Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Evening News with MarkZ. 05/13/2025

Evening News with MarkZ. 05/13/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good evening one and all

Member: Lots going on...here and over there.....

Member: I’m hearing 46 Iraqi companies are in the US right now until May 14th for direct investments in American. They would not be able to do that without an international rate

Evening News with MarkZ. 05/13/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good evening one and all

Member: Lots going on...here and over there.....

Member: I’m hearing 46 Iraqi companies are in the US right now until May 14th for direct investments in American. They would not be able to do that without an international rate

MZ: buckle up…the news really is solid.

Member: Do you think the trigger has been pulled and it’s a slow roll out?

MZ: yes.

Member: Could we have appointments before the rate is on forex?

MZ: If it works like Kuwait- yes. I was told they would try to slide up in a week or so before forex….but in this day and age- I don’t know how they can do that.

MZ: I do know a couple of historic bond contacts with appointments set in stone for tomorrow. Then a couple more with appointments on Wed and Thurs. these are different bonds then some seen previously

MZ: I am hopeful we get some idea on timing from those.

MZ: “Spokesman for the Secretary General of the Arab League: Preparations for the Baghdad summit were successful in all aspects” Many folks attending are already showing up including folks from the IMF ect.

Member: This starts over the weekend.

MZ: “IMF praises Iraq’s progress in economic reforms. Ready to advise”

MZ: “ Swift and the Federal Reserve put Iraq at the mercy of the global economy” this points out that Iraq is now “International”

Member: Interenational requires an RV.

MZ: We are waiting for that announcement

Member: Have a great night everyone. See you all in the morning

Mod: Mark's next travel schedule. He leaves on May 17th (which is Mark's dad 80th B-Day) and comes back on May 21st. Zester will host the podcast when Mark is gone. Mark will pop in when he can.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Al-Nusairi: Our Dinar Continues To Recover Until It Reaches The Official Price

Money and Business Economy News – Baghdad Economic and banking advisor Samir Al-Nusairi confirmed on Sunday that the Iraqi dinar has been gradually recovering for several weeks due to internal and external reasons that have directly impacted controlling fluctuations in the US dollar exchange rate, regardless of the many reasons that led to its decline and its reaching 10 cents, after the difference between the official and parallel rates had been 20 cents for a long period.

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Al-Nusairi: Our Dinar Continues To Recover Until It Reaches The Official Price

Money and Business Economy News – Baghdad Economic and banking advisor Samir Al-Nusairi confirmed on Sunday that the Iraqi dinar has been gradually recovering for several weeks due to internal and external reasons that have directly impacted controlling fluctuations in the US dollar exchange rate, regardless of the many reasons that led to its decline and its reaching 10 cents, after the difference between the official and parallel rates had been 20 cents for a long period.

Al-Nusairi pointed out that the main reason for the recovery is the reform policies of the Central Bank and the government in reforming the

processes of regulating foreign trade financing,

compliance with international standards, and

regularity in the global financial system, as well as the

new mechanisms for foreign transfers to secure imports and

cover them in US dollars and other currencies by

dealing directly with correspondent banks through more than 20 Iraqi banks that have opened accounts and banking relationships with these banks.

The Central Bank also succeeded in

securing and providing 95% of the demand for the dollar at the official price and

covering the needs of citizens for cash dollars and

distributing it with transparency, fairness, and strict monitoring,

which contributed to reducing the practices of speculators in the informal market.

He added to the important role of the government in implementing its strategy in financial and banking reform, especially the implementation of paragraphs (1-7) included in the government program,

in addition to removing opportunities for speculators to manipulate the exchange rate according to administrative, supervisory, and economic policies.

Al-Nusairi bet on the Iraqi dinar's continued recovery through 2025, following the completion of the banking reform project's objectives and the Central Bank of Iraq's third strategy.

He also noted that the government will continue implementing its reform and investment programs,

attracting more foreign and Arab investments to the country, which have exceeded $88 billion,

completing the development path,

investing in gas,

developing oil projects, and

supporting the private industrial sector.

Al-Nusairi concluded his remarks by praising the programmes and measures adopted by the Central Bank, which contributed to reducing inflation to 2.8% and maintaining the general price level, which is one of the objectives of monetary policy. https://economy-news.net/content.php?id=55333

Iraq To Recover Half A Billion Dollars In Smuggled Funds By 2024

May 10, 13:35 Information/Baghdad... The Federal Integrity Commission revealed on Saturday that

Iraq had successfully recovered more than half a billion dollars in smuggled funds during 2024.

"The government has placed anti-corruption efforts at the top of its agenda," said the commission's chairman, Mohammed Ali al-Lami, in a statement followed by Al-Maalouma News Agency. He added that "the efforts of the government and the judiciary have contributed to the recovery of smuggled funds."

Al-Lami confirmed that "Iraq succeeded in recovering more than half a billion dollars in smuggled funds during 2024," indicating that "we provided privileges and protection to those who cooperated in uncovering corruption cases." End/25

https://almaalomah.me/news/98296/economy/العراق-يستعيد-نصف-مليار-دولار-من-الأموال-المهربة-خلال-2024

A Dangerous Financial Maneuver... Will Employee Salaries Survive The Liquidity Crunch?

May 13, 2025 Baghdad/Iraq Observer Iraq is facing a liquidity crisis in the local dinar, coupled with a continued decline in the dollar exchange rate in local markets.

This is increasing citizens' and employees' concerns about the government's ability to meet its financial obligations, most notably securing the salaries of employees and retirees on time.

The government has resorted to withdrawing cash from tax deposits,

previously linked to the so-called "theft of the century,"

in an attempt to cover the liquidity deficit

and ensure continued funding for essential obligations, most notably salaries.

Experts believe the crisis is

not related to the availability of hard currency, as

the government has a substantial dollar reserve thanks to oil exports.

Rather, it stems from a scarcity of Iraqi dinar liquidity, which is forcing it to implement swift financial maneuvers, such as using tax deposits, to secure employee salaries and avoid any delays in disbursing them.

Dinar withdrawal is “weak”

In turn, economic expert Abdul Rahman Al-Mashhadani confirmed that "Iraq exports more than 3.1 million barrels of oil per day, and oil revenues last month amounted to approximately $7.7 billion,

an amount sufficient to cover salaries and a portion of operating and investment expenses."

He explained to the Iraq Observer that "the government needs approximately 7 trillion and 850 billion Iraqi dinars per month to secure salaries for employees and retirees and social security benefits,

adding that oil revenues, when transferred, are supposed to cover this amount and exceed it,

but the problem lies in the weak withdrawal of the Iraqi dinar from the market."

He stressed that "approximately 90% of the issued currency is not returning to the banking system as quickly as required,

making it difficult for the Central Bank to supply the government with cash liquidity in a timely manner,

despite the latter having parliamentary authorization to borrow from the Central Bank under the 2024 budget law, a process also included in the 2023 budget." He added,

"The government has not yet resorted to direct borrowing from the Central Bank this year,

with the exception of the latter's rediscounting of treasury bonds sold to government and private banks worth approximately 3 trillion dinars."

Al-Mashhadani noted that "the liquidity provision mechanism is still suffering from bottlenecks,

which has prompted the government to resort to using tax deposits to compensate for this shortfall at the present time."

On April 15, the Council of Ministers decided to authorize the Minister of Finance to withdraw tax deposits less than five years old to secure funding for state employee salaries for April and subsequent months.

This move has faced legal criticism, as

experts have asserted that tax deposits are not considered public revenue until five years have passed without claims,

making their early withdrawal illegal and reflecting the fragility of the state's financial situation.

