Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Iraq Economic News and Points To Ponder Saturday Afternoon 2-7-26

Elon Musk Predicts America Will Go Bankrupt Due To Mounting Debt.

Money and Business Economy News - Follow-up American businessman Elon Musk stated on Friday that "only robots and artificial intelligence are capable of helping the United States overcome the problem of accumulating public debt, which threatens the country with bankruptcy," as he put it.

Musk added, in an interview with bloggers Duvarsh Patel and John Collison: "Perhaps we can slow down America's approach to bankruptcy and buy enough time until artificial intelligence and robots can help solve the problem. That is the only thing capable of addressing the public debt situation."

Elon Musk Predicts America Will Go Bankrupt Due To Mounting Debt.

Money and Business Economy News - Follow-up American businessman Elon Musk stated on Friday that "only robots and artificial intelligence are capable of helping the United States overcome the problem of accumulating public debt, which threatens the country with bankruptcy," as he put it.

Musk added, in an interview with bloggers Duvarsh Patel and John Collison: "Perhaps we can slow down America's approach to bankruptcy and buy enough time until artificial intelligence and robots can help solve the problem. That is the only thing capable of addressing the public debt situation."

He explained that interest payments on the US public debt exceed the size of the country's military budget, saying, "More than a trillion dollars are paid in interest," expressing his displeasure with the matter.

Musk added: "Without artificial intelligence and robots, we are in trouble, because public debt is accumulating at an insane rate." https://economy-news.net/content.php?id=65376

The World's Richest Man Admits: Wealth Does Not Guarantee Happiness

Money and Business Economy News - Follow-up Elon Musk, whose net worth reached $668 billion and who became the richest man on Earth, believes that money does not bring happiness.

Although his wealth enables him to pursue his dream of colonizing Mars, make huge donations to politicians like US President Donald Trump, and not feel any financial hardship, it seems that it is not worth it for him.

“Whoever said money can’t buy happiness really knew what they were saying,” Musk wrote on the X platform, which he bought for $44 billion in 2022, according to Agence France-Presse (AFP).

The post, which included a sad emoji, had garnered more than 66 million views by Thursday morning.

Reactions to Musk ranged from sympathy to ridicule, with some advising him to turn to religion or charity work.

One of the replies from Charmaine Harbert's account, commenting on the relationship between wealth and happiness, said: "But it certainly gives you a good start."

Another added: "Are you worried about providing a home for your children?... No?... Then stop complaining and thank God for His blessings."

Musk's net worth is $668 billion, and late last year Tesla shareholders approved a compensation package for him as CEO that could be worth up to $1 trillion.

Musk's group includes Tesla, the electric car manufacturer; XAI, an artificial intelligence startup; and SpaceX, an aerospace company. https://economy-news.net/content.php?id=65380

Dollar Closes Strong In Baghdad, Erbil

2026-02-07 Shafaq News– Baghdad/ Erbil The US dollar closed Saturday’s trading at a higher rate in Baghdad and Erbil, rising by 100 Iraqi dinars compared with the previous session.

According to a Shafaq News market survey, the dollar traded in Baghdad at 149,950 Iraqi dinars per 100 dollars, after opening at 149,850 dinars in the previous session at the Al-Kifah and Al-Harithiya exchanges.

Local exchange shops in the capital sold the dollar at 150,500 dinars per 100 dollars, while buying prices stood at 149,500 dinars. In Erbil, the selling price reached 149,750 dinars for every 100 dollars, and the buying price was 149,600.

https://www.shafaq.com/en/Economy/Dollar-closes-strong-in-Baghdad-Erbil-8

Surprise Deductions Hit Iraqi Salaries, Pensions

2026-02-07 Shafaq News- Baghdad Iraqi public-sector employees and retirees saw unexpected cuts to their monthly salaries and pensions on Saturday after state banks deducted multiple loan installments at once.

A source explained to our agency that the deductions were linked to outstanding loans and cash advances, but some state-run banks, including Rafidain and Rasheed, recovered two or more installments in a single payment instead of applying standard monthly deductions.

Several affected individuals told Shafaq News, on condition of anonymity, that the reduced payments disrupted household finances, prompting demands for an urgent investigation by parliament and oversight bodies.

Authorities, including the National Pensions Authority and the banks involved, have yet to issue an official explanation.

The salary shock comes as broader disruptions continue to strain state finances, such as decisions to raise customs tariffs on certain luxury goods, triggering protests and causing a buildup of cargo containers at border crossings and ports. The resulting slowdown in trade has weighed on public revenues, which economic experts say was among the factors contributing to delays in paying state employee salaries for January.

Read more: Iraq’s budget paralysis: How the 1/12 rule reduced state finances to salary payments

https://www.shafaq.com/en/Economy/Surprise-deductions-hit-Iraqi-salaries-pensions

Gold Prices Rise In Baghdad And Erbil Markets

2026-02-07 Shafaq News- Baghdad/ Erbil On Saturday, gold prices hovered around 1.06 million IQD per mithqal in Baghdad and Erbil markets, continuing their upward trend, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 1,044,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 1,040,000 IQD. The same gold had sold for 1,037,000 IQD on Thursday.

The selling price for 21-carat Iraqi gold stood at 1,014,000 IQD, with a buying price of 1,010,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 1,045,000 and 1,055,000 IQD, while Iraqi gold sold for between 1,015,000 and 1,025,000 IQD.

In Erbil, 22-carat gold was sold at 1,150,000 IQD per mithqal, 21-carat gold at 1,095,000 IQD, and 18-carat gold at 940,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-rise-in-Baghdad-and-Erbil-markets-8-4

Basrah Oil Prices End Week In Decline

2026-02-07 Shafaq News- Baghdad Basrah Heavy and Basrah Medium crude grades closed the week lower, retreating as global oil markets eased amid reduced concerns over supply disruptions in the Middle East.

Basrah Heavy edged up 7 cents in its final Friday session to $63.35 a barrel, but posted a weekly loss of 40 cents, or 0.63%.

Basrah Medium also rose 7 cents on Friday to settle at $65.80 a barrel, recording a weekly decline of 40 cents, equivalent to 0.61%.

The pullback came as Brent and US crude headed for their first weekly losses in more than a month, trading more than 3% below their recent six-month highs.

Oil prices softened as fears of Middle East supply disruptions eased and investors shifted focus to the outcome of ongoing US–Iran nuclear talks. https://www.shafaq.com/en/Economy/Basrah-oil-prices-end-week-in-decline

“Tidbits From TNT” Saturday 2-7-2026

TNT:

Tishwash: Iraqi traders' association announces market closures in protest against customs duties

The Iraqi Traders Association announced on Friday its call for a general closure of all commercial markets throughout Iraq, starting next Sunday and continuing until further notice.

The group explained in a statement received by (Al-Mada) that this step comes in protest against the new customs fees, and to demand the immediate removal of the accumulated containers from the port of Umm Qasr.

The Iraqi Traders Association called on all merchants and market owners to adhere to the closure, stressing that this step aims to achieve legitimate demands and protect the interests of the commercial sector.

TNT:

Tishwash: Iraqi traders' association announces market closures in protest against customs duties

The Iraqi Traders Association announced on Friday its call for a general closure of all commercial markets throughout Iraq, starting next Sunday and continuing until further notice.

The group explained in a statement received by (Al-Mada) that this step comes in protest against the new customs fees, and to demand the immediate removal of the accumulated containers from the port of Umm Qasr.

The Iraqi Traders Association called on all merchants and market owners to adhere to the closure, stressing that this step aims to achieve legitimate demands and protect the interests of the commercial sector. link

************

Tishwash: The US Treasury freezes the assets of Halbousi and two of his party leaders

An official source in Anbar province revealed on Wednesday that Jordan and the UAE have frozen the assets of the head of the Progress Party, Mohammed al-Halbousi, and two of his party leaders, due to their inclusion in the US sanctions.

