Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Basel III and Physical Gold

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

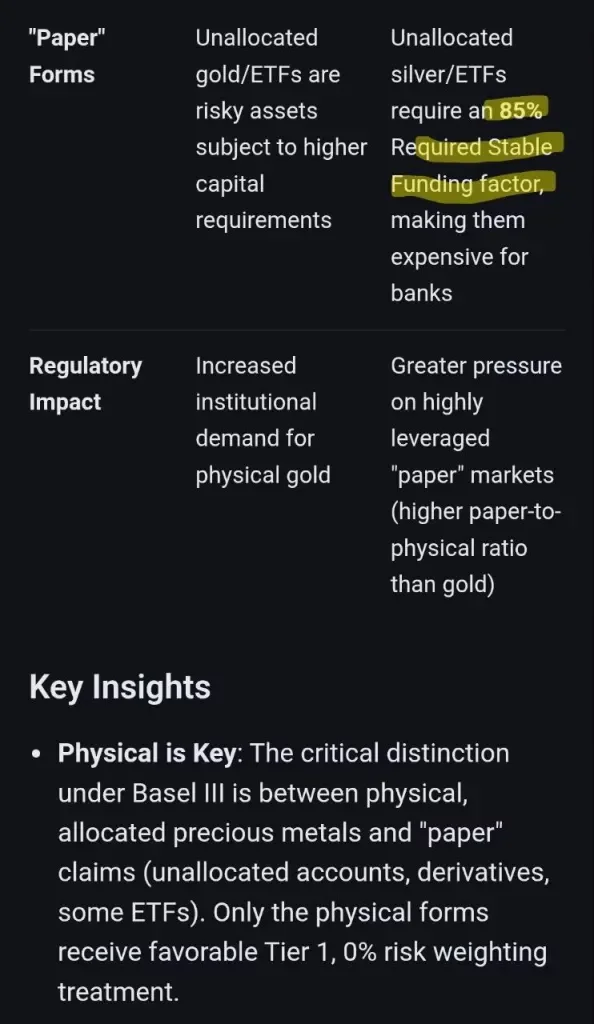

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

GP Q: Basel III and Physical Gold

1-3-2025

BASEL III + PHYSICAL GOLD

Basel III is a global banking regulation that significantly upgraded gold’s status from Tier 3 to Tier 1 (High-Quality Liquid Asset) as of mid-2025, meaning banks can hold physical gold at 100% value for capital reserves, like cash, increasing demand and its safe-haven appeal.

While silver also benefits, gold’s boost is: more direct as a recognized zero-risk asset, contrasting with paper gold

and incentivising banks to hold more physical metal, potentially driving prices up and shifting focus from speculative paper markets.

What Basel III Means for Gold:

Tier 1 Asset:

Physical, allocated gold is now treated like cash and U.S. Treasuries, with a 0% risk weighting.

Increased Demand:

Banks are encouraged to increase physical gold holdings to meet capital requirements, boosting institutional demand.

Reduced Capital Burden:

Gold no longer requires extra capital charges, making it more efficient for banks to hold.

Shift to Physical:

The rule lessens the appeal of speculative “paper gold,” pushing for more physical metal.

Impact on Silver:

Indirect Benefits:

Silver also benefits from Basel III’s focus on tangible assets, but its impact is more complex due to massive paper-to-physical ratios (around 300:1).

Price Volatility:

Unwinding massive paper silver positions could create significant supply shocks, potentially driving prices up dramatically.

Key Change Date:

The Basel III “Endgame” rules, bringing gold to Tier 1 status, became effective for many globally on July 1, 2025, though U.S. adoption has a transition period.

In essence:

Basel III formally recognizes gold as “money” again by making physical gold a top-tier reserve asset, strengthening its role as a core financial instrument for banks

Weekend Coffee with MarkZ. 01/03/2026

Weekend Coffee with MarkZ. 01/03/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

The first 45 minutes is CBD Guru’s -Then Mark and Zester with news.

Member: Welcome to the first weekend of 2026….Hoping it’s a good one

Weekend Coffee with MarkZ. 01/03/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

The first 45 minutes is CBD Guru’s -Then Mark and Zester with news.

Member: Welcome to the first weekend of 2026….Hoping it’s a good one

Member: Good Morning Mark, Mods and fellow RV’ers..I am a little excited today

MZ: Things are definitely getting interesting. To start its still very quiet on the Historic bond side.

Member: If they signed NDA’s – of course they are quiet…..we all should be quiet after we exchange as well.

Member: Anybody think we will get this RV started in the month of January ?

Member: Japan and China are dumping US Treasuries…I believe the Petrodollar is going down

Member: I’m wondering with the big changes in Venezuela- will the Bolivar now be in the first basket?

Member: I read that the Bolivar had increased by 480%. hoping its true! they need it..we need it

Member: The Venezuela people liberated! The Iran people rising up! Maybe Iran will also be in the first basket?

Member: Irans currency has crashed……so protesters are trying to reinstate the former Prince and overthrow the bad guys right now.

Member: Crown Prince Reza Pahlavi has encouraged and backed the protestors this time! Telling them to iverthrow the Iranian regime

MZ: Have they indeed made these moves so that those counties could be in the first basket? Could this be the first domino to fall? We may be seeing two large regime changes this week.

Member: I hope we don’t have to wait for Iran to implement all the things that Iraq has? If that is the case we may be waiting another two-three years for Iran.

Member: I think the Iranian Crown Prince Palavi will be rightfully returned to power…I believe he was raised and educated in the US?

Member: IMO-Iraq and Iran are working to tie their currencies together

Member: Im thinking Mark Savaya (Special US Envoy to Iraq) may be en route to Iraq now while the focus is on Muduro and Venezuela.

MZ: “The Iraqi Government allocates “high” capital for the Rafidain bank in its new form” It has been reformed. We were told just before the RV we would see a reformation of Iraqi banks. This is a big one.

MZ: “Government Advisor expects global oil prices to rise after events in Venezuela” this may be good to support the value of their currency

Member: Some rumors floating around say Dong @ $5.35/5.40 ? Hope its true.

MZ: I have a short bank story. Somewhere between $5.35 and $5.40 take home for people who have been allowed to deposit …but cannot yet move it out of that bank. It comes with serious restrictions….but it seems something is going on. I am trying to get to the root of this and confirm.

MZ: Can you imagine taking home $5.35 and $5.40 on exchanging dong. And this is after fees and the spread. So I will be tracking that story and hope to have verification by Monday. That one got me excited

Member: $5.35 or $5.40 on dong? wow! So dinar would be stellar!

Member: Next week should be interesting with silver markets.

Member: A $15.7B Silver Whale Just Entered the Market — U.S. Banks Trigger Emergency Risk Alerts

MZ: There was about a 50 million silver ounce short or paper that was bought and sold cheap. I wonder if they are going to buy the paper ounces and then demand delivery. Silver right now for physical is running about $80-$90 dollars right now. That could be game over. We also had a brand new buyer in the silver market who just dropped $15.7 billion for physical silver. So we are looking at a very interesting week coming up.

MZ: Iran, Venezuela and silver all happening at the same time.

Member: Sounds like they've started the countdown for launch. Happy New Year! The Best is Yet to Come!

Member: Hope everyone has a great weekend….maybe this is our last weekend broke!!!