Government employees,

along with social security beneficiaries and retirees, are hoping to receive their salaries before Eid al-Adha, amidst uncertainty over the government's ability to provide the necessary liquidity in a timely manner. https://observeriraq.net/مناورة-مالية-خطيرة-هل-تنجو-رواتب-الموظ/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 5-13-25

Good Afternoon Dinar Recaps,

COINBASE BECOMES FIRST BITCOIN AND CRYPTO COMPANY TO JOIN THE S&P 500

Coinbase joins the S&P 500, marking a milestone for Bitcoin, further highlighting Bitcoin’s strong performance, outperforming gold and the S&P 500 over the years.

Coinbase Global Inc. (NASDAQ: COIN) is officially joining the S&P 500 starting May 19. It will replace Discover Financial Services (NYSE: DFS), which is being acquired by Capital One Financial (NYSE: COF), an existing member of the index.

Good Afternoon Dinar Recaps,

COINBASE BECOMES FIRST BITCOIN AND CRYPTO COMPANY TO JOIN THE S&P 500

Coinbase joins the S&P 500, marking a milestone for Bitcoin, further highlighting Bitcoin’s strong performance, outperforming gold and the S&P 500 over the years.

Coinbase Global Inc. (NASDAQ: COIN) is officially joining the S&P 500 starting May 19. It will replace Discover Financial Services (NYSE: DFS), which is being acquired by Capital One Financial (NYSE: COF), an existing member of the index.

This is a big move for Coinbase and an even bigger signal for Bitcoin. For a crypto company to be added to one of the most important indexes in the U.S. shows how far this industry has come. It’s not just hype anymore—it’s becoming a real part of the traditional financial system.

“Thank you to everyone who made it possible for a crypto company to join the S&P 500 for the first time in history,” Coinbase posted on their X account.

To get into the S&P 500, a company needs to meet a few strict requirements. They need a market cap of at least $18 billion, have most of their shares held by the public, be profitable over the last four quarters, and be listed on a U.S. exchange. Coinbase checks all of those boxes, with a market cap over $40 billion and solid recent earnings.

Once Coinbase is added, every fund that tracks the S&P 500 will need to include it in their portfolios. That means more demand for the stock, which could push the price up in the short term. But even more important, it brings more exposure and credibility to the entire crypto space.

“Congratulations Brian Armstrong on $COIN being added to the S&P 500 Index,” said Strategy Executive Chairman Michael Saylor. “A major milestone for Coinbase and for Bitcoin.”

Now let’s talk about Bitcoin. Coinbase is one of the top platforms people use to buy and sell Bitcoin. Having it in the S&P 500 makes Bitcoin exposure more accessible to traditional investors. It also helps reduce the idea that Bitcoin and crypto are just some risky gamble.

And the numbers speak for themselves. Over the past 14 years, Bitcoin has outperformed the S&P 500 and gold by a huge margin. Since 2010, Bitcoin has surged a staggering 7,200,000%, compared to the S&P 500’s 306% and gold’s 116%. Even when looking at shorter timeframes, Bitcoin consistently beats both. For instance:

In the past year:

Bitcoin: +27%

Gold: +37%

S&P 500: +5%

In the last five years:

