Thoughts from DJ and Michael Murdoch Late Monday PM 9-28-2020

DJ: DID YOU KNOW?

This information is for those involved in currencies. The actual complexity of global currency exchanges is far more expansive then most are aware of.

Vital in the exchange process are key components such as “The Global Currency Reserve” and “the currency valuation process”.

There are many currencies that can’t be directly converted to each other. In those situations a “mediator currency is required”. So banks use the US dollar as a mediator.

Simply put, converting currency A to USD and then USD to currency B. So whoever holds the “currency reserve status” has an economic advantage over the rest of the world and they collects a double commission on exchanges: currency A to USD and USD to currency B.

It is worth revisiting the time period between both world wars and the British pound dominance to American dollar dominance which took place. Transition of global currency reserve status is an incremental replacement process where the new reserve currency pulls a substantial percentage of wealth from the existing currency.

This wealth doesn’t transfer overnight but takes many years, sometime decades or half a century before the substantial percentage of value and trade interest are fully realigned with the new currency structures.

The transition from the British pound sterling to the USD in 1944 happened over a 72 year period. In 1872 the size of the American economy surpassed that of the British economy. But even though the American economy was larger in GDP comparison it still took until 1945 for the pound’s share of foreign exchange reserves in institutions around the world to be replaced by the dollar.

The new international monetary system being developed will be built upon the payment corridors and “Internet of Value”. In simple terms, the “internet of values” refers to an online space in which individuals can instantly transfer value between each other, negating the need for a middleman and eliminating all third-party costs)

This system is more developed than most of us would consider. For sure there will be other crypto assets that contribute to the new international monetary system but it will be the “mediator currencies “ which will serve as the inter Ledger bridge exchange assets that connect all the ledgers and assets through a frictionless and scalable movement of value around the world.

Like the old systems that moved wealth from region to region it will now be the inter Ledger that will move value everywhere.

Think of it as a sort of blockchain multiculturalism which will carry the characteristics and identifiers of the whole world into a new value-based ecosystem which exists everywhere simultaneously.

This transition is happening, make no mistake, but don’t expect a big announcement to herald in the day. It will just happen.

A Currency’s value is determined by supply and demand. The economics of “supply and demand” dictate that when demand is high, prices rise. The more demand the higher the value. The lower the demand the less the value.

Currency exchange rates are quoted as relative values, meaning the price of one currency is described in terms of another. For example: one U.S. dollar can buy 11 South African rand and 11 South African rand can buy $ 1 U.S.

So speaking in terms of global, cross-border, exchange values, what determines demand? World trade! The “balance of trade” influences currency exchange rates through its effect on supply and demand for “foreign exchange” and can lead to an appreciation or depreciation of currencies.

A country with a high demand for its goods tends to export more then it imports increasing demand. A country that imports more than it exports will have less demand for its currency, which influences the price of that currency on the world market.

The sovereigns work this system like a pay plan. By purposely keeping their currency under-valued it allows them to manipulate their “balance of trade” therefore allowing more manufacturing and exporting of their goods.

A prime example is Vietnam and their dong. They have masterfully controlled their currency values which have resulted in the massive expansion of their manufacturing base.

By revaluing the global currencies to their true values and transition into a value-based eco-system that exist simultaneously everywhere, the traditional methodology of valuing currency will take on a new paradigm.

Global trade and the rule of supply and demand will have some influence but with all currency hedged against the same value assets, all boats (currencies) will rise and fall at the same time leveling the playing field for countries with suppressed manufacturing enabling them to compete in the global markets.

Ultimately we will see as many as five global currency reserves depending on what sector of the world you transact in.

Don’t forget how all this came about. The power play by the global elite to control currency values and create money out of thin air then turn around and loan it back to countries and large corporations and collect the interest on it (Fed Reserve System, Rothschild’s and the Rockefellers) is truly diabolical.

You can’t manipulate the value of an asset backed currency like they have with the fiat circumstance that they created.

The concept of reserve currency and how currency is valued is changing. I am still a bit skeptical simply because, as always, everything seems like a good idea at the time. The cause and effect of this won’t be realized for some time. Will it ultimately work or not? Time will tell.

To see the logic, not speculation, of why a GCR is eminent, J.C. Collins a financial author and economist wrote a compelling summary of “Why the Vietnamese Dong Will Reset”

You can Google it for the article …..It is relevant because all the other countries revaluing their currencies follow pretty much the same scenario.

For a PDF on “Balance of Payments” and how it works and acts as a global indicator for trade, send a request subject line “Balance of Payments”.

For those of you who have “Prime” go to a newly released (2017) series called “Hidden Agenda-Real Conspiracies that Affect our Lives” and watch the first episode on global finance.

If you do, keep in mind this narrative was wrote in the mid 1970’s. You will be amazed just how unscrupulous the power hungry oligarchs of the world actually were, and are, and how today’s environment parallels the same narratives from 45 years ago.

DJ

"Latest Intel, Just came out" by Michael Murdock - 9.28.20

Entry Submitted by Michael Murdock at 9:06 PM EDT on September 28, 2020

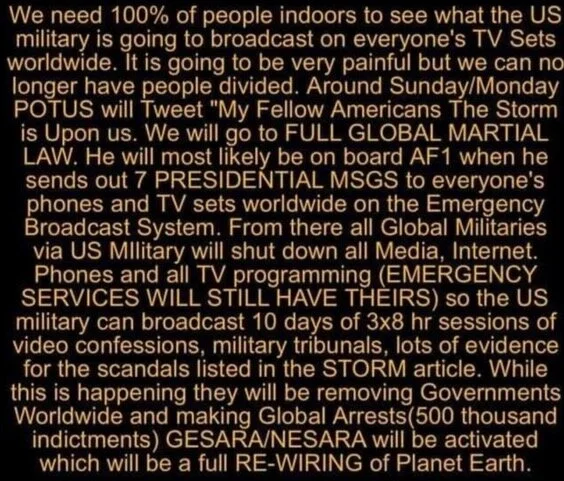

My friends, this came across the wire this evening so I thought I’d share with you.

People are saying this will happen this coming week. Yes it’s in advance of what I shared in my last message to you.

When these things come forward and I’m included in the notifications, I share.

Breathe deep over the next few days, much is going on behind the scenes that we’re not seeing which is good! October is going to be full of surprises, more than in the past.

Keep your eyes open for your ballots as well. If you receive more than one, let law enforcement know. Let the media know. Let your Mayor or Governor know. Call out the mail-in-ballot fraud. It’s important.

That’s all for this moment.

Hope you are all doing well and I pray for any of you in areas where storms or cold is coming to be safe and free.

God bless you all.

Michael Murdock, US Navy Veteran

https://inteldinarchronicles.blogspot.com/2020/09/latest-intel-just-came-out-by-michael.html