"New Dollar Backed by Gold Coming This October? and more 9-16-2020

From Recaps Archives

New Dollar Backed by Gold Coming This October 2020?

May 27, 2020/Anthony Anderson

Capitalism has a natural way of resetting itself. Markets reward winners while punishing losers. Losing businesses restructure, find a better angle to compete, or they go bankrupt. The business owner, hopefully, wise enough not to fall into complete ruin, starts over and re-enters the market, wiser and more competitive than before (at least, that’s the idea).

If an entire economy gets mismanaged, then the same austere consequences that may befall a single company also befalls an economy. That is, unless a governing body intervenes, deviating from the natural course of “capitalism proper.” This latter route is what the Federal Reserve has done for decades and continues to do to this day.

By bailing out the nation’s “bad economic actors,” and forestalling the resetting process, the Fed is consigning the future of the United States to a weakened state. By putting the nation into massive debt, the future growth of a “natural” economy is being choked to death, forever reliant on central bank stimulus.

There will be a breaking point. But it may be far from what most anticipate.

Amid the COVID-19 crisis, central banks across the world have been working to put out the economic flames to which we as of yet see no end. Interest rates have already been driven to near zero (some are at record negative rates) with central banks pledging to continue asset purchases in the Trillions of dollars.

With most central banks virtually “out of ammo” to counter the deflationary trend in the equities markets, the only viable solution is to...unsurprisingly...extend quantitative easing. With the negative consequences affecting almost every major economy across the globe, the US is in a particularly precarious situation.

And it all comes down to what might happen this October when the International Monetary Fund (IMF) meets, between October 12-18th, to revalue its Special Drawing Rights (SDR)-- the world’s reserve currency waiting in the wings. Essentially, a new “Bretton Woods” is in the making.

A New Bretton Woods Minus the Dollar?

The IMF’s SDR is a form of “world money,” created in 1969 as an alternative to the US dollar (in case the dollar somehow fails...that was the idea). They were issued on several occasions from 1970–80, but then there were no issues for almost 30 years, until August 2009, which was in response to the last financial crisis.

Well, here we go again. The IMF knows that SDRs are unpopular, but they also know the world is desperate for liquidity right now during the COVID-19 pandemic. To exploit this crisis, the elites are thinking big about a new Bretton Woods-style conference, a new international financial system, and a global tax system. SDRs would eventually replace the U.S. dollar as the global reserve currency.

According to a recent Project Syndicate report, both the IMF and World Bank are “being asked to throw away their rulebooks to save the world’s imperiled developing economies.” The problem with the current financial system, hammered out in 1944 at Bretton Woods, is that it was “built for a different world,” aimed at preventing wars (think WWII) and regulating economic function on a global scale. Clearly, it was a world of industrial production, manufacturing, trade, and most importantly, clear borders where physical goods--cash and commodities--were traded.

Today’s digital world hardly recognizes yesterday’s economic needs and reality. A new technological and governance structure is necessary to upgrade a defunct system, so goes the argument. If you read between the lines, the prospect looks less like a rebalance and more like a “fiscal reckoning” on a global scale.

When it comes to the IMF and World Bank, voting rights are based on the size of each shareholder. The G-20 nations make up the key players, the largest being the US with 16.5% voting power (and, conversely, veto power).

Although the Trump administration has generally been cooperative with the IMF over the course of President Trump’s tenure, things took a turn in recent months. President Trump’s move to halt the World Health Organization (WHO) funding took the world by surprise. Secondly, the US Treasury Department made it clear that, according to news site Foreign Policy, it wasn’t going along with “the SDR bandwagon,” Treasury Secretary Steven Mnuchin viewing SDR expansion as “ill-targeted.”

“Because SDRs are issued on a symmetrical basis in proportion to existing shareholding, 70 percent would go to G-20 members—most of which did not need them. Only 3 percent would go to those most in need. If members of the G-20 want to increase the SDRs available to poorer countries, they can start by lending them some of theirs,” states Foreign Policy.

So, What’s the Immediate Threat, and Trump’s Potential Response?

The rumor, and big fear, is that the IMF may opt to remove the US from the global SDR basket, effectively reducing the US’s veto rights from the world stage. SDRs would then be a step closer to replacing the greenback as the world’s reserve currency.

Considering the potential damage that the Fed’s QE will inflict on the dollar, weakening its status as the world’s currency, the potential IMF move toward replacing greenbacks with SDRs would cause a massive devaluation of the dollar, possibly up to 80%. As much as President Trump has been influencing Fed actions (despite the bank’s statement to the contrary), having pressured their 180 turn from raising to cutting rates amid a balance sheet reduction, President Trump has never been a fan of the Fed.

With the Fed pledging to load up its balance sheet, and with the nation’s debt skyrocketing to heights unprecedented, it seems as if the bank and nation would be heading toward a state of insolvency. But this is where things get interesting.