Bitcoin: +1,138%

Gold: +85%

S&P 500: +92%

@ Newshounds News™

Source: Bitcoin Magazine

~~~~~~~~~

SAUDI ARABIA DROPS BRICS, INKS $600B STRATEGIC DEAL WITH US IN 2025

A new agreement has been signed, and it is poised to have major geopolitical ramifications as Saudi Arabia has seemingly dropped BRICS, inking a new deal with the US in 2025. Indeed, Riyadh has agreed to a “strategic economic partnership” with the United States amid a visit from President Donald Trump on Tuesday.

Both Trump and Crown Prince Mohammed Bin Salman have reached the landmark agreement that will increase cooperation in energy, mining, defense, and other ventures. Indeed, the memorandum was reached in what is the US president’s first major foreign trip since his return to the White House.

Saudi Arabia & US Reach New Deal Despite BRICS Standoff

Since his return to the Oval Office, Donald Trump has not been shy about his feelings toward the BRICS economic alliance. Earlier this year, he threatened 150% tariffs on the bloc. Specifically, he warned of repercussions for its continued de-dollarization efforts.

His stance only complicated the relationship between the collective and the recent expansion nation, Saudi Arabia. With tensions rising during Trump’s second term, Riyadh was seemingly caught in the middle. Now, it appears to have made its choice, as Saudi Arabia has turned from BRICS, signing a new strategic deal with the US in 2025.

The memorandum and agreement encompassed a host of sectors, including energy, defense, health, and the arts. Additionally, the letter of intent will see the US aid Saudi Arabia in the development of its armed forces. Moreover, they have plans for the Saudi Ministry of Interior and FBI to cooperate in one of many partnership aspects.

Abdulaziz Alghashian, Director of Research at Riyadh’s Observe Research Foundation Middle East, recently discussed the agreement. He noted that the deal’s reach “speaks to the depth” of the two nations' relationship. With the US and BRICS standing so opposed, it questions Saudi Arabia’s commitment to its cause.

However, that may not be the case. Alghashian noted that the deal “won’t come at the cost of relations with others.” Yet, only time will tell if that is the case. Just weeks ago, the US and China were on the doorstep of a trade war. Moreover, those tensions don’t appear to be entirely resolved.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Show Me A Sign by Dr. Dinar

Show Me A Sign by Dr. Dinar

5-13-2025

Since the very beginning that's all we've ever wanted. All we've ever asked for. Is a sign, Some kind of a sign to say it's real. To show some kind of progress, no matter how large or small.

Is that too much to ask for? I mean, we've paid our dues. And continue to pay them to this day, even if only in sheer perseverance. Especially those that are members of the various "Members Only" sites that are prevalent all across Dinarland.

Heck, back then we even paid our dues in the form of "Layaways" and "Reserves". Although we were told those programs were both SEC, as well as UST approved, as it turns out that wasn't the case.

Show Me A Sign by Dr. Dinar

5-13-2025

Since the very beginning that's all we've ever wanted. All we've ever asked for. Is a sign, Some kind of a sign to say it's real. To show some kind of progress, no matter how large or small.

Is that too much to ask for? I mean, we've paid our dues. And continue to pay them to this day, even if only in sheer perseverance. Especially those that are members of the various "Members Only" sites that are prevalent all across Dinarland.

Heck, back then we even paid our dues in the form of "Layaways" and "Reserves". Although we were told those programs were both SEC, as well as UST approved, as it turns out that wasn't the case.

It was more akin to betting on a horse race where all of the horses were three legged and forced to run the entire track backwards. In other words, nobody came out a winner.

As far as a sign goes, even though we wanted so desperately to see one, how do we know for certain if we'd even recognize it if we did see one. In those days 99% of us wore our RV Goggles 24/7. Day or night, anywhere and everywhere we went. We never left home without 'em. Ya know, in case we ran into a sign.

Just as it was with a spare 25K note or 12. Depending on what we were hearing throughout Dinarland at any given time it definitely couldn't hurt.

Last thing you wanted as a currency holder was to be caught unprepared in case the RV "popped" while you were out 'n about running errands. No way you were gonna risk it, taking a chance on missing out on a once in a lifetime opportunity such as this. Not even.

Fast forward a scant 15 years or so, to a world of $5 a gallon gas and $15 McBurgers. Talk about a change we never saw coming. When I first got involved minimum wage was about $7.50 and now it's $16.50 or some such insanity very close to that. It's no wonder a burger & fries requires taking out a 3rd mortgage.

Anyway, speaking of signs, one thing easily seen has to be the presto-change'o to the soon to be released GCR. Please don't ask me how soon soon is, for that is up to each individual to determine on their own. Soon obviously holds a different meaning for everyone based on the length of involvement. Although it's still and always will be a four letter word.

Way back when, a decade or so ago, we'd heard whispers of another system, possibly running on parallel train tracks, but nothing we could neither confirm nor deny. Simply another rumor among a sandbox full of rumors. Just another stacked sky high on a very tall pile.

Speaking of a litter box... oops, I mean sandbox full, we were already living in the land of rumor overload. Last thing we needed nor wanted was yet another unexplored rumor rabbit hole in need of exploration. Our plates were full of it. We were already up to our necks in secret source stuff. Enough already. No time nor headroom for yet another shiny pizza squirrel shaped object to chase after.

And wouldn't ya know it, just our luck. Like a salmon swimming upstream to meet a grizzly fate, turns out there was no escape to be had after all. Like a snowball descending from the top of Everest, gathering steam & scooping up anything and everything in its path to who knows where, it appears the GCR has pretty much swallowed up anything and everything that dared get in its path. Including the RV of the IQD.

Yes, this GCR is an animal of a different breed indeed. Which can be both good & bad, depending on your point of view. From one persons perspective they can yearn for simpler times, when it was all Iraq. All RV of the IQD focused. All The. Time! Without a doubt they were simpler, much more mentally manageable times.

The problem was the signs were much fewer and further between which left us weary and hangry for more. Constantly on the need for new & improved content to chew on. And resources weren't nearly as plentiful as they are these days. Perhaps that's because we've gone global.

Now we're living that "be careful what you wish for" level of lunacy. They're saying the signs are everywhere, all you have to do is know where to look. Who am I to argue. Last thing I want is for people to open their eyes and realize I don't exactly know where to look, nor whom or what to believe. I think that's all part of the "look over here, not over there" design.

Without a doubt we rarely, if ever heard anyone mention the word trillions back in the old days. It just didn't exist. Nowadays kids are reading it every morning on the back of cereal boxes.

Okay, so in our case it mostly has to do with the National Debt and in their case it has to do with how many different colored marshmallows there are in their cereal. Still, it's a word you never heard. And when you think about it, that's actually a good thing. That brings us closer to the need to change the entire system.

For all we know these multi trillions in debt, not to mention the $7 trillion interest payment soon coming due to a Fed Reserve near you, combined with the tariff's (discussions with China in Switzerland? hmmm) & trade wars could be just what the good doctor ordered.

Who knows, could this be the "soft" crash we've heard rumored about for far too long? I hope I'm not the only one grabbing at plastic straws, choosing to think outside the litter box at this stage of the game.

If you've yet to swap out your RV goggles for a fresh pair of GCR goggles at this stage of the game then I'm not really sure what to say. If asset-backed hasn't become part of your daily discussions, then you very well could be getting left behind. The train has already left the station.

I'm sorry to say the tailgating days of roasting hotdogs in bank parking lots, waiting for the doors to open bright and early the next morning, tellers at the ready waiting for you to play a round of "Name Your Rate" while row after row of De La Rue machines spin their collective brains out in the background are long gone.

Now the focus is much more on a global economic level and as each Country unloads their US treasuries, demanding to be reimbursed in real to the touch physical gold, the noose gets tighter, the chair legs get wobblier, and the entire global economy continues to lose its footing as the once thought of as semi sorta stable FIAT foundation proves itself on the daily to be anything but stable.

Will the BRICS+ Brigade turn out to be the global gamechanger we are hoping and some are predicting it will? That still remains to be seen.

One thing's for certain. They're going to continue to chug away on the sidelines, gathering one Country after another in hopes of gaining the strength needed to fuel the gold backed digital journey. I don't know about you but I definitely hope they succeed in their efforts.

As I see it it's only a matter of time before the entire FIAT system gets kicked to the curb, in favor of a new flavor of currency, one that's much more stable with a whole lot less volatility to boot. And it wouldn't hurt if there's a bit of the shiny stuff added in for good measure.

Yes, of you've been watching all of the physical gold related going's on as of late there's no denying there's a globally golden game goin' on. No, they don't want you to notice it nor be aware of it, but it's happening as we speak.

It's basically an episode of "Hoarders - Golden Edition". Never before in the history of history making have we witnessed such a rush to grab gold. Physical gold. Lots and lots of gold.

It's akin to a modern day Gold Rush but instead of selling Levi's and shovels, they're selling US Treasuries by the bucket load. Is anybody really coming right out and saying as much? Actually, one might be very surprised by just how many people are fully aware of these golden shenanigans.

Not that you don't have to do fair amount of digging to discover these nuggets but with each passing day these discoveries seem to multiply. As if they were meant to be found by those with the desire to search.

And who knows, perhaps this will all lead to a script flip of epic proportions. One where rather than push back against the shift, the US decides to do what they do best.

That being to hang on the longest, refusing to acquiesce to the undeniable global changes, declaring it's their way or the highway, all the while knowing they will eventually have to get away from the world of the worthlessly fractured FIAT factor and enter the asset-backed world.

And do it in such a way as to make it appear as if it was their idea all along. We simply weren't aware of it because, although it's all we've ever looked for, for some strange reason we didn't see the signs.

Hang in there folks. I truly believe we're getting closer with each passing day and before you know it you'll be ever so grateful that you never gave up.

Sincerely,

Dr. Dinar

Disclaimer; I'm not a Wealth Manager, Financial Advisor, CPA, Tax Attorney, RV/GCR Committee member, certifiable Gold Miner nor a shovel salesman. I'm simply someone that chooses to believe in the power of positive thinking and on the odd chance this GCR thing truly is real, I want to make sure I'm there at the finish line to enjoy it.

Tuesday Coffee with MarkZ. 05/13/2025

Tuesday Coffee with MarkZ. 05/13/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Today is a GREAT Day to have a Great Day

Member: Good Morning Mark, mods and RV’ers

Member: Mark, I had a dream last night that mid-podcast (you had a guest on) you snuck away and changed shirts to your “special” shirt! And put your gold hat on! Wish it was prophetic!

Tuesday Coffee with MarkZ. 05/13/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Today is a GREAT Day to have a Great Day

Member: Good Morning Mark, mods and RV’ers

Member: Mark, I had a dream last night that mid-podcast (you had a guest on) you snuck away and changed shirts to your “special” shirt! And put your gold hat on! Wish it was prophetic!

Member: Mark. What’s the word on the street about an RV happening soon?

Member: Mark, what is the status of your contacts who were waiting for their wire transfers?

MZ: On the bond side its still eerily quiet.

MZ: On the group side it is confusing….you have some groups getting notices for preparation …you have others hearing nothing but crickets….My opinion is it is purposeful to keep us guessing.

Member: Those who are quiet could it be nda's

Member: MarkZ: are we at 30% of bonds yet And/Or historical assets included in that 30%????

MZ: I do not think we are at the 30% yet…But we are knocking at the door.

Member: the QFS Maintenance from my banker source. He is well confident that the 15th is the go date for automated transactions to start. Right now it is being handled manually.

Member: To be honest, the bankers do not call it the QFS. We do.

Member: I read on another forum that the someone working for a cybersecurity center was informed they would be working 24/7 over the next 5-7days

MZ: Almost sounds like they are expecting something big. Hope its us.

Member: UST Scott Bessent keeps mentioning Currency Manipulation in his trade negotiaions!

Member: I can't believe people are still saying nothing is happening???

Member: There are lots of very big names having very big meetings. I hope that is very great news

Member: I saw a Gold Ad commercial discus a "Rio Reset" meeting happening in Rio on July 6th and 7th. involving Russia, China and others. this ad was during Megan Kelly show.

Member: Did anyone see militia man and crew posted early this morning? news getting more hopeful

Member: MM says Iran wants to drop 4 zeros on the rial

MZ: This should really have you folks excited- it makes me more comfortable that Iran will be in the first basket: “Central Bank of Iran: Deleting 4 zeros from the national currency is at the heart of the work plan for the current year” They do not just chop the zeros off….they increase the value. They want to reform the monetary system of Iran in the current year.

MZ: This will increase banks balance sheets and curb inflation and increase cash liquidity.. they are working on a similar plan as Iraq. Increasing the value of their currency.

Member: So what currencies are in the first basket.

MZ: Iraq, Indonesia, Vietnam, …at this point I believe we will see Iran and Venezuela. Zimbabwe as well.

Member: Old list but still could be correct: 1. US 2. UK 3. Kuwait 4. Canada 5. Mexico 6. Russia 7. China 8. Venezuela 9. Iranian Rial 10. IRAQ 11. Indonesia Rupiah 12. Malaysia 13. Vietnamese 14. Brazil 15. Saudi Arabia 16. Qatar 17. United Arab Emirates 18. Turkey 19. Afghanistan possibly20. India 21. Libya 22. Japan23. Zimbabwe

Member: Rumor is - Iraq is exchanging dollar-for-dollar on the Dinar in country

MZ: There is quite a bit of news mentioning parity , zeros dropping and possibly 1 to 1 rates. I still believe its going to be higher – but I love hearing these conversations. But if all I got was a buck rate…..I would be happy and gone.

Member: At one to one….if all currencies were at parity. The dong, Rial, Rupiah, bolivar. dinar and all the others we hold would be worth $1. That would be still be wonderful…much more then they are worth now.

Member: I wonder- Is there any real benefit to keep IQD undervalued and losing billions on imports each year?

Member: The corruption and infrastructure had to be brought up to speed Plus the Iraqi us war sent Iraq into the atone age Then black market and corruption spread

Member: Question: who's paying for IQD RV? CBI or hidden funds?

Member: Mark, How long before the revaluation of the Kuwaiti dinar did the news oscillate?

MZ: About 10 days they managed to keep things quiet from the world.

Member: Are we waiting for the Arab summit for the RV announcement?

MZ: We will know in 4 days.

Member: My gut feeling is this week. Too many contacts being quiet, Trump going to middle east and the Arab Summit on the 17th.

MZ: “ The Arab Summit in Baghdad: Leadership of the Arab Decision and a major economic shift for Iraq” Iraq is expecting a “pivotal event” at the meeting of Arab leaders, kings and Presidents.

MZ: “ I took advantage of the dollar exchange rate difference: Judiciary recovers 11 billion dinars from company that fraudulently transferred money out of the country” this is reducing corruption and the amount of dinar in circulation. About 66 billion dinar has been recovered.

MZ: “Iraq is ready for the withdrawal of foreign forces and the transformation of the relationship with the International coalition” Iraq has trained and prepared and ready to be partners with the coalition now. To be equals and peers.

MZ: The US will still have forces there but they will not be responsible for security in Iraq. Iraq will be.

Member: It certainly looks like we're heading in the RV direction! I'm excited again.

Member: Thanks Mark and everyone. Stay positive and looking forward to podcast tonight

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Tuesday 5-13-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 13 May 2025

Compiled Tues. 13 May 2025 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Reliable sources confirm that money has already (allegedly) begun to circulate discreetly through the global network.

On Mon, 5 May, bondholders(allegedly) received liquidity under strict non-disclosure agreements (NDAs). Meanwhile, the dinar and the dong are being (allegedly) traded on Middle Eastern corridors, in an undisclosed but very real manner.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Tues. 13 May 2025

Compiled Tues. 13 May 2025 12:01 am EST by Judy Byington

Global Currency Reset: (Rumors)

Reliable sources confirm that money has already (allegedly) begun to circulate discreetly through the global network.

On Mon, 5 May, bondholders(allegedly) received liquidity under strict non-disclosure agreements (NDAs). Meanwhile, the dinar and the dong are being (allegedly) traded on Middle Eastern corridors, in an undisclosed but very real manner.

Mon. 12 May(allegedly) marked the ignition point. From this moment on, the Quantum Financial System begins synchronization. Layer Tier 4B notifications (we, the Internet Group) are ready. Everything is set. The channels are secure. The next step is delivery.

The following events are expected between Mon, 12 May 12 & Wed, 14 May:

– Activation of the Emergency Broadcast System on phones

– Direct access via email or portal with instructions to schedule an exchange

– Confirmation discreetly posted to select VR Intelligence Centers

After notification, you will have 10 days to schedule your appointment and until May 31 to complete it.

• Only Redemption Centers can process ZIM bonds

• Redemption Centers offer enhanced sovereign rates

• Regular bank exchanges will be limited and will yield lower market rates.

All ZIM redemptions end on Saturday, May 31. After this period, ZIM will no longer be eligible and redeemable; only basic currency exchanges will be possible.

This is not speculation. This is the schedule. This is the protocol. The system is live. The movement has begun. The silence is intentional. Prepare calmly. Observe carefully.

From here everything accelerates. Your time is approaching. Instructions will come to you.

