Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

1-17-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

1-17-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-17-26

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Overview

Central banks around the world are accelerating gold purchases at a pace not seen in decades, reflecting growing concern over the long-term credibility of the U.S. dollar. Geopolitical fragmentation, sanctions risk, and increasing political pressure on monetary policy have driven reserve managers toward tangible, politically neutral assets. Gold’s share of global central bank reserves has now climbed above 25%, marking a historic inflection point in reserve strategy.

Key Developments

Central banks have increased gold purchases at multi-decade record levels

Gold now accounts for more than one-quarter of global central bank reserves

Prices have surged to historic highs, confirming sustained institutional demand

China alone reportedly holds over 2,000 tonnes of gold

Emerging market central banks are leading the diversification trend

What’s Really Driving the Shift

This move is not about speculation or short-term hedging. It is about systemic risk management.

Gold offers:

No counterparty risk

Immunity from sanctions and payment freezes

Protection against political interference in monetary policy

Universal acceptability outside any single financial system

As trust in fiat governance weakens, central banks are opting for assets that cannot be debased, frozen, or reprogrammed.

Why It Matters

Accelerated gold accumulation is a classic signal of declining confidence in dominant reserve currencies

Reserve diversification weakens the structural demand for dollar-denominated assets

Gold reasserts itself as a neutral anchor in a fragmenting monetary order

This behavior historically precedes monetary regime adjustments, not follows them

When central banks move first, markets follow later.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation during a Global Reset:

Gold accumulation signals preparation for currency realignment

Tangible reserve backing strengthens the case for future repricing

Fiat-heavy systems face pressure as reserve composition shifts

Holders positioned ahead of formal policy changes benefit most

Gold is not replacing currencies — it is redefining what backs them.

Implications for the Global Reset

Pillar 1 – Assets: Gold regains prominence as a reserve foundation

Pillar 2 – Monetary Trust: Confidence migrates from fiat promises to physical backing

Reserve Architecture: Diversification reduces single-currency dominance

Resets are built quietly in vaults before they appear in headlines.

When central banks choose metal over paper, the message is already clear.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Mumbai Emerges as a Hub for Multipolar Economic Coordination

New Global Economic Cooperation Forum signals accelerating shift away from Western-led frameworks

Overview

A new Global Economic Cooperation 2026 Forum has been announced for February 17–19 in Mumbai, bringing together policymakers, economic planners, and institutional leaders to explore alternative models of global collaboration. The forum reflects growing momentum among emerging and middle powers to coordinate trade, investment, and financial policy outside traditional Western-dominated institutions.

Key Developments

The inaugural forum will convene in Mumbai in mid-February

Focus areas include trade integration, investment flows, and economic coordination

Participants are expected from emerging markets and middle powers

The initiative emphasizes multipolar cooperation rather than bloc dependency

Timing aligns with rising global fragmentation in trade and finance systems

Why This Forum Is Different

Unlike legacy institutions shaped after World War II, this forum is structured around pragmatic economic alignment rather than ideology. Its emphasis is on:

Flexible cooperation across regions

Reduced reliance on dollar-centric systems

Strategic alignment among economies navigating sanctions, debt stress, and trade disruption

This is coalition-building by design — not protest, but preparation.

Why It Matters

Signals intentional coordination for alternative economic architecture

Reinforces the decline of single-center economic governance

Creates space for new trade and settlement frameworks

Aligns with broader moves toward regionalization and multipolar finance

Economic resets rarely begin with formal announcements — they begin with forums like this.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the Global Reset narrative:

Multipolar coordination supports future currency repricing

Trade integration outside Western systems reduces legacy currency dominance

New settlement mechanisms create opportunities for value recalibration

Forums like this often precede policy harmonization and monetary shifts

Currency value changes are negotiated long before they are declared.

Implications for the Global Reset

Pillar 1 – Trade: Expands non-Western trade coordination pathways

Pillar 2 – Finance: Supports diversification away from dollar-centric systems

Institutional Realignment: Signals early-stage restructuring of global governance

This is not a summit for headlines — it is a workshop for the next system.

Global resets don’t start at the G7 — they start where the future is being built.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Economic Times — Inaugural Global Economic Cooperation Forum to be held in Mumbai Feb 17–19

