“Tidbits From TNT” Monday Morning 12-22-2025

TNT:

Tishwash: Iraqi state-owned banks suspend operations until the beginning of next year

Iraqi state-owned banks will begin their annual inventory and audit procedures this week, which will halt their operations until the beginning of next year.

An informed source told Shafaq News Agency that "this step comes to pave the way for settling accounting holds and preparing the statistics and financial data for the past year," noting that "the work will include not promoting banking service requests and temporarily halting all banking activities during the inventory period, and this procedure is carried out annually."

The source confirmed that "banks will resume their normal operations and begin promoting banking transactions and services at the beginning of next year after completing the inventory and auditing procedures in accordance with the approved regulations link

Tishwash: A new shift in customs procedures is expected at the beginning of next year.

The General Authority of Customs announced the full implementation of the advance customs declaration system at the beginning of next year, to include all imported goods and merchandise.

The Director General of the Authority, Thamer Qasim Dawood, explained in a press statement that "the Authority has begun the gradual implementation of the system, as the first phase included five basic materials: gold, mobile phones, jewelry, curtains, in addition to some other goods such as cooling devices and cars."

He pointed out that "the period from the first until (31) of this month represents a trial phase in preparation for generalizing the system to all goods and merchandise in the federal customs centers, stressing that the Kurdistan Region of Iraq ports are temporarily excluded because they are not linked to the ASYCUDA system adopted by the Authority."

Daoud stressed that “the electronic link between customs declarations and the Central Bank of Iraq will directly contribute to reducing currency smuggling and money transfers without corresponding goods.” link

************

Tishwash: Financial reform in Iraq: A plan on paper or the beginning of economic change?

Amid the end of the current government's term, the latest decisions came under the title of financial reform in Iraq to reduce expenditures and maximize resources, but they face implementation challenges due to the government's limited powers, which raises questions about its ability to address deep financial imbalances and secure real economic stability before the next government takes over.

After the Iraqi government reached the end of its constitutional term, it launched a package of financial decisions under the title of “reducing spending and maximizing revenues,” without having political or time cover to ensure that they would be turned into effective policies.

These decisions, issued by a government with limited powers, are not binding on the next government, nor are they part of its program, making them closer to reforms on paper, put forward at the last minute to manage financial pressure rather than to address the roots of the crisis, amid widespread doubts about their ability to be implemented or to continue after the formation of the new government.

Decisions of the Ministerial Council for the Economy

The Ministerial Council for the Economy, during a meeting dedicated to discussing the issue of reducing spending and maximizing revenues, approved a package of decisions aimed at controlling public expenditures and strengthening the state’s financial resources.

The decisions included reviewing the allowances and salaries of the three presidencies and working to equalize them with the salaries of the Prime Minister's office staff, in addition to updating the salary scale for all state employees, based on the recommendations of the Ministry of Planning. The Council also decided to reduce the allowances for official travel for state employees by 90%, limiting such travel to cases of extreme necessity and requiring the approval of the relevant minister, as well as reducing the supervision and monitoring percentages for new projects.

Maximizing non-oil revenues

For his part, the Prime Minister’s advisor, Dr. Mazhar Muhammad Saleh, confirmed that the recent drop in oil prices to below $60 a barrel constitutes a manageable financial pressure and does not amount to a financial crisis, noting that Iraq still possesses important safety margins, foremost among them comfortable foreign reserves and public debt levels within safe limits, in addition to the continued ability to meet basic obligations, primarily salaries and service spending.

Saleh said that the continuation of global oil prices at these levels may be reflected in the 2026 budget with a manageable deficit, the size of which depends on price developments, production levels, and the extent of control over public spending.

He pointed out that fiscal policy is working to manage this deficit by rearranging priorities, maximizing non-oil revenues, and making limited use of domestic financing tools when necessary, without compromising economic stability.

Saleh added that the government adopted clear standards for reducing unnecessary spending, including reviewing the salaries and allowances of the three presidencies, and reducing foreign delegations by up to 90%, while maintaining only delegations of a sovereign and necessary nature, in accordance with the principle of justice and accountability starting from the highest level of the state.

He stressed that these measures will not affect vital investment projects or basic services for citizens, as spending related to the water, electricity, health and education sectors has been neutralized, with priority given to projects with advanced completion rates, in addition to protecting the salaries of the middle and lower segments.

He concluded by saying that the current fiscal policy is based on smart management of public spending, which maintains economic and social stability, and deals with fluctuations in oil prices as periodic challenges that require adaptation and reform, without imposing additional burdens on the citizen.

In extra time

Economic expert Ziad al-Hashemi believes that the Iraqi government is now playing for time, after the damage has been done, as he put it, and is trying to score last points in its favor by proposing a financial reform plan aimed at reducing spending and increasing revenues.