~~~~~~~~~~~~~

What We Think We Know as of Tues. 13 May 2025:

Mon. 12 May 2025 Fox News: The Patriot Wealth Reset has begun. The first-ever gold asset Bitcoin-backed Bills are HERE. Not digital. Not theory. Real, physical money — (allegedly) signed and announced by Trump himself. Last seven days and then the door slams shut. https://cutt.ly/Official_BITCOINBILL_ByTrump

Possible Timing:

Fri. 9 May 2025: Operation Sandman was (allegedly) in effect – a collaboration of 100 nations to simultaneously sell off their US holdings in order to collapse the US Dollar

Global Currency Reset:

Mon. 12 May 2025: Iran will drop four zeros from its national currency, the Rial, and rename it the Toman, hinting at an RV. @MelaniastasiaRomanov

Operation Sandman has been ACTIVATED. Over 100 nations just began DUMPING U.S. TREASURIES in a synchronized assault to COLLAPSE the dollar and BREAK the Deepstate’s financial stranglehold.

Mon. 12 May 2025: BOOM!!! JULY 1, 2025: THE GOLD STANDARD RETURNS – THE BASEL III ENDGAME BEGINS – A MONETARY RESET IS COMING! – amg-news.com – American Media Group

Read full post here: https://dinarchronicles.com/2025/05/13/restored-republic-via-a-gcr-update-as-of-may-13-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Television says from the United States of America that 46 business leaders from Iraq including Kurdistan will be attending a conference in the United States of American from the 11th to the 14th. This is pretty interesting. These are some of the most powerful business leaders in Iraq going to your country. FRANK: Do you think any American businessman wants to deal with 1310? Of course not. All of this is...signs pointing in one direction that you are the prettiest girl at the party and everybody want to kiss you...

Walkingstick [Iraqi banking friend Aki update] WALKINGSTICK: When do you think they're ever going to release the new exchange rate? AKI: Of course they have a date. Why do you think I'm here [in Michigan US]? WALKINGSTICK: Why don't you tell me. AKI: You know I'm here to collect the three zero notes. This is what I have been assigned to do. I am not to give out lower notes... Walkingtick: He's going to help the Middle Easterners in his Michigan area and in the east coast of the United States.