Zester joins the stream about minute 45. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED WEEKEND! SEE YOU ALL MONDAY MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Saturday 1-3-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 3 Jan. 2026

Compiled Sat. 3 Jan. 2026 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Fri. 2 Jan. 2025 Four major banks (allegedly) stopped trading silver at 3:15 AM this morning. BRICS (stating with Russia, BRICS 5 major countries are Brazil, Russia, India, China & So. Africa)) are (allegedly) pushing for world to have currencies backed by precious metals and assets.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 3 Jan. 2026

Compiled Sat. 3 Jan. 2026 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Fri. 2 Jan. 2025 Four major banks (allegedly) stopped trading silver at 3:15 AM this morning. BRICS (stating with Russia, BRICS 5 major countries are Brazil, Russia, India, China & So. Africa)) are (allegedly) pushing for world to have currencies backed by precious metals and assets.

Fri. 2 Jan. 2026 QFS GLOBAL ALERT Tier 4B ACTIVATED Secure floor confirms: Global ISO-20022 rainbow currency rollout now(allegedly) at 92.7% live across 209 sovereign treasuries – final sync (allegedly) locked in Zurich and Hong Kong nodes. …Quantum Financial System on Telegram

The GCR/RV shotgun start became (allegedly) mathematically irreversible at 03:47 UTC December 31, 2025 – no reversals possible.

In the last 18 hours, Tier 4B escalation hit critical mass: 41,000+ high-value Zim holders (allegedly) received encrypted redemption codes via secure military channels, with first batch of private appointments (allegedly) scheduled in Reno and Baghdad facilities. Quantum entanglement security locks engaged on all off-ledger mirrored accounts now (allegedly) fully transitioned to on-ledger status.

Rainbow currency treasuries(allegedly) fully funded; gold-backed digital certificates(allegedly) streaming live through Zimbabwe/Hong Kong/Moscow liquidity pools.

Military-protected redemption centers(allegedly) reporting 1:1 asset-backed parity screens active.

Humanitarian & infrastructure project wallets(allegedly) activated in waves – Saint Germain World Trust tranches (allegedly) released, Dragon Family yellow/gold dragon bonds (allegedly) redeemed.

Adjudicated settlements Tier 4A(allegedly) completed, NESARA debt jubilee packets (allegedly) uploaded to quantum ledgers. Med-bed allocation trusts funded and sovereign rate vs street rate screens (allegedly) deployed. 800# release (allegedly) sequence initiated with NDA 72–96 hour windows enforced.

The quantum grid is humming – no delays, no contingencies. The old world just ended. The new one is (allegedly) already funded.

Read Full Post Here: https://dinarchronicles.com/2026/01/03/restored-republic-via-a-gcr-update-as-of-january-3-2026/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man Iraq has lots of natural resources, somewhere in the neighborhood of 16 trillion. You have to take that into consideration. Low inflation, plenty of foreign reserves, plenty of gold…and a huge amount of non-oil revenue streams, ties to global financial integration, political stability reduces risks for International partners such as the European Bank for Reconstruction and Development $100 million dollar facility…They’re headed into the global markets. It’s obvious. It’s clear as day…

Jeff These elections are happening faster than they ever have…They completed their parliament in record time…Everything is coming together correctly and fast, like in record time.

Frank26 [Iraq boots-on-the-ground report] OMAR: The CBI put this out on the television. This is absolute…The Central Bank of Iraq is rolling out a new currency mechanism by the end of this month. They’re tightening up the circulation of the dinar, cutting it down by about 5.5% this last quarter to make things a bit more sturdier. It’s all part of the bigger plan to stabilize the currency. They’re not messing with the exchange rate itself. They’re pushing for a more digital approach…more international… FRANK: Yes, the monetary mechanism is streamlining everything that is required for a new exchange rate.

************

Triple Digits Silver Soon! JP Morgan Holds 750 M oz Silver | Andy Schectman Silver

Smart Stock Trading: 1-3-2025

In this interview, Andy Schectman, President of Miles Franklin Precious Metals, delivers a bullish outlook on silver, predicting a massive rally potentially reaching 50X its current value due to an impending revaluation driven by global monetary shifts, de-dollarization, supply shortages, and institutional demand.

He warns that the transition will be turbulent ("buckle up, it's going to be rough"), with economic challenges ahead as the US dollar weakens and fiat systems face stress.

Schectman highlights 2026 as a pivotal year where gold and silver could outperform all other assets, but emphasizes that most Americans are unprepared for the coming financial disruptions, including inflation, debt crises, and BRICS-related changes.

Key drivers include physical silver shortages, manipulation suppression ending, central bank accumulation, and silver's dual role as an industrial and monetary metal.

Timestamps:

– The Psychological Thresholds for Silver's Price

– JP Morgan's Historic Flip from Biggest Silver Short to Long

– Physical Silver Removed from COMEX Vaults and Supply Tightening

– Record-Breaking Deliveries of Physical Silver and Gold

– US Banks Exit Silver Shorts; Foreign Banks Remain Exposed

– China's Export Ban and the Geopolitical Race for Silver

– Silver Supply Shortages and Physical Demand

– The Potential 50X Rally in Silver and Revaluation Drivers

– De-Dollarization, BRICS, and Global Monetary Shifts

– US Debt Crisis, Inflation, and Economic Turbulence Ahead ("Buckle Up")

– Manipulation Ending and Institutional/Central Bank Buying

– Silver's Dual Role (Industrial + Monetary) and Shortage Risks

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-3-26

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Good Morning Dinar Recaps,

U.S. Strikes Venezuela as Trump Claims Maduro Captured

Direct military action escalates regime-change risk and global fallout

Overview

U.S. President Donald Trump announced a large-scale U.S. military strike on Venezuela

Trump claimed Venezuelan President Nicolás Maduro and his wife were captured and removed from the country

Multiple explosions were reported across Caracas, including military and aviation sites

U.S. officials confirmed Maduro has been indicted on narco-terrorism charges

Russia, Iran, and regional actors condemned the operation as armed aggression

Key Developments

U.S. forces reportedly targeted major Venezuelan military installations, including airbases, ports, and command centers

Trump stated the operation was conducted with U.S. law enforcement, with a press conference scheduled to provide details

U.S. Attorney General confirmed Maduro and Cilia Flores were indicted in the Southern District of New York

Flight tracking transponders were disabled, obscuring U.S. military aircraft movements

Russia and Iran called for emergency clarification, warning of escalation and sovereignty violations

Colombia deployed forces to its border, citing regional security concerns

Why It Matters

This marks a dramatic escalation in U.S.–Venezuela relations, shifting from sanctions and pressure to direct kinetic action. The removal of a sitting head of state by force represents a rare and destabilizing precedent in modern geopolitics.

Venezuela sits atop some of the world’s largest oil reserves. Any disruption to governance, energy infrastructure, or regional stability has direct implications for energy markets, sanctions frameworks, and geopolitical alignment.

The operation also raises serious questions about international law, sovereignty, and retaliation risk, particularly given condemnation from major powers.

Why It Matters to Foreign Currency Holders

For foreign currency holders, this event highlights acute reset risks:

Regime removal events trigger immediate FX and capital flow shocks

Sanctions, asset freezes, and payment restrictions escalate rapidly

Energy-linked currencies face heightened volatility

Political legitimacy directly impacts monetary credibility

In reset terms, forceful regime change accelerates currency repricing and settlement fragmentation.

