Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Wednesday Morning 5-14-2025

TNT:

Tishwash: Al-Sudani steps up preparations for the "important event" in Baghdad.

Al-Sudani steps up preparations for the "important event" in Baghdad.

Prime Minister Mohammed Shia al-Sudani chaired a meeting to follow up on the final arrangements for the Arab Summit and the Economic and Development Summit, scheduled to be held in the capital, Baghdad, next Saturday.

According to a statement issued by his office during the meeting, al-Sudani was briefed on the security, administrative, and logistical plans for securing the summit, in addition to reviewing the organizational and technical aspects to ensure a good reception and optimal organization of the conference activities.

TNT:

Tishwash: Al-Sudani steps up preparations for the "important event" in Baghdad.

Al-Sudani steps up preparations for the "important event" in Baghdad.

Prime Minister Mohammed Shia al-Sudani chaired a meeting to follow up on the final arrangements for the Arab Summit and the Economic and Development Summit, scheduled to be held in the capital, Baghdad, next Saturday.

According to a statement issued by his office during the meeting, al-Sudani was briefed on the security, administrative, and logistical plans for securing the summit, in addition to reviewing the organizational and technical aspects to ensure a good reception and optimal organization of the conference activities.

The Prime Minister directed all state institutions and departments to enhance work and coordination efforts, each according to their jurisdiction, to ensure the success of the summit, stressing that this event represents an important milestone that reflects Iraq's status and its pivotal and active role in the Arab and regional arenas.

In this context, the Minister of Interior and Chairman of the Supreme Security Committee for the Arab Summit, Abdul Amir al-Shammari, earlier chaired an expanded meeting that included the ministry's undersecretaries and a number of commanders and officers, to review the final touches of the security plans and procedures for the upcoming Arab Summit in the capital, Baghdad.

During the meeting, according to a statement issued by the Ministry of Interior, a comprehensive discussion was held on coordination between various security formations to ensure the highest levels of protection and organization, reflecting a positive image of Iraq.

The Minister of Interior emphasized the importance of high commitment and discipline in implementing tasks and plans, emphasizing that the success of the summit represents a shared national responsibility that requires the highest levels of preparedness and professionalism. He directed the continuation of security practices, the scrutiny of all requirements, and the unification of efforts on a single path. link

************

Tishwash: The Minister of Finance affirms Iraq's keenness to strengthen its relations with the World Bank.

Finance Minister Taif Sami affirmed on Tuesday Iraq's keenness to strengthen relations with the World Bank and benefit from its expertise.

The ministry said in a statement, seen by Al-Eqtisad News, that "Finance Minister Taif Sami received today the World Bank Representative to Iraq, Emmanuel Salinas Muñoz," indicating that "during the meeting, areas of joint cooperation between the two sides were discussed, especially with regard to supporting economic programs and financing development projects."

He continued, "The two parties discussed prospects for strengthening the partnership in vital sectors, including energy, education and health, and the importance of continuing coordination to implement financial and administrative reforms, in line with the priorities of the Iraqi government and its plans for sustainable development.

The Minister of Finance stressed "Iraq's keenness to strengthen its relations with the World Bank and benefit from its technical and financial expertise."

The World Bank representative reiterated "the institution's commitment to supporting the Iraqi government's efforts in implementing reform programs and achieving economic stability." link

************

Tishwash: The Arab Summit in Baghdad and Joint Arab Economic Cooperation

Samir Al-Nusairi

The 34th Arab Summit will be held in Baghdad soon, amidst the economic, political and security challenges and crises sweeping the world, the Arab region and the geographical region, at a time when most countries are suffering from the current trade war between America and China, which has disrupted international trade and complicated ways to facilitate the economic and financial process, in addition to the effects of wars, conflicts and disputes in the region and the world on the current economic situation and expectations of slowing economic growth and inflationary stagnation and the suffering of countries that depend primarily on oil as the main resource for the country, as well as the accumulated suffering of poor countries from the food and energy crises.

All of the above factors make Iraq, which is witnessing security and economic stability, enjoys balanced foreign relations with countries of the world, and strong and open relations with Arab countries. This is supported by the success of the current government in achieving fundamental stages of comprehensive economic, financial, and banking reform, which will be reflected in building a solid national economy and a solid financial and banking sector, as economic indicators indicate in 2024 and the first quarter of 2025.

Foreign exchange reserves and gold reserves exceed $100 billion, with a sufficiency rate of 140% to cover the local currency in cash circulation and to cover imports, the recovery of the Iraqi dinar, and the relative stability of the exchange rate against the US dollar. The annual inflation rate reached 2.8% and the core inflation rate 2.5%, which means maintaining the general level of prices despite the food crisis and the repercussions of the current global trade war.

What strengthens the Iraqi economy are the giant economic and investment projects and joint projects with Arab and friendly countries, such as the Development Road Project, gas investment, regulating foreign trade financing, building solid financial and banking relations with the world's correspondent banks, complying with international standards, and combating money laundering and terrorist financing.

Therefore, holding the Arab Summit in Baghdad is an important step towards Iraq's return to its Arab fold and its openness to building balanced political, economic and security relations with sister nations. This will enable Iraq to launch an initiative for a joint Arab strategic cooperation project, similar to the one currently implemented by global economic blocs. This initiative aims to formulate a strategy for Arab economic integration, unify joint policies and programs to support and enhance Arab development work and confront potential risks.

The experience of previous successful coordination relations with Egypt, Jordan, Saudi Arabia and the rest of the Gulf states has established important pillars for Arab economic cooperation, which supports Iraq's position in calling for the establishment of an Arab economic bloc that serves the supreme interests of the Arab peoples in all fields, especially cooperation, communication and strengthening financial and banking relations among them, particularly in foreign banking transactions.

Motivating and encouraging investment companies to invest in Iraq will lead to strengthening the financing and investment sectors, especially economic infrastructure projects. link

************

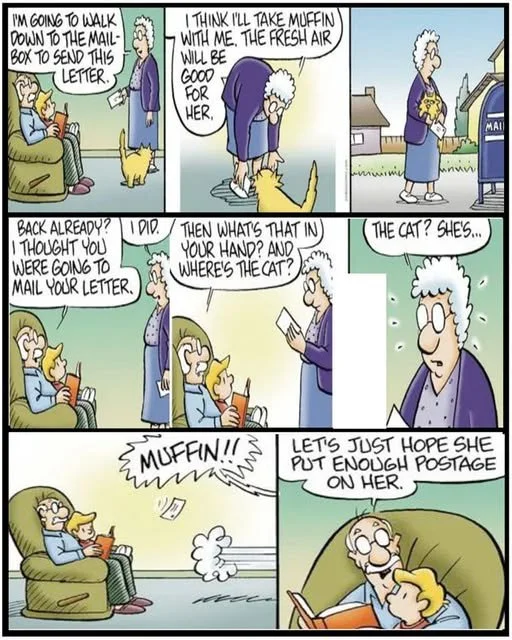

Mot: Life is Getting Really tough fir dis Young Man!!!

Mot: . Ya Knows -- Lately it Seems ~~~~

Iraq Economic News And Points To Ponder Tuesday Evening 5-13-25

SWIFT And The US Federal Reserve Put Iraq At The Mercy Of The Global Economy.

Information/Special..Economist Hassan Al-Sheikh warned on Tuesday that Iraq has become more vulnerable to global economic shocks due to its increasing connection to the international financial system, particularly after joining the SWIFT global financial system and engaging directly with the US Federal Reserve.

In a statement to Al-Maalouma News Agency, Al-Sheikh said, "Over the past two years, Iraq has entered the global economy with a strong push through international bank transfers, subjecting banks to strict oversight, and opening channels with international banks.

SWIFT And The US Federal Reserve Put Iraq At The Mercy Of The Global Economy.