************

U.S. Consumer Is Breaking Down – Markets Just Don’t See It Yet | Stephanie Pomboy

Kitco News: 5-12-2025

Will the trillion-dollar corporate debt wall crash the stock market in 2025? Wall Street is cheering a 90-day tariff truce between the U.S. and China – but Stephanie Pomboy says the real crisis is just beginning.

The MacroMavens founder warns that a trillion-dollar corporate debt wall is about to hit, credit delinquencies are surging, and the Treasury still has no plan to finance its deficits.

As markets rally, Pomboy says the Fed is trapped, the consumer is maxed out, and a deeper economic reset is unavoidable. Key topics:

10-year Treasury yield as the most critical macro signal

U.S. consumer and corporate credit distress

Why Pomboy is still buying gold – and not buying stocks

Fed’s political paralysis and looming policy error

The economic implications of deglobalization and trade reset

Iraq Economic News And Points To Ponder Tuesday Morning 5-13-25

Monetary Policy Raises The Value Of The Dinar And Reduces Reliance On The Parallel Market.

Economic 2025/05/11 Baghdad: Hussein Thaghab The Iraqi dinar has recently recorded strong performance against the dollar, driven by a series of monetary measures adopted by the Central Bank, which have contributed to reducing demand for hard currency in the parallel market and enhancing the confidence of traders in official channels.

This improvement comes amid ongoing government efforts to consolidate financial stability and

stimulate business activity through effective monetary instruments and transparent and direct financing mechanisms.

Monetary Policy Raises The Value Of The Dinar And Reduces Reliance On The Parallel Market.

Economic 2025/05/11 Baghdad: Hussein Thaghab The Iraqi dinar has recently recorded strong performance against the dollar, driven by a series of monetary measures adopted by the Central Bank, which have contributed to reducing demand for hard currency in the parallel market and enhancing the confidence of traders in official channels.

This improvement comes amid ongoing government efforts to consolidate financial stability and

stimulate business activity through effective monetary instruments and transparent and direct financing mechanisms.

Deputy Governor of the Central Bank of Kuwait, Dr. Ammar Hamad, confirmed to Al-Sabah that

this increase reflects the success of the monetary policy pursued by the bank in reducing reliance on the parallel market and providing safe and transparent sources of financing for foreign trade.

He explained that this policy has enabled the commercial family to obtain dollars through official channels that adhere to international standards, without having to resort to the unregulated market.

Hamad noted that the Central Bank continues to work toward consolidating the local banking system and raising its operational efficiency to levels consistent with international banking standards, making it a fundamental pillar in driving economic development in Iraq.

He added that the bank is adopting advanced mechanisms that enable banks to offer diverse banking products that support various economic sectors and facilitate financing and cash flow operations.

For his part, the Prime Minister's Advisor for Financial Affairs, Dr. Mazhar Mohammed Salih, explained that a number of factors contributed to strengthening the value of the dinar, most notably the weak demand for the dollar in the parallel market, as a result of the Central Bank's policies regarding financing foreign trade for the private sector.

He explained that the bank strengthens Iraqi banks' dollar balances through their correspondents abroad, especially banks with a high credit rating (AAA), which speeds up the execution of international transfers

and reduces the need for dollars in the local market.

He also indicated that the move towards using alternative currencies such as the euro, yuan, dirham, and lira in banking transactions has helped reduce excessive reliance on the dollar.

Saleh also noted that enabling small businesses to access financing sources directly through Iraqi banks,

without costly intermediaries, has helped reduce operating costs and improved commercial efficiency,

as this segment represents approximately 60% of private sector trade.

He added that travelers can now easily obtain their foreign currency dues via payment cards at a subsidized exchange rate of 1,320 dinars to the dollar, in addition to the ability to receive dollars in cash at Iraqi airports, which has eased pressure on the parallel market.

In the same context, economic expert Nazir Al-Saadi emphasized that the money transfer services provided by the Central Bank have become safer and more effective,which has prompted business families to move away from the parallel market,

which is characterized by significant risks and high costs.

He explained that relying on official transfers not only ensures the safety of transactions,but also reduces the final cost of imports,which is positively reflected in the prices offered to consumers.

He added that random transfers from the parallel market often caused losses to importers due to failure to implement them or due to price fluctuations, while the Central Bank mechanism provides a stable financial system that preserves the value of the currency and reduces Opportunities for manipulation. https://alsabaah.iq/114242-.html

Arab Countries On The Gray List For Money Laundering... What About Iraq?

Economy 2025-05-12 | 2,734 views Asharq Al-Awsat revealed on Monday that seven Arab countries are on the gray list. The report emphasized that this does not mean they are directly involved in financial corruption, but rather serves as an international warning about the existence of systemic loopholes that could weaken the economy and threaten investor and market confidence.

This places the country under scrutiny, considering it an environment that could be exploited for money laundering or terrorist financing unless it swiftly implements strict legal and institutional reforms.

In the Arab region, several countries have entered this list, some of which have already left,

while others remain for reasons ranging from weak legislation, weak banking oversight, and political instability.

This makes the issue more complex and impactful for the region's economies, which are highly dependent on cross-border financial flows.

The grey list refers to countries placed on the Financial Action Task Force's (FATF) "enhanced monitoring list."

The list includes countries with "strategic deficiencies" in their anti-money laundering, counter-terrorism financing, and proliferation regimes, but which have demonstrated a high-level political commitment to work with the FATF to implement a clear reform plan within a specific timeframe.

The Financial Action Task Force (FATF) is an intergovernmental body established in 1989at the initiative of the Group of Seven industrialized nations and headquartered in Paris.

It is concerned with setting standards and promoting the implementation of legal, regulatory, and practical measures to combat money laundering, the financing of terrorism, and the proliferation of weapons of mass destruction at the national and international levels.

*Arab countries on the list

As of the latest official update issued by the Financial Action Task Force in February 2025, the following countries from the Arab region are included on the “grey list”:

1. Algeria

Algeria was listed in October 2024 following a joint assessment with the Middle East and North Africa Financial Action Task Force (MENAFATF), due to weak risk oversight, the absence of an effective beneficial ownership framework, and a lack of suspicious transaction reports.

Algeria is implementing an action plan that includes strengthening financial oversight, developing a suspicious transaction reporting system, and updating the legal framework for targeted financial sanctions.

2. Lebanon

Lebanon was added to the list in October 2024 due to the collapse of its banking system and its increasing reliance on cash transactions, which reflects a lack of confidence in the banking system and makes it difficult to track cash flows, in addition to the lack of judicial independence and concerns about terrorist financing.

authorities are seeking The Lebanese to implement a comprehensive reform plan to strengthen the anti-money laundering and counter-terrorism financing system.

3. Syria

Syria has been on the list since February 2010 due to strategic deficiencies in combating money laundering and terrorist financing. Despite some improvements, Syria continues to cooperate with the Financial Action Task Force to address these deficiencies .

4. Yemen

Yemen was listed in February 2014 due to its inability to implement reforms due to the security situation, despite completing the agreed-upon action plan. However, Yemen continues its efforts to strengthen its anti-money laundering and counter-terrorism financing regime.

*Arab countries removed from the list

Three Arab countries have been removed from the "grey list" after implementing comprehensive

reforms to their anti-money laundering and counter-terrorism financing systems.

These countries are: the UAE, Morocco, and Jordan.

1. UAE

The UAE was placed on the "grey list" in March 2022 due to "strategic deficiencies" in its anti-money laundering and counter-terrorist financing regime, such as poor understanding of risks, limited use of financial information, and challenges in implementing sanctions.