Observer Research Foundation — Multipolarity and the Future of Global Economic Governance

~~~~~~~~~~

Inside BRICS’ Real De-Dollarization Strategy: Payments Over Politics

Why infrastructure — not a new currency — is quietly reshaping global finance

Overview

For much of 2024 and early 2025, public discussion around BRICS de-dollarization focused on the idea of a new shared currency to rival the U.S. dollar. That narrative missed what was actually happening. Rather than building a euro-style monetary union, BRICS countries pursued a more practical strategy: payment infrastructure, bilateral settlement, and local-currency trade.

The result is a quiet but measurable reduction in dollar usage — achieved not through ideology, but through systems.

Key Developments

BRICS countries prioritized interoperable payment systems instead of a single currency

Russia’s SPFS, China’s CIPS, and India’s UPI were connected through pilot frameworks under BRICS Pay

Russia and China now settle the vast majority of bilateral trade in rubles and yuan

Local-currency trade expanded across energy, commodities, and infrastructure finance

BRICS-backed institutions increased non-dollar lending to Global South projects

This approach sidestepped political resistance while producing tangible outcomes.

Why Payments Became the Strategy

Creating a shared currency would require unified monetary policy, fiscal discipline, and economic convergence — conditions that do not exist inside BRICS. Member economies range from China’s multi-trillion-dollar system to frontier markets still stabilizing basic financial infrastructure.

Instead, BRICS focused on what could be built now:

Clearing systems that bypass dollar settlement

Bilateral trade invoicing in local currencies

Commodity-backed financing structures

Multilateral lending outside Western-dominated institutions

As Russia’s leadership has emphasized publicly, alternatives emerged not as confrontation — but as necessity.

Local Currency Trade and Commodity Finance

Energy trade provided the fastest proof of concept. Oil, gas, and commodities were increasingly settled in yuan, rubles, rupees, and reais, reducing dollar exposure without disrupting supply chains.

Meanwhile, the New Development Bank expanded lending in domestic currencies, supporting infrastructure and development projects without dollar-denominated debt risk. Commodity-backed settlement pilots added further insulation from currency volatility.

Each transaction was incremental — but cumulative impact matters.

Political Limits Still Apply

Despite technical progress, political realities capped ambition. Proposals for a unified BRICS currency were quietly deprioritized in 2025. Leaders acknowledged that monetary integration was premature, particularly amid external trade pressures and tariff threats.

This restraint did not stall de-dollarization — it refined it.

Why It Matters

De-dollarization is happening through systems, not symbols

Payment infrastructure reduces dollar dependency without formal confrontation

Bilateral clearing erodes reserve currency dominance transaction by transaction

This model is scalable beyond BRICS to the wider Global South

The shift is structural, not rhetorical.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global reset mechanics:

Payment systems matter more than headline currency launches

Local settlement reduces artificial demand for reserve currencies

Commodity-backed finance supports future currency repricing

Infrastructure-first de-dollarization favors measured realignment, not shock events

Currency value changes long before exchange rates move.

Implications for the Global Reset

Pillar 1 – Trade: Local-currency invoicing reshapes global trade flows

Pillar 2 – Finance: Payment rails weaken legacy settlement dominance

Pillar 4 – Assets: Commodities reassert monetary relevance

This is de-dollarization by design — not declaration.

The dollar isn’t being overthrown — it’s being routed around.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — Inside BRICS’ Next De-Dollarization Playbook: Pay Systems Over Politics

Reuters — Russia and China deepen use of local currencies in trade settlements

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

************

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

**************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

*************

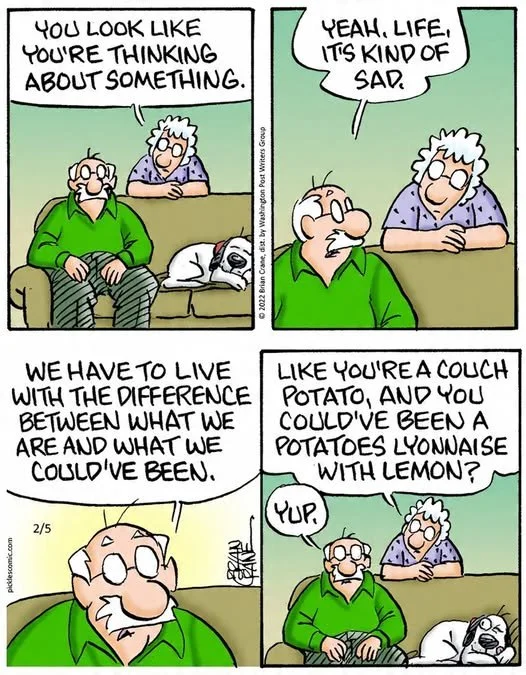

Mot: Simply Can't Win !!! -- Can He!!!???

Mot: Love the Wisdom of the ""Wee Folks""!!!

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-17-26

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Overview

China-led cross-border digital currency infrastructure has reached a new milestone, as transaction volumes on a multilateral central bank digital currency platform surged dramatically. What began as a limited experiment has evolved into a functioning settlement network used by sovereign institutions, signaling a structural shift in how international trade can be cleared outside legacy dollar-based systems.

Key Developments

A China-backed cross-border digital currency platform recorded tens of billions of dollars in cumulative transactions

Participating central banks include China, Hong Kong, Thailand, the UAE, and Saudi Arabia

The digital yuan accounts for the vast majority of settlement volume

Government-level wholesale transactions have now occurred on the platform

The system operates outside SWIFT and traditional correspondent banking rails

What’s Actually Changing

This is not a retail crypto story. It is institution-to-institution settlement infrastructure being tested live.

Unlike experimental pilots of the past, this platform:

Settles trade directly between central banks

Reduces reliance on intermediary banks

Shortens settlement times from days to seconds

Limits exposure to sanctions and correspondent risk

The most important shift is architectural: payments are being designed without the dollar as a mandatory bridge asset.

Why It Matters

Parallel payment systems weaken the monopoly power of existing reserve currency rails

Trade can increasingly settle without touching U.S. banking infrastructure

Financial influence moves from enforcement to infrastructure control

Once operational, these systems are difficult to unwind

This is how monetary transitions occur quietly — before headlines, not after them.

Why It Matters to Foreign Currency Holders

Foreign currency holders anticipating revaluation during a Global Reset should note:

Alternative settlement systems reduce forced demand for a single reserve currency

Cross-border CBDCs create conditions for regional currency repricing

Infrastructure precedes valuation changes, not the other way around

When trade no longer needs legacy rails, currency hierarchies begin to adjust

This development does not flip the switch — it installs the wiring.

Implications for the Global Reset

Payments Pillar: Live CBDC settlement outside dollar rails

Trade Pillar: Sovereign trade increasingly bypasses correspondent banking

Monetary Power: Influence shifts from currency dominance to network control

The reset does not arrive as an announcement. It arrives as redundancy.

When the rails change, the destination eventually follows.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — China-led cross-border digital currency platform sees surge

Bank for International Settlements — mBridge Project Overview

~~~~~~~~~~

Bank of England Warns Populism Is Undermining Monetary Trust — Confidence Becomes the Risk

Central banks defend credibility as political pressure intensifies

Overview

The Governor of the Bank of England issued a blunt warning that rising populism and political interference are eroding trust in financial institutions. The statement reflects growing concern among central bankers that confidence — not inflation — may become the next systemic vulnerability.

Key Developments

The Bank of England warned of political pressure undermining institutional independence

Central bank credibility was framed as a core pillar of financial stability

Trust erosion was linked to market volatility and capital flight risk

Similar concerns are emerging across multiple Western monetary authorities

What the Warning Really Signals

Central banks rarely speak publicly about trust unless it is already being tested.

This warning suggests:

Monetary authority is being challenged politically

Policy credibility increasingly requires communication management

Financial stability now depends as much on perception as policy tools

Institutional legitimacy is no longer assumed

When trust must be defended verbally, it is already under strain.

Why It Matters

Fiat systems function on confidence, not convertibility

Political interference weakens long-term policy credibility

Markets price trust faster than inflation data

History shows currency transitions often follow legitimacy crises, not recessions

This is a confidence signal — not a policy one.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies expecting a Global Reset:

Declining institutional trust accelerates diversification away from legacy systems

Confidence fractures create sudden repricing windows

Reset events often follow legitimacy loss, not official failure

Holders positioned early benefit from disorderly adjustments

Trust is the invisible reserve asset. When it erodes, values shift.

Implications for the Global Reset

Confidence Pillar: Institutional trust becomes a limiting factor

Monetary Pillar: Independence questioned, credibility strained

Capital Flows: Investors hedge against political monetary risk

Resets begin when belief systems crack — not when systems collapse.

When central banks defend trust, the real currency is already moving.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — Bank of England governor warns against populism and erosion of trust

Financial Stability Board — Central Bank Independence and Financial Stability

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The U.S. Mint Has SUSPENDED ALL SALES Of Silver Numismatic Products.