Implications for the Global Reset

Pillar: Geopolitics Now Overrides Monetary Stability

Military action can instantly invalidate financial assumptions.Pillar: Energy and Currency Risk Are Interlinked

Resource control remains central to financial power.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Trump Says Maduro Captured as U.S. Attacks Venezuela: Live Updates”

Reuters – “Russia and Iran condemn U.S. strikes on Venezuela, call for de-escalation”

~~~~~~~~~~

Contenders Emerge to Replace Nicolás Maduro as Venezuela’s Leader

Power vacuum opens amid claims of regime removal

Overview

U.S. President Donald Trump announced that Nicolás Maduro had been captured and removed from Venezuela

The announcement has created an immediate political power vacuum

Opposition figures long sidelined by Caracas are now emerging as potential successors

The situation remains fluid, with competing claims and high uncertainty

Leadership transition carries major implications for sanctions, energy markets, and currency stability

Key Developments

Trump stated the operation was conducted with U.S. law enforcement, asserting Maduro and his wife were flown out of the country

Edmundo González, recognized by the U.S. as the winner of the disputed 2024 election, is viewed as a leading contender

González fled to Spain after an arrest warrant was issued, following the Supreme Court’s validation of Maduro’s re-election

María Corina Machado, head of Vente Venezuela, is widely regarded as the true opposition leader

Machado won the 2023 opposition primary but was barred from running by the Supreme Tribunal of Justice

She has remained in exile after escaping Venezuela and received the 2025 Nobel Peace Prize

Why It Matters

The removal of Maduro — if confirmed — represents a historic rupture in Venezuelan politics. Leadership transitions following external intervention are inherently unstable, particularly in a country facing economic collapse, sanctions, and institutional erosion.

Who governs next will determine whether Venezuela moves toward reintegration with global markets or descends into prolonged instability. Competing claims to legitimacy, fractured institutions, and external influence raise the risk of prolonged uncertainty.

Why It Matters to Foreign Currency Holders

For foreign currency holders, leadership uncertainty in Venezuela highlights critical reset dynamics:

Political legitimacy directly affects sanctions relief and settlement access

Regime change events trigger rapid FX repricing

Energy-linked currencies and regional trade flows face elevated volatility

Confidence, not reserves, drives currency stabilization in transition periods

In reset terms, currency value depends on governance credibility and access to global systems.

Implications for the Global Reset

Pillar: Political Transitions Drive Monetary Repricing

Leadership legitimacy shapes currency access and trust.Pillar: Sanctions Relief Hinges on Governance Outcomes

Reset pathways open or close based on political alignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Contenders to Replace Nicolás Maduro as Venezuela’s Leader”

Reuters – “Venezuela opposition figures re-emerge as power vacuum opens after Maduro removal claims”

~~~~~~~~~~

BRICS Shapes a New Global Economy as Canada Weighs Strategic Alignment

Commodity power and multipolar finance redraw global trade pathways

Overview

The BRICS bloc is reshaping global trade through commodity concentration and alternative financial infrastructure

BRICS members now control roughly 44% of global grain production and nearly half of the world’s population

Canada’s position as a major commodity exporter places it at a strategic crossroads

Multipolar settlement systems are expanding alongside traditional markets

Middle powers are gaining leverage by navigating between economic blocs

Key Developments

BRICS has expanded to ten full members, significantly increasing control over agricultural output and strategic resources

Plans for a BRICS grain exchange aim to establish independent pricing mechanisms, reducing reliance on Western benchmarks

Local-currency settlement frameworks are advancing, offering alternatives to dollar-denominated trade

Canada remains the world’s third-largest wheat exporter, accounting for roughly 15% of global trade

Rising U.S. tariff pressure and trade uncertainty are accelerating diversification discussions in Canada

Why It Matters

The BRICS initiative reflects a structural shift in how trade and pricing power are organized. Rather than replacing the existing system outright, BRICS is building parallel channels that allow commodity exporters and importers to operate with greater flexibility.

For countries like Canada, this moment is pivotal. Access to alternative markets representing a substantial share of global demand offers resilience, especially as traditional trade relationships face rising political and tariff risk.

This is not ideological realignment — it is strategic optionality.

Why It Matters to Foreign Currency Holders

For foreign currency holders, these developments highlight key reset dynamics:

Commodity-backed trade strengthens currency credibility

Settlement optionality reduces single-currency dependency

Bloc-based pricing alters FX demand patterns

Middle-power currencies gain leverage through access, not dominance

In reset terms, currencies tied to real assets and diversified trade routes gain strategic value.

Implications for the Global Reset

Pillar: Commodity Control Shapes Monetary Influence

Pricing power follows production and access.Pillar: Multipolar Settlement Expands Currency Choice

Optionality replaces dependence.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Shapes a New Global Economy as Canada Prepares to Lead”

Reuters – “BRICS expansion boosts commodity influence and local-currency trade”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Saturday Morning 1-3-26

Map Of Arab Monetary Reserves: Iraq Ranks Third With $112 Billion

January 2, 2026 Baghdad/Iraq Observer With the acceleration of economic crises and trade tensions globally, questions arise about financial resilience and a country's ability to withstand the volatility of global markets. One of the safety valves and first lines of defense is the foreign exchange reserves a country holds. World Bank data even measures these reserves by the number of months of import coverage.

Map Of Arab Monetary Reserves: Iraq Ranks Third With $112 Billion

January 2, 2026 Baghdad/Iraq Observer With the acceleration of economic crises and trade tensions globally, questions arise about financial resilience and a country's ability to withstand the volatility of global markets. One of the safety valves and first lines of defense is the foreign exchange reserves a country holds. World Bank data even measures these reserves by the number of months of import coverage.

Countries’ policies on building or relying on reserves vary to a degree that is related to their exposure to different risks, population size, imports, international relations, and the international standing of their currency.

What if Egypt paid off all its debts? An unprecedented scenario for a debt-free economy.

In the Arab world, the picture begins in Riyadh, where Saudi Arabia tops the list with a massive reserve of nearly $463 billion. This figure is not merely a financial indicator, but a reflection of a robust oil-based economy and a strategic vision that seeks to diversify income sources through mega-projects within the framework of "Vision 2030."

The UAE occupies second place, amid rapid growth and strong reserve coverage of up to about 7 months with a balanced asset management policy between return and risk.

Iraq Pulls Off A Surprise

In October 2025, reserves reached $256.9 billion (AED 991.6 billion), according to central bank data.

The surprise comes from Baghdad. Despite years of turmoil, the Iraqi central bank has reserves of up to $112 billion, thanks to oil exports which remain the backbone of its economy.

In November 2025, Iraq's foreign currency reserves stood at approximately $112 billion, according to data from the Central Bank of Iraq. These reserves represent one of the highest levels in the region after Saudi Arabia and the UAE, covering more than 15 months of imports and providing Iraq with a significant safety net despite internal political and economic challenges.

Libya ranks fourth in the Arab world with large foreign currency reserves.

From the Gulf to the heart of Africa, despite political divisions, Libya maintains its fourth position in the Arab world with foreign currency reserves approaching $99 billion, covering about four years of imports.

Oil and gas exports define the features of economic power, as Arab countries' finances seize their windfall by increasing reserves and managing liquidity during periods of recession.

Qatar's central bank's foreign exchange reserves rose to $71.7 billion last November, covering 11 months of imports.

Egypt's substantial reserves exceeded $50.2 billion.

In Cairo, the most populous Arab country, foreign currency reserves stand at approximately $50.2 billion, a significant figure for supporting the Egyptian pound amidst import pressures and debt repayments. These reserves are now sufficient to cover more than six months of imports.

The figures at the Central Bank of Egypt improved during a year that witnessed an improvement in most indicators, and a rise in dollar revenues from exports, tourism and remittances from Egyptians abroad to more than $100 billion combined.

Reserves in Morocco and Algeria

Both Morocco and Algeria maintain similar levels of foreign exchange reserves, ranging between $39 billion and $41 billion.