The source told Al-Maalomah News Agency that “Jordan and the UAE have frozen the assets of the head of the Progress Alliance, Mohammed al-Halbousi, the current governor of Anbar, Omar Mishaan Dabbous, and Hebat al-Halbousi, the Speaker of Parliament, due to their inclusion in the US Federal Reserve’s decision.”

He added that "the targeted party leaders stole huge sums of money after assuming leadership positions in the central and local governments and transferred them to banks outside Iraq."

He indicated that “Mohammed al-Halbousi and Speaker of Parliament Hebat al-Halbousi failed to convince the acting US ambassador in Baghdad to mediate to lift the freeze on his funds outside Iraq and the rest of the party leaders.”

He explained that "Al-Halbousi owns, undeclared, banks and exchange offices used in currency smuggling operations from Iraq to neighboring countries," stressing that "Al-Halbousi's talks with officials at the US Embassy in Baghdad and the Kuwaiti ambassador failed to release frozen assets outside Iraq due to their inclusion in the US sanctions." link

************

Tishwash: Al-Maliki maneuvers: “An honorable retirement” and restoring the golden age of “Da’wa”

Throwing the ball into the "framework's" court... and Washington brandishes the oil file.

Nouri al-Maliki, the candidate for the next prime minister, has thrown the ball into the court of the "Coordination Framework" regarding the decision to replace him, just hours before a meeting described as crucial to resolving the crisis surrounding the selection of the new prime minister.

It appears that Maliki has shifted his candidacy back to the Shiite alliance, at a time when data from the "Framework" indicates that two-thirds of its constituent groups, according to the majority definition within the alliance, still support the leader of the State of Law Coalition. This makes "withdrawal" the easiest way to end his candidacy.

Until recently, Maliki was clinging to the position, which he acquired as a result of what was described as a "sudden development"—one that he said personally surprised him—related to the stance of his political rival, Mohammed Shia al-Sudani, the outgoing prime minister.At the time of writing, the forces within the "Coordination Framework" were preparing to hold a meeting Wednesday evening, which sources told Al-Mada was expected to be "decisive," either to proceed with Maliki as a candidate or to move towards removing and replacing him.

However, informed political sources believe that Maliki will attempt during this meeting to obtain renewed confirmation that he is the "sole candidate," given the difficulty of his supporters within the coalition backing down.

Simultaneously, Maliki's nomination is facing increasing external and internal pressure. Washington is strongly pushing for his replacement, threatening to cut aid to Iraq, while the factions of Ammar al-Hakim, leader of the Hikma Movement, and Qais al-Khazali, leader of Asa'ib Ahl al-Haq, reject Maliki's appointment as prime minister.In his first media appearance after being nominated, Maliki affirmed that he is "committed to this nomination until the end," stating that "only the Coordination Framework will decide whether I continue or not, and it will decide on the alternative."

It is worth noting that the Coordination Framework voted for Maliki for the first time since its establishment nearly five years ago, with a majority, amidst divisions within the coalition, and there have been no indications so far of a change in this majority's position.

Within Shia circles, there is a prevailing opinion that Sudani's withdrawal from the race in favor of Maliki was a "political entrapment," given that the State of Law leader is rejected by several internal and external parties.According to former MP Mishaan al-Jubouri, "Sudani withdrew after hearing from Savia, Trump's envoy to Baghdad, who is the subject of much controversy, that Maliki would not succeed."Conversely, Maliki, according to political sources, is relying on the position of former US envoy Zalmay Khalilzad, who informed him that he was "acceptable in Washington."

What does Maliki want?Nouri al-Maliki waited four prime ministers for the position to return to him, as he views the premiership as a "dignified end," considering himself one of the founding fathers of the political system in Baghdad after 2003, according to a former MP.

Maliki received the first title of "leader" after the regime change, and his famous phrase "We won't give it up" was widely used, indicating his determination to cling to power.

Despite receiving more than 700,000 votes in the 2014 elections, the position went to Haider al-Abadi.Maliki believes today that “the time is right to restore the reputation of the Dawa Party,” according to a former deputy who asked not to be named, especially after the party lost “important positions” or what was known as the “deep state” since Adel Abdul Mahdi took over the premiership in 2018.According to his opponents, Maliki and his supporters are using a combination of intimidation and conspiracy theories to remain the sole candidate. These tactics include claims that three countries are inciting US President Donald Trump against him, and warning of a "danger threatening Iraq" should the coalition withdraw its support for him.

Hassan Fad'am, a leader and former member of parliament in the Hikma Movement, told Al-Mada that Maliki's primary motivation for clinging to the position is a "lust for power," adding that securing his appointment as prime minister will be extremely difficult.Maliki is in his late seventies, and the opposition suggests his health is unstable.

Qusay Mahbouba, a close associate of al-Sudani, countered that "age is not an obstacle in politics," pointing out to Al-Mada that many world leaders assume office at advanced ages.Mahbouba believes that talk of finding a "compromise candidate" implies a move towards a weak and easily manipulated figure, asserting that Maliki's decision to run for the position at this time stems from a "high sense of responsibility."

During the two months of negotiations within the Shiite alliance that followed the recent elections, the "Coordination Framework" was unable to dissuade Maliki from running for prime minister for a third term.

Ghalib al-Da'mi, an academic and political analyst, says that Maliki was not directly seeking the premiership, but rather that Sudani pushed him to do so.In an interview with Al-Mada, he points out that Maliki stated in a recent interview that he would withdraw if his personal interests conflicted with the national interest, but only on the condition that this was done through the party that nominated him and that the withdrawal did not open the door to foreign interference in Iraqi decision-making.

Consequently, the "Coordination Framework" may convene another meeting to nominate an alternative to Maliki if a political understanding with the United States regarding the next phase is not reached.

Al-Da'mi believes that the United States has become convinced that the current political class in Iraq is incapable of engaging with Washington's objectives, particularly concerning dealings with Iran, implementing UN resolutions on sanctions, financial support, and the operations of Iranian companies within Iraq.Al-Daami adds that the recent American stance, manifested in tweets and warning statements, is not targeting Nouri al-Maliki personally, but rather expresses a broader objection to the entire "coordination framework" due to its failure to adhere to these procedures.

According to al-Daami, al-Maliki was not initially attached to the premiership, nor was he seeking it. Rather, he was betting on Mohammed Shia al-Sudani stepping aside in favor of nominating another figure or a compromise candidate, before being surprised by al-Sudani's support for his own candidacy. Meanwhile, Washington is escalating its warnings.The US State Department confirmed it would halt aid to Iraq if Nouri al-Maliki were to assume the premiership, warning of the country's potential descent into chaos once again.

A State Department official told Al-Mada in an exclusive statement that Washington's position is based on the vision of US President Donald Trump, who had previously warned against al-Maliki's return to power. The official added, quoting Trump: "The last time al-Maliki was in power, the country descended into poverty and total chaos. That should not be allowed to happen again."The official explained that US policy toward Iraq "requires a government capable of working effectively and respectfully with the United States," emphasizing that his country is "prepared to use the full range of tools to implement the president's policy," and that this position "has been clearly communicated to the Iraqi political leadership."

In the same vein, Bloomberg reported last Tuesday, citing US officials, that Washington had informed Iraqi officials of the possibility of reducing Iraqi oil export revenues should Maliki assume the premiership. The agency added that a new warning was issued during a meeting held last week in Turkey between the Governor of the Central Bank of Iraq, Ali Al-Alaq, and senior US officials.Last week, Trump described Maliki's reappointment as prime minister as a "bad choice" for Iraq, asserting that his country "will not help Baghdad" if this scenario materializes. link

************

Mot: and How is Your Day!!!