The U.S. Mint has SUSPENDED ALL SALES of silver numismatic products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The U.S. Mint has SUSPENDED ALL SALES of silver numismatic products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The entity that prints the currency can no longer source the metal to back it. In this emergency deep dive, we expose the catastrophic disconnect between the Paper Price and the Physical Reality. While Comex silver just hit a new All-Time High of 91.54, the Shanghai Gold Exchange has already shattered the triple−digit barrier, fixing at 100.15.

There are now two prices for silver on Earth: the fake paper price in New York, and the real physical price in China. We analyze the "Whale Raid" on the commercial vaults that triggered this shutdown. Data confirms that 1.3 Million ounces of silver were drained from the JPMorgan vault in a single day, causing a systemic bleed of "Eligible" inventory.

Strategic entities are bypassing the exchange, taking delivery, and shipping metal East to capture the massive arbitrage spread. We map out the "Endgame" scenario. With the Mint closed, dealers rationing inventory, and the Gold-to-Silver ratio collapsing, the path to $300 silver is mathematically locked in.

We discuss the "Ounces to Acres" exit strategy and why selling for dollars during a currency reset is a fatal mistake. The Mint is closed. The Vault is open. And the price is vertical.

Buy the Everything Bubble or Lose to Inflation?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

In a recent video from Heresy Financial, market educator Joe Brown tackles this critical dilemma head-on. Brown, a former stockbroker with a unique perspective on the markets, argues that labeling the current situation a bubble oversimplifies the issue.

Instead, he suggests that the root cause of rising asset prices lies in the significant loss of purchasing power of the U.S. dollar.

Brown’s insight is that when you measure asset prices against other stores of value, like gold, the picture changes dramatically. Many assets that appear expensive in dollar terms are, in fact, becoming cheaper when measured against gold.

This indicates that the rising prices we’re seeing aren’t solely the result of overvaluation, but rather a reflection of the dollar’s declining purchasing power.

The culprit behind this debasement is inflation, fueled by a combination of factors including Federal Reserve policies, quantitative easing (QE), and a surge in the money supply. In this environment, holding cash is a losing proposition, as the value of your money erodes over time.

So, how can investors navigate this challenging landscape? Brown recommends a two-pronged approach. First, he advocates for a diversified portfolio with multiple uncorrelated asset classes.

This allows you to rebalance your portfolio and capitalize on relative mispricings without trying to time the market. By spreading your investments across different asset classes, you can reduce your exposure to any one particular market.

Second, Brown suggests allocating a small portion of your portfolio to an aggressive trading strategy, designed to capitalize on market volatility and chaos. His own method has delivered an impressive 36.4% annualized return over the past five years, outpacing major indices by a significant margin.

Looking to the future, Brown warns that Federal Reserve policies are shifting back toward liquidity and monetary easing, signaling continued inflation and asset price inflation. As a result, investors can expect increased market volatility, with frequent bear markets likely to persist. To thrive in this environment, you’ll need strategies that can handle both growth and risk.

In conclusion, the “everything bubble” dilemma is a complex issue that requires a nuanced approach. By understanding the root causes of rising asset prices and adopting a diversified, proactive investment strategy, you can position yourself for success in a rapidly changing market. Watch the full video from Heresy Financial to learn more and take the first step toward securing your financial future.

TIMECODES

0:00 Assets Are in an Everything Bubble

0:21 Staying in Cash Means Losing Purchasing Power

0:50 Gold Silver and Stocks at All Time Highs

1:23 Commodities Are Breaking Records Too

1:43 The Cost of Living Keeps Rising

2:28 The Most Important Question: Compared to What?

4:21 Why Bubbles Are Usually Isolated to One Asset Class

5:11 The Everything Bubble Is Driven by Currency Debasement

6:08 Gold vs Stocks Shows No Clear Bubble

6:51 Bitcoin Appears Expensive Relative to Gold

7:31 How to Navigate the Everything Bubble

8:11 Diversify Across Uncorrelated Asset Classes

8:52 Rebalancing Between Assets Buys Low Sells High

10:04 The Barbell Approach to Portfolio Allocation

10:44 My 36% Average Annual Return Strategy

11:12 The Federal Reserve Restarted Quantitative Easing

12:00 Banks Will Do QE for the Fed Through Deregulation

12:42 Expect More Volatility and Bear Markets Ahead

13:17 Profit From Chaos Instead of Sitting on Sidelines

The Quiet Money Reset, How the IQD Fits in and What to do

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

This shift, though not dramatic or abrupt, is profound in its implications for the global economy and individual financial security.

At the heart of this transformation is the recognition that traditional monetary systems, heavily reliant on unlimited debt and trust, are being reevaluated.

The presenter in a recent video discussion highlights that this reliance is being replaced by a new paradigm that emphasizes stronger balance sheets and currencies backed by tangible assets. This change is not occurring in a vacuum but is instead being guided by global regulatory frameworks, such as those set forth by the Bank of International Settlements (BIS).

For individuals, navigating this changing landscape requires a proactive and diversified approach. The advice is clear: to remain protected and flexible, one should consider diversifying their holdings across different currencies, accounts, and types of assets.

Keeping debt levels low is also paramount, as is focusing on real-world value rather than getting caught up in hype. The days of placing all your financial eggs in one basket, or worse, keeping them in a safe deposit box, are behind us. A diversified strategy is key to effective risk management in this new era.

The examples of the Iraqi dinar and the Vietnamese dong are particularly instructive. These currencies are being repositioned in a way that ties their value to real economic production, potentially making them valuable in the long term.

This move underscores the broader trend towards asset-backed currencies and away from fiat currency that is not backed by tangible assets.

As this monetary reset continues to unfold, it is crucial for individuals to stay informed and remain calm.

The complexities behind this global shift are multifaceted, and staying abreast of developments is essential for making informed financial decisions.

In conclusion, the ongoing transformation in global monetary systems represents a significant shift towards a more transparent, accountable, and asset-backed financial framework.

While the journey is complex and gradual, being prepared and adopting a diversified financial strategy can help navigate the changes ahead. For further insights and information, watching the full video from Edu Matrix can provide viewers with a more comprehensive understanding of this quiet revolution and its implications for the future.

“Tidbits From TNT” Friday 1-16-2025

TNT:

Tishwash: A high-level delegation from the Kurdistan Region is participating in the Davos World Economic Forum.

The head of the Kurdistan Region's Department of Foreign Relations, Safeen Dizayee, announced on Thursday (January 15, 2026) that a high-level delegation from the Kurdistan Region will participate in the Davos Forum this year.