These figures are not just data in central bank reports, but indicators of the strength of countries and their ability to withstand fluctuations in oil prices, the challenges of inflation, and to ensure the stability of local currencies.

The world's largest foreign exchange reserves

Globally, China has the largest foreign exchange reserves, exceeding $3.2 trillion, followed by Japan, which exceeds $1 trillion.

Ultimately, whoever holds the reserves holds the initiative, and in a world full of fluctuations, these treasuries are the first line of defense for the stability of Arab economies. LINK

Economist: The Rise Of The Dollar In Iraq Is Linked To External Fluctuations

Economy December 31, 2025 12:49 Information/Baghdad... Economic expert Duraid Al-Anzi confirmed on Wednesday that the recent fluctuations in the dollar exchange rate in Iraq are not a result of monetary policies, but rather reflect the direct effects of fluctuations in neighboring foreign currencies.

Al-Anzi told the Information Agency, "The dollar exchange rate is experiencing frequent, but limited, rises and falls. The main reason is the economic and political pressures in neighboring countries, which directly affect import activity and prices in the Iraqi market."

He added, "The Iraqi dinar is asserting its strength in the local market, making some imported goods relatively cheap at present," emphasizing that this process is beyond the control of the Central Bank or the Iraqi government.

Al-Anzi pointed out that "the stability of neighboring currencies could lead to a stabilization of the dollar exchange rate in Iraq at certain levels," explaining that the current situation reflects the actual demand for dollars in regional trade and not any internal changes in the Iraqi economy. End/25 LINK

Experts Stress The Importance Of Digital Banking Transformation

Economic 2025/12/31 Baghdad: Al-Sabah Economic experts have urged the need to redouble efforts in digital transformation of banking transactions, stressing that this step is capable of producing a package of positive results, including absorbing cash liquidity and eliminating bureaucracy, as well as enhancing financial inclusion and keeping pace with global competition.

Digital transformation in banking transactions is also a key factor in providing integrated banking services without the need for direct interaction in all banking operations, as well as its role in creating greater value for customers and achieving strategic goals for banks.

Economic expert Dr. Mahmoud Dagher believes that the current stage requires a serious shift from traditional methods to adopting advanced banking applications that encompass all operations and services without exception.

He emphasized that it is no longer worthwhile to continue working with the current core banking systems in their old forms; rather, it is necessary to upgrade them and move to newer “Tier One” systems capable of keeping pace with rapid developments.

In The Banking Sector. Integrated Banking Services

Dagher added to Al-Sabah that this transformation requires competent human resources who possess the technical expertise and ability to manage and operate systems and applications with high efficiency, noting that achieving these requirements will open the way for providing integrated banking services without the need for direct contact, in line with the nature of modern banking products, whether Islamic or traditional, which are managed today via mobile phone or computer, and contribute to improving the quality of services and enhancing the confidence of customers in the banking sector.

Key Pillars Of Transformation

For his part, banking expert Dr. Nabil Rahim Al-Abadi questioned whether updating traditional systems was sufficient to create a genuine financial future. He pointed out that banks suddenly found themselves in a race against time and against evolving customer expectations.

Their lives have been completely digitized.

Al-Abadi answers his own question, in an interview with Al-Sabah, by saying that technical upgrades alone will not create a miracle, pointing out that what we need at this critical juncture consists of three basic pillars.

He explained that what banks need is a smart infrastructure, not just an electronic one, noting that the goal is not merely to digitize current transactions, but to build flexible and interoperable systems capable of anticipating customer behavior, providing proactive financial solutions, and seamlessly integrating with the broader digital economy (including e-commerce).

Towards smart cities). Furthermore, investing in secure cloud infrastructure and big data systems and their analysis is the backbone.

This Stage. Staff Rehabilitation

The expert added that the second pillar is the existence of a digital mindset before digital applications, explaining that the biggest challenge is the corporate culture and human affairs, as the banking system needs a new generation of leaders who think like tech-first companies, and radical development programs to rehabilitate the current staff, as the transformation is a transformation in organizational thought and behavior, and not in the programming code alone.

The banking expert identified the third pillar as contingent upon the availability of a legislative framework and national coordination, emphasizing that banks cannot operate in isolation. He stressed the need for flexible and rapidly evolving legislation that regulates digital payments, financial data, and cybersecurity, and keeps pace with innovations such as open banking. Furthermore, coordination between the central bank and other government entities (such as tax and trade authorities) is crucial for breaking down barriers and creating a unified experience.

For The Citizen. The Option... A Big Leap

Al-Abadi stated that the path forward is not about upgrading outdated systems, but rather a radical redesign of the value proposition.

He emphasized that the banks that will survive and thrive are those that understand they are transforming from places you go to into services available everywhere, at all times, and in a personalized way. This is the essence of the transformation we are waiting for. Time waits for no one, and the only option is a giant leap, not small steps.

Rapid Transformations

It is noted that Iraq is witnessing an accelerated digital transformation in the banking sector, led by the Central Bank, with the aim of enhancing financial inclusion and reducing reliance on cash through the launch of projects such as the instant payment system and local cards, the establishment of new digital banks, and the development of infrastructure, with a focus on cybersecurity and raising community awareness to meet the growing challenges of financial technology in order to achieve a more transparent and efficient economy. LINK

Saleh's Appearance: The Revenue Improvement Is Temporary, And The Solution Lies In Diversifying The Economy And Boosting Productive Spending.

Time: 2025/12/30 {Economic: Al-Furat News} Economic expert Mazhar Muhammad Saleh confirmed on Tuesday that the efficiency achieved in managing public liquidity, fulfilling basic obligations, and controlling deficit levels when revenues improve and work to maximize them, is a periodic improvement, not a structural one, due to its direct link to the price cycle of the basic resource, namely oil.

Saleh explained in his interview with Al-Furat News Agency that "this reality constantly calls for a move towards financial strengthening as a preventive option, which is based in essence on examining public spending, analyzing the structure of expenditures, and raising their efficiency to the highest possible level, before thinking about resorting to financing through borrowing."

He explained that “the steps taken to diversify the sources of national income cannot bear fruit through isolated or circumstantial financial measures, but rather require a comprehensive strategy based on an investment budget guided by results and economic impact, not by being satisfied with the logic of allocations, and the transformation from a spending state to a production state, in which public resources are employed to generate sustainable added value, in addition to linking the financial policy with a clear industrial and commercial policy, capable of stimulating the productive sectors and enhancing the competitiveness of the national economy.”

He concluded by saying that "the general budget will remain, otherwise, hostage to the cycle of a single resource, no matter how much its management tools improve in the short term, and no matter how high the level of situational financial discipline." From... Ragheed LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

FRANK26….1-2-26…….BE CAREFUL

KTFA

Friday Night Video

FRANK26….1-2-26…….BE CAREFUL

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26….1-2-26…….BE CAREFUL

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

1-2-2026

Iraqi Dinar Update: Rounding Things Off For Imminent Completion (Exciting Times For Us)

Expanded Analysis on Iraq’s Projected Timeline for International Exchange Rate

January 1, 2026, 05:29 PM CST

In-Depth Projection of Iraq’s New Dinar Exchange Rate Launch

Ariel : Iraqi Dinar Update, Rounding Things off for Imminent Completion

1-2-2026

Iraqi Dinar Update: Rounding Things Off For Imminent Completion (Exciting Times For Us)

Expanded Analysis on Iraq’s Projected Timeline for International Exchange Rate

January 1, 2026, 05:29 PM CST

In-Depth Projection of Iraq’s New Dinar Exchange Rate Launch

The Projected Timeline for Iraq’s International Exchange Rate Deployment, reportedly locked in at March 31, 2026, isn’t just a date it’s the culmination of a seismic shift brewing beneath the surface of Baghdad’s financial corridors.