Information/Special..Economist Hassan Al-Sheikh warned on Tuesday that Iraq has become more vulnerable to global economic shocks due to its increasing connection to the international financial system, particularly after joining the SWIFT global financial system and engaging directly with the US Federal Reserve.

In a statement to Al-Maalouma News Agency, Al-Sheikh said, "Over the past two years, Iraq has entered the global economy with a strong push through international bank transfers, subjecting banks to strict oversight, and opening channels with international banks.

This has made it vulnerable to any external economic change, whether in oil prices or financial and monetary policies."

He pointed out that Iraq, which prior to 2020 was virtually isolated from the global financial system, is now severely restricted, negatively impacting its general budget, which already suffers from a widening financial deficit.

The sheikh added that this interdependence not only threatens the stability of oil prices,

but also makes any global economic or customs decision directly impact the state's finances.

He warned of worsening crises if steps are not taken to strengthen the independence of the Iraqi economy. He pointed out that any breakthrough in the US-Iranian negotiations could open the door for Iraq to overcome some of the obstacles, particularly those related to sanctions imposed on the Central Bank.

This could allow Baghdad to freely withdraw its funds, provide better access to dollars,

and perhaps even restore the exchange rate to 120,000 dinars to $100.

He pointed out that this would allow Iraq to import Iranian gas more smoothly, which would contribute to improving the performance of the electricity sector. https://almaalomah.me/news/98623/economy/سويفت-والفيدرالي-الأميركي-يضعان-العراق-تحت-رحمة-الاقتصاد-الع

Minister Of Finance Affirms Iraq's Keenness To Strengthen Relations With World Bank

Economy Yesterday, 21:15 Baghdad – INA Finance Minister Taif Sami affirmed, on Tuesday, Iraq's keenness to strengthen relations with the World Bank and benefit from its expertise.

The ministry said in a statement received by the Iraqi News Agency (INA): "Minister of Finance Taif Sami received today the World Bank Representative to Iraq, Emmanuel Salinas Muñoz," indicating that

"during the meeting, areas of joint cooperation between the two sides were discussed,

especially with regard to supporting economic programs and financing development projects."

He continued, "The two parties discussed prospects for strengthening partnership in vital sectors, including energy, education, and health, and the importance of continuing coordination to implement financial and administrative reforms, in line with the Iraqi government's priorities and plans for sustainable development."

The Minister of Finance affirmed "Iraq's keenness to strengthen its relations with the World Bank

and benefit from its technical and financial expertise."

The World Bank representative reiterated the institution's commitment to supporting the Iraqi government's efforts to implement reform programs and achieve economic stability. https://www.ina.iq/234152--.html

Economist: Iraq Has Export Resources To Mitigate The Damage Caused By The Drop In Oil Prices.

May 11, 10:54 AM Information/Baghdad...Economic researcher Diaa Abdul Karim explained on Sunday that Iraq possesses numerous resources that could be exported abroad and their revenues utilized, particularly petroleum derivatives.

Abdul Karim told Al-Maalouma, "There is an urgent need to develop oil refineries

to ensure that gas is not burned or wasted and that

all derivatives are utilized to

achieve self-sufficiency and

export the remainder abroad."

He added, "The rise and fall in the price of a barrel of oil is the most prominent concern for

Iraqi citizens and employees, as everyone is waiting and hoping for a rise in the price of oil, while the government should be more inclined to export derivatives."

He explained that "Iraq has minerals,natural resources, and petroleum derivatives that can be leveraged to boost budget revenues and reduce reliance on oil as the primary source of funding for the budget, in order to avoid the fluctuations and occasional shocks of the global market." https://almaalomah.me/news/98371/economy/اقتصادي:-العراق-يمتلك-موارد-للتصدير-لتلافي-اضرار-انخفاض-أسعا

Trade: Iraq To Be The Fourth Largest Arab Economy By 2025

Economy Yesterday, 11:18 Baghdad – INA The Ministry of Trade announced today, Tuesday, that Iraq will be the fourth largest Arab economy by 2025, noting that the volume of trade with 11 countries rose to $65 billion in the first half of 2024.

Ministry spokesman Mohammed Hanoun told the Iraqi News Agency (INA):

"Iraq is an important economic player in the region, witnessing a remarkable development in the volume of trade with Arab countries, and working to strengthen its regional and international economic role."

He indicated that "the volume of trade between Iraq and 11 countries rose to $65 billion in the first half of 2024, a 10% increase compared to the same period in 2023."

He added that "the volume of trade between Iraq and Saudi Arabia reached $1.3 billion in 2024,

reflecting a significant increase compared to previous years," noting that "the volume of trade with the Hashemite Kingdom of Jordan exceeded $1 billion annually,after increasing by 45.6 percent in 2024."

He stated that "the United Arab Emirates exported goods to Iraq worth $22 billion in 2024," noting that "Iraq's economic role in the region and the world has begun to grow and expand, ranking 51st globally and fourth in the Arab world on the list of the world's largest economies for 2025, according to a report issued by the American magazine "CEO World."

He continued, "The development road project, estimated to cost $17 billion, aims to make Iraq a regional transportation hub by linking its southern hinterland to the Turkish border in the north, enhancing its role as an economic hub in the region."

He emphasized that "Iraq's move is to strengthen its economic position by developing trade relations with Arab countries, reviewing all previous agreements, and implementing strategic projects aimed at diversifying its economy and reducing its dependence on oil."

He pointed out that "Iraq's commitment to hosting the Arab Summit reflects its commitment to leading Arab efforts toward achieving economic and development integration, having called for the establishment of an Arab economic bloc that would invest in the human and geographical resources of Arab countries,

with the goal of

achieving effective economic integration,

providing job opportunities, and

achieving social justice."

He noted that "By hosting the Arab Summit, Iraq seeks to focus on food security and sustainable development, and to develop an Arab strategy for food security, in addition to supporting initiatives related to artificial intelligence, energy, water, and education, with the goal of achieving sustainable development in the region."

It's worth noting that Iraq has proposed, in previous meetings, the most recent of which was the preparatory meeting for the Arab Economic and Social Development Summit held in Baghdad yesterday, the establishment of an Arab Council comprising trade ministers under the umbrella of the League of Arab States, to enhance coordination and integration in trade policies among member states. https://www.ina.iq/234111--2025.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Evening 5-13-25

Good Evening Dinar Recaps,

US BANKING AUTHORITY CLEARS PATH FOR CRYPTO SERVICES AT NATIONAL BANKS

OCC and Fed's synchronized policy shift opens doors for national banks to enter crypto markets amid rising customer demand.

The Office of the Comptroller of the Currency (OCC) confirmed on May 13 that national banks are now authorized to engage in a wide range of crypto-asset activities, removing long-standing regulatory ambiguities that had kept many financial institutions on the sidelines.

Good Evening Dinar Recaps,

US BANKING AUTHORITY CLEARS PATH FOR CRYPTO SERVICES AT NATIONAL BANKS

OCC and Fed's synchronized policy shift opens doors for national banks to enter crypto markets amid rising customer demand.

The Office of the Comptroller of the Currency (OCC) confirmed on May 13 that national banks are now authorized to engage in a wide range of crypto-asset activities, removing long-standing regulatory ambiguities that had kept many financial institutions on the sidelines.

In tandem with recent moves by the Federal Reserve, the policy shift opens the door for national banks to offer crypto custody, execute trades at customer direction, and outsource digital asset services under established third-party risk guidelines.

OCC announcements and letters

The OCC’s announcement, delivered via a statement and supported by Interpretive Letters 1183 and 1184, marks a coordinated rollback of prior restrictions.

Letter 1183, issued March 7, formally rescinds the 2021 supervisory “non-objection” process set out in Letter 1179.

Letter 1184, issued May 7, extends authority by permitting banks to buy and sell cryptocurrencies held in custody when directed by clients.

These policy updates align with the Federal Reserve’s April 24 decision to retract its pre-approval guidance for crypto activities.