Dziyi told Kurdistan Media Network that the high-level delegation will hold several meetings and discussions with participating delegations during the forum.

TNT:

Tishwash: A high-level delegation from the Kurdistan Region is participating in the Davos World Economic Forum.

The head of the Kurdistan Region's Department of Foreign Relations, Safeen Dizayee, announced on Thursday (January 15, 2026) that a high-level delegation from the Kurdistan Region will participate in the Davos Forum this year.

Dziyi told Kurdistan Media Network that the high-level delegation will hold several meetings and discussions with participating delegations during the forum.

He noted that during the World Economic Forum in Davos in the Swiss Alps, from January 19 to 23, political issues, challenges, regional and international changes, and economic issues will be discussed.

This year's forum will be attended by US President Donald Trump, leading the "largest US delegation" in the history of participation, as announced by the forum's president, Børge Brende, on Tuesday.

This year's forum is expected to be attended by a record 64 heads of state and government, along with 850 global business leaders, as part of a gathering of approximately 3,000 participants from 130 countries. link

************

Tishwash: Dr. Mahmoud Dagher: The current stage requires the adoption of advanced banking methods and applications.

Financial and economic expert, Dr. Mahmoud Dagher, stressed that the current stage requires a serious shift from traditional methods to adopting advanced banking application models that include all operations and services without exception, stressing that it is no longer useful to continue working on traditional banking systems, but rather it is necessary to move to newer systems that are able to keep pace with the rapid developments in the banking sector.

Dagher said that this transformation requires, in parallel, competent human resources who possess the technical expertise and ability to manage and operate systems and applications with high efficiency.

He pointed out that fulfilling these requirements will open the way for providing integrated banking services without the need for direct interaction, in line with the nature of modern banking products, whether Islamic or traditional, which are managed today via mobile phone or computer, and will contribute to improving the quality of services and enhancing customer confidence in the banking sector. link

************

Tishwash: The Central Bank Governor discusses with Oliver Wyman ways to improve Iraq's sovereign and credit ratings.

The National Team and the Technical Committee for Sovereign Rating held a joint meeting with Oliver Wyman Consulting. The meeting was chaired by the head of the National Team, His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, and attended by Dr. Mazhar Mohammed Saleh, Advisor to the Prime Minister and Head of the Technical Committee, along with a group of experts from relevant ministries and the private sector.

The purpose of the meeting was to discuss mechanisms for improving the sovereign and credit ratings of the Republic of Iraq. During the meeting, the most prominent pillars and key issues requiring work in cooperation with international rating agencies S&P, Fitch, and Moody's were discussed.

Emphasis was placed on the importance of applying the five pillars adopted in rating methodologies: institutional quality and financial strength, monetary strength, economic structure and growth prospects, political events and risks, and governance and overall stability.

The meeting also addressed the need to build a comprehensive economic and financial base for Iraq that reflects the reform process, institutional capacities, and future opportunities, ensuring its practical applicability.

Furthermore, the importance of direct and continuous communication with international rating agencies was stressed to enhance mutual understanding and achieve sustainable positive results.

This meeting comes within the framework of the government’s efforts to improve the image of the Iraqi economy and enhance international confidence, as the Iraqi government had announced in September 2025 the formation of the National Team for Improving the Credit Rating, which includes a select group of experts and representatives of various economic sectors, with the aim of raising the sovereign rating and supporting financial and economic stability in the country.

Central Bank of Iraq,

Media Office,

January 14, 2026 link

************

Tishwash: After 19 years, Iraq officially returns its ambassador to Moscow.

The Russian presidency announced on Wednesday that Iraq will reinstate its former ambassador, Abdul Karim Hashim Mustafa, to represent it diplomatically in Moscow, 19 years after Mustafa assumed this position.

According to a statement from the Russian presidency, President Vladimir Putin will receive the credentials of Iraqi Ambassador Abdul Karim Hashim Mustafa, along with a group of other ambassadors, in a ceremony to be held at the Kremlin on Thursday, January 15.

Putin will also receive the credentials of the ambassadors of Somalia, Mohamed Abu Bakr Zubair; Gabon, Sosthene Ndimbe; Sri Lanka, Shobini Kaushala Gunasekera; Senegal, Stephane Sylvain Sambo; Rwanda, Joseph Nzapamoita; and Mauritania, Sidiati Cheikh Ould Ahmed Aicha.

Also, the credentials of the ambassadors of Algeria, Tawfiq Jumaa; Bangladesh, Nasrul Islam; Egypt, Hamdi Shaaban Abdel Halim Mohamed; Ghana, Kuma Stem Jeho Appiah; Namibia, Monica Ndilwaike Nshandi; and South Korea, Lee Seok-bae.

Ambassadors from the Middle East will also present their credentials to the Russian President: Bashir Saleh Azzam from Lebanon and Sami bin Mohammed Al-Saadan from Saudi Arabia.

Putin will also receive the credentials of South Korean Ambassador Lee Seok-bae.

The handover ceremony will take place in the Alexander Hall of the Kremlin Palace, as is customary.

According to the Iraqi Ministry of Foreign Affairs website, Abdul Karim Hashim Mustafa has been Iraq’s permanent representative to the United Nations and other international organizations in Geneva since February 2021.

Prior to his appointment in Geneva, Abdul Karim Hashim Mustafa served as Senior Undersecretary of the Iraqi Ministry of Foreign Affairs and also as Undersecretary of the Ministry of Foreign Affairs for Administrative and Financial Affairs. He also served as an advisor to the Iraqi Prime Minister on international relations and diplomacy.

Mustafa was Iraq’s ambassador to the Kingdom of Morocco and to the People’s Republic of China, and from December 2004 to July 2007, he was Iraq’s ambassador to the Russian Federation.

Abdul Karim Hashim Mustafa holds a PhD in Pharmaceutical Sciences from the University of Grenoble in France, obtained in 1987, and a Diploma of Advanced Studies (Master's) in Pharmaceutical Sciences from the same university, obtained in 1984.

Born in Iraq on March 6, 1959, he is married and has three children. In addition to Arabic, he speaks French and English fluently. link

************

Mot: No Matter What They Say!!!!