Mot: . Always Awesome to be the ""Example""

Weekend Coffee with MarkZ, 02/07/2026

Weekend Coffee with MarkZ, 02/07/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

MZ: Matt and Lucas (CBD Guru’s) take the first 45 minutes before the news.

Member: Good Saturday Morning and welcome to the weekend

Weekend Coffee with MarkZ, 02/07/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

MZ: Matt and Lucas (CBD Guru’s) take the first 45 minutes before the news.

Member: Good Saturday Morning and welcome to the weekend

Member: Hope Mark has some good news today.

MZ: Bond side is still very quiet…..but, lets pull all the Historic bond updates from last week together as a review. I am still being told that sovereigns, bonds and then currency.

MZ: Sovereigns have a lot of money that came from the D2 (Dubai 2) funds

MZ: there is a possibility that I will be able to share some banking info soon . Parts will be redacted…but a friend is getting that together for me which has me excited.

Member: Rumors today are these rates…IQD, 8.73. VND, 5.12 presently

MZ: Most of the other news today is over Iran and Iraq and Maliki and power.

MZ: “British Institute: Maliki’s candidacy for the presidency of the Iraqi government is an indicator of Iranian -US rivalry” They are pointing out how much Iranian influence is still in Iraq. And the US does not like Iranian influence.

MZ: “US State Department: We will use all our tools to prevent Maliki’s return” Of course they will

MZ: “US Treasury freezes the assets of Halbousi and two of his party leaders” They are still cleaning up corruptions and these were laundering funds to go to Iran. This one is huge and I believe they will keep exposing politicians until they Iraq gets their act together- drops Malike and gets their government sat.

Member: Mark I keep remembering what you said about Kuwait and all the distractions right before it popped.

Member: Charlie Ward video was something everyone needs to watch it's about silver having problems and nobody is talking about it

Member: Looks like silver may crash the entire system…..starting Monday.

Member: Olympics just started…Also Super Bowl tomorrow……lots of distractions going on

Member: I’ve heard some interesting things for tonight into tomorrow morning. Wouldn’t that be a blessing if it’s true and the ride be finally over

Member: I hope everyone has a wonderful and blessed day today. Thank you MarkZ and all the Mods, I appreciate all the work you do to make this possible.

Member: Hope everyone enjoys super bowl Sunday ……have a safe and warm weekend.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED WEEKEND! SEE YOU ALL MONDAY MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Saturday 2-7-2026

KTFA:

Clare: S&P affirms Iraq's credit rating with a stable outlook

2/7/2026 - Baghdad

Standard & Poor's (S&P) credit rating agency has affirmed Iraq's credit rating at B-/B with a stable outlook.

According to a previous World Bank report, Iraq remains committed to pursuing stability and sustainable growth, despite the significant challenges it has faced in recent years, including the war against terrorism and economic fluctuations.

KTFA:

Clare: S&P affirms Iraq's credit rating with a stable outlook

2/7/2026 - Baghdad

Standard & Poor's (S&P) credit rating agency has affirmed Iraq's credit rating at B-/B with a stable outlook.

According to a previous World Bank report, Iraq remains committed to pursuing stability and sustainable growth, despite the significant challenges it has faced in recent years, including the war against terrorism and economic fluctuations.

The government has focused on rebuilding infrastructure, improving public services, and pushing forward economic reforms, supported by international partnerships aimed at promoting sustainable development and human capital development.

The World Bank noted that Iraq’s oil-based growth model has been a major source of economic instability, limiting its ability to achieve stable growth and sustainable development. Continued reliance on oil revenues makes the Iraqi economy more vulnerable to risks amid the accelerating global shift towards reducing carbon emissions.

The bank explained that Iraq is among the countries most exposed to the effects and shocks of climate change, both in terms of physical risks, such as rising temperatures, water scarcity and extreme weather events, and in terms of financial vulnerabilities that exacerbate these challenges.LINK

*************

Clare: Trade Bank of Iraq: Plan to increase the number of branches to 70

2/6/2026 – Baghdad:

The Trade Bank of Iraq (TBI) announced on Friday a plan to increase its number of branches to 70.

TBI Chairman Bilal al-Hamdani stated, according to the official news agency, that "the bank has prepared a plan to increase the number of its branches over the next five years, aiming to reach more than 70 branches within Iraq." He explained that "the opening of new branches necessitates securing staff and funding."

He also noted that "the bank is currently working on opening branches outside Iraq, including in Saudi Arabia, Abu Dhabi, and the United States.

The opening of branches in England and Brazil is pending approval from the bank's board of directors," adding that "these countries have existing business dealings with Iraq."

He confirmed that "a branch in Saudi Arabia will be opened next June." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Bruce [via WiserNow] We're hearing that one of the redemption leaders we talked to says we are right at the tip of this. We are right there now... it's good to hear that we're right there at the edge of this...

Mnt Goat The problem arises with Iran and it has been all about Iran all along and their corruption schemes to control the Iraq economy for their own benefit. This has stalled this currency reform process to the end stages that we now await...Iraq entered this critical stage of successful reforms and on the edge of the next stage, which included the reinstatement. Yes it was targeted for last month...The election process appears to be on hold. We await some news any day now... This situation could change on a dime and most probably we will wake up some morning and it will be over, for the good of Iraq.

Jeff Article: "The US State Department told Shafaq News: We will use all our tools to prevent Maliki's return" This is a distraction... They're trying to show and portray instability so you and I don't know when the rate's going to change. It's all this this. If you're not a sharp analytical thinker, it's going to make you mad and upset you, which when they first came out talking about Maliki going in there, it made everybody mad. They succeeded. They did their job. It's nothing more than a distraction.

************

CHARLIE WARD: ONE MOVE THAT BREAKS THE ENTIRE SYSTEM

2-7-2026

A large buyer of Silver wants physical delivery now. Banks and Comex do not have it. Monday Morning will be interesting.

Seeds of Wisdom RV and Economics Updates Saturday Morning 2-7-26

Good Morning Dinar Recaps,

ECB EXPANDS EURO LIQUIDITY ACCESS — A NEW FRONT IN GLOBAL CURRENCY COMPETITION

Europe opens its monetary umbrella wider, challenging dollar hegemony and reshaping reserve dynamics

Good Morning Dinar Recaps,

ECB EXPANDS EURO LIQUIDITY ACCESS — A NEW FRONT IN GLOBAL CURRENCY COMPETITION

Europe opens its monetary umbrella wider, challenging dollar hegemony and reshaping reserve dynamics

Overview

In a major shift with global-system implications, the European Central Bank (ECB) is expanding access to its euro liquidity facilities, making emergency euro funding cheaper and simpler for foreign central banks. The initiative forms part of a broader EU strategy to boost the euro’s global use, deepen geopolitical partnerships, and address doubts about U.S. monetary leadership. The move comes amid persistent concerns over dollar volatility and a multipolar reserve currency landscape.

Key Developments

Euro Liquidity Safety Net Expanded

The ECB is broadening access to its Eurep liquidity facility, allowing more non-euro-area central banks to borrow euros with eased terms — including lower rates and higher caps — during market stress. This is part of an EU strategy to build economic alliances and promote the euro’s international role.Strategic Currency Diplomacy

The liquidity expansion isn’t purely technical; it aligns with the EU’s efforts to court geopolitical partners and mitigate reliance on the U.S. dollar. Easier access to euro funding supports use of the euro in trade, finance, and regional liquidity networks.Broader Euro Policy Initiatives

Euro-zone ministers are reportedly preparing discussions on euro-denominated stablecoins and joint EU debt issuance to further strengthen the currency’s global footprint. These talks reflect an emerging push toward European monetary instruments that can compete with dollar-centered systems.Market and Geopolitical Context

The move occurs amid mounting concerns about dollar reliability — including policy unpredictability and growing diversification of central bank reserves. Investors are increasing allocations to gold and alternative assets as confidence in the existing fiat hierarchy weakens.