The Central Bank of Iraq (CBI) has been quietly welding together a framework to launch a redenominated dinar, sheering off those burdensome three zeros to breathe new life into an economy long shackled by cash-heavy chaos and oil dependency.

Backchannel whispers from the Green Zone, captured via live camera feeds, reveal a relentless push since the new parliament’s swearing-in on December 28, 2025, with U.S. Special Envoy Mark Savaya cracking the whip to align every gear.

This isn’t some hopeful guesswork; it’s a calculated strike, fueled by exclusive info with banknote printing contracts and digital spine integrations racing toward completion.

The global stage is set, with Syria’s recent two-zero redenomination on January 5, 2026, serving as a live test case that Iraq’s analysts are dissecting with hawk-like precision.

March 31 emerges as the hard deadline, a moment where Iraq could pivot from a regional footnote to a forex powerhouse, but only if the pieces lock into place without a hitch. The stakes feel electric, with every move monitored by nations clutching IQD stacks, waiting to see if Baghdad can pull this off.

The economic foundation supporting this timeline rests on rock-solid indicators that demand attention, especially after years of skepticism about Iraq’s fiscal resolve. Inflation’s dipped below 2% annualized, a rare breath of stability in a region prone to volatility, while gold reserves climb past 130 tons, offering a buffer that whispers confidence to international watchers.

Foreign exchange reserves, hovering around $97 billion as of late 2025, cover import needs with room to spare, a stark contrast to the 2020 devaluation that slashed the dinar’s value by 24% amid oil price crashes.

The CBI’s simulations, leaked through defector channels, project a new rate of 1 new IQD = 1 USD, a bold leap that hinges on this 3-month window to prove its worth. Oil wealth, still the backbone with 5th-largest global reserves, fuels this ambition, but the real game-changer is the digital overhaul Phase III of the Unified Treasury Account nearing 95% integration by March 1, 2026.

This isn’t just tech for tech’s sake; it’s the backbone that’ll hold the new rate steady against speculative sharks circling the forex waters. The establishment narrative of slow progress gets shredded here Iraq’s moving fast, and the data backs it up with unrelenting clarity.

Digging into the exclusive intel, the subterranean machinations reveal a level of preparation that’s downright jaw-dropping if you’ve been paying attention to Iraq’s past stumbles.

Swiss printing firms, contracted under a cloak of secrecy, are churning out new banknotes with biometric ink and holographic defenses, slated for delivery to Baghdad and Erbil vaults by February 15 details you won’t find in any public briefing.

The ASYCUDA customs system, fully live at Umm Qasr by February 28, locks in pre-declaration protocols that scream for a stable benchmark, with drone footage showing smugglers already sweating under enhanced surveillance since December 20, 2025.

Savaya’s fingerprints are all over this, with encrypted directives pushing forensic AI audits to map laundering networks by February 15, a move that ties directly to the rate’s success.

Parliament’s Monetary Reform Committee, fast-tracked post-inauguration, targets March 15 for enabling laws, a deadline driven by Savaya’s backroom muscle flexing with tribal leaders.

Speculation of course but it’s a machine humming with intent, and the global silence on these moves only heightens the intrigue. The audacity of keeping this under wraps while the world watches Syria’s rollout shows Iraq’s playing a long game with precision.

Read Full Article: https://www.patreon.com/posts/iraqi-dinar-off-147191078

**************

Ariel : Ultimate Trigger Point

When you look at what Mark Savaya laid out in his Middle East plan for his New Years messianic for the Iraqi people. You will appreciated what Scott Bessent says in this clip below.

Because a lot of what he says hinges on the Clarity Act being passed in the senate soon. Which will be the ultimate trigger point for everything else to fall in place.

Amil’ie Crypto Barbie: TREASURY SECRETARY SCOTT BESSEN SAYS: „2025 WAS SETTING THE TABLE - THE FEAST & THE BANQUET WILL BE IN 2026!“ 3,2,1… ITS GO TIME

https://x.com/i/status/2006865843385483744

You Need To Understand This

The silver market’s impending explosion, as detailed in John A.G.’s broadcast from Currency Archive, isn’t isolated financial theater it’s a seismic trigger directly intertwined with the Middle East’s currency overhauls, where asset-backed resets like Iraq’s Delete 3 Zeros Project gain rocket fuel from China’s January 2, 2026, export ban on silver.

This ban, sealing borders and requiring licenses for strategic metals, slams the door on 84-ton Shanghai stockpiles, forcing industrial giants like Samsung and Tesla into panic buys that shatter Comex’s paper facade patterns piercing through global vaults show this repricing to $84/oz or higher as the catalyst for nations like Iraq to accelerate redenominations, leveraging silver shortages to anchor new rates against fiat volatility.

The 36-hour countdown to “Silvergeddon” on January 2 mirrors the urgency in Baghdad, where CBI’s forex simulations, project a March 31 launch (Not Set In Stone Yet) precisely to capitalize on this chaos, turning Comex breakdowns into opportunities for BRICS-aligned currencies.

Syria’s January 5 two-zero cut, with its COMEX 589 serial nod, sets the stage regionally, as defector intel from Damascus confirms shared anti-laundering protocols with Iraq to purge Iranian proxy flows amid the silver squeeze.

Treasury Secretary Scott Bessent’s declaration “2025 was setting the table the feast and the banquet will be in 2026” reinforces this, with classified White House memos revealing his forecast as code for Q1 resets kicking off a year of economic feasts, where Iraq’s oil-silver synergy devours manipulations.

This isn’t coincidence; it’s a orchestrated global pivot, with Middle East reforms riding the silver wave to sovereignty.

Source(s): https://x.com/Prolotario1/status/2006873927096930501

https://dinarchronicles.com/2026/01/02/ariel-prolotario1-ultimate-trigger-point/

Structural Breakdown of the Currency System

Structural Breakdown of the Currency System

Liberty and Finance: 1-1-2026

The global financial landscape is facing unprecedented challenges, with the US debt crisis taking center stage.

The current debt stands at a staggering $38 trillion, and experts warn that this number is unsustainable.

The abandonment of the gold standard in 1971 has led to persistent currency debasement and a loss of trust in the US dollar as the world’s reserve currency.

Structural Breakdown of the Currency System

Liberty and Finance: 1-1-2026

The global financial landscape is facing unprecedented challenges, with the US debt crisis taking center stage.

The current debt stands at a staggering $38 trillion, and experts warn that this number is unsustainable.

The abandonment of the gold standard in 1971 has led to persistent currency debasement and a loss of trust in the US dollar as the world’s reserve currency.

In this blog post, we’ll explore the implications of this crisis, the growing significance of gold and silver as stores of value, and the potential risks associated with the increasing trend towards cashless digital currencies.

The US debt crisis is a complex issue, and there’s no easy solution in sight.

The loss of confidence in the US dollar is reflected in the diminished demand for US Treasury bonds, forcing the Federal Reserve to intervene through quantitative easing and money printing. This has further weakened the dollar, creating a vicious cycle of debt monetization. As a result, investors are increasingly looking for alternative stores of value, such as gold and silver.

Central banks around the world have been accumulating gold reserves, signaling a shift away from trust in paper currencies.

Gold and silver are not speculative assets, but rather essential, long-term stores of value that protect against inflation and currency debasement. In times of economic uncertainty, precious metals have consistently proven to be a reliable safe haven.