The UAE was removed from the grey list on February 23, 2024, after implementing a series of institutional and legislative reforms, including the establishment of the Executive Office for Combating Money Laundering and Terrorist Financing to enhance national coordination, the establishment of a specialized court for financial crimes, and the updating of criminal laws and the imposition of stricter penalties.

The country also increased the pace of investigations and prosecutions and activated a system for reporting suspicious transactions.

FATF commended this progress, considering it sufficient to remove the UAE from the list.

2. Morocco

Morocco was placed on the “grey list” due to weak risk-based oversight, insufficient accuracy of beneficial ownership information for legal entities, limited diversity of suspicious transaction reports, and limited effectiveness of investigations and prosecutions.

Morocco was removed from the grey list in February 2023 after implementing a series of substantive reforms within the framework of the action plan agreed upon with the Financial Action Task Force.

The measures included strengthening the legal and regulatory framework for combating money laundering and terrorist financing, improving the effectiveness of investigations and prosecutions, updating the suspicious transaction reporting system, and enhancing international cooperation and the exchange of financial information.

3. Jordan

Gaps such as weak risk-based oversight, insufficient beneficial ownership data, inadequate prosecutions, and an ineffective financial sanctions regime have placed Jordan under enhanced FATF scrutiny.

After the country adopted reforms that included improving transparency in beneficial ownership data, strengthening investigations and prosecutions in money laundering cases, tightening oversight of non-profit organizations, and improving its targeted financial sanctions regime, Jordan was removed from the gray list in October 2023.

Listing: Punishment or Regulatory Measure?

Gray listing is not a penalty in the legal sense; rather, it is an international regulatory measure that indicates strategic deficiencies in a country's

anti-money laundering and counter-terrorist financing (AML/CFT) systems.

However, despite its regulatory nature, it has quasi-punitive consequences, such as diminished investor confidence, tightened international banking supervision, and increased costs for financial transactions.

Listing obliges a country to implement an action plan within a specified period under FATF supervision and serves as an international warning requiring urgent reforms.

*What about Iraq ?

On August 20, 2024, Iraq's Anti-Money Laundering and Counter-Terrorism Financing Office announced that the country was no longer on the gray list for money laundering, following the establishment of updated, comprehensive, and confidential databases that meet international requirements.

, Hussein Al-Maqram, reported The office's representative at the Central Bank of Iraq the

completion of the international mutual evaluation conducted by a team of international experts on Iraq.

The 14-month evaluation aimed to assess Iraq's technical compliance with the legal framework,

regulations, instructions, and controls for combating money laundering and terrorist financing.

In a statement to the media, Muqrin explained that the international expert team evaluated the effectiveness of anti-money laundering and counter-terrorism financing systems by providing statistics and practical cases to demonstrate the extent to which the legislative framework is being implemented, in addition to conducting field visits."

He added that "the evaluation report was discussed and approved by the Middle East and North Africa Financial Action Task Force (MENAFATF) last May," noting that

"the initial results confirmed that the Republic of Iraq has moved away from inclusion on the gray list,

and an action plan and recommendations were formulated by

international evaluators to ensure compliance with international standards."

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Morning 5-13-25

Good Morning Dinar Recaps,

ARIZONA GOVERNOR KILLS TWO CRYPTO BILLS, CRACKS DOWN ON BITCOIN ATMS

Governor Katie Hobbs vetoed two major pro-crypto bills:

Senate Bill 1373, which proposed a Digital Assets Strategic Reserve Fund, and

Senate Bill 1025, the Arizona Strategic Bitcoin Reserve Act that would have allowed up to 10% of state treasury and retirement funds to be invested in Bitcoin.

She also rejected Senate Bill 1024, which would have allowed state agencies to accept crypto payments for taxes and fees.

Good Morning Dinar Recaps,

ARIZONA GOVERNOR KILLS TWO CRYPTO BILLS, CRACKS DOWN ON BITCOIN ATMS

Governor Katie Hobbs vetoed two major pro-crypto bills:

Senate Bill 1373, which proposed a Digital Assets Strategic Reserve Fund, and

Senate Bill 1025, the Arizona Strategic Bitcoin Reserve Act that would have allowed up to 10% of state treasury and retirement funds to be invested in Bitcoin.

She also rejected Senate Bill 1024, which would have allowed state agencies to accept crypto payments for taxes and fees.

Hobbs cited “volatility in cryptocurrency markets” as a core reason for vetoing, stating the proposals posed too much financial risk for public funds.

However, she approved House Bill 2387, which imposes strict consumer protections on Bitcoin ATMs:

Requires multilingual scam warnings and acknowledgment from users before transactions.

Caps daily transactions at $2,000 for new users and $10,500 for returning users after 10 days.

Mandates detailed receipts, visible 24/7 customer support info, and a 30-day refund policy for fraud victims.

Additionally, Hobbs signed House Bill 2749, modernizing unclaimed property laws to let Arizona hold unclaimed crypto in its original form rather than converting to fiat.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BRICS: US & CHINA AGREE TO TARIFF PAUSE, BUT WHO’S NEXT?

The US and China have agreed to a 90-day tariff pause, signaling a potential thaw in tensions and offering hope for a broader trade deal.

President Trump called it a “total reset” in relations, easing fears of an imminent trade war between the world’s two largest economies.

China’s role in BRICS remains pivotal, and the agreement has sparked speculation about which BRICS nation may secure relief next.

India has already finalized trade terms with the US, while Brazil still faces a 10% tariff, and South Africa’s has been lowered from 30% to 10%.

Russia was never included in the initial US tariff plan, giving the BRICS alliance some strategic leverage.

The European Union (EU) may be next on the negotiation list, though Trump called the EU “nastier than China” in recent comments.

BRICS' united trade front is believed to be effective, with growing optimism that tariff relief deals for other members are coming soon.

The 2025 BRICS summit could expand the alliance, increasing its global influence during ongoing trade negotiations.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 5-13-2025

TNT:

Tishwash: Al-Sudani inspects the "Heart of the World" hotel in preparation for receiving delegations participating in the Arab Summit.

Prime Minister Mohammed Shia al-Sudani reviewed preparations for receiving delegations participating in the Arab Summit on Sunday.

The Prime Minister's media office said in a statement received by the Iraq Observer, "Prime Minister Mohammed Shia al-Sudani visited the Heart of the World Hotel in the capital, Baghdad, today, Sunday, which is one of the hotels that will host the delegations participating in the Arab Summit in Baghdad."

The statement added, "During a tour of the hotel, which is one of the most prominent modern hotel projects in the capital, Baghdad, Al-Sudani viewed its halls, corridors, and tourist facilities, as well as the distinctive equipment and services it includes that are worthy of Iraq's guests."

TNT:

Tishwash: Al-Sudani inspects the "Heart of the World" hotel in preparation for receiving delegations participating in the Arab Summit.

Prime Minister Mohammed Shia al-Sudani reviewed preparations for receiving delegations participating in the Arab Summit on Sunday.

The Prime Minister's media office said in a statement received by the Iraq Observer, "Prime Minister Mohammed Shia al-Sudani visited the Heart of the World Hotel in the capital, Baghdad, today, Sunday, which is one of the hotels that will host the delegations participating in the Arab Summit in Baghdad."

The statement added, "During a tour of the hotel, which is one of the most prominent modern hotel projects in the capital, Baghdad, Al-Sudani viewed its halls, corridors, and tourist facilities, as well as the distinctive equipment and services it includes that are worthy of Iraq's guests."