Why It Matters

Reserve Currency Competition: Expanding euro liquidity signals an active challenge to the dollar’s unrivaled position, pushing the global system toward a multipolar reserve currency structure.

Monetary Diplomacy Over Policy Neutrality: Central banks are no longer passive actors; they’re using liquidity access and credit arrangements as strategic tools to bind partners and influence global finance.

Institutional Confidence Shifts: With investors increasingly diversifying into gold and non-dollar assets, the ECB’s moves could entrench these trends and accelerate structural realignment.

Why It Matters to Foreign Currency Holders

Diversification Pressure: As central banks seek alternatives, currency reserve compositions are shifting, potentially weakening traditional dollar dominance and elevating the euro’s relative share.

Strategic Asset Importance: Growing euro liquidity access, emerging stablecoin frameworks, and joint debt issuance discussions may reshape how global capital allocates across fiat currencies and digital monetary instruments.

Implications for the Global Reset

Pillar 1 – Monetary Transition Stress

The ECB’s outreach reflects a monetary system under stress: the traditional dollar-centric framework is losing unchallenged control. As central banks seek alternatives and diversify reserves, confidence in long-established monetary hierarchies becomes fragile, accelerating structural transition pressures.

Pillar 2 – Paper vs. Physical Divide

While euro liquidity lines and policy instruments remain rooted in fiat structures, the trend of reserve diversification — including gold accumulation outside dollar assets — underscores the widening gap between paper monetary instruments and perceived tangible stores of value. This dynamic deepens systemic distrust in fiat dominance and reinforces demand for real assets.

Seeds of Wisdom Team View

The ECB’s expansion of euro liquidity access is a quiet revolution in global monetary policy — one that shifts from passive monetary stewardship to assertive currency diplomacy. This isn’t just about easing liquidity during stress; it’s about offering an institutional alternative to the U.S. dollar at a time when confidence in traditional fiat hierarchies is fraying. As reserve diversification intensifies and strategic instruments emerge, the global financial order is tilting toward a more multipolar architecture.

This is not just liquidity policy — it’s a strategic play to elevate the euro as a viable alternative in a fracturing global financial order.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “ECB’s safety net is part of EU plan to court new allies”