Together, these actions dissolve the primary regulatory hurdles that had delayed widespread adoption of crypto services by traditional financial institutions.

“The U.S. banking system is now deemed well-positioned to support digital asset activity,” the OCC stated.

Future of crypto within US TradFi Sector

With the global crypto market cap around $3.33 trillion as of May 13, the scale of the opportunity is no longer viewed as speculative. National banks now have the opportunity to compete for custody fees and customer retention in a space once dominated by fintech firms.

“More than 50 million Americans hold some form of cryptocurrency,” said Acting Comptroller Rodney E. Hood.

“The digitalization of financial services is not a trend; it is a transformation.”

The shift is framed as a structural evolution, supporting integration within banking models, not experimentation.

Next steps

Letters 1183 and 1184 emphasize AML compliance, yet omit guidance on private key management and capital adequacy.

Integration of AML systems, wallet infrastructure, and third-party contracts may take 6–12 months.

Ongoing jurisdictional questions between the SEC and CFTC create regulatory gray zones for some tokens.

FDIC does not insure digital asset holdings, a vital point for customer awareness.

Still, this represents the most pronounced shift in U.S. banking crypto policy since 2020’s Letter 1170.

The policy aligns U.S. oversight with Europe and Asia, where regulated crypto services are already common. Political pressure to counter alleged efforts like “Operation Chokepoint 2.0” has influenced this evolution.

As Letters 1183 and 1184 take effect, competition is expected to intensify. Traditional banks may quickly gain ground if they can translate permission into readiness—leveraging trust and regulatory infrastructure as advantages.

@ Newshounds News™

Source: CryptoSlate

~~~~~~~~~

CARDANO’S BIG NEWS: BRAVE WALLET INTEGRATION

Brave Wallet integration allows over 70 million users to send and receive Cardano’s ADA tokens.

Charles Hoskinson teases major updates, linked to the Midnight upgrade, for Cardano's future growth.

ADA has broken past key levels, suggesting potential price surge toward $0.86 and $1.

After jumping 20% last week, Cardano (ADA) has now dropped 5%, but there’s more behind it. With the Brave Wallet now supporting ADA and Cardano’s founder teasing more surprises, the stage is set for ADA price to hit a monthly high.

So, is ADA on its way to $1?

Cardano’s Brave Wallet Integration

The Brave browser, which has over 70 million users, has officially added support for ADA in its built-in crypto wallet. Reacting to the news, Cardano’s founder Charles Hoskinson hinted that this is just the beginning.

He suggested that several more big updates will roll out through the Summer and Fall of 2025.

Hoskinson even joked that VPN and advertising companies might be in for a shock once these integrations go live.

His message was clear: Cardano is entering a new phase of real-world adoption, and the Midnight upgrade is just the start.

ADA Eyeing $1 Mark – Key Levels To Watch

This Brave integration has brought back fresh hopes in the Cardano community, especially after ADA’s recent dip.

As of now, ADA price is currently trading around $0.79, down 4% today. Still, many traders see this as a healthy correction, not a warning sign.

Looking at the chart, ADA has already broken past the $0.72 and $0.75 levels, which is a good sign. It is now sitting close to the $0.786 level, which is an important zone.

If it can break through this and hold, the next targets could be around $0.86 and even higher, like $1.00.

Bullish Momentum Isn’t Over Yet

One more positive sign is that the trading volume is strong—currently at $1.88 billion, reflecting a surge of 65% seen in the last 24 hours. This means a lot of people are buying and selling ADA right now.

Technical signs like RSI also hint at a bullish momentum as it is still at 61.

However, if it fails to move higher, the price might fall back down to support near $0.72 or $0.67.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

Isaac Update

5/13/2025

Isaac will post in his Telegram Room tomorrow after his appointment.

Isaac's Telegram Room Link

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Al-Nusairi: Our Dinar Continues To Recover Until It Reaches The Official Price

Money and Business Economy News – Baghdad Economic and banking advisor Samir Al-Nusairi confirmed on Sunday that the Iraqi dinar has been gradually recovering for several weeks due to internal and external reasons that have directly impacted controlling fluctuations in the US dollar exchange rate, regardless of the many reasons that led to its decline and its reaching 10 cents, after the difference between the official and parallel rates had been 20 cents for a long period.

Iraq Economic News And Points To Ponder Tuesday Afternoon 5-13-25

Al-Nusairi: Our Dinar Continues To Recover Until It Reaches The Official Price

Money and Business Economy News – Baghdad Economic and banking advisor Samir Al-Nusairi confirmed on Sunday that the Iraqi dinar has been gradually recovering for several weeks due to internal and external reasons that have directly impacted controlling fluctuations in the US dollar exchange rate, regardless of the many reasons that led to its decline and its reaching 10 cents, after the difference between the official and parallel rates had been 20 cents for a long period.

Al-Nusairi pointed out that the main reason for the recovery is the reform policies of the Central Bank and the government in reforming the

processes of regulating foreign trade financing,

compliance with international standards, and

regularity in the global financial system, as well as the

new mechanisms for foreign transfers to secure imports and

cover them in US dollars and other currencies by

dealing directly with correspondent banks through more than 20 Iraqi banks that have opened accounts and banking relationships with these banks.

The Central Bank also succeeded in

securing and providing 95% of the demand for the dollar at the official price and

covering the needs of citizens for cash dollars and

distributing it with transparency, fairness, and strict monitoring,

which contributed to reducing the practices of speculators in the informal market.

He added to the important role of the government in implementing its strategy in financial and banking reform, especially the implementation of paragraphs (1-7) included in the government program,

in addition to removing opportunities for speculators to manipulate the exchange rate according to administrative, supervisory, and economic policies.

Al-Nusairi bet on the Iraqi dinar's continued recovery through 2025, following the completion of the banking reform project's objectives and the Central Bank of Iraq's third strategy.

He also noted that the government will continue implementing its reform and investment programs,

attracting more foreign and Arab investments to the country, which have exceeded $88 billion,

completing the development path,

investing in gas,

developing oil projects, and

supporting the private industrial sector.

Al-Nusairi concluded his remarks by praising the programmes and measures adopted by the Central Bank, which contributed to reducing inflation to 2.8% and maintaining the general price level, which is one of the objectives of monetary policy. https://economy-news.net/content.php?id=55333

Iraq To Recover Half A Billion Dollars In Smuggled Funds By 2024

May 10, 13:35 Information/Baghdad... The Federal Integrity Commission revealed on Saturday that

Iraq had successfully recovered more than half a billion dollars in smuggled funds during 2024.

"The government has placed anti-corruption efforts at the top of its agenda," said the commission's chairman, Mohammed Ali al-Lami, in a statement followed by Al-Maalouma News Agency. He added that "the efforts of the government and the judiciary have contributed to the recovery of smuggled funds."

Al-Lami confirmed that "Iraq succeeded in recovering more than half a billion dollars in smuggled funds during 2024," indicating that "we provided privileges and protection to those who cooperated in uncovering corruption cases." End/25

https://almaalomah.me/news/98296/economy/العراق-يستعيد-نصف-مليار-دولار-من-الأموال-المهربة-خلال-2024

A Dangerous Financial Maneuver... Will Employee Salaries Survive The Liquidity Crunch?

May 13, 2025 Baghdad/Iraq Observer Iraq is facing a liquidity crisis in the local dinar, coupled with a continued decline in the dollar exchange rate in local markets.

This is increasing citizens' and employees' concerns about the government's ability to meet its financial obligations, most notably securing the salaries of employees and retirees on time.

The government has resorted to withdrawing cash from tax deposits,

previously linked to the so-called "theft of the century,"

in an attempt to cover the liquidity deficit

and ensure continued funding for essential obligations, most notably salaries.

Experts believe the crisis is

not related to the availability of hard currency, as

the government has a substantial dollar reserve thanks to oil exports.

Rather, it stems from a scarcity of Iraqi dinar liquidity, which is forcing it to implement swift financial maneuvers, such as using tax deposits, to secure employee salaries and avoid any delays in disbursing them.

Dinar withdrawal is “weak”

In turn, economic expert Abdul Rahman Al-Mashhadani confirmed that "Iraq exports more than 3.1 million barrels of oil per day, and oil revenues last month amounted to approximately $7.7 billion,

an amount sufficient to cover salaries and a portion of operating and investment expenses."

He explained to the Iraq Observer that "the government needs approximately 7 trillion and 850 billion Iraqi dinars per month to secure salaries for employees and retirees and social security benefits,

adding that oil revenues, when transferred, are supposed to cover this amount and exceed it,

but the problem lies in the weak withdrawal of the Iraqi dinar from the market."

He stressed that "approximately 90% of the issued currency is not returning to the banking system as quickly as required,

making it difficult for the Central Bank to supply the government with cash liquidity in a timely manner,

despite the latter having parliamentary authorization to borrow from the Central Bank under the 2024 budget law, a process also included in the 2023 budget." He added,

"The government has not yet resorted to direct borrowing from the Central Bank this year,

with the exception of the latter's rediscounting of treasury bonds sold to government and private banks worth approximately 3 trillion dinars."

Al-Mashhadani noted that "the liquidity provision mechanism is still suffering from bottlenecks,

which has prompted the government to resort to using tax deposits to compensate for this shortfall at the present time."

On April 15, the Council of Ministers decided to authorize the Minister of Finance to withdraw tax deposits less than five years old to secure funding for state employee salaries for April and subsequent months.

This move has faced legal criticism, as

experts have asserted that tax deposits are not considered public revenue until five years have passed without claims,

making their early withdrawal illegal and reflecting the fragility of the state's financial situation.

Government employees,

along with social security beneficiaries and retirees, are hoping to receive their salaries before Eid al-Adha, amidst uncertainty over the government's ability to provide the necessary liquidity in a timely manner. https://observeriraq.net/مناورة-مالية-خطيرة-هل-تنجو-رواتب-الموظ/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 5-13-25

Good Afternoon Dinar Recaps,

COINBASE BECOMES FIRST BITCOIN AND CRYPTO COMPANY TO JOIN THE S&P 500

Coinbase joins the S&P 500, marking a milestone for Bitcoin, further highlighting Bitcoin’s strong performance, outperforming gold and the S&P 500 over the years.

Coinbase Global Inc. (NASDAQ: COIN) is officially joining the S&P 500 starting May 19. It will replace Discover Financial Services (NYSE: DFS), which is being acquired by Capital One Financial (NYSE: COF), an existing member of the index.

Good Afternoon Dinar Recaps,

COINBASE BECOMES FIRST BITCOIN AND CRYPTO COMPANY TO JOIN THE S&P 500

Coinbase joins the S&P 500, marking a milestone for Bitcoin, further highlighting Bitcoin’s strong performance, outperforming gold and the S&P 500 over the years.

Coinbase Global Inc. (NASDAQ: COIN) is officially joining the S&P 500 starting May 19. It will replace Discover Financial Services (NYSE: DFS), which is being acquired by Capital One Financial (NYSE: COF), an existing member of the index.

This is a big move for Coinbase and an even bigger signal for Bitcoin. For a crypto company to be added to one of the most important indexes in the U.S. shows how far this industry has come. It’s not just hype anymore—it’s becoming a real part of the traditional financial system.

“Thank you to everyone who made it possible for a crypto company to join the S&P 500 for the first time in history,” Coinbase posted on their X account.

To get into the S&P 500, a company needs to meet a few strict requirements. They need a market cap of at least $18 billion, have most of their shares held by the public, be profitable over the last four quarters, and be listed on a U.S. exchange. Coinbase checks all of those boxes, with a market cap over $40 billion and solid recent earnings.

Once Coinbase is added, every fund that tracks the S&P 500 will need to include it in their portfolios. That means more demand for the stock, which could push the price up in the short term. But even more important, it brings more exposure and credibility to the entire crypto space.

“Congratulations Brian Armstrong on $COIN being added to the S&P 500 Index,” said Strategy Executive Chairman Michael Saylor. “A major milestone for Coinbase and for Bitcoin.”

Now let’s talk about Bitcoin. Coinbase is one of the top platforms people use to buy and sell Bitcoin. Having it in the S&P 500 makes Bitcoin exposure more accessible to traditional investors. It also helps reduce the idea that Bitcoin and crypto are just some risky gamble.

And the numbers speak for themselves. Over the past 14 years, Bitcoin has outperformed the S&P 500 and gold by a huge margin. Since 2010, Bitcoin has surged a staggering 7,200,000%, compared to the S&P 500’s 306% and gold’s 116%. Even when looking at shorter timeframes, Bitcoin consistently beats both. For instance:

In the past year:

Bitcoin: +27%

Gold: +37%

S&P 500: +5%

In the last five years:

Bitcoin: +1,138%

Gold: +85%

S&P 500: +92%

@ Newshounds News™

Source: Bitcoin Magazine