With the IMF attempting to pull off a fiscal reckoning minus the US dollar, President Trump may (as his advisor Judy Shelton has advocated and as President Kennedy tried to do in 1963) pull off a global reckoning of his own, by issuing US Treasury Notes backed by gold.

The NEW dollars would be pegged to gold, possibly at a modest starting point of $10K or even higher, effectively returning the Gold Standard.

So, following a massive plunge in dollar values, we’d see a surge in gold prices and, with the new dollars, a surge in gold-backed dollar values as well.

I think you all see where the dangers and, more importantly, the opportunities are as we approach the October deadline.

I leave you with the Presidents Good Friday Prayer for Our Nation to have its portion of Silver and Gold!

Gold-Backed Digital Currency Based On Blockchain Technology

Jul. 31, 2020 2:41 PM ET

Summary

A digital currency can be based on blockchain and cryptocurrency technology.

The DECP.

How a digital currency can be backed by gold.

The countries with the most gold.

Now is the time for investors to acquire gold before the price rises further.

Editor's note: This article was updated August 5th, 2020 to correct terms and to clarify the analysis.

This article attempts to examine how a gold-backed digital currency based on blockchain technology could be implemented and what it might be like.

Much of the information in this article will already be known to veteran gold investors, but retail investors that have recently been attracted to gold by the recent price rises will find it interesting.

Max Keiser in an RT show suggested that the new Chinese digital currency could be backed by gold. His theory was that the PBoC would declare that it had 20,000 tons of gold, and this huge amount would serve as a reserve backing for the new digital currency.

The amount of gold that China might have is discussed below. This writer is not privy to the plans of the PBoC and therefore can only speculate on the matter. The US, which has the dominant global reserve currency and the most important Forex currency, as far as I know, has not announced plans to introduce a national digital currency based on blockchain technology. It does not need further discussion here to note that a digital currency can be based on blockchain as Bitcoin has shown that blockchain can be applied to a currency.

What is significant about Bitcoin is that it is a cryptocurrency and users can evade government supervision. Bitcoin is therefore a useful tool for money laundering. A national digital currency with blockchain technology that allowed the authorities to check on the wallet of the user of the app, on the other hand, would make it possible for the financial authorities of a country to check on all the purchases of all individuals. This is the sort of control that the CCP would like to have and explains the great interest of the PBoC in developing a national digital currency based on blockchain technology, namely, DECP, (Digital Electronic Currency Payment) along with cryptocurrency technology that does not allow the user to operate anonymously.

An app for smart phones has been prepared to make payments via cell phone with the new national digital currency possible. Details are leaking out while the system is being tested in four major Chinese cities and four major Chinese banks are involved in the process as are Ten Cent and Alibaba. The DECP app can be downloaded to a smart phone. It should be noted that a huge number of Chinese already have smart phones and make payments via their smart phones. The number of smart phone users in China in 2020 is estimated to be 0.78 billion with 1.6 billion mobile phone subscriptions (Topic: Smartphone market in China).

Backed by Gold

When it is a question of how a national digital currency based on block chain and crypt-currency technology can be backed by gold, one can only speculate on how this could be implemented. Given the huge amount of fiat currency in circulation, it seems impossible that any country could resort to making the currency redeemable in gold bullion and have gold coins circulate. One possibility is simply that the country wants to have a large amount of gold in its reserves so that the digital currency gains credit and trust as Max Keiser has suggested.

With the gold price already over $2,000.00 an ounce, there is simply no way that the amount of gold currently existing could cover the fiat money that has been issued. The USGS (United States Geological Survey) estimates that about 244,000 tons have been discovered to date with 187,000 tons produced and 57,000 tons in current underground reserves. Yearly gold production is between 2,500 to 3,000 tons. Most of this gold has been used for jewellery and industrial purposes. (How much gold has been found in the world?)

The only way that any currency, fiat or digital, could be redeemable in gold is to have the gold price increase enormously. There are some pundits that have preconized a gold price of $10,000.00 an ounce or even $20,000.00 an ounce. That price would be far too low to be able to guarantee that the fiat currency, and that includes digital currency based on blockchain technology, could be redeemed in gold. Even a gram (there are 28 grams in one ounce) would then be extremely expensive to purchase. At the present time a gram of fine gold (0.9999) costs around $90 or a bit more. An ounce is going for around $2,050.00 at the time of writing.

Assuming that the money supply even with a digital currency could be increased by central banks and that the amount of gold currently existing is finite or at best increasing only slowly, the price of gold would levitate in the currency of a particular country as the currency of a particular country is debased by its central bank increasing the money supply in that currency. In this way countries that increased their money supply in a gold-backed system would see their currency depreciate against gold. The US has benefited enormously from having the US dollar as the most important global reserve currency and can afford to have an annual trade deficit of $600B and still have a viable currency. Still more impressive is that US federal debt has become the standard global investment vehicle.