Reuters — “ECB to widen access to euro loans in bid to boost global role, sources say”

~~~~~~~~~~

TURKEY REKINDLES PUSH TO JOIN BRICS WITH CHINA’S HELP

Ankara deepens strategic ties with Beijing as part of a multipolar realignment of global alliances

Overview

Turkey has renewed its bid to join the BRICS bloc, actively seeking China’s diplomatic support to secure full membership at the 2026 summit. Although its 2024 application did not result in full accession — with BRICS instead offering “partner country” status — Ankara is intensifying negotiations with Beijing and other members to break the current impasse. This effort comes as the bloc continues to expand and as emerging powers seek alternatives to Western-centric structures.

Key Developments

Diplomacy with BRICS Members

Turkey’s Ambassador to China is now holding talks in Beijing to strengthen Ankara’s bid for full BRICS membership, reflecting a strategic outreach to one of the bloc’s largest and most influential members.Partner Country Status as Transitional Step

BRICS has previously offered Turkey “partner country” status, which may serve as a pathway to full membership — though Ankara has not publicly confirmed acceptance.Geopolitical Balancing Act

Turkey maintains complex ties with Western institutions (like NATO and the EU) while seeking to deepen economic and political cooperation with China, Russia, and other BRICS members — a multifaceted approach that reflects Ankara’s pursuit of strategic autonomy.Pakistan and Other Aspirants

Simultaneously, Pakistan’s desire to join BRICS has been reiterated by its government, highlighting a broader trend of Global South actors seeking inclusion in the bloc.

Why It Matters

Multipolar Shift: Turkey’s BRICS push signals a broader challenge to the traditional Western-led order, reinforcing the bloc’s role as a platform for alternative geopolitical alignments.

Economic Diversification: For Ankara, BRICS engagement represents access to alternative finance mechanisms, trade networks, and infrastructure cooperation beyond EU and Western frameworks.

Consensus Politics: Unlike NATO or the EU, BRICS decisions require unanimous approval, meaning Turkey’s bid — and China’s support — will test internal cohesion and strategic priorities among member states.

Why It Matters to Foreign Currency Holders

FX & Reserve Diversification: Successful Turkish accession would expand BRICS’ demographic and economic weight — reinforcing its argument for diversified reserves and alternatives to dollar-centric financial arrangements.

Regional Financial Integration: Deepening economic cooperation between Turkey and BRICS countries may accelerate trade settlement in local currencies, influencing long-term currency substitution trends.

Implications for the Global Reset

Pillar 1 – Monetary Transition Stress

Turkey’s bid to join BRICS exemplifies how middle powers are responding to stress in the existing monetary landscape — seeking alliances that may offer alternatives to traditional dollar-centric systems. This momentum suggests growing institutional competition between Western financial orders and emerging multipolar networks.

Pillar 2 – Paper vs. Physical Divide

The BRICS expansion debate highlights systemic friction between established fiat currency networks and emerging blocs that emphasize trade, infrastructure financing, and alternative reserve arrangements. Turkey’s pivot illustrates how nations are weighing strategic economic autonomy over entrenched financial dependencies.

Seeds of Wisdom Team View

Turkey’s renewed BRICS membership effort — backed by sustained engagement with China and broader BRICS members — is not merely diplomatic theatre. It reflects a strategic rebalancing in global governance and economic architecture. As Ankara moves to diversify alliances beyond Western institutions, its entry into BRICS would be a symbolic and practical milestone in the ongoing shift toward a multipolar global system.

This may not just be geopolitical posturing — it’s a deliberate pivot toward alternative economic and political networks that could reshape post-Western order dynamics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

watcher.guru — “Efforts For Turkey To Join BRICS Underway With China’s Help”

Turkiye Today — “BRICS offers Türkiye ‘partner country’ status”

Business Recorder — “Pakistan reiterates desire to join BRICS”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different:

• No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Morning 2-7-26

S&P Affirms Iraq's Credit Rating With A Stable Outlook

Money and Business Economy News – Baghdad Standard & Poor's (S&P) credit rating agency has affirmed Iraq's credit rating at B-/B with a stable outlook.

According to a previous World Bank report, Iraq remains committed to pursuing stability and sustainable growth, despite the significant challenges it has faced in recent years, including the war against terrorism and economic fluctuations.

S&P Affirms Iraq's Credit Rating With A Stable Outlook

Money and Business Economy News – Baghdad Standard & Poor's (S&P) credit rating agency has affirmed Iraq's credit rating at B-/B with a stable outlook.

According to a previous World Bank report, Iraq remains committed to pursuing stability and sustainable growth, despite the significant challenges it has faced in recent years, including the war against terrorism and economic fluctuations.

The government has focused on rebuilding infrastructure, improving public services, and pushing forward economic reforms, supported by international partnerships aimed at promoting sustainable development and human capital development.

The World Bank noted that Iraq’s oil-based growth model has been a major source of economic instability, limiting its ability to achieve stable growth and sustainable development. Continued reliance on oil revenues makes the Iraqi economy more vulnerable to risks amid the accelerating global shift towards reducing carbon emissions.

The bank explained that Iraq is among the countries most exposed to the effects and shocks of climate change, both in terms of physical risks, such as rising temperatures, water scarcity and extreme weather events, and in terms of financial vulnerabilities that exacerbate these challenges. https://economy-news.net/content.php?id=65424

More Than 1.2 Million Tons... Remarkable Growth In Non-Oil Trade Between Iran And The Kurdistan Region

Money and Business Economy News – Baghdad The border crossings in the Kurdistan Region recorded a remarkable increase in non-oil trade with Iran, with exports coming from the Iranian Kurdistan province through these crossings reaching about 1.27 million tons, with a total value of $643 million.

Customs data indicated that the volume of goods imported through border crossings linked to the Kurdistan Region of Iraq reached approximately 217,000 tons, with an estimated value of $650 million, reflecting the growing land trade between the two sides.

The Kurdistan Region has several official border crossings with Iran, most notably the Haji Omran crossing located northeast of Erbil Governorate, opposite the Iranian Tamarjin (Piranshahr) crossing, and the Bashmakh crossing in Penjwen District of Sulaymaniyah Governorate, which is adjacent to Kurdistan Governorate in Iran.

The Bashmakh border crossing is one of the most prominent crossings linking Iraq, via the Kurdistan Region, with Iran, and it plays an important role in supporting trade and the flow of non-oil goods between the two countries. https://economy-news.net/content.php?id=65423

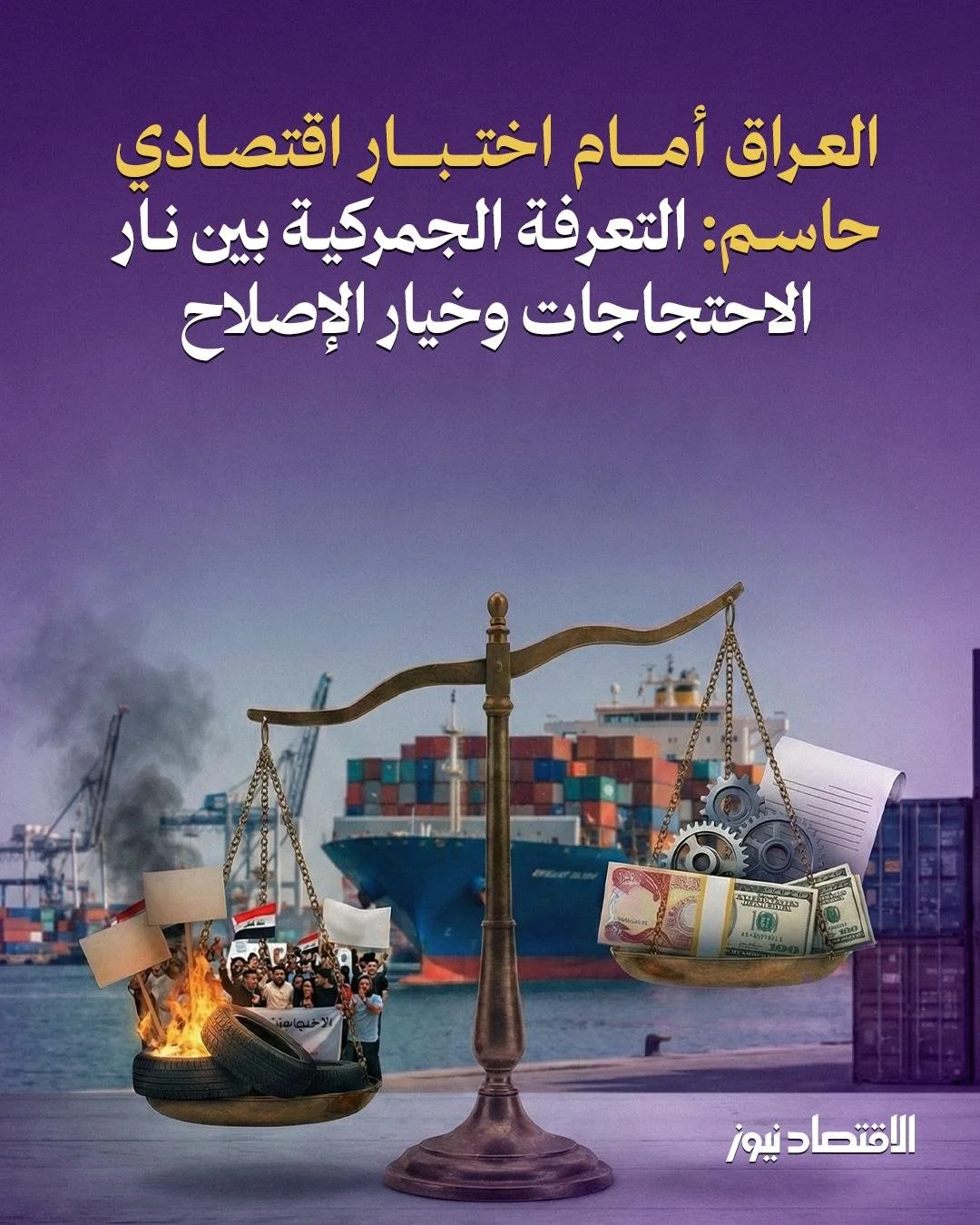

Iraq Faces A Crucial Economic Test: Customs Tariffs Caught Between The Flames Of Protests And The Option Of Reform.

Economy News – Baghdad Amid a volatile economic climate and increasing pressure on the local market, Iraq has entered a new phase of trade and economic tension with the General Authority of Customs announcing the implementation of the new customs tariff starting from the beginning of 2026, at a rate of 15% on luxury goods.

This move, which came under the slogan of "regulating trade and supporting the national product," sparked mixed reactions, which quickly turned into field protests and calls for a general strike, amid warnings of its repercussions on the Iraqi economy, traders, and consumers alike.

Earlier, the Director General of the Authority, Thamer Qasim Dawood, explained that the decision excludes basic and essential goods that affect the lives of citizens, noting that new fees were imposed that also included the automotive sector, through the mandatory application of Iraqi specifications to imported goods, and the imposition of fees on hybrid cars for the first time.

The amendments also included unifying the rates of fees on medicines and medical supplies at 5%, imposing a new tax at a similar rate on gold, in addition to adopting the electronic “ASYCUDA” system as a tool for collecting tax deposits and regulating import operations.

In contrast, the Prime Minister's financial advisor, Mazhar Muhammad Salih, believes that these measures—despite their difficulty—fall within the realm of financial and economic reform. He argues that they represent an attempt to reduce trade distortions, combat fraud and manipulation, protect external transfer channels from financial corruption, and support local production.

Saleh added during his interview with “Al-Eqtisad News” that these steps also contribute to maintaining the integrity of external transfer routes and reducing financial corruption phenomena, adding that the customs tariff came based on an economic policy reading of the country’s financial reality, and on orientations aimed at supporting the national product and regulating foreign trade, and that this option falls within the sovereign discretionary powers of economic policy.

He explained that imposing this tariff aims to achieve a delicate balance between maximizing public revenues on the one hand and maintaining economic stability and preventing market imbalances on the other, stressing that the success of these measures remains linked to the ability of the market and economic actors to gradually adapt to them.

The debate didn't stop at the government's explanation; it extended to the voices of experts and market players. Economist Nabil Al-Marsoumi warned that implementing the ASYCUDA system in conjunction with increased customs duties led to a sharp decline in trade volume and a drop in state customs revenues equivalent to 71 billion dinars in just one month.

He also pointed to the direct impact of these measures on more than one million traders and about 350,000 commercial establishments, which are now suffering from a slowdown in the movement of goods and the accumulation of containers in the country’s ports, especially in the port of Umm Qasr.

The crisis reached its peak with the Baghdad Chamber of Commerce announcing a complete closure of markets starting Sunday, February 2, 2026, in protest against what it described as the "excessive customs burden," demanding urgent government intervention to mitigate economic damage and expedite customs clearance procedures.

A few days ago, the General Authority of Customs in the Ministry of Finance issued a directive to adopt a reduction rate of 25% on the average import values recorded in the ASYCUDA system.

Over the past month, Iraq has witnessed angry demonstrations in several provinces, protesting the decision to impose new taxes and fees, and to apply customs tariffs to imported goods. https://economy-news.net/content.php?id=65418

Customs Denies "Unprecedented Increase": Current Tariff Conforms To International Standards; Traders Threaten Strike

Money and Business Economy News – Baghdad The director of the Iraqi Customs Authority, Thamer Qasim, confirmed on Saturday that the customs tariff currently in place is based on international standards, and there is no such thing as an "unprecedented increase" in the tariff.

Qasim said, "The General Authority of Customs is an executive body to implement the decisions issued by the government, and it has completed all procedures and implemented the ASYCUDA system and applied the Customs Tariff Law and the classification of goods based on type."