Al-Hashemi points out that “governments in various countries around the world usually present their financial programs at the beginning of their formation, to address previous imbalances, improve the quality of spending, maximize returns, and draw up a systematic and disciplined financial policy. However, what happened in Iraq was the complete opposite of that.”

Over the past four years, Al-Hashemi explains that “the government program was based primarily on expanding spending, through highly politicized financial budgets, which contributed to inflating salaries and subsidies, and piling up government employees in numbers that exceed the needs and capacity of state institutions, in addition to maximizing the financial deficit and accumulating debts, and allowing corruption to operate freely.”

He adds that all of this “happened at a time when Iraq’s financial revenues, especially oil revenues and others, were witnessing a significant decline, yet the government ignored internal warnings and international reports that repeatedly sounded the alarm, warning of the risks of inflated spending in light of deteriorating revenues, without receiving any response.”

Lost opportunities for reform

After the opportunities for reform were lost and the financial crisis worsened dangerously during the past years, Al-Hashemi points out that “the government is now emerging, at the end of its lifespan, with a financial reform plan, after the financial pressure has reached its peak, and the possible solutions are now only harsh and painful, and their impact will most likely be felt by the citizen before anyone else.”

Al-Hashemi raises questions about the mechanisms for implementing this plan, asking about “how it can be implemented by a caretaker government with limited powers, which does not have enough time to implement broad reform measures, in addition to the ambiguity of the implementing bodies, the commitment mechanisms, and the timetables, in light of the imminent formation of a new government.”

It is likely that “this move is an attempt by the government to polish its image in its final days, by announcing a financial reform plan, perhaps with the aim of encouraging political parties to reappoint the current Prime Minister and give him a chance to implement this plan.”

He concluded by saying: “In any case, the next government, whether the current Prime Minister is reappointed or another figure is chosen, will face an extremely difficult financial test, which will force it to take more harsh and painful measures, and financial austerity may be the most prominent theme for the next four years.”

Crisis management, not economic reform

For his part, academic and economic researcher Nawar Al-Saadi believes that “the real goal of these measures is not to launch a comprehensive economic reform in the strict sense, as the caretaker government lacks the political cover and sufficient time to proceed with reforms of this kind.”

Al-Saadi says that “the goal is limited to reducing the financial bleeding and containing the risks until the responsibility is transferred to the next government,” adding that these steps “carry a dual message; the first is directed to the markets and regulatory bodies, indicating that the financial situation is still under control for the time being. The second is to the next government, indicating that the margin for maneuver has become narrower than it was previously.”

Al-Saadi explains that “the problem lies in the structure of the economic decision itself. Iraq does not suffer from a lack of plans or diagnosis, but rather from a weakness of executive will and the prioritization of short-term political calculations at the expense of painful reforms.”

Al-Saadi notes that “what is happening today is more of a crisis management effort than a genuine economic reform. The recent decisions may help alleviate the immediate pressure on the treasury, but they do not address the root causes of the problem, which are the bloated public sector, the fragility of non-oil revenues, and the weakness of financial governance.”

He concluded by warning that “unless the next government moves from the logic of ‘temporary austerity’ to comprehensive structural reform, Iraq will remain stuck in the same cycle, between high spending in years of plenty and belated austerity decisions with the first tremor in oil prices.” link

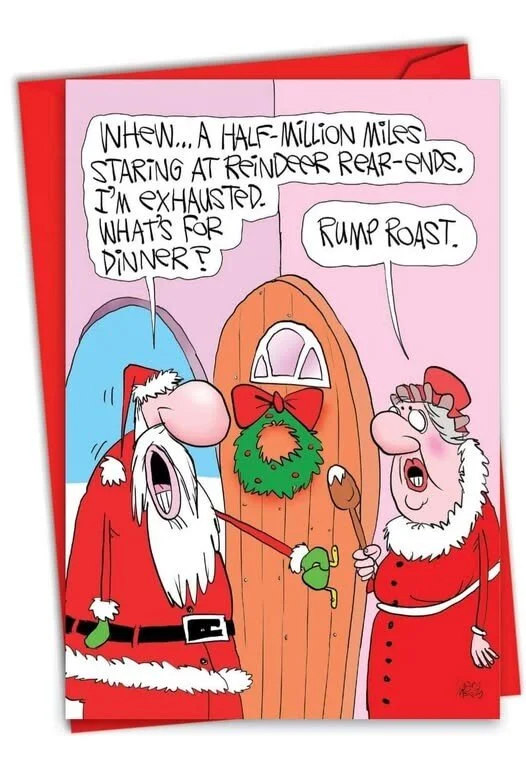

Mot: . Poor ole Santa!!!!

Mot: Asking for a Friend!!!