He continued, "He also toured the press center dedicated to the Arab Summit to review the preparations for the work of journalists and media personnel at this center, which will constitute an integrated media platform for covering the Arab Summit." link

***************

Tishwash: Economists: The Arab Summit is an opportunity to activate partnerships and investments.

The Arab economic arena is witnessing increasing momentum ahead of the Arab Summit in Baghdad, with economic experts and specialists unanimously agreeing that this event could mark the beginning of a new phase of joint Arab economic action, based on investing in the wealth and potential of Arab countries and redrawing the map of cooperation in light of regional and international changes. This vision comes within the context of a widespread belief that Baghdad now possesses the elements of stability and readiness to host major strategic projects that will benefit all Arab economies.

New prospects for cooperation

Economic expert Haider Karim al-Gharawi told Al-Sabah that holding the summit in Baghdad opens new horizons for cooperation between Iraq and its Arab brethren, given the common elements upon which fruitful economic partnerships can be built.

He explained that the presence of Arab leaders or their representatives in Baghdad and their direct exposure to the Iraqi reality could create new visions and strengthen the conviction that Iraq possesses an attractive work environment capable of accommodating bilateral partnership projects that achieve benefits for all parties. In various sectors.

Al-Gharawi added that the summit represents a rare opportunity to present Iraq's development plans directly to delegations without the need for intermediaries, which will help accelerate agreements and reach practical and effective cooperation formulas.

He considered that the mere fact that the summit is being held in Baghdad sends a reassuring message to the world that Iraq has returned to the path of stability and economic openness. He also spoke about the possibility of creating common economic interests with major international companies that can leverage their expertise to support Arab-style production projects, making the summit a starting point for a formula for Arab industrial and production integration capable of competing in the global market.

The Summit and the Road to Development

For his part, economic expert Dr. Nabil Al-Marsoumi explained that the summit represents an opportunity to enhance economic cooperation between Iraq and Arab countries, particularly neighboring countries. He pointed out that Iraq has active economic relations with its regional surroundings, including the electrical connection with Jordan, which is close to completion, in addition to economic relations with Saudi Arabia and Kuwait, which can be activated through comprehensive economic agreements.

He emphasized that the summit could contribute to reviving agreements related to the "Development Road" project, which is one of the largest strategic projects that serves not only Iraq, but also extends its benefits to other Arab countries, especially the UAE and Qatar, as it provides a potential corridor for Qatari gas to Europe. It is also a gateway to strengthening economic relations, diversifying trade exchange, and pursuing joint projects in the energy, contracting, and housing sectors, areas that usually constitute a key focus of major economic conferences, thus enhancing opportunities for sustainable development and Arab integration.

Iraq in the regional equation

Economic researcher Suhad Al-Shammari considered the holding of the Arab Summit in Baghdad a pivotal event at various levels, noting in her interview with Al-Sabah that the meeting of Arab leaders, kings and presidents in the Iraqi capital reflects the extent of Arab interest in Iraq's role and position in the new regional equation.

She explained that discussing issues that have a direct impact on the region through the Baghdad Summit carries a clear message that Iraq has become secure and has a virgin economy that can accommodate the most important investment projects, which means that countries are now dealing with Iraq from a new economic perspective that charts the compass of political cooperation based on common interest.

Al-Shammari indicated that the summit carries indications of Iraq's return to playing an influential geopolitical role in the region, and opens the horizon for bringing viewpoints closer between Arab countries. It also reflects the qualitative shift that Iraq has witnessed in terms of reconstruction and development, noting that the "Development Road" project represents an important economic gateway and is on its way to completion within the specified timeframe, at a time when Baghdad has regained its luster as a vibrant capital witnessing a major development movement, which enhances Iraq's position as a key player in the economic and And the Arab politician.

The summit and the elements of success

These intersecting visions reflect a firm belief among experts that the Baghdad Summit possesses all the ingredients for economic success, making it a strategic platform for launching comprehensive Arab initiatives based on integration in the fields of energy, transportation, and infrastructure. These initiatives contribute to building an Arab economic system capable of confronting challenges and exploiting available opportunities, within a path of sustainable cooperation that the region has always embraced. Much needed. link

*************

Tishwash: The Prime Minister appreciates the International Monetary Fund's efforts in supporting Iraq and its financial and monetary institutions.

Prime Minister Mohammed Shia Al-Sudani praised the efforts of the International Monetary Fund in supporting Iraq and its financial and monetary institutions.

His media office said in a statement, "Prime Minister Mohammed Shia Al-Sudani received today, Monday, the head of the International Monetary Fund mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

Al-Sudani appreciated the efforts of the International Monetary Fund in supporting Iraq and its financial and monetary institutions, which would restore their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability, stressing that the achievements made by the government in the financial, banking and economic fields represent positive steps towards achieving stability and sustainable development in the country.

Al-Sudani pointed out "the importance of continued support from international partners for the government in intensifying efforts to mitigate the impact of the challenges facing the region, which would facilitate the implementation of steps aimed at diversifying and sustaining the economy, through the investment environment it has provided that has attracted major development projects.

For his part, Polan praised the significant progress made by the Iraqi government in the field of economic reform, through the development of the tax and customs system, expressing the International Monetary Fund's readiness to increase coordination and joint work, and to provide the necessary advice in areas of enhancing non-oil revenues. link

************

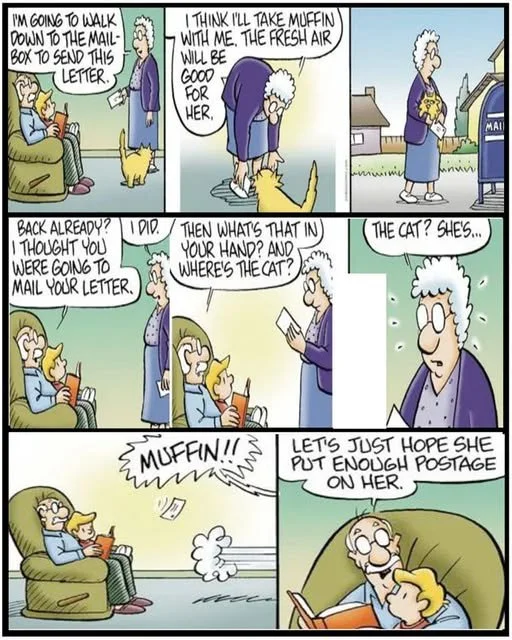

Mot: Come on ""Earl"" -- LOL

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

5-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

5-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News And Points To Ponder Monday Evening 5-12-25

Prime Minister: The International Monetary Fund Is A Key Partner In Strengthening Iraq's Economy And Stabilizing It

Economy | 08:46 - 12/05/2025 Mawazine News - Baghdad - Prime Minister Mohammed Shia Al-Sudani received on Monday the Head of the International Monetary Fund (IMF) Mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

According to a statement from his media office received by Mawazine News, Al-Sudani praised the IMF's efforts in supporting Iraq and its financial and monetary institutions, thus restoring their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability.

Prime Minister: The International Monetary Fund Is A Key Partner In Strengthening Iraq's Economy And Stabilizing It

Economy | 08:46 - 12/05/2025 Mawazine News - Baghdad - Prime Minister Mohammed Shia Al-Sudani received on Monday the Head of the International Monetary Fund (IMF) Mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

According to a statement from his media office received by Mawazine News, Al-Sudani praised the IMF's efforts in supporting Iraq and its financial and monetary institutions, thus restoring their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability.

He stressed that the government's achievements in the financial, banking and economic fields represent positive steps towards achieving stability and sustainable development in the country.