He explained that "some traders see an increase because the trader used to rely on a fixed fee, and this is not internationally acceptable. Today, we have adopted international standards, procedures, and demarcation as is the case in neighboring countries."

Qassem pointed out that there is no such thing as an "unprecedented increase in customs tariffs," but rather it is a departure from the fixed fee and the adoption of a system of tariffs on goods and merchandise.

He explained that "the customs tariff on cars exists, and the exemption was only on hybrid cars, and customs duties were imposed on the import of hybrids, and this exists and is approved in neighboring countries and regional countries."

Traders, who called for a general strike at all customs outlets, described the increase in tariffs and additional fees as an outrageous rise that will negatively affect trade and local markets. https://economy-news.net/content.php?id=65425

Iraq Ranks Seventeenth Globally On The List Of Countries With The Cheapest Gasoline Prices.

Economy News – Baghdad The Eco Iraq Observatory announced that Iraq ranks seventeenth globally on the list of countries with the cheapest gasoline prices. While revealing a government trend to increase the prices of oil derivatives in order to maximize state revenues, it warned of the repercussions of this step due to the direct economic damage it may cause to citizens and market activity.

The observatory said in a statement received by "Al-Eqtisad News" that "cars in Iraq consume about one billion liters of gasoline of various types every month, as well as similar quantities of gas oil."

He pointed out that “Iraq ranks seventeenth globally in terms of the cheapest fuel prices, with the price of a liter of gasoline being about $0.649, while the global average is $1.30 per liter,” indicating that “the government’s direction is towards raising prices under the pretext of the high cost of local production, as well as seeking to maximize the revenues of the state, which is suffering from a deficit.”

The observatory added that "the potential increase will include all products, including gasoline, gas oil, kerosene, jet fuel, and fuel oil."

The observatory strongly criticized this move, considering that it “will lead to higher transportation, production and service costs, and its direct impact on the prices of basic commodities, as well as putting pressure on citizens’ purchasing power and slowing down market activity.”

The observatory also warned that "raising fuel prices could exacerbate inflation rates and negatively affect commercial and industrial activity," calling on the government to carefully study financial alternatives and not impose additional burdens on citizens in light of the current economic conditions. https://economy-news.net/content.php?id=65417

MilitiaMan and Crew: IQD News Update-REER-Global Integration-Financial System-In Final Stage

MilitiaMan and Crew: IQD News Update-REER-Global Integration-Financial System-In Final Stage

2-6-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-REER-Global Integration-Financial System-In Final Stage

2-6-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….2-6-26…….THAT’S RARE

KTFA

Friday Night Video

FRANK26….2-6-26…….THAT’S RARE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26….2-6-26…….THAT’S RARE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

IQD Back to 1310, No Word from Parliament on Maliki yet

IQD Back to 1310, No Word from Parliament on Maliki yet

Edu Matrix: 2-6-2026

As I sit down to write this blog post, I’m drawing from a recent video update from a traveler currently exploring the Middle East, specifically Iraq and Egypt.

The insights shared in this video offer a candid and personal look at the region, touching on the intricate web of political, economic, and cultural observations that define this fascinating yet challenging part of the world.

IQD Back to 1310, No Word from Parliament on Maliki yet

Edu Matrix: 2-6-2026

As I sit down to write this blog post, I’m drawing from a recent video update from a traveler currently exploring the Middle East, specifically Iraq and Egypt.

The insights shared in this video offer a candid and personal look at the region, touching on the intricate web of political, economic, and cultural observations that define this fascinating yet challenging part of the world.

One of the most striking aspects of the video is the traveler’s concern over the uncertain political landscape in Iraq. The potential reappointment of Nouri al-Maliki as Prime Minister has sparked worries about its implications on U.S.-Iraq relations and regional stability.

This development is not just a local issue; it has far-reaching consequences that could affect the broader Middle East and beyond. The uncertainty surrounding such political decisions can significantly impact the lives of locals and travelers alike, influencing everything from day-to-day security to long-term economic prospects.

The traveler’s observations on the cancellation of many flights in the Middle East are particularly noteworthy. These cancellations are not just a minor inconvenience; they significantly affect travel plans, forcing a reevaluation of itineraries and accommodations to manage both safety concerns and budget constraints.

For anyone traveling in or through the region, such disruptions can be a considerable challenge, requiring flexibility and a readiness to adapt to changing circumstances.

Beyond the political landscape, the video provides valuable economic insights, highlighting fluctuations in currency and precious metals. The Iraqi dinar’s recovery against the U.S. dollar is an interesting development, suggesting a degree of economic resilience in the face of political uncertainty.

Similarly, the steady performance of the Vietnamese dong and Argentine peso offers a broader perspective on global economic trends, indicating that stability is not confined to traditional economic powerhouses.

The discussion on gold and silver underscores their strong yet volatile status, a characteristic that has long defined these precious metals. Investors and travelers alike keep a close eye on these markets, as they can be both a safe haven and a source of risk.

Perhaps most intriguing is the sharp decline in Bitcoin, a cryptocurrency that has been notable for its unpredictability. The lack of a clear cause for this decline serves as a cautionary note to investors, highlighting the inherent risks in the rapidly evolving world of digital currencies.

What sets this video apart is its blend of geopolitical analysis, economic insights, and personal travel reflections. The traveler’s experiences offer a nuanced perspective on the complexities of living and traveling in the Middle East during times of political uncertainty. It’s a reminder that behind every headline and economic indicator, there are real people navigating the challenges and opportunities presented by their surroundings.

Traveling through the Middle East today is an exercise in navigating complexity. The region is a mosaic of political, economic, and cultural elements, each influencing the others in intricate ways.

For travelers, locals, and observers alike, staying informed and adaptable is key to understanding and engaging with this dynamic part of the world. As we continue to watch developments in the region, the blend of analysis, insight, and personal reflection offered by travelers on the ground will remain invaluable, providing a window into the realities of life in the Middle East.

Echo X: A New Digital Asset-Backed US Dollar (And More)

Echo X: A New Digital Asset-Backed US Dollar

2-6-2026

Echo 𝕏 @echodatruth

If China is racing toward a gold-backed digital currency to challenge the dollar… wouldn’t it be ironic if the U.S. answered with something even stronger?

Not a Fed note. A new U.S. Treasury Dollar.

Backed by real-world assets such as gold, silver, copper, oil, equities, real estate… everything America already has.

Echo X: A New Digital Asset-Backed US Dollar

2-6-2026

Echo 𝕏 @echodatruth

If China is racing toward a gold-backed digital currency to challenge the dollar… wouldn’t it be ironic if the U.S. answered with something even stronger?

Not a Fed note. A new U.S. Treasury Dollar.

Backed by real-world assets such as gold, silver, copper, oil, equities, real estate… everything America already has.

An asset-backed digital dollar rooted in production, resources, and sovereignty, not debt and money printing.

That’s how you don’t lose dominance.

That’s how you reset the system and keep America on top.

Know What You Hold!

CoinDesk: Treasury Secretary Scott Bessent addresses rumors that China is building digital assets to challenge the American financial system:

Watch on X: https://x.com/i/status/2019450481962099187

Source(s): https://x.com/echodatruth/status/2019452187462803879

https://dinarchronicles.com/2026/02/06/echo-x-a-new-digital-asset-backed-us-dollar/

************

Echo X: Jackpot, the Silver Warrior has the Key

2-6-2026

Echo 𝕏 @echodatruth

JACKPOT

The Silver Warrior has the key now, not the banks, not Wall Street, not the Fed. The key represents access. Authority. The ability to unlock what’s been hidden for decades.

Front and center you see America’s Hidden Wealth and that $210 trillion number. That’s not debt. That’s value.

Notice what happens when the lever is pulled, the redeemable assets light up starting with silver, gold, energy, land, infrastructure, real commodities. No paper. No IOUs. Just real assets balancing the system back out.

Silver isn’t random either. It’s always been the people’s money. It bridges the physical world and modern systems. That’s why the warrior is silver-clad.

Deuteronomy 8:18;

It says God gives the power to get wealth, not to worship it, but to restore order and establish truth.

This isn’t about creating a new system.

It’s about unlocking what was already there.

The vault was never empty, it was locked.

And now the key has changed hands.

Know What You Hold.

US Debt Clock.Org:

Seeds of Wisdom RV and Economics Updates Friday Afternoon 2-6-26

Good Afternoon Dinar Recaps,

U.S. and EU Accelerate Critical Minerals Stockpiling

Strategic resources replace free-market assumptions

Good Afternoon Dinar Recaps,

U.S. and EU Accelerate Critical Minerals Stockpiling

Strategic resources replace free-market assumptions

Overview

The United States and European Union have accelerated coordinated efforts to stockpile critical minerals essential for defense systems, clean energy technologies, and advanced manufacturing. This marks a strategic shift away from just-in-time global supply chains toward national and bloc-level resource security.

Key Developments

The U.S. launched Project Vault, a multibillion-dollar initiative to secure critical mineral reserves.

EU nations including France, Germany, and Italy are leading coordinated stockpiling efforts.

Policies aim to reduce dependency on Chinese supply chains for rare earths and battery materials.

Governments are treating minerals as strategic assets rather than market commodities.

Why It Matters

Control over critical minerals now underpins industrial capacity, military readiness, and energy transition goals. Stockpiling reflects a structural shift toward economic nationalism and strategic planning.

Why It Matters to Foreign Currency Holders

As minerals become strategic reserves, currencies linked to resource security gain long-term relevance.

Reserve diversification weakens single-currency dominance, supporting multipolar trade settlement and regional monetary blocs.

Implications for the Global Reset

Pillar 1 – Supply Chain Sovereignty

Resource control replaces globalization assumptions with strategic stockpiling and domestic resilience.

Pillar 2 – Bloc Economics

Allied nations coordinate reserves, reinforcing bloc-based trade and financial systems.

In the new economy, resources are power — not just commodities.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Sustainable Switch: U.S. and EU stockpile critical minerals”

Reuters — “Italy, France and Germany to lead EU critical materials stockpiling plan”