~~~~~~~~~

SAUDI ARABIA DROPS BRICS, INKS $600B STRATEGIC DEAL WITH US IN 2025

A new agreement has been signed, and it is poised to have major geopolitical ramifications as Saudi Arabia has seemingly dropped BRICS, inking a new deal with the US in 2025. Indeed, Riyadh has agreed to a “strategic economic partnership” with the United States amid a visit from President Donald Trump on Tuesday.

Both Trump and Crown Prince Mohammed Bin Salman have reached the landmark agreement that will increase cooperation in energy, mining, defense, and other ventures. Indeed, the memorandum was reached in what is the US president’s first major foreign trip since his return to the White House.

Saudi Arabia & US Reach New Deal Despite BRICS Standoff

Since his return to the Oval Office, Donald Trump has not been shy about his feelings toward the BRICS economic alliance. Earlier this year, he threatened 150% tariffs on the bloc. Specifically, he warned of repercussions for its continued de-dollarization efforts.

His stance only complicated the relationship between the collective and the recent expansion nation, Saudi Arabia. With tensions rising during Trump’s second term, Riyadh was seemingly caught in the middle. Now, it appears to have made its choice, as Saudi Arabia has turned from BRICS, signing a new strategic deal with the US in 2025.

The memorandum and agreement encompassed a host of sectors, including energy, defense, health, and the arts. Additionally, the letter of intent will see the US aid Saudi Arabia in the development of its armed forces. Moreover, they have plans for the Saudi Ministry of Interior and FBI to cooperate in one of many partnership aspects.

Abdulaziz Alghashian, Director of Research at Riyadh’s Observe Research Foundation Middle East, recently discussed the agreement. He noted that the deal’s reach “speaks to the depth” of the two nations' relationship. With the US and BRICS standing so opposed, it questions Saudi Arabia’s commitment to its cause.

However, that may not be the case. Alghashian noted that the deal “won’t come at the cost of relations with others.” Yet, only time will tell if that is the case. Just weeks ago, the US and China were on the doorstep of a trade war. Moreover, those tensions don’t appear to be entirely resolved.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News And Points To Ponder Tuesday Morning 5-13-25

Monetary Policy Raises The Value Of The Dinar And Reduces Reliance On The Parallel Market.

Economic 2025/05/11 Baghdad: Hussein Thaghab The Iraqi dinar has recently recorded strong performance against the dollar, driven by a series of monetary measures adopted by the Central Bank, which have contributed to reducing demand for hard currency in the parallel market and enhancing the confidence of traders in official channels.

This improvement comes amid ongoing government efforts to consolidate financial stability and

stimulate business activity through effective monetary instruments and transparent and direct financing mechanisms.

Monetary Policy Raises The Value Of The Dinar And Reduces Reliance On The Parallel Market.