Retail investors would do well to focus on the broader economic context rather than short-term price fluctuations or attempts to time the market.

While some countries are embracing cashless digital currencies, others are pushing back against this trend.

Initiatives in Switzerland and Sweden aim to protect citizens’ rights to use cash, highlighting concerns about privacy, financial control, and vulnerability to cyber disruptions.

The increasing centralization and programmability of money raise red flags about government control and seizure of assets, especially in times of geopolitical or economic crisis.

The bond market is facing a crisis of its own, with declining demand from traditional buyers like China and Japan.

The Fed has become the primary purchaser, creating an unsustainable cycle of debt monetization. Rising yields threaten to increase government interest expenses, potentially destabilizing markets, including stocks and real estate, which are heavily reliant on cheap borrowing.

Artificial support mechanisms, such as stock buybacks and insider trading, have kept markets afloat despite underlying economic weaknesses.

The conversation around the global financial crisis is not just about numbers; it’s also about the erosion of trust in governments and institutions.

Currency manipulation and inflation misreporting have been likened to a form of societal betrayal. Honest leadership and transparency are needed to address these systemic issues, but the political realities suggest that such candor is unlikely.

In conclusion, the global financial landscape is facing significant challenges, and it’s essential to be prepared.

Gold and silver are becoming increasingly important as stores of value, and investors would do well to consider them as part of their wealth protection strategy. It’s also crucial to remain vigilant about the evolving financial landscape and to be aware of the potential risks associated with cashless digital currencies.

By staying informed and taking a long-term view, individuals can protect their wealth and navigate the uncertain economic waters ahead.

Iraq Economic News and Points To Ponder Friday Afternoon 1-2-26

The First American Convoy To Leave Ain Al-Asad Base In Anbar In 2026... Indications Of A Partial Withdrawal

Baratha News Agency1682026-01-01 An informed source revealed on Thursday (January 1, 2026) that the first convoy moved from Ain al-Assad base west of Anbar, in an indication of the beginning of a partial withdrawal of US forces from Iraq.

The source said, “Dozens of large trucks moved this morning from Ain al-Assad base towards the highway, amid tight security measures and escort by more than one Apache helicopter,” noting that “the exact destination of the convoy is unknown, whether it is towards Harir base in Erbil or one of the crossings with Syria towards its bases in Hasakah.”

The First American Convoy To Leave Ain Al-Asad Base In Anbar In 2026... Indications Of A Partial Withdrawal

Baratha News Agency1682026-01-01 An informed source revealed on Thursday (January 1, 2026) that the first convoy moved from Ain al-Assad base west of Anbar, in an indication of the beginning of a partial withdrawal of US forces from Iraq.

The source said, “Dozens of large trucks moved this morning from Ain al-Assad base towards the highway, amid tight security measures and escort by more than one Apache helicopter,” noting that “the exact destination of the convoy is unknown, whether it is towards Harir base in Erbil or one of the crossings with Syria towards its bases in Hasakah.”

The source indicated that "this convoy is the first during 2026, and may constitute a new indication of a partial withdrawal of US forces, which are expected to end their presence at this base in the coming months."

This development comes within the framework of the agreement between Baghdad and Washington to end the mission of the international coalition in Iraq, which was established through the work of the “Higher Military Committee” and the joint statement issued in September 2024, where the two sides agreed to set a timetable for reducing the military presence of the coalition and turning it into a bilateral security partnership, with a gradual reduction of the number of forces and the redeployment of some of them in the Kurdistan Region, and the handover of military sites, including the Ain al-Asad base, to the Iraqi authorities during the years 2025 and 2026. https://burathanews.com/arabic/news/469463

.An Economist Identifies Possible Government Strategies To Reduce Waste And Financial Corruption.

Time: 2025/12/27 21:19:46 Readings: 105 times {Economic: Al-Furat News} Economic expert, Salah Nouri, confirmed that the government has the ability to take a number of practical measures to reduce waste and financial corruption, noting that the success of these steps depends on political will and commitment to actual implementation.

The most concise and informative news can be found on the Al-Furat News Telegram channel. To subscribe, click here.

Nouri told Al-Furat News Agency that: “The Central Bank of Iraq had previously implemented an initiative to support small and medium enterprises by providing funds for lending,” indicating that “the initiative achieved modest success, while the Ministry of Finance is currently unable to support this sector due to the financial difficulties and shortage of cash liquidity it is suffering from.”

Regarding measures to reduce waste and financial corruption, Nouri pointed out that "the most prominent of these is full compliance with the decision of the Supreme Federal Court No. 89/Federal/2019, which canceled Legislative Decision No. 44 of 2008, especially paragraph six related to political quotas in filling special grades from director general and below," stressing that "failure to comply with this decision has contributed to the continuation of administrative failures."

He added that “supporting the Integrity Commission and the Federal Board of Supreme Audit with competent, honest, and politically independent staff is a fundamental step in combating corruption,” noting that “the retirement law that suddenly reduced the legal age has led to the depletion of a large number of advanced and highly competent experts in the two institutions.”

The expert explained that “the Prime Minister’s adoption of periodic evaluations of the performance of central ministries and local governments throughout the year will enable the government to identify shortcomings and obstacles and take the necessary administrative and legal measures to correct implementation paths and improve overall performance.” Raghid LINK

Iraq Ranks High Among The Largest Oil Exporters For 2025

December 31, 2025 Baghdad/Iraq Observer Iraq ranked fourth globally in oil exports for 2025, despite recording a relative decline in exports of about 190,005 barrels per day.

Oil trade in 2025 was affected by geopolitical turmoil and changes in shipping routes for the second year in a row, and traded volumes saw notable changes among major exporters and importers.

The world’s largest oil exporters boosted their shipments to markets as production increased, and this was met with a smaller increase in global imports, amid weak economic activity and slowing demand growth, particularly in Asia and Europe, according to data from the 2025 Annual Harvest File issued by the Washington-based Energy Research Unit.

This, along with Western sanctions on Russian and Iranian oil and changes in shipping routes, led to a rise in floating oil stockpiles, curbing the increase in oil trade in 2025 to approximately 4% (1.8 million barrels per day).

Trade was also affected by geopolitical turmoil throughout the year; from US-China tensions over the Panama Canal, to concerns about the closure of the Strait of Hormuz – through which 21 million barrels of oil pass daily – during the Israel-Iran war, to the continued impact on traffic in the Red Sea, despite a relative improvement over 2024 . LINK

Oil Announces Its Annual Liquefied Gas Production

January 1, 2026 Baghdad/Iraq Observer The Ministry of Oil revealed on Thursday that annual production of liquefied gas in Iraq will reach three million tons during 2025, stressing that this achievement will boost oil revenues, with a plan to expand and develop production to seven million tons.

The Undersecretary of the Ministry for Gas Affairs, Izzat Saber Ismail, said in a press statement seen by the “Iraq Observer” agency that “the current production capacity of liquefied gas has reached three million tons per year of gas” (LPG), noting that “the Basra Gas Company contributes two million tons, about one million of which are allocated for export, while the remaining quantity is directed to cover local consumption.”

He added that “the North and South Gas Companies have a plan aimed at raising total production in Iraq to more than four million tons during the next year.”

He pointed out that “the ministry’s plans include reaching a production capacity of seven million tons, which will enhance Iraq’s position in regional markets and generate additional economic returns for the public treasury.”

https://observeriraq.net/النفط-تعلن-انتاجها-السنوي-من-الغاز-الم/

Al-Lami: Iraq Is Nearing Self-Sufficiency In Gas.