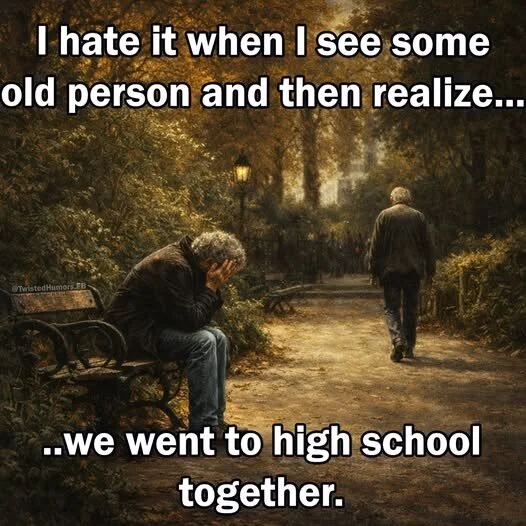

Mot: Scariest Thing Just Happened to Me!!!!

Seeds of Wisdom RV and Economics Updates Friday Morning 1-16-26

Good Morning Dinar Recaps,

Dollar Strength Returns as Markets Rally and Commodities Pull Back

Short-term confidence masks deeper reset pressures beneath global markets

Good Morning Dinar Recaps,

Dollar Strength Returns as Markets Rally and Commodities Pull Back

Short-term confidence masks deeper reset pressures beneath global markets

Overview

Global equity markets rallied across Asia and the U.S. on strong tech momentum and solid economic data.

The U.S. dollar strengthened, reducing expectations for near-term Federal Reserve rate cuts.

Oil, gold, and other commodities pulled back, reflecting a temporary shift away from safe-haven positioning.

Beneath the surface, currency divergence and liquidity fragmentation continue to build reset pressure.

Key Developments at a Glance

Asian equities climbed, led by AI and semiconductor optimism tied to U.S.–Taiwan trade activity.

U.S. stocks advanced on bank earnings and technology sector strength.

The dollar rose to multi-week highs, supported by resilient U.S. economic data.

Oil and precious metals declined, easing inflation fears but stressing exporter currencies.

Asian Markets Rise as Dollar Strengthens

Asian markets moved higher as investor sentiment improved:

AI and semiconductor demand boosted technology-heavy indexes, particularly in Asia.

Trade optimism surrounding Taiwan and U.S. chip supply chains lifted regional confidence.

Strong U.S. data reduced expectations for rapid monetary easing, which supported the dollar.

Currency reactions underscored growing global divergence:

The Japanese yen showed volatility, prompting renewed speculation about government intervention.

Other regional currencies struggled to keep pace with the stronger dollar, highlighting uneven liquidity conditions.

U.S. Markets Rally While Commodities Retreat

U.S. equities followed Asia higher:

Bank earnings surprised to the upside, reinforcing confidence in the financial system.

Technology stocks rebounded, reinforcing risk-on sentiment.

At the same time:

Oil prices fell sharply, as immediate Middle East escalation fears cooled.

Gold and silver pulled back, reflecting reduced short-term demand for safety rather than a reversal of longer-term trends.

This combination suggests markets are pricing stability in the short run, even as structural risks persist.

What This Signals Beneath the Surface

While headline moves appear constructive:

Dollar strength tightens global financial conditions, especially for emerging and frontier markets.

Commodity pullbacks can strain exporter economies, increasing FX and debt stress.

Diverging currency performance reflects fragmentation, not harmony, in global monetary conditions.

These are classic symptoms of a system late in a cycle, not early in one.

Why It Matters

Short-term dollar strength does not resolve long-term debt and liquidity imbalances

Equity rallies can coexist with rising systemic risk

Commodity weakness may delay inflation but amplify currency stress elsewhere

Market calm often precedes structural repricing, not stability.

Why It Matters to Foreign Currency Holders

For readers holding foreign currency in anticipation of a Global Reset:

Dollar strength can delay, but not cancel, realignment scenarios

Currency value is increasingly tied to trade resilience and liquidity access

Exporter currencies may face pressure before broader reset dynamics unfold

Resets historically occur after periods of apparent market confidence

Temporary rallies should not be confused with long-term monetary resolution.

Implications for the Global Reset

Pillar 1 – Liquidity Divergence: Stronger dollar conditions expose weaker links in the global system

Pillar 2 – Asset Repricing: Commodities and currencies continue adjusting unevenly

This is not a return to normal — it is the calm inside a rebalancing system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Asian stocks climb as AI optimism rises, dollar firms and commodities slide