Economic 2025/05/11 Baghdad: Hussein Thaghab The Iraqi dinar has recently recorded strong performance against the dollar, driven by a series of monetary measures adopted by the Central Bank, which have contributed to reducing demand for hard currency in the parallel market and enhancing the confidence of traders in official channels.

This improvement comes amid ongoing government efforts to consolidate financial stability and

stimulate business activity through effective monetary instruments and transparent and direct financing mechanisms.

Deputy Governor of the Central Bank of Kuwait, Dr. Ammar Hamad, confirmed to Al-Sabah that

this increase reflects the success of the monetary policy pursued by the bank in reducing reliance on the parallel market and providing safe and transparent sources of financing for foreign trade.

He explained that this policy has enabled the commercial family to obtain dollars through official channels that adhere to international standards, without having to resort to the unregulated market.

Hamad noted that the Central Bank continues to work toward consolidating the local banking system and raising its operational efficiency to levels consistent with international banking standards, making it a fundamental pillar in driving economic development in Iraq.

He added that the bank is adopting advanced mechanisms that enable banks to offer diverse banking products that support various economic sectors and facilitate financing and cash flow operations.

For his part, the Prime Minister's Advisor for Financial Affairs, Dr. Mazhar Mohammed Salih, explained that a number of factors contributed to strengthening the value of the dinar, most notably the weak demand for the dollar in the parallel market, as a result of the Central Bank's policies regarding financing foreign trade for the private sector.

He explained that the bank strengthens Iraqi banks' dollar balances through their correspondents abroad, especially banks with a high credit rating (AAA), which speeds up the execution of international transfers

and reduces the need for dollars in the local market.

He also indicated that the move towards using alternative currencies such as the euro, yuan, dirham, and lira in banking transactions has helped reduce excessive reliance on the dollar.

Saleh also noted that enabling small businesses to access financing sources directly through Iraqi banks,

without costly intermediaries, has helped reduce operating costs and improved commercial efficiency,

as this segment represents approximately 60% of private sector trade.

He added that travelers can now easily obtain their foreign currency dues via payment cards at a subsidized exchange rate of 1,320 dinars to the dollar, in addition to the ability to receive dollars in cash at Iraqi airports, which has eased pressure on the parallel market.

In the same context, economic expert Nazir Al-Saadi emphasized that the money transfer services provided by the Central Bank have become safer and more effective,which has prompted business families to move away from the parallel market,

which is characterized by significant risks and high costs.

He explained that relying on official transfers not only ensures the safety of transactions,but also reduces the final cost of imports,which is positively reflected in the prices offered to consumers.

He added that random transfers from the parallel market often caused losses to importers due to failure to implement them or due to price fluctuations, while the Central Bank mechanism provides a stable financial system that preserves the value of the currency and reduces Opportunities for manipulation. https://alsabaah.iq/114242-.html

Arab Countries On The Gray List For Money Laundering... What About Iraq?

Economy 2025-05-12 | 2,734 views Asharq Al-Awsat revealed on Monday that seven Arab countries are on the gray list. The report emphasized that this does not mean they are directly involved in financial corruption, but rather serves as an international warning about the existence of systemic loopholes that could weaken the economy and threaten investor and market confidence.

This places the country under scrutiny, considering it an environment that could be exploited for money laundering or terrorist financing unless it swiftly implements strict legal and institutional reforms.

In the Arab region, several countries have entered this list, some of which have already left,

while others remain for reasons ranging from weak legislation, weak banking oversight, and political instability.

This makes the issue more complex and impactful for the region's economies, which are highly dependent on cross-border financial flows.

The grey list refers to countries placed on the Financial Action Task Force's (FATF) "enhanced monitoring list."

The list includes countries with "strategic deficiencies" in their anti-money laundering, counter-terrorism financing, and proliferation regimes, but which have demonstrated a high-level political commitment to work with the FATF to implement a clear reform plan within a specific timeframe.

The Financial Action Task Force (FATF) is an intergovernmental body established in 1989at the initiative of the Group of Seven industrialized nations and headquartered in Paris.

It is concerned with setting standards and promoting the implementation of legal, regulatory, and practical measures to combat money laundering, the financing of terrorism, and the proliferation of weapons of mass destruction at the national and international levels.

*Arab countries on the list

As of the latest official update issued by the Financial Action Task Force in February 2025, the following countries from the Arab region are included on the “grey list”:

1. Algeria

Algeria was listed in October 2024 following a joint assessment with the Middle East and North Africa Financial Action Task Force (MENAFATF), due to weak risk oversight, the absence of an effective beneficial ownership framework, and a lack of suspicious transaction reports.

Algeria is implementing an action plan that includes strengthening financial oversight, developing a suspicious transaction reporting system, and updating the legal framework for targeted financial sanctions.

2. Lebanon

Lebanon was added to the list in October 2024 due to the collapse of its banking system and its increasing reliance on cash transactions, which reflects a lack of confidence in the banking system and makes it difficult to track cash flows, in addition to the lack of judicial independence and concerns about terrorist financing.

authorities are seeking The Lebanese to implement a comprehensive reform plan to strengthen the anti-money laundering and counter-terrorism financing system.

3. Syria

Syria has been on the list since February 2010 due to strategic deficiencies in combating money laundering and terrorist financing. Despite some improvements, Syria continues to cooperate with the Financial Action Task Force to address these deficiencies .

4. Yemen

Yemen was listed in February 2014 due to its inability to implement reforms due to the security situation, despite completing the agreed-upon action plan. However, Yemen continues its efforts to strengthen its anti-money laundering and counter-terrorism financing regime.

*Arab countries removed from the list

Three Arab countries have been removed from the "grey list" after implementing comprehensive

reforms to their anti-money laundering and counter-terrorism financing systems.

These countries are: the UAE, Morocco, and Jordan.

1. UAE

The UAE was placed on the "grey list" in March 2022 due to "strategic deficiencies" in its anti-money laundering and counter-terrorist financing regime, such as poor understanding of risks, limited use of financial information, and challenges in implementing sanctions.

The UAE was removed from the grey list on February 23, 2024, after implementing a series of institutional and legislative reforms, including the establishment of the Executive Office for Combating Money Laundering and Terrorist Financing to enhance national coordination, the establishment of a specialized court for financial crimes, and the updating of criminal laws and the imposition of stricter penalties.

The country also increased the pace of investigations and prosecutions and activated a system for reporting suspicious transactions.

FATF commended this progress, considering it sufficient to remove the UAE from the list.

2. Morocco

Morocco was placed on the “grey list” due to weak risk-based oversight, insufficient accuracy of beneficial ownership information for legal entities, limited diversity of suspicious transaction reports, and limited effectiveness of investigations and prosecutions.

Morocco was removed from the grey list in February 2023 after implementing a series of substantive reforms within the framework of the action plan agreed upon with the Financial Action Task Force.

The measures included strengthening the legal and regulatory framework for combating money laundering and terrorist financing, improving the effectiveness of investigations and prosecutions, updating the suspicious transaction reporting system, and enhancing international cooperation and the exchange of financial information.

3. Jordan

Gaps such as weak risk-based oversight, insufficient beneficial ownership data, inadequate prosecutions, and an ineffective financial sanctions regime have placed Jordan under enhanced FATF scrutiny.

After the country adopted reforms that included improving transparency in beneficial ownership data, strengthening investigations and prosecutions in money laundering cases, tightening oversight of non-profit organizations, and improving its targeted financial sanctions regime, Jordan was removed from the gray list in October 2023.

Listing: Punishment or Regulatory Measure?

Gray listing is not a penalty in the legal sense; rather, it is an international regulatory measure that indicates strategic deficiencies in a country's

anti-money laundering and counter-terrorist financing (AML/CFT) systems.

However, despite its regulatory nature, it has quasi-punitive consequences, such as diminished investor confidence, tightened international banking supervision, and increased costs for financial transactions.