~~~~~~~~~~

Bank of England Holds Rates as Markets Reprice the Future

Monetary caution signals turning point

Overview

The Bank of England voted narrowly to hold interest rates steady, triggering immediate market reactions and reinforcing expectations of rate cuts later this year. The decision highlights growing concerns about slowing growth and softening inflation across major economies.

Key Developments

The Monetary Policy Committee voted 5–4 to hold rates unchanged.

Sterling weakened following the announcement as markets priced in future cuts.

UK gilt yields declined, reflecting shifting investor expectations.

Policymakers acknowledged rising downside risks to economic growth.

Why It Matters

Central bank caution signals the end of aggressive tightening cycles. As monetary policy pivots, capital flows, currencies, and asset valuations adjust globally.

Why It Matters to Foreign Currency Holders

Interest-rate divergence weakens currency stability and increases demand for diversification.

Reserve diversification weakens single-currency dominance, reinforcing hedging into alternative stores of value.

Implications for the Global Reset

Pillar 1 – Monetary Transition

Rate-holding and future easing reflect structural limits of debt-driven economies.

Pillar 2 – Capital Reallocation

Shifting yield expectations accelerate movement into hard assets, emerging markets, and non-traditional reserves.

When central banks hesitate, the system speaks

Sources

Reuters — “Bank of England leaves rates unchanged after tight vote, sterling falls”