Economy January 1, 11:39 Information/Baghdad... MP Ali Al-Lami confirmed on Thursday that the timeframe for Iraq to reach self-sufficiency in gas has been reduced by 20%, expecting this to be achieved during the first quarter of 2027.

Al-Lami told Al-Maalouma that “the file of achieving self-sufficiency in gas and ending the flaring of associated gas in oil fields has reached advanced stages, with the time period specified for achieving this goal being reduced by up to 20%,” predicting that it will be officially announced in the first quarter of 2027.

He added that “ending the flaring of associated gas has multiple positive dimensions, most notably reducing the negative impacts on the environment and public health, as well as investing large quantities of gas in generating electricity and supporting national industries.”

He pointed out that “the introduction of other projects to develop gas fields will contribute to increasing production capacity nationwide, leading to a reduction in reliance on imports and achieving self-sufficiency in this vital resource.” https://almaalomah.me/news/119662/economy/اللامي:-العراق-يقترب-من-الاكتفاء-الذاتي-من-الغاز

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-2-26

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Overview

Global sovereign debt levels remain at historic highs, pressuring government finances worldwide

Bond market volatility is resurfacing, particularly in long-dated government debt

Higher-for-longer interest rates are colliding with massive refinancing needs

Central banks are constrained, unable to stabilize bond markets without risking inflation credibility

Bond stress is increasingly viewed as a leading reset trigger

Key Developments

Governments face trillions in debt rollovers over the next two years, raising refinancing risk

Rising yields are increasing debt-service costs, squeezing fiscal budgets

Bond markets are no longer acting as shock absorbers, amplifying volatility instead

Foreign demand for sovereign debt is weakening, especially where fiscal discipline is questioned

Central banks continue balance-sheet reduction, removing a major source of artificial bond demand

Why It Matters

Debt markets form the foundation of the modern financial system. When confidence in sovereign bonds weakens, currencies, equities, credit, and trade financing all reprice.

Unlike banking crises, which can be addressed with liquidity, bond crises are credibility crises. Once investors question a government’s ability to service debt without inflation or monetization, stabilization becomes far more difficult.

Historically, systemic resets follow bond market stress — not equity selloffs.

Why It Matters to Foreign Currency Holders

For foreign currency holders, bond instability creates asymmetric risk:

Debt-heavy currencies weaken first, regardless of reserve status

Rising yields can signal distress rather than strength

Capital flows shift rapidly when fiscal sustainability is questioned

Settlement confidence erodes when monetization becomes the backstop

In reset terms, currency value increasingly reflects debt credibility, not political power.

Implications for the Global Reset

Pillar: Debt Sustainability Defines Monetary Credibility

Currencies fail when debt cannot be credibly serviced.Pillar: Bond Markets Trigger Repricing Cycles

They move slowly — then all at once.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Why investors will learn to love government bonds again — after volatility”

Bank for International Settlements – Annual Economic Report: Global Debt and Financial Stability

~~~~~~~~~~

Iran Unrest Escalates as Inflation and Currency Collapse Fuel Instability

Domestic pressure collides with external escalation risk

Overview

Nationwide protests have erupted across Iran, driven by soaring inflation and currency collapse

The unrest represents Iran’s most serious internal challenge in three years

Security forces have reportedly used force against demonstrators, resulting in deaths and arrests

U.S. warnings of possible intervention have heightened geopolitical risk

Economic stress and external pressure are converging at a critical moment

Key Developments

Protests began over rising prices and cost-of-living pressures, then spread across multiple cities

The Iranian rial has plunged to historic lows, intensifying public anger and instability

President Masoud Pezeshkian acknowledged government failures, while warning unrest would not be tolerated

U.S. President Donald Trump warned Washington could act if protesters are fired upon, escalating tensions

Iran continues to face sanctions pressure and regional confrontation, limiting policy flexibility

Why It Matters

Iran’s unrest reflects a classic reset pattern: currency failure precedes political instability. Inflation, sanctions, and isolation have eroded purchasing power and public trust, leaving the government with narrowing options.

What makes this episode particularly dangerous is timing. Domestic unrest is unfolding amid heightened regional tension involving the United States and Israel, increasing the risk that internal instability spills outward into broader conflict.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iran’s situation highlights systemic warning signals:

Currency collapse accelerates social unrest and political fracture

Sanctions magnify FX volatility and settlement risk

Escalation risk drives capital flight and safe-haven demand

Access to global payment systems matters more than reserves

In reset terms, currencies fail first at home — then in global markets.

Implications for the Global Reset

Pillar: Currency Credibility Equals Political Stability

When money fails, legitimacy erodes.Pillar: Sanctions Expose Structural Weaknesses

Isolation accelerates internal fracture points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Trump warns Iran as protests rage over inflation and currency collapse”

Financial Times – “Iran unrest tests leadership as economic pressure mounts”

~~~~~~~~~~

Eurozone Expands as Bulgaria Moves Closer to Adoption

Currency bloc growth signals deeper monetary realignment

Overview

Bulgaria has moved closer to joining the euro area, advancing deeper European monetary integration

The expansion comes amid global currency volatility and geopolitical fragmentation

Eurozone growth strengthens bloc cohesion but also raises policy complexity

Monetary alignment increasingly reflects access and stability, not just growth metrics

Currency blocs are becoming more relevant in the reset phase

Key Developments

European institutions approved Bulgaria’s progress toward euro adoption, citing fiscal and inflation benchmarks

The move expands the euro’s geographic and financial footprint

Concerns over disinformation and political influence accompanied the process, underscoring strategic sensitivity

Eurozone policymakers face rising internal divergence, even as membership expands

Bloc expansion reinforces the euro’s role as an alternative settlement anchor

Why It Matters

Eurozone expansion reflects a broader reset trend: currencies are consolidating into trusted networks. As global trade and finance fragment, nations are seeking protection through larger, rules-based monetary blocs.

While expansion strengthens the euro’s reach, it also increases internal complexity. More members mean greater strain on shared fiscal discipline and monetary coordination, especially during periods of stress.

This is less about optimism — and more about positioning for stability in a fractured global system.

Why It Matters to Foreign Currency Holders

For foreign currency holders, eurozone expansion signals:

Bloc-aligned currencies gain settlement credibility

FX stability increasingly depends on network inclusion

Peripheral currencies outside blocs face repricing risk

Monetary policy becomes more political and structural

In reset terms, access to trusted currency systems matters more than independence.

Implications for the Global Reset

Pillar: Currency Blocs Replace Global Uniformity

Monetary order is reorganizing around trusted networks.Pillar: Access Defines Currency Value

Inclusion matters more than scale alone.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – “Bulgaria moves closer to joining the eurozone despite disinformation concerns”