Listing obliges a country to implement an action plan within a specified period under FATF supervision and serves as an international warning requiring urgent reforms.

*What about Iraq ?

On August 20, 2024, Iraq's Anti-Money Laundering and Counter-Terrorism Financing Office announced that the country was no longer on the gray list for money laundering, following the establishment of updated, comprehensive, and confidential databases that meet international requirements.

, Hussein Al-Maqram, reported The office's representative at the Central Bank of Iraq the

completion of the international mutual evaluation conducted by a team of international experts on Iraq.

The 14-month evaluation aimed to assess Iraq's technical compliance with the legal framework,

regulations, instructions, and controls for combating money laundering and terrorist financing.

In a statement to the media, Muqrin explained that the international expert team evaluated the effectiveness of anti-money laundering and counter-terrorism financing systems by providing statistics and practical cases to demonstrate the extent to which the legislative framework is being implemented, in addition to conducting field visits."

He added that "the evaluation report was discussed and approved by the Middle East and North Africa Financial Action Task Force (MENAFATF) last May," noting that

"the initial results confirmed that the Republic of Iraq has moved away from inclusion on the gray list,

and an action plan and recommendations were formulated by

international evaluators to ensure compliance with international standards."

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Morning 5-13-25

Good Morning Dinar Recaps,

ARIZONA GOVERNOR KILLS TWO CRYPTO BILLS, CRACKS DOWN ON BITCOIN ATMS

Governor Katie Hobbs vetoed two major pro-crypto bills:

Senate Bill 1373, which proposed a Digital Assets Strategic Reserve Fund, and

Senate Bill 1025, the Arizona Strategic Bitcoin Reserve Act that would have allowed up to 10% of state treasury and retirement funds to be invested in Bitcoin.

She also rejected Senate Bill 1024, which would have allowed state agencies to accept crypto payments for taxes and fees.

Good Morning Dinar Recaps,

ARIZONA GOVERNOR KILLS TWO CRYPTO BILLS, CRACKS DOWN ON BITCOIN ATMS

Governor Katie Hobbs vetoed two major pro-crypto bills:

Senate Bill 1373, which proposed a Digital Assets Strategic Reserve Fund, and

Senate Bill 1025, the Arizona Strategic Bitcoin Reserve Act that would have allowed up to 10% of state treasury and retirement funds to be invested in Bitcoin.

She also rejected Senate Bill 1024, which would have allowed state agencies to accept crypto payments for taxes and fees.

Hobbs cited “volatility in cryptocurrency markets” as a core reason for vetoing, stating the proposals posed too much financial risk for public funds.

However, she approved House Bill 2387, which imposes strict consumer protections on Bitcoin ATMs:

Requires multilingual scam warnings and acknowledgment from users before transactions.

Caps daily transactions at $2,000 for new users and $10,500 for returning users after 10 days.

Mandates detailed receipts, visible 24/7 customer support info, and a 30-day refund policy for fraud victims.

Additionally, Hobbs signed House Bill 2749, modernizing unclaimed property laws to let Arizona hold unclaimed crypto in its original form rather than converting to fiat.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

BRICS: US & CHINA AGREE TO TARIFF PAUSE, BUT WHO’S NEXT?

The US and China have agreed to a 90-day tariff pause, signaling a potential thaw in tensions and offering hope for a broader trade deal.

President Trump called it a “total reset” in relations, easing fears of an imminent trade war between the world’s two largest economies.

China’s role in BRICS remains pivotal, and the agreement has sparked speculation about which BRICS nation may secure relief next.

India has already finalized trade terms with the US, while Brazil still faces a 10% tariff, and South Africa’s has been lowered from 30% to 10%.

Russia was never included in the initial US tariff plan, giving the BRICS alliance some strategic leverage.

The European Union (EU) may be next on the negotiation list, though Trump called the EU “nastier than China” in recent comments.

BRICS' united trade front is believed to be effective, with growing optimism that tariff relief deals for other members are coming soon.

The 2025 BRICS summit could expand the alliance, increasing its global influence during ongoing trade negotiations.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 5-13-2025

TNT:

Tishwash: Al-Sudani inspects the "Heart of the World" hotel in preparation for receiving delegations participating in the Arab Summit.

Prime Minister Mohammed Shia al-Sudani reviewed preparations for receiving delegations participating in the Arab Summit on Sunday.

The Prime Minister's media office said in a statement received by the Iraq Observer, "Prime Minister Mohammed Shia al-Sudani visited the Heart of the World Hotel in the capital, Baghdad, today, Sunday, which is one of the hotels that will host the delegations participating in the Arab Summit in Baghdad."

The statement added, "During a tour of the hotel, which is one of the most prominent modern hotel projects in the capital, Baghdad, Al-Sudani viewed its halls, corridors, and tourist facilities, as well as the distinctive equipment and services it includes that are worthy of Iraq's guests."

TNT:

Tishwash: Al-Sudani inspects the "Heart of the World" hotel in preparation for receiving delegations participating in the Arab Summit.

Prime Minister Mohammed Shia al-Sudani reviewed preparations for receiving delegations participating in the Arab Summit on Sunday.

The Prime Minister's media office said in a statement received by the Iraq Observer, "Prime Minister Mohammed Shia al-Sudani visited the Heart of the World Hotel in the capital, Baghdad, today, Sunday, which is one of the hotels that will host the delegations participating in the Arab Summit in Baghdad."

The statement added, "During a tour of the hotel, which is one of the most prominent modern hotel projects in the capital, Baghdad, Al-Sudani viewed its halls, corridors, and tourist facilities, as well as the distinctive equipment and services it includes that are worthy of Iraq's guests."

He continued, "He also toured the press center dedicated to the Arab Summit to review the preparations for the work of journalists and media personnel at this center, which will constitute an integrated media platform for covering the Arab Summit." link

***************

Tishwash: Economists: The Arab Summit is an opportunity to activate partnerships and investments.

The Arab economic arena is witnessing increasing momentum ahead of the Arab Summit in Baghdad, with economic experts and specialists unanimously agreeing that this event could mark the beginning of a new phase of joint Arab economic action, based on investing in the wealth and potential of Arab countries and redrawing the map of cooperation in light of regional and international changes. This vision comes within the context of a widespread belief that Baghdad now possesses the elements of stability and readiness to host major strategic projects that will benefit all Arab economies.

New prospects for cooperation

Economic expert Haider Karim al-Gharawi told Al-Sabah that holding the summit in Baghdad opens new horizons for cooperation between Iraq and its Arab brethren, given the common elements upon which fruitful economic partnerships can be built.

He explained that the presence of Arab leaders or their representatives in Baghdad and their direct exposure to the Iraqi reality could create new visions and strengthen the conviction that Iraq possesses an attractive work environment capable of accommodating bilateral partnership projects that achieve benefits for all parties. In various sectors.

Al-Gharawi added that the summit represents a rare opportunity to present Iraq's development plans directly to delegations without the need for intermediaries, which will help accelerate agreements and reach practical and effective cooperation formulas.

He considered that the mere fact that the summit is being held in Baghdad sends a reassuring message to the world that Iraq has returned to the path of stability and economic openness. He also spoke about the possibility of creating common economic interests with major international companies that can leverage their expertise to support Arab-style production projects, making the summit a starting point for a formula for Arab industrial and production integration capable of competing in the global market.

The Summit and the Road to Development

For his part, economic expert Dr. Nabil Al-Marsoumi explained that the summit represents an opportunity to enhance economic cooperation between Iraq and Arab countries, particularly neighboring countries. He pointed out that Iraq has active economic relations with its regional surroundings, including the electrical connection with Jordan, which is close to completion, in addition to economic relations with Saudi Arabia and Kuwait, which can be activated through comprehensive economic agreements.