Reuters – U.S. stocks rise, oil slides as geopolitical fears ease and dollar strengthens

~~~~~~~~~~

*********************************************

Iran Crisis Exposes the Limits of BRICS Unity and Moral Authority

Economic collapse and nationwide unrest test the bloc’s credibility in a multipolar world

Overview

Iran is facing nationwide protests amid severe economic collapse and currency devaluation.

The Iranian rial has plunged to roughly 1.42 million per U.S. dollar, with inflation above 40%.

BRICS unity is under strain, as member states issue cautious, divergent responses.

Moral authority and credibility of BRICS are increasingly questioned on the global stage.

Key Developments at a Glance

Mass strikes and protests spread across all 31 Iranian provinces, beginning in Tehran’s Grand Bazaar.

Internet access was cut nationwide as chants against clerical rule intensified.

BRICS members largely remained silent, calling for calm without condemning violence.

Internal divisions within BRICS resurfaced over Iran’s 2024 admission and ongoing sanctions exposure.

Economic Collapse Fuels Political Defiance

Iran’s economic breakdown has turned into a political flashpoint:

Currency collapse and inflation have gutted household purchasing power.

Fuel price hikes, power shortages, and subsidy removals have deepened public anger.

According to the Atlantic Council, Iran’s growth is negligible compared to other BRICS nations, while inflation remains the worst in the bloc.

Economic desperation has transformed into open defiance, testing whether BRICS solidarity can withstand internal instability among its members.

BRICS Silence Highlights Internal Contradictions

Responses from BRICS capitals reveal deep fractures:

China urged peace and stability, prioritizing order over accountability.

Russia condemned Western “interference,” framing the unrest as an internal matter.

India, Brazil, and South Africa called for calm without addressing reported abuses.

These divergent positions underscore that BRICS is a coalition of convenience, not a unified values-based alliance.

U.S. Signals Intervention as Bloc Hesitates

While BRICS avoided public confrontation:

The White House signaled openness to private communications with Iran.

President Trump publicly encouraged Iranian protesters and warned regime officials.

Analysts note the contrast between Western rhetoric and BRICS restraint sharpens questions about the bloc’s global role.

Iran’s accession to BRICS in 2024 was controversial from the start, with India, Brazil, and South Africa expressing concerns about sanctions and Western backlash—debates that now appear prescient.

Moral Authority Under the Microscope

Human rights organizations report:

Widespread violations of civil liberties during the crackdown.

Threats from Iranian officials promising no leniency toward protesters.

BRICS promotes itself as an alternative to Western hegemony, rooted in sovereignty, dignity, and development. Remaining silent amid violent repression risks undermining that entire narrative.

Why It Matters

BRICS credibility depends on consistency, not just expansion.

Internal crises expose limits of bloc-based protection from sanctions and scrutiny.

Multipolar systems without shared standards risk fragmentation, not stability.

This moment forces a reckoning over whether state sovereignty can coexist with moral legitimacy.

Why It Matters to Foreign Currency Holders

For those holding foreign currency in anticipation of a Global Reset:

Iran’s collapse shows how fast currencies can disintegrate under sanctions and mismanagement.

Bloc membership alone does not guarantee protection from currency failure.

Reset scenarios favor stability, governance, and trust, not just political alignment.

Divergence inside BRICS highlights risk differentiation, not uniform revaluation outcomes.

Currency realignment historically punishes weak fundamentals before rewarding stronger systems.

Implications for the Global Reset

Pillar 1 – Credibility Stress: Moral and governance fractures weaken bloc cohesion.

Pillar 2 – Currency Reality Check: Political alignment cannot override economic collapse.

This is not just unrest — it is a stress test of multipolar legitimacy.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – Iran Crisis Exposes the Limits of BRICS Unity and Moral Authority

Reuters – Iran’s economy reels as currency plunges and unrest spreads nationwide

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 1-16-26

Agreements Are On The Horizon To Resolve The Presidential Issue.

Negotiations to choose the president of the republic remain a central focus of the Iraqi political scene, given the approaching constitutional deadlines and the limited time available. Dialogues continue between the two main Kurdish parties, the Patriotic Union of Kurdistan and the Kurdistan Democratic Party, amid adherence to the political norms adopted since 2005, in parallel with initial indications that may open the door to an understanding that ends the current stalemate.

Agreements Are On The Horizon To Resolve The Presidential Issue.

Negotiations to choose the president of the republic remain a central focus of the Iraqi political scene, given the approaching constitutional deadlines and the limited time available. Dialogues continue between the two main Kurdish parties, the Patriotic Union of Kurdistan and the Kurdistan Democratic Party, amid adherence to the political norms adopted since 2005, in parallel with initial indications that may open the door to an understanding that ends the current stalemate.

In this context, President Abdul Latif Jamal Rashid met on Tuesday with Mohsen al-Mandalawi, head of the Al-Asas Coalition, to discuss political developments and ways to complete constitutional requirements within the established timeframes. During the meeting, the President emphasized the importance of unifying visions and strengthening coordination among national forces to reach political agreements that contribute to consolidating stability and supporting state institutions.

Al-Mandalawi, in turn, praised the Presidency's role in supporting the political de-escalation process, affirming his coalition's commitment to fulfilling the remaining requirements based on the principles of partnership and national consensus.

In parallel, the corridors of the Coordination Framework are witnessing escalating political activity. MP Bahaa al-Araji affirmed that the understandings between the Reconstruction and Development Coalition and the State of Law Coalition stem from the principle of complementary roles within the Coordination Framework, serving the requirements of the current phase.

Al-Araji indicated that supporting Nouri al-Maliki's candidacy aligns with the slogan "Iraq First," emphasizing that the priority today must be achieving progress and transcending the logic of procrastination and unproductive political competition.

Regarding the presidency, MP Sarwa Mohammed Rashid, from the Patriotic Union of Kurdistan (PUK) bloc, told Al-Sabah newspaper that political negotiations are still ongoing within the party and with the Kurdistan Democratic Party (KDP), in coordination with other political forces. She stressed adherence to the political convention that allocates the presidency to the PUK.

She clarified that this entitlement is not based on narrow partisan considerations, but rather on political understandings that have contributed to maintaining national balance and political stability in previous phases.

Rashid added that the Patriotic Union of Kurdistan (PUK) has finalized its choice to nominate Nizar Amidi for the presidency, noting his extensive political experience and active presence in Baghdad, as well as his ability to manage the position as a symbol of national unity, a guarantor of constitutional implementation, and a servant of all components of the Iraqi people without exception.

In contrast, Abdul Salam Barwari, a member of the Kurdistan Democratic Party (KDP), told Al-Sabah newspaper that "there is no definitive new development yet," but there are positive indicators that can be built upon.

He explained that KDP leader Masoud Barzani has presented two main options: the first is to agree on a single candidate from both parties and present him in Baghdad, while the second is to leave the decision to the Kurdish blocs within the Council of Representatives, as happened in the election of former President Fuad Masoum.

Barwari predicted that the outlines of an agreement will become clear within the next week, especially given the link between this issue and the reactivation of the Kurdistan Region Parliament and the formation of the local government.

For her part, political researcher Zahraa Al-Saadi believes that the issue of choosing the president of the republic is one of the most complex issues in the current political stage, warning that the continuation of the Kurdish dispute may keep the position under time pressure and open the door to national interventions to find a consensus formula that enjoys broad acceptance, in order to ensure that the political process is not disrupted and to maintain institutional stability in the country. https://alsabaah.iq/126439-.html

Government Advisor: The Current Economic Recession Is Seasonal And Will Subside With The Revitalization Of Public Spending.

Time: 2026/01/16 14:04:49 {Economic: Al-Furat News} The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that markets are experiencing a seasonal recession globally and locally at the beginning of each calendar year, while pointing to the factors affecting the stability of the exchange rate in light of the current regional conditions.

Saleh told Al-Furat News Agency, “At the beginning of each calendar year, markets experience a seasonal recession following the peak of purchases that precedes Christmas, a pattern known in international economic trends.” He explained that “this recession is clearly reflected in our country in consumption indicators, which tend to decline temporarily as a result of the partial depletion of income at the end of the year and the onset of the winter season.”

He added that “individuals and the private sector are anticipating trends in government spending and fiscal policy at the start of the new year, which coincides with a slowdown in the circulation of liquidity within the markets, as households and traders tend to hold onto cash while awaiting clarity on the financial outlook, especially in light of the delay in approving or activating the general budget.”

