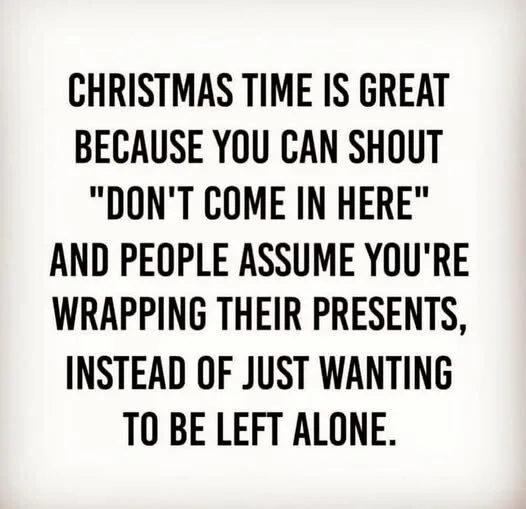

Mot: aaaahhhhhhh -- Quiet Time!!!!