He emphasized that the summit could contribute to reviving agreements related to the "Development Road" project, which is one of the largest strategic projects that serves not only Iraq, but also extends its benefits to other Arab countries, especially the UAE and Qatar, as it provides a potential corridor for Qatari gas to Europe. It is also a gateway to strengthening economic relations, diversifying trade exchange, and pursuing joint projects in the energy, contracting, and housing sectors, areas that usually constitute a key focus of major economic conferences, thus enhancing opportunities for sustainable development and Arab integration.

Iraq in the regional equation

Economic researcher Suhad Al-Shammari considered the holding of the Arab Summit in Baghdad a pivotal event at various levels, noting in her interview with Al-Sabah that the meeting of Arab leaders, kings and presidents in the Iraqi capital reflects the extent of Arab interest in Iraq's role and position in the new regional equation.

She explained that discussing issues that have a direct impact on the region through the Baghdad Summit carries a clear message that Iraq has become secure and has a virgin economy that can accommodate the most important investment projects, which means that countries are now dealing with Iraq from a new economic perspective that charts the compass of political cooperation based on common interest.

Al-Shammari indicated that the summit carries indications of Iraq's return to playing an influential geopolitical role in the region, and opens the horizon for bringing viewpoints closer between Arab countries. It also reflects the qualitative shift that Iraq has witnessed in terms of reconstruction and development, noting that the "Development Road" project represents an important economic gateway and is on its way to completion within the specified timeframe, at a time when Baghdad has regained its luster as a vibrant capital witnessing a major development movement, which enhances Iraq's position as a key player in the economic and And the Arab politician.

The summit and the elements of success

These intersecting visions reflect a firm belief among experts that the Baghdad Summit possesses all the ingredients for economic success, making it a strategic platform for launching comprehensive Arab initiatives based on integration in the fields of energy, transportation, and infrastructure. These initiatives contribute to building an Arab economic system capable of confronting challenges and exploiting available opportunities, within a path of sustainable cooperation that the region has always embraced. Much needed. link

*************

Tishwash: The Prime Minister appreciates the International Monetary Fund's efforts in supporting Iraq and its financial and monetary institutions.

Prime Minister Mohammed Shia Al-Sudani praised the efforts of the International Monetary Fund in supporting Iraq and its financial and monetary institutions.

His media office said in a statement, "Prime Minister Mohammed Shia Al-Sudani received today, Monday, the head of the International Monetary Fund mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

Al-Sudani appreciated the efforts of the International Monetary Fund in supporting Iraq and its financial and monetary institutions, which would restore their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability, stressing that the achievements made by the government in the financial, banking and economic fields represent positive steps towards achieving stability and sustainable development in the country.

Al-Sudani pointed out "the importance of continued support from international partners for the government in intensifying efforts to mitigate the impact of the challenges facing the region, which would facilitate the implementation of steps aimed at diversifying and sustaining the economy, through the investment environment it has provided that has attracted major development projects.

For his part, Polan praised the significant progress made by the Iraqi government in the field of economic reform, through the development of the tax and customs system, expressing the International Monetary Fund's readiness to increase coordination and joint work, and to provide the necessary advice in areas of enhancing non-oil revenues. link

************

Mot: Come on ""Earl"" -- LOL

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

5-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew: Iraqi Dinar News Update-Iran Removing Zeros-Green Light-Economic Reality-Trade-IMF-WB-BIS-UST-Timing

5-12-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Iraq Economic News And Points To Ponder Monday Evening 5-12-25

Prime Minister: The International Monetary Fund Is A Key Partner In Strengthening Iraq's Economy And Stabilizing It

Economy | 08:46 - 12/05/2025 Mawazine News - Baghdad - Prime Minister Mohammed Shia Al-Sudani received on Monday the Head of the International Monetary Fund (IMF) Mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

According to a statement from his media office received by Mawazine News, Al-Sudani praised the IMF's efforts in supporting Iraq and its financial and monetary institutions, thus restoring their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability.

Prime Minister: The International Monetary Fund Is A Key Partner In Strengthening Iraq's Economy And Stabilizing It

Economy | 08:46 - 12/05/2025 Mawazine News - Baghdad - Prime Minister Mohammed Shia Al-Sudani received on Monday the Head of the International Monetary Fund (IMF) Mission to Iraq, Jean-Guillaume Poulin, and the Fund's Resident Representative in Iraq, Mohammed Jaber.

According to a statement from his media office received by Mawazine News, Al-Sudani praised the IMF's efforts in supporting Iraq and its financial and monetary institutions, thus restoring their vital role at the local and international levels, especially since the Fund is a key partner in Iraq's efforts to reform the economy and enhance its stability.

He stressed that the government's achievements in the financial, banking and economic fields represent positive steps towards achieving stability and sustainable development in the country.

He pointed out the importance of continued support from international partners for the government in intensifying efforts to mitigate the impact of the challenges facing the region, thus facilitating the implementation of steps aimed at diversifying and sustaining the economy, through the investment environment it has provided that has attracted major development projects.

For his part, Polan praised the "significant progress made by the Iraqi government in economic reform, through the development of the tax and customs systems."

He expressed the IMF's readiness to increase coordination and joint action, and to provide the necessary advice on enhancing non-oil revenues. https://www.mawazin.net/Details.aspx?jimare=261358

Rafidain Bank: The "Riyada" Initiative Is A Development Tool For Transforming The Iraqi Economy.

A wish | 09:25 - 12/05/2025 Mawazine News - Baghdad - Rafidain Bank confirmed on Monday that the Riyada initiative represented a development tool for changing the structure of the Iraqi economy and transformed young people from job seekers to opportunity creators.

While noting that the first phase of the initiative financed more than 8,000 small projects, he noted that the second phase will finance more than 10,000 new projects.

Rafidain Bank Director Ali Karim Al-Fatlawi said in a statement to the official agency, followed by Mawazine News, that "the Riyada initiative launched by the bank represents a qualitative shift in the role of banking institutions," indicating that "it is no longer limited to providing financing, but has become a development tool for changing the structure of the Iraqi economy and empowering youth."

He added, "The initiative is not merely financing small projects, but rather a new economic future written by the youth of Iraq," noting that "the state is no longer the largest employer alone, but has become an enabler and motivator of the private sector, especially graduates and entrepreneurs."

He continued, "The first phase of the initiative resulted in financing more than 8,000 small projects, each of which provided between two and five direct job opportunities, reflecting a real shift in the role of youth from job seekers to opportunity creators.

" He noted that "the bank has allocated sufficient resources for the second phase and is preparing to finance more than 10,000 new projects in cooperation with relevant authorities."

He stated that "Rafidain Bank is today adopting an integrated development role, not just a traditional banking role," explaining that "financing has become a means to build small production units that support the market and break the cycle of unemployment."

He pointed out that "the most prominent challenges facing the implementation of the initiative are the need for institutional integration," calling on the Central Bank and all national institutions to "actively engage in supporting the Riyada initiative by allocating concessionary financing windows, launching a national fund to guarantee loans for entrepreneurs, and integrating the initiative into the upcoming financial inclusion strategy." https://www.mawazin.net/Details.aspx?jimare=261361

A Delegation Of 46 Iraqi Businessmen Participates In The US Investment Summit To Enhance Economic Cooperation

The US Embassy in Baghdad announced on Sunday that a delegation of 46 business leaders from across Iraq, including the Kurdistan Region, will travel to the United States to participate in the annual SelectUSA Investment Summit, scheduled to be held in Washington, D.C., from May 11 to 14.

The embassy explained in a statement that the delegation represents a wide range of economic sectors, including technology, cybersecurity, tourism, hospitality, food and beverage, franchises, agriculture, construction, investment, pharmaceuticals, real estate, and oil and gas, reflecting the diversity of cooperation and investment opportunities between the two countries.

The SelectUSA Summit, organized by the US Department of Commerce, is the largest event dedicated to promoting foreign direct investment in the United States, bringing together international investors with representatives of state and local governments, along with government officials, with the goal of facilitating investment entry into the US market.