Saleh explained that "the transition of the executive authority from a caretaker status to exercising its full powers also affects this vision," noting that "the slowdown in liquidity leads to a temporary contraction in aggregate demand, which deepens the seasonal recession."

The financial advisor explained that "this recession often relieves pressure on consumer demand for foreign currency, leading to relative stability in the unofficial exchange rate, as long as external government spending and trade transfers have not yet entered their active phase."

Saleh warned that "this stability is being disrupted by noise in the information market, making it fragile and sensitive to the effects of regional geopolitics, which are exposed to strategic risks and fluctuating expectations in a highly sensitive environment."

He added that "this recession will begin to gradually recede with the revitalization of public spending, the acceleration of budget implementation, and the increase in liquidity turnover, which will re-stimulate consumption and increase commercial demand for foreign currency from its official sources, within limits that monetary policy can manage."

Saleh concluded by saying that "the improvement in consumption, liquidity and exchange market indicators together constitutes an early sign of the end of the seasonal recession and the entry of markets into a phase of gradual recovery." LINK

The Brother Of Grand Ayatollah Sistani Has Passed Away.

Time: 2026/01/16 14:29:41 Reading: 300 times Local: Al-Furat News} His Eminence Ayatollah Sayyid Hadi al-Sistani, brother of the Supreme Religious Authority, His Eminence Grand Ayatollah Imam Ali al-Husseini al-Sistani, may his shadow last, passed away today, Friday.

His Eminence’s death came on a day that coincided with the anniversary of the death of the Prophet’s uncle and guardian, Abu Talib, peace be upon him, which added more sadness and sorrow to this day in religious and popular circles.

The agency extends its deepest condolences and sympathies to the Supreme Religious Authority, Imam Al-Sistani, may his shadow last, and to all believers on this painful loss, asking God Almighty to have mercy on the deceased and grant him a spacious place in Paradise. LINK

The Sudanese Offers His Condolences To Grand Ayatollah Sistani On The Death Of His Brother

Time: 2026/01/16 15:28:36 Reading: 60 times

{Political: Al-Furat News} Prime Minister Mohammed Shia Al-Sudani sent a telegram of condolence to the Supreme Religious Authority, His Eminence Grand Ayatollah Imam Ali Al-Husseini Al-Sistani (may his shadow last), on the death of his brother, His Eminence Ayatollah Sayyid Hadi Al-Sistani (may God Almighty have mercy on him).

The message of condolence read: “I extend my deepest condolences and sincere sympathy to His Eminence Grand Ayatollah Sayyid Ali al-Sistani (may his shadow last) and his two honorable sons, on the death of his brother, His Eminence Ayatollah Sayyid Hadi al-Sistani, after a noble life spent in research, study, diligence and serving knowledge.”

Al-Sudani concluded his message by saying: "May God have mercy on the deceased and grant patience and solace to his family, relatives and loved ones." LINK

Mr. Al-Hakim Offers His Condolences On The Death Of The Brother Of The Supreme Religious Authority, Imam Al-Sistani

Time: 2026/01/16 14:58:20 {Political: Al-Furat News} The head of the National State Forces Alliance, Mr. Ammar Al-Hakim, offered his condolences to the Supreme Religious Authority, His Eminence Grand Ayatollah Imam Ali Al-Husseini Al-Sistani (may his shadow last), on the death of his brother, the scholar, the proof, Mr. Hadi Al-Sistani (may God Almighty have mercy on him).

In his message of condolence, His Eminence Sayyid al-Hakim said: “With great sadness and pain, I received the news of the death of the brother of the Supreme Religious Authority, His Eminence Imam Sayyid Ali al-Husseini al-Sistani (may his shadow last), the eminent scholar, His Eminence Sayyid Hadi al-Sistani (may God Almighty have mercy on him), who answered the call of his Lord after a life spent in knowledge and learning and teaching the sciences of the purified family of Muhammad (peace be upon them).”

It is worth mentioning that the deceased was one of the prominent scholars who dedicated their lives to serving the noble science and spreading the knowledge of the Ahl al-Bayt (peace be upon them). LINK

Trade Ministry Reassures Iraqis: We Have Sufficient And Secure Stocks Of Food Basket Items

Time: 2026/01/16 16:28:56 Reading: 15 times

{Local: Al-Furat News} The Ministry of Trade confirmed on Friday that there is a sufficient and secure stock of food basket items in its warehouses spread throughout the governorates, while noting the stability of the supply situation and the absence of any indications of shortages of items.

A statement from the Ministry's media office, a copy of which was received by Al-Furat News, stated that "the Ministry has a sufficient and secure stock of food basket items in its warehouses spread across all governorates," stressing that "the supply situation is stable and there are no indications of any shortage of items."

The statement explained that "these measures come based on the directives of the Minister of Trade, Atheer Dawood Al-Ghurairi, regarding the need to strengthen the strategic reserve and ensure the continuity of supplying food basket items, in addition to continuous field monitoring of the supply situation in order to achieve stability and enhance citizens' confidence."

He added that "the ministry continues to implement its approved plans according to precise timetables to ensure the continuous supply of food agents and to meet the needs of citizens without interruption, in line with the government's priorities in supporting food security and maintaining market stability."

The statement indicated that "the ministry relies on daily monitoring and follow-up mechanisms for storage, processing and transportation operations, as well as continuing to conclude contracts and secure basic materials in a way that contributes to enhancing the availability of goods and price stability in local markets," stressing "the ministry's commitment to continuing to work to implement the minister's directives to maintain the availability of food supplies and ensure their delivery to citizens in all governorates." LINK

Seeds of Wisdom RV and Economics Updates Thursday Evening 1-15-26

Good Evening Dinar Recaps,

Central Banks Test New Payment Rails as Dollar Weakens and Gold Surges

Why global financial plumbing and currency volatility are converging now

Good Evening Dinar Recaps,

Central Banks Test New Payment Rails as Dollar Weakens and Gold Surges

Why global financial plumbing and currency volatility are converging now

Overview

Major central banks have entered live testing of a new cross-border payment system, signaling a structural shift in global settlement infrastructure.

The U.S. dollar has weakened while gold prices remain elevated, reflecting growing uncertainty around fiat stability.

Together, these developments highlight accelerating changes to the global monetary order that are central to the Global Reset narrative.

Key Developments at a Glance

Cross-border payments: Central banks moved into the user-testing phase of a BIS-led global settlement project.

Dollar pressure: Markets reacted to political and policy uncertainty with renewed dollar softness.

Gold strength: Gold continues to trade near record highs as investors seek monetary hedges.

Infrastructure focus: Attention has shifted from speculation to the underlying rails of global finance.

Central Banks Advance Cross-Border Payments Testing

A coalition of leading central banks, including the U.S., Europe, and key emerging markets, has begun advanced testing of a new cross-border payment and settlement framework under the Bank for International Settlements.

This phase moves beyond theory into real-world application, focusing on:

Faster interbank settlement

Reduced reliance on correspondent banking

Lower transaction costs across borders

The testing phase suggests central banks are preparing for a future where legacy systems such as SWIFT may no longer be sufficient for global trade and capital flows.

Dollar Weakness and Gold Strength Signal Trust Shift

At the same time, financial markets are responding to rising uncertainty:

The U.S. dollar has shown renewed weakness, particularly against major and commodity-linked currencies.

Gold demand remains strong, driven by concerns over debt levels, monetary credibility, and geopolitical risk.

This divergence reflects a broader theme: confidence is shifting away from purely fiat-based systems toward hard assets and alternative settlement mechanisms.

Why It Matters

Payment rails shape power: Whoever controls settlement infrastructure influences trade, liquidity, and sanctions enforcement.

Dollar dominance faces structural pressure: Infrastructure diversification reduces automatic dollar dependence.

Gold’s role is being reaffirmed: Central banks and investors continue to treat gold as monetary insurance.

These are not isolated events — they are interlocking signals of systemic transition.

Why It Matters to Foreign Currency Holders

For readers holding foreign currency in anticipation of a Global Reset:

New payment systems can reprice currency utility, not just exchange rates

Dollar volatility creates space for alternative reserve and settlement currencies

Gold-linked or commodity-backed systems gain relevance as trust in fiat erodes

Currency value follows settlement demand, not political promises

In reset scenarios, currencies tied to trade, infrastructure, or hard assets tend to benefit first.

Implications for the Global Reset

Pillar 1 – Infrastructure Reset: Central banks are rebuilding global payment plumbing quietly but decisively.

Pillar 2 – Trust Reset: Markets are signaling declining confidence in debt-heavy fiat systems through gold accumulation.

This is not short-term market noise — it is long-term monetary repositioning.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Top central banks forge ahead with closely watched cross-border payments testing

Financial Times – Dollar slips as gold holds near record highs amid central bank uncertainty