The Countries with the Most Gold

It is estimated that India has the most gold with about 21,000 tons, mostly in jewellery owned by women. The US has the most gold in official central bank reserves, 8,113 tons.

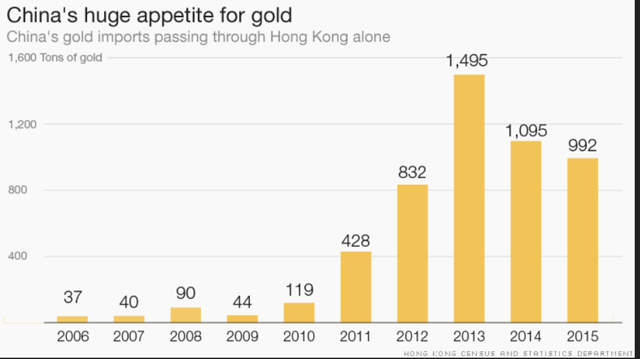

The US is followed by Germany, Italy, France and Russia. China is in 6th place with Switzerland and Japan following and the Netherlands and India in 9th and 10th place. It is not at all clear that the amount reported by China corresponds to reality. Chinese gold imports passing through Hong Kong alone would indicate that the official Chinese figures are far below what they actually are.

China is also the world's largest gold producer.

Then there are the gold ETFs that have thousands of tons of gold bullion. See the ETF data base ( Gold ETF List ), particularly the section on precious metals ( Precious Metals ETFs ).

The biggest gold ETF is SPDR Gold Shares with a NAV of $36 billion, but it has a high expense ratio, 0.40%. The Sprott gold ETF has over 2.3 million ounces of bullion.

Reckoning It Out

A ton of gold has 32,150.7 troy ounces. A metric ton (British) has 2,240 pounds. Do not confuse a short US ton (2,000 pounds) with a metric ton when you are buying gold. That could be a very costly mistake.

To give an idea of what an ounce of gold would cost should it be redeemable in US dollars under a gold-backed currency, one can calculate that the US has 8,000 tons of gold (rounded off). Multiplying this number by 32,150 ounces per ton, the result is 257,200,000 ounces. The current US M2 money supply ( U.S. National Debt Clock : Real Time ) is $18,600,000,000,000 (rounded off).

Dividing $18,600,000,000,000 dollars by 257,200,000 ounces of gold, one gets $72,317 per ounce. In 1971 when Nixon took the US off the gold standard, the official price was $35 per ounce of gold. The current gold price of slightly over $2,000 an ounce makes it clear that the constitution of a gold-based currency of any sort in any country would be a difficult undertaking.

For the US to guarantee that US dollars could be convertible to gold, the Treasury would have to ask for a price of around $72,000.00 for an ounce of gold, and then the current money supply could then be redeemable in gold. This is absurd speculation.

Gold would be so valuable that it could hardly be used as a means of exchange. It could not function as a currency. Even if China had 20,000 tons of gold, the price that would have to be asked for even a gram would make gold practically unusable as a currency.

The conclusion is that gold coins cannot be a viable means of exchange. There are also other problems related to physical gold, but they can be left out of this discussion. For an economy to be able to function in the modern world, the currency has to be electronic. This rules out gold being used as a daily currency although it could still function as a part of the reserves of a central bank. So it is possible to consider that gold is still money, but that its use is restricted. People could own gold and trade it and redeem it for fiat currency on the gold market, but the payment system would still be fiat money.

The Conclusion

If there is going to be any sort of gold-backed blockchain digital currency, then the gold backing will be large amounts in the vaults of the central bank held as part of the bank's reserves to bolster confidence in the fiat currency in circulation. In fact central banks have been buying large amounts of gold and increasing the amount of gold held in their reserves. The BIS has promoted gold to the first tier of reserves so that the value of the gold counts 100% towards the total of the reserves of central banks.

One could conclude that the time for investors to buy gold is right now before the price goes far over $2,000.00 an ounce. Despite the various inconveniences of owning physical gold, investors can protect themselves against US dollar depreciation by owning the yellow metal outright. For those that prefer liquidity and ease of trading, ETFs are a better solution, but they are still in US dollars. One could consider an ETF in a different fiat currency, but that would still be a fiat currency. As a fiat currency depreciates, the price in gold should theoretically rise to compensate for the depreciation.

The End of Gold Price Manipulation

At the present time the paper gold market does not really properly reflect supply and demand. The price is manipulated as can be seen from gold price charts. At 8:00 AM, when the market is very thin, sell orders of a billion dollars drive down the price. When the price recovers, another huge sell order arrives and consequently drives down the price. After the paper markets have been replaced with markets where real gold is sold and bought, the real price of gold will increase significantly. It is not to be reckoned that the price will rise to $70,000.00 an ounce, but it will easily go up to $5,000.00 or even $10,000.00 an ounce as investors seek a safe haven refuge for capital.

https://seekingalpha.com/article/4363035-gold-backed-digital-currency-based-on-blockchain-technology