Reuters – “Bulgaria clears hurdles toward euro adoption as bloc expands”

~~~~~~~~~~

BRICS De-Dollarization Agenda for 2026 Enters Implementation Phase

From planning to parallel financial systems

Overview

BRICS has shifted from de-dollarization rhetoric to real-world execution

India’s 2026 BRICS presidency is accelerating alternative financial infrastructure

Payment systems, gold-backed settlement, and CBDC interoperability are now operational

Dollar use in intra-BRICS trade is already sharply reduced

This marks a structural change in global settlement architecture

Key Developments

India formally assumed the BRICS presidency, with the 18th BRICS Summit expected in New Delhi later this year

BRICS Pay is expanding as a decentralized payment network, linking national systems such as CIPS, SPFS, and UPI

Intra-BRICS trade has reduced U.S. dollar usage by roughly two-thirds, according to bloc-linked estimates

CBDC interoperability frameworks are under active development, connecting the digital yuan, ruble, and rupee

The BRICS Unit, a gold-backed settlement instrument, is scheduled for launch in 2026, following a 2025 pilot backed by gold and member currencies

The New Development Bank continues expanding local currency lending, reducing reliance on dollar-based debt

Why It Matters

The BRICS agenda has entered what analysts describe as “De-dollarization 2.0” — not the abandonment of the dollar, but the construction of parallel systems that make the dollar optional.

Rather than challenging the dollar directly, BRICS members are routing around it, building payment rails, settlement units, and financing mechanisms that operate independently of Western-controlled systems.

This is not a sudden break — it is a gradual rebalancing of monetary power.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the implications are clear:

Settlement optionality weakens single-currency dominance

Gold-linked and asset-backed instruments regain relevance

Currencies tied to alternative payment rails gain strategic value

Dollar-based leverage tools lose exclusivity

In reset terms, currency power now flows through infrastructure, not headlines.

Implications for the Global Reset

Pillar: Parallel Financial Systems Are Now Live

De-dollarization is operational, not theoretical.Pillar: Gold Re-enters the Settlement Layer

Asset backing restores trust outside fiat-only systems.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS De-Dollarization Agenda for 2026 Advances With Global Launch”

Reuters – “BRICS nations expand local currency trade and payment systems amid sanctions pressure”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

Smart Stock Trading and Gold Silver Investing: 1-2-2026

In this interview, Andy Schectman, President of Miles Franklin Precious Metals, delivers a bullish outlook on silver, predicting a massive rally potentially reaching 50X its current value due to an impending revaluation driven by global monetary shifts, de-dollarization, supply shortages, and institutional demand.

He warns that the transition will be turbulent ("buckle up, it's going to be rough"), with economic challenges ahead as the US dollar weakens and fiat systems face stress.

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

Smart Stock Trading and Gold Silver Investing: 1-2-2026

In this interview, Andy Schectman, President of Miles Franklin Precious Metals, delivers a bullish outlook on silver, predicting a massive rally potentially reaching 50X its current value due to an impending revaluation driven by global monetary shifts, de-dollarization, supply shortages, and institutional demand.

He warns that the transition will be turbulent ("buckle up, it's going to be rough"), with economic challenges ahead as the US dollar weakens and fiat systems face stress.

Schectman highlights 2026 as a pivotal year where gold and silver could outperform all other assets, but emphasizes that most Americans are unprepared for the coming financial disruptions, including inflation, debt crises, and BRICS-related changes.

Key drivers include physical silver shortages, manipulation suppression ending, central bank accumulation, and silver's dual role as an industrial and monetary metal.

Timestamps:

– The Psychological Thresholds for Silver's Price

– JP Morgan's Historic Flip from Biggest Silver Short to Long

– Physical Silver Removed from COMEX Vaults and Supply Tightening

– Record-Breaking Deliveries of Physical Silver and Gold

– US Banks Exit Silver Shorts; Foreign Banks Remain Exposed

– China's Export Ban and the Geopolitical Race for Silver

– Silver Supply Shortages and Physical Demand

– The Potential 50X Rally in Silver and Revaluation Drivers

– De-Dollarization, BRICS, and Global Monetary Shifts

– US Debt Crisis, Inflation, and Economic Turbulence Ahead ("Buckle Up")

– Manipulation Ending and Institutional/Central Bank Buying

– Silver's Dual Role (Industrial + Monetary) and Shortage Risks

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Welcome to a new Year……..

Member: Greetings going into 2026. Happy New Years to ALL

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Welcome to a new Year……..

Member: Greetings going into 2026. Happy New Years to ALL

Member: so I'm guessing Iraq is still using their 1310 rate and not international?

Member: I had really been hopeful they would actually do it for Jan 1……sigh

MZ: Its all good and lots of things are happening. It’s going to be an epic year.

Member: Hopefully It’s going to be an epic weekend!!!

Member: Mark, we need to see all of the accomplishments that have put us this close to the RV. That will keep everyone connected and more confident that it will happen soon.

MZ: I will try to do that over the next few days.

Member: Mark with Iraq it seems they r moving but no fan fair… do u think they will just switch very quietly and we see it days later?

MZ: That is exactly what I believe it will appear like to the rest of the world. They are going to try to keep this as quiet as they can. It will appear differently to us….we are more plugged in and banks will want us to come in so they have liquidity

MZ: There is so much focus on Iran right now.

Member: Could Iraq use the instability in Iran to no do the RV…..they always seem to have an excuse not to flip the switch

MZ: I have a theory that this is why we are not already in the bank today. Maybe they are delaying for a very short time because it appears Iran may be ready to go with it. (RV?) Maybe Venezuela as well??? Just a theory

MZ: “Trump threatens intervention in Iran to protect the protestors” the government has started shooting into the protests.

Member: The Iranians are chanting for the Prince. And carrying the flag with the sun and lion.

Member: I wonder- Are the Iraqi citizens getting tired of waiting on their RV? After all, they were promised an increase in their purchasing power.

MZ: “ Iraqi dinar Strengthens at year end amid reduced market activity and holiday calm”

MZ: No bond updates which is really odd. I had expected something but all I am hearing is silence.

Member: Silence on Bonds could be a good sign.

MZ: It could be a good sign but I would feel better if we knew.

Member: As per other podcasters- the QFS is in progress.....

Member: The rumor is many countries released new currency on Jan 1.

Member: My PNC bank said they are no longer selling Vietnamese Dong....called Chase bank & they said the same thing

Member: Just found out my bank (CU) started dealing with foreign currency. Just had to buy me a little more IQD. Excited.

Member: When Dinar recaps sends us 800 # will it be in a separate email from their normal email they send us everyday ?

Member: They stated a while ago…..they would have fireworks and the announcement on their front page…….they might send a special email out to their group……guess we wait and see.

Member: Thanks Mark and Mr. C. Hope everyone has a wonderful weekend. Stay warm

Mr. Cottrell joins the stream today. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

Seeds of Wisdom RV and Economics Updates Friday Morning 1-2-26

Trade Fragmentation: The Downstream Consequence of Systemic Stress

How fractured commerce and payment systems reveal deeper global economic realignments

Overview

Global trade networks are increasingly splitting into regional and strategic blocs as geopolitical tensions, sanctions regimes, and financial fragmentation intensify.

Trade fragmentation is not the initial trigger of systemic crisis — it is a downstream consequence of deeper monetary and financial stress.

As payment system access becomes weaponized and currency volatility rises, nations are realigning trade corridors based on trust, interoperability, and financial access rather than comparative advantage.

Trade Fragmentation: The Downstream Consequence of Systemic Stress

How fractured commerce and payment systems reveal deeper global economic realignments

Overview

Global trade networks are increasingly splitting into regional and strategic blocs as geopolitical tensions, sanctions regimes, and financial fragmentation intensify.

Trade fragmentation is not the initial trigger of systemic crisis — it is a downstream consequence of deeper monetary and financial stress.

As payment system access becomes weaponized and currency volatility rises, nations are realigning trade corridors based on trust, interoperability, and financial access rather than comparative advantage.

Key Developments

Sanctions and counter-sanctions have constrained access to traditional trade settlement systems, prompting several nations to explore alternative payment rails and bilateral settlement arrangements.

Major economies and trading blocs are increasingly negotiating currency swap lines, local currency trade agreements, and digital payment linkages to bypass dominance by any single system.

Supply chains are being reshaped — not just for efficiency, but for redundancy and security, with firms and governments diversifying sourcing to reduce exposure to any one currency or financial network.