He pointed out the importance of continued support from international partners for the government in intensifying efforts to mitigate the impact of the challenges facing the region, thus facilitating the implementation of steps aimed at diversifying and sustaining the economy, through the investment environment it has provided that has attracted major development projects.

For his part, Polan praised the "significant progress made by the Iraqi government in economic reform, through the development of the tax and customs systems."

He expressed the IMF's readiness to increase coordination and joint action, and to provide the necessary advice on enhancing non-oil revenues. https://www.mawazin.net/Details.aspx?jimare=261358

Rafidain Bank: The "Riyada" Initiative Is A Development Tool For Transforming The Iraqi Economy.

A wish | 09:25 - 12/05/2025 Mawazine News - Baghdad - Rafidain Bank confirmed on Monday that the Riyada initiative represented a development tool for changing the structure of the Iraqi economy and transformed young people from job seekers to opportunity creators.

While noting that the first phase of the initiative financed more than 8,000 small projects, he noted that the second phase will finance more than 10,000 new projects.

Rafidain Bank Director Ali Karim Al-Fatlawi said in a statement to the official agency, followed by Mawazine News, that "the Riyada initiative launched by the bank represents a qualitative shift in the role of banking institutions," indicating that "it is no longer limited to providing financing, but has become a development tool for changing the structure of the Iraqi economy and empowering youth."

He added, "The initiative is not merely financing small projects, but rather a new economic future written by the youth of Iraq," noting that "the state is no longer the largest employer alone, but has become an enabler and motivator of the private sector, especially graduates and entrepreneurs."

He continued, "The first phase of the initiative resulted in financing more than 8,000 small projects, each of which provided between two and five direct job opportunities, reflecting a real shift in the role of youth from job seekers to opportunity creators.

" He noted that "the bank has allocated sufficient resources for the second phase and is preparing to finance more than 10,000 new projects in cooperation with relevant authorities."

He stated that "Rafidain Bank is today adopting an integrated development role, not just a traditional banking role," explaining that "financing has become a means to build small production units that support the market and break the cycle of unemployment."

He pointed out that "the most prominent challenges facing the implementation of the initiative are the need for institutional integration," calling on the Central Bank and all national institutions to "actively engage in supporting the Riyada initiative by allocating concessionary financing windows, launching a national fund to guarantee loans for entrepreneurs, and integrating the initiative into the upcoming financial inclusion strategy." https://www.mawazin.net/Details.aspx?jimare=261361

A Delegation Of 46 Iraqi Businessmen Participates In The US Investment Summit To Enhance Economic Cooperation

The US Embassy in Baghdad announced on Sunday that a delegation of 46 business leaders from across Iraq, including the Kurdistan Region, will travel to the United States to participate in the annual SelectUSA Investment Summit, scheduled to be held in Washington, D.C., from May 11 to 14.

The embassy explained in a statement that the delegation represents a wide range of economic sectors, including technology, cybersecurity, tourism, hospitality, food and beverage, franchises, agriculture, construction, investment, pharmaceuticals, real estate, and oil and gas, reflecting the diversity of cooperation and investment opportunities between the two countries.

The SelectUSA Summit, organized by the US Department of Commerce, is the largest event dedicated to promoting foreign direct investment in the United States, bringing together international investors with representatives of state and local governments, along with government officials, with the goal of facilitating investment entry into the US market.

The embassy explained that this participation is part of a series of important economic visits that have strengthened bilateral relations, noting the visit of a delegation from the US International Development Finance Corporation to Baghdad in May, in addition to the participation of more than 100 businessmen and companies from the American-Iraqi Chamber of Commerce in a business forum held in Baghdad last April.

The embassy emphasized that these efforts aim to support Iraqi businessmen in exploring growth and investment opportunities within the United States and strengthening the economic partnership between the two countries. https://www.radionawa.com/all-detail.aspx?jimare=41825

While Chairing The Economic And Social Council Meeting, Iraq Calls For The Formation Of An Arab Economic Bloc

Monday, May 12, 2025 3:35 PM | Economic Number of reads: 255 Baghdad / NINA / Iraq called, during the meeting of the Economic and Social Council, for the formation of an Arab economic bloc.

Director General of the Department of Foreign Economic Relations at the Ministry of Trade, and member of the presidency of the current session of the Arab Development Summit, Riyadh Fakher Al-Hashemi, said in a speech during the meeting of the Economic and Social Council at the level of senior officials, according to the official agency:

"Our meeting is not just an entitlement, but rather a sincere Arab platform to translate aspirations into action, and to address development challenges through constructive dialogue, genuine cooperation, and common will."

Al-Hashemi added: "Our Arab reality today requires us to take a serious stance and clear positions in order to chart applicable development paths capable of creating job opportunities and achieving social justice. Today, we are called upon to go beyond traditional frameworks and move towards strategic projects that move towards a truly integrated economy, effective social cooperation, and joint investment."

He continued: "The Arab economic bloc is not only important, but it is a historic entitlement, if we invest in the available elements of human and natural resources, as we are working today to formulate an agenda rich in issues, which represents a priority in the Arab development process, and lays the foundation for qualitative outcomes." /https://ninanews.com/Website/News/Details?key=1226423

The Dollar Rises Again By 144,000 Against The Iraqi Dinar.

Economy | 10:38 - 12/05/2025 Mawazine News – Baghdad Mawazine News publishes today, Monday, the exchange rates of the dollar against the Iraqi dinar in local markets. - Selling 143,750 dinars for $100. Purchase 141,750 dinars for $100. https://www.mawazin.net/Details.aspx?jimare=261303

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Monday Evening 5-12-25

Good afternoon Dinar Recaps,

US HOUSE PASSES CONTROVERSIAL STABLECOIN BILL BACKED BY TRUMP, DIVIDES DEMOCRATS

▪️The House passed the Stablecoin Innovation and Protection Act of 2025 late Thursday.

▪️The bill, supported by President Trump, aims to create a federal framework for stablecoin issuance while preserving state-level oversight.

▪️Democrats remain split over the bill’s impact on consumer protections, foreign issuers, and financial surveillance.

Good afternoon Dinar Recaps,

US HOUSE PASSES CONTROVERSIAL STABLECOIN BILL BACKED BY TRUMP, DIVIDES DEMOCRATS

▪️The House passed the Stablecoin Innovation and Protection Act of 2025 late Thursday.

▪️The bill, supported by President Trump, aims to create a federal framework for stablecoin issuance while preserving state-level oversight.

▪️Democrats remain split over the bill’s impact on consumer protections, foreign issuers, and financial surveillance.

The U.S. House of Representatives has passed the Stablecoin Innovation and Protection Act of 2025, a landmark piece of crypto legislation backed by President Donald Trump. The legislation, which passed with significant Republican support, proposes a federal framework for stablecoin issuance and sets broad new guidelines for how both private and public entities may issue and manage digital dollar-pegged tokens.

While the bill preserves some roles for state regulators—allowing entities like Wyoming’s digital asset office to license issuers—it also gives the U.S. Treasury, Federal Reserve, and SEC more say in oversight, compliance, and financial stability risks.

President Trump called the passage a "historic win for American financial innovation", noting that the bill will help the United States "compete with foreign stablecoins and preserve dollar dominance."

Still, Democrats remain deeply divided. Some, including Rep. Richie Torres (D-NY), backed the legislation, arguing that clear rules would help weed out bad actors and prevent future Terra-style collapses.

Others, including Rep. Maxine Waters (D-CA), warned that the bill "guts core consumer protections" and would "allow foreign and unvetted entities to flood the market with opaque dollar tokens."