The embassy explained that this participation is part of a series of important economic visits that have strengthened bilateral relations, noting the visit of a delegation from the US International Development Finance Corporation to Baghdad in May, in addition to the participation of more than 100 businessmen and companies from the American-Iraqi Chamber of Commerce in a business forum held in Baghdad last April.

The embassy emphasized that these efforts aim to support Iraqi businessmen in exploring growth and investment opportunities within the United States and strengthening the economic partnership between the two countries. https://www.radionawa.com/all-detail.aspx?jimare=41825

While Chairing The Economic And Social Council Meeting, Iraq Calls For The Formation Of An Arab Economic Bloc

Monday, May 12, 2025 3:35 PM | Economic Number of reads: 255 Baghdad / NINA / Iraq called, during the meeting of the Economic and Social Council, for the formation of an Arab economic bloc.

Director General of the Department of Foreign Economic Relations at the Ministry of Trade, and member of the presidency of the current session of the Arab Development Summit, Riyadh Fakher Al-Hashemi, said in a speech during the meeting of the Economic and Social Council at the level of senior officials, according to the official agency:

"Our meeting is not just an entitlement, but rather a sincere Arab platform to translate aspirations into action, and to address development challenges through constructive dialogue, genuine cooperation, and common will."

Al-Hashemi added: "Our Arab reality today requires us to take a serious stance and clear positions in order to chart applicable development paths capable of creating job opportunities and achieving social justice. Today, we are called upon to go beyond traditional frameworks and move towards strategic projects that move towards a truly integrated economy, effective social cooperation, and joint investment."

He continued: "The Arab economic bloc is not only important, but it is a historic entitlement, if we invest in the available elements of human and natural resources, as we are working today to formulate an agenda rich in issues, which represents a priority in the Arab development process, and lays the foundation for qualitative outcomes." /https://ninanews.com/Website/News/Details?key=1226423

The Dollar Rises Again By 144,000 Against The Iraqi Dinar.

Economy | 10:38 - 12/05/2025 Mawazine News – Baghdad Mawazine News publishes today, Monday, the exchange rates of the dollar against the Iraqi dinar in local markets. - Selling 143,750 dinars for $100. Purchase 141,750 dinars for $100. https://www.mawazin.net/Details.aspx?jimare=261303

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Monday Evening 5-12-25

Good afternoon Dinar Recaps,

US HOUSE PASSES CONTROVERSIAL STABLECOIN BILL BACKED BY TRUMP, DIVIDES DEMOCRATS

▪️The House passed the Stablecoin Innovation and Protection Act of 2025 late Thursday.

▪️The bill, supported by President Trump, aims to create a federal framework for stablecoin issuance while preserving state-level oversight.

▪️Democrats remain split over the bill’s impact on consumer protections, foreign issuers, and financial surveillance.

Good afternoon Dinar Recaps,

US HOUSE PASSES CONTROVERSIAL STABLECOIN BILL BACKED BY TRUMP, DIVIDES DEMOCRATS

▪️The House passed the Stablecoin Innovation and Protection Act of 2025 late Thursday.

▪️The bill, supported by President Trump, aims to create a federal framework for stablecoin issuance while preserving state-level oversight.

▪️Democrats remain split over the bill’s impact on consumer protections, foreign issuers, and financial surveillance.

The U.S. House of Representatives has passed the Stablecoin Innovation and Protection Act of 2025, a landmark piece of crypto legislation backed by President Donald Trump. The legislation, which passed with significant Republican support, proposes a federal framework for stablecoin issuance and sets broad new guidelines for how both private and public entities may issue and manage digital dollar-pegged tokens.

While the bill preserves some roles for state regulators—allowing entities like Wyoming’s digital asset office to license issuers—it also gives the U.S. Treasury, Federal Reserve, and SEC more say in oversight, compliance, and financial stability risks.

President Trump called the passage a "historic win for American financial innovation", noting that the bill will help the United States "compete with foreign stablecoins and preserve dollar dominance."

Still, Democrats remain deeply divided. Some, including Rep. Richie Torres (D-NY), backed the legislation, arguing that clear rules would help weed out bad actors and prevent future Terra-style collapses.

Others, including Rep. Maxine Waters (D-CA), warned that the bill "guts core consumer protections" and would "allow foreign and unvetted entities to flood the market with opaque dollar tokens."

The bill contains provisions that bar federal agencies from banning privacy-preserving technologies in stablecoin wallets but allows the Treasury to block specific transactions or protocols if national security risks are found. The move was seen as a concession to civil liberties groups and more libertarian-leaning Republicans.

Additionally, the bill defines what constitutes a “payment stablecoin” and allows registered institutions—like banks or licensed money services businesses—to issue them, provided they maintain 1:1 reserves in highly liquid assets such as dollars, Treasury bills, or central bank reserves.

However, it’s the international implications that may be most contentious. The bill would allow U.S.-licensed foreign firms to issue stablecoins within the U.S. market, so long as they report to U.S. regulators and pass quarterly audits. That move drew criticism from some lawmakers who fear it will benefit firms tied to adversarial governments.

Rep. Katie Porter (D-CA), who voted against the bill, said: "We are green-lighting a digital dollar shadow economy before we’ve even set the rules of the road."

The bill now heads to the Senate, where its prospects remain uncertain. Senate Banking Chair Sherrod Brown (D-OH) has yet to endorse the bill and is said to be drafting a competing version with tighter controls on foreign issuers and stricter anti-money laundering requirements.

For now, the House victory gives Trump a significant policy win as crypto continues to be a major wedge issue ahead of the 2026 midterm elections.

@ Newshounds News™

Source: The Block

~~~~~~~~~

GDP OF BRICS COUNTRIES OUTPERFORMS GLOBAL AVERAGE, US DISTANTLY BEHIND

The GDP of BRICS countries has outperformed market expectations and is exceeding the global average in 2025, according to the World Economic Outlook report published by the International Monetary Fund (IMF). The US, on the other hand, is distantly behind as its economy is growing in a limited manner this year.

In 2025, BRICS countries—Brazil, Russia, India, China, and South Africa—saw a combined growth of 3.4%, which exceeded expectations. The current consensus forecast predicts the GDP growth of the US at only 1.4% in 2025. The US economy is lagging behind this year with minimal growth, and the tariffs are threatening what little is left.

Below is the list of BRICS countries’ GDP projections for 2025:

Ethiopia (6.6%)

India (6.2%)

Indonesia (4.7%)

United Arab Emirates (4%)

China (4%)

South Africa (3.4%)

Brazil (2.3%)

BRICS GDP Shines in 2025, US Economy On the Razor’s Edge

The latest data from the IMF also shows that BRICS accounts for 40% of the global GDP in 2025. That’s massive, as they already cover nearly half of the world’s economy. Their Purchasing Power Parity (PPP) is projected to reach 41% this year, signifying that the alliance is growing rapidly.

“There is no way that BRICS is not relevant, given the size of its population (and GDP in 2025). And there are also countries that are key in the supply of commodities, such as Brazil and Russia, which supply energy, food, and even very important strategic minerals,” said Rodrigo Cezar, Professor of International Relations at the Getulio Vargas Foundation (FGV) and a specialist in international political economy.

“So the BRICS countries are going to be very relevant in terms of dictating or giving direction to the prices of these materials,” leaving the US economy under its mercy, explained Cezar.

BRICS GDP could pressurize the markets in 2025, leading to it dominating the prices of the commodity markets this year.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Iraq and Iran” News posted by Clare at KTFA 5-12-2025

KTFA:

Clare: Iraq on Trump's agenda during his Middle East tour

5/12/2025

US President Donald Trump is embarking on a tour of the Middle East, including Saudi Arabia, the UAE, and Qatar. This visit is described as crucial given the profound changes taking place in the region .