Investing.com — “Bank of England governor signals possible rate cuts after close vote”

~~~~~~~~~~

BRICS Intra-Bloc Trade Surpasses US$1.2 Trillion as Global Commerce Shifts

Verified data confirms accelerating BRICS trade integration and multipolar realignment

Overview

Verified international trade data confirms that intra-BRICS trade exports exceeded US$1.2 trillion by 2024, reflecting a sustained and measurable expansion of economic integration among BRICS nations. While some reports have overstated recent milestones, authoritative sources such as UNCTAD show that BRICS trade growth is real, structural, and accelerating—reshaping global commerce patterns as emerging economies deepen cooperation outside traditional Western-centric systems.

Key Developments

1. Intra-BRICS Trade Exceeds US$1.2 Trillion

According to the UN Conference on Trade and Development (UNCTAD), exports traded within BRICS countries rose from just US$84 billion in 2003 to approximately US$1.2 trillion by 2024, marking one of the most significant long-term trade integration trends in the global economy.

2. BRICS Nations Account for a Major Share of Global Trade

Official BRICS data shows member nations now represent roughly 26% of global goods trade, with combined exports nearing US$6 trillion in recent reporting periods. This growth reflects expanding South-South trade relationships and reduced dependence on traditional trans-Atlantic trade corridors.

3. China, India, and Russia Drive Trade Momentum

China remains the dominant exporter within BRICS, while India’s total external trade exceeded US$800 billion, and Russia’s bilateral trade with China surpassed US$200 billion annually. These trade corridors form the backbone of BRICS economic integration.

4. Expansion Strengthens Trade Networks

The inclusion of newer members such as UAE, Iran, Egypt, Ethiopia, Indonesia, and Saudi Arabia has expanded trade connectivity across energy, manufacturing, logistics, and commodities, reinforcing the bloc’s economic gravity.

Why It Matters

The verified rise in BRICS trade highlights a durable shift toward multipolar commerce:

Trade is increasingly routed through non-Western corridors

Emerging economies are coordinating production and consumption internally

Supply chains are diversifying away from legacy hubs

This is not a short-term surge—it reflects two decades of compounding integration.

Why It Matters to Foreign Currency Holders

As BRICS trade volumes grow internally, local-currency settlements and bilateral trade agreements gain traction. While the US dollar remains dominant globally, expanding intra-BRICS trade reduces exclusive reliance on dollar-based settlement systems over time and introduces incremental pressure on legacy reserve structures.

Implications for the Global Reset

Pillar 1: Multipolar Trade Architecture

BRICS trade growth confirms the emergence of parallel trade ecosystems that operate alongside—rather than beneath—Western frameworks.

Pillar 2: Economic Sovereignty

Deeper intra-bloc trade enhances national policy flexibility, reduces exposure to external shocks, and supports long-term financial independence for participating nations.

This is not speculation — it is a data-verified structural transition.

This is not just trade — it is global economic re-balancing in motion.

Seeds of Wisdom Team / Newshounds News™ Exclusive

Sources

UNCTAD — “Trade and Development Report 2025: BRICS Trade Integration Trends”

BRICS Official Portal — “BRICS Foreign Trade Data and Global Trade Share”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Bruce’s Big Call Dinar Intel Thursday Night 2-5-26

Bruce’s Big Call Dinar Intel Thursday Night 2-5-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call. It's Thursday, February 5th and you're listening to the big call. Glad to have everybody back again, looking forward to a nice call tonight, and we welcome you from wherever you are located, all around the globe, as the satellite team gets our signal out in as many as 200 countries around the globe sometimes. So thank you for listening. We look forward to having a good call

So let's get into where we are on Intel. I did not receive quite as much today as I thought I would, but I'll tell you what I did receive. All right, this is kind of where we are. We had the impression that today could have been in play for us to receive numbers. We did not get our numbers today. So hence, we don't have a celebration call, per se now, right?

Bruce’s Big Call Dinar Intel Thursday Night 2-5-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call. It's Thursday, February 5th and you're listening to the big call. Glad to have everybody back again, looking forward to a nice call tonight, and we welcome you from wherever you are located, all around the globe, as the satellite team gets our signal out in as many as 200 countries around the globe sometimes. So thank you for listening. We look forward to having a good call

So let's get into where we are on Intel. I did not receive quite as much today as I thought I would, but I'll tell you what I did receive. All right, this is kind of where we are. We had the impression that today could have been in play for us to receive numbers. We did not get our numbers today. So hence, we don't have a celebration call, per se now, right?

We don't, however, what we have heard from one of our redemption center leaders indicated that, let's see, how did he say? He said, he said he thought that the numbers that we're looking for would be triggered by new rates on the screens.

Now, did we get new rates Wednesday, like we had hoped? No. Did we get new rates today? Thursday on the screen? Not exactly. We did catch a couple of rates on bank screens that were solid enough, but then on redemption center screens, where I'm more attuned, we had 42 currencies fluctuating 90 miles an hour, so not settling, but just moving continually.

Okay, and that's good, because that's better than not having any rates on the screens yet, so at least they're up and moving as of gonna say lunchtime today. Okay, so that's good –

Then. And we heard that once the numbers settle in and we've got 42 / 44 / 48 rates, whatever the total number is going to be on the redemption center screens that that would trigger the 800 number release, makes sense, right? You've got solid rates on the screen. Boom. What's holding us up? Let's get the 800 numbers out and go.

Then we had another source that indicated that the trigger for our notifications to come out would be the use of the EBS EAS system, emergency broadcasting system, emergency alert system, that those would be once those came up, which was suggested To be this weekend, Saturday, Sunday, that that would trigger the 800 number release, as you know, in the emails, I thought, okay, maybe that's when we get the release.

Then we heard later on this afternoon, not really earlier this afternoon, actually, that that trigger would be primarily happening on Sunday, then I'm thinking, okay, rates are up on the screens. New rates coming up on the screens on Sunday. That's what we've heard. We've heard wednesday and sunday wasn't really yesterday. It's not really today.

It could be Sunday. So we get new rates on the screens. Let's say Sunday locked in. We'd see them on Monday, or that's when the redemption center leaders would see them. Now, are they going to go in Sunday afternoon, Sunday evening, to see if there are new rates?

Anything's possible. But I believe they'd see them Monday at 9:30 whenever it is there to report to their to the redemption centers.

More than likely, if we got new rates this coming Sunday, which is the eighth - hello China, then what about new rates on bank screens and redemption center screens Monday morning? Maybe that's the trigger release.

Now, my own interpretation of the EBS EAS is that those would occur in conjunction with us receiving numbers and setting our appointments and going for exchanges, because EBS would theoretically be cover for us, a type of cover that we while we're going for our exchanges and that's what we've heard in the past, and we still believe that it could be used for that.

So I think the real scenario is going to include both components, new rates, solid on the screens, and EBS EAS going, and that would be disclosure of who knows what it will include. But those two, I think, are going to work together, where you have rates solid, we get numbers, and then EBS EAS is there to cover us for our exchanges.

That's all I'm envisioning that. So does that happen Sunday into Monday? Do we wake up to email Monday morning? This is what I'm trying to nail down. Unfortunately, I don't have that for tonight's call. We're going to have to have a call on Tuesday and see whether or not that has been the case, whether we have numbers, whether we're setting appointments, whether we're starting Monday or Tuesday.

You know, that's probably the scenario. If this is going to go now, like we have been told it will, by a number of sources, but we are getting pushed. We were pushed from today to the weekend and maybe Sundays in play for numbers, okay, but maybe we don't see the rates until they hit the screen on Monday

I know the Redemption center leader did a 45 minute video conference call yesterday all over the country, with Scott Bessent from our treasury, our treasury secretary, and another individual from Wells Fargo and a couple of other individuals.

So, I mean, it was basically a video conference call designed around security, a security for us at redemption centers and a bank, maybe a few others were discussed. We don't really have a whole rundown on it, but we have the gist of it .

So this is the time we have, and we build on it. We're going to build on the Intel that we have. And of course, sometimes Tuesday night, because it did, and sometimes Thursday night, which it hasn't yet, but I will probably be getting more intel, more information, after tonight's call, and that's usually what happens.

But let us take what we have right now, thankful for what we have, and look forward to getting these numbers either over the weekend or first part of next week, and then we'll take it set our appointments and go in for our exchanges and redemption of Zim

We're hearing that one of the redemption leaders we talked to says we are right at the tip of this. We are right there now. Does that mean one day, two days? What does it mean?

It's hard to say when people say things that aren't definitive, it's good to hear that we're right there at the edge of this, you know. But you know, we like, we like to create a timeline where we can see ourselves getting notified, setting appointments, and going in for our exchanges and redemption of Zim at the redemption centers. And that is the name of the game.

All right. So as we approach today is the fifth we're still early in the month. I believe we are still looking at getting this thing done, and hopefully we have no obstacles and we can go ahead and move forward.

I know that we have a a some form of temporary return of hostages between Russia and Ukraine that took place today, and that's good, and maybe that war is coming to an end soon. That's what we're going to believe for and pray for.

Otherwise, I'm going to enjoy the opening ceremonies of the Olympics tomorrow afternoon, and then look forward to seeing some great Skiing on Saturday morning, early. Okay, so everybody hang in there.

We will plan on talking to you Tuesday, and we're going to believe for great information and news, bringing in of the toll free numbers.

All right, so everybody, I want to thank Bob. I want to thank Sue's commentary,

God bless you guys. Have a great weekend, and we'll talk to you Tuesday. Okay. God Bless

Bruce’s Big Call Dinar Intel Thursday Night 2-5-26 REPLAY LINK Intel Begins 1:30:40

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26 REPLAY LINK Intel Begins 1:06:46

Bruce’s Big Call Dinar Intel Thursday Night 1-27-26 REPLAY LINK Intel Begins 1:26:36

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26 REPLAY LINK Intel Begins 1:23:23

Bruce’s Big Call Dinar Intel Thursday Night 1-22-26 REPLAY LINK Intel Begins 1:19:00

Bruce’s Big Call Dinar Intel Tuesday Night 1-20-26 REPLAY LINK Intel Begins 1:07:15

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Gold Preserves Purchasing Power — Fiat Destroys It

Gold Preserves Purchasing Power — Fiat Destroys It

Lynette Zang: 2-6-2026

Inflation doesn’t happen by accident — it’s built into the fiat system.

While gold preserves purchasing power over decades, fiat currency is designed to lose value over time.

This video breaks down why gold remains real money, why purchasing power keeps eroding, and what history tells us about the fate of paper currencies.

Gold Preserves Purchasing Power — Fiat Destroys It

Lynette Zang: 2-6-2026

Inflation doesn’t happen by accident — it’s built into the fiat system.

While gold preserves purchasing power over decades, fiat currency is designed to lose value over time.

This video breaks down why gold remains real money, why purchasing power keeps eroding, and what history tells us about the fate of paper currencies.

Chapters:

00:00 – Fiat Money vs Sound Money

00:36 – The Paradigm Shift to Gold and Silver

01:07 – The Four Pillars of Sound Money

01:39 – Why Gold Forces Government Discipline

02:16 – Inflation by Design and Wealth Confiscation

03:17 – Will the Dollar Be Next?

03:46 – How Silver Was Removed From Money

04:35 – Silver Preserves Purchasing Power

05:11 – Why Sound Money Can’t Be Inflated Away