~~~~~~~~~~

Dollar Slips as Gold Holds Firm in a World Losing Monetary Certainty

Currency volatility signals deeper cracks in the global financial system

January 2026

Overview

The U.S. dollar is weakening amid rising political and monetary uncertainty.

Gold continues to trade near record highs, reinforcing its role as a monetary hedge.

Currency markets are flashing stress signals as investors reassess trust in fiat systems.

These moves reflect more than market noise — they point to a structural shift underway.

Key Developments at a Glance

Dollar pressure: The dollar has softened against major and commodity-linked currencies.

Gold resilience: Gold prices remain elevated despite changing rate expectations.

Investor behavior: Capital is rotating toward perceived stores of value.

Central bank backdrop: Questions around policy independence and debt sustainability linger.

Why the Dollar Is Under Pressure

The dollar’s recent weakness reflects compounding macro risks, not a single event:

Rising U.S. debt and fiscal strain are weighing on long-term confidence

Political pressure on monetary policy has unsettled markets

Global diversification efforts are slowly reducing automatic dollar demand

As more countries explore alternative settlement systems and reserve diversification, the dollar’s dominance faces incremental but persistent erosion.

Gold’s Strength Sends a Message

Gold’s ability to hold near record highs is especially telling:

It is outperforming confidence in fiat currencies, not just inflation expectations

Central banks continue to accumulate gold as strategic insurance

Investors increasingly treat gold as a neutral reserve asset, free from political control

Gold’s resilience suggests that markets are hedging against systemic risk, not just short-term volatility.

Currency Volatility Reflects Trust Repricing

Across global FX markets:

Volatility is rising, even in traditionally stable currency pairs

Safe-haven behavior is shifting, favoring hard assets over paper claims

Confidence gaps between currencies are widening, based on fiscal and geopolitical exposure

This repricing of trust is a classic feature of monetary transition periods.

Why It Matters

Currencies are confidence instruments, and confidence is fragmenting

Dollar weakness amplifies global inflation and trade realignments

Gold’s role is being quietly re-monetized in central bank strategy

These dynamics often precede larger structural changes rather than resolve themselves quickly.

Why It Matters to Foreign Currency Holders

For readers holding foreign currency with expectations tied to a Global Reset:

Currency value depends on trust, trade, and settlement relevance

Dollar volatility creates openings for revaluation narratives

Hard-asset-aligned systems gain credibility faster in uncertain environments

Resets tend to reward preparedness, not timing perfection

Periods like this historically favor those positioned ahead of monetary realignment, not after it becomes obvious.

Implications for the Global Reset

Pillar 1 – Confidence Shift: Markets are questioning long-held assumptions about fiat stability

Pillar 2 – Reserve Rebalancing: Gold and alternative currencies are reclaiming strategic importance

This is how resets begin — not with announcements, but with market behavior.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – Dollar slips as gold holds near record highs amid central bank uncertainty

Reuters – Gold steadies near record as investors weigh policy risks and dollar weakness

~~~~~~~~~~

U.S. Aircraft Carrier Shifts From South China Sea Toward Iran Hotspot

One carrier, two flashpoints — and a rapidly tightening global chessboard

January 2026

Overview

A U.S. Nimitz-class aircraft carrier was operating in the South China Sea before redeployment toward the Middle East.

The move coincides with escalating tensions involving Iran and renewed unrest inside the country.

The redeployment links Indo-Pacific deterrence with Middle East escalation risks.

Markets, energy flows, and global trade routes face rising geopolitical stress.

Key Developments at a Glance

Carrier movement: The USS Abraham Lincoln was observed operating near contested South China Sea waters before orders to shift theaters.

Dual-theater pressure: The carrier’s presence overlapped with Chinese military drills near Taiwan.

Iran flashpoint: Rising internal unrest and U.S. warnings have elevated regional risk levels.

Force projection: The redeployment would make the Abraham Lincoln the only active U.S. carrier in the Middle East.

Why the South China Sea Still Matters

The South China Sea remains one of the most contested maritime corridors in the world:

China claims sovereignty over most of the waterway, despite overlapping claims from neighboring nations.

U.S. naval operations aim to signal freedom of navigation and alliance commitments.

Recent Chinese military drills near Taiwan increased regional tension while the carrier was nearby.

The carrier’s operations underscored how Indo-Pacific deterrence remains stretched as global crises multiply.

Why Iran Is Pulling U.S. Forces West

The redeployment comes amid:

Escalating internal unrest in Iran, described as the largest in years

U.S. warnings and rhetoric signaling potential consequences if violence against protesters continued

Iranian statements warning U.S. and allied bases could become targets

Shifting a carrier strike group signals credible military readiness, not merely diplomatic pressure.

Strategic Implications of the Redeployment

The U.S. is forced to balance multiple flashpoints simultaneously

Carrier scarcity magnifies the signal of escalation

Any disruption in the Middle East raises immediate energy and shipping concerns

This movement reflects a world where crisis response is no longer sequential — it is simultaneous.